| 2nd Quarter FY2021 Earnings Presentation Nasdaq: AUB July 22, 2021 |

| Forward Looking Statements 2 Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include, projections, predictions, expectations, or beliefs about future events or results that are not statements of historical fact. Such forward-looking statements are based on various assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other factors, some of which cannot be predicted or quantified, that may cause actual results, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are often accompanied by words that convey projected future events or outcomes such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other statements concerning opinions or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of, or trends affecting, the Company will not differ materially from any projected future results, performance, or achievements expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to the effects of or changes in: • changes in interest rates; • general economic and financial market conditions, in the United States generally and particularly in the markets in which the Company operates and which its loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels and slowdowns in economic growth, including as a result of COVID-19; • the quality or composition of the loan or investment portfolios and changes therein; • demand for loan products and financial services in the Company’s market area; • the Company’s ability to manage its growth or implement its growth strategy; • the effectiveness of expense reduction plans; • the introduction of new lines of business or new products and services; • the Company’s ability to recruit and retain key employees; • the incremental cost and/or decreased revenues associated with exceeding $10 billion in assets; • real estate values in the Bank’s lending area; • an insufficient ACL; • changes in accounting principles; • the Company’s liquidity and capital positions; • concentrations of loans secured by real estate, particularly commercial real estate; • the effectiveness of the Company’s credit processes and management of the Company’s credit risk; • the Company’s ability to compete in the market for financial services and increased competition from fintech companies; • technological risks and developments, and cyber threats, attacks, or events; • the potential adverse effects of unusual and infrequently occurring events, such as weather- related disasters, terrorist acts or public health events (such as COVID-19), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on supply chains and methods used to distribute products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; • the effect of steps the Company takes in response to COVID-19, the severity and duration of the pandemic, the uncertainty regarding new variants of COVID-19 that have emerged, the speed and efficacy of vaccine and treatment developments, the impact of loosening or tightening of government restrictions, the pace of recovery when the pandemic subsides and the heightened impact it has on many of the risks described herein; • the discontinuation of LIBOR and its impact on the financial markets, and the Company’s ability to manage operational, legal and compliance risks related to the discontinuation of LIBOR and implementation of one or more alternate reference rates, • performance by the Company’s counterparties or vendors; • deposit flows; • the availability of financing and the terms thereof; • the level of prepayments on loans and mortgage-backed securities; • legislative or regulatory changes and requirements, including the impact of the CARES Act, as amended by the CAA, and other legislative and regulatory reactions to COVID-19; • potential claims, damages, and fines related to litigation or government actions, including litigation or actions arising from the Company’s participation in and administration of programs related to COVID-19, including, among other things, the CARES Act, as amended by the CAA; • the effects of changes in federal, state or local tax laws and regulations; • monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of the Treasury and the Federal Reserve; • changes to applicable accounting principles and guidelines; and • other factors, many of which are beyond the control of the Company. Please refer to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Annual Report on Form 10 K for the year ended December 31, 2020 and related disclosures in other filings, which have been filed with the SEC and are available on the SEC’s website at www.sec.gov. All of the forward-looking statements made in this presentation are expressly qualified by the cautionary statements contained or referred to herein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or its businesses or operations. Readers are cautioned not to rely too heavily on the forward-looking statements contained in this presentation. Forward-looking statements speak only as of the date they are made and the Company does not undertake any obligation to update, revise or clarify these forward-looking statements, whether as a result of new information, future events or otherwise. |

| Additional Information 3 Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP disclosures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. Please see “Reconciliation of Non-GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (Nasdaq: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank has 129 branches and approximately 150 ATMs located throughout Virginia, and in portions of Maryland and North Carolina. Certain non-bank financial services affiliates of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Old Dominion Capital Management, Inc., and its subsidiary, Outfitter Advisors, Ltd., and Dixon, Hubard, Feinour, & Brown, Inc., which provide investment advisory services; Atlantic Union Financial Consultants, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. Effective March 1, 2021, Middleburg Financial, the Bank’s wealth management division was rebranded to Atlantic Union Bank Wealth Management, and Middleburg Investment Services, LLC changed its name to Atlantic Union Financial Consultants, LLC. |

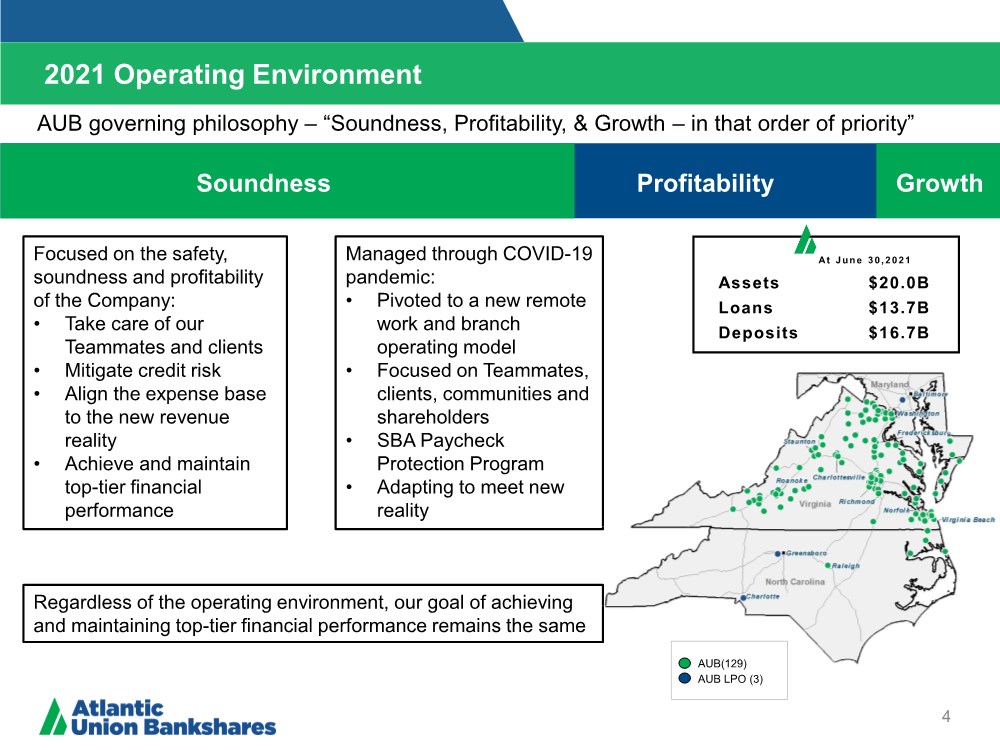

| 2021 Operating Environment 4 Soundness Profitability Growth At June 30,2021 Assets $20.0B Loans $13.7B Deposits $16.7B Managed through COVID-19 pandemic: • Pivoted to a new remote work and branch operating model • Focused on Teammates, clients, communities and shareholders • SBA Paycheck Protection Program • Adapting to meet new reality AUB governing philosophy –“Soundness, Profitability, & Growth – in that order of priority” Focused on the safety, soundness and profitability of the Company: • Take care of our Teammates and clients • Mitigate credit risk • Align the expense base to the new revenue reality • Achieve and maintain top-tier financial performance Regardless of the operating environment, our goal of achieving and maintaining top-tier financial performance remains the same AUB(129) AUB LPO (3) |

| 2021 Operating Environment – Managing through the Pandemic 5 Soundness Profitability Growth During challenging times, it is important to remember our governing philosophy –“Soundness, Profitability, & Growth – in that order of priority” This core philosophy is serving us well as we manage the Company through the current coronavirus pandemic crisis. We continue to effectively manage through the pandemic with an intense focus on: Taking care of our Teammates and clients – they will remember how we treated them during this period. Mitigating credit risk – batten down the hatches and protect the Bank by working with our business and consumer clients to assist them through these tough times. Aligning the expense base to the lower for longer interest rate environment – ensure sustained top tier financial performance on the other side. We believe that by effectively managing through this crisis, we have become a stronger, more agile company that is well positioned to take advantage of growth opportunities as economic activity normalizes. |

| Core Values Refined 6 CARING Working together toward common goals, acting with kindness, respect and a genuine concern for others. COURAGEOUS Speaking openly, honestly and accepting our challenges and mistakes as opportunities to learn and grow. COMMITTED Driven to help our clients, Teammates and company succeed, doing what is right and accountable for our actions. Diversity Equity Inclusion Statement Atlantic Union Bank embraces diversity of thought and identity to better serve our stakeholders and achieve our purpose. We commit to cultivating a welcoming workplace where Teammate and customer perspectives are valued and respected. Culture How we come together and interact as a team to accomplish our business and societal goals. |

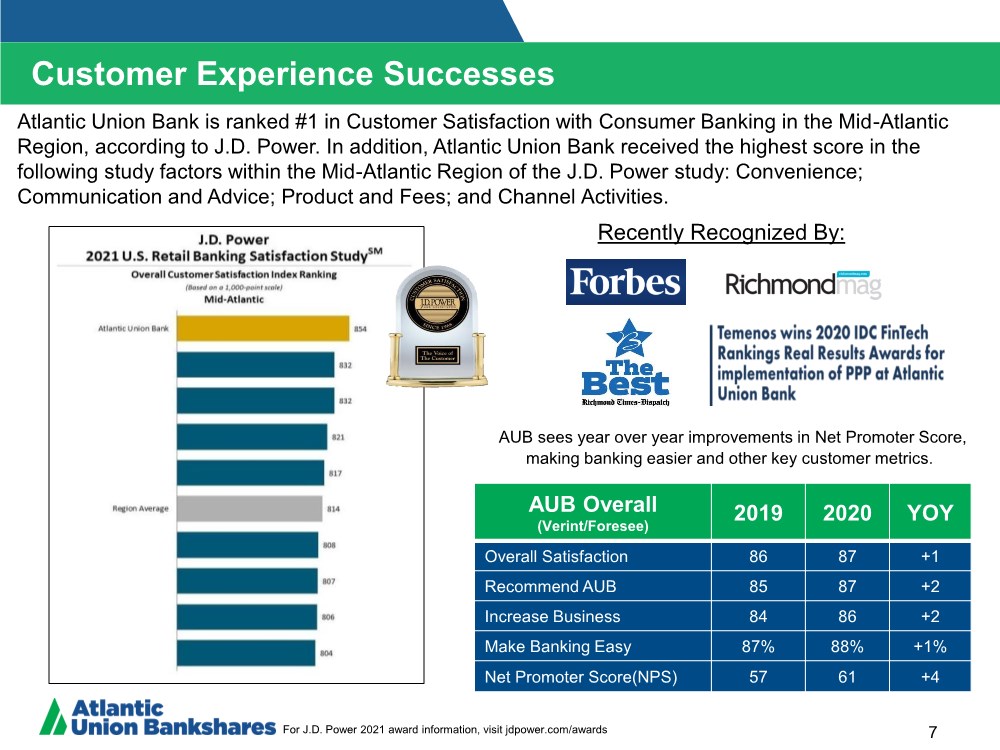

| Customer Experience Successes 7 AUB Overall (Verint/Foresee) 2019 2020 YOY Overall Satisfaction 86 87 +1 Recommend AUB 85 87 +2 Increase Business 84 86 +2 Make Banking Easy 87% 88% +1% Net Promoter Score(NPS) 57 61 +4 Atlantic Union Bank is ranked #1 in Customer Satisfaction with Consumer Banking in the Mid-Atlantic Region, according to J.D. Power. In addition, Atlantic Union Bank received the highest score in the following study factors within the Mid-Atlantic Region of the J.D. Power study: Convenience; Communication and Advice; Product and Fees; and Channel Activities. AUB sees year over year improvements in Net Promoter Score, making banking easier and other key customer metrics. Recently Recognized By: For J.D. Power 2021 award information, visit jdpower.com/awards |

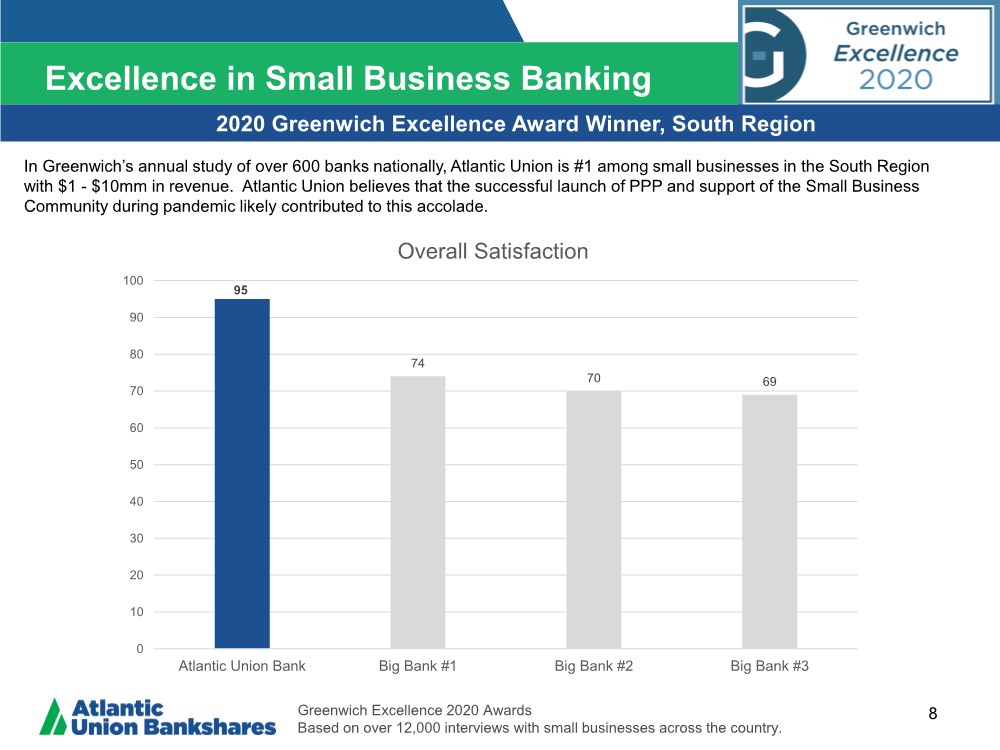

| Excellence in Small Business Banking 8 2020 Greenwich Excellence Award Winner, South Region Greenwich Excellence 2020 Awards Based on over 12,000 interviews with small businesses across the country. 95 74 70 69 0 10 20 30 40 50 60 70 80 90 100 Atlantic Union Bank Big Bank #1 Big Bank #2 Big Bank #3 Overall Satisfaction In Greenwich’s annual study of over 600 banks nationally, Atlantic Union is #1 among small businesses in the South Region with $1 - $10mm in revenue. Atlantic Union believes that the successful launch of PPP and support of the Small Business Community during pandemic likely contributed to this accolade. |

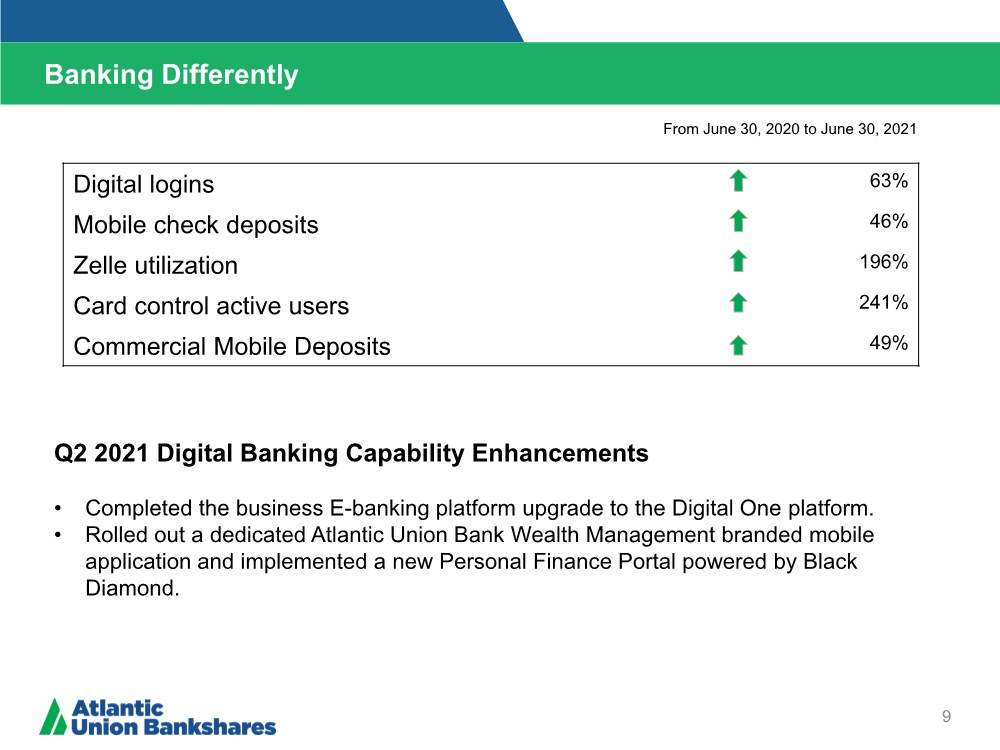

| Banking Differently 9 Digital logins 63% Mobile check deposits 46% Zelle utilization 196% Card control active users 241% Commercial Mobile Deposits 49% Q2 2021 Digital Banking Capability Enhancements • Completed the business E-banking platform upgrade to the Digital One platform. • Rolled out a dedicated Atlantic Union Bank Wealth Management branded mobile application and implemented a new Personal Finance Portal powered by Black Diamond. From June 30, 2020 to June 30, 2021 |

| 2021 Operating Environment – Managing through the Pandemic 10 Soundness Profitability Growth During challenging times, it is important to remember our governing philosophy –“Soundness, Profitability, & Growth – in that order of priority” This core philosophy is serving us well as we manage the Company through the current coronavirus pandemic crisis. We continue to effectively manage through the pandemic with an intense focus on: Taking care of our Teammates and clients – they will remember how we treated them during this period. Mitigating credit risk – batten down the hatches and protect the Bank by working with our business and consumer clients to assist them through these tough times. Aligning the expense base to the lower for longer interest rate environment – ensure sustained top tier financial performance on the other side. We believe that by effectively managing through this crisis, we have become a stronger, more agile company that is well positioned to take advantage of growth opportunities as economic activity normalizes. |

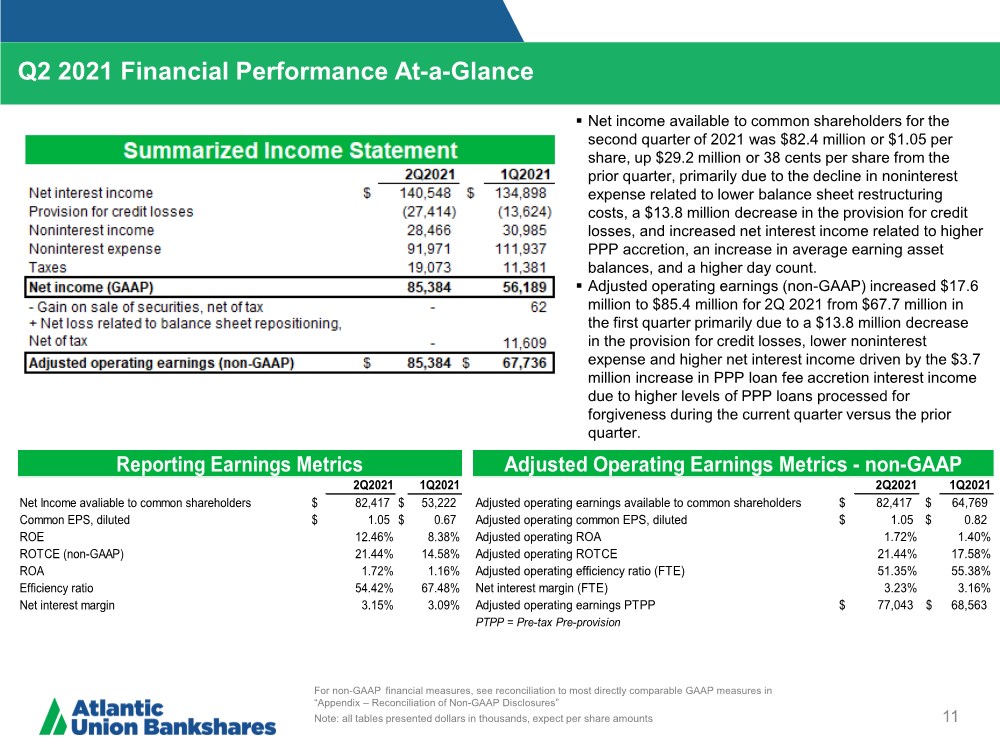

| Q2 2021 Financial Performance At-a-Glance 11 For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Note: all tables presented dollars in thousands, expect per share amounts .. Net income available to common shareholders for the second quarter of 2021 was $82.4 million or $1.05 per share, up $29.2 million or 38 cents per share from the prior quarter, primarily due to the decline in noninterest expense related to lower balance sheet restructuring costs, a $13.8 million decrease in the provision for credit losses, and increased net interest income related to higher PPP accretion, an increase in average earning asset balances, and a higher day count. .. Adjusted operating earnings (non-GAAP) increased $17.6 million to $85.4 million for 2Q 2021 from $67.7 million in the first quarter primarily due to a $13.8 million decrease in the provision for credit losses, lower noninterest expense and higher net interest income driven by the $3.7 million increase in PPP loan fee accretion interest income due to higher levels of PPP loans processed for forgiveness during the current quarter versus the prior quarter. 2Q2021 1Q2021 Net Income avaliable to common shareholders $ 82,417 $ 53,222 Common EPS, diluted $ 1.05 $ 0.67 ROE 12.46% 8.38% ROTCE (non-GAAP) 21.44% 14.58% ROA 1.72% 1.16% Efficiency ratio 54.42% 67.48% Net interest margin 3.15% 3.09% Reporting Earnings Metrics 2Q2021 1Q2021 Adjusted operating earnings available to common shareholders $ 82,417 $ 64,769 Adjusted operating common EPS, diluted $ 1.05 $ 0.82 Adjusted operating ROA 1.72% 1.40% Adjusted operating ROTCE 21.44% 17.58% Adjusted operating efficiency ratio (FTE) 51.35% 55.38% Net interest margin (FTE) 3.23% 3.16% Adjusted operating earnings PTPP $ 77,043 $ 68,563 PTPP = Pre-tax Pre-provision Adjusted Operating Earnings Metrics - non-GAAP |

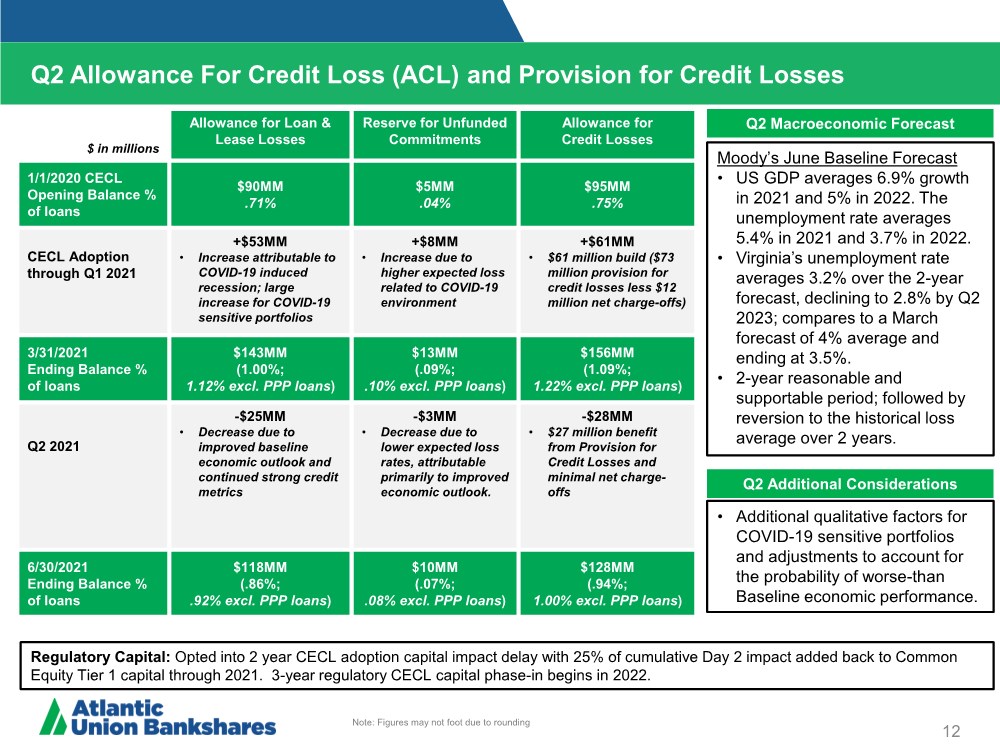

| Q2 Allowance For Credit Loss (ACL) and Provision for Credit Losses 12 Q2 Macroeconomic Forecast Q2 Additional Considerations Moody’s June Baseline Forecast • US GDP averages 6.9% growth in 2021 and 5% in 2022. The unemployment rate averages 5.4% in 2021 and 3.7% in 2022. • Virginia’s unemployment rate averages 3.2% over the 2-year forecast, declining to 2.8% by Q2 2023; compares to a March forecast of 4% average and ending at 3.5%. • 2-year reasonable and supportable period; followed by reversion to the historical loss average over 2 years. • Additional qualitative factors for COVID-19 sensitive portfolios and adjustments to account for the probability of worse-than Baseline economic performance. Regulatory Capital: Opted into 2 year CECL adoption capital impact delay with 25% of cumulative Day 2 impact added back to Common Equity Tier 1 capital through 2021. 3-year regulatory CECL capital phase-in begins in 2022. $ in millions Allowance for Loan & Lease Losses Reserve for Unfunded Commitments Allowance for Credit Losses 1/1/2020 CECL Opening Balance % of loans $90MM ..71% $5MM ..04% $95MM ..75% CECL Adoption through Q1 2021 +$53MM • Increase attributable to COVID-19 induced recession; large increase for COVID-19 sensitive portfolios +$8MM • Increase due to higher expected loss related to COVID-19 environment +$61MM • $61 million build ($73 million provision for credit losses less $12 million net charge-offs) 3/31/2021 Ending Balance % of loans $143MM (1.00%; 1.12% excl. PPP loans) $13MM (.09%; ..10% excl. PPP loans) $156MM (1.09%; 1.22% excl. PPP loans) Q2 2021 -$25MM • Decrease due to improved baseline economic outlook and continued strong credit metrics -$3MM • Decrease due to lower expected loss rates, attributable primarily to improved economic outlook. -$28MM • $27 million benefit from Provision for Credit Losses and minimal net charge- offs 6/30/2021 Ending Balance % of loans $118MM (.86%; ..92% excl. PPP loans) $10MM (.07%; ..08% excl. PPP loans) $128MM (.94%; 1.00% excl. PPP loans) Note: Figures may not foot due to rounding |

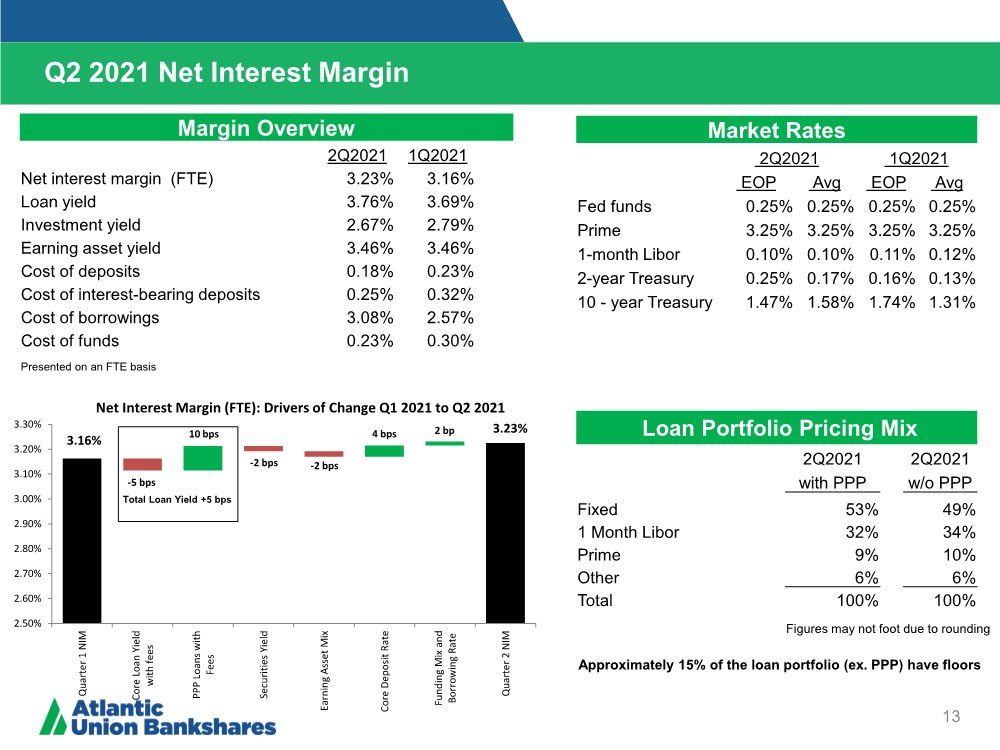

| 3.16% 3.23% 2.50% 2.60% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% Quarter 1 NIM Core Loan Yield with fees PPP Loans with Fees Securities Yield Earning Asset Mix Core Deposit Rate Funding Mix and Borrowing Rate Quarter 2 NIM Net Interest Margin (FTE): Drivers of Change Q1 2021 to Q2 2021 -5 bps 10 bps -2 bps -2 bps 3.23% 4 bps 2 bp 13 Q2 2021 Net Interest Margin Market Rates 2Q2021 1Q2021 EOP Avg EOP Avg Fed funds 0.25% 0.25% 0.25% 0.25% Prime 3.25% 3.25% 3.25% 3.25% 1-month Libor 0.10% 0.10% 0.11% 0.12% 2-year Treasury 0.25% 0.17% 0.16% 0.13% 10 - year Treasury 1.47% 1.58% 1.74% 1.31% Margin Overview 2Q2021 1Q2021 Net interest margin (FTE) 3.23% 3.16% Loan yield 3.76% 3.69% Investment yield 2.67% 2.79% Earning asset yield 3.46% 3.46% Cost of deposits 0.18% 0.23% Cost of interest-bearing deposits 0.25% 0.32% Cost of borrowings 3.08% 2.57% Cost of funds 0.23% 0.30% Presented on an FTE basis Approximately 15% of the loan portfolio (ex. PPP) have floors Loan Portfolio Pricing Mix 2Q2021 2Q2021 with PPP w/o PPP Fixed 53% 49% 1 Month Libor 32% 34% Prime 9% 10% Other 6% 6% Total 100% 100% Total Loan Yield +5 bps Figures may not foot due to rounding |

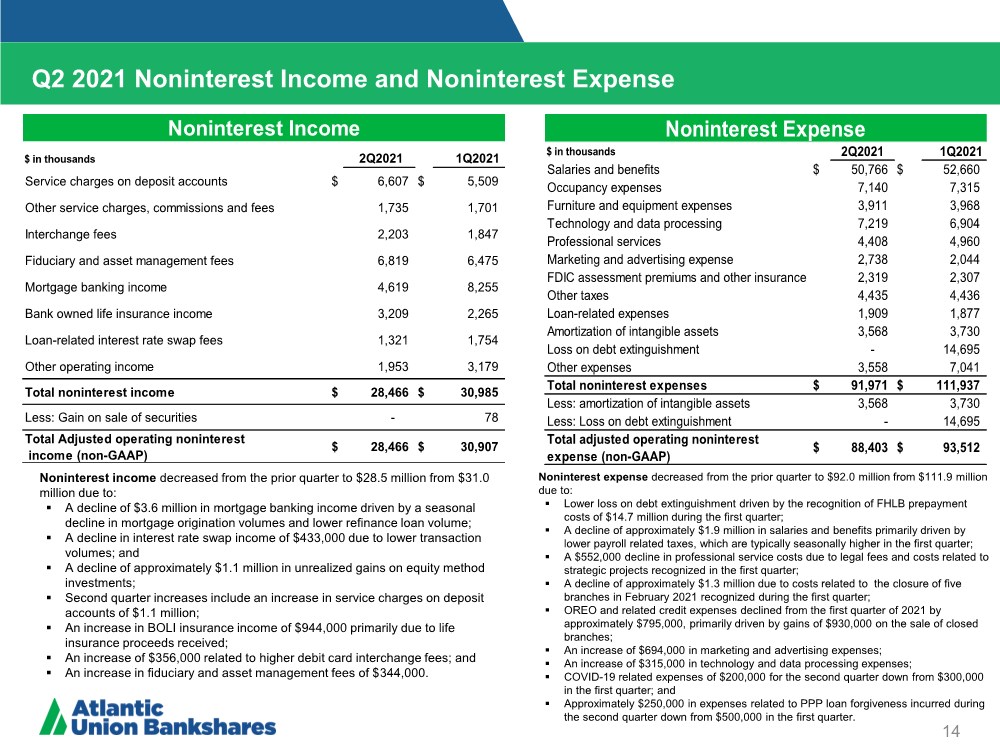

| 14 Noninterest income decreased from the prior quarter to $28.5 million from $31.0 million due to: .. A decline of $3.6 million in mortgage banking income driven by a seasonal decline in mortgage origination volumes and lower refinance loan volume; .. A decline in interest rate swap income of $433,000 due to lower transaction volumes; and .. A decline of approximately $1.1 million in unrealized gains on equity method investments; .. Second quarter increases include an increase in service charges on deposit accounts of $1.1 million; .. An increase in BOLI insurance income of $944,000 primarily due to life insurance proceeds received; .. An increase of $356,000 related to higher debit card interchange fees; and .. An increase in fiduciary and asset management fees of $344,000. Q2 2021 Noninterest Income and Noninterest Expense Noninterest expense decreased from the prior quarter to $92.0 million from $111.9 million due to: .. Lower loss on debt extinguishment driven by the recognition of FHLB prepayment costs of $14.7 million during the first quarter; .. A decline of approximately $1.9 million in salaries and benefits primarily driven by lower payroll related taxes, which are typically seasonally higher in the first quarter; .. A $552,000 decline in professional service costs due to legal fees and costs related to strategic projects recognized in the first quarter; .. A decline of approximately $1.3 million due to costs related to the closure of five branches in February 2021 recognized during the first quarter; .. OREO and related credit expenses declined from the first quarter of 2021 by approximately $795,000, primarily driven by gains of $930,000 on the sale of closed branches; .. An increase of $694,000 in marketing and advertising expenses; .. An increase of $315,000 in technology and data processing expenses; .. COVID-19 related expenses of $200,000 for the second quarter down from $300,000 in the first quarter; and .. Approximately $250,000 in expenses related to PPP loan forgiveness incurred during the second quarter down from $500,000 in the first quarter. $ in thousands 2Q2021 1Q2021 Service charges on deposit accounts $ 6,607 $ 5,509 Other service charges, commissions and fees 1,735 1,701 Interchange fees 2,203 1,847 Fiduciary and asset management fees 6,819 6,475 Mortgage banking income 4,619 8,255 Bank owned life insurance income 3,209 2,265 Loan-related interest rate swap fees 1,321 1,754 Other operating income 1,953 3,179 Total noninterest income $ 28,466 $ 30,985 Less: Gain on sale of securities - 78 Total Adjusted operating noninterest income (non-GAAP) $ 28,466 $ 30,907 Noninterest Income $ in thousands 2Q2021 1Q2021 Salaries and benefits $ 50,766 $ 52,660 Occupancy expenses 7,140 7,315 Furniture and equipment expenses 3,911 3,968 Technology and data processing 7,219 6,904 Professional services 4,408 4,960 Marketing and advertising expense 2,738 2,044 FDIC assessment premiums and other insurance 2,319 2,307 Other taxes 4,435 4,436 Loan-related expenses 1,909 1,877 Amortization of intangible assets 3,568 3,730 Loss on debt extinguishment - 14,695 Other expenses 3,558 7,041 Total noninterest expenses $ 91,971 $ 111,937 Less: amortization of intangible assets 3,568 3,730 Less: Loss on debt extinguishment - 14,695 Total adjusted operating noninterest expense (non-GAAP) $ 88,403 $ 93,512 Noninterest Expense |

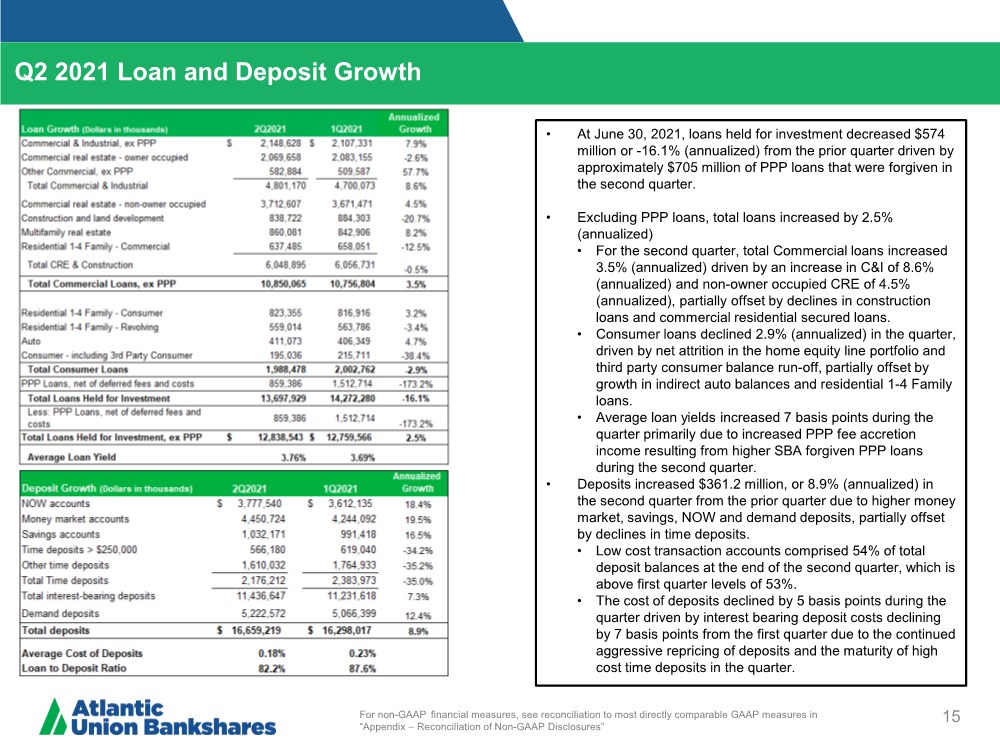

| 15 Q2 2021 Loan and Deposit Growth For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” • At June 30, 2021, loans held for investment decreased $574 million or -16.1% (annualized) from the prior quarter driven by approximately $705 million of PPP loans that were forgiven in the second quarter. • Excluding PPP loans, total loans increased by 2.5% (annualized) • For the second quarter, total Commercial loans increased 3.5% (annualized) driven by an increase in C&I of 8.6% (annualized) and non-owner occupied CRE of 4.5% (annualized), partially offset by declines in construction loans and commercial residential secured loans. • Consumer loans declined 2.9% (annualized) in the quarter, driven by net attrition in the home equity line portfolio and third party consumer balance run-off, partially offset by growth in indirect auto balances and residential 1-4 Family loans. • Average loan yields increased 7 basis points during the quarter primarily due to increased PPP fee accretion income resulting from higher SBA forgiven PPP loans during the second quarter. • Deposits increased $361.2 million, or 8.9% (annualized) in the second quarter from the prior quarter due to higher money market, savings, NOW and demand deposits, partially offset by declines in time deposits. • Low cost transaction accounts comprised 54% of total deposit balances at the end of the second quarter, which is above first quarter levels of 53%. • The cost of deposits declined by 5 basis points during the quarter driven by interest bearing deposit costs declining by 7 basis points from the first quarter due to the continued aggressive repricing of deposits and the maturity of high cost time deposits in the quarter. |

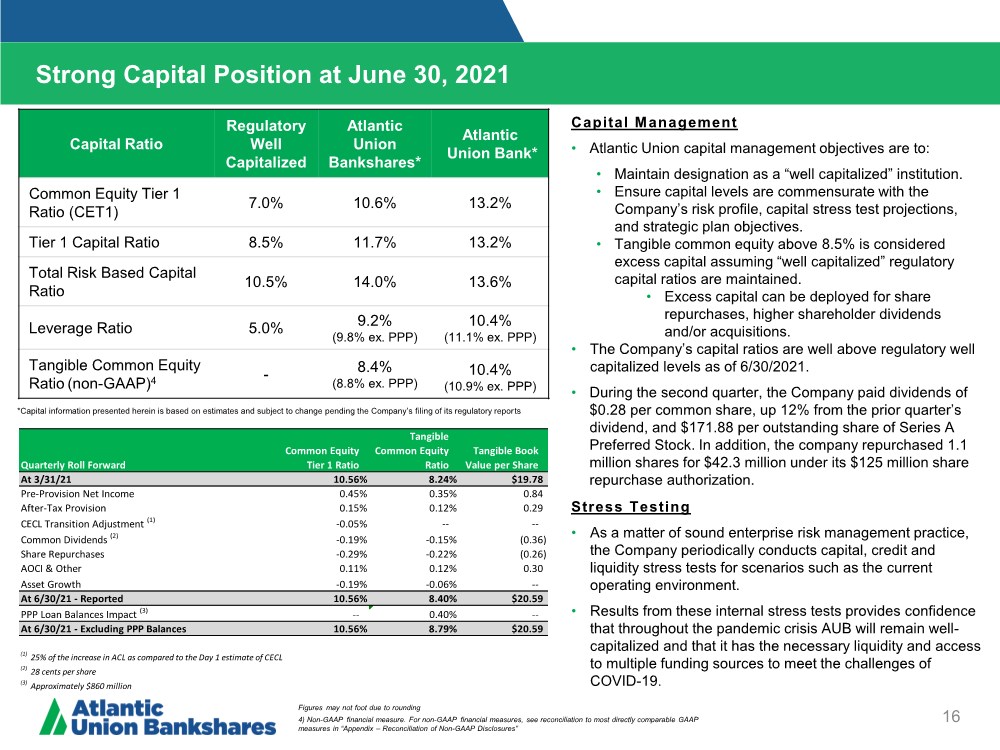

| Strong Capital Position at June 30, 2021 16 Capital Ratio Regulatory Well Capitalized Atlantic Union Bankshares* Atlantic Union Bank* Common Equity Tier 1 Ratio (CET1) 7.0% 10.6% 13.2% Tier 1 Capital Ratio 8.5% 11.7% 13.2% Total Risk Based Capital Ratio 10.5% 14.0% 13.6% Leverage Ratio 5.0% 9.2% (9.8% ex. PPP) 10.4% (11.1% ex. PPP) Tangible Common Equity Ratio (non-GAAP)4 - 8.4% (8.8% ex. PPP) 10.4% (10.9% ex. PPP) *Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulatory reports Stress Testing • As a matter of sound enterprise risk management practice, the Company periodically conducts capital, credit and liquidity stress tests for scenarios such as the current operating environment. • Results from these internal stress tests provides confidence that throughout the pandemic crisis AUB will remain well- capitalized and that it has the necessary liquidity and access to multiple funding sources to meet the challenges of COVID-19. Capital Management • Atlantic Union capital management objectives are to: • Maintain designation as a “well capitalized” institution. • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives. • Tangible common equity above 8.5% is considered excess capital assuming “well capitalized” regulatory capital ratios are maintained. • Excess capital can be deployed for share repurchases, higher shareholder dividends and/or acquisitions. • The Company’s capital ratios are well above regulatory well capitalized levels as of 6/30/2021. • During the second quarter, the Company paid dividends of $0.28 per common share, up 12% from the prior quarter’s dividend, and $171.88 per outstanding share of Series A Preferred Stock. In addition, the company repurchased 1.1 million shares for $42.3 million under its $125 million share repurchase authorization. Figures may not foot due to rounding 4) Non-GAAP financial measure. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Quarterly Roll Forward Common Equity Tier 1 Ratio Tangible Common Equity Ratio Tangible Book Value per Share At 3/31/21 10.56% 8.24% $19.78 Pre-Provision Net Income 0.45% 0.35% 0.84 After-Tax Provision 0.15% 0.12% 0.29 CECL Transition Adjustment (1) -0.05% -- -- Common Dividends (2) -0.19% -0.15% (0.36) Share Repurchases -0.29% -0.22% (0.26) AOCI & Other 0.11% 0.12% 0.30 Asset Growth -0.19% -0.06% -- At 6/30/21 - Reported 10.56% 8.40% $20.59 PPP Loan Balances Impact (3) -- 0.40% -- At 6/30/21 - Excluding PPP Balances 10.56% 8.79% $20.59 (1) 25% of the increase in ACL as compared to the Day 1 estimate of CECL (2) 28 cents per share (3) Approximately $860 million |

| Appendix |

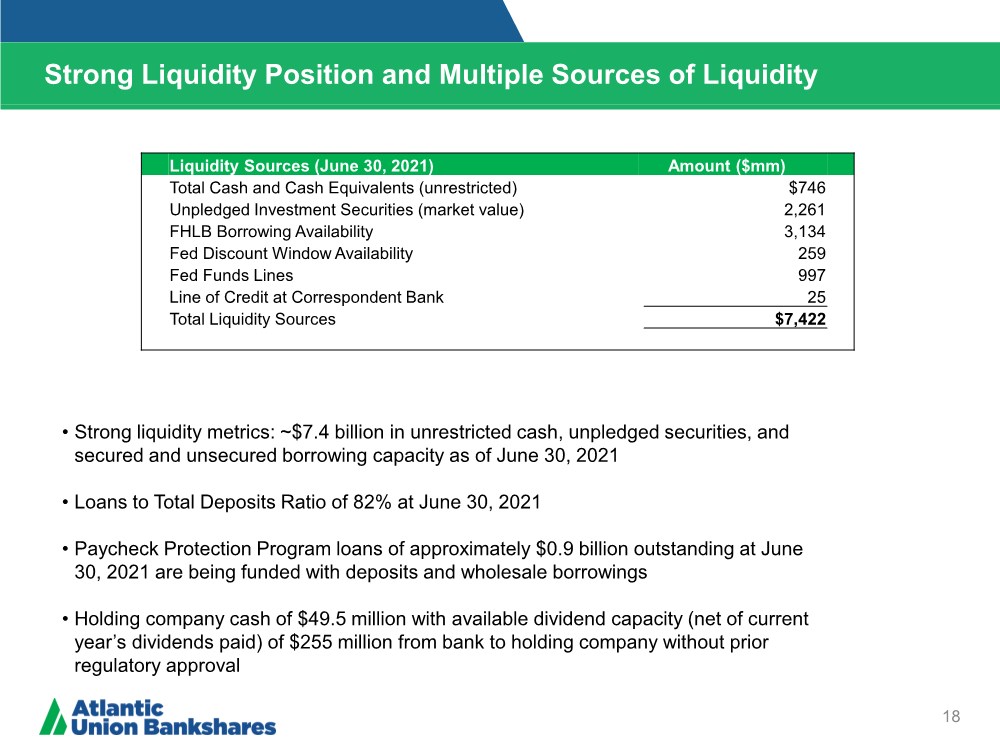

| Strong Liquidity Position and Multiple Sources of Liquidity 18 • Strong liquidity metrics: ~$7.4 billion in unrestricted cash, unpledged securities, and secured and unsecured borrowing capacity as of June 30, 2021 • Loans to Total Deposits Ratio of 82% at June 30, 2021 • Paycheck Protection Program loans of approximately $0.9 billion outstanding at June 30, 2021 are being funded with deposits and wholesale borrowings • Holding company cash of $49.5 million with available dividend capacity (net of current year’s dividends paid) of $255 million from bank to holding company without prior regulatory approval Liquidity Sources (June 30, 2021) Amount ($mm) Total Cash and Cash Equivalents (unrestricted) $746 Unpledged Investment Securities (market value) 2,261 FHLB Borrowing Availability 3,134 Fed Discount Window Availability 259 Fed Funds Lines 997 Line of Credit at Correspondent Bank 25 Total Liquidity Sources $7,422 |

| Reconciliation of Non-GAAP Disclosures 19 Operating Earnings Per Share The Company has provided supplemental performance measures on a tax-equivalent, tangible, operating, adjusted, or pre-tax pre-provision basis. These non-GAAP financial measures are supplements to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. |

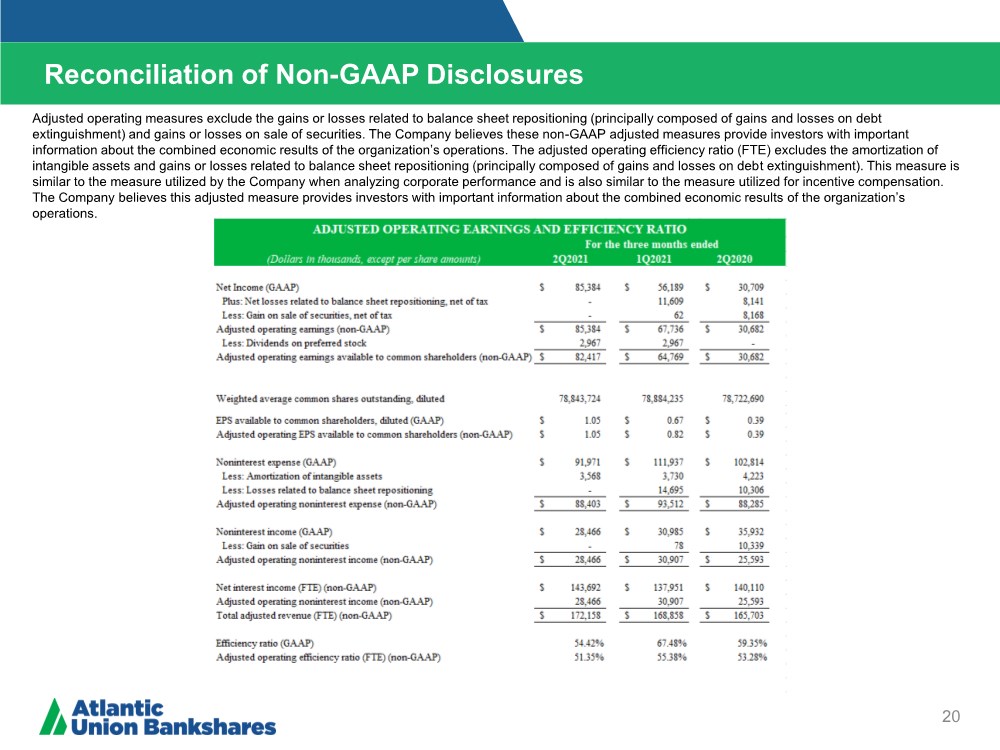

| Reconciliation of Non-GAAP Disclosures 20 Operating Earnings Per Share Adjusted operating measures exclude the gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment) and gains or losses on sale of securities. The Company believes these non-GAAP adjusted measures provide investors with important information about the combined economic results of the organization’s operations. The adjusted operating efficiency ratio (FTE) excludes the amortization of intangible assets and gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment). This measure is similar to the measure utilized by the Company when analyzing corporate performance and is also similar to the measure utilized for incentive compensation. The Company believes this adjusted measure provides investors with important information about the combined economic results of the organization’s operations. |

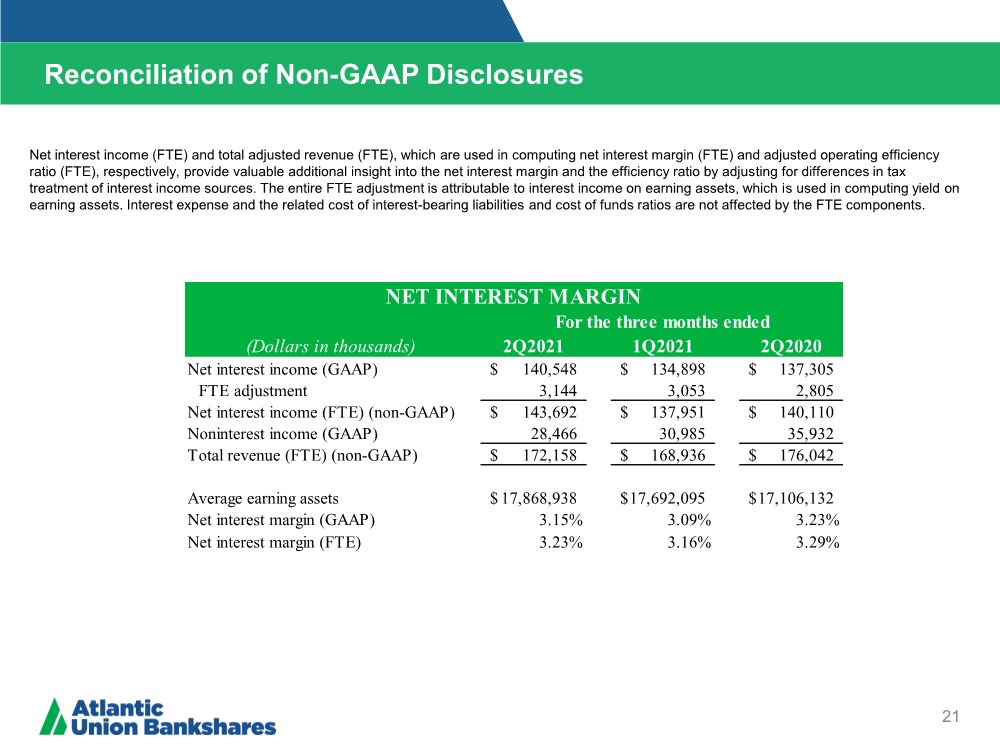

| Reconciliation of Non-GAAP Disclosures 21 Operating Earnings Per Share Net interest income (FTE) and total adjusted revenue (FTE), which are used in computing net interest margin (FTE) and adjusted operating efficiency ratio (FTE), respectively, provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. (Dollars in thousands) 2Q2021 1Q2021 2Q2020 Net interest income (GAAP) 140,548 $ 134,898 $ 137,305 $ FTE adjustment 3,144 3,053 2,805 Net interest income (FTE) (non-GAAP) 143,692 $ 137,951 $ 140,110 $ Noninterest income (GAAP) 28,466 30,985 35,932 Total revenue (FTE) (non-GAAP) 172,158 $ 168,936 $ 176,042 $ Average earning assets 17,868,938 $ 17,692,095 $ 17,106,132 $ Net interest margin (GAAP) 3.15% 3.09% 3.23% Net interest margin (FTE) 3.23% 3.16% 3.29% NET INTEREST MARGIN For the three months ended |

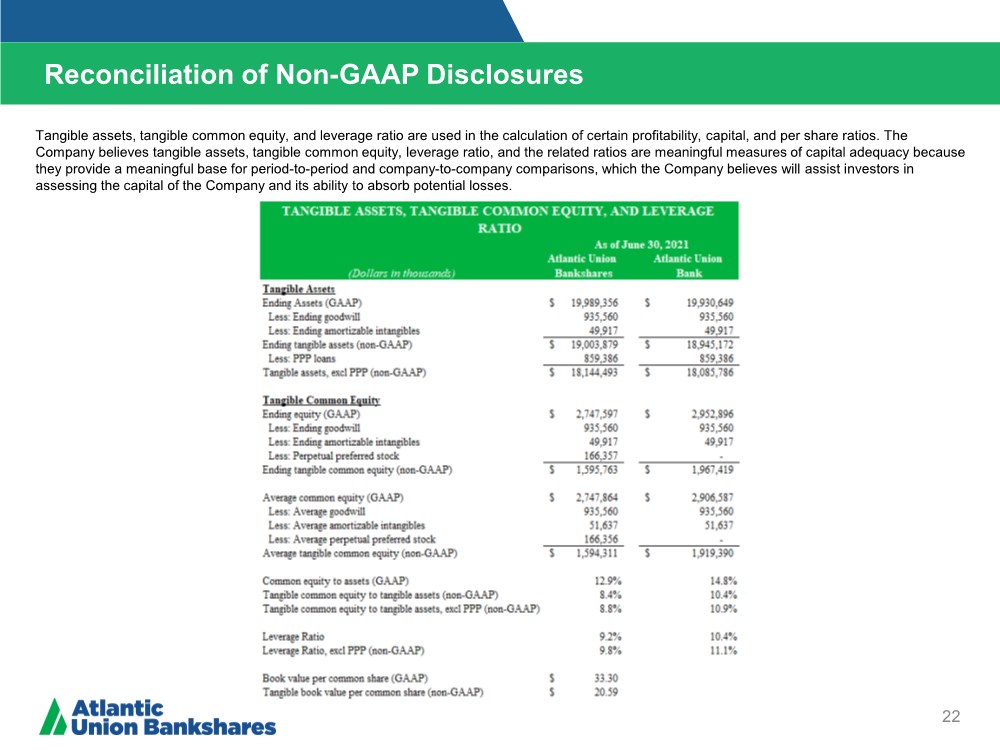

| Reconciliation of Non-GAAP Disclosures 22 Tangible assets, tangible common equity, and leverage ratio are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity, leverage ratio, and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. |

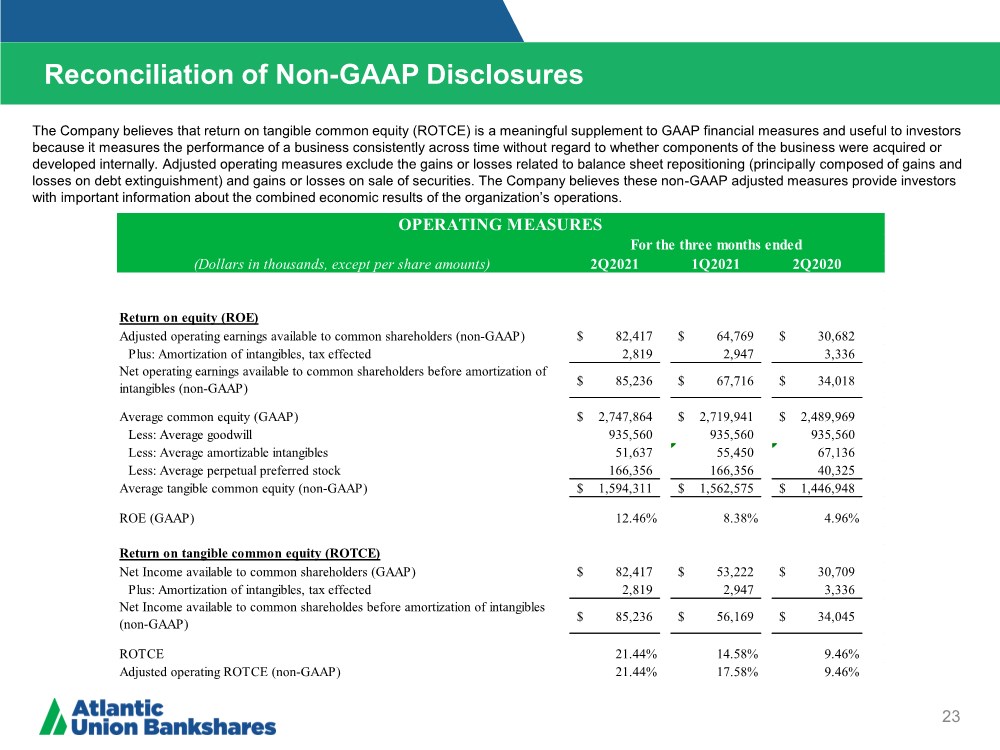

| Reconciliation of Non-GAAP Disclosures 23 Operating Earnings Per Share The Company believes that return on tangible common equity (ROTCE) is a meaningful supplement to GAAP financial measures and useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. Adjusted operating measures exclude the gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment) and gains or losses on sale of securities. The Company believes these non-GAAP adjusted measures provide investors with important information about the combined economic results of the organization’s operations. (Dollars in thousands, except per share amounts) 2Q2021 1Q2021 2Q2020 Return on equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) 82,417 $ 64,769 $ 30,682 $ Plus: Amortization of intangibles, tax effected 2,819 2,947 3,336 Net operating earnings available to common shareholders before amortization of intangibles (non-GAAP) 85,236 $ 67,716 $ 34,018 $ Average common equity (GAAP) 2,747,864 $ 2,719,941 $ 2,489,969 $ Less: Average goodwill 935,560 935,560 935,560 Less: Average amortizable intangibles 51,637 55,450 67,136 Less: Average perpetual preferred stock 166,356 166,356 40,325 Average tangible common equity (non-GAAP) 1,594,311 $ 1,562,575 $ 1,446,948 $ ROE (GAAP) 12.46% 8.38% 4.96% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) 82,417 $ 53,222 $ 30,709 $ Plus: Amortization of intangibles, tax effected 2,819 2,947 3,336 Net Income available to common shareholdes before amortization of intangibles (non-GAAP) 85,236 $ 56,169 $ 34,045 $ ROTCE 21.44% 14.58% 9.46% Adjusted operating ROTCE (non-GAAP) 21.44% 17.58% 9.46% OPERATING MEASURES For the three months ended |

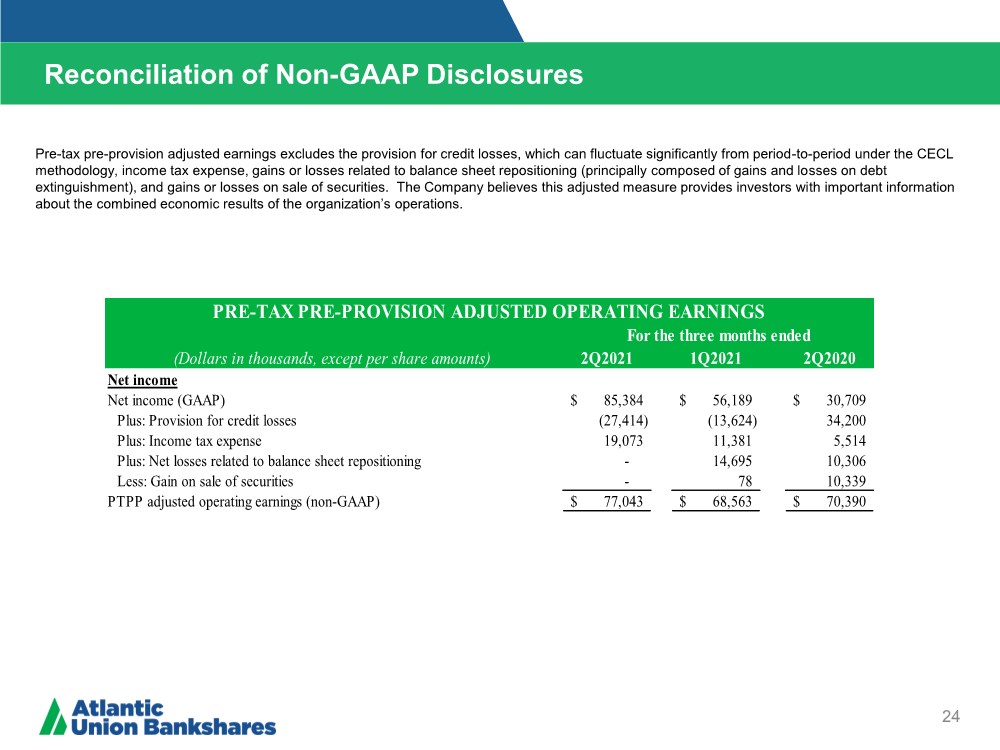

| Reconciliation of Non-GAAP Disclosures 24 Operating Earnings Per Share Pre-tax pre-provision adjusted earnings excludes the provision for credit losses, which can fluctuate significantly from period-to-period under the CECL methodology, income tax expense, gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment), and gains or losses on sale of securities. The Company believes this adjusted measure provides investors with important information about the combined economic results of the organization’s operations. (Dollars in thousands, except per share amounts) 2Q2021 1Q2021 2Q2020 Net income Net income (GAAP) 85,384 $ 56,189 $ 30,709 $ Plus: Provision for credit losses (27,414) (13,624) 34,200 Plus: Income tax expense 19,073 11,381 5,514 Plus: Net losses related to balance sheet repositioning - 14,695 10,306 Less: Gain on sale of securities - 78 10,339 PTPP adjusted operating earnings (non-GAAP) 77,043 $ 68,563 $ 70,390 $ PRE-TAX PRE-PROVISION ADJUSTED OPERATING EARNINGS For the three months ended |

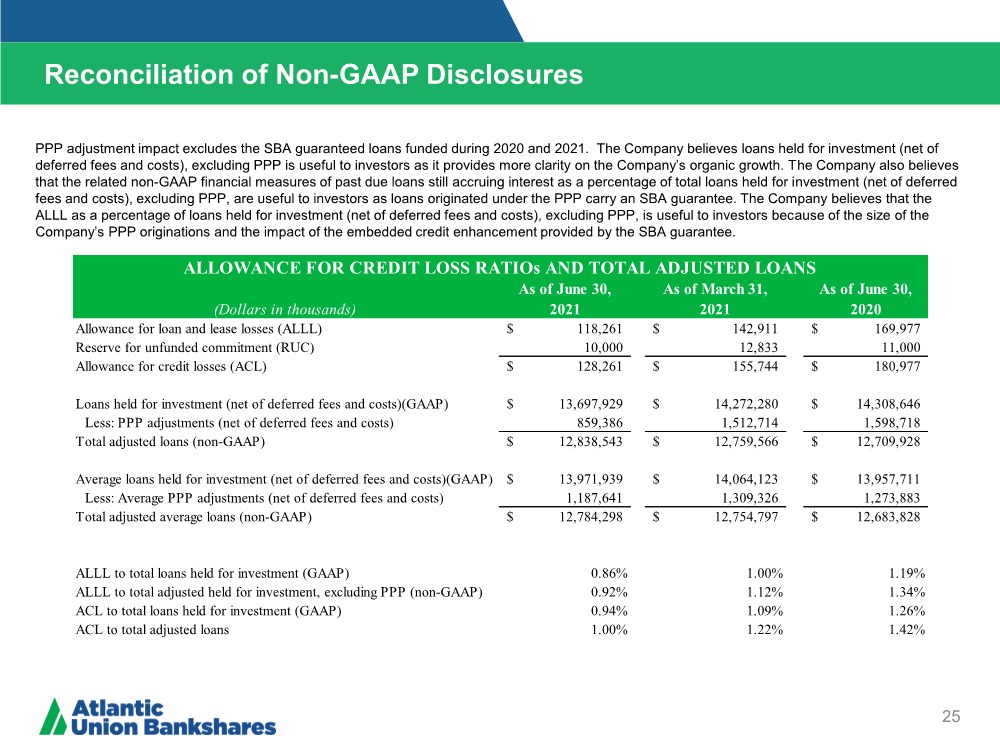

| Reconciliation of Non-GAAP Disclosures 25 ($ IN THOUSANDS) Operating Earnings Per Share PPP adjustment impact excludes the SBA guaranteed loans funded during 2020 and 2021. The Company believes loans held for investment (net of deferred fees and costs), excluding PPP is useful to investors as it provides more clarity on the Company’s organic growth. The Company also believes that the related non-GAAP financial measures of past due loans still accruing interest as a percentage of total loans held for investment (net of deferred fees and costs), excluding PPP, are useful to investors as loans originated under the PPP carry an SBA guarantee. The Company believes that the ALLL as a percentage of loans held for investment (net of deferred fees and costs), excluding PPP, is useful to investors because of the size of the Company’s PPP originations and the impact of the embedded credit enhancement provided by the SBA guarantee. (Dollars in thousands) As of June 30, 2021 As of March 31, 2021 As of June 30, 2020 Allowance for loan and lease losses (ALLL) 118,261 $ 142,911 $ 169,977 $ Reserve for unfunded commitment (RUC) 10,000 12,833 11,000 Allowance for credit losses (ACL) 128,261 $ 155,744 $ 180,977 $ Loans held for investment (net of deferred fees and costs)(GAAP) 13,697,929 $ 14,272,280 $ 14,308,646 $ Less: PPP adjustments (net of deferred fees and costs) 859,386 1,512,714 1,598,718 Total adjusted loans (non-GAAP) 12,838,543 $ 12,759,566 $ 12,709,928 $ Average loans held for investment (net of deferred fees and costs)(GAAP) 13,971,939 $ 14,064,123 $ 13,957,711 $ Less: Average PPP adjustments (net of deferred fees and costs) 1,187,641 1,309,326 1,273,883 Total adjusted average loans (non-GAAP) 12,784,298 $ 12,754,797 $ 12,683,828 $ ALLL to total loans held for investment (GAAP) 0.86% 1.00% 1.19% ALLL to total adjusted held for investment, excluding PPP (non-GAAP) 0.92% 1.12% 1.34% ACL to total loans held for investment (GAAP) 0.94% 1.09% 1.26% ACL to total adjusted loans 1.00% 1.22% 1.42% ALLOWANCE FOR CREDIT LOSS RATIOs AND TOTAL ADJUSTED LOANS |