Exhibit 99.1

|

|

Exhibit 99.1

Union First Market Bankshares KBW Carolina & Virginia

Bank Conference

September 2012

|

|

Overview

Financial Performance

Near-Term Outlook

Q&A

| 2 |

|

|

|

Forward-Looking Statement

Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise and are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other statements concerning opinions or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance or achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of and changes in: general economic and bank industry conditions, the interest rate environment, legislative and regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the stock and bond markets, accounting standards or interpretations of existing standards, mergers and acquisitions, technology, and consumer spending and savings habits. The Company does not update any forward-looking statements that may be made from time to time by or on behalf of the Company.

| 3 |

|

|

|

Company Overview

One of the largest financial services organizations headquartered in Virginia Holding company formed in 1993 – Banking history in some of our communities goes back more than 100 years

Assets of $4.0 Billion

Comprehensive financial services provider offering commercial and retail banking, mortgage, investment, trust and insurance products and services

| 4 |

|

|

|

Union First Market’s Strengths

Excellent branch network, competitive banking products and services and a loyal client base Well positioned for organic growth given commercial activity, household income levels and population growth in its footprint Strong balance sheet and solid capital base Conservative lender with improving asset quality metrics Experienced management team Successful acquirer and integrator Proven financial performance in both good and bad economic climates

| 5 |

|

|

|

Virginia Population Expansion

Population Change, 2000 to 2010

Lost Population

Gained 0—5,000

Gained 5,001-10,000

Gained 10,001-25,000

Gained 25,001-50,000

Gained more than 50,000

Source: Weldon Cooper Center, UVA

| 6 |

|

|

|

Union First Market Footprint

Added 8 new branches in 2011 Closed 4 branches in 2012

Only community bank with a presence in top 7 Virginia banking markets

Banking market ranking includes deposits, economic and population growth

Along major corridors (I-95, I-64, I-81) Stable/Growing population markets Economically diverse markets

| 7 |

|

|

|

Quality Franchise

Company Ticker State Branches Assets

| 1 |

|

Cullen/Frost Bankers, Inc. CFR TX 128 $18.5 |

| 2 |

|

Pinnacle Financial Partners, Inc. PNFP TN 34 4.8 |

| 3 |

|

Union First Market Bankshares Corp. UBSH VA 100 3.9 |

Dollars in billions

Richmond, VA MSA

Deposits Market

Branch in Market Share

Rank Institution (ST) Count($M)(%)

| 1 |

|

Bank of America Corp. (NC) 31 10,621 35.8 |

| 2 |

|

Wells Fargo & Co. (CA) 65 6,322 21.3 |

| 3 |

|

SunTrust Banks Inc. (GA) 47 2,930 9.9 |

| 4 |

|

BB&T Corp. (NC) 48 2,580 8.7 |

| 5 |

|

Union First Market Bkshs Corp. (VA) 45 1,567 5.3 |

| 6 |

|

Franklin Financial Corp. (VA) 8 662 2.2 |

| 7 |

|

Village Bank & Trust Finl Corp (VA) 15 506 1.7 |

| 8 |

|

First Capital Bancorp Inc. (VA) 7 439 1.5 |

9 C&F Financial Corp. (VA) 11 409 1.4

| 10 |

|

Community Bankers Trust Corp (VA) 9 377 1.3 |

Totals (1-10) 286 26,413 89.0

Totals (1-35) 384 29,683 100.0

Proj.

‘10-’15 pop. growth >5%: 3

Top 5 DMS in top 50 MSA: 6

>40% based of franchise in based in 1 MSA:35

Concentrated footprint in one state:47

Banks and thrifts greater than $3.0B in assets:220

Franchise

Scale

Source: SNL Financial as of 6/30/11

| 8 |

|

|

|

First Half Highlights

More than 2,200 new households in the first half

Continued deposit and loan growth

Closed 4 branches in May as part of branch rationalization analysis

New mortgage originators and low rate environment driving strong growth in non-interest income

Asset quality continues to improve Capital levels remain strong

Raised Quarterly Dividend twice in 2012 – now at 10 cents a share

9

|

|

Financial Performance

$ 3,000,000 $ 2,837 $2,819 $2,842 $2,888

$ 2,500,000

$ 2,000,000 $1,874 $1,874

$ 1,500,000

$ 1,000,000

2008 2009 2010 2011 1Q 2012 2Q 2012

$ 3,500,000

$3,175 $3,216 $3,219

$ 3,070

$ 3,000,000

$ 2,500,000

$ 1,927 $ 1,916

$ 2,000,000

$ 1,500,000

$ 1,000,000

2008 2009 2010 2011 1Q 2012 2Q 2012

Deposits ($M)

$3,907 $3,948 $3,982

$3,837

$ 4,000,000

$ 3,500,000

$ 3,000,000

$2,552 $2,587

$ 2,500,000

$ 2,000,000

$ 1,500,000

$ 1,000,000

2008 2009 2010 2011 1Q 2012 2Q 2012

Loans ($M)

Assets ($M)

10

|

|

Investment Portfolio

Total Portfolio is $647 MM Did not invest in or 16.2% of assets Pooled TRUPs 2Q12 yield on total securities of 3.68%

Investment Portfolio % of Portfolio $ in thousands

U.S. government and agency securities 0.6% 3,576

Obligations of states and political subdivisions 32.1% 207,783

Corporate and other bonds 1.5% 9,391

Mortgage-backed securities 62.4% 403,510

Federal Reserve Bank stock – restricted 1.0% 6,754

Federal Home Loan Bank stock – restricted 1.9% 12,537

Other securities 0.5% 3,283

Total securities 100.0% 646,834

Data as of Q2 2012

11

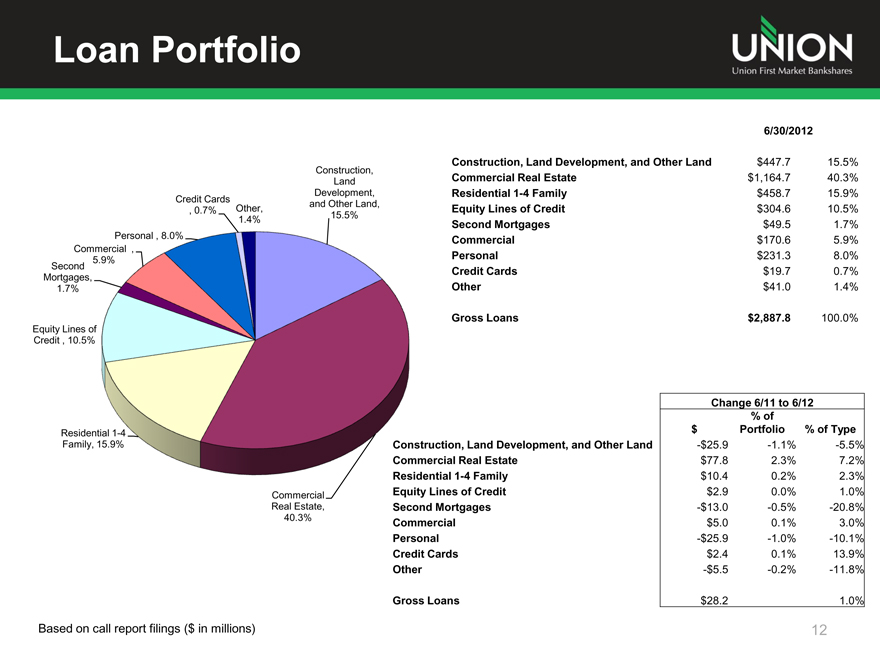

Loan Portfolio

Construction,

Land

Development,

Credit Cards

, 0.7% Other, and Other Land,

1.4% 15.5%

Personal , 8.0%

Commercial ,

Second 5.9%

Mortgages,

1.7%

Equity Lines of

Credit , 10.5%

Residential 1-4

Family, 15.9%

Commercial

Real Estate,

40.3%

6/30/2012

Construction, Land Development, and Other Land $447.7 15.5%

Commercial Real Estate $1,164.7 40.3%

Residential 1-4 Family $458.7 15.9%

Equity Lines of Credit $304.6 10.5%

Second Mortgages $49.5 1.7%

Commercial $170.6 5.9%

Personal $231.3 8.0%

Credit Cards $19.7 0.7%

Other $41.0 1.4%

Gross Loans $2,887.8 100.0%

Change 6/11 to 6/12

% of

$ Portfolio % of Type

Construction, Land Development, and Other Land -$25.9 -1.1% -5.5%

Commercial Real Estate $77.8 2.3% 7.2%

Residential 1-4 Family $10.4 0.2% 2.3%

Equity Lines of Credit $2.9 0.0% 1.0%

Second Mortgages -$13.0 -0.5% -20.8%

Commercial $5.0 0.1% 3.0%

Personal -$25.9 -1.0% -10.1%

Credit Cards $2.4 0.1% 13.9%

Other -$5.5 -0.2% -11.8%

Gross Loans $28.2 1.0%

Based on call report filings ($ in millions)

12

|

|

Construction & Development

Change 6/11 to 6/12

% of

$ Portfolio % of Type

Raw Land -$23.1 -3.9% -21.9%

Land Development / Commercial Lots $3.6 2.3% 2.9%

Construction Loans to Builders $1.9 1.2% 3.0%

Residential Non Builder Lots -$2.7 -0.1% -6.4%

Residential Builder Lots -$7.6 -1.0% -13.9%

Commercial Construction -$9.3 -1.3% -14.8%

Consumer Construction $8.3 2.1% 48.3%

Other (including loan settlement) $3.0 0.7% 272.7%

-$25.9 -5.5%

Consumer Other (including

Construction, loan settlement),

5.7% 0.9%

Commercial

Construction,

12.0% Raw Land, 18.4%

Residential

Builder Lots,

10.5%

Residential Non

Builder Lots,

8.9%

Land

Development /

Construction Commercial Lots,

Loans to Builders, 28.9%

6/30/2012

Raw Land $82.5 18.4%

Land Development / Commercial Lots $129.5 28.9%

Construction Loans to Builders $65.7 14.7%

Residential Non Builder Lots $39.8 8.9%

Residential Builder Lots $47.0 10.5%

Commercial Construction $53.6 12.0%

Consumer Construction $25.5 5.7%

Other (including loan settlement) $4.1 0.9%

$447.7 100.0%

Based on call report filings ($ in millions)

13

|

|

Commercial Real Estate

Small Mixed Use Other,

Building, 2.7% 0.4%

Special Use, 6.1%

Hotel, Motel,

B&B, 4.8% Owner Occupied

Commercial RE,

41.2%

Multi Family, 11.8%

Office Warehouse,

8.2%

Owner

Office, 11.9% Retail

Office

Change 6/11 to 6/12

% of

$ Portfolio % of Type

Owner Occupied Commercial RE $17.4 -1.4% 3.8%

Retail $16.2 0.6% 12.2%

Office $13.0 0.3% 10.3%

Office Warehouse -$4.8 -1.0% -4.8%

Multi Family $33.6 2.2% 32.3%

Hotel, Motel, B&B -$3.2 -0.6% -5.4%

Special Use $11.0 0.6% 18.4%

Small Mixed Use Building -$2.5 -0.4% -7.4%

Other -$2.8 -0.3% -35.0%

$77.9 7.2%

6/30/2012

Owner Occupied Commercial RE $480.2 41.2%

Retail $148.8 12.8%

Office $139.1 11.9%

Office Warehouse $95.9 8.2%

Multi Family $137.5 11.8%

Hotel, Motel, B&B $55.7 4.8%

Special Use $70.8 6.1%

Small Mixed Use Building $31.5 2.7%

Other $5.2 0.4%

$1,164.7 100.0%

Based on call report filings ($ in millions)

14

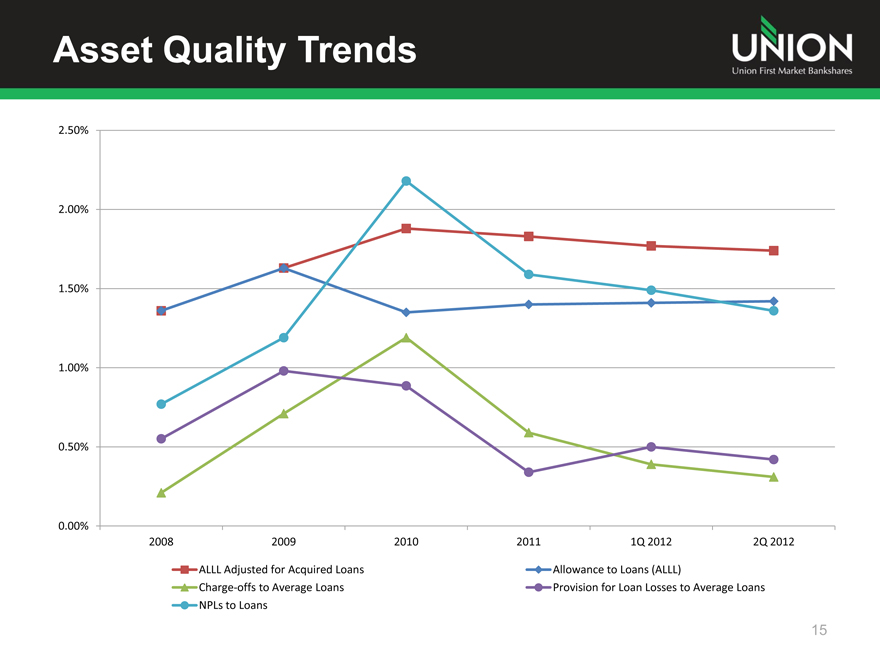

Asset Quality Trends

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

2008 2009 2010 2011 1Q 2012 2Q 2012

ALLL Adjusted for Acquired Loans Allowance to Loans (ALLL)

Charge-offs to Average Loans Provision for Loan Losses to Average Loans

NPLs to Loans

15

|

|

NPAs by Type

OREO / Real Estate

Investment, 2.0%

Other, 0.5%

Construction and

Land Development,

29.6%

OREO, 45.7%

Commercial, 11.1%

Commercial Non-

Owner Occupied,

Consumer, 4.1% 0.4%

Commercial Owner

Occupied, 6.5%

6/30/2012

Construction and Land Development $22.2 29.6%

Commercial $8.3 11.1%

Commercial Non-Owner Occupied $0.3 0.4%

Commercial Owner Occupied $4.9 6.5%

Consumer $3.1 4.1%

OREO $34.3 45.7%

OREO / Real Estate Investment $1.5 2.0%

Other $0.4 0.5%

$75.0 100.0%

11.1% Change 6/11 to 6/12

% of

$ Portfolio % of Type

Construction and Land Development -$ 5.2 -0.6% -19.0%

Commercial -$ 4.5 -3.1% -35.2%

Commercial Non-Owner Occupied -$ 1.4 -1.5% -82.4%

Commercial Owner Occupied -$ 1.7 -0.8% -25.8%

Consumer -$ 1.5 -0.9% -32.6%

OREO -$ 1.3 6.4% -3.7%

OREO / Real Estate Investment $ 0.0 0.3% 0.0%

Other $ 0.0 0.1% 0.0%

-$15.6 -17.2%

Based on call report filings ($ in millions)

16

|

|

NPAs by Market

Rappahannock, Northern Virginia,

3.5% Other, 2.1% 0.0%

Charlottesville,

Hampton Roads, 9.1%

4.1%

Northern Neck,

13.7%

Fredericksburg,

33.6%

Richmond, 33.9%

17

|

|

NPAs by Market

6/30/2012

$ % of

Portfolio

Charlottesville

$6.8 9.1%

Richmond

$25.4 33.9%

Fredericksburg

$25.2 33.6%

Northern Neck

$10.3 13.7%

Hampton Roads

$3.1 4.1%

Rappahannock

$2.6 3.5%

Northern Virginia

$0.0 0.0%

Other

$1.6 2.1%

$75.0 100.0%

Change 6/11 to 6/12

$ % of % of

Portfolio Market

Charlottesville

$4.0 6.0% 142.9%

Richmond

-$4.7 0.6% -15.6%

Fredericksburg -$4.0 1.4% -13.7%

Northern Neck -$0.8 1.5% -7.2%

Hampton Roads

-$1.8 -1.3% -36.7%

Rappahannock

-$3.0 -2.7% -53.6%

Northern Virginia -$1.9 -2.1% -100.0%

Other

-$3.4 -3.4% -68.0%

-$15.6 -17.2%

Based on call report filings (S in millions)

18

|

|

OREO by Type

King

Real Estate

Investment, 4.2% Other, 0.0%

Consumer, 11.7%

Commercial Owner Real

Occupied, 0.0% Construction and

Land Development,

39.4%

Commercial Non-

Owner Occupied,

17.9%

Commercial, 1.7%

King Carter Golf

Community, 25.1%

Change 6/11 to 6/12

% of

$ Portfolio % of Type

Construction and Land Development -$ 4.2 -9.9% -23.0%

King Carter Golf Community $ 0.3 1.7% 3.4%

Commercial $ 0.6 1.7% 0.0%

Commercial Non-Owner Occupied $ 2.0 6.0% 45.5%

Commercial Owner Occupied $ 0.0 0.0% 0.0%

Consumer $ 0.0 0.4% 0.0%

Real Estate Investment $ 0.0 0.1% 0.0%

Other $ 0.0 0.0% 0.0%

-$ 1.3 -3.5%

6/30/2012

Construction and Land Development $14.1 39.4%

King Carter Golf Community $9.0 25.1%

Commercial $0.6 1.7%

Commercial Non-Owner Occupied $6.4 17.9%

Commercial Owner Occupied $0.0 0.0%

Consumer $4.2 11.7%

Real Estate Investment $1.5 4.2%

Other $0.0 0.0%

$35.8 100.0%

Based on call report filings ($ in millions)

19

|

|

Deposit Composition

Change 6/11 to 6/12

Composition

$ % Swing

Demand Deposits $71.2 14% 2%

NOW accounts $46.7 12% 1%

Money market $63.6 8% 1%

Savings $23.0 13% 0%

CDs > 100k $28.6 6% 0%

CDs < 100k $-97.3 -15% -4%

$136.9 4%

Demand

CDs < 100k Deposits

18% 18%

CDs > 100k

17%

NOW accounts

13%

Savings

6%

Money market

28%

06/30/12

Demand Deposits $591.8 18%

NOW accounts $425.2 13%

Money market $905.7 28%

Savings $198.7 6%

CDs > 100k $534.7 17%

CDs < 100k $562.9 17%

$3,218.9 100%

$ in millions

20

|

|

Capital Ratios

| 16.00% |

|

14.70% 14.68% 14.51% 14.64% 14.55% |

14.00%

12.00%

| 10.00% |

|

8.64% 8.91% 8.97% 9.11% |

8.22%

8.00%

6.00%

4.00%

2.00%

0.00%

2009 2010 2011 1Q 2012 2Q 2012

Total risk-based capital Tangible Equity/Tangible Assets

21

|

|

Net Income

$35,000

$30,445

$30,000

$25,992

$24,822

$25,000 $22,922

$19,756

$20,000 $17,925

$16,343

$14,514

$15,000

$10,000 $8,360

$5,000

$0

2004 2005 2006 2007 2008 2009 2010 2011 1H 2012

22

|

|

Net Interest Margin

3.92%

3.89%

3.52%

3.22%

3.30%

3.69%

3.97%

4.22%

4.23%

4.23%*

4.28%*

4.47%*

4.47%*

4.34%*

4.20%

4.28%*

4.25%*

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

5.00%

4.50%

4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00%

| * |

|

Excludes acquisition accounting impact |

23

|

|

ROA/ROE Peer Comparison

ROA

0.86 0.86

0.90

0.85

0.80

0.75 0.69

0.70

0.65

0.60

0.55

0.50

National Virginia Union

ROE

8.56 7.84

9.00

8.00 6.17

7.00

6.00

5.00

4.00

3.00

2.00

1.00

0.00

National Virginia Union

Median as of June 30, 2012

National banks includes all $2—$8 Billion banks

24

|

|

ROA/ROE Quarterly Trends

1.00% 0.91% 0.93%

0.90% 0.83% 0.84% 0.82% 0.86%

0.80% 0.71%

0.70% 0.66%

0.60%

0.50% 0.46%

0.40%

0.30%

0.20%

0.10%

0.00%

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

ROE

9.00% 8.41% 8.02% 7.84%

8.00% 7.46% 7.49% 7.51%

7.00% 5.81% 6.21%

6.00%

5.00% 4.07%

4.00%

3.00%

2.00%

1.00%

0.00%

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

25

|

|

Top-Tier Financial Performance

Focus has primarily been on merger integration, products and asset quality over the past few years

Strong results from that effort

Customer surveys show satisfaction at all-time high and teammate surveys show similar high marks

Now time to turn to fee income and non-interest expense levels to improve profitability and increase returns We are working to create a roadmap to improve efficiency, increase revenue and reduce expenses

26

|

|

Mortgage Update

A large national insurance company decided to exit the mortgage business in late 2011

Union Mortgage hired 28 originators as well as additional processors and leaders Contribution from mortgage company doubled in second quarter to $470,000

April was not profitable as we finished adding support staff

Expect originators to reach full capacity as the year progresses

27

|

|

2012 Outlook

Stable to growing economy in footprint – impact of Federal budget cuts (including defense) not known Positive asset quality trends continue as commercial and residential real estate market stabilize further

Expect continued loan growth

Project increasing contribution from Union Mortgage Group Still plenty of expansion opportunities in Virginia

Organic Acquisition

28

|

|

Value Proposition

Branch footprint is a competitive advantage and brings a unique franchise value

Strong balance sheet and capital base

Experienced management team Successful acquirer and integrator

Proven financial performance in all market environments

Higher ROA and ROE than Virginia peers Increased quarterly dividend twice in 2012

29

|

|

APPENDIX

|

|

Risk Management

Lending Philosophy Control Environment

In-market lender Strong internal policies

Granular portfolio analysis Active compliance, audit teams Full guarantees of commercial Positive regulatory relations credits

Acted Early In The Current Cycle

Best In Class Risk Mitigation Reappraised loans starting in late

Practices 2007

Our standard practice for years Received additional collateral where Forward looking necessary Move early to protect Working with clients wherever Special Assets Committee possible Better results than Virginia peers

31

|

|

Positioned Well to Succeed

Key Findings from our Fall 2011 surveys:

94% of our customers gave us either an “A” (66%) or “B”

(28%)

Higher than either Union Bank & Trust or First Market Bank scored prior to the merger

Only 85% of prospects gave their Bank “A” or “B” Net promoter score of 49% compared to competitors’ score of 21% Teammates rate us high as an employer and as a bank

83% gave Union “A” (28%) or “B” (55%) as an employer 93% rated Union “A” (50%) or “B” (43%) as a bank

68% of Teammates are likely to recommend us as a bank

Customers rate Teammates higher than Teammates rate themselves

96% of customers gave Teammates an “A” (79%) or “B” (17%)

32

|

|

THANK YOU!