Investor Presentation Exhibit 99.1 |

Investor Presentation Exhibit 99.1 |

Certain statements in this report may constitute “forward-looking

statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking

statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise and are

not statements of historical fact. Such statements are

often characterized by the use of qualified words (and their

derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other

statements concerning opinions or judgment of the Company and its

management about future events. Although the Company believes that its expectations with respect to forward-looking

statements are based upon reasonable assumptions within the

bounds of its existing knowledge of its business and operations,

there can be no assurance that actual results, performance or

achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking

statements. Actual future results and trends may differ

materially from historical results or those anticipated

depending on a variety of factors, including, but not limited

to, the effects of and changes in: general economic conditions, the interest rate environment, legislative and regulatory requirements, competitive

pressures, new products and delivery systems, inflation, changes

in the stock and bond markets, technology, and consumer spending

and savings habits. The Company does not update any

forward-looking statements that may be made from time to time by or on behalf of the Company. Forward Looking Information |

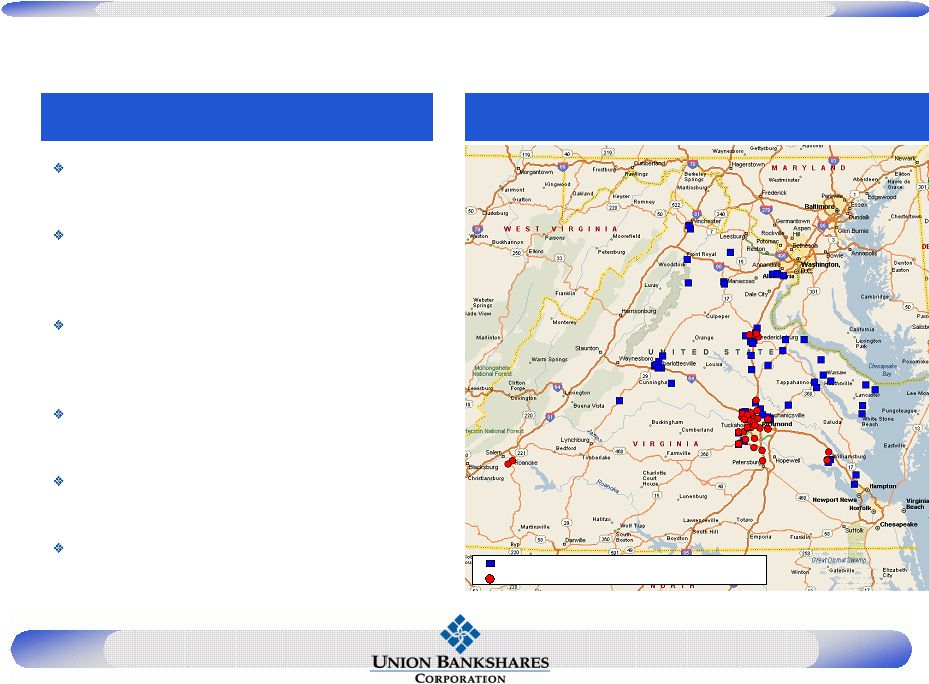

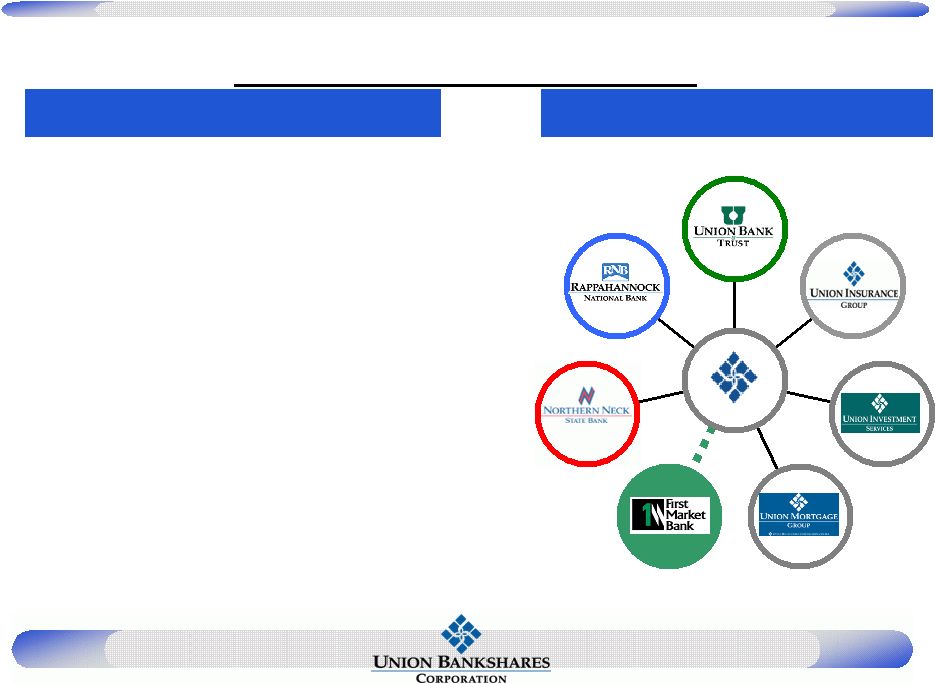

Overview One of the Largest Virginia- Based Financial Services Organization Holding Company formed in 1993 Assets of $2.6 Billion Three 100 Year Old Banks Comprehensive financial services provider offering: banking, mortgage, investment, brokerage and insurance Proven merger integrator |

Outline Purpose and Values 2008 Financial Performance 2009 Outlook First Market Bank - Overview Q & A |

“Helping People Find Financial Solutions” Purpose Statement |

Values Customer Focus Knowledge Integrity & Trust Respect Partnership |

2008 Financial Performance |

Financial Overview Asset Quality Liquidity Margin |

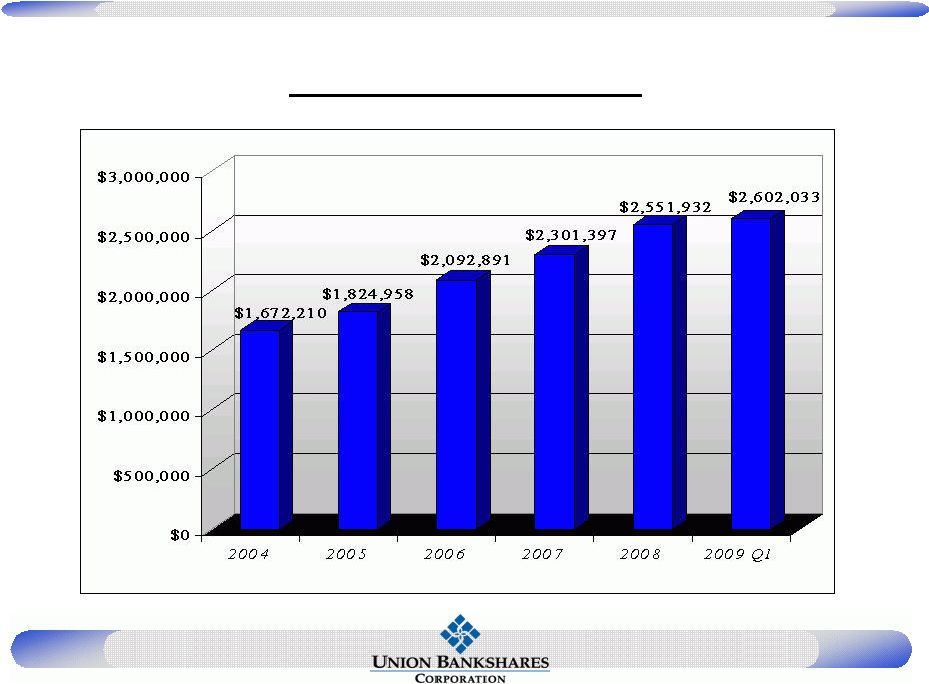

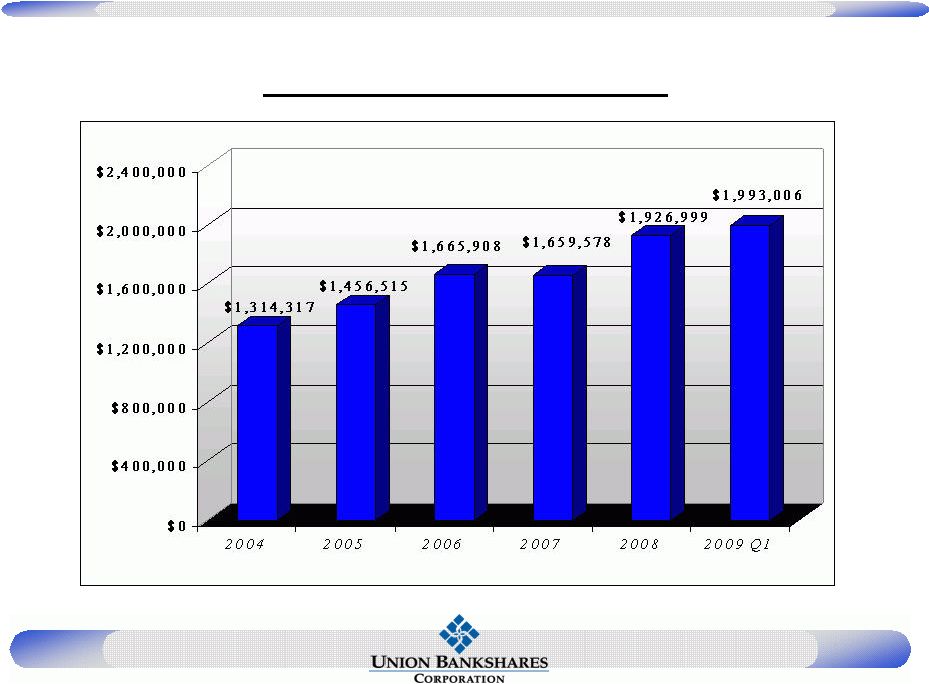

Asset Growth |

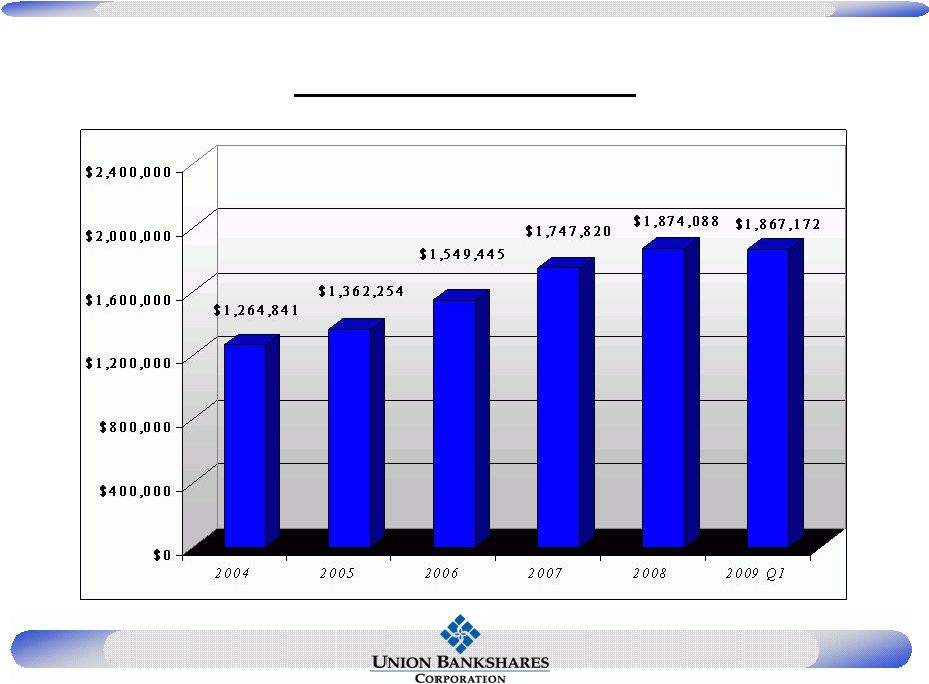

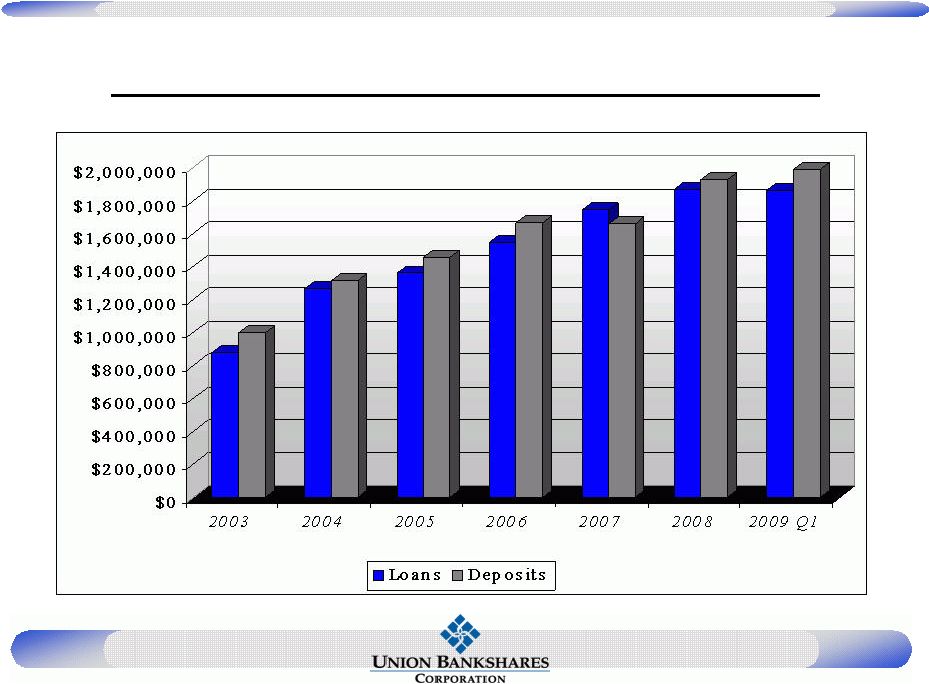

Loan Growth |

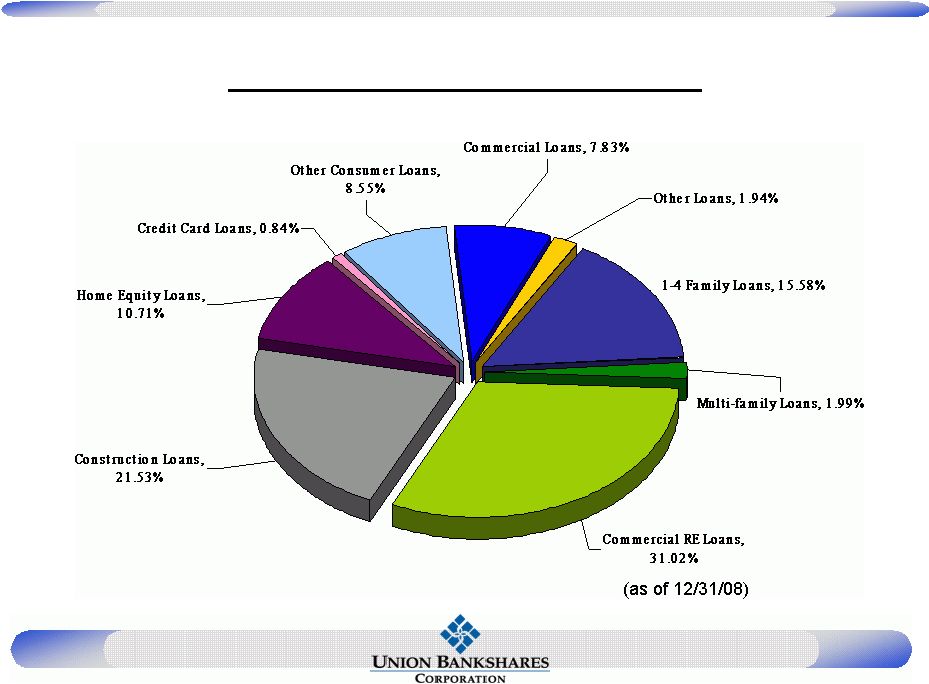

Loan Composition |

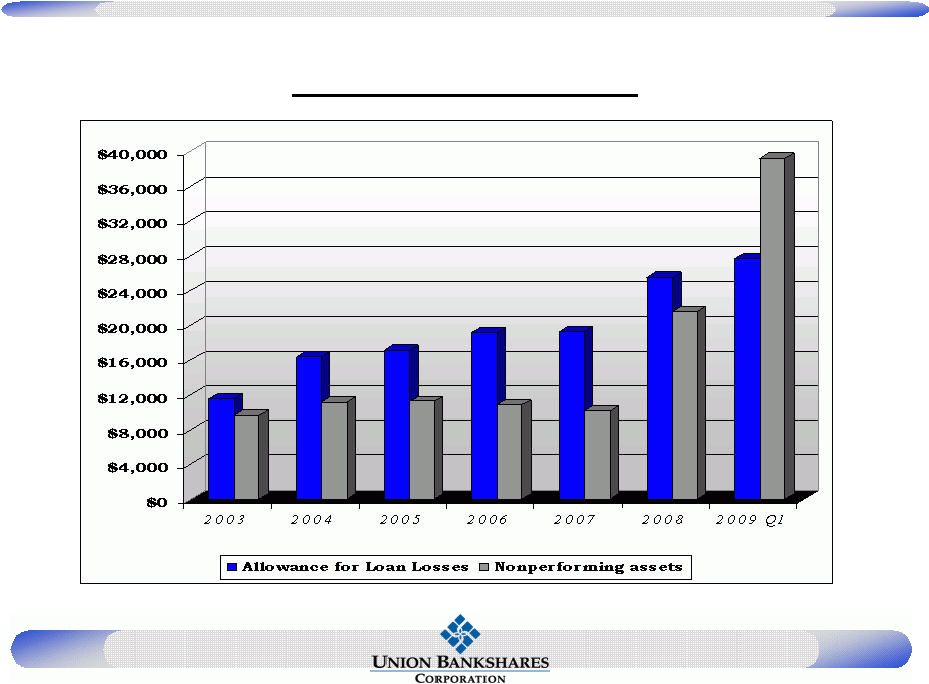

Asset Quality |

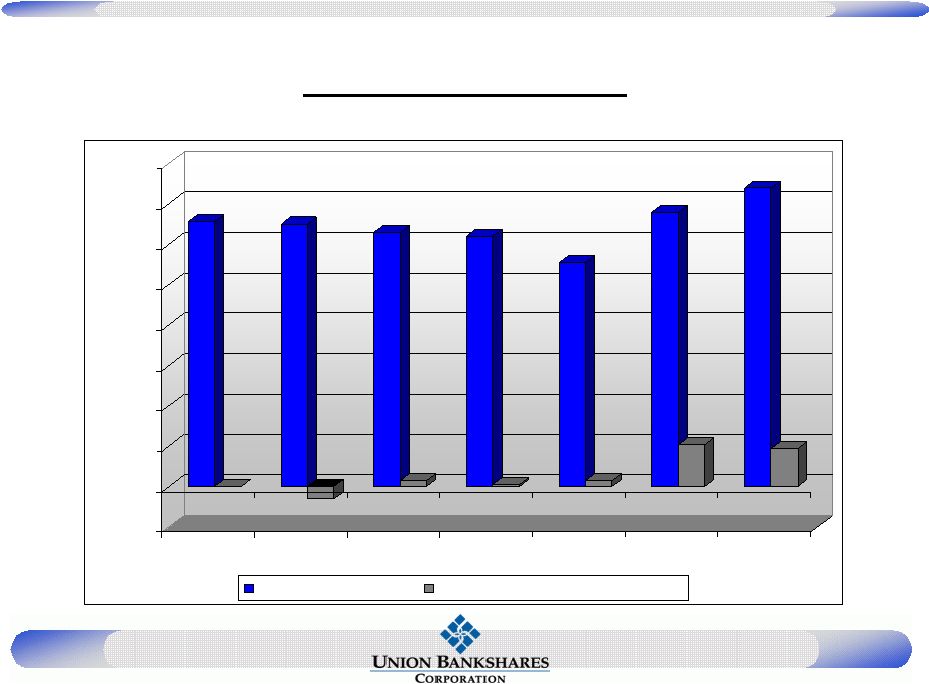

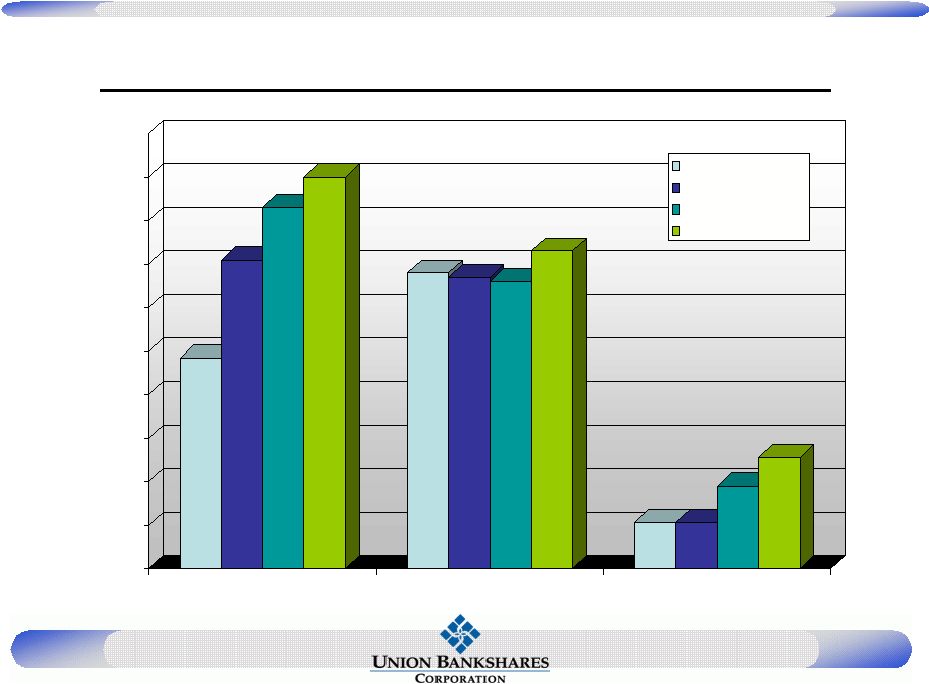

ALL & C/O’s 1.31% 0.00% 1.30% -0.06% 1.26% 0.03% 1.24% 0.01% 1.11% 0.03% 1.36% 0.21% 1.48% 0.19% -0.20% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2003 2004 2005 2006 2007 2008 2009 Q1 Allowance to Loans Charge-offs to Avg Loans, Net *Q1 figures not annualized |

Deposit Growth |

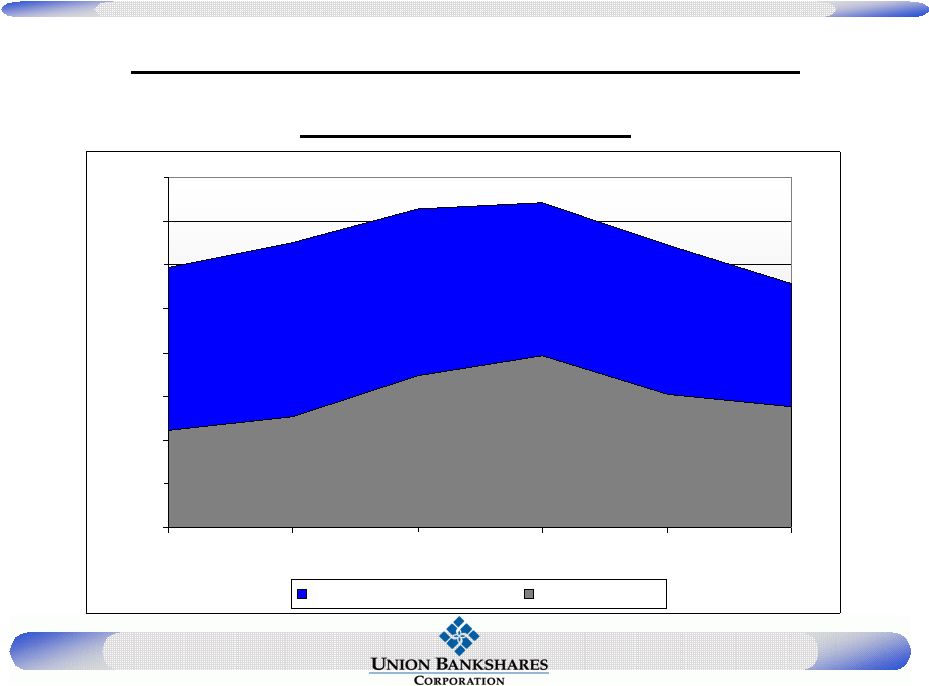

Reduced Funding Reliance |

Yield on Earning Assets and Cost of Funds 7.42% 6.46% 5.59% 7.28% 5.96% 6.53% 2.23% 2.52% 3.47% 3.93% 3.06% 2.77% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2004 2005 2006 2007 2008 2009 Q1 Yield on Earning Assets Cost of Funds |

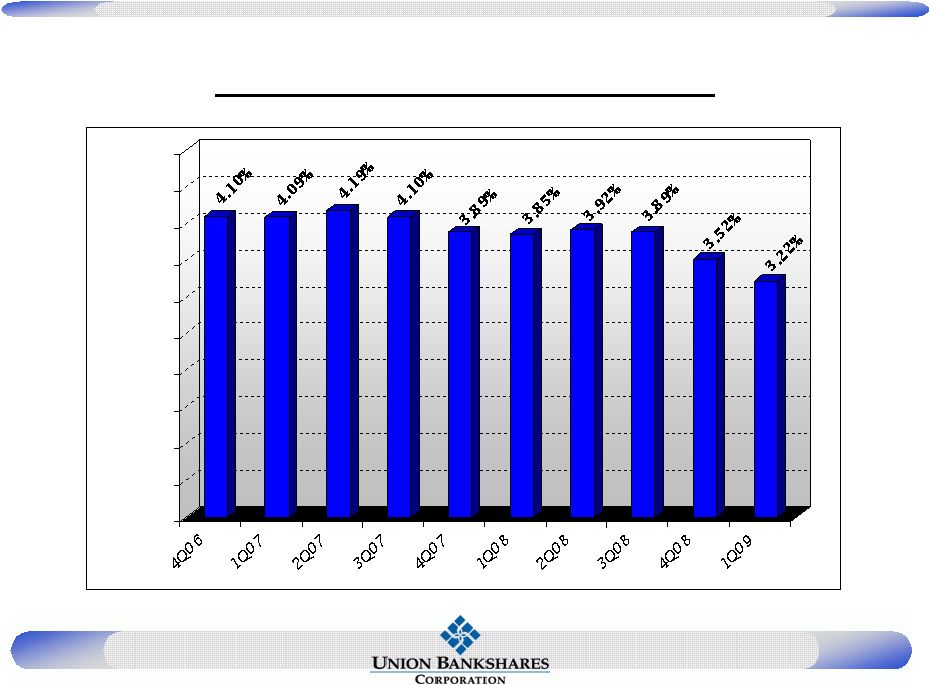

Net Interest Margin 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% |

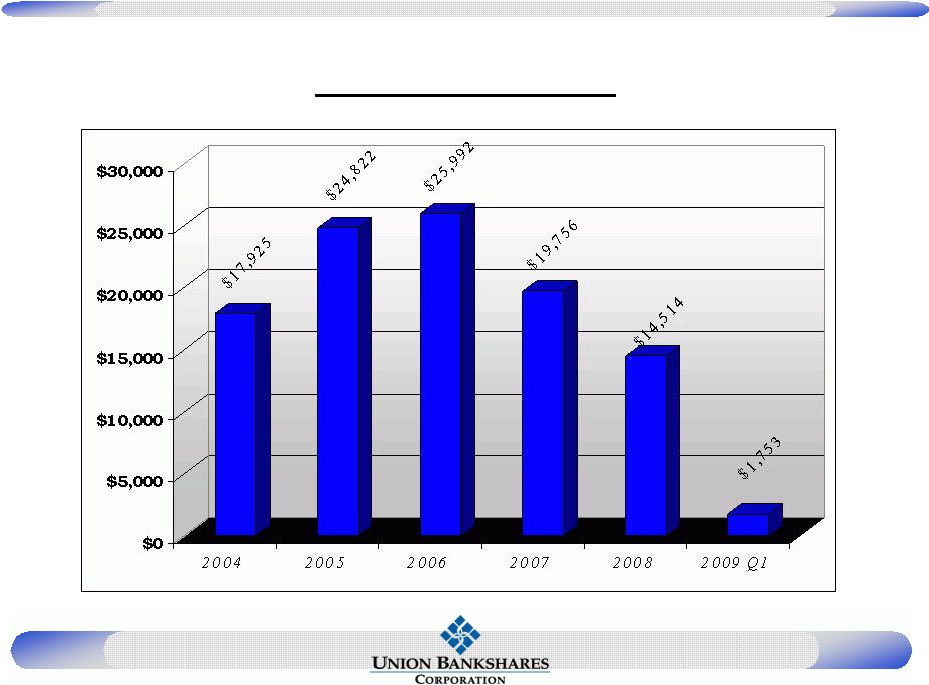

Net Income |

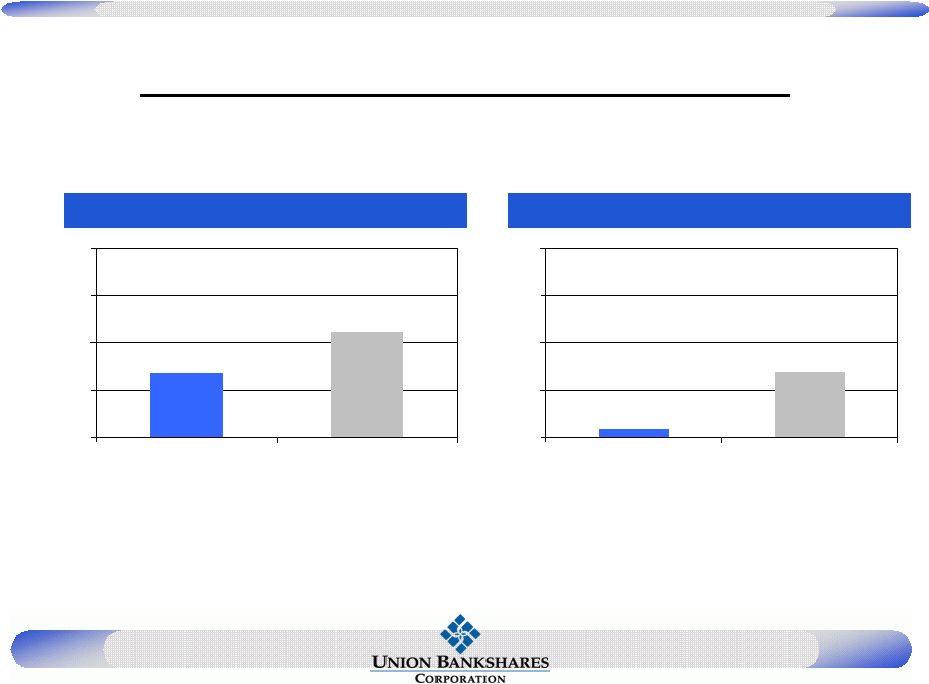

UBSH ROA Performance

to Peers (as of 12/31/08) 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% ROA UBSH Va Banks Select Peer National Peer |

UBSH ROE Performance

to Peers (as of 12/31/08) 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% ROE ROTE UBSH Va Public Banks Select Peer National Peer |

UBSH NPAs/ALLL/NCOs to Peers (as of 12/31/08) 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% NPAs/Assets ALLL/Loans NCOs/Loans UBSH Va Public Banks Select Peer National Peer |

UBSH Asset Quality to Peers (as of 12/31/08) 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% ALLL/NPAs UBSH Va Public Banks Select Peer National Peer |

2009 Outlook |

2009 Priorities Profitability – Increase Margin – Grow Earning Assets Asset Quality – Diversify Loan Portfolio Credit Risk – Enhance Credit Risk Processes Liquidity – Increase Consumer & Business Household Growth – Increase cross sell for new and existing customers |

& Creating Richmond and Central Virginia’s Bank of Choice

|

th Pro Forma Franchise Merger Highlights Pro forma Company becomes the largest community bank in Virginia $4.0 billion in assets Mid-Atlantic franchise with strong presence in high growth Virginia markets Moves UBSH from 11 to 6 th in deposit market share in Virginia; from 8 to 5 th in the Richmond MSA Exceptional management with highly regarded Board Complementary strengths and identifiable synergies Accretive to earnings in 2010 Pro Forma Footprint Union Bankshares Corporation (58 Branches) First Market Bank, FSB (39 Branches) th |

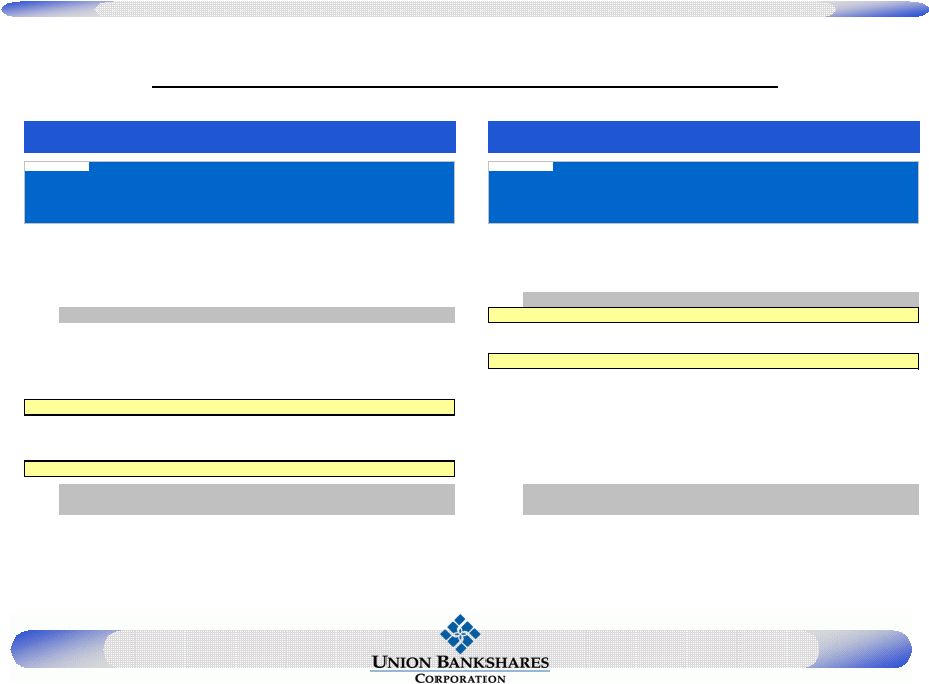

Pro

Forma Deposit Market Share Virginia Market Share Richmond MSA Market Share Source: SNL Financial Deposit data as of 6/30/2008; pro forma for pending and recently completed acquisitions Total Total Deposits Market Branch in Market Share Rank Institution Count ($000) (%) 1 Bank of America Corp. (NC) 34 7,516,564 28.99 2 Wells Fargo & Co. (CA) 66 6,197,746 23.90 3 BB&T Corp. (NC) 47 2,986,091 11.52 4 SunTrust Banks Inc. (GA) 46 2,883,220 11.12 Pro Forma 47 1,484,446 5.73 5 First Market Bank, FSB (VA) 31 989,981 3.82 6 Franklin Financial Corporation (VA) 7 621,707 2.40 7 Eastern Virginia Bankshares (VA) 19 604,244 2.33 8 Union Bankshares Corp. (VA) 16 494,465 1.91 9 Village Bank & Trust Finl Corp (VA) 15 448,013 1.73 10 C&F Financial Corp. (VA) 11 379,226 1.46 11 Central Virginia Bankshares (VA) 8 367,085 1.42 12 Community Bankers Trust Corp (VA) 8 361,426 1.39 13 Bk of Southside Virginia Corp. (VA) 9 305,951 1.18 14 Hampton Roads Bankshares Inc. (VA) 5 254,457 0.98 15 Virginia BanCorp Inc. (VA) 7 243,007 0.94 Top 10 292 23,121,257 89.17 Totals 384 25,929,088 100.00 Total Total Deposits Market Branch in Market Share Rank Institution Count ($000) (%) 1 Wells Fargo & Co. (CA) 299 25,887,623 18.06 2 BB&T Corp. (NC) 396 19,751,974 13.78 3 Bank of America Corp. (NC) 213 18,270,437 12.75 4 Capital One Financial Corp. (VA) 95 17,407,071 12.14 5 SunTrust Banks Inc. (GA) 249 14,208,406 9.91 Pro Forma 97 2,883,704 2.01 6 StellarOne Corp. (VA) 66 2,427,374 1.69 7 Carter Bank & Trust (VA) 89 2,269,885 1.58 8 Virginia Commerce Bancorp Inc. (VA) 27 2,100,405 1.47 9 TowneBank (VA) 22 1,990,788 1.39 10 United Bankshares Inc. (WV) 45 1,889,176 1.32 11 Union Bankshares Corp. (VA) 58 1,791,798 1.25 12 PNC Financial Services Group (PA) 104 1,779,437 1.24 13 Hampton Roads Bankshares Inc. (VA) 44 1,352,045 0.94 14 Burke & Herbert Bank & Trust (VA) 20 1,194,302 0.83 15 First Market Bank, FSB (VA) 39 1,091,906 0.76 Top 10 1,501 106,203,139 74.09 Totals 2,750 143,340,900 100.00 |

*

Depends on regulatory, SEC and shareholder approval Transaction

Overview Name: Union First Market Bankshares Corporation Headquarters: Richmond, VA Board: Existing UBSH Board plus: James E. Ukrop Steven A. Markel David J. Fairchild Leadership: Targeted Closing Date: * Late 3rd / Early 4th Quarter of 2009 Chairman: Ronald L. Hicks (UBSH) Chief Executive Officer: G. William Beale (UBSH) President: David J. Fairchild (FMB) Chief Financial Officer: D. Anthony Peay (UBSH) Chief Banking Officer: John C. Neal (UBSH) Corporate Structure Pro Forma Overview |

th Transaction Detail Consideration: (1) 100% Common Stock Preferred Shares: First Market’s outstanding $10.0 million 9.0% preferred shares will be converted into common equity Shares to be Issued: Common Shareholders: 6.7 million shares Preferred Shareholders: 703 thousand shares (2) Pre-Conversion Post-Conversion Pro Forma Ownership: of Preferred of Preferred Current Union Shareholders: 67.0% 64.8%

Current First Market Shareholders: 33.0 35.2 Value of First Market Shares: $105.4 million (Assumes $14.23 stock price for UBSH (2) ) Cost Savings: (3) Approximately 9.0% of the combined expense base Phase In: 100% in 2010 Estimated Deal Charges $8.0 million after-tax (1) Capital Purchase Program / Troubled Asset Relief Program funds were not used in this

transaction (2) Estimated conversion shares and deal value as of pre-market announcement on March 30 , 2009; actual shares issued in preferred conversion are based on the 10-day average trading

price near close (as defined in the Merger Agreement), provided that it shall not be more than $16.89 nor less than $12.89 (3) To include costs associated with overlapping branches and other duplicative

functions, managed through normal attrition and retirement as much as possible |

Source: SNL Financial

and company filings Comparable transactions do not include merger of equals (1) Based on First Market’s tangible equity of $89.4 million as of 12/31/2008 (2) Core deposits include total deposits less jumbo certificates of deposits Comparable transactions include all bank and thrift transactions in Maryland, Virginia and North Carolina

announced after 7/1/2007 with deal values between $20 million and $500 million Comparable Acquisitions 118 161 50 100 150 200 250 UBSH / First Market Comparable Transactions 1.7 13.8 0.0 10.0 20.0 30.0 40.0 UBSH / First Market Comparable Transactions Price / Tangible Book Value (1) (%) Core Deposit Premium (2) (%) |

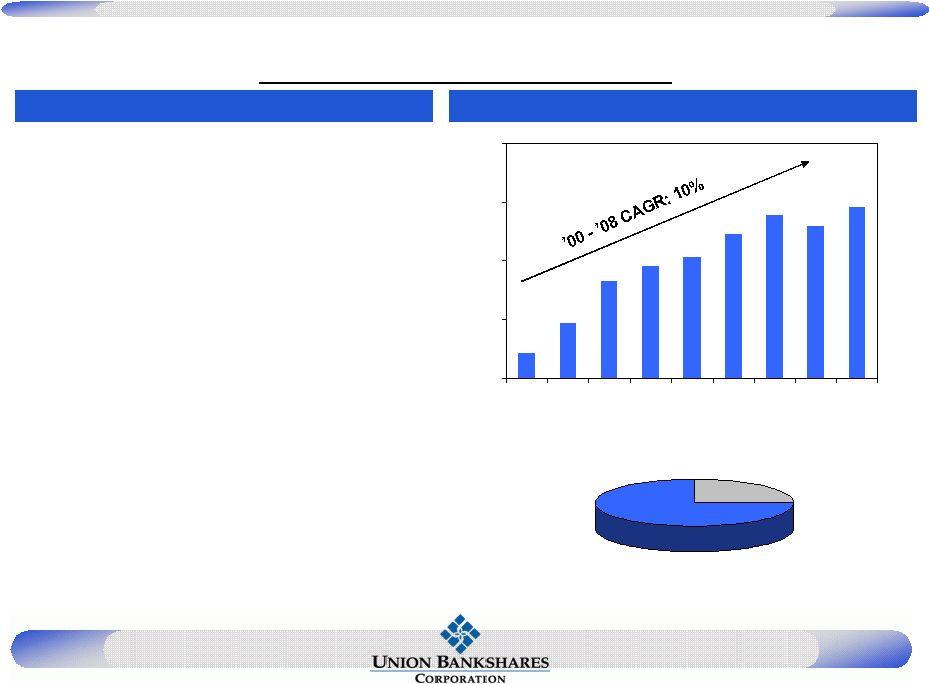

• Virginia’s 11 th largest community bank – Assets: $1.3 billion – Gross Loans: $1.0 billion – Deposits: $1.1 billion – Tangible Common Equity: $79.4 million • Successful partnership with Ukrop’s Super Markets, Inc. • 39 branches – 13 traditional branches – 26 supermarket branches • Comprehensive financial services provider – Banking – Mortgage – Investment – Brokerage – Trust – Insurance First Market Overview Deposits Over Time ($mm) First Market Overview Consumer Deposits 75.0% Business Deposits 25.0% $510 $634 $815 $875 $916 $1,011 $1,095 $1,047 $1,128 $400 $650 $900 $1,150 $1,400 2000 2001 2002 2003 2004 2005 2006 2007 2008 |

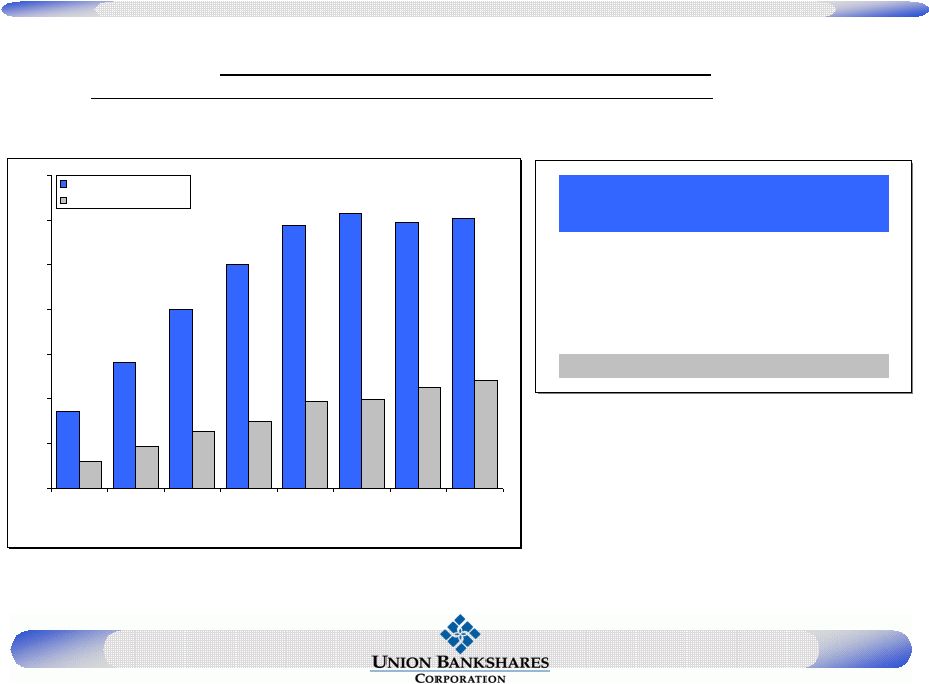

Supermarket Relationship • Successful supermarket partnership generates retail customer relationships Median Aggregate Deposits of In-Store Locations ($MM) Source: SNL Financial “Comparable locations” include 71 full-service branches in high-end grocery stores Medians calculated at June 30 each year First Market deposit range and current deposits as of 12/31/08 *Includes 4,040 in-store

locations in the U.S. open over 5 years In-Store Locations Open 5+

Years* Branch Deposit Median Size Range Deposits Quartile ($MM) ($MM) 1 $21.0 - $114.3 $28.6 2 $12.9 - $21.0 $16.5 3 $7.2 - $12.9 $9.9 4 $1.0 - $7.2 $4.3 First Market $15.3 - $40.3 $25.5 • In-Store locations generate over 75% of retail deposit accounts $30.7 $2.9 $4.7 $6.3 $7.4 $9.7 $30.1 $29.7 $14.1 $20.0 $25.0 $29.5 $8.6 $10.0 $12.1 $11.3 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 1 2 3 4 5 6 7 8 First Market Comparable Locations Years Open |

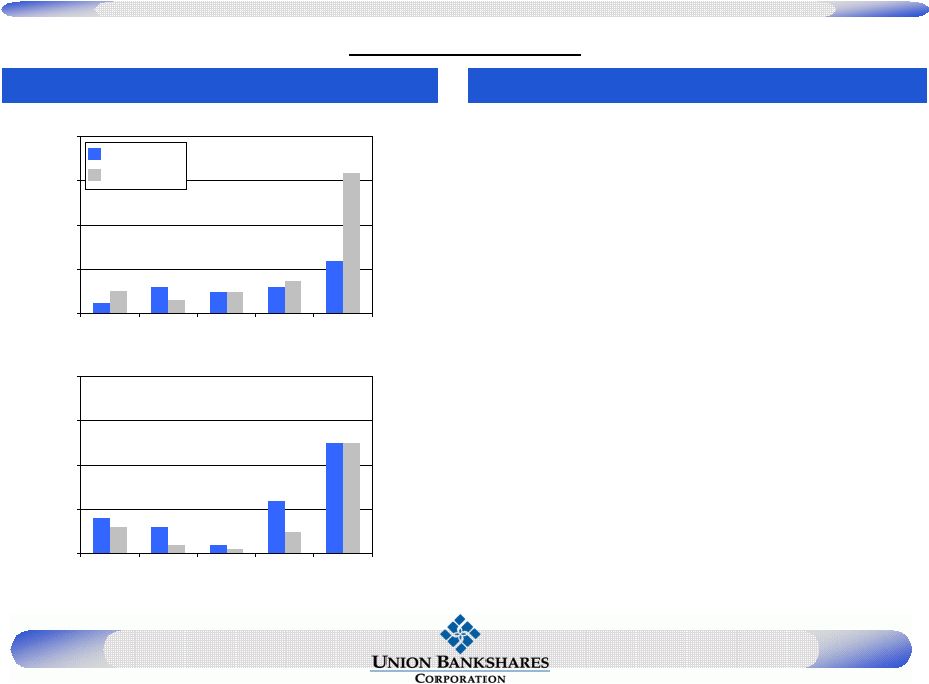

• Performed extensive due diligence – Financial and legal due diligence – Credit due diligence conducted by management and third party loan review specialists • Reviewed all non-performing, substandard and watch-list loans in excess of $250 thousand • Reviewed 66% of commercial real estate loans • Determined potential losses under stress scenarios • Interviewed key personnel • Modeled using estimated fair market value adjustment of 2.5% of gross loans • Current loan loss reserve equals 1.30% Credit Review Due Diligence Process Asset Quality 0.30 0.30 0.59 0.26 0.25 0.12 0.37 0.15 1.59 0.25 0.00 0.50 1.00 1.50 2.00 2004 2005 2006 2007 2008 NPAs / Loans + OREO Peer Group (1) First Market 0.06 0.02 0.12 0.25 0.08 0.06 0.02 0.05 0.25 0.01 0.00 0.10 0.20 0.30 0.40 2004 2005 2006 2007 2008 Net Charge-offs / Avg. Loans

(%) (%) Source: SNL Financial (1) Peer group includes select banks and thrifts headquartered in Virginia with assets

between $1.0 billion and $5.0 billion |

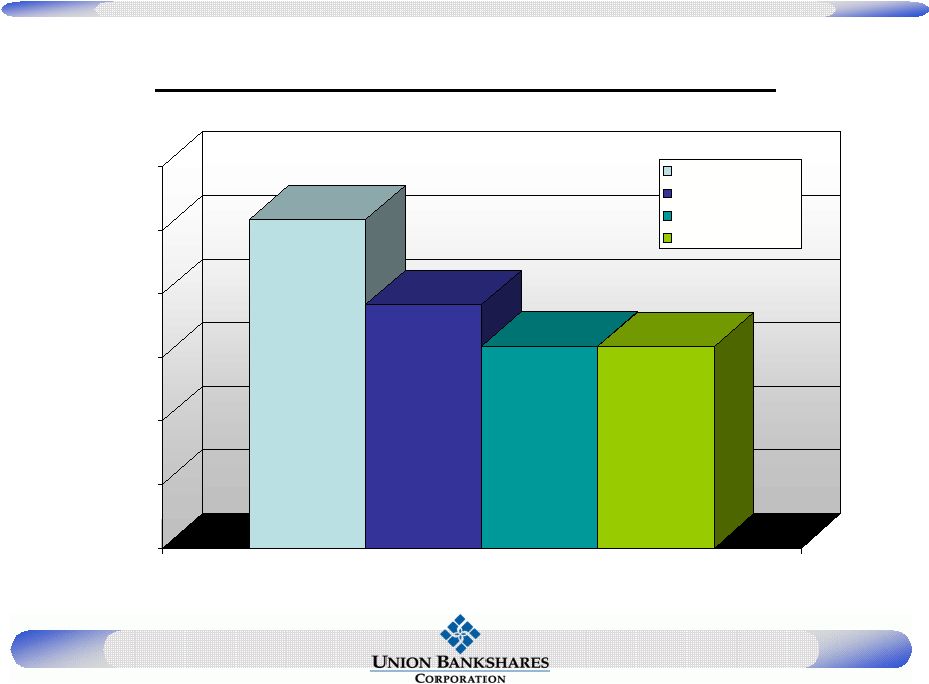

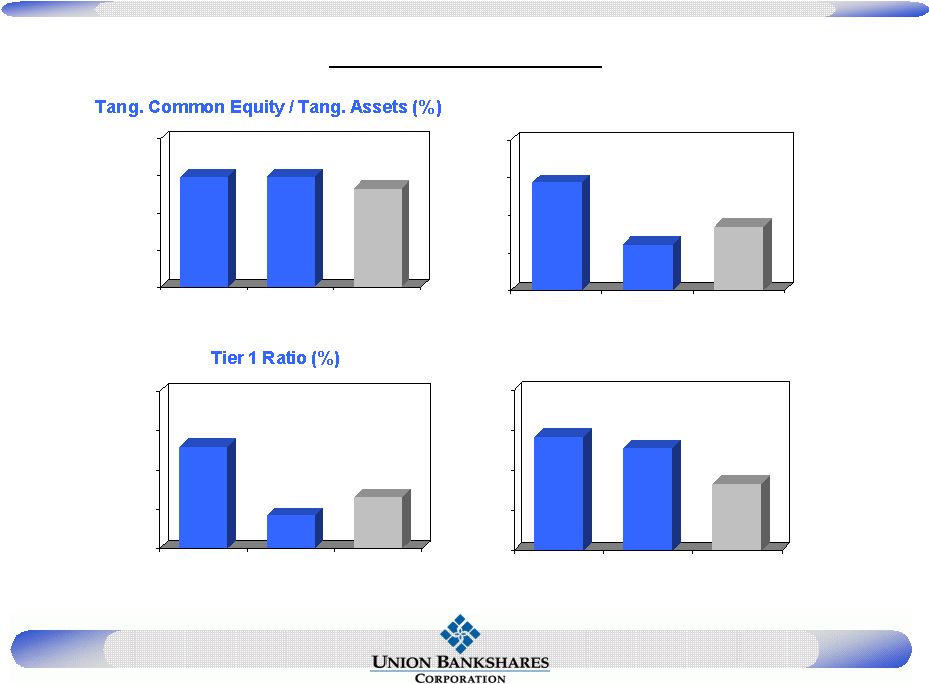

Capital Impact Capital ratios projected at close Leverage Ratio (%)

Total Capital Ratio (%) 13.83 13.56 12.67 11.00 12.00 13.00 14.00 15.00 UBSH Stand Alone First Market Stand Alone Pro Forma 5.98 5.97 5.65 3.00 4.00 5.00 6.00 7.00 UBSH Stand Alone First Market Stand Alone Pro Forma 10.87 9.23 9.71 8.00 9.00 10.00 11.00 12.00 UBSH Stand Alone First Market Stand Alone Pro Forma 12.59 10.86 11.33 10.00 11.00 12.00 13.00 14.00 UBSH Stand Alone First Market Stand Alone Pro Forma |

Acquisition Blueprint Good Demographics / Growth Market OR …Unique Product / Service (e.g. Trust,

Wealth Management) Management Retention Thorough Due Diligence Process Low Integration Risk EPS Accretive Tangible Common Equity to Assets above 5.5% |

Additional Information and Where to Find It In connection with the merger, Union will file with the Securities and Exchange

Commission (the “SEC”) a registration statement on Form S-4 to

register the shares of Union common stock to be issued to First Market

stockholders. The registration statement will include a joint proxy statement/prospectus that will be sent to the stockholders of Union and First Market seeking their approval of the

merger. In addition, Union may file other relevant documents

concerning the merger with the SEC. Investors and stockholders of Union are

urged to read the registration statement on Form S-4 and the joint proxy

statement/prospectus included within the registration statement and any other relevant documents to be filed with the SEC in connection with the merger, because they will

contain important information about Union, First Market and the proposed

transaction. Investors and stockholders of Union may obtain free

copies of these documents, when available, through the website maintained by the SEC at http://www.sec.gov. Free copies of the joint proxy statement/prospectus also may

be obtained by directing a request by telephone or mail to Union Bankshares

Corporation, Post Office Box 446, Bowling Green, Virginia 22427,

Attention: Investor Relations (telephone: (804) 633-5031) or by

accessing Union’s website at http://www.ubsh.com under “Investor Relations – SEC Filings.” The information on Union’s website is not, and shall not be deemed to be, a part of this presentation or incorporated into other

filings Union makes with the SEC. Union and its directors, executive officers and certain members of management may be

deemed to be participants in the solicitation of proxies from the

stockholders of Union in connection with the merger. Information about the

directors and executive officers of Union is set forth in the proxy statement for Union’s 2009 annual meeting of shareholders filed with the SEC on March 19, 2009.

Additional information regarding the interests of these participants and

other persons who may be deemed participants in the merger may be obtained

by reading the joint proxy statement/prospectus regarding the merger when it becomes available. |

& Creating Richmond and Central Virginia’s Bank of Choice |

Questions? Thank you! |