| 2 nd Quarter 2024 Earnings Presentation NYSE: AUB July 25, 2024 |

| 2 Forward Looking Statements This presentation and statements by our management may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include, without limitation, statements on slides entitled “Q2 2024 Highlights,“ “Loan and Deposit Trends,” and “2024 Financial Outlook,” statements regarding our expectations with regard to the benefits of the American National Bankshares Inc. ("American National") acquisition, our business, financial and operating results, including our deposit base and funding, the impact of future economic conditions, changes in economic conditions, our asset quality, our customer relationships, and statements that include other projections, predictions, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such forward-looking statements are based on certain assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other factors, some of which cannot be predicted or quantified, that may cause actual results, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” “continue,” “confidence,” or words of similar meaning or other statements concerning opinions or judgment of the Company and our management about future events. Although we believe that our expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of our existing knowledge of our business and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, us will not differ materially from any projected future results, performance, achievements or trends expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of or changes in: • market interest rates and their related impacts on macroeconomic conditions, customer and client behavior, our funding costs and our loan and securities portfolios; • inflation and its impacts on economic growth and customer and client behavior; • adverse developments in the financial industry generally, such as bank failures, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs, and related impacts on customer and client behavior; • the sufficiency of liquidity and changes in our capital position; • general economic and financial market conditions, in the United States generally and particularly in the markets in which we operate and which our loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels and slowdowns in economic growth; • the impact of purchase accounting with respect to our acquisition of American National, or any change in the assumptions used regarding the assets acquired and liabilities assumed to determine the fair value and credit marks; • the possibility that the anticipated benefits of the American National acquisition, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the recent integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where we do business, or as a result of other unexpected factors or events; • potential adverse reactions or changes to business or employee relationships, including those resulting from the American National acquisition; • monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of the Treasury and the Federal Reserve; • the quality or composition of our loan or investment portfolios and changes therein; • demand for loan products and financial services in our market areas; • our ability to manage our growth or implement our growth strategy; • the effectiveness of expense reduction plans; • the introduction of new lines of business or new products and services; • our ability to recruit and retain key employees; • real estate values in our lending area; • changes in accounting principles, standards, rules, and interpretations, and the related impact on our financial statements; • an insufficient ACL or volatility in the ACL resulting from the CECL methodology, either alone or as that may be affected by changing economic conditions, credit concentrations, inflation, changing interest rates, or other factors; • concentrations of loans secured by real estate, particularly commercial real estate; • the effectiveness of our credit processes and management of our credit risk; • our ability to compete in the market for financial services and increased competition from fintech companies; • technological risks and developments, and cyber threats, attacks, or events; • operational, technological, cultural, regulatory, legal, credit, and other risks associated with the exploration, consummation and integration of potential future acquisitions, whether involving stock or cash considerations; • the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, geopolitical conflicts or public health events (such as pandemics), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of our borrowers to satisfy their obligations to us, on the value of collateral securing loans, on the demand for our loans or our other products and services, on supply chains and methods used to distribute products and services, on incidents of cyberattack and fraud, on our liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of our business operations and on financial markets and economic growth; • performance by our counterparties or vendors; • deposit flows; • the availability of financing and the terms thereof; • the level of prepayments on loans and mortgage-backed securities; • the effects of legislative or regulatory changes and requirements, including changes in federal, state or local tax laws; • actual or potential claims, damages, and fines related to litigation or government actions, which may result in, among other things, additional costs, fines, penalties, restrictions on our business activities, reputational harm, or other adverse consequences; • any event or development that would cause us to conclude that there was an impairment of any asset, including intangible assets, such as goodwill; and • other factors, many of which are beyond our control. Please also refer to such other factors as discussed throughout Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2023, and related disclosures in other filings, which have been filed with the U.S. Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking statements, and all of the forward-looking statements are expressly qualified by the cautionary statements contained or referred to herein and therein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or our businesses or operations. Readers are cautioned not to rely too heavily on the forward-looking statements. Forward-looking statements speak only as of the date they are made. We do not intend or assume any obligation to update, revise or clarify any forward-looking statements that may be made from time to time by or on behalf of the Company, whether as a result of new information, future events or otherwise, except as required by law. |

| 3 Additional Information Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods, show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance, or show the potential effects of accumulated other comprehensive income (or AOCI) or unrealized losses on securities on the Company's capital. This presentation also includes certain projections of non-GAAP financial measures. Due to the inherent variability and difficulty associated with making accurate forecasts and projections of information that is excluded from these projected non-GAAP measures, and the fact that some of the excluded information is not currently ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable projected GAAP financial measures without unreasonable effort. Consequently, no disclosure of projected comparable GAAP measures is included, and no reconciliation of forward-looking non-GAAP financial information is included. Please see “Reconciliation of Non-GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (NYSE: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank had 129 branches and approximately 150 ATMs located throughout Virginia and in portions of Maryland and North Carolina as of June 30, 2024. Certain non-bank financial services affiliates of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Atlantic Union Financial Consultants, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. |

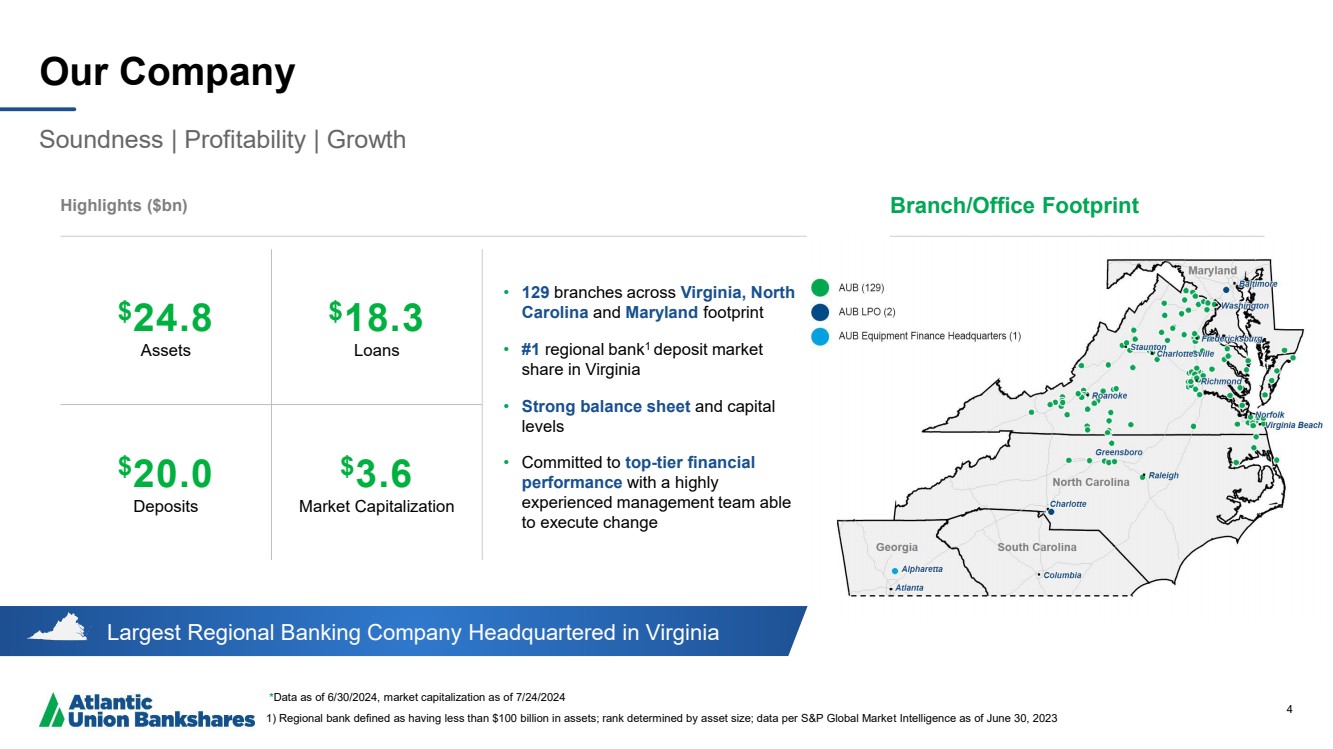

| 4 Largest Regional Banking Company Headquartered in Virginia Our Company Soundness | Profitability | Growth *Data as of 6/30/2024, market capitalization as of 7/24/2024 1) Regional bank defined as having less than $100 billion in assets; rank determined by asset size; data per S&P Global Market Intelligence as of June 30, 2023 Highlights ($bn) • 129 branches across Virginia, North Carolina and Maryland footprint • #1 regional bank1 deposit market share in Virginia • Strong balance sheet and capital levels • Committed to top-tier financial performance with a highly experienced management team able to execute change 4 $24.8 Assets $18.3 Loans $20.0 Deposits $3.6 Market Capitalization Branch/Office Footprint |

| 5 Our Shareholder Value Proposition Leading Regional Presence Dense, uniquely valuable presence across attractive markets Financial Strength Solid balance sheet & capital levels Attractive Financial Profile Solid dividend yield & payout ratio with earnings upside Strong Growth Potential Organic & acquisition opportunities Peer-Leading Performance Committed to top-tier financial performance |

| 6 Q2 2024 Highlights Loan and Deposit Growth • Pro forma loan growth, as if the American National balances were included as of March 31, 2024, was 3.9% annualized in Q2 2024 from Q1 2024, inclusive of the fair value marks on American National loans • Pro forma deposit growth, as if the American National balances were included as of March 31, 2024, was 2.8% annualized in Q2 2024 from Q1 2024 Asset Quality • Q2 2024 net charge-offs at 4 bps annualized • Nonperforming assets consistent with last two quarters Positioning for Long Term • Lending pipelines positioned for mid-single digit annualized loan growth in second half of 2024 • Granular growing deposit base • Focus on organic growth and performance of the core banking franchise Differentiated Client Experience • Responsive, strong and capable alternative to large national banks, while competitive with and more capable than smaller banks Focus on Integration • Core Systems integration completed over Memorial Day weekend 2024 • For the month after integration, we more than doubled new account opening averages in converted American National branches compared to the prior 8 weeks • Experienced integration team with our third integration of a $3 billion bank in 6 years Capitalize on Strategic Opportunities • Closed acquisition of American National Bankshares Inc. on April 1, 2024 • Selectively adding commercial bankers in North Carolina 6 |

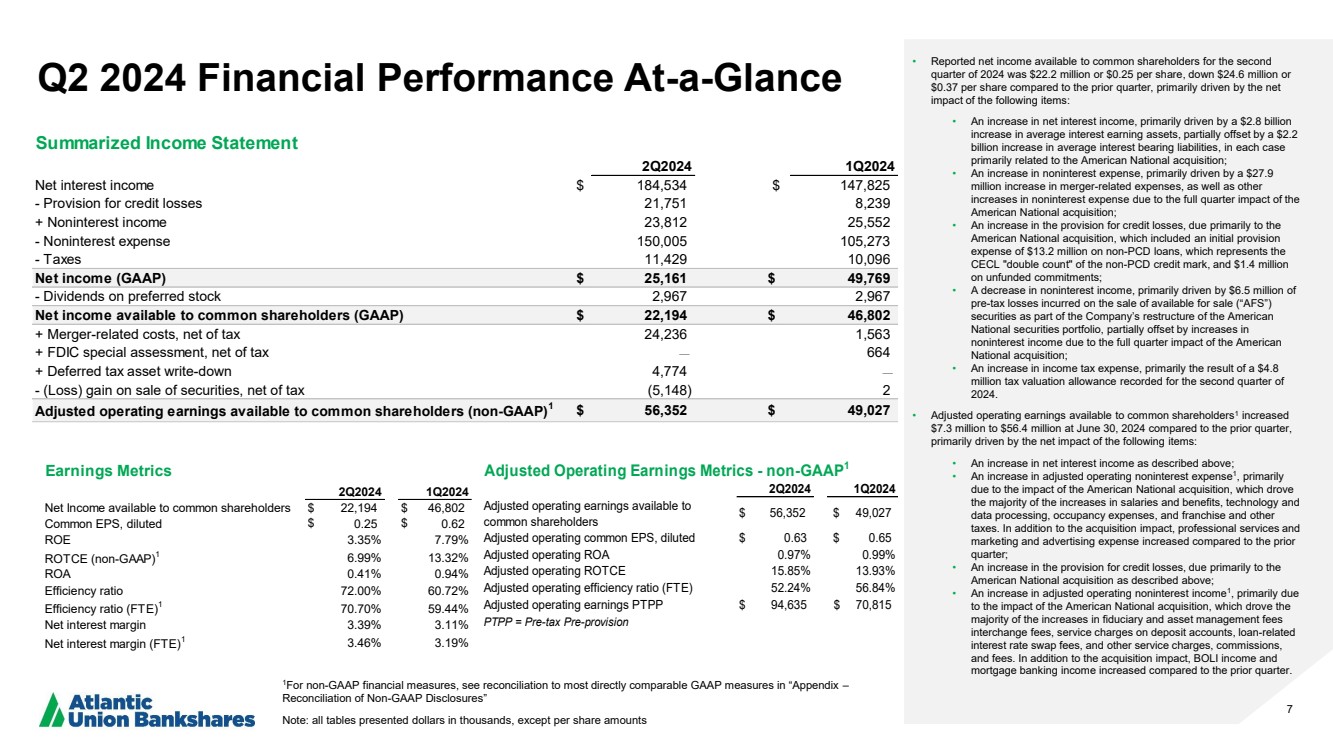

| 7 Q2 2024 Financial Performance At-a-Glance 1For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Note: all tables presented dollars in thousands, except per share amounts • Reported net income available to common shareholders for the second quarter of 2024 was $22.2 million or $0.25 per share, down $24.6 million or $0.37 per share compared to the prior quarter, primarily driven by the net impact of the following items: • An increase in net interest income, primarily driven by a $2.8 billion increase in average interest earning assets, partially offset by a $2.2 billion increase in average interest bearing liabilities, in each case primarily related to the American National acquisition; • An increase in noninterest expense, primarily driven by a $27.9 million increase in merger-related expenses, as well as other increases in noninterest expense due to the full quarter impact of the American National acquisition; • An increase in the provision for credit losses, due primarily to the American National acquisition, which included an initial provision expense of $13.2 million on non-PCD loans, which represents the CECL "double count" of the non-PCD credit mark, and $1.4 million on unfunded commitments; • A decrease in noninterest income, primarily driven by $6.5 million of pre-tax losses incurred on the sale of available for sale (“AFS”) securities as part of the Company’s restructure of the American National securities portfolio, partially offset by increases in noninterest income due to the full quarter impact of the American National acquisition; • An increase in income tax expense, primarily the result of a $4.8 million tax valuation allowance recorded for the second quarter of 2024. • Adjusted operating earnings available to common shareholders1 increased $7.3 million to $56.4 million at June 30, 2024 compared to the prior quarter, primarily driven by the net impact of the following items: • An increase in net interest income as described above; • An increase in adjusted operating noninterest expense1 , primarily due to the impact of the American National acquisition, which drove the majority of the increases in salaries and benefits, technology and data processing, occupancy expenses, and franchise and other taxes. In addition to the acquisition impact, professional services and marketing and advertising expense increased compared to the prior quarter; • An increase in the provision for credit losses, due primarily to the American National acquisition as described above; • An increase in adjusted operating noninterest income1 , primarily due to the impact of the American National acquisition, which drove the majority of the increases in fiduciary and asset management fees interchange fees, service charges on deposit accounts, loan-related interest rate swap fees, and other service charges, commissions, and fees. In addition to the acquisition impact, BOLI income and mortgage banking income increased compared to the prior quarter. 2Q2024 1Q2024 Net Income available to common shareholders $ 22,194 $ 46,802 Common EPS, diluted $ 0.25 $ 0.62 ROE 3.35% 7.79% ROTCE (non-GAAP)1 6.99% 13.32% ROA 0.41% 0.94% Efficiency ratio 72.00% 60.72% Efficiency ratio (FTE)1 70.70% 59.44% Net interest margin 3.39% 3.11% Net interest margin (FTE)1 3.46% 3.19% Earnings Metrics 2Q2024 1Q2024 Net interest income $ 184,534 $ 147,825 - Provision for credit losses 21,751 8,239 + Noninterest income 23,812 25,552 - Noninterest expense 150,005 105,273 - Taxes 11,429 10,096 Net income (GAAP) $ 25,161 $ 49,769 - Dividends on preferred stock 2,967 2,967 Net income available to common shareholders (GAAP) $ 22,194 $ 46,802 + Merger-related costs, net of tax 24,236 1,563 + FDIC special assessment, net of tax — 664 + Deferred tax asset write-down 4,774 — - (Loss) gain on sale of securities, net of tax (5,148) 2 Adjusted operating earnings available to common shareholders (non-GAAP)1 $ 56,352 $ 49,027 Summarized Income Statement 2Q2024 1Q2024 Adjusted operating earnings available to common shareholders $ 56,352 $ 49,027 Adjusted operating common EPS, diluted $ 0.63 $ 0.65 Adjusted operating ROA 0.97% 0.99% Adjusted operating ROTCE 15.85% 13.93% Adjusted operating efficiency ratio (FTE) 52.24% 56.84% Adjusted operating earnings PTPP $ 94,635 $ 70,815 PTPP = Pre-tax Pre-provision Adjusted Operating Earnings Metrics - non-GAAP1 |

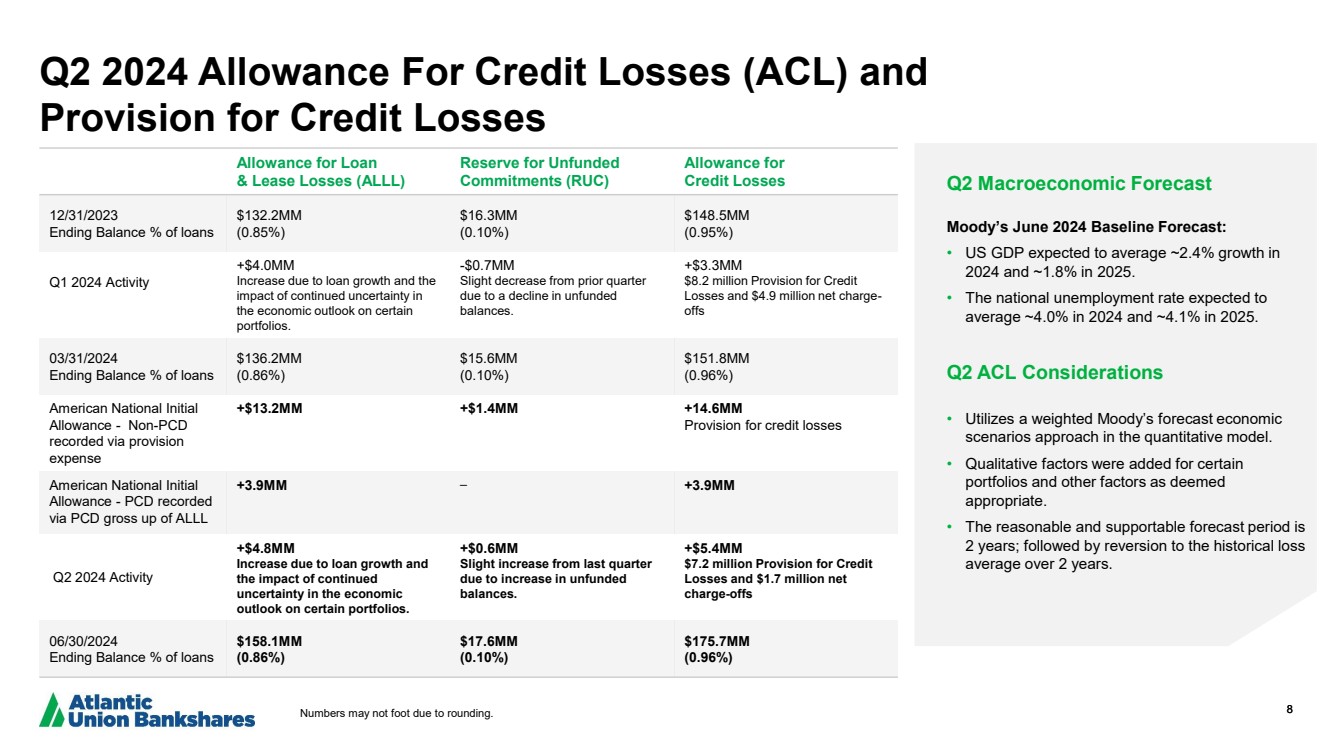

| 8 Q2 2024 Allowance For Credit Losses (ACL) and Provision for Credit Losses Q2 Macroeconomic Forecast Q2 ACL Considerations Numbers may not foot due to rounding. Moody’s June 2024 Baseline Forecast: • US GDP expected to average ~2.4% growth in 2024 and ~1.8% in 2025. • The national unemployment rate expected to average ~4.0% in 2024 and ~4.1% in 2025. • Utilizes a weighted Moody’s forecast economic scenarios approach in the quantitative model. • Qualitative factors were added for certain portfolios and other factors as deemed appropriate. • The reasonable and supportable forecast period is 2 years; followed by reversion to the historical loss average over 2 years. Allowance for Loan & Lease Losses (ALLL) Reserve for Unfunded Commitments (RUC) Allowance for Credit Losses 12/31/2023 Ending Balance % of loans $132.2MM (0.85%) $16.3MM (0.10%) $148.5MM (0.95%) Q1 2024 Activity +$4.0MM Increase due to loan growth and the impact of continued uncertainty in the economic outlook on certain portfolios. -$0.7MM Slight decrease from prior quarter due to a decline in unfunded balances. +$3.3MM $8.2 million Provision for Credit Losses and $4.9 million net charge-offs 03/31/2024 Ending Balance % of loans $136.2MM (0.86%) $15.6MM (0.10%) $151.8MM (0.96%) American National Initial Allowance - Non-PCD recorded via provision expense +$13.2MM +$1.4MM +14.6MM Provision for credit losses American National Initial Allowance - PCD recorded via PCD gross up of ALLL +3.9MM ─ +3.9MM Q2 2024 Activity +$4.8MM Increase due to loan growth and the impact of continued uncertainty in the economic outlook on certain portfolios. +$0.6MM Slight increase from last quarter due to increase in unfunded balances. +$5.4MM $7.2 million Provision for Credit Losses and $1.7 million net charge-offs 06/30/2024 Ending Balance % of loans $158.1MM (0.86%) $17.6MM (0.10%) $175.7MM (0.96%) |

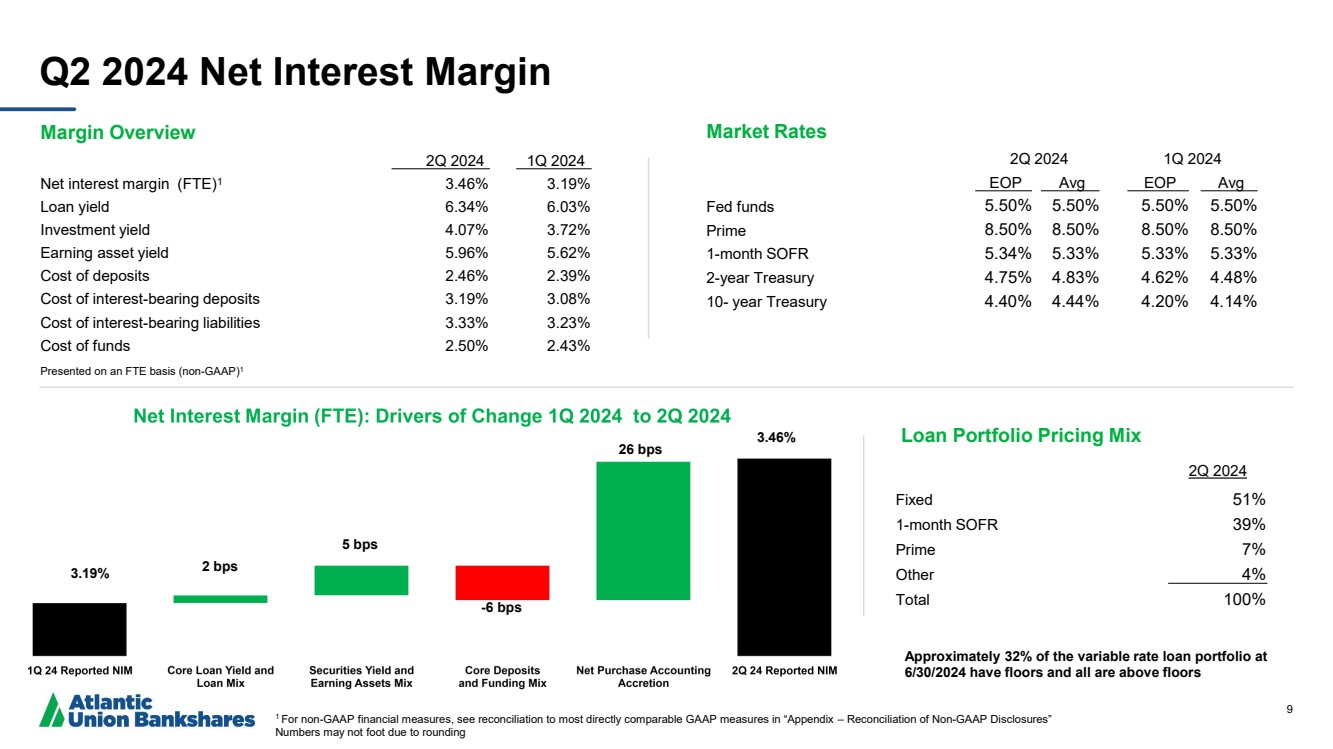

| 9 Q2 2024 Net Interest Margin Market Rates 2Q 2024 1Q 2024 EOP Avg EOP Avg Fed funds 5.50% 5.50% 5.50% 5.50% Prime 8.50% 8.50% 8.50% 8.50% 1-month SOFR 5.34% 5.33% 5.33% 5.33% 2-year Treasury 4.75% 4.83% 4.62% 4.48% 10- year Treasury 4.40% 4.44% 4.20% 4.14% Margin Overview 2Q 2024 1Q 2024 Net interest margin (FTE)1 3.46% 3.19% Loan yield 6.34% 6.03% Investment yield 4.07% 3.72% Earning asset yield 5.96% 5.62% Cost of deposits 2.46% 2.39% Cost of interest-bearing deposits 3.19% 3.08% Cost of interest-bearing liabilities 3.33% 3.23% Cost of funds 2.50% 2.43% Presented on an FTE basis (non-GAAP)1 Approximately 32% of the variable rate loan portfolio at 6/30/2024 have floors and all are above floors Loan Portfolio Pricing Mix 2Q 2024 Fixed 51% 1-month SOFR 39% Prime 7% Other 4% Total 100% 1 For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Numbers may not foot due to rounding 3.19% 2 bps -6 bps 5 bps 3.19% 26 bps 3.46% |

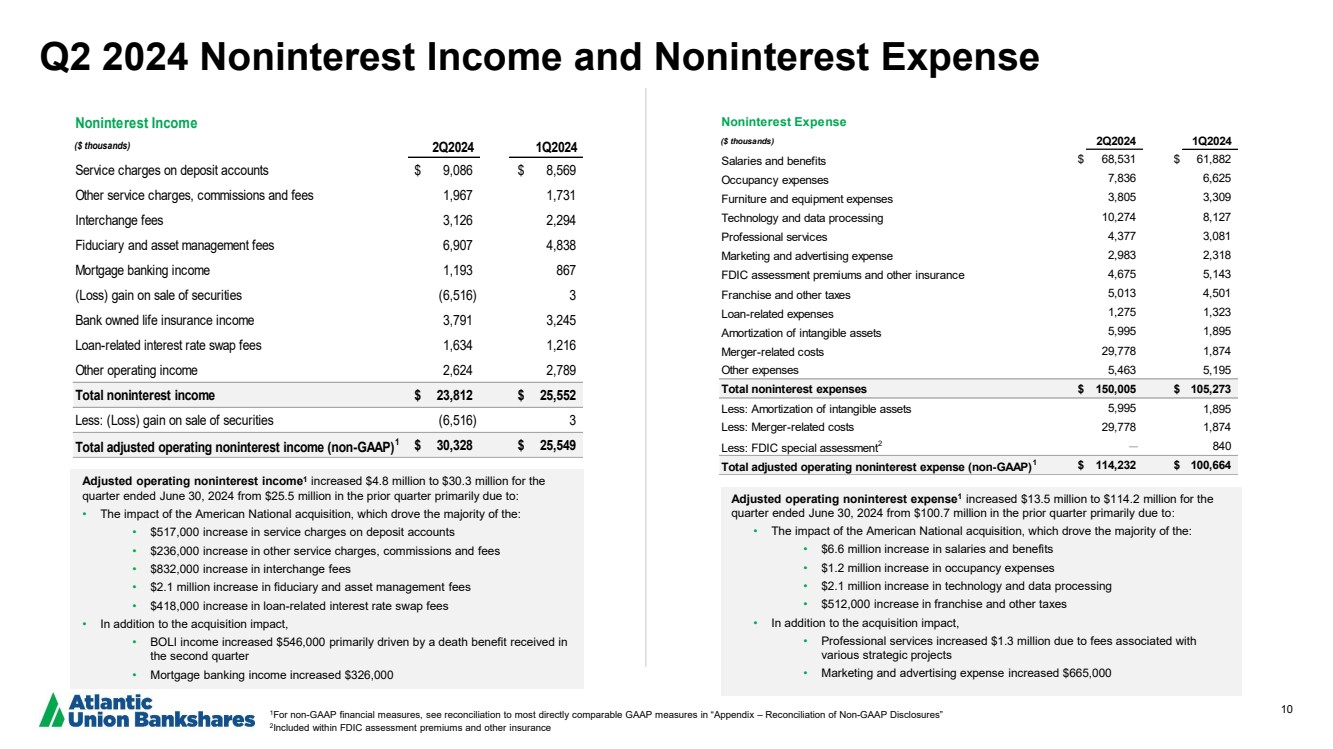

| 10 Adjusted operating noninterest expense1 increased $13.5 million to $114.2 million for the quarter ended June 30, 2024 from $100.7 million in the prior quarter primarily due to: • The impact of the American National acquisition, which drove the majority of the: • $6.6 million increase in salaries and benefits • $1.2 million increase in occupancy expenses • $2.1 million increase in technology and data processing • $512,000 increase in franchise and other taxes • In addition to the acquisition impact, • Professional services increased $1.3 million due to fees associated with various strategic projects • Marketing and advertising expense increased $665,000 Adjusted operating noninterest income1 increased $4.8 million to $30.3 million for the quarter ended June 30, 2024 from $25.5 million in the prior quarter primarily due to: • The impact of the American National acquisition, which drove the majority of the: • $517,000 increase in service charges on deposit accounts • $236,000 increase in other service charges, commissions and fees • $832,000 increase in interchange fees • $2.1 million increase in fiduciary and asset management fees • $418,000 increase in loan-related interest rate swap fees • In addition to the acquisition impact, • BOLI income increased $546,000 primarily driven by a death benefit received in the second quarter • Mortgage banking income increased $326,000 Q2 2024 Noninterest Income and Noninterest Expense 1For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” 2 Included within FDIC assessment premiums and other insurance Noninterest Expense ($ thousands) 2Q2024 1Q2024 Salaries and benefits $ 68,531 $ 61,882 Occupancy expenses 7,836 6,625 Furniture and equipment expenses 3,805 3,309 Technology and data processing 10,274 8,127 Professional services 4,377 3,081 Marketing and advertising expense 2,983 2,318 FDIC assessment premiums and other insurance 4,675 5,143 Franchise and other taxes 5,013 4,501 Loan-related expenses 1,275 1,323 Amortization of intangible assets 5,995 1,895 Merger-related costs 29,778 1,874 Other expenses 5,463 5,195 Total noninterest expenses $ 150,005 $ 105,273 Less: Amortization of intangible assets 5,995 1,895 Less: Merger-related costs 29,778 1,874 Less: FDIC special assessment2 — 840 Total adjusted operating noninterest expense (non-GAAP)1 $ 114,232 $ 100,664 Noninterest Income ($ thousands) 2Q2024 1Q2024 Service charges on deposit accounts $ 9,086 $ 8,569 Other service charges, commissions and fees 1,967 1,731 Interchange fees 3,126 2,294 Fiduciary and asset management fees 6,907 4,838 Mortgage banking income 1,193 867 (Loss) gain on sale of securities (6,516) 3 Bank owned life insurance income 3,791 3,245 Loan-related interest rate swap fees 1,634 1,216 Other operating income 2,624 2,789 Total noninterest income $ 23,812 $ 25,552 Less: (Loss) gain on sale of securities (6,516) 3 Total adjusted operating noninterest income (non-GAAP)1 $ 30,328 $ 25,549 |

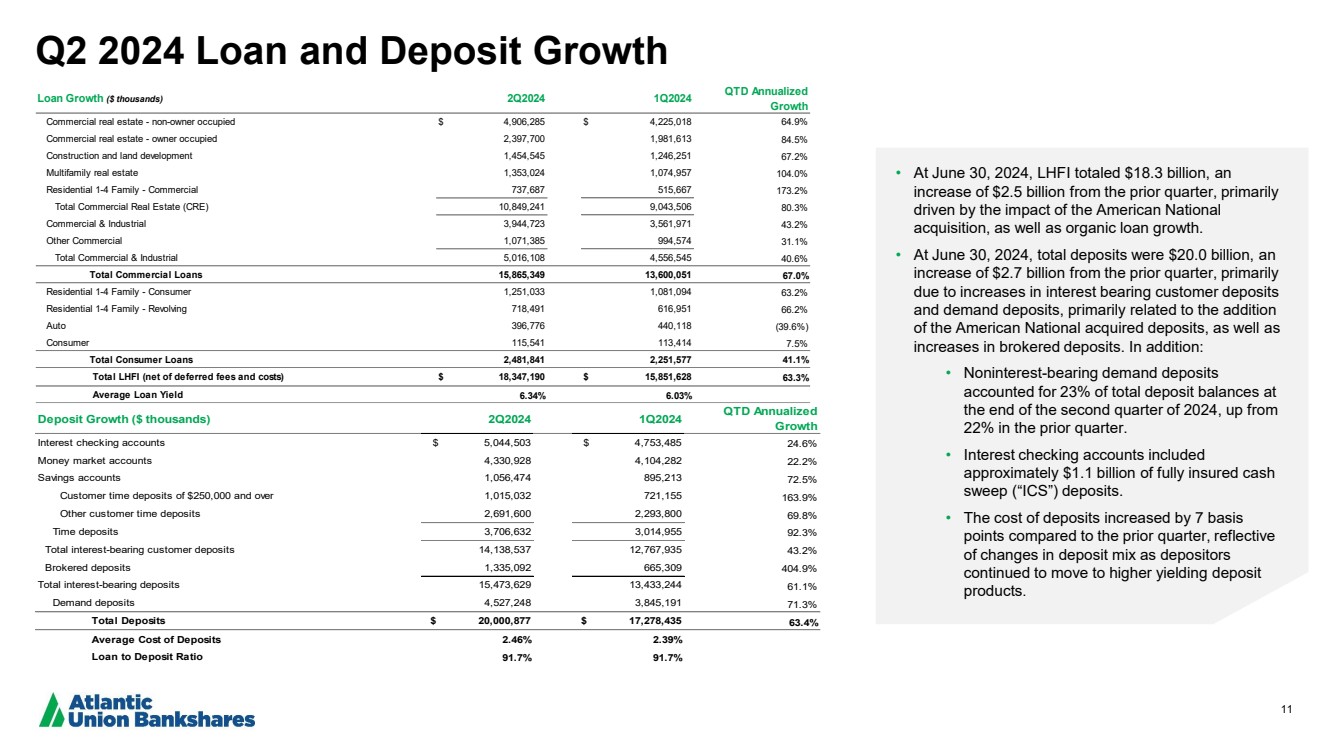

| 11 Q2 2024 Loan and Deposit Growth • At June 30, 2024, LHFI totaled $18.3 billion, an increase of $2.5 billion from the prior quarter, primarily driven by the impact of the American National acquisition, as well as organic loan growth. • At June 30, 2024, total deposits were $20.0 billion, an increase of $2.7 billion from the prior quarter, primarily due to increases in interest bearing customer deposits and demand deposits, primarily related to the addition of the American National acquired deposits, as well as increases in brokered deposits. In addition: • Noninterest-bearing demand deposits accounted for 23% of total deposit balances at the end of the second quarter of 2024, up from 22% in the prior quarter. • Interest checking accounts included approximately $1.1 billion of fully insured cash sweep (“ICS”) deposits. • The cost of deposits increased by 7 basis points compared to the prior quarter, reflective of changes in deposit mix as depositors continued to move to higher yielding deposit products. Loan Growth ($ thousands) 2Q2024 1Q2024 QTD Annualized Growth Commercial real estate - non-owner occupied $ 4,906,285 $ 4,225,018 64.9% Commercial real estate - owner occupied 2,397,700 1,981,613 84.5% Construction and land development 1,454,545 1,246,251 67.2% Multifamily real estate 1,353,024 1,074,957 104.0% Residential 1-4 Family - Commercial 737,687 515,667 173.2% Total Commercial Real Estate (CRE) 10,849,241 9,043,506 80.3% Commercial & Industrial 3,944,723 3,561,971 43.2% Other Commercial 1,071,385 994,574 31.1% Total Commercial & Industrial 5,016,108 4,556,545 40.6% Total Commercial Loans 15,865,349 13,600,051 67.0% Residential 1-4 Family - Consumer 1,251,033 1,081,094 63.2% Residential 1-4 Family - Revolving 718,491 616,951 66.2% Auto 396,776 440,118 (39.6%) Consumer 115,541 113,414 7.5% Total Consumer Loans 2,481,841 2,251,577 41.1% Total LHFI (net of deferred fees and costs) $ 18,347,190 $ 15,851,628 63.3% Average Loan Yield 6.34% 6.03% Deposit Growth ($ thousands) 2Q2024 1Q2024 QTD Annualized Growth Interest checking accounts $ 5,044,503 $ 4,753,485 24.6% Money market accounts 4,330,928 4,104,282 22.2% Savings accounts 1,056,474 895,213 72.5% Customer time deposits of $250,000 and over 1,015,032 721,155 163.9% Other customer time deposits 2,691,600 2,293,800 69.8% Time deposits 3,706,632 3,014,955 92.3% Total interest-bearing customer deposits 14,138,537 12,767,935 43.2% Brokered deposits 1,335,092 665,309 404.9% Total interest-bearing deposits 15,473,629 13,433,244 61.1% Demand deposits 4,527,248 3,845,191 71.3% Total Deposits $ 20,000,877 $ 17,278,435 63.4% Average Cost of Deposits 2.46% 2.39% Loan to Deposit Ratio 91.7% 91.7% |

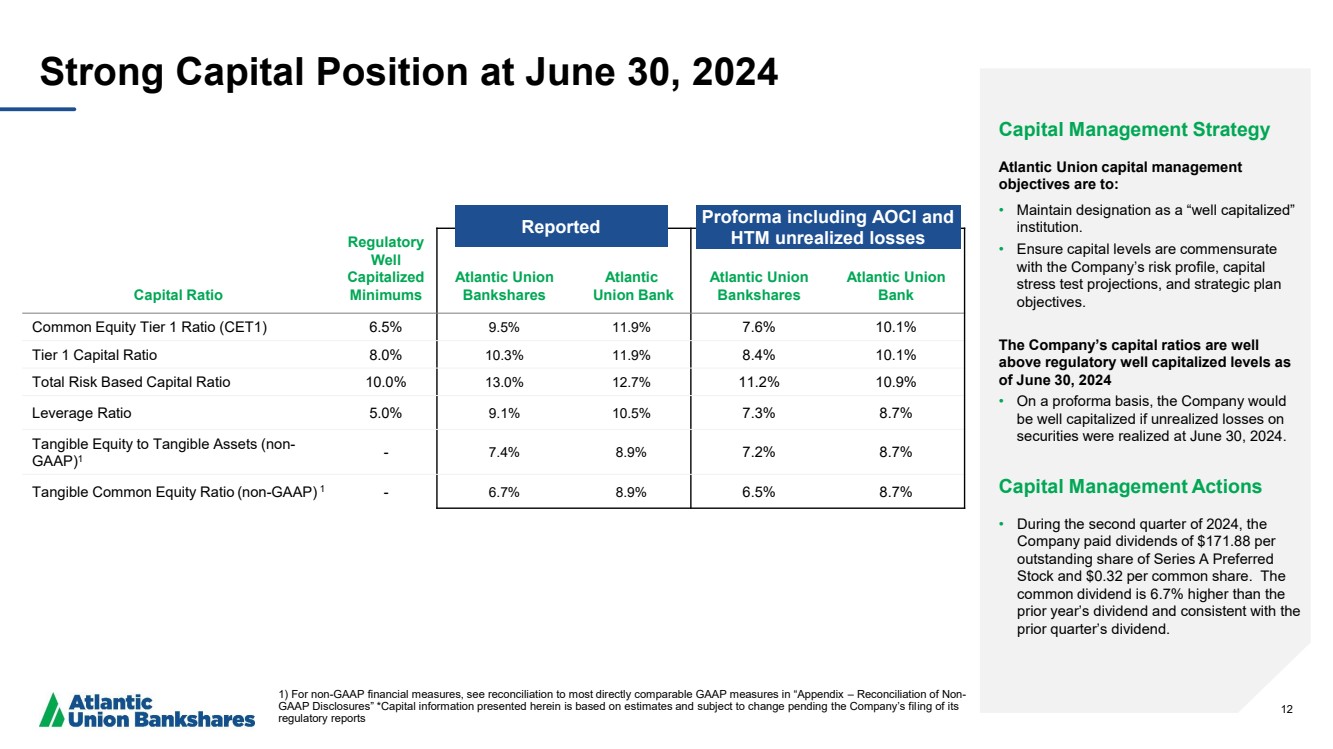

| 12 Capital Ratio Regulatory Well Capitalized Minimums Atlantic Union Bankshares Atlantic Union Bank Atlantic Union Bankshares Atlantic Union Bank Common Equity Tier 1 Ratio (CET1) 6.5% 9.5% 11.9% 7.6% 10.1% Tier 1 Capital Ratio 8.0% 10.3% 11.9% 8.4% 10.1% Total Risk Based Capital Ratio 10.0% 13.0% 12.7% 11.2% 10.9% Leverage Ratio 5.0% 9.1% 10.5% 7.3% 8.7% Tangible Equity to Tangible Assets (non-GAAP)1 - 7.4% 8.9% 7.2% 8.7% Tangible Common Equity Ratio (non-GAAP) 1 - 6.7% 8.9% 6.5% 8.7% Strong Capital Position at June 30, 2024 1) For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” *Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulatory reports Capital Management Strategy Atlantic Union capital management objectives are to: • Maintain designation as a “well capitalized” institution. • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives. The Company’s capital ratios are well above regulatory well capitalized levels as of June 30, 2024 • On a proforma basis, the Company would be well capitalized if unrealized losses on securities were realized at June 30, 2024. Capital Management Actions • During the second quarter of 2024, the Company paid dividends of $171.88 per outstanding share of Series A Preferred Stock and $0.32 per common share. The common dividend is 6.7% higher than the prior year’s dividend and consistent with the prior quarter’s dividend. Reported Proforma including AOCI and HTM unrealized losses |

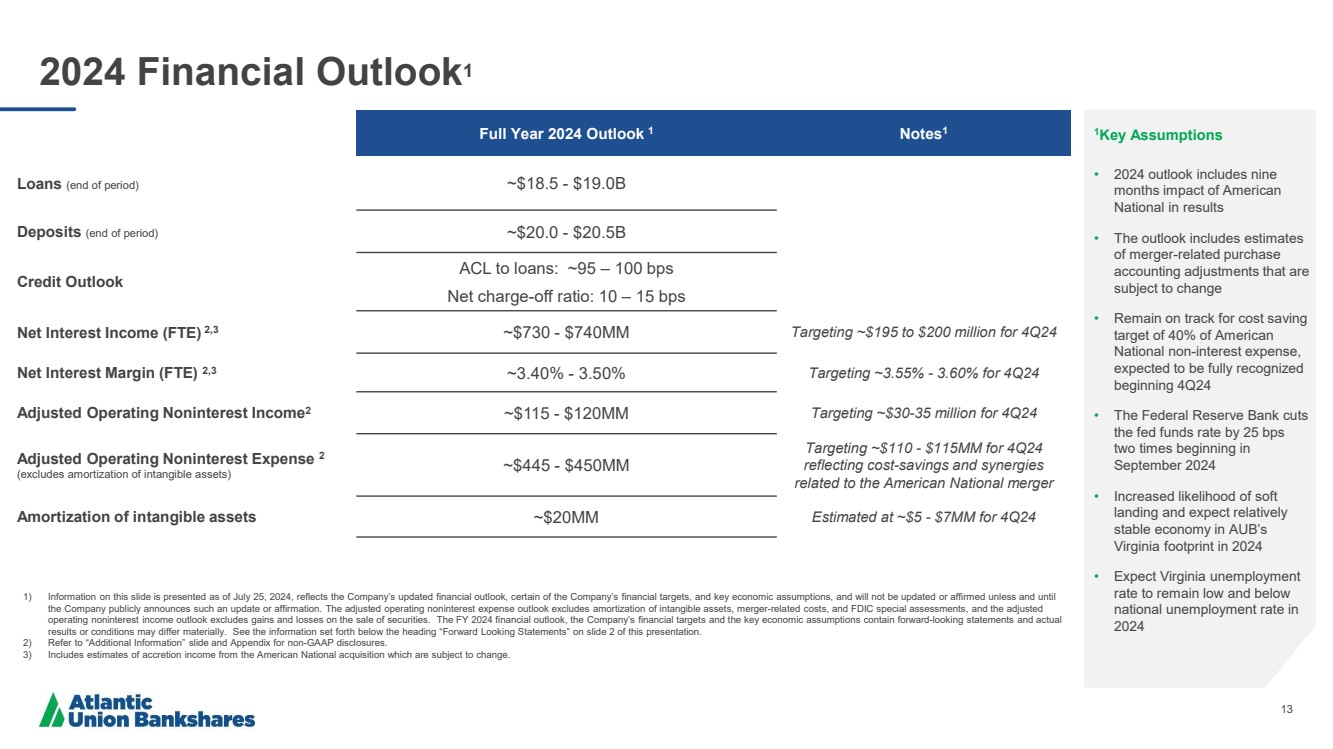

| 13 2024 Financial Outlook1 1Key Assumptions • 2024 outlook includes nine months impact of American National in results • The outlook includes estimates of merger-related purchase accounting adjustments that are subject to change • Remain on track for cost saving target of 40% of American National non-interest expense, expected to be fully recognized beginning 4Q24 • The Federal Reserve Bank cuts the fed funds rate by 25 bps two times beginning in September 2024 • Increased likelihood of soft landing and expect relatively stable economy in AUB’s Virginia footprint in 2024 • Expect Virginia unemployment rate to remain low and below national unemployment rate in 2024 Full Year 2024 Outlook 1 Notes1 Loans (end of period) ~$18.5 - $19.0B Deposits (end of period) ~$20.0 - $20.5B Credit Outlook ACL to loans: ~95 – 100 bps Net charge-off ratio: 10 – 15 bps Net Interest Income (FTE) 2,3 ~$730 - $740MM Targeting ~$195 to $200 million for 4Q24 Net Interest Margin (FTE) 2,3 ~3.40% - 3.50% Targeting ~3.55% - 3.60% for 4Q24 Adjusted Operating Noninterest Income2 ~$115 - $120MM Targeting ~$30-35 million for 4Q24 Adjusted Operating Noninterest Expense 2 (excludes amortization of intangible assets) ~$445 - $450MM Targeting ~$110 - $115MM for 4Q24 reflecting cost-savings and synergies related to the American National merger Amortization of intangible assets ~$20MM Estimated at ~$5 - $7MM for 4Q24 1) Information on this slide is presented as of July 25, 2024, reflects the Company’s updated financial outlook, certain of the Company’s financial targets, and key economic assumptions, and will not be updated or affirmed unless and until the Company publicly announces such an update or affirmation. The adjusted operating noninterest expense outlook excludes amortization of intangible assets, merger-related costs, and FDIC special assessments, and the adjusted operating noninterest income outlook excludes gains and losses on the sale of securities. The FY 2024 financial outlook, the Company’s financial targets and the key economic assumptions contain forward-looking statements and actual results or conditions may differ materially. See the information set forth below the heading “Forward Looking Statements” on slide 2 of this presentation. 2) Refer to “Additional Information” slide and Appendix for non-GAAP disclosures. 3) Includes estimates of accretion income from the American National acquisition which are subject to change. |

| 14 Appendix |

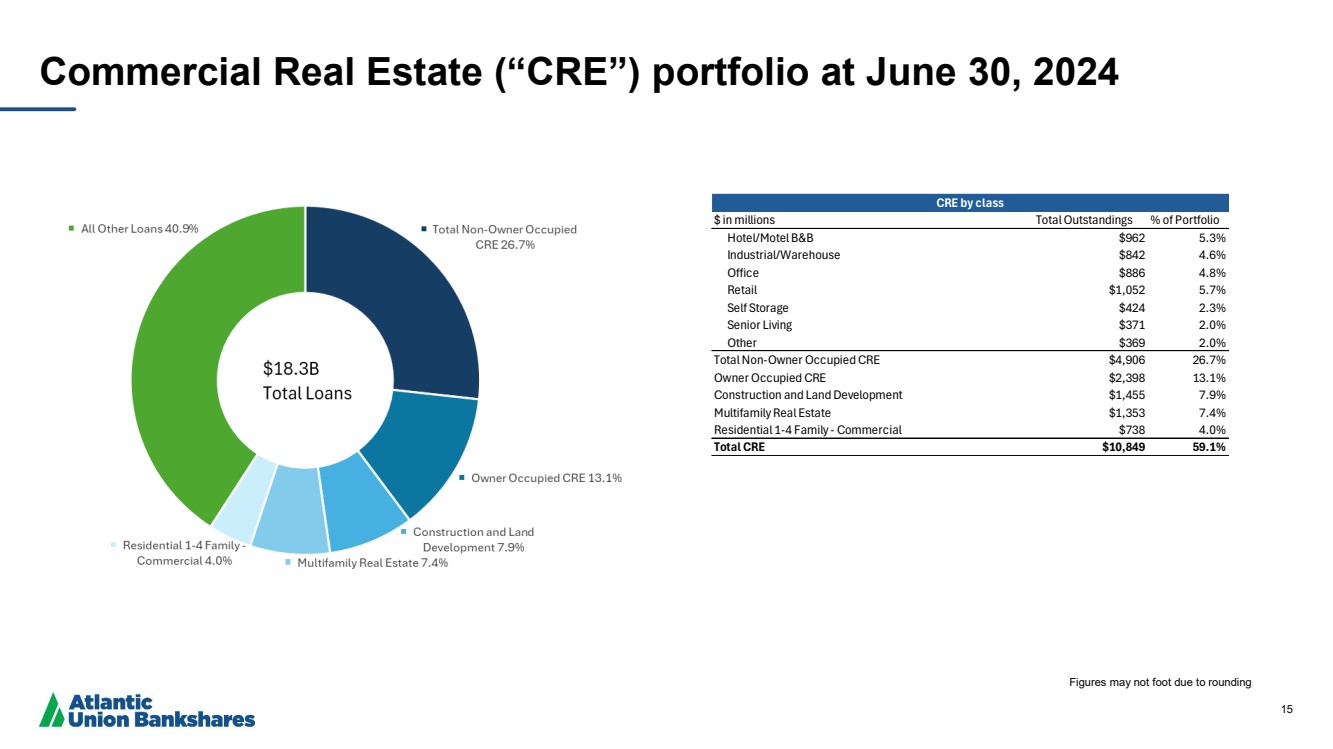

| 15 Commercial Real Estate (“CRE”) portfolio at June 30, 2024 Figures may not foot due to rounding CRE by class $ in millions Total Outstandings % of Portfolio Hotel/Motel B&B $962 5.3% Industrial/Warehouse $842 4.6% Office $886 4.8% Retail $1,052 5.7% Self Storage $424 2.3% Senior Living $371 2.0% Other $369 2.0% Total Non-Owner Occupied CRE $4,906 26.7% Owner Occupied CRE $2,398 13.1% Construction and Land Development $1,455 7.9% Multifamily Real Estate $1,353 7.4% Residential 1-4 Family - Commercial $738 4.0% Total CRE $10,849 59.1% |

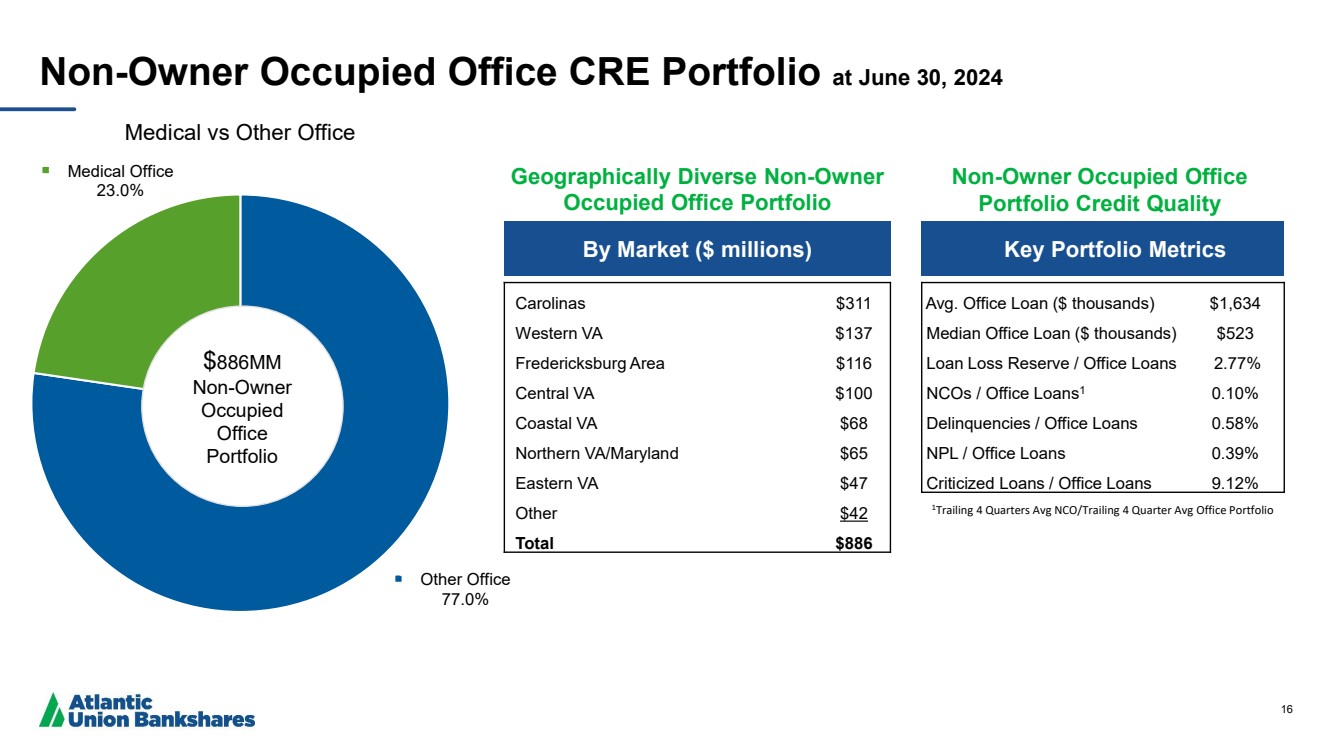

| 16 Other Office 77.0% Medical Office 23.0% Medical vs Other Office By Market ($ millions) Key Portfolio Metrics Carolinas $311 Western VA $137 Fredericksburg Area $116 Central VA $100 Coastal VA $68 Northern VA/Maryland $65 Eastern VA $47 Other $42 Total $886 Avg. Office Loan ($ thousands) $1,634 Median Office Loan ($ thousands) $523 Loan Loss Reserve / Office Loans 2.77% NCOs / Office Loans1 0.10% Delinquencies / Office Loans 0.58% NPL / Office Loans 0.39% Criticized Loans / Office Loans 9.12% Non-Owner Occupied Office CRE Portfolio at June 30, 2024 $886MM Non-Owner Occupied Office Portfolio Non-Owner Occupied Office Portfolio Credit Quality Geographically Diverse Non-Owner Occupied Office Portfolio 1Trailing 4 Quarters Avg NCO/Trailing 4 Quarter Avg Office Portfolio |

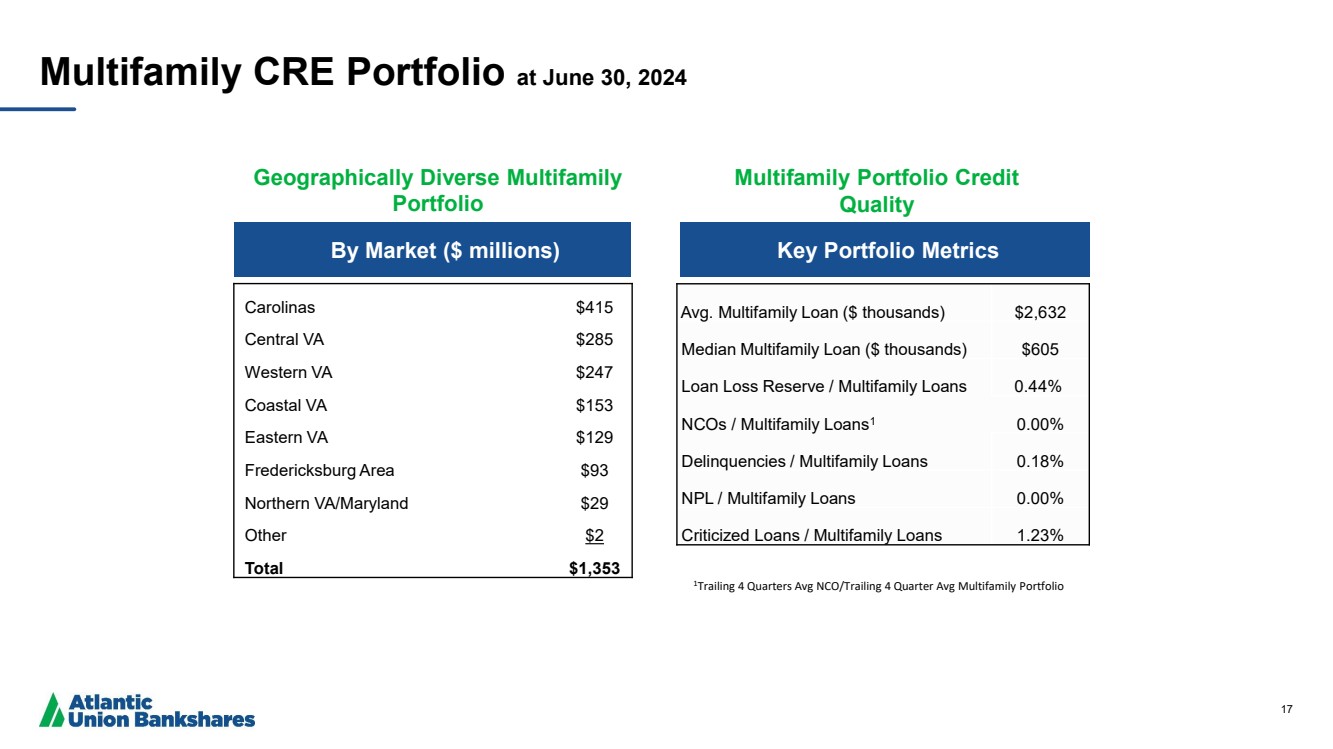

| 17 By Market ($ millions) Key Portfolio Metrics Carolinas $415 Central VA $285 Western VA $247 Coastal VA $153 Eastern VA $129 Fredericksburg Area $93 Northern VA/Maryland $29 Other $2 Total $1,353 Multifamily CRE Portfolio at June 30, 2024 Multifamily Portfolio Credit Quality Geographically Diverse Multifamily Portfolio 1Trailing 4 Quarters Avg NCO/Trailing 4 Quarter Avg Multifamily Portfolio Avg. Multifamily Loan ($ thousands) $2,632 Median Multifamily Loan ($ thousands) $605 Loan Loss Reserve / Multifamily Loans 0.44% NCOs / Multifamily Loans1 0.00% Delinquencies / Multifamily Loans 0.18% NPL / Multifamily Loans 0.00% Criticized Loans / Multifamily Loans 1.23% |

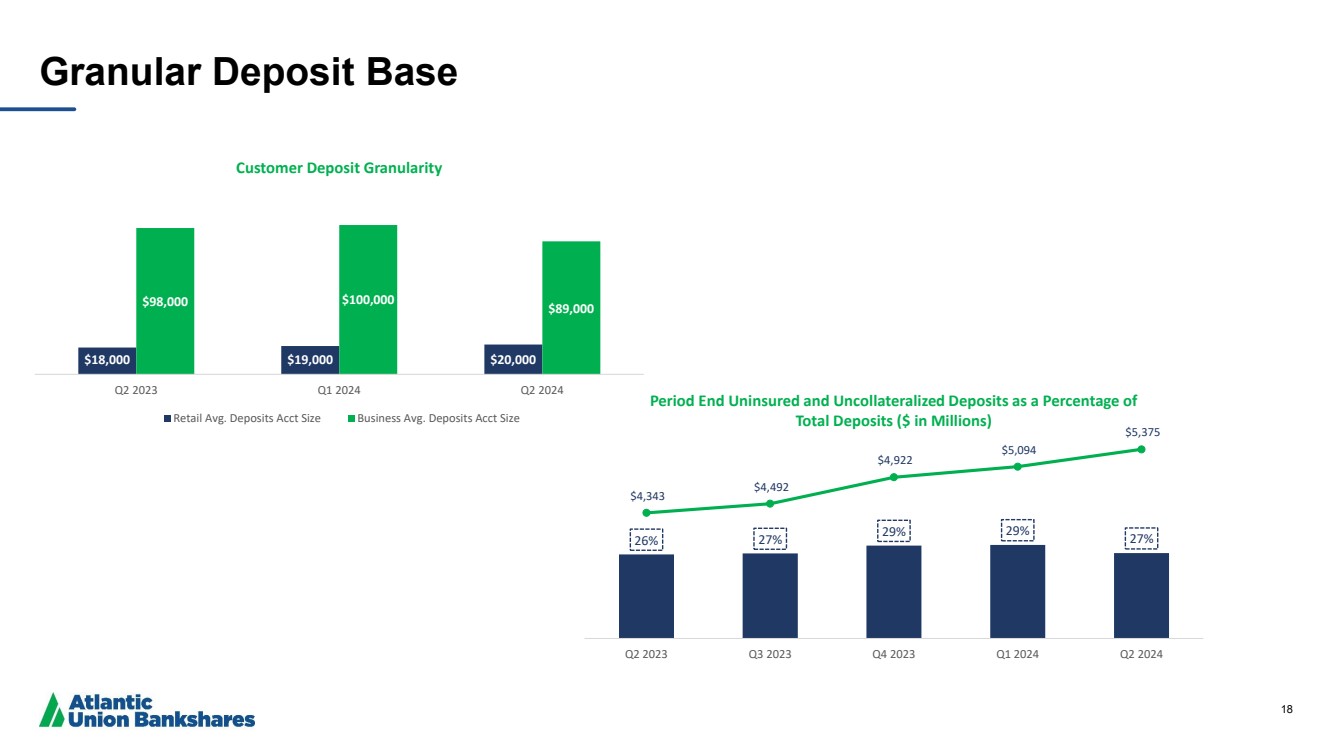

| 18 Granular Deposit Base 26% 27% 29% 29% 27% $4,343 $4,492 $4,922 $5,094 $5,375 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Period End Uninsured and Uncollateralized Deposits as a Percentage of Total Deposits ($ in Millions) $18,000 $19,000 $20,000 $98,000 $100,000 $89,000 Q2 2023 Q1 2024 Q2 2024 Customer Deposit Granularity Retail Avg. Deposits Acct Size Business Avg. Deposits Acct Size |

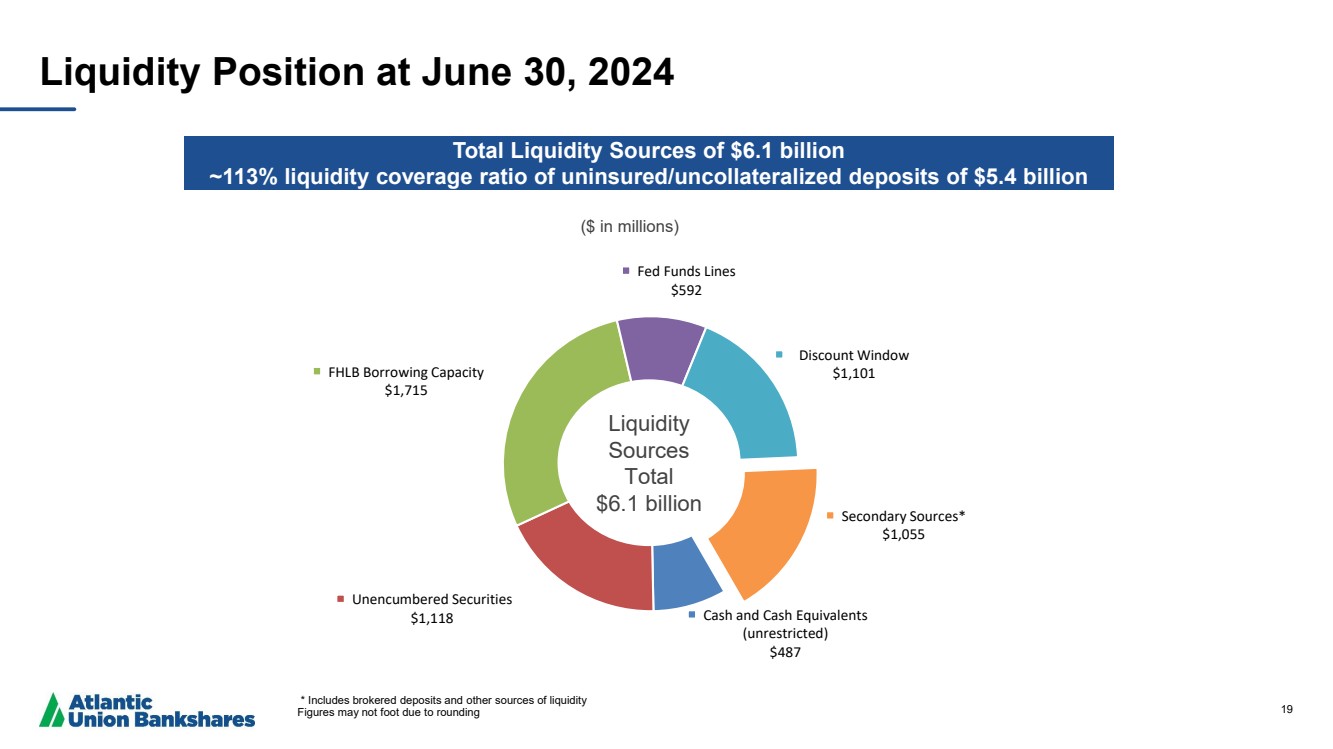

| 19 Cash and Cash Equivalents (unrestricted) $487 Unencumbered Securities $1,118 FHLB Borrowing Capacity $1,715 Fed Funds Lines $592 Discount Window $1,101 Secondary Sources* $1,055 ($ in millions) Liquidity Position at June 30, 2024 Total Liquidity Sources of $6.1 billion ~113% liquidity coverage ratio of uninsured/uncollateralized deposits of $5.4 billion * Includes brokered deposits and other sources of liquidity Figures may not foot due to rounding Liquidity Sources Total $6.1 billion |

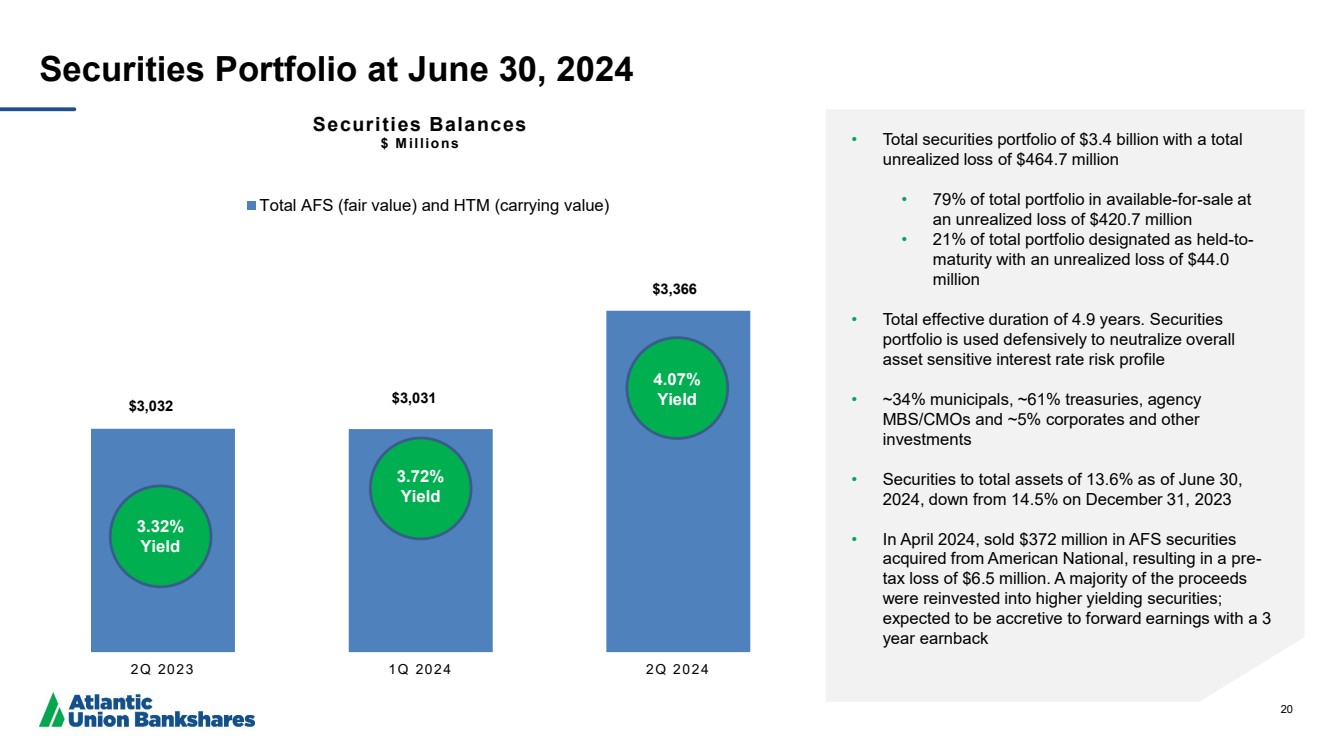

| 20 Securities Portfolio at June 30, 2024 • Total securities portfolio of $3.4 billion with a total unrealized loss of $464.7 million • 79% of total portfolio in available-for-sale at an unrealized loss of $420.7 million • 21% of total portfolio designated as held-to-maturity with an unrealized loss of $44.0 million • Total effective duration of 4.9 years. Securities portfolio is used defensively to neutralize overall asset sensitive interest rate risk profile • ~34% municipals, ~61% treasuries, agency MBS/CMOs and ~5% corporates and other investments • Securities to total assets of 13.6% as of June 30, 2024, down from 14.5% on December 31, 2023 • In April 2024, sold $372 million in AFS securities acquired from American National, resulting in a pre-tax loss of $6.5 million. A majority of the proceeds were reinvested into higher yielding securities; expected to be accretive to forward earnings with a 3 year earnback $3,032 $3,032 $3,031 $3,366 2Q 2023 1Q 2024 2Q 2024 Securities Balances $ M illions Total AFS (fair value) and HTM (carrying value) 4.07% Yield 3.72% Yield 3.32% Yield |

| 21 Reconciliation of Non-GAAP Disclosures The Company has provided supplemental performance measures determined by methods other than in accordance with GAAP. These non-GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. |

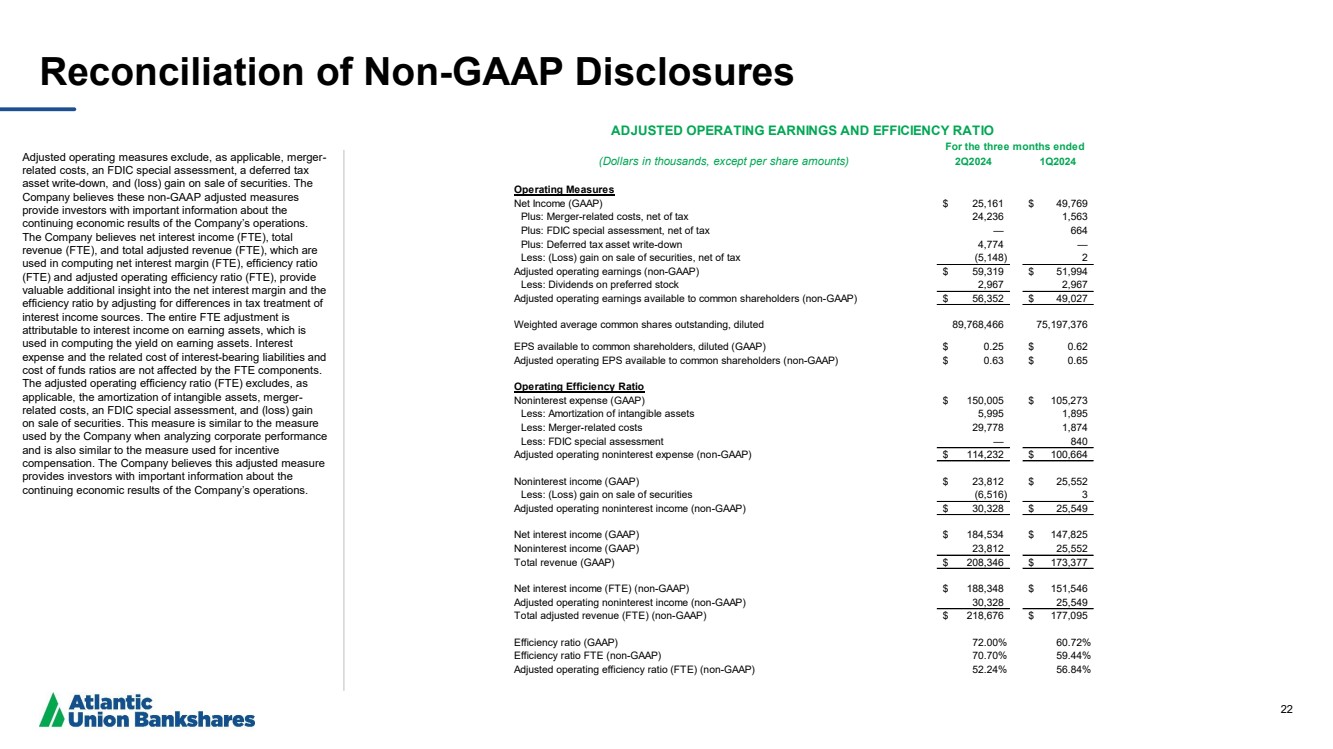

| 22 Reconciliation of Non-GAAP Disclosures Adjusted operating measures exclude, as applicable, merger-related costs, an FDIC special assessment, a deferred tax asset write-down, and (loss) gain on sale of securities. The Company believes these non-GAAP adjusted measures provide investors with important information about the continuing economic results of the Company’s operations. The Company believes net interest income (FTE), total revenue (FTE), and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing the yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. The adjusted operating efficiency ratio (FTE) excludes, as applicable, the amortization of intangible assets, merger-related costs, an FDIC special assessment, and (loss) gain on sale of securities. This measure is similar to the measure used by the Company when analyzing corporate performance and is also similar to the measure used for incentive compensation. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations. (Dollars in thousands, except per share amounts) 2Q2024 1Q2024 Operating Measures Net Income (GAAP) $ 25,161 $ 49,769 Plus: Merger-related costs, net of tax 24,236 1,563 Plus: FDIC special assessment, net of tax — 664 Plus: Deferred tax asset write-down 4,774 — Less: (Loss) gain on sale of securities, net of tax (5,148) 2 Adjusted operating earnings (non-GAAP) $ 59,319 $ 51,994 Less: Dividends on preferred stock 2,967 2,967 Adjusted operating earnings available to common shareholders (non-GAAP) $ 56,352 $ 49,027 Weighted average common shares outstanding, diluted 89,768,466 75,197,376 EPS available to common shareholders, diluted (GAAP) $ 0.25 $ 0.62 Adjusted operating EPS available to common shareholders (non-GAAP) $ 0.63 $ 0.65 Operating Efficiency Ratio Noninterest expense (GAAP) $ 150,005 $ 105,273 Less: Amortization of intangible assets 5,995 1,895 Less: Merger-related costs 29,778 1,874 Less: FDIC special assessment — 840 Adjusted operating noninterest expense (non-GAAP) $ 114,232 $ 100,664 Noninterest income (GAAP) $ 23,812 $ 25,552 Less: (Loss) gain on sale of securities (6,516) 3 Adjusted operating noninterest income (non-GAAP) $ 30,328 $ 25,549 Net interest income (GAAP) $ 184,534 $ 147,825 Noninterest income (GAAP) 23,812 25,552 Total revenue (GAAP) $ 208,346 $ 173,377 Net interest income (FTE) (non-GAAP) $ 188,348 $ 151,546 Adjusted operating noninterest income (non-GAAP) 30,328 25,549 Total adjusted revenue (FTE) (non-GAAP) $ 218,676 $ 177,095 Efficiency ratio (GAAP) 72.00% 60.72% Efficiency ratio FTE (non-GAAP) 70.70% 59.44% Adjusted operating efficiency ratio (FTE) (non-GAAP) 52.24% 56.84% ADJUSTED OPERATING EARNINGS AND EFFICIENCY RATIO For the three months ended |

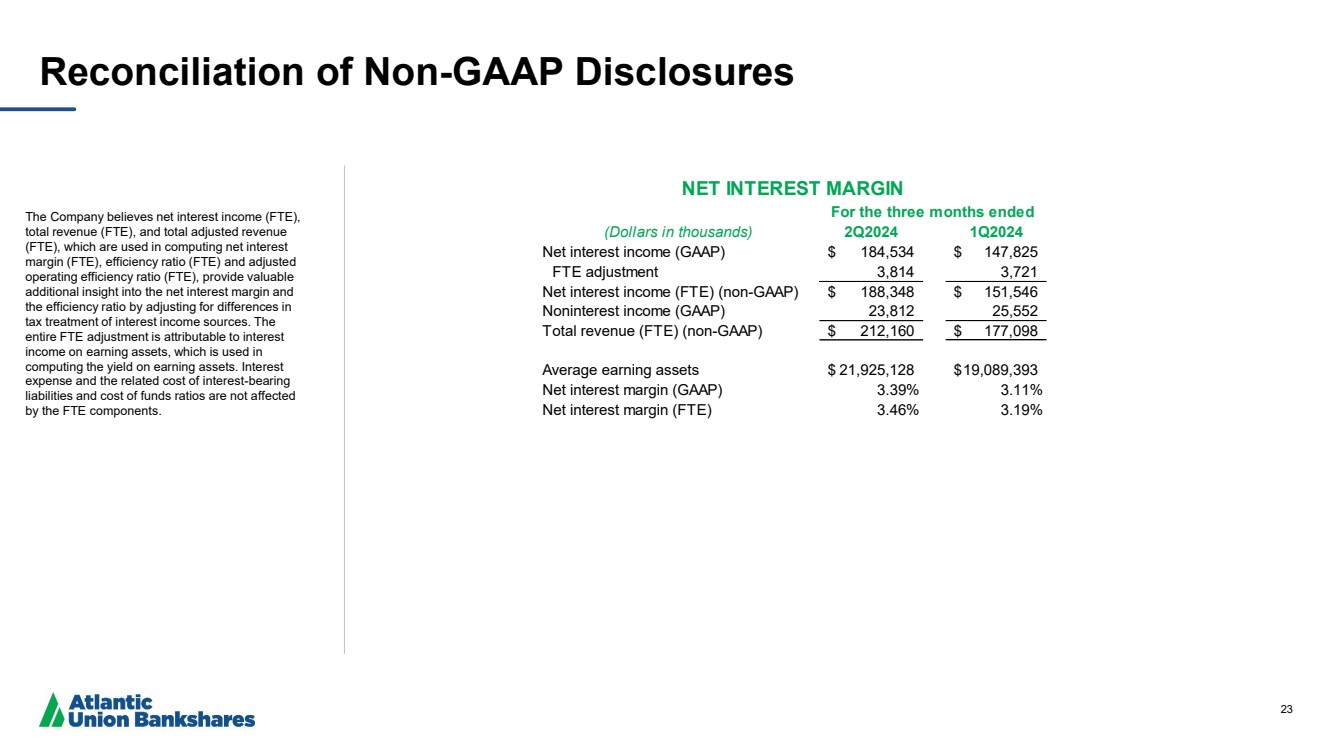

| 23 Reconciliation of Non-GAAP Disclosures The Company believes net interest income (FTE), total revenue (FTE), and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing the yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. (Dollars in thousands) 2Q2024 1Q2024 Net interest income (GAAP) $ 184,534 $ 147,825 FTE adjustment 3,814 3,721 Net interest income (FTE) (non-GAAP) $ 188,348 $ 151,546 Noninterest income (GAAP) 23,812 25,552 Total revenue (FTE) (non-GAAP) $ 212,160 $ 177,098 Average earning assets $ 21,925,128 $19,089,393 Net interest margin (GAAP) 3.39% 3.11% Net interest margin (FTE) 3.46% 3.19% NET INTEREST MARGIN For the three months ended |

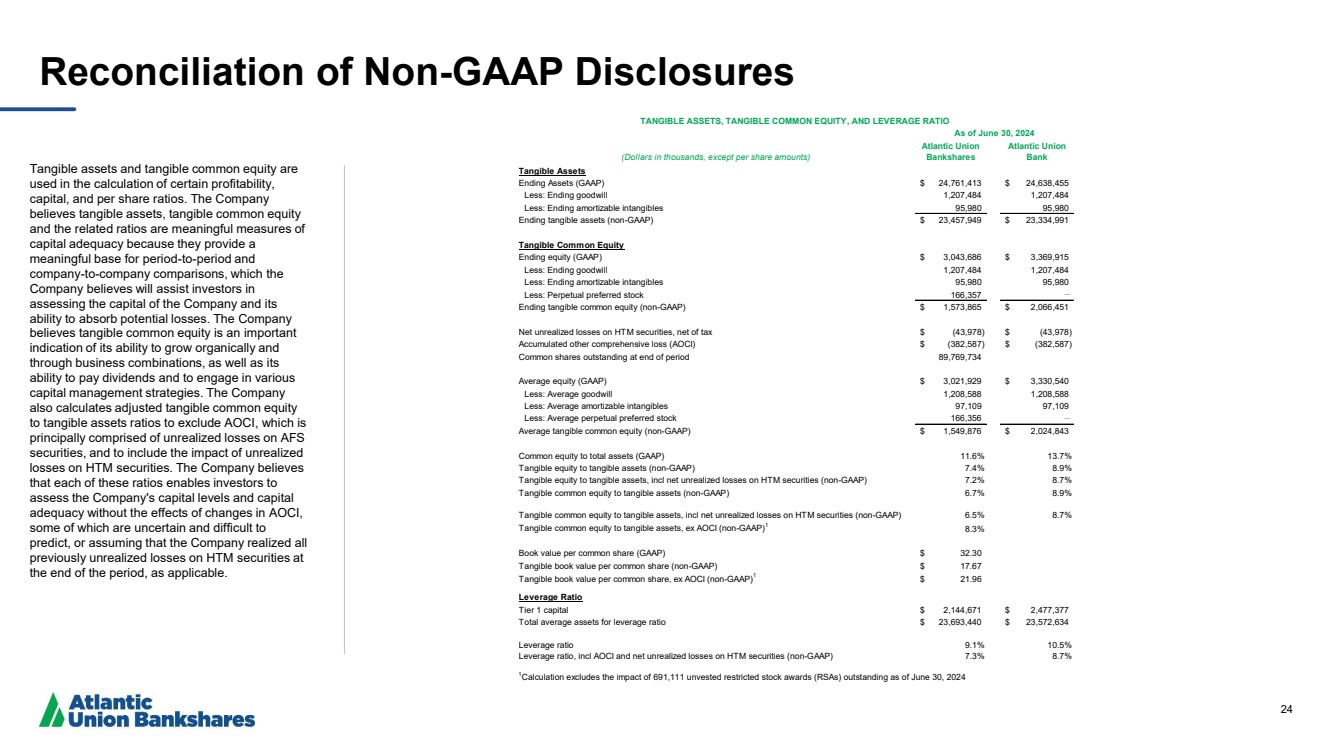

| 24 Reconciliation of Non-GAAP Disclosures Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. The Company also calculates adjusted tangible common equity to tangible assets ratios to exclude AOCI, which is principally comprised of unrealized losses on AFS securities, and to include the impact of unrealized losses on HTM securities. The Company believes that each of these ratios enables investors to assess the Company's capital levels and capital adequacy without the effects of changes in AOCI, some of which are uncertain and difficult to predict, or assuming that the Company realized all previously unrealized losses on HTM securities at the end of the period, as applicable. (Dollars in thousands, except per share amounts) Atlantic Union Bankshares Atlantic Union Bank Tangible Assets Ending Assets (GAAP) $ 24,761,413 $ 24,638,455 Less: Ending goodwill 1,207,484 1,207,484 Less: Ending amortizable intangibles 95,980 95,980 Ending tangible assets (non-GAAP) $ 23,457,949 $ 23,334,991 Tangible Common Equity Ending equity (GAAP) $ 3,043,686 $ 3,369,915 Less: Ending goodwill 1,207,484 1,207,484 Less: Ending amortizable intangibles 95,980 95,980 Less: Perpetual preferred stock 166,357 — Ending tangible common equity (non-GAAP) $ 1,573,865 $ 2,066,451 Net unrealized losses on HTM securities, net of tax $ (43,978) $ (43,978) Accumulated other comprehensive loss (AOCI) $ (382,587) $ (382,587) Common shares outstanding at end of period 89,769,734 Average equity (GAAP) $ 3,021,929 $ 3,330,540 Less: Average goodwill 1,208,588 1,208,588 Less: Average amortizable intangibles 97,109 97,109 Less: Average perpetual preferred stock 166,356 — Average tangible common equity (non-GAAP) $ 1,549,876 $ 2,024,843 Less: Perpetual preferred stock Common equity to total assets (GAAP) 11.6% 13.7% Tangible equity to tangible assets (non-GAAP) 7.4% 8.9% Tangible equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 7.2% 8.7% Tangible common equity to tangible assets (non-GAAP) 6.7% 8.9% Tangible common equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 6.5% 8.7% Tangible common equity to tangible assets, ex AOCI (non-GAAP)1 8.3% Book value per common share (GAAP) $ 32.30 Tangible book value per common share (non-GAAP) $ 17.67 Tangible book value per common share, ex AOCI (non-GAAP)1 $ 21.96 Leverage Ratio Tier 1 capital $ 2,144,671 $ 2,477,377 Total average assets for leverage ratio $ 23,693,440 $ 23,572,634 Leverage ratio 9.1% 10.5% Leverage ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 7.3% 8.7% TANGIBLE ASSETS, TANGIBLE COMMON EQUITY, AND LEVERAGE RATIO As of June 30, 2024 1Calculation excludes the impact of 691,111 unvested restricted stock awards (RSAs) outstanding as of June 30, 2024 |

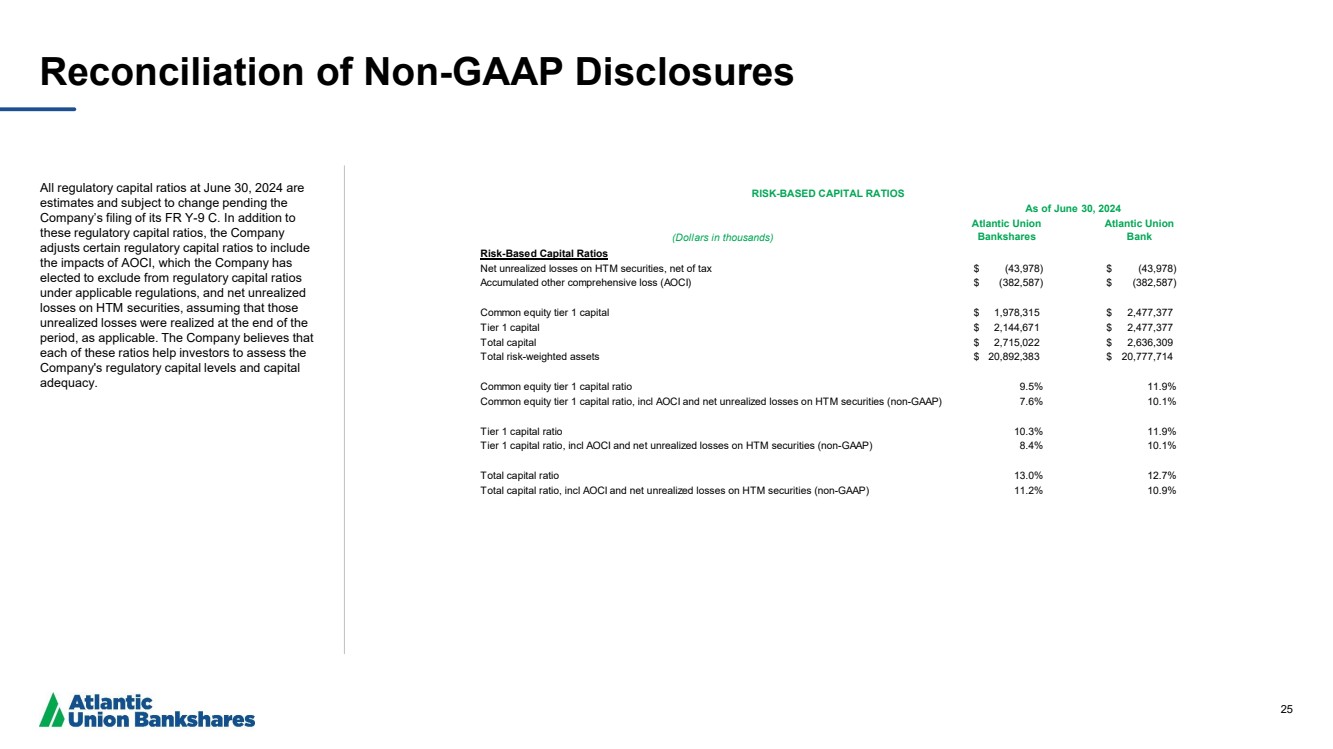

| 25 Reconciliation of Non-GAAP Disclosures All regulatory capital ratios at June 30, 2024 are estimates and subject to change pending the Company’s filing of its FR Y-9 C. In addition to these regulatory capital ratios, the Company adjusts certain regulatory capital ratios to include the impacts of AOCI, which the Company has elected to exclude from regulatory capital ratios under applicable regulations, and net unrealized losses on HTM securities, assuming that those unrealized losses were realized at the end of the period, as applicable. The Company believes that each of these ratios help investors to assess the Company's regulatory capital levels and capital adequacy. (Dollars in thousands) Atlantic Union Bankshares Atlantic Union Bank Risk-Based Capital Ratios Net unrealized losses on HTM securities, net of tax $ (43,978) $ (43,978) Accumulated other comprehensive loss (AOCI) $ (382,587) $ (382,587) Common equity tier 1 capital $ 1,978,315 $ 2,477,377 Tier 1 capital $ 2,144,671 $ 2,477,377 Total capital $ 2,715,022 $ 2,636,309 Total risk-weighted assets $ 20,892,383 $ 20,777,714 Common equity tier 1 capital ratio 9.5% 11.9% Common equity tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 7.6% 10.1% Tier 1 capital ratio 10.3% 11.9% Tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 8.4% 10.1% Total capital ratio 13.0% 12.7% Total capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 11.2% 10.9% RISK-BASED CAPITAL RATIOS As of June 30, 2024 |

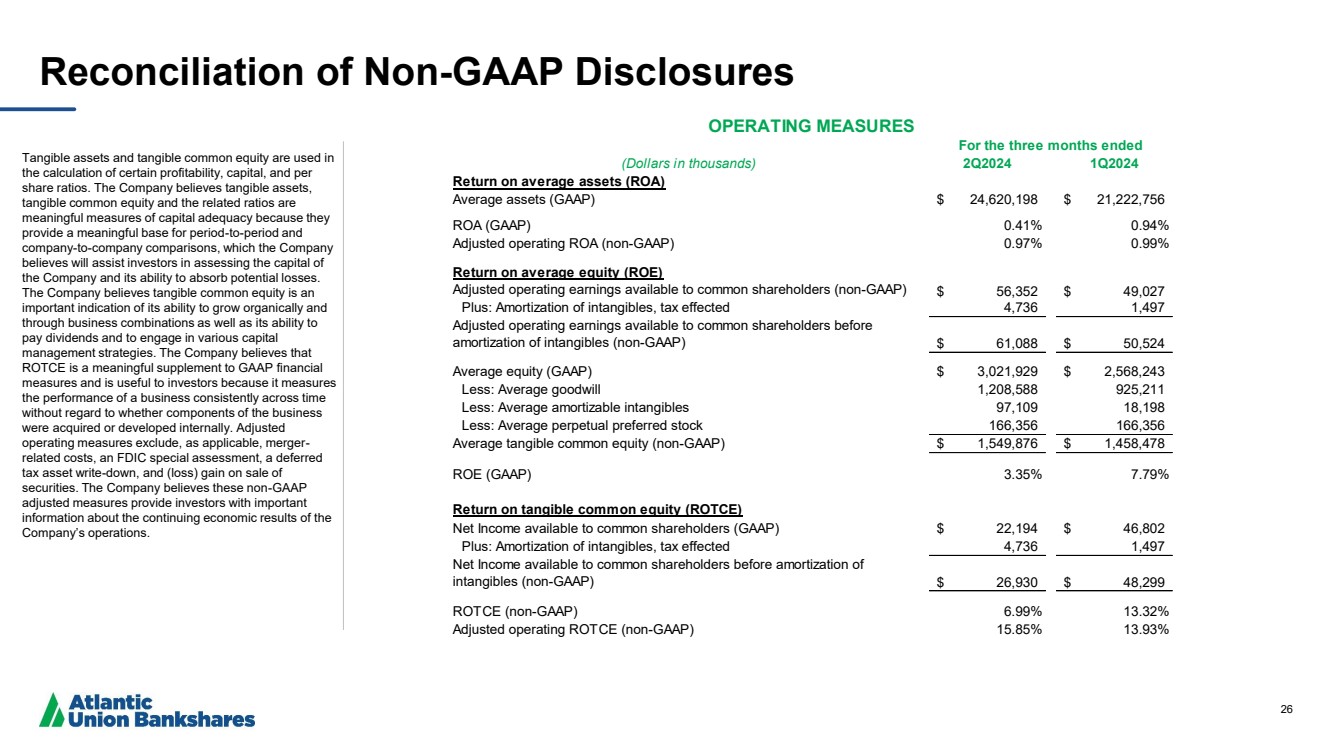

| 26 Reconciliation of Non-GAAP Disclosures Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations as well as its ability to pay dividends and to engage in various capital management strategies. The Company believes that ROTCE is a meaningful supplement to GAAP financial measures and is useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. Adjusted operating measures exclude, as applicable, merger-related costs, an FDIC special assessment, a deferred tax asset write-down, and (loss) gain on sale of securities. The Company believes these non-GAAP adjusted measures provide investors with important information about the continuing economic results of the Company’s operations. (Dollars in thousands) 2Q2024 1Q2024 Return on average assets (ROA) Average assets (GAAP) $ 24,620,198 $ 21,222,756 ROA (GAAP) 0.41% 0.94% Adjusted operating ROA (non-GAAP) 0.97% 0.99% Return on average equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) $ 56,352 $ 49,027 Plus: Amortization of intangibles, tax effected 4,736 1,497 Adjusted operating earnings available to common shareholders before amortization of intangibles (non-GAAP) $ 61,088 $ 50,524 Average equity (GAAP) $ 3,021,929 $ 2,568,243 Less: Average goodwill 1,208,588 925,211 Less: Average amortizable intangibles 97,109 18,198 Less: Average perpetual preferred stock 166,356 166,356 Average tangible common equity (non-GAAP) $ 1,549,876 $ 1,458,478 ROE (GAAP) 3.35% 7.79% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) $ 22,194 $ 46,802 Plus: Amortization of intangibles, tax effected 4,736 1,497 Net Income available to common shareholders before amortization of intangibles (non-GAAP) $ 26,930 $ 48,299 ROTCE (non-GAAP) 6.99% 13.32% Adjusted operating ROTCE (non-GAAP) 15.85% 13.93% For the three months ended OPERATING MEASURES |

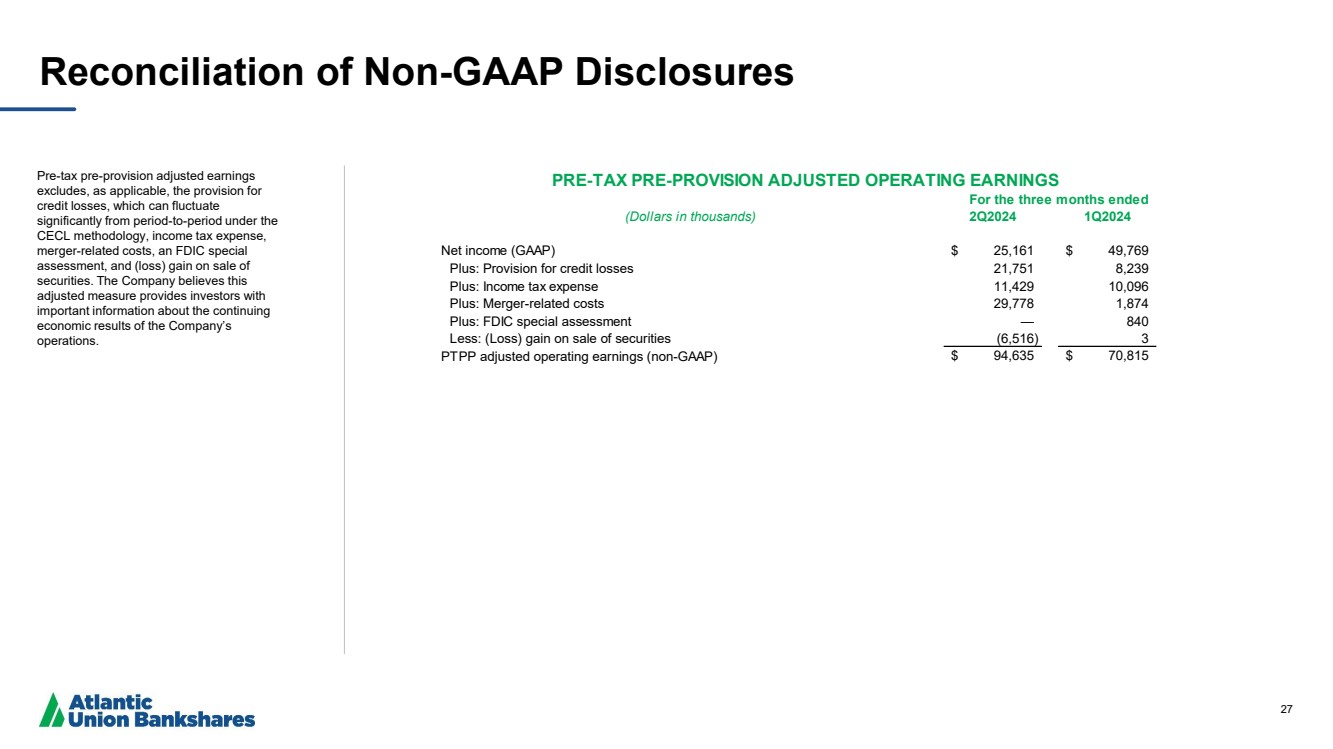

| 27 Reconciliation of Non-GAAP Disclosures Pre-tax pre-provision adjusted earnings excludes, as applicable, the provision for credit losses, which can fluctuate significantly from period-to-period under the CECL methodology, income tax expense, merger-related costs, an FDIC special assessment, and (loss) gain on sale of securities. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations. (Dollars in thousands) 2Q2024 1Q2024 Net income (GAAP) $ 25,161 $ 49,769 Plus: Provision for credit losses 21,751 8,239 Plus: Income tax expense 11,429 10,096 Plus: Merger-related costs 29,778 1,874 Plus: FDIC special assessment — 840 Less: (Loss) gain on sale of securities (6,516) 3 PTPP adjusted operating earnings (non-GAAP) $ 94,635 $ 70,815 For the three months ended PRE-TAX PRE-PROVISION ADJUSTED OPERATING EARNINGS |