| Q2 2025 EARNINGS PRESENTATION NYSE: AUB JULY 24, 2025 |

| 2 FORWARD-LOOKING STATEMENTS This presentation and statements by our management may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include, without limitation, statements regarding our recently completed acquisition of Sandy Spring Bancorp, Inc. (“Sandy Spring”) and expectations with regard to the benefits of the Sandy Spring acquisition, statements regarding our business, financial and operating results, including our deposit base and funding; the impact of changes in economic conditions, anticipated changes in the interest rate environment and the related impacts on our net interest margin, changes in economic, fiscal or trade policy and the potential impacts on our business, loan demand and economic conditions, in our markets and nationally; management’s beliefs regarding our liquidity, capital resources, asset quality, CRE loan portfolio and our customer relationships; statements regarding our North Carolina expansion strategy and the impact of such strategy, statements that include other projections, predictions, expectations, or beliefs about future events or results or otherwise are not statements of historical fact, and statements on the slides entitled “2025 Financial Outlook (inclusive of Sandy Spring beginning April 1st)” and “North Carolina Expansion Strategy”. Such forward-looking statements are based on certain assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other factors, some of which cannot be predicted or quantified, that may cause actual results, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “seek to,” “potential,” “continue,” “confidence,” or words of similar meaning or other statements concerning opinions or judgment of Atlantic Union Bankshares Corporation (the “Company,” “AUB,” “we,” “us” or “our”) and our management about future events. Although we believe that our expectations with respect to forward-looking statements are based on reasonable assumptions within the bounds of our existing knowledge of our business and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, us will not differ materially from any projected future results, performance, achievements or trends expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of or changes in: • market interest rates and their related impacts on macroeconomic conditions, customer and client behavior, our funding costs and our loan and securities portfolios; • economic conditions, including inflation and recessionary conditions and their related impacts on economic growth and customer and client behavior; • U.S. and global trade policies and tensions, including change in, or the imposition of, tariffs and/or trade barriers and the economic impacts, volatility and uncertainty resulting therefrom, and geopolitical instability; • volatility in the financial services sector, including failures or rumors of failures of other depository institutions, along with actions taken by governmental agencies to address such turmoil, and the effects on the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital; • legislative or regulatory changes and requirements, including as part of the regulatory reform agenda of the Trump administration, including changes in federal state or local tax laws and changes impacting the rulemaking, supervision, examination and enforcement priorities of the federal banking agencies; • the sufficiency of liquidity and changes in our capital position; • general economic and financial market conditions in the United States generally and particularly in the markets in which we operate and which our loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels, U.S. fiscal debt, budget and tax matters, and slowdowns in economic growth; • the diversion of management’s attention from ongoing business operations and opportunities due to our recent acquisition of Sandy Spring; • the impact of purchase accounting with respect to the Sandy Spring acquisition, or any change in the assumptions used regarding the assets acquired and liabilities assumed to determine the fair value and credit marks; • the possibility that the anticipated benefits of our acquisition activity, including our acquisitions of Sandy Spring and American National, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the strength of the economy, competitive factors in the areas where we do business, or as a result of other unexpected factors or events, or with respect to our acquisition of Sandy Spring, as a result of the impact of, or problems arising from, the integration of the two companies; • the integration of the business and operations of Sandy Spring may take longer or be more costly than anticipated; • potential adverse reactions or changes to business or employee relationships, including those resulting from our acquisitions of Sandy Spring and American National; • our ability to identify, recruit and retain key employees • monetary, fiscal and regulatory policies of the U.S. government, including policies of the U.S. Department of the Treasury and the Federal Reserve; • the quality or composition of our loan or investment portfolios and changes in these portfolios; • demand for loan products and financial services in our market areas; • our ability to manage our growth or implement our growth strategy; • the effectiveness of expense reduction plans; • the introduction of new lines of business or new products and services; • real estate values in our lending area; • changes in accounting principles, standards, rules, and interpretations, and the related impact on our financial statements; • an insufficient ACL or volatility in the ACL resulting from the CECL methodology, either alone or as that may be affected by changing economic conditions, credit concentrations, inflation, changing interest rates, or other factors; • concentrations of loans secured by real estate, particularly commercial real estate; • the effectiveness of our credit processes and management of our credit risk; • our ability to compete in the market for financial services and increased competition from fintech companies; • technological risks and developments, and cyber threats, attacks, or events; • operational, technological, cultural, regulatory, legal, credit, and other risks associated with the exploration, consummation and integration of potential future acquisitions, whether involving stock or cash consideration; • the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, geopolitical conflicts or public health events (such as pandemics), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of our borrowers to satisfy their obligations to us, on the value of collateral securing loans, on the demand for our loans or our other products and services, on supply chains and methods used to distribute products and services, on incidents of cyberattack and fraud, on our liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of our business operations and on financial markets and economic growth; • performance by our counterparties or vendors; • deposit flows; • the availability of financing and the terms thereof; • the level of prepayments on loans and mortgage-backed securities; • actual or potential claims, damages, and fines related to litigation or government actions, which may result in, among other things, additional costs, fines, penalties, restrictions on our business activities, reputational harm, or other adverse consequences; • any event or development that would cause us to conclude that there was an impairment of any asset, including intangible assets, such as goodwill; and • other factors, many of which are beyond our control. Please also refer to such other factors as discussed throughout Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2024, and related disclosures in other filings, which have been filed with the U.S. Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking statements, and all forward-looking statements are expressly qualified by the cautionary statements contained or referred to herein and therein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or our businesses or operations. Readers are cautioned not to rely too heavily on forward-looking statements. Forward-looking statements speak only as of the date they are made. We do not intend or assume any obligation to update, revise or clarify any forward-looking statements that may be made from time to time by or on behalf of the Company, whether because of new information, future events or otherwise, except as required by law. |

| 3 ADDITIONAL INFORMATION Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures are a supplement to GAAP, which is used to prepare our financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, our non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. We use the non-GAAP financial measures discussed herein in our analysis of our performance. Our management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods, show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in our underlying performance, or show the potential effects of accumulated other comprehensive income (or AOCI) or unrealized losses on securities on our capital. This presentation also includes certain projections of non-GAAP financial measures. Due to the inherent variability and difficulty associated with making accurate forecasts and projections of information that is excluded from these projected non-GAAP measures, and the fact that some of the excluded information is not currently ascertainable or accessible, we are unable to quantify certain amounts that would be required to be included in the most directly comparable projected GAAP financial measures without unreasonable effort. Consequently, no disclosure of projected comparable GAAP measures is included, and no reconciliation of forward-looking non-GAAP financial information is included. Please see “Reconciliation of Non-GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. Market and Industry Data Unless otherwise indicated, market data and certain industry forecast data used in this presentation were obtained from internal reports, where appropriate, as well as third party sources and other publicly available information. Data regarding the industries in which the Company competes, its market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond the Company's control. In addition, assumptions and estimates of the Company and its industries' future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause future performance to differ materially from assumptions and estimates. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (NYSE: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank has branches and ATMs located in Virginia, Maryland and North Carolina. Certain non-bank financial services affiliates of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Atlantic Union Financial Consultants, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. |

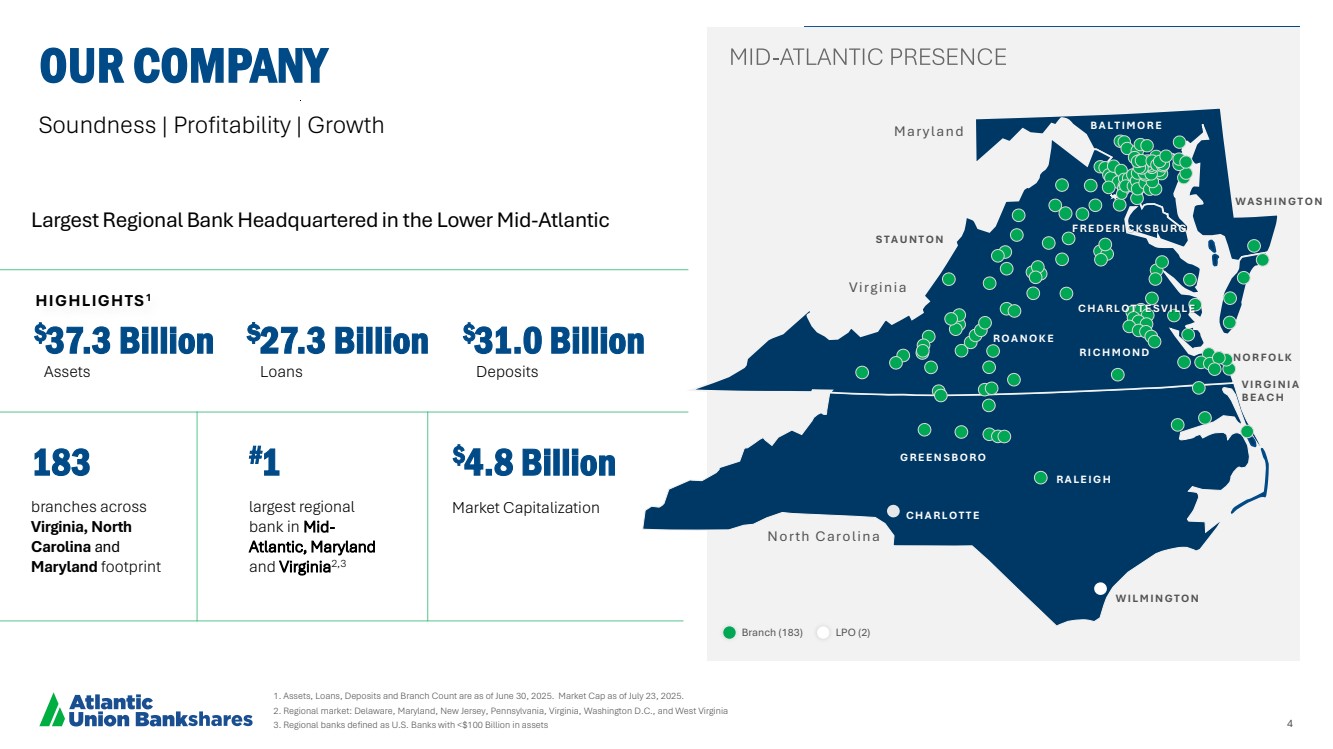

| 4 N O R F O L K V I R G I N I A B E A C H M a ry l a n d V irg in ia No rth C a ro l in a C H A R L O T T E W I L M I N G T O N B A L T I M O R E R A L E I G H G R E E N S B O R O W A S H I N G T O N R O A N O K E S T A U N T O N C H A R L O T T E S V I L L E R I C H M O N D F R E D E R I C K S B U R G HIGHLIGHTS1 branches across Virginia, North Carolina and Maryland footprint 183 largest regional bank in Mid-Atlantic, Maryland and Virginia2,3 #1 $37.3 Billion Assets $27.3 Billion Loans $31.0 Billion Deposits $4.8 Billion Market Capitalization Soundness | Profitability | Growth 1. Assets, Loans, Deposits and Branch Count are as of June 30, 2025. Market Cap as of July 23, 2025. 2. Regional market: Delaware, Maryland, New Jersey, Pennsylvania, Virginia, Washington D.C., and West Virginia 3. Regional banks defined as U.S. Banks with <$100 Billion in assets OUR COMPANY Branch (183) LPO (2) Largest Regional Bank Headquartered in the Lower Mid-Atlantic |

| 5 Dense, uniquely valuable presence across attractive markets FINANCIAL STRENGTH Solid balance sheet & capital levels PEER-LEADING PERFORMANCE Committed to top-tier financial performance ATTRACTIVE FINANCIAL PROFILE Solid dividend yield & payout ratio with earnings upside STRONG GROWTH POTENTIAL Organic & acquisition opportunities OUR SHAREHOLDER VALUE PROPOSITION Positioned for growth and long-term shareholder value creation as a preeminent regional bank with a leading presence in attractive markets LEADING REGIONAL PRESENCE |

| AUB Q2 2025 FINANCIAL RESULTS |

| 7 1. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measure in "Appendix - Reconciliation of Non-GAAP Disclosures” HIGHLIGHTS Q2 2025 LOANS & DEPOSITS Assuming the Sandy Spring acquisition closed on March 31 instead of April 1, and excluding both the loan fair value marks on the acquired loans and the effect of the CRE loan sale transaction, our loan growth was approximately 4% annualized in Q2 2025 Paid down approximately $340 million in brokered deposits Loan/Deposit ratio of 88.2% at June 30, 2025 POSITIONING FOR LONG TERM Lending pipelines remain healthy Focus on systems integration of Sandy Spring, performance of the core banking franchise, and building out North Carolina franchise Focused on generating positive operating leverage DIFFERENTIATED CLIENT EXPERIENCE Responsive, strong and capable alternative to large national banks, while competitive with and more capable than smaller banks CAPITALIZE ON STRATEGIC OPPORTUNITIES Closed the acquisition of Sandy Spring on April 1, 2025 Sandy Spring core systems conversion scheduled for October 2025 FINANCIAL RATIOS Q2 2025 adjusted operating return on tangible common equity of 23.8%1 Q2 2025 adjusted operating return on assets of 1.46%1 Q2 2025 adjusted operating efficiency ratio (FTE) of 48.31 ASSET QUALITY Q2 2025 net charge-offs at 1 basis point of total average loans held for investment annualized Increased Allowance for Credit Loss to 1.25% of loans held for investment Credit marked Sandy Spring’s loan portfolio and brought onto AUB’s more conservative risk rating system 7 |

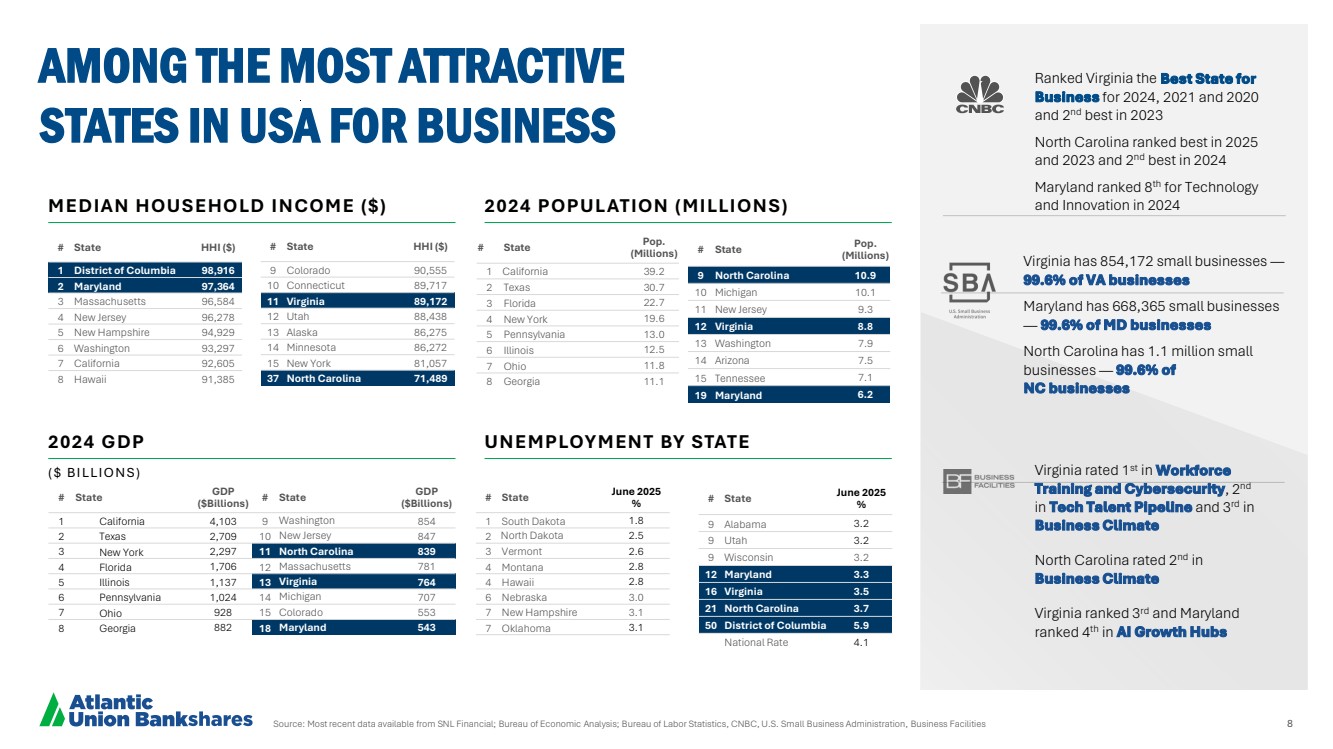

| Source: Most recent data available from SNL Financial; Bureau of Economic Analysis; Bureau of Labor Statistics, CNBC, U.S. Small Business Administration, Business Facilities 8 AMONG THE MOST ATTRACTIVE STATES IN USA FOR BUSINESS Virginia rated 1st in Workforce Training and Cybersecurity, 2nd in Tech Talent Pipeline and 3 rd in Business Climate North Carolina rated 2nd in Business Climate Virginia ranked 3rd and Maryland ranked 4th in AI Growth Hubs # State June 2025 % 1 South Dakota 1.8 2 North Dakota 2.5 3 Vermont 2.6 4 Montana 2.8 4 Hawaii 2.8 6 Nebraska 3.0 7 New Hampshire 3.1 7 Oklahoma 3.1 # State Pop. (Millions) 1 California 39.2 2 Texas 30.7 3 Florida 22.7 4 New York 19.6 5 Pennsylvania 13.0 6 Illinois 12.5 7 Ohio 11.8 8 Georgia 11.1 # State HHI ($) 1 District of Columbia 98,916 2 Maryland 97,364 3 Massachusetts 96,584 4 New Jersey 96,278 5 New Hampshire 94,929 6 Washington 93,297 7 California 92,605 8 Hawaii 91,385 # State GDP ($Billions) 1 California 4,103 2 Texas 2,709 3 New York 2,297 4 Florida 1,706 5 Illinois 1,137 6 Pennsylvania 1,024 7 Ohio 928 8 Georgia 882 # State Pop. (Millions) 9 North Carolina 10.9 10 Michigan 10.1 11 New Jersey 9.3 12 Virginia 8.8 13 Washington 7.9 14 Arizona 7.5 15 Tennessee 7.1 19 Maryland 6.2 # State HHI ($) 9 Colorado 90,555 10 Connecticut 89,717 11 Virginia 89,172 12 Utah 88,438 13 Alaska 86,275 14 Minnesota 86,272 15 New York 81,057 37 North Carolina 71,489 # State June 2025 % 9 Alabama 3.2 9 Utah 3.2 9 Wisconsin 3.2 12 Maryland 3.3 16 Virginia 3.5 21 North Carolina 3.7 50 District of Columbia 5.9 National Rate 4.1 # State GDP ($Billions) 9 Washington 854 10 New Jersey 847 11 North Carolina 839 12 Massachusetts 781 13 Virginia 764 14 Michigan 707 15 Colorado 553 18 Maryland 543 Ranked Virginia the Best State for Business for 2024, 2021 and 2020 and 2nd best in 2023 North Carolina ranked best in 2025 and 2023 and 2nd best in 2024 Maryland ranked 8th for Technology and Innovation in 2024 Virginia has 854,172 small businesses — 99.6% of VA businesses Maryland has 668,365 small businesses — 99.6% of MD businesses North Carolina has 1.1 million small businesses — 99.6% of NC businesses MEDIAN HOUSEHOLD INCOME ($) 2024 POPULATION (MILLIONS) 2024 GDP UNEMPLOYMENT BY STATE ( $ B I LLI O N S ) |

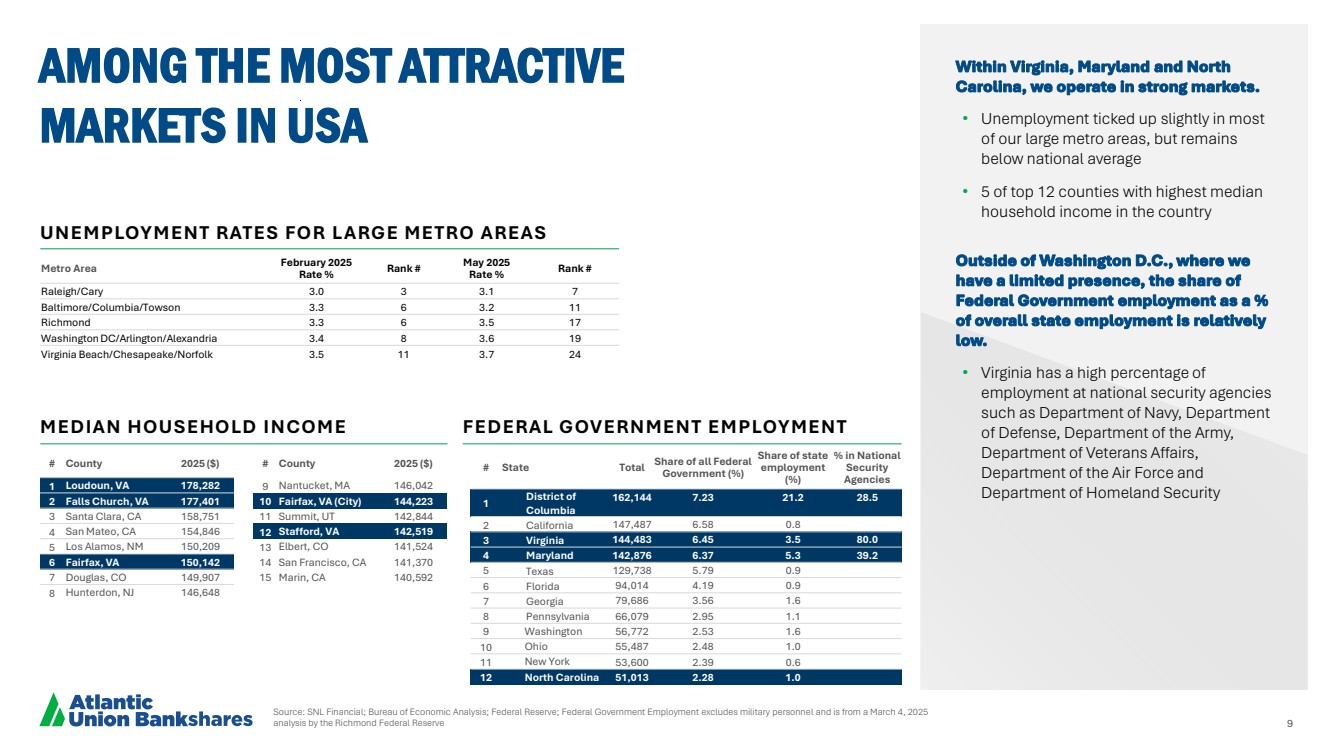

| 9 Source: SNL Financial; Bureau of Economic Analysis; Federal Reserve; Federal Government Employment excludes military personnel and is from a March 4, 2025 analysis by the Richmond Federal Reserve AMONG THE MOST ATTRACTIVE MARKETS IN USA # County 2025 ($) 1 Loudoun, VA 178,282 2 Falls Church, VA 177,401 3 Santa Clara, CA 158,751 4 San Mateo, CA 154,846 5 Los Alamos, NM 150,209 6 Fairfax, VA 150,142 7 Douglas, CO 149,907 8 Hunterdon, NJ 146,648 # State Total Share of all Federal Government (%) Share of state employment (%) % in National Security Agencies 1 District of Columbia 162,144 7.23 21.2 28.5 2 California 147,487 6.58 0.8 3 Virginia 144,483 6.45 3.5 80.0 4 Maryland 142,876 6.37 5.3 39.2 5 Texas 129,738 5.79 0.9 6 Florida 94,014 4.19 0.9 7 Georgia 79,686 3.56 1.6 8 Pennsylvania 66,079 2.95 1.1 9 Washington 56,772 2.53 1.6 10 Ohio 55,487 2.48 1.0 11 New York 53,600 2.39 0.6 12 North Carolina 51,013 2.28 1.0 # County 2025 ($) 9 Nantucket, MA 146,042 10 Fairfax, VA (City) 144,223 11 Summit, UT 142,844 12 Stafford, VA 142,519 13 Elbert, CO 141,524 14 San Francisco, CA 141,370 15 Marin, CA 140,592 UNEMPLOYMENT RATES FOR LARGE METRO AREAS MEDIAN HOUSEHOLD INCOME FEDERAL GOVERNMENT EMPLOYMENT Metro Area February 2025 Rate % Rank # May 2025 Rate % Rank # Raleigh/Cary 3.0 3 3.1 7 Baltimore/Columbia/Towson 3.3 6 3.2 11 Richmond 3.3 6 3.5 17 Washington DC/Arlington/Alexandria 3.4 8 3.6 19 Virginia Beach/Chesapeake/Norfolk 3.5 11 3.7 24 Within Virginia, Maryland and North Carolina, we operate in strong markets. • Unemployment ticked up slightly in most of our large metro areas, but remains below national average • 5 of top 12 counties with highest median household income in the country Outside of Washington D.C., where we have a limited presence, the share of Federal Government employment as a % of overall state employment is relatively low. • Virginia has a high percentage of employment at national security agencies such as Department of Navy, Department of Defense, Department of the Army, Department of Veterans Affairs, Department of the Air Force and Department of Homeland Security |

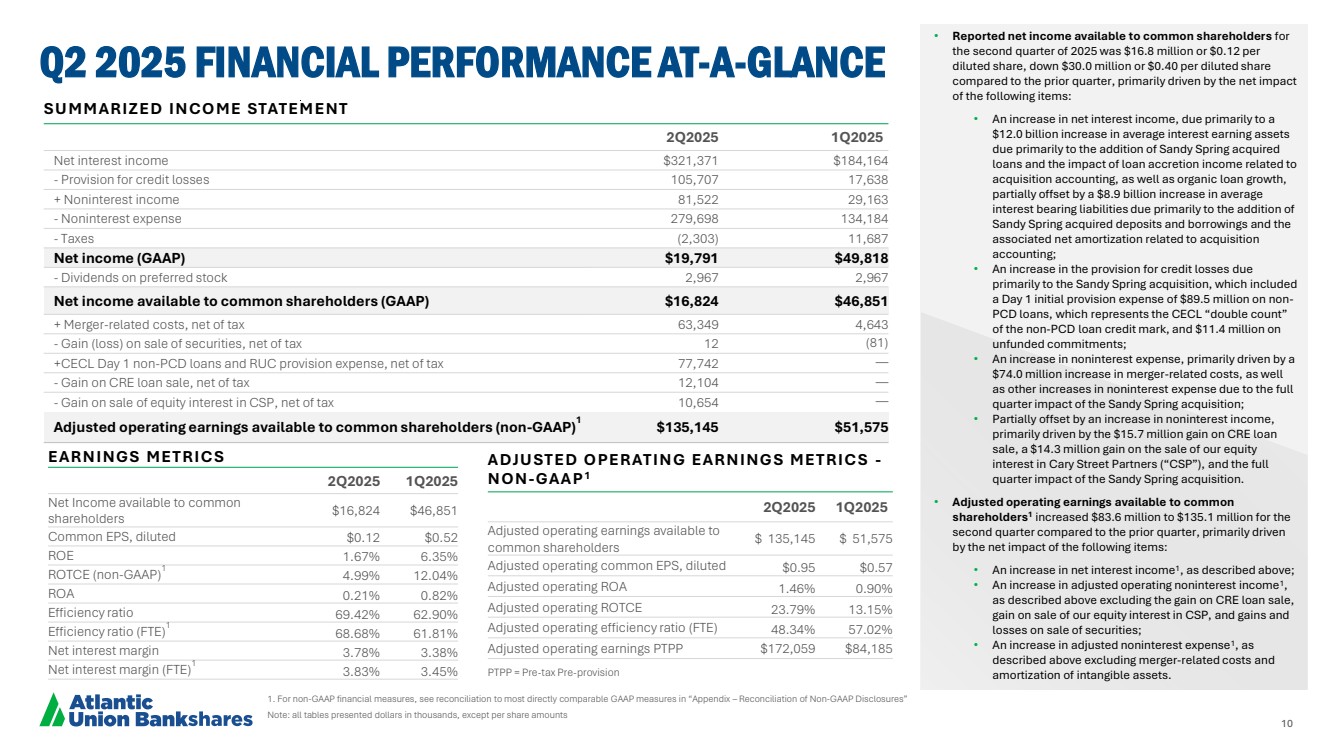

| 10 1. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Note: all tables presented dollars in thousands, except per share amounts Q2 2025 FINANCIAL PERFORMANCE AT-A-GLANCE • Reported net income available to common shareholders for the second quarter of 2025 was $16.8 million or $0.12 per diluted share, down $30.0 million or $0.40 per diluted share compared to the prior quarter, primarily driven by the net impact of the following items: • An increase in net interest income, due primarily to a $12.0 billion increase in average interest earning assets due primarily to the addition of Sandy Spring acquired loans and the impact of loan accretion income related to acquisition accounting, as well as organic loan growth, partially offset by a $8.9 billion increase in average interest bearing liabilities due primarily to the addition of Sandy Spring acquired deposits and borrowings and the associated net amortization related to acquisition accounting; • An increase in the provision for credit losses due primarily to the Sandy Spring acquisition, which included a Day 1 initial provision expense of $89.5 million on non-PCD loans, which represents the CECL “double count” of the non-PCD loan credit mark, and $11.4 million on unfunded commitments; • An increase in noninterest expense, primarily driven by a $74.0 million increase in merger-related costs, as well as other increases in noninterest expense due to the full quarter impact of the Sandy Spring acquisition; • Partially offset by an increase in noninterest income, primarily driven by the $15.7 million gain on CRE loan sale, a $14.3 million gain on the sale of our equity interest in Cary Street Partners (“CSP”), and the full quarter impact of the Sandy Spring acquisition. • Adjusted operating earnings available to common shareholders1 increased $83.6 million to $135.1 million for the second quarter compared to the prior quarter, primarily driven by the net impact of the following items: • An increase in net interest income1 , as described above; • An increase in adjusted operating noninterest income1 , as described above excluding the gain on CRE loan sale, gain on sale of our equity interest in CSP, and gains and losses on sale of securities; • An increase in adjusted noninterest expense1 , as described above excluding merger-related costs and amortization of intangible assets. SUMMARIZED INCOME STATEMENT 2Q2025 1Q2025 Net interest income $321,371 $184,164 - Provision for credit losses 105,707 17,638 + Noninterest income 81,522 29,163 - Noninterest expense 279,698 134,184 - Taxes (2,303) 11,687 Net income (GAAP) $19,791 $49,818 - Dividends on preferred stock 2,967 2,967 Net income available to common shareholders (GAAP) $16,824 $46,851 + Merger-related costs, net of tax 63,349 4,643 - Gain (loss) on sale of securities, net of tax 12 (81) +CECL Day 1 non-PCD loans and RUC provision expense, net of tax 77,742 — - Gain on CRE loan sale, net of tax 12,104 — - Gain on sale of equity interest in CSP, net of tax 10,654 — Adjusted operating earnings available to common shareholders (non-GAAP)1 $135,145 $51,575 EARNINGS METRICS 2Q2025 1Q2025 Net Income available to common shareholders $16,824 $46,851 Common EPS, diluted $0.12 $0.52 ROE 1.67% 6.35% ROTCE (non-GAAP)1 4.99% 12.04% ROA 0.21% 0.82% Efficiency ratio 69.42% 62.90% Efficiency ratio (FTE)1 68.68% 61.81% Net interest margin 3.78% 3.38% Net interest margin (FTE)1 3.83% 3.45% ADJUSTED OPERATING EARNINGS METRICS - NON-GAAP1 2Q2025 1Q2025 Adjusted operating earnings available to common shareholders $ 135,145 $ 51,575 Adjusted operating common EPS, diluted $0.95 $0.57 Adjusted operating ROA 1.46% 0.90% Adjusted operating ROTCE 23.79% 13.15% Adjusted operating efficiency ratio (FTE) 48.34% 57.02% Adjusted operating earnings PTPP $172,059 $84,185 PTPP = Pre-tax Pre-provision |

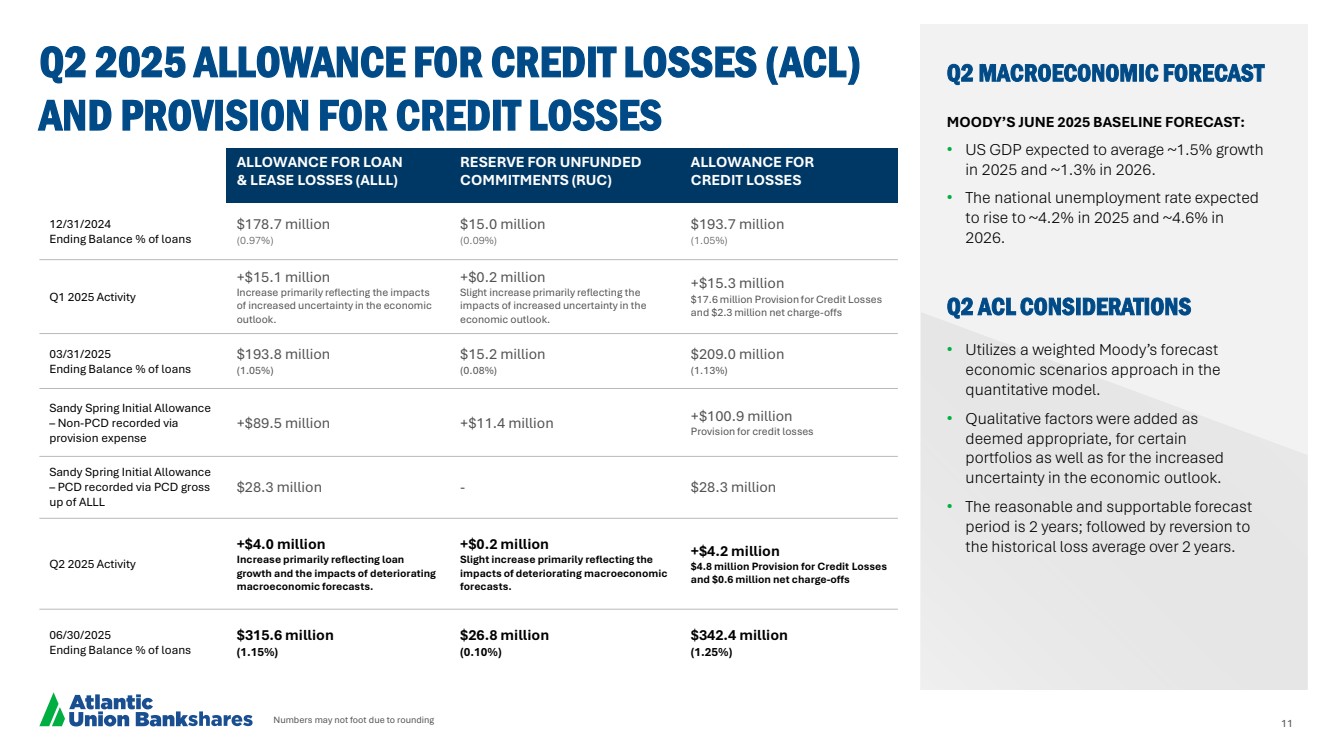

| 11 Numbers may not foot due to rounding Q2 2025 ALLOWANCE FOR CREDIT LOSSES (ACL) AND PROVISION FOR CREDIT LOSSES Q2 MACROECONOMIC FORECAST Q2 ACL CONSIDERATIONS MOODY’S JUNE 2025 BASELINE FORECAST: • US GDP expected to average ~1.5% growth in 2025 and ~1.3% in 2026. • The national unemployment rate expected to rise to ~4.2% in 2025 and ~4.6% in 2026. • Utilizes a weighted Moody’s forecast economic scenarios approach in the quantitative model. • Qualitative factors were added as deemed appropriate, for certain portfolios as well as for the increased uncertainty in the economic outlook. • The reasonable and supportable forecast period is 2 years; followed by reversion to the historical loss average over 2 years. ALLOWANCE FOR LOAN & LEASE LOSSES (ALLL) RESERVE FOR UNFUNDED COMMITMENTS (RUC) ALLOWANCE FOR CREDIT LOSSES 12/31/2024 Ending Balance % of loans $178.7 million (0.97%) $15.0 million (0.09%) $193.7 million (1.05%) Q1 2025 Activity +$15.1 million Increase primarily reflecting the impacts of increased uncertainty in the economic outlook. +$0.2 million Slight increase primarily reflecting the impacts of increased uncertainty in the economic outlook. +$15.3 million $17.6 million Provision for Credit Losses and $2.3 million net charge-offs 03/31/2025 Ending Balance % of loans $193.8 million (1.05%) $15.2 million (0.08%) $209.0 million (1.13%) Sandy Spring Initial Allowance – Non-PCD recorded via provision expense +$89.5 million +$11.4 million +$100.9 million Provision for credit losses Sandy Spring Initial Allowance – PCD recorded via PCD gross up of ALLL $28.3 million - $28.3 million Q2 2025 Activity +$4.0 million Increase primarily reflecting loan growth and the impacts of deteriorating macroeconomic forecasts. +$0.2 million Slight increase primarily reflecting the impacts of deteriorating macroeconomic forecasts. +$4.2 million $4.8 million Provision for Credit Losses and $0.6 million net charge-offs 06/30/2025 Ending Balance % of loans $315.6 million (1.15%) $26.8 million (0.10%) $342.4 million (1.25%) |

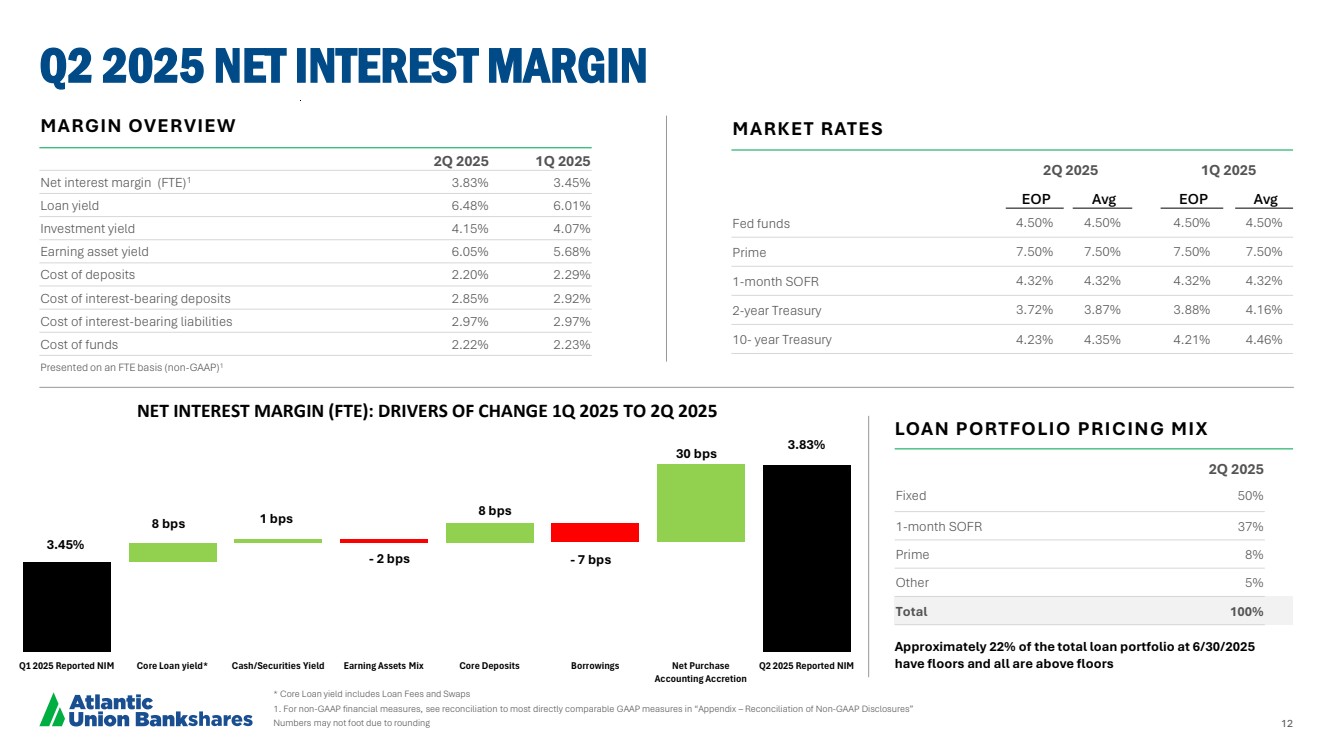

| 12 NET INTEREST MARGIN (FTE): DRIVERS OF CHANGE 1Q 2025 TO 2Q 2025 Q1 2025 Reported NIM Core Loan yield* Cash/Securities Yield Earning Assets Mix Core Deposits Borrowings Net Purchase Accounting Accretion Q2 2025 Reported NIM * Core Loan yield includes Loan Fees and Swaps 1. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Numbers may not foot due to rounding Q2 2025 NET INTEREST MARGIN MARKET RATES 2Q 2025 1Q 2025 EOP Avg EOP Avg Fed funds 4.50% 4.50% 4.50% 4.50% Prime 7.50% 7.50% 7.50% 7.50% 1-month SOFR 4.32% 4.32% 4.32% 4.32% 2-year Treasury 3.72% 3.87% 3.88% 4.16% 10- year Treasury 4.23% 4.35% 4.21% 4.46% MARGIN OVERVIEW 2Q 2025 1Q 2025 Net interest margin (FTE)1 3.83% 3.45% Loan yield 6.48% 6.01% Investment yield 4.15% 4.07% Earning asset yield 6.05% 5.68% Cost of deposits 2.20% 2.29% Cost of interest-bearing deposits 2.85% 2.92% Cost of interest-bearing liabilities 2.97% 2.97% Cost of funds 2.22% 2.23% Presented on an FTE basis (non-GAAP)1 Approximately 22% of the total loan portfolio at 6/30/2025 have floors and all are above floors LOAN PORTFOLIO PRICING MIX 2Q 2025 Fixed 50% 1-month SOFR 37% Prime 8% Other 5% Total 100% 3.45% 8 bps - 2 bps 30 bps 1 bps 3.83% 8 bps - 7 bps |

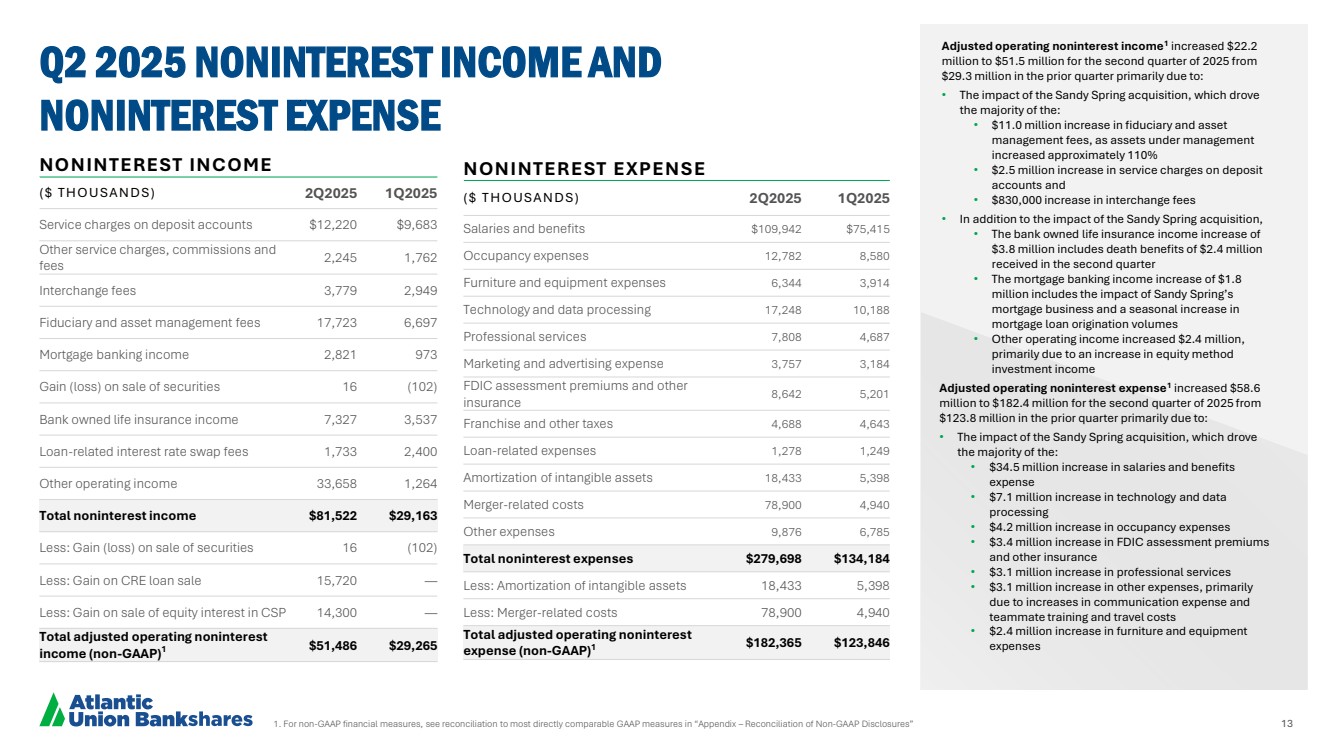

| 1. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” 13 Q2 2025 NONINTEREST INCOME AND NONINTEREST EXPENSE NONINTEREST EXPENSE ( $ T H O U S A N D S ) 2Q2025 1Q2025 Salaries and benefits $109,942 $75,415 Occupancy expenses 12,782 8,580 Furniture and equipment expenses 6,344 3,914 Technology and data processing 17,248 10,188 Professional services 7,808 4,687 Marketing and advertising expense 3,757 3,184 FDIC assessment premiums and other insurance 8,642 5,201 Franchise and other taxes 4,688 4,643 Loan-related expenses 1,278 1,249 Amortization of intangible assets 18,433 5,398 Merger-related costs 78,900 4,940 Other expenses 9,876 6,785 Total noninterest expenses $279,698 $134,184 Less: Amortization of intangible assets 18,433 5,398 Less: Merger-related costs 78,900 4,940 Total adjusted operating noninterest expense (non-GAAP)1 $182,365 $123,846 NONINTEREST INCOME ( $ T H O U S A N D S ) 2Q2025 1Q2025 Service charges on deposit accounts $12,220 $9,683 Other service charges, commissions and fees 2,245 1,762 Interchange fees 3,779 2,949 Fiduciary and asset management fees 17,723 6,697 Mortgage banking income 2,821 973 Gain (loss) on sale of securities 16 (102) Bank owned life insurance income 7,327 3,537 Loan-related interest rate swap fees 1,733 2,400 Other operating income 33,658 1,264 Total noninterest income $81,522 $29,163 Less: Gain (loss) on sale of securities 16 (102) Less: Gain on CRE loan sale 15,720 — Less: Gain on sale of equity interest in CSP 14,300 — Total adjusted operating noninterest income (non-GAAP)1 $51,486 $29,265 Adjusted operating noninterest income1 increased $22.2 million to $51.5 million for the second quarter of 2025 from $29.3 million in the prior quarter primarily due to: • The impact of the Sandy Spring acquisition, which drove the majority of the: • $11.0 million increase in fiduciary and asset management fees, as assets under management increased approximately 110% • $2.5 million increase in service charges on deposit accounts and • $830,000 increase in interchange fees • In addition to the impact of the Sandy Spring acquisition, • The bank owned life insurance income increase of $3.8 million includes death benefits of $2.4 million received in the second quarter • The mortgage banking income increase of $1.8 million includes the impact of Sandy Spring’s mortgage business and a seasonal increase in mortgage loan origination volumes • Other operating income increased $2.4 million, primarily due to an increase in equity method investment income Adjusted operating noninterest expense1 increased $58.6 million to $182.4 million for the second quarter of 2025 from $123.8 million in the prior quarter primarily due to: • The impact of the Sandy Spring acquisition, which drove the majority of the: • $34.5 million increase in salaries and benefits expense • $7.1 million increase in technology and data processing • $4.2 million increase in occupancy expenses • $3.4 million increase in FDIC assessment premiums and other insurance • $3.1 million increase in professional services • $3.1 million increase in other expenses, primarily due to increases in communication expense and teammate training and travel costs • $2.4 million increase in furniture and equipment expenses |

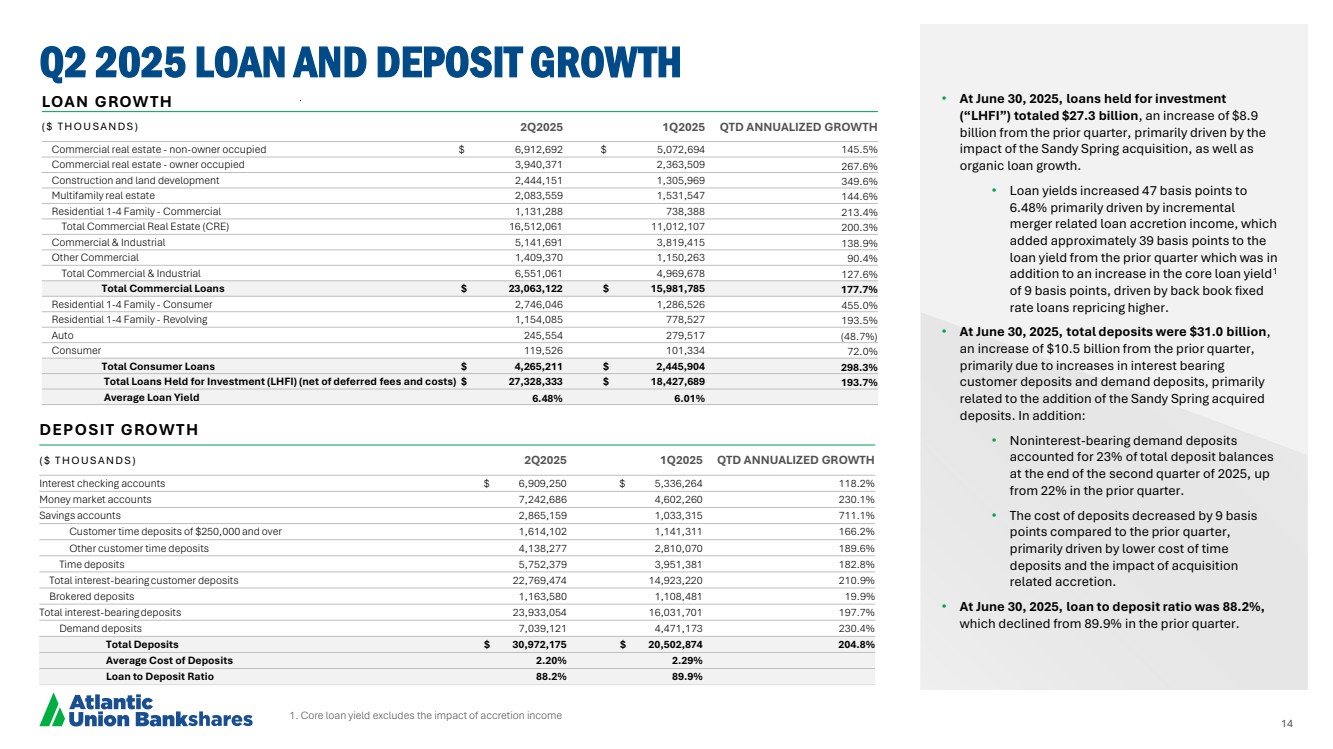

| 14 Q2 2025 LOAN AND DEPOSIT GROWTH LOAN GROWTH ( $ T H O U S A N D S ) 2Q2025 1Q2025 QTD ANNUALIZED GROWTH Commercial real estate - non-owner occupied $ 6,912,692 $ 5,072,694 145.5% Commercial real estate - owner occupied 3,940,371 2,363,509 267.6% Construction and land development 2,444,151 1,305,969 349.6% Multifamily real estate 2,083,559 1,531,547 144.6% Residential 1-4 Family - Commercial 1,131,288 738,388 213.4% Total Commercial Real Estate (CRE) 16,512,061 11,012,107 200.3% Commercial & Industrial 5,141,691 3,819,415 138.9% Other Commercial 1,409,370 1,150,263 90.4% Total Commercial & Industrial 6,551,061 4,969,678 127.6% Total Commercial Loans $ 23,063,122 $ 15,981,785 177.7% Residential 1-4 Family - Consumer 2,746,046 1,286,526 455.0% Residential 1-4 Family - Revolving 1,154,085 778,527 193.5% Auto 245,554 279,517 (48.7%) Consumer 119,526 101,334 72.0% Total Consumer Loans $ 4,265,211 $ 2,445,904 298.3% Total Loans Held for Investment (LHFI) (net of deferred fees and costs) $ 27,328,333 $ 18,427,689 193.7% Average Loan Yield 6.48% 6.01% DEPOSIT GROWTH ( $ T H O U S A N D S ) 2Q2025 1Q2025 QTD ANNUALIZED GROWTH Interest checking accounts $ 6,909,250 $ 5,336,264 118.2% Money market accounts 7,242,686 4,602,260 230.1% Savings accounts 2,865,159 1,033,315 711.1% Customer time deposits of $250,000 and over 1,614,102 1,141,311 166.2% Other customer time deposits 4,138,277 2,810,070 189.6% Time deposits 5,752,379 3,951,381 182.8% Total interest-bearing customer deposits 22,769,474 14,923,220 210.9% Brokered deposits 1,163,580 1,108,481 19.9% Total interest-bearing deposits 23,933,054 16,031,701 197.7% Demand deposits 7,039,121 4,471,173 230.4% Total Deposits $ 30,972,175 $ 20,502,874 204.8% Average Cost of Deposits 2.20% 2.29% Loan to Deposit Ratio 88.2% 89.9% • At June 30, 2025, loans held for investment (“LHFI”) totaled $27.3 billion, an increase of $8.9 billion from the prior quarter, primarily driven by the impact of the Sandy Spring acquisition, as well as organic loan growth. • Loan yields increased 47 basis points to 6.48% primarily driven by incremental merger related loan accretion income, which added approximately 39 basis points to the loan yield from the prior quarter which was in addition to an increase in the core loan yield1 of 9 basis points, driven by back book fixed rate loans repricing higher. • At June 30, 2025, total deposits were $31.0 billion, an increase of $10.5 billion from the prior quarter, primarily due to increases in interest bearing customer deposits and demand deposits, primarily related to the addition of the Sandy Spring acquired deposits. In addition: • Noninterest-bearing demand deposits accounted for 23% of total deposit balances at the end of the second quarter of 2025, up from 22% in the prior quarter. • The cost of deposits decreased by 9 basis points compared to the prior quarter, primarily driven by lower cost of time deposits and the impact of acquisition related accretion. • At June 30, 2025, loan to deposit ratio was 88.2%, which declined from 89.9% in the prior quarter. 1. Core loan yield excludes the impact of accretion income |

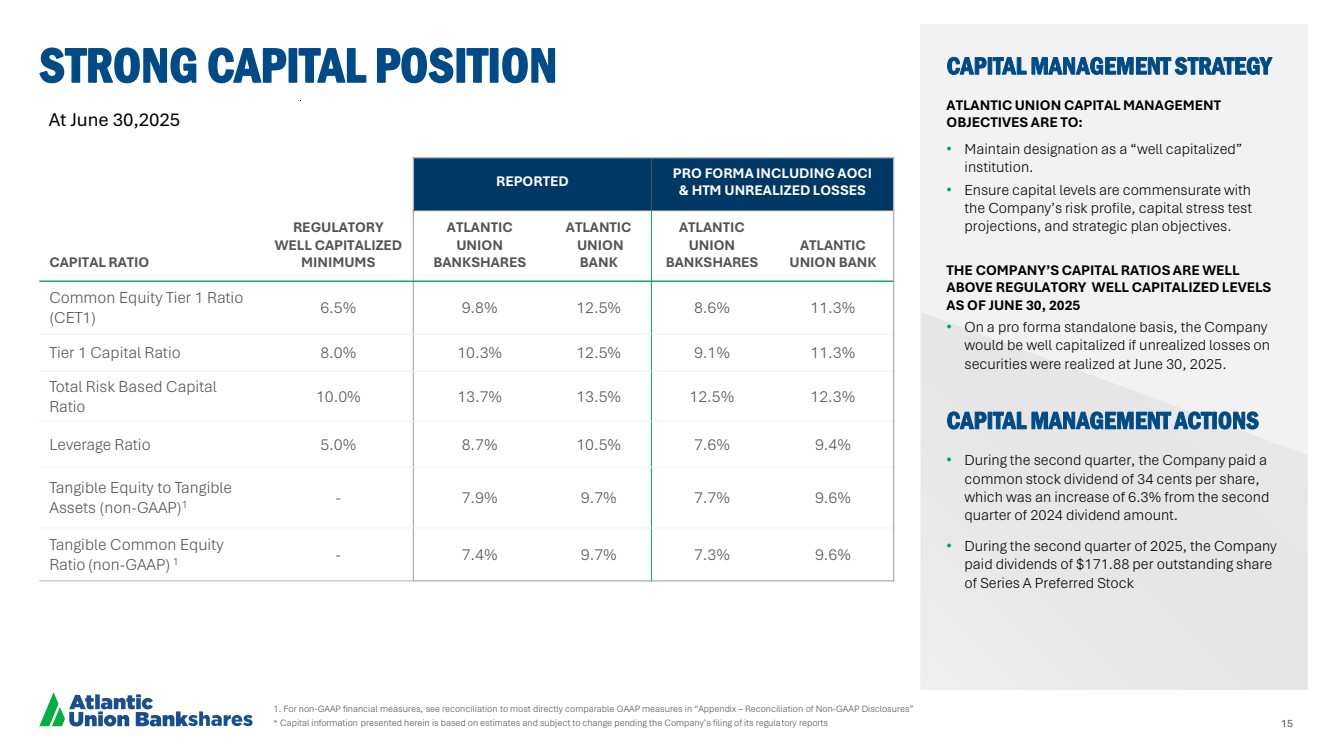

| 15 CAPITAL RATIO REGULATORY WELL CAPITALIZED MINIMUMS REPORTED PRO FORMA INCLUDING AOCI & HTM UNREALIZED LOSSES ATLANTIC UNION BANKSHARES ATLANTIC UNION BANK ATLANTIC UNION BANKSHARES ATLANTIC UNION BANK Common Equity Tier 1 Ratio (CET1) 6.5% 9.8% 12.5% 8.6% 11.3% Tier 1 Capital Ratio 8.0% 10.3% 12.5% 9.1% 11.3% Total Risk Based Capital Ratio 10.0% 13.7% 13.5% 12.5% 12.3% Leverage Ratio 5.0% 8.7% 10.5% 7.6% 9.4% Tangible Equity to Tangible Assets (non-GAAP)1 - 7.9% 9.7% 7.7% 9.6% Tangible Common Equity Ratio (non-GAAP) 1 - 7.4% 9.7% 7.3% 9.6% 1. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” * Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulatory reports STRONG CAPITAL POSITION CAPITAL MANAGEMENT STRATEGY ATLANTIC UNION CAPITAL MANAGEMENT OBJECTIVES ARE TO: • Maintain designation as a “well capitalized” institution. • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives. THE COMPANY’S CAPITAL RATIOS ARE WELL ABOVE REGULATORY WELL CAPITALIZED LEVELS AS OF JUNE 30, 2025 • On a pro forma standalone basis, the Company would be well capitalized if unrealized losses on securities were realized at June 30, 2025. CAPITAL MANAGEMENT ACTIONS • During the second quarter, the Company paid a common stock dividend of 34 cents per share, which was an increase of 6.3% from the second quarter of 2024 dividend amount. • During the second quarter of 2025, the Company paid dividends of $171.88 per outstanding share of Series A Preferred Stock At June 30,2025 |

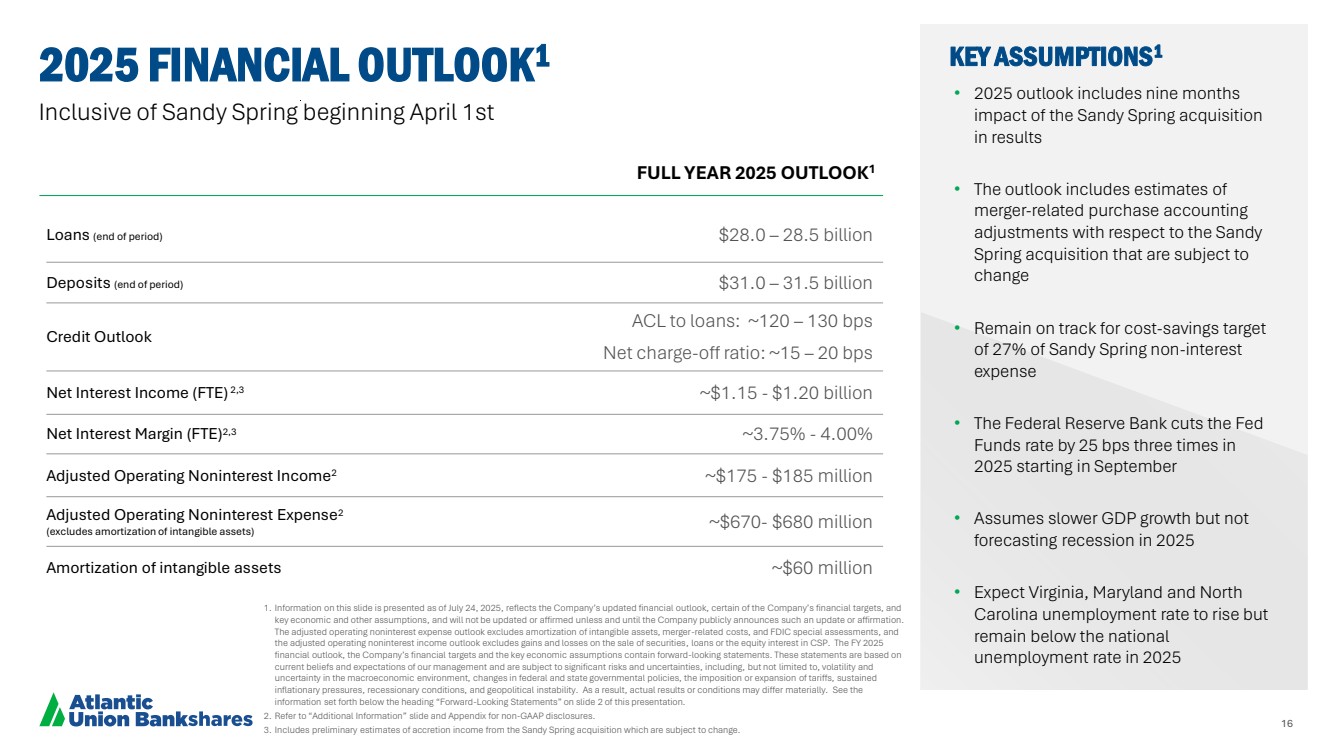

| 16 1. Information on this slide is presented as of July 24, 2025, reflects the Company’s updated financial outlook, certain of the Company’s financial targets, and key economic and other assumptions, and will not be updated or affirmed unless and until the Company publicly announces such an update or affirmation. The adjusted operating noninterest expense outlook excludes amortization of intangible assets, merger-related costs, and FDIC special assessments, and the adjusted operating noninterest income outlook excludes gains and losses on the sale of securities, loans or the equity interest in CSP. The FY 2025 financial outlook, the Company’s financial targets and the key economic assumptions contain forward-looking statements. These statements are based on current beliefs and expectations of our management and are subject to significant risks and uncertainties, including, but not limited to, volatility and uncertainty in the macroeconomic environment, changes in federal and state governmental policies, the imposition or expansion of tariffs, sustained inflationary pressures, recessionary conditions, and geopolitical instability. As a result, actual results or conditions may differ materially. See the information set forth below the heading “Forward-Looking Statements” on slide 2 of this presentation. 2. Refer to “Additional Information” slide and Appendix for non-GAAP disclosures. 3. Includes preliminary estimates of accretion income from the Sandy Spring acquisition which are subject to change. 2025 FINANCIAL OUTLOOK1 • 2025 outlook includes nine months impact of the Sandy Spring acquisition in results • The outlook includes estimates of merger-related purchase accounting adjustments with respect to the Sandy Spring acquisition that are subject to change • Remain on track for cost-savings target of 27% of Sandy Spring non-interest expense • The Federal Reserve Bank cuts the Fed Funds rate by 25 bps three times in 2025 starting in September • Assumes slower GDP growth but not forecasting recession in 2025 • Expect Virginia, Maryland and North Carolina unemployment rate to rise but remain below the national unemployment rate in 2025 Loans (end of period) $28.0 – 28.5 billion Deposits (end of period) $31.0 – 31.5 billion Credit Outlook ACL to loans: ~120 – 130 bps Net charge-off ratio: ~15 – 20 bps Net Interest Income (FTE) 2,3 ~$1.15 - $1.20 billion Net Interest Margin (FTE)2,3 ~3.75% - 4.00% Adjusted Operating Noninterest Income2 ~$175 - $185 million Adjusted Operating Noninterest Expense2 (excludes amortization of intangible assets) ~$670- $680 million Amortization of intangible assets ~$60 million KEY ASSUMPTIONS1 FULL YEAR 2025 OUTLOOK1 Inclusive of Sandy Spring beginning April 1st |

| AUB FRANCHISE PERSPECTIVES |

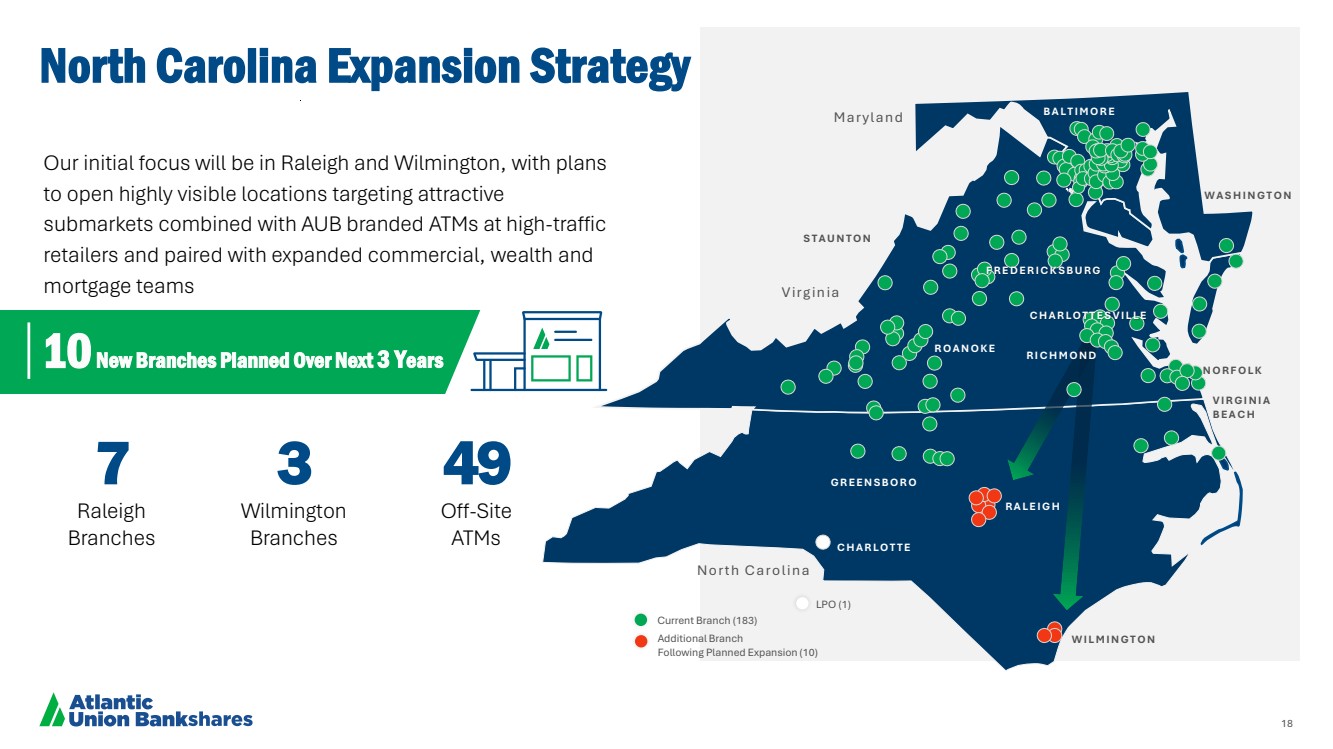

| 18 10 New Branches Planned Over Next 3 Years Our initial focus will be in Raleigh and Wilmington, with plans to open highly visible locations targeting attractive submarkets combined with AUB branded ATMs at high-traffic retailers and paired with expanded commercial, wealth and mortgage teams North Carolina Expansion Strategy 7 Raleigh Branches 3 Wilmington Branches 49 Off-Site ATMs N O R F O L K V I R G I N I A B E A C H M a ry l a n d V irg in ia No rth C a ro l in a C H A R L O T T E W I L M I N G T O N B A L T I M O R E R A L E I G H G R E E N S B O R O W A S H I N G T O N R O A N O K E S T A U N T O N C H A R L O T T E S V I L L E R I C H M O N D F R E D E R I C K S B U R G Current Branch (183) LPO (1) Additional Branch Following Planned Expansion (10) |

| Q2 2025 APPENDIX |

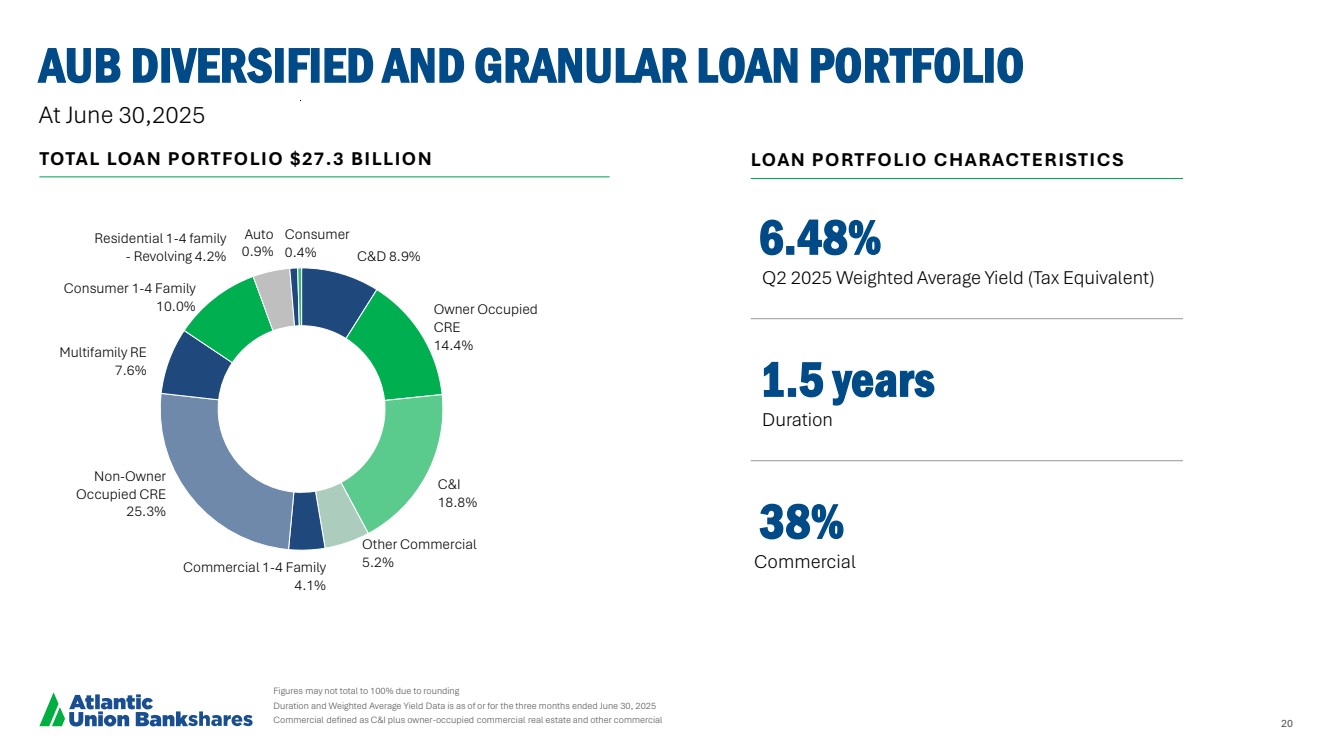

| 20 AUB DIVERSIFIED AND GRANULAR LOAN PORTFOLIO Figures may not total to 100% due to rounding Duration and Weighted Average Yield Data is as of or for the three months ended June 30, 2025 Commercial defined as C&I plus owner-occupied commercial real estate and other commercial Duration Q2 2025 Weighted Average Yield (Tax Equivalent) C&D 8.9% Owner Occupied CRE 14.4% C&I 18.8% Other Commercial Commercial 1-4 Family 5.2% 4.1% Non-Owner Occupied CRE 25.3% Multifamily RE 7.6% Consumer 1-4 Family 10.0% Residential 1-4 family - Revolving 4.2% Auto 0.9% Consumer 0.4% TOTAL LOAN PORTFOLIO $27.3 BILLION Total Portfolio Characteristics At June 30,2025 LOAN PORTFOLIO CHARACTERISTICS 1.5 years Duration 38% Commercial 6.48% Q2 2025 Weighted Average Yield (Tax Equivalent) |

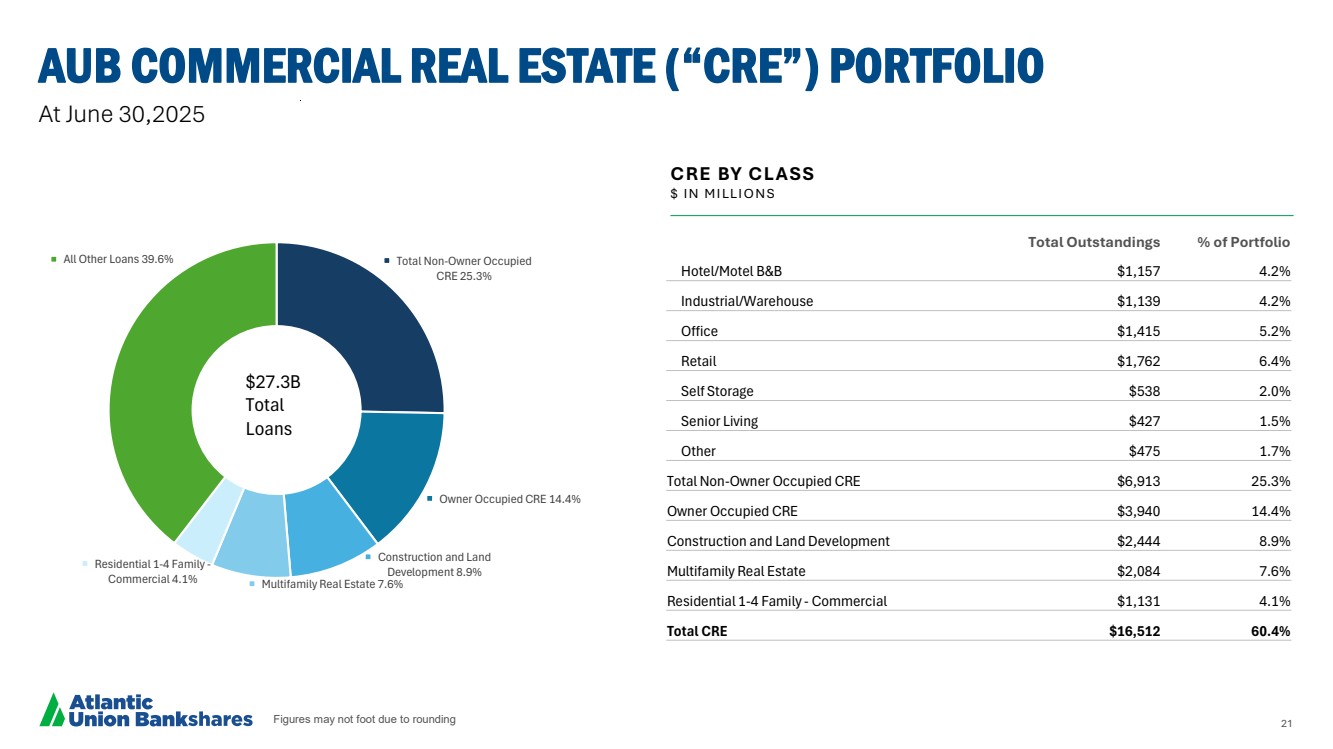

| 21 Total Non-Owner Occupied CRE 25.3% Owner Occupied CRE 14.4% Construction and Land Development 8.9% Multifamily Real Estate 7.6% Residential 1-4 Family - Commercial 4.1% All Other Loans 39.6% Figures may not foot due to rounding AUB COMMERCIAL REAL ESTATE (“CRE”) PORTFOLIO At June 30,2025 CRE BY CLASS $ I N M I LLI O N S $27.3B Total Loans Total Outstandings % of Portfolio Hotel/Motel B&B $1,157 4.2% Industrial/Warehouse $1,139 4.2% Office $1,415 5.2% Retail $1,762 6.4% Self Storage $538 2.0% Senior Living $427 1.5% Other $475 1.7% Total Non-Owner Occupied CRE $6,913 25.3% Owner Occupied CRE $3,940 14.4% Construction and Land Development $2,444 8.9% Multifamily Real Estate $2,084 7.6% Residential 1-4 Family - Commercial $1,131 4.1% Total CRE $16,512 60.4% |

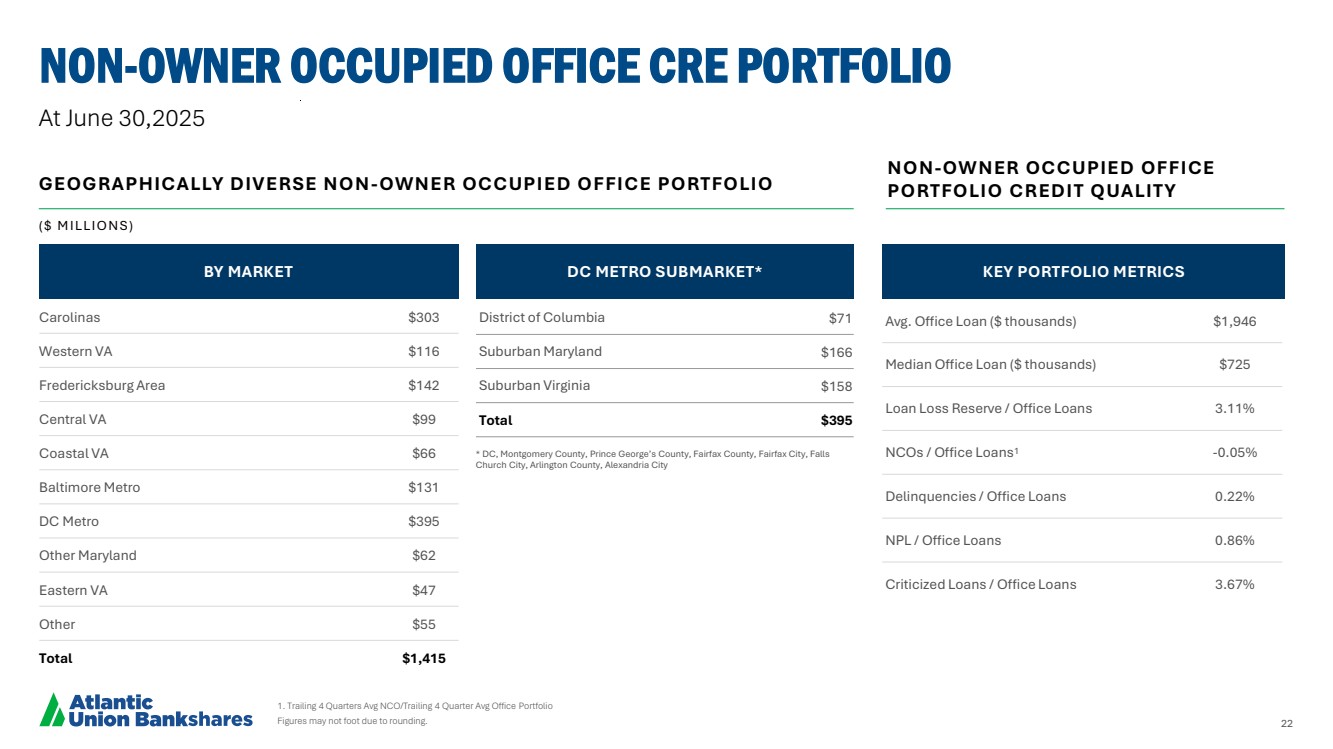

| 22 At June 30,2025 1. Trailing 4 Quarters Avg NCO/Trailing 4 Quarter Avg Office Portfolio Figures may not foot due to rounding. NON-OWNER OCCUPIED OFFICE CRE PORTFOLIO NON-OWNER OCCUPIED OFFICE GEOGRAPHICALLY DIVERSE NON PORTFOLIO CREDIT QUALITY -OWNER OCCUPIED OFFICE PORTFOLIO * DC, Montgomery County, Prince George’s County, Fairfax County, Fairfax City, Falls Church City, Arlington County, Alexandria City ( $ M I LLI O N S ) Avg. Office Loan ($ thousands) $1,946 Median Office Loan ($ thousands) $725 Loan Loss Reserve / Office Loans 3.11% NCOs / Office Loans1 -0.05% Delinquencies / Office Loans 0.22% NPL / Office Loans 0.86% Criticized Loans / Office Loans 3.67% Carolinas $303 Western VA $116 Fredericksburg Area $142 Central VA $99 Coastal VA $66 Baltimore Metro $131 DC Metro $395 Other Maryland $62 Eastern VA $47 Other $55 Total $1,415 District of Columbia $71 Suburban Maryland $166 Suburban Virginia $158 Total $395 BY MARKET DC METRO SUBMARKET* KEY PORTFOLIO METRICS |

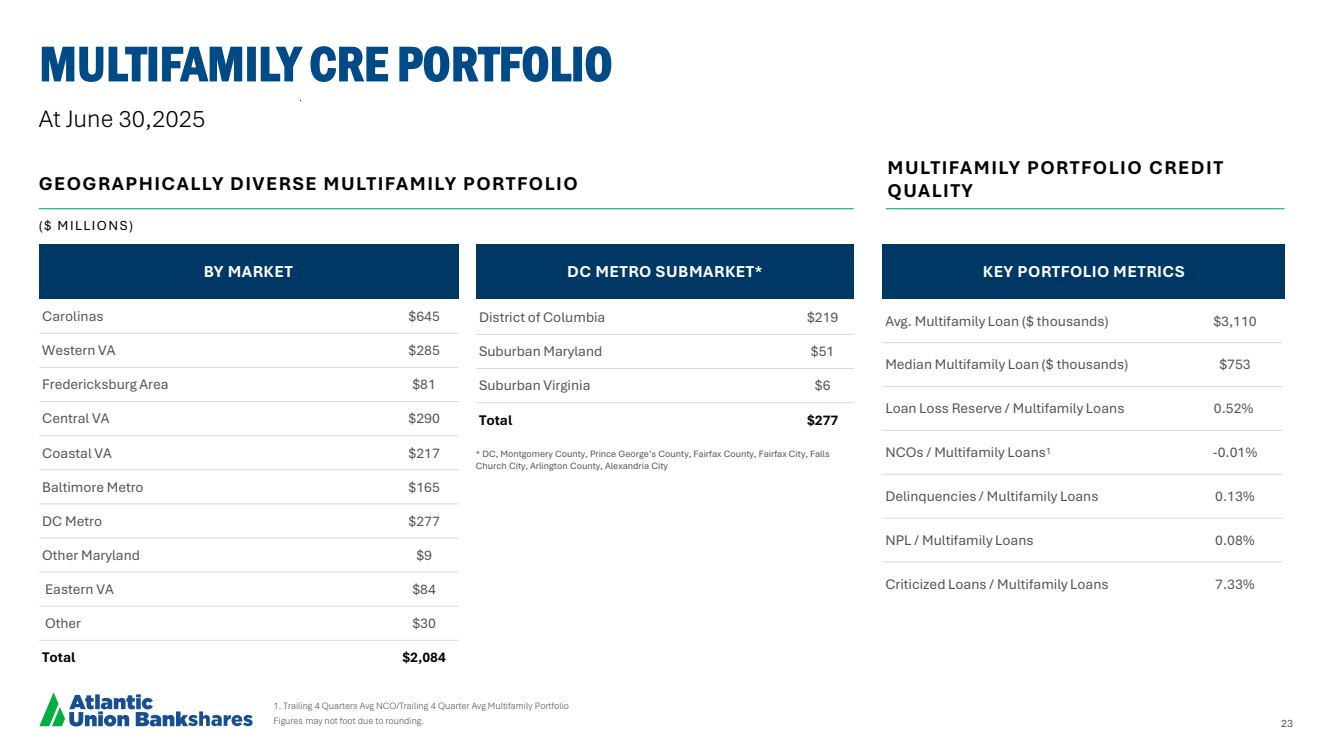

| 23 MULTIFAMILY CRE PORTFOLIO 1. Trailing 4 Quarters Avg NCO/Trailing 4 Quarter Avg Multifamily Portfolio Figures may not foot due to rounding. Avg. Multifamily Loan ($ thousands) $3,110 Median Multifamily Loan ($ thousands) $753 Loan Loss Reserve / Multifamily Loans 0.52% NCOs / Multifamily Loans1 -0.01% Delinquencies / Multifamily Loans 0.13% NPL / Multifamily Loans 0.08% Criticized Loans / Multifamily Loans 7.33% Carolinas $645 Western VA $285 Fredericksburg Area $81 Central VA $290 Coastal VA $217 Baltimore Metro $165 DC Metro $277 Other Maryland $9 Eastern VA $84 Other $30 Total $2,084 At June 30,2025 District of Columbia $219 Suburban Maryland $51 Suburban Virginia $6 Total $277 * DC, Montgomery County, Prince George’s County, Fairfax County, Fairfax City, Falls Church City, Arlington County, Alexandria City BY MARKET MULTIFAMILY PORTFOLIO CREDIT GEOGRAPHICALLY DIVERSE MULTIFAMILY PORTFOLIO QUALITY DC METRO SUBMARKET* KEY PORTFOLIO METRICS ( $ M I LLI O N S ) |

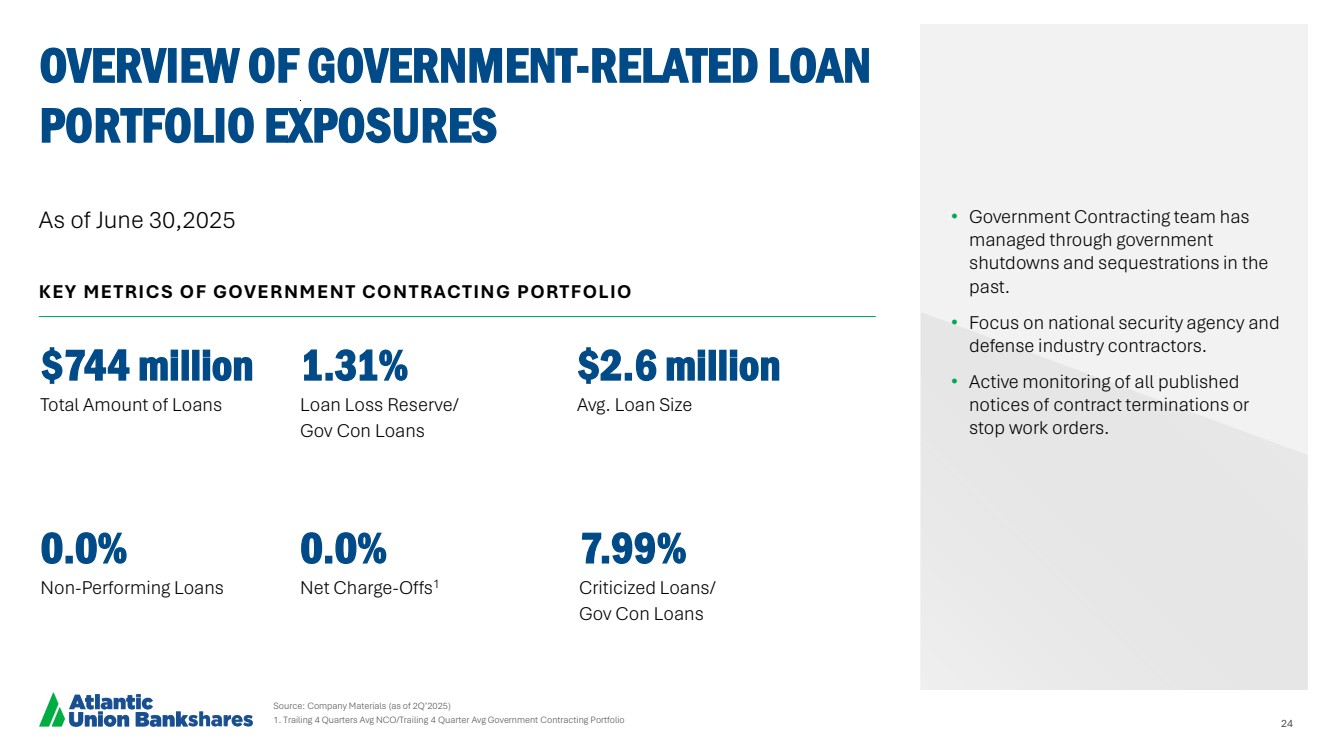

| 24 $744 million 1.31% $2.6 million Total Amount of Loans Loan Loss Reserve/ Gov Con Loans Avg. Loan Size 0.0% 0.0% 7.99% Non-Performing Loans Net Charge-Offs1 Criticized Loans/ Gov Con Loans Source: Company Materials (as of 2Q’2025) 1. Trailing 4 Quarters Avg NCO/Trailing 4 Quarter Avg Government Contracting Portfolio OVERVIEW OF GOVERNMENT-RELATED LOAN PORTFOLIO EXPOSURES • Government Contracting team has managed through government shutdowns and sequestrations in the past. • Focus on national security agency and defense industry contractors. • Active monitoring of all published notices of contract terminations or stop work orders. KEY METRICS OF GOVERNMENT CONTRACTING PORTFOLIO As of June 30,2025 |

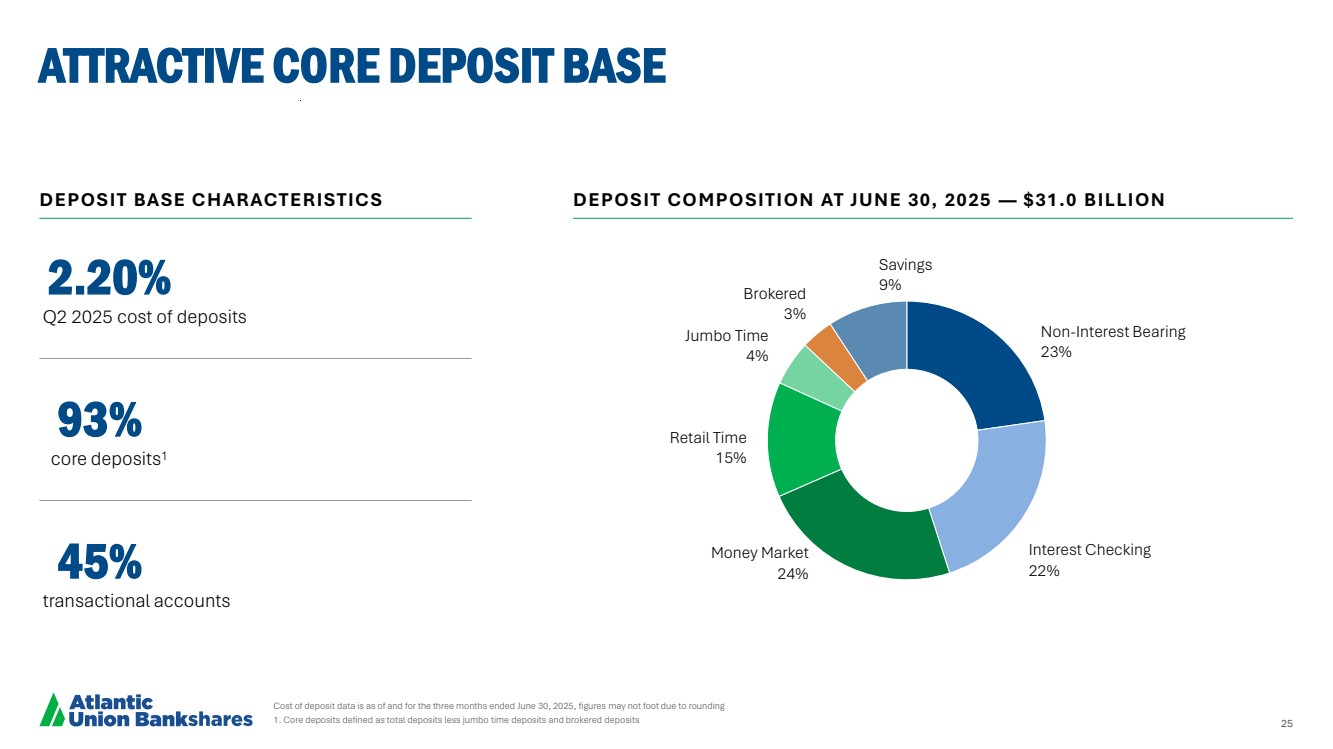

| 25 ATTRACTIVE CORE DEPOSIT BASE Cost of deposit data is as of and for the three months ended June 30, 2025, figures may not foot due to rounding 1. Core deposits defined as total deposits less jumbo time deposits and brokered deposits Non-Interest Bearing 23% Interest Checking 22% Money Market 24% Retail Time 15% Jumbo Time 4% Brokered 3% Savings 9% DEPOSIT BASE CHARACTERISTICS DEPOSIT COMPOSITION AT JUNE 30, 2025 — $31.0 BILLION 93% core deposits1 45% transactional accounts 2.20% Q2 2025 cost of deposits |

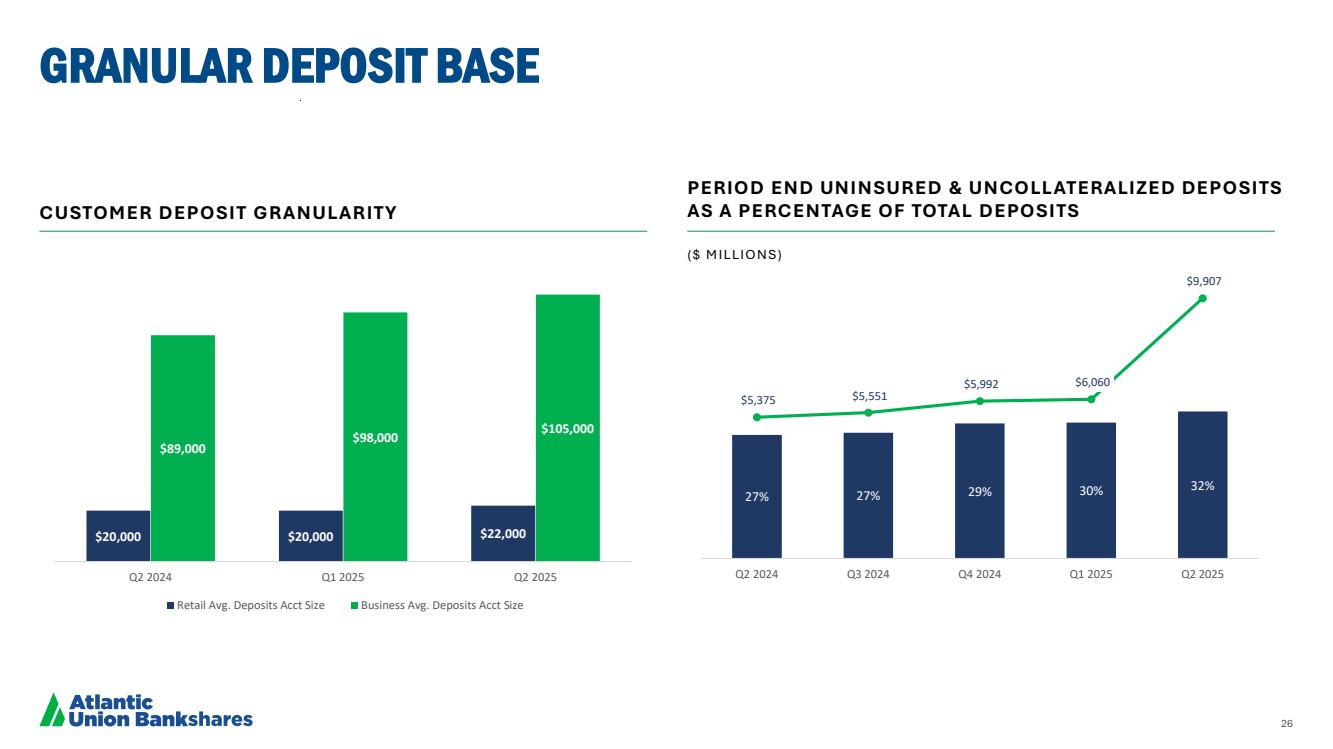

| 26 GRANULAR DEPOSIT BASE CUSTOMER DEPOSIT GRANULARITY PERIOD END UNINSURED & UNCOLLATERALIZED DEPOSITS AS A PERCENTAGE OF TOTAL DEPOSITS ( $ M I LLI O N S ) 27% 27% 29% 30% 32% $5,375 $5,551 $5,992 $6,060 $9,907 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 $20,000 $20,000 $22,000 $89,000 $98,000 $105,000 Q2 2024 Q1 2025 Q2 2025 Retail Avg. Deposits Acct Size Business Avg. Deposits Acct Size |

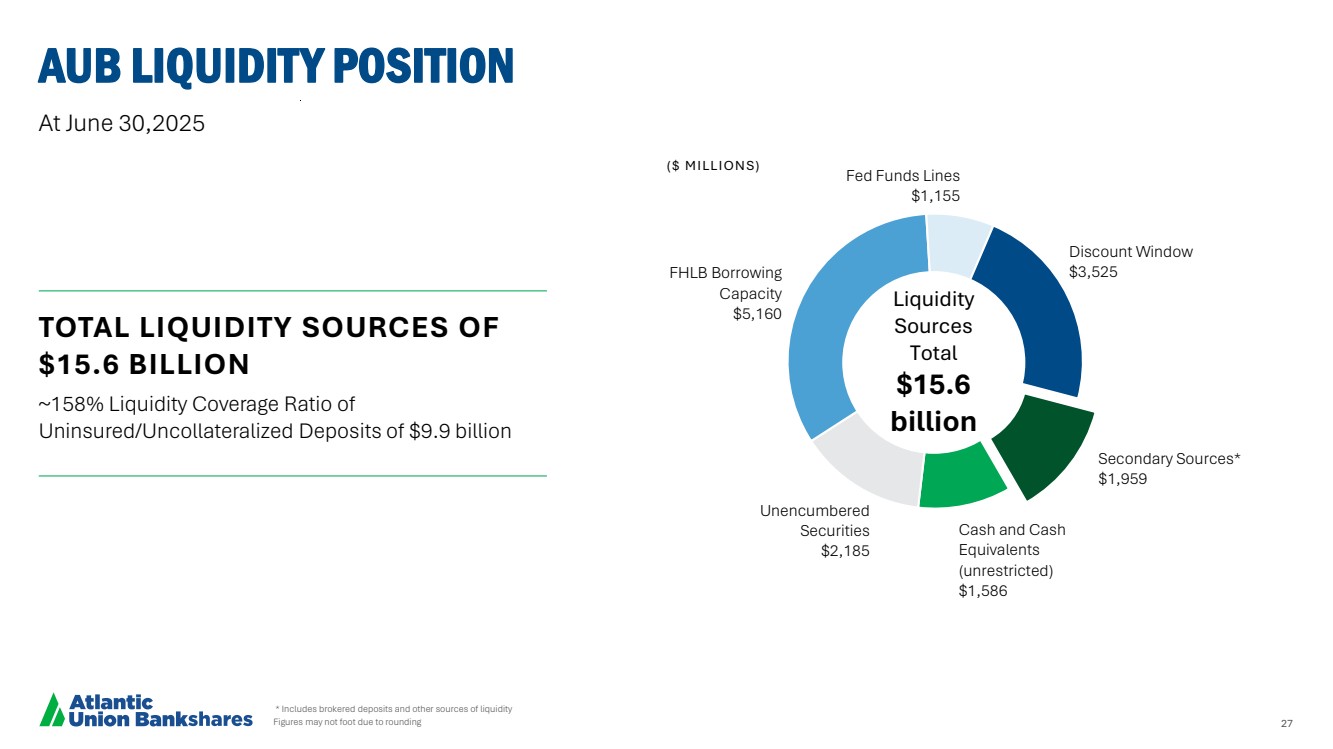

| 27 Cash and Cash Equivalents (unrestricted) $1,586 Unencumbered Securities $2,185 FHLB Borrowing Capacity $5,160 Fed Funds Lines $1,155 Discount Window $3,525 Secondary Sources* $1,959 AUB LIQUIDITY POSITION * Includes brokered deposits and other sources of liquidity Figures may not foot due to rounding Liquidity Sources Total $15.6 billion At June 30,2025 TOTAL LIQUIDITY SOURCES OF $15.6 BILLION ~158% Liquidity Coverage Ratio of Uninsured/Uncollateralized Deposits of $9.9 billion ($ MILLIONS) |

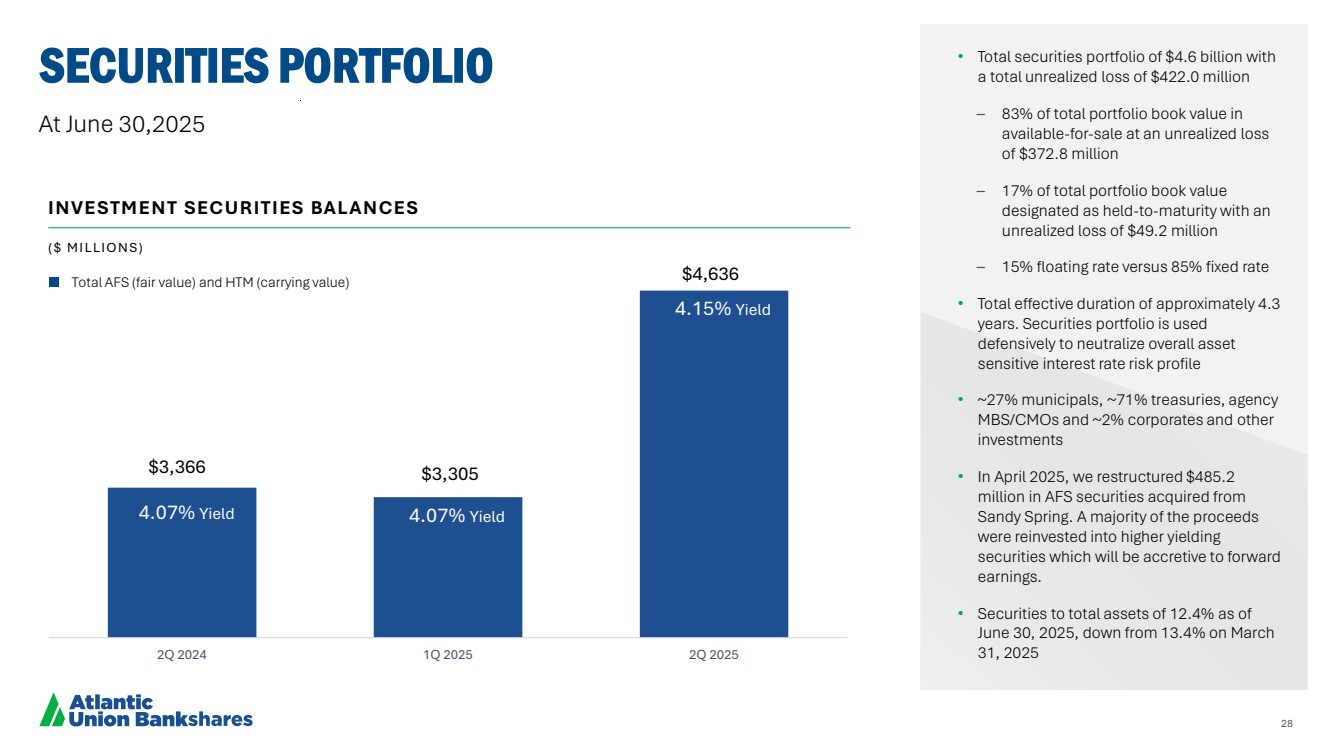

| 28 SECURITIES PORTFOLIO • Total securities portfolio of $4.6 billion with a total unrealized loss of $422.0 million – 83% of total portfolio book value in available-for-sale at an unrealized loss of $372.8 million – 17% of total portfolio book value designated as held-to-maturity with an unrealized loss of $49.2 million – 15% floating rate versus 85% fixed rate • Total effective duration of approximately 4.3 years. Securities portfolio is used defensively to neutralize overall asset sensitive interest rate risk profile • ~27% municipals, ~71% treasuries, agency MBS/CMOs and ~2% corporates and other investments • In April 2025, we restructured $485.2 million in AFS securities acquired from Sandy Spring. A majority of the proceeds were reinvested into higher yielding securities which will be accretive to forward earnings. • Securities to total assets of 12.4% as of June 30, 2025, down from 13.4% on March 31, 2025 $3,366 $3,305 $4,636 2Q 2024 1Q 2025 2Q 2025 4.07% Yield 4.07% Yield 4.15% Yield INVESTMENT SECURITIES BALANCES Total AFS (fair value) and HTM (carrying value) At June 30,2025 ( $ M I LLI O N S ) |

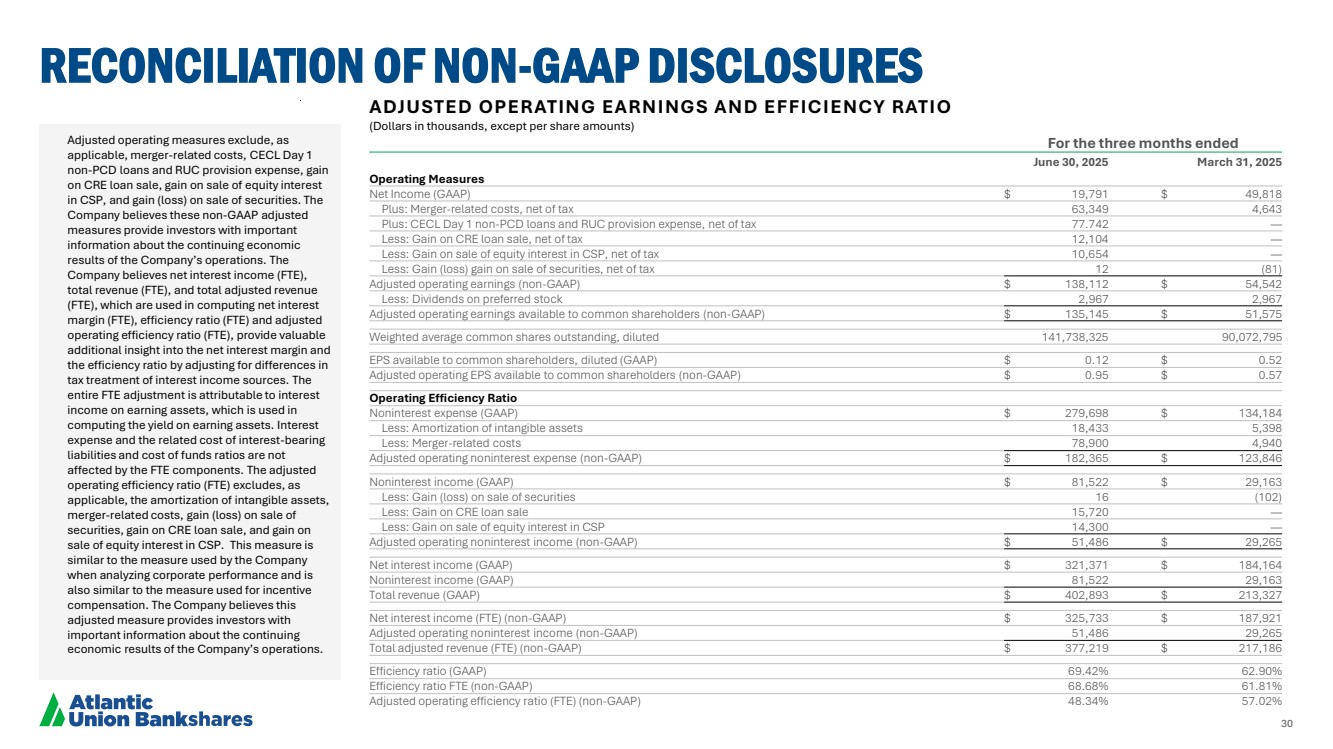

| 29 RECONCILIATION OF NON-GAAP DISCLOSURES We have provided supplemental performance measures determined by methods other than in accordance with GAAP. These non-GAAP financial measures are a supplement to GAAP, which we use to prepare our financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, our non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. We use the non-GAAP financial measures discussed herein in our analysis of our performance. Management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in our underlying performance or show the potential effects of accumulated other comprehensive income or unrealized losses on held to maturity securities on our capital. Due to the impact of completing the Sandy Spring acquisition in the second quarter of 2025 and the acquisition of American National Bankshares in the second quarter of 2024, we updated our non-GAAP operating measures beginning in the second quarter of 2025 to exclude the CECL Day 1 non-PCD loans and RUC provision expense. The CECL Day 1 non-PCD loans and RUC provision expense is comprised of the initial provision expense on non-PCD loans, which represents the CECL “double count” of the non-PCD credit mark, and the additional provision for unfunded commitments. The Company does not view the CECL Day 1 non-PCD loans and RUC provision expense as organic costs to run the Company’s business and believes this updated presentation will provide investors with additional information to assist in period-to-period and company-to-company comparisons of operating performance, which will aid investors in analyzing the Company’s performance. |

| 30 RECONCILIATION OF NON-GAAP DISCLOSURES ADJUSTED OPERATING EARNINGS AND EFFICIENCY RATIO (Dollars in thousands, except per share amounts) For the three months ended June 30, 2025 March 31, 2025 Operating Measures Net Income (GAAP) $ 19,791 $ 49,818 Plus: Merger-related costs, net of tax 63,349 4,643 Plus: CECL Day 1 non-PCD loans and RUC provision expense, net of tax 77.742 — Less: Gain on CRE loan sale, net of tax 12,104 — Less: Gain on sale of equity interest in CSP, net of tax 10,654 — Less: Gain (loss) gain on sale of securities, net of tax 12 (81) Adjusted operating earnings (non-GAAP) $ 138,112 $ 54,542 Less: Dividends on preferred stock 2,967 2,967 Adjusted operating earnings available to common shareholders (non-GAAP) $ 135,145 $ 51,575 Weighted average common shares outstanding, diluted 141,738,325 90,072,795 EPS available to common shareholders, diluted (GAAP) $ 0.12 $ 0.52 Adjusted operating EPS available to common shareholders (non-GAAP) $ 0.95 $ 0.57 Operating Efficiency Ratio Noninterest expense (GAAP) $ 279,698 $ 134,184 Less: Amortization of intangible assets 18,433 5,398 Less: Merger-related costs 78,900 4,940 Adjusted operating noninterest expense (non-GAAP) $ 182,365 $ 123,846 Noninterest income (GAAP) $ 81,522 $ 29,163 Less: Gain (loss) on sale of securities 16 (102) Less: Gain on CRE loan sale 15,720 — Less: Gain on sale of equity interest in CSP 14,300 — Adjusted operating noninterest income (non-GAAP) $ 51,486 $ 29,265 Net interest income (GAAP) $ 321,371 $ 184,164 Noninterest income (GAAP) 81,522 29,163 Total revenue (GAAP) $ 402,893 $ 213,327 Net interest income (FTE) (non-GAAP) $ 325,733 $ 187,921 Adjusted operating noninterest income (non-GAAP) 51,486 29,265 Total adjusted revenue (FTE) (non-GAAP) $ 377,219 $ 217,186 Efficiency ratio (GAAP) 69.42% 62.90% Efficiency ratio FTE (non-GAAP) 68.68% 61.81% Adjusted operating efficiency ratio (FTE) (non-GAAP) 48.34% 57.02% Adjusted operating measures exclude, as applicable, merger-related costs, CECL Day 1 non-PCD loans and RUC provision expense, gain on CRE loan sale, gain on sale of equity interest in CSP, and gain (loss) on sale of securities. The Company believes these non-GAAP adjusted measures provide investors with important information about the continuing economic results of the Company’s operations. The Company believes net interest income (FTE), total revenue (FTE), and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing the yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. The adjusted operating efficiency ratio (FTE) excludes, as applicable, the amortization of intangible assets, merger-related costs, gain (loss) on sale of securities, gain on CRE loan sale, and gain on sale of equity interest in CSP. This measure is similar to the measure used by the Company when analyzing corporate performance and is also similar to the measure used for incentive compensation. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations. |

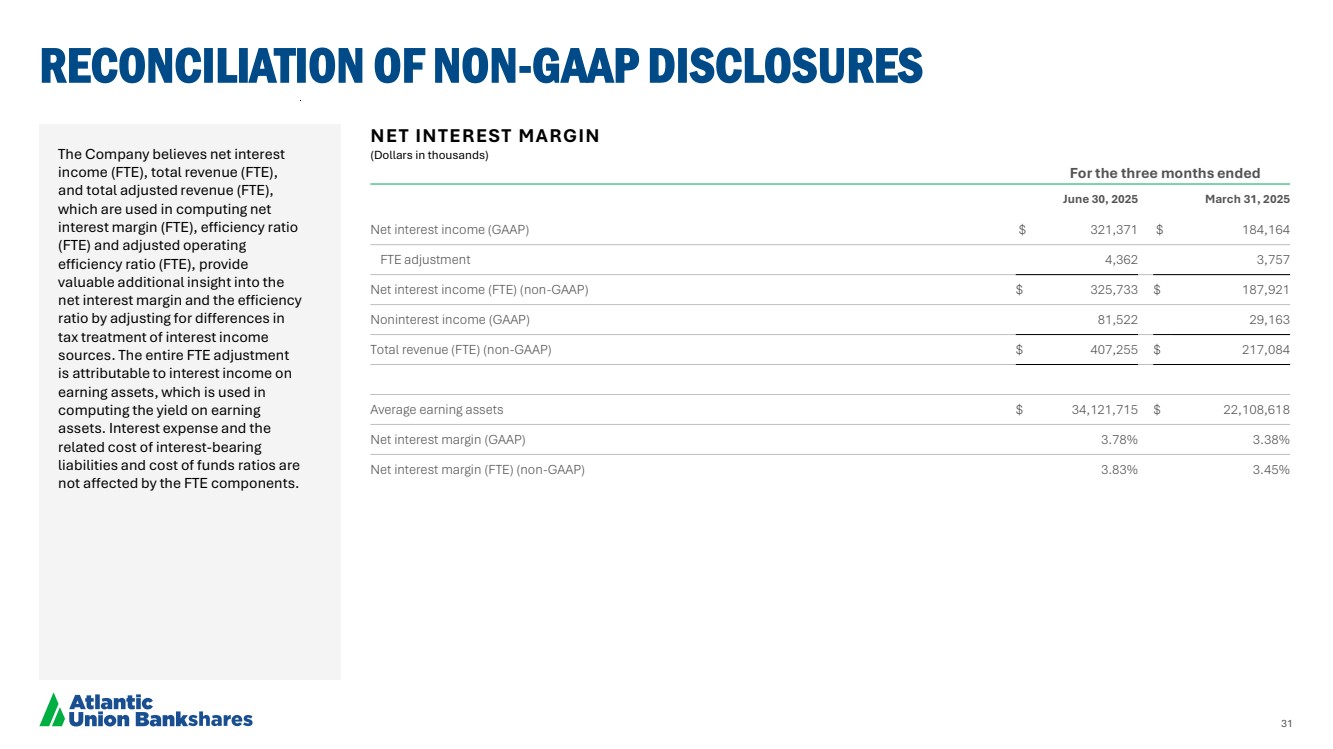

| 31 RECONCILIATION OF NON-GAAP DISCLOSURES The Company believes net interest income (FTE), total revenue (FTE), and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing the yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. NET INTEREST MARGIN (Dollars in thousands) For the three months ended June 30, 2025 March 31, 2025 Net interest income (GAAP) $ 321,371 $ 184,164 FTE adjustment 4,362 3,757 Net interest income (FTE) (non-GAAP) $ 325,733 $ 187,921 Noninterest income (GAAP) 81,522 29,163 Total revenue (FTE) (non-GAAP) $ 407,255 $ 217,084 Average earning assets $ 34,121,715 $ 22,108,618 Net interest margin (GAAP) 3.78% 3.38% Net interest margin (FTE) (non-GAAP) 3.83% 3.45% |

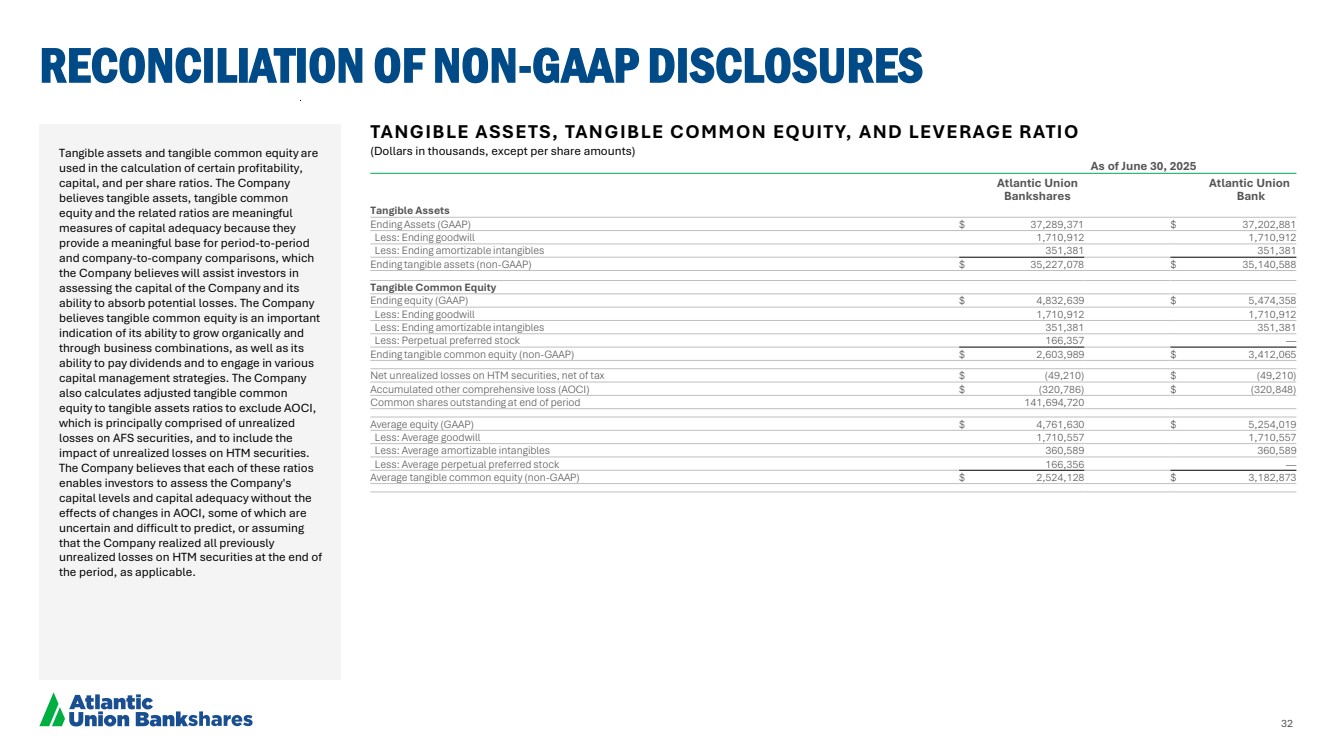

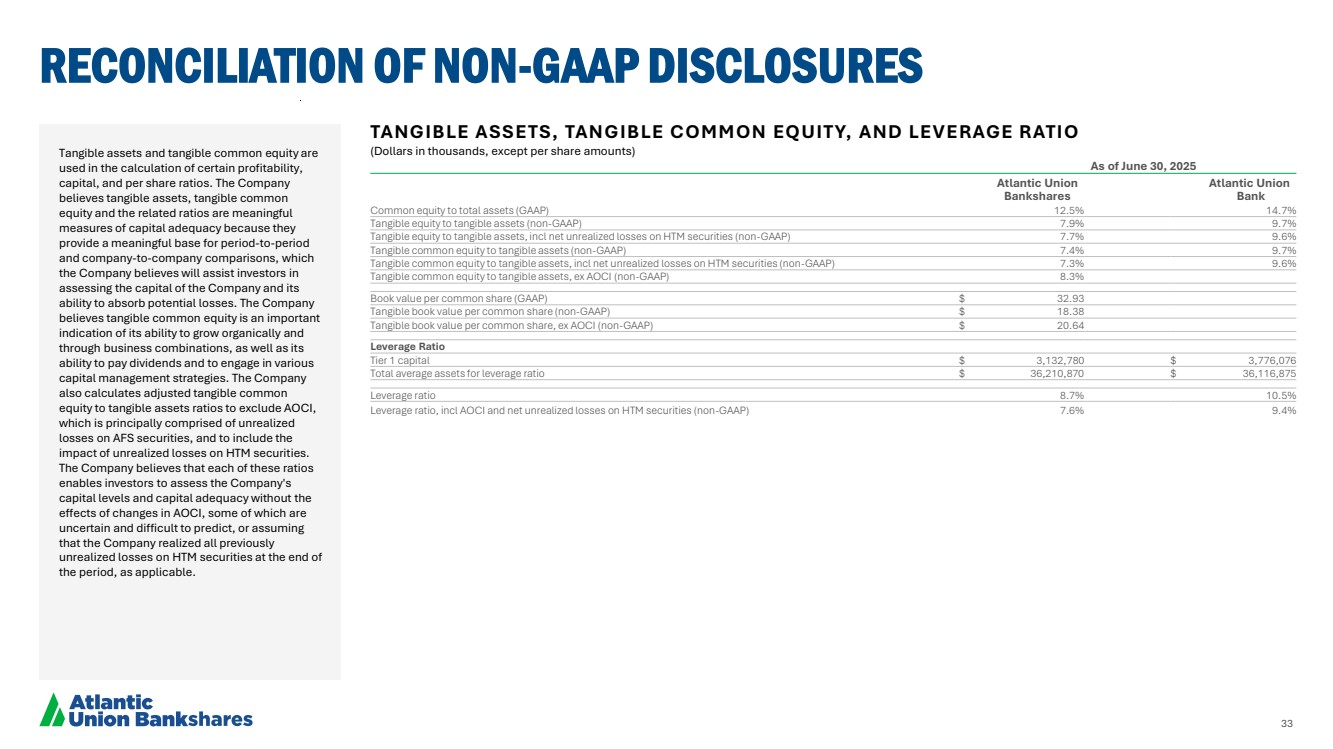

| 32 RECONCILIATION OF NON-GAAP DISCLOSURES TANGIBLE ASSETS, TANGIBLE COMMON EQUITY, AND LEVERAGE RATIO (Dollars in thousands, except per share amounts) As of June 30, 2025 Atlantic Union Bankshares Atlantic Union Bank Tangible Assets Ending Assets (GAAP) $ 37,289,371 $ 37,202,881 Less: Ending goodwill 1,710,912 1,710,912 Less: Ending amortizable intangibles 351,381 351,381 Ending tangible assets (non-GAAP) $ 35,227,078 $ 35,140,588 Tangible Common Equity Ending equity (GAAP) $ 4,832,639 $ 5,474,358 Less: Ending goodwill 1,710,912 1,710,912 Less: Ending amortizable intangibles 351,381 351,381 Less: Perpetual preferred stock 166,357 — Ending tangible common equity (non-GAAP) $ 2,603,989 $ 3,412,065 Net unrealized losses on HTM securities, net of tax $ (49,210) $ (49,210) Accumulated other comprehensive loss (AOCI) $ (320,786) $ (320,848) Common shares outstanding at end of period 141,694,720 Average equity (GAAP) $ 4,761,630 $ 5,254,019 Less: Average goodwill 1,710,557 1,710,557 Less: Average amortizable intangibles 360,589 360,589 Less: Average perpetual preferred stock 166,356 — Average tangible common equity (non-GAAP) $ 2,524,128 $ 3,182,873 Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. The Company also calculates adjusted tangible common equity to tangible assets ratios to exclude AOCI, which is principally comprised of unrealized losses on AFS securities, and to include the impact of unrealized losses on HTM securities. The Company believes that each of these ratios enables investors to assess the Company's capital levels and capital adequacy without the effects of changes in AOCI, some of which are uncertain and difficult to predict, or assuming that the Company realized all previously unrealized losses on HTM securities at the end of the period, as applicable. |

| 33 RECONCILIATION OF NON-GAAP DISCLOSURES TANGIBLE ASSETS, TANGIBLE COMMON EQUITY, AND LEVERAGE RATIO (Dollars in thousands, except per share amounts) As of June 30, 2025 Atlantic Union Bankshares Atlantic Union Bank Common equity to total assets (GAAP) 12.5% 14.7% Tangible equity to tangible assets (non-GAAP) 7.9% 9.7% Tangible equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 7.7% 9.6% Tangible common equity to tangible assets (non-GAAP) 7.4% 9.7% Tangible common equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 7.3% 9.6% Tangible common equity to tangible assets, ex AOCI (non-GAAP) 8.3% Book value per common share (GAAP) $ 32.93 Tangible book value per common share (non-GAAP) $ 18.38 Tangible book value per common share, ex AOCI (non-GAAP) $ 20.64 Leverage Ratio Tier 1 capital $ 3,132,780 $ 3,776,076 Total average assets for leverage ratio $ 36,210,870 $ 36,116,875 Leverage ratio 8.7% 10.5% Leverage ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 7.6% 9.4% Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. The Company also calculates adjusted tangible common equity to tangible assets ratios to exclude AOCI, which is principally comprised of unrealized losses on AFS securities, and to include the impact of unrealized losses on HTM securities. The Company believes that each of these ratios enables investors to assess the Company's capital levels and capital adequacy without the effects of changes in AOCI, some of which are uncertain and difficult to predict, or assuming that the Company realized all previously unrealized losses on HTM securities at the end of the period, as applicable. |

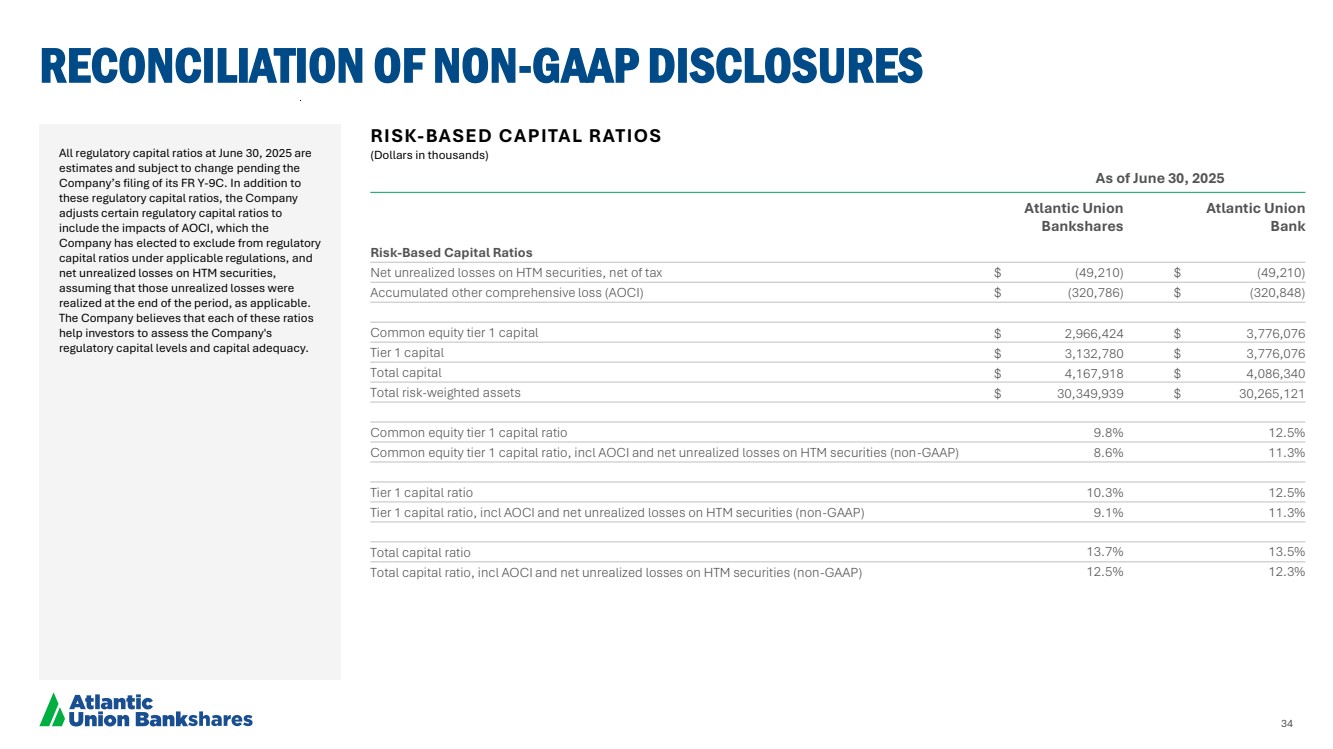

| 34 RECONCILIATION OF NON-GAAP DISCLOSURES RISK-BASED CAPITAL RATIOS (Dollars in thousands) As of June 30, 2025 Atlantic Union Bankshares Atlantic Union Bank Risk-Based Capital Ratios Net unrealized losses on HTM securities, net of tax $ (49,210) $ (49,210) Accumulated other comprehensive loss (AOCI) $ (320,786) $ (320,848) Common equity tier 1 capital $ 2,966,424 $ 3,776,076 Tier 1 capital $ 3,132,780 $ 3,776,076 Total capital $ 4,167,918 $ 4,086,340 Total risk-weighted assets $ 30,349,939 $ 30,265,121 Common equity tier 1 capital ratio 9.8% 12.5% Common equity tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 8.6% 11.3% Tier 1 capital ratio 10.3% 12.5% Tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 9.1% 11.3% Total capital ratio 13.7% 13.5% Total capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 12.5% 12.3% All regulatory capital ratios at June 30, 2025 are estimates and subject to change pending the Company’s filing of its FR Y-9C. In addition to these regulatory capital ratios, the Company adjusts certain regulatory capital ratios to include the impacts of AOCI, which the Company has elected to exclude from regulatory capital ratios under applicable regulations, and net unrealized losses on HTM securities, assuming that those unrealized losses were realized at the end of the period, as applicable. The Company believes that each of these ratios help investors to assess the Company's regulatory capital levels and capital adequacy. |

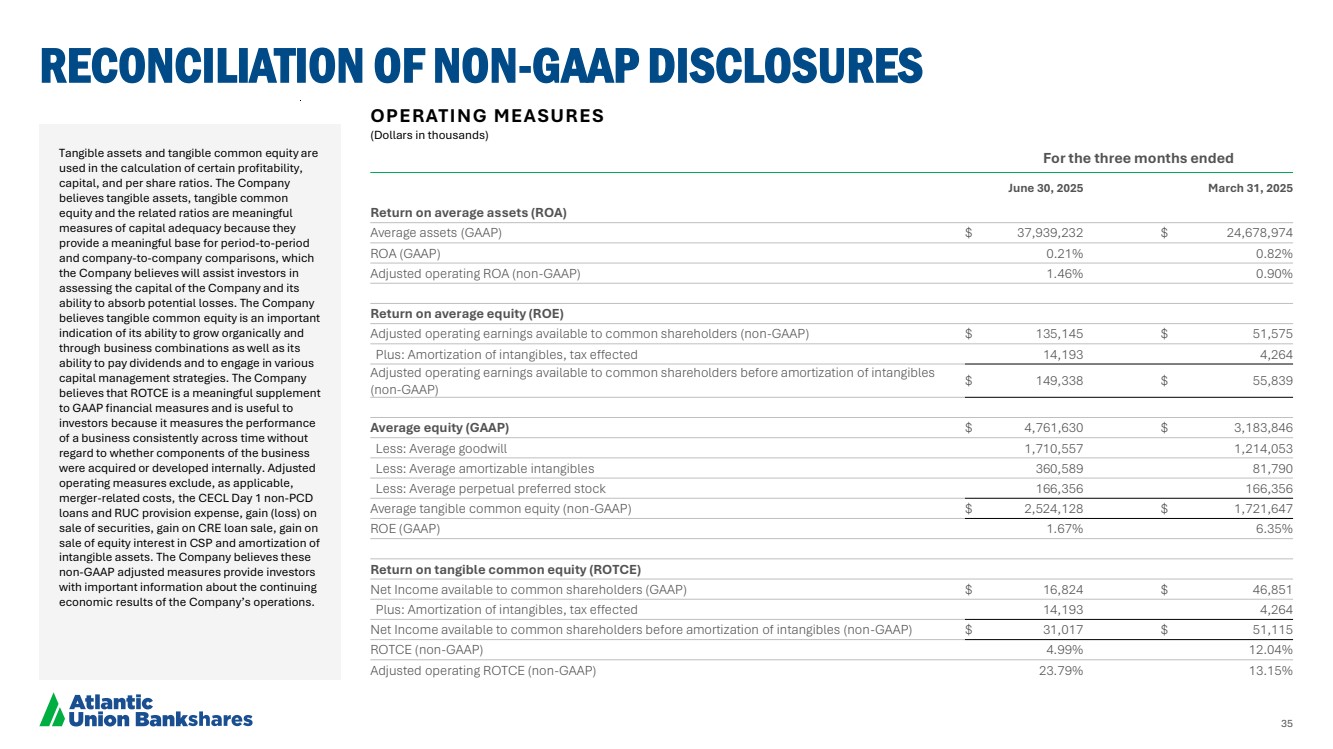

| 35 RECONCILIATION OF NON-GAAP DISCLOSURES OPERATING MEASURES (Dollars in thousands) For the three months ended June 30, 2025 March 31, 2025 Return on average assets (ROA) Average assets (GAAP) $ 37,939,232 $ 24,678,974 ROA (GAAP) 0.21% 0.82% Adjusted operating ROA (non-GAAP) 1.46% 0.90% Return on average equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) $ 135,145 $ 51,575 Plus: Amortization of intangibles, tax effected 14,193 4,264 Adjusted operating earnings available to common shareholders before amortization of intangibles (non-GAAP) $ 149,338 $ 55,839 Average equity (GAAP) $ 4,761,630 $ 3,183,846 Less: Average goodwill 1,710,557 1,214,053 Less: Average amortizable intangibles 360,589 81,790 Less: Average perpetual preferred stock 166,356 166,356 Average tangible common equity (non-GAAP) $ 2,524,128 $ 1,721,647 ROE (GAAP) 1.67% 6.35% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) $ 16,824 $ 46,851 Plus: Amortization of intangibles, tax effected 14,193 4,264 Net Income available to common shareholders before amortization of intangibles (non-GAAP) $ 31,017 $ 51,115 ROTCE (non-GAAP) 4.99% 12.04% Adjusted operating ROTCE (non-GAAP) 23.79% 13.15% Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations as well as its ability to pay dividends and to engage in various capital management strategies. The Company believes that ROTCE is a meaningful supplement to GAAP financial measures and is useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. Adjusted operating measures exclude, as applicable, merger-related costs, the CECL Day 1 non-PCD loans and RUC provision expense, gain (loss) on sale of securities, gain on CRE loan sale, gain on sale of equity interest in CSP and amortization of intangible assets. The Company believes these non-GAAP adjusted measures provide investors with important information about the continuing economic results of the Company’s operations. |

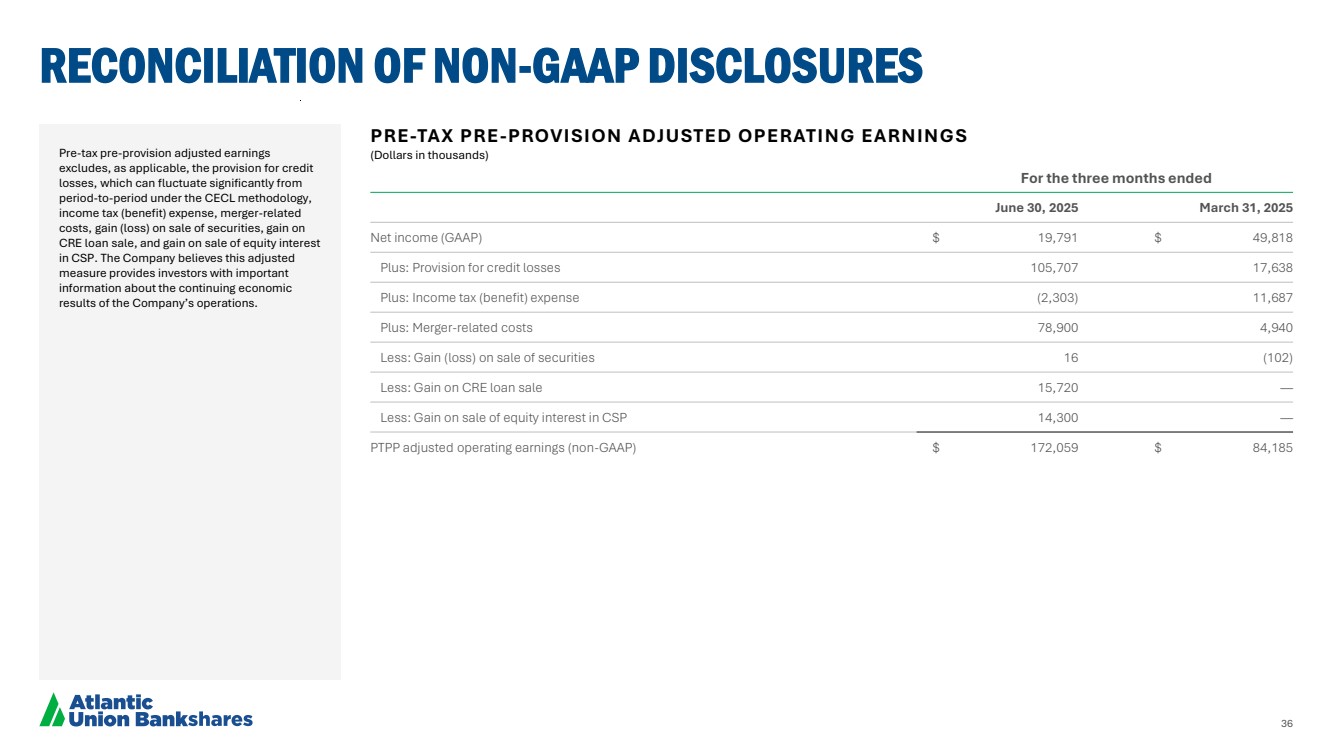

| 36 RECONCILIATION OF NON-GAAP DISCLOSURES PRE-TAX PRE-PROVISION ADJUSTED OPERATING EARNINGS (Dollars in thousands) For the three months ended June 30, 2025 March 31, 2025 Net income (GAAP) $ 19,791 $ 49,818 Plus: Provision for credit losses 105,707 17,638 Plus: Income tax (benefit) expense (2,303) 11,687 Plus: Merger-related costs 78,900 4,940 Less: Gain (loss) on sale of securities 16 (102) Less: Gain on CRE loan sale 15,720 — Less: Gain on sale of equity interest in CSP 14,300 — PTPP adjusted operating earnings (non-GAAP) $ 172,059 $ 84,185 Pre-tax pre-provision adjusted earnings excludes, as applicable, the provision for credit losses, which can fluctuate significantly from period-to-period under the CECL methodology, income tax (benefit) expense, merger-related costs, gain (loss) on sale of securities, gain on CRE loan sale, and gain on sale of equity interest in CSP. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations. |