UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 0-20293

UNION BANKSHARES CORPORATION

(Exact name of registrant as specified in its charter)

| VIRGINIA | 54-1598552 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

212 North Main Street, P.O. Box 446, Bowling Green, Virginia 22427

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code is (804) 633-5031

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock $1.33 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2006 was approximately $368,875,052.

The number of shares of common stock outstanding as of February 1, 2007 was 13,303,912.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be used in conjunction with the registrant’s 2007 Annual Meeting of Shareholders are incorporated into Part III of this Form 10-K.

FORM 10-K

INDEX

i

FORWARD-LOOKING STATEMENTS

Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other statements concerning opinions or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance or achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of and changes in: general economic conditions, the interest rate environment, legislative and regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the stock and bond markets, technology, and consumer spending and savings habits. The Company does not update any forward-looking statements that may be made from time to time by or on behalf of the Company.

GENERAL

Union Bankshares Corporation (the “Company”) is a multi-bank holding company organized under Virginia law and registered under the Bank Holding Company Act of 1956. The Company is headquartered in Bowling Green, Virginia. The Company is committed to the delivery of financial services through its five community bank subsidiaries (the “Community Banks”) and three non-bank financial services affiliates. The Company’s Community Banks and non-bank financial services affiliates are:

| Community Banks | ||

| Union Bank & Trust Company |

Bowling Green, Virginia | |

| Northern Neck State Bank |

Warsaw, Virginia | |

| Rappahannock National Bank |

Washington, Virginia | |

| Bay Community Bank |

Newport News, Virginia | |

| Prosperity Bank & Trust Company |

Fairfax County, Virginia | |

| Financial Services Affiliates | ||

| Union Mortgage Group, Inc. |

Annandale, Virginia | |

| Union Investment Services, Inc. |

Ashland, Virginia | |

| Union Insurance Group, LLC |

Bowling Green, Virginia | |

History

The Company was formed in connection with the July 1993 merger of Northern Neck Bankshares Corporation and Union Bancorp, Inc. In connection with the merger, Union Bank and Trust Company (“Union Bank”) and Northern Neck State Bank became wholly owned bank subsidiaries of the Company. Although the Company was formed in 1993, the Community Banks are among the oldest in Virginia. Union Bank and Rappahannock National Bank began business in 1902 and Northern Neck State Bank dates back to 1907. On September 1, 1996, King George State Bank and on July 1, 1998, Rappahannock National Bank became wholly-owned subsidiaries of the Company. On February 22, 1999, Bay Community Bank (formerly Bank of Williamsburg) began business as a newly organized bank. In June 1999, King George State Bank was merged into Union Bank and ceased to be a subsidiary bank. The

1

Company acquired Guaranty Financial Corporation and its wholly owned subsidiary, Guaranty Bank (“Guaranty”), on May 1, 2004, and operated Guaranty as a separate subsidiary until September 13, 2004, which is when the operations of Guaranty were merged with Union Bank, the Company’s largest subsidiary. The Company acquired Prosperity Bank & Trust Company (“Prosperity”) on April 1, 2006 and operates it as an independent bank subsidiary.

Product Offerings and Market Distribution

The Company is one of the largest community banking organizations based in Virginia, providing full service banking to the Northern, Central, Rappahannock, Tidewater and Northern Neck regions of Virginia through 51 locations of its bank subsidiaries. Union Bank currently has 33 locations in the counties of Albemarle, Caroline, Chesterfield, Fluvanna, Hanover, Henrico, King George, King William, Nelson, Spotsylvania, Stafford, Westmoreland and the Cities of Charlottesville and Fredericksburg; Northern Neck State Bank has nine locations in the counties of Essex, Lancaster, Northumberland, Richmond and Westmoreland; Rappahannock National Bank has two locations in Washington and Front Royal, Virginia; Bay Community Bank has four locations in Williamsburg, Newport News and Grafton, Virginia; and Prosperity has three locations in Springfield and Burke, Virginia. Additionally, Union Bank operates a loan production office in Manassas, Virginia.

Each of the Community Banks are full service retail commercial banks offering consumers and businesses a wide range of banking and related financial services, including checking, savings, certificates of deposit and other depository services, as well as loans for commercial, industrial, residential mortgage and consumer purposes. Also, the Community Banks issue credit cards and deliver automated teller machine services through the use of reciprocally shared ATMs in the major ATM networks as well as remote ATMs for the convenience of their customers and other consumers. Furthermore, each of the Community Banks offers internet banking services and online bill payment for all of its customers, whether consumer or commercial.

The Company provides other financial services through its non-bank affiliates, Union Investment Services, Inc., Union Mortgage Group, Inc. (“Union Mortgage”), and formerly Mortgage Capital Investors, Inc. and Union Insurance Group, LLC. Bay Community Bank owns a non-controlling interest in Johnson Mortgage Company, LLC.

Union Investment Services, Inc. has provided securities, brokerage and investment advisory services since its formation in February 1993. It has five offices within the Community Banks’ trade areas and is a full service investment company handling all aspects of wealth management including stocks, bonds, annuities, mutual funds and financial planning.

On February 11, 1999, the Company acquired CMK Corporation t/a Union Mortgage, a mortgage loan brokerage company headquartered in Springfield, Virginia, by merger of CMK Corporation into Union Mortgage, later to become a wholly owned subsidiary of Union Bank. Union Mortgage has eleven offices in the following locations: Virginia (seven), Maryland (three) and South Carolina (one). Union Mortgage is also licensed to do business in selected states throughout the Mid-Atlantic and Southeast, as well as Washington, D.C. It provides a variety of mortgage products to customers in those areas. The mortgage loans originated by Union Mortgage are generally sold in the secondary market through purchase agreements with institutional investors.

On August 31, 2003, the Company formed Union Insurance Group, LLC (“UIG”), an insurance agency, in which each of the subsidiary banks owns a proportionate stake based on asset size. This agency operates in a joint venture with Bankers Insurance, LLC, a large insurance agency owned by community banks across Virginia and managed by the Virginia Bankers Association. UIG generates revenue through sales of various insurance products, including long term care insurance and business owner policies.

2

SEGMENTS

The Company has two reportable segments: its traditional full service community banking business and its mortgage loan origination business, each as described above. For more financial data and other information about each of the Company’s operating segments, refer to the “Management’s Discussion and Analysis of Financial Condition and Result of Operations” section, “Community Bank Segment” and to Note 18 “Segment Reporting” in the “Notes to Consolidated Financial Statements”.

EXPANSION AND STRATEGIC ACQUISITIONS

The Company expands its market area and increases its market share through internal growth, de novo expansion and strategic acquisitions. Strategic acquisitions by the Company to date have included whole bank acquisitions and financial affiliations, as well as branch and deposit acquisitions and purchases of former bank branch facilities. The Company generally considers acquisitions of companies in strong growth markets or with unique products or services that will benefit the entire organization. Targeted acquisitions are priced to be economically feasible with minimal short-term drag to achieve positive long-term benefits. These acquisitions may be paid for in the form of cash, stock, debt or a combination thereof. The amount and type of consideration and deal charges paid could have a dilutive short-term effect on the Company’s earnings per share or book value. However, cost savings and revenue enhancements in such transactions are anticipated to provide long-term economic benefit to the Company.

On April 3, 2006, the Company announced it had completed the acquisition of Prosperity, effective April 1, 2006, in a transaction valued at approximately $36 million. Prosperity, with nearly $130 million in assets, operates three branches in Springfield and Burke, Virginia, located in Fairfax County, a suburb in the Washington, D.C area.

In addition to the Prosperity acquisition, the Company grew through de novo expansion, opening five new branches throughout Virginia in the last two years:

| • | Twin Hickory, Union Bank branch, located in Richmond (December 2006) |

| • | Front Royal, Rappahannock National Bank branch located in Front Royal (December 2006) |

| • | Grafton, Bay Community Bank branch located in Grafton (March 2006) |

| • | Sycamore Square, Union Bank branch located in Midlothian (May 2005) |

| • | Monticello, Bay Community Bank branch, located in Williamsburg (January 2005) |

During 2006, the Company completed the relocation of Union Bank’s Ladysmith branch in Caroline County to a new facility directly behind the former location. Additionally, Union Bank’s Arlington Boulevard leased branch in the City of Charlottesville completed its relocation to an owned branch space on Barracks Road.

The Company is also in the process of constructing a new 70,000 square foot operations center in Caroline County, Virginia at a cost of approximately $13 million. The facility is located near the intersection of Interstate 95 and Route 1 approximately twelve miles west of the current facility in Bowling Green, Virginia. The new facility will accommodate the Company’s anticipated growth and provide improved access to the Greater Richmond and Fredericksburg workforce. Management anticipates that the existing operations center in Bowling Green will be either sold or leased.

EMPLOYEES

As of December 31, 2006, the Company had approximately 646 full-time equivalent employees, including executive officers, loan and other banking officers, branch personnel, operations personnel and other support personnel. None of the Company’s employees is represented by a union or covered under a collective bargaining agreement. Management of the Company considers its employee relations to be excellent.

3

COMPETITION

The financial services industry remains highly competitive and is constantly evolving. The Company experiences strong competition in all aspects of its business. In its market areas, the Company competes with large national and regional financial institutions, credit unions and other independent community banks, as well as credit unions, consumer finance companies, mortgage companies, loan production offices, mutual funds and life insurance companies. Competition has increasingly come from out-of-state banks through their acquisitions of Virginia-based banks. Competition for deposits and loans is affected by various factors including interest rates offered, the number and location of branches and types of products offered, as well as the reputation of the institution. In addition, credit unions have been allowed to increasingly expand their membership definitions and to offer more attractive loan and deposit pricing due to their favorable tax status. The Company’s non-bank financial services affiliates also operate in highly competitive environments.

The Company is headquartered in Bowling Green, Virginia and is one of the largest independent bank holding companies in Virginia. The Company believes its community bank framework and philosophy provide a competitive advantage, particularly with regard to larger national and regional institutions, allowing the Company to compete effectively in the markets it serves. The Company’s Community Banks generally have strong and growing market shares within the markets they serve. The Company’s deposit market share in Virginia was 1.27% and 1.28% as of June 30, 2006 and 2005, respectively.

SUPERVISION AND REGULATION

Bank holding companies and banks are extensively and increasingly regulated under both federal and state law. The following description briefly addresses certain provisions of federal and state laws as well as certain regulations and proposed regulations, and the potential impact of such provisions on the Company and the Community Banks. To the extent statutory or regulatory provisions or proposals are described herein, the description is qualified in its entirety by reference to the particular statutory or regulatory provisions or proposals.

Bank Holding Companies

As a bank holding company registered under the Bank Holding Company Act of 1956 (the “BHCA”), the Company is subject to regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). The Federal Reserve has jurisdiction under the BHCA to approve any bank or non-bank acquisition, merger or consolidation proposed by a bank holding company. The BHCA generally limits the activities of a bank holding company and its subsidiaries to that of banking, managing or controlling banks, or any other activity that is so closely related to banking or to managing or controlling banks as to be a proper incident thereto.

Since September 1995, the BHCA has permitted bank holding companies from any state to acquire banks and bank holding companies located in any other state, subject to certain conditions, including nationwide and state imposed concentration limits. Banks are also able to branch across state lines, provided certain conditions are met, including that applicable state law must expressly permit such interstate branching. Virginia has adopted legislation that permits branching across state lines, provided there is reciprocity with the state in which the out-of-state bank is based. The Company has no plans to branch outside of the Commonwealth of Virginia.

There are a number of obligations and restrictions imposed on bank holding companies and their depository institution subsidiaries by federal law and regulatory policy. Collectively, these are designed to reduce potential loss exposure to the depositors of such depository institutions and to the Federal Deposit

4

Insurance Corporation (the “FDIC”) insurance funds in the event the depository institution becomes in danger of default or is in default. For example, under a policy of the Federal Reserve with respect to bank holding company operations, a bank holding company is required to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so absent such policy. In addition, the “cross-guarantee” provisions of federal law require insured depository institutions under common control to reimburse the FDIC for any loss suffered or reasonably anticipated by the Deposit Insurance Fund (“DIF”) as a result of the default of a commonly controlled insured depository institution in danger of default. The FDIC may decline to enforce the cross-guarantee provisions if it determines that a waiver is in the best interest of the BIF. The FDIC’s claim for damages is superior to claims of stockholders of the insured depository institution or its holding company but is subordinate to claims of depositors, secured creditors and holders of subordinated debt (other than affiliates) of the commonly controlled insured depository institutions.

The Federal Deposit Insurance Act (the “FDIA”) also provides that amounts received from the liquidation or other resolution of any insured depository institution by any receiver must be distributed (after payment of secured claims) to pay the deposit liabilities of the institution prior to payment of any other general creditor or stockholder. This provision would give depositors a preference over general and subordinated creditors and stockholders in the event a receiver is appointed to distribute the assets of such depository institutions.

The Company is registered under the bank holding company laws of Virginia. Accordingly, the Company and the Community Banks (other than Rappahannock National Bank, which is regulated and supervised by the Office of the Comptroller of the Currency (“OCC”)) are subject to regulation and supervision by the State Corporation Commission of Virginia (the “SCC”) and the Federal Reserve.

Capital Requirements

The Federal Reserve, the OCC and the FDIC have issued substantially similar risk-based and leverage capital guidelines applicable to United States banking organizations. In addition, those regulatory agencies may from time to time require that a banking organization maintain capital above the minimum levels because of its financial condition or actual or anticipated growth. Under the risk-based capital requirements of these federal bank regulatory agencies, the Company and each of the Community Banks are required to maintain a minimum ratio of total capital to risk-weighted assets of at least 8.0%. At least half of the total capital is required to be “Tier 1 capital”, which consists principally of common and certain qualifying preferred shareholders’ equity (including Trust Preferred Securities), less certain intangibles and other adjustments. The remainder (“Tier 2 capital”) consists of a limited amount of subordinated and other qualifying debt (including certain hybrid capital instruments) and a limited amount of the general loan loss allowance. The Tier 1 and total capital to risk-weighted asset ratios of the Company as of December 31, 2006 were 11.63% and 12.78%, respectively, exceeding the minimum requirements.

In addition, each of the federal regulatory agencies has established a minimum leverage capital ratio (Tier 1 capital to average adjusted assets) (“Tier 1 leverage ratio”). These guidelines provide for a minimum Tier 1 leverage ratio of 4% for banks and bank holding companies that meet certain specified criteria, including that they have the highest regulatory examination rating and are not contemplating significant growth or expansion. The Tier 1 leverage ratio of the Company as of December 31, 2006, was 9.57%, which is above the minimum requirements. The guidelines also provide that banking organizations experiencing internal growth or making acquisitions will be expected to maintain strong capital positions substantially above the minimum supervisory levels, without significant reliance on intangible assets.

Limits on Dividends and Other Payments

The Company is a legal entity, separate and distinct from its subsidiary institutions. A significant portion of the revenues of the Company result from dividends paid to it by the Community Banks. There are various legal limitations applicable to the payment of dividends by the Community Banks to the Company, as well as the payment of dividends by the Company to its respective shareholders.

5

The Community Banks are subject to various statutory restrictions on their ability to pay dividends to the Company. Under the current supervisory practices of the Community Banks’ regulatory agencies, prior approval from those agencies is required if cash dividends declared in any given year exceed net income for that year, plus retained net profits of the two preceding years. The payment of dividends by the Community Banks or the Company may also be limited by other factors, such as requirements to maintain capital above regulatory guidelines. Bank regulatory agencies have the authority to prohibit the Community Banks or the Company from engaging in an unsafe or unsound practice in conducting their business. The payment of dividends, depending on the financial condition of the Community Banks, or the Company, could be deemed to constitute such an unsafe or unsound practice.

Under the FDIA, insured depository institutions such as the Community Banks are prohibited from making capital distributions, including the payment of dividends, if, after making such distribution, the institution would become “undercapitalized” (as such term is used in the statute). Based on the Community Banks’ current financial condition, the Company does not expect that this provision will have any impact on its ability to obtain dividends from the Community Banks. Non-bank subsidiaries pay the parent company dividends periodically on a non-regulated basis.

In addition to dividends it receives from the Community Banks, the Company receives management fees from its affiliated companies for various services provided to them including: data processing, item processing, loan operations, deposit operations, financial accounting, human resources, funds management, credit administration, credit support, sales and marketing, collections, facilities management, call center, legal, compliance and internal audit. These fees are charged to each subsidiary based upon various specific allocation methods measuring the estimated usage of such services by that subsidiary. The fees are eliminated from the financial statements in the consolidation process.

Under federal law, the Community Banks may not, subject to certain limited exceptions, make loans or extensions of credit to, or investments in the securities of, the Company or take securities of the Company as collateral for loans to any borrower. The Community Banks are also subject to collateral security requirements for any loans or extensions of credit permitted by such exceptions.

The Community Banks

The Community Banks are supervised and regularly examined by the Federal Reserve and the SCC, except for Rappahannock National Bank, which is examined by the OCC. The various laws and regulations administered by the regulatory agencies affect corporate practices, such as the payment of dividends, incurrence of debt and acquisition of financial institutions and other companies, and affect business practices, such as the payment of interest on deposits, the charging of interest on loans, types of business conducted and location of offices.

The Community Banks are also subject to the requirements of the Community Reinvestment Act (the “CRA”). The CRA imposes on financial institutions an affirmative and ongoing obligation to meet the credit needs of the local communities, including low- and moderate-income neighborhoods, consistent with the safe and sound operation of those institutions. Each financial institution’s efforts in meeting community credit needs currently are evaluated as part of the examination process pursuant to up to ten assessment factors. These factors also are considered in evaluating mergers, acquisitions and applications to open a branch or facility. Many of the banks’ competitors, such as credit unions, are not subject to the requirements of CRA.

Deposit accounts with the Community Banks are insured by the FDIC, and therefore the banks are subject to insurance assessments imposed by the FDIC. On February 15, 2006, federal legislation to reform federal deposit insurance was enacted. This new legislation required, among other things, that the FDIC adopt regulations increasing the maximum amount of federal deposit insurance coverage per separately insured depositor to $130 thousand (with a cost of living adjustment to become effective in five years). The legislation also gave the FDIC greater discretion to identify the relative risks all institutions present to the deposit insurance fund and set risk-based premiums.

6

On November 2, 2006, the FDIC adopted final regulations establishing a risk-based assessment system that is intended to more closely tie each bank’s deposit insurance assessments to the risk it poses to the deposit insurance fund. Under the new risk-based assessment system, which became effective in the beginning of 2007, the FDIC will evaluate each bank’s risk based on three primary factors: (1) its supervisory rating, (2) its financial ratios, and (3) its long-term debt issuer rating, if the bank has one. The new rates for most banks will vary between five and seven cents for every $100 of domestic deposits. In 2006, under prior regulations, the Company paid only the base assessment rate for “well capitalized” institutions which amounted to $195 thousand in deposit insurance premiums.

Other Safety and Soundness Regulations

The federal banking agencies have broad powers under current federal law to make prompt corrective action to resolve problems of insured depository institutions. The extent of these powers depends upon whether the institutions in question are “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” or “critically undercapitalized.” All such terms are defined under uniform regulations defining such capital levels issued by each of the federal banking agencies. The Community Banks each meet the definition of being “well capitalized” as of December 31, 2006.

The Gramm-Leach-Bliley Act

Effective on March 11, 2001, the Gramm-Leach Bliley Act (the “GLB Act”) allows a bank holding company or other company to certify its status as a financial holding company, thereby allowing such company to engage in activities that are financial in nature, that are incidental to such activities, or are complementary to such activities. The GLB Act enumerates certain activities that are deemed financial in nature, such as underwriting insurance or acting as an insurance principal, agent or broker; underwriting; dealing in or making markets in securities; and engaging in merchant banking under certain restrictions. It also authorizes the Federal Reserve to determine by regulation what other activities are financial in nature, or incidental or complementary thereto.

USA Patriot Act of 2001

In October 2001, the USA Patriot Act of 2001 was enacted in response to the terrorist attacks in New York, Pennsylvania and Northern Virginia which occurred on September 11, 2001. The Patriot Act intended to strengthen U.S. law enforcement and the intelligence communities’ abilities to work cohesively to combat terrorism on a variety of fronts. The continuing and potential impact of the Patriot Act and related regulations and policies on financial institutions of all kinds is significant and wide ranging. The Patriot Act contains sweeping anti-money laundering and financial transparency laws, and imposes various regulations, including standards for verifying client identification at account opening, and rules to promote cooperation among financial institutions, regulators and law enforcement entities in identifying parties that may be involved in terrorism or money laundering.

Check 21

On October 28, 2003, President Bush signed into law the Check Clearing for the 21st Century Act, also known as Check 21. Check 21 gives “substitute checks,” such as a digital image of a check and copies made from that image, the same legal standing as the original paper check. Some of the major provisions of Check 21 include:

| • | allowing check truncation without making it mandatory; |

| • | demanding that every financial institution communicate to accountholders in writing a description of its substitute check processing program and their rights under the law; |

| • | legalizing substitutions for and replacements of paper checks without agreement from consumers; |

| • | retaining in place the previously mandated electronic collection and return of checks between financial institutions only when individual agreements are in place; |

7

| • | requiring that when accountholders request verification, financial institutions produce the original check (or a copy that accurately represents the original) and demonstrate that the account debit was accurate and valid; and |

| • | requiring recrediting of funds to an individual’s account on the next business day after a consumer proves that the financial institution has erred. |

Effect of Governmental Monetary Policies

The Company’s operations are affected not only by general economic conditions, but also by the policies of various regulatory authorities. In particular, the Federal Reserve regulates money and credit conditions and interest rates in order to influence general economic conditions. These policies have a significant influence on overall growth and distribution of loans, investments and deposits, and affect interest rates charged on loans or paid for time and savings deposits. Federal Reserve monetary policies have had a significant effect on the operating results of commercial banks in the past and are expected to do so in the future. We are unable to predict the effect of possible changes in monetary policies upon the future operating results of the Company.

Proposed Legislation and Regulatory Action

New regulations and statutes are regularly proposed that contain wide-ranging proposals for altering the structures, regulations, and competitive relationships of the nation’s financial institutions. The Company cannot predict whether or in what form any proposed regulation or statute will be adopted or the extent to which the Company’s business may be affected by any new regulation or statute.

Filings with the SEC

The Company files annual, quarterly and other reports under the Securities Exchange Act of 1934 with the Securities and Exchange Commission (“SEC”). These reports are posted and are available at no cost on the Company’s website, www.ubsh.com, through the Investor Relations link, as soon as reasonably practicable after the Company files such documents with the SEC. The Company’s filings are also available through the SEC’s website at www.sec.gov.

General economic conditions, either national or within the Company’s local markets could materially impact the Company’s financial condition and performance.

The Company is affected by general economic conditions in the United States and the local markets within which it operates. Significant decline in general economic conditions caused by inflation, recession, unemployment or other factors beyond the Company’s control could negatively impact the growth rate of loans (including mortgage originations) and deposits, the quality of the loan portfolio, loan and deposit pricing and other key drivers of the Company’s business. Such negative developments could adversely impact the Company’s financial condition and performance.

Changes in interest rates could adversely affect the Company’s income and cash flows.

The Company’s income and cash flows depend to a great extent on the difference between the interest rates earned on interest-earning assets such as loans and investment securities, and the interest rates paid on interest-bearing liabilities such as deposits and borrowings. These rates are highly sensitive to many factors that are beyond the Company’s control, including general economic conditions and the policies of various governmental and regulatory agencies (in particular, the Federal Reserve). Changes in monetary policy, including changes in interest rates, will influence the origination of loans, the prepayment speed of loans, the purchase of investments, the generation of deposits and the rates received on loans and investment securities and paid on deposits or other sources of funding. The impact of these changes may be magnified if the Company does not effectively manage the relative sensitivity of its assets and liabilities to changes in market interest rates. Fluctuations in these areas may adversely affect the Company and its shareholders. Community banks are often at a competitive disadvantage in managing their costs of funds compared to the large regional, super-regional or national banks that have access to the national and international capital markets.

8

The Company generally seeks to maintain a neutral position in terms of the volume of assets and liabilities that mature or re-price during any period so that it may reasonably maintain its net interest margin; however, interest rate fluctuations, loan prepayments, loan production and deposit flows are constantly changing and influence the ability to maintain a neutral position. Generally, the Company’s earnings will be more sensitive to fluctuations in interest rates the greater the variance in volume of assets and liabilities that mature and re-price in any period. The extent and duration of the sensitivity will depend on the cumulative variance over time, the velocity and direction of interest rates, shape of the yield curve, and whether the Company is more asset sensitive or liability sensitive. Accordingly, the Company may not be successful in maintaining a neutral position and, as a result, the Company’s net interest margin may be impacted.

The Company faces substantial competition that could adversely affect the Company’s growth and/or operating results.

The Company operates in a competitive market for financial services and faces intense competition from other financial institutions both in making loans and in attracting deposits. Many of these financial institutions have been in business for many years, are significantly larger, have established customer bases, and have greater financial resources and lending limits.

The inability of the Company to successfully manage its growth or implement its growth strategy may adversely affect the results of operations and financial conditions.

The Company may not be able to successfully implement its growth strategy if unable to identify attractive markets, locations or opportunities to expand in the future. The ability to manage growth successfully also depends on whether the Company can maintain capital levels adequate to support its growth, maintain cost controls, asset quality and successfully integrate any businesses acquired into the organization.

As the Company continues to implement its growth strategy by opening new branches or acquiring branches or banks, it expects to incur increased personnel, occupancy and other operating expenses. In the case of new branches, the Company must absorb those higher expenses while it begins to generate new deposits, and there is a further time lag involved in redeploying new deposits into attractively priced loans and other higher yielding earning assets. Thus, the Company’s plans to branch could depress earnings in the short run, even if it efficiently executes a branching strategy leading to long-term financial benefits.

Difficulties in combining the operations of acquired entities with the Company’s own operations may prevent the Company from achieving the expected benefits from acquisitions.

The Company may not be able to achieve fully the strategic objectives and operating efficiencies in an acquisition. Inherent uncertainties exist in integrating the operations of an acquired entity. In addition, the markets and industries in which the Company and its potential acquisition targets operate are highly competitive. The Company may lose customers or the customers of acquired entities as a result of an acquisition. The Company also may lose key personnel, either from the acquired entity or from itself, as a result of an acquisition. These factors could contribute to the Company not achieving the expected benefits from its acquisitions within desired time frames, if at all. Future business acquisitions could be material to the Company and it may issue additional shares of common stock to pay for those acquisitions, which would dilute current shareholders’ ownership interests. Acquisitions also could require the Company to use substantial cash or other liquid assets or to incur debt. In those events, it could become more susceptible to economic downturns and competitive pressures.

The Company’s exposure to operational risk may adversely affect the Company.

Similar to other financial institutions, the Company is exposed to many types of operational risk, including reputational risk, legal and compliance risk, the risk of fraud or theft by employees or outsiders, unauthorized transactions by employees or operational errors, including clerical or record-keeping errors or those resulting from faulty or disabled computer or telecommunications systems.

9

The Company’s dependency on its management team and the unexpected loss of any of those personnel could adversely affect operations.

The Company is a customer-focused and relationship-driven organization. Future growth is expected to be driven by a large part in the relationships maintained with customers. While the Company has assembled an experienced management team, is building the depth of that team and has management development plans in place, the unexpected loss of key employees could have a material adverse effect on the Company’s business and may result in lower revenues.

The Company’s concentration in loans secured by real estate may adversely impact earnings due to changes in the real estate markets.

The Company offers a variety of secured loans, including commercial lines of credit, commercial term loans, real estate, construction, home equity, consumer and other loans. Many of the Company’s loans are secured by real estate (both residential and commercial) in the Company’s market area. A major change in the real estate market, resulting in deterioration in the value of this collateral, or in the local or national economy, could adversely affect the customer’s ability to pay these loans, which in turn could impact the Company. Risk of loan defaults and foreclosures are unavoidable in the banking industry, and the Company tries to limit its exposure to this risk by monitoring extensions of credit carefully. The Company cannot fully eliminate credit risk, and as a result credit losses may occur in the future.

If the Company’s allowance for loan losses becomes inadequate, the results of operations may be adversely affected.

The Company maintains an allowance for loan losses that it believes is a reasonable estimate of potential losses within the loan portfolio. Through a periodic review and consideration of the loan portfolio, management determines the amount of the allowance for loan losses by considering general market conditions, credit quality of the loan portfolio, the collateral supporting the loans and performance of customers relative to their financial obligations with the Company. The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates, which may be beyond the Company’s control, and these losses may exceed current estimates. Rapidly growing loan portfolios are, by their nature, unseasoned. As a result, estimating loan loss allowances is more difficult, and may be more susceptible to changes in estimates, and to losses exceeding estimates, than more seasoned portfolios. Although the Company believes the allowance for loan losses is a reasonable estimate of known and inherent losses in the loan portfolio, it cannot fully predict such losses or that the loss allowance will be adequate in the future. Excessive loan losses could have a material impact on financial performance. Consistent with the loan loss reserve methodology, the Company expects to make additions to the allowance for loan loss as a result of its growth strategy, which may affect the Company’s short-term earnings.

Federal and state regulators periodically review the allowance for loan losses and may require the Company to increase its provision for loan losses or recognize further loan charge-offs, based on judgments different than those of management. Any increase in the amount of the provision or loans charged-off as required by these regulatory agencies could have a negative effect on the Company’s operating results.

Legislative or regulatory changes or actions, or significant litigation, could adversely impact the Company or the businesses in which the Company is engaged.

The Company is subject to extensive state and federal regulation, supervision and legislation that govern almost all aspects of its operations. Laws and regulations may change from time to time and are primarily intended for the protection of consumers, depositors and the deposit insurance funds. The impact of any changes to laws and regulations or other actions by regulatory agencies may negatively impact the Company or its ability to increase the value of its business. Additionally, actions by regulatory agencies or

10

significant litigation against the Company could cause it to devote significant time and resources to defending itself and may lead to penalties that materially affect the Company and its shareholders. Future changes in the laws or regulations or their interpretations or enforcement could be materially adverse to the Company and its shareholders.

Changes in accounting standards could impact reported earnings.

The accounting standard setters, including the Financial Accounting Standards Board, SEC and other regulatory bodies, periodically change the financial accounting and reporting standards that govern the preparation of the Company’s consolidated financial statements. These changes can be hard to predict and can materially impact how it records and reports its financial condition and results of operations. In some cases, the Company could be required to apply a new or revised standard retroactively, resulting in the restatement of prior period financial statements.

ITEM 1B.—UNRESOLVED STAFF COMMENTS.

The Company does not have any unresolved staff comments to report for the year ended December 31, 2006.

The Company, through its subsidiaries, owns or leases buildings that are used in the normal course of business. The corporate headquarters is located at 212 N. Main Street, Bowling Green, Virginia, in a building owned by the Company. The Company’s subsidiaries own or lease various other offices in the counties and cities in which they operate. In addition to the properties listed below, the Company has acquired land and is constructing a new operations center in nearby Carmel Church, Virginia which it anticipates will be completed during the second quarter of 2007. See the Note 1 “Summary of Significant Accounting Policies” in the “Notes to the Consolidated Financial Statements”, of this Form 10-K for information with respect to the amounts at which bank premises and equipment are carried and commitments under long-term leases.

Unless otherwise indicated, the properties listed below are owned by the Company and its subsidiaries as of December 31, 2006.

11

| CORPORATE HEADQUARTERS | ||

| 212 North Main Street |

Bowling Green, Virginia | |

| BANKING OFFICES | ||

| Union Bank and Trust Company: | ||

| 211 North Main Street |

Bowling Green, Virginia | |

| 7349 Ladysmith Road |

Ladysmith, Virginia | |

| U.S. Route 301 |

Port Royal, Virginia | |

| 4540 Lafayette Boulevard |

Fredericksburg, Virginia | |

| U.S. Route 1 and Ashcake Road |

Ashland, Virginia | |

| 4210 Plank Road |

Fredericksburg, Virginia | |

| 10415 Courthouse Road |

Spotsylvania, Virginia | |

| 9665 Sliding Hill Road |

Ashland, Virginia | |

| 700 Kenmore Avenue |

Fredericksburg, Virginia | |

| U.S. Route 360 |

Manquin, Virginia | |

| 9534 Chamberlayne Road |

Mechanicsville, Virginia | |

| Cambridge and Layhill Road |

Falmouth, Virginia (leased) | |

| Massaponax Church Road and U.S. Route 1 |

Spotsylvania, Virginia (leased) | |

| Brock Road and Route 3 |

Spotsylvania, Virginia (leased) | |

| 2811 Fall Hill Avenue |

Fredericksburg, Virginia | |

| 6479 Mechanicsville Turnpike |

Mechanicsville, Virginia | |

| 10045 Kings Highway |

King George, Virginia | |

| 840 McKinney Boulevard |

Colonial Beach, Virginia | |

| 5510 Morris Road |

Spotsylvania, Virginia | |

| 4690 Pouncey Tract Road |

Glen Allen, Virginia (leased) | |

| 8300 Bell Creek Road |

Mechanicsville, Virginia | |

| 1773 Parham Road |

Richmond, Virginia | |

| 11101 Hull Street Road |

Midlothian, Virginia | |

| 13644 Hull Street Road |

Midlothian, Virginia | |

| 400 East Main Street |

Charlottesville, Virginia (leased) | |

| 1700 Seminole Trail |

Charlottesville, Virginia (leased) | |

| 124 Main Street |

Lovingston, Virginia | |

| 2151 Barracks Road |

Charlottesville, Virginia | |

| 1658 State Farm Boulevard |

Charlottesville, Virginia | |

| 5980 Thomas Jefferson Parkway |

Palmyra, Virginia | |

| 3290 Worth Crossing |

Charlottesville, Virginia | |

| 13700 Midlothian Turnpike |

Midlothian, Virginia (leased) | |

| 11163 Nuckols Road |

Glen Allen, Virginia | |

| Northern Neck State Bank: | ||

| 5839 Richmond Road |

Warsaw, Virginia | |

| 4256 Richmond Road |

Warsaw, Virginia | |

| 17191 Kings Highway |

Montross, Virginia | |

| 1649 Tappahannock Boulevard |

Tappahannock, Virginia | |

| 1660 Tappahannock Boulevard (Wal-Mart) |

Tappahannock, Virginia (leased) | |

| 15043 Northumberland Highway |

Burgess, Virginia | |

| 284 North Main Street |

Kilmarnock, Virginia | |

| 876 Main Street |

Reedville, Virginia | |

| 485 Chesapeake Drive |

White Stone, Virginia | |

12

| Rappahannock National Bank: | ||

| 7 Bank Road |

Washington, Virginia | |

| 473 South Street |

Front Royal, Virginia (leased) | |

| Bay Community Bank: | ||

| 5125 John Tyler Highway |

Williamsburg, Virginia | |

| 603 Pilot House Drive |

Newport News, Virginia (leased) | |

| 171 Monticello Avenue |

Williamsburg, Virginia (leased) | |

| 5030 George Washington Memorial Highway |

Grafton, Virginia | |

| Prosperity Bank & Trust Company (all leased): | ||

| 5803 Rolling Road |

Springfield, Virginia | |

| 6975A Springfield Boulevard |

Springfield, Virginia | |

| 6050A Burke Commons Road |

Burke, Virginia | |

| Union Investment Services, Inc. | ||

| 111 Davis Court |

Bowling Green, Virginia | |

| 10469 Atlee Station Road, Suite 100 |

Ashland, Virginia | |

| 2811 Fall Hill Avenue |

Fredericksburg, Virginia | |

| 171 Monticello Avenue |

Williamsburg, Virginia | |

| 1658 State Farm Boulevard |

Charlottesville, Virginia | |

| 13700 Midlothian Turnpike |

Midlothian, Virginia (leased) | |

| LOAN PRODUCTION OFFICES | ||

| Union Bank and Trust Company: | ||

| 9282 Corporate Circle, Building 7 |

Manassas, Virginia (leased) | |

| Union Mortgage Group, Inc. (all leased): | ||

| 3 Hillcrest Drive, #A100 |

Frederick, Maryland | |

| 7501 Greenway Center, #140 |

Greenbelt, Maryland | |

| 2670 Crain Highway, Suite 407 |

Waldorf, Maryland | |

| 3120 Waccamaw Boulevard, Suite F |

Myrtle Beach, South Carolina | |

| 5440 Jeff Davis Highway, #103 |

Fredericksburg, Virginia | |

| 6330 Newtown Road, #211 |

Norfolk, Virginia | |

| 7619 Little River Turnpike, Suite 400 |

Annandale, Virginia | |

| 1658 State Farm Boulevard |

Charlottesville, Virginia | |

| 10469 Atlee Station Road, #120 |

Ashland, Virginia | |

| 11830 Canon Boulevard, Suite D |

Newport News, Virginia | |

| 760 Lynnhaven Parkway, Suite 140 |

Virginia Beach, Virginia | |

In the ordinary course of its operations, the Company and its subsidiaries are parties to various legal proceedings. Based on the information presently available, and after consultation with legal counsel, management believes that the ultimate outcome in such proceedings, in the aggregate, will not have a material adverse effect on the business or the financial condition or results of operations of the Company.

ITEM 4.—SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of security holders during the fourth quarter of the year ended December 31, 2006.

13

ITEM 5.—MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

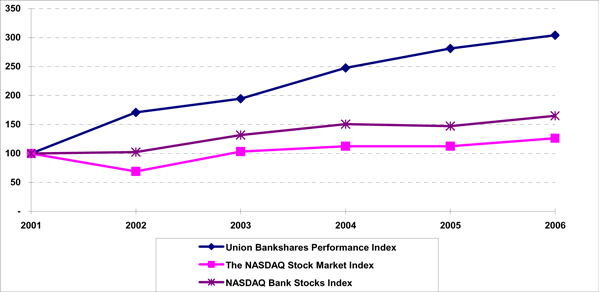

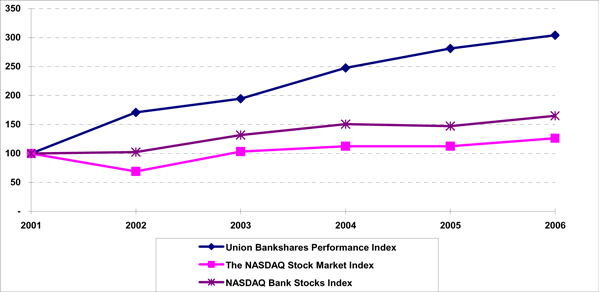

The following performance graph does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates the performance graph by reference therein.

Five-Year Stock Performance Graph

The following chart compares the yearly percentage change in the cumulative shareholder return on the Company’s common stock during the five years ended December 31, 2006, with (1) the Total Return Index for the NASDAQ Stock Market (U.S. Companies) and (2) the Total Return Index for NASDAQ Bank Stocks. This comparison assumes $100.00 was invested on December 31, 2001, in the common stock and the comparison groups and assumes the reinvestment of all cash dividends prior to any tax effect and retention of all stock dividends. The Company’s total cumulative return was 204.1% over the five year period ending December 31, 2006 compared to 65.2% and 26.2% for the NASDAQ Bank Stocks and NASDAQ composite:

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |||||||

| Union Bankshares Performance Index | 100.00 | 170.98 | 194.61 | 247.65 | 281.10 | 304.09 | ||||||

| The NASDAQ Stock Market Index | 100.00 | 69.13 | 103.36 | 112.49 | 112.49 | 126.22 | ||||||

| NASDAQ Bank Stocks Index | 100.00 | 102.37 | 131.69 | 150.71 | 147.23 | 165.21 |

Information on Common Stock, Market Prices and Dividends

There were 13,303,519 shares of the Company’s common stock outstanding at the close of business on December 31, 2006, which were held by 2,432 shareholders of record. The closing price of the Company’s stock on December 31, 2006 was $30.59 per share compared to $28.73 on December 31, 2005.

On September 7, 2006, the Company’s Board of Directors declared a three-for-two stock split to shareholders of record as of the close of business on October 2, 2006. Accordingly, share and per share amounts for all periods presented have been retroactively adjusted to reflect the effect of the three-for-two split.

14

The following table summarizes the high and low closing sales prices and dividends declared for quarterly periods during the years ended December 31, 2006 and 2005.

| Market Values | Declared Dividends | |||||||||||||||||

| 2006 | 2005 | 2006 | 2005 | |||||||||||||||

| High | Low | High | Low | |||||||||||||||

| First Quarter |

$ | 32.06 | $ | 28.89 | $ | 24.79 | $ | 20.49 | $ | 0.15 | $ | — | ||||||

| Second Quarter |

29.30 | 25.64 | 26.16 | 19.59 | 0.15 | 0.25 | ||||||||||||

| Third Quarter |

30.40 | 26.20 | 29.41 | 25.19 | 0.16 | — | ||||||||||||

| Fourth Quarter |

32.10 | 27.85 | 32.70 | 25.66 | 0.17 | 0.27 | ||||||||||||

| $ | 0.63 | $ | 0.52 | |||||||||||||||

Regulatory restrictions on the ability of the Community Banks to transfer funds to the Company at December 31, 2006, are set forth in Note 17 “Parent Company Financial Information” contained in the “Notes to the Consolidated Financial Statements”, of this Form 10-K. A discussion of certain limitations on the ability of the Community Banks to pay dividends to the Company and the ability of the Company to pay dividends on its common stock, is set forth in Part I. Business, of this Form 10-K under the headings “Supervision and Regulation - Limits on Dividends and Other Payments” and “Supervision and Regulation - The Community Banks.”

In October 2005, the Company announced that starting in 2006, it would begin paying its dividend on a quarterly basis instead of semi-annually. It is anticipated the dividends will continue to be paid near the end of February, May, August and November. In making its decision on the payment of dividends on the Company’s common stock, the Board of Directors considers operating results, financial condition, capital adequacy, regulatory requirements, shareholder returns and other factors.

Stock Repurchase Program

The Board of Directors has authorized management of the Company to buy up to 225,000 shares of its outstanding common stock in the open market at prices that management and the Board of Directors determine to be prudent. This authorization expires May 31, 2007. The Company considers current market conditions and the Company’s current capital level, in addition to other factors, when deciding whether to repurchase stock. It is anticipated that any repurchased shares will be used primarily for general corporate purposes, including the Company’s dividend reinvestment plan, incentive stock plan and other employee benefit plans. No shares have been purchased under this authorization to date.

15

ITEM 6.—SELECTED FINANCIAL DATA.

The following table sets forth selected financial data for the Company over the past five years ended December 31, (in thousands, except per share amounts):

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

| Results of Operations |

||||||||||||||||||||

| Interest and dividend income |

$ | 129,156 | $ | 102,317 | $ | 80,544 | $ | 67,017 | $ | 65,205 | ||||||||||

| Interest expense |

52,441 | 32,967 | 25,652 | 23,905 | 24,627 | |||||||||||||||

| Net interest income |

76,715 | 69,350 | 54,892 | 43,112 | 40,578 | |||||||||||||||

| Provision for loan losses |

1,450 | 1,172 | 2,154 | 2,307 | 2,878 | |||||||||||||||

| Net interest income after provision for loan losses |

75,265 | 68,178 | 52,738 | 40,805 | 37,700 | |||||||||||||||

| Noninterest income |

28,245 | 25,510 | 23,302 | 22,840 | 17,538 | |||||||||||||||

| Noninterest expenses |

67,567 | 58,275 | 51,221 | 40,725 | 35,922 | |||||||||||||||

| Income before income taxes |

35,943 | 35,413 | 24,819 | 22,920 | 19,316 | |||||||||||||||

| Income tax expense |

9,951 | 10,591 | 6,894 | 6,256 | 4,811 | |||||||||||||||

| Net income |

$ | 25,992 | $ | 24,822 | $ | 17,925 | $ | 16,664 | $ | 14,505 | ||||||||||

| Financial Condition |

||||||||||||||||||||

| Assets |

$ | 2,092,891 | $ | 1,824,958 | $ | 1,672,210 | $ | 1,234,732 | $ | 1,115,725 | ||||||||||

| Loans, net of unearned income |

1,549,445 | 1,362,254 | 1,264,841 | 878,267 | 714,765 | |||||||||||||||

| Deposits |

1,665,908 | 1,456,515 | 1,314,317 | 999,771 | 897,645 | |||||||||||||||

| Stockholders’ equity |

199,416 | 179,358 | 162,758 | 118,501 | 105,492 | |||||||||||||||

| Ratios |

||||||||||||||||||||

| Return on average assets |

1.30 | % | 1.43 | % | 1.19 | % | 1.42 | % | 1.41 | % | ||||||||||

| Return on average equity |

13.64 | % | 14.49 | % | 12.18 | % | 14.88 | % | 14.91 | % | ||||||||||

| Cash basis return on average assets (1) |

1.40 | % | 1.51 | % | 1.26 | % | 1.45 | % | 1.46 | % | ||||||||||

| Cash basis return on average equity (1) |

20.31 | % | 19.57 | % | 15.78 | % | 16.08 | % | 16.43 | % | ||||||||||

| Efficiency ratio (2) |

64.37 | % | 61.43 | % | 65.51 | % | 61.75 | % | 58.90 | % | ||||||||||

| Equity to assets |

9.53 | % | 9.82 | % | 9.73 | % | 9.60 | % | 9.46 | % | ||||||||||

| Asset Quality |

||||||||||||||||||||

| Allowance for loan losses |

$ | 19,148 | $ | 17,116 | $ | 16,384 | $ | 11,519 | $ | 9,179 | ||||||||||

| Allowance for loan losses / total outstanding loans |

1.24 | % | 1.26 | % | 1.30 | % | 1.31 | % | 1.28 | % | ||||||||||

| Per Share Data |

||||||||||||||||||||

| Earnings per share, basic |

$ | 1.97 | $ | 1.89 | $ | 1.42 | $ | 1.47 | $ | 1.28 | ||||||||||

| Earnings per share, diluted |

1.94 | 1.87 | 1.41 | 1.46 | 1.27 | |||||||||||||||

| Cash basis earnings per share, diluted (1) |

2.03 | 1.93 | 1.46 | 1.48 | 1.28 | |||||||||||||||

| Cash dividends paid |

0.63 | 0.52 | 0.45 | 0.40 | 0.35 | |||||||||||||||

| Market value per share |

30.59 | 28.73 | 25.62 | 20.33 | 18.17 | |||||||||||||||

| Book value per share |

14.99 | 13.59 | 12.41 | 10.36 | 9.28 | |||||||||||||||

| Price to earnings ratio, diluted |

15.77 | 15.34 | 18.21 | 14.06 | 14.34 | |||||||||||||||

| Price to book value ratio |

2.04 | 2.11 | 2.07 | 1.96 | 1.96 | |||||||||||||||

| Dividend payout ratio |

31.98 | % | 27.21 | % | 31.92 | % | 27.40 | % | 27.08 | % | ||||||||||

| Weighted average shares outstanding, basic |

13,233,101 | 13,142,999 | 12,604,187 | 11,404,308 | 11,333,859 | |||||||||||||||

| Weighted average shares outstanding, diluted |

13,361,773 | 13,275,074 | 12,723,213 | 11,513,156 | 11,434,754 | |||||||||||||||

| (1) | Refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation”, section |

“Non GAAP Measures” for a reconciliation.

| (2) | The efficiency ratio is calculated by dividing noninterest expense over the sum of net interest income plus noninterest income. |

16

ITEM 7.—MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

The following discussion and analysis provides information about the major components of the results of operations and financial condition, liquidity and capital resources of the Company and its subsidiaries. This discussion and analysis should be read in conjunction with the “Consolidated Financial Statements” and the “Notes to the Consolidated Financial Statements” presented in Item 8. “Financial Statements and Supplementary Data”, of this Form 10-K. In addition, share and per share amounts for all periods presented have been retroactively adjusted to reflect the effect of the three-for-two stock split in October 2006.

CRITICAL ACCOUNTING POLICIES

General

The accounting and reporting policies of the Company and its subsidiaries are in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and conform to general practices within the banking industry. The Company’s financial position and results of operations are affected by management’s application of accounting policies, including estimates, assumptions and judgments made to arrive at the carrying value of assets and liabilities and amounts reported for revenues, expenses and related disclosures. Different assumptions in the application of these policies could result in material changes in the Company’s consolidated financial position and/or results of operations.

The more critical accounting and reporting policies include the Company’s accounting for the allowance for loan losses, and merger and acquisitions, and goodwill and intangibles. The Company’s accounting policies are fundamental to understanding the Company’s consolidated financial position and consolidated results of operations. Accordingly, the Company’s significant accounting policies are discussed in detail in Note 1 “Summary of Significant Accounting Policies” in the “Notes to the Consolidated Financial Statements”.

The following is a summary of the Company’s critical accounting policies that are highly dependent on estimates, assumptions and judgments.

Allowance for Loan Losses

The allowance for loan losses is an estimate of the losses that may be sustained in the loan portfolio. The allowance is based on two basic principles of accounting: (i) Statement of Financial Accounting Standard (“SFAS”) No. 5, Accounting for Contingencies (“SFAS No. 5”), which requires that losses be accrued when occurrence is probable and can be reasonably estimated and (ii) SFAS No. 114, Accounting by Creditors for Impairment of a Loan (“SFAS No. 114”), as amended, which requires that losses be accrued based on the differences between the value of collateral, present value of future cash flows or values that are observable in the secondary market and the loan balance.

The Company’s allowance for loan losses is the accumulation of various components that are calculated based on independent methodologies. All components of the allowance represent an estimation performed pursuant to either SFAS No. 5 or SFAS No. 114. Management’s estimate of each SFAS No. 5 component is based on certain observable data that management believes are most reflective of the underlying credit losses being estimated. This evaluation includes credit quality trends; collateral values; loan volumes; geographic, borrower and industry concentrations; seasoning of the loan portfolio; the findings of internal credit quality assessments and results from external bank regulatory examinations. These factors, as well as historical losses and current economic and business conditions, are used in developing estimated loss factors used in the calculations.

The Company adopted SFAS No. 114, which has been amended by SFAS No. 118, Accounting by Creditors for Impairment of a Loan – Income Recognition and Disclosures (“SFAS No. 118”). SFAS No.

17

114, as amended, requires that the impairment of loans that have been separately identified for evaluation is to be measured based on the present value of expected future cash flows or, alternatively, the observable market price of the loans or the fair value of the collateral. However, for those loans that are collateral dependent (that is, if repayment of those loans is expected to be provided solely by the underlying collateral) and for which management has determined foreclosure is probable, the measure of impairment is to be based on the net realizable value of the collateral. SFAS No. 114, as amended, also requires certain disclosures about investments in impaired loans and the allowance for loan losses and interest income recognized on loans.

Reserves for commercial loans are determined by applying estimated loss factors to the portfolio based on management’s evaluation and “risk grading” of the commercial loan portfolio. Reserves are provided for noncommercial loan categories using historical loss factors applied to the total outstanding loan balance of each loan category. Additionally, environmental factors based on national and local economic activity, as well as portfolio specific attributes are considered in the allowance for loan losses. Specific reserves are determined on a loan-by-loan basis based on management’s evaluation of the Company’s exposure for each credit, given the current payment status of the loan and the net realizable value of any underlying collateral.

While management uses the best information available to establish the allowance for loan and lease losses, future adjustments to the allowance may be necessary if economic conditions differ substantially from the assumptions used in making the valuations or, if required by regulators, based upon information available to them at the time of their examinations. Such adjustments to original estimates, as necessary, are made in the period in which these factors and other relevant considerations indicate that loss levels may vary from previous estimates.

Mergers and Acquisitions

The Company’s strategy focuses on high growth areas with strong market demographics and targets organizations that have a comparable corporate culture, strong performance and good asset quality, among other factors.

The Company accounts for acquisitions under the purchase method of accounting and accordingly is required to record the assets acquired, including identified intangible assets and liabilities assumed at their fair value, which often involves estimates based on third party valuations, such as appraisals, or internal valuations based on discounted cash flow analyses or other valuation techniques, which are inherently subjective. The amortization of identified intangible assets is based upon the estimated economic benefits to be received, which is also subjective. These estimates also include the establishment of various accruals and allowances based on planned facility dispositions and employee severance considerations, among other acquisition-related items. In addition, purchase acquisitions typically result in goodwill, which is subject to at least annual impairment testing, or more frequently if certain indicators are in evidence, based on the fair value of net assets acquired compared to the carrying value of goodwill.

The Company and the acquired entity also incur merger-related costs during an acquisition. The Company capitalizes direct costs of the acquisition, such as investment banker and attorneys’ fees and includes them as part of the purchase price. Other merger-related internal costs associated with acquisitions are expensed as incurred. Some examples of these merger-related costs include, but are not limited to, systems conversions, integration planning consultants and advertising fees. These merger-related costs are included within the Consolidated Statement of Income classified within the noninterest expense line. The acquired entity records merger-related costs which result from a plan to exit an activity, involuntarily terminate or relocate employees and are recognized as liabilities assumed as of the consummation date of the acquisition.

The Company’s merger-related costs for the years ended December 31, 2006, 2005 and 2004 were $263 thousand, $17 thousand, and $343 thousand, respectively. Prior to the mergers, the acquired entities, Prosperity and Guaranty, recorded merger-related costs of approximately $807 thousand and $1.3 million and principally related to employee severance and investment banker fees.

18

Goodwill and Intangible Assets

SFAS No. 141, Business Combinations, requires the purchase method of accounting be used for all business combinations initiated after June 30, 2001. For purchase acquisitions, the Company is required to record assets acquired, including identifiable intangible assets, and liabilities assumed at their fair value, which in many instances involves estimates based on third party valuations, such as appraisals, or internal valuations based on discounted cash flow analysis or other valuation techniques. Effective January 1, 2001, the Company adopted SFAS No. 142, Goodwill and Other Intangible Asset (“SFAS 142”), which prescribes the accounting for goodwill and intangible assets subsequent to initial recognition. The provisions of SFAS No. 142 discontinue the amortization of goodwill and intangible assets with indefinite lives but require at least an annual impairment review and more frequently if certain impairment indicators are in evidence. Additionally, the Company adopted SFAS No. 147, Acquisitions of Certain Financial Institutions, on January 1, 2002 and determined that core deposit intangibles will continue to be amortized over their estimated useful lives.

Goodwill totaled $50.0 million and $31.3 million at the years ended December 31, 2006 and 2005, respectively. Based on the testing of goodwill for impairment, there were no impairment charges for 2006, 2005 or 2004. Core deposit intangible assets are being amortized over the period of expected benefit, which ranges from 5 to 15 years. Core deposit intangibles, net of amortization, amounted to $12.3 million and $8.5 million at the years ended December 31, 2006 and 2005, respectively. Amortization expense of core deposit intangibles for the years ended December 31, 2006, 2005 and 2004 totaled $1.7 million, $1.2 million and $1.0 thousand, respectively.

RESULTS OF OPERATIONS

Net Income

For the year ended December 31, 2006 compared to the year ended December 31, 2005, net income increased $1.2 million, or 4.7%, from $24.8 million to $26.0 million, which represented an increase in earnings per share, on a diluted basis, of $.07, or 3.7%, from $1.87 to $1.94. Return on average equity for the year ended December 31, 2006 was 13.64% and return on average assets was 1.30%, compared to 14.49% and 1.43%, respectively, for the same period in 2005.

The acquisition of Prosperity and its related operating results have been reflected in the financial statements since April 1, 2006. Prosperity’s net income included in the Company’s financial statements amounted to $1.1 million since acquisition. In addition, the Company incurred other expenses relating to the acquisition of Prosperity, including interest expense in connection with the issuance of a Trust Preferred Capital Note and merger-related costs. Since acquisition, the interest expense and merger related costs were $1.8 million and $263 thousand before taxes, respectively.

The Company’s continued expansion in both new and existing markets also impacted results for the year. Three new bank branches were opened in 2006, following the opening of two branches in 2005. The costs associated with these branches include personnel, occupancy, marketing and other related expenses and are typically greater than the revenue generated for the first 18-24 months as the branch expands the customer base in those markets. Additionally, during 2006 the Company completed the relocation of its Ladysmith branch in Caroline County to a new facility adjacent to the former location and relocated its Arlington Boulevard branch in the City of Charlottesville to a new building on Barracks Road.

19

Net Interest Income

Net interest income, which represents the principal source of earnings for the Company, is the amount by which interest income exceeds interest expense. The net interest margin is net interest income expressed as a percentage of average earning assets. Changes in the volume and mix of interest-earning assets and interest-bearing liabilities, as well as their respective yields and rates, have a significant impact on the level of net interest income, the net interest margin and net income.

For the year ended December 31, 2006 compared to the same period in 2005, the net interest margin, on a tax equivalent basis (TEQ), declined 9 basis points from 4.46% to 4.37%. Net interest income (TEQ) increased $7.5 million, or 10.5%, from $71.4 million to $79.0 million. Average interest-earning assets grew $205.4 million, or 12.8%, ($110.1 million from the Prosperity acquisition), while average interest-bearing and noninterest-bearing liabilities grew $203.1 million, or 15.6%, ($63.7 million from the Prosperity acquisition) and $38.5 million, or 15.7%, respectively. Furthermore, the yields on average interest-earning assets and the costs on average interest-bearing liabilities increased 75 and 95 basis points, to 7.28% and 3.47%, respectively. The interest rate spread compression together with average interest-bearing liabilities growing at a faster pace than average interest-earning assets are contributing factors associated with the decline in the net interest margin. For the years ended December 31, 2006 and 2005, the Company collected $464 thousand and $311 thousand of foregone interest, respectively, which has been excluded from the net interest margin calculation.

Management carefully analyzes its local markets and the potential impact economic indicators (i.e. interest rates, housing sales, etc.) present. The Federal funds tightening cycle increased rates a quarter percentage point seventeen consecutive times beginning in June 2004. Economic indicators show signs of a slowing economy, particularly in the residential housing market where inventory levels remain high and demand has waned. During much of this period of rising interest rates, the Company’s net interest margin benefited from the delay between increases in asset yields and the lagging increases in funding costs on its deposit products. As customers have shifted out of lower cost deposit transaction accounts to higher rate CD products, the Company’s funding costs have risen, negatively impacting the margin. With long-term rates virtually the same (or lower) than short-term rates, the current interest rate environment will continue to put pressure on the interest margin throughout the industry. Management anticipates continued declines in the Company’s net interest margin (albeit at a slower pace than recent declines) until the yield curve assumes its more normal shape with short-term rates lower than long-term rates.

20

The following table shows interest income on earning assets and related average yields, as well as interest expense on interest-bearing liabilities and related average rates paid for the years ended December 31, (dollars in thousands):

| 2006 | 2005 | 2004 | ||||||||||||||||||||||||||||

| Average Balance |

Interest Income / Expense |

Yield / Rate |

Average Balance |

Interest Income / Expense |

Yield / Rate |

Average Balance |

Interest Income / Expense |

Yield / Rate |

||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||||

| Securities: |

||||||||||||||||||||||||||||||

| Taxable |

$ | 188,461 | $ | 9,883 | 5.24 | % | $ | 154,954 | $ | 7,791 | 5.03 | % | $ | 159,709 | $ | 7,709 | 4.83 | % | ||||||||||||

| Tax-exempt |

89,407 | 6,546 | 7.32 | % | 74,936 | $ | 5,677 | 7.58 | % | 80,224 | 6,049 | 7.54 | % | |||||||||||||||||

| Total securities |

277,868 | 16,429 | 5.91 | % | 229,890 | $ | 13,468 | 5.86 | % | 239,933 | 13,758 | 5.73 | % | |||||||||||||||||

| Loans, net (2) (3) |

1,489,794 | 111,771 | 7.50 | % | 1,315,695 | $ | 88,089 | 6.70 | % | 1,104,942 | 67,114 | 6.07 | % | |||||||||||||||||

| Loans held for sale |

25,129 | 1,572 | 6.26 | % | 38,975 | $ | 2,367 | 6.07 | % | 34,326 | 1,917 | 5.58 | % | |||||||||||||||||

| Federal funds sold |

8,837 | 1,438 | 5.35 | % | 11,143 | $ | 349 | 3.13 | % | 8,090 | 102 | 1.26 | % | |||||||||||||||||

| Money market investments |

151 | 3 | 2.24 | % | 73 | $ | 2 | 2.79 | % | 101 | 1 | 0.99 | % | |||||||||||||||||

| Interest-bearing deposits in other banks |

1,104 | 57 | 5.13 | % | 1,665 | $ | 49 | 2.92 | % | 3,645 | 29 | 0.80 | % | |||||||||||||||||

| Other interest-bearing deposits |

2,598 | 129 | 4.96 | % | 2,598 | $ | 81 | 3.13 | % | 1,889 | 33 | 1.75 | % | |||||||||||||||||

| Total earning assets |

1,805,481 | 131,399 | 7.28 | % | 1,600,039 | $ | 104,405 | 6.53 | % | 1,392,926 | 82,954 | 5.96 | % | |||||||||||||||||

| Allowance for loan losses |

(18,468 | ) | (16,687 | ) | (14,167 | ) | ||||||||||||||||||||||||

| Total non-earning assets |

211,055 | 154,653 | 126,098 | |||||||||||||||||||||||||||

| Total assets |