Investor Presentation

Investor Presentation

First Quarter 2010

First Quarter 2010

Exhibit 99.1 |

Investor Presentation

Investor Presentation

First Quarter 2010

First Quarter 2010

Exhibit 99.1 |

Agenda

Overview

Purpose and Values

Financial Performance

First Market Update

2010 Outlook

Q & A

2 |

Forward Looking Statement

3

Certain statements in this report may constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are statements that include projections, predictions,

expectations or beliefs about future events or results or otherwise and are not statements of historical fact.

Such statements are often characterized by the use of qualified words

(and their derivatives) such as “expect,”

“believe,” “estimate,” “plan,”

“project,” “anticipate” or other statements concerning opinions or judgment of the

Company and its management about future events. Although the

Company believes that its expectations with respect to

forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of

its business and operations, there can be no assurance that actual

results, performance or achievements of the Company will not

differ materially from any future results, performance or achievements expressed or implied by

such forward-looking statements. Actual future results and

trends may differ materially from historical results or those

anticipated depending on a variety of factors, including, but not limited to, the effects of and changes in: general

economic conditions, the interest rate environment, legislative and

regulatory requirements, competitive pressures, new products and

delivery systems, inflation, changes in the stock and bond markets, technology, and consumer

spending and savings habits. The Company does not update any

forward-looking statements that may be made from time to

time by or on behalf of the Company. |

Overview

One of the Largest Virginia-Based Financial Services

Organization

Holding Company formed in 1993

Assets of $3.85 Billion

Comprehensive financial services provider offering:

banking, mortgage, investment, brokerage and insurance

4 |

Investment Highlights

Attractive branch footprint in growth

markets that will recover early

Proven financial performance

Experienced management team

Proven acquirer and integrator

5 |

Purpose and Values |

Purpose Statement

“Helping People Find

Financial Solutions”

7 |

Values

Customer Focus

Integrity & Trust

Knowledge

Respect

Partnership

Integrity

Service

Caring

Passion

Creativity

Achievement

8 |

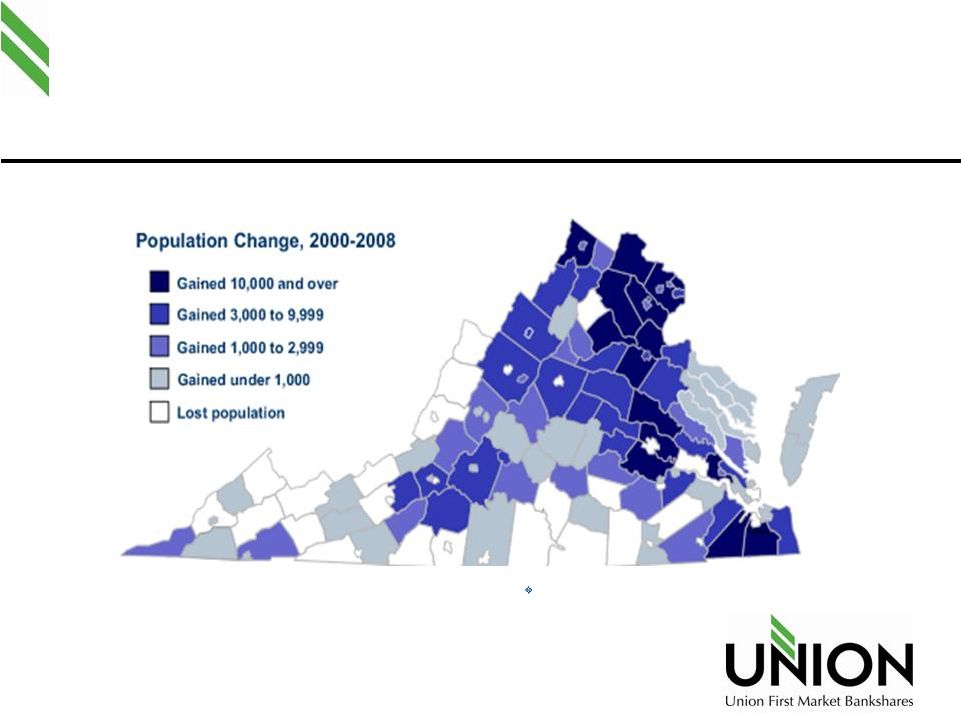

Virginia Population Expansion

Source: Weldon Cooper Center, UVA

9 |

Diversity Supports Growth in Virginia

Charlottesville

University of Virginia & Medical

College

High tech and professional businesses

Virginia

Beach

-

Norfolk

Military

Shipbuilding

Tourism

Fredericksburg

Defense and security contractors

Health care

Retail

Northern Virginia

Nation’s Capital

Defense and security contractors

Associations (lobbyists)

High tech

Richmond

State Capital

Fortune 500 headquarters

Finance and insurance

Fort Lee doubling in size

VCU & Medical College of Va.

10 |

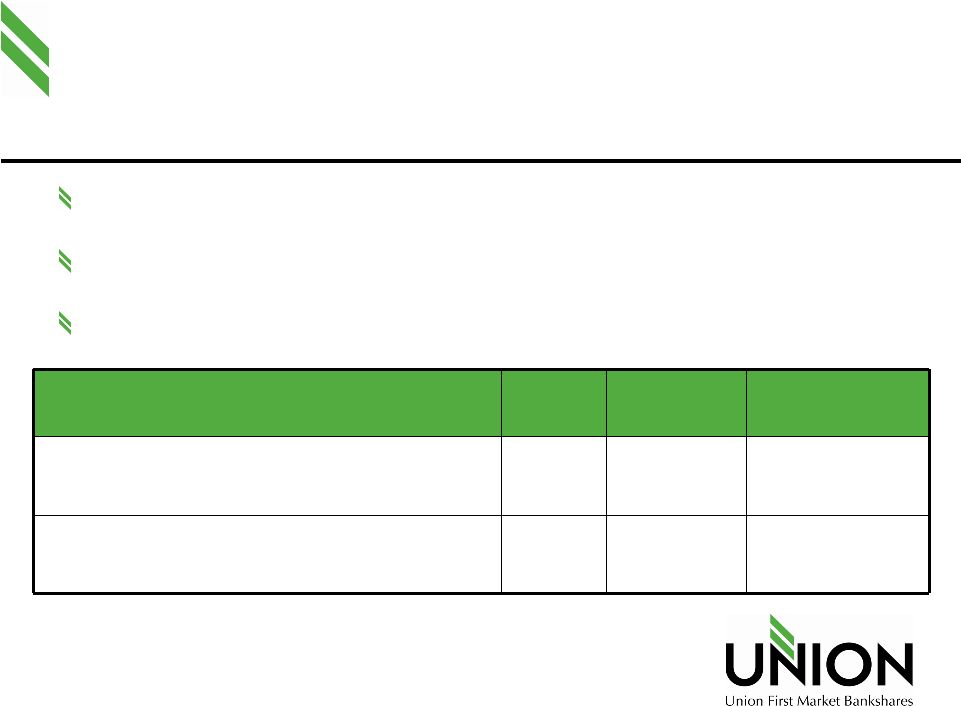

Experienced Leadership

Age

Years in

Position

Total Years

in Banking

Executive Management Team (7)

Average

54

12

192

27

Senior Leadership Team (21)

52

10

536

26

(1) Includes executive management team

Varied Backgrounds

Experienced Market Disruptions

Problem solvers

11

Average

(1) |

Risk Management

Risk Mitigation Practices

Act early, ensure collateral,

move to protect

Re-risk ratings

Re-appraisals of CRE

Special Asset Committee

Stress testing on CRE

concentrations

Lending Philosophy

In market lender

Community bank lending

Granular portfolio

Full guarantees of commercial

credits

Avoid high risk categories

No shared national credits

No sub-prime loans

Minimal participations

12 |

Financial Performance |

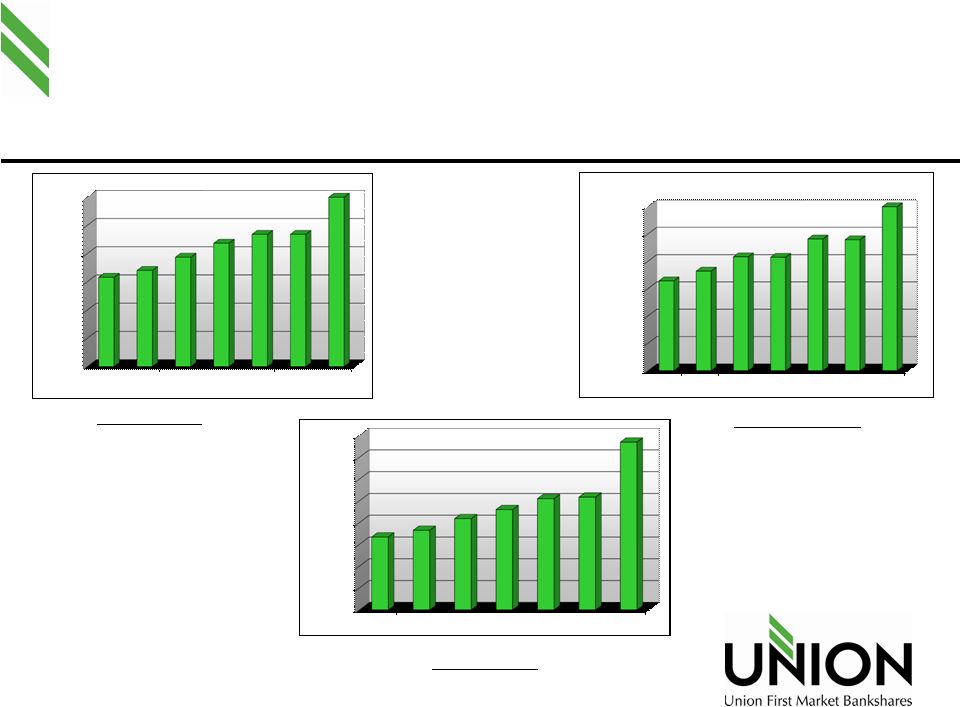

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

$3,000,000

$3,500,000

$4,000,000

2004

2005

2006

2007

2008

2009

2010 Q1

$1,672,210

$1,824,958

$2,092,891

$2,301,397

$2,551,932

$2,587,272

$3,849,699

$0

$400,000

$800,000

$1,200,000

$1,600,000

$2,000,000

$2,400,000

2004

2005

2006

2007

2008

2009

2010 Q1

$1,314,317

$1,456,515

$1,665,908

$1,659,578

$1,926,999

$1,916,364

$3,072,015

$0

$400,000

$800,000

$1,200,000

$1,600,000

$2,000,000

$2,400,000

2004

2005

2006

2007

2008

2009

2010 Q1

$1,264,841

$1,362,254

$1,549,445

$1,747,820

$1,874,088

$1,874,224

$2,850,166

Strong Balance Sheet Growth

Assets

($M)

Deposits

($M)

Loans

($M)

14 |

Investment Portfolio Highlights

Total Portfolio is $529 MM or

13.8% of assets

Did not invest in

Pooled TRUPs

Data as of Q1 2010

Investment Portfolio

% of Portfolio

U.S. government and agency securities

2.3%

Obligations of states and political subdivisions

26.0%

Corporate and other bonds

3.0%

Mortgage-backed securities

63.7%

Federal Reserve Bank stock -restricted

0.7%

Federal Home Loan Bank stock -restricted

4.2%

Other securities

0.1%

Total securities

100.0%

15 |

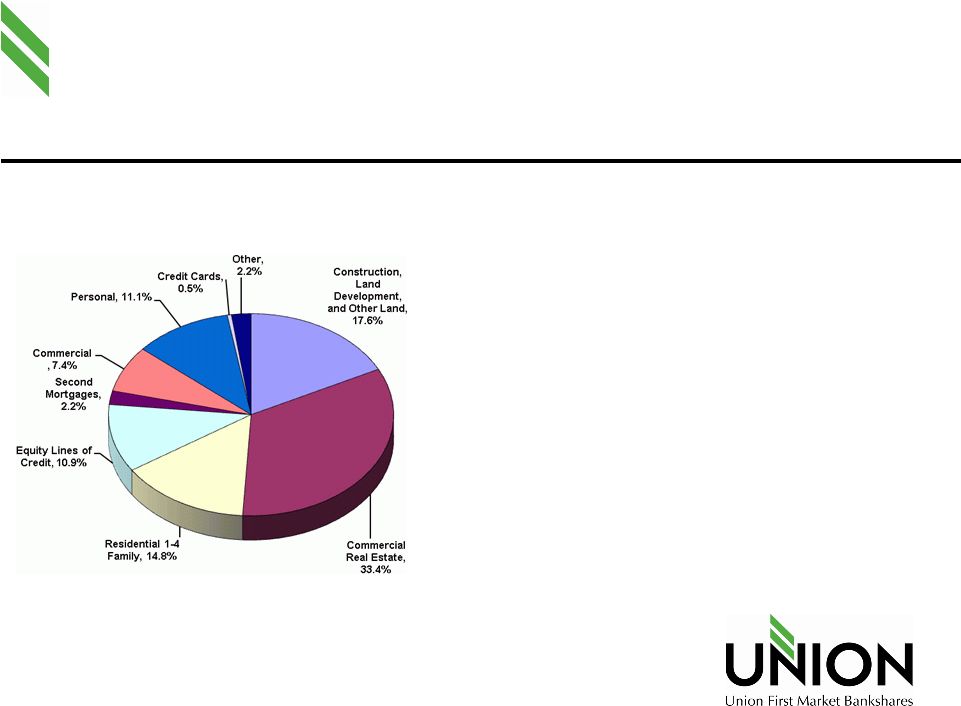

Loan Composition Q1 2010

Loan Portfolio by Type

3/31/2010

$

%

Construction, Land Development, and Other Land

$500,909

17.6%

Commercial Real Estate

$951,387

33.4%

Residential 1-4 Family

$421,138

14.8%

Equity Lines of Credit

$309,765

10.9%

Second Mortgages

$62,762

2.2%

Commercial

$211,663

7.4%

Personal

$315,750

11.1%

Credit Cards

$13,615

0.5%

Other

$63,177

2.2%

Gross Loans

$2,850,166

100.0%

16 |

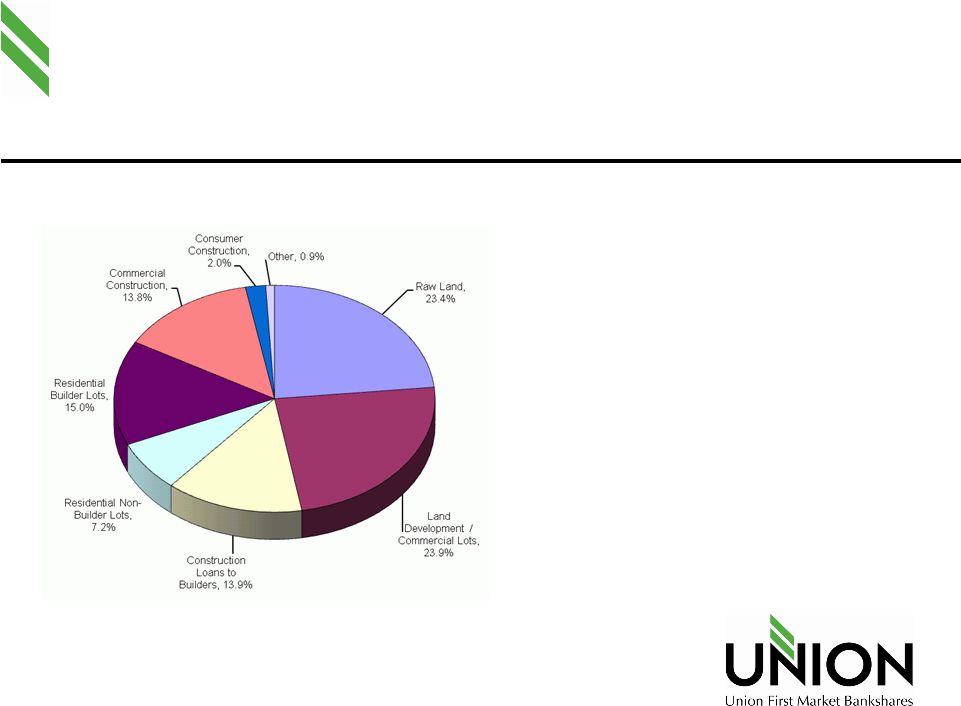

Loan Composition Q1

2010 Construction & Development

3/31/2010

$

%

Raw Land

$117.1

23.4%

Land Development / Commercial Lots

$119.7

23.9%

Construction Loans to Builders

$69.4

13.9%

Residential Non-Builder Lots

$36.2

7.2%

Residential Builder Lots

$74.9

15.0%

Commercial Construction

$69.0

13.8%

Consumer Construction

$10.2

2.0%

Other (including loan settlement)

$4.4

0.9%

$500.9

100.0%

17 |

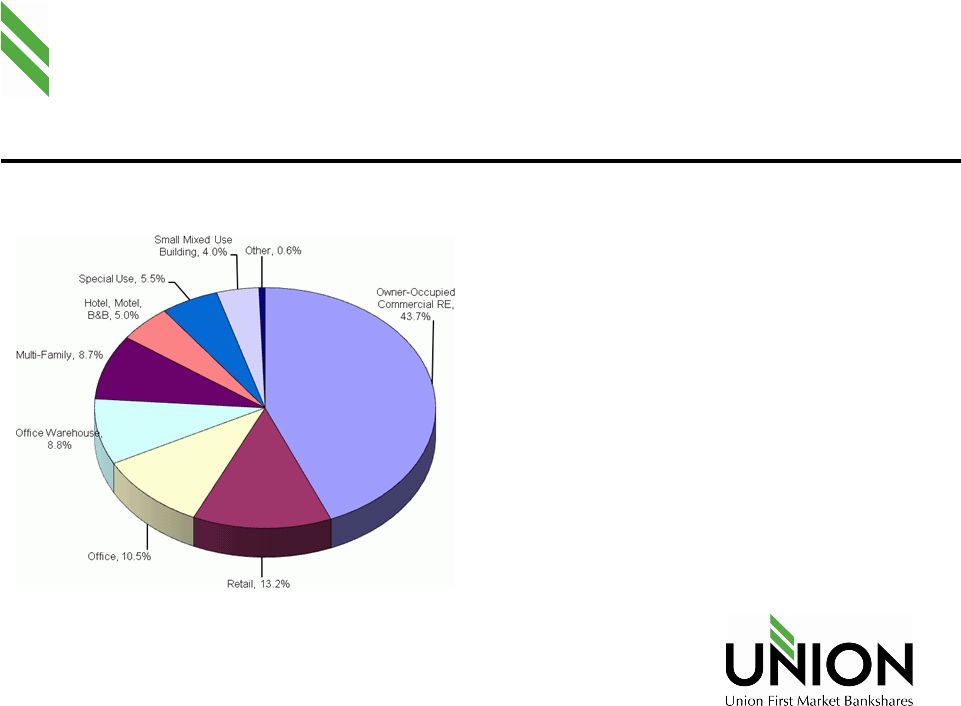

Loan Composition Q1 2010

Commercial Real Estate by Type

3/31/2010

$

%

Owner-Occupied Commercial RE

$415.7

43.7%

Retail

$125.4

13.2%

Office

$99.7

10.5%

Office Warehouse

$84.1

8.8%

Multi-Family

$83.2

8.7%

Hotel, Motel, B&B

$47.5

5.0%

Special Use

$52.1

5.5%

Small Mixed Use Building

$38.1

4.0%

Other

$5.6

0.6%

$951.4

100.0%

18 |

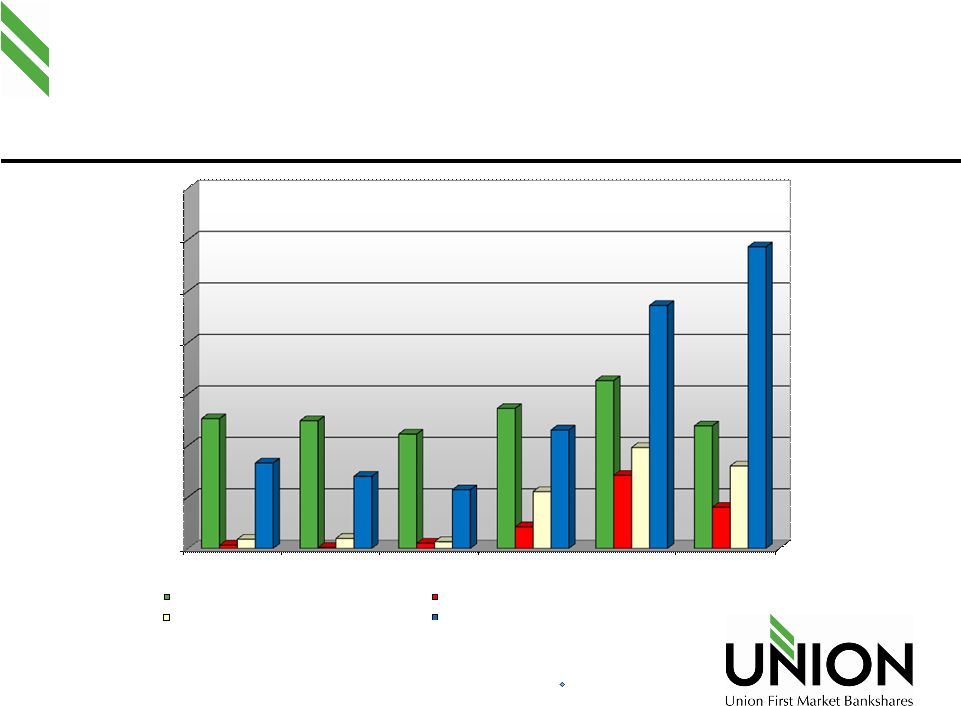

Asset Quality

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2005

2006

2007

2008

2009

2010 Q1

1.26%

1.24%

1.11%

1.36%

1.63%

1.19%

0.03%

0.01%

0.05%

0.21%

0.71%

0.40%

0.09%

0.10%

0.06%

0.55%

0.98%

0.80%

0.83%

0.70%

0.57%

1.15%

2.36%

2.93%

Allowance to Loans

Charge-offs to Avg Loans, Net

Provision for loan losses as % of average loans

NPAs / Loans + OREO

Annualized

19 |

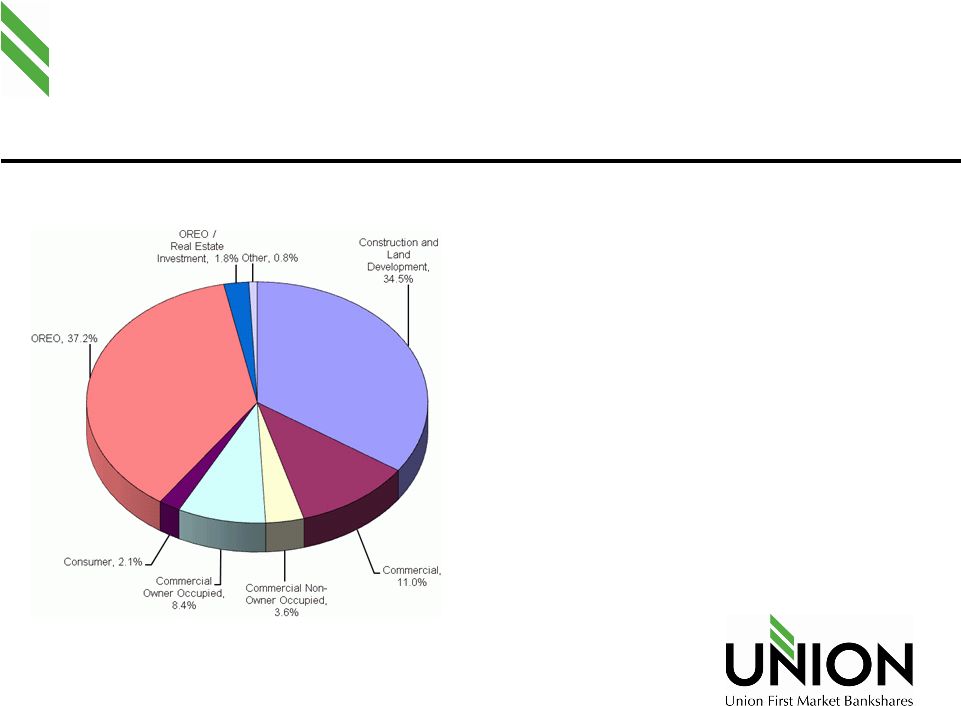

NPAs

by Type Q1 2010

Non-Performing Assets by Type

3/31/2010

$

%

Construction and Land Development

$21.9

34.5%

Commercial

$7.0

11.0%

Commercial Non-Owner Occupied

$2.3

3.6%

Commercial Owner Occupied

$5.3

8.4%

Consumer

$1.3

2.1%

OREO

$23.6

37.2%

OREO / Real Estate Investment

$1.5

2.4%

Other

$0.5

0.8%

$63.4

100.0%

20 |

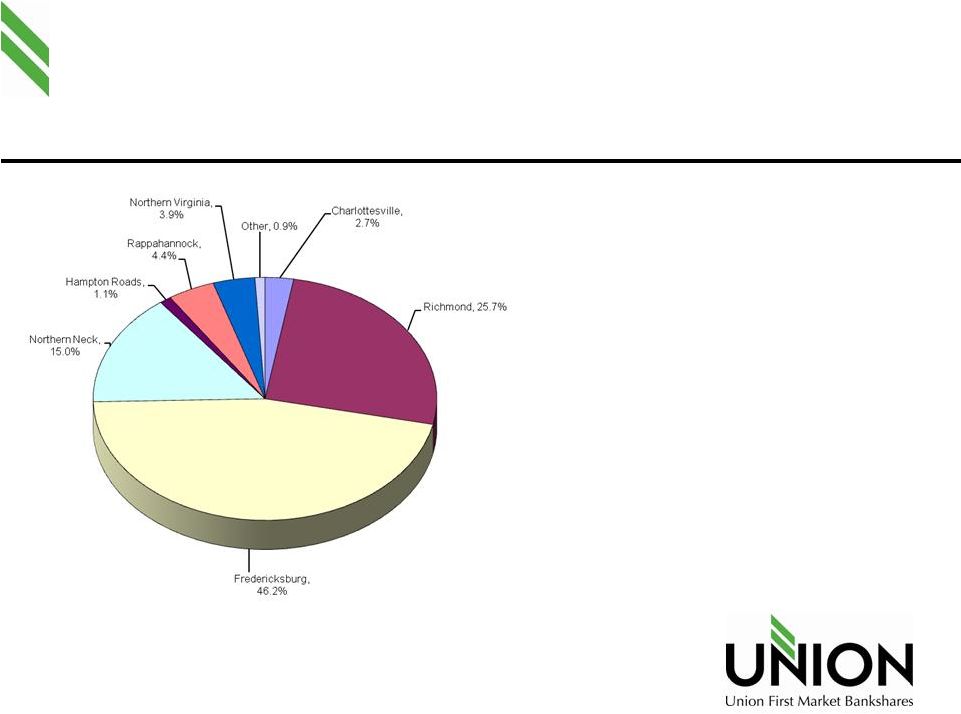

NPAs

by Market Q1 2010

Non-Performing Assets by Market

3/31/2010 *

$

%

Charlottesville

$1.7

2.7%

Richmond

$16.3

25.7%

Fredericksburg

$29.3

46.2%

Northern Neck

$9.5

15.0%

Hampton Roads

$0.7

1.1%

Rappahannock

$2.8

4.4%

Northern Virginia

$2.5

3.9%

Other

$0.6

0.9%

$63.4

100.0%

21 |

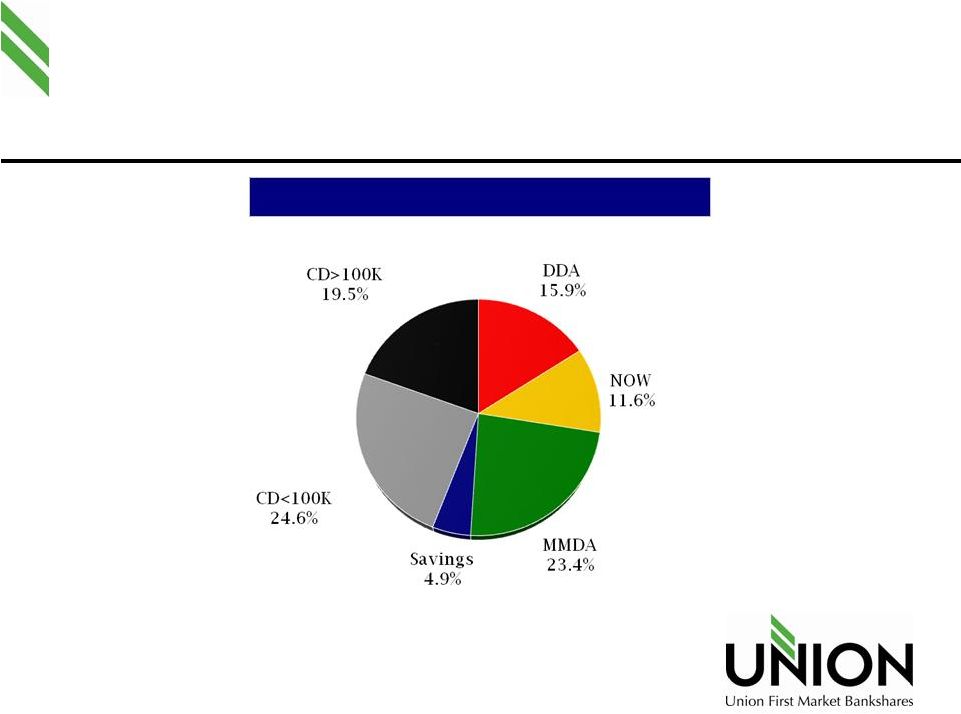

Q1 2010

Deposit Composition

22 |

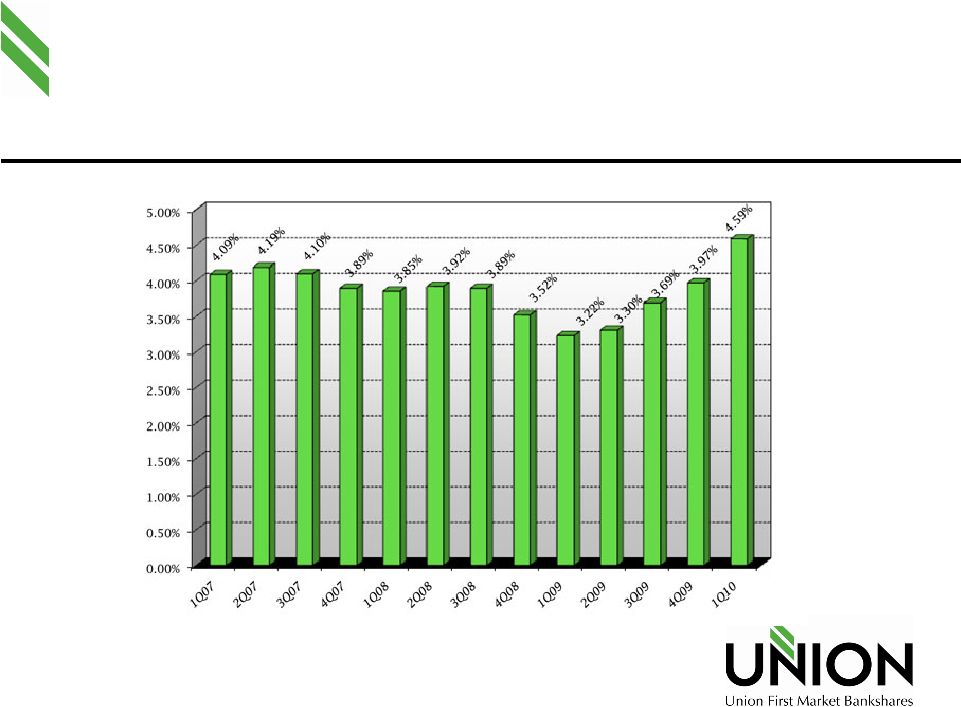

Net Interest Margin

(1) 4.22% excluding fair value accounting accretion/amortization

23

(1) |

First Market Update |

First Market Bank Update

Closed February 1, 2010

Two Branches Closed March, 2010

Data Merge Completed March, 2010

25 |

Combined Franchise

Largest community bank in Virginia

$3.85 billion Mid-Atlantic franchise with strong

presence in high growth Virginia markets

Moves

Union

from

11

th

to

6

th

in

deposit

market

share

in Virginia;

from

8

th

to

5

th

in

the

Richmond

MSA

Exceptional management with highly regarded Board

Complementary strengths and identifiable synergies

Accretive to earnings in 2010

26

Union Bankshares

Corporation (58 Branches)

First Market Bank, FSB (39 Branches) |

Transaction

Detail 27

(1) Capital Purchase Program / Troubled Asset Relief Program funds were

not used in this transaction (2) To include costs associated with

overlapping branches and other duplicative functions,

managed through normal attrition and retirement as much as possible

Consideration:

(1)

100% Common Stock

Preferred Shares:

First Market’s outstanding $10.0 million 9.0% preferred shares

converted into common equity

Shares Issued:

Common Shareholders:

6.7 million shares

Preferred Shareholders:

776 thousand shares

Post Transaction Ownership:

Former Union Shareholders:

71.2%

Former First Market Shareholders:

28.8

Cost Savings:

(2)

Approximately 9.0% of the combined expense base

Estimated Deal Charges

$8.0 million after-tax |

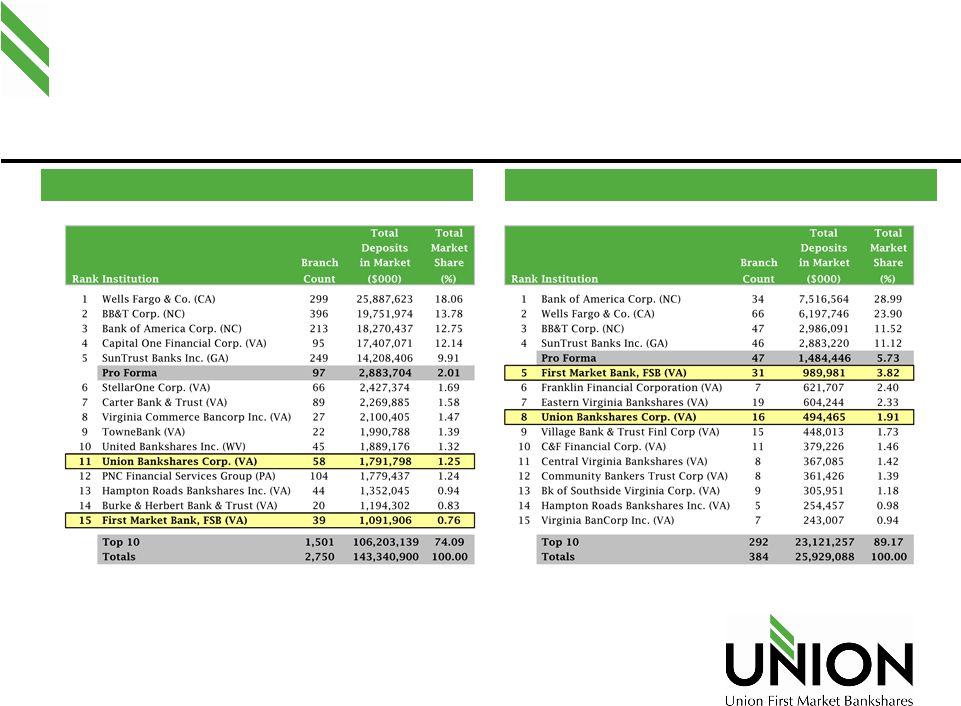

Pro Forma Deposit

Market Share Virginia Market Share

Richmond MSA Market Share

28

Source: SNL Financial

Deposit data as of 6/30/2008; pro forma for pending and recently

completed acquisitions |

2010 Outlook/Priorities |

2010 Outlook

Uncertain/slow economic recovery

Residential real estate exposure will

continue to impact asset quality

Interest rates expected to remain low until

late 2010

Loan demand sluggish

Deposits

stable

-

few

higher

rate

alternatives

30 |

2010 Priorities

Increased Net Income

Continued Focus on Credit Quality

Effective Integration of First Market Bank

Deposit Retention

Achievement of Cost Saves

Market Share Growth

Take advantage of market opportunities

Redeem First Market Bank US Treasury

Preferred Stock

31 |

Market Opportunity

Growth in lending relationships

Hiring relationship teams

Synergies

32 |

Acquisition Blueprint

Good Demographics / Growth Market OR …Unique Product /

Service (e.g. Trust, Wealth Management)

Management Retention

Thorough Due Diligence Process

Low Integration Risk

EPS Accretive

Tangible Common Equity to Assets above 6.0%

33 |

Summary

Attractive branch footprint in growth

markets that will recover early

Proven financial performance

Experienced management team

Proven acquirer and integrator

34 |

Thank You! |