UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Union Bankshares Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

UNION BANKSHARES CORPORATION

March 8, 2004

Dear Fellow Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Union Bankshares Corporation. The meeting will be held on Tuesday, April 20, 2004 at 3:00 p.m. at the Riverside Conference Center, 95 Riverside Parkway, Fredericksburg, Virginia. A map of the location of the meeting place and general directions may be found on the back page of the attached proxy statement.

The primary business of the meeting will be to elect three new and three continuing directors and ratify the appointment of the Company’s independent auditors for 2004. We also will report to you on the condition and performance of the Company and its subsidiaries, and you will have ample opportunity to question management or directors on matters that affect the interests of all shareholders. The meeting will be followed by a reception that we hope you will be able to attend.

We hope you will be with us on April 20th. Whether you plan to attend or not, please complete, sign, date and return the enclosed proxy card as soon as possible in the postage-paid envelope provided.

We appreciate your continued loyalty and support.

| Sincerely, |

| G. William Beale |

| President and Chief Executive Officer |

UNION BANKSHARES CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held on April 20, 2004

The Annual Meeting of Shareholders of Union Bankshares Corporation (the “Company”) will be held at the Riverside Conference Center, 95 Riverside Parkway, Fredericksburg, Virginia at 3:00 p.m. on April 20, 2004 for the following purposes:

| 1. | To elect three (3) directors to serve as Class II nominees for a three-year term; |

| 2. | To elect three (3) directors previously appointed by the Board to serve the remaining two-year portion of the Class I term of directors; |

| 3. | To ratify the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent auditors for the year ended December 31, 2004; and |

| 4. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

All shareholders of record at the close of business on February 20, 2004, are entitled to notice of and to vote at the meeting and any adjournments thereof.

| By Order of the Board of Directors |

| D. Anthony Peay |

| Executive Vice President and Corporate Secretary |

March 8, 2004

Please promptly complete and return the enclosed proxy, whether or not you plan to attend the Annual Meeting. If you attend the meeting in person, you may withdraw your proxy and vote your own shares.

UNION BANKSHARES CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

APRIL 20, 2004

GENERAL

The enclosed proxy is solicited by the Board of Directors of Union Bankshares Corporation (the “Company”) for the Annual Meeting of Shareholders of the Company to be held on Tuesday, April 20, 2004, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders or any adjournment thereof. The approximate mailing date of this Proxy Statement and accompanying proxy is March 8, 2004.

Revocation and Voting of Proxies

Execution of a proxy will not affect a shareholder’s right to attend the Annual Meeting and to vote in person. Any shareholder who has executed and returned a proxy may revoke it by attending the Annual Meeting and requesting to vote in person. A shareholder may also revoke his proxy at any time before it is exercised by filing a written notice with the Company or by submitting a proxy bearing a later date. Proxies will extend to, and will be voted at, any adjourned session of the Annual Meeting.

Voting Rights of Shareholders

Only shareholders of record at the close of business on February 20, 2004 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. At the close of business on February 20, 2004, there were 7,627,965 shares of the Company’s common stock outstanding and entitled to vote at the Annual Meeting. The Company has no other class of stock outstanding. A majority of the votes entitled to be cast, represented in person or by proxy, will constitute a quorum for the transaction of business.

Each share of common stock entitles the record holder thereof to one vote upon each matter to be voted upon at the Annual Meeting. Shares for which the holder has elected to abstain or to withhold the proxies’ authority to vote (including broker non-votes) on a matter will count toward a quorum, but will not be included in determining the number of votes cast with respect to such matter.

Solicitation of Proxies

The cost of solicitation of proxies will be borne by the Company. Solicitation is being made by mail, and if necessary, may be made in person or by telephone, or special letter by officers and employees of the Company or its subsidiaries, acting without compensation other than regular compensation.

ELECTION OF DIRECTORS—PROPOSALS ONE and TWO

Directors

The Company’s Board is divided into three classes (I, II and III). The term of office for Class II directors will expire at the Annual Meeting and the nominees to serve as Class II directors are set forth below. Each of the Class II nominees currently serves as a director of the Company. If elected, the Class II nominees will serve until the Annual Meeting of Shareholders held in 2007.

1

The Board has also nominated R. Hunter Morin, Robert C. Sledd and Ronald L. Tillett to serve as Class I directors. Mr. Tillett was appointed to the Board in April 2003 and Messrs. Morin and Sledd were appointed to the Board in October 2003 and each of the Class I nominees currently serves a as director of the Company. If elected, the Class I nominees will serve until the Annual Meeting of Shareholders held in 2006.

William M. Wright and M. Raymond Piland, III are retiring from the Board consistent with the Board’s retirement policy and Frank B. Bradley, III has chosen to resign voluntarily at this time. He has no disagreement with the management of the Company. Each of the resigning Class I directors have chosen to do so effective with the Annual Meeting of Shareholders.

The persons named in the proxy will vote for the election of the nominees named below unless authority is withheld. If for any reason the persons named as nominees below should become unavailable to serve, an event which management does not anticipate, proxies will be voted for such other persons as the Board of Directors may designate.

The Board of Directors recommends the nominees, as set forth below, for election. The Board of Directors recommends that shareholders vote for these nominees. The nominees receiving the greatest number of affirmative votes cast at the Annual Meeting will be elected.

| Name (Age) |

Served as Director Since (1) |

Principal Occupation During Past Five Years (2) | ||

| Class I (Nominees) (Directors To Be Elected to Serve Until the 2006 Annual Meeting): | ||||

| R. Hunter Morin (60) |

2003 | President and Founder of GeMROI Company since 1984, a Fredericksburg, Virginia based marketing organization which provides marketing, merchandising, and sales for a variety of major millwork and building materials manufacturers | ||

| Robert C. Sledd (51) |

2003 | Chairman of the Board of Performance Food Group Co. since 1995; President and CEO of Performance Group Co. between 1987 and 2001. | ||

| Ronald L. Tillett (47) |

2003 | Managing Director, Public Finance, Morgan Keegan & Company, Inc. since 2001; Secretary of Finance—Commonwealth of Virginia from 1996 to 2001. | ||

| Class II (Nominees) (Directors To Be Elected to Serve Until the 2007 Annual Meeting): | ||||

| Ronald L. Hicks (57) |

1985 | Chairman of the Board of the Company since 1998; Attorney, of Counsel to Jarrell, Hicks and Sasser, Spotsylvania County, Virginia; Chairman of the Board of Union Bank & Trust Company from 1987 2003. | ||

2

| Name (Age) |

Served as Director Since (1) |

Principal Occupation During Past Five Years (2) | ||

| W. Tayloe Murphy, Jr. (70) |

1966 | Attorney, in Warsaw, Virginia; Secretary of Natural Resources for the State of Virginia; Delegate of the Virginia General Assembly from 1982 until 2000. | ||

| A. D. Whittaker (64) |

1981 | President, A. D. Whittaker, Inc., a commercial construction firm in Hanover County, Virginia. | ||

| Class III (Directors Serving Until the 2005 Annual Meeting): | ||||

| G. William Beale (54) |

1990 | President and CEO of the Company since its inception in 1993; President and Chief Executive Officer of Union Bank & Trust Company from 1991 to 2004. | ||

| B. Walton Mahon (75) |

1965 | Investor; Formerly served as Chairman of the Board of the Company from 1993 to 1998 and as President of Union Bank & Trust Company from 1965 to 1991. | ||

| (1) | With the exception of Directors Morin, Sledd and Tillet, who were appointed to the Board in 2003, each director has served on the Board of Directors of the Company since the consummation of the affiliation of Union Bancorp, Inc. and Northern Neck Bankshares Corporation in July 1993, which created the Company. The date above refers to the year in which Messrs. Beale, Hicks, Mahon, and Whittaker were first elected to the Board of Directors of Union Bank & Trust Company, and Mr. Murphy was first elected to the Board of Directors of Northern Neck State Bank. |

| (2) | Each director, other than Mr. Beale, has been deemed by the Board of Directors as an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the rules of the National Association of Securities Dealers, Inc. (the “NASD”). |

Board of Directors and Committees

Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of the director’s duties and to attend all regularly scheduled Board, committee and shareholder meetings. There were 12 meetings of the Board of Directors in 2003 and at least once a quarter, the non-management directors met without management in attendance for a portion of the meeting. Each incumbent director attended greater than 75% of the aggregate number of meetings of the Board of Directors and its committees of which he was a member in 2003.

There are no family relationships among any of the directors or among any directors and any executive officer of the Company. Mr. Sledd serves as Chairman of the Board of Directors of Performance Food Group Co., a publicly traded company registered pursuant to Section 12 of the Securities Exchange Act of 1934.

The Board of Directors has, among others, a standing Executive Committee, Audit Committee, Nominating Committee and Compensation Committee.

Executive Committee. The Executive Committee is composed of G. William Beale, Ronald L. Hicks, W. Tayloe Murphy and A. D. Whittaker. The committee, which is subject to the supervision and

3

control of the Board of Directors, has been delegated substantially all of the powers of the Board of Directors to act between meetings of the Board, except for certain matters reserved to the Board by law. In 2003, there were two meetings of the Executive Committee.

Audit Committee. The Audit Committee is composed of Ronald L. Tillett, Chairman and A. D. Whittaker, M. Raymond Piland, III and Frank B. Bradley, III. In addition, each of the Company’s subsidiary banks has designated one of its directors to serve as a non-voting advisor to the Audit Committee. These advisors include Daniel I. Hansen of the Union Bank & Trust Company Board, William H. Hughes of the Northern Neck State Bank Board, Elisabeth Jones of the Rappahannock National Bank Board and Alison Morrison of the Bank of Williamsburg Board. The functions of the committee are to engage the independent certified public accountants, to approve the scope of the independent accountants’ audit, to review the reports of examination by the regulatory agencies, the independent accountants and the internal auditor and to issue its report to the Board of Directors. All members of the Audit Committee are “independent directors” within the meaning of the standards of NASD and the regulations of the Securities and Exchange Commission (the “SEC”). Mr. Tillett is a “financial expert” as defined by the regulations of the SEC and all Audit Committee members have significant financial experience in accordance with the standards of NASD. The Audit Committee met six times in 2003. A copy of the committee’s charter is attached as Appendix A and is available on the Company’s website: www.ubsh.com.

Compensation Committee. The Compensation Committee consists of Ronald L. Hicks, W. Tayloe Murphy and A. D. Whittaker, each of whom is an “independent director” according to the standards of NASD. The function of this committee is to recommend the compensation to be paid to the executive officers of the Company. It also administers all incentive and stock option plans for the benefit of such officers and directors eligible to participate in such plans. The Compensation Committee met two times in 2003. A copy of the committee’s charter is available on the Company’s website: www.ubsh.com.

Nominating Committee. The Nominating Committee consists of Ronald L. Hicks, W. Tayloe Murphy and A.D. Whitaker, each of whom is “independent” according to the standards of NASD. The function of this committee is to recommend individuals for election to the Board of Directors of the Company. The Nominating Committee will accept recommendations from shareholders consistent with the provisions of proposed Rule 14a-11 of the Securities Exchange Act of 1934. Members of the Board of Directors of Union Bankshares Corporation are expected to have the appropriate skill and characteristics necessary to function in the Company’s current operating environment and contribute to its future direction and strategies. These include legal, financial, management and other relevant skills, as well as varying experience, age, judgments, residence and background. Messrs. Morin, Sledd and Tillett, appointed by the Board in anticipation of pending retirements of Messrs. Piland and Whitaker and a planned resignation by Mr. Bradley, the previous chairman of the Audit Committee, were evaluated using these criteria. Mr. Tillett assumed the responsibilities as chairman of the Audit Committee shortly after his appointment and Mr. Bradley remained a member of the Audit Committee to facilitate Mr. Tillett’s transition. The Nominating Committee met three times in 2003. A copy of the committee’s charter is available on the Company’s website: www.ubsh.com.

Shareholder Communication

Shareholders may communicate with all or any member of the Board of Directors by addressing correspondence to the “Board of Directors” or to the individual director and addressing such communication to D. Anthony Peay, Secretary, Union Bankshares Corporation, P.O. Box 446, Bowling Green, Virginia 22427. All communication so addressed will be forwarded to the Chairman of the Board of Directors (in the case of correspondence addressed to the “Board of Directors”) or to the individual director without exception. All of the directors attended the Annual Meeting of Shareholders held in 2003. Consistent with the Company’s corporate governance policy, directors are expected to attend the Annual Meeting of Shareholders held in 2004 and each should be available to shareholders to discuss Company’s matters. A copy of the corporate governance policy is available on the Company’s website: www.ubsh.com.

4

Directors’ Fees

As compensation for their services, each member of the Board of Directors of the Company receives $600 for each meeting of the Board attended. In addition, standing committee members receive $325 for each committee meeting attended. Additionally, each director who attends a minimum of 75% of all Board and committee meetings since the last Annual Meeting of Shareholders (or since the appointment of a new director in the case of a new director’s first year of service) receives a $15,000 annual retainer (or pro-rated portion thereof in the case of a new director) paid in shares of the Company’s common stock based on the average closing price on the five consecutive trading days ending on December 1. Mr. Beale does not receive any additional compensation above his regular salary for service as a director or for attending any Board or committee meeting.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee’s Report to the Shareholders, which follows, was approved and adopted by the committee on February 17, 2004 and accepted by the Board of Directors on February 26, 2004.

The Board of the Company has a standing Audit Committee that consists of the independent directors whose names appear at the end of this report.

While management has the primary responsibility for the financial statements and the reporting process, including the Company’s system of internal controls, the Audit Committee monitors and reviews the Company’s financial reporting process on behalf of the Board of Directors. The role and responsibilities of the Audit Committee are set forth in a written charter adopted by the Board. The Committee reviews and reassesses its charter periodically and recommends any changes to the Board for approval.

The Company’s independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted accounting principles and to issue a report thereon. The Audit Committee monitors these processes. However, the Audit Committee does not complete its monitoring prior to Company’s public announcements of financial results and, necessarily, in its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent auditors, who, in their report, express an opinion on the conformity of the Company’s consolidated annual financial statements to accounting principles generally accepted in the United States.

In this context, the Audit Committee met and held discussions with management and the Company’s independent auditors, Yount, Hyde & Barbour, P.C. (“YHB”), with respect to the Company’s financial statements for the fiscal year ended December 31, 2003 and with Cherry Bekeart & Holland, L.L.P. (“CBH”) for services provided to Mortgage Capital Investors, Inc. (“MCII”) for the year ended December 31, 2003. Management represented to the Audit Committee that the consolidated financial statements of the Company were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

5

In addition, the Audit Committee discussed with the independent auditors the auditors’ independence from the Company and MCII and its management, and the independent auditors provided to the Audit Committee the written disclosures and letter required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

The Audit Committee also discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the internal controls of the Company and MCII, and the overall quality of the financial reporting of the Company and MCII.

Principal Accounting Fees

External auditors billed the following fees for services provided to the Company and MCII during 2003 and 2002:

| YHB |

CBH | |||||||||||||||

| 2003 |

2002 |

2003 |

2002 | |||||||||||||

| Fees ($) |

Percent of Total (%) |

Fees ($) |

Percent of Total (%) |

Fees ($) |

Percent of Total (%) |

Fees ($) |

Percent of Total (%) | |||||||||

| Audit Fees (1) |

68,200 | 67 | 66,200 | 69 | 21,884 | 100 | 20,434 | 66 | ||||||||

| Audit Related Fees (2) |

19,861 | 20 | 17,734 | 19 | — | — | — | — | ||||||||

| Tax Fees (3) |

13,543 | 13 | 11,500 | 12 | — | — | — | — | ||||||||

| All Other Fees |

— | — | — | — | — | — | 10,655 | 34 | ||||||||

| Total |

101,604 | 100 | 95,434 | 100 | 21,884 | 100 | 31,089 | 100 | ||||||||

| (1) | Audit Fees: Audit and review services, consents, and review of documents filed with the SEC. |

| (2) | Audit-related Fees: Employee benefit plan audits, Federal Home Loan Bank collateral verification audit, attest report on internal controls under FDICIA, and consultation concerning financial accounting and reporting standards. |

| (3) | Tax Fees: Preparation of federal and state tax returns, review of quarterly estimated tax payments, and consultation concerning tax compliance issues. |

The Audit Committee has considered the provision by YBH and CBH of the above non-audit services to the Company and has determined that the provision of these services by YBH and CHB is compatible with maintaining each firm’s independence from the Company and MCII, respectively. During the year, each engagement beyond the scope of the annual audit engagement is pre-approved with the Committee’s approval at the direction of the Company’s chief financial officer.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the Securities and Exchange Commission.

Ronald L. Tillett, Chairman

Frank B. Bradley, III

M. Raymond Piland III

A. D. Whittaker

6

OWNERSHIP OF COMPANY COMMON STOCK

The following table sets forth, as of February 20, 2004, certain information with respect to the beneficial ownership of the Company’s common stock held by each director and director-nominee of the Company, each executive officer named in the Summary Compensation Table below, and by all the directors and executive officers as a group. As of February 20, 2004, no shareholder of the Company beneficially owned 5% or more of the Company’s common stock.

| Name |

Amount and Nature of Beneficial Ownership (1) |

Percent of Class |

||||

| G. William Beale |

39,658 | (3)(4) | (2 | ) | ||

| Frank B. Bradley, III |

1,665 | (2 | ) | |||

| Ronald L. Hicks |

27,595 | (3) | (2 | ) | ||

| B. Walton Mahon |

99,220 | (3) | 1.28 | % | ||

| R. Hunter Morin |

2,042 | (2 | ) | |||

| W. Tayloe Murphy, Jr. |

165,787 | (3) | 2.13 | % | ||

| M. Raymond Piland, III |

11,345 | (3) | (2 | ) | ||

| Robert C. Sledd |

232 | (2 | ) | |||

| Ronald L. Tillett |

865 | (2 | ) | |||

| A. D. Whittaker |

54,211 | (3) | (2 | ) | ||

| William M. Wright |

45,113 | (3) | (2 | ) | ||

| John C. Neal |

18,119 | (3)(4) | (2 | ) | ||

| N. Byrd Newton |

25,705 | (3)(4) | (2 | ) | ||

| D. Anthony Peay |

7,244 | (3)(4) | (2 | ) | ||

| All directors and executive officers as a group |

498,801 | (3)(4) | 6.42 | % |

| (1) | For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person is deemed to be the beneficial owner of a security if he has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he has the right to acquire beneficial ownership of the security within 60 days. |

| (2) | Represents less than 1% of the Company’s common stock. |

| (3) | Includes shares held by affiliated corporations, close relatives and children, and shares held jointly with spouses or as custodians or trustees, as follows: Mr. Beale, 4,235 shares; Mr. Hicks, 10,818 shares; Mr. Mahon, 21,455 shares; Mr. Murphy, 70,400 shares; Mr. Piland, 2,880 shares; Mr. Whittaker, 30,498 shares; Mr. Wright, 4,128 shares; Mr. Neal, 420 shares; Mr. Newton, 5,298 shares; and Mr. Peay, 464 shares. |

| (4) | Includes shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s 1993 Stock Incentive Plan as follows: Mr. Beale, 20,320 shares; Mr. Neal, 12,336 shares; Mr. Newton, 5,500 shares; Mr. Peay, 4,100 shares. |

7

EXECUTIVE COMPENSATION

The following table provides information on the compensation accrued or paid by the Company or its subsidiaries during the calendar years 2003, 2002 and 2001 for the chief executive officer and the three other executive officers (the “named executive officers”) who received total annual salary and bonus in excess of $100,000 during 2002.

Summary Compensation Table

| Long-Term Compensation |

|||||||||||||

| Annual Compensation (1) |

Securities Underlying Options (2) |

All Other Compensation (3) | |||||||||||

| Name and Principal Position |

Year |

Salary |

Bonus |

||||||||||

| G. William Beale President/CEO Union Bankshares |

2003 2002 2001 |

$ |

220,000 220,000 184,200 |

$ |

139,605 8,764 35,177 |

3,500 3,500 2,500 |

$ |

28,040 47,911 40,414 | |||||

| John C. Neal President/CEO Union Bank |

2003 2002 2001 |

$ |

139,000 139,000 129,375 |

$ |

74,327 6,143 24,296 |

2,500 2,500 1,500 |

$ |

17,518 34,113 23,207 | |||||

| N. Byrd Newton President/CEO Northern Neck State Bank |

2003 2002 2001 |

$ |

120,000 120,000 115,000 |

$ |

63,019 8,296 6,634 |

1,500 500 500 |

$ |

10,848 12,929 9,077 | |||||

| D. Anthony Peay EVP/CFO Union Bankshares |

2003 2002 2001 |

$ |

120,000 120,000 96,643 |

$ |

62,906 4,578 18,248 |

2,000 2,000 1,500 |

$ |

17,192 28,373 17,497 | |||||

| (1) | The amount of compensation in the form of perquisites or other personal benefits did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported in each year. |

| (2) | While the Company’s 2003 Incentive Stock Plan permits the granting of restricted stock awards, no such awards have been made. This plan is the Company’s only stock-based long-term compensation plan currently in effect. |

| (3) | Includes for 2003: (i) $6,581 accrued on behalf of Mr. Beale under deferred compensation arrangements; (ii) a contribution of $8,809 to Mr. Beale’s, $6,811 to Mr. Neal’s, $2,700 to Mr. Newton’s and $5,622 to Mr. Peay’s plan account under the Profit Sharing and Thrift Plan for the 2003 Plan Year; (iii) a $6,050 matching contribution to Mr. Beale’s, $4,170 to Mr. Neal’s, $3,600 to Mr. Newton’s and $3,600 to Mr. Peay’s 401(k) plan account under the Profit Sharing and Thrift Plan for the 2003 Plan Year; (iv) an estimated contribution of $5,570 to Mr. Beale’s, $5,886 to Mr. Neal’s, $3,562 to Mr. Newton’s and $5,179 to Mr. Peay’s Employee Stock Ownership Plan account for the 2003 Plan Year, and (v) economic benefit attributable to a bank owned life insurance plan of $1,030, $651, $986 and $288 for Messrs. Beale, Neal, Newton and Peay, respectively. |

8

Stock Option Grants in 2003

The Company’s 1993 Incentive Stock Plan and 2003 Incentive Stock Plan provide for the granting of both incentive and non-qualified stock options and restricted stock awards to executive officers and key employees of the Company and its subsidiaries. No restricted stock awards have been granted under the plan. The following table provides certain information concerning stock options granted during 2003 to the named executive officers.

| Individual Grants |

||||||||||||||||

| Name |

Number of Shares Underlying Options Granted |

Percent of Total Options Granted to Employees in 2003 |

Exercise Price per Share |

Expiration Date |

Potential Realizable Value (1) | |||||||||||

| 5% |

10% | |||||||||||||||

| G. William Beale |

3,500 | 5.2 | % | $ | 27.87 | 1/23/13 | $ | 61,346 | $ | 155,462 | ||||||

| John C. Neal |

2,500 | 3.7 | 27.87 | 1/23/13 | 43,818 | 111,044 | ||||||||||

| N. Byrd Newton |

1,500 | 2.2 | 27.87 | 1/23/13 | 26,291 | 66,626 | ||||||||||

| D. Anthony Peay |

2,000 | 3.0 | 27.87 | 1/23/13 | 35,055 | 88,835 | ||||||||||

| (1) | Potential realizable value at the assumed annual rates of stock price appreciation indicated, based on actual option term (10 years) and annual compounding, less cost of shares at exercise price. |

Stock Option Exercises in 2003 and Year-End Option Values

The following table shows certain information with respect to the number of shares acquired on exercise and the number and value of unexercised options at year-end for the named executive officers.

| Name |

Number of Shares Acquired on Exercise |

Value Realized |

Number of Shares Underlying Unexercised Options at December 31, 2003 |

Value of Unexercised In-the-Money Options at December 31, 2003 (1) | |||||||||||

| Exercisable |

Unexercisable |

Exercisable |

Unexercisable | ||||||||||||

| G. William Beale |

1,031 | $ | 29,033 | 18,180 | 8,280 | $ | 253,628 | $ | 84,736 | ||||||

| John C. Neal |

-0- | — | 10,802 | 5,868 | 161,648 | 59,684 | |||||||||

| N. Byrd Newton |

-0- | — | 4,500 | 2,900 | 57,788 | 26,401 | |||||||||

| D. Anthony Peay |

-0- | — | 3,000 | 4,500 | 37,163 | 44,379 | |||||||||

| (1) | Calculated by subtracting the exercise price from the fair market value of the stock at December 31, 2003 (the closing price of the Company’s common stock as reported on Nasdaq on such date). |

Employee and Director Benefit Plans

Stock Incentive Plan. The Company maintains a stock incentive plan that is designed to attract and retain qualified personnel in key positions, provide employees with a proprietary interest in the Company as an incentive to contribute to the success of the Company and reward employees for outstanding performance and the attainment of targeted goals. The Company’s 2003 Stock Incentive Plan replaced the 1993 Stock Incentive Plan, and became effective on July 1, 2003, after shareholders approved the plan at the Annual Meeting of Shareholders held in 2003. The stock incentive plan makes available 350,000 shares

9

which may be awarded to employees of the Company and its subsidiaries in the form of incentive stock options intended to comply with the requirements of Section 422 of the Internal Revenue Code of 1986 (“incentive stock options”), non-statutory stock options and restricted stock. No such awards were made during 2003.

The stock incentive plan is administered by a committee of the Board of Directors of the Company, each member of which is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934. Unless sooner terminated, the stock incentive plan is in effect for a period of 10 years from the date of adoption by the Board of Directors.

Under the stock incentive plan, the committee determines which employees will be granted options, whether such options will be incentive or non-qualified options, the number of shares subject to each option, whether such options may be exercised by delivering other shares of common stock and when such options become exercisable. In general, the per share exercise price of an incentive stock option must be at least equal to the fair market value of a share of common stock on the date the option is granted. The per share exercise price of a non-qualified stock option must not be less than 50% of the fair market value of a share of common stock on the date the option is granted. Stock options shall become vested and exercisable in the manner specified by the committee. In general, each stock option or portion thereof shall be exercisable at any time on or after it vests and is exercisable until ten years after its grant. Stock options are nontransferable except by will or by the laws of descent and distribution.

The committee also determines which employees will be awarded restricted stock, the number of shares to be awarded and when such shares become vested. The value of the restricted stock is at least equal to the value of the fair market value of the Company’s common stock on the date the stock is granted.

Deferred Director Compensation Plan. In 1985, Union Bank & Trust Company (“Union Bank”) offered its directors the option to participate in a deferred supplemental compensation program. Participating directors have entered into agreements with Union Bank to participate in the program. To participate in this plan, a director must have elected to forego the director’s fees that would otherwise be payable to him by Union Bank for a period of twelve consecutive months beginning immediately after his election to participate.

While its obligation under each agreement represents an unsecured, general obligation of Union Bank, a substantial portion of the benefits payable under the agreements is funded by key-person life insurance owned by Union Bank on each director. The fees deferred by each participating director in 1985 were applied towards the first year’s premium expense of a life insurance policy and thereafter Union Bank pays the premiums. Similarly, in 1991, a sum equivalent to year of director compensation was applied towards the first year’s premium expense of a life insurance policy on the life of Mr. Beale. Subsequently, Union Bank has paid the premium necessary to carry such policy thereafter. Each agreement provides that the director will receive from Union Bank a designated fixed amount, payable in equal monthly installments over a period of ten years beginning upon his retirement at age 65. No interest is paid on the installments. The amount of each director’s monthly benefit is actuarially determined based on, among other factors, the age and health condition of each director at the time he elects to participate in the program. In the event a director retires but dies before receiving all the installments due under the agreement, Union Bank has the option of making one lump sum payment (based on the discounted present value of the remaining installment obligation) to the director’s designated beneficiary or his estate or continuing the balance of the installment payments in accordance with the original payment plan. Each agreement further provides that a reduced fixed amount is payable in the event of a director’s death prior to reaching retirement age.

The agreement with Mr. Beale calls for Union Bank to pay him $26,500 per year for ten years upon his retirement at age 65. The other participating directors will receive from Union Bank an annual

10

installment in the following amounts upon their retirement (as defined below) from the Board of Directors of the Company, as follows: Mr. Piland, $13,004; Mr. Hicks, $55,364; Mr. Whittaker, $16,345; and Mr. Mahon, $5,887. As of December 31, 2003, Union Bank had accrued approximately $401,500 to cover its obligations under all these agreements.

Employment Contracts and Termination and Change in Control Arrangements

The Company and Mr. Beale entered into an employment agreement effective April 1, 1999. The agreement had a two-year initial term and is extended for successive one-year terms unless the Company elects not to extend the term of the agreement by providing at least twelve months prior notice, which it has not done. The initial employment agreement provided for an annual base salary of $170,000, which has been adjusted annually at the discretion of the Board, and annual cash bonuses in such amounts as determined by the Board. The Company may terminate Mr. Beale’s employment at any time for “Cause” (as defined in the agreement) without incurring any additional obligations to him. If the Company terminates Mr. Beale’s employment for any reason other than for “Cause” or if Mr. Beale terminates his employment for “Good Reason” (as defined in the agreement), the Company will be obligated to continue to provide the compensation and benefits specified in the agreement until the expiration of its term. The employment agreement will terminate in the event that there is a change in control of the Company, at which time the change in control agreement described below between the Company and Mr. Beale will become effective and any termination benefits will be determined and paid solely pursuant to the change in control agreement.

The Company also has an agreement with Messrs. Beale, Neal, Newton and Peay that becomes effective upon a change in control of the Company. Under the terms of these agreements, the Company or its successor agrees to continue Messrs. Beale, Neal, Newton and Peay in its employ for a term of three years after the date of a change in control. During the term of the contracts, Messrs. Beale, Neal, Newton and Peay will retain commensurate authority and responsibilities and compensation benefits. They will receive base salaries at least equal to that paid in the immediate prior year and bonuses at least equal to the annual bonuses paid prior to the change in control. If the employment of either of Messrs. Beale, Neal, Newton or Peay is terminated during the three years other than for cause or disability as defined in the agreement, or if either of them should terminate employment because a material term of their contract is breached by the Company, such terminating employee will be entitled to a lump sum payment, in cash, within thirty days after the date of termination. This lump sum will be equal to 2.9 times the sum of Mr. Beale’s base salary, annual bonus, and equivalent benefits, and 2.0 times the sum of the base salary, annual bonus and equivalent benefits of Messrs. Neal, Newton and Peay.

Compensation Committee Report on Executive Compensation

Compensation for the President and Chief Executive Officer of the Company is determined by the Board of Directors, excluding the President and Chief Executive Officer, based on the recommendation of the Compensation Committee of the Board. The Compensation Committee annually reviews and approves corporate goals and objectives relevant to CEO compensation, evaluates the CEO’s performance in light of these goals and objectives, and recommends to the Board the CEO’s compensation levels based on this evaluation. In determining the long-term incentive component of CEO compensation, the Committee considers the Company’s performance and relative shareholder return, the value of similar incentive awards to CEOs at comparable companies and the awards given to the CEO in past years.

Compensation for executive officers other than the President and Chief Executive Officer is determined by the Board of Directors based on the recommendation of the Compensation Committee, with the input of the President and Chief Executive Officer. Compensation levels for all executive officers are determined based on the performance of the Company, performance judgments as to the past and future contributions of the individual officers and compensation paid to executives in similar positions in the industry.

11

The Board and the Compensation Committee establish overall compensation using both objective and subjective criteria based on the factors noted above. With respect to the objective portion of the performance evaluation, the Compensation Committee specifically considers the growth in earnings per share and the relative level of return on equity in its deliberations. The subjective component focuses on the Committee’s perception of the performance by the executive officer of his or her individual responsibilities as defined by the Committee and in comparison to the compensation paid to persons in comparable positions within the industry. The Company’s executive compensation program considers base salary its primary component, followed by short-term incentive compensation and long-term incentive compensation.

Members of the Compensation Committee

Ronald L. Hicks

W. Tayloe Murphy

A. D. Whittaker

Compensation Committee Interlocks and Insider Participation

During 2003 and up to the present time, there were transactions between Union Bank and Northern Neck State Bank and the members of the Compensation Committee (Messrs. Hicks, Murphy and Whittaker), or their associates, all consisting of extensions of credit by either Bank in the ordinary course of its business. Each transaction was made on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with the general public. In the opinion of management, none of the transactions involve more than the normal risk of collectibility or present other unfavorable features.

INTEREST OF DIRECTORS AND OFFICERS IN CERTAIN TRANSACTIONS

Certain directors and officers of the Company and its subsidiaries and members of their immediate families, and corporations, partnerships and other entities with which such persons are associated, are customers of Union Bank, Northern Neck State Bank, Rappahannock National Bank, Bank of Williamsburg, Union Investment Services and Mortgage Capital Investors. As such, these persons engaged in transactions with the Company and its subsidiaries in the ordinary course of business during 2003, and will have additional transactions with these companies in the future. All loans extended and commitments to lend by the banks to such persons are made in the ordinary course of business upon substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unaffiliated persons and do not involve more than the normal risk of collection or present other unfavorable features.

12

SHAREHOLDER RETURN

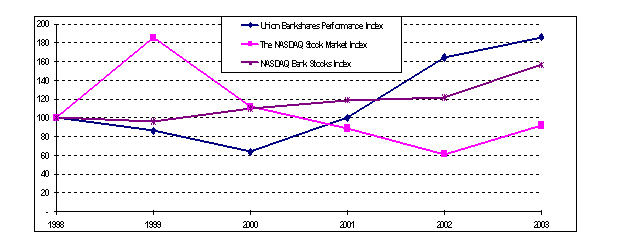

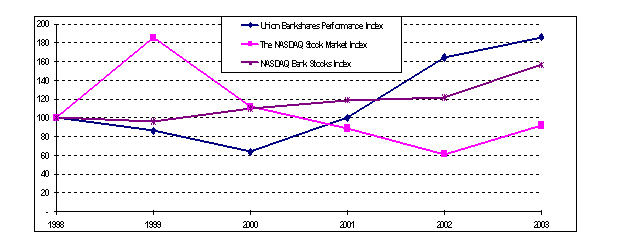

The Company is subject to the rules of the Securities and Exchange Commission that require all public companies to present a graph of total investment return in their annual proxy statements. The graph below compares the yearly percentage change in the Company’s cumulative total shareholder return with the cumulative total return of the Nasdaq Stock Market Index and of the Nasdaq National Market (“Nasdaq/NM”) Bank Index, assuming that investments of $100 were made on December 31, 1998, and that dividends were reinvested.

| 1998 |

1999 |

2000 |

2001 |

2002 |

2003 | |||||||||||||

| Union Bankshares Performance Index |

$ | 100.00 | $ | 86.19 | $ | 63.93 | $ | 100.00 | $ | 164.49 | $ | 186.02 | ||||||

| Nasdaq Stock Market Index |

100.00 | 185.43 | 111.83 | 88.76 | 61.37 | 91.75 | ||||||||||||

| Nasdaq/NM Bank Index |

100.00 | 96.15 | 109.84 | 118.92 | 121.74 | 156.62 | ||||||||||||

INDEPENDENT AUDITORS—PROPOSAL THREE

The Audit Committee has appointed Yount, Hyde & Barbour, P.C. as the Company’s independent public accountants for the year ending December 31, 2004, and the Board has directed that such selection of independent public accountants be ratified by the shareholders at the Annual Meeting. Yount, Hyde & Barbour, P.C. has been serving the Company since 1999. Representatives of Yount, Hyde & Barbour, P.C. are expected to be present at the Annual Meeting and will be given an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The Board of Directors recommends that you vote FOR the ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent auditors for the fiscal year ending December 31, 2004.

13

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, directors and executive officers of the Company are required to file reports with the Securities and Exchange Commission indicating their holdings of and transactions in the Company’s common stock. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company, insiders of the Company complied with all filing requirements during 2003, except one instance in which Mr. Morin failed to file a Form 4 in connection with the acquisition of stock in November 2003, shortly after his appointment to the Board, which Form 4 has been subsequently filed.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors of the Company has no knowledge of any matters to be presented for consideration at the Annual Meeting other than those referred to above. If any other matters properly come before the Annual Meeting, the persons named in the accompanying proxy intend to vote such proxy, to the extent entitled, in accordance with the recommendation of the Board of Directors.

SHAREHOLDER PROPOSALS

In order for a shareholder proposal to be considered for possible inclusion in the 2005 Proxy Statement, it must be received by the Company’s Corporate Secretary, D. Anthony Peay, Union Bankshares Corporation, 212 N. Main Street, P.O. Box 446, Bowling Green, Virginia 22427 on or before November 8, 2004.

ADDITIONAL INFORMATION

“Householding” of Proxy Materials. The Securities and Exchange Commission has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for shareholders and cost savings for companies. The Company and some brokers household proxy materials, delivering a single proxy statement to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once you have received notice from your broker or the Company that they or the Company will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker if your shares are held in a brokerage account or the Company if you hold registered shares. You can notify us by sending a written request to Union Bankshares Corporation, Corporate Secretary, D. Anthony Peay, Union Bankshares Corporation, 212 N. Main Street, P.O. Box 446, Bowling Green, Virginia 22427.

Annual Report on Form 10-K. Accompanying this Proxy Statement is a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2003. The Company encourages its shareholders to read the Form 10-K as it contains information on the Company and its subsidiaries, as well as the Company’s audited financial statements.

14

APPENDIX A

Union Bankshares Corporation

Audit Committee Charter

STATEMENT OF POLICY

A soundly conceived, effective Audit Committee is essential to the management, operation, and financial reporting process of Union Bankshares Corporation and its subsidiaries. The Audit Committee shall provide assistance to the corporate directors in fulfilling their responsibilities to the shareholders relating to corporate accounting, reporting practices of the corporation, and the quality and integrity of the financial reports of the corporation. In so doing, it is the responsibility of the Audit Committee to maintain free and open means of communication between the directors, the independent auditors, the internal auditors, and the financial management of the corporation.

ORGANIZATION

Members

There shall be a committee of the Board of Directors known as the Audit Committee. This committee shall be composed of at least three directors of Union Bankshares Corporation, each of whom is an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers and is free of any relationship that, in the opinion of the Board of Directors, would interfere with their exercise of independent judgment as a committee member. All Audit Committee members shall be financially literate and one director shall constitute a “financial expert” consistent with the regulations of the Securities and Exchange Commission.

At the committee’s discretion, management of the corporation may attend meetings of the Audit Committee, but this attendance should be in a non-voting capacity.

Committee membership standards will be maintained in accordance with applicable banking laws and regulations.

Meetings

The Audit Committee shall meet on a quarterly or four (4) times per year basis. The Audit Committee will also hold a special meeting in February for review and discussion of the annual audit with management and the independent auditors. The committee reserves the right to meet at other times as required and/or to meet without members of corporate management, internal audit, or the independent accounting firm.

Minutes

Minutes shall be prepared for all meetings of the Audit Committee to document the Committee’s discharge of its responsibilities. The minutes shall provide an accurate record of the proceedings, and shall be approved at or before the next meeting of the Committee.

15

AUTHORITY

The authority of the Audit Committee is derived from the full Board of Directors of Union Bankshares Corporation.

The Audit Committee is appointed by the Board to assist the Board in monitoring (1) the integrity of the financial statements of the Company, (2) the compliance of the Company with legal and regulatory requirements and (3) the independence and performance of the Company’s internal and external auditors.

The Audit Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee, including members of subsidiary Boards. The Audit Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee.

RESPONSIBILITIES

In fulfilling the stated role within the framework of the Audit Committee’s Statement of Policy, the primary, general responsibilities of the Audit Committee will be as follows:

| • | To provide for an internal audit function to serve all subsidiaries of the corporation in an examining and advisory capacity. |

| • | To provide for all required external audits of all corporate subsidiaries by suitable independent accountants. |

| • | To serve as a focal point and reporting outlet for communications among non-committee directors, corporate management, internal auditors, and independent accountants. |

| • | To assist the Board of Directors in fulfilling its fiduciary responsibilities for financial reporting and internal accounting and operations controls. |

| • | To act as an agent for the Board of Directors to help ensure the independence of internal auditors and independent accountants, the integrity of management, and the adequacy of disclosure to stockholders. |

| • | To maintain a Whistleblower Protection Policy. |

Specific duties of the Audit Committee, within the noted general responsibilities, will include, but not be limited to the following items:

| 1. | Review and reassess the adequacy of this Charter annually and submit it to the Board for approval. |

| 2. | Review the annual audited financial statements with management, including major issues regarding accounting and auditing principles and practices as well as the adequacy of internal controls that could significantly affect the Company’s financial statements. |

| 3. | Review an analysis prepared by management and the independent auditor of significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements. |

16

| 4. | Based on the review and discussions noted in numbers 2 and 3 above, recommend to the Board of Directors that the audited financial statements be included in the Company’s annual report on Form 10-K. |

| 5. | Discuss quarterly Forms 10-Q with the external auditors prior to the filing of such forms. |

| 6. | Meet with management, as deemed necessary by the Audit Committee, to review the Company’s major financial risk exposures, including the allowance for loan losses, and the steps management has taken to monitor and control such exposures. |

| 7. | Review major changes to the Company’s auditing and accounting principles and practices as suggested by the independent auditor, internal auditors or management. |

| 8. | Appoint the independent auditor, which firm is ultimately accountable to the Audit Committee and the Board. |

| 9. | Pre-approve any non-audit services provided by the independent auditors, including tax services, before the services are rendered. |

| 10. | Approve the fees to be paid to the independent auditor. |

| 11. | Receive periodic reports from the independent auditor regarding the auditor’s independence, discuss such reports with the auditor, and if so determined by the Audit Committee, recommend that the Board take appropriate action to insure the independence of the auditor. |

| 12. | Evaluate the performance of the independent auditor and, if so determined by the Audit Committee, recommend that the Board replace the independent auditor. |

| 13. | Review the appointment and replacement of the senior internal auditing executive. |

| 14. | Review the significant reports to management prepared by the internal auditing department and management’s responses. |

| 15. | Meet with the independent auditor prior to its annual audit to review the planning and staffing of the audit. |

| 16. | Discuss with the independent auditor the matters required to be discussed by Statement of Auditing Standards No. 61 relating to the conduct of the audit. |

| 17. | Review with the independent auditor any problems or difficulties the auditor may have encountered and any management letter provided by the auditor and the Company’s response to that letter. Such review should include: |

| a. | Any difficulties encountered in the course of the audit work, including any restrictions on the scope of the activities or access to required information. |

| b. | Any changes required in the planned scope of the internal audit. |

| c. | The internal audit department responsibilities, budget and staffing. |

17

| 18. | Review with the Company’s General Counsel legal matters that may have a material impact on the financial statements, the Company’s compliance policies and any material reports or inquiries received from regulators or governmental agencies. |

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with accounting principles generally accepted in the United States. This is the responsibility of management and the independent auditor. Nor is it the duty of the Audit Committee to conduct investigations, to resolve disagreements, if any, between management and the independent auditor or to assure compliance with laws and regulations and the Company’s Code of Conduct.

18

[map to site of Annual Meeting included in copy mailed to shareholders]

19

| x PLEASE MARK VOTES AS IN THIS EXAMPLE |

REVOCABLE PROXY UNION BANKSHARES CORPORATION |

For | With- hold |

For All Except | ||||||

| ANNUAL MEETING OF SHAREHOLDERS APRIL 20, 2004 |

1. | To elect three Class I directors to serve until the Annual Meeting of Shareholders in 2006. (except as marked to the contrary below): |

¨ | ¨ | ¨ | |||||

| The undersigned hereby appoints G. William Beale and B. Walton Mahon, jointly and severally, proxies, with full power to act alone and with full power of substitution, to represent the undersigned and vote all shares of the Company standing in the name of the undersigned at the Annual Meeting of Shareholders of Union Bankshares Corporation to be held on Tuesday, April 20, 2004, at 3:00 p.m. at the Riverside Conference Center at 95 Riverside Parkway, Fredricksburg, Virginia, or any adjournment thereof, on each of the following matters: |

R. Hunter Morin, Robert C. Sledd and Ronald L. Tillett

To elect three Class II directors to serve until the Annual Meeting of Shareholders in 2007. (except as marked to the contrary below):

Ronald L. Hicks, W. Taylor Murphy, Jr. and A. D. Whitaker.

INSTRUCTION: To withhold authority to vote for any individual nominee, mark “For All Except” and write that nominee’s name in the space provided below.

| |||||||||

| For | Against | Abstain | ||||||||

| 2. | To ratify the appointment of Yount, Hyde, Barbour, P.C. as independent auditors for the Company for 2004. |

¨ | ¨ | ¨ | ||||||

| 3. | The transaction of any other business which may properly come before the Annual Meeting. Management at present knows of no other business to be presented at the Annual Meeting. |

|||||||||

| Date Please be sure to sign and date this Proxy in the box below.

|

The meeting will be followed by a reception. Please check this box if you plan to attend. |

è

|

¨ | |||||||

| Shareholder sign above Co-holder (if any) sign above | This proxy, when properly executed, will be voted in the manner directed by the undersigned shareholder. If no direction is made, this proxy will be voted “FOR” each proposal. | |||||||||

| + |

+ |

é Detach above card, sign, date and mail in postage paid envelope provided. é

UNION BANKSHARES CORPORATION

When signing as attorney, executor, administrator, trustee or guardian, please give full title. If more than one

fiduciary, all should sign. All joint owners MUST sign

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.

|

|