| Annual Shareholders’ Meeting NYSE: AUB May 7, 2024 |

| 2 Forward Looking Statements This presentation and statements by our management may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include, without limitation, statements on slides entitled “Q1 2024 Highlights and FY 2023 Highlights,” “2024 Financial Outlook,” statements regarding our strategic priorities, plans, and initiatives, including how we plan to execute on such priorities, plans, and initiatives, including our planned transformation agenda, the impact of future economic conditions, statements about our capital management strategy, and statements that include other projections, predictions, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such forward-looking statements are based on certain assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other factors, some of which cannot be predicted or quantified, that may cause actual results, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” “”position,” “continue,” “confidence,” or words of similar meaning or other statements concerning opinions or judgment of the Company and our management about future events. Although we believe that our expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of our existing knowledge of our business and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, us will not differ materially from any projected future results, performance, achievements or trends expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of or changes in: • market interest rates and their related impacts on macroeconomic conditions, customer and client behavior, our funding costs and our loan and securities portfolios; • inflation and its impacts on economic growth and customer and client behavior; • adverse developments in the financial industry generally, such as bank failures, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs, and related impacts on customer and client behavior; • the sufficiency of liquidity; • general economic and financial market conditions, in the United States generally and particularly in the markets in which we operate and which our loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels and slowdowns in economic growth; • the impact of purchase accounting with respect to our merger with American National Bankshares Inc. (“American National”), or any change in the assumptions used regarding the assets acquired and liabilities assumed to determine the fair value and credit marks; • the possibility that the anticipated benefits of our merger with American National, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where we do business, or as a result of other unexpected factors or events; • potential adverse reactions or changes to business or employee relationships, including those resulting from our merger with American National; • the integration of the business and operations of American National may take longer or be more costly than anticipated; • monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of the Treasury and the Federal Reserve; • the quality or composition of our loan or investment portfolios and changes therein; • demand for loan products and financial services in our market areas; • our ability to manage our growth or implement our growth strategy; • the effectiveness of expense reduction plans; • the introduction of new lines of business or new products and services; • our ability to recruit and retain key employees; • real estate values in our lending area; • changes in accounting principles, standards, rules, and interpretations, and the related impact on our financial statements; • an insufficient ACL or volatility in the ACL resulting from the CECL methodology, either alone or as that may be affected by changing economic conditions, credit concentrations, inflation, changing interest rates, or other factors; • our liquidity and capital positions; • concentrations of loans secured by real estate, particularly commercial real estate; • the effectiveness of our credit processes and management of our credit risk; • our ability to compete in the market for financial services and increased competition from fintech companies; • technological risks and developments, and cyber threats, attacks, or events; • operational, technological, cultural, regulatory, legal, credit, and other risks associated with the exploration, consummation and integration of potential future acquisitions, whether involving stock or cash considerations; • the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, geopolitical conflicts or public health events (such as pandemics), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of our borrowers to satisfy their obligations to us, on the value of collateral securing loans, on the demand for our loans or our other products and services, on supply chains and methods used to distribute products and services, on incidents of cyberattack and fraud, on our liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of our business operations and on financial markets and economic growth; • performance by our counterparties or vendors; • deposit flows; • the availability of financing and the terms thereof; • the level of prepayments on loans and mortgage-backed securities; • legislative or regulatory changes and requirements; • actual or potential claims, damages, and fines related to litigation or government actions, which may result in, among other things, additional costs, fines, penalties, restrictions on our business activities, reputational harm, or other adverse consequences; • the effects of changes in federal, state or local tax laws and regulations; • any event or development that would cause us to conclude that there was an impairment of any asset, including intangible assets, such as goodwill; and • other factors, many of which are beyond our control. Please also refer to such other factors as discussed throughout Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2023, and related disclosures in other filings, which have been filed with the U.S. Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking statements, and all of the forward-looking statements are expressly qualified by the cautionary statements contained or referred to herein and therein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or our businesses or operations. Readers are cautioned not to rely too heavily on the forward-looking statements. Forward-looking statements speak only as of the date they are made. We do not intend or assume any obligation to update, revise or clarify any forward-looking statements that may be made from time to time by or on behalf of the Company, whether as a result of new information, future events or otherwise, except as required by law. |

| 3 Additional Information Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods, show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance, or show the potential effects of accumulated other comprehensive income (or AOCI) or unrealized losses on securities on the Company's capital. This presentation also includes certain projections of non-GAAP financial measures. Due to the inherent variability and difficulty associated with making accurate forecasts and projections of information that is excluded from these projected non-GAAP measures, and the fact that some of the excluded information is not currently ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable projected GAAP financial measures without unreasonable effort. Consequently, no disclosure of projected comparable GAAP measures is included, and no reconciliation of forward-looking non-GAAP financial information is included. Please see “Reconciliation of Non-GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (NYSE: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank has 135 branches and 150 ATMs located throughout Virginia and in portions of Maryland and North Carolina as of April 1, 2024. Certain non-bank financial services affiliates of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Atlantic Union Financial Consultants, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. |

| 4 4 John Asbury Chief Executive Officer |

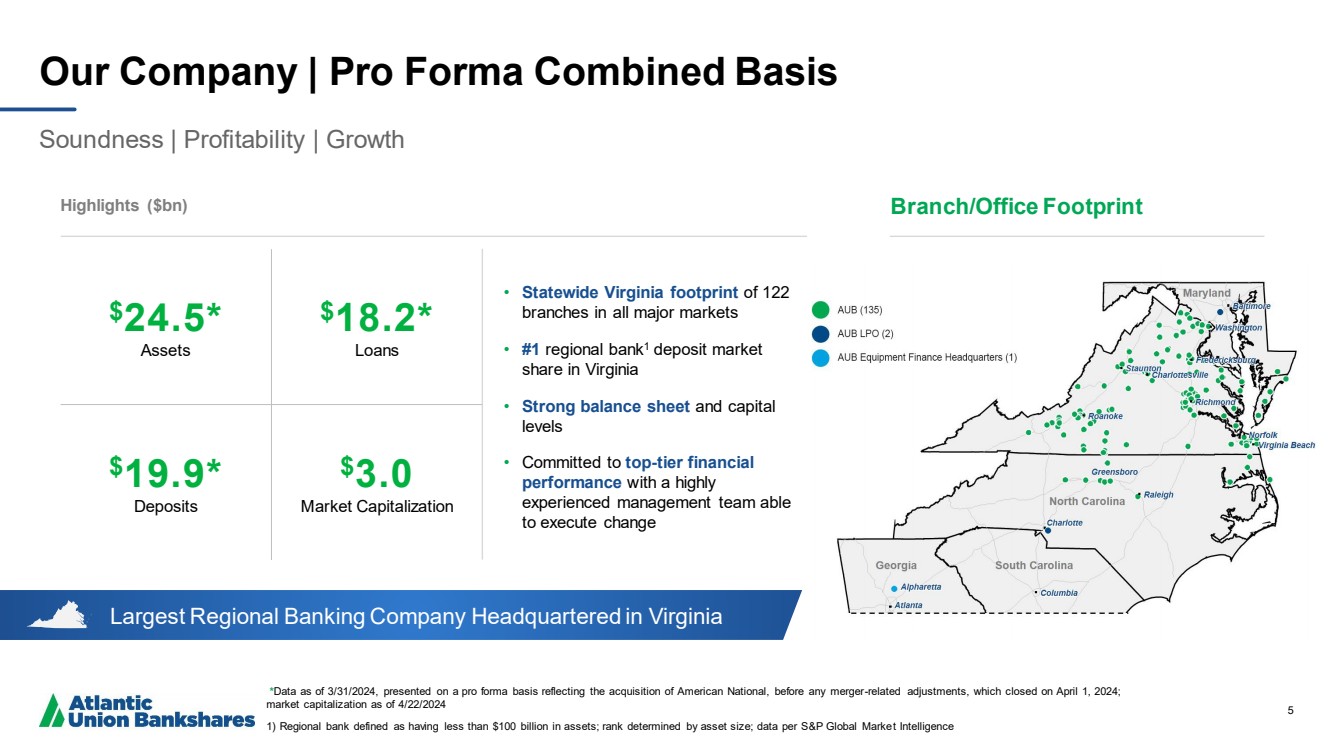

| 5 Largest Regional Banking Company Headquartered in Virginia Our Company | Pro Forma Combined Basis Soundness | Profitability | Growth *Data as of 3/31/2024, presented on a pro forma basis reflecting the acquisition of American National, before any merger-related adjustments, which closed on April 1, 2024; market capitalization as of 4/22/2024 1) Regional bank defined as having less than $100 billion in assets; rank determined by asset size; data per S&P Global Market Intelligence Highlights ($bn) • Statewide Virginia footprint of 122 branches in all major markets • #1 regional bank1 deposit market share in Virginia • Strong balance sheet and capital levels • Committed to top-tier financial performance with a highly experienced management team able to execute change 5 $24.5* Assets $18.2* Loans $19.9* Deposits $3.0 Market Capitalization Branch/Office Footprint |

| 6 Our Shareholder Value Proposition Leading Regional Presence Dense, uniquely valuable presence across attractive markets Financial Strength Solid balance sheet & capital levels Attractive Financial Profile Solid dividend yield & payout ratio with earnings upside Strong Growth Potential Organic & acquisition opportunities Peer-Leading Performance Committed to top-tier financial performance |

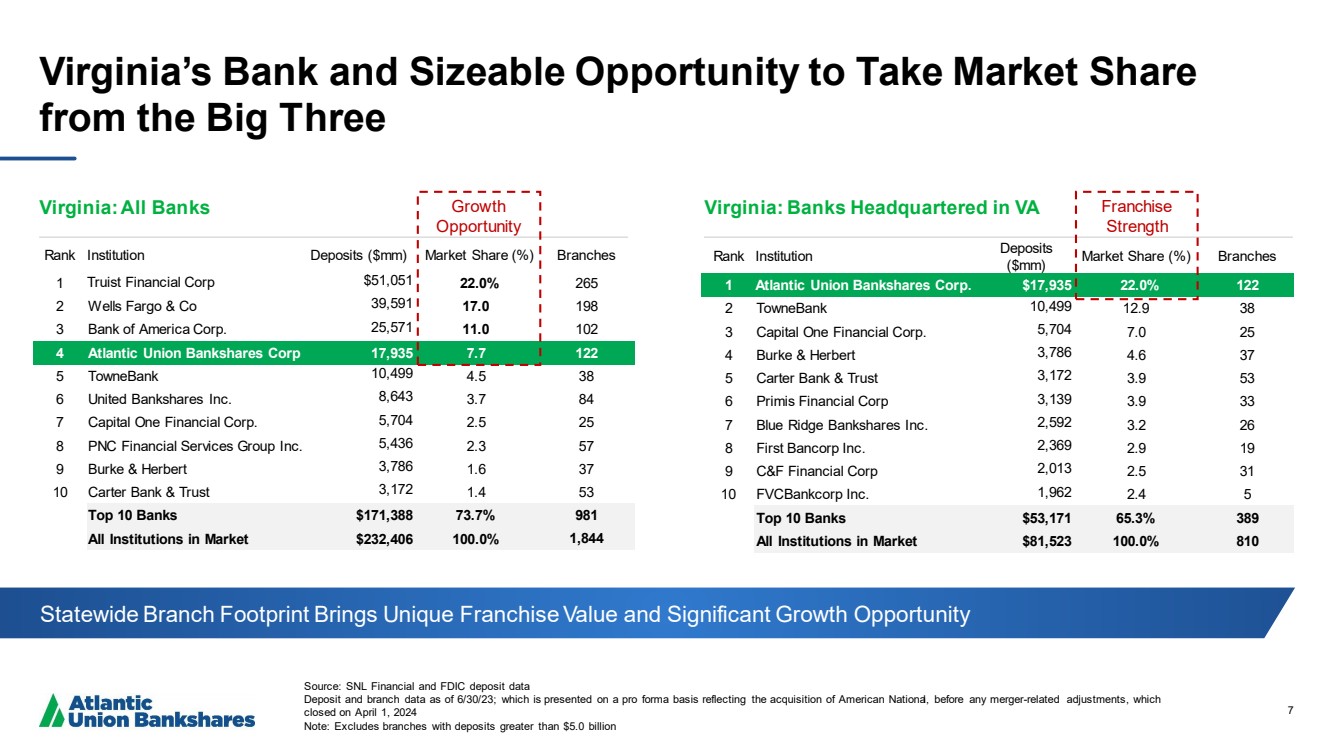

| 7 Virginia’s Bank and Sizeable Opportunity to Take Market Share from the Big Three Source: SNL Financial and FDIC deposit data Deposit and branch data as of 6/30/23; which is presented on a pro forma basis reflecting the acquisition of American National, before any merger-related adjustments, which closed on April 1, 2024 Note: Excludes branches with deposits greater than $5.0 billion Virginia: All Banks Virginia: Banks Headquartered in VA Rank Institution Deposits ($mm) Market Share (%) Branches 1 Truist Financial Corp $51,051 22.0% 265 2 Wells Fargo & Co 39,591 17.0 198 3 Bank of America Corp. 25,571 11.0 102 4 Atlantic Union Bankshares Corp 17,935 7.7 122 5 TowneBank 10,499 4.5 38 6 United Bankshares Inc. 8,643 3.7 84 7 Capital One Financial Corp. 5,704 2.5 25 8 PNC Financial Services Group Inc. 5,436 2.3 57 9 Burke & Herbert 3,786 1.6 37 10 Carter Bank & Trust 3,172 1.4 53 Top 10 Banks $171,388 73.7% 981 All Institutions in Market $232,406 100.0% 1,844 Rank Institution Deposits ($mm) Market Share (%) Branches 1 Atlantic Union Bankshares Corp. $17,935 22.0% 122 2 TowneBank 10,499 12.9 38 3 Capital One Financial Corp. 5,704 7.0 25 4 Burke & Herbert 3,786 4.6 37 5 Carter Bank & Trust 3,172 3.9 53 6 Primis Financial Corp 3,139 3.9 33 7 Blue Ridge Bankshares Inc. 2,592 3.2 26 8 First Bancorp Inc. 2,369 2.9 19 9 C&F Financial Corp 2,013 2.5 31 10 FVCBankcorp Inc. 1,962 2.4 5 Top 10 Banks $53,171 65.3% 389 All Institutions in Market $81,523 100.0% 810 Statewide Branch Footprint Brings Unique Franchise Value and Significant Growth Opportunity Growth Opportunity Franchise Strength |

| 8 Q1 2024 and FY 2023 Highlights Loan and Deposit Growth • 5.6% annualized loan growth in Q1 2024 from Q4 2023 and 8.7% from Q1 2023 • 11.0% annualized deposit growth in Q1 2024 from Q4 2023 and 5.0% from Q1 2023 Asset Quality • Q1 2024 net charge-offs at 13 bps annualized which is the same as Q1 2023 • Net charge-offs of 5 bps for FY 2023 Positioning for Long Term • In 2023, restructured the Company’s securities portfolio by ~$500mm in February/March and ~$200mm in the third quarter to improve go-forward earnings trajectory • In 2023, took strategic actions to reduce expenses • Granular growing deposit base • Focus on organic growth and performance of the core banking franchise Differentiated Client Experience • Responsive, strong and capable alternative to large national banks, while competitive with and more capable than smaller banks Focus on Smooth Integration • Core Systems conversion planned for late May 2024 • Integration off to a good start and one mock system conversion completed • Experienced integration team with our third integration of a $3 billion bank in 6 years Capitalize on Strategic Opportunities • Announced intention to acquire American National Bankshares in July 2023 and closed acquisition of American National on April 1, 2024 8 |

| 9 Caring Working together toward common goals, acting with kindness, respect and a genuine concern for others. Courageous Speaking openly, honestly and accepting our challenges and mistakes as opportunities to learn and grow. Committed Driven to help our clients, Teammates and company succeed, doing what is right and accountable for our actions. Our Core Values Culture — HOW we come together and interact as a team to accomplish our business and societal goals. Diversity, Equity, Inclusion, and Belonging Statement Atlantic Union Bank embraces diversity of thought and identity to better serve our stakeholders and achieve our purpose. We commit to cultivating a welcoming workplace where Teammate and customer perspectives are valued and respected. |

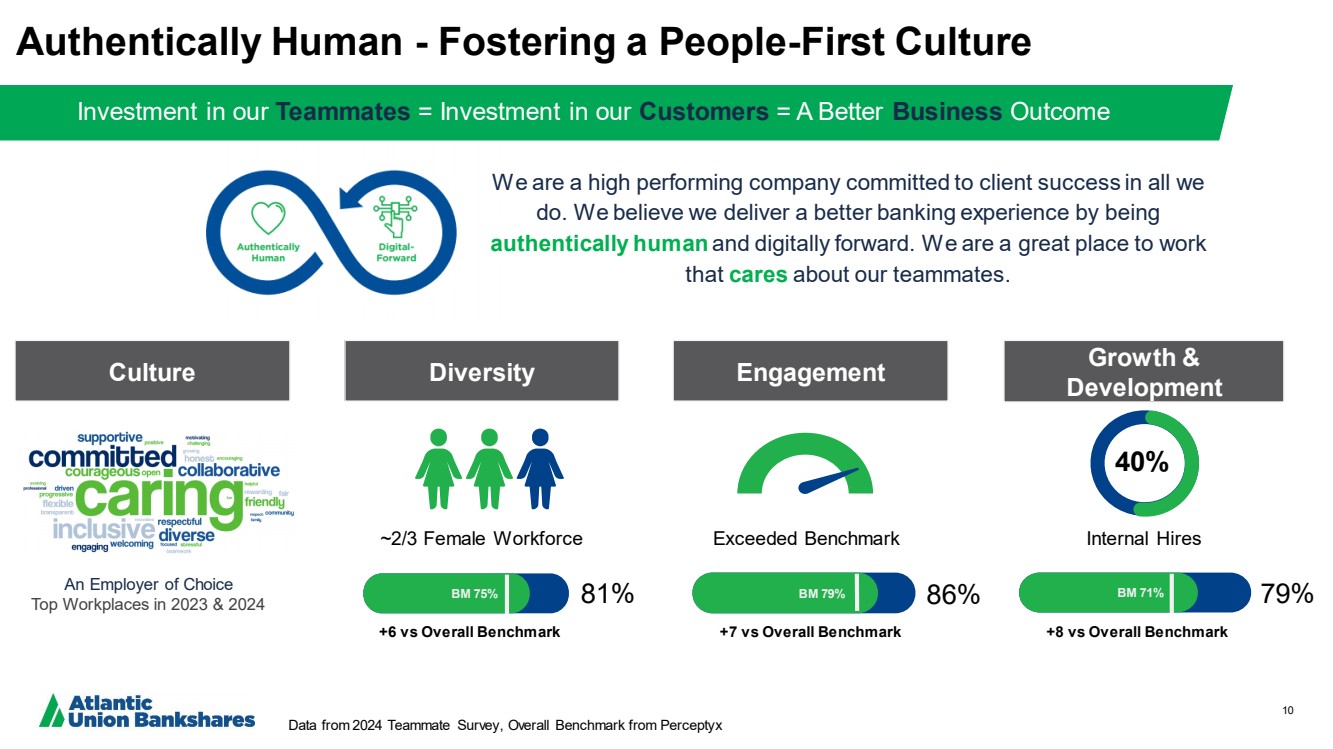

| 10 Authentically Human - Fostering a People-First Culture Engagement Growth & Development ~2/3 Female Workforce Exceeded Benchmark Internal Hires +6 vs Overall Benchmark +7 vs Overall Benchmark +8 vs Overall Benchmark An Employer of Choice Top Workplaces in 2023 & 2024 Investment in our Teammates = Investment in our Customers = A Better Business Outcome Culture Diversity We are a high performing company committed to client success in all we do. We believe we deliver a better banking experience by being authentically human and digitally forward. We are a great place to work that cares about our teammates. BM 75% 81% BM 79% 86% BM 71% 79% Data from 2024 Teammate Survey, Overall Benchmark from Perceptyx 40% |

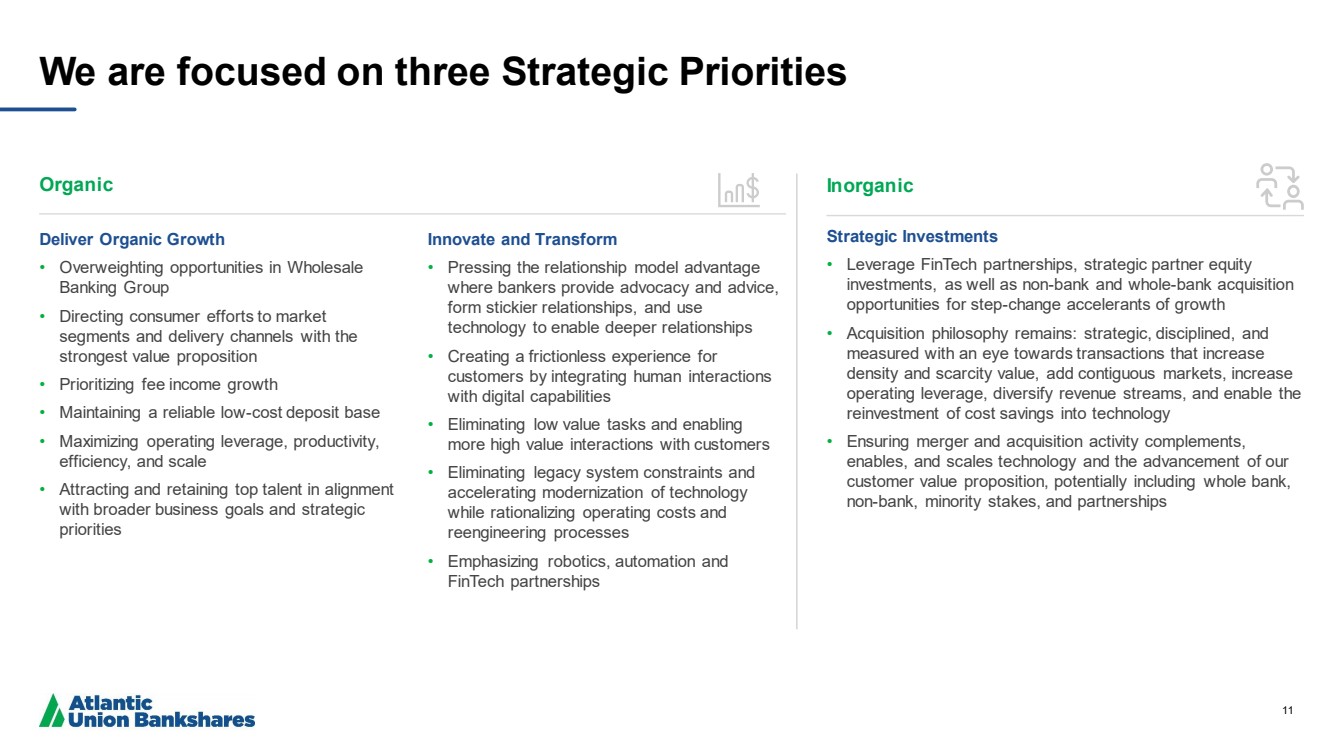

| 11 We are focused on three Strategic Priorities Organic Deliver Organic Growth • Overweighting opportunities in Wholesale Banking Group • Directing consumer efforts to market segments and delivery channels with the strongest value proposition • Prioritizing fee income growth • Maintaining a reliable low-cost deposit base • Maximizing operating leverage, productivity, efficiency, and scale • Attracting and retaining top talent in alignment with broader business goals and strategic priorities Innovate and Transform • Pressing the relationship model advantage where bankers provide advocacy and advice, form stickier relationships, and use technology to enable deeper relationships • Creating a frictionless experience for customers by integrating human interactions with digital capabilities • Eliminating low value tasks and enabling more high value interactions with customers • Eliminating legacy system constraints and accelerating modernization of technology while rationalizing operating costs and reengineering processes • Emphasizing robotics, automation and FinTech partnerships Inorganic Strategic Investments • Leverage FinTech partnerships, strategic partner equity investments, as well as non-bank and whole-bank acquisition opportunities for step-change accelerants of growth • Acquisition philosophy remains: strategic, disciplined, and measured with an eye towards transactions that increase density and scarcity value, add contiguous markets, increase operating leverage, diversify revenue streams, and enable the reinvestment of cost savings into technology • Ensuring merger and acquisition activity complements, enables, and scales technology and the advancement of our customer value proposition, potentially including whole bank, non-bank, minority stakes, and partnerships |

| 12 12 Maria Tedesco President and Chief Operating Officer |

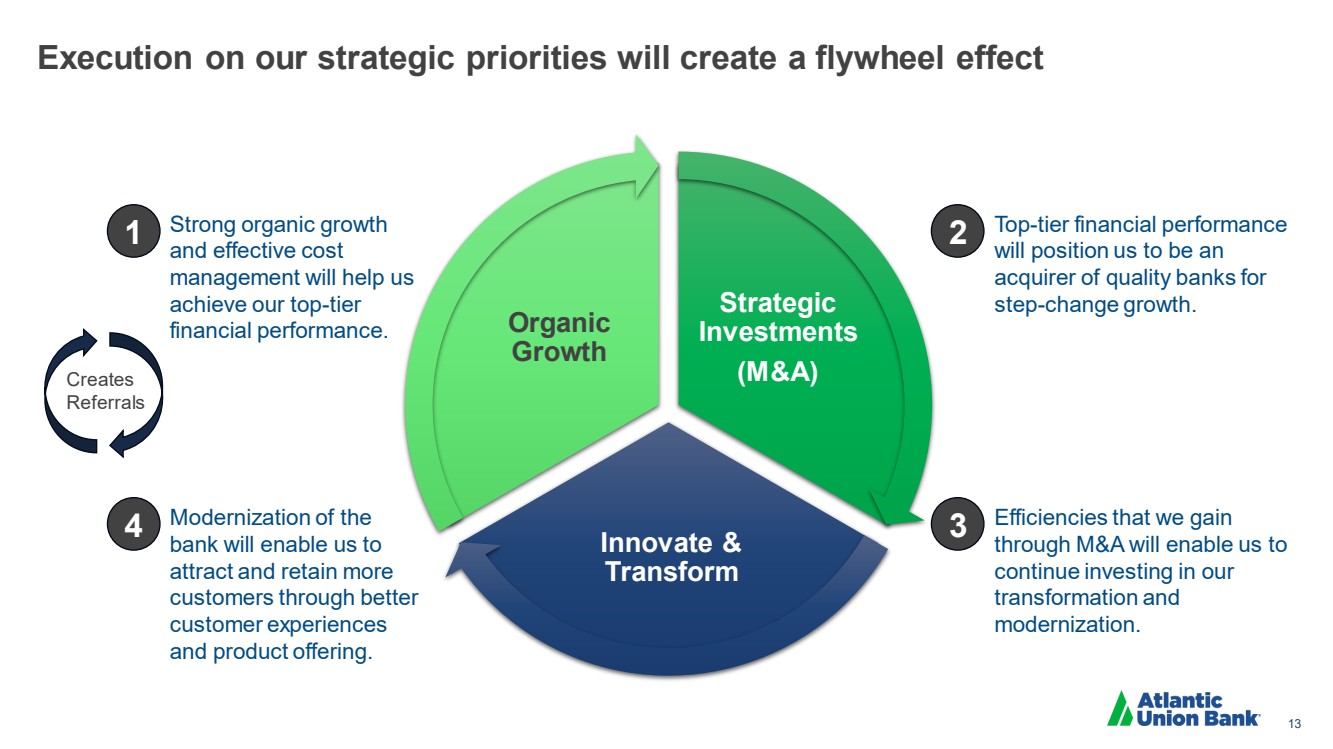

| 13 Strategic Investments (M&A) Innovate & Transform Organic Growth Execution on our strategic priorities will create a flywheel effect Strong organic growth and effective cost management will help us achieve our top-tier financial performance. Top-tier financial performance will position us to be an acquirer of quality banks for step-change growth. 1 2 Efficiencies that we gain through M&A will enable us to continue investing in our transformation and modernization. 3 Modernization of the bank will enable us to attract and retain more customers through better customer experiences and product offering. 4 Creates Referrals |

| 14 Operating Group Strategic Initiatives to Achieve Bank Priorities Improve client experience by engaging FinTechs to offer the latest products and services more effectively and efficiently Drive disproportionate growth through Wholesale Banking and Business Banking while optimizing and segmenting Consumer Banking Relentlessly focus on customer experience by coupling our personal relationship advantage, responsiveness, deep customer and local market knowledge with technology enabled experiences Accelerate the modernization of our technology base while rationalizing operating costs and reengineering processes Maintain a strong core funding base, growing fee revenues and exhibiting discipline in management of credit, risk, capital and expenses Attract and retain top talent through culture, rewards, and career development opportunities while embracing “the future of work” and integrating disruptive forces in the modern workplace Methodically pursue disciplined M&A and strategic partner equity investments |

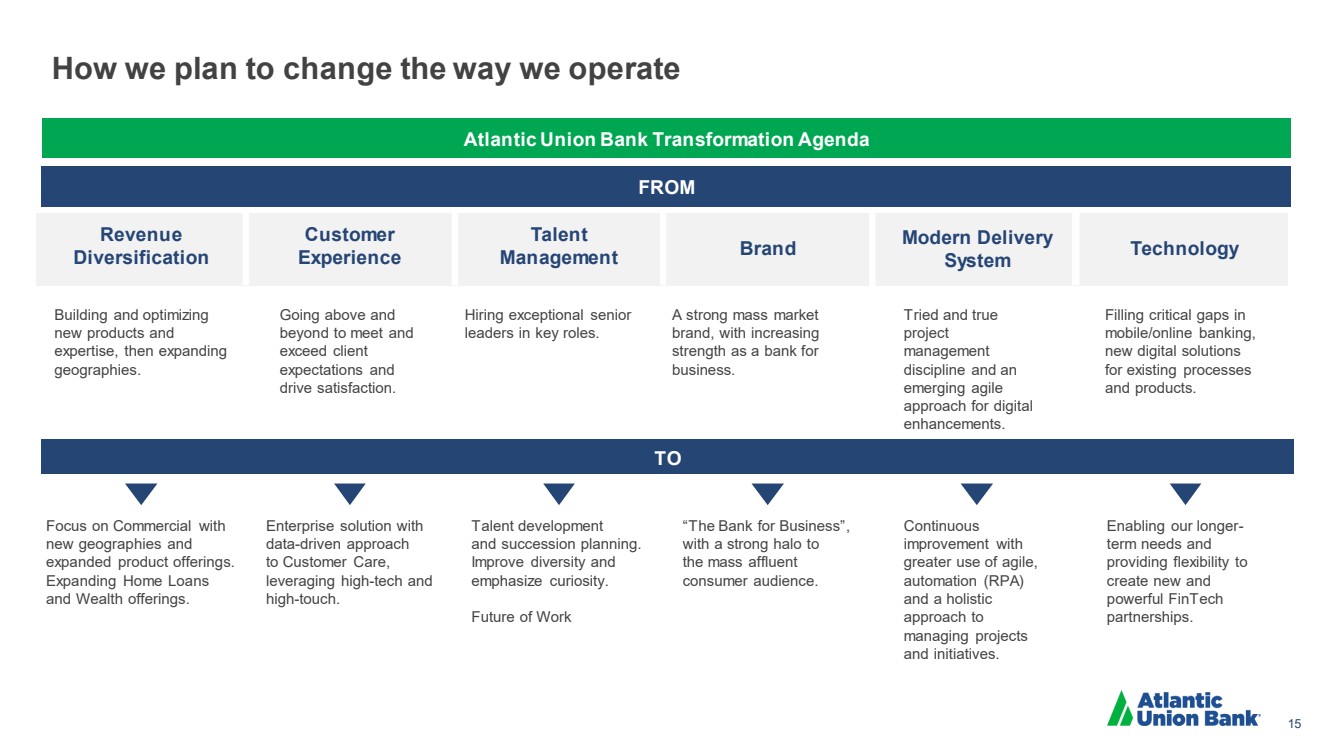

| 15 How we plan to change the way we operate Building and optimizing new products and expertise, then expanding geographies. Going above and beyond to meet and exceed client expectations and drive satisfaction. Hiring exceptional senior leaders in key roles. A strong mass market brand, with increasing strength as a bank for business. Tried and true project management discipline and an emerging agile approach for digital enhancements. Filling critical gaps in mobile/online banking, new digital solutions for existing processes and products. Focus on Commercial with new geographies and expanded product offerings. Expanding Home Loans and Wealth offerings. Enterprise solution with data-driven approach to Customer Care, leveraging high-tech and high-touch. Talent development and succession planning. Improve diversity and emphasize curiosity. Future of Work “The Bank for Business”, with a strong halo to the mass affluent consumer audience. Continuous improvement with greater use of agile, automation (RPA) and a holistic approach to managing projects and initiatives. Enabling our longer-term needs and providing flexibility to create new and powerful FinTech partnerships. FROM TO Revenue Diversification Customer Experience Talent Management Brand Modern Delivery System Technology Atlantic Union Bank Transformation Agenda |

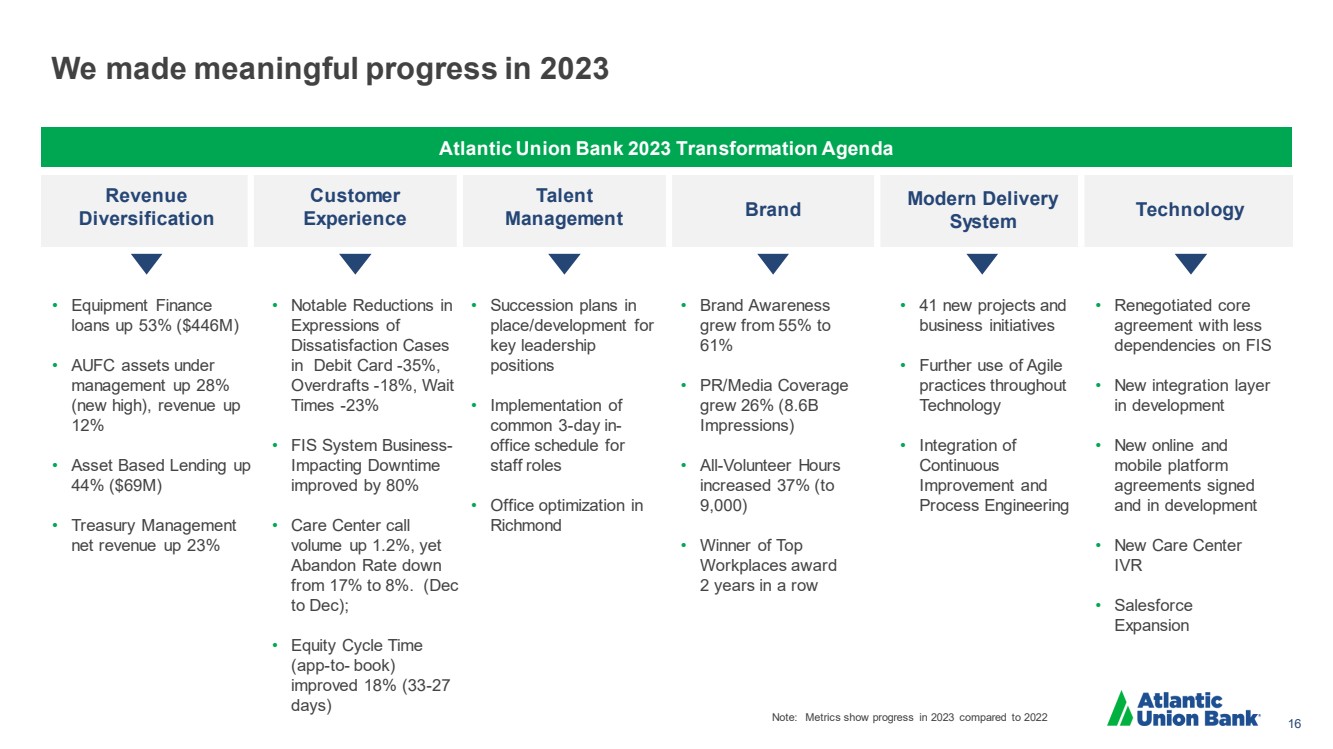

| 16 We made meaningful progress in 2023 Atlantic Union Bank 2023 Transformation Agenda Revenue Diversification Customer Experience Talent Management Brand Modern Delivery System Technology • Equipment Finance loans up 53% ($446M) • AUFC assets under management up 28% (new high), revenue up 12% • Asset Based Lending up 44% ($69M) • Treasury Management net revenue up 23% • Notable Reductions in Expressions of Dissatisfaction Cases in Debit Card -35%, Overdrafts -18%, Wait Times -23% • FIS System Business-Impacting Downtime improved by 80% • Care Center call volume up 1.2%, yet Abandon Rate down from 17% to 8%. (Dec to Dec); • Equity Cycle Time (app-to- book) improved 18% (33-27 days) • Succession plans in place/development for key leadership positions • Implementation of common 3-day in-office schedule for staff roles • Office optimization in Richmond • Brand Awareness grew from 55% to 61% • PR/Media Coverage grew 26% (8.6B Impressions) • All-Volunteer Hours increased 37% (to 9,000) • Winner of Top Workplaces award 2 years in a row • 41 new projects and business initiatives • Further use of Agile practices throughout Technology • Integration of Continuous Improvement and Process Engineering • Renegotiated core agreement with less dependencies on FIS • New integration layer in development • New online and mobile platform agreements signed and in development • New Care Center IVR • Salesforce Expansion Note: Metrics show progress in 2023 compared to 2022 |

| 17 17 Rob Gorman Chief Financial Officer |

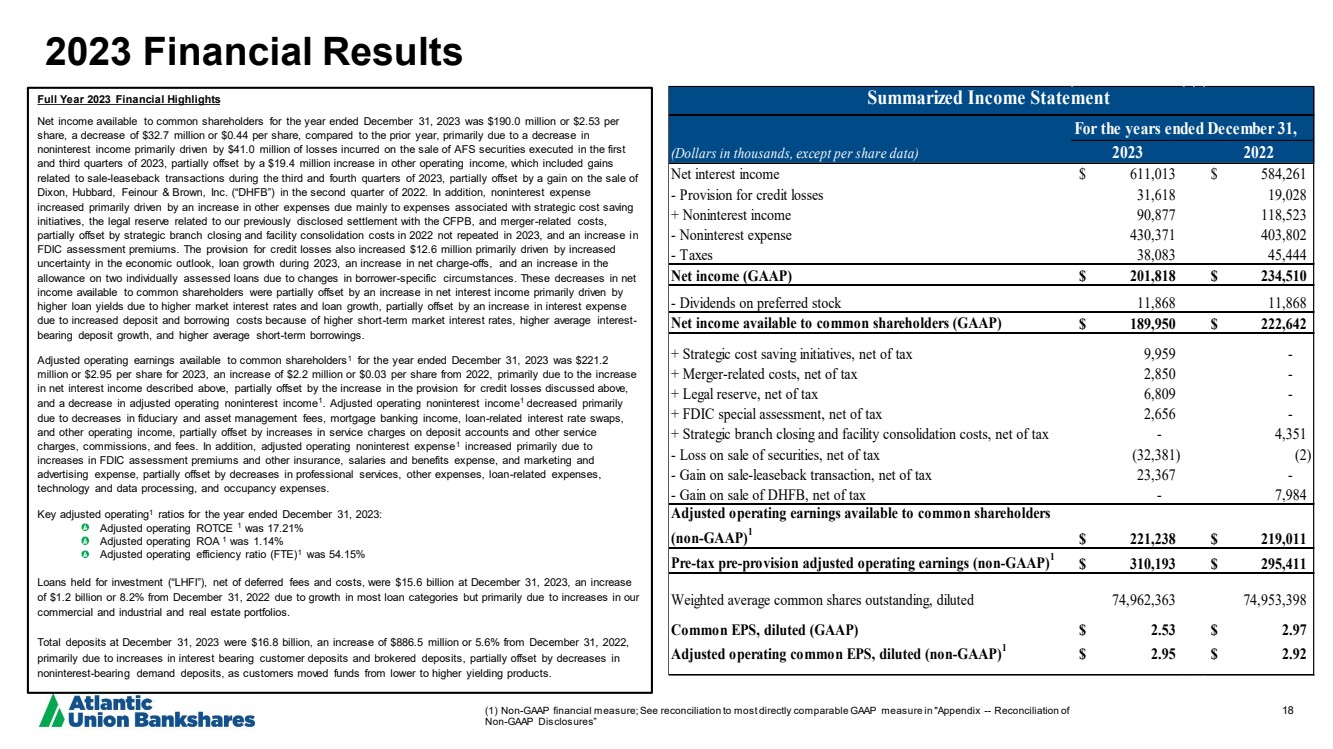

| 18 Full Year 2023 Financial Highlights Net income available to common shareholders for the year ended December 31, 2023 was $190.0 million or $2.53 per share, a decrease of $32.7 million or $0.44 per share, compared to the prior year, primarily due to a decrease in noninterest income primarily driven by $41.0 million of losses incurred on the sale of AFS securities executed in the first and third quarters of 2023, partially offset by a $19.4 million increase in other operating income, which included gains related to sale-leaseback transactions during the third and fourth quarters of 2023, partially offset by a gain on the sale of Dixon, Hubbard, Feinour & Brown, Inc. (“DHFB”) in the second quarter of 2022. In addition, noninterest expense increased primarily driven by an increase in other expenses due mainly to expenses associated with strategic cost saving initiatives, the legal reserve related to our previously disclosed settlement with the CFPB, and merger-related costs, partially offset by strategic branch closing and facility consolidation costs in 2022 not repeated in 2023, and an increase in FDIC assessment premiums. The provision for credit losses also increased $12.6 million primarily driven by increased uncertainty in the economic outlook, loan growth during 2023, an increase in net charge-offs, and an increase in the allowance on two individually assessed loans due to changes in borrower-specific circumstances. These decreases in net income available to common shareholders were partially offset by an increase in net interest income primarily driven by higher loan yields due to higher market interest rates and loan growth, partially offset by an increase in interest expense due to increased deposit and borrowing costs because of higher short-term market interest rates, higher average interest-bearing deposit growth, and higher average short-term borrowings. Adjusted operating earnings available to common shareholders1 for the year ended December 31, 2023 was $221.2 million or $2.95 per share for 2023, an increase of $2.2 million or $0.03 per share from 2022, primarily due to the increase in net interest income described above, partially offset by the increase in the provision for credit losses discussed above, and a decrease in adjusted operating noninterest income1 .. Adjusted operating noninterest income1 decreased primarily due to decreases in fiduciary and asset management fees, mortgage banking income, loan-related interest rate swaps, and other operating income, partially offset by increases in service charges on deposit accounts and other service charges, commissions, and fees. In addition, adjusted operating noninterest expense1 increased primarily due to increases in FDIC assessment premiums and other insurance, salaries and benefits expense, and marketing and advertising expense, partially offset by decreases in professional services, other expenses, loan-related expenses, technology and data processing, and occupancy expenses. Key adjusted operating1 ratios for the year ended December 31, 2023: Adjusted operating ROTCE 1 was 17.21% Adjusted operating ROA 1 was 1.14% Adjusted operating efficiency ratio (FTE)1 was 54.15% Loans held for investment (“LHFI”), net of deferred fees and costs, were $15.6 billion at December 31, 2023, an increase of $1.2 billion or 8.2% from December 31, 2022 due to growth in most loan categories but primarily due to increases in our commercial and industrial and real estate portfolios. Total deposits at December 31, 2023 were $16.8 billion, an increase of $886.5 million or 5.6% from December 31, 2022, primarily due to increases in interest bearing customer deposits and brokered deposits, partially offset by decreases in noninterest-bearing demand deposits, as customers moved funds from lower to higher yielding products. For the years ended December 31, (Dollars in thousands, except per share data) 2023 2022 Net interest income $ 611,013 $ 584,261 - Provision for credit losses 31,618 19,028 + Noninterest income 90,877 118,523 - Noninterest expense 430,371 403,802 - Taxes 38,083 45,444 Net income (GAAP) $ 201,818 $ 234,510 - Dividends on preferred stock 11,868 11,868 Net income available to common shareholders (GAAP) $ 189,950 $ 222,642 + Strategic cost saving initiatives, net of tax 9,959 - + Merger-related costs, net of tax 2,850 - + Legal reserve, net of tax 6,809 - + FDIC special assessment, net of tax 2,656 - + Strategic branch closing and facility consolidation costs, net of tax - 4,351 - Loss on sale of securities, net of tax (32,381) (2) - Gain on sale-leaseback transaction, net of tax 23,367 - - Gain on sale of DHFB, net of tax - 7,984 Adjusted operating earnings available to common shareholders (non-GAAP)1 $ 221,238 $ 219,011 Pre-tax pre-provision adjusted operating earnings (non-GAAP)1 $ 310,193 $ 295,411 Weighted average common shares outstanding, diluted 74,962,363 74,953,398 Common EPS, diluted (GAAP) $ 2.53 $ 2.97 Adjusted operating common EPS, diluted (non-GAAP)1 $ 2.95 $ 2.92 Summarized Income Statement 2023 Financial Results (1) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures” |

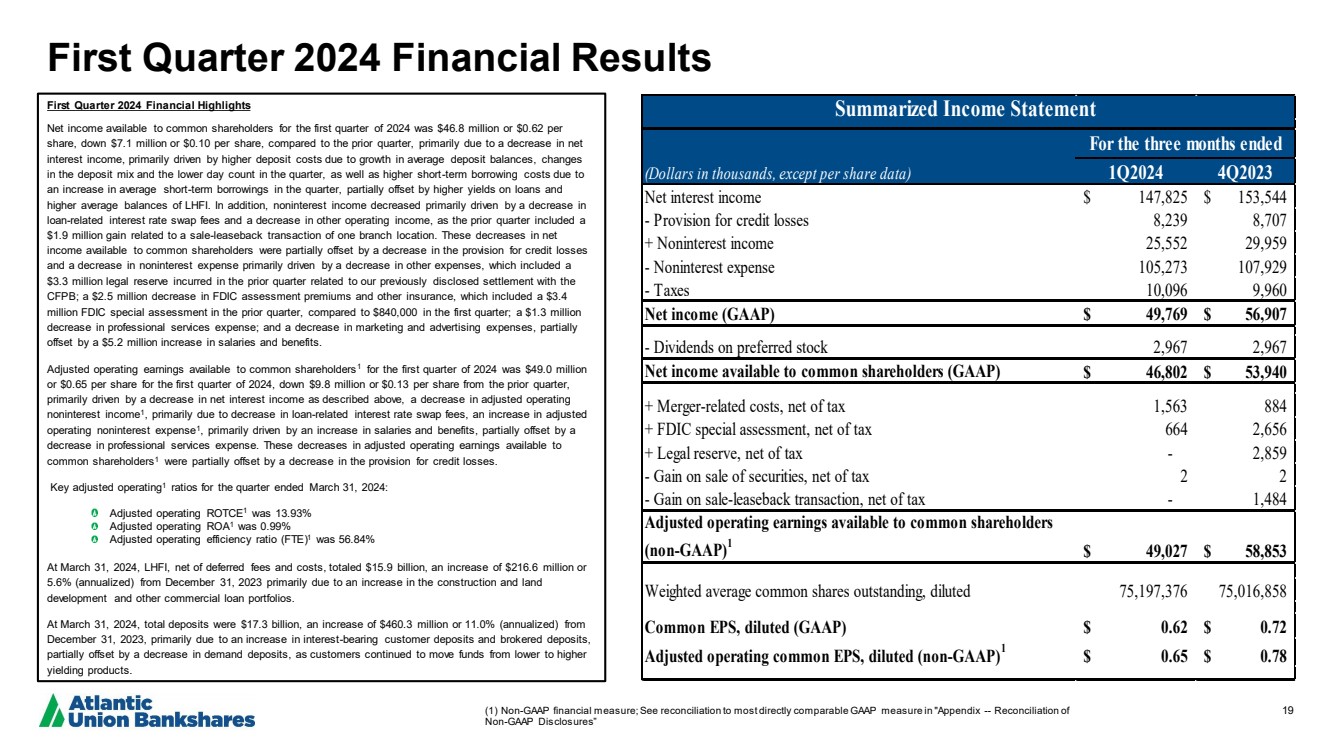

| 19 First Quarter 2024 Financial Highlights Net income available to common shareholders for the first quarter of 2024 was $46.8 million or $0.62 per share, down $7.1 million or $0.10 per share, compared to the prior quarter, primarily due to a decrease in net interest income, primarily driven by higher deposit costs due to growth in average deposit balances, changes in the deposit mix and the lower day count in the quarter, as well as higher short-term borrowing costs due to an increase in average short-term borrowings in the quarter, partially offset by higher yields on loans and higher average balances of LHFI. In addition, noninterest income decreased primarily driven by a decrease in loan-related interest rate swap fees and a decrease in other operating income, as the prior quarter included a $1.9 million gain related to a sale-leaseback transaction of one branch location. These decreases in net income available to common shareholders were partially offset by a decrease in the provision for credit losses and a decrease in noninterest expense primarily driven by a decrease in other expenses, which included a $3.3 million legal reserve incurred in the prior quarter related to our previously disclosed settlement with the CFPB; a $2.5 million decrease in FDIC assessment premiums and other insurance, which included a $3.4 million FDIC special assessment in the prior quarter, compared to $840,000 in the first quarter; a $1.3 million decrease in professional services expense; and a decrease in marketing and advertising expenses, partially offset by a $5.2 million increase in salaries and benefits. Adjusted operating earnings available to common shareholders1 for the first quarter of 2024 was $49.0 million or $0.65 per share for the first quarter of 2024, down $9.8 million or $0.13 per share from the prior quarter, primarily driven by a decrease in net interest income as described above, a decrease in adjusted operating noninterest income1 , primarily due to decrease in loan-related interest rate swap fees, an increase in adjusted operating noninterest expense1 , primarily driven by an increase in salaries and benefits, partially offset by a decrease in professional services expense. These decreases in adjusted operating earnings available to common shareholders1 were partially offset by a decrease in the provision for credit losses. Key adjusted operating1 ratios for the quarter ended March 31, 2024: Adjusted operating ROTCE1 was 13.93% Adjusted operating ROA1 was 0.99% Adjusted operating efficiency ratio (FTE)1 was 56.84% At March 31, 2024, LHFI, net of deferred fees and costs, totaled $15.9 billion, an increase of $216.6 million or 5.6% (annualized) from December 31, 2023 primarily due to an increase in the construction and land development and other commercial loan portfolios. At March 31, 2024, total deposits were $17.3 billion, an increase of $460.3 million or 11.0% (annualized) from December 31, 2023, primarily due to an increase in interest-bearing customer deposits and brokered deposits, partially offset by a decrease in demand deposits, as customers continued to move funds from lower to higher yielding products. (Dollars in thousands, except per share data) 1Q2024 4Q2023 Net interest income $ 147,825 $ 153,544 - Provision for credit losses 8,239 8,707 + Noninterest income 25,552 29,959 - Noninterest expense 105,273 107,929 - Taxes 10,096 9,960 Net income (GAAP) $ 49,769 $ 56,907 - Dividends on preferred stock 2,967 2,967 Net income available to common shareholders (GAAP) $ 46,802 $ 53,940 + Merger-related costs, net of tax 1,563 884 + FDIC special assessment, net of tax 664 2,656 + Legal reserve, net of tax - 2,859 - Gain on sale of securities, net of tax 2 2 - Gain on sale-leaseback transaction, net of tax - 1,484 Adjusted operating earnings available to common shareholders (non-GAAP)1 $ 49,027 $ 58,853 Weighted average common shares outstanding, diluted 75,197,376 75,016,858 Common EPS, diluted (GAAP) $ 0.62 $ 0.72 Adjusted operating common EPS, diluted (non-GAAP)1 $ 0.65 $ 0.78 For the three months ended Summarized Income Statement First Quarter 2024 Financial Results (1) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures” |

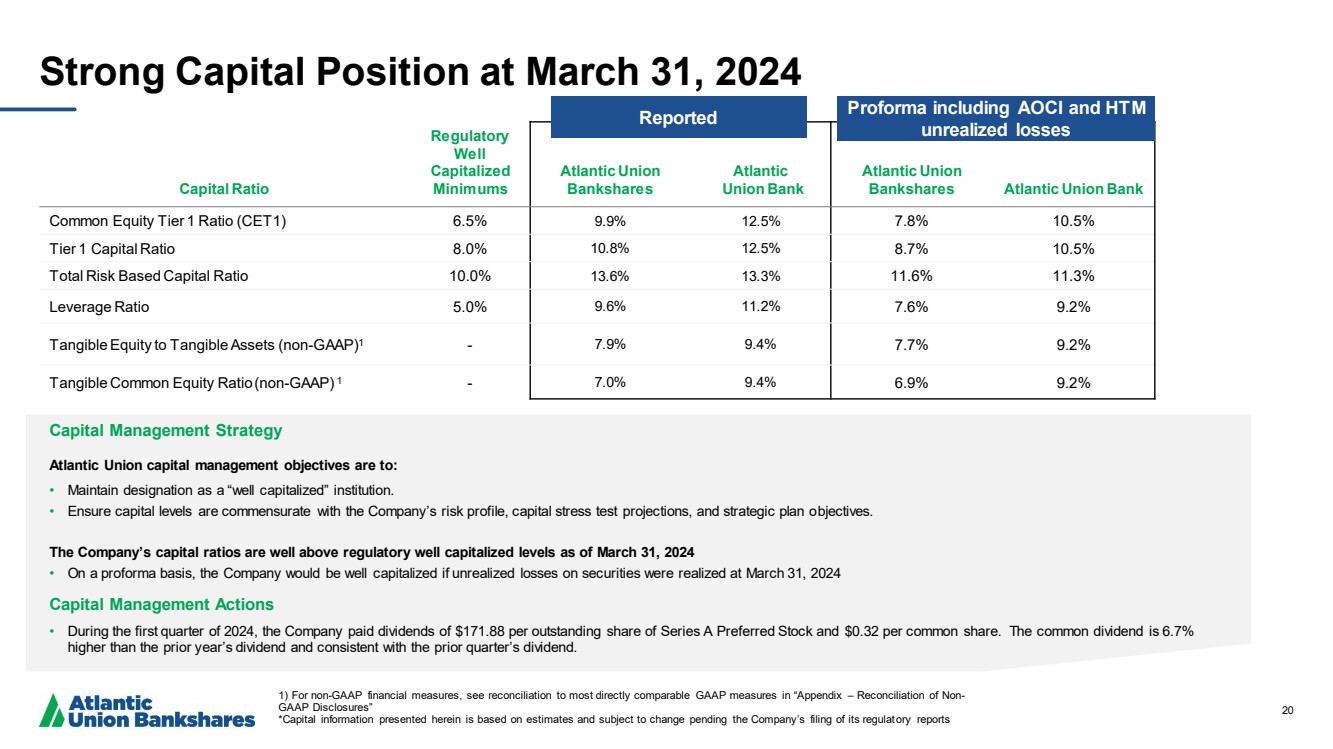

| 20 Capital Ratio Regulatory Well Capitalized Minimums Atlantic Union Bankshares Atlantic Union Bank Atlantic Union Bankshares Atlantic Union Bank Common Equity Tier 1 Ratio (CET1) 6.5% 9.9% 12.5% 7.8% 10.5% Tier 1 Capital Ratio 8.0% 10.8% 12.5% 8.7% 10.5% Total Risk Based Capital Ratio 10.0% 13.6% 13.3% 11.6% 11.3% Leverage Ratio 5.0% 9.6% 11.2% 7.6% 9.2% Tangible Equity to Tangible Assets (non-GAAP)1 - 7.9% 9.4% 7.7% 9.2% Tangible Common Equity Ratio(non-GAAP) 1 - 7.0% 9.4% 6.9% 9.2% Strong Capital Position at March 31, 2024 1) For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” *Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulatory reports Capital Management Strategy Atlantic Union capital management objectives are to: • Maintain designation as a “well capitalized” institution. • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives. The Company’s capital ratios are well above regulatory well capitalized levels as of March 31, 2024 • On a proforma basis, the Company would be well capitalized if unrealized losses on securities were realized at March 31, 2024 Capital Management Actions • During the first quarter of 2024, the Company paid dividends of $171.88 per outstanding share of Series A Preferred Stock and $0.32 per common share. The common dividend is 6.7% higher than the prior year’s dividend and consistent with the prior quarter’s dividend. Reported Proforma including AOCI and HTM unrealized losses |

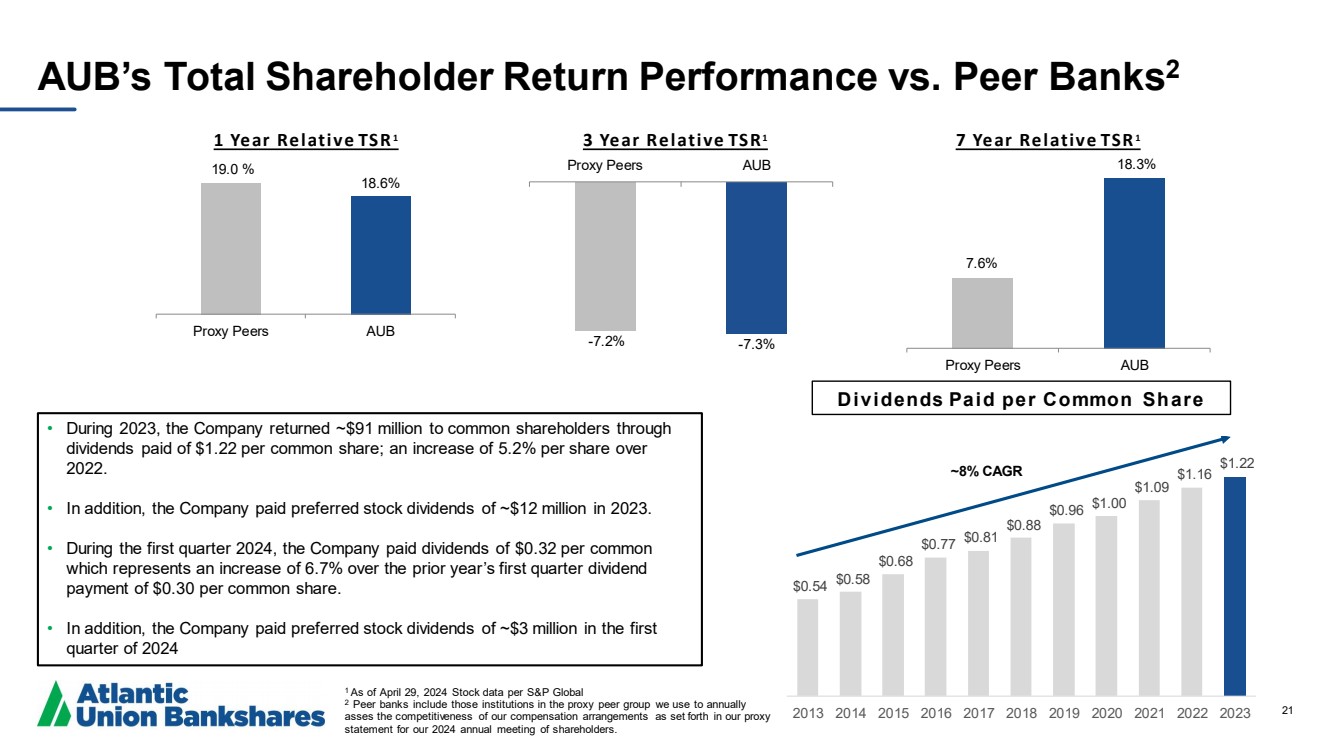

| 21 $0.54 $0.58 $0.68 $0.77 $0.81 $0.88 $0.96 $1.00 $1.09 $1.16 $1.22 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 -7.2% -7.3% Proxy Peers AUB 3 Year Relative TSR1 1 As of April 29, 2024 Stock data per S&P Global 2 Peer banks include those institutions in the proxy peer group we use to annually asses the competitiveness of our compensation arrangements as set forth in our proxy statement for our 2024 annual meeting of shareholders. 1 Year Relative TSR1 19.0 % 18.6% Proxy Peers AUB 7.6% 18.3% Proxy Peers AUB 7 Year Relative TSR1 Dividends Paid per Common Share ~8% CAGR AUB’s Total Shareholder Return Performance vs. Peer Banks2 • During 2023, the Company returned ~$91 million to common shareholders through dividends paid of $1.22 per common share; an increase of 5.2% per share over 2022. • In addition, the Company paid preferred stock dividends of ~$12 million in 2023. • During the first quarter 2024, the Company paid dividends of $0.32 per common which represents an increase of 6.7% over the prior year’s first quarter dividend payment of $0.30 per common share. • In addition, the Company paid preferred stock dividends of ~$3 million in the first quarter of 2024 |

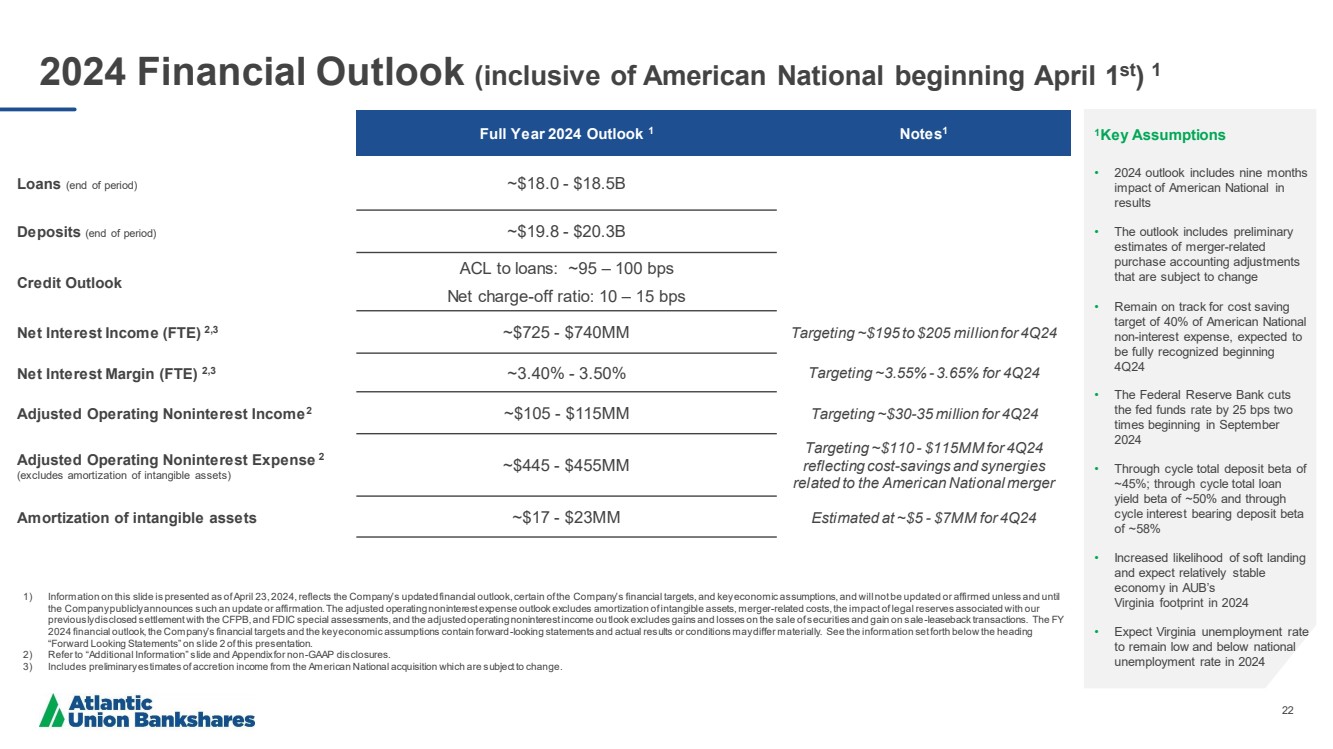

| 22 2024 Financial Outlook (inclusive of American National beginning April 1st) 1 1Key Assumptions • 2024 outlook includes nine months impact of American National in results • The outlook includes preliminary estimates of merger-related purchase accounting adjustments that are subject to change • Remain on track for cost saving target of 40% of American National non-interest expense, expected to be fully recognized beginning 4Q24 • The Federal Reserve Bank cuts the fed funds rate by 25 bps two times beginning in September 2024 • Through cycle total deposit beta of ~45%; through cycle total loan yield beta of ~50% and through cycle interest bearing deposit beta of ~58% • Increased likelihood of soft landing and expect relatively stable economy in AUB’s Virginia footprint in 2024 • Expect Virginia unemployment rate to remain low and below national unemployment rate in 2024 Full Year 2024 Outlook 1 Notes1 Loans (end of period) ~$18.0 - $18.5B Deposits (end of period) ~$19.8 - $20.3B Credit Outlook ACL to loans: ~95 – 100 bps Net charge-off ratio: 10 – 15 bps Net Interest Income (FTE) 2,3 ~$725 - $740MM Targeting ~$195 to $205 million for 4Q24 Net Interest Margin (FTE) 2,3 ~3.40% - 3.50% Targeting ~3.55% - 3.65% for 4Q24 Adjusted Operating Noninterest Income2 ~$105 - $115MM Targeting ~$30-35 million for 4Q24 Adjusted Operating Noninterest Expense 2 (excludes amortization of intangible assets) ~$445 - $455MM Targeting ~$110 - $115MM for 4Q24 reflecting cost-savings and synergies related to the American National merger Amortization of intangible assets ~$17 - $23MM Estimated at ~$5 - $7MM for 4Q24 1) Information on this slide is presented as of April 23, 2024, reflects the Company’s updated financial outlook, certain of the Company’s financial targets, and key economic assumptions, and will not be updated or affirmed unless and until the Company publicly announces such an update or affirmation. The adjusted operating noninterest expense outlook excludes amortization of intangible assets, merger-related costs, the impact of legal reserves associated with our previously disclosed settlement with the CFPB, and FDIC special assessments, and the adjusted operating noninterest income ou tlook excludes gains and losses on the sale of securities and gain on sale-leaseback transactions. The FY 2024 financial outlook, the Company’s financial targets and the key economic assumptions contain forward-looking statements and actual results or conditions may differ materially. See the information set forth below the heading “Forward Looking Statements” on slide 2 of this presentation. 2) Refer to “Additional Information” slide and Appendix for non-GAAP disclosures. 3) Includes preliminary estimates of accretion income from the American National acquisition which are subject to change. |

| 23 Appendix |

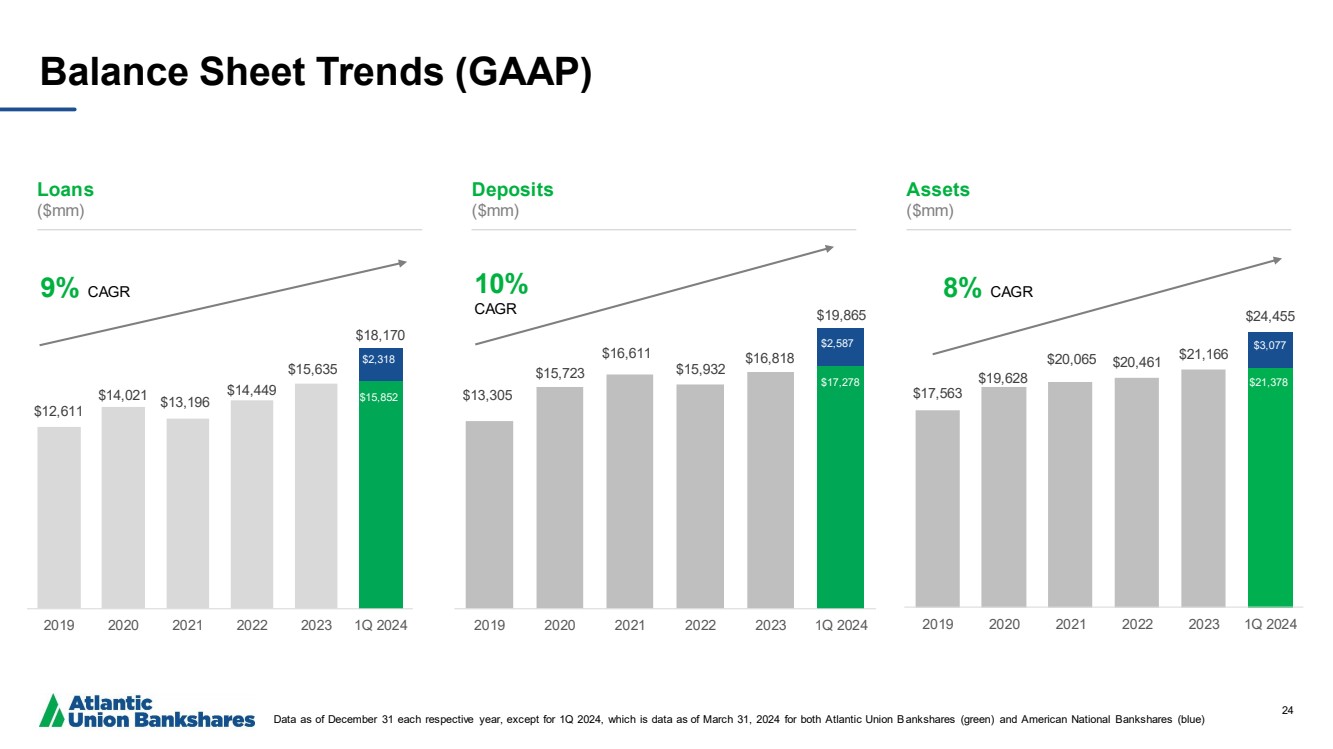

| 24 10% 8% CAGR CAGR $17,563 $19,628 $20,065 $20,461 $21,166 $24,455 2019 2020 2021 2022 2023 1Q 2024 $13,305 $15,723 $16,611 $15,932 $16,818 $19,865 2019 2020 2021 2022 2023 1Q 2024 Balance Sheet Trends (GAAP) Data as of December 31 each respective year, except for 1Q 2024, which is data as of March 31, 2024 for both Atlantic Union Bankshares (green) and American National Bankshares (blue) Loans ($mm) Deposits ($mm) Assets ($mm) 9% CAGR $12,611 $14,021 $13,196 $14,449 $15,635 $18,170 2019 2020 2021 2022 2023 1Q 2024 $15,852 $17,278 $21,378 $2,318 $2,587 $3,077 |

| 25 Reconciliation of Non-GAAP Disclosures The Company has provided supplemental performance measures on a tax-equivalent, tangible, operating, adjusted, or pre-tax pre-provision basis. These non-GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. |

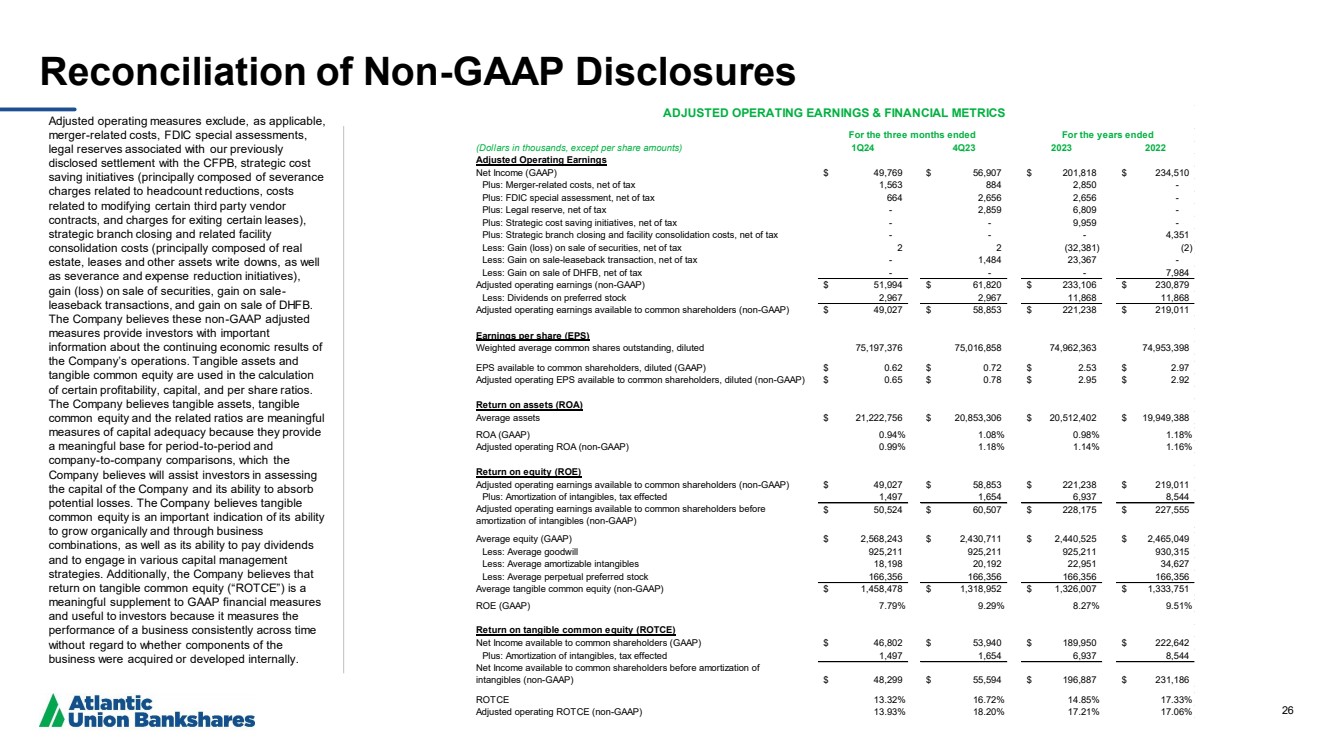

| 26 Reconciliation of Non -GAAP Disclosures Adjusted operating measures exclude, as applicable, merger -related costs, FDIC special assessments, legal reserves associated with our previously disclosed settlement with the CFPB, strategic cost saving initiatives (principally composed of severance charges related to headcount reductions, costs related to modifying certain third party vendor contracts, and charges for exiting certain leases), strategic branch closing and related facility consolidation costs (principally composed of real estate, leases and other assets write downs, as well as severance and expense reduction initiatives), gain (loss) on sale of securities, gain on sale - leaseback transactions, and gain on sale of DHFB. The Company believes these non -GAAP adjusted measures provide investors with important information about the continuing economic results of the Company’s operations. Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period -to -period and company -to -company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. Additionally, the Company believes that return on tangible common equity (“ROTCE”) is a meaningful supplement to GAAP financial measures and useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. (Dollars in thousands, except per share amounts) 1Q24 4Q23 2023 2022 Adjusted Operating Earnings Net Income (GAAP) $ 49,769 $ 56,907 $ 201,818 $ 234,510 Plus: Merger-related costs, net of tax 1,563 884 2,850 - Plus: FDIC special assessment, net of tax 664 2,656 2,656 - Plus: Legal reserve, net of tax - 2,859 6,809 - Plus: Strategic cost saving initiatives, net of tax - - 9,959 - Plus: Strategic branch closing and facility consolidation costs, net of tax - - - 4,351 Less: Gain (loss) on sale of securities, net of tax 2 2 (32,381) (2) Less: Gain on sale-leaseback transaction, net of tax - 1,484 23,367 - Less: Gain on sale of DHFB, net of tax - - - 7,984 Adjusted operating earnings (non-GAAP) $ 51,994 $ 61,820 $ 233,106 $ 230,879 Less: Dividends on preferred stock 2,967 2,967 11,868 11,868 Adjusted operating earnings available to common shareholders (non-GAAP) $ 49,027 $ 58,853 $ 221,238 $ 219,011 Earnings per share (EPS) Weighted average common shares outstanding, diluted 75,197,376 75,016,858 74,962,363 74,953,398 EPS available to common shareholders, diluted (GAAP) $ 0.62 $ 0.72 $ 2.53 $ 2.97 Adjusted operating EPS available to common shareholders, diluted (non-GAAP) $ 0.65 $ 0.78 $ 2.95 $ 2.92 Return on assets (ROA) Average assets $ 21,222,756 $ 20,853,306 $ 20,512,402 $ 19,949,388 ROA (GAAP) 0.94% 1.08% 0.98% 1.18% Adjusted operating ROA (non-GAAP) 0.99% 1.18% 1.14% 1.16% Return on equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) $ 49,027 $ 58,853 $ 221,238 $ 219,011 Plus: Amortization of intangibles, tax effected 1,497 1,654 6,937 8,544 Adjusted operating earnings available to common shareholders before amortization of intangibles (non-GAAP) $ 50,524 $ 60,507 $ 228,175 $ 227,555 Average equity (GAAP) $ 2,568,243 $ 2,430,711 $ 2,440,525 $ 2,465,049 Less: Average goodwill 925,211 925,211 925,211 930,315 Less: Average amortizable intangibles 18,198 20,192 22,951 34,627 Less: Average perpetual preferred stock 166,356 166,356 166,356 166,356 Average tangible common equity (non-GAAP) $ 1,458,478 $ 1,318,952 $ 1,326,007 $ 1,333,751 ROE (GAAP) 7.79% 9.29% 8.27% 9.51% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) $ 46,802 $ 53,940 $ 189,950 $ 222,642 Plus: Amortization of intangibles, tax effected 1,497 1,654 6,937 8,544 Net Income available to common shareholders before amortization of intangibles (non-GAAP) $ 48,299 $ 55,594 $ 196,887 $ 231,186 ROTCE 13.32% 16.72% 14.85% 17.33% Adjusted operating ROTCE (non-GAAP) 13.93% 18.20% 17.21% 17.06% ADJUSTED OPERATING EARNINGS & FINANCIAL METRICS For the three months ended For the years ended |

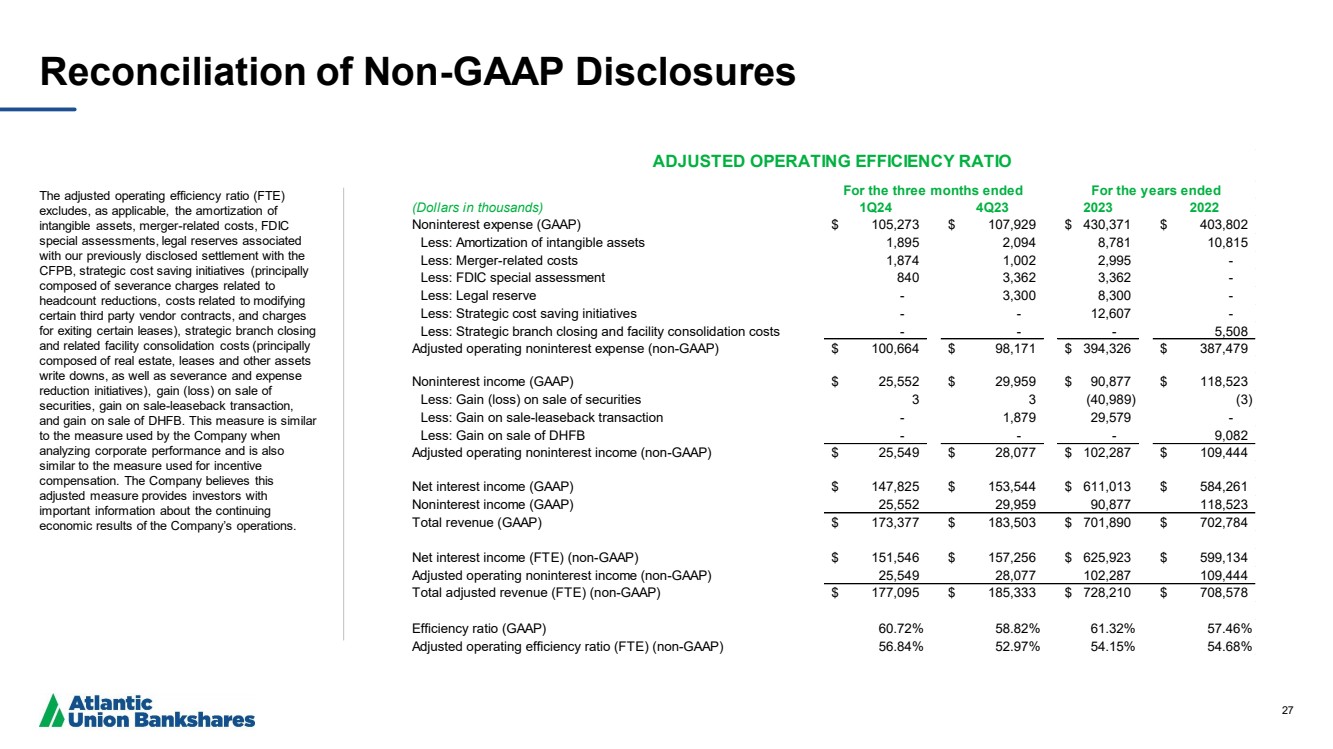

| 27 Reconciliation of Non-GAAP Disclosures The adjusted operating efficiency ratio (FTE) excludes, as applicable, the amortization of intangible assets, merger-related costs, FDIC special assessments, legal reserves associated with our previously disclosed settlement with the CFPB, strategic cost saving initiatives (principally composed of severance charges related to headcount reductions, costs related to modifying certain third party vendor contracts, and charges for exiting certain leases), strategic branch closing and related facility consolidation costs (principally composed of real estate, leases and other assets write downs, as well as severance and expense reduction initiatives), gain (loss) on sale of securities, gain on sale-leaseback transaction, and gain on sale of DHFB. This measure is similar to the measure used by the Company when analyzing corporate performance and is also similar to the measure used for incentive compensation. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations. (Dollars in thousands) 1Q24 4Q23 2023 2022 Noninterest expense (GAAP) $ 105,273 $ 107,929 $ 430,371 $ 403,802 Less: Amortization of intangible assets 1,895 2,094 8,781 10,815 Less: Merger-related costs 1,874 1,002 2,995 - Less: FDIC special assessment 840 3,362 3,362 - Less: Legal reserve - 3,300 8,300 - Less: Strategic cost saving initiatives - - 12,607 - Less: Strategic branch closing and facility consolidation costs - - - 5,508 Adjusted operating noninterest expense (non-GAAP) $ 100,664 $ 98,171 $ 394,326 $ 387,479 Noninterest income (GAAP) $ 25,552 $ 29,959 $ 90,877 $ 118,523 Less: Gain (loss) on sale of securities 3 3 (40,989) (3) Less: Gain on sale-leaseback transaction - 1,879 29,579 - Less: Gain on sale of DHFB - - - 9,082 Adjusted operating noninterest income (non-GAAP) $ 25,549 $ 28,077 $ 102,287 $ 109,444 Net interest income (GAAP) $ 147,825 $ 153,544 $ 611,013 $ 584,261 Noninterest income (GAAP) 25,552 29,959 90,877 118,523 Total revenue (GAAP) $ 173,377 $ 183,503 $ 701,890 $ 702,784 Net interest income (FTE) (non-GAAP) $ 151,546 $ 157,256 $ 625,923 $ 599,134 Adjusted operating noninterest income (non-GAAP) 25,549 28,077 102,287 109,444 Total adjusted revenue (FTE) (non-GAAP) $ 177,095 $ 185,333 $ 728,210 $ 708,578 Efficiency ratio (GAAP) 60.72% 58.82% 61.32% 57.46% Adjusted operating efficiency ratio (FTE) (non-GAAP) 56.84% 52.97% 54.15% 54.68% ADJUSTED OPERATING EFFICIENCY RATIO For the three months ended For the years ended |

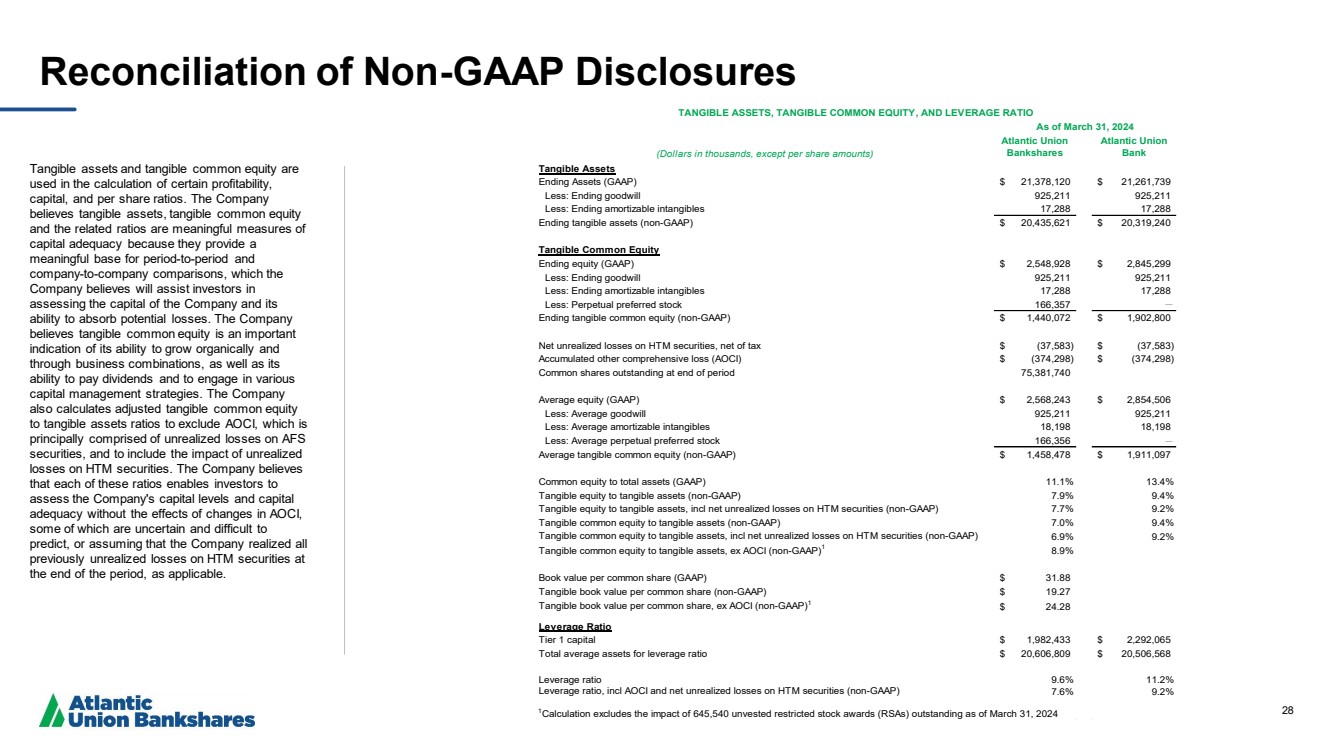

| 28 Reconciliation of Non-GAAP Disclosures Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. The Company also calculates adjusted tangible common equity to tangible assets ratios to exclude AOCI, which is principally comprised of unrealized losses on AFS securities, and to include the impact of unrealized losses on HTM securities. The Company believes that each of these ratios enables investors to assess the Company's capital levels and capital adequacy without the effects of changes in AOCI, some of which are uncertain and difficult to predict, or assuming that the Company realized all previously unrealized losses on HTM securities at the end of the period, as applicable. (Dollars in thousands, except per share amounts) Atlantic Union Bankshares Atlantic Union Bank Tangible Assets Ending Assets (GAAP) $ 21,378,120 $ 21,261,739 Less: Ending goodwill 925,211 925,211 Less: Ending amortizable intangibles 17,288 17,288 Ending tangible assets (non-GAAP) $ 20,435,621 $ 20,319,240 Tangible Common Equity Ending equity (GAAP) $ 2,548,928 $ 2,845,299 Less: Ending goodwill 925,211 925,211 Less: Ending amortizable intangibles 17,288 17,288 Less: Perpetual preferred stock 166,357 — Ending tangible common equity (non-GAAP) $ 1,440,072 $ 1,902,800 Net unrealized losses on HTM securities, net of tax $ (37,583) $ (37,583) Accumulated other comprehensive loss (AOCI) $ (374,298) $ (374,298) Common shares outstanding at end of period 75,381,740 Average equity (GAAP) $ 2,568,243 $ 2,854,506 Less: Average goodwill 925,211 925,211 Less: Average amortizable intangibles 18,198 18,198 Less: Average perpetual preferred stock 166,356 — Average tangible common equity (non-GAAP) $ 1,458,478 $ 1,911,097 Less: Perpetual preferred stock Common equity to total assets (GAAP) 11.1% 13.4% Tangible equity to tangible assets (non-GAAP) 7.9% 9.4% Tangible equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 7.7% 9.2% Tangible common equity to tangible assets (non-GAAP) 7.0% 9.4% Tangible common equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 6.9% 9.2% Tangible common equity to tangible assets, ex AOCI (non-GAAP)1 8.9% Book value per common share (GAAP) $ 31.88 Tangible book value per common share (non-GAAP) $ 19.27 Tangible book value per common share, ex AOCI (non-GAAP)1 $ 24.28 Leverage Ratio Tier 1 capital $ 1,982,433 $ 2,292,065 Total average assets for leverage ratio $ 20,606,809 $ 20,506,568 Leverage ratio 9.6% 11.2% Leverage ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 7.6% 9.2% TANGIBLE ASSETS, TANGIBLE COMMON EQUITY, AND LEVERAGE RATIO As of March 31, 2024 1Calculation excludes the impact of 645,540 unvested restricted stock awards (RSAs) outstanding as of March 31, 2024 |

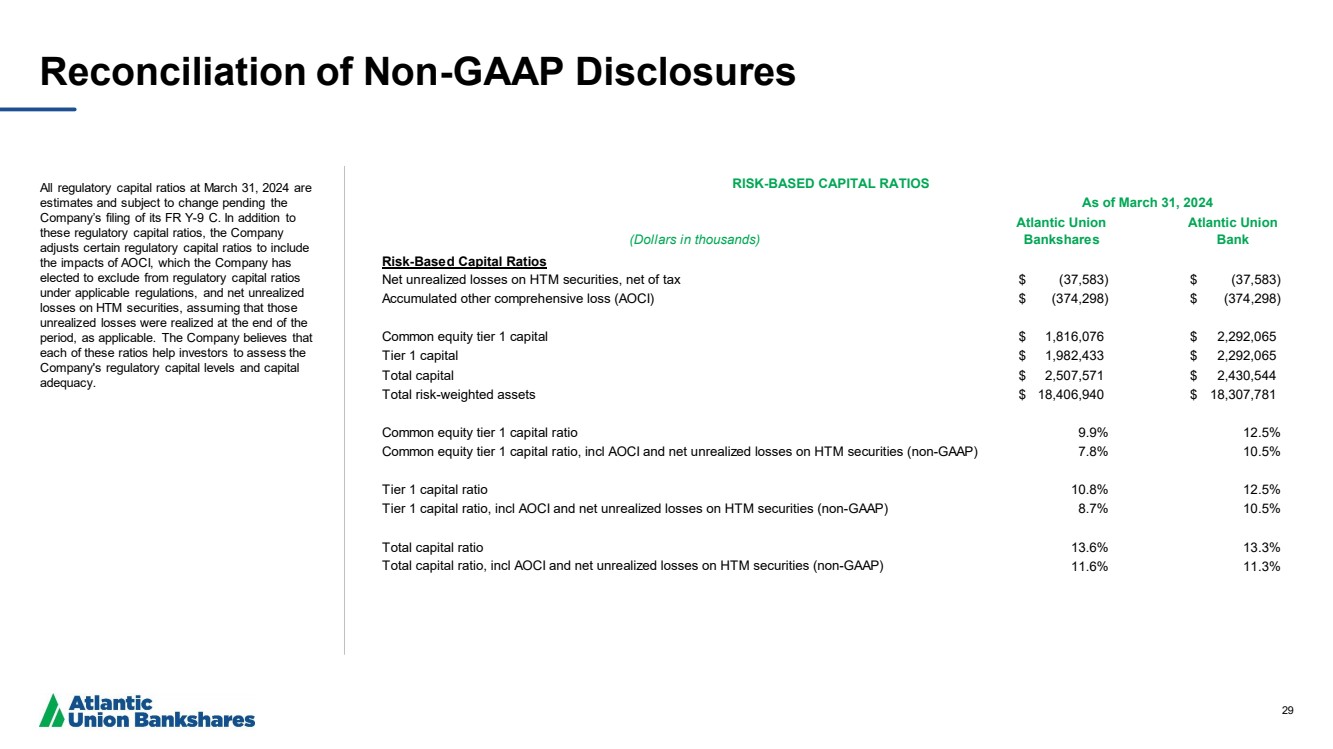

| 29 Reconciliation of Non-GAAP Disclosures All regulatory capital ratios at March 31, 2024 are estimates and subject to change pending the Company’s filing of its FR Y-9 C. In addition to these regulatory capital ratios, the Company adjusts certain regulatory capital ratios to include the impacts of AOCI, which the Company has elected to exclude from regulatory capital ratios under applicable regulations, and net unrealized losses on HTM securities, assuming that those unrealized losses were realized at the end of the period, as applicable. The Company believes that each of these ratios help investors to assess the Company's regulatory capital levels and capital adequacy. (Dollars in thousands) Atlantic Union Bankshares Atlantic Union Bank Risk-Based Capital Ratios Net unrealized losses on HTM securities, net of tax $ (37,583) $ (37,583) Accumulated other comprehensive loss (AOCI) $ (374,298) $ (374,298) Common equity tier 1 capital $ 1,816,076 $ 2,292,065 Tier 1 capital $ 1,982,433 $ 2,292,065 Total capital $ 2,507,571 $ 2,430,544 Total risk-weighted assets $ 18,406,940 $ 18,307,781 Common equity tier 1 capital ratio 9.9% 12.5% Common equity tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 7.8% 10.5% Tier 1 capital ratio 10.8% 12.5% Tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 8.7% 10.5% Total capital ratio 13.6% 13.3% Total capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 11.6% 11.3% RISK-BASED CAPITAL RATIOS As of March 31, 2024 |

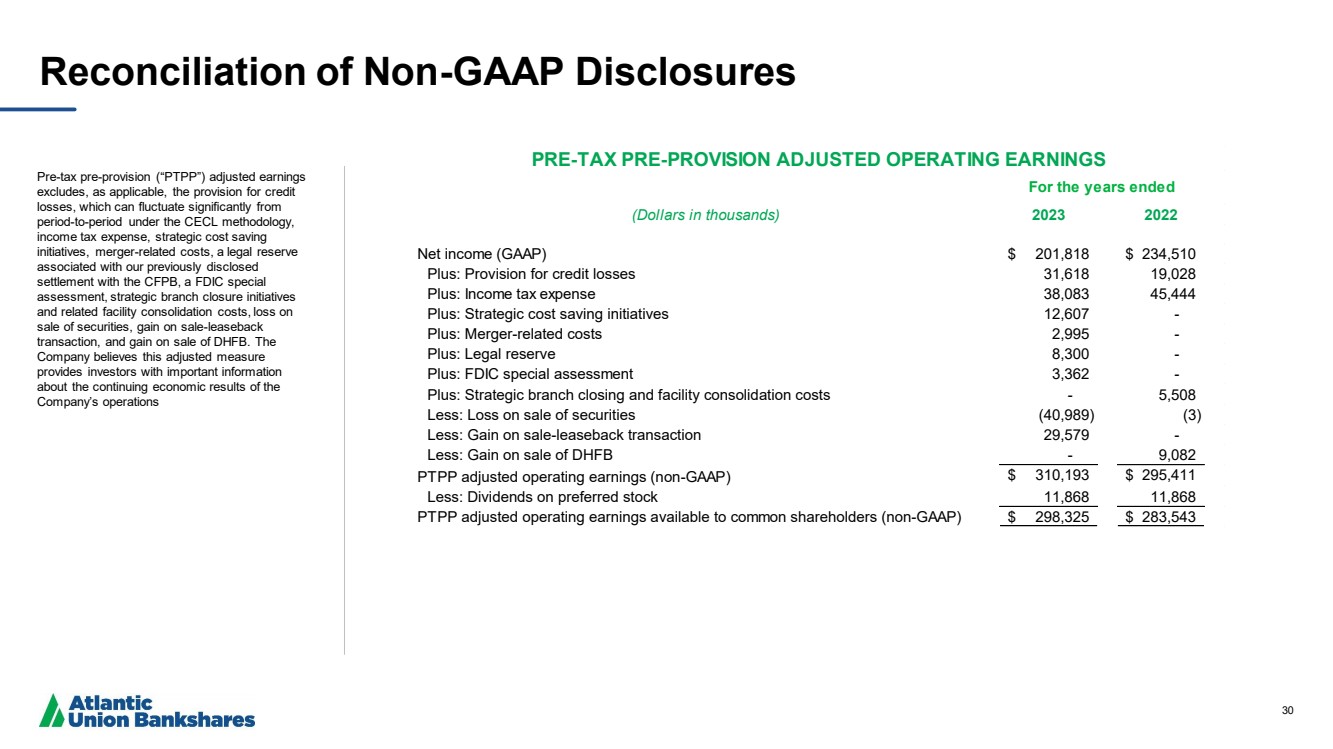

| 30 Reconciliation of Non-GAAP Disclosures Pre-tax pre-provision (“PTPP”) adjusted earnings excludes, as applicable, the provision for credit losses, which can fluctuate significantly from period-to-period under the CECL methodology, income tax expense, strategic cost saving initiatives, merger-related costs, a legal reserve associated with our previously disclosed settlement with the CFPB, a FDIC special assessment, strategic branch closure initiatives and related facility consolidation costs, loss on sale of securities, gain on sale-leaseback transaction, and gain on sale of DHFB. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations (Dollars in thousands) 2023 2022 Net income (GAAP) $ 201,818 $ 234,510 Plus: Provision for credit losses 31,618 19,028 Plus: Income tax expense 38,083 45,444 Plus: Strategic cost saving initiatives 12,607 - Plus: Merger-related costs 2,995 - Plus: Legal reserve 8,300 - Plus: FDIC special assessment 3,362 - Plus: Strategic branch closing and facility consolidation costs - 5,508 Less: Loss on sale of securities (40,989) (3) Less: Gain on sale-leaseback transaction 29,579 - Less: Gain on sale of DHFB - 9,082 PTPP adjusted operating earnings (non-GAAP) $ 310,193 $ 295,411 Less: Dividends on preferred stock 11,868 11,868 PTPP adjusted operating earnings available to common shareholders (non-GAAP) $ 298,325 $ 283,543 PRE-TAX PRE-PROVISION ADJUSTED OPERATING EARNINGS For the years ended |