| 4th Quarter and FY2020 Earnings Presentation Nasdaq: AUB January 26, 2021 |

| Forward Looking Statements 2 Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include, without limitation, projections, predictions, expectations or beliefs about future events or results that are not statements of historical fact. Such forward-looking statements are based on various assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other factors, some of which cannot be predicted or quantified, that may cause actual results, performance or achievements to be materially different from those expressed or implied by such forward- looking statements. Forward-looking statements are often accompanied by words that convey projected future events or outcomes such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other statements concerning opinions or judgment of Atlantic Union Bankshares Corporation (“Atlantic Union” or the “Company”) and its management about future events. Although Atlantic Union believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of, or trends affecting, the Company will not differ materially from any projected future results, performance, or achievements or trends expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to: changes in interest rates; general economic and financial market conditions in the United States generally and particularly in the markets in which the Company operates and which its loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels and slowdowns in economic growth, including as a result of COVID- 19; the quality or composition of the loan or investment portfolios and changes therein; demand for loan products and financial services in the Company’s market area; the Company’s ability to manage its growth or implement its growth strategy; the effectiveness of expense reduction plans; the introduction of new lines of business or new products and services; the Company’s ability to recruit and retain key employees; the incremental cost and/or decreased revenues associated with exceeding $10 billion in assets; real estate values in the Bank’s lending area; an insufficient ACL; changes in accounting principles relating to loan loss recognition (CECL); the Company’s liquidity and capital positions; concentrations of loans secured by real estate, particularly commercial real estate; the effectiveness of the Company’s credit processes and management of the Company’s credit risk; the Company’s ability to compete in the market for financial services and increased competition relating to fintech; technological risks and developments, and cyber threats, attacks, or events; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts or public health events (such as COVID-19), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third- party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; the effect of steps the Company takes in response to COVID-19, the severity and duration of the pandemic, the speed and efficacy of vaccine and treatment developments, the impact of loosening or tightening of government restrictions, the pace of recovery when the pandemic subsides and the heightened impact it has on many of the risks described herein; performance by the Company’s counterparties or vendors; deposit flows; the availability of financing and the terms thereof; the level of prepayments on loans and mortgage-backed securities; legislative or regulatory changes and requirements, including the impact of the CARES Act, as amended by the CAA, and other legislative and regulatory reactions to COVID-19; potential claims, damages, and fines related to litigation or government actions, including litigation or actions arising from the Company’s participation in and administration of programs related to COVID-19, including, among other things, the CARES Act, as amended by the CAA; the effects of changes in federal, state or local tax laws and regulations; monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of the Treasury and the Federal Reserve; changes to applicable accounting principles and guidelines; and other factors, many of which are beyond the control of the Company. Please refer to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, comparable “Risk Factors” sections of the Company’s Quarterly Reports on Form 10-Q, and related disclosures in other filings, which have been filed with the Securities and Exchange Commission (the “SEC”), and are available on the SEC’s website at www.sec.gov. All of the forward-looking statements made in this presentation are expressly qualified by the cautionary statements contained or referred to herein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or its businesses or operations. You are cautioned not to rely too heavily on the forward-looking statements contained in this presentation. Forward-looking statements speak only as of the date they are made and the Company does not undertake any obligation to update, revise or clarify these forward-looking statements, whether as a result of new information, future events or otherwise. |

| Additional Information 3 Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP disclosures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. Please see “Reconciliation of Non-GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (Nasdaq: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank has 134 branches and approximately 155 ATMs located throughout Virginia, and in portions of Maryland and North Carolina. Middleburg Financial is a brand name used by Atlantic Union Bank and certain affiliates when providing trust, wealth management, private banking, and investment advisory products and services. Certain non-bank affiliates of Atlantic Union Bank include: Old Dominion Capital Management, Inc., and its subsidiary, Outfitter Advisors, Ltd., and Dixon, Hubard, Feinour, & Brown, Inc., which provide investment advisory services; Middleburg Investment Services, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. |

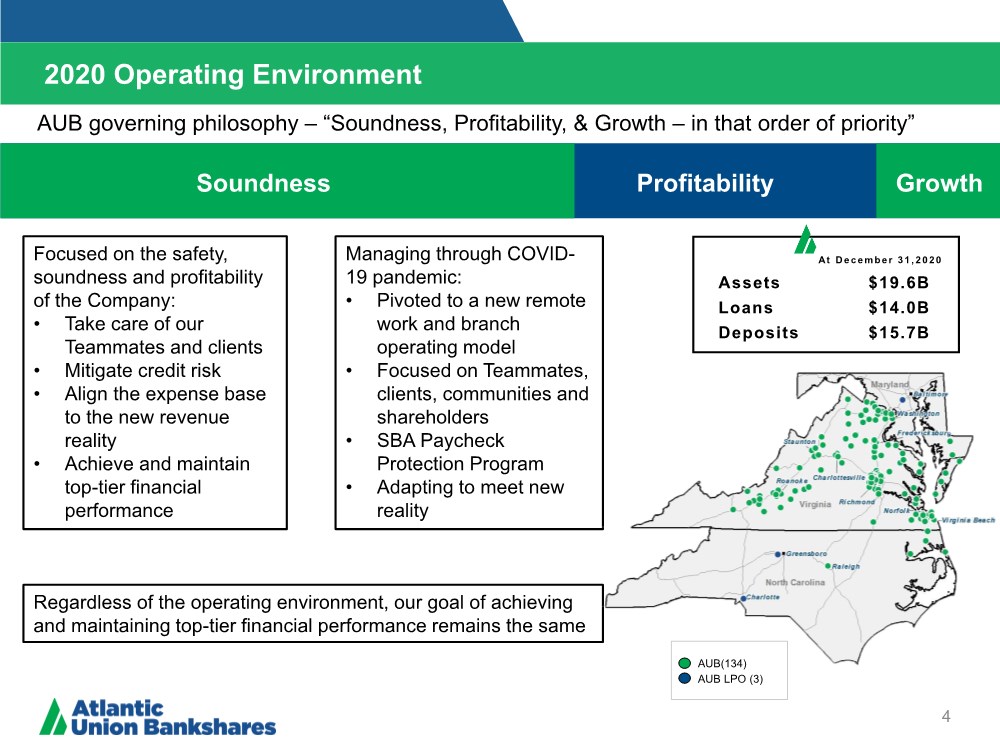

| 2020 Operating Environment 4 Soundness Profitability Growth At December 31,2020 Assets $19.6B Loans $14.0B Deposits $15.7B Managing through COVID- 19 pandemic: • Pivoted to a new remote work and branch operating model • Focused on Teammates, clients, communities and shareholders • SBA Paycheck Protection Program • Adapting to meet new reality AUB governing philosophy –“Soundness, Profitability, & Growth – in that order of priority” Focused on the safety, soundness and profitability of the Company: • Take care of our Teammates and clients • Mitigate credit risk • Align the expense base to the new revenue reality • Achieve and maintain top-tier financial performance Regardless of the operating environment, our goal of achieving and maintaining top-tier financial performance remains the same AUB(134) AUB LPO (3) |

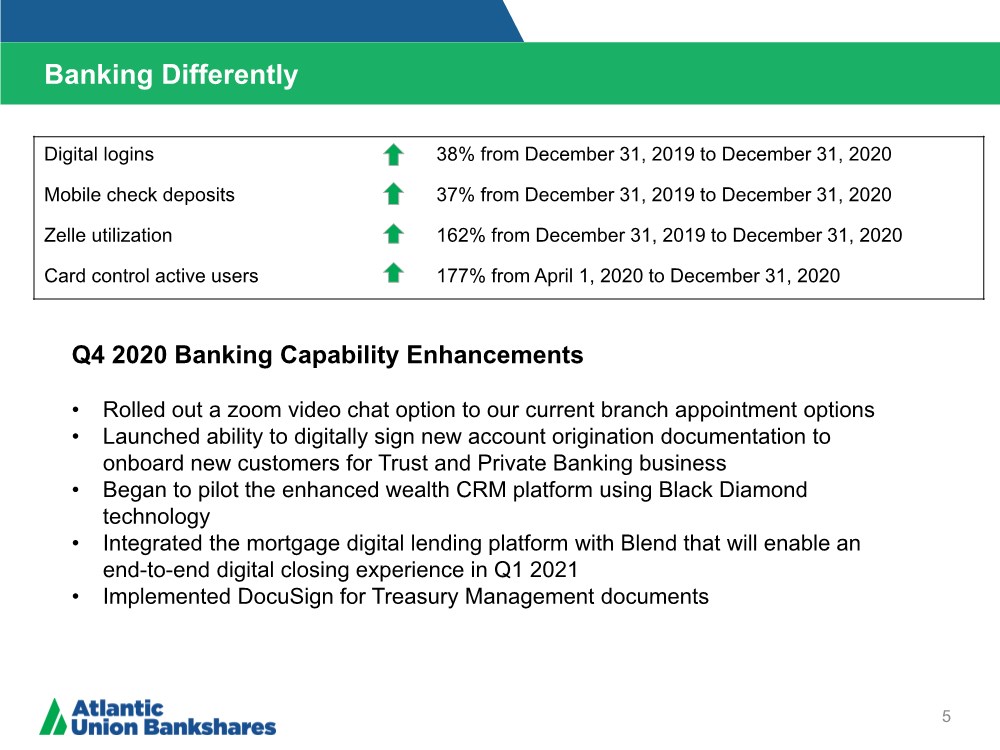

| Banking Differently 5 Digital logins 38% from December 31, 2019 to December 31, 2020 Mobile check deposits 37% from December 31, 2019 to December 31, 2020 Zelle utilization 162% from December 31, 2019 to December 31, 2020 Card control active users 177% from April 1, 2020 to December 31, 2020 Q4 2020 Banking Capability Enhancements • Rolled out a zoom video chat option to our current branch appointment options • Launched ability to digitally sign new account origination documentation to onboard new customers for Trust and Private Banking business • Began to pilot the enhanced wealth CRM platform using Black Diamond technology • Integrated the mortgage digital lending platform with Blend that will enable an end-to-end digital closing experience in Q1 2021 • Implemented DocuSign for Treasury Management documents |

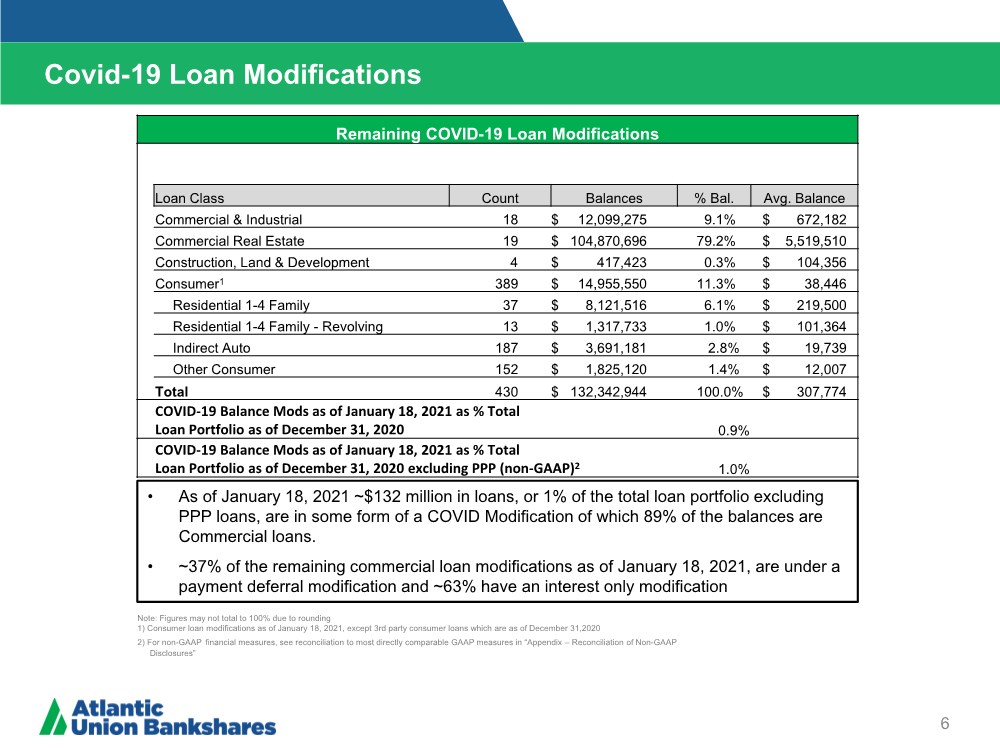

| Covid-19 Loan Modifications 6 • As of January 18, 2021 ~$132 million in loans, or 1% of the total loan portfolio excluding PPP loans, are in some form of a COVID Modification of which 89% of the balances are Commercial loans. • ~37% of the remaining commercial loan modifications as of January 18, 2021, are under a payment deferral modification and ~63% have an interest only modification Note: Figures may not total to 100% due to rounding 1) Consumer loan modifications as of January 18, 2021, except 3rd party consumer loans which are as of December 31,2020 2) For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Remaining COVID-19 Loan Modifications Loan Class Count Balances % Bal. Avg. Balance Commercial & Industrial 18 $ 12,099,275 9.1% $ 672,182 Commercial Real Estate 19 $ 104,870,696 79.2% $ 5,519,510 Construction, Land & Development 4 $ 417,423 0.3% $ 104,356 Consumer1 389 $ 14,955,550 11.3% $ 38,446 Residential 1-4 Family 37 $ 8,121,516 6.1% $ 219,500 Residential 1-4 Family - Revolving 13 $ 1,317,733 1.0% $ 101,364 Indirect Auto 187 $ 3,691,181 2.8% $ 19,739 Other Consumer 152 $ 1,825,120 1.4% $ 12,007 Total 430 $ 132,342,944 100.0% $ 307,774 COVID-19 Balance Mods as of January 18, 2021 as % Total Loan Portfolio as of December 31, 2020 0.9% COVID-19 Balance Mods as of January 18, 2021 as % Total Loan Portfolio as of December 31, 2020 excluding PPP (non-GAAP)2 1.0% |

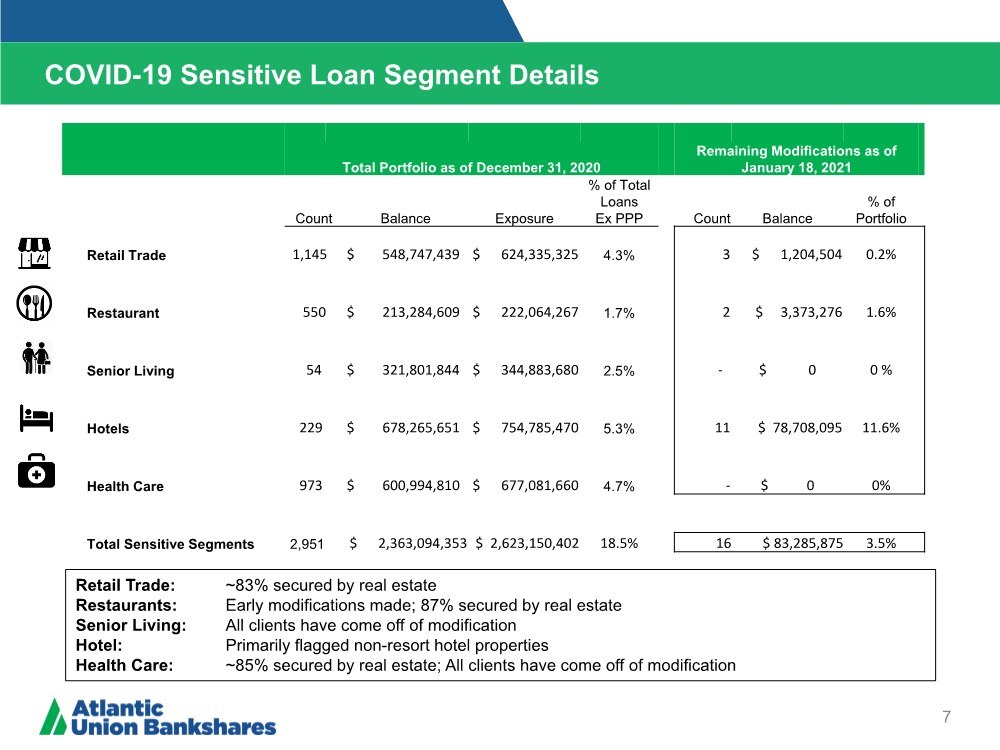

| COVID-19 Sensitive Loan Segment Details 7 Total Portfolio as of December 31, 2020 Remaining Modifications as of January 18, 2021 Count Balance Exposure % of Total Loans Ex PPP Count Balance % of Portfolio Retail Trade 1,145 $ 548,747,439 $ 624,335,325 4.3% 3 $ 1,204,504 0.2% Restaurant 550 $ 213,284,609 $ 222,064,267 1.7% 2 $ 3,373,276 1.6% Senior Living 54 $ 321,801,844 $ 344,883,680 2.5% - $ 0 0 % Hotels 229 $ 678,265,651 $ 754,785,470 5.3% 11 $ 78,708,095 11.6% Health Care 973 $ 600,994,810 $ 677,081,660 4.7% - $ 0 0% Total Sensitive Segments 2,951 $ 2,363,094,353 $ 2,623,150,402 18.5% 16 $ 83,285,875 3.5% Retail Trade: ~83% secured by real estate Restaurants: Early modifications made; 87% secured by real estate Senior Living: All clients have come off of modification Hotel: Primarily flagged non-resort hotel properties Health Care: ~85% secured by real estate; All clients have come off of modification |

| 2020 Operating Environment – Adapting to the New Reality 8 Soundness Profitability Growth During challenging times, it is important to remember our governing philosophy –“Soundness, Profitability, & Growth – in that order of priority” We believe this core philosophy is serving us well as we manage the Company through the COVID- 19 pandemic crisis We are managing through an unprecedented crisis that requires intense focus on the safety, soundness and profitability of the Company at this time. Growth is not our main focus. What we are doing now is: Taking care of our Teammates and clients – they will remember how we treated them during this period Mitigating credit risk – We are focused on battening down the hatches and protecting the Bank working with our business and consumer clients to assist them through these tough times Aligning the expense base to the new revenue reality – We aim to ensure sustained top tier financial performance once the pandemic subsides We believe that by effectively managing through this crisis, we will become a stronger company that is well positioned to take advantage of growth opportunities as economic activity resumes aided by government support and stimulus |

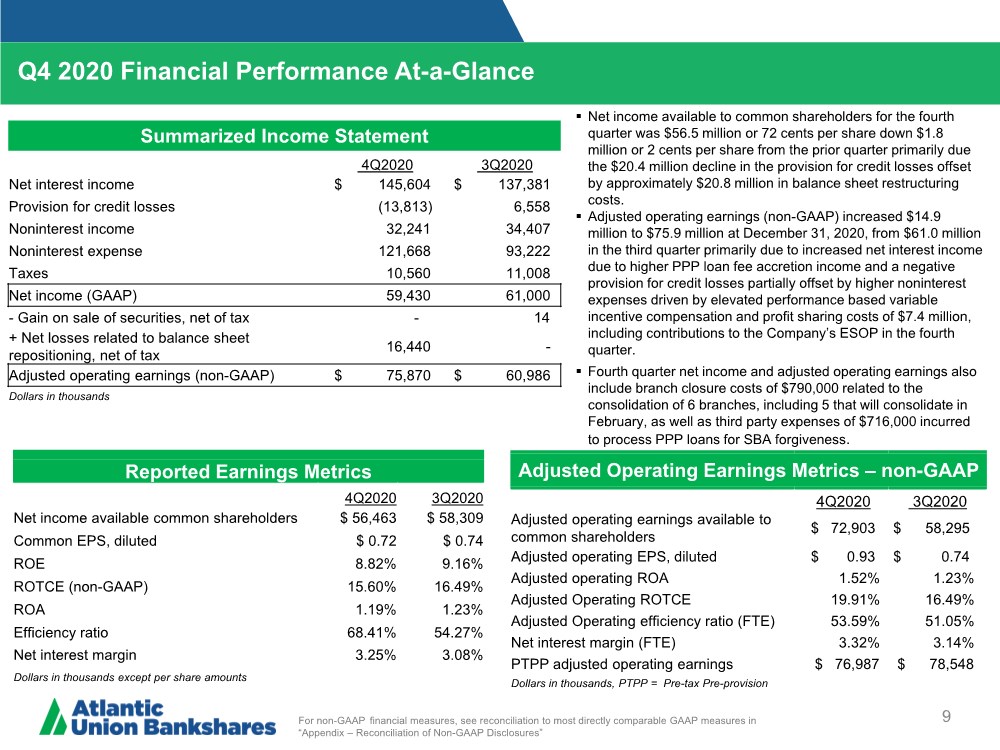

| Q4 2020 Financial Performance At-a-Glance 9 Summarized Income Statement 4Q2020 3Q2020 Net interest income $ 145,604 $ 137,381 Provision for credit losses (13,813) 6,558 Noninterest income 32,241 34,407 Noninterest expense 121,668 93,222 Taxes 10,560 11,008 Net income (GAAP) 59,430 61,000 - Gain on sale of securities, net of tax - 14 + Net losses related to balance sheet repositioning, net of tax 16,440 - Adjusted operating earnings (non-GAAP) $ 75,870 $ 60,986 Dollars in thousands Reported Earnings Metrics 4Q2020 3Q2020 Net income available common shareholders $ 56,463 $ 58,309 Common EPS, diluted $ 0.72 $ 0.74 ROE 8.82% 9.16% ROTCE (non-GAAP) 15.60% 16.49% ROA 1.19% 1.23% Efficiency ratio 68.41% 54.27% Net interest margin 3.25% 3.08% Dollars in thousands except per share amounts Adjusted Operating Earnings Metrics – non-GAAP 4Q2020 3Q2020 Adjusted operating earnings available to common shareholders $ 72,903 $ 58,295 Adjusted operating EPS, diluted $ 0.93 $ 0.74 Adjusted operating ROA 1.52% 1.23% Adjusted Operating ROTCE 19.91% 16.49% Adjusted Operating efficiency ratio (FTE) 53.59% 51.05% Net interest margin (FTE) 3.32% 3.14% PTPP adjusted operating earnings $ 76,987 $ 78,548 Dollars in thousands, PTPP = Pre-tax Pre-provision For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” .. Net income available to common shareholders for the fourth quarter was $56.5 million or 72 cents per share down $1.8 million or 2 cents per share from the prior quarter primarily due the $20.4 million decline in the provision for credit losses offset by approximately $20.8 million in balance sheet restructuring costs. .. Adjusted operating earnings (non-GAAP) increased $14.9 million to $75.9 million at December 31, 2020, from $61.0 million in the third quarter primarily due to increased net interest income due to higher PPP loan fee accretion income and a negative provision for credit losses partially offset by higher noninterest expenses driven by elevated performance based variable incentive compensation and profit sharing costs of $7.4 million, including contributions to the Company’s ESOP in the fourth quarter. .. Fourth quarter net income and adjusted operating earnings also include branch closure costs of $790,000 related to the consolidation of 6 branches, including 5 that will consolidate in February, as well as third party expenses of $716,000 incurred to process PPP loans for SBA forgiveness. |

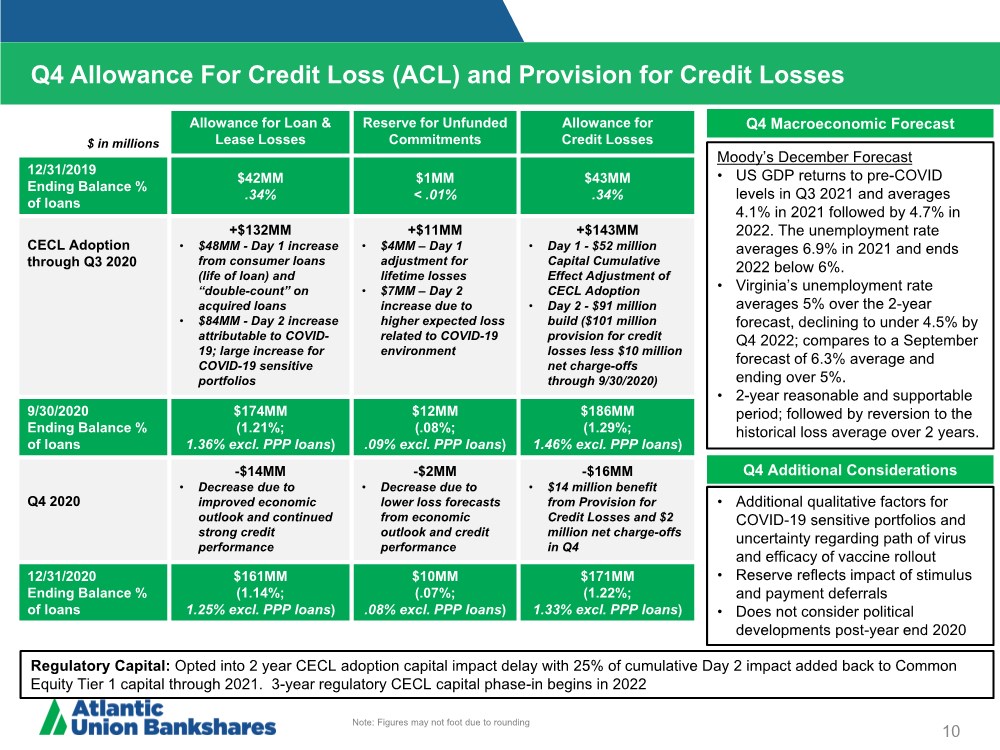

| Q4 Allowance For Credit Loss (ACL) and Provision for Credit Losses 10 Q4 Macroeconomic Forecast Q4 Additional Considerations Moody’s December Forecast • US GDP returns to pre-COVID levels in Q3 2021 and averages 4.1% in 2021 followed by 4.7% in 2022. The unemployment rate averages 6.9% in 2021 and ends 2022 below 6%. • Virginia’s unemployment rate averages 5% over the 2-year forecast, declining to under 4.5% by Q4 2022; compares to a September forecast of 6.3% average and ending over 5%. • 2-year reasonable and supportable period; followed by reversion to the historical loss average over 2 years. • Additional qualitative factors for COVID-19 sensitive portfolios and uncertainty regarding path of virus and efficacy of vaccine rollout • Reserve reflects impact of stimulus and payment deferrals • Does not consider political developments post-year end 2020 Regulatory Capital: Opted into 2 year CECL adoption capital impact delay with 25% of cumulative Day 2 impact added back to Common Equity Tier 1 capital through 2021. 3-year regulatory CECL capital phase-in begins in 2022 $ in millions Allowance for Loan & Lease Losses Reserve for Unfunded Commitments Allowance for Credit Losses 12/31/2019 Ending Balance % of loans $42MM ..34% $1MM < .01% $43MM ..34% CECL Adoption through Q3 2020 +$132MM • $48MM - Day 1 increase from consumer loans (life of loan) and “double-count” on acquired loans • $84MM - Day 2 increase attributable to COVID- 19; large increase for COVID-19 sensitive portfolios +$11MM • $4MM – Day 1 adjustment for lifetime losses • $7MM – Day 2 increase due to higher expected loss related to COVID-19 environment +$143MM • Day 1 - $52 million Capital Cumulative Effect Adjustment of CECL Adoption • Day 2 - $91 million build ($101 million provision for credit losses less $10 million net charge-offs through 9/30/2020) 9/30/2020 Ending Balance % of loans $174MM (1.21%; 1.36% excl. PPP loans) $12MM (.08%; ..09% excl. PPP loans) $186MM (1.29%; 1.46% excl. PPP loans) Q4 2020 -$14MM • Decrease due to improved economic outlook and continued strong credit performance -$2MM • Decrease due to lower loss forecasts from economic outlook and credit performance -$16MM • $14 million benefit from Provision for Credit Losses and $2 million net charge-offs in Q4 12/31/2020 Ending Balance % of loans $161MM (1.14%; 1.25% excl. PPP loans) $10MM (.07%; ..08% excl. PPP loans) $171MM (1.22%; 1.33% excl. PPP loans) Note: Figures may not foot due to rounding |

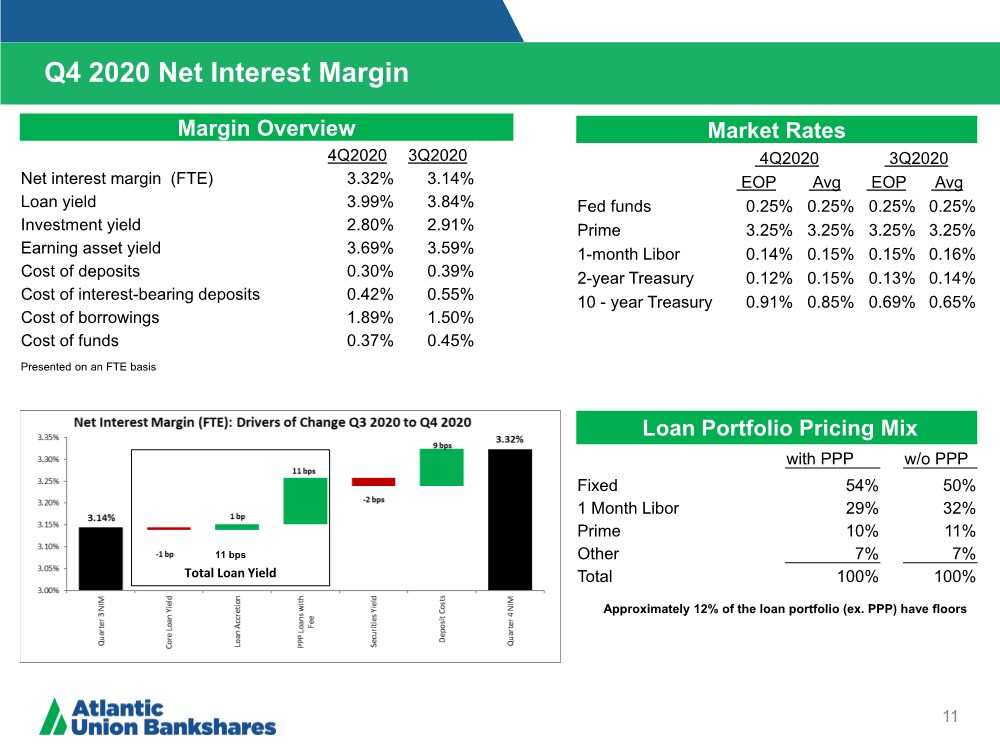

| Total Loan Yield 11 Q4 2020 Net Interest Margin Market Rates 4Q2020 3Q2020 EOP Avg EOP Avg Fed funds 0.25% 0.25% 0.25% 0.25% Prime 3.25% 3.25% 3.25% 3.25% 1-month Libor 0.14% 0.15% 0.15% 0.16% 2-year Treasury 0.12% 0.15% 0.13% 0.14% 10 - year Treasury 0.91% 0.85% 0.69% 0.65% Margin Overview 4Q2020 3Q2020 Net interest margin (FTE) 3.32% 3.14% Loan yield 3.99% 3.84% Investment yield 2.80% 2.91% Earning asset yield 3.69% 3.59% Cost of deposits 0.30% 0.39% Cost of interest-bearing deposits 0.42% 0.55% Cost of borrowings 1.89% 1.50% Cost of funds 0.37% 0.45% Presented on an FTE basis Approximately 12% of the loan portfolio (ex. PPP) have floors Loan Portfolio Pricing Mix with PPP w/o PPP Fixed 54% 50% 1 Month Libor 29% 32% Prime 10% 11% Other 7% 7% Total 100% 100% 11 bps |

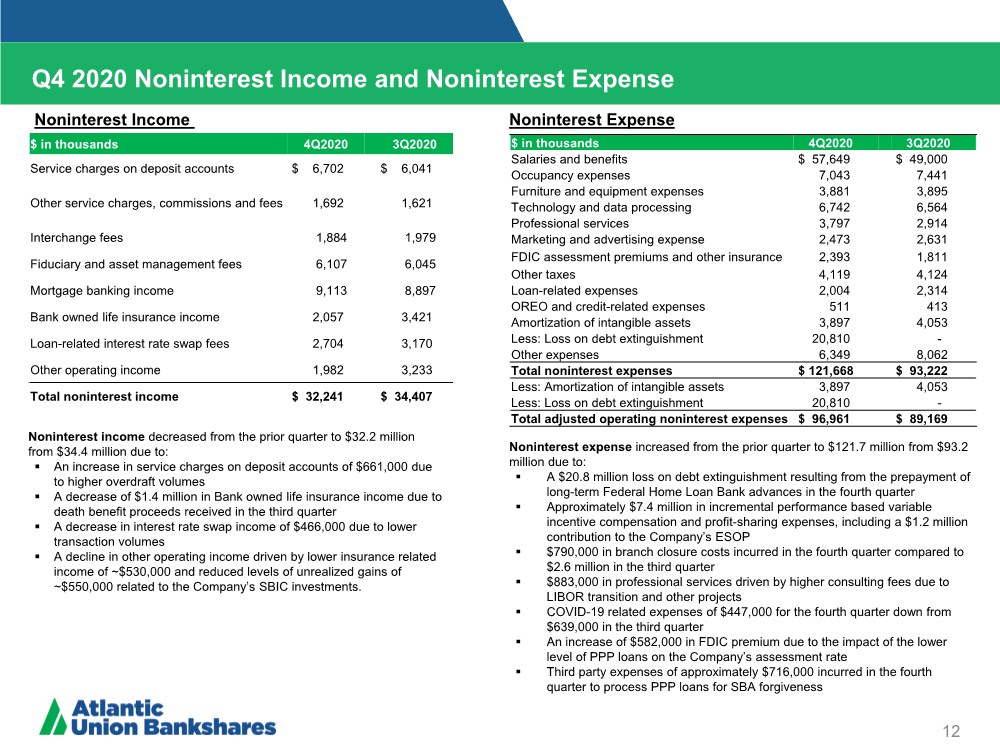

| 12 Noninterest income decreased from the prior quarter to $32.2 million from $34.4 million due to: .. An increase in service charges on deposit accounts of $661,000 due to higher overdraft volumes .. A decrease of $1.4 million in Bank owned life insurance income due to death benefit proceeds received in the third quarter .. A decrease in interest rate swap income of $466,000 due to lower transaction volumes .. A decline in other operating income driven by lower insurance related income of ~$530,000 and reduced levels of unrealized gains of ~$550,000 related to the Company’s SBIC investments. $ in thousands 4Q2020 3Q2020 Service charges on deposit accounts $ 6,702 $ 6,041 Other service charges, commissions and fees 1,692 1,621 Interchange fees 1,884 1,979 Fiduciary and asset management fees 6,107 6,045 Mortgage banking income 9,113 8,897 Bank owned life insurance income 2,057 3,421 Loan-related interest rate swap fees 2,704 3,170 Other operating income 1,982 3,233 Total noninterest income $ 32,241 $ 34,407 $ in thousands 4Q2020 3Q2020 Salaries and benefits $ 57,649 $ 49,000 Occupancy expenses 7,043 7,441 Furniture and equipment expenses 3,881 3,895 Technology and data processing 6,742 6,564 Professional services 3,797 2,914 Marketing and advertising expense 2,473 2,631 FDIC assessment premiums and other insurance 2,393 1,811 Other taxes 4,119 4,124 Loan-related expenses 2,004 2,314 OREO and credit-related expenses 511 413 Amortization of intangible assets 3,897 4,053 Less: Loss on debt extinguishment 20,810 - Other expenses 6,349 8,062 Total noninterest expenses $ 121,668 $ 93,222 Less: Amortization of intangible assets 3,897 4,053 Less: Loss on debt extinguishment 20,810 - Total adjusted operating noninterest expenses $ 96,961 $ 89,169 Q4 2020 Noninterest Income and Noninterest Expense Noninterest Income Noninterest Expense Noninterest expense increased from the prior quarter to $121.7 million from $93.2 million due to: .. A $20.8 million loss on debt extinguishment resulting from the prepayment of long-term Federal Home Loan Bank advances in the fourth quarter .. Approximately $7.4 million in incremental performance based variable incentive compensation and profit-sharing expenses, including a $1.2 million contribution to the Company’s ESOP .. $790,000 in branch closure costs incurred in the fourth quarter compared to $2.6 million in the third quarter .. $883,000 in professional services driven by higher consulting fees due to LIBOR transition and other projects .. COVID-19 related expenses of $447,000 for the fourth quarter down from $639,000 in the third quarter .. An increase of $582,000 in FDIC premium due to the impact of the lower level of PPP loans on the Company’s assessment rate .. Third party expenses of approximately $716,000 incurred in the fourth quarter to process PPP loans for SBA forgiveness |

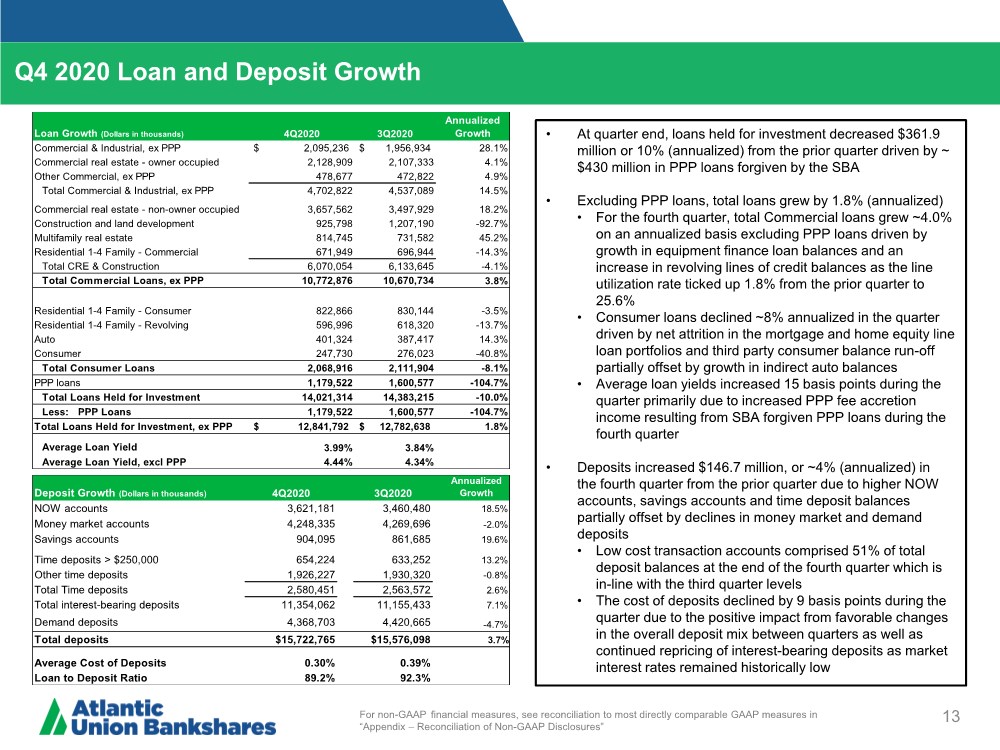

| 13 Q4 2020 Loan and Deposit Growth For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” • At quarter end, loans held for investment decreased $361.9 million or 10% (annualized) from the prior quarter driven by ~ $430 million in PPP loans forgiven by the SBA • Excluding PPP loans, total loans grew by 1.8% (annualized) • For the fourth quarter, total Commercial loans grew ~4.0% on an annualized basis excluding PPP loans driven by growth in equipment finance loan balances and an increase in revolving lines of credit balances as the line utilization rate ticked up 1.8% from the prior quarter to 25.6% • Consumer loans declined ~8% annualized in the quarter driven by net attrition in the mortgage and home equity line loan portfolios and third party consumer balance run-off partially offset by growth in indirect auto balances • Average loan yields increased 15 basis points during the quarter primarily due to increased PPP fee accretion income resulting from SBA forgiven PPP loans during the fourth quarter • Deposits increased $146.7 million, or ~4% (annualized) in the fourth quarter from the prior quarter due to higher NOW accounts, savings accounts and time deposit balances partially offset by declines in money market and demand deposits • Low cost transaction accounts comprised 51% of total deposit balances at the end of the fourth quarter which is in-line with the third quarter levels • The cost of deposits declined by 9 basis points during the quarter due to the positive impact from favorable changes in the overall deposit mix between quarters as well as continued repricing of interest-bearing deposits as market interest rates remained historically low Deposit Growth (Dollars in thousands) 4Q2020 3Q2020 Annualized Growth NOW accounts 3,621,181 3,460,480 18.5% Money market accounts 4,248,335 4,269,696 -2.0% Savings accounts 904,095 861,685 19.6% Time deposits > $250,000 654,224 633,252 13.2% Other time deposits 1,926,227 1,930,320 -0.8% Total Time deposits 2,580,451 2,563,572 2.6% Total interest-bearing deposits 11,354,062 11,155,433 7.1% Demand deposits 4,368,703 4,420,665 -4.7% Total deposits $15,722,765 $15,576,098 3.7% Average Cost of Deposits 0.30% 0.39% Loan to Deposit Ratio 89.2% 92.3% Loan Growth (Dollars in thousands) 4Q2020 3Q2020 Annualized Growth Commercial & Industrial, ex PPP $ 2,095,236 $ 1,956,934 28.1% Commercial real estate - owner occupied 2,128,909 2,107,333 4.1% Other Commercial, ex PPP 478,677 472,822 4.9% Total Commercial & Industrial, ex PPP 4,702,822 4,537,089 14.5% Commercial real estate - non-owner occupied 3,657,562 3,497,929 18.2% Construction and land development 925,798 1,207,190 -92.7% Multifamily real estate 814,745 731,582 45.2% Residential 1-4 Family - Commercial 671,949 696,944 -14.3% Total CRE & Construction 6,070,054 6,133,645 -4.1% Total Commercial Loans, ex PPP 10,772,876 10,670,734 3.8% Residential 1-4 Family - Consumer 822,866 830,144 -3.5% Residential 1-4 Family - Revolving 596,996 618,320 -13.7% Auto 401,324 387,417 14.3% Consumer 247,730 276,023 -40.8% Total Consumer Loans 2,068,916 2,111,904 -8.1% PPP loans 1,179,522 1,600,577 -104.7% Total Loans Held for Investment 14,021,314 14,383,215 -10.0% Less: PPP Loans 1,179,522 1,600,577 -104.7% Total Loans Held for Investment, ex PPP $ 12,841,792 $ 12,782,638 1.8% Average Loan Yield 3.99% 3.84% Average Loan Yield, excl PPP 4.44% 4.34% |

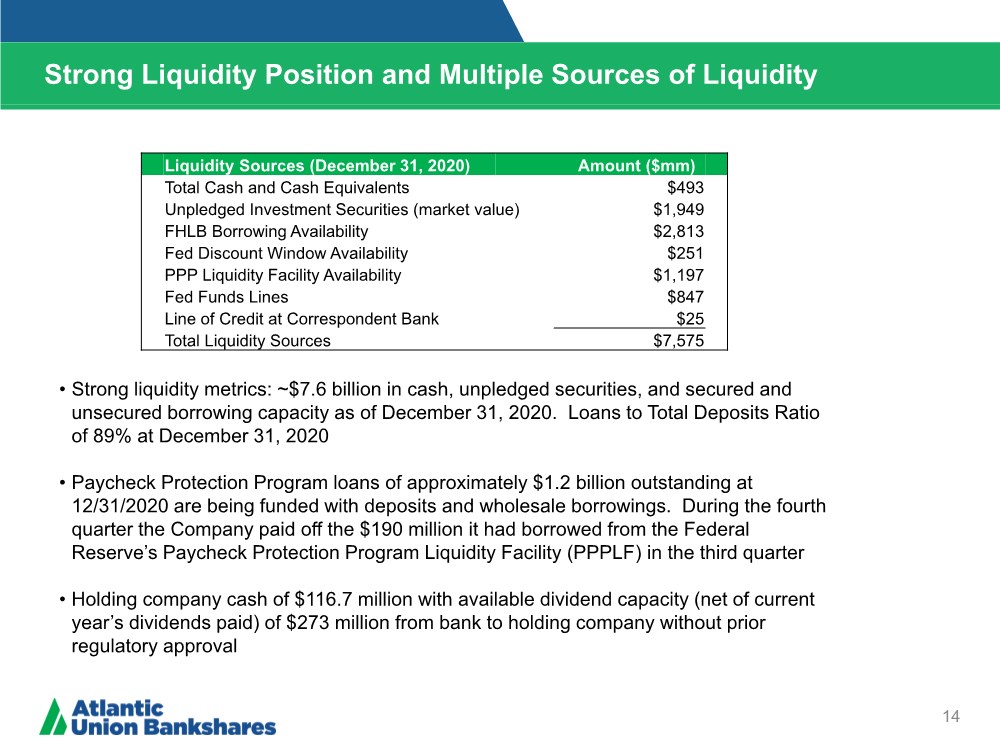

| Strong Liquidity Position and Multiple Sources of Liquidity 14 • Strong liquidity metrics: ~$7.6 billion in cash, unpledged securities, and secured and unsecured borrowing capacity as of December 31, 2020. Loans to Total Deposits Ratio of 89% at December 31, 2020 • Paycheck Protection Program loans of approximately $1.2 billion outstanding at 12/31/2020 are being funded with deposits and wholesale borrowings. During the fourth quarter the Company paid off the $190 million it had borrowed from the Federal Reserve’s Paycheck Protection Program Liquidity Facility (PPPLF) in the third quarter • Holding company cash of $116.7 million with available dividend capacity (net of current year’s dividends paid) of $273 million from bank to holding company without prior regulatory approval Liquidity Sources (December 31, 2020) Amount ($mm) Total Cash and Cash Equivalents $493 Unpledged Investment Securities (market value) $1,949 FHLB Borrowing Availability $2,813 Fed Discount Window Availability $251 PPP Liquidity Facility Availability $1,197 Fed Funds Lines $847 Line of Credit at Correspondent Bank $25 Total Liquidity Sources $7,575 |

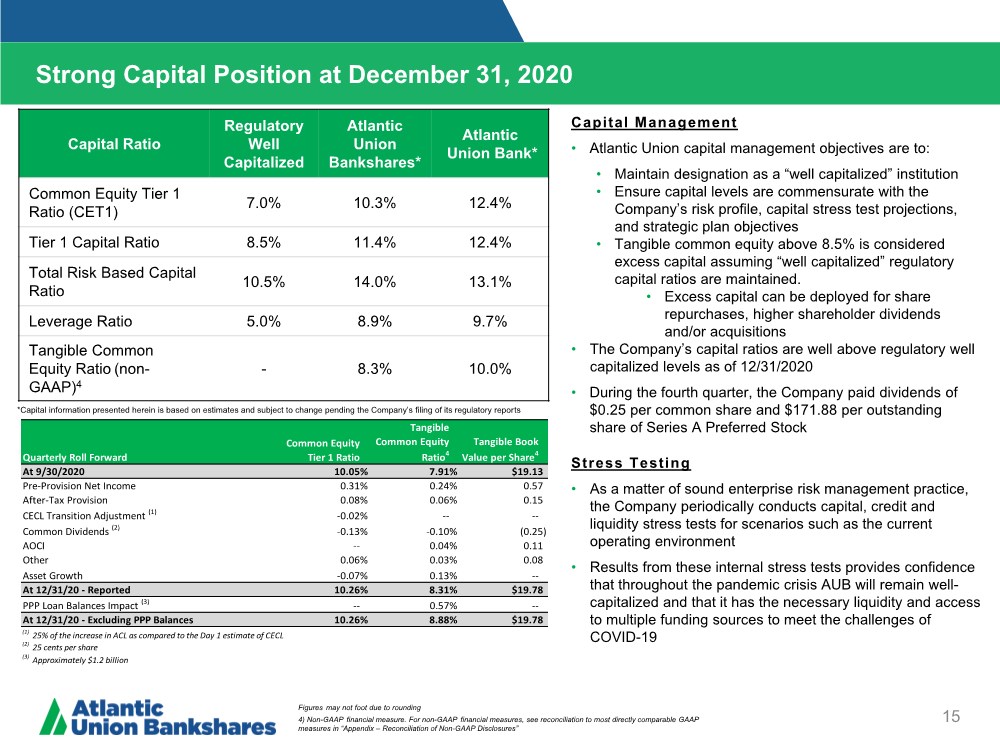

| Strong Capital Position at December 31, 2020 15 Capital Ratio Regulatory Well Capitalized Atlantic Union Bankshares* Atlantic Union Bank* Common Equity Tier 1 Ratio (CET1) 7.0% 10.3% 12.4% Tier 1 Capital Ratio 8.5% 11.4% 12.4% Total Risk Based Capital Ratio 10.5% 14.0% 13.1% Leverage Ratio 5.0% 8.9% 9.7% Tangible Common Equity Ratio (non- GAAP)4 - 8.3% 10.0% *Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulatory reports Stress Testing • As a matter of sound enterprise risk management practice, the Company periodically conducts capital, credit and liquidity stress tests for scenarios such as the current operating environment • Results from these internal stress tests provides confidence that throughout the pandemic crisis AUB will remain well- capitalized and that it has the necessary liquidity and access to multiple funding sources to meet the challenges of COVID-19 Capital Management • Atlantic Union capital management objectives are to: • Maintain designation as a “well capitalized” institution • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives • Tangible common equity above 8.5% is considered excess capital assuming “well capitalized” regulatory capital ratios are maintained. • Excess capital can be deployed for share repurchases, higher shareholder dividends and/or acquisitions • The Company’s capital ratios are well above regulatory well capitalized levels as of 12/31/2020 • During the fourth quarter, the Company paid dividends of $0.25 per common share and $171.88 per outstanding share of Series A Preferred Stock Figures may not foot due to rounding 4) Non-GAAP financial measure. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Quarterly Roll Forward Common Equity Tier 1 Ratio Tangible Common Equity Ratio4 Tangible Book Value per Share4 At 9/30/2020 10.05% 7.91% $19.13 Pre-Provision Net Income 0.31% 0.24% 0.57 After-Tax Provision 0.08% 0.06% 0.15 CECL Transition Adjustment (1) -0.02% -- -- Common Dividends (2) -0.13% -0.10% (0.25) AOCI -- 0.04% 0.11 Other 0.06% 0.03% 0.08 Asset Growth -0.07% 0.13% -- At 12/31/20 - Reported 10.26% 8.31% $19.78 PPP Loan Balances Impact (3) -- 0.57% -- At 12/31/20 - Excluding PPP Balances 10.26% 8.88% $19.78 (1) 25% of the increase in ACL as compared to the Day 1 estimate of CECL (2) 25 cents per share (3) Approximately $1.2 billion |

| Appendix |

| Reconciliation of Non-GAAP Disclosures 17 Operating Earnings Per Share The Company has provided supplemental performance measures on a tax-equivalent, tangible, operating, adjusted, or pre-tax pre-provision basis. These non-GAAP financial measures are supplements to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. |

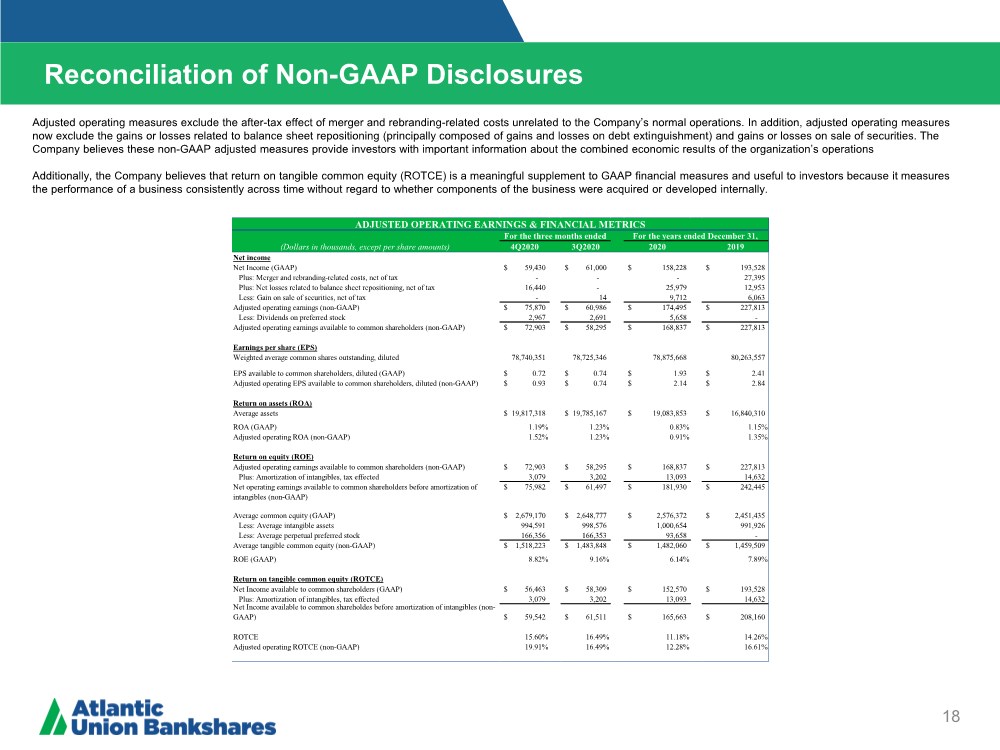

| Reconciliation of Non-GAAP Disclosures 18 Operating Earnings Per Share Adjusted operating measures exclude the after-tax effect of merger and rebranding-related costs unrelated to the Company’s normal operations. In addition, adjusted operating measures now exclude the gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment) and gains or losses on sale of securities. The Company believes these non-GAAP adjusted measures provide investors with important information about the combined economic results of the organization’s operations Additionally, the Company believes that return on tangible common equity (ROTCE) is a meaningful supplement to GAAP financial measures and useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. (Dollars in thousands, except per share amounts) 4Q2020 3Q2020 2020 2019 Net income Net Income (GAAP) 59,430 $ 61,000 $ 158,228 $ 193,528 $ Plus: Merger and rebranding-related costs, net of tax - - - 27,395 Plus: Net losses related to balance sheet repositioning, net of tax 16,440 - 25,979 12,953 Less: Gain on sale of securities, net of tax - 14 9,712 6,063 Adjusted operating earnings (non-GAAP) 75,870 $ 60,986 $ 174,495 $ 227,813 $ Less: Dividends on preferred stock 2,967 2,691 5,658 - Adjusted operating earnings available to common shareholders (non-GAAP) 72,903 $ 58,295 $ 168,837 $ 227,813 $ Earnings per share (EPS) Weighted average common shares outstanding, diluted 78,740,351 78,725,346 78,875,668 80,263,557 EPS available to common shareholders, diluted (GAAP) 0.72 $ 0.74 $ 1.93 $ 2.41 $ Adjusted operating EPS available to common shareholders, diluted (non-GAAP) 0.93 $ 0.74 $ 2.14 $ 2.84 $ Return on assets (ROA) Average assets 19,817,318 $ 19,785,167 $ 19,083,853 $ 16,840,310 $ ROA (GAAP) 1.19% 1.23% 0.83% 1.15% Adjusted operating ROA (non-GAAP) 1.52% 1.23% 0.91% 1.35% Return on equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) 72,903 $ 58,295 $ 168,837 $ 227,813 $ Plus: Amortization of intangibles, tax effected 3,079 3,202 13,093 14,632 Net operating earnings available to common shareholders before amortization of intangibles (non-GAAP) 75,982 $ 61,497 $ 181,930 $ 242,445 $ Average common equity (GAAP) 2,679,170 $ 2,648,777 $ 2,576,372 $ 2,451,435 $ Less: Average intangible assets 994,591 998,576 1,000,654 991,926 Less: Average perpetual preferred stock 166,356 166,353 93,658 - Average tangible common equity (non-GAAP) 1,518,223 $ 1,483,848 $ 1,482,060 $ 1,459,509 $ ROE (GAAP) 8.82% 9.16% 6.14% 7.89% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) 56,463 $ 58,309 $ 152,570 $ 193,528 $ Plus: Amortization of intangibles, tax effected 3,079 3,202 13,093 14,632 Net Income available to common shareholdes before amortization of intangibles (non- GAAP) 59,542 $ 61,511 $ 165,663 $ 208,160 $ ROTCE 15.60% 16.49% 11.18% 14.26% Adjusted operating ROTCE (non-GAAP) 19.91% 16.49% 12.28% 16.61% ADJUSTED OPERATING EARNINGS & FINANCIAL METRICS For the three months ended For the years ended December 31, |

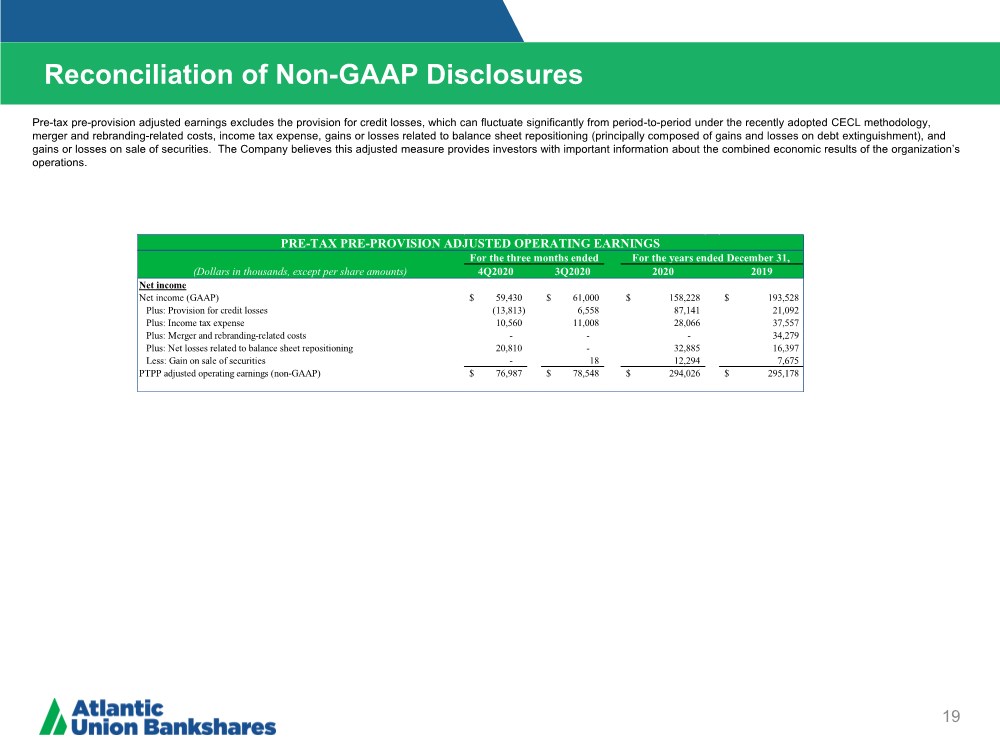

| Reconciliation of Non-GAAP Disclosures 19 Operating Earnings Per Share Pre-tax pre-provision adjusted earnings excludes the provision for credit losses, which can fluctuate significantly from period-to-period under the recently adopted CECL methodology, merger and rebranding-related costs, income tax expense, gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment), and gains or losses on sale of securities. The Company believes this adjusted measure provides investors with important information about the combined economic results of the organization’s operations. (Dollars in thousands, except per share amounts) 4Q2020 3Q2020 2020 2019 Net income Net income (GAAP) 59,430 $ 61,000 $ 158,228 $ 193,528 $ Plus: Provision for credit losses (13,813) 6,558 87,141 21,092 Plus: Income tax expense 10,560 11,008 28,066 37,557 Plus: Merger and rebranding-related costs - - - 34,279 Plus: Net losses related to balance sheet repositioning 20,810 - 32,885 16,397 Less: Gain on sale of securities - 18 12,294 7,675 PTPP adjusted operating earnings (non-GAAP) 76,987 $ 78,548 $ 294,026 $ 295,178 $ PRE-TAX PRE-PROVISION ADJUSTED OPERATING EARNINGS For the three months ended For the years ended December 31, |

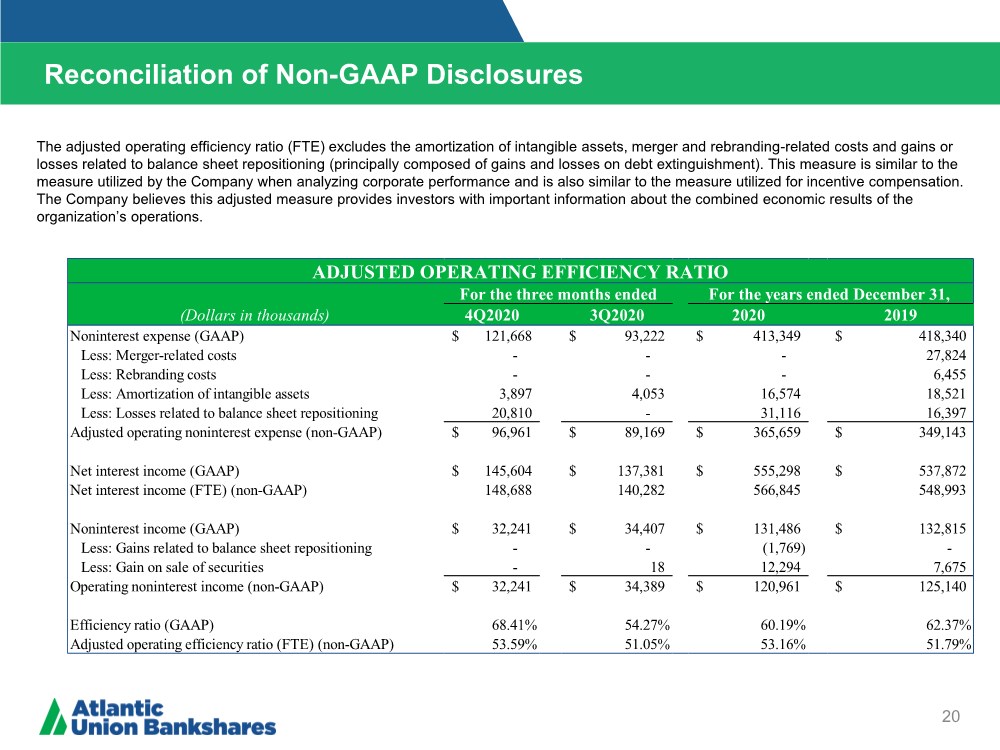

| Reconciliation of Non-GAAP Disclosures 20 Operating Earnings Per Share The adjusted operating efficiency ratio (FTE) excludes the amortization of intangible assets, merger and rebranding-related costs and gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment). This measure is similar to the measure utilized by the Company when analyzing corporate performance and is also similar to the measure utilized for incentive compensation. The Company believes this adjusted measure provides investors with important information about the combined economic results of the organization’s operations. (Dollars in thousands) 4Q2020 3Q2020 2020 2019 Noninterest expense (GAAP) 121,668 $ 93,222 $ 413,349 $ 418,340 $ Less: Merger-related costs - - - 27,824 Less: Rebranding costs - - - 6,455 Less: Amortization of intangible assets 3,897 4,053 16,574 18,521 Less: Losses related to balance sheet repositioning 20,810 - 31,116 16,397 Adjusted operating noninterest expense (non-GAAP) 96,961 $ 89,169 $ 365,659 $ 349,143 $ Net interest income (GAAP) 145,604 $ 137,381 $ 555,298 $ 537,872 $ Net interest income (FTE) (non-GAAP) 148,688 140,282 566,845 548,993 Noninterest income (GAAP) 32,241 $ 34,407 $ 131,486 $ 132,815 $ Less: Gains related to balance sheet repositioning - - (1,769) - Less: Gain on sale of securities - 18 12,294 7,675 Operating noninterest income (non-GAAP) 32,241 $ 34,389 $ 120,961 $ 125,140 $ Efficiency ratio (GAAP) 68.41% 54.27% 60.19% 62.37% Adjusted operating efficiency ratio (FTE) (non-GAAP) 53.59% 51.05% 53.16% 51.79% For the three months ended For the years ended December 31, ADJUSTED OPERATING EFFICIENCY RATIO |

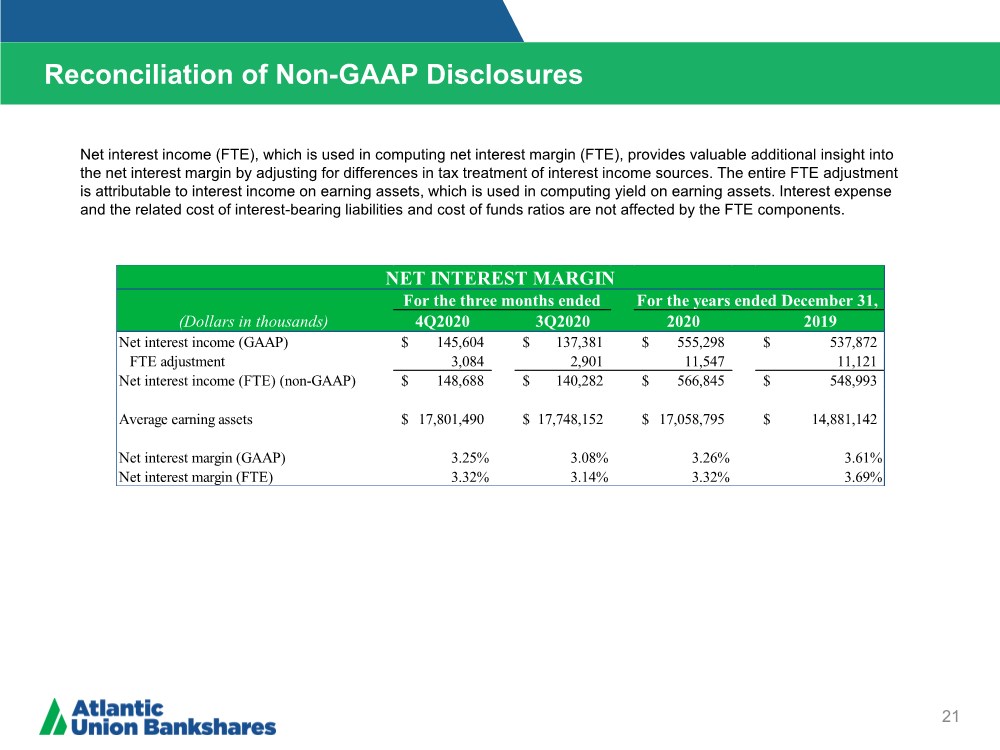

| Reconciliation of Non-GAAP Disclosures 21 Operating Earnings Per Share Net interest income (FTE), which is used in computing net interest margin (FTE), provides valuable additional insight into the net interest margin by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. For the years ended December 31, (Dollars in thousands) 4Q2020 3Q2020 2020 2019 Net interest income (GAAP) 145,604 $ 137,381 $ 555,298 $ 537,872 $ FTE adjustment 3,084 2,901 11,547 11,121 Net interest income (FTE) (non-GAAP) 148,688 $ 140,282 $ 566,845 $ 548,993 $ Average earning assets 17,801,490 $ 17,748,152 $ 17,058,795 $ 14,881,142 $ Net interest margin (GAAP) 3.25% 3.08% 3.26% 3.61% Net interest margin (FTE) 3.32% 3.14% 3.32% 3.69% For the three months ended NET INTEREST MARGIN |

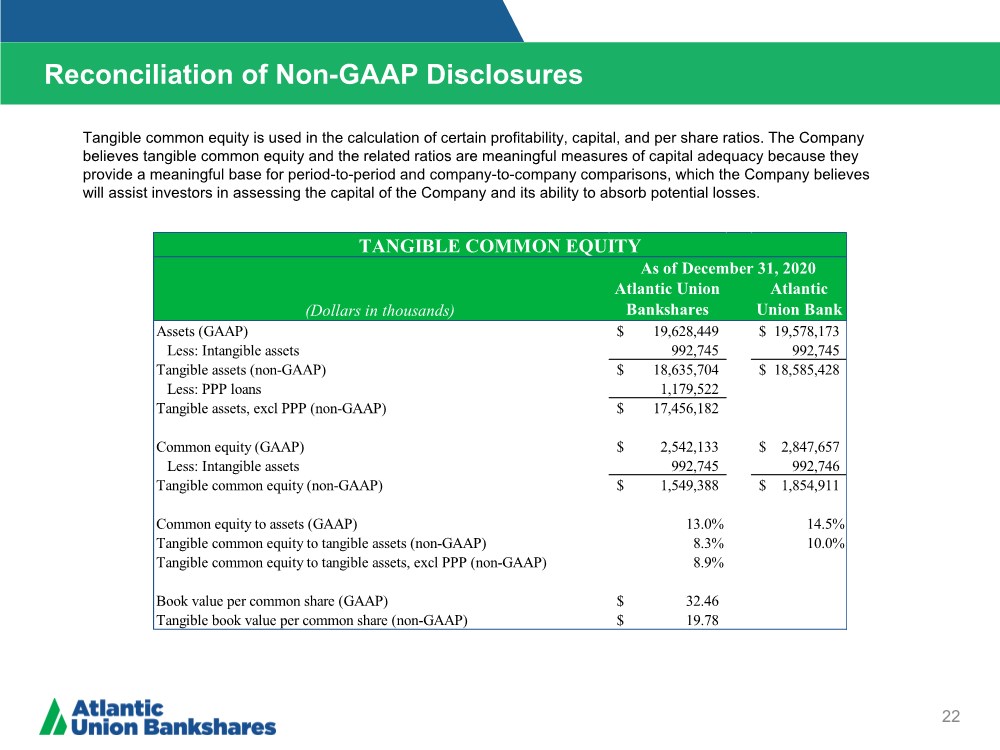

| Reconciliation of Non-GAAP Disclosures 22 Operating Earnings Per Share Tangible common equity is used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. (Dollars in thousands) Atlantic Union Bankshares Atlantic Union Bank Assets (GAAP) 19,628,449 $ 19,578,173 $ Less: Intangible assets 992,745 992,745 Tangible assets (non-GAAP) 18,635,704 $ 18,585,428 $ Less: PPP loans 1,179,522 Tangible assets, excl PPP (non-GAAP) 17,456,182 $ Common equity (GAAP) 2,542,133 $ 2,847,657 $ Less: Intangible assets 992,745 992,746 Tangible common equity (non-GAAP) 1,549,388 $ 1,854,911 $ Common equity to assets (GAAP) 13.0% 14.5% Tangible common equity to tangible assets (non-GAAP) 8.3% 10.0% Tangible common equity to tangible assets, excl PPP (non-GAAP) 8.9% Book value per common share (GAAP) 32.46 $ Tangible book value per common share (non-GAAP) 19.78 $ TANGIBLE COMMON EQUITY As of December 31, 2020 |

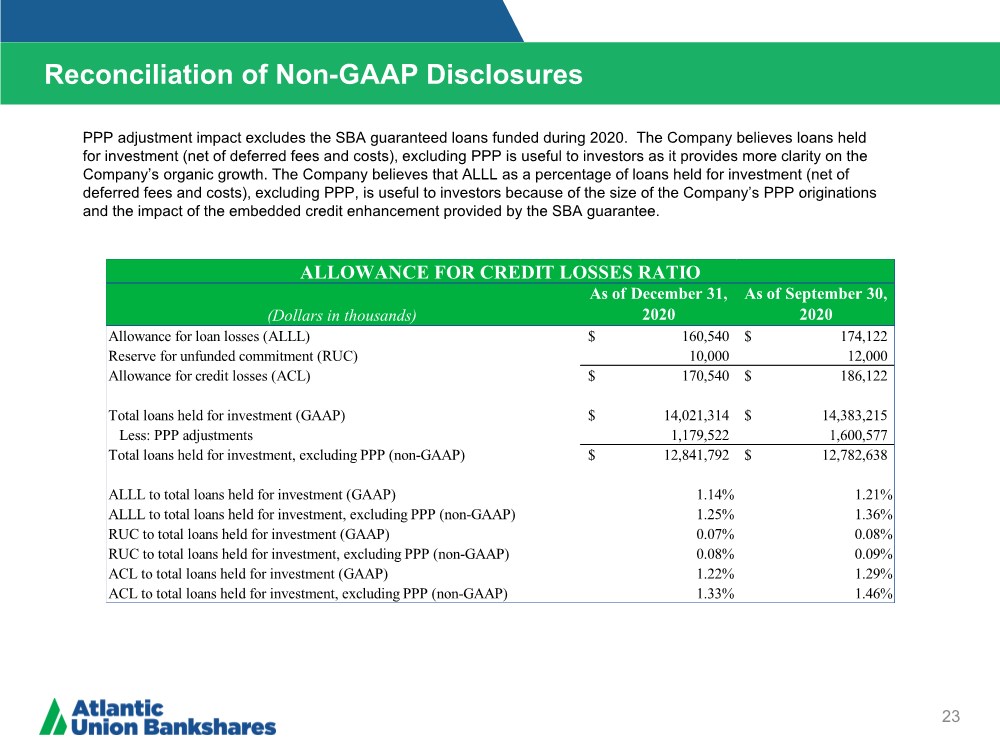

| Reconciliation of Non-GAAP Disclosures 23 ($ IN THOUSANDS) Operating Earnings Per Share PPP adjustment impact excludes the SBA guaranteed loans funded during 2020. The Company believes loans held for investment (net of deferred fees and costs), excluding PPP is useful to investors as it provides more clarity on the Company’s organic growth. The Company believes that ALLL as a percentage of loans held for investment (net of deferred fees and costs), excluding PPP, is useful to investors because of the size of the Company’s PPP originations and the impact of the embedded credit enhancement provided by the SBA guarantee. (Dollars in thousands) As of December 31, 2020 As of September 30, 2020 Allowance for loan losses (ALLL) 160,540 $ 174,122 $ Reserve for unfunded commitment (RUC) 10,000 12,000 Allowance for credit losses (ACL) 170,540 $ 186,122 $ Total loans held for investment (GAAP) 14,021,314 $ 14,383,215 $ Less: PPP adjustments 1,179,522 1,600,577 Total loans held for investment, excluding PPP (non-GAAP) 12,841,792 $ 12,782,638 $ ALLL to total loans held for investment (GAAP) 1.14% 1.21% ALLL to total loans held for investment, excluding PPP (non-GAAP) 1.25% 1.36% RUC to total loans held for investment (GAAP) 0.07% 0.08% RUC to total loans held for investment, excluding PPP (non-GAAP) 0.08% 0.09% ACL to total loans held for investment (GAAP) 1.22% 1.29% ACL to total loans held for investment, excluding PPP (non-GAAP) 1.33% 1.46% ALLOWANCE FOR CREDIT LOSSES RATIO |