Investor Presentation Nasdaq: UBSH - current AUB - starting May 20 May 2019 1 1 starting May 20, 2019

Forward Looking Statements Certain statements in this presentation may constitute “forward-looking statements” an insufficient allowance for loan losses; within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- the quality or composition of the loan or investment portfolios; looking statements include, without limitation, projections, predictions, expectations or concentrations of loans secured by real estate, particularly commercial real estate; beliefs about future events or results that are not statements of historical fact. Such the effectiveness of the Company’s credit processes and management of the forward-looking statements are based on various assumptions as of the time they are Company’s credit risk; made, and are inherently subject to known and unknown risks, uncertainties, and other demand for loan products and financial services in the Company’s market area; factors that may cause actual results, performance or achievements to be materially the Company’s ability to compete in the market for financial services; different from those expressed or implied by such forward-looking statements. Forward- technological risks and developments, and cyber threats, attacks, or events; looking statements are often accompanied by words that convey projected future performance by the Company’s counterparties or vendors; events or outcomes such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” deposit flows; “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or the availability of financing and the terms thereof; other statements concerning opinions or judgment of Union Bankshares Corporation the level of prepayments on loans and mortgage-backed securities; (“Union” or the “Company”) and its management about future events. legislative or regulatory changes and requirements; the impact of the Tax Cuts and Jobs Act of 2017 (the “Tax Act”), including, but not Although Union believes that its expectations with respect to forward-looking limited to, the effect of the lower corporate tax rate, including on the valuation of the statements are based upon reasonable assumptions within the bounds of its existing Company’s tax assets and liabilities; knowledge of its business and operations, there can be no assurance that actual changes in the effect of the Tax Act due to issuance of interpretive regulatory results, performance, or achievements of, or trends affecting, the Company will not guidance or enactment of corrective or supplement legislation; differ materially from any projected future results, performance, or achievements or monetary and fiscal policies of the U.S. government including policies of the U.S. trends expressed or implied by such forward-looking statements. Actual future results, Department of the Treasury and the Board of Governors of the Federal Reserve performance, achievements or trends may differ materially from historical results or System; those anticipated depending on a variety of factors, including, but not limited to: changes to applicable accounting principles and guidelines; and other factors, many of which are beyond the control of the Company. changes in interest rates; general economic and financial market conditions in the United States generally and Please refer to the “Risk Factors” and “Management’s Discussion and Analysis of particularly in the markets in which the Company operates and which its loans are Financial Condition and Results of Operation” sections of the Company’s Annual concentrated, including the effects of declines in real estate values, an increase in Report on Form 10-K for the year ended December 31, 2018, comparable “Risk Factor” unemployment levels and slowdowns in economic growth; sections of the Company’s Quarterly Reports on Form 10-Q, and related disclosures in the Company’s ability to manage its growth or implement its growth strategy; other filings, which have been filed with the Securities and Exchange Commission (the the possibility that any of the anticipated benefits of the acquisition of Access “SEC”), and are available on the SEC’s website at www.sec.gov. All of the forward- National Corporation (together with subsidiaries, “Access”) will not be realized or will looking statements made in this presentation are expressly qualified by the cautionary not be realized within the expected time period, the expected revenue synergies and statements contained or referred to herein. The actual results or developments cost savings from the acquisition may not be fully realized or realized within the anticipated may not be realized or, even if substantially realized, they may not have the expected time frame, revenues following the acquisition may be lower than expected, expected consequences to or effects on the Company or its businesses or operations. or customer and employee relationships and business operations may be disrupted You are cautioned not to rely too heavily on the forward-looking statements contained in by the acquisition; this presentation. Forward-looking statements speak only as of the date they are made the Company’s ability to recruit and retain key employees; and the Company does not undertake any obligation to update, revise or clarify these the incremental cost and/or decreased revenues associated with exceeding $10 forward-looking statements, whether as a result of new information, future events or billion in assets; otherwise. real estate values in the Company’s lending area; 2

Additional Information Unaudited Pro Forma Financial Information events that may obscure trends in the Company’s underlying performance. The unaudited pro forma financial information included herein is presented for informational purposes only and does not necessarily Please see “Reconciliation of Non-GAAP Disclosures” at the end of this reflect the financial results of the combined company had the companies presentation for a reconciliation to the nearest GAAP financial measure. actually been combined during periods presented. The adjustments No Offer or Solicitation included in this unaudited pro forma financial information are preliminary and may be significantly revised and may not agree to actual amounts This presentation does not constitute an offer to sell or a solicitation of an finally recorded by Union. This financial information does not reflect the offer to buy any securities. No offer of securities shall be made except by benefits of the Access merger’s expected cost savings and expense means of a prospectus meeting the requirements of the Securities Act of efficiencies, opportunities to earn additional revenue, potential impacts of 1933, as amended, and no offer to sell or solicitation of an offer to buy current market conditions on revenues or asset dispositions, among shall be made in any jurisdiction in which such offer, solicitation or sale other factors, and includes various preliminary estimates and may not would be unlawful. necessarily be indicative of the financial position or results of operations About Union Bankshares Corporation that would have occurred if the merger had been completed on the date or at the beginning of the period indicated or which may be attained in Headquartered in Richmond, Virginia, Union Bankshares Corporation the future. (Nasdaq: UBSH) is the holding company for Union Bank & Trust. Union Bank & Trust has 155 branches, 15 of which are operated as Access Non-GAAP Financial Measures National Bank, a division of Union Bank & Trust of Richmond, Virginia, or This presentation contains certain financial information determined by Middleburg Bank, a division of Union Bank & Trust of Richmond, methods other than in accordance with generally accepted accounting Virginia, and seven of which are operated as Xenith Bank, a division of principles in the United States (“GAAP”). These non-GAAP disclosures Union Bank & Trust of Richmond, Virginia, and approximately 200 ATMs have limitations as an analytical tool and should not be considered in located throughout Virginia, and in portions of Maryland and North isolation or as a substitute for analysis of our results as reported under Carolina. Certain non-bank affiliates of the Company include: Old GAAP, nor are they necessarily comparable to non-GAAP performance Dominion Capital Management, Inc., and its subsidiary Outfitter measures that may be presented by other companies. The Company Advisors, Ltd., Dixon, Hubard, Feinour, & Brown, Inc., Capital Fiduciary uses the non-GAAP financial measures discussed herein in its analysis Advisors, LLC, and Middleburg Investment Services, LLC, all of which of the Company’s performance. The Company’s management believes provide investment advisory and/or brokerage services; Union Insurance that these non-GAAP financial measures provide additional Group, LLC, which offers various lines of insurance products; and understanding of ongoing operations, enhance comparability of results of Middleburg Trust Company, which provides trust services. operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of items or 3

The “New Union” Story: FROM VIRGINIA COMMUNITY BANK TO VIRGINIA’S BANK Virginia’s Bank The Union “Moat” • Franchise cannot be replicated • Virginia’s first statewide, independent bank in 20 years • “Crown jewel” deposit base - 44% transaction accounts • The alternative to large competitors • Dense, compact and contiguous $16B+ bank • Organic growth model + effective consolidator Larger Bank Executive Leadership Talent Magnet • Knows the “seams” of the large institutions & how to • Extensive hiring from larger institutions at all levels compete against them • 25 C&I bankers in 2018, we know the people we hire • Makes tough decisions – think differently, challenge, and rarely use recruiters escape the past • All market leaders and bankers hired from the markets • Accustomed to more complex environment than Union they serve “Soundness, profitability & growth in that order of priority” Underpinning for how we run our company 4

Our Value Proposition Shareholder Scale SOLID DIVIDEND YIELD LARGEST VA REGIONAL BANK & PAYOUT RATIO WITH UNIQUE VALUE IN BRANCH EARNINGS UPSIDE FOOTPRINT Opportunity Strength COMMITTED TO TOP-TIER BALANCE SHEET PERFORMANCE & CAPITAL LEVELS Growth ORGANIC & ACQUISITION OPPORTUNITIES 5

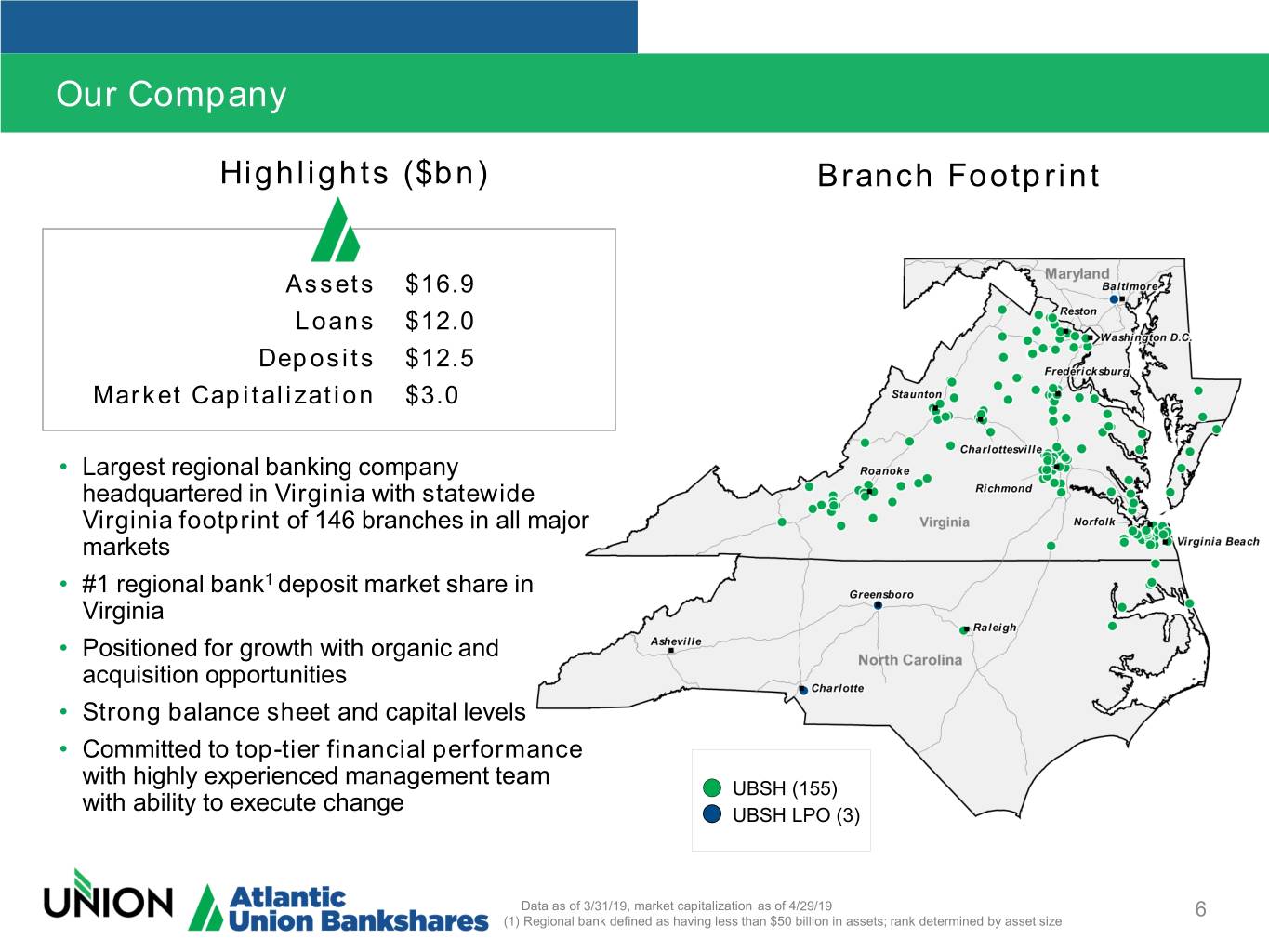

Our Company Highlights ($bn) Branch Footprint Assets $16.9 Loans $12.0 Deposits $12.5 Market Capitalization $3.0 • Largest regional banking company headquartered in Virginia with statewide Virginia footprint of 146 branches in all major markets • #1 regional bank1 deposit market share in Virginia • Positioned for growth with organic and acquisition opportunities • Strong balance sheet and capital levels • Committed to top-tier financial performance with highly experienced management team UBSH (155) with ability to execute change UBSH LPO (3) Data as of 3/31/19, market capitalization as of 4/29/19 6 (1) Regional bank defined as having less than $50 billion in assets; rank determined by asset size

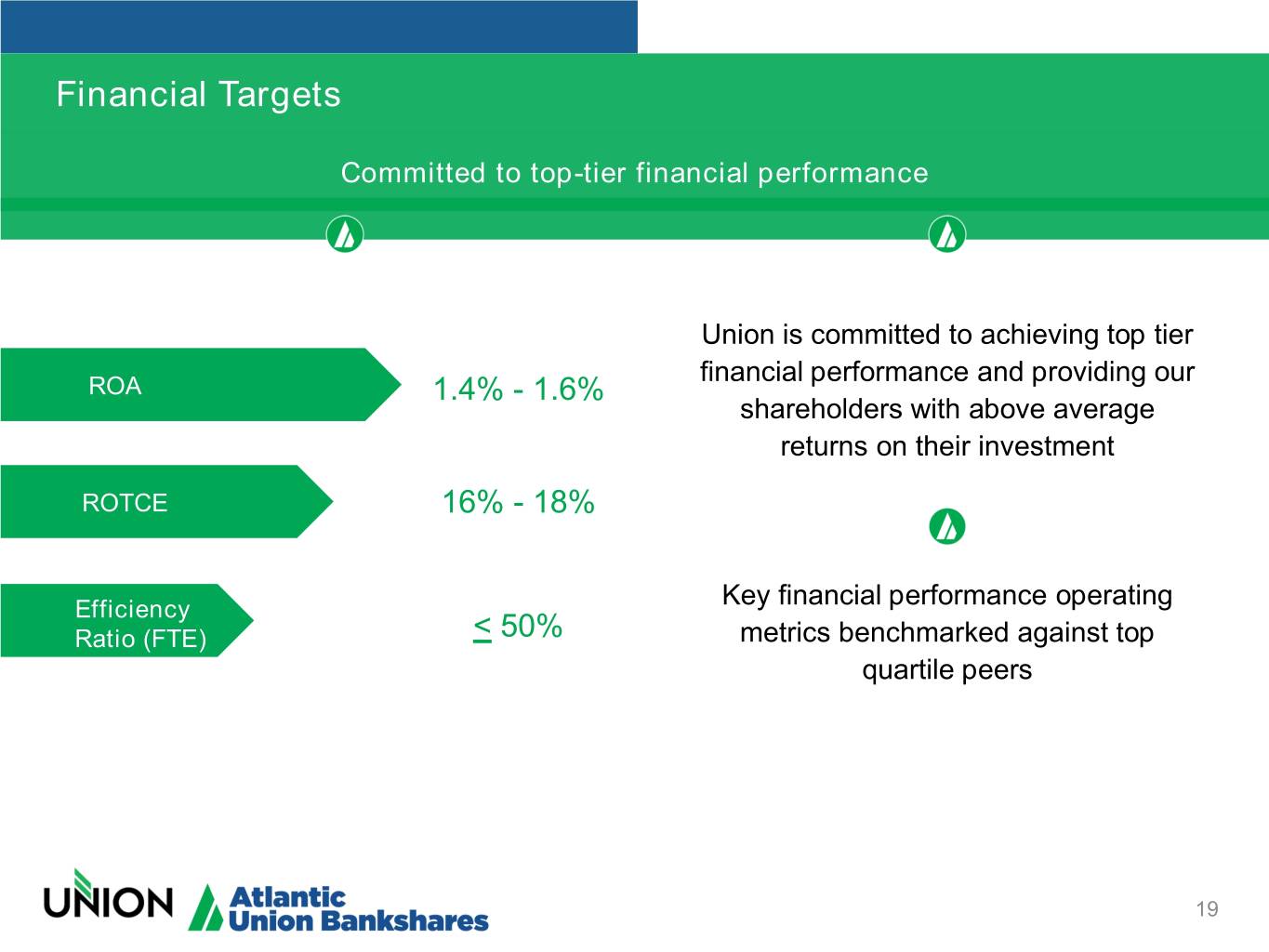

Investment Highlights The Right The Right The Right The Right Scale Markets Team Targets • Largest Virginia • Uniquely positioned in one • New management team • Focus on top tier headquartered regional of the most attractive led by John Asbury performance metrics and banking company ($16.9 markets in the U.S. (30+ years of profitability to drive upside billion in assets) banking experience) • Access acquisition • Committed to realizing • #1 deposit market share accelerates growth in the • Experienced executives Access merger cost ranking in Virginia among attractive Northern Virginia with a proven track record savings and achieving Virginia-based banks(1) market from larger institutions and business synergy experience in M&A opportunities in 2019 • Operating with a statewide • C&I platform primed for integration Virginia footprint of 146 growth, with an opportunity • Operating Targets: ROA: branches in all major to leverage platform and • Union is an attractive 1.4% - 1.6% / ROTCE: markets with 9 additional commercial deposit destination for top tier 16% - 18% / Efficiency branches in North Carolina gathering expertise across talent, leading to Ratio (FTE): < 50% and Maryland our footprint successful recruiting efforts and an improved • Diversified business model competitive position Well positioned to take advantage of market disruption Source: SNL Financial and FDIC deposit data (1) Excludes branches with deposits greater than $1.0 billion 7

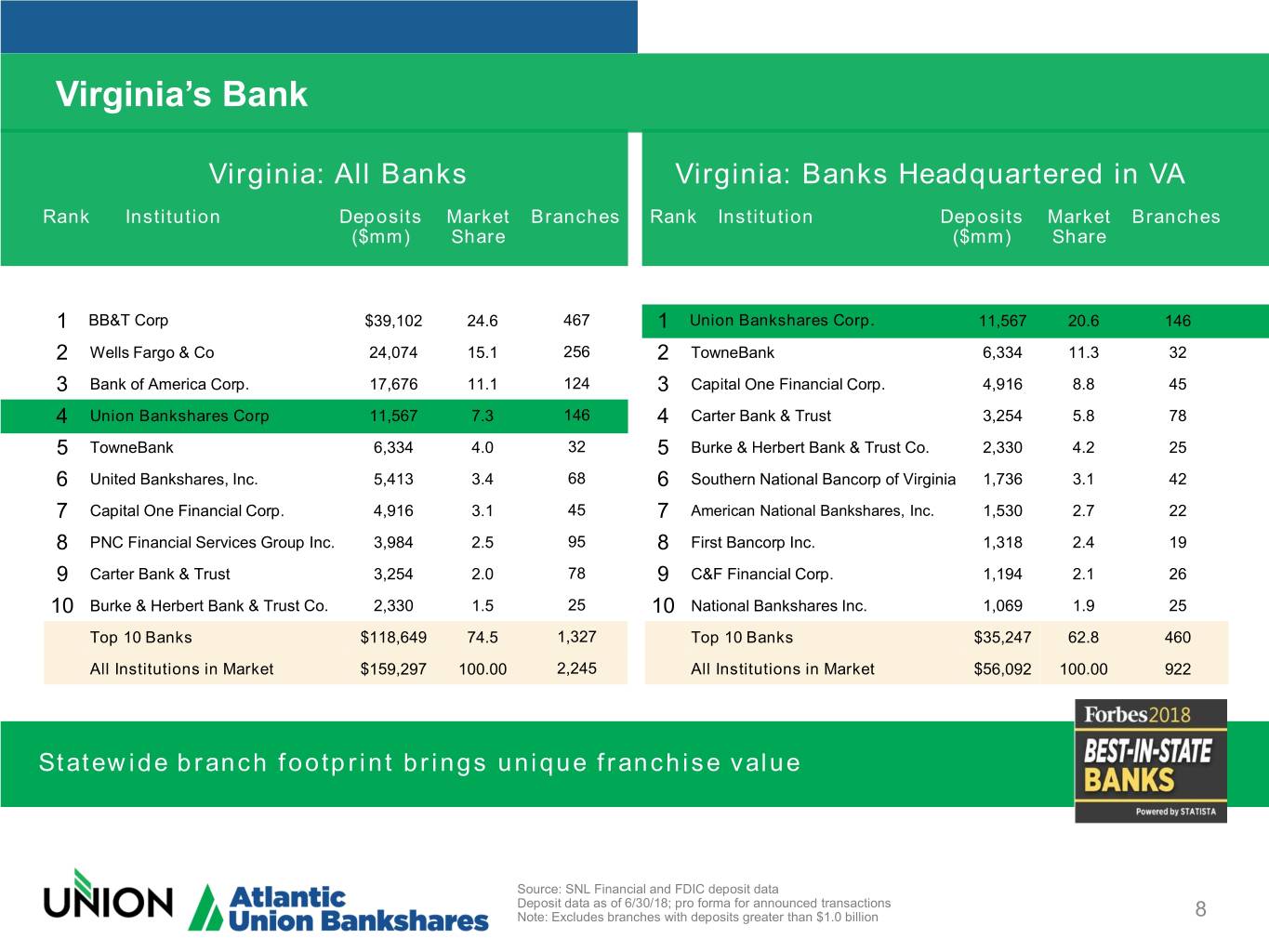

Virginia’s Bank Virginia: All Banks Virginia: Banks Headquartered in VA Rank Institution Deposits Market Branches Rank Institution Deposits Market Branches ($mm) Share ($mm) Share 1 BB&T Corp $39,102 24.6 467 1 Union Bankshares Corp. 11,567 20.6 146 2 Wells Fargo & Co 24,074 15.1 256 2 TowneBank 6,334 11.3 32 3 Bank of America Corp. 17,676 11.1 124 3 Capital One Financial Corp. 4,916 8.8 45 4 Union Bankshares Corp 11,567 7.3 146 4 Carter Bank & Trust 3,254 5.8 78 5 TowneBank 6,334 4.0 32 5 Burke & Herbert Bank & Trust Co. 2,330 4.2 25 6 United Bankshares, Inc. 5,413 3.4 68 6 Southern National Bancorp of Virginia 1,736 3.1 42 7 Capital One Financial Corp. 4,916 3.1 45 7 American National Bankshares, Inc. 1,530 2.7 22 8 PNC Financial Services Group Inc. 3,984 2.5 95 8 First Bancorp Inc. 1,318 2.4 19 9 Carter Bank & Trust 3,254 2.0 78 9 C&F Financial Corp. 1,194 2.1 26 10 Burke & Herbert Bank & Trust Co. 2,330 1.5 25 10 National Bankshares Inc. 1,069 1.9 25 Top 10 Banks $118,649 74.5 1,327 Top 10 Banks $35,247 62.8 460 All Institutions in Market $159,297 100.00 2,245 All Institutions in Market $56,092 100.00 922 Statewide branch footprint brings unique franchise value Source: SNL Financial and FDIC deposit data Deposit data as of 6/30/18; pro forma for announced transactions Note: Excludes branches with deposits greater than $1.0 billion 8

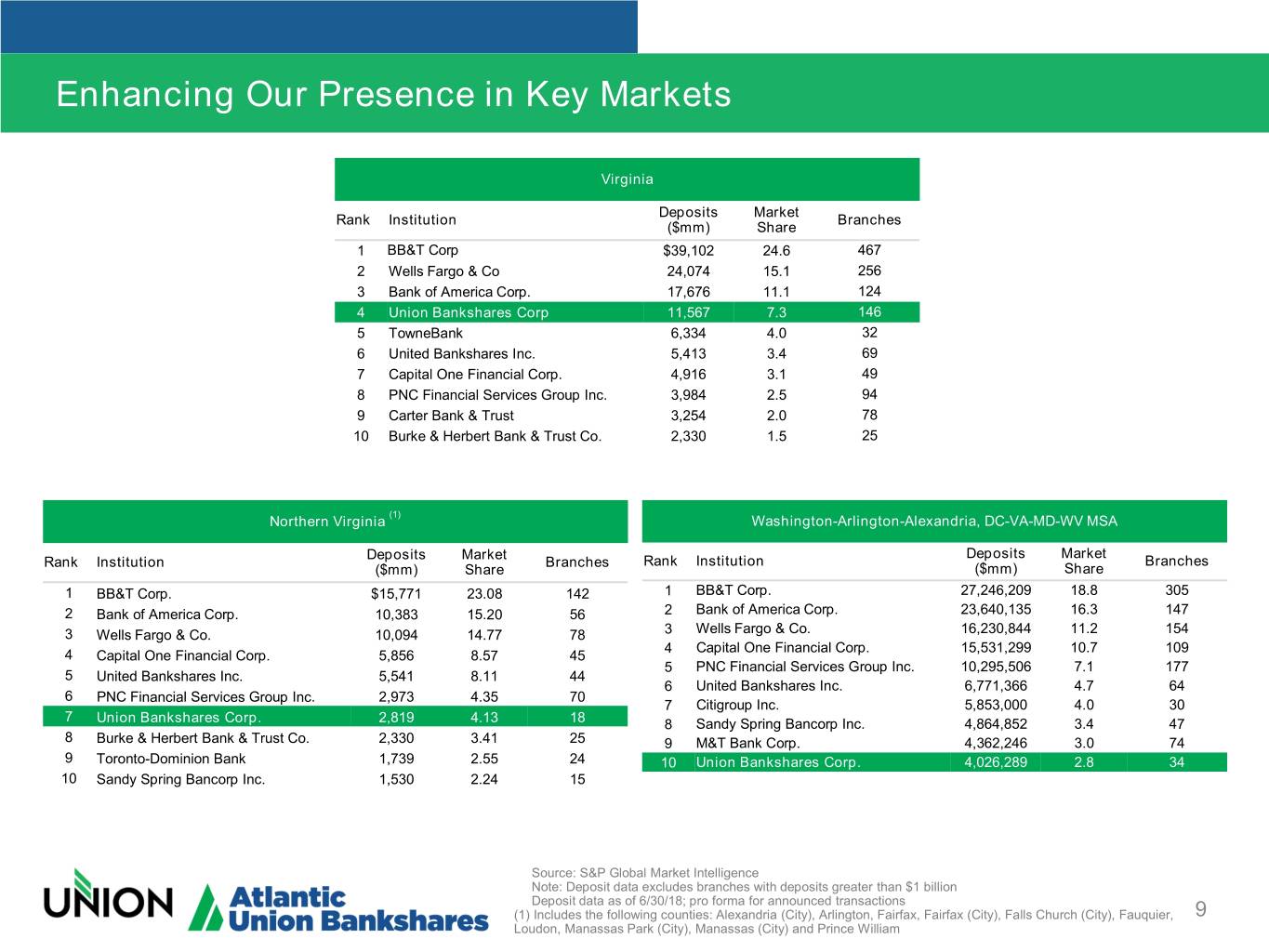

Enhancing Our Presence in Key Markets Virginia Deposits Market Rank Institution Branches ($mm) Share 1 BB&T Corp $39,102 24.6 467 2 Wells Fargo & Co 24,074 15.1 256 3 Bank of America Corp. 17,676 11.1 124 4 Union Bankshares Corp 11,567 7.3 146 5 TowneBank 6,334 4.0 32 6 United Bankshares Inc. 5,413 3.4 69 7 Capital One Financial Corp. 4,916 3.1 49 8 PNC Financial Services Group Inc. 3,984 2.5 94 9 Carter Bank & Trust 3,254 2.0 78 10 Burke & Herbert Bank & Trust Co. 2,330 1.5 25 (1) Northern Virginia Washington-Arlington-Alexandria, DC-VA-MD-WV MSA Deposits Market Deposits Market Rank Institution Branches Rank Institution Branches ($mm) Share ($mm) Share 1 BB&T Corp. $15,771 23.08 142 1 BB&T Corp. 27,246,209 18.8 305 2 Bank of America Corp. 10,383 15.20 56 2 Bank of America Corp. 23,640,135 16.3 147 3 Wells Fargo & Co. 10,094 14.77 78 3 Wells Fargo & Co. 16,230,844 11.2 154 4 Capital One Financial Corp. 15,531,299 10.7 109 4 Capital One Financial Corp. 5,856 8.57 45 5 PNC Financial Services Group Inc. 10,295,506 7.1 177 5 United Bankshares Inc. 5,541 8.11 44 6 United Bankshares Inc. 6,771,366 4.7 64 6 PNC Financial Services Group Inc. 2,973 4.35 70 7 Citigroup Inc. 5,853,000 4.0 30 7 Union Bankshares Corp. 2,819 4.13 18 8 Sandy Spring Bancorp Inc. 4,864,852 3.4 47 8 Burke & Herbert Bank & Trust Co. 2,330 3.41 25 9 M&T Bank Corp. 4,362,246 3.0 74 9 Toronto-Dominion Bank 1,739 2.55 24 10 Union Bankshares Corp. 4,026,289 2.8 34 10 Sandy Spring Bancorp Inc. 1,530 2.24 15 Source: S&P Global Market Intelligence Note: Deposit data excludes branches with deposits greater than $1 billion Deposit data as of 6/30/18; pro forma for announced transactions (1) Includes the following counties: Alexandria (City), Arlington, Fairfax, Fairfax (City), Falls Church (City), Fauquier, 9 Loudon, Manassas Park (City), Manassas (City) and Prince William

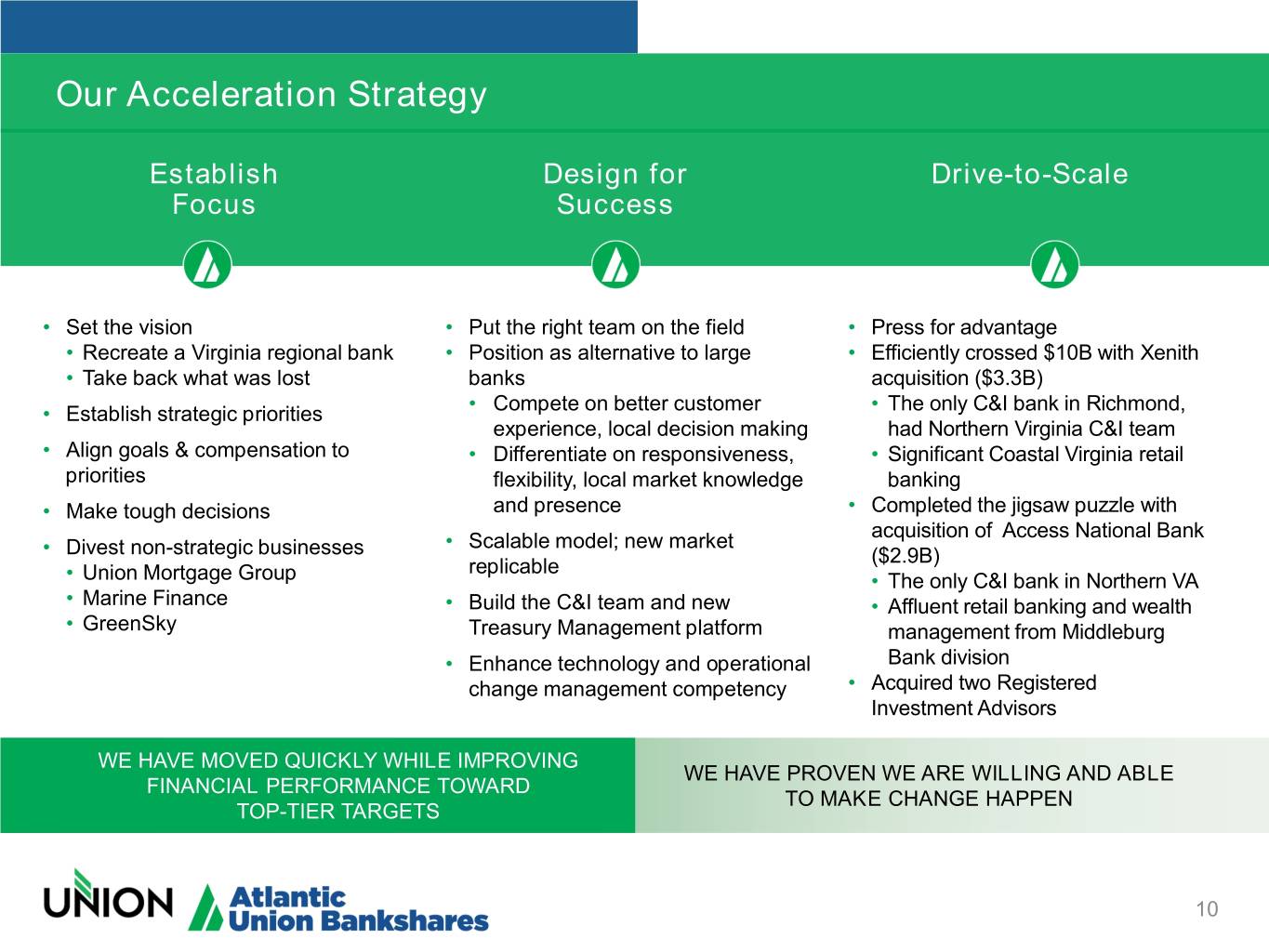

Our Acceleration Strategy Establish Design for Drive-to-Scale Focus Success • Set the vision • Put the right team on the field • Press for advantage • Recreate a Virginia regional bank • Position as alternative to large • Efficiently crossed $10B with Xenith • Take back what was lost banks acquisition ($3.3B) • Establish strategic priorities • Compete on better customer • The only C&I bank in Richmond, experience, local decision making had Northern Virginia C&I team • Align goals & compensation to • Differentiate on responsiveness, • Significant Coastal Virginia retail priorities flexibility, local market knowledge banking • Make tough decisions and presence • Completed the jigsaw puzzle with acquisition of Access National Bank • Divest non-strategic businesses • Scalable model; new market replicable ($2.9B) • Union Mortgage Group • The only C&I bank in Northern VA • Marine Finance • Build the C&I team and new • Affluent retail banking and wealth • GreenSky Treasury Management platform management from Middleburg • Enhance technology and operational Bank division change management competency • Acquired two Registered Investment Advisors WE HAVE MOVED QUICKLY WHILE IMPROVING WE HAVE PROVEN WE ARE WILLING AND ABLE FINANCIAL PERFORMANCE TOWARD TO MAKE CHANGE HAPPEN TOP-TIER TARGETS 10

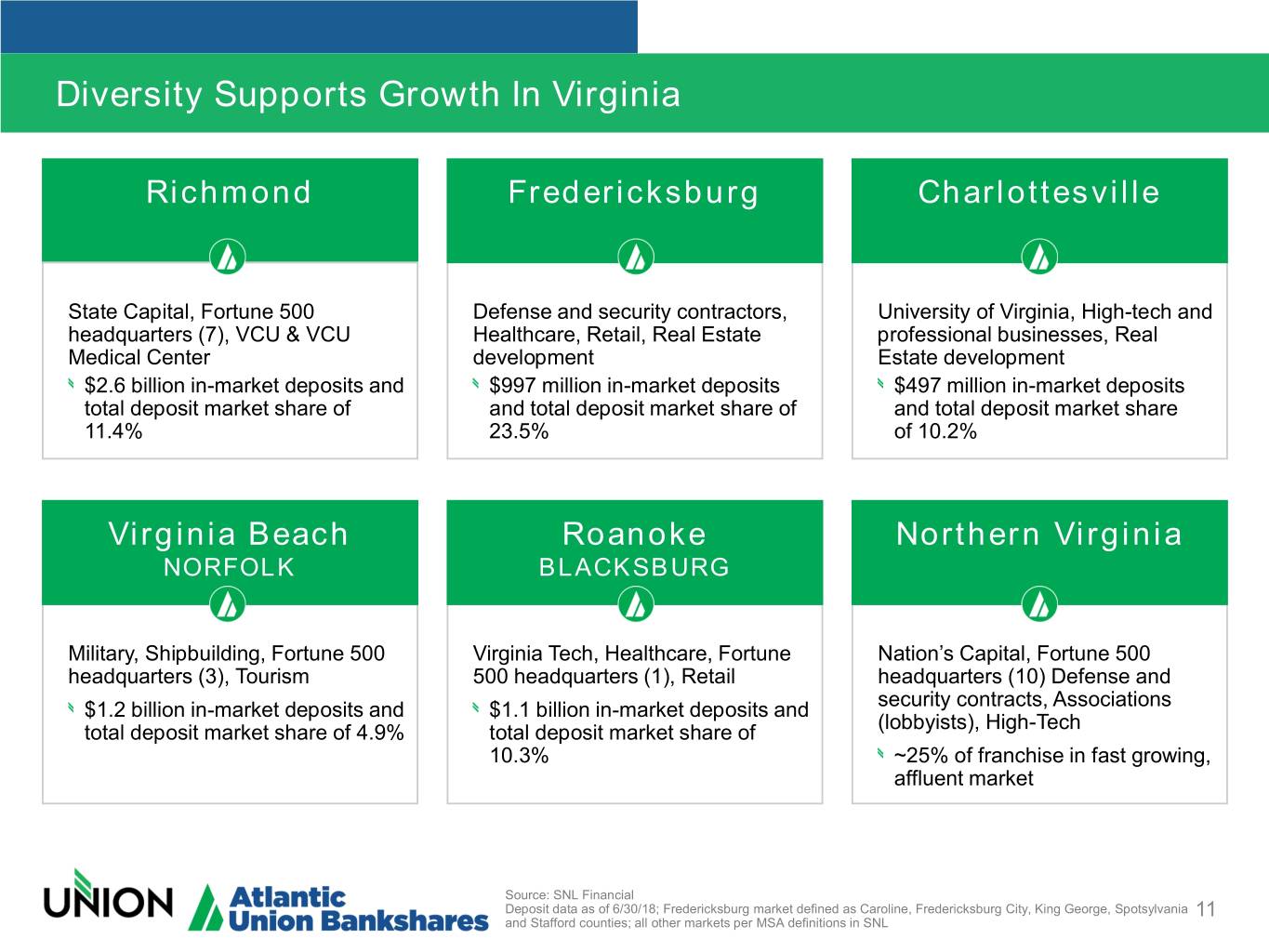

Diversity Supports Growth In Virginia Richmond Fredericksburg Charlottesville State Capital, Fortune 500 Defense and security contractors, University of Virginia, High-tech and headquarters (7), VCU & VCU Healthcare, Retail, Real Estate professional businesses, Real Medical Center development Estate development $2.6 billion in-market deposits and $997 million in-market deposits $497 million in-market deposits total deposit market share of and total deposit market share of and total deposit market share 11.4% 23.5% of 10.2% Virginia Beach Roanoke Northern Virginia NORFOLK BLACKSBURG Military, Shipbuilding, Fortune 500 Virginia Tech, Healthcare, Fortune Nation’s Capital, Fortune 500 headquarters (3), Tourism 500 headquarters (1), Retail headquarters (10) Defense and $1.2 billion in-market deposits and $1.1 billion in-market deposits and security contracts, Associations total deposit market share of 4.9% total deposit market share of (lobbyists), High-Tech 10.3% ~25% of franchise in fast growing, affluent market Source: SNL Financial Deposit data as of 6/30/18; Fredericksburg market defined as Caroline, Fredericksburg City, King George, Spotsylvania 11 and Stafford counties; all other markets per MSA definitions in SNL

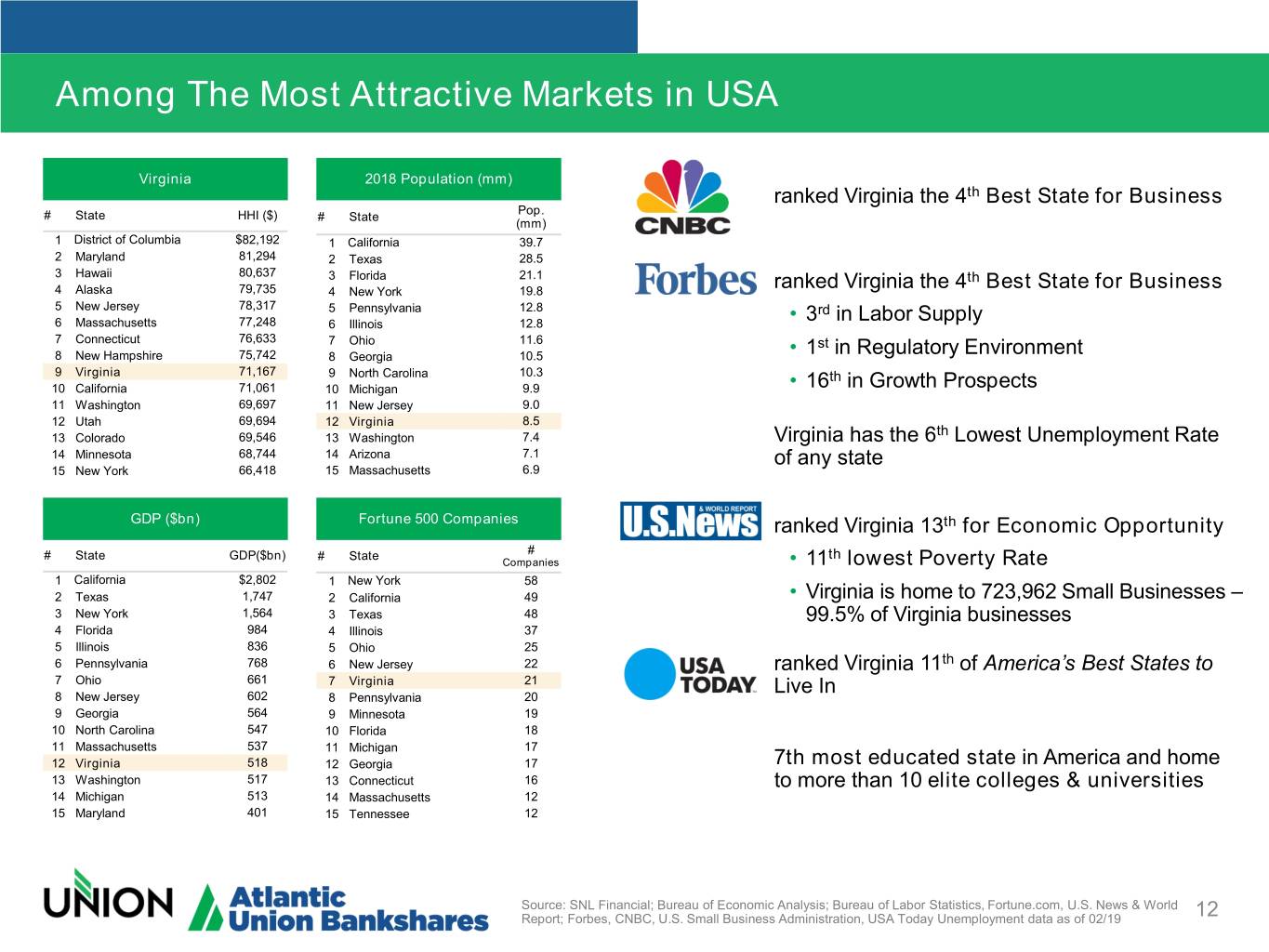

Among The Most Attractive Markets in USA Virginia 2018 Population (mm) ranked Virginia the 4th Best State for Business Pop. # State HHI ($) # State (mm) 1 District of Columbia $82,192 1 California 39.7 2 Maryland 81,294 2 Texas 28.5 3 Hawaii 80,637 3 Florida 21.1 th 4 Alaska 79,735 4 New York 19.8 ranked Virginia the 4 Best State for Business 5 New Jersey 78,317 5 Pennsylvania 12.8 rd 6 Massachusetts 77,248 6 Illinois 12.8 • 3 in Labor Supply 7 Connecticut 76,633 7 Ohio 11.6 st 8 New Hampshire 75,742 8 Georgia 10.5 • 1 in Regulatory Environment 9 Virginia 71,167 9 North Carolina 10.3 th 10 California 71,061 10 Michigan 9.9 • 16 in Growth Prospects 11 Washington 69,697 11 New Jersey 9.0 12 Utah 69,694 12 Virginia 8.5 th 13 Colorado 69,546 13 Washington 7.4 Virginia has the 6 Lowest Unemployment Rate 14 Minnesota 68,744 14 Arizona 7.1 of any state 15 New York 66,418 15 Massachusetts 6.9 GDP ($bn) Fortune 500 Companies ranked Virginia 13th for Economic Opportunity # State GDP($bn) # State # th Companies • 11 lowest Poverty Rate 1 California $2,802 1 New York 58 2 Texas 1,747 2 California 49 • Virginia is home to 723,962 Small Businesses – 3 New York 1,564 3 Texas 48 99.5% of Virginia businesses 4 Florida 984 4 Illinois 37 5 Illinois 836 5 Ohio 25 6 Pennsylvania 768 6 New Jersey 22 ranked Virginia 11th of America’s Best States to 7 Ohio 661 7 Virginia 21 Live In 8 New Jersey 602 8 Pennsylvania 20 9 Georgia 564 9 Minnesota 19 10 North Carolina 547 10 Florida 18 11 Massachusetts 537 11 Michigan 17 12 Virginia 518 12 Georgia 17 7th most educated state in America and home 13 Washington 517 13 Connecticut 16 to more than 10 elite colleges & universities 14 Michigan 513 14 Massachusetts 12 15 Maryland 401 15 Tennessee 12 Source: SNL Financial; Bureau of Economic Analysis; Bureau of Labor Statistics, Fortune.com, U.S. News & World Report; Forbes, CNBC, U.S. Small Business Administration, USA Today Unemployment data as of 02/19 12

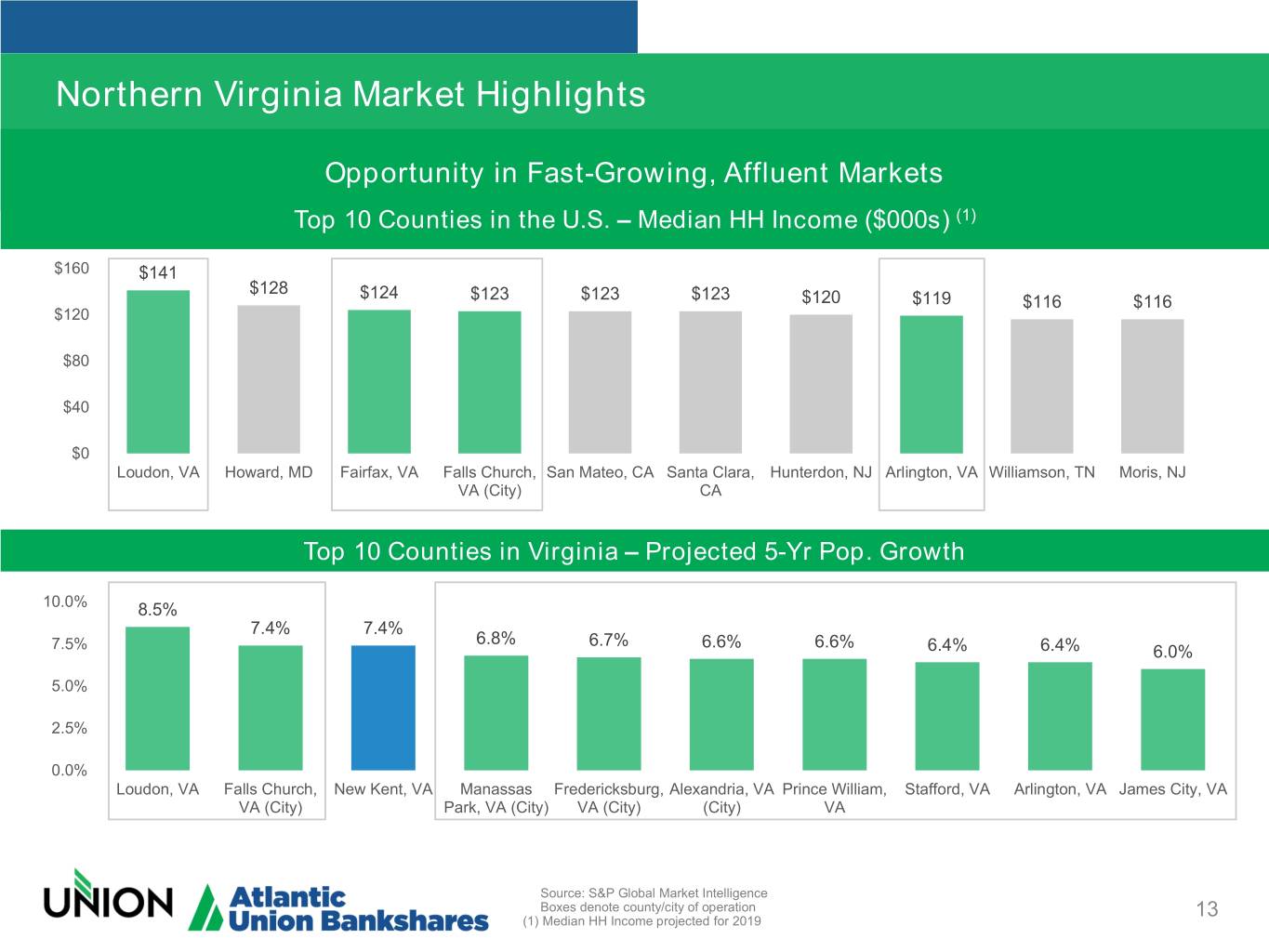

Northern Virginia Market Highlights Opportunity in Fast-Growing, Affluent Markets Top 10 Counties in the U.S. – Median HH Income ($000s) (1) $160 $141 $128 $124 $123 $123 $123 $120 $119 $116 $116 $120 $80 $40 $0 Loudon, VA Howard, MD Fairfax, VA Falls Church, San Mateo, CA Santa Clara, Hunterdon, NJ Arlington, VA Williamson, TN Moris, NJ VA (City) CA Top 10 Counties in Virginia – Projected 5-Yr Pop. Growth 10.0% 8.5% 7.4% 7.4% 6.8% 6.7% 6.6% 6.6% 7.5% 6.4% 6.4% 6.0% 5.0% 2.5% 0.0% Loudon, VA Falls Church, New Kent, VA Manassas Fredericksburg, Alexandria, VA Prince William, Stafford, VA Arlington, VA James City, VA VA (City) Park, VA (City) VA (City) (City) VA Source: S&P Global Market Intelligence Boxes denote county/city of operation 13 (1) Median HH Income projected for 2019

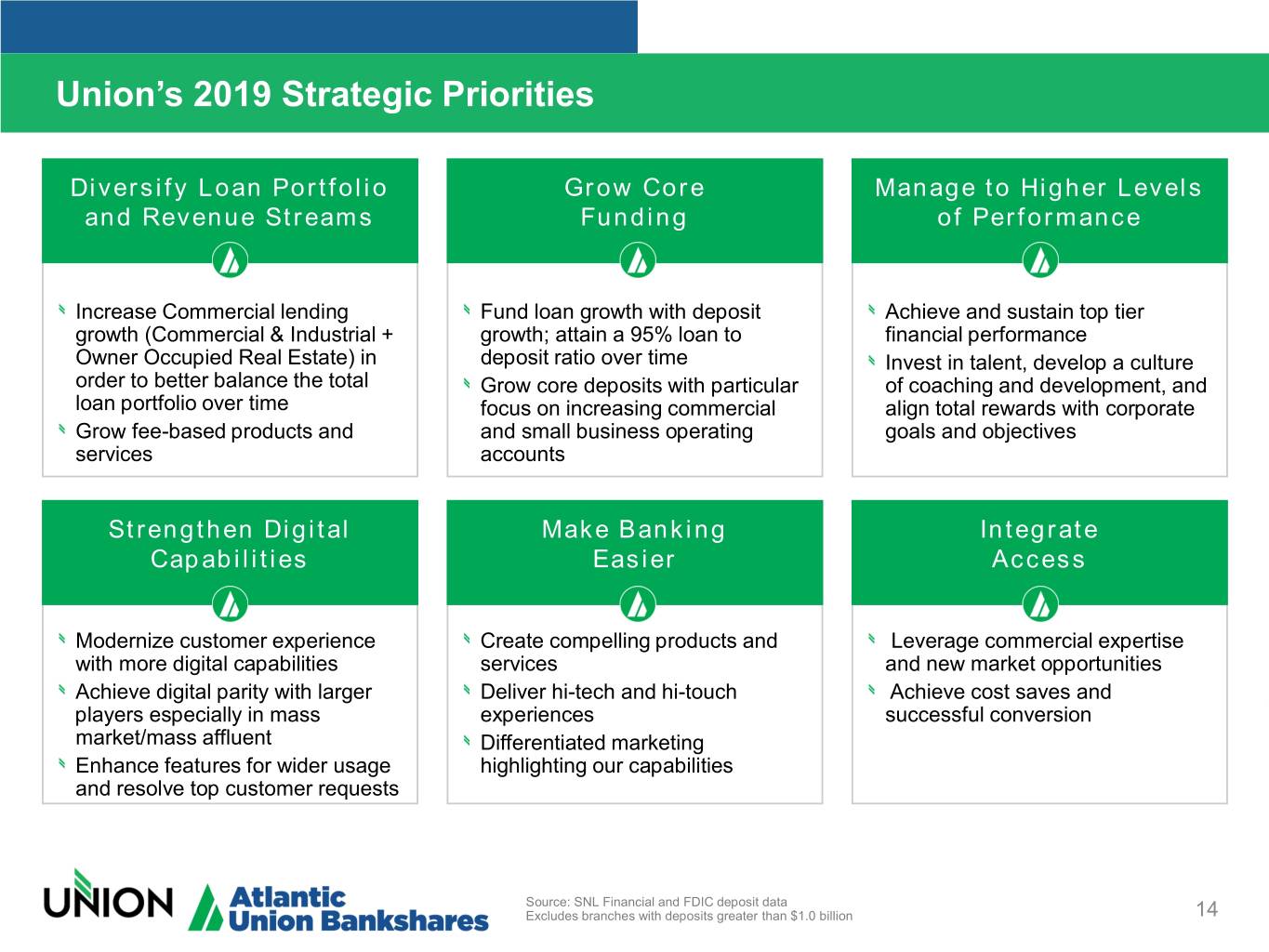

Union’s 2019 Strategic Priorities Diversify Loan Portfolio Grow Core Manage to Higher Levels and Revenue Streams Funding of Performance Increase Commercial lending Fund loan growth with deposit Achieve and sustain top tier growth (Commercial & Industrial + growth; attain a 95% loan to financial performance Owner Occupied Real Estate) in deposit ratio over time Invest in talent, develop a culture order to better balance the total Grow core deposits with particular of coaching and development, and loan portfolio over time focus on increasing commercial align total rewards with corporate Grow fee-based products and and small business operating goals and objectives services accounts Strengthen Digital Make Banking Integrate Capabilities Easier Access Modernize customer experience Create compelling products and Leverage commercial expertise with more digital capabilities services and new market opportunities Achieve digital parity with larger Deliver hi-tech and hi-touch Achieve cost saves and players especially in mass experiences successful conversion market/mass affluent Differentiated marketing Enhance features for wider usage highlighting our capabilities and resolve top customer requests Source: SNL Financial and FDIC deposit data Excludes branches with deposits greater than $1.0 billion 14

Brand Transition - A Unified Bank Brand Across All Markets On May 20, we are rebranding Union Bank & Trust to Atlantic Union Bank to reduce brand complexity and ensure recognition and clarity in the marketplace. Maintaining ‘Union’ in the new brand is key because it represents the unification of multiple banks that have come together over time to deliver better banking to our customers and has been a focal point for nearly 100 years. THE NEW NAME REFERENCES OUR GEOGRAPHIC EXPANSION THROUGHOUT THE MID-ATLANTIC REGION FROM MARYLAND TO NORTH CAROLINA. 15

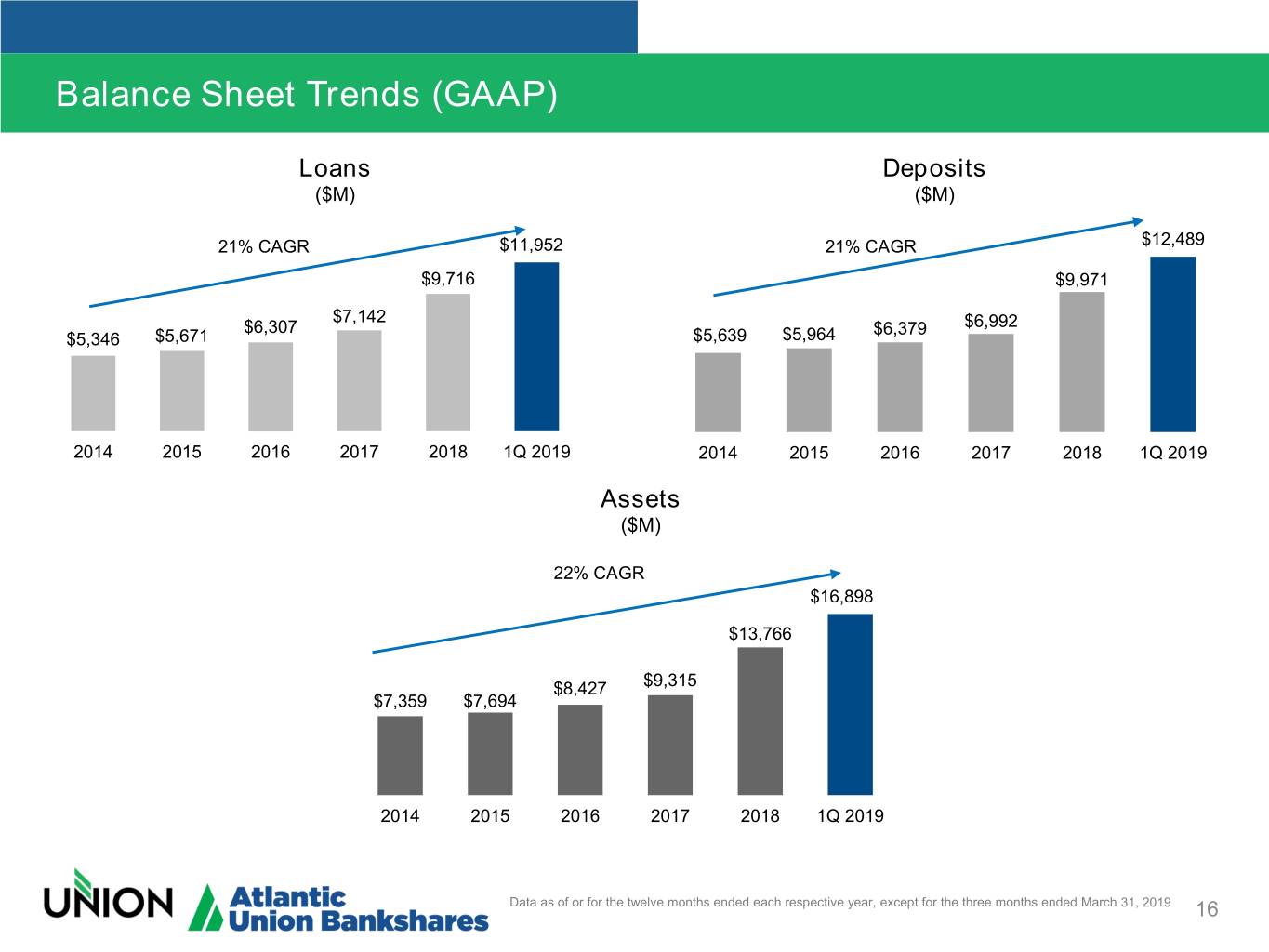

Balance Sheet Trends (GAAP) Loans Deposits ($M) ($M) 21% CAGR $11,952 21% CAGR $12,489 $9,716 $9,971 $7,142 $6,307 $6,379 $6,992 $5,346 $5,671 $5,639 $5,964 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Assets ($M) 22% CAGR $16,898 $13,766 $8,427 $9,315 $7,359 $7,694 2014 2015 2016 2017 2018 1Q 2019 Data as of or for the twelve months ended each respective year, except for the three months ended March 31, 2019 16

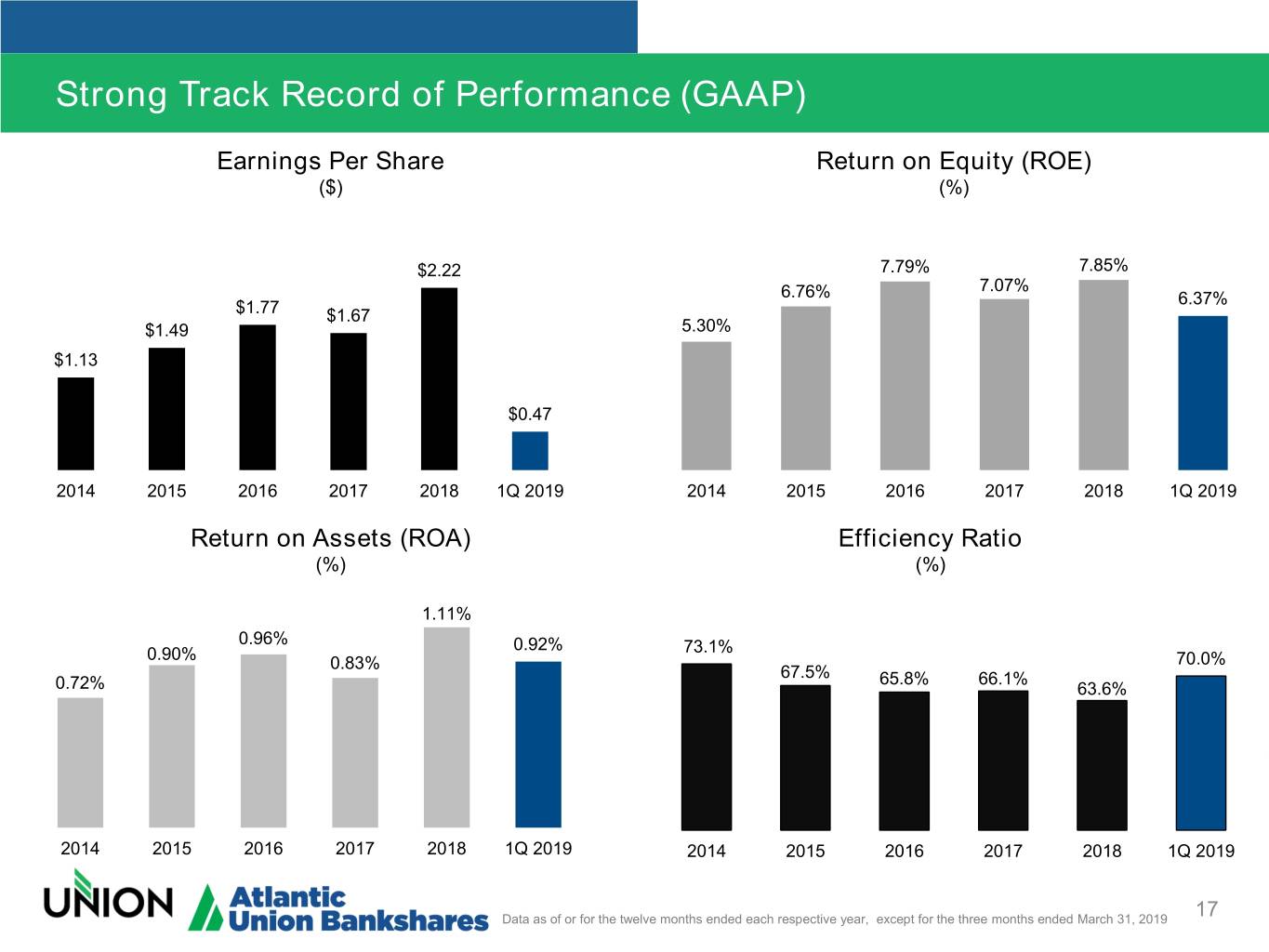

Strong Track Record of Performance (GAAP) Earnings Per Share Return on Equity (ROE) ($) (%) $2.22 7.79% 7.85% 7.07% 6.76% 6.37% $1.77 $1.67 $1.49 5.30% $1.13 $0.47 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Return on Assets (ROA) Efficiency Ratio (%) (%) 1.11% 0.96% 0.92% 0.90% 73.1% 0.83% 70.0% 67.5% 65.8% 66.1% 0.72% 63.6% 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Data as of or for the twelve months ended each respective year, except for the three months ended March 31, 2019 17

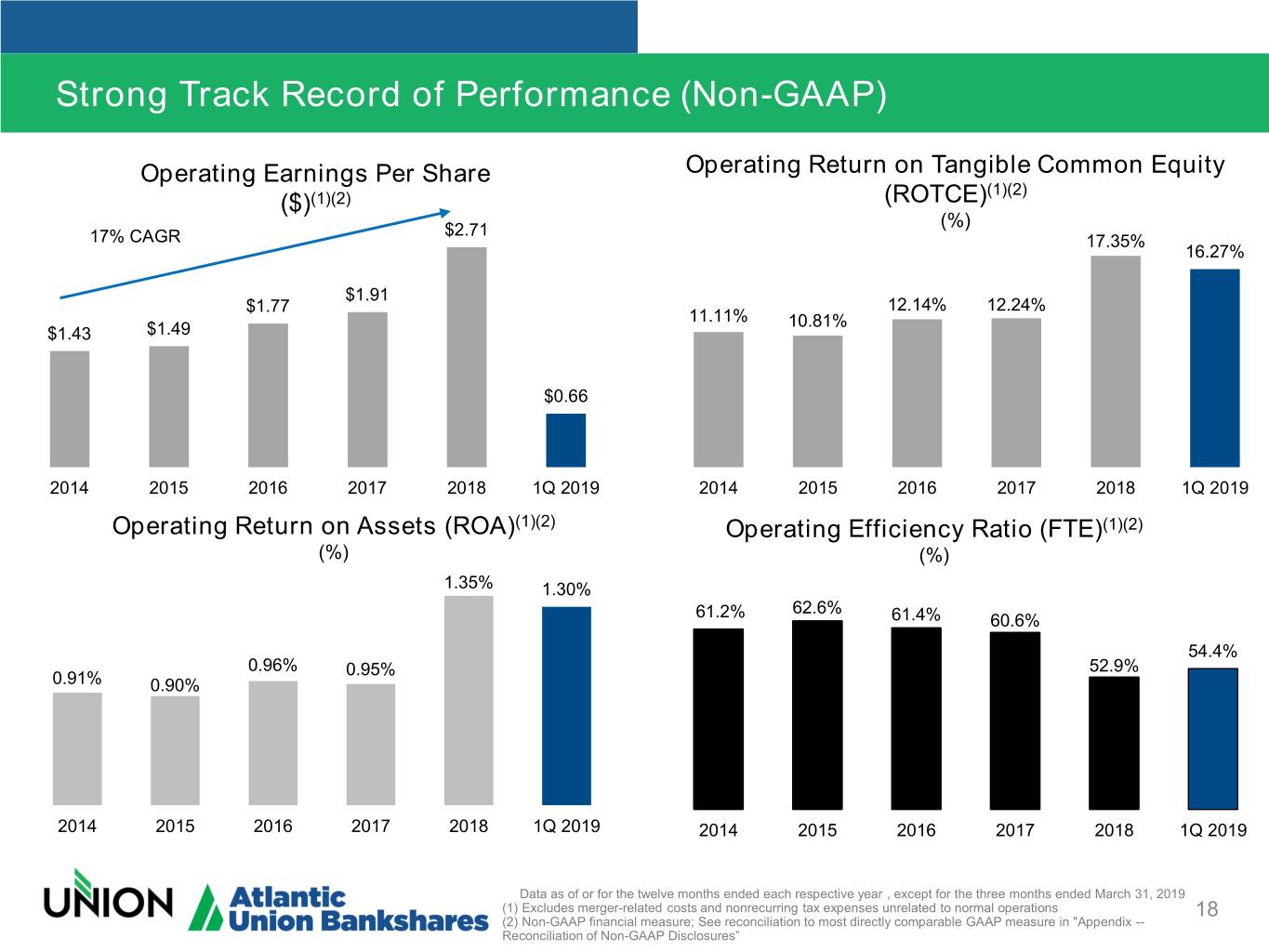

Strong Track Record of Performance (Non-GAAP) Operating Earnings Per Share Operating Return on Tangible Common Equity (1)(2) ($)(1)(2) (ROTCE) $2.71 (%) 17% CAGR 17.35% 16.27% $1.91 $1.77 12.14% 12.24% 11.11% 10.81% $1.43 $1.49 $0.66 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Operating Return on Assets (ROA)(1)(2) Operating Efficiency Ratio (FTE)(1)(2) (%) (%) 1.35% 1.30% 61.2% 62.6% 61.4% 60.6% 54.4% 0.96% 0.95% 52.9% 0.91% 0.90% 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Data as of or for the twelve months ended each respective year , except for the three months ended March 31, 2019 (1) Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations 18 (2) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures”

Financial Targets Committed to top-tier financial performance Union is committed to achieving top tier financial performance and providing our ROA 1.4% - 1.6% shareholders with above average returns on their investment ROTCE 16% - 18% Efficiency Key financial performance operating Ratio (FTE) < 50% metrics benchmarked against top quartile peers 19

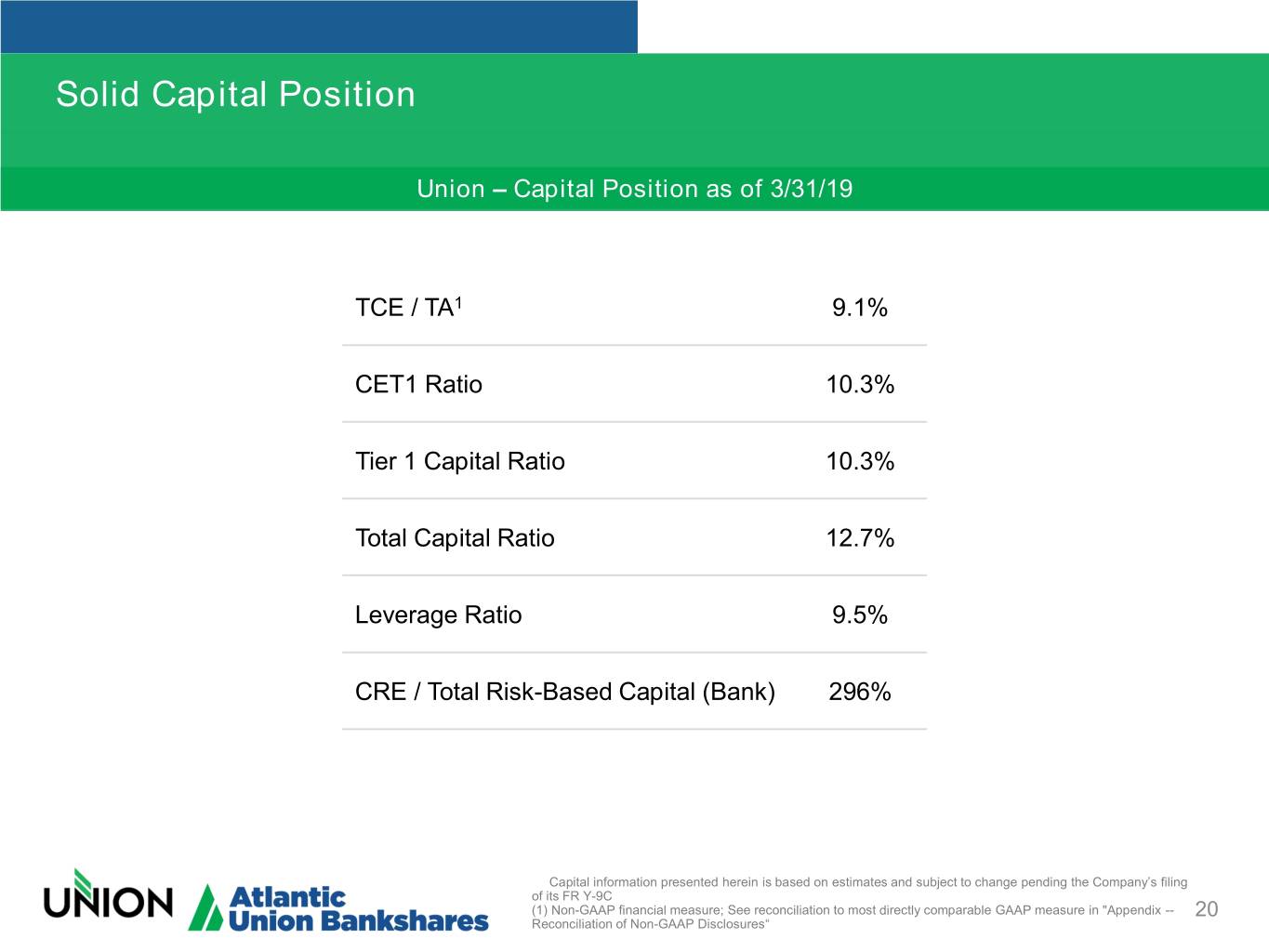

Solid Capital Position Union – Capital Position as of 3/31/19 TCE / TA1 9.1% CET1 Ratio 10.3% Tier 1 Capital Ratio 10.3% Total Capital Ratio 12.7% Leverage Ratio 9.5% CRE / Total Risk-Based Capital (Bank) 296% Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its FR Y-9C (1) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- 20 Reconciliation of Non-GAAP Disclosures“

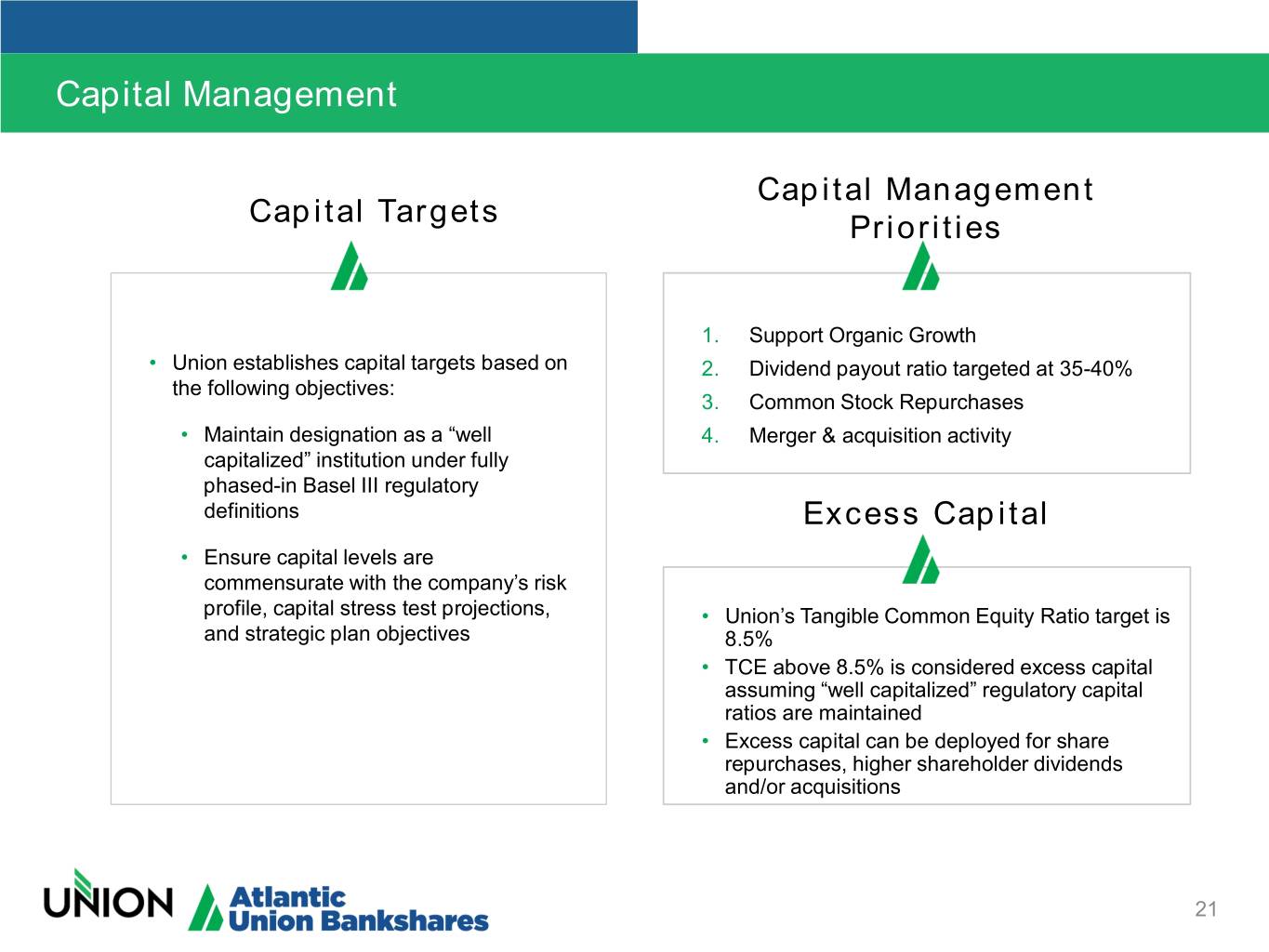

Capital Management Capital Management Capital Targets Priorities 1. Support Organic Growth • Union establishes capital targets based on 2. Dividend payout ratio targeted at 35-40% the following objectives: 3. Common Stock Repurchases • Maintain designation as a “well 4. Merger & acquisition activity capitalized” institution under fully phased-in Basel III regulatory definitions Excess Capital • Ensure capital levels are commensurate with the company’s risk profile, capital stress test projections, • Union’s Tangible Common Equity Ratio target is and strategic plan objectives 8.5% • TCE above 8.5% is considered excess capital assuming “well capitalized” regulatory capital ratios are maintained • Excess capital can be deployed for share repurchases, higher shareholder dividends and/or acquisitions 21

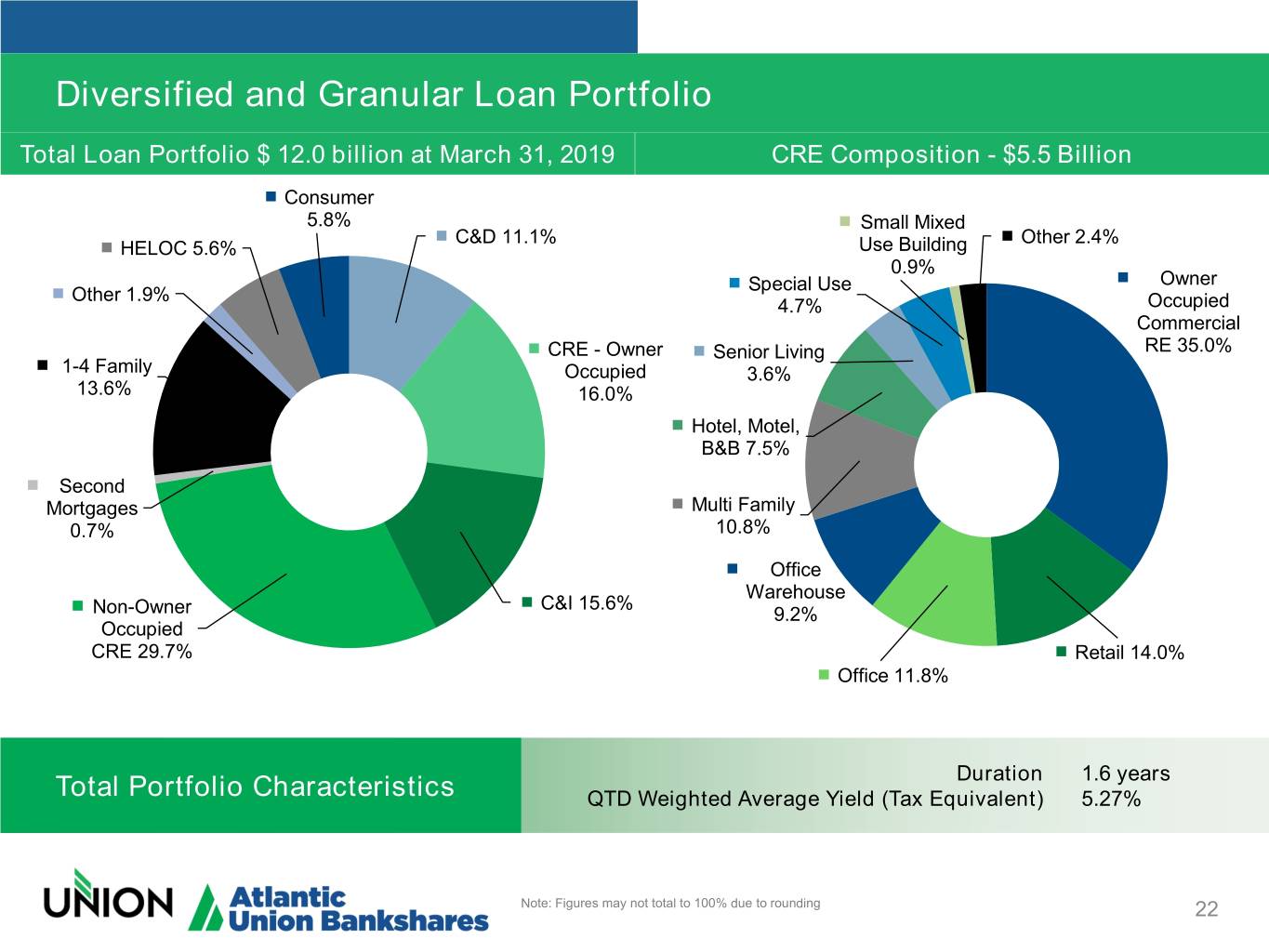

Diversified and Granular Loan Portfolio Total Loan Portfolio $ 12.0 billion at March 31, 2019 CRE Composition - $5.5 Billion Consumer 5.8% Small Mixed C&D 11.1% Other 2.4% HELOC 5.6% Use Building 0.9% Special Use Owner Other 1.9% 4.7% Occupied Commercial CRE - Owner Senior Living RE 35.0% 1-4 Family Occupied 3.6% 13.6% 16.0% Hotel, Motel, B&B 7.5% Second Mortgages Multi Family 0.7% 10.8% Office Warehouse C&I 15.6% Non-Owner 9.2% Occupied CRE 29.7% Retail 14.0% Office 11.8% Duration 1.6 years Total Portfolio Characteristics QTD Weighted Average Yield (Tax Equivalent) 5.27% Note: Figures may not total to 100% due to rounding 22

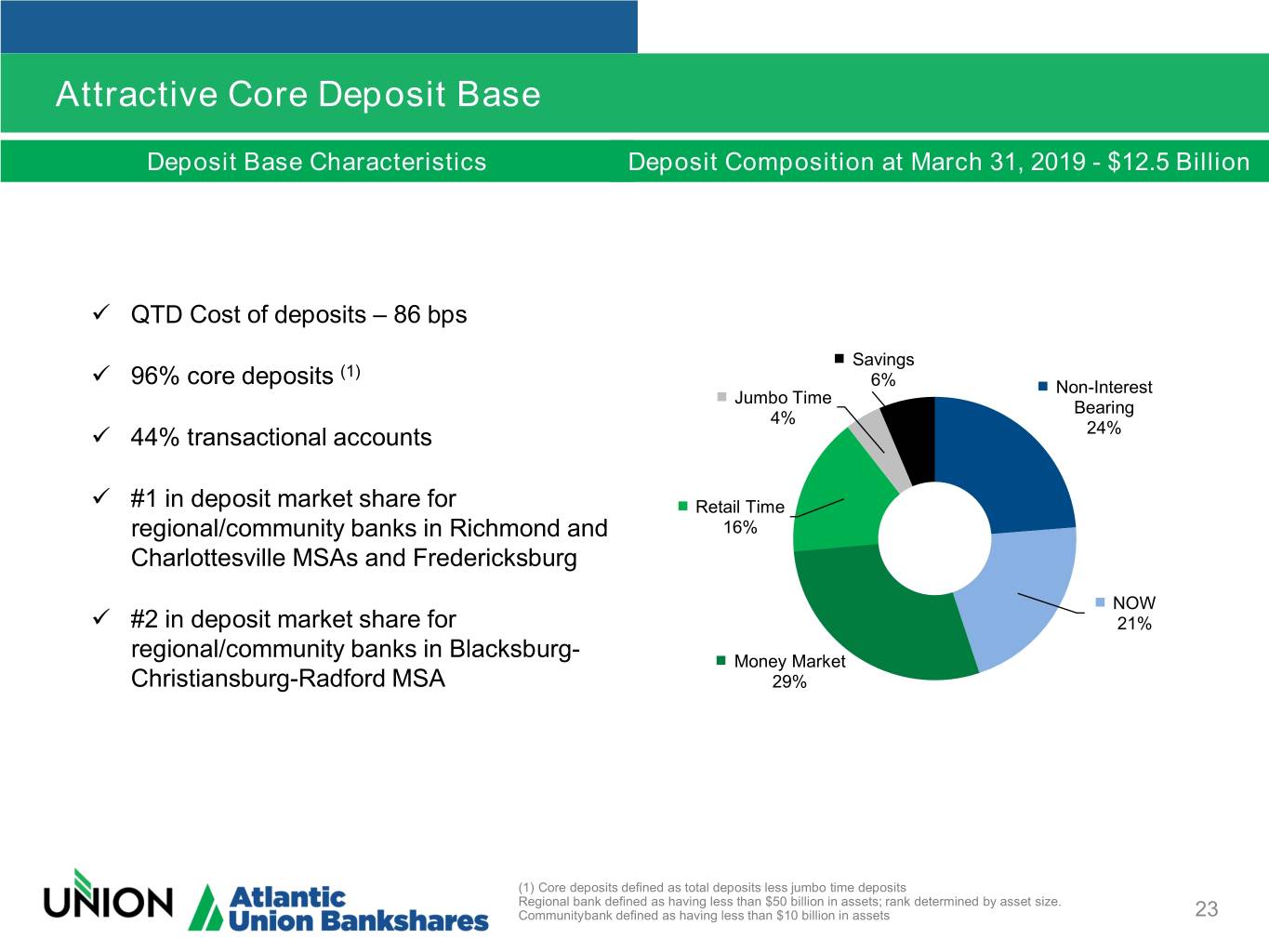

Attractive Core Deposit Base Deposit Base Characteristics Deposit Composition at March 31, 2019 - $12.5 Billion QTD Cost of deposits – 86 bps Savings (1) 96% core deposits 6% Non-Interest Jumbo Time Bearing 4% 44% transactional accounts 24% #1 in deposit market share for Retail Time regional/community banks in Richmond and 16% Charlottesville MSAs and Fredericksburg NOW #2 in deposit market share for 21% regional/community banks in Blacksburg- Money Market Christiansburg-Radford MSA 29% (1) Core deposits defined as total deposits less jumbo time deposits Regional bank defined as having less than $50 billion in assets; rank determined by asset size. Communitybank defined as having less than $10 billion in assets 23

Investment Thesis The Right The Right The Right The Right Scale Markets Team Targets • $16.9 billion in assets • Growing, economically • Deep team with broad • Targeting top tier diversified experience operating performance • Strong market share • Presence across state • Experience in M&A • ROA: 1.4% - 1.6% • Extensive product mix, integration enhanced C&I focus • Scale in the sizable • ROTCE: 16% - 18% Northern Virginia, • Attractive destination 1 Richmond and Hampton for top tier talent • Efficiency Ratio : < 50% Roads markets Well positioned to take advantage of market disruption (1) Efficiency Ratio (FTE) 24

Appendix

Executive Management Team • 2+ years at Union John Asbury • 30+ years of experience in the banking industry, primarily at Bank of America and Regions Bank President & CEO • Former President and CEO of First National Bank of Santa Fe • Joined October 2018 Maria Tedesco • 30+ years of experience in the banking industry President Union Bank & Trust • Former Chief Operating Officer for Retail at BMO Harris. • 6 years at Union Robert Gorman • 30+ years of experience in the banking industry CFO • Former Senior Vice President at SunTrust Banks, Inc. • 1+ years Union David Ring • 30+ years of experience in the banking industry Commercial Banking Group Executive • Former Head of Commercial Banking – Atlantic Region at Wells Fargo • Joined February 2019 Shawn O’Brien • 20+ years of experience in the banking industry Consumer Banking Group Executive • Former Executive Director, Consumer Segment Group and Business Planning – BBVA Compass Robert Martin • 6 years at Union • 25+ years of experience in banking, financial services and wealth management President, Union Wealth Management • Former Sun Trust Private Wealth 26

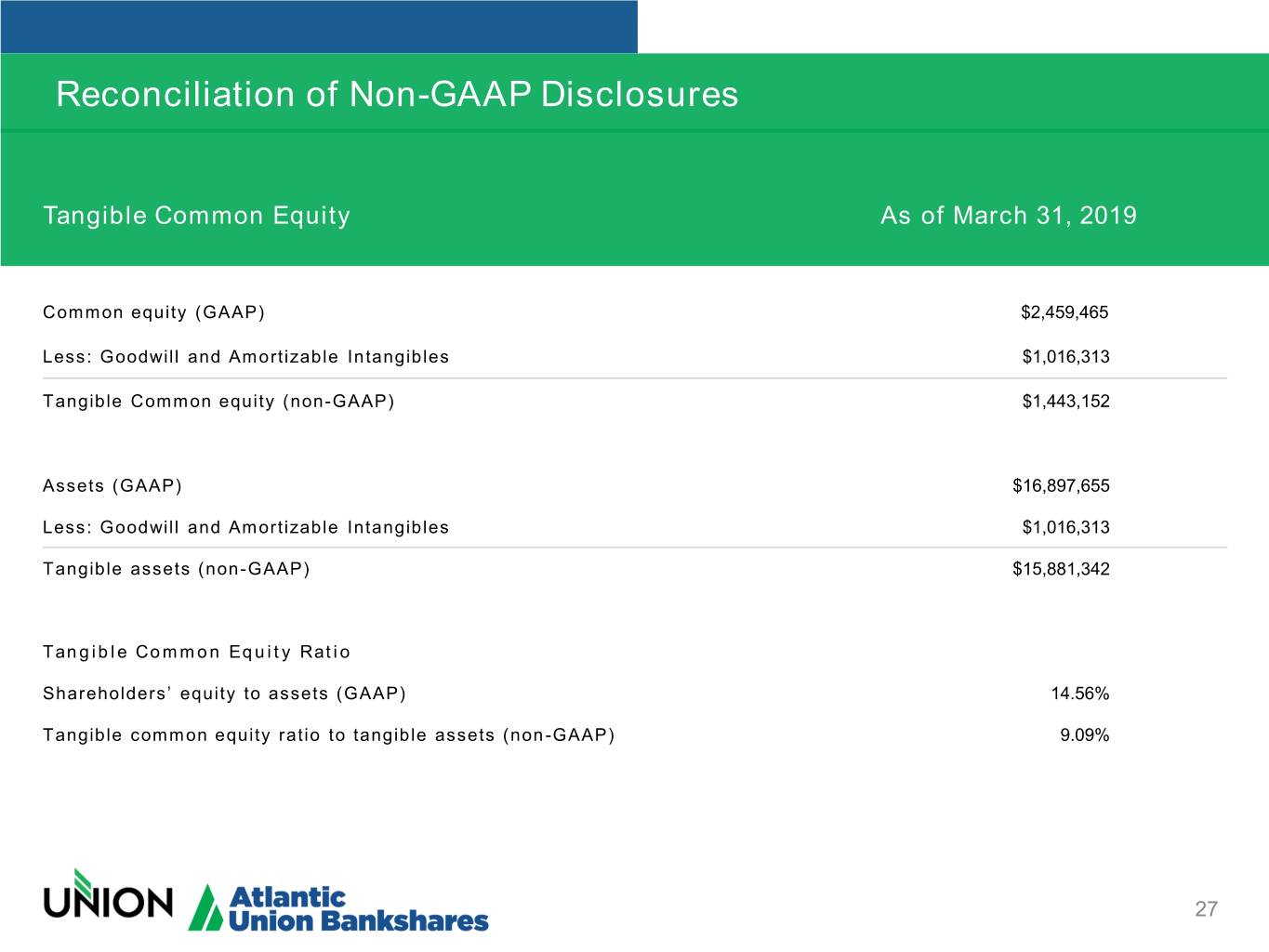

Reconciliation of Non-GAAP Disclosures Tangible Common Equity As of March 31, 2019 Common equity (GAAP) $2,459,465 Less: Goodwill and Amortizable Intangibles $1,016,313 Tangible Common equity (non-GAAP) $1,443,152 Assets (GAAP) $16,897,655 Less: Goodwill and Amortizable Intangibles $1,016,313 Tangible assets (non-GAAP) $15,881,342 Tangible Common Equity Ratio Shareholders’ equity to assets (GAAP) 14.56% Tangible common equity ratio to tangible assets (non-GAAP) 9.09% 27

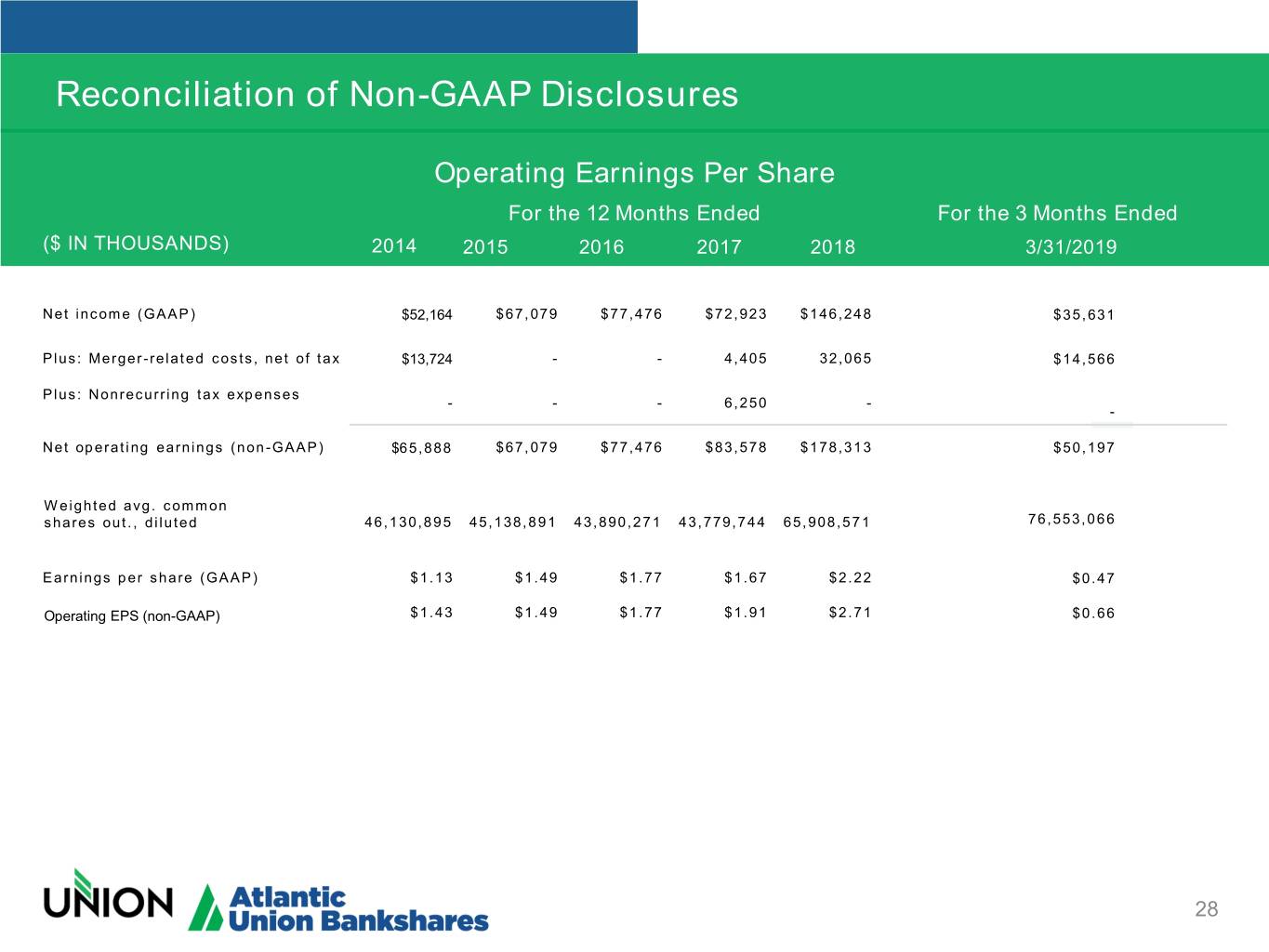

Reconciliation of Non-GAAP Disclosures Operating Earnings Per Share For the 12 Months Ended For the 3 Months Ended ($ IN THOUSANDS) 2014 2015 2016 2017 2018 3/31/2019 Net incom e (GAAP) $52,164 $67,079 $77,476 $72,923 $146,24 8 $35,631 Plus: Merger-relat e d costs, net of tax $13,724 - - 4,405 32,065 $14,566 Plus: Nonrecurring tax expenses - - - 6,250 - - Net operating earnings (non -GAAP) $65,888 $67,079 $77,476 $83,578 $178,31 3 $50,197 W eighted avg. com m on shares out., diluted 46,130,8 9 5 45,138,8 9 1 43,890,2 7 1 43,779,7 4 4 65,908,5 7 1 76,553,0 6 6 Earnings per share (GAAP) $1.13 $1.49 $1.77 $1.67 $2.22 $0.47 Operating EPS (non-GAAP) $1.43 $1.49 $1.77 $1.91 $2.71 $0.66 28

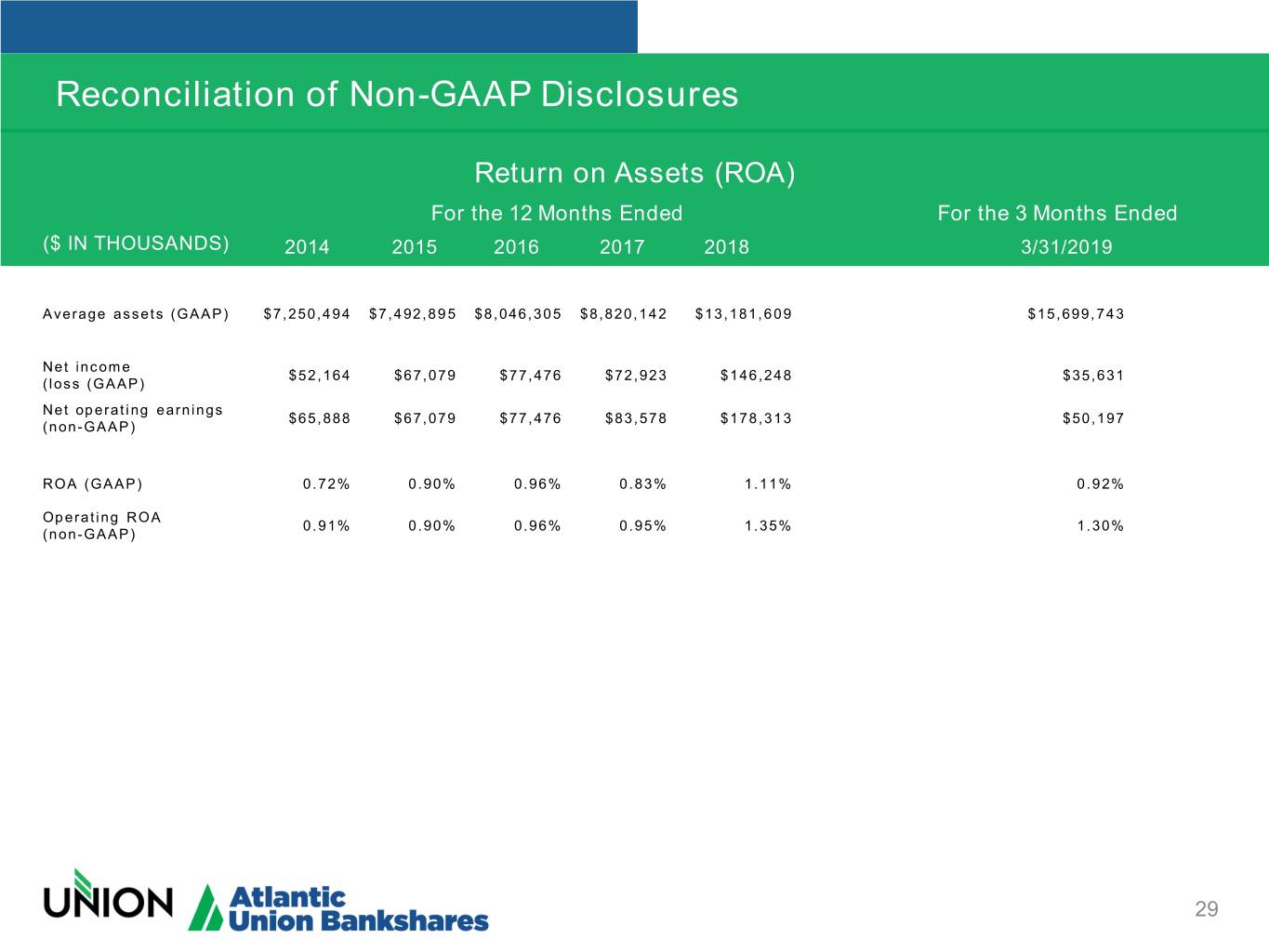

Reconciliation of Non-GAAP Disclosures Return on Assets (ROA) For the 12 Months Ended For the 3 Months Ended ($ IN THOUSANDS) 2014 2015 2016 2017 2018 3/31/2019 Average assets (GAAP) $7,250,4 9 4 $7,492,8 9 5 $8,046,3 0 5 $8,820,1 4 2 $13,181, 6 0 9 $15,699, 7 4 3 Net incom e $52,164 $67,079 $77,476 $72,923 $146,24 8 $35,631 (loss (GAAP) Net operating earnings $65,888 $67,079 $77,476 $83,578 $178,31 3 $50,197 (non-GAAP) ROA (GAAP) 0.72% 0.90% 0.96% 0.83% 1.11% 0.92% Operating ROA 0.91% 0.90% 0.96% 0.95% 1.35% 1.30% (non-GAAP) 29

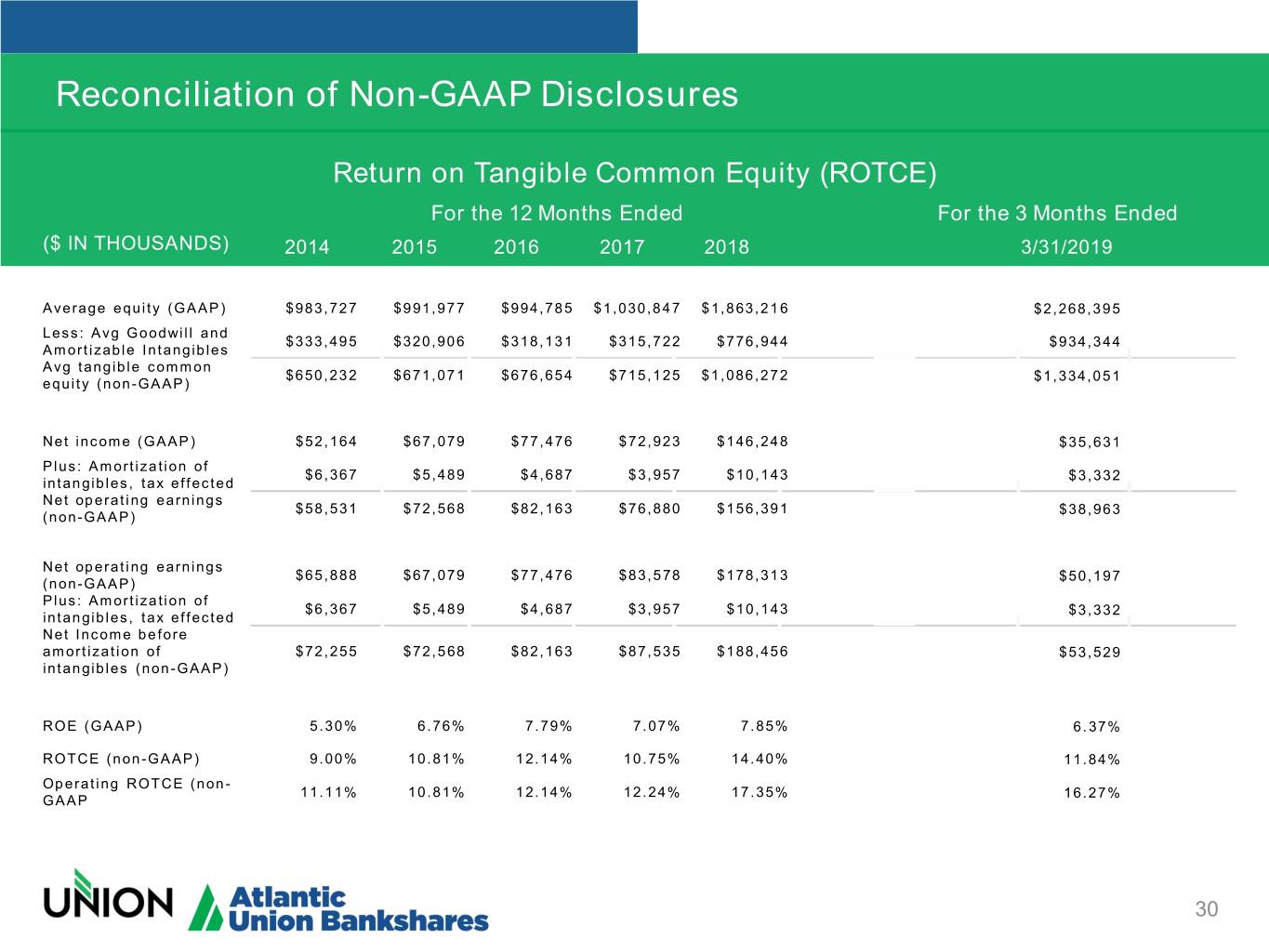

Reconciliation of Non-GAAP Disclosures Return on Tangible Common Equity (ROTCE) For the 12 Months Ended For the 3 Months Ended ($ IN THOUSANDS) 2014 2015 2016 2017 2018 3/31/2019 Average equity (GAAP) $983,72 7 $991,97 7 $994,78 5 $1,030,8 4 7 $1,863,2 1 6 $2,268,3 9 5 Less: Avg Goodwill and $333,49 5 $320,90 6 $318,13 1 $315,72 2 $776,94 4 $934,3 44 Am ortizable Intangibles Avg tangible com m on $650,23 2 $671,07 1 $676,65 4 $715,12 5 $1,086,2 7 2 $1,334,0 5 1 equity (non-GAAP) Net incom e (GAAP) $52,164 $67,079 $77,476 $72,923 $146,24 8 $35,631 Plus: Am ortization of $6,367 $5,489 $4,687 $3,957 $10,143 $3,332 intangibles, tax effected Net operating earnings $58,531 $72,568 $82,163 $76,880 $156,39 1 $38,963 (non-GAAP) Net operating earnings $65,888 $67,079 $77,476 $83,578 $178,31 3 $50,197 (non-GAAP) Plus: Am ortization of $6,367 $5,489 $4,687 $3,957 $10,143 $3,332 intangibles, tax effected Net Incom e before am ortization of $72,255 $72,568 $82,163 $87,535 $188,456 $53,529 intangibles (non -GAAP) ROE (GAAP) 5.30% 6.76% 7.79% 7.07% 7.85% 6.37% ROTCE (non-GAAP) 9.00% 10.81% 12.14% 10.75% 14.40% 11.84% Operating ROTCE (non - 11.11% 10.81% 12.14% 12.24% 17.35% 16.27% GAAP 30

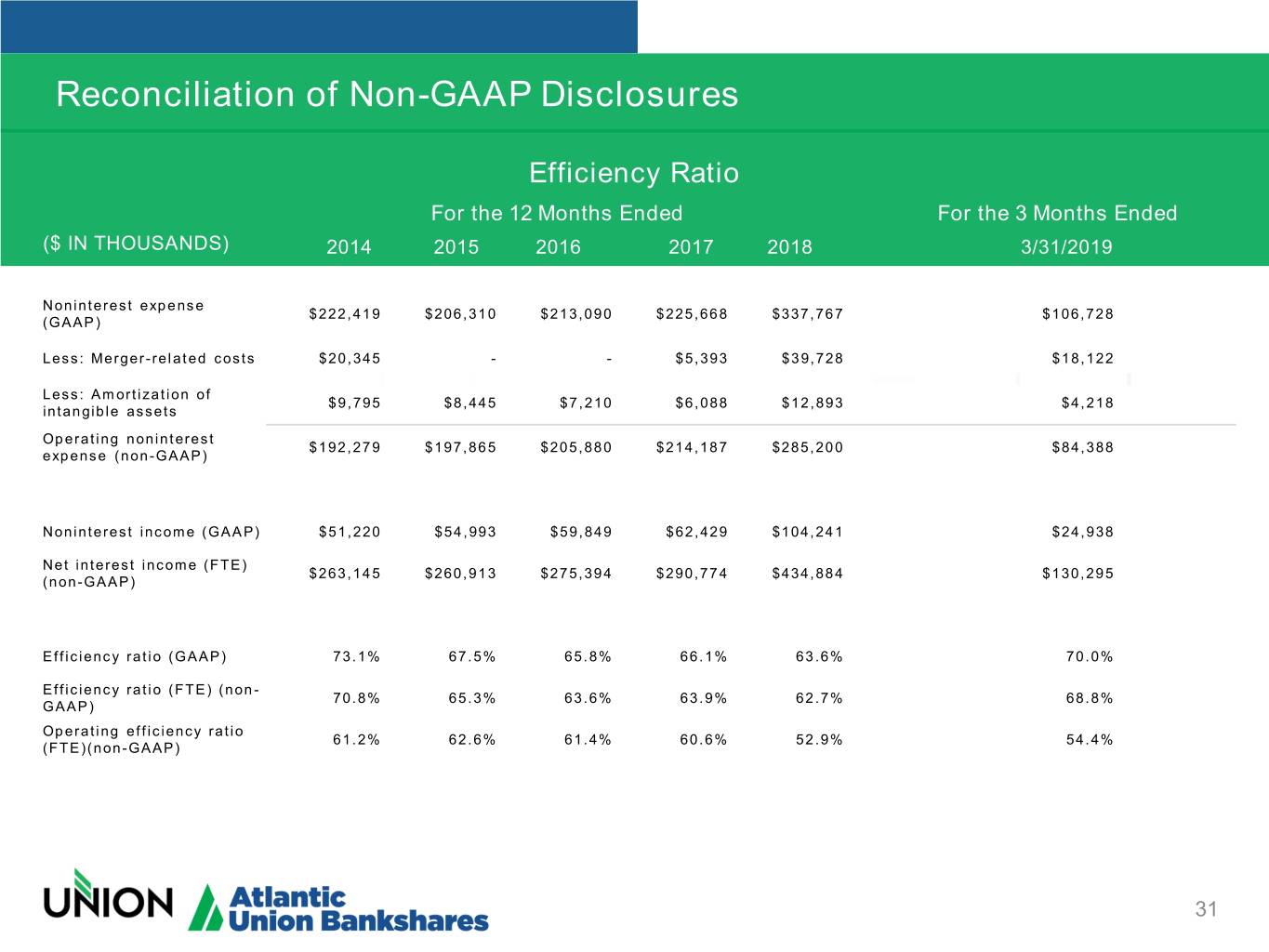

Reconciliation of Non-GAAP Disclosures Efficiency Ratio For the 12 Months Ended For the 3 Months Ended ($ IN THOUSANDS) 2014 2015 2016 2017 2018 3/31/2019 Noninterest expens e $222,41 9 $206,31 0 $213,09 0 $225,66 8 $337,76 7 $106,72 8 (GAAP) Less: Merger-rel at ed costs $20,345 - - $5,393 $39,728 $18,122 Less: Am ortization of $9,795 $8,445 $7,210 $6,088 $12,893 $4,218 intangible assets Operating noninterest $192,27 9 $197,86 5 $205,88 0 $214,18 7 $285,20 0 $84,388 expense (non-GAAP) Noninterest incom e (GAAP) $51,220 $54,993 $59,849 $62,429 $104,24 1 $24,938 Net interest incom e (FTE) $263,14 5 $260,91 3 $275,39 4 $290,77 4 $434,88 4 $130,29 5 (non-GAAP) Efficiency ratio (GAAP) 73.1% 67.5% 65.8% 66.1% 63.6% 70.0% Efficiency ratio (FTE) (non - 70.8% 65.3% 63.6% 63.9% 62.7% 68.8% GAAP) Operating efficiency ratio 61.2% 62.6% 61.4% 60.6% 52.9% 54.4% (FTE)(non-GAAP) 31

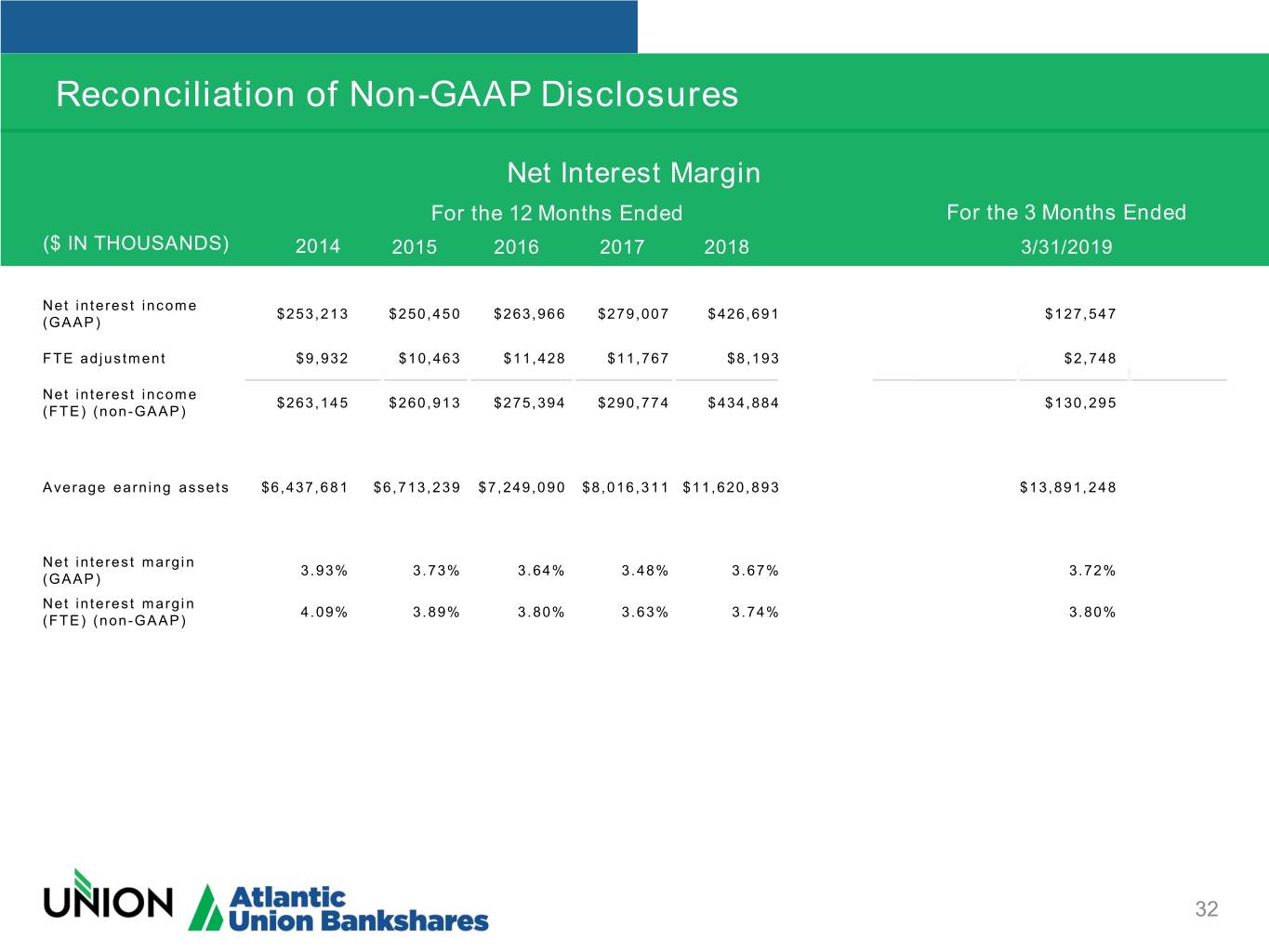

Reconciliation of Non-GAAP Disclosures Net Interest Margin For the 12 Months Ended For the 3 Months Ended ($ IN THOUSANDS) 2014 2015 2016 2017 2018 3/31/2019 Net interest incom e $253,21 3 $250,45 0 $263,96 6 $279,00 7 $426,69 1 $127,54 7 (GAAP) FTE adjustm ent $9,932 $10,463 $11,428 $11,767 $8,193 $2,748 Net interest incom e $263,14 5 $260,91 3 $275,39 4 $290,77 4 $434,88 4 $130,29 5 (FTE) (non-GAAP) Average earning assets $6,437,6 8 1 $6,713,2 3 9 $7,249,0 9 0 $8,016,3 1 1 $11,620, 8 9 3 $13,891, 2 4 8 Net interest m argin 3.93% 3.73% 3.64% 3.48% 3.67% 3.72% (GAAP) Net interest m argin 4.09% 3.89% 3.80% 3.63% 3.74% 3.80% (FTE) (non-GAAP) 32