Exhibit 99.1

Exhibit 99.1

UNION

Union First Market Bankshares

Investor Presentation

February 2013

UNION

Union First Market Bankshares

Overview

Financial Performance

Near-Term Outlook

Q&A

2

Forward-Looking Statement

UNION

Union First Market Bankshares

Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise and are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other statements concerning opinions or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance or achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of and changes in: general economic and bank industry conditions, the interest rate environment, legislative and regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the stock and bond markets, accounting standards or interpretations of existing standards, mergers and acquisitions, technology, and consumer spending and savings habits. The Company does not update any forward-looking statements that may be made from time to time by or on behalf of the Company.

3

Company Overview

UNION

Union First Market Bankshares

One of the largest financial services organizations headquartered in Virginia Holding company formed in 1993 – Banking history in our communities goes back more than 100 years

Assets of $4.1 Billion

Comprehensive financial services provider offering commercial and retail banking, mortgage, investment, trust and insurance products and services

4

Union First Market’s Strengths

UNION

Union First Market Bankshares

Excellent branch network, competitive banking products and services and a loyal client base Well positioned for organic growth given commercial activity, household income levels and population growth in its footprint Strong balance sheet and solid capital base Conservative lender with improving asset quality metrics Experienced management team, building depth Successful acquirer and integrator Proven financial performance in both good and bad economic climates

5

Union First Market Footprint

UNION

Union First Market Bankshares

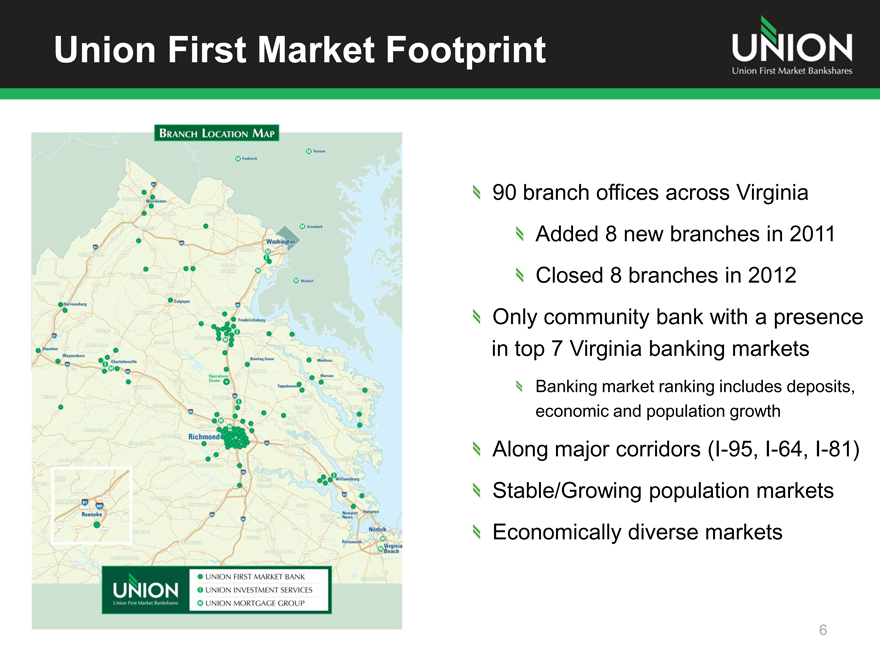

90 branch offices across Virginia

Added 8 new branches in 2011 Closed 8 branches in 2012

Only community bank with a presence in top 7 Virginia banking markets

Banking market ranking includes deposits, economic and population growth

Along major corridors (I-95, I-64, I-81) Stable/Growing population markets Economically diverse markets

6

Quality Franchise

UNION

Union First Market Bankshares

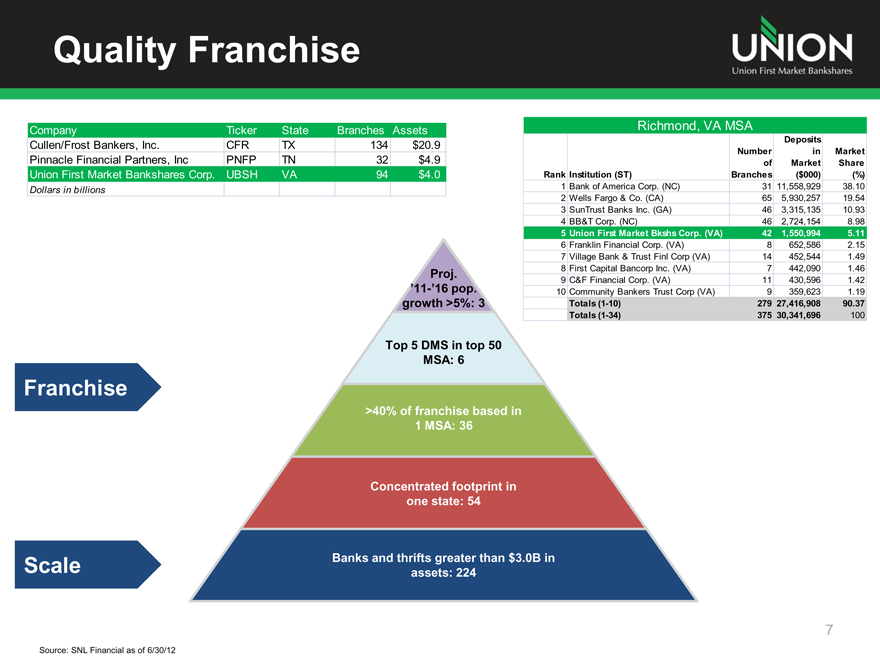

Company Ticker State Branches Assets

Cullen/Frost Bankers, Inc. CFR TX 134 $20.9

Pinnacle Financial Partners, Inc PNFP TN 32 $4.9

Union First Market Bankshares Corp. UBSH VA 94 $4.0

Dollars in billions

Franchise

Scale

Richmond, VA MSA

Deposits

Number in Market

of Market Share

Rank Institution (ST) Branches ($000) (%)

1 Bank of America Corp. (NC) 31 11,558,929 38.10

2 Wells Fargo & Co. (CA) 65 5,930,257 19.54

3 SunTrust Banks Inc. (GA) 46 3,315,135 10.93

4 BB&T Corp. (NC) 46 2,724,154 8.98

5 Union First Market Bkshs Corp. (VA) 42 1,550,994 5.11

6 Franklin Financial Corp. (VA) 8 652,586 2.15

7 Village Bank & Trust Finl Corp (VA) 14 452,544 1.49

8 First Capital Bancorp Inc. (VA) 7 442,090 1.46

9 C&F Financial Corp. (VA) 11 430,596 1.42

10 Community Bankers Trust Corp (VA) 9 359,623 1.19

Totals (1-10) 279 27,416,908 90.37

Totals (1-34) 375 30,341,696 100

Proj.

’11-’16 pop. growth >5%: 3

Top 5 DMS in top 50 MSA: 6

franchise >40% based of franchise in based in 1 MSA: 36

Concentrated footprint in one state: 54

Banks and thrifts greater than $3.0B in assets: 224

Source: SNL Financial as of 6/30/12

7

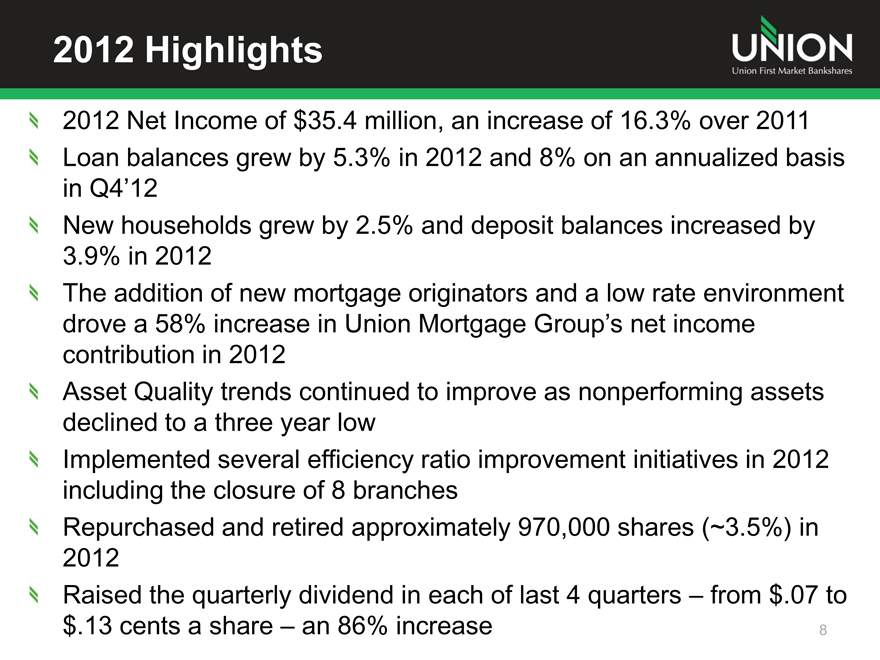

2012 Highlights

UNION

Union First Market Bankshares

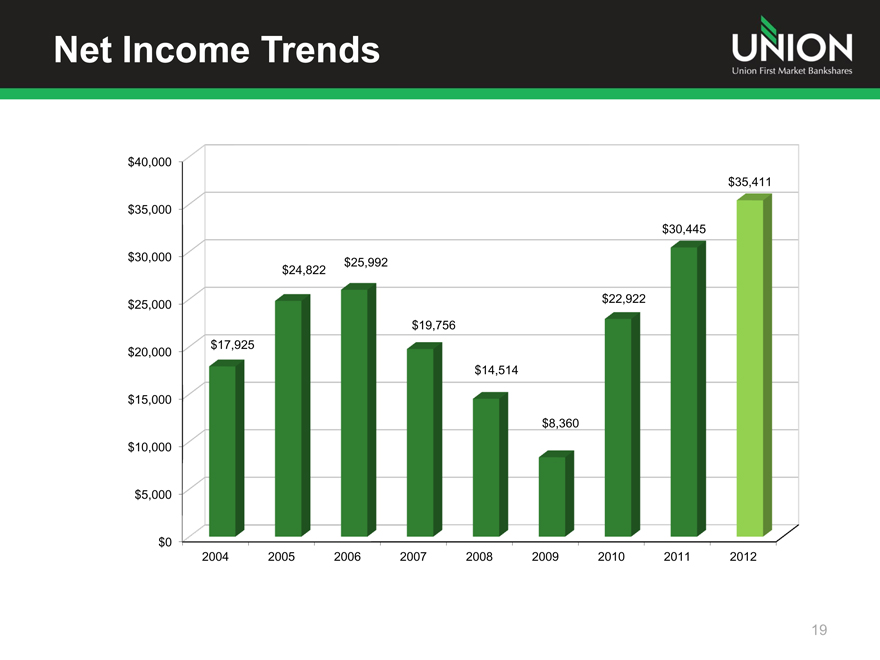

2012 Net Income of $35.4 million, an increase of 16.3% over 2011

Loan balances grew by 5.3% in 2012 and 8% on an annualized basis

in Q4’12

New households grew by 2.5% and deposit balances increased by

3.9% in 2012

The addition of new mortgage originators and a low rate environment

drove a 58% increase in Union Mortgage Group’s net income

contribution in 2012

Asset Quality trends continued to improve as nonperforming assets

declined to a three year low

Implemented several efficiency ratio improvement initiatives in 2012

including the closure of 8 branches

Repurchased and retired approximately 970,000 shares (~3.5%) in

2012

Raised the quarterly dividend in each of last 4 quarters – from $.07 to

$.13 cents a share – an 86% increase

8

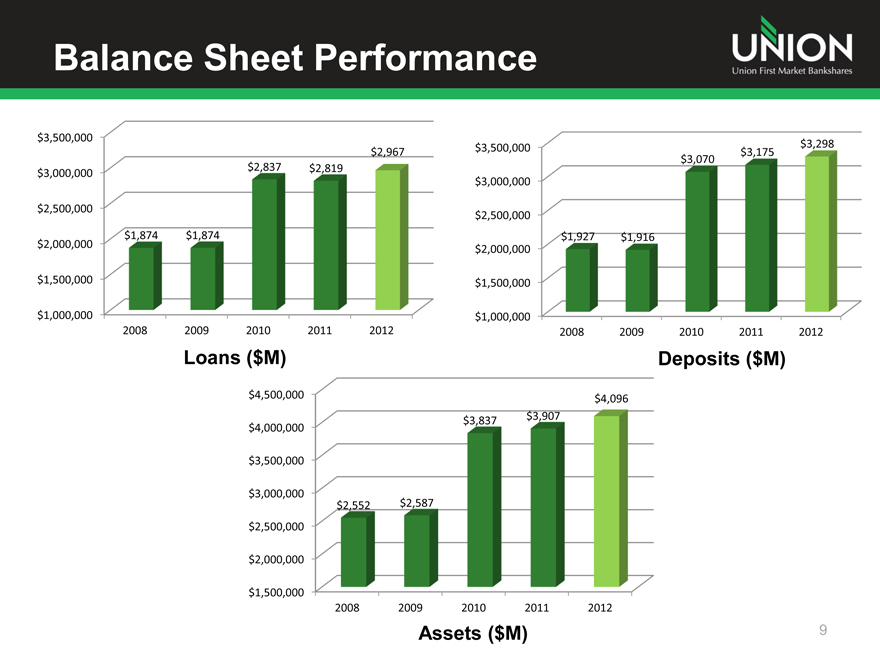

Balance Sheet Performance

UNION

Union First Market Bankshares

$3,500,000 $3,000,000 $2,500,000 $2,000,000 $1,500,000 $1,000,000

2008 2009 2010 2011 2012

$1,874

$1,874

$2,837 $2,819

$2,967

Loans ($M)

$4,500,000 $4,000,000 $3,500,000 $3,000,000 $2,500,000 $2,000,000 $1,500,000

2008 2009 2010 2011 2012

$2,552 $2,587

$3,907 $3,837

$4,096

Assets ($M)

$3,500,000 $3,000,000 $2,500,000 $2,000,000 $1,500,000 $1,000,000

2008 2009 2010 2011 2012

$1,927 $1,916

$3,175 $3,070

$3,298

Deposits ($M)

9

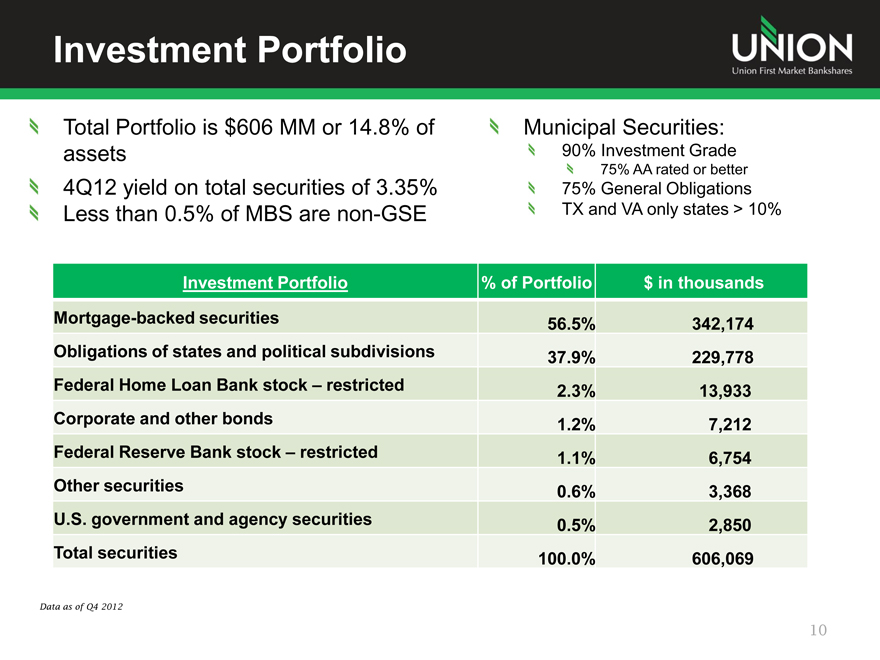

Investment Portfolio

UNION

Union First Market Bankshares

Total Portfolio is $606 MM or 14.8% of assets

4Q12 yield on total securities of 3.35% Less than 0.5% of MBS are non-GSE

Municipal Securities:

90% Investment Grade

75% AA rated or better

75% General Obligations TX and VA only states > 10%

Investment Portfolio % of Portfolio $ in thousands

Mortgage-backed securities 56.5% 342,174

Obligations of states and political subdivisions 37.9% 229,778

Federal Home Loan Bank stock – restricted 2.3% 13,933

Corporate and other bonds 1.2% 7,212

Federal Reserve Bank stock – restricted 1.1% 6,754

Other securities 0.6% 3,368

U.S. government and agency securities 0.5% 2,850

Total securities 100.0% 606,069

Data as of Q4 2012

10

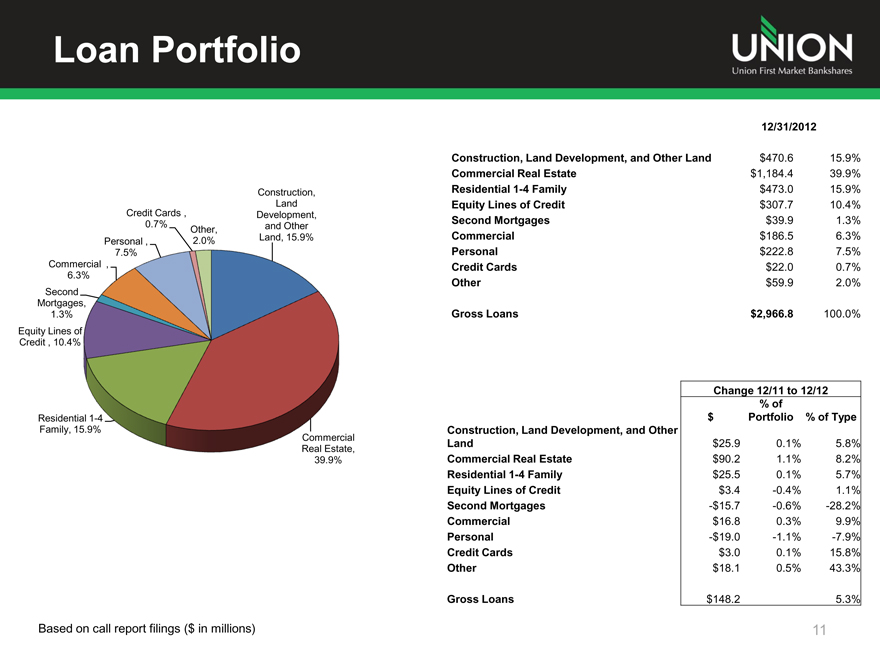

Loan Portfolio

UNION

Union First Market Bankshares

Construction,

Land

Credit Cards , Development,

0.7% Other, and Other

Personal, 2.0% Land, 15.9%

7.5%

Commercial,

6.3%

Second

Mortgages,

1.3%

Equity Lines of

Credit, 10.4%

Residential 1-4

Family, 15.9%

Commercial

Real Estate,

39.9%

12/31/2012

Construction, Land Development, and Other Land $470.6 15.9%

Commercial Real Estate $1,184.4 39.9%

Residential 1-4 Family $473.0 15.9%

Equity Lines of Credit $307.7 10.4%

Second Mortgages $39.9 1.3%

Commercial $186.5 6.3%

Personal $222.8 7.5%

Credit Cards $22.0 0.7%

Other $59.9 2.0%

Gross Loans $2,966.8 100.0%

Change 12/11 to 12/12

% of

$ Portfolio % of Type

Construction, Land Development, and Other

Land $25.9 0.1% 5.8%

Commercial Real Estate $90.2 1.1% 8.2%

Residential 1-4 Family $25.5 0.1% 5.7%

Equity Lines of Credit $3.4 -0.4% 1.1%

Second Mortgages -$15.7 -0.6% -28.2%

Commercial $16.8 0.3% 9.9%

Personal -$19.0 -1.1% -7.9%

Credit Cards $3.0 0.1% 15.8%

Other $18.1 0.5% 43.3%

Gross Loans $148.2 5.3%

Based on call report filings ($ in millions)

11

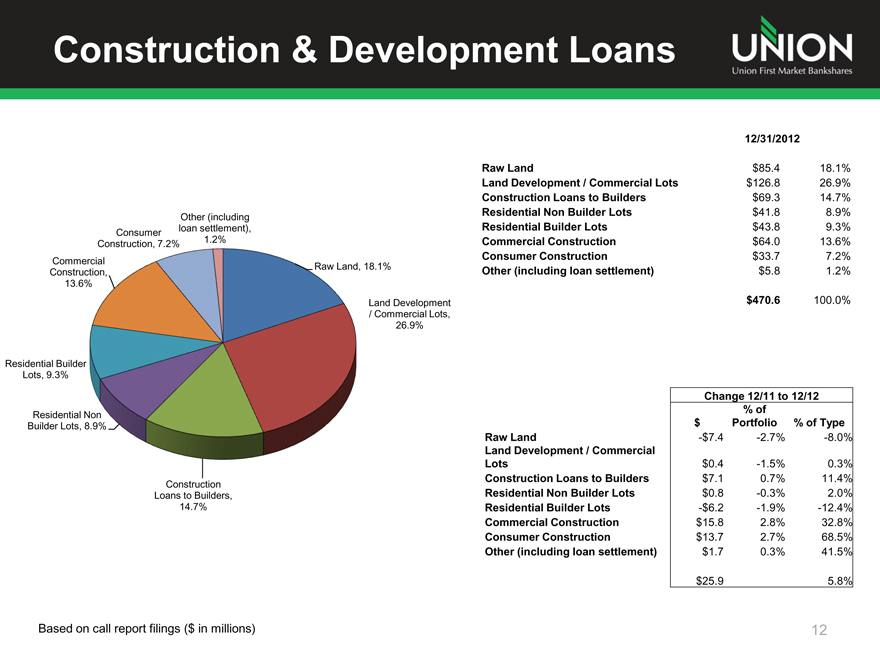

Construction & Development Loans

UNION

Union First Market Bankshares

Other (including

Consumer loan settlement),

Construction, 7.2% 1.2%

Commercial Raw Land, 18.1%

Construction,

13.6%

Land Development

/ Commercial Lots,

26.9%

Residential Builder

Lots, 9.3%

Residential Non

Builder Lots, 8.9%

Construction

Loans to Builders,

14.7%

12/31/2012

Raw Land $85.4 18.1%

Land Development / Commercial Lots $126.8 26.9%

Construction Loans to Builders $69.3 14.7%

Residential Non Builder Lots $41.8 8.9%

Residential Builder Lots $43.8 9.3%

Commercial Construction $64.0 13.6%

Consumer Construction $33.7 7.2%

Other (including loan settlement) $5.8 1.2%

$470.6 100.0%

Change 12/11 to 12/12

% of

$ Portfolio % of Type

Raw Land -$7.4 -2.7% -8.0%

Land Development / Commercial

Lots $0.4 -1.5% 0.3%

Construction Loans to Builders $7.1 0.7% 11.4%

Residential Non Builder Lots $0.8 -0.3% 2.0%

Residential Builder Lots -$6.2 -1.9% -12.4%

Commercial Construction $15.8 2.8% 32.8%

Consumer Construction $13.7 2.7% 68.5%

Other (including loan settlement) $1.7 0.3% 41.5%

$25.9 5.8%

Based on call report filings ($ in millions)

12

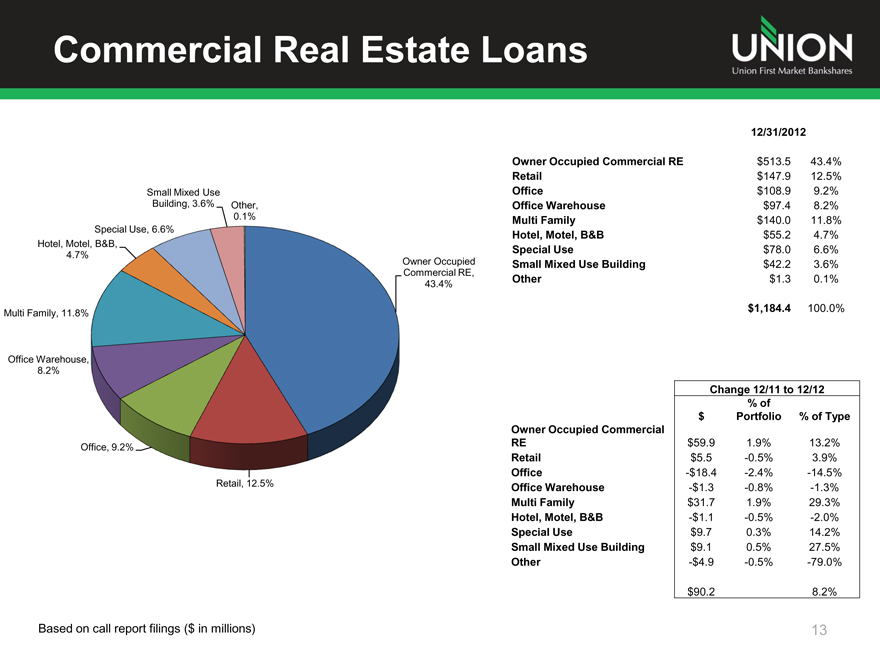

Commercial Real Estate Loans

UNION

Union First Market Bankshares

Small Mixed Use

Building, 3.6% Other,

0.1%

Special Use, 6.6%

Hotel, Motel, B&B,

4.7%

Owner Occupied

Commercial RE,

43.4%

Multi Family, 11.8%

Office Warehouse,

8.2%

Office, 9.2%

Retail, 12.5%

12/31/2012

Owner Occupied Commercial RE $513.5 43.4%

Retail $147.9 12.5%

Office $108.9 9.2%

Office Warehouse $97.4 8.2%

Multi Family $140.0 11.8%

Hotel, Motel, B&B $55.2 4.7%

Special Use $78.0 6.6%

Small Mixed Use Building $42.2 3.6%

Other $1.3 0.1%

$1,184.4 100.0%

Change 12/11 to 12/12

% of

$ Portfolio % of Type

Owner Occupied Commercial

RE $59.9 1.9% 13.2%

Retail $5.5 -0.5% 3.9%

Office -$18.4 -2.4% -14.5%

Office Warehouse -$1.3 -0.8% -1.3%

Multi Family $31.7 1.9% 29.3%

Hotel, Motel, B&B -$1.1 -0.5% -2.0%

Special Use $9.7 0.3% 14.2%

Small Mixed Use Building $9.1 0.5% 27.5%

Other -$4.9 -0.5% -79.0%

$90.2 8.2%

Based on call report filings ($ in millions)

13

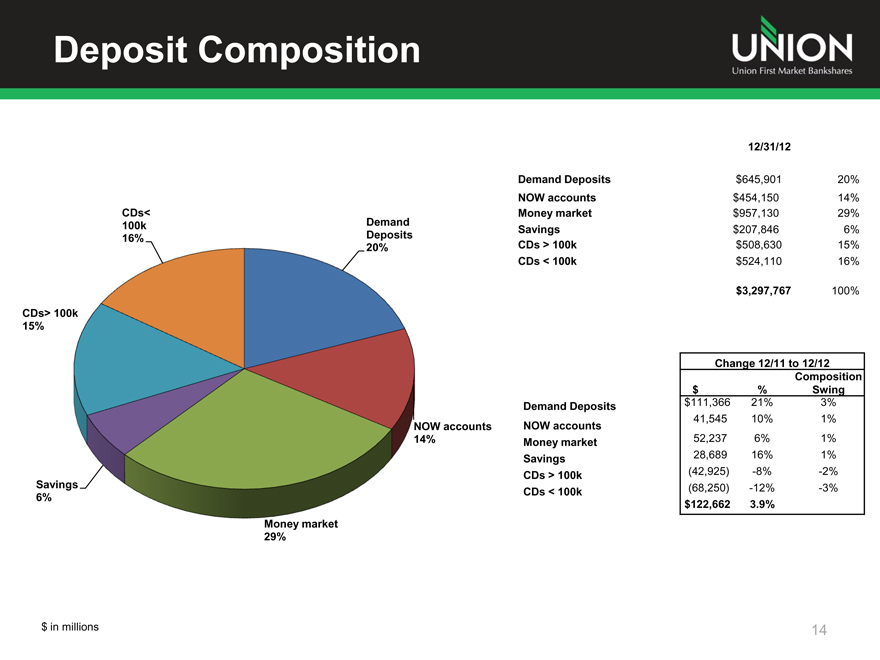

Deposit Composition

UNION

Union First Market Bankshares

CDs<

100k Demand

16% Deposits

20%

CDs> 100k

15%

NOW accounts

14%

Savings

6%

Money market

29%

12/31/12

Demand Deposits $645,901 20%

NOW accounts $454,150 14%

Money market $957,130 29%

Savings $207,846 6%

CDs > 100k $508,630 15%

CDs < 100k $524,110 16%

$3,297,767 100%

Change 12/11 to 12/12

Composition

$ % Swing

Demand Deposits $111,366 21% 3%

NOW accounts 41,545 10% 1%

Money market 52,237 6% 1%

Savings 28,689 16% 1%

CDs > 100k (42,925) -8% -2%

CDs < 100k (68,250) -12% -3%

$122,662 3.9%

$ in millions

14

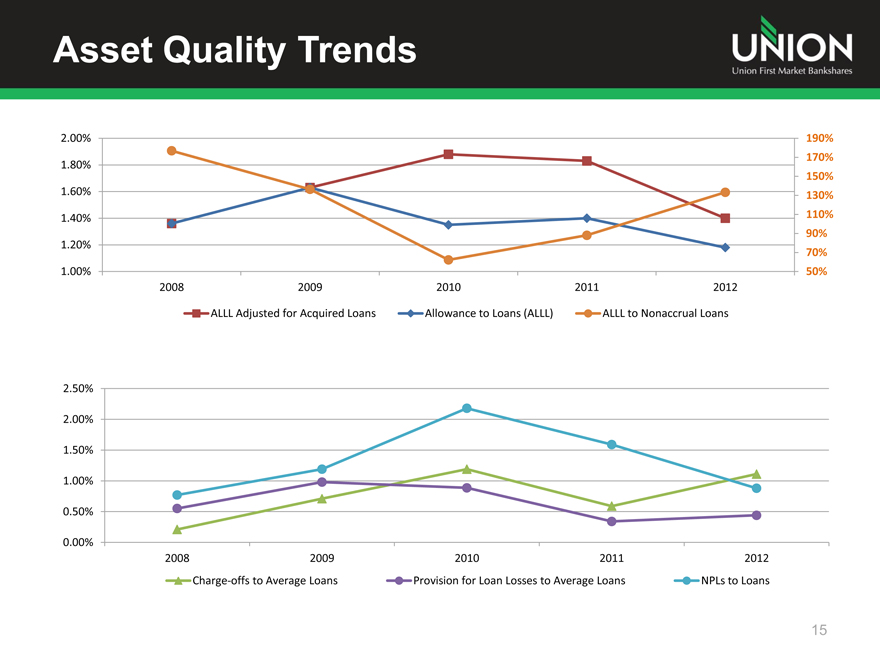

Asset Quality Trends

UNION

Union First Market Bankshares

2.00% 1.80% 1.60% 1.40% 1.20% 1.00%

2008

2009

2010

2011

2012

ALLL Adjusted for Acquired Loans

Allowance to Loans (ALLL)

ALLL to Nonaccrual Loans

190% 170% 150% 130% 110% 90% 70% 50%

2.50% 2.00% 1.50% 1.00% 0.50% 0.00%

2008 2009 2010 2011 2012

Charge-offs to Average Loans

Provision for Loan Losses to Average Loans

NPLs to Loans

15

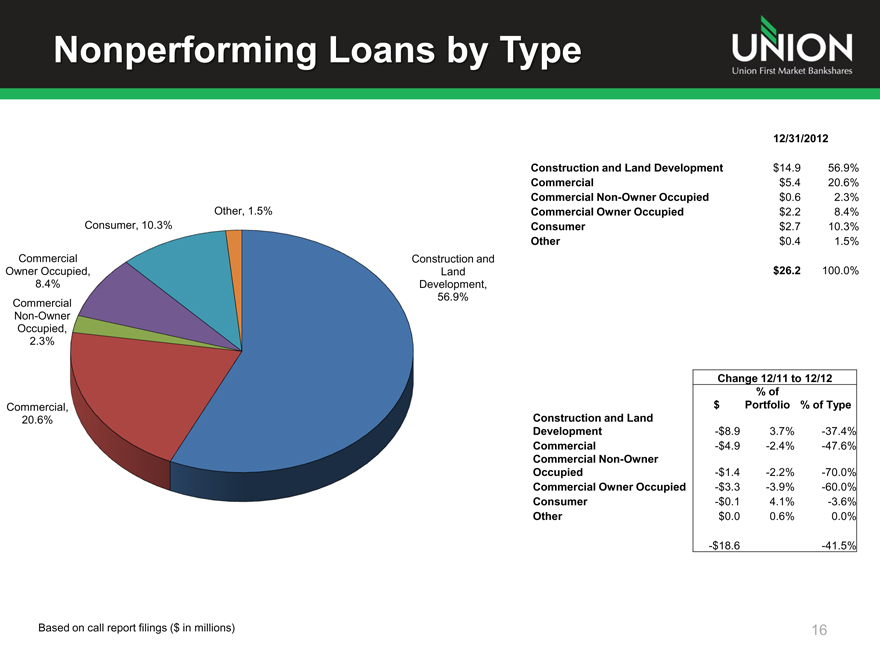

Nonperforming Loans by Type

UNION

Union First Market Bankshares

Other, 1.5%

Consumer, 10.3%

Commercial Construction and

Owner Occupied, Land

8.4% Development,

Commercial 56.9%

Non-Owner

Occupied,

2.3%

Commercial,

20.6%

12/31/2012

Construction and Land Development $14.9 56.9%

Commercial $5.4 20.6%

Commercial Non-Owner Occupied $0.6 2.3%

Commercial Owner Occupied $2.2 8.4%

Consumer $2.7 10.3%

Other $0.4 1.5%

$26.2 100.0%

Change 12/11 to 12/12

% of

$ Portfolio % of Type

Construction and Land

Development -$8.9 3.7% -37.4%

Commercial -$4.9 -2.4% -47.6%

Commercial Non-Owner

Occupied -$1.4 -2.2% -70.0%

Commercial Owner Occupied -$3.3 -3.9% -60.0%

Consumer -$0.1 4.1% -3.6%

Other $0.0 0.6% 0.0%

-$18.6 -41.5%

Based on call report filings ($ in millions)

16

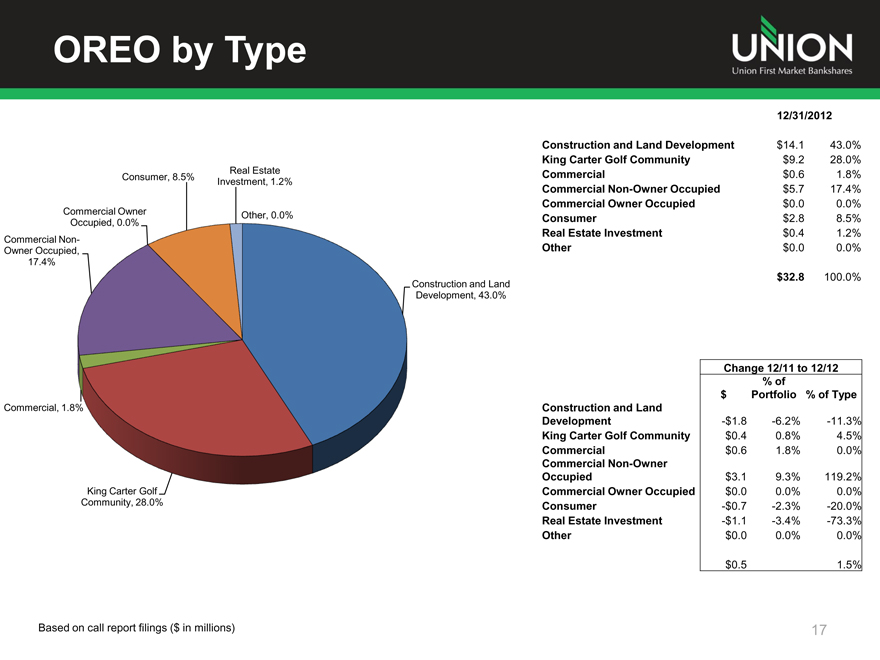

OREO by Type

UNION

Union First Market Bankshares

Real Estate

Consumer, 8.5% Investment, 1.2%

Commercial Owner Other, 0.0%

Occupied, 0.0%

Commercial Non-

Owner Occupied,

17.4%

Construction and Land

Development, 43.0%

Commercial, 1.8%

King Carter Golf

Community, 28.0%

12/31/2012

Construction and Land Development $14.1 43.0%

King Carter Golf Community $9.2 28.0%

Commercial $0.6 1.8%

Commercial Non-Owner Occupied $5.7 17.4%

Commercial Owner Occupied $0.0 0.0%

Consumer $2.8 8.5%

Real Estate Investment $0.4 1.2%

Other $0.0 0.0%

$32.8 100.0%

Change 12/11 to 12/12

% of

$ Portfolio % of Type

Construction and Land

Development -$1.8 -6.2% -11.3%

King Carter Golf Community $0.4 0.8% 4.5%

Commercial $0.6 1.8% 0.0%

Commercial Non-Owner

Occupied $3.1 9.3% 119.2%

Commercial Owner Occupied $0.0 0.0% 0.0%

Consumer -$0.7 -2.3% -20.0%

Real Estate Investment -$1.1 -3.4% -73.3%

Other $0.0 0.0% 0.0%

$0.5 1.5%

Based on call report filings ($ in millions)

17

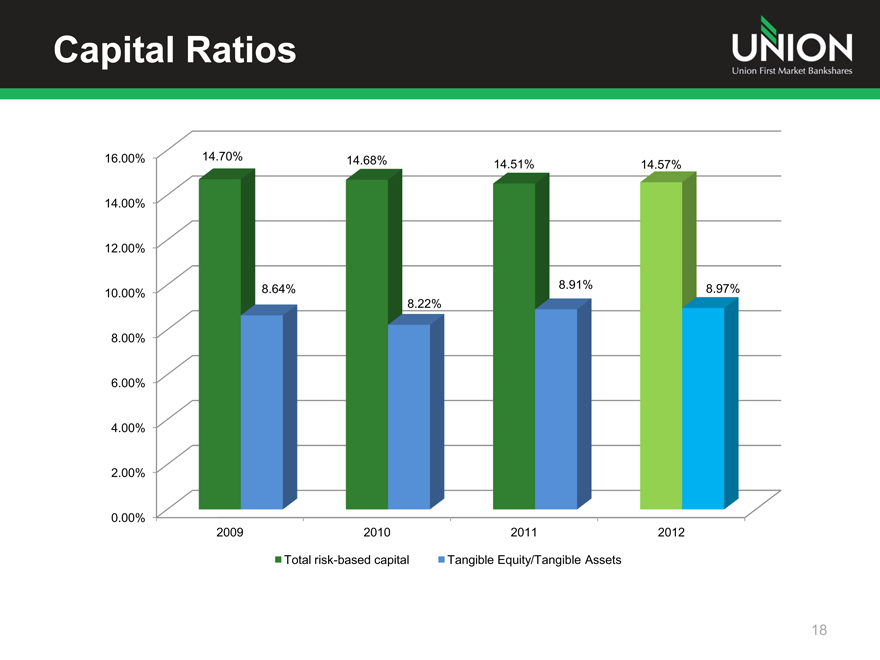

Capital Ratios

UNION

Union First Market Bankshares

16.00%

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

2009 2010 2011 2012

14.70% 14.68%

14.51% 14.57%

8.64%

8.22%

8.91%

8.97%

Total risk-based capital

Tangible Equity/Tangible Assets

18

Net Income Trends

UNION

Union First Market Bankshares

$40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $0

2004 2005 2006 2007 2008 2009 2010 2011 2012

$17,925

$25,992 $24,822

$19,756

$14,514

$8,360

$22,922

$30,445

$35,411

19

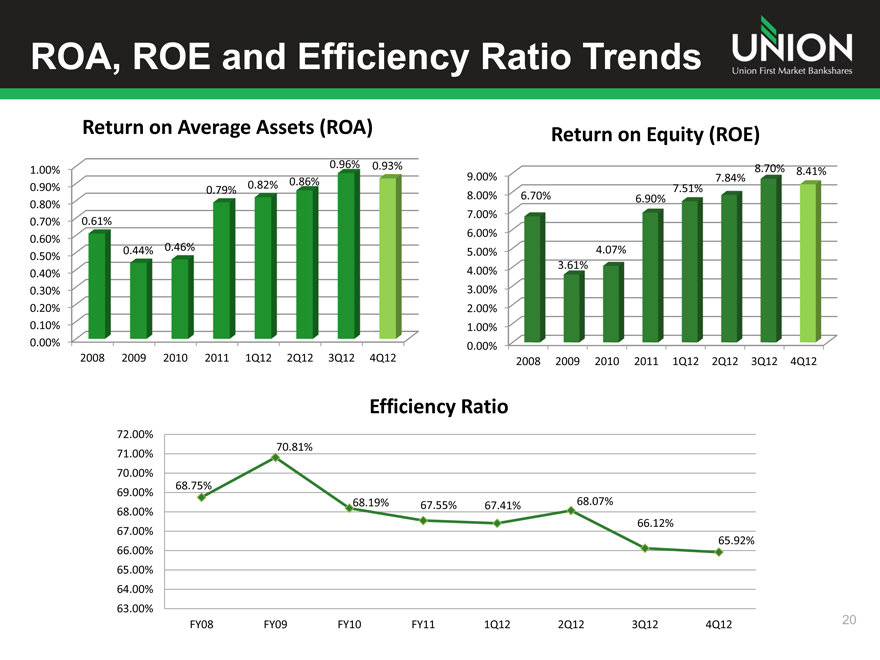

ROA, ROE and Efficiency Ratio Trends

UNION

Union First Market Bankshares

Return on Average Assets (ROA)

1.00% 0.90% 0.80% 0.70% 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00%

2008 2009 2010 2011 1Q12 2Q12 3Q12 4Q12

0.96% 0.93%

0.82% 0.86%

0.79%

0.61%

0.44% 0.46%

Return on Equity (ROE)

9.00% 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00%

2008 2009 2010 2011 1Q12 2Q12 3Q12 4Q12

7.84% 8.70% 8.41%

7.51%

6.70% 6.90%

4.07%

3.61%

Efficiency Ratio

72.00% 71.00% 70.00% 69.00% 68.00% 67.00% 66.00% 65.00% 64.00% 63.00%

FY08 FY09 FY10 FY11 1Q12 2Q12 3Q12 4Q12

70.81%

68.75%

68.19% 67.55% 67.41% 68.07%

66.12%

65.92%

20

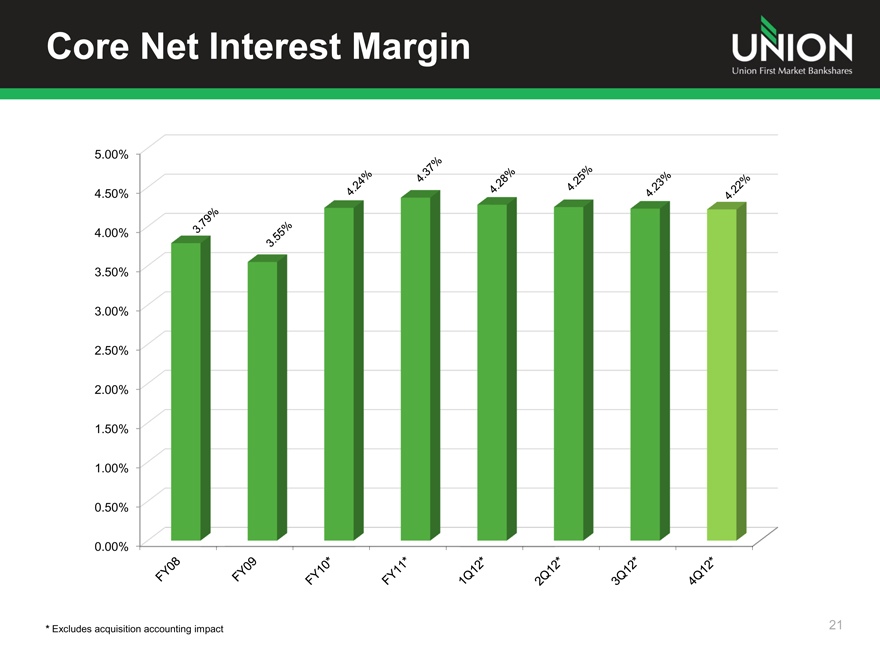

Core Net Interest Margin

UNION

Union First Market Bankshares

5.00%

4.50%

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

FY08 FY09 FY10* FY11* 1Q12* 2Q12* 3Q12* 4Q128

3.79% 3.55% 4.24% 4.37% 4.28% 4.25% 4.23% 4.22%

* Excludes acquisition accounting impact

21

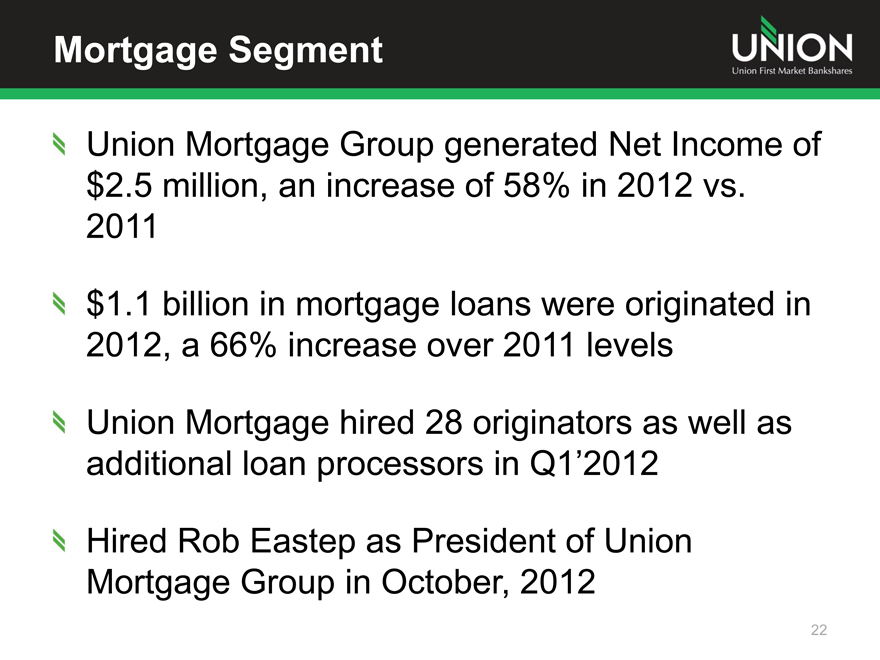

Mortgage Segment

UNION

Union First Market Bankshares

Union Mortgage Group generated Net Income of

$2.5 million, an increase of 58% in 2012 vs.

2011

$1.1 billion in mortgage loans were originated in 2012, a 66% increase over 2011 levels

Union Mortgage hired 28 originators as well as additional loan processors in Q1’2012

Hired Rob Eastep as President of Union Mortgage Group in October, 2012

22

Top-Tier Financial Performance Focus

UNION

Union First Market Bankshares

Union is committed to achieving top tier financial performance and providing our shareholders with above average returns on their investment In 2012, Union developed key financial performance metrics benchmarked against top quartile peers and set internal targets designed to measure progress towards achievement of top tier financial results

Minimum targets were set for ROA (>1%), ROE (>10%) and efficiency ratio (<65%)

Several initiatives were implemented that will result in increased non-interest income and expense savings in 2013—including the closure of 8 branches in 2012

23

2013 Outlook

UNION

Union First Market Bankshares

Stable to growing economy in footprint Mid-single digit loan growth Modest margin compression Continued asset quality improvement as commercial and residential real estate markets stabilize further

Increasing profitability and contribution from Union Mortgage Group Improving ROA, ROE and Efficiency Ratio

24

Value Proposition

UNION

Union First Market Bankshares

Branch footprint is a competitive advantage and brings a unique franchise value Strong balance sheet and capital base

Best in class net interest margin

Experienced management team

Successful acquirer and integrator

Proven financial performance in all market environments Commitment to top tier financial performance Focused on shareholder returns

Attractive valuation vs. peer group

25

UNION

Union First Market Bankshares

THANK YOU!