Investor Presentation

June 10, 2013

The Next Great Virginia Bank

The Next Great Virginia Bank

Exhibit 99.2 |

Investor Presentation

June 10, 2013

The Next Great Virginia Bank

The Next Great Virginia Bank

Exhibit 99.2 |

Forward-Looking Statement

2

Statements made in this presentation, other than those concerning historical financial information,

may be considered forward-looking statements, which speak only as of the date of this

presentation and are based on current expectations and involve a number of assumptions. These

include statements as to the anticipated benefits of the merger, including future financial and

operating results, cost savings and enhanced revenues that may be realized from the merger as well as other

statements of expectations regarding the merger and any other statements regarding future results or

expectations. Each of Union and StellarOne intends such forward-looking statements to be

covered by the safe harbor provisions for forward- looking statements contained in the

Private Securities Litigation Reform Act of 1995 and is including this statement for purposes

of these safe harbor provisions. The companies’ respective abilities to predict results, or the actual effect of future

plans or strategies, is inherently uncertain. Factors which could have a material effect on the

operations and future prospects of each of Union and StellarOne and the resulting company,

include but are not limited to: (1) the businesses of Union and/or StellarOne may not be

integrated successfully or such integration may be more difficult, time-consuming or costly

than expected; (2) expected revenue synergies and cost savings from the merger may not be fully realized or

realized within the expected time frame; (3) revenues following the merger may be lower than expected;

(4) customer and employee relationships and business operations may be disrupted by the merger;

(5) the ability to obtain required regulatory and stockholder approvals, and the ability to

complete the merger on the expected timeframe may be more difficult, time-consuming or

costly than expected; (6) changes in interest rates, general economic conditions,

legislative/regulatory changes, monetary and fiscal policies of the U.S. government, including

policies of the U.S. Treasury and the Board of Governors of the Federal Reserve; the quality

and composition of the loan and securities portfolios; demand for loan products; deposit flows;

competition; demand for financial services in the companies’ respective market areas;

their implementation of new technologies; their ability to develop and maintain secure and reliable electronic

systems; and accounting principles, policies, and guidelines, and (7) other risk factors detailed from

time to time in filings made by Union or StellarOne with the SEC. Union and StellarOne

undertake no obligation to update or clarify these forward-looking statements, whether as a

result of new information, future events or otherwise. |

Creates the dominant community bank in Virginia

Scale overshadows in-state competitors

Expands presence to include all major Virginia markets

Broadens and deepens competitive strengths

Transaction Rationale

3

Results in top tier financial performance post integration

Double-digit EPS accretion with manageable tangible book value dilution

Accretive to capitalization

Positioned to deploy excess capital post closing

Exceeds internal rate of return thresholds

Acquisition Highlights

Strategic

Merit

Financially

Attractive |

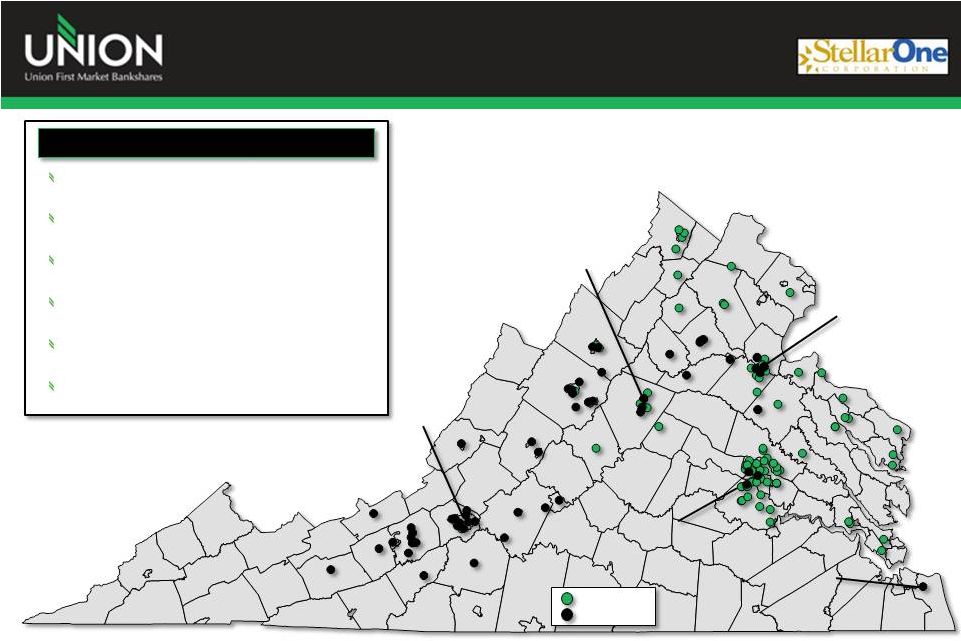

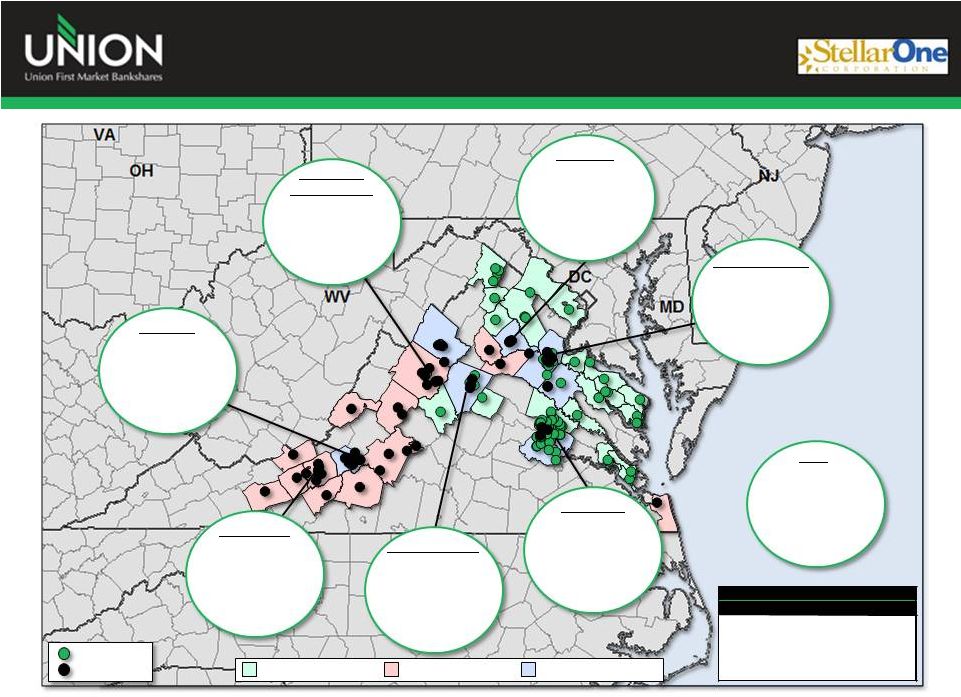

The Next Great Virginia Bank

4

Pro Forma Highlights

(1)

UBSH (90)

STEL (56)

Roanoke

Roanoke

Charlottesville

Charlottesville

Richmond

Richmond

Virginia Beach

Virginia Beach

Source: SNL Financial and MapInfo Professional

(1)

Assumes transaction was consummated on 3/31/2013

(2)

Estimated at close

Branches

FTEs

Assets

Loans

Deposits

TCE / TA Ratio

(2)

146

1,766

$7.1 Billion

$5.2 Billion

$5.8 Billion

~ 9.3%

Fredericksburg

Fredericksburg |

Rank

Institution (ST)

Number

of

Branches

Deposits in

Market

($mm)

Market

Share

(%)

1

Wells Fargo & Co. (CA)

295

29,350

17.4

2

Bank of America Corp. (NC)

177

22,233

13.2

3

BB&T Corp. (NC)

379

21,452

12.7

4

Capital One Financial Corp. (VA)

86

18,540

11.0

5

SunTrust Banks Inc. (GA)

239

17,168

10.2

Pro Forma - Union First Market Bkshs Corp. (VA)

146

5,702

3.4

6

United Bankshares Inc. (WV)

68

4,176

2.5

7

Carter Bank & Trust (VA)

88

3,502

2.1

8

Union First Market Bkshs Corp. (VA)

90

3,227

1.9

9

TowneBank (VA)

21

3,096

1.8

10

PNC Financial Services Group (PA)

101

2,829

1.7

11

StellarOne Corp. (VA)

56

2,475

1.5

12

Burke & Herbert Bank & Trust (VA)

25

2,077

1.2

13

Cardinal Financial Corp. (VA)

25

1,893

1.1

14

Citigroup Inc. (NY)

12

1,763

1.0

15

First Citizens BancShares Inc. (NC)

47

1,249

0.7

Totals (1-10)

1,544

125,572

74.3

Totals (1-136)

2,616

169,012

100.0

Growing Market Share

5

Virginia Deposit Market Share

Source: SNL Financial

Deposit data as of 6/30/2012; pro forma for pending transactions

|

Competitive Positioning

6

Richmond

Charlottesville

Source:

SNL

Financial

and

U.S.

Census

Bureau;

Deposit

data

as

of

6/30/2012

Note: Small businesses have less than 100 employees

Staunton / Harrisonburg

Population:

Households:

Small Businesses:

Market Deposits ($mm):

UBSH

Branches:

Deposits ($mm):

Pro Forma

42

4

46

$1,551

$44

$1,595

1,285,296

498,695

29,814

$73,641

STEL

Population:

Households:

Small Businesses:

Market Deposits ($mm):

UBSH

Branches:

Deposits ($mm):

Pro Forma

7

3

10

$330

$89

$419

205,406

80,055

5,449

$3,610

STEL

Population:

Households:

Small Businesses:

Market Deposits ($mm):

UBSH

Branches:

Deposits ($mm):

Pro Forma

4

10

14

$51

$437

$488

246,985

94,146

5,583

$3,368

STEL

Market Rank:

5

27

5

Market Rank:

6

8

5

Roanoke

Population:

Households:

Small Businesses:

Market Deposits ($mm):

UBSH

Branches:

Deposits ($mm):

Pro Forma

1

10

11

$16

$339

$355

311,468

129,484

7,864

$7,148

STEL

Market Rank:

15

6

6

Blacksburg

Population:

Households:

Small Businesses:

Market Deposits ($mm):

UBSH

Branches:

Deposits ($mm):

Pro Forma

-

9

9

-

$696

$696

165,000

64,572

3,135

$2,665

STEL

Market Rank:

-

1

1

Market Rank:

14

2

2

Fredericksburg

Population:

Households:

Small Businesses:

Market Deposits ($mm):

UBSH

Branches:

Deposits ($mm):

Pro Forma

14

5

19

$664

$156

$820

332,897

114,196

6,326

$3,449

STEL

Market Rank:

3

10

2 |

Pro Forma Branch Franchise

7

Source: SNL Financial and MapInfo Professional

(1)

Represents the number of STEL branches within a given radius of a UBSH branch; Shown

as a percent of STEL total branches Richmond

Rank: #5

Deposits: $1.6 bn

Market Tot.: $73.6 bn

Mkt. Share: 5.3%

Blacksburg

Rank: #1

Deposits: $696 mm

Market Tot.: $2.7 bn

Mkt. Share: 26.1%

Staunton /

Harrisonburg

Rank: #2

Deposits: $488 mm

Market Tot.: $3.4 bn

Mkt. Share: 14.4%

Culpeper

Rank: #1

Deposits: $202 mm

Market Tot.: $0.6 bn

Mkt. Share: 33.5%

MSA

Market Share Rank

Company Deposits

Total Market Deposits

Market Share

Roanoke

Deposits: $355 mm

Market Tot.: $7.2 bn

Mkt. Share: 4.9%

Rank: #6

Charlottesville

Rank: #5

Deposits: $419 mm

Market Tot.: $3.6 bn

Mkt. Share: 11.6%

VA

VA

Fredericksburg

Rank: #2

Deposits: $820mm

Market Tot.: $3.4 bn

Mkt. Share: 23.7%

UBSH Counties

STEL Counties

Overlapping Counties

UBSH (90)

STEL (56)

Branch Overlap

(1)

Distance

Branches

% of Franchise

< 1/2 mi:

8

14.3%

< 1 mi:

13

23.2%

< 2 mi:

19

33.9%

< 5 mi:

26

46.4% |

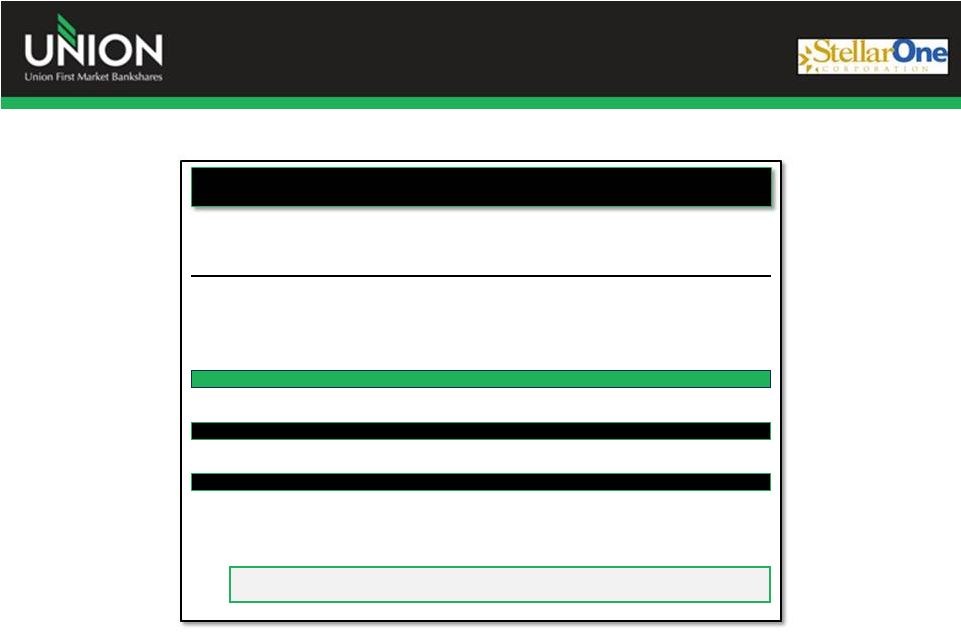

Transaction Terms

8

Transaction:

Union First Market Bankshares Corporation acquisition of StellarOne

Corporation Fixed Exchange Ratio:

0.9739x shares of UBSH common stock for each share of STEL

Consideration:

100% stock

Transaction Value

(1)

:

$19.50

per share or $445.1

million

Ownership Split:

52.9% UBSH / 47.1% STEL

Name:

Union First Market Bankshares Corporation

Named Executives:

Chief Executive Officer:

President of the Bank:

Chief Financial Officer:

Chief Banking Officer:

Chief Retail Officer:

G. William Beale (UBSH)

John Neal (UBSH)

Robert Gorman (UBSH)

D. Anthony Peay (UBSH)

Elizabeth Bentley (UBSH)

Board Composition:

(11) UBSH / (8) STEL

Chairman:

Vice Chairman:

Raymond Smoot Jr. (STEL)

Ronald Hicks (UBSH)

Capital:

Excess capital generated in the transaction will be used to repurchase shares

post closing of the acquisition

Required Approval:

Customary regulatory and shareholder approvals of both UBSH and STEL

shareholders

Expected Close:

Q4 2013 / Q1 2014

(1)

Based on UBSH closing price of $20.02 as of 6/7/2013 |

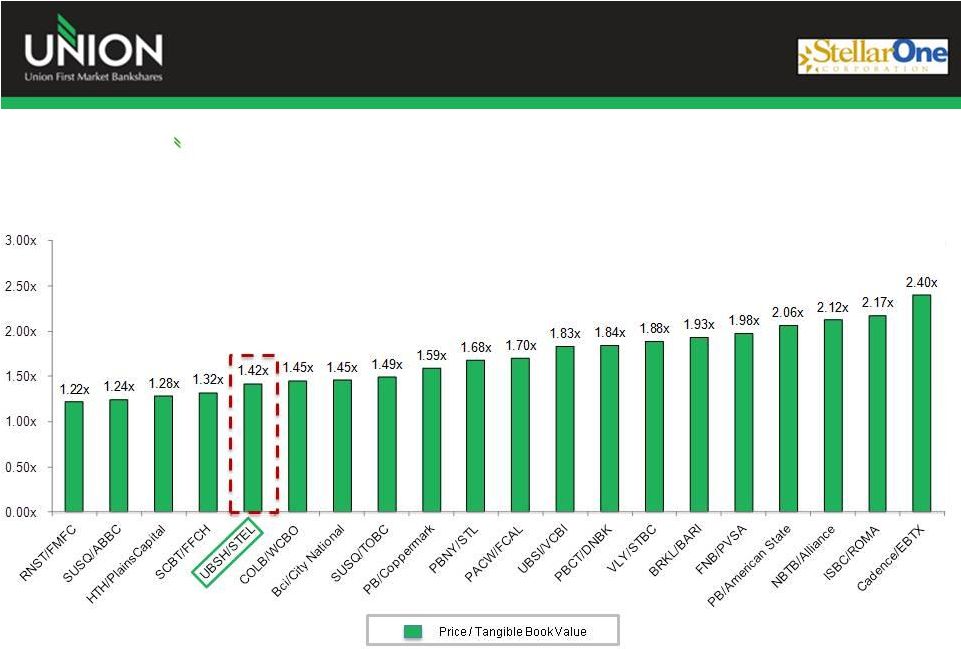

Transaction Pricing Comparison

9

Source: SNL Financial; Based on STEL’s tangible book value per share of

$13.76 Recent nationwide bank & thrift transactions with deal values

between $150 million and $1 billion since 1/1/2011

|

Due Diligence

10

Comprehensive 4 week due diligence process

Face-to-face interview sessions for all lines of

business

3

rd

party resources

Loan review

Legal & Tax

Reviewed individual loan files for $842 million or 61%

of outstanding commercial loans

Examined an additional $156 million of unfunded

commitments

Sample included 61% of Bank-rated special mention

and substandard loans totaling $134 million or 10%

of the commercial portfolio

Reviewed residential, consumer and OREO on a

portfolio level

Modeled a credit mark of $53.5 million or 2.5% of the

loan and OREO portfolio

Due Diligence Highlights

Credit Due Diligence |

Financial Impact

11

Impact

Assumptions

Net expense savings of 32%

(2)

, or $28 million pre-tax

65% phased in by 2014

100% thereafter

No revenue enhancements were modeled

Share repurchases planned for 2014 and 2015 with excess capital

One time merger related expenses of approximately $19.5 million after-tax

No significant data processing termination charge

(1)

Estimated at closing

(2)

Net expense savings contemplates the potential for lost revenue in specific

areas EPS

Book Value

Capital

(1)

IRR

Double digit

accretion to earnings per share with fully phased in expense savings

Single digit

tangible book value per share dilution

Accretive

in

approximately

5

years

Approximately 25 bps accretive

to

tangible common equity / tangible assets

Total risk-based capital in excess of 14.0%

Internal

rate

of

return

>

20% |

Creates the dominant community bank in Virginia

Enhances competitive position in major markets

Accretive to EPS

Generates excess capital

Strong IRR

Summary

12

The Next Great Virginia Bank |

APPENDIX |

Union First Market Bankshares

Overview

Source: SNL Financial; Market data as of 6/7/2013

(1)

First Call Consensus estimates

(2)

Core income excludes extraordinary items, non-recurring items and gains/losses

on sale of securities Market Valuation

Net Charge-Offs / Average Loans

0.05%

0.21%

0.69%

0.58%

0.55%

0.56%

0.33%

0.00%

0.50%

1.00%

1.50%

2007

2008

2009

2010

2011

2012

Q1 2013

Headquarters:

Richmond, Virginia

Ticker:

UBSH

Established:

1902

Branches:

90

Chief Executive Officer:

G. William Beale

Chief Financial Officer:

Robert Gorman

14

Price (6/7/13):

Market Cap. ($mm):

Price / Book:

Price / Tang. Book:

Price / 2014 EPS:

(1)

Dividend Yield:

Financial Highlights

(Dollars in thousands)

Years Ended, December 31,

Quarter Ended

2010

2011

2012

3/31/2013

Balance Sheet Items

Total Assets

$3,837,247

$3,907,087

$4,095,865

$4,051,135

Total Net Loans

2,872,821

2,853,936

3,099,629

3,066,238

Deposits

3,070,059

3,175,105

3,297,767

3,311,749

Equity

428,085

421,639

435,863

430,773

Tangible Common Equity

308,440

341,092

360,652

356,631

Profitability

Net Income to Common

$21,008

$27,769

$35,411

$8,983

Core ROAA

(2)

0.91

%

0.91

%

0.98

%

0.95

%

Core ROAE

(2)

8.2

7.9

9.0

8.9

Net Interest Margin

4.56

4.57

4.34

4.23

Efficiency Ratio

59.3

63.0

63.5

67.0

Fee Income / Op. Rev.

18.4

17.5

20.9

20.7

Balance Sheet Ratios

TCE / TA

8.22

%

8.91

%

8.97

%

8.97

%

Total Capital Ratio

14.68

14.51

14.57

14.44

Asset Quality

NPLs / Loans

2.57

%

4.97

%

2.48

%

2.12

%

NPAs / Loans + OREO

3.76

6.01

3.49

3.24

LLR / Loans

1.32

1.36

1.11

1.11

$20.02

$497.7

1.16x

1.40x

12.8x

2.6% |

StellarOne Corporation

Overview

Source: SNL Financial; Market data as of 6/7/2013

(1)

First Call Consensus estimates

(2)

Core income excludes extraordinary items, non-recurring items and gains/losses

on sale of securities Market Valuation

Net Charge-Offs / Average Loans

0.12%

0.80%

1.24%

1.17%

0.86%

0.40%

0.28%

0.00%

0.50%

1.00%

1.50%

2007

2008

2009

2010

2011

2012

Q1 2013

Headquarters:

Charlottesville, Virginia

Ticker:

STEL

Established:

1900

Branches:

56

Chief Executive Officer:

O.R. Barham Jr.

Chief Financial Officer:

Jeffrey Farrar

15

Price (6/7/13):

Market Cap. ($mm):

Price / Book:

Price / Tang. Book:

Price / 2014 EPS:

(1)

Dividend Yield:

Financial Highlights

(Dollars in thousands)

Years Ended, December 31,

Quarter Ended

2010

2011

2012

3/31/2013

Balance Sheet Items

Total Assets

$2,940,442

$2,917,928

$3,023,204

$3,013,889

Total Net Loans

2,114,071

2,041,082

2,087,547

2,142,477

Deposits

2,386,102

2,395,600

2,484,324

2,476,005

Equity

426,437

414,173

431,642

428,753

Tangible Common Equity

277,360

294,327

313,741

310,479

Profitability

Net Income to Common

$7,900

$13,430

$22,163

$5,911

Core ROAA

(2)

0.32

%

0.57

%

0.77

%

0.84

%

Core ROAE

(2)

2.3

3.9

5.4

5.9

Net Interest Margin

3.65

3.80

3.80

3.73

Efficiency Ratio

70.8

70.4

68.3

68.2

Fee Income / Op. Rev.

25.7

25.0

24.0

23.8

Balance Sheet Ratios

TCE / TA

9.84

%

10.52

%

10.80

%

10.72

%

Total Capital Ratio

15.44

16.42

16.86

16.47

Asset Quality

NPLs / Loans

3.87

%

3.36

%

2.79

%

2.42

%

NPAs / Loans + OREO

4.35

3.76

3.06

2.71

LLR / Loans

1.75

1.57

1.41

1.34

$16.21

$365.9

0.85x

1.18x

14.8x

2.5% |

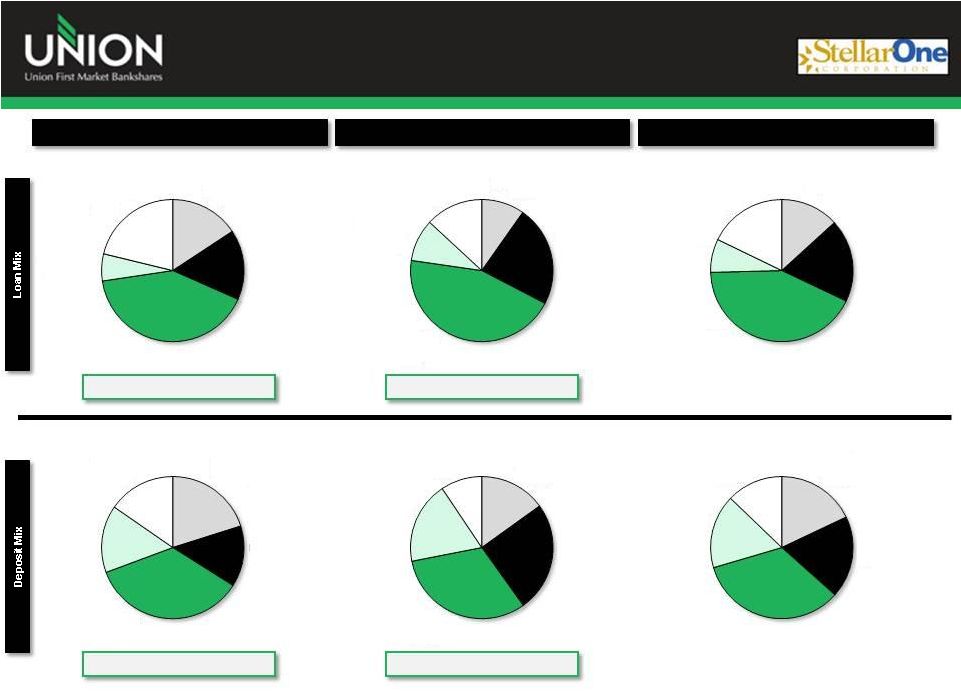

Loan and Deposit Composition

16

Cost of Total Deposits: 0.48%

Cost of Total Deposits: 0.51%

Union First Market Bankshares Corporation

StellarOne Corporation

Pro Forma

Total:

Total:

Total:

Yield on Loans: 5.05%

Yield on Loans: 4.82%

Total:

Total:

Total:

$2,974mm

$2,141mm

$5,115mm

$3,312mm

$2,476mm

$5,788mm

Source: SNL Financial

UBSH loan and deposit data as of 3/31/2013 per SEC filings

STEL loan and deposit data as of 3/31/2013 per SEC filings

Construction

15.7%

Residential

R.E.

15.9%

Commercial

R.E.

41.0%

Commercial &

Industrial

6.2%

Consumer &

Other

21.2%

Construction

9.8%

Residential

R.E.

22.9%

Commercial

R.E.

44.7%

Commercial &

Industrial

9.6%

Consumer &

Other

13.1%

Demand

Deposits

20.1%

NOW & Other

Trans. Accts

13.9%

MMDA & Other

Savings

35.4%

Retail Time

Deposits

15.3%

Jumbo Time

Deposits

15.3%

Demand

Deposits

15.1%

NOW & Other

Trans. Accts

25.1%

MMDA & Other

Savings

31.8%

Retail Time

Deposits

18.7%

Jumbo Time

Deposits

9.4%

Demand

Deposits

17.9%

NOW & Other

Trans. Accts

18.7%

MMDA & Other

Savings

33.8%

Retail Time

Deposits

16.8%

Jumbo Time

Deposits

12.8%

Construction

13.2%

Residential

R.E.

18.8%

Commercial

R.E.

42.5%

Commercial &

Industrial

7.6%

Consumer &

Other

17.8% |

Additional Information

17

Additional Information and Where to Find It In connection with

the proposed merger, Union will file with the Securities and Exchange Commission (the “SEC”) a registration statement on

Form S-4 to register the shares of Union common stock to be issued to the stockholders of

StellarOne. The registration statement will include a joint proxy statement/prospectus which

will be sent to the stockholders of Union and StellarOne seeking their approval of the merger and related

matters. In addition, each of Union and StellarOne may file other relevant documents concerning the

proposed merger with the SEC.

Investors and stockholders of both companies are urged to read the registration statement on Form

S-4 and the joint proxy statement/prospectus included within the registration statement and

any other relevant documents to be filed with the SEC in connection with the proposed merger

because they will contain important information about Union, StellarOne and the proposed transaction.

Investors and stockholders may obtain free copies of these documents through the website

maintained by the SEC at www.sec.gov. Free copies of the joint proxy statement/prospectus also

may be obtained by directing a request by telephone or mail to Union First Market Bankshares Corporation, 1051 East Cary Street, Suite

1200, Richmond, Virginia 23219, Attention: Investor Relations (telephone: (804) 633-5031), or

StellarOne Corporation, 590 Peter Jefferson Pkwy, Suite 250, Charlottesville, Virginia 22911,

Attention: Investor Relations (telephone: (434) 964-2217), or by accessing Union’s website at

www.bankatunion.com under “Investor Relations” or StellarOne’s website at

www.stellarone.com under “Investor Relations.” The information on Union’s and

StellarOne’s websites is not, and shall not be deemed to be, a part of this presentation or incorporated into other filings either

company makes with the SEC. Union and StellarOne

and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from

the stockholders of Union and/or StellarOne in connection with the merger. Information about the

directors and executive officers of Union is set forth in the proxy statement for Union’s

2013 annual meeting of stockholders filed with the SEC on April 23, 2013. Information about the

directors and executive officers of StellarOne is set forth in the proxy statement for

StellarOne’s 2013 annual meeting of stockholders filed with the SEC on April 9, 2013.

Additional information regarding the interests of these participants and other persons who may be deemed participants

in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger

when it becomes available. |