| Investor Presentation NYSE: AUB February - March 2023 |

| 2 Forward Looking Statements This presentation and statements by the Company’s management may constitute “forward - looking statements” within the meaning of t he Private Securities Litigation Reform Act of 1995. Forward - looking statements are statements that include, without limitation, statements on slides entitled “Financial Outlook” and “Top - Tier Financial Targets”, statements regarding the Company ’s strategic priorities, outlook on future economic conditions and the impacts of current economic uncertainties, and statements that include, projections, predictions, expectations, or beliefs about future events or results, including the Com pan y’s financial targets, or otherwise are not statements of historical fact. Such forward - looking statements are based on certain assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties, and other fac tor s, some of which cannot be predicted or quantified, that may cause actual results, performance, achievements, or trends to be materially different from those expressed or implied by such forward - looking statements. Such statements are often characteri zed by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “antici pat e,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other statements concerning opini ons or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward - looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its b usiness and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, the Company will not differ materially from any projected future results, performance, achievements or trends expr ess ed or implied by such forward - looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to the eff ects of or changes in: • market interest rates and their related impacts on macroeconomic conditions, customer and client behavior, the Company’s funding costs and the Company’s loan and securities portfolios; • inflation and its impacts on economic growth and customer and client behavior; • general economic and financial market conditions, in the United States generally and particularly in the markets in which the Company operates and which its loans are concentrated, including the effects of declines in real estate values, an increase in unemployment levels and slowdowns in economic growth; • monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of the Treasury and the Federal Reserve; • the quality or composition of the Company’s loan or investment portfolios and changes therein; • demand for loan products and financial services in the Company’s market areas; • the Company’s ability to manage its growth or implement its growth strategy; • the effectiveness of expense reduction plans; • the introduction of new lines of business or new products and services; • the Company’s ability to recruit and retain key employees; • real estate values in the Company’s lending area; • an insufficient ACL; • changes in accounting principles, standards, rules, and interpretations, and the related impact on the Company’s financial statements; • volatility in the ACL resulting from the CECL methodology, either alone or as that may be affected by conditions arising out of the COVID - 19 pandemic, inflation, changing interest rates, or other factors; • the Company’s liquidity and capital positions; • concentrations of loans secured by real estate, particularly commercial real estate; • the effectiveness of the Company’s credit processes and management of the Company’s credit risk; • the Company’s ability to compete in the market for financial services and increased competition from fintech companies; • technological risks and developments, and cyber threats, attacks, or events; • operational, technological, cultural, regulatory, legal, credit, and other risks associated with the exploration, consummation and integration of potential future acquisitions, whether involving stock or cash considerations; • the potential adverse effects of unusual and infrequently occurring events, such as weather - related disasters, terrorist acts, geopolitical conflicts (such as the ongoing conflict between Russia and Ukraine) or public health events (such as COVID - 19), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on supply chains and methods used to distribute products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third - party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; • the effect of steps the Company takes in response to the COVID - 19 pandemic, the severity and duration of the pandemic, the uncertainty regarding new variants of COVID - 19 that have emerged, the speed and efficacy of vaccine and treatment developments, the impact of loosening or tightening of government restrictions, the pace of recovery when the pandemic subsides and the heightened impact it has on many of the risks described herein; • the discontinuation of LIBOR and its impact on the financial markets, and the Company’s ability to manage operational, legal and compliance risks related to the discontinuation of LIBOR and implementation of one or more alternate reference rates; • performance by the Company’s counterparties or vendors; • deposit flows; • the availability of financing and the terms thereof; • the level of prepayments on loans and mortgage - backed securities; • legislative or regulatory changes and requirements; • potential claims, damages, and fines related to litigation or government actions; • the effects of changes in federal, state or local tax laws and regulations; • any event or development that would cause the Company to conclude that there was an impairment of any asset, including intangible assets, such as goodwill; and • other factors, many of which are beyond the control of the Company. Please also refer to such other factors as discussed throughout Part I, Item 1A. “Risk Factors” and Part II, Item 7, “Managem ent ’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company’s most recent Annual Report on Form 10 - K and related disclosures in other filings, which have been filed with the U.S. Securities and Exchange Commission (“SEC”) and are ava ilable on the SEC’s website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward - looking statements, and all of the forward - looking statements are expressly qualified by the cautionary statements contained or referred to herein and therein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or its businesses or operations. Readers are cautioned not to rely too heavily on the forward - looking statements, and undue reliance should not be placed on such forward - looking statements. Forward - looking statements speak only as of the date they are made. The Company does not intend or assume any obligation to update, revise or clarify any forward - looking statements that may be made from time to time by or on behalf of the Company, whether as a result of new information, future events or o the rwise. |

| 3 Additional Information Non - GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). These non - GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and should not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Company’s non - GAAP financial measures may not be comparable to non - GAAP financial measures of other companies. The Company uses the non - GAAP financial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non - GAAP financial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure trends in the Company’s underlying performance. Please see “Reconciliation of Non - GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About Atlantic Union Bankshares Corporation Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation (NYSE: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank has 114 branches and approximately 130 ATMs located throughout Virginia, and in portions of Maryland and North Carolina. Certain non - bank financial services affiliates of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Atlantic Union Financial Consultants, LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products. On January 18, 2023, the Company completed the transfer of the listing of its common stock and its depositary shares, each representing a 1/400th interest in a share of the Company’s 6.875% Perpetual Non - Cumulative Preferred Stock, Series A, from The Nasdaq Stock Market LLC to the New York Stock Exchange, under the ticker symbols of "AUB" and "AUB.PRA", respectively. |

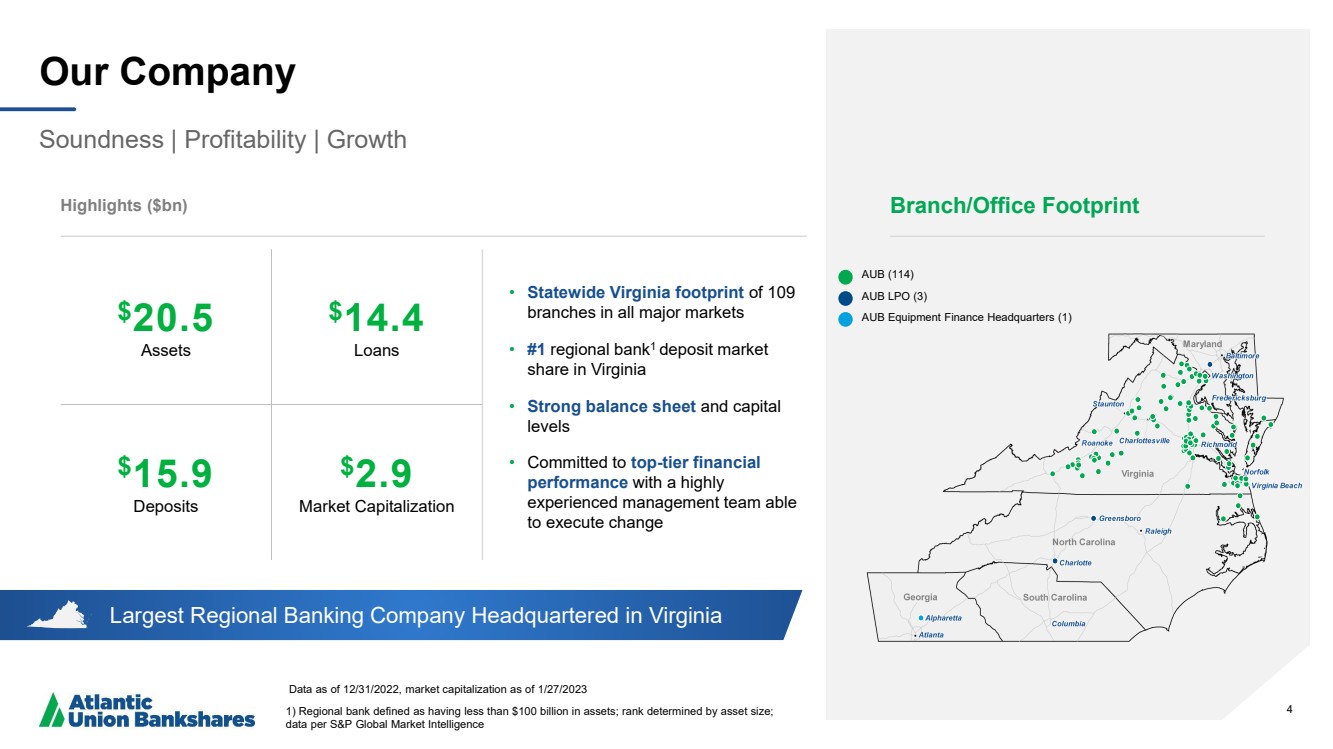

| 4 Largest Regional Banking Company Headquartered in Virginia Our Company Soundness | Profitability | Growth Data as of 12/31/2022, market capitalization as of 1/27/2023 1) Regional bank defined as having less than $100 billion in assets; rank determined by asset size; data per S&P Global Market Intelligence Highlights ($bn) • Statewide Virginia footprint of 109 branches in all major markets • #1 regional bank 1 deposit market share in Virginia • Strong balance sheet and capital levels • Committed to top - tier financial performance with a highly experienced management team able to execute change 4 $ 20 ..5 Assets $ 14.4 Loans $ 15.9 Deposits $ 2 ..9 Market Capitalization Branch/Office Footprint AUB (114) AUB LPO (3) AUB Equipment Finance Headquarters (1) |

| 5 A Transformation Story From Virginia Community Bank to Virginia’s Bank and More (1) As of December 31, 2022 Virginia’s Bank The Atlantic Union “Moat” – Stronger than Ever • Virginia’s first and only statewide, independent bank in over 20 years • The alternative to large competitors • Organic growth model + effective consolidator • Scarcity value - franchise difficult to replicate • “Crown jewel” deposit base - 57% transaction accounts 1 • Dense, compact and contiguous ~$20B bank 1 Larger Bank Executive Leadership Talent Magnet • Knows the “seams” of the large institutions & how to compete against them • Makes tough decisions – think differently, challenge, escape the past • Does what we say we will do • Extensive hiring from larger institutions at all levels • We know the people we hire and rarely use recruiters • Client facing market leaders and bankers hired from the markets they serve “Soundness, profitability & growth in that order of priority” | Our philosophy for how we run our company |

| 6 Our Shareholder Value Proposition Leading Regional Presence Dense, uniquely valuable presence across attractive markets Financial Strength Solid balance sheet & capital levels Attractive Financial Profile Solid dividend yield & payout ratio with earnings upside Strong Growth Potential Organic & acquisition opportunities Peer - Leading Performance Committed to top - tier financial performance |

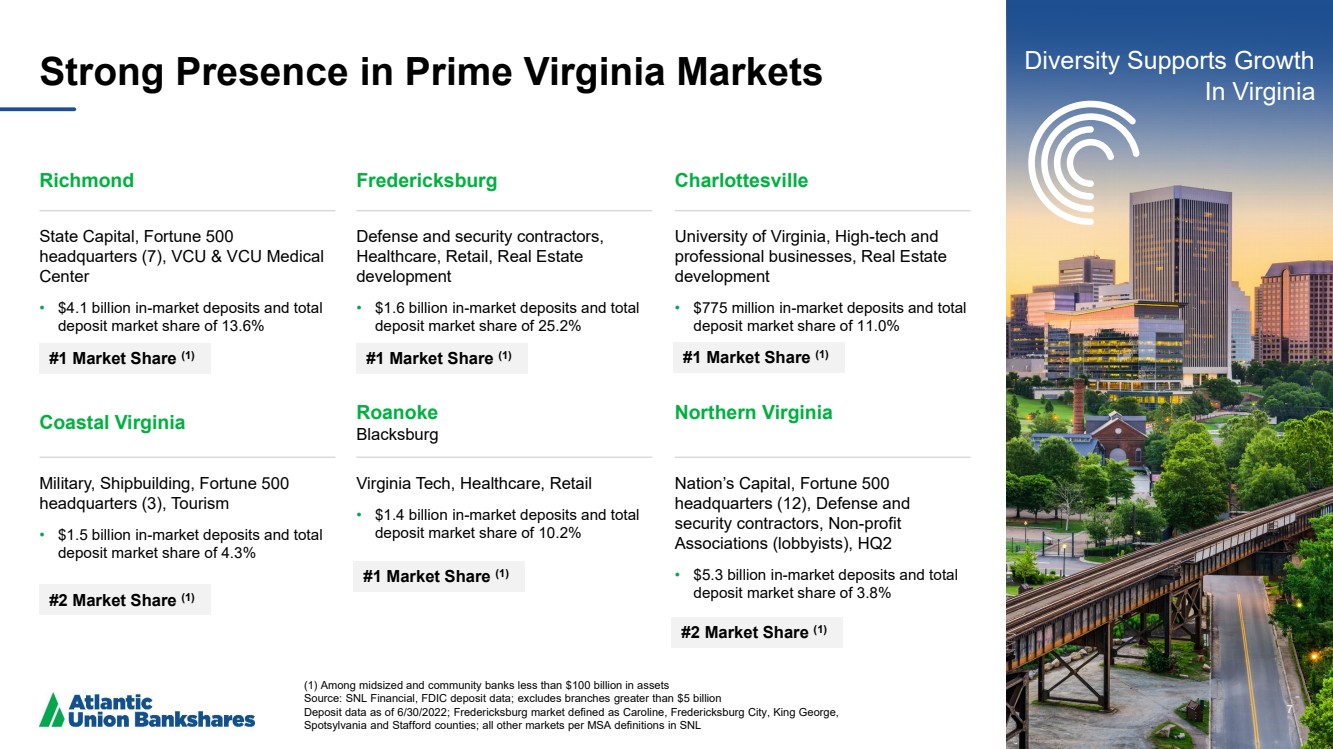

| 7 Strong Presence in Prime Virginia Markets (1) Among midsized and community banks less than $100 billion in assets Source: SNL Financial, FDIC deposit data; excludes branches greater than $5 billion Deposit data as of 6/30/2022; Fredericksburg market defined as Caroline, Fredericksburg City, King George, Spotsylvania and Stafford counties; all other markets per MSA definitions in SNL 7 Coastal Virginia Military, Shipbuilding, Fortune 500 headquarters (3), Tourism • $ 1.5 billion in - market deposits and total deposit market share of 4.3% Roanoke Blacksburg Virginia Tech, Healthcare, Retail • $1.4 billion in - market deposits and total deposit market share of 10.2% Northern Virginia Nation’s Capital, Fortune 500 headquarters ( 12), Defense and security contractors, Non - profit Associations (lobbyists), HQ2 • $ 5.3 billion in - market deposits and total deposit market share of 3.8% Diversity Supports Growth In Virginia Richmond State Capital, Fortune 500 headquarters (7), VCU & VCU Medical Center • $ 4.1 billion in - market deposits and total deposit market share of 13.6% Fredericksburg Defense and security contractors, Healthcare, Retail, Real Estate development • $ 1.6 billion in - market deposits and total deposit market share of 25.2% Charlottesville University of Virginia, High - tech and professional businesses, Real Estate development • $ 775 million in - market deposits and total deposit market share of 11.0% #1 Market Share (1) #2 Market Share (1) #2 Market Share (1) #1 Market Share (1) #1 Market Share (1) #1 Market Share (1) |

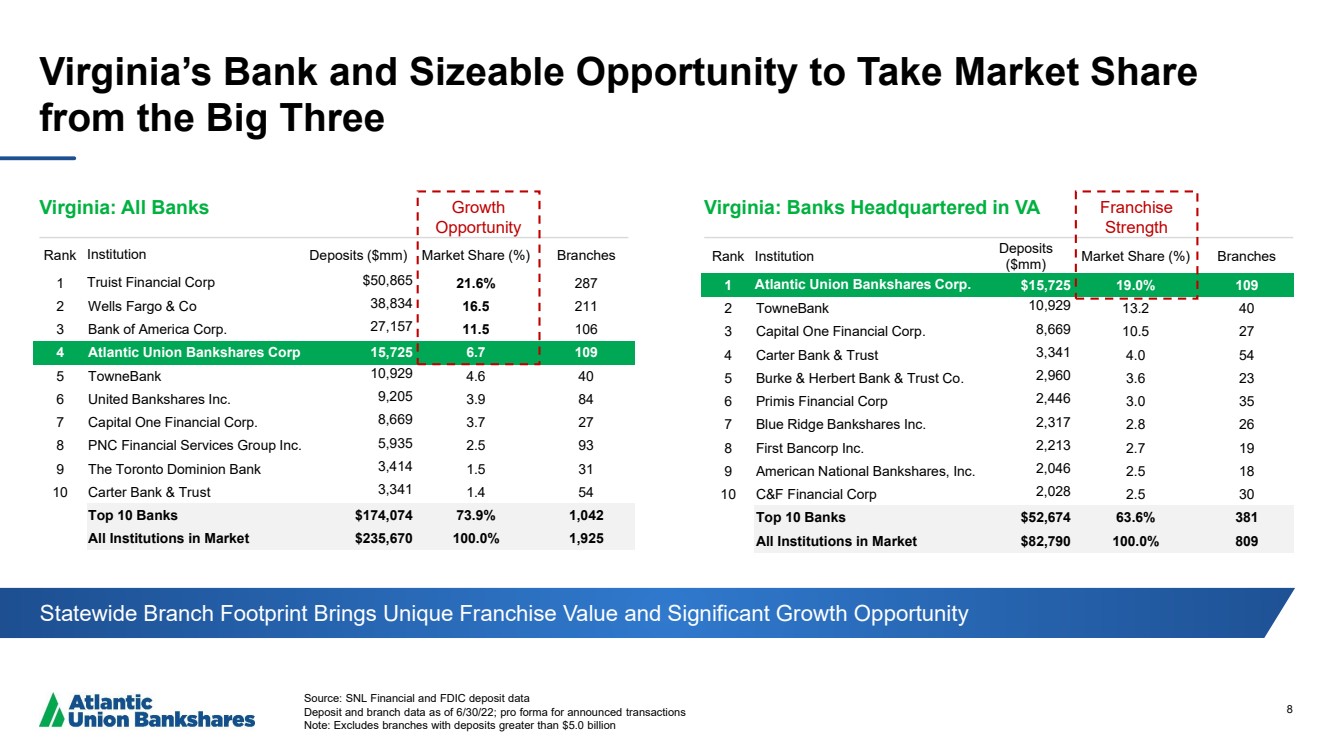

| 8 Virginia’s Bank and Sizeable Opportunity to Take Market Share from the Big Three Source: SNL Financial and FDIC deposit data Deposit and branch data as of 6/30/22; pro forma for announced transactions Note: Excludes branches with deposits greater than $5.0 billion Virginia: All Banks Virginia: Banks Headquartered in VA Rank Institution Deposits ($mm) Market Share (%) Branches 1 Truist Financial Corp $50,865 21.6% 287 2 Wells Fargo & Co 38,834 16.5 211 3 Bank of America Corp. 27,157 11.5 106 4 Atlantic Union Bankshares Corp 15,725 6.7 109 5 TowneBank 10,929 4.6 40 6 United Bankshares Inc. 9,205 3.9 84 7 Capital One Financial Corp. 8,669 3.7 27 8 PNC Financial Services Group Inc. 5,935 2.5 93 9 The Toronto Dominion Bank 3,414 1.5 31 10 Carter Bank & Trust 3,341 1.4 54 Top 10 Banks $174,074 73.9% 1,042 All Institutions in Market $235,670 100.0% 1,925 Rank Institution Deposits ($mm) Market Share (%) Branches 1 Atlantic Union Bankshares Corp. $15,725 19.0% 109 2 TowneBank 10,929 13.2 40 3 Capital One Financial Corp. 8,669 10.5 27 4 Carter Bank & Trust 3,341 4.0 54 5 Burke & Herbert Bank & Trust Co. 2,960 3.6 23 6 Primis Financial Corp 2,446 3.0 35 7 Blue Ridge Bankshares Inc. 2,317 2.8 26 8 First Bancorp Inc. 2,213 2.7 19 9 American National Bankshares, Inc. 2,046 2.5 18 10 C&F Financial Corp 2,028 2.5 30 Top 10 Banks $52,674 63.6% 381 All Institutions in Market $82,790 100.0% 809 Statewide Branch Footprint Brings Unique Franchise Value and Significant Growth Opportunity Growth Opportunity Franchise Strength |

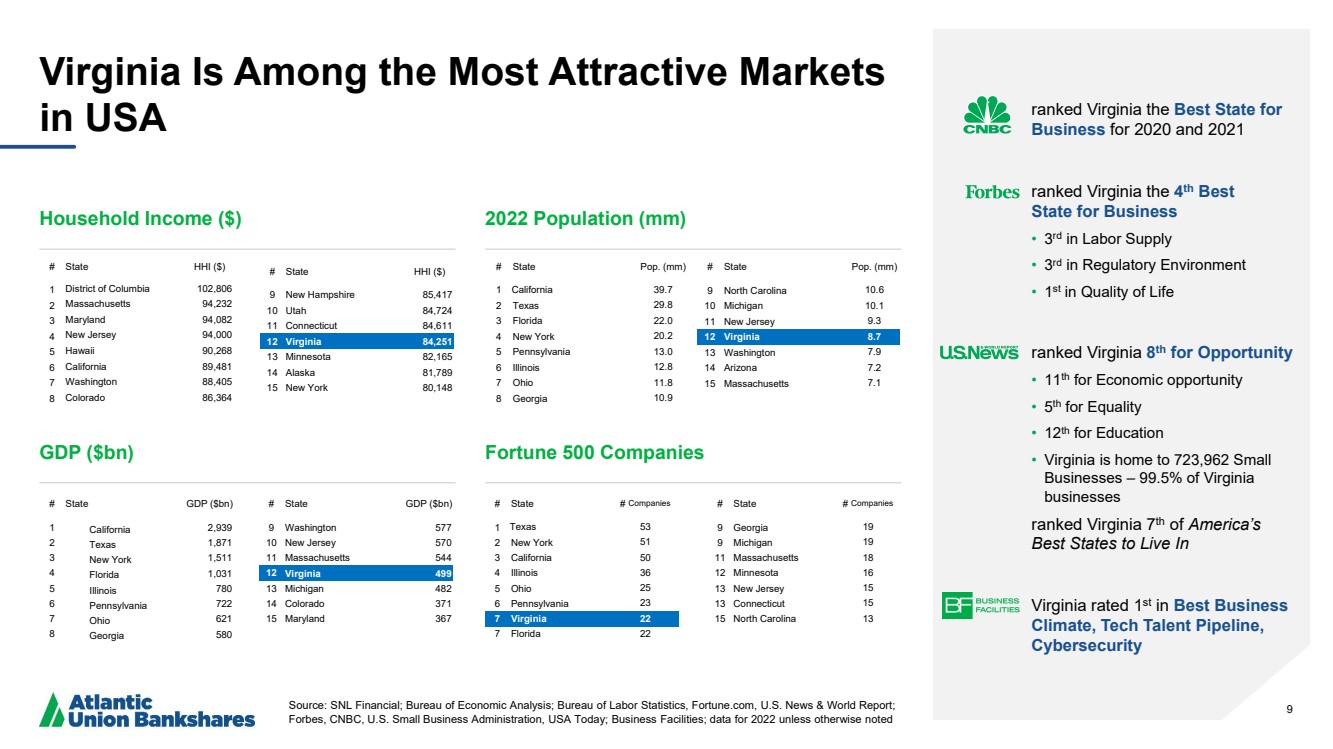

| 9 Virginia Is Among the Most Attractive Markets in USA Source: SNL Financial; Bureau of Economic Analysis; Bureau of Labor Statistics, Fortune.com, U.S. News & World Report; Forbes, CNBC, U.S. Small Business Administration, USA Today; Business Facilities; data for 2022 unless otherwise noted 9 ranked Virginia the Best State for Business for 2020 and 2021 ranked Virginia the 4 th Best State for Business • 3 rd in Labor Supply • 3 rd in Regulatory Environment • 1 st in Quality of Life ranked Virginia 8 th for Opportunity • 11 th for Economic opportunity • 5 th for Equality • 12 th for Education • Virginia is home to 723,962 Small Businesses – 99.5% of Virginia businesses ranked Virginia 7 th of America’s Best States to Live In Virginia rated 1 st in Best Business Climate, Tech Talent Pipeline, Cybersecurity # State # Companies 1 Texas 53 2 New York 51 3 California 50 4 Illinois 36 5 Ohio 25 6 Pennsylvania 23 7 Virginia 22 7 Florida 22 # State Pop. (mm) 1 California 39.7 2 Texas 29.8 3 Florida 22.0 4 New York 20.2 5 Pennsylvania 13.0 6 Illinois 12.8 7 Ohio 11.8 8 Georgia 10.9 # State HHI ($) 1 District of Columbia 102,806 2 Massachusetts 94,232 3 Maryland 94,082 4 New Jersey 94,000 5 Hawaii 90,268 6 California 89,481 7 Washington 88,405 8 Colorado 86,364 # State GDP ($bn) 1 California 2,939 2 Texas 1,871 3 New York 1,511 4 Florida 1,031 5 Illinois 780 6 Pennsylvania 722 7 Ohio 621 8 Georgia 580 Household Income ($) 2022 Population (mm) # State Pop. (mm) 9 North Carolina 10.6 10 Michigan 10.1 11 New Jersey 9.3 12 Virginia 8.7 13 Washington 7.9 14 Arizona 7.2 15 Massachusetts 7.1 # State HHI ($) 9 New Hampshire 85,417 10 Utah 84,724 11 Connecticut 84,611 12 Virginia 84,251 13 Minnesota 82,165 14 Alaska 81,789 15 New York 80,148 GDP ($bn) Fortune 500 Companies # State # Companies 9 Georgia 19 9 Michigan 19 11 Massachusetts 18 12 Minnesota 16 13 New Jersey 15 13 Connecticut 15 15 North Carolina 13 # State GDP ($bn) 9 Washington 577 10 New Jersey 570 11 Massachusetts 544 12 Virginia 499 13 Michigan 482 14 Colorado 371 15 Maryland 367 |

| 10 Q4 2022 Highlights and 2023 Outlook Loan Growth • 15.3% annualized loan growth, ex - Paycheck Protection Program (PPP) (Non - GAAP) 1 , during Q4 2022 • Line of Credit Utilization of 35% • Expect ~6 % - 8% loan growth for 2023 Asset Quality • Net Charge - offs at 2 bps annualized for Q4 2022 Positioning for Long Term • Building solid Asset - Based lending pipeline • Drive organic growth and performance of the core banking franchise Differentiated Client Experience • Continued progress on digital roadmap • Foreign exchange, syndication and SBA 7A lending programs help close product gaps Operating Leverage Focus • ~11% pre - PPP adjusted revenue growth 1 year over year and ~7% pre - PPP adjusted revenue 1 growth from Q3 2022 • ~4% adjusted operating non - interest expense growth 1 year over year and ~Flat adjusted operating non - interest expenses from Q3 2022 • Pre - PPP adjusted operating leverage 1 of ~7% year over year • Pre - PPP adjusted operating leverage 1 of ~7% quarter over quarter Capitalize on Strategic Opportunities • Selectively consider M&A, minority stakes and strategic partnerships as a supplemental strategy 10 1 For non - GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non - GAAP Disclosures” |

| 11 Caring Working together toward common goals, acting with kindness, respect and a genuine concern for others. Courageous Speaking openly, honestly and accepting our challenges and mistakes as opportunities to learn and grow. Committed Driven to help our clients, Teammates and company succeed, doing what is right and accountable for our actions. Our Core Values Culture — HOW we come together and interact as a team to accomplish our business and societal goals. Diversity, Equity, and Inclusion Statement Atlantic Union Bank embraces diversity of thought and identity to better serve our stakeholders and achieve our purpose. We commit to cultivating a welcoming workplace where Teammate and customer perspectives are valued and respected. |

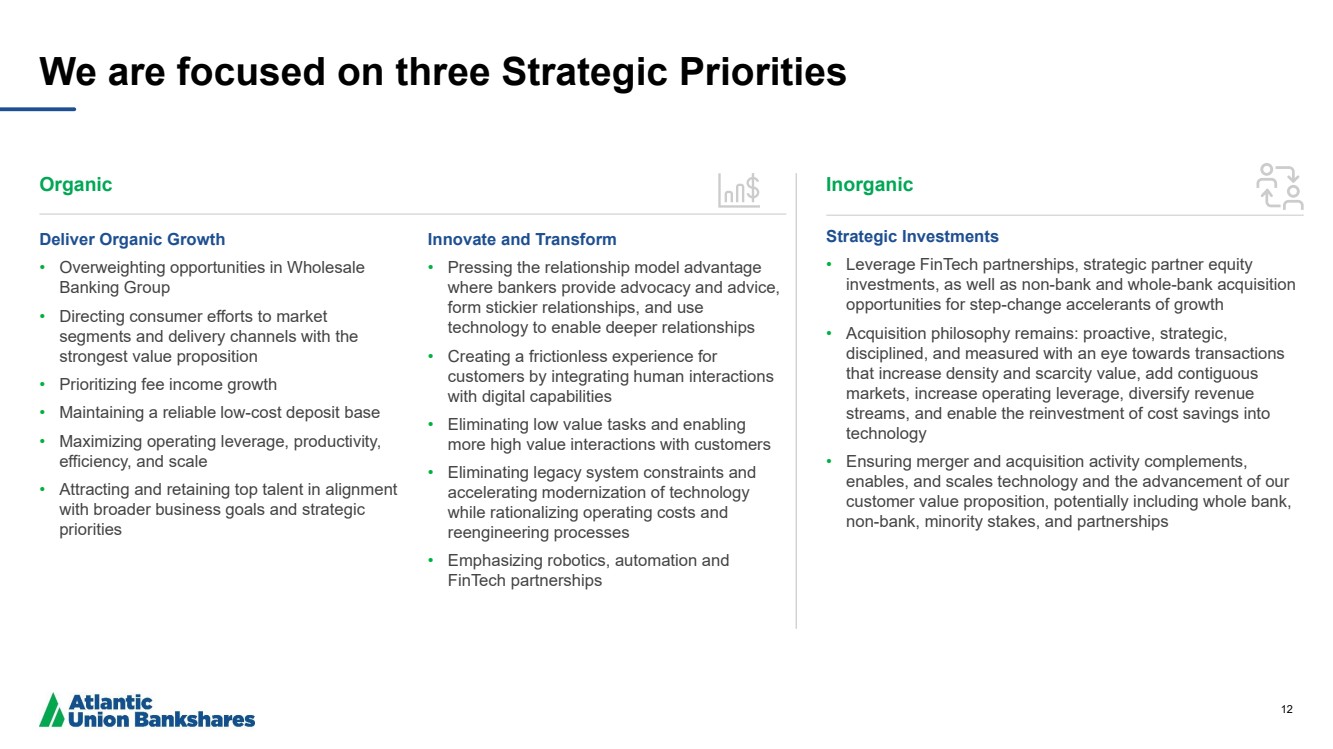

| 12 We are focused on three Strategic Priorities Organic Deliver Organic Growth • Overweighting opportunities in Wholesale Banking Group • Directing consumer efforts to market segments and delivery channels with the strongest value proposition • Prioritizing fee income growth • Maintaining a reliable low - cost deposit base • Maximizing operating leverage, productivity, efficiency, and scale • Attracting and retaining top talent in alignment with broader business goals and strategic priorities Innovate and Transform • Pressing the relationship model advantage where bankers provide advocacy and advice, form stickier relationships, and use technology to enable deeper relationships • Creating a frictionless experience for customers by integrating human interactions with digital capabilities • Eliminating low value tasks and enabling more high value interactions with customers • Eliminating legacy system constraints and accelerating modernization of technology while rationalizing operating costs and reengineering processes • Emphasizing robotics, automation and FinTech partnerships Inorganic Strategic Investments • Leverage FinTech partnerships, strategic partner equity investments, as well as non - bank and whole - bank acquisition opportunities for step - change accelerants of growth • Acquisition philosophy remains: proactive, strategic, disciplined, and measured with an eye towards transactions that increase density and scarcity value, add contiguous markets, increase operating leverage, diversify revenue streams, and enable the reinvestment of cost savings into technology • Ensuring merger and acquisition activity complements, enables, and scales technology and the advancement of our customer value proposition, potentially including whole bank, non - bank, minority stakes, and partnerships |

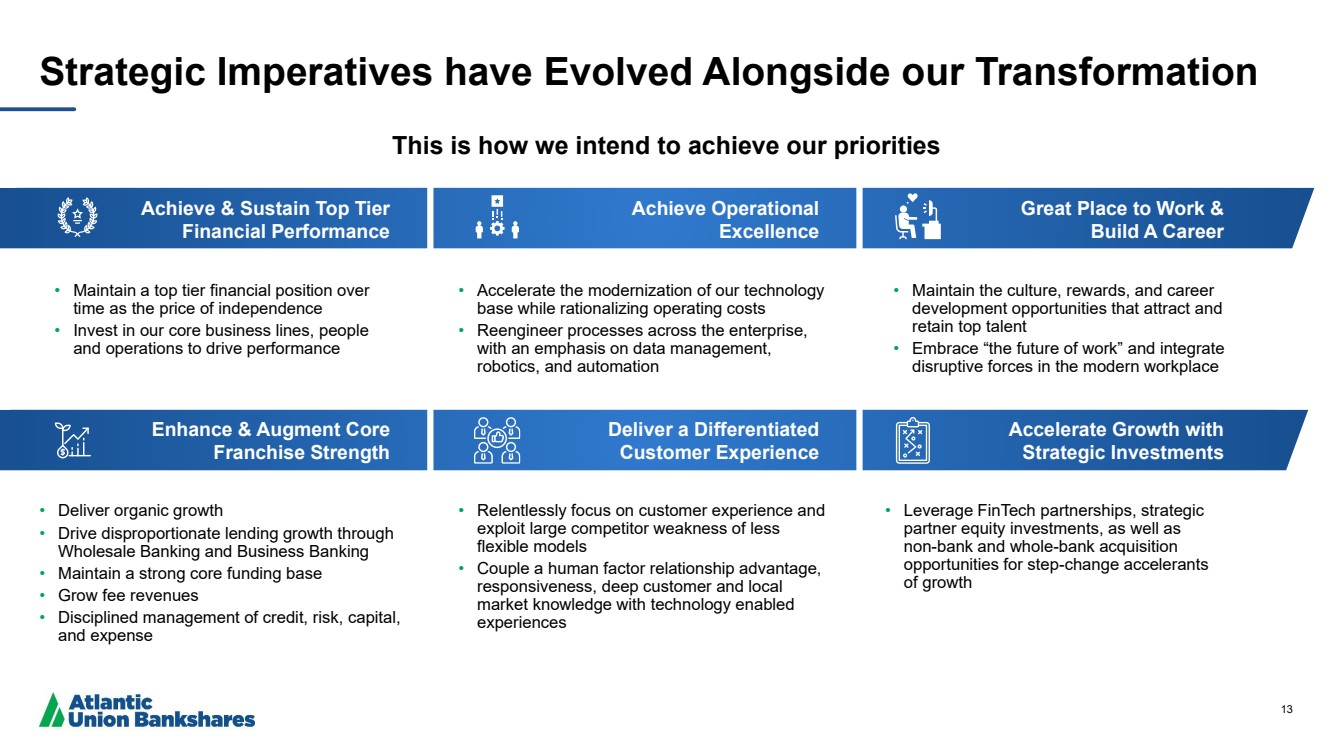

| 13 • Maintain a top tier financial position over time as the price of independence • Invest in our core business lines, people and operations to drive performance Strategic Imperatives have Evolved Alongside our Transformation Achieve & Sustain Top Tier Financial Performance • Accelerate the modernization of our technology base while rationalizing operating costs • Reengineer processes across the enterprise, with an emphasis on data management, robotics, and automation • Maintain the culture, rewards, and career development opportunities that attract and retain top talent • Embrace “the future of work” and integrate disruptive forces in the modern workplace • Deliver organic growth • Drive disproportionate lending growth through Wholesale Banking and Business Banking • Maintain a strong core funding base • Grow fee revenues • Disciplined management of credit, risk, capital, and expense Enhance & Augment Core Franchise Strength Achieve Operational Excellence Deliver a Differentiated Customer Experience Great Place to Work & Build A Career Accelerate Growth with Strategic Investments • Relentlessly focus on customer experience and exploit large competitor weakness of less flexible models • Couple a human factor relationship advantage, responsiveness, deep customer and local market knowledge with technology enabled experiences • Leverage FinTech partnerships, strategic partner equity investments, as well as non - bank and whole - bank acquisition opportunities for step - change accelerants of growth This is how we intend to achieve our priorities |

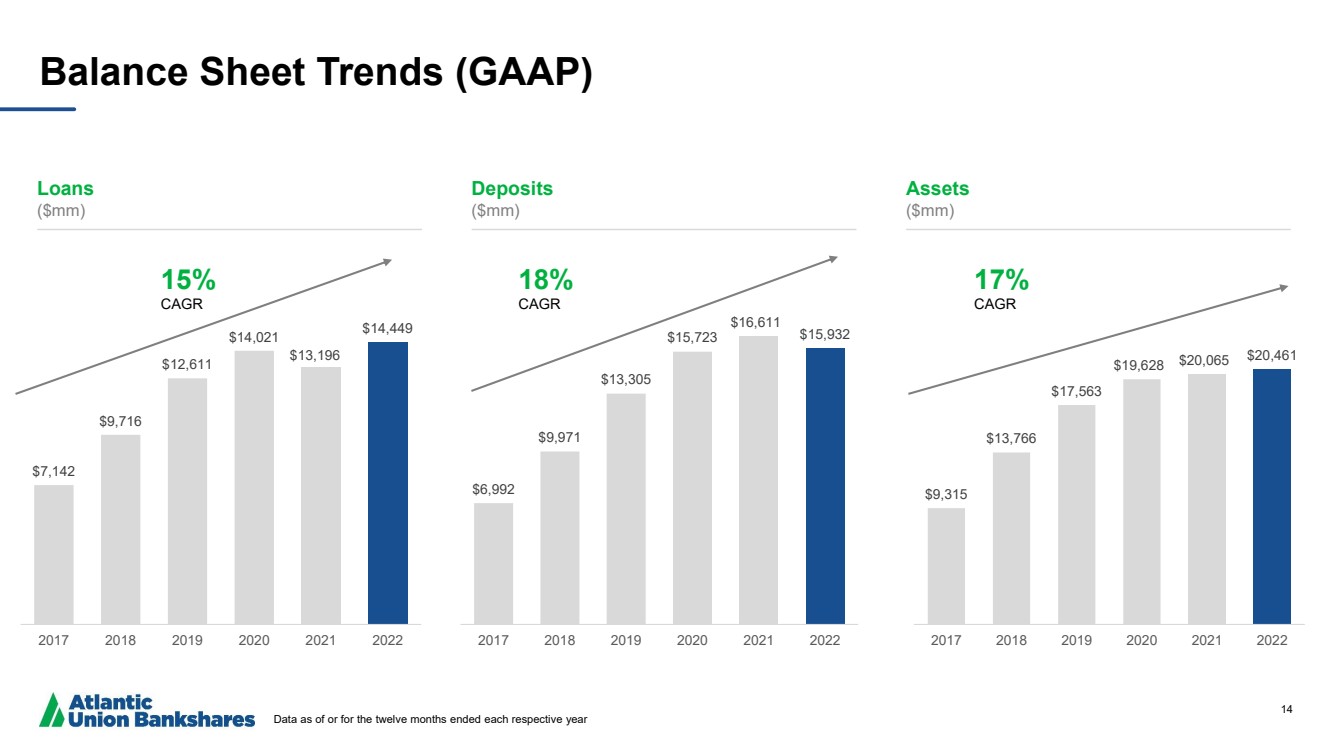

| 14 Balance Sheet Trends (GAAP) Data as of or for the twelve months ended each respective year Loans ($mm) Deposits ($mm) Assets ($mm) $7,142 $9,716 $12,611 $14,021 $13,196 $14,449 2017 2018 2019 2020 2021 2022 15 % CAGR $6,992 $9,971 $13,305 $15,723 $16,611 $15,932 2017 2018 2019 2020 2021 2022 18 % CAGR $9,315 $13,766 $17,563 $19,628 $20,065 $20,461 2017 2018 2019 2020 2021 2022 17 % CAGR |

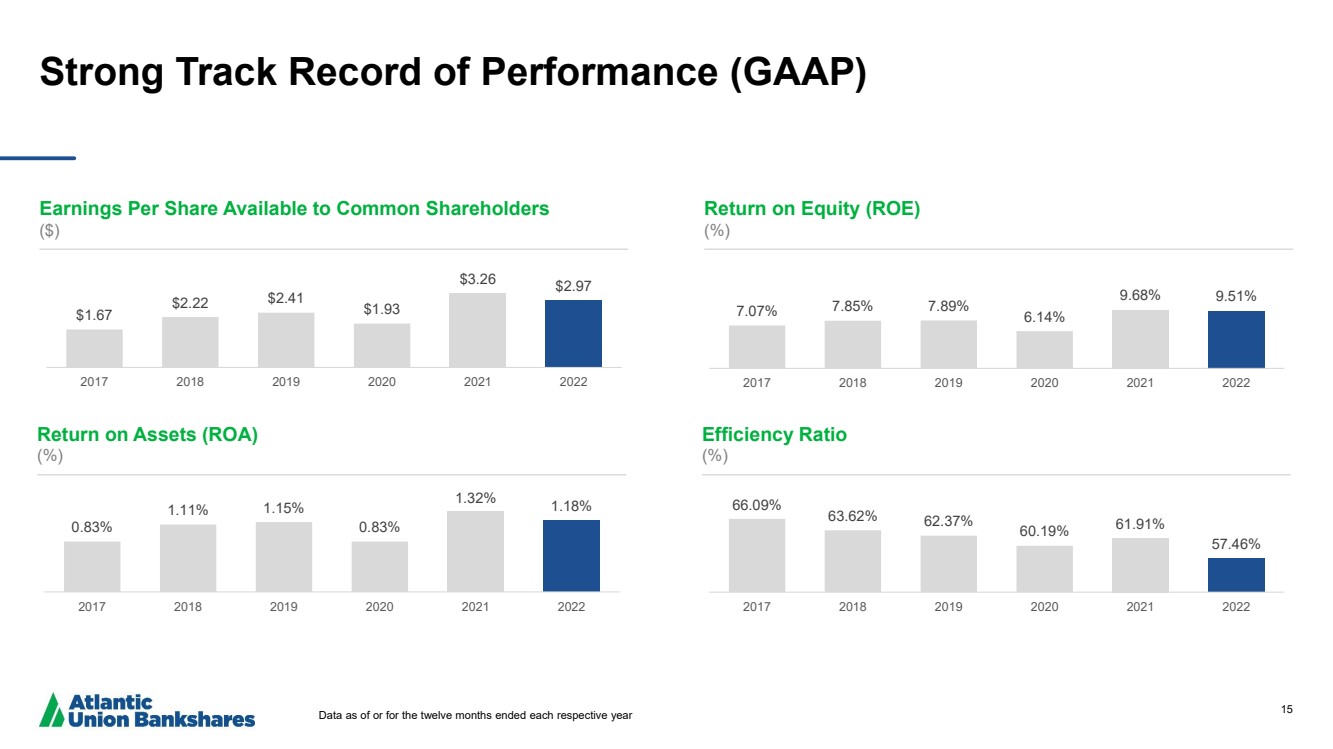

| 15 Strong Track Record of Performance (GAAP ) Earnings Per Share Available to Common Shareholders ($) Return on Equity (ROE) (%) Return on Assets (ROA) (%) Efficiency Ratio (%) $1.67 $2.22 $2.41 $1.93 $3.26 $2.97 2017 2018 2019 2020 2021 2022 7.07% 7.85% 7.89% 6.14% 9.68% 9.51% 2017 2018 2019 2020 2021 2022 66.09% 63.62% 62.37% 60.19% 61.91% 57.46% 2017 2018 2019 2020 2021 2022 0.83% 1.11% 1.15% 0.83% 1.32% 1.18% 2017 2018 2019 2020 2021 2022 Data as of or for the twelve months ended each respective year |

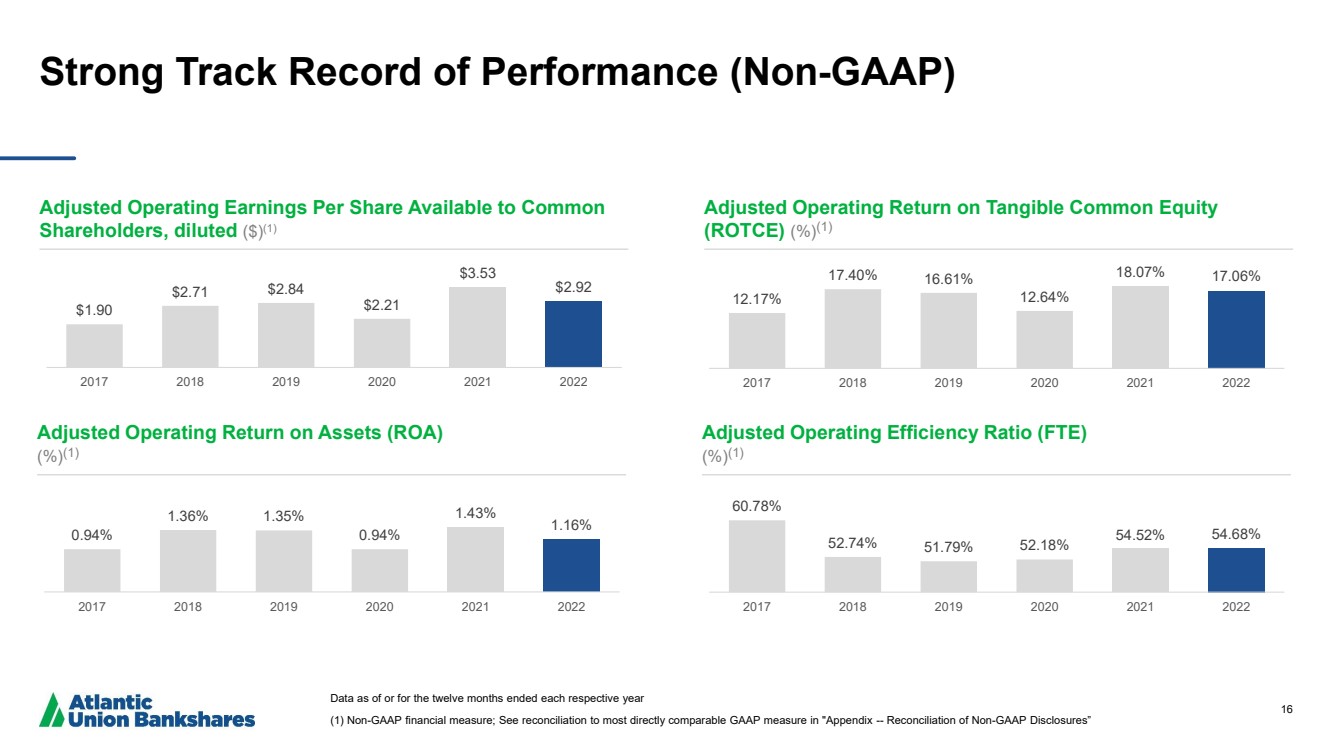

| 16 Strong Track Record of Performance (Non - GAAP ) Data as of or for the twelve months ended each respective year (1 ) Non - GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non - GAAP Disclosures” Adjusted Operating Earnings Per Share Available to Common Shareholders, diluted ($) (1) Adjusted Operating Return on Tangible Common Equity (ROTCE) (%) (1) Adjusted Operating Return on Assets (ROA) (%) (1) Adjusted Operating Efficiency Ratio (FTE) (%) (1) $1.90 $2.71 $2.84 $2.21 $3.53 $2.92 2017 2018 2019 2020 2021 2022 12.17% 17.40% 16.61% 12.64% 18.07% 17.06% 2017 2018 2019 2020 2021 2022 60.78% 52.74% 51.79% 52.18% 54.52% 54.68% 2017 2018 2019 2020 2021 2022 0.94% 1.36% 1.35% 0.94% 1.43% 1.16% 2017 2018 2019 2020 2021 2022 |

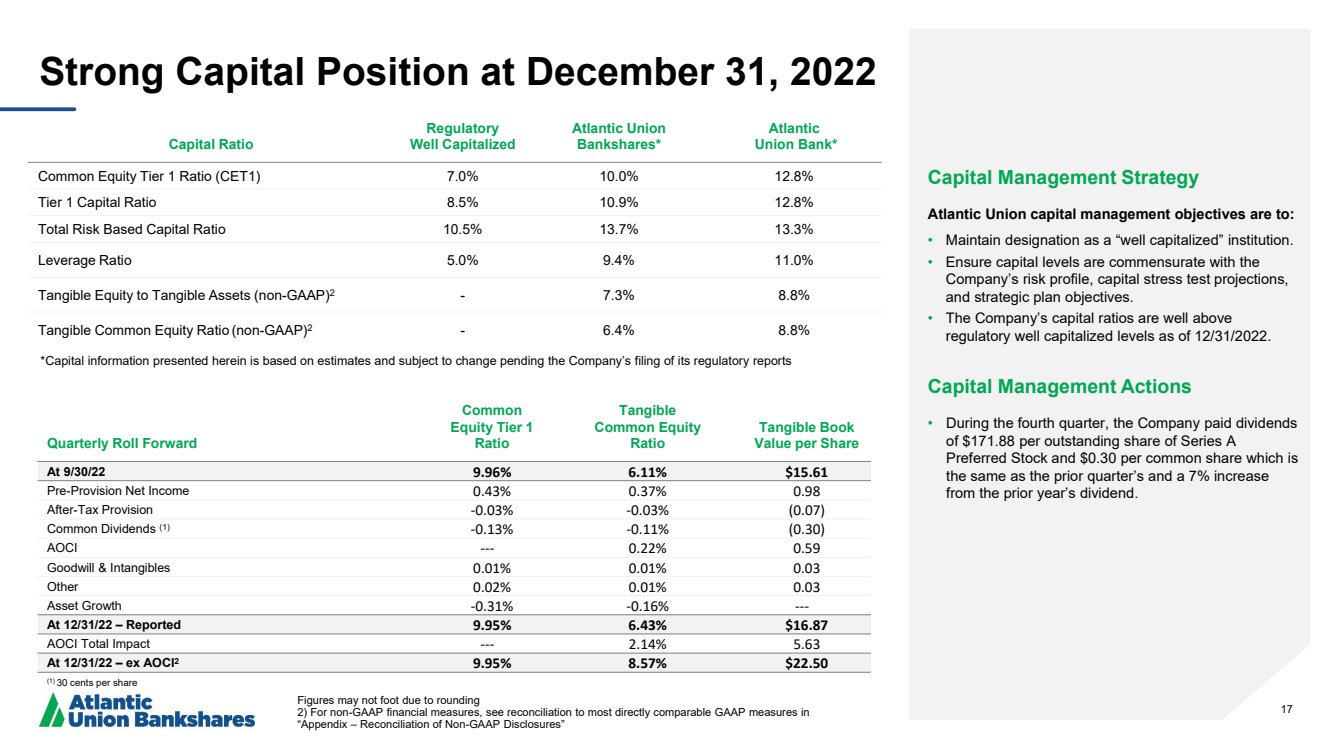

| 17 Strong Capital Position at December 31, 2022 Capital Ratio Regulatory Well Capitalized Atlantic Union Bankshares* Atlantic Union Bank* Common Equity Tier 1 Ratio (CET1) 7.0% 10.0% 12.8% Tier 1 Capital Ratio 8.5% 10.9% 12.8% Total Risk Based Capital Ratio 10.5% 13.7% 13.3% Leverage Ratio 5.0% 9.4% 11.0% Tangible Equity to Tangible Assets ( non - GAAP) 2 - 7.3% 8.8% Tangible Common Equity Ratio (non - GAAP) 2 - 6.4% 8.8% Figures may not foot due to rounding 2) For non - GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non - GAAP Disclosures” Capital Management Strategy Atlantic Union capital management objectives are to: • Maintain designation as a “well capitalized” institution. • Ensure capital levels are commensurate with the Company’s risk profile, capital stress test projections, and strategic plan objectives. • The Company’s capital ratios are well above regulatory well capitalized levels as of 12/31/2022. Capital Management Actions • During the fourth quarter, the Company paid dividends of $171.88 per outstanding share of Series A Preferred Stock and $0.30 per common share which is the same as the prior quarter’s and a 7% increase from the prior year’s dividend. Quarterly Roll Forward Common Equity Tier 1 Ratio Tangible Common Equity Ratio Tangible Book Value per Share At 9/30/22 9.96% 6.11% $15.61 Pre - Provision Net Income 0.43% 0.37% 0.98 After - Tax Provision - 0.03% - 0.03% (0.07) Common Dividends (1) - 0.13% - 0.11% (0.30) AOCI --- 0.22% 0.59 Goodwill & Intangibles 0.01% 0.01% 0.03 Other 0.02% 0.01% 0.03 Asset Growth - 0.31% - 0.16% --- At 12/31/22 – Reported 9.95% 6.43% $16.87 AOCI Total Impact --- 2.14% 5.63 At 12/31/22 – ex AOCI 2 9.95% 8.57% $22.50 (1) 30 cents per share *Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its regulat or y reports |

| 18 Top - Tier Financial Targets Committed to top - tier financial performance 1.3 % – 1.5 % Return on Assets ≤ 51 % (1) Efficiency Ratio (FTE) Atlantic Union is committed to achieving top tier financial performance and providing our shareholders with above average returns on their investment regardless of the operating environment Key financial performance operating metrics benchmarked against top quartile peers 18 (1 ) includes the approximately 2.4% efficiency ratio impact of the Virginia franchise tax expense (vs. state income tax). We expect to achieve these financial targets for the Full Year 2023 18 % – 20 % Return on Tangible Common Equity |

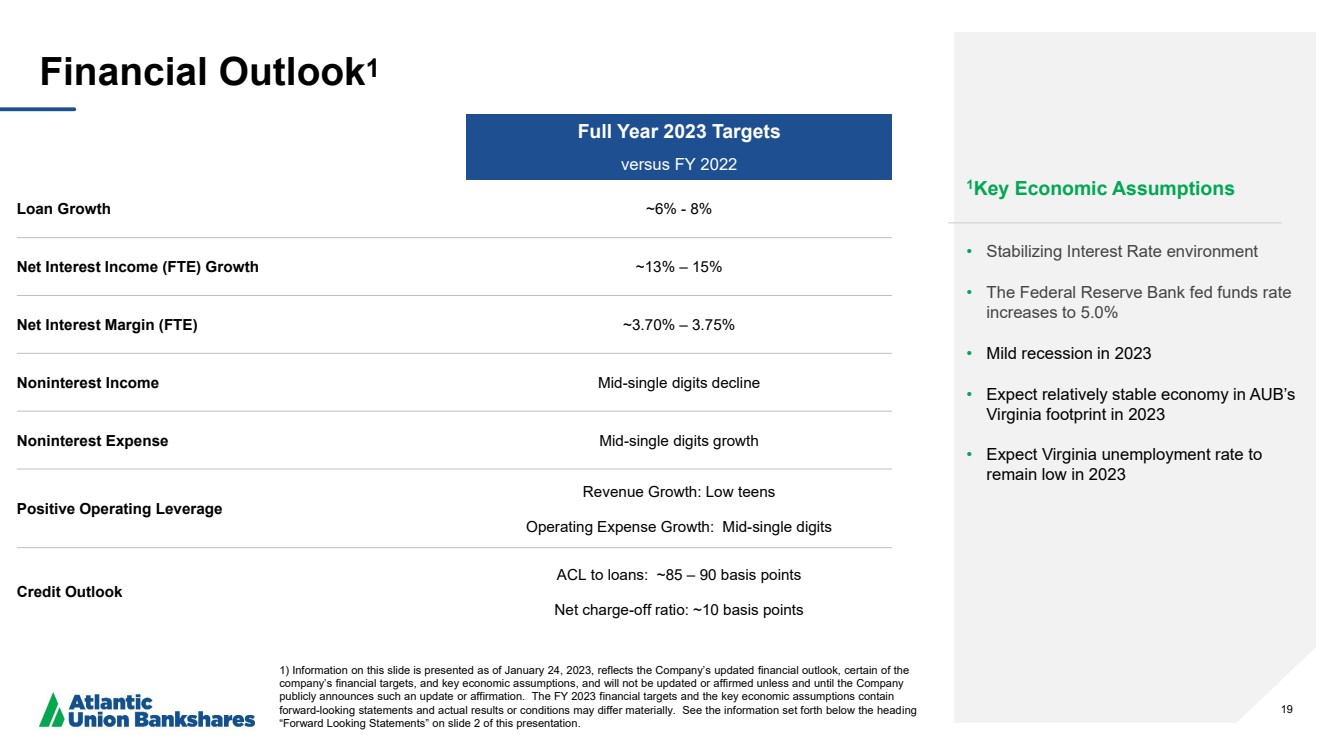

| 19 Financial Outlook 1 1 Key Economic Assumptions • Stabilizing Interest Rate environment • The Federal Reserve Bank fed funds rate increases to 5.0% • Mild recession in 2023 • Expect relatively stable economy in AUB’s Virginia footprint in 2023 • Expect Virginia unemployment rate to remain low in 2023 Full Year 2023 Targets versus FY 2022 Loan Growth ~6% - 8% Net Interest Income (FTE) Growth ~13% – 15% Net Interest Margin (FTE) ~3.70% – 3.75% Noninterest Income Mid - single digits decline Noninterest Expense Mid - single digits growth Positive Operating Leverage Revenue Growth: Low teens Operating Expense Growth: M id - single digits Credit Outlook ACL to loans: ~85 – 90 basis points Net charge - off ratio: ~10 basis points 1) Information on this slide is presented as of January 24, 2023, reflects the Company’s updated financial outlook, certain o f t he company’s financial targets, and key economic assumptions, and will not be updated or affirmed unless and until the Company publicly announces such an update or affirmation. The FY 2023 financial targets and the key economic assumptions contain forward - looking statements and actual results or conditions may differ materially. See the information set forth below the head ing “Forward Looking Statements” on slide 2 of this presentation. |

| 20 We Believe We Are Well Positioned For The Current Environment And Optimistic About Our Future Top Tier Financial Performance Increased Shareholder Value Strong Credit Expense Management Actions Asset Sensitivity Growth Footing |

| 21 Appendix |

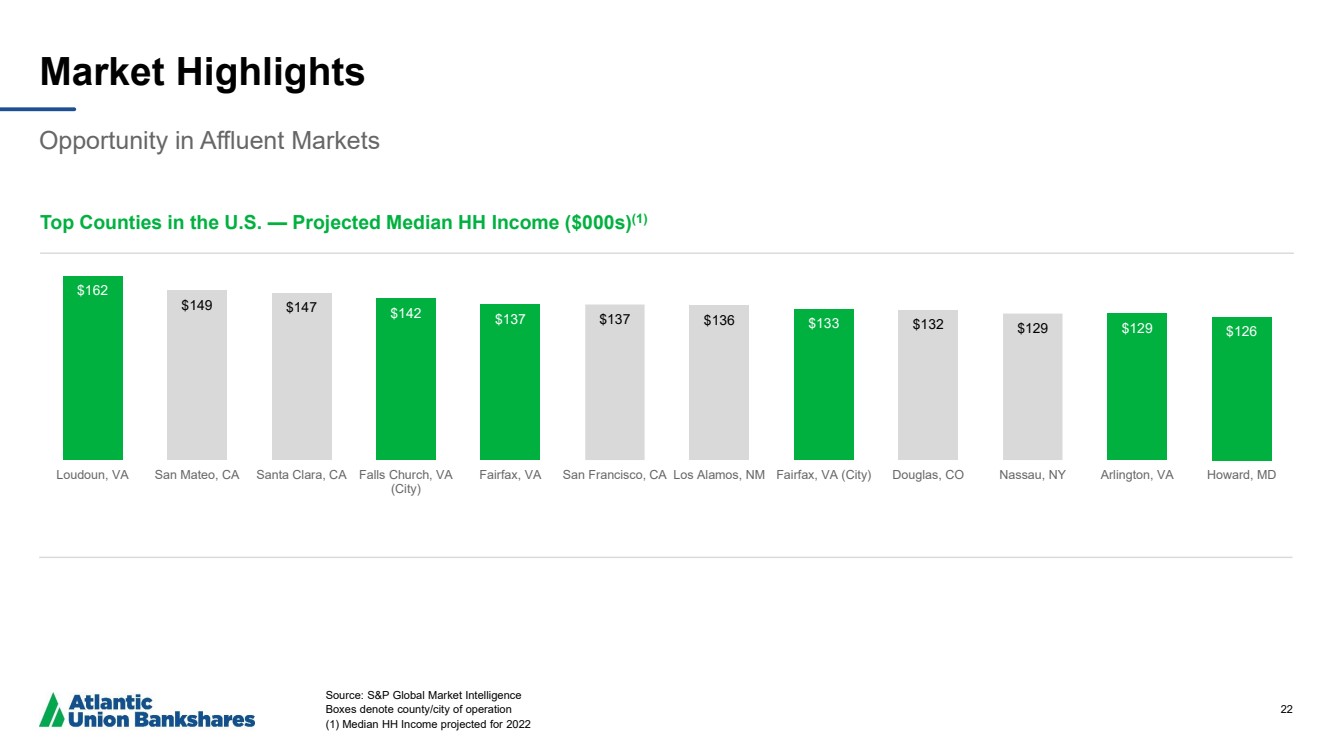

| 22 Market Highlights Opportunity in Affluent Markets Source: S&P Global Market Intelligence Boxes denote county/city of operation (1) Median HH Income projected for 2022 Top Counties in the U.S. — Projected Median HH Income ($000s) (1) $162 $149 $147 $142 $137 $137 $ 136 $133 $132 $ 129 $129 $126 Loudoun, VA San Mateo, CA Santa Clara, CA Falls Church, VA (City) Fairfax, VA San Francisco, CA Los Alamos, NM Fairfax, VA (City) Douglas, CO Nassau, NY Arlington, VA Howard, MD |

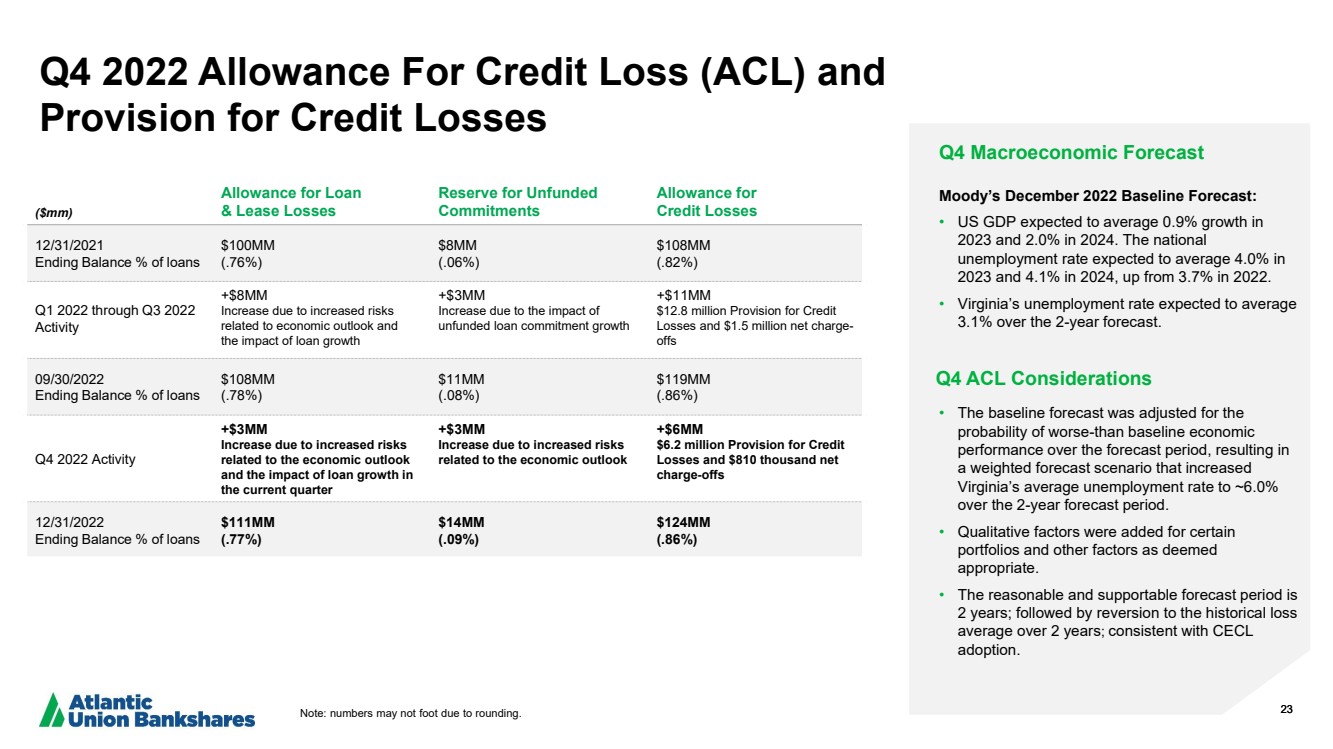

| 23 Q4 2022 Allowance For Credit Loss (ACL) and Provision for Credit Losses 23 Q4 Macroeconomic Forecast Moody’s December 2022 Baseline Forecast: • US GDP expecte d to average 0.9% growth in 2023 and 2.0% in 2024. The national unemployment rate expected to average 4.0% in 2023 and 4.1% in 2024, up from 3.7% in 2022. • Virginia’s unemployment rate expected to average 3.1% over the 2 - year forecast. Q4 ACL Considerations • The baseline forecast was adjusted for the probability of worse - than baseline economic performance over the forecast period, resulting in a weighted forecast scenario that increased Virginia’s average unemployment rate to ~6.0% over the 2 - year forecast period. • Qualitative factors were added for certain portfolios and other factors as deemed appropriate. • The reasonable and supportable forecast period is 2 years; followed by reversion to the historical loss average over 2 years ; consistent with CECL adoption. ($mm) Allowance for Loan & Lease Losses Reserve for Unfunded Commitments Allowance for Credit Losses 12/31/2021 Ending Balance % of loans $100MM (.76% ) $8MM (.06% ) $108MM (.82 %) Q1 2022 through Q3 2022 Activity +$8MM Increase due to increased risks related to economic outlook and the impact of loan growth +$3MM Increase due to the impact of unfunded loan commitment growth +$11MM $12.8 million Provision for Credit Losses and $1.5 million net charge - offs 09/30/2022 Ending Balance % of loans $108MM (.78%) $11MM (.08%) $119MM (.86%) Q4 2022 Activity +$3MM Increase due to increased risks related to the economic outlook and the impact of loan growth in the current quarter +$3MM Increase due to increased risks related to the economic outlook +$6MM $6.2 million Provision for Credit Losses and $810 thousand net charge - offs 12/31/2022 Ending Balance % of loans $111MM (.77%) $14MM (.09%) $124MM (.86%) Note: numbers may not foot due to rounding. |

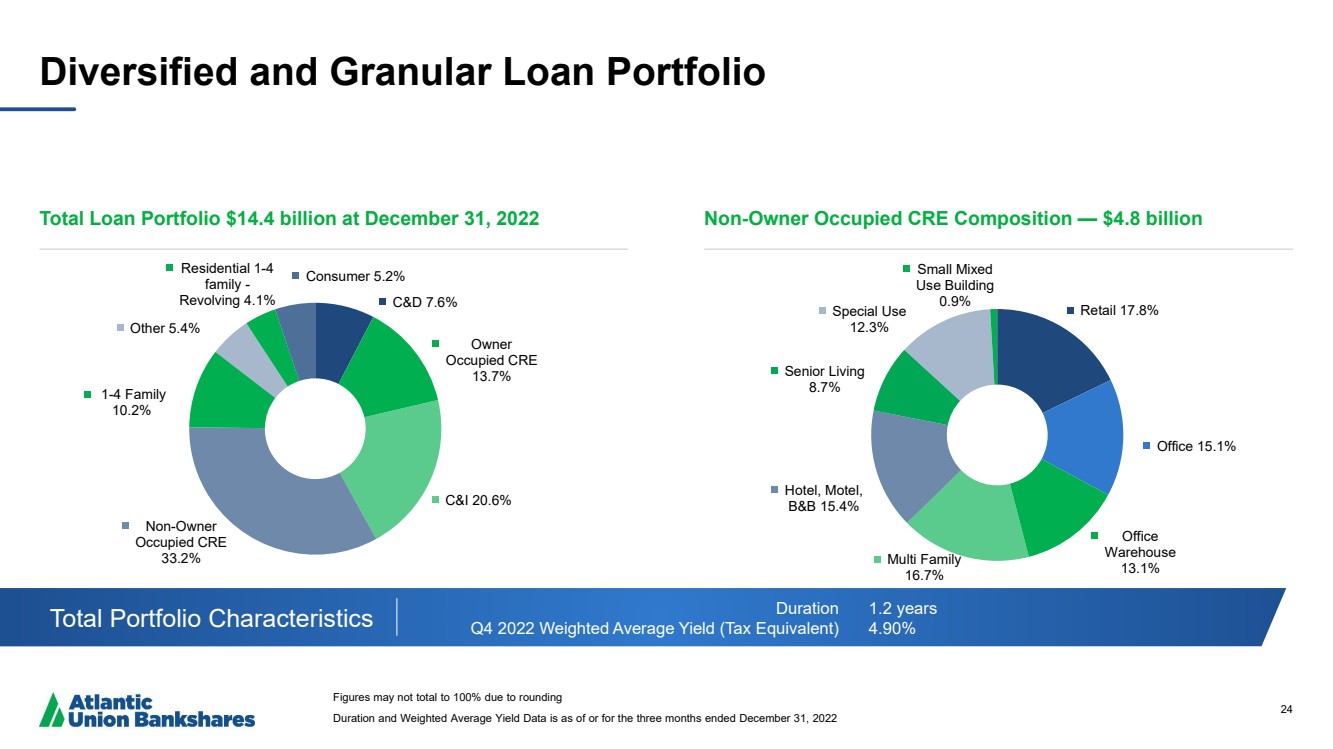

| 24 Diversified and Granular Loan Portfolio Total Loan Portfolio $ 14.4 billion at December 31, 2022 Non - Owner Occupied CRE Composition — $ 4.8 billion Total Portfolio Characteristics Duration Q4 2022 Weighted Average Yield (Tax Equivalent) 1.2 years 4.90% Figures may not total to 100% due to rounding Duration and Weighted Average Yield Data is as of or for the three months ended December 31, 2022 C&D 7.6% Owner Occupied CRE 13.7% C&I 20.6% Non - Owner Occupied CRE 33.2% 1 - 4 Family 10.2% Other 5.4% Residential 1 - 4 family - Revolving 4.1% Consumer 5.2% Retail 17.8% Office 15.1% Office Warehouse 13.1% Multi Family 16.7% Hotel, Motel, B&B 15.4% Senior Living 8.7% Special Use 12.3% Small Mixed Use Building 0.9% |

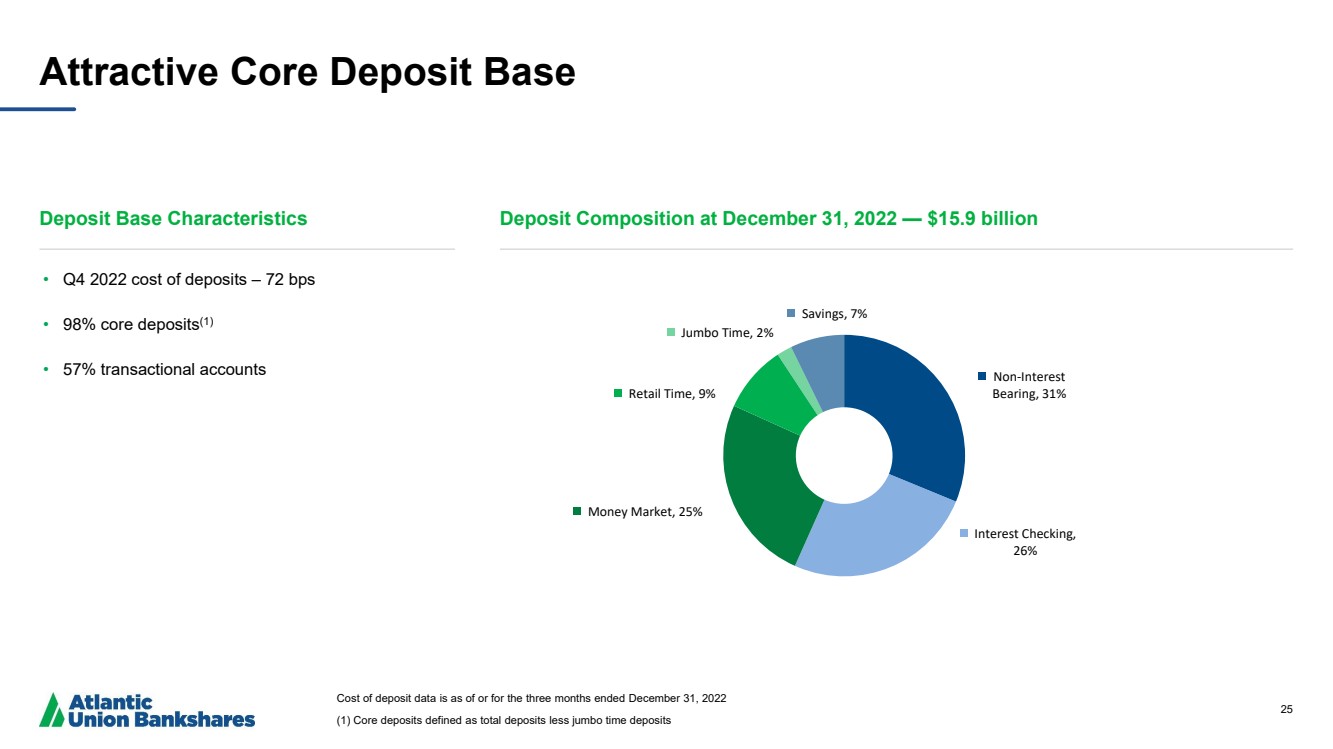

| 25 Attractive Core Deposit Base Deposit Base Characteristics Deposit Composition at December 31, 2022 — $ 15.9 billion Cost of deposit data is as of or for the three months ended December 31, 2022 ( 1) Core deposits defined as total deposits less jumbo time deposits • Q4 2022 cost of deposits – 72 bps • 98% core deposits (1) • 57% transactional accounts Non - Interest Bearing , 31% Interest Checking, 26% Money Market , 25% Retail Time , 9% Jumbo Time , 2% Savings , 7% |

| 26 Reconciliation of Non - GAAP Disclosures The Company has provided supplemental performance measures on a tax - equivalent, tangible, operating, adjusted, or pre - tax pre - pr ovision basis. These non - GAAP financial measures are a supplement to GAAP, which is used to prepare the Company’s financial statements, and sho uld not be considered in isolation or as a substitute for comparable measures calculated in accordance with GAAP. In addition, the Compa ny’ s non - GAAP financial measures may not be comparable to non - GAAP financial measures of other companies. The Company uses the non - GAAP financ ial measures discussed herein in its analysis of the Company’s performance. The Company’s management believes that these non - GAAP fi nancial measures provide additional understanding of ongoing operations, enhance comparability of results of operations with prior pe rio ds and show the effects of significant gains and charges in the periods presented without the impact of items or events that may obscure tren ds in the Company’s underlying performance. |

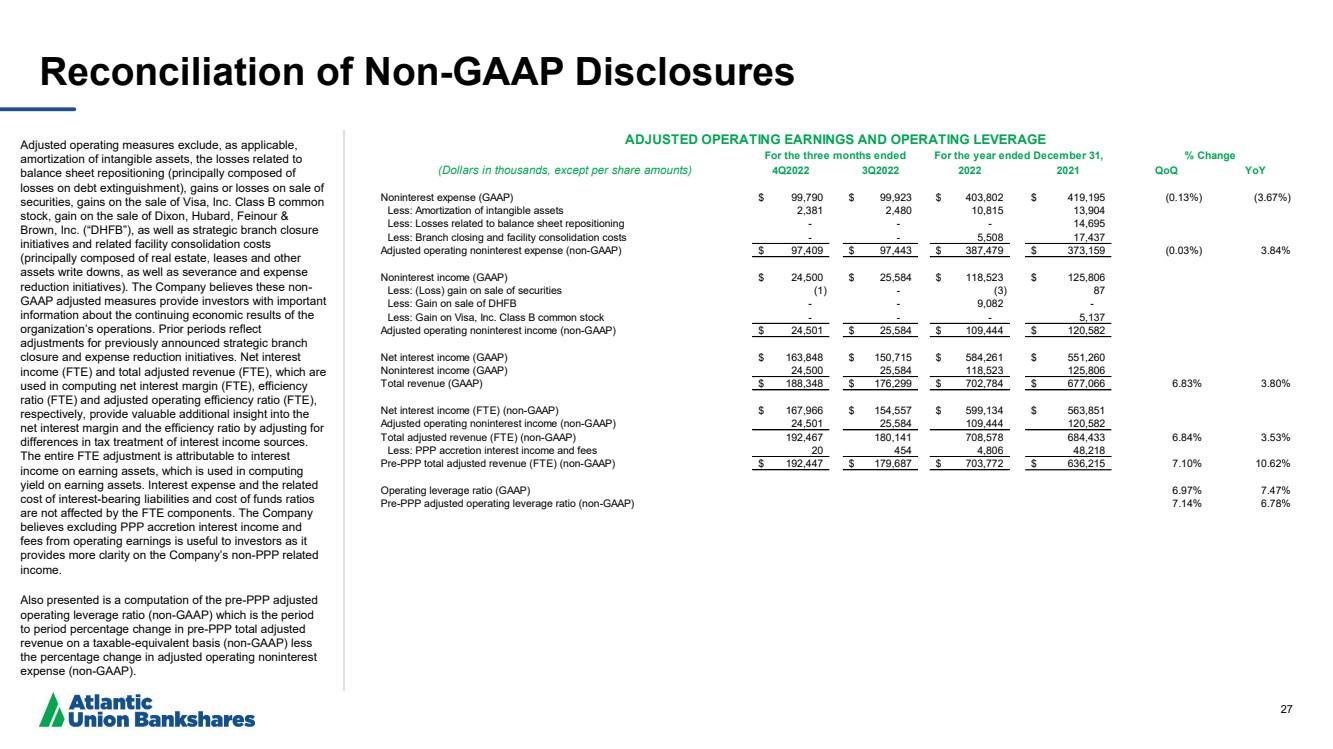

| 27 Reconciliation of Non - GAAP Disclosures Adjusted operating measures exclude, as applicable, amortization of intangible assets, the losses related to balance sheet repositioning (principally composed of losses on debt extinguishment), gains or losses on sale of securities, gains on the sale of Visa, Inc. Class B common stock, gain on the sale of Dixon, Hubard , Feinour & Brown, Inc. (“DHFB”), as well as strategic branch closure initiatives and related facility consolidation costs (principally composed of real estate, leases and other assets write downs, as well as severance and expense reduction initiatives). The Company believes these non - GAAP adjusted measures provide investors with important information about the continuing economic results of the organization’s operations. Prior periods reflect adjustments for previously announced strategic branch closure and expense reduction initiatives. Net interest income (FTE) and total adjusted revenue (FTE), which are used in computing net interest margin (FTE), efficiency ratio (FTE) and adjusted operating efficiency ratio (FTE), respectively, provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest - bearing liabilities and cost of funds ratios are not affected by the FTE components. The Company believes excluding PPP accretion interest income and fees from operating earnings is useful to investors as it provides more clarity on the Company’s non - PPP related income. Also presented is a computation of the pre - PPP adjusted operating leverage ratio (non - GAAP) which is the period to period percentage change in pre - PPP total adjusted revenue on a taxable - equivalent basis (non - GAAP) less the percentage change in adjusted operating noninterest expense (non - GAAP). (Dollars in thousands, except per share amounts) 4Q2022 3Q2022 2022 2021 QoQ YoY Noninterest expense (GAAP) 99,790 $ 99,923 $ 403,802 $ 419,195 $ (0.13%) (3.67%) Less: Amortization of intangible assets 2,381 2,480 10,815 13,904 Less: Losses related to balance sheet repositioning - - - 14,695 Less: Branch closing and facility consolidation costs - - 5,508 17,437 Adjusted operating noninterest expense (non-GAAP) 97,409 $ 97,443 $ 387,479 $ 373,159 $ (0.03%) 3.84% Noninterest income (GAAP) 24,500 $ 25,584 $ 118,523 $ 125,806 $ Less: (Loss) gain on sale of securities (1) - (3) 87 Less: Gain on sale of DHFB - - 9,082 - Less: Gain on Visa, Inc. Class B common stock - - - 5,137 Adjusted operating noninterest income (non-GAAP) 24,501 $ 25,584 $ 109,444 $ 120,582 $ Net interest income (GAAP) 163,848 $ 150,715 $ 584,261 $ 551,260 $ Noninterest income (GAAP) 24,500 25,584 118,523 125,806 Total revenue (GAAP) 188,348 $ 176,299 $ 702,784 $ 677,066 $ 6.83% 3.80% Net interest income (FTE) (non-GAAP) 167,966 $ 154,557 $ 599,134 $ 563,851 $ Adjusted operating noninterest income (non-GAAP) 24,501 25,584 109,444 120,582 Total adjusted revenue (FTE) (non-GAAP) 192,467 180,141 708,578 684,433 6.84% 3.53% Less: PPP accretion interest income and fees 20 454 4,806 48,218 Pre-PPP total adjusted revenue (FTE) (non-GAAP) 192,447 $ 179,687 $ 703,772 $ 636,215 $ 7.10% 10.62% Operating leverage ratio (GAAP) 6.97% 7.47% Pre-PPP adjusted operating leverage ratio (non-GAAP) 7.14% 6.78% % Change ADJUSTED OPERATING EARNINGS AND OPERATING LEVERAGE For the three months ended For the year ended December 31, |

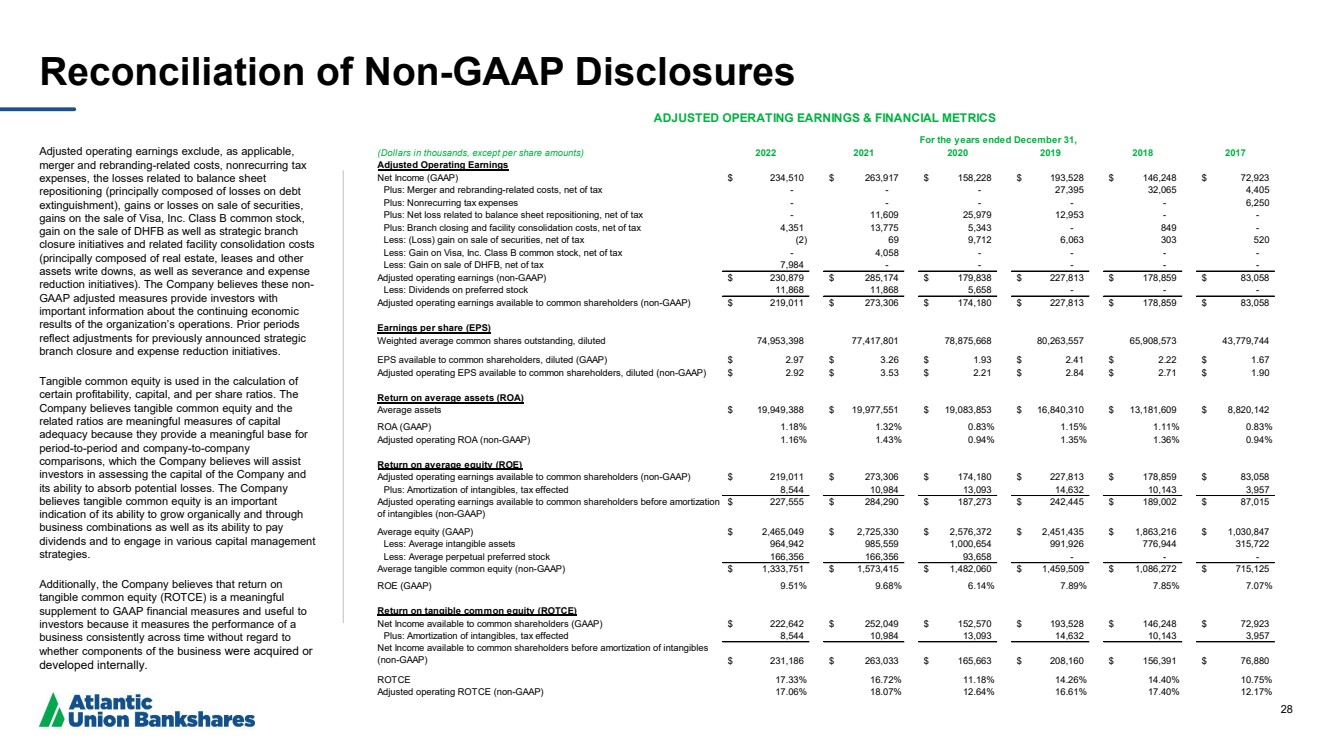

| 28 Reconciliation of Non - GAAP Disclosures Adjusted operating earnings exclude, as applicable, merger and rebranding - related costs, nonrecurring tax expenses, the losses related to balance sheet repositioning (principally composed of losses on debt extinguishment), gains or losses on sale of securities, gains on the sale of Visa, Inc. Class B common stock, gain on the sale of DHFB as well as strategic branch closure initiatives and related facility consolidation costs (principally composed of real estate, leases and other assets write downs, as well as severance and expense reduction initiatives). The Company believes these non - GAAP adjusted measures provide investors with important information about the continuing economic results of the organization’s operations. Prior periods reflect adjustments for previously announced strategic branch closure and expense reduction initiatives. Tangible common equity is used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period - to - period and company - to - company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations as well as its ability to pay dividends and to engage in various capital management strategies. Additionally, the Company believes that return on tangible common equity (ROTCE) is a meaningful supplement to GAAP financial measures and useful to investors because it measures the performance of a business consistently across time without regard to whether components of the business were acquired or developed internally. (Dollars in thousands, except per share amounts) 2022 2021 2020 2019 2018 2017 Adjusted Operating Earnings Net Income (GAAP) 234,510 $ 263,917 $ 158,228 $ 193,528 $ 146,248 $ 72,923 $ Plus: Merger and rebranding-related costs, net of tax - - - 27,395 32,065 4,405 Plus: Nonrecurring tax expenses - - - - - 6,250 Plus: Net loss related to balance sheet repositioning, net of tax - 11,609 25,979 12,953 - - Plus: Branch closing and facility consolidation costs, net of tax 4,351 13,775 5,343 - 849 - Less: (Loss) gain on sale of securities, net of tax (2) 69 9,712 6,063 303 520 Less: Gain on Visa, Inc. Class B common stock, net of tax - 4,058 - - - - Less: Gain on sale of DHFB, net of tax 7,984 - - - - - Adjusted operating earnings (non-GAAP) 230,879 $ 285,174 $ 179,838 $ 227,813 $ 178,859 $ 83,058 $ Less: Dividends on preferred stock 11,868 11,868 5,658 - - - Adjusted operating earnings available to common shareholders (non-GAAP) 219,011 $ 273,306 $ 174,180 $ 227,813 $ 178,859 $ 83,058 $ Earnings per share (EPS) Weighted average common shares outstanding, diluted 74,953,398 77,417,801 78,875,668 80,263,557 65,908,573 43,779,744 EPS available to common shareholders, diluted (GAAP) 2.97 $ 3.26 $ 1.93 $ 2.41 $ 2.22 $ 1.67 $ Adjusted operating EPS available to common shareholders, diluted (non-GAAP) 2.92 $ 3.53 $ 2.21 $ 2.84 $ 2.71 $ 1.90 $ Return on average assets (ROA) Average assets 19,949,388 $ 19,977,551 $ 19,083,853 $ 16,840,310 $ 13,181,609 $ 8,820,142 $ ROA (GAAP) 1.18% 1.32% 0.83% 1.15% 1.11% 0.83% Adjusted operating ROA (non-GAAP) 1.16% 1.43% 0.94% 1.35% 1.36% 0.94% Return on average equity (ROE) Adjusted operating earnings available to common shareholders (non-GAAP) 219,011 $ 273,306 $ 174,180 $ 227,813 $ 178,859 $ 83,058 $ Plus: Amortization of intangibles, tax effected 8,544 10,984 13,093 14,632 10,143 3,957 Adjusted operating earnings available to common shareholders before amortization of intangibles (non-GAAP) 227,555 $ 284,290 $ 187,273 $ 242,445 $ 189,002 $ 87,015 $ Average equity (GAAP) 2,465,049 $ 2,725,330 $ 2,576,372 $ 2,451,435 $ 1,863,216 $ 1,030,847 $ Less: Average intangible assets 964,942 985,559 1,000,654 991,926 776,944 315,722 Less: Average perpetual preferred stock 166,356 166,356 93,658 - - - Average tangible common equity (non-GAAP) 1,333,751 $ 1,573,415 $ 1,482,060 $ 1,459,509 $ 1,086,272 $ 715,125 $ ROE (GAAP) 9.51% 9.68% 6.14% 7.89% 7.85% 7.07% Return on tangible common equity (ROTCE) Net Income available to common shareholders (GAAP) 222,642 $ 252,049 $ 152,570 $ 193,528 $ 146,248 $ 72,923 $ Plus: Amortization of intangibles, tax effected 8,544 10,984 13,093 14,632 10,143 3,957 Net Income available to common shareholders before amortization of intangibles (non-GAAP) 231,186 $ 263,033 $ 165,663 $ 208,160 $ 156,391 $ 76,880 $ ROTCE 17.33% 16.72% 11.18% 14.26% 14.40% 10.75% Adjusted operating ROTCE (non-GAAP) 17.06% 18.07% 12.64% 16.61% 17.40% 12.17% ADJUSTED OPERATING EARNINGS & FINANCIAL METRICS For the years ended December 31, |

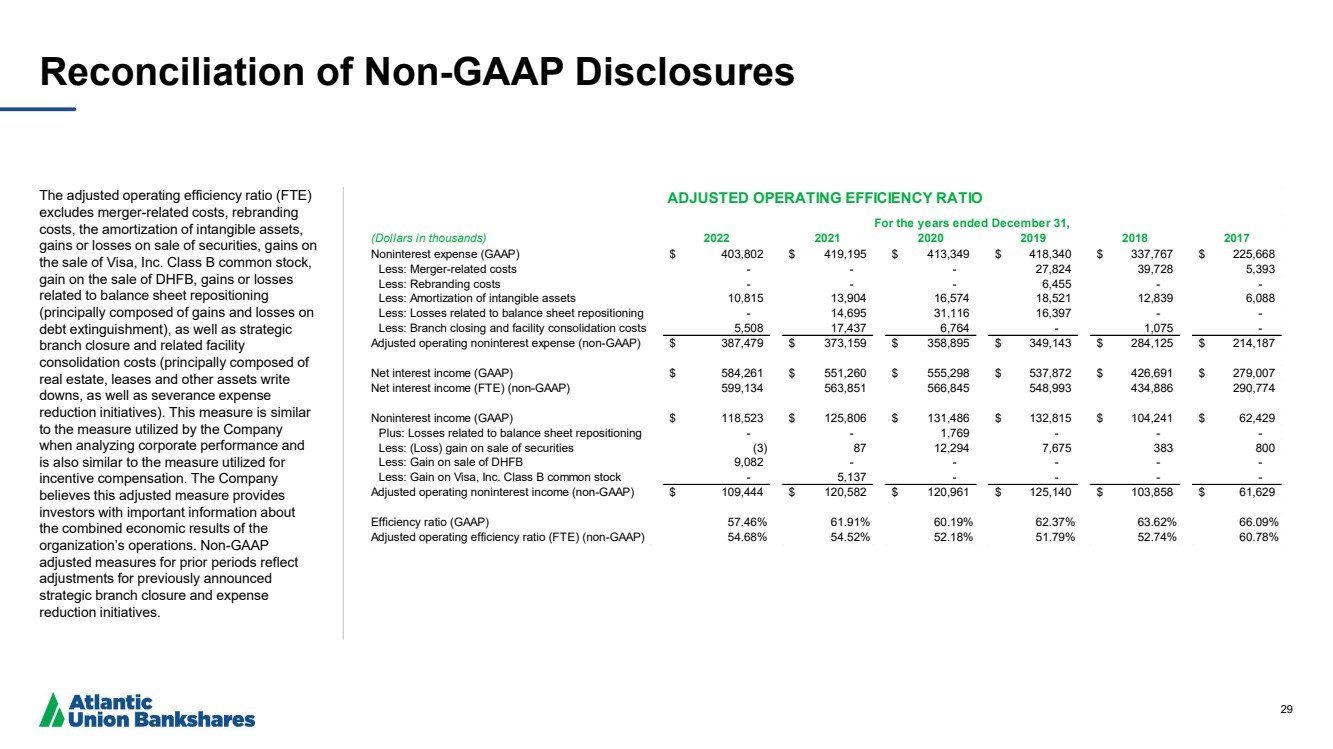

| 29 Reconciliation of Non - GAAP Disclosures The adjusted operating efficiency ratio (FTE) excludes merger - related costs, rebranding costs, the amortization of intangible assets, gains or losses on sale of securities, gains on the sale of Visa, Inc. Class B common stock, gain on the sale of DHFB, gains or losses related to balance sheet repositioning (principally composed of gains and losses on debt extinguishment), as well as strategic branch closure and related facility consolidation costs (principally composed of real estate, leases and other assets write downs, as well as severance expense reduction initiatives) .. This measure is similar to the measure utilized by the Company when analyzing corporate performance and is also similar to the measure utilized for incentive compensation. The Company believes this adjusted measure provides investors with important information about the combined economic results of the organization’s operations. Non - GAAP adjusted measures for prior periods reflect adjustments for previously announced strategic branch closure and expense reduction initiatives. (Dollars in thousands) 2022 2021 2020 2019 2018 2017 Noninterest expense (GAAP) 403,802 $ 419,195 $ 413,349 $ 418,340 $ 337,767 $ 225,668 $ Less: Merger-related costs - - - 27,824 39,728 5,393 Less: Rebranding costs - - - 6,455 - - Less: Amortization of intangible assets 10,815 13,904 16,574 18,521 12,839 6,088 Less: Losses related to balance sheet repositioning - 14,695 31,116 16,397 - - Less: Branch closing and facility consolidation costs 5,508 17,437 6,764 - 1,075 - Adjusted operating noninterest expense (non-GAAP) 387,479 $ 373,159 $ 358,895 $ 349,143 $ 284,125 $ 214,187 $ Net interest income (GAAP) 584,261 $ 551,260 $ 555,298 $ 537,872 $ 426,691 $ 279,007 $ Net interest income (FTE) (non-GAAP) 599,134 563,851 566,845 548,993 434,886 290,774 Noninterest income (GAAP) 118,523 $ 125,806 $ 131,486 $ 132,815 $ 104,241 $ 62,429 $ Plus: Losses related to balance sheet repositioning - - 1,769 - - - Less: (Loss) gain on sale of securities (3) 87 12,294 7,675 383 800 Less: Gain on sale of DHFB 9,082 - - - - - Less: Gain on Visa, Inc. Class B common stock - 5,137 - - - - Adjusted operating noninterest income (non-GAAP) 109,444 $ 120,582 $ 120,961 $ 125,140 $ 103,858 $ 61,629 $ Efficiency ratio (GAAP) 57.46% 61.91% 60.19% 62.37% 63.62% 66.09% Adjusted operating efficiency ratio (FTE) (non-GAAP) 54.68% 54.52% 52.18% 51.79% 52.74% 60.78% ADJUSTED OPERATING EFFICIENCY RATIO For the years ended December 31, |

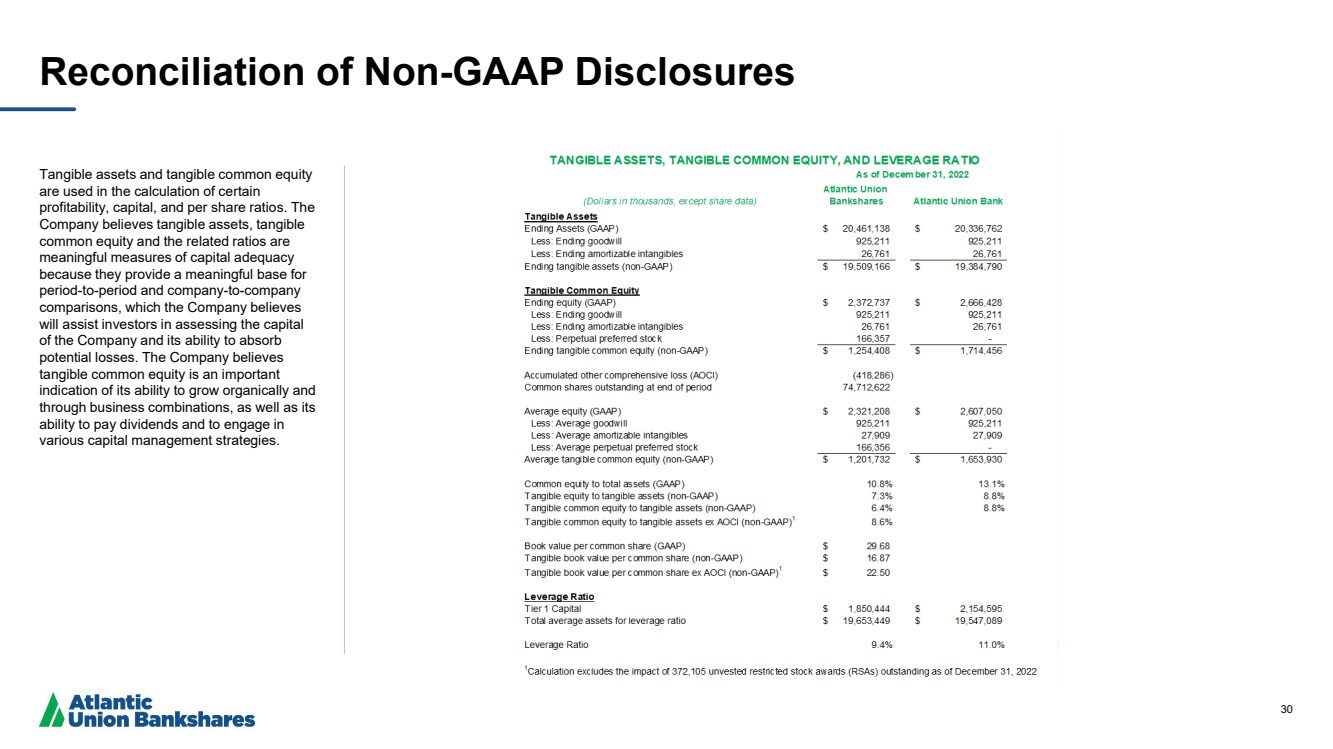

| 30 Reconciliation of Non - GAAP Disclosures Tangible assets and tangible common equity are used in the calculation of certain profitability, capital, and per share ratios. The Company believes tangible assets, tangible common equity and the related ratios are meaningful measures of capital adequacy because they provide a meaningful base for period - to - period and company - to - company comparisons, which the Company believes will assist investors in assessing the capital of the Company and its ability to absorb potential losses. The Company believes tangible common equity is an important indication of its ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. |

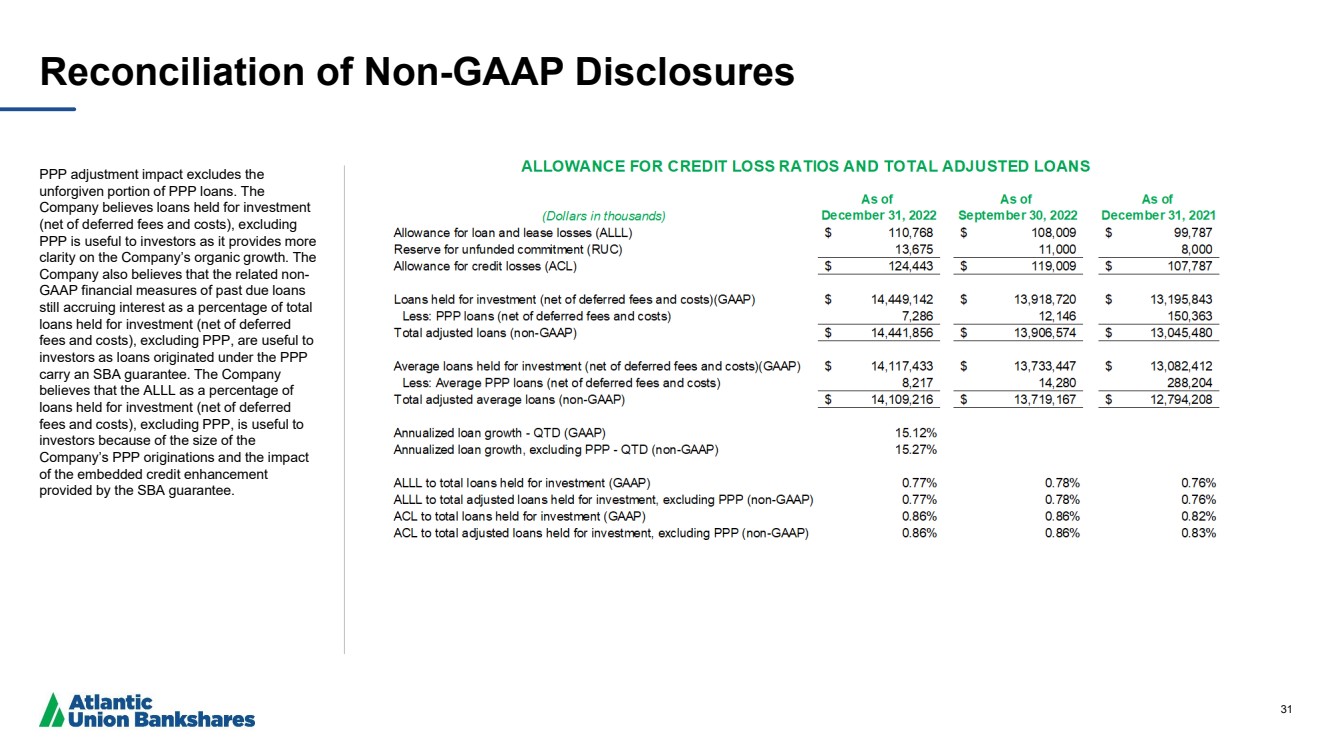

| 31 Reconciliation of Non - GAAP Disclosures PPP adjustment impact excludes the unforgiven portion of PPP loans. The Company believes loans held for investment (net of deferred fees and costs), excluding PPP is useful to investors as it provides more clarity on the Company’s organic growth. The Company also believes that the related non - GAAP financial measures of past due loans still accruing interest as a percentage of total loans held for investment (net of deferred fees and costs), excluding PPP, are useful to investors as loans originated under the PPP carry an SBA guarantee. The Company believes that the ALLL as a percentage of loans held for investment (net of deferred fees and costs), excluding PPP, is useful to investors because of the size of the Company’s PPP originations and the impact of the embedded credit enhancement provided by the SBA guarantee. |