| 4th Quarter and Full Year 2023 Earnings Presentation NYSE: AUB January 23, 2024 |

| 2 Forward Looking Statements This presentation and statements by our management may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include, without limitation, statements on slides entitled "Q4 2023 Highlights and FY 2023 Highlights,“ “Loan and Deposit Betas,” and “Financial Outlook,” statements regarding our strategic priorities, liquidity and capital management strategies, expectations related to our business, financial, and operating results, including our deposit base and funding, the impact of changes in economic conditions, the impact of our cost saving measures, our securities portfolio restructuring, or changes in asset quality, and statements that include, other projections, predictions, expectations, or beliefs about future events or results, including our ability to meet our top tier financial targets, or otherwise are not statements of historical fact. Such forward-looking statements are based on certain assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other factors, some of which cannot be predicted or quantified, that may cause actual results, performance, achievements, or trends to be materially different from those expressed or implied by such forward-looking statements. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” “continue,” “confidence,” “should,” or words of similar meaning or other statements concerning opinions or judgments of our management about future events. Although we believe that our expectations with respect to forward-looking statements are based on reasonable assumptions within the bounds of our existing knowledge of our business and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, us will not differ materially from any projected future results, performance, achievements or trends expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to the effects of or changes in: • market interest rates and their related impacts on macroeconomic conditions, customer and client behavior, our funding costs and our loan and securities portfolios; • inflation and its impacts on economic growth and customer and client behavior; • adverse developments in the financial industry, such as bank failures, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs, and related impacts on customer behavior; • the sufficiency of liquidity; • general economic and financial market conditions, in the United States generally and particularly in the markets in which we operate and which our loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels and slowdowns in economic growth; • our failure to close our proposed merger with American National Bankshares Inc. (“American National”) when expected or at all because required regulatory approvals and other conditions to closing are not received or satisfied on a timely basis or at all, and the risk that any regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the merger; • the occurrence of any event, change or circumstance that could give rise to the right of either party to terminate the merger agreement between the Company and American National; • any change in the purchase accounting assumptions used regarding the American National assets acquired and liabilities assumed to determine the fair value and credit marks, particularly in light of the current interest rate environment; • the risks that the anticipated benefits of the proposed merger, including cost savings and strategic gains, are not realized when expected or at all; • the proposed merger may be more expensive or take longer to complete than anticipated, including as a result of unexpected factors or events, and may divert management’s attention from ongoing business operations and opportunities; • potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed merger; • government monetary and fiscal policies, including policies of the U.S. Treasury and the Federal Reserve; • the quality or composition of our loan or investment portfolios and changes therein; • demand for loan products and financial services in our market areas; • our ability to manage our growth or implement our growth strategy; • the effectiveness of expense reduction plans; • the introduction of new lines of business or new products and services; • our ability to recruit and retain key employees; • real estate values in our lending area; • changes in accounting principles, standards, rules, and interpretations, and the related impact on our financial statements; • an insufficient ACL or volatility in the ACL resulting from the CECL methodology, either alone or as that may be affected by inflation, changing interest rates, or other factors; • our liquidity and capital positions; • concentrations of loans secured by real estate, particularly commercial real estate; • the effectiveness of our credit processes and management of our credit risk; • our ability to compete in the market for financial services and increased competition from fintech companies; • technological risks and developments, and cyber threats, attacks, or events; • operational, technological, cultural, regulatory, legal, credit, and other risks associated with the exploration, consummation and integration of potential future acquisitions, whether involving stock or cash considerations; • the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, geopolitical conflicts or public health events, and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of our borrowers to satisfy their obligations to us, on the value of collateral securing loans, on the demand for our loans or our other products and services, on supply chains and methods used to distribute products and services, on incidents of cyberattack and fraud, on our liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of our business operations and on financial markets and economic growth; • performance by our counterparties or vendors; • deposit flows; • the availability of financing and the terms thereof; • the level of prepayments on loans and mortgage-backed securities; • legislative or regulatory changes and requirements; • actual or potential claims, damages, and fines related to litigation or government actions, which may result in, among other things, additional costs, fines, penalties, restrictions on our business activities, reputational harm, or other adverse consequences; • the effects of changes in federal, state or local tax laws and regulations; • any event or development that would cause us to conclude that there was an impairment of any asset, including intangible assets, such as goodwill; and • other factors, many of which are beyond our control. Please also refer to such other factors as discussed throughout Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2022, Part II, Item 1A. Risk Factors in our Quarterly Reports on Form 10-Q, and related disclosures in other filings, which have been filed with the U.S. Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking statements, and all of the forward-looking statements are expressly our businesses or operations. Readers are cautioned not to rely too heavily on the forward-looking statements, and undue reliance should not be placed on such forward-looking statements. Forward-looking statements speak only as of the date they are made. We do not intend or assume any obligation to update, revise or clarify any forward-looking statements that may be made from time to time by or on behalf of the Company, whether as a result of new information, future events or otherwise. |

| 3 Additional Information Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods, show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance, or show the potential effects of accumulated other comprehensive income (or AOCI) or unrealized losses on securities on the Company's capital. Please see “Reconciliation of Non-GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (NYSE: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank has 109 branches and 123 ATMs located throughout Virginia, and in portions of Maryland and North Carolina as of December 31, 2023. Certain non-bank financial services affiliates of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Atlantic Union Financial Consultants, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. |

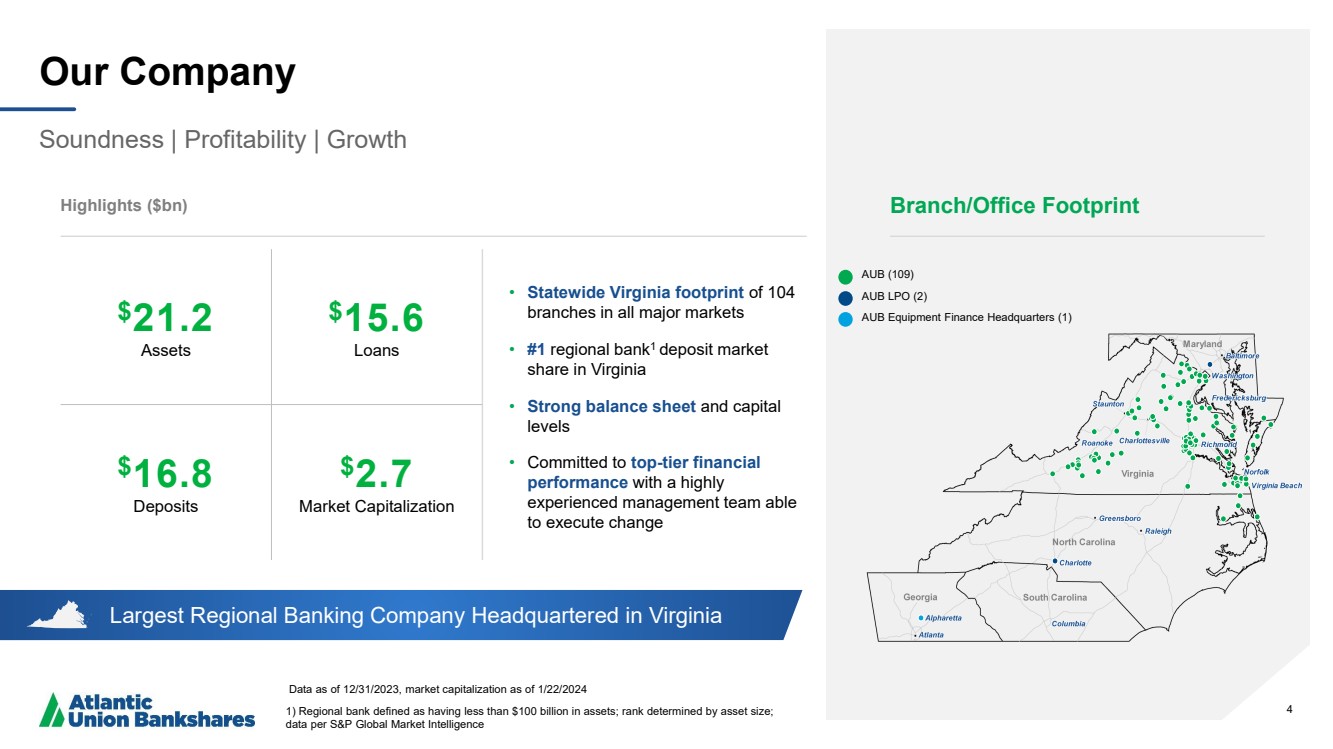

| 4 Largest Regional Banking Company Headquartered in Virginia Our Company Soundness | Profitability | Growth Data as of 12/31/2023, market capitalization as of 1/22/2024 1) Regional bank defined as having less than $100 billion in assets; rank determined by asset size; data per S&P Global Market Intelligence Highlights ($bn) • Statewide Virginia footprint of 104 branches in all major markets • #1 regional bank1 deposit market share in Virginia • Strong balance sheet and capital levels • Committed to top-tier financial performance with a highly experienced management team able to execute change 4 $21.2 Assets $15.6 Loans $16.8 Deposits $2.7 Market Capitalization Branch/Office Footprint AUB (109) AUB LPO (2) AUB Equipment Finance Headquarters (1) |

| 5 Our Shareholder Value Proposition Leading Regional Presence Dense, uniquely valuable presence across attractive markets Financial Strength Solid balance sheet & capital levels Attractive Financial Profile Solid dividend yield & payout ratio with earnings upside Strong Growth Potential Organic & acquisition opportunities Peer-Leading Performance Committed to top-tier financial performance |

| 6 Q4 2023 and FY 2023 Highlights Loan and Deposit Growth • 9.1% annualized loan growth in Q4 2023 and 8.2% for FY 2023 • 0.7% annualized deposit growth in Q4 2023 and 5.6% for FY 2023 • Line of Credit Utilization increased modestly from Q3 2023 Asset Quality • Q4 2023 net charge-offs at 3 bps annualized and net charge-offs of 5 bps for FY 2023 Positioning for Long Term • In 2023, restructured the Company’s securities portfolio by ~$500mm in February/March and ~$200mm in the third quarter to improve go-forward earnings trajectory • Lending pipelines down moderately • Granular growing deposit base • Focus on organic growth and performance of the core banking franchise Differentiated Client Experience • Responsive, strong and capable alternative to large national banks, while competitive with and more capable than smaller banks Operating Leverage Focus • ~2.8% adjusted revenue growth1 year over year • ~1.8% adjusted operating noninterest expense increase1 year over year • Adjusted operating leverage1 of ~1.0% year over year • Took strategic actions to reduce expenses in Q2 Capitalize on Strategic Opportunities • Announced intention to acquire American National Bankshares and expect to close in the first quarter of 2024 6 1 For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures.”’ Adjusted operating leverage is for the full year 2023 compared to the full year 2022. |

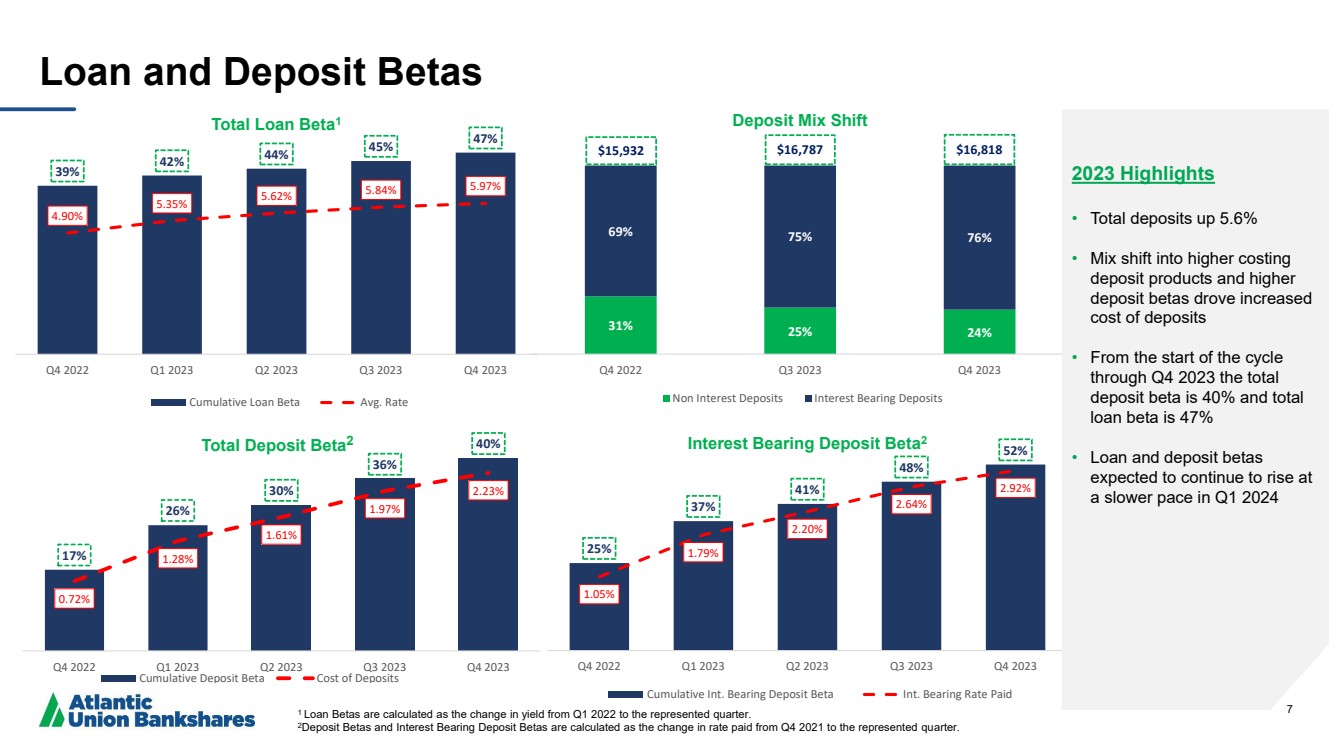

| 7 25% 37% 41% 48% 52% 1.05% 1.79% 2.20% 2.64% 2.92% Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Interest Bearing Deposit Beta2 Cumulative Int. Bearing Deposit Beta Int. Bearing Rate Paid 31% 25% 24% 69% 75% 76% Q4 2022 Q3 2023 Q4 2023 Deposit Mix Shift Non Interest Deposits Interest Bearing Deposits $15,932 $16,787 $16,818 Loan and Deposit Betas 2023 Highlights • Total deposits up 5.6% • Mix shift into higher costing deposit products and higher deposit betas drove increased cost of deposits • From the start of the cycle through Q4 2023 the total deposit beta is 40% and total loan beta is 47% • Loan and deposit betas expected to continue to rise at a slower pace in Q1 2024 1 Loan Betas are calculated as the change in yield from Q1 2022 to the represented quarter. 2Deposit Betas and Interest Bearing Deposit Betas are calculated as the change in rate paid from Q4 2021 to the represented quarter. 17% 26% 30% 36% 40% 0.72% 1.28% 1.61% 1.97% 2.23% Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Total Deposit Beta2 Cumulative Deposit Beta Cost of Deposits 39% 42% 44% 45% 47% 4.90% 5.35% 5.62% 5.84% 5.97% Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Total Loan Beta1 Cumulative Loan Beta Avg. Rate |

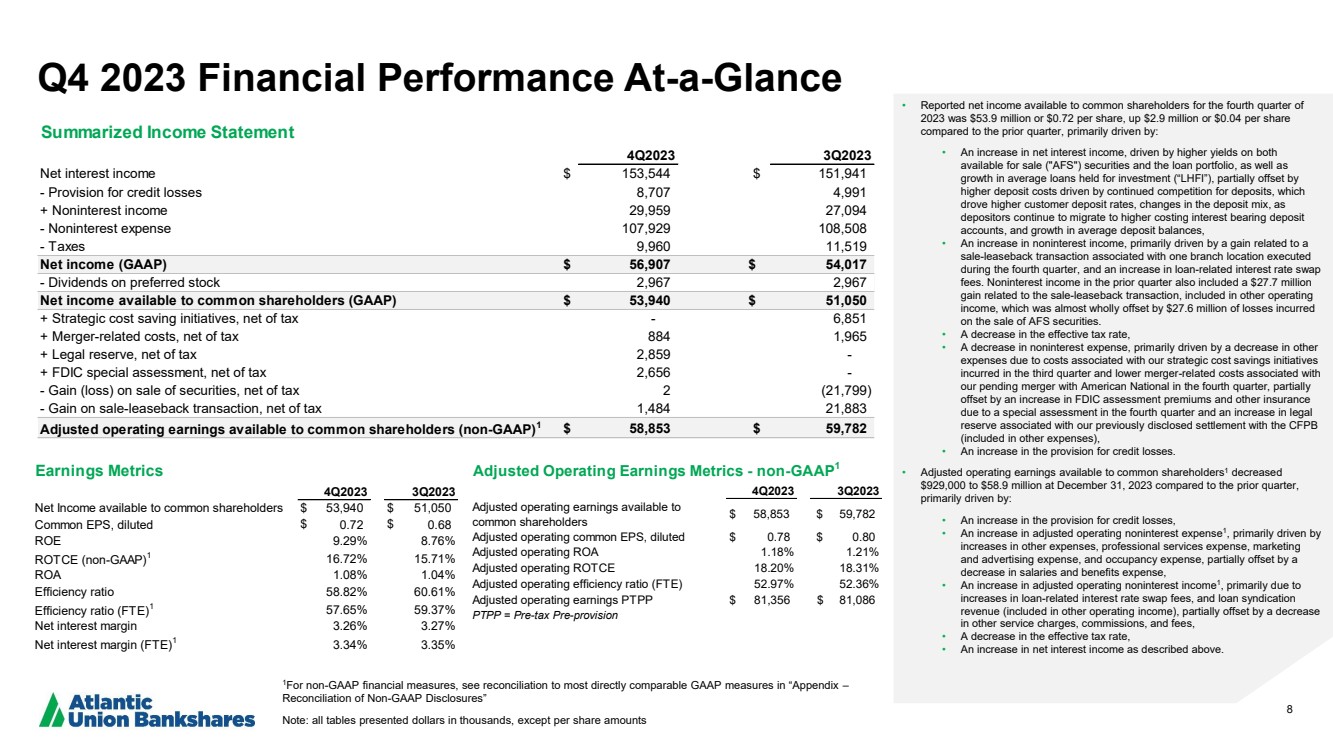

| 8 Q4 2023 Financial Performance At-a-Glance 1For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Note: all tables presented dollars in thousands, except per share amounts • Reported net income available to common shareholders for the fourth quarter of 2023 was $53.9 million or $0.72 per share, up $2.9 million or $0.04 per share compared to the prior quarter, primarily driven by: • An increase in net interest income, driven by higher yields on both available for sale ("AFS") securities and the loan portfolio, as well as growth in average loans held for investment (“LHFI”), partially offset by higher deposit costs driven by continued competition for deposits, which drove higher customer deposit rates, changes in the deposit mix, as depositors continue to migrate to higher costing interest bearing deposit accounts, and growth in average deposit balances, • An increase in noninterest income, primarily driven by a gain related to a sale-leaseback transaction associated with one branch location executed during the fourth quarter, and an increase in loan-related interest rate swap fees. Noninterest income in the prior quarter also included a $27.7 million gain related to the sale-leaseback transaction, included in other operating income, which was almost wholly offset by $27.6 million of losses incurred on the sale of AFS securities. • A decrease in the effective tax rate, • A decrease in noninterest expense, primarily driven by a decrease in other expenses due to costs associated with our strategic cost savings initiatives incurred in the third quarter and lower merger-related costs associated with our pending merger with American National in the fourth quarter, partially offset by an increase in FDIC assessment premiums and other insurance due to a special assessment in the fourth quarter and an increase in legal reserve associated with our previously disclosed settlement with the CFPB (included in other expenses), • An increase in the provision for credit losses. • Adjusted operating earnings available to common shareholders1 decreased $929,000 to $58.9 million at December 31, 2023 compared to the prior quarter, primarily driven by: • An increase in the provision for credit losses, • An increase in adjusted operating noninterest expense1 , primarily driven by increases in other expenses, professional services expense, marketing and advertising expense, and occupancy expense, partially offset by a decrease in salaries and benefits expense, • An increase in adjusted operating noninterest income1 , primarily due to increases in loan-related interest rate swap fees, and loan syndication revenue (included in other operating income), partially offset by a decrease in other service charges, commissions, and fees, • A decrease in the effective tax rate, • An increase in net interest income as described above. 4Q2023 3Q2023 Net Income available to common shareholders $ 53,940 $ 51,050 Common EPS, diluted $ 0.72 $ 0.68 ROE 9.29% 8.76% ROTCE (non-GAAP)1 16.72% 15.71% ROA 1.08% 1.04% Efficiency ratio 58.82% 60.61% Efficiency ratio (FTE)1 57.65% 59.37% Net interest margin 3.26% 3.27% Net interest margin (FTE)1 3.34% 3.35% Earnings Metrics 4Q2023 3Q2023 Adjusted operating earnings available to common shareholders $ 58,853 $ 59,782 Adjusted operating common EPS, diluted $ 0.78 $ 0.80 Adjusted operating ROA 1.18% 1.21% Adjusted operating ROTCE 18.20% 18.31% Adjusted operating efficiency ratio (FTE) 52.97% 52.36% Adjusted operating earnings PTPP $ 81,356 $ 81,086 PTPP = Pre-tax Pre-provision Adjusted Operating Earnings Metrics - non-GAAP1 4Q2023 3Q2023 Net interest income $ 153,544 $ 151,941 - Provision for credit losses 8,707 4,991 + Noninterest income 29,959 27,094 - Noninterest expense 107,929 108,508 - Taxes 9,960 11,519 Net income (GAAP) $ 56,907 $ 54,017 - Dividends on preferred stock 2,967 2,967 Net income available to common shareholders (GAAP) $ 53,940 $ 51,050 + Strategic cost saving initiatives, net of tax - 6,851 + Merger-related costs, net of tax 884 1,965 + Legal reserve, net of tax 2,859 - + FDIC special assessment, net of tax 2,656 - - Gain (loss) on sale of securities, net of tax 2 (21,799) - Gain on sale-leaseback transaction, net of tax 1,484 21,883 Adjusted operating earnings available to common shareholders (non-GAAP)1 $ 58,853 $ 59,782 Summarized Income Statement |

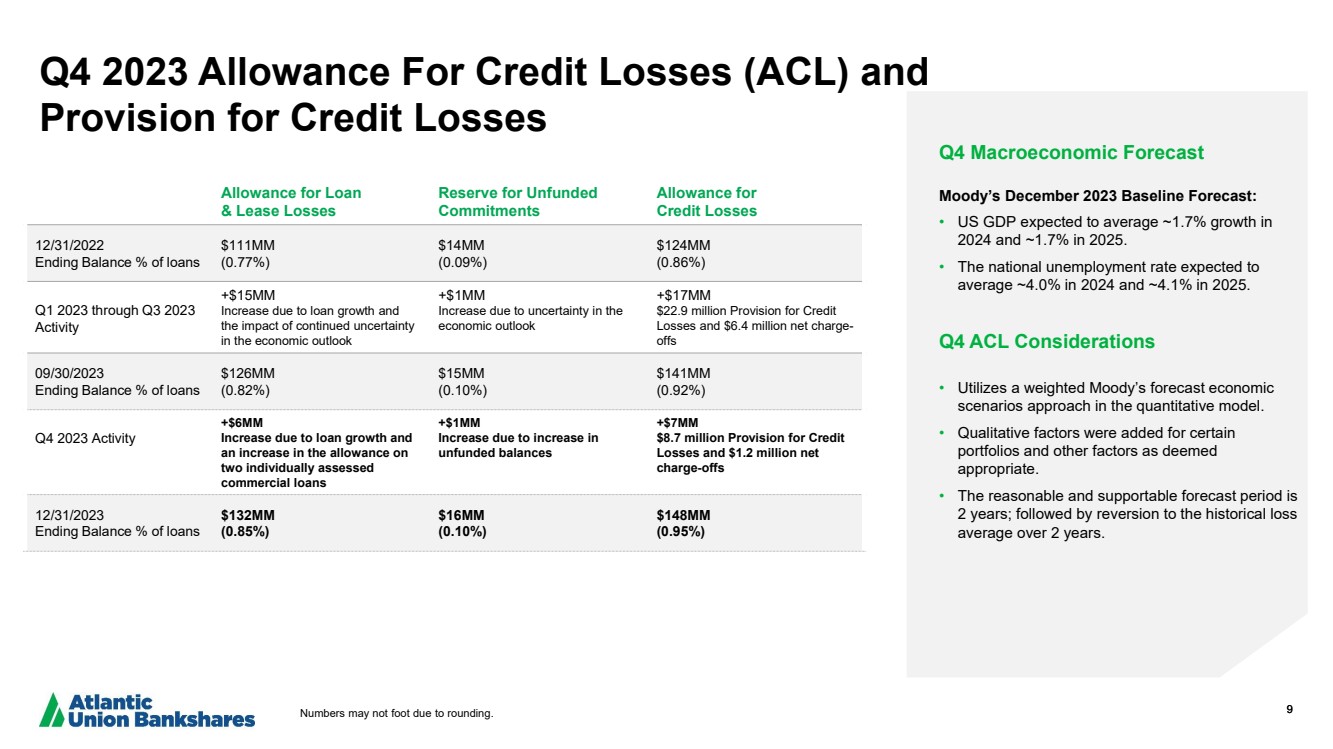

| 9 Q4 2023 Allowance For Credit Losses (ACL) and Provision for Credit Losses Q4 Macroeconomic Forecast Moody’s December 2023 Baseline Forecast: • US GDP expected to average ~1.7% growth in 2024 and ~1.7% in 2025. • The national unemployment rate expected to average ~4.0% in 2024 and ~4.1% in 2025. Q4 ACL Considerations • Utilizes a weighted Moody’s forecast economic scenarios approach in the quantitative model. • Qualitative factors were added for certain portfolios and other factors as deemed appropriate. • The reasonable and supportable forecast period is 2 years; followed by reversion to the historical loss average over 2 years. Allowance for Loan & Lease Losses Reserve for Unfunded Commitments Allowance for Credit Losses 12/31/2022 Ending Balance % of loans $111MM (0.77%) $14MM (0.09%) $124MM (0.86%) Q1 2023 through Q3 2023 Activity +$15MM Increase due to loan growth and the impact of continued uncertainty in the economic outlook +$1MM Increase due to uncertainty in the economic outlook +$17MM $22.9 million Provision for Credit Losses and $6.4 million net charge-offs 09/30/2023 Ending Balance % of loans $126MM (0.82%) $15MM (0.10%) $141MM (0.92%) Q4 2023 Activity +$6MM Increase due to loan growth and an increase in the allowance on two individually assessed commercial loans +$1MM Increase due to increase in unfunded balances +$7MM $8.7 million Provision for Credit Losses and $1.2 million net charge-offs 12/31/2023 Ending Balance % of loans $132MM (0.85%) $16MM (0.10%) $148MM (0.95%) Numbers may not foot due to rounding. |

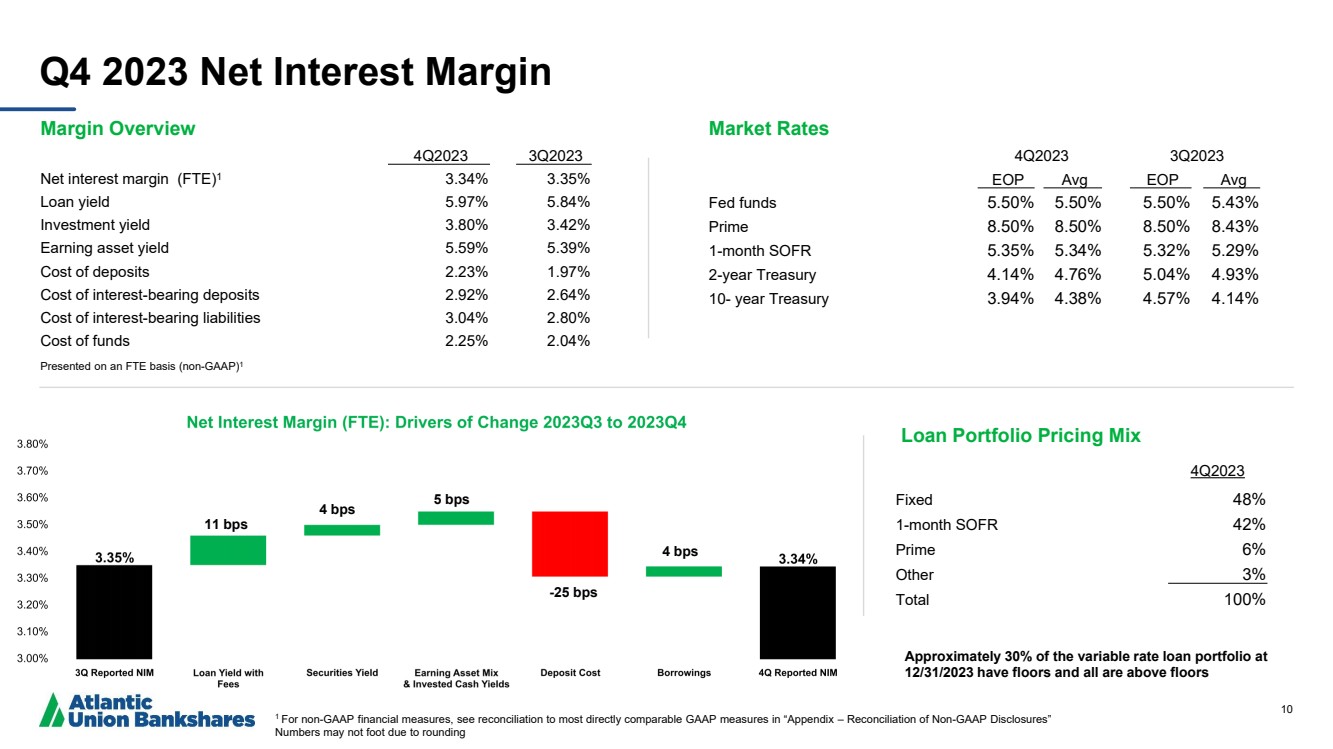

| 10 Q4 2023 Net Interest Margin Market Rates 4Q2023 3Q2023 EOP Avg EOP Avg Fed funds 5.50% 5.50% 5.50% 5.43% Prime 8.50% 8.50% 8.50% 8.43% 1-month SOFR 5.35% 5.34% 5.32% 5.29% 2-year Treasury 4.14% 4.76% 5.04% 4.93% 10- year Treasury 3.94% 4.38% 4.57% 4.14% Margin Overview 4Q2023 3Q2023 Net interest margin (FTE)1 3.34% 3.35% Loan yield 5.97% 5.84% Investment yield 3.80% 3.42% Earning asset yield 5.59% 5.39% Cost of deposits 2.23% 1.97% Cost of interest-bearing deposits 2.92% 2.64% Cost of interest-bearing liabilities 3.04% 2.80% Cost of funds 2.25% 2.04% Presented on an FTE basis (non-GAAP)1 Approximately 30% of the variable rate loan portfolio at 12/31/2023 have floors and all are above floors Loan Portfolio Pricing Mix 4Q2023 Fixed 48% 1-month SOFR 42% Prime 6% Other 3% Total 100% 1 For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Numbers may not foot due to rounding 11 bps 4 bps -25 bps 4 bps 5 bps |

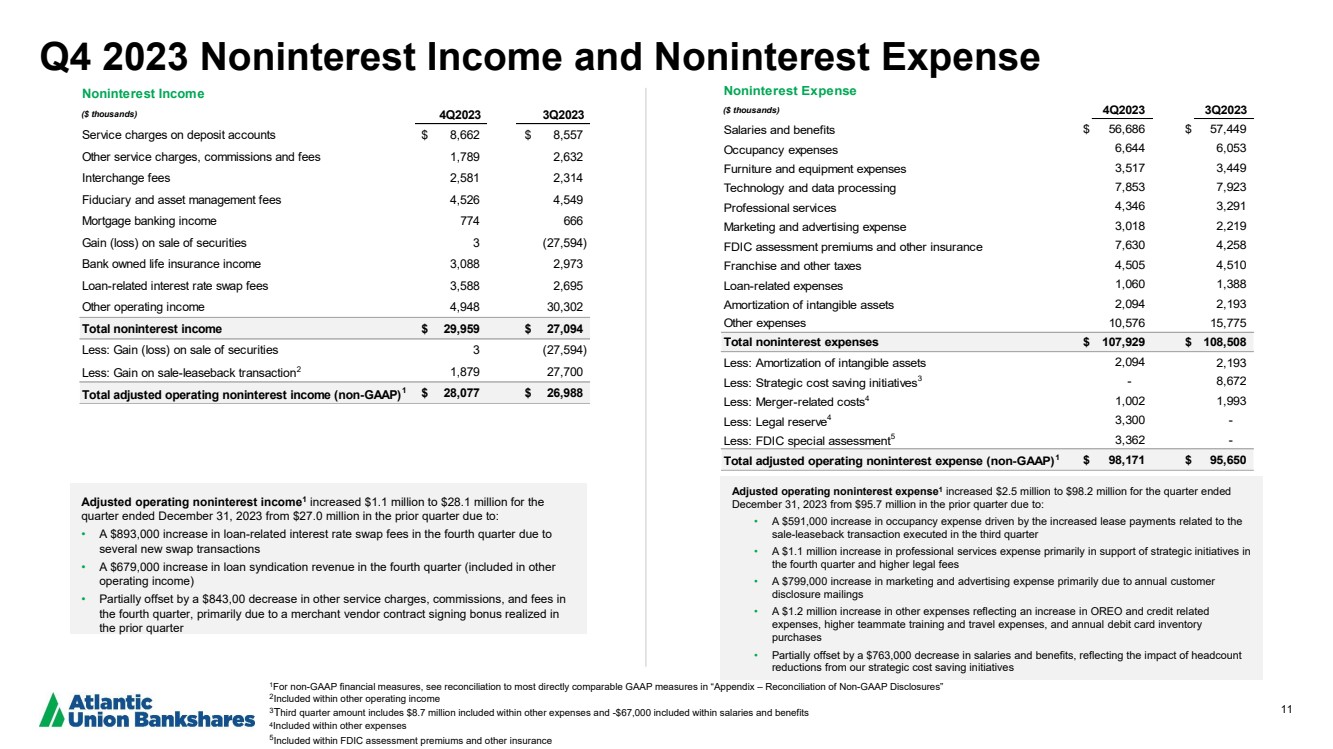

| 11 Adjusted operating noninterest expense1 increased $2.5 million to $98.2 million for the quarter ended December 31, 2023 from $95.7 million in the prior quarter due to: • A $591,000 increase in occupancy expense driven by the increased lease payments related to the sale-leaseback transaction executed in the third quarter • A $1.1 million increase in professional services expense primarily in support of strategic initiatives in the fourth quarter and higher legal fees • A $799,000 increase in marketing and advertising expense primarily due to annual customer disclosure mailings • A $1.2 million increase in other expenses reflecting an increase in OREO and credit related expenses, higher teammate training and travel expenses, and annual debit card inventory purchases • Partially offset by a $763,000 decrease in salaries and benefits, reflecting the impact of headcount reductions from our strategic cost saving initiatives Adjusted operating noninterest income1 increased $1.1 million to $28.1 million for the quarter ended December 31, 2023 from $27.0 million in the prior quarter due to: • A $893,000 increase in loan-related interest rate swap fees in the fourth quarter due to several new swap transactions • A $679,000 increase in loan syndication revenue in the fourth quarter (included in other operating income) • Partially offset by a $843,00 decrease in other service charges, commissions, and fees in the fourth quarter, primarily due to a merchant vendor contract signing bonus realized in the prior quarter Q4 2023 Noninterest Income and Noninterest Expense 1For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” 2 Included within other operating income 4 Included within other expenses 3Third quarter amount includes $8.7 million included within other expenses and -$67,000 included within salaries and benefits 5 Included within FDIC assessment premiums and other insurance Noninterest Expense ($ thousands) 4Q2023 3Q2023 Salaries and benefits $ 56,686 $ 57,449 Occupancy expenses 6,644 6,053 Furniture and equipment expenses 3,517 3,449 Technology and data processing 7,853 7,923 Professional services 4,346 3,291 Marketing and advertising expense 3,018 2,219 FDIC assessment premiums and other insurance 7,630 4,258 Franchise and other taxes 4,505 4,510 Loan-related expenses 1,060 1,388 Amortization of intangible assets 2,094 2,193 Other expenses 10,576 15,775 Total noninterest expenses $ 107,929 $ 108,508 Less: Amortization of intangible assets 2,094 2,193 Less: Strategic cost saving initiatives3 - 8,672 Less: Merger-related costs4 1,002 1,993 Less: Legal reserve4 3,300 - Less: FDIC special assessment5 3,362 - Total adjusted operating noninterest expense (non-GAAP)1 $ 98,171 $ 95,650 Noninterest Income ($ thousands) 4Q2023 3Q2023 Service charges on deposit accounts $ 8,662 $ 8,557 Other service charges, commissions and fees 1,789 2,632 Interchange fees 2,581 2,314 Fiduciary and asset management fees 4,526 4,549 Mortgage banking income 774 666 Gain (loss) on sale of securities 3 (27,594) Bank owned life insurance income 3,088 2,973 Loan-related interest rate swap fees 3,588 2,695 Other operating income 4,948 30,302 Total noninterest income $ 29,959 $ 27,094 Less: Gain (loss) on sale of securities 3 (27,594) Less: Gain on sale-leaseback transaction2 1,879 27,700 Total adjusted operating noninterest income (non-GAAP)1 $ 28,077 $ 26,988 |

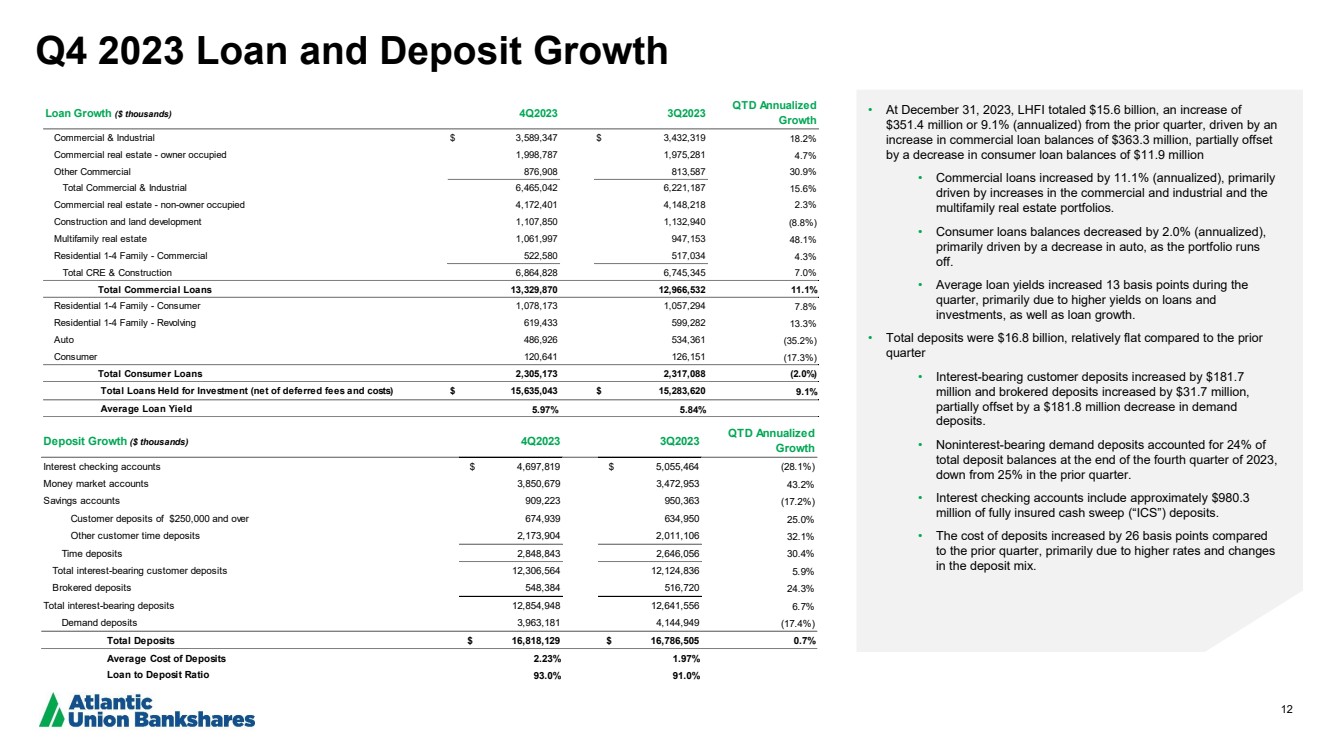

| 12 Q4 2023 Loan and Deposit Growth • At December 31, 2023, LHFI totaled $15.6 billion, an increase of $351.4 million or 9.1% (annualized) from the prior quarter, driven by an increase in commercial loan balances of $363.3 million, partially offset by a decrease in consumer loan balances of $11.9 million • Commercial loans increased by 11.1% (annualized), primarily driven by increases in the commercial and industrial and the multifamily real estate portfolios. • Consumer loans balances decreased by 2.0% (annualized), primarily driven by a decrease in auto, as the portfolio runs off. • Average loan yields increased 13 basis points during the quarter, primarily due to higher yields on loans and investments, as well as loan growth. • Total deposits were $16.8 billion, relatively flat compared to the prior quarter • Interest-bearing customer deposits increased by $181.7 million and brokered deposits increased by $31.7 million, partially offset by a $181.8 million decrease in demand deposits. • Noninterest-bearing demand deposits accounted for 24% of total deposit balances at the end of the fourth quarter of 2023, down from 25% in the prior quarter. • Interest checking accounts include approximately $980.3 million of fully insured cash sweep (“ICS”) deposits. • The cost of deposits increased by 26 basis points compared to the prior quarter, primarily due to higher rates and changes in the deposit mix. Loan Growth ($ thousands) 4Q2023 3Q2023 QTD Annualized Growth Commercial & Industrial $ 3,589,347 $ 3,432,319 18.2% Commercial real estate - owner occupied 1,998,787 1,975,281 4.7% Other Commercial 876,908 813,587 30.9% Total Commercial & Industrial 6,465,042 6,221,187 15.6% Commercial real estate - non-owner occupied 4,172,401 4,148,218 2.3% Construction and land development 1,107,850 1,132,940 (8.8%) Multifamily real estate 1,061,997 947,153 48.1% Residential 1-4 Family - Commercial 522,580 517,034 4.3% Total CRE & Construction 6,864,828 6,745,345 7.0% Total Commercial Loans 13,329,870 12,966,532 11.1% Residential 1-4 Family - Consumer 1,078,173 1,057,294 7.8% Residential 1-4 Family - Revolving 619,433 599,282 13.3% Auto 486,926 534,361 (35.2%) Consumer 120,641 126,151 (17.3%) Total Consumer Loans 2,305,173 2,317,088 (2.0%) Total Loans Held for Investment (net of deferred fees and costs) $ 15,635,043 $ 15,283,620 9.1% Average Loan Yield 5.97% 5.84% Deposit Growth ($ thousands) 4Q2023 3Q2023 QTD Annualized Growth Interest checking accounts $ 4,697,819 $ 5,055,464 (28.1%) Money market accounts 3,850,679 3,472,953 43.2% Savings accounts 909,223 950,363 (17.2%) Customer deposits of $250,000 and over 674,939 634,950 25.0% Other customer time deposits 2,173,904 2,011,106 32.1% Time deposits 2,848,843 2,646,056 30.4% Total interest-bearing customer deposits 12,306,564 12,124,836 5.9% Brokered deposits 548,384 516,720 24.3% Total interest-bearing deposits 12,854,948 12,641,556 6.7% Demand deposits 3,963,181 4,144,949 (17.4%) Total Deposits $ 16,818,129 $ 16,786,505 0.7% Average Cost of Deposits 2.23% 1.97% Loan to Deposit Ratio 93.0% 91.0% |

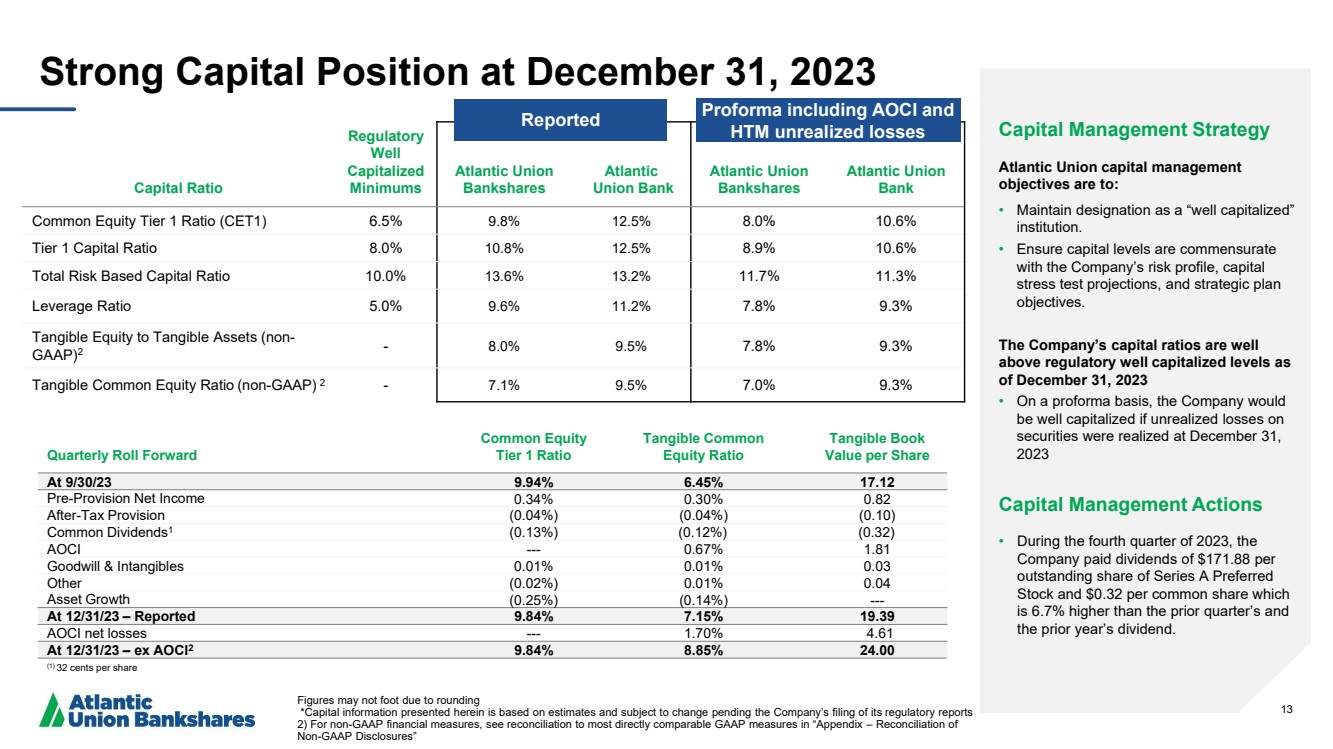

| 13 Capital Ratio Regulatory Well Capitalized Minimums Atlantic Union Bankshares Atlantic Union Bank Atlantic Union Bankshares Atlantic Union Bank Common Equity Tier 1 Ratio (CET1) 6.5% 9.8% 12.5% 8.0% 10.6% Tier 1 Capital Ratio 8.0% 10.8% 12.5% 8.9% 10.6% Total Risk Based Capital Ratio 10.0% 13.6% 13.2% 11.7% 11.3% Leverage Ratio 5.0% 9.6% 11.2% 7.8% 9.3% Tangible Equity to Tangible Assets (non-GAAP)2 - 8.0% 9.5% 7.8% 9.3% Tangible Common Equity Ratio (non-GAAP) 2 - 7.1% 9.5% 7.0% 9.3% Strong Capital Position at December 31, 2023 Figures may not foot due to rounding *Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulatory reports 2) For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Capital Management Strategy Atlantic Union capital management objectives are to: • Maintain designation as a “well capitalized” institution. • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives. The Company’s capital ratios are well above regulatory well capitalized levels as of December 31, 2023 • On a proforma basis, the Company would be well capitalized if unrealized losses on securities were realized at December 31, 2023 Capital Management Actions • During the fourth quarter of 2023, the Company paid dividends of $171.88 per outstanding share of Series A Preferred Stock and $0.32 per common share which is 6.7% higher than the prior quarter’s and the prior year’s dividend. Quarterly Roll Forward Common Equity Tier 1 Ratio Tangible Common Equity Ratio Tangible Book Value per Share At 9/30/23 9.94% 6.45% 17.12 Pre-Provision Net Income 0.34% 0.30% 0.82 After-Tax Provision (0.04%) (0.04%) (0.10) Common Dividends1 (0.13%) (0.12%) (0.32) AOCI --- 0.67% 1.81 Goodwill & Intangibles 0.01% 0.01% 0.03 Other (0.02%) 0.01% 0.04 Asset Growth (0.25%) (0.14%) --- At 12/31/23 – Reported 9.84% 7.15% 19.39 AOCI net losses --- 1.70% 4.61 At 12/31/23 – ex AOCI2 9.84% 8.85% 24.00 (1) 32 cents per share Reported Proforma including AOCI and HTM unrealized losses |

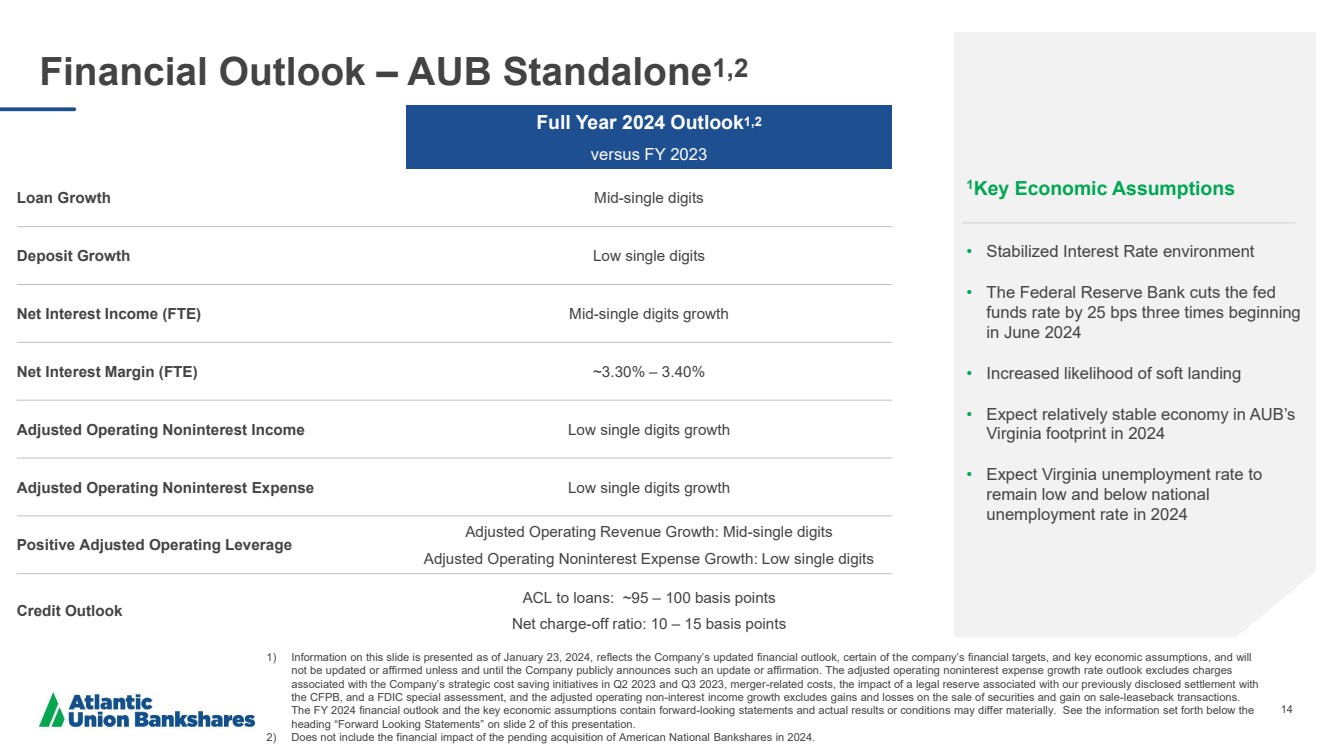

| 14 Financial Outlook – AUB Standalone1,2 1Key Economic Assumptions • Stabilized Interest Rate environment • The Federal Reserve Bank cuts the fed funds rate by 25 bps three times beginning in June 2024 • Increased likelihood of soft landing • Expect relatively stable economy in AUB’s Virginia footprint in 2024 • Expect Virginia unemployment rate to remain low and below national unemployment rate in 2024 Full Year 2024 Outlook1,2 versus FY 2023 Loan Growth Mid-single digits Deposit Growth Low single digits Net Interest Income (FTE) Mid-single digits growth Net Interest Margin (FTE) ~3.30% – 3.40% Adjusted Operating Noninterest Income Low single digits growth Adjusted Operating Noninterest Expense Low single digits growth Positive Adjusted Operating Leverage Adjusted Operating Revenue Growth: Mid-single digits Adjusted Operating Noninterest Expense Growth: Low single digits Credit Outlook ACL to loans: ~95 – 100 basis points Net charge-off ratio: 10 – 15 basis points 1) Information on this slide is presented as of January 23, 2024, reflects the Company’s updated financial outlook, certain of the company’s financial targets, and key economic assumptions, and will not be updated or affirmed unless and until the Company publicly announces such an update or affirmation. The adjusted operating noninterest expense growth rate outlook excludes charges associated with the Company’s strategic cost saving initiatives in Q2 2023 and Q3 2023, merger-related costs, the impact of a legal reserve associated with our previously disclosed settlement with the CFPB, and a FDIC special assessment, and the adjusted operating non-interest income growth excludes gains and losses on the sale of securities and gain on sale-leaseback transactions. The FY 2024 financial outlook and the key economic assumptions contain forward-looking statements and actual results or conditions may differ materially. See the information set forth below the heading “Forward Looking Statements” on slide 2 of this presentation. 2) Does not include the financial impact of the pending acquisition of American National Bankshares in 2024. |

| 15 Appendix |

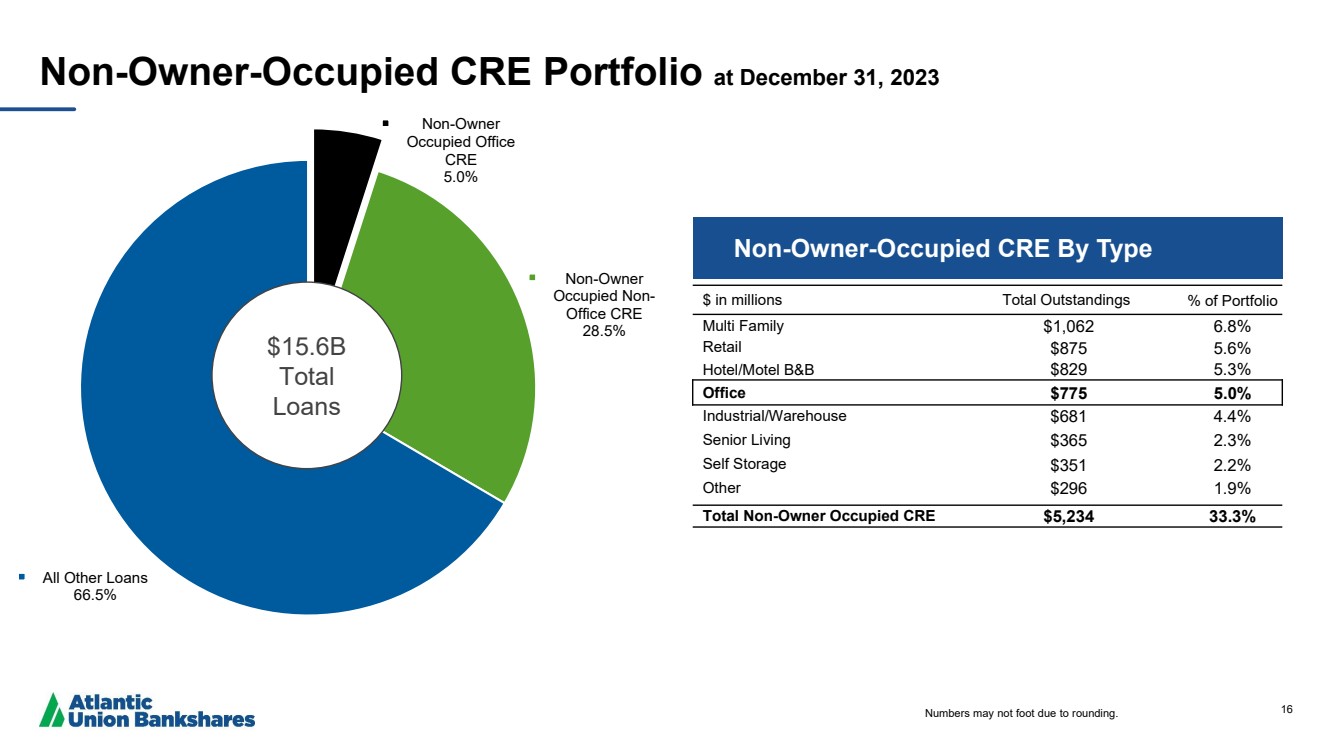

| 16 Non-Owner Occupied Office CRE 5.0% Non-Owner Occupied Non-Office CRE 28.5% All Other Loans 66.5% Non-Owner-Occupied CRE Portfolio at December 31, 2023 $ in millions Total Outstandings % of Portfolio Multi Family $1,062 6.8% Retail $875 5.6% Hotel/Motel B&B $829 5.3% Office $775 5.0% Industrial/Warehouse $681 4.4% Senior Living $365 2.3% Self Storage $351 2.2% Other $296 1.9% Total Non-Owner Occupied CRE $5,234 33.3% $15.6B Total Loans Non-Owner-Occupied CRE By Type Numbers may not foot due to rounding. |

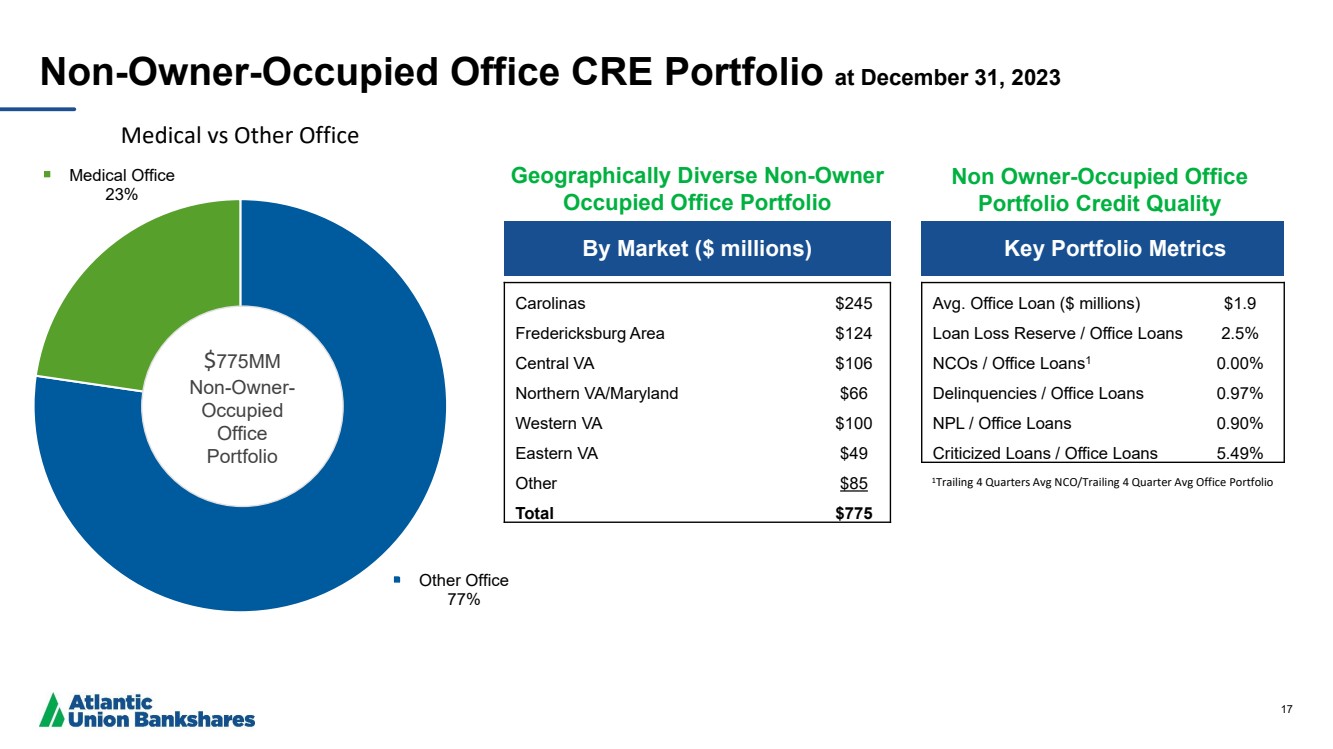

| 17 Other Office 77% Medical Office 23% Medical vs Other Office By Market ($ millions) Key Portfolio Metrics Carolinas $245 Fredericksburg Area $124 Central VA $106 Northern VA/Maryland $66 Western VA $100 Eastern VA $49 Other $85 Total $775 Avg. Office Loan ($ millions) $1.9 Loan Loss Reserve / Office Loans 2.5% NCOs / Office Loans1 0.00% Delinquencies / Office Loans 0.97% NPL / Office Loans 0.90% Criticized Loans / Office Loans 5.49% Non-Owner-Occupied Office CRE Portfolio at December 31, 2023 $775MM Non-Owner-Occupied Office Portfolio Non Owner-Occupied Office Portfolio Credit Quality Geographically Diverse Non-Owner Occupied Office Portfolio 1Trailing 4 Quarters Avg NCO/Trailing 4 Quarter Avg Office Portfolio |

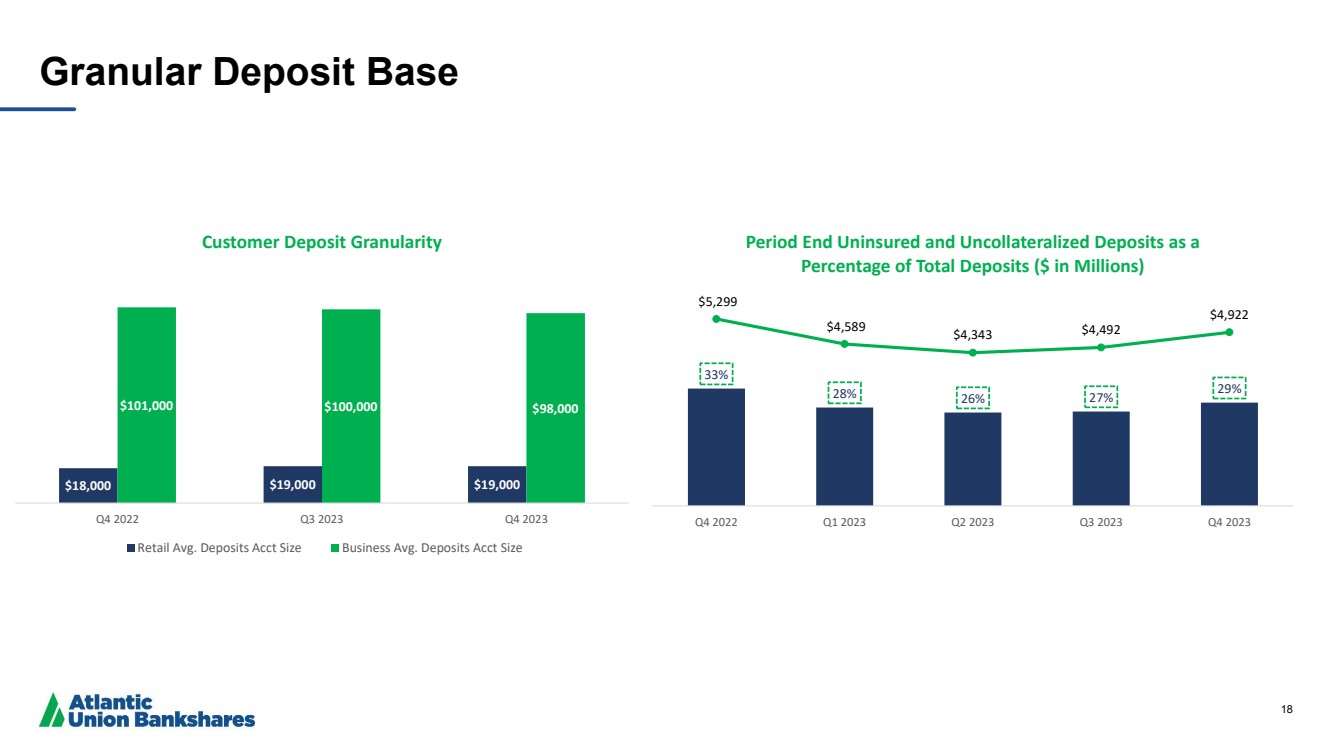

| 18 Granular Deposit Base 33% 28% 26% 27% 29% $5,299 $4,589 $4,343 $4,492 $4,922 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Period End Uninsured and Uncollateralized Deposits as a Percentage of Total Deposits ($ in Millions) $18,000 $19,000 $19,000 $101,000 $100,000 $98,000 Q4 2022 Q3 2023 Q4 2023 Customer Deposit Granularity Retail Avg. Deposits Acct Size Business Avg. Deposits Acct Size |

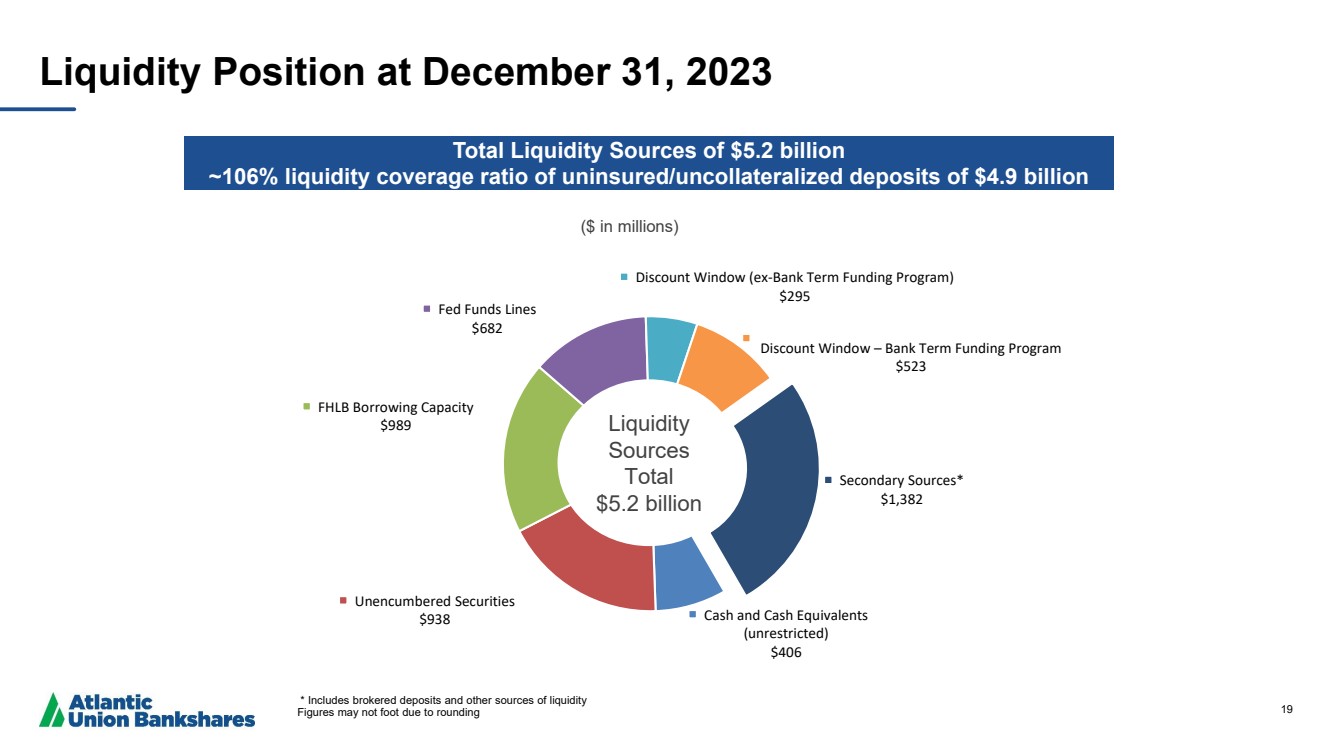

| 19 Cash and Cash Equivalents (unrestricted) $406 Unencumbered Securities $938 FHLB Borrowing Capacity $989 Fed Funds Lines $682 Discount Window (ex-Bank Term Funding Program) $295 Discount Window – Bank Term Funding Program $523 Secondary Sources* $1,382 ($ in millions) Liquidity Position at December 31, 2023 Total Liquidity Sources of $5.2 billion ~106% liquidity coverage ratio of uninsured/uncollateralized deposits of $4.9 billion * Includes brokered deposits and other sources of liquidity Figures may not foot due to rounding Liquidity Sources Total $5.2 billion |

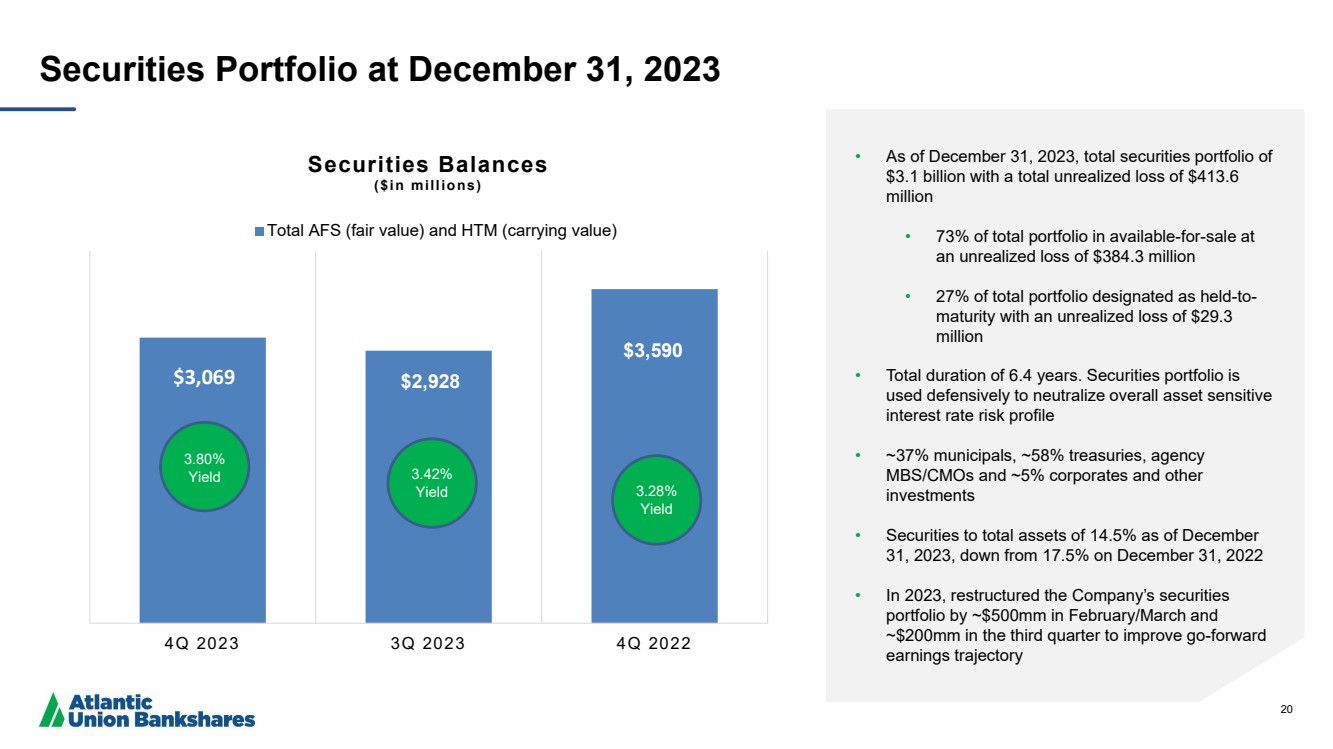

| 20 Securities Portfolio at December 31, 2023 • As of December 31, 2023, total securities portfolio of $3.1 billion with a total unrealized loss of $413.6 million • 73% of total portfolio in available-for-sale at an unrealized loss of $384.3 million • 27% of total portfolio designated as held-to-maturity with an unrealized loss of $29.3 million • Total duration of 6.4 years. Securities portfolio is used defensively to neutralize overall asset sensitive interest rate risk profile • ~37% municipals, ~58% treasuries, agency MBS/CMOs and ~5% corporates and other investments • Securities to total assets of 14.5% as of December 31, 2023, down from 17.5% on December 31, 2022 • In 2023, restructured the Company’s securities portfolio by ~$500mm in February/March and ~$200mm in the third quarter to improve go-forward earnings trajectory $3,032 $3,069 4Q 2023 3Q 2023 4Q 2022 Securities Balances ($in millions) Total AFS (fair value) and HTM (carrying value) 3.80% Yield 3.28% Yield 3.42% Yield $2,928 $3,590 $3,069 |

| 21 Reconciliation of Non-GAAP Disclosures The Company has provided supplemental performance measures on a tax-equivalent, tangible, operating, adjusted, or pre-tax pre-provision basis. These non-GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non-GAAP financial measures may not be comparable to non-GAAP financial measures of other companies. The Company uses the non-GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. |

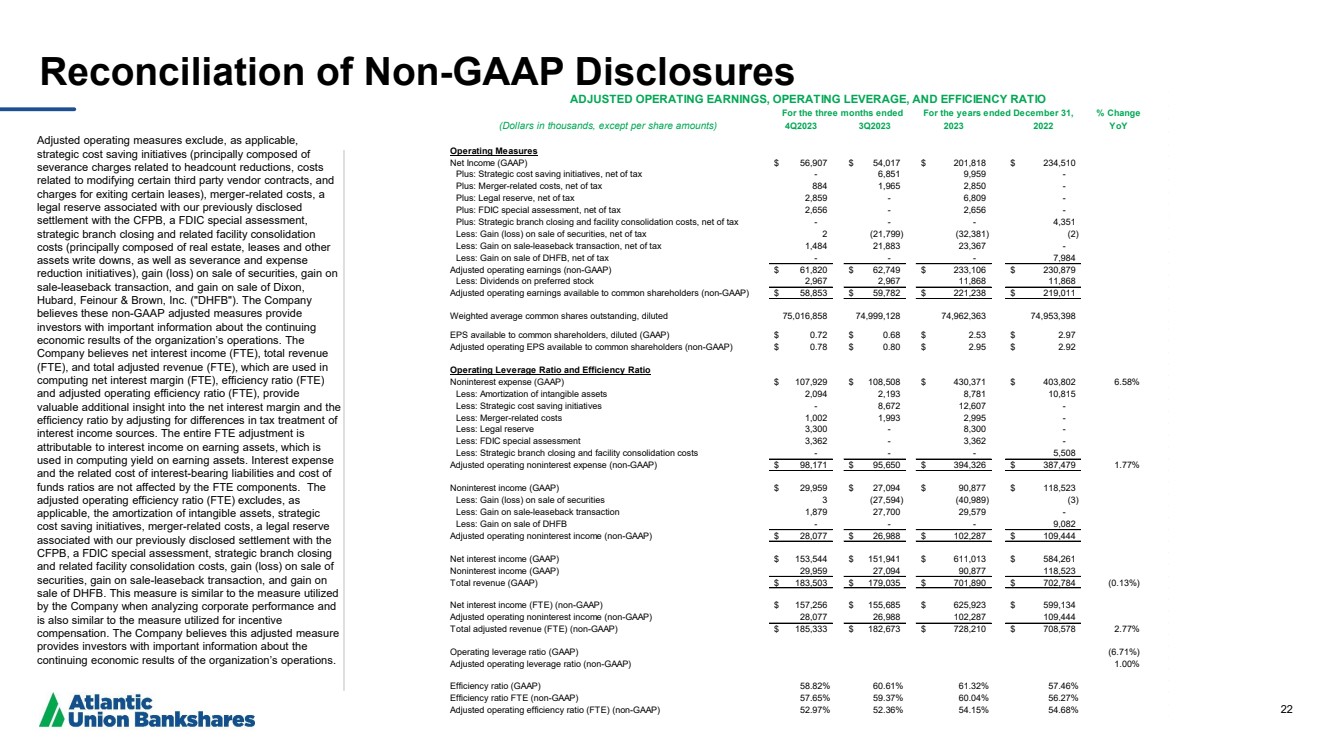

| 22 Reconciliation of Non -GAAP Disclosures Adjusted operating measures exclude, as applicable, strategic cost saving initiatives (principally composed of severance charges related to headcount reductions, costs related to modifying certain third party vendor contracts, and charges for exiting certain leases), merger -related costs, a legal reserve associated with our previously disclosed settlement with the CFPB, a FDIC special assessment, strategic branch closing and related facility consolidation costs (principally composed of real estate, leases and other assets write downs, as well as severance and expense reduction initiatives), gain (loss) on sale of securities, gain on sale -leaseback transaction, and gain on sale of Dixon, Hubard, Feinour & Brown, Inc. ("DHFB"). The Company believes these non -GAAP adjusted measures provide investors with important information about the continuing economic results of the organization’s operations. The Company believes net interest income (FTE), total revenue (FTE), and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest -bearing liabilities and cost of funds ratios are not affected by the FTE components. The adjusted operating efficiency ratio (FTE) excludes, as applicable, the amortization of intangible assets, strategic cost saving initiatives, merger -related costs, a legal reserve associated with our previously disclosed settlement with the CFPB, a FDIC special assessment, strategic branch closing and related facility consolidation costs, gain (loss) on sale of securities, gain on sale -leaseback transaction, and gain on sale of DHFB. This measure is similar to the measure utilized by the Company when analyzing corporate performance and is also similar to the measure utilized for incentive compensation. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the organization’s operations. % Change (Dollars in thousands, except per share amounts) 4Q2023 3Q2023 2023 2022 YoY Operating Measures Net Income (GAAP) $ 56,907 $ 54,017 $ 201,818 $ 234,510 Plus: Strategic cost saving initiatives, net of tax - 6,851 9,959 - Plus: Merger-related costs, net of tax 884 1,965 2,850 - Plus: Legal reserve, net of tax 2,859 - 6,809 - Plus: FDIC special assessment, net of tax 2,656 - 2,656 - Plus: Strategic branch closing and facility consolidation costs, net of tax - - - 4,351 Less: Gain (loss) on sale of securities, net of tax 2 (21,799) (32,381) (2) Less: Gain on sale-leaseback transaction, net of tax 1,484 21,883 23,367 - Less: Gain on sale of DHFB, net of tax - - - 7,984 Adjusted operating earnings (non-GAAP) $ 61,820 $ 62,749 $ 233,106 $ 230,879 Less: Dividends on preferred stock 2,967 2,967 11,868 11,868 Adjusted operating earnings available to common shareholders (non-GAAP) $ 58,853 $ 59,782 $ 221,238 $ 219,011 Weighted average common shares outstanding, diluted 75,016,858 74,999,128 74,962,363 74,953,398 EPS available to common shareholders, diluted (GAAP) $ 0.72 $ 0.68 $ 2.53 $ 2.97 Adjusted operating EPS available to common shareholders (non-GAAP) $ 0.78 $ 0.80 $ 2.95 $ 2.92 Operating Leverage Ratio and Efficiency Ratio Noninterest expense (GAAP) $ 107,929 $ 108,508 $ 430,371 $ 403,802 6.58% Less: Amortization of intangible assets 2,094 2,193 8,781 10,815 Less: Strategic cost saving initiatives - 8,672 12,607 - Less: Merger-related costs 1,002 1,993 2,995 - Less: Legal reserve 3,300 - 8,300 - Less: FDIC special assessment 3,362 - 3,362 - Less: Strategic branch closing and facility consolidation costs - - - 5,508 Adjusted operating noninterest expense (non-GAAP) $ 98,171 $ 95,650 $ 394,326 $ 387,479 1.77% Noninterest income (GAAP) $ 29,959 $ 27,094 $ 90,877 $ 118,523 Less: Gain (loss) on sale of securities 3 (27,594) (40,989) (3) Less: Gain on sale-leaseback transaction 1,879 27,700 29,579 - Less: Gain on sale of DHFB - - - 9,082 Adjusted operating noninterest income (non-GAAP) $ 28,077 $ 26,988 $ 102,287 $ 109,444 Net interest income (GAAP) $ 153,544 $ 151,941 $ 611,013 $ 584,261 Noninterest income (GAAP) 29,959 27,094 90,877 118,523 Total revenue (GAAP) $ 183,503 $ 179,035 $ 701,890 $ 702,784 (0.13%) Net interest income (FTE) (non-GAAP) $ 157,256 $ 155,685 $ 625,923 $ 599,134 Adjusted operating noninterest income (non-GAAP) 28,077 26,988 102,287 109,444 Total adjusted revenue (FTE) (non-GAAP) $ 185,333 $ 182,673 $ 728,210 $ 708,578 2.77% Operating leverage ratio (GAAP) (6.71%) Adjusted operating leverage ratio (non-GAAP) 1.00% Efficiency ratio (GAAP) 58.82% 60.61% 61.32% 57.46% Efficiency ratio FTE (non-GAAP) 57.65% 59.37% 60.04% 56.27% Adjusted operating efficiency ratio (FTE) (non-GAAP) 52.97% 52.36% 54.15% 54.68% ADJUSTED OPERATING EARNINGS, OPERATING LEVERAGE, AND EFFICIENCY RATIO For the three months ended For the years ended December 31, |

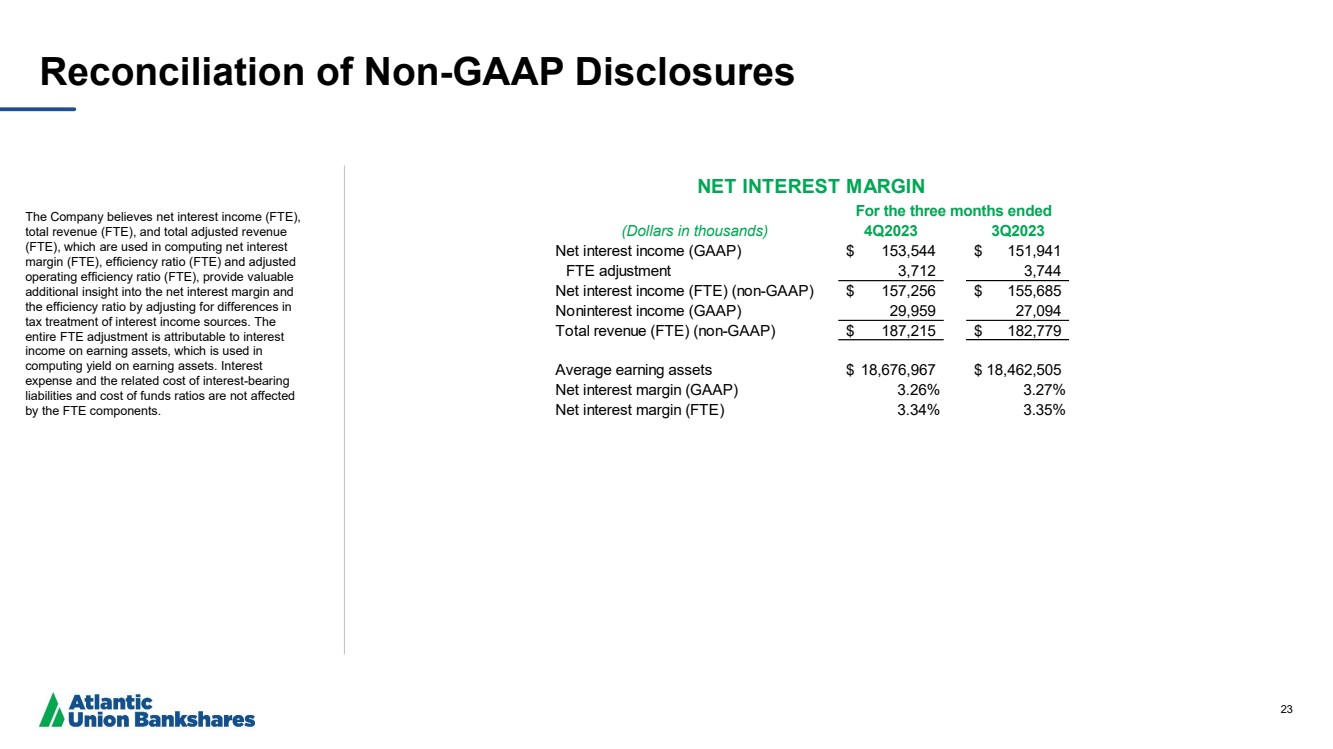

| 23 Reconciliation of Non-GAAP Disclosures The Company believes net interest income (FTE), total revenue (FTE), and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components. (Dollars in thousands) 4Q2023 3Q2023 Net interest income (GAAP) $ 153,544 $ 151,941 FTE adjustment 3,712 3,744 Net interest income (FTE) (non-GAAP) $ 157,256 $ 155,685 Noninterest income (GAAP) 29,959 27,094 Total revenue (FTE) (non-GAAP) $ 187,215 $ 182,779 Average earning assets $ 18,676,967 $ 18,462,505 Net interest margin (GAAP) 3.26% 3.27% Net interest margin (FTE) 3.34% 3.35% NET INTEREST MARGIN For the three months ended |

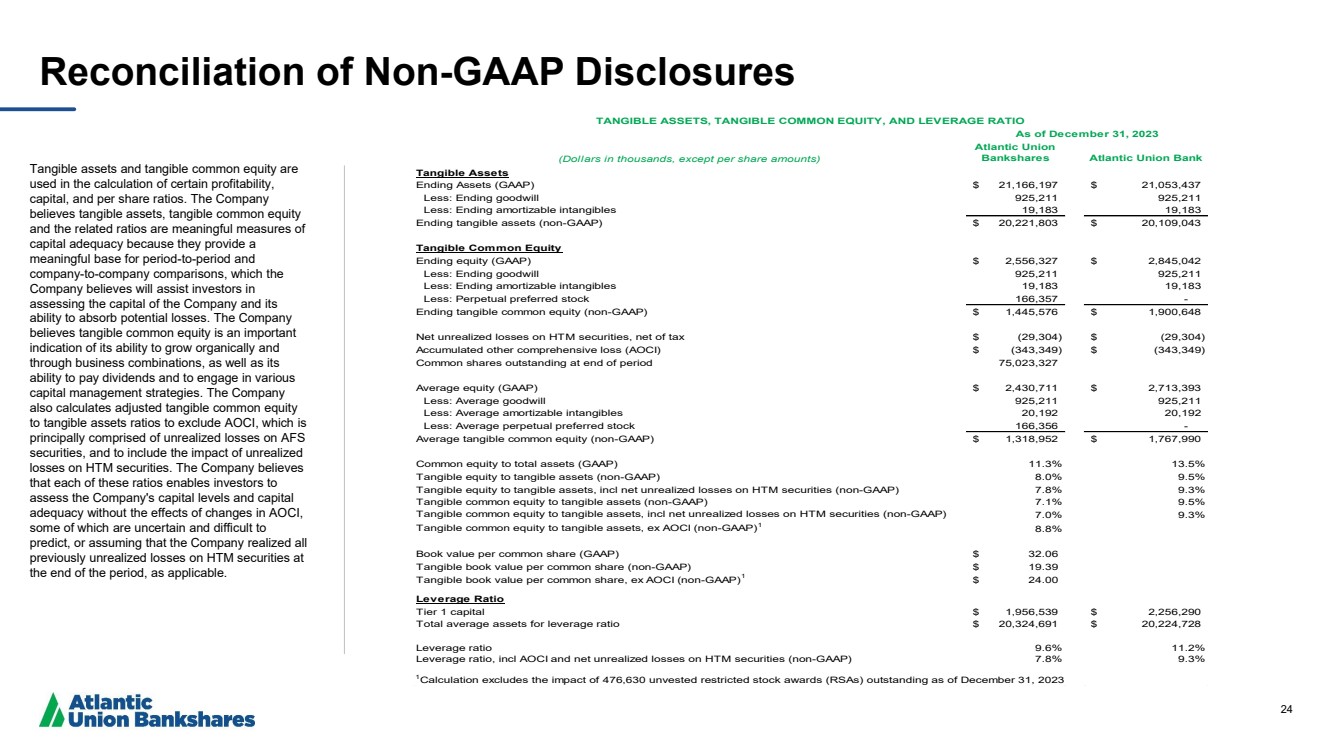

| 24 Reconciliation of Non-GAAP Disclosures Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. The Company also calculates adjusted tangible common equity to tangible assets ratios to exclude AOCI, which is principally comprised of unrealized losses on AFS securities, and to include the impact of unrealized losses on HTM securities. The Company believes that each of these ratios enables investors to assess the Company's capital levels and capital adequacy without the effects of changes in AOCI, some of which are uncertain and difficult to predict, or assuming that the Company realized all previously unrealized losses on HTM securities at the end of the period, as applicable. (Dollars in thousands, except per share amounts) Atlantic Union Bankshares Atlantic Union Bank Tangible Assets Ending Assets (GAAP) $ 21,166,197 $ 21,053,437 Less: Ending goodwill 925,211 925,211 Less: Ending amortizable intangibles 19,183 19,183 Ending tangible assets (non-GAAP) $ 20,221,803 $ 20,109,043 Tangible Common Equity Ending equity (GAAP) $ 2,556,327 $ 2,845,042 Less: Ending goodwill 925,211 925,211 Less: Ending amortizable intangibles 19,183 19,183 Less: Perpetual preferred stock 166,357 - Ending tangible common equity (non-GAAP) $ 1,445,576 $ 1,900,648 Net unrealized losses on HTM securities, net of tax $ (29,304) $ (29,304) Accumulated other comprehensive loss (AOCI) $ (343,349) $ (343,349) Common shares outstanding at end of period 75,023,327 Average equity (GAAP) $ 2,430,711 $ 2,713,393 Less: Average goodwill 925,211 925,211 Less: Average amortizable intangibles 20,192 20,192 Less: Average perpetual preferred stock 166,356 - Average tangible common equity (non-GAAP) $ 1,318,952 $ 1,767,990 Less: Perpetual preferred stock Common equity to total assets (GAAP) 11.3% 13.5% Tangible equity to tangible assets (non-GAAP) 8.0% 9.5% Tangible equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 7.8% 9.3% Tangible common equity to tangible assets (non-GAAP) 7.1% 9.5% Tangible common equity to tangible assets, incl net unrealized losses on HTM securities (non-GAAP) 7.0% 9.3% Tangible common equity to tangible assets, ex AOCI (non-GAAP)1 8.8% Book value per common share (GAAP) $ 32.06 Tangible book value per common share (non-GAAP) $ 19.39 Tangible book value per common share, ex AOCI (non-GAAP)1 $ 24.00 Leverage Ratio Tier 1 capital $ 1,956,539 $ 2,256,290 Total average assets for leverage ratio $ 20,324,691 $ 20,224,728 Leverage ratio 9.6% 11.2% Leverage ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 7.8% 9.3% TANGIBLE ASSETS, TANGIBLE COMMON EQUITY, AND LEVERAGE RATIO As of December 31, 2023 1Calculation excludes the impact of 476,630 unvested restricted stock awards (RSAs) outstanding as of December 31, 2023 |

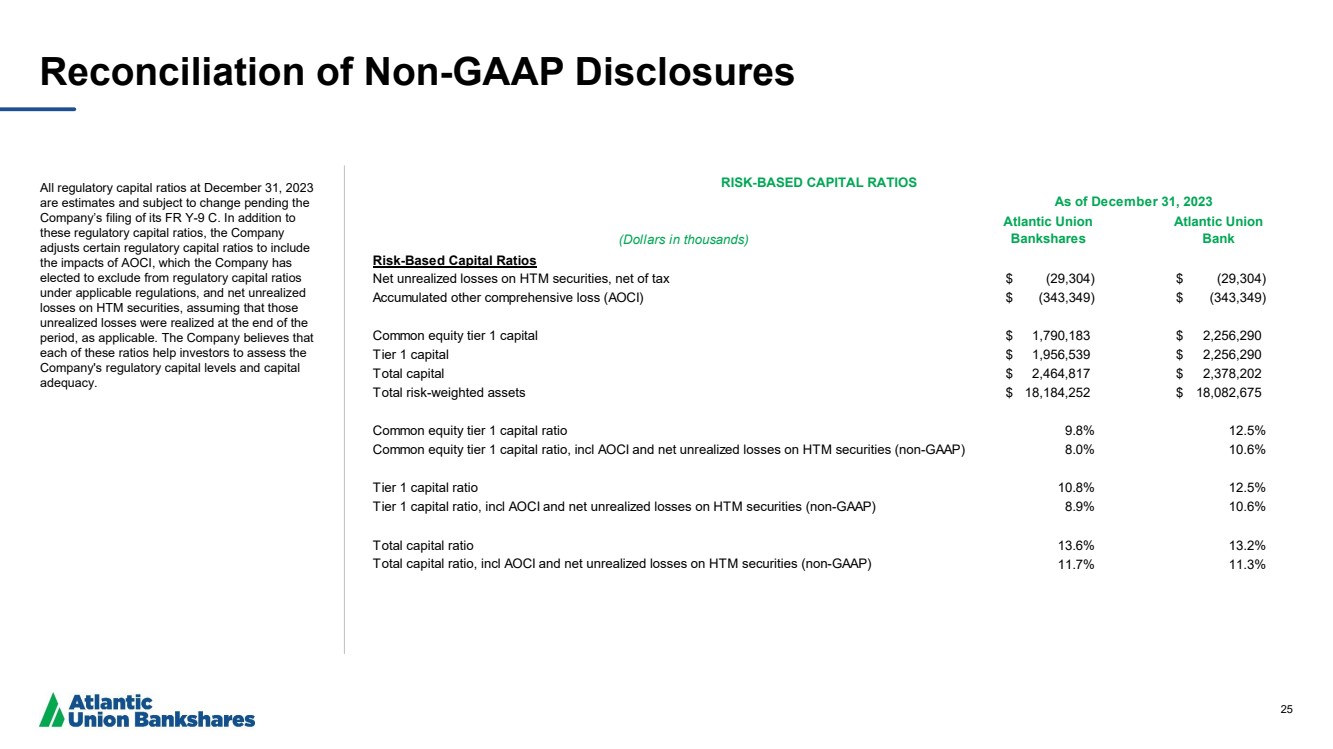

| 25 Reconciliation of Non-GAAP Disclosures All regulatory capital ratios at December 31, 2023 are estimates and subject to change pending the Company’s filing of its FR Y-9 C. In addition to these regulatory capital ratios, the Company adjusts certain regulatory capital ratios to include the impacts of AOCI, which the Company has elected to exclude from regulatory capital ratios under applicable regulations, and net unrealized losses on HTM securities, assuming that those unrealized losses were realized at the end of the period, as applicable. The Company believes that each of these ratios help investors to assess the Company's regulatory capital levels and capital adequacy. (Dollars in thousands) Atlantic Union Bankshares Atlantic Union Bank Risk-Based Capital Ratios Net unrealized losses on HTM securities, net of tax $ (29,304) $ (29,304) Accumulated other comprehensive loss (AOCI) $ (343,349) $ (343,349) Common equity tier 1 capital $ 1,790,183 $ 2,256,290 Tier 1 capital $ 1,956,539 $ 2,256,290 Total capital $ 2,464,817 $ 2,378,202 Total risk-weighted assets $ 18,184,252 $ 18,082,675 Common equity tier 1 capital ratio 9.8% 12.5% Common equity tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 8.0% 10.6% Tier 1 capital ratio 10.8% 12.5% Tier 1 capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 8.9% 10.6% Total capital ratio 13.6% 13.2% Total capital ratio, incl AOCI and net unrealized losses on HTM securities (non-GAAP) 11.7% 11.3% RISK-BASED CAPITAL RATIOS As of December 31, 2023 |

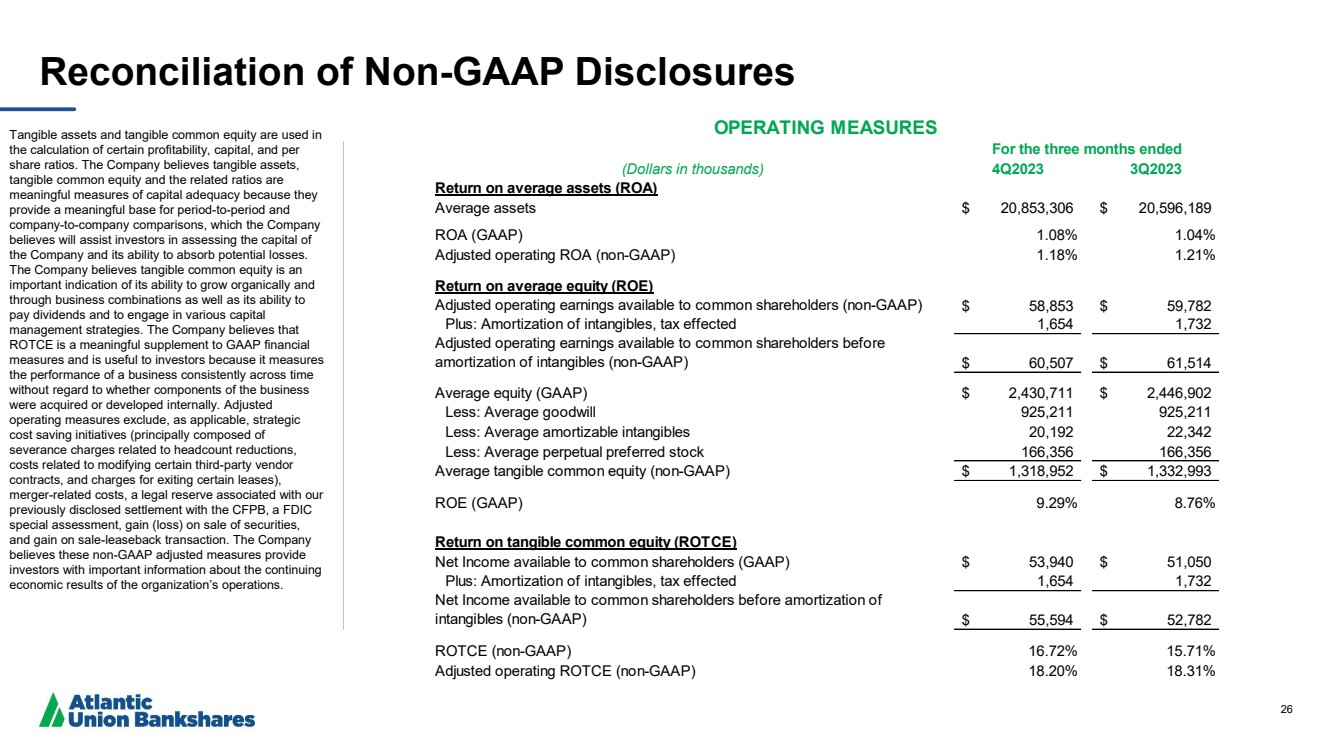

| 26 Reconciliation of Non-GAAP Disclosures Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period-to-period and company-to-company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations as well as its ability to pay dividends and to engage in various capital management strategies. The Company believes that ROTCE is a meaningful supplement to GAAP financial measures and is useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. Adjusted operating measures exclude, as applicable, strategic cost saving initiatives (principally composed of severance charges related to headcount reductions, costs related to modifying certain third-party vendor contracts, and charges for exiting certain leases), merger-related costs, a legal reserve associated with our previously disclosed settlement with the CFPB, a FDIC special assessment, gain (loss) on sale of securities, and gain on sale-leaseback transaction. The Company believes these non-GAAP adjusted measures provide investors with important information about the continuing economic results of the organization’s operations. (Dollars in thousands) 4Q2023 3Q2023 Return on average assets (ROA) Average assets $ 20,853,306 $ 20,596,189 ROA (GAAP) 1.08% 1.04% Adjusted operating ROA (non-GAAP) 1.18% 1.21% Return on average equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) $ 58,853 $ 59,782 Plus: Amortization of intangibles, tax effected 1,654 1,732 Adjusted operating earnings available to common shareholders before amortization of intangibles (non-GAAP) $ 60,507 $ 61,514 Average equity (GAAP) $ 2,430,711 $ 2,446,902 Less: Average goodwill 925,211 925,211 Less: Average amortizable intangibles 20,192 22,342 Less: Average perpetual preferred stock 166,356 166,356 Average tangible common equity (non-GAAP) $ 1,318,952 $ 1,332,993 ROE (GAAP) 9.29% 8.76% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) $ 53,940 $ 51,050 Plus: Amortization of intangibles, tax effected 1,654 1,732 Net Income available to common shareholders before amortization of intangibles (non-GAAP) $ 55,594 $ 52,782 ROTCE (non-GAAP) 16.72% 15.71% Adjusted operating ROTCE (non-GAAP) 18.20% 18.31% For the three months ended OPERATING MEASURES |

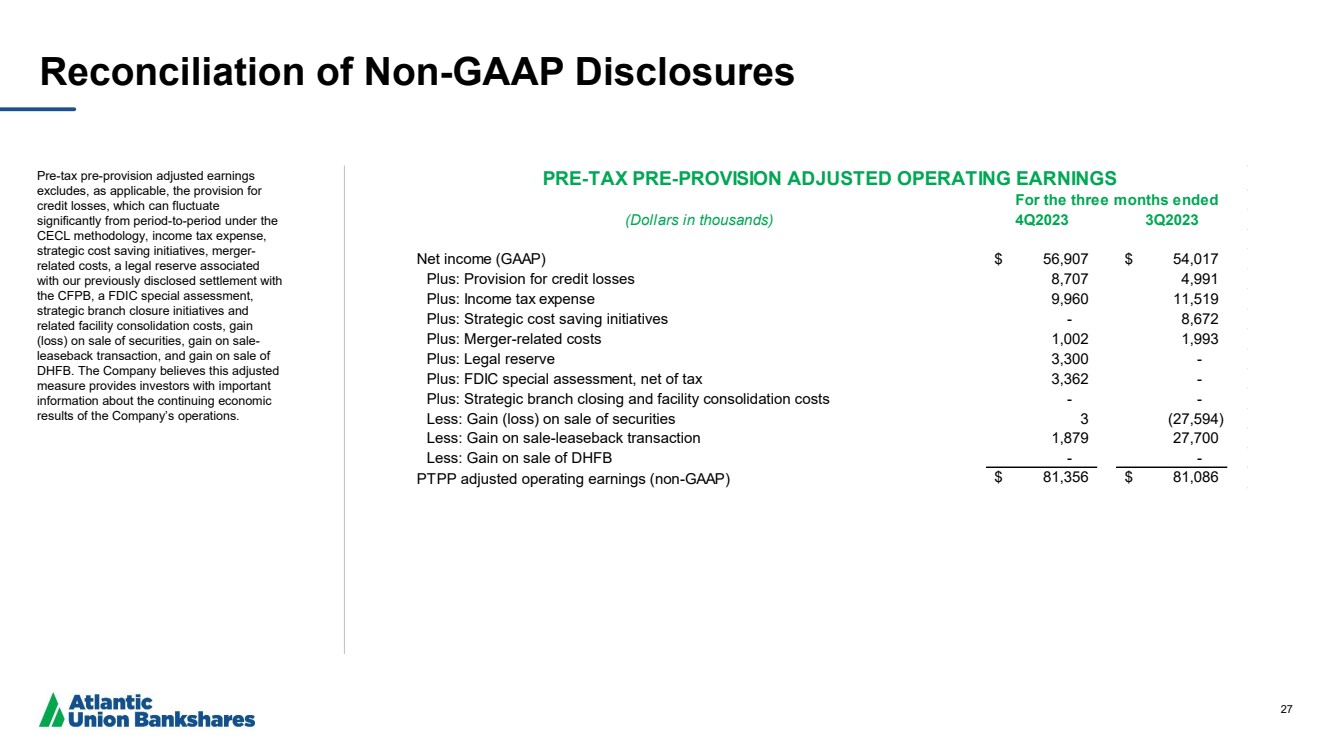

| 27 Reconciliation of Non-GAAP Disclosures Pre-tax pre-provision adjusted earnings excludes, as applicable, the provision for credit losses, which can fluctuate significantly from period-to-period under the CECL methodology, income tax expense, strategic cost saving initiatives, merger-related costs, a legal reserve associated with our previously disclosed settlement with the CFPB, a FDIC special assessment, strategic branch closure initiatives and related facility consolidation costs, gain (loss) on sale of securities, gain on sale-leaseback transaction, and gain on sale of DHFB. The Company believes this adjusted measure provides investors with important information about the continuing economic results of the Company’s operations. (Dollars in thousands) 4Q2023 3Q2023 Net income (GAAP) $ 56,907 $ 54,017 Plus: Provision for credit losses 8,707 4,991 Plus: Income tax expense 9,960 11,519 Plus: Strategic cost saving initiatives - 8,672 Plus: Merger-related costs 1,002 1,993 Plus: Legal reserve 3,300 - Plus: FDIC special assessment, net of tax 3,362 - Plus: Strategic branch closing and facility consolidation costs - - Less: Gain (loss) on sale of securities 3 (27,594) Less: Gain on sale-leaseback transaction 1,879 27,700 Less: Gain on sale of DHFB - - PTPP adjusted operating earnings (non-GAAP) $ 81,356 $ 81,086 For the three months ended PRE-TAX PRE-PROVISION ADJUSTED OPERATING EARNINGS |