Exhibit 99.1 Bill Cimino VICE PRESIDENT DIRECTOR OF INVESTOR RELATIONS

Forward Looking Statements Certain statements in this presentation may constitute forward-looking Please refer to the “Risk Factors” and “Management’s Discussion and statements within the meaning of the Private Securities Litigation Reform Act Analysis of Financial Condition and Results of Operation” sections of the of 1995. Forward-looking statements include, without limitation, projections, Company’s Annual Report on Form 10-K for the year ended December 31, predictions, expectations or beliefs about future events or results that are not 2017 and related disclosures in other filings, which have been filed with the statements of historical fact. Such forward-looking statements are based on Securities and Exchange Commission (the “SEC”), and are available on the various assumptions as of the time they are made, and are inherently subject SEC’s website at www.sec.gov. The actual results or developments to known and unknown risks, uncertainties, and other factors that may cause anticipated may not be realized or, even if substantially realized, they may not actual results, performance or achievements to be materially different from have the expected consequences to or effects on the Company or its those expressed or implied by such forward-looking statements. Forward- businesses or operations. You are cautioned not to rely too heavily on the looking statements are often accompanied by words that convey projected forward-looking statements contained in this presentation. Forward-looking future events or outcomes such as “expect,” “believe,” “estimate,” “plan,” statements speak only as of the date they are made and the Company does “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” not undertake any obligation to update, revise or clarify these forward-looking or words of similar meaning or other statements concerning opinions or statements, whether as a result of new information, future events or judgment of the Company and its management about future events. otherwise. Although Union Bankshares Corporation (“Union” or the “Company”) believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of the Company will not differ materially from any projected future results, performance, or achievements expressed or implied by such forward-looking statements. Actual future results, performance or achievements may differ materially from historical results or those anticipated depending on a variety of factors. 2

Additional Information Unaudited Pro Forma Financial Information No Offer or Solicitation The unaudited pro forma financial information included herein is presented for This presentation does not constitute an offer to sell or a solicitation of an offer informational purposes only and does not necessarily reflect the financial to buy any securities or a solicitation of any vote or approval with respect to results of the combined company had the companies actually been combined the proposed acquisition by Union of Access National Bank. No offer of during periods presented. The adjustments included in this unaudited pro forma securities shall be made except by means of a prospectus meeting the financial information are preliminary and may be significantly revised and may requirements of the Securities Act of 1933, as amended, and no offer to sell or not agree to actual amounts finally recorded by Union. This financial solicitation of an offer to buy shall be made in any jurisdiction in which such information does not reflect the benefits of the Access National Corporation offer, solicitation or sale would be unlawful. (“Access” or “ANCX”) merger’s expected cost savings and expense efficiencies, About Union Bankshares Corporation opportunities to earn additional revenue, potential impacts of current market conditions on revenues or asset dispositions, among other factors, and Headquartered in Richmond, Virginia, Union Bankshares Corporation (Nasdaq: includes various preliminary estimates and may not necessarily be indicative of UBSH) is the holding company for Union Bank & Trust. Union Bank & Trust has the financial position or results of operations that would have occurred if the 140 branches, 7 of which are operated as Xenith Bank, a division of Union Bank merger had been completed on the date or at the beginning of the period & Trust of Richmond, Virginia, and approximately 190 ATMs located throughout indicated or which may be attained in the future. Virginia, and in portions of Maryland and North Carolina. Non-bank affiliates of the holding company include: Old Dominion Capital Management, Inc. and Non-GAAP Financial Measures Dixon, Hubard, Feinour, & Brown, Inc., which both provide investment advisory This presentation contains certain financial information determined by methods services, and Union Insurance Group, LLC, which offers various lines of other than in accordance with generally accepted accounting policies in the insurance products. United States (“GAAP”). These non-GAAP disclosures have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Management uses these non-GAAP measures in its analysis of performance because it believes the measures are material and will be used as measures of performance by investors. Please see “Reconciliation of Non- GAAP Disclosures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure. 3

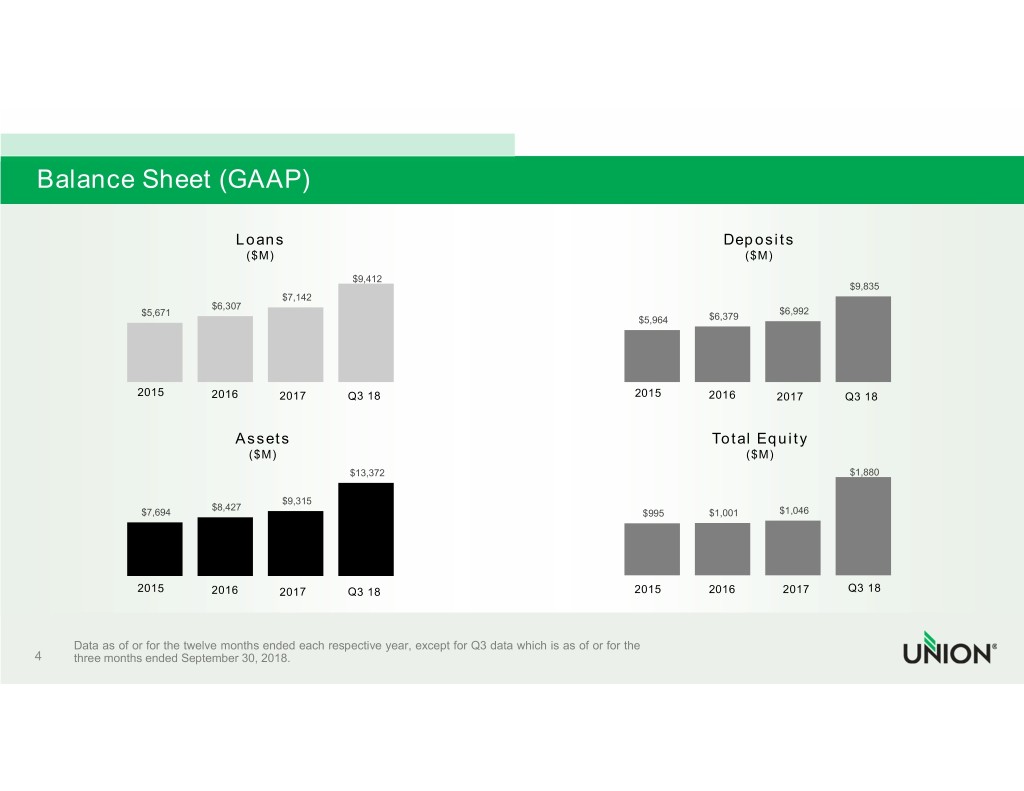

Balance Sheet (GAAP) Loans Deposits ($M) ($M) $9,412 $9,835 $7,142 $6,307 $5,671 $6,992 $5,964 $6,379 2015 2016 2017 Q3 18 2015 2016 2017 Q3 18 Assets Total Equity ($M) ($M) $13,372 $1,880 $9,315 $8,427 $7,694 $995 $1,001 $1,046 2015 2016 2017 Q3 18 2015 2016 2017 Q3 18 Data as of or for the twelve months ended each respective year, except for Q3 data which is as of or for the 4 three months ended September 30, 2018.

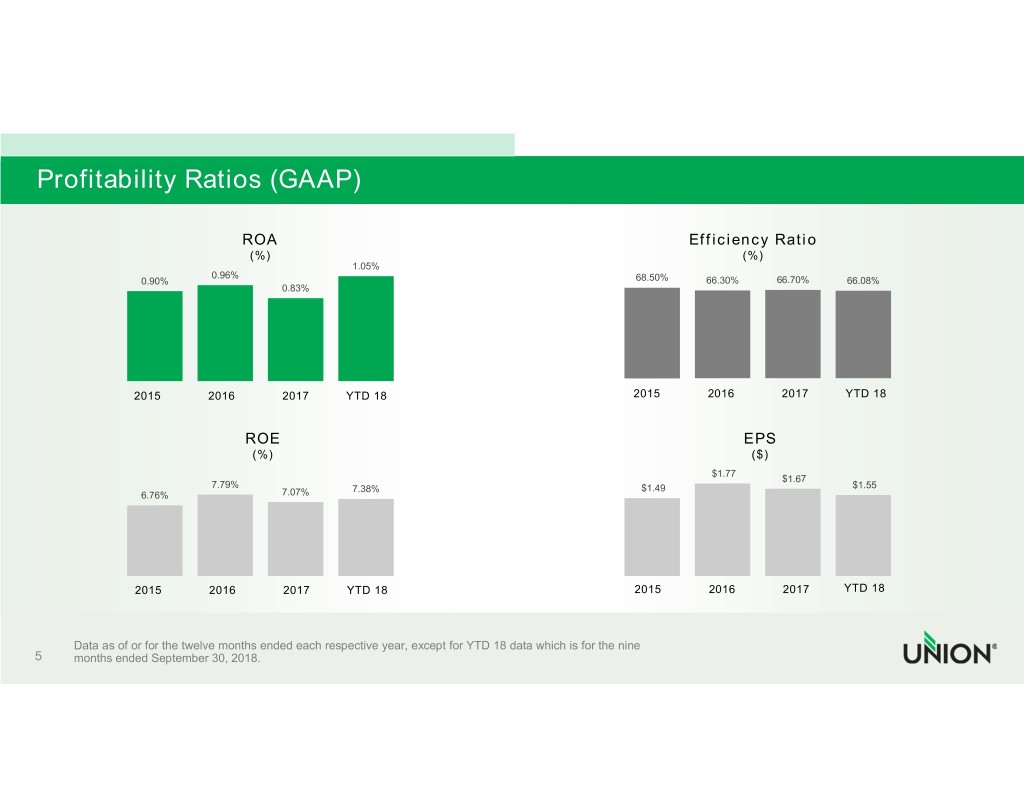

Profitability Ratios (GAAP) ROA Efficiency Ratio (%) (%) 1.05% 0.96% 0.90% 68.50% 66.30% 66.70% 66.08% 0.83% 2015 2016 2017 YTD 18 2015 2016 2017 YTD 18 ROE EPS (%) ($) $1.77 $1.67 7.79% 7.38% $1.49 $1.55 6.76% 7.07% 2015 2016 2017 YTD 18 2015 2016 2017 YTD 18 Data as of or for the twelve months ended each respective year, except for YTD 18 data which is for the nine 5 months ended September 30, 2018.

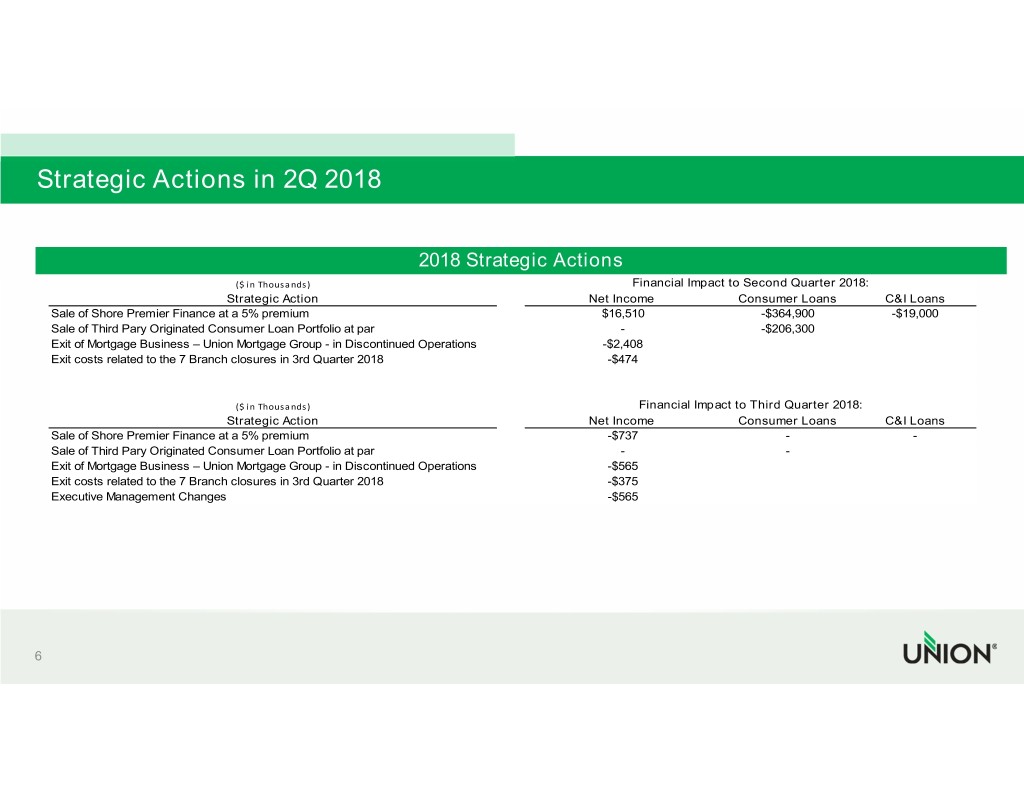

Strategic Actions in 2Q 2018 2018 Strategic Actions Financial Impact to Second Quarter 2018: ($ in Thousands) Strategic ActionFor the Twelve Months Ended 12/31 Net Income Three Consumer Months LoansEnded C&I LoansNine Months Ended (DollarsSale in of thousands) Shore Premier Finance at a 5% premium2014 2015 2016 2017 $16,510 3/31/2018 6/30/2018 -$364,900 9/30/2018 -$19,000 9/30/2018 Sale of Third Pary Originated Consumer Loan Portfolio at par - -$206,300 Sale Exitof Shore of Mortgage Premier Business Finance – at Union a 5% Mortgage pre Group$52,164 - in Discontinued $67,079 Operations $77,476 $72,923 -$2,408 $16,639 $47,327 $38,197 $102,163 Sale Exitof Third costs Pary related Originated to the 7 Branch closures in 3rd $13,724 Quarter 2018 - - $4,405 -$474 $22,236 $6,537 $1,129 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - Net operating earnings (non-GAAP) $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 $132,065 ($ in Thousands) Financial Impact to Third Quarter 2018: Weighted avg. common shares out., Strategicdiluted 46,130,895 Action 45,138,891 43,890,271 43,779,744 Net Income 65,636,262 Consumer 65,965,577 Loans 66,013,152 C&I Loans 65,873,202 Sale of Shore Premier Finance at a 5% premium -$737 - - EPS Sale(GAAP) of Third Pary Originated Consumer Loan Portfolio $1.13 at par $1.49 $1.77 $1.67 - $0.25 $0.72 - $0.58 $1.55 OperatingExit of EPS Mortgage (non-GAAP) Business – Union Mortgage Group $1.43 - in Discontinued $1.49 Operations $1.77 $1.91 -$565 $0.59 $0.82 $0.60 $2.01 Exit costs related to the 7 Branch closures in 3rd Quarter 2018 -$375 Executive Management Changes -$565 6

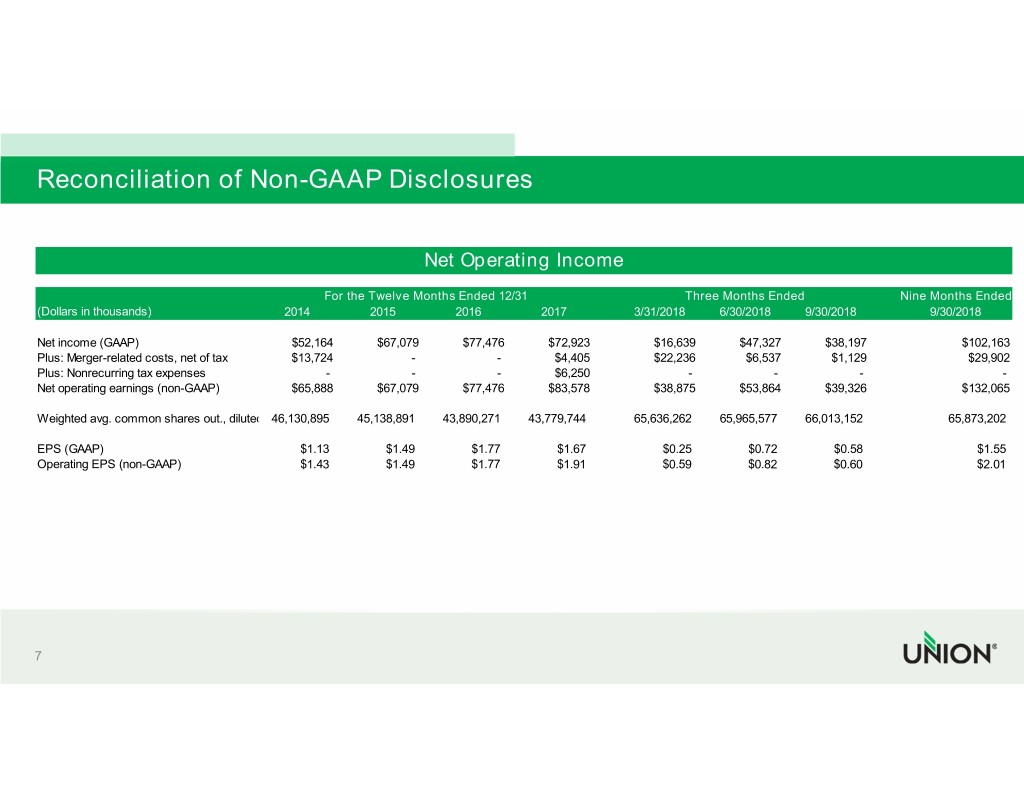

Reconciliation of Non-GAAP Disclosures Net Operating Income For the Twelve Months Ended 12/31 Three Months Ended Nine Months Ended (Dollars in thousands) 2014 2015 2016 2017 3/31/2018 6/30/2018 9/30/2018 9/30/2018 Net income (GAAP) $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 $102,163 Plus: Merger-related costs, net of tax $13,724 - - $4,405 $22,236 $6,537 $1,129 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - Net operating earnings (non-GAAP) $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 $132,065 Weighted avg. common shares out., diluted 46,130,895 45,138,891 43,890,271 43,779,744 65,636,262 65,965,577 66,013,152 65,873,202 EPS (GAAP) $1.13 $1.49 $1.77 $1.67 $0.25 $0.72 $0.58 $1.55 Operating EPS (non-GAAP) $1.43 $1.49 $1.77 $1.91 $0.59 $0.82 $0.60 $2.01 7

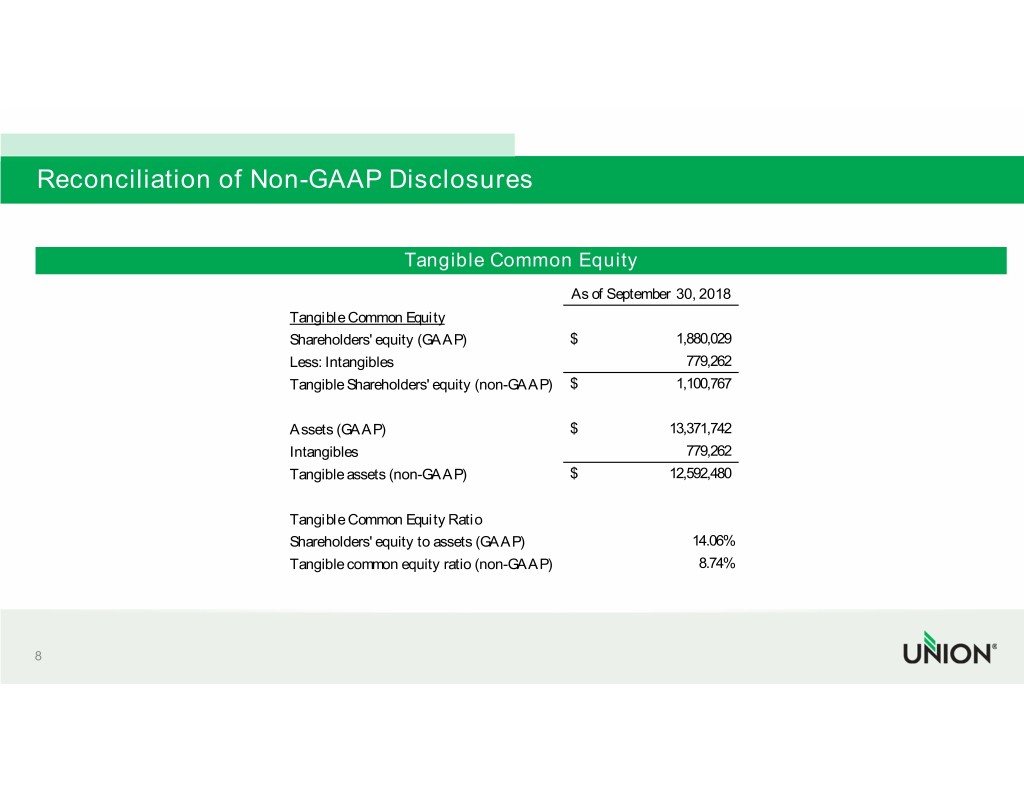

Reconciliation of Non-GAAP Disclosures Tangible Common Equity For the Twelve Months Ended 12/31As of September 30, Three 2018 Months Ended Nine Months Ended (Dollars in thousands) 2014Tangible Common 2015 Equity 2016 2017 3/31/2018 6/30/2018 9/30/2018 9/30/2018 Sale of Shore Premier Finance at a 5% pre Shareholders'$52,164 equity $67,079 (GAAP) $77,476 $72,923 $ $16,639 1,880,029 $47,327 $38,197 $102,163 Sale of Third Pary Originated Less: $13,724 Intangibles - - $4,405 $22,236 779,262 $6,537 $1,129 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - Net operating earnings (non-GAAP)Tangible $65,888 Shareholders' $67,079 equity $77,476 (non-GAAP) $83,578 $ $38,875 1,100,767 $53,864 $39,326 $132,065 Weighted avg. common shares out., diluted 46,130,895 45,138,891 43,890,271 43,779,744 65,636,262 65,965,577 66,013,152 65,873,202 Assets (GAAP) $ 13,371,742 EPS (GAAP)Intangibles $1.13 $1.49 $1.77 $1.67 $0.25 779,262 $0.72 $0.58 $1.55 Operating EPS (non-GAAP) $1.43 $1.49 $1.77 $1.91 $0.59 $0.82 $0.60 $2.01 Tangible assets (non-GAAP) $ 12,592,480 Tangible Common Equity Ratio Shareholders' equity to assets (GAAP) 14.06% Tangible common equity ratio (non-GAAP) 8.74% 8

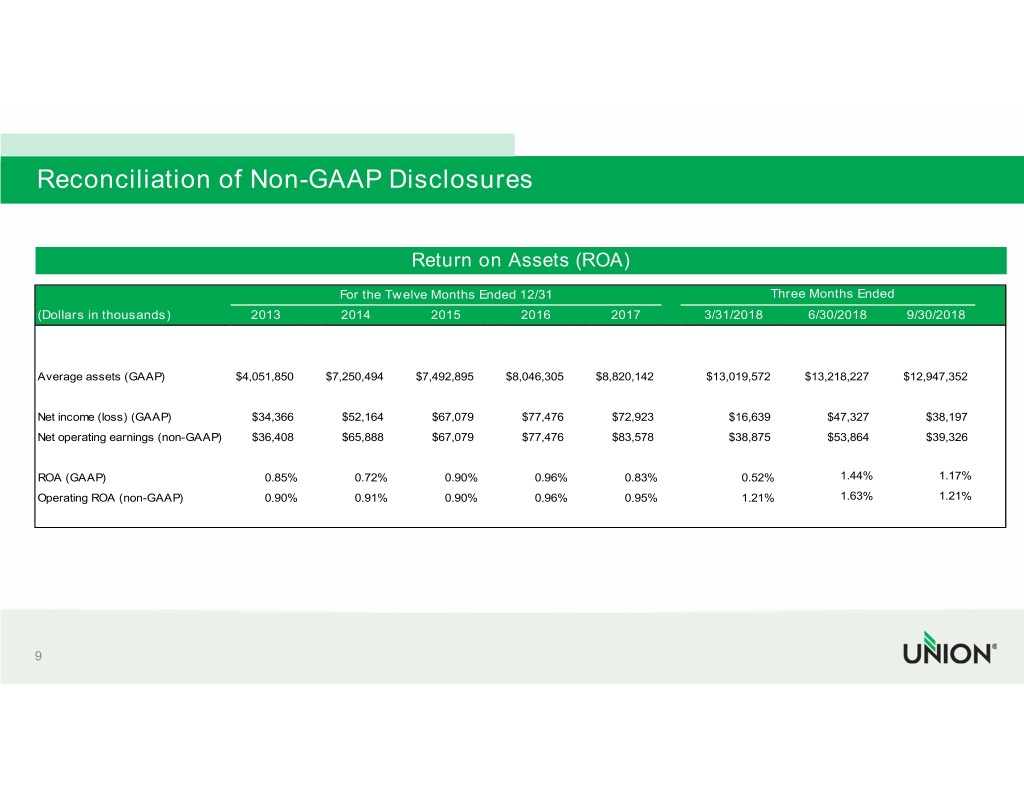

Reconciliation of Non-GAAP Disclosures Return on Assets (ROA) ForFor the the Twelve TwelveTwelve Months Months Months Ended Ended Ended 12/31 12/31 12/31 Three Months Ended Three MonthsMonths Ended Ended Nine Months Ended (Dollars(Dollars(Dollars in inthousands) inthousands) thousands) 2013 20132014 2014 2015 2015 2015 2016 2016 2016 2017 2017 2017 3/31/2018 3/31/2018 3/31/2018 6/30/2018 6/30/2018 9/30/20186/30/2018 9/30/2018 9/30/2018 9/30/2018 Sale of Shore Premier Finance at a 5% pre $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 $102,163 Sale of Third Pary Originated $13,724 - - $4,405 $22,236 $6,537 $1,129 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - Average assetsassets (GAAP) (GAAP) $4,051,850 $4,051,850 $7,250,494 $7,250,494 $7,492,895 $7,492,895 $8,046,305 $8,046,305 $8,820,142 $8,820,142 $13,019,572 $13,019,572 $13,218,227 $13,218,227 $12,947,352 $12,947,352 Net operating earnings (non-GAAP) $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 $132,065 NetWeighted income avg. (loss)(loss) common (GAAP) (GAAP) shares out., dilute $34,366 $34,366d 46,130,895 $52,164 $52,164 45,138,891 $67,079 $67,079 43,890,271 $77,476 $77,476 43,779,744 $72,923 $72,923 65,636,262 $16,639 65,965,577 $16,639 $47,327 66,013,152 $47,327 $38,197 $38,197 65,873,202 Net operating earnings (non-GAAP) $36,408 $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 NetEPS operating (GAAP) earnings (non-GAAP) $36,408 $1.13 $65,888 $1.49 $67,079 $1.77 $77,476 $1.67 $83,578 $0.25 $38,875 $0.72 $53,864 $0.58 $39,326 $1.55 Operating EPS (non-GAAP) $1.43 $1.49 $1.77 $1.91 $0.59 $0.82 $0.60 $2.01 1.44% 1.17% ROA (GAAP) 0.85% 0.85% 0.72% 0.72% 0.90% 0.90% 0.96% 0.96% 0.83% 0.83% 0.52% 0.52% 1.44% 1.17% 1.63% 1.21% Operating ROAROA (non-GAAP)(non-GAAP) 0.90% 0.90% 0.91% 0.91% 0.90% 0.90% 0.96% 0.96% 0.95% 0.95% 1.21% 1.21% 1.63% 1.21% 9

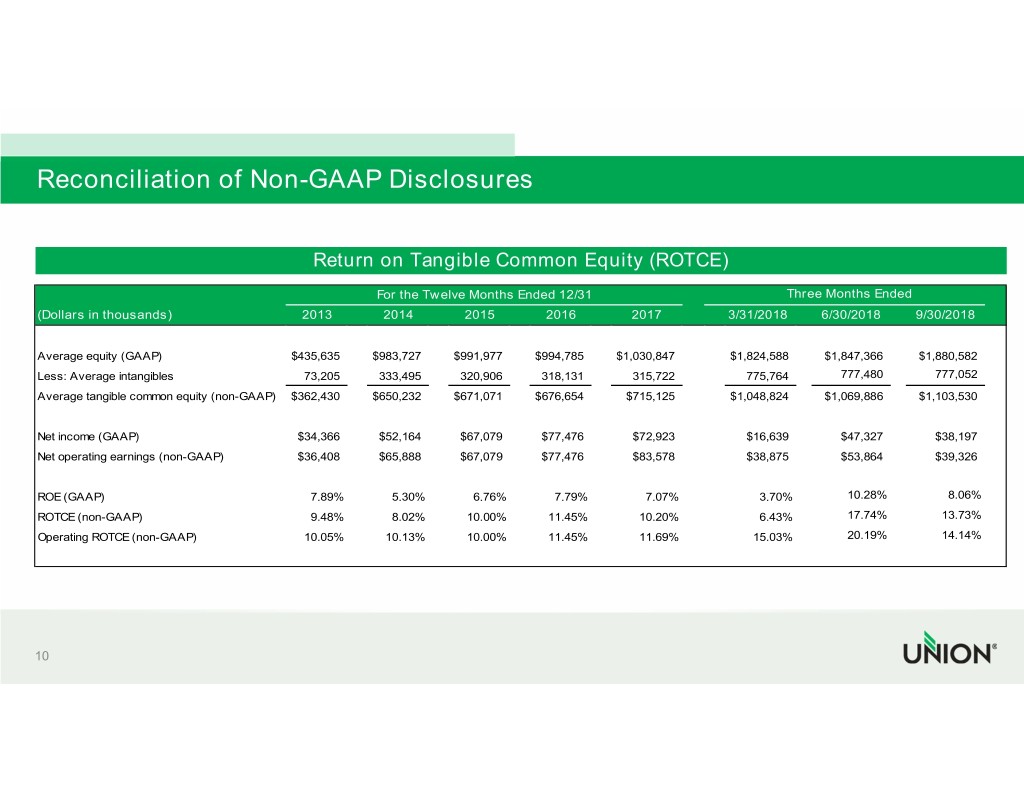

Reconciliation of Non-GAAP Disclosures Return on Tangible Common Equity (ROTCE) ForFor the the TwelveFor Twelve the Months Twelve Months Ended Months Ended 12/31 Ended 12/31 12/31 Three Months Ended Three Three Months Months Ended EndedNine Months Ended (Dollars(Dollars(Dollars in inthousands) thousands) in thousands) 20132014 2013 2014 2015 2014 2015 2016 2015 2016 2016 2017 2017 2017 3/31/2018 3/31/2018 3/31/2018 6/30/2018 6/30/2018 9/30/20186/30/2018 9/30/2018 9/30/2018 9/30/2018 Sale of Shore Premier Finance at a 5% pre $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 $102,163 SaleAverage of Third equity Pary (GAAP) Originated $435,635 $13,724 $983,727 - $991,977 - $994,785 $4,405 $1,030,847 $22,236 $1,824,588 $6,537 $1,847,366 $1,129 $1,880,582 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - AverageLess: Average assets intangibles (GAAP) $4,051,850 73,205 $7,250,494 333,495 $7,492,895 320,906 $8,046,305 318,131 $8,820,142 315,722 775,764$13,019,572 777,480 $13,218,227 777,052 $12,947,352 Net operating earnings (non-GAAP) $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 $132,065 Average tangible common equity (non-GAAP) $362,430 $650,232 $671,071 $676,654 $715,125 $1,048,824 $1,069,886 $1,103,530 NetWeighted income avg. (loss) common (GAAP) shares out., dilute $34,366d 46,130,895 $52,164 45,138,891 $67,079 43,890,271 $77,476 43,779,744 $72,923 65,636,262 65,965,577 $16,639 66,013,152 $47,327 $38,197 65,873,202 Net income (GAAP) $34,366 $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 NetEPS operating (GAAP) earnings (non-GAAP) $36,408 $1.13 $65,888 $1.49 $67,079 $1.77 $77,476 $1.67 $83,578 $0.25 $38,875 $0.72 $53,864 $0.58 $39,326 $1.55 OperatingNet operating EPS earnings (non-GAAP) (non-GAAP) $36,408 $1.43 $65,888 $1.49 $67,079 $1.77 $77,476 $1.91 $83,578 $0.59 $38,875 $0.82 $53,864 $0.60 $39,326 $2.01 ROA (GAAP) 0.85% 0.72% 0.90% 0.96% 0.83% 0.52% 1.44% 1.17% OperatingROE (GAAP) ROA (non-GAAP) 0.90% 7.89% 0.91% 5.30% 0.90% 6.76% 7.79% 0.96% 7.07% 0.95% 3.70% 1.21% 10.28%1.63% 8.06% 1.21% ROTCE (non-GAAP) 9.48% 8.02% 10.00% 11.45% 10.20% 6.43% 17.74% 13.73% Operating ROTCE (non-GAAP) 10.05% 10.13% 10.00% 11.45% 11.69% 15.03% 20.19% 14.14% 10

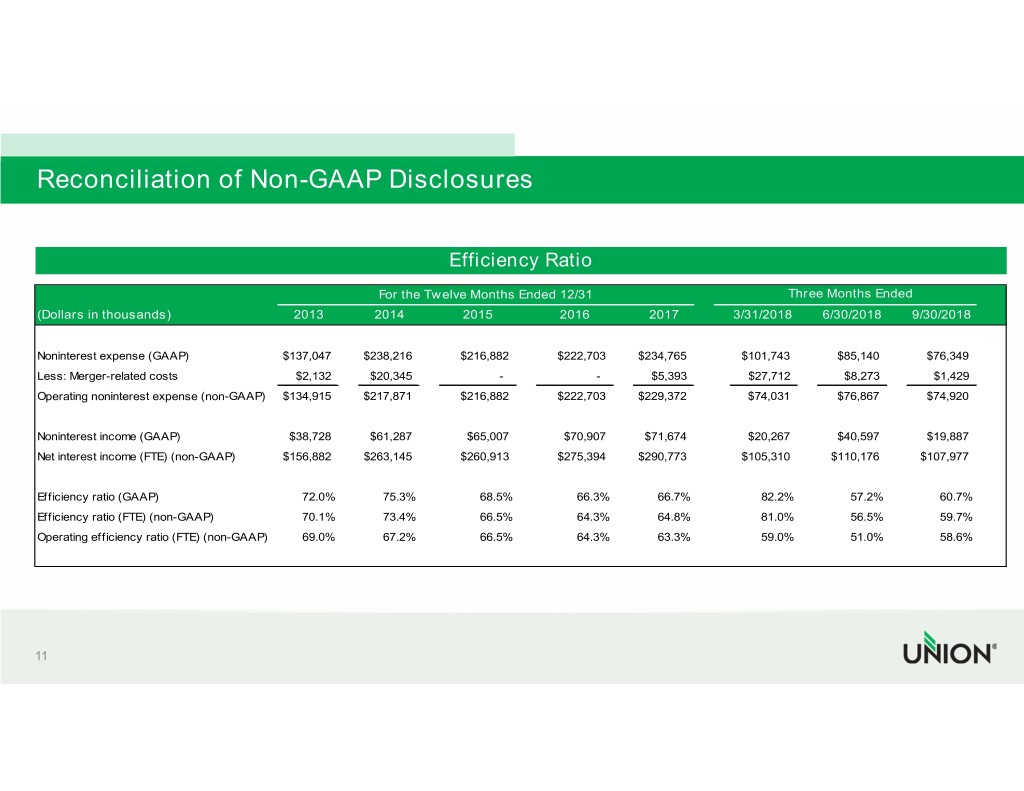

Reconciliation of Non-GAAP Disclosures Efficiency Ratio ForFor the the TwelveFor Twelve the Months Twelve Months Ended Months Ended 12/31 Ended 12/31 12/31 Three Months Ended Three Three Months Months Ended EndedNine Months Ended (Dollars(Dollars(Dollars in inthousands) thousands)in thousands) 20132014 2013 2014 2015 2014 2015 2016 2015 2016 2017 2016 2017 3/31/20182017 3/31/2018 3/31/2018 6/30/2018 6/30/2018 9/30/20186/30/2018 9/30/2018 9/30/2018 9/30/2018 Sale of Shore Premier Finance at a 5% pre $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 $102,163 SaleNoninterest of Third expense Pary Originated (GAAP) $137,047 $13,724 $238,216 - $216,882 - $222,703 $4,405 $234,765 $22,236 $101,743 $6,537 $85,140 $1,129 $76,349 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - AverageLess: Merger-related assets (GAAP) costs $4,051,850 $2,132 $7,250,494 $20,345 $7,492,895 - $8,046,305 - $8,820,142 $5,393 $13,019,572 $27,712 $8,273 $13,218,227 $1,429 $12,947,352 Net operating earnings (non-GAAP) $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 $132,065 Operating noninterest expense (non-GAAP) $134,915 $217,871 $216,882 $222,703 $229,372 $74,031 $76,867 $74,920 NetWeighted income avg. (loss) common (GAAP) shares out., dilute $34,366d 46,130,895 $52,164 45,138,891 $67,079 43,890,271 $77,476 43,779,744 $72,923 65,636,262 65,965,577 $16,639 66,013,152 $47,327 $38,197 65,873,202 Noninterest income (GAAP) $38,728 $61,287 $65,007 $70,907 $71,674 $20,267 $40,597 $19,887 NetEPS operating (GAAP) earnings (non-GAAP) $36,408 $1.13 $65,888 $1.49 $67,079 $1.77 $77,476 $1.67 $83,578 $0.25 $38,875 $0.72 $53,864 $0.58 $39,326 $1.55 OperatingNet interest EPS income (non-GAAP) (FTE) (non-GAAP) $156,882 $1.43 $263,145 $1.49 $260,913 $1.77 $275,394 $1.91 $290,773 $0.59 $105,310 $0.82 $110,176 $0.60 $107,977 $2.01 ROA (GAAP) 0.85% 0.72% 0.90% 0.96% 0.83% 0.52% 1.44% 1.17% OperatingEfficiency ratioROA (GAAP) (non-GAAP) 0.90% 72.0% 0.91% 75.3% 0.90% 68.5% 0.96% 66.3% 0.95% 66.7% 82.2% 1.21% 57.2%1.63% 60.7% 1.21% Efficiency ratio (FTE) (non-GAAP) 70.1% 73.4% 66.5% 64.3% 64.8% 81.0% 56.5% 59.7% Operating efficiency ratio (FTE) (non-GAAP) 69.0% 67.2% 66.5% 64.3% 63.3% 59.0% 51.0% 58.6% 11

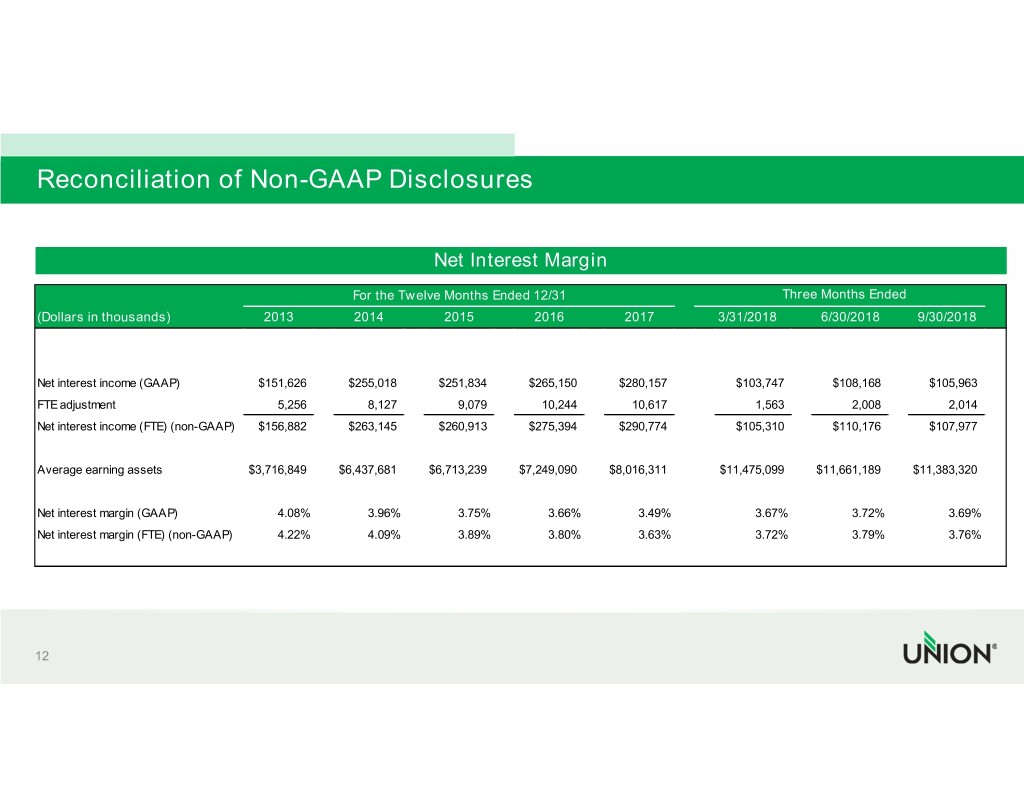

Reconciliation of Non-GAAP Disclosures Net Interest Margin ForFor theFor the Twelve the Twelve Twelve Months Months Months Ended Ended Ended 12/31 12/31 12/31 Three Months Ended Three Three Months Months Ended EndedNine Months Ended (Dollars(Dollars(Dollars in in inthousands) thousands) thousands) 2013 20132014 2014 2014 2015 2015 2015 2016 2016 2016 2017 2017 2017 3/31/2018 3/31/2018 6/30/2018 3/31/2018 9/30/20186/30/2018 6/30/2018 9/30/2018 9/30/2018 9/30/2018 Sale of Shore Premier Finance at a 5% pre $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 $102,163 Sale of Third Pary Originated $13,724 - - $4,405 $22,236 $6,537 $1,129 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - Average assets (GAAP) $4,051,850 $7,250,494 $7,492,895 $8,046,305 $8,820,142 $13,019,572 $13,218,227 $12,947,352 Net interestoperating income earnings (GAAP) (non-GAAP) $151,626 $65,888 $255,018 $67,079 $251,834 $77,476 $265,150 $83,578 $280,157 $38,875 $53,864 $103,747 $39,326 $108,168 $105,963 $132,065 FTE adjustment 5,256 8,127 9,079 10,244 10,617 1,563 2,008 2,014 Weighted avg. common shares out., diluted 46,130,895 45,138,891 43,890,271 43,779,744 65,636,262 65,965,577 66,013,152 65,873,202 Net incomeinterest (loss) income (GAAP) (FTE) (non-GAAP) $34,366 $156,882 $52,164 $263,145 $67,079 $260,913 $77,476 $275,394 $72,923 $290,774 $16,639 $105,310 $47,327 $110,176 $38,197 $107,977 NetEPS operating (GAAP) earnings (non-GAAP) $36,408 $1.13 $65,888 $1.49 $67,079 $1.77 $77,476 $1.67 $83,578 $0.25 $38,875 $0.72 $53,864 $0.58 $39,326 $1.55 OperatingAverage earning EPS (non-GAAP) assets $3,716,849 $1.43 $6,437,681 $1.49 $6,713,239 $1.77 $7,249,090 $1.91 $8,016,311 $0.59 $11,475,099 $0.82 $11,661,189 $0.60 $11,383,320 $2.01 ROA (GAAP) 0.85% 0.72% 0.90% 0.96% 0.83% 0.52% 1.44% 1.17% OperatingNet interest ROA margin (non-GAAP) (GAAP) 0.90% 4.08% 0.91% 3.96% 0.90% 3.75% 0.96% 3.66% 0.95% 3.49% 1.21% 3.67%1.63% 3.72% 1.21% 3.69% Net interest margin (FTE) (non-GAAP) 4.22% 4.09% 3.89% 3.80% 3.63% 3.72% 3.79% 3.76% 12

John Asbury PRESIDENT & CEO, UNION BANKSHARES CEO, UNION BANK & TRUST

The “New Union” Story: FROM VIRGINIA COMMUNITY BANK TO VIRGINIA’S BANK Virginia’s Bank The Union “Moat” • Franchise cannot be replicated • Virginia’s first statewide, independent bank in 20 years • “Crown jewel” deposit base - 46% transaction accounts* • The alternative to large competitors • Dense, compact and contiguous $16B bank* • Organic growth model + effective consolidator Larger Bank Executive Leadership Talent Magnet • Knows the “seams” of the large institutions & how to compete against them • Extensive hiring from larger institutions at all levels • Makes tough decisions – think differently, challenge, escape the past • 25 C&I bankers YTD, we know the people we hire and rarely use recruiters • Accustomed to more complex environment than Union • All market leaders and bankers hired from the markets they serve “Soundness, profitability & growth Underpinning for how we run our company in that order of priority” 14 * Pro Forma with Access National Bank

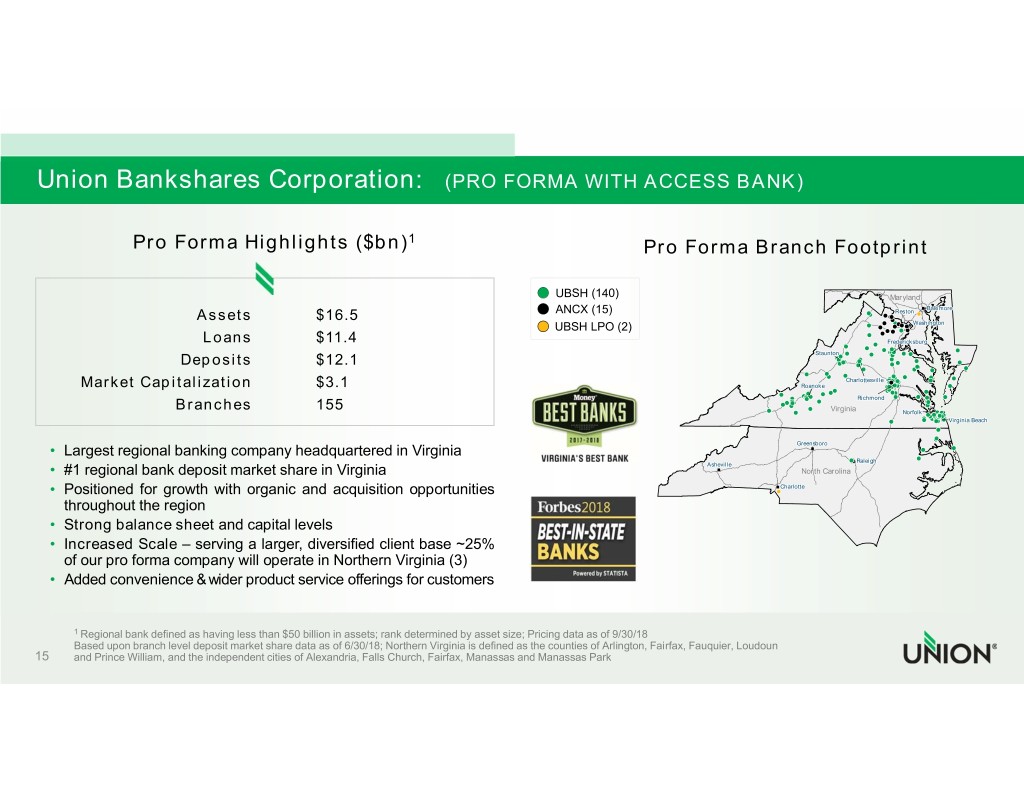

Union Bankshares Corporation: (PRO FORMA WITH ACCESS BANK) Pro Forma Highlights ($bn)1 Pro Forma Branch Footprint UBSH (140) Maryland BaltimoreBaltimore ANCX (15) RestonReston Assets $16.5 Washington UBSH LPO (2) Loans $11.4 FredericksburgFredericksburg StauntonStaunton Deposits $12.1 CharlottesvilleCharlottesville Market Capitalization $3.1 RoanokeRoanoke RichmondRichmond Branches 155 Virginia NorfolkNorfolk VirginiaVirginia BeachBeach Greensboro • Largest regional banking company headquartered in Virginia Raleigh AshevilleAsheville Raleigh • #1 regional bank deposit market share in Virginia North Carolina • Positioned for growth with organic and acquisition opportunities Charlotte throughout the region • Strong balance sheet and capital levels • Increased Scale – serving a larger, diversified client base ~25% of our pro forma company will operate in Northern Virginia (3) • Added convenience & wider product service offerings for customers 1 Regional bank defined as having less than $50 billion in assets; rank determined by asset size; Pricing data as of 9/30/18 Based upon branch level deposit market share data as of 6/30/18; Northern Virginia is defined as the counties of Arlington, Fairfax, Fauquier, Loudoun 15 and Prince William, and the independent cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park

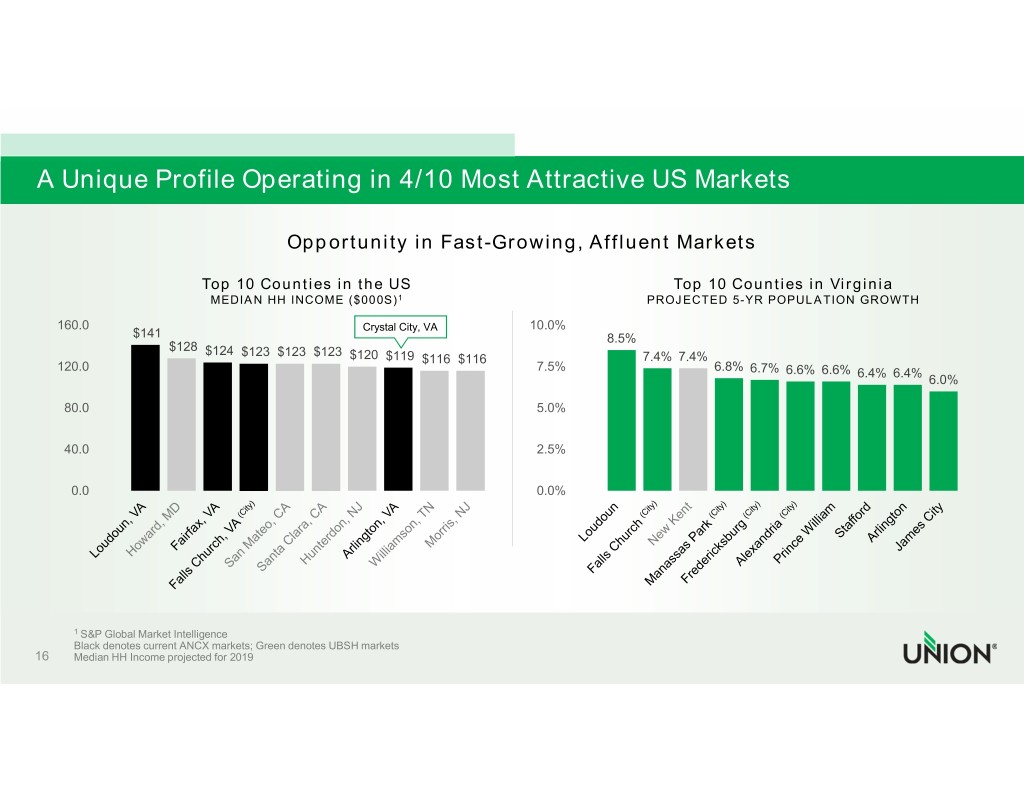

A Unique Profile Operating in 4/10 Most Attractive US Markets Opportunity in Fast-Growing, Affluent Markets Top 10 Counties in the US Top 10 Counties in Virginia MEDIAN HH INCOME ($000S)1 PROJECTED 5-YR POPULATION GROWTH 160.0 Crystal City, VA 10.0% $141 8.5% $128 $124 $123 $123 $123 $120 $119 $116 $116 7.4% 7.4% 120.0 7.5% 6.8% 6.7% 6.6% 6.6% 6.4% 6.4% 6.0% 80.0 5.0% 40.0 2.5% 0.0 0.0% 1 S&P Global Market Intelligence Black denotes current ANCX markets; Green denotes UBSH markets 16 Median HH Income projected for 2019

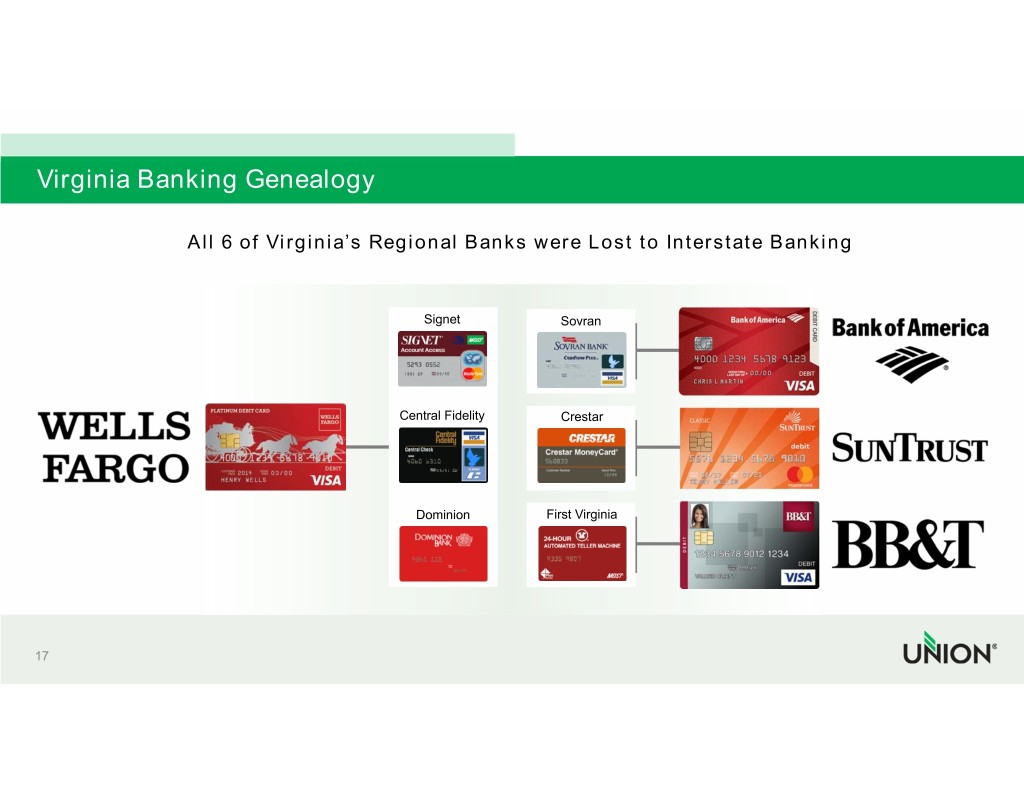

Virginia Banking Genealogy All 6 of Virginia’s Regional Banks were Lost to Interstate Banking Signet Sovran Central Fidelity Crestar Dominion First Virginia 17

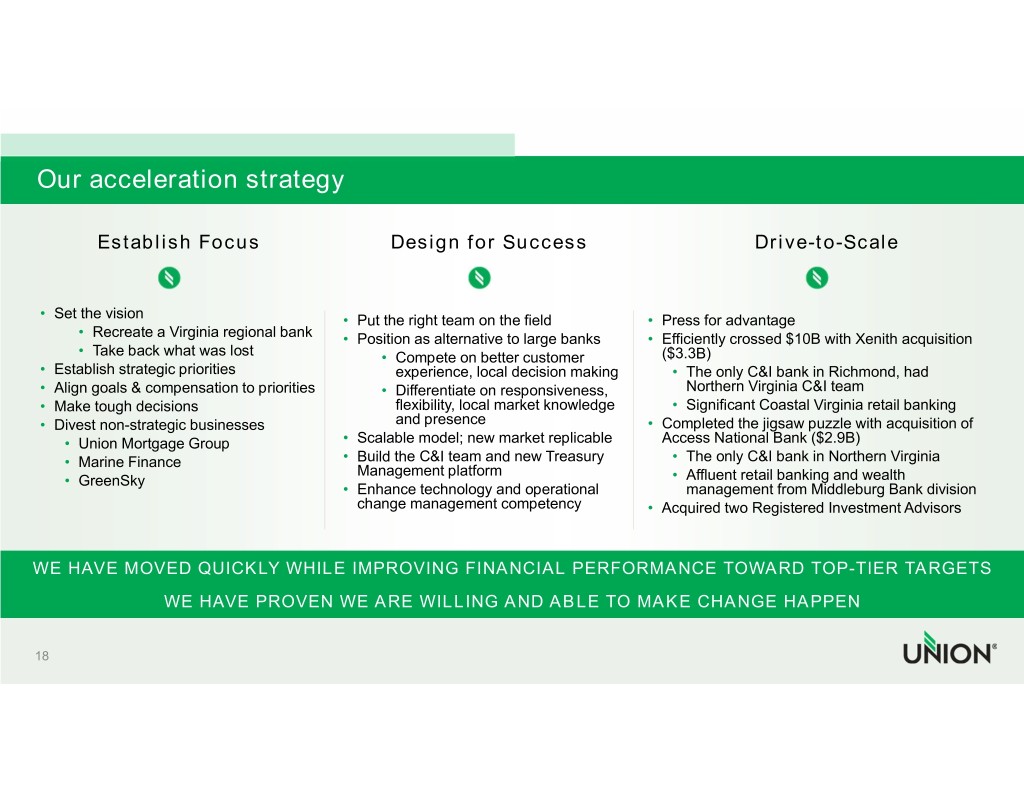

Our acceleration strategy Establish Focus Design for Success Drive-to-Scale • Set the vision • Put the right team on the field • Press for advantage • Recreate a Virginia regional bank • Position as alternative to large banks • Efficiently crossed $10B with Xenith acquisition • Take back what was lost • Compete on better customer ($3.3B) • Establish strategic priorities experience, local decision making • The only C&I bank in Richmond, had • Align goals & compensation to priorities • Differentiate on responsiveness, Northern Virginia C&I team • Make tough decisions flexibility, local market knowledge • Significant Coastal Virginia retail banking • Divest non-strategic businesses and presence • Completed the jigsaw puzzle with acquisition of • Union Mortgage Group • Scalable model; new market replicable Access National Bank ($2.9B) • Marine Finance • Build the C&I team and new Treasury • The only C&I bank in Northern Virginia Management platform • GreenSky • Affluent retail banking and wealth • Enhance technology and operational management from Middleburg Bank division change management competency • Acquired two Registered Investment Advisors WE HAVE MOVED QUICKLY WHILE IMPROVING FINANCIAL PERFORMANCE TOWARD TOP-TIER TARGETS WE HAVE PROVEN WE ARE WILLING AND ABLE TO MAKE CHANGE HAPPEN 18

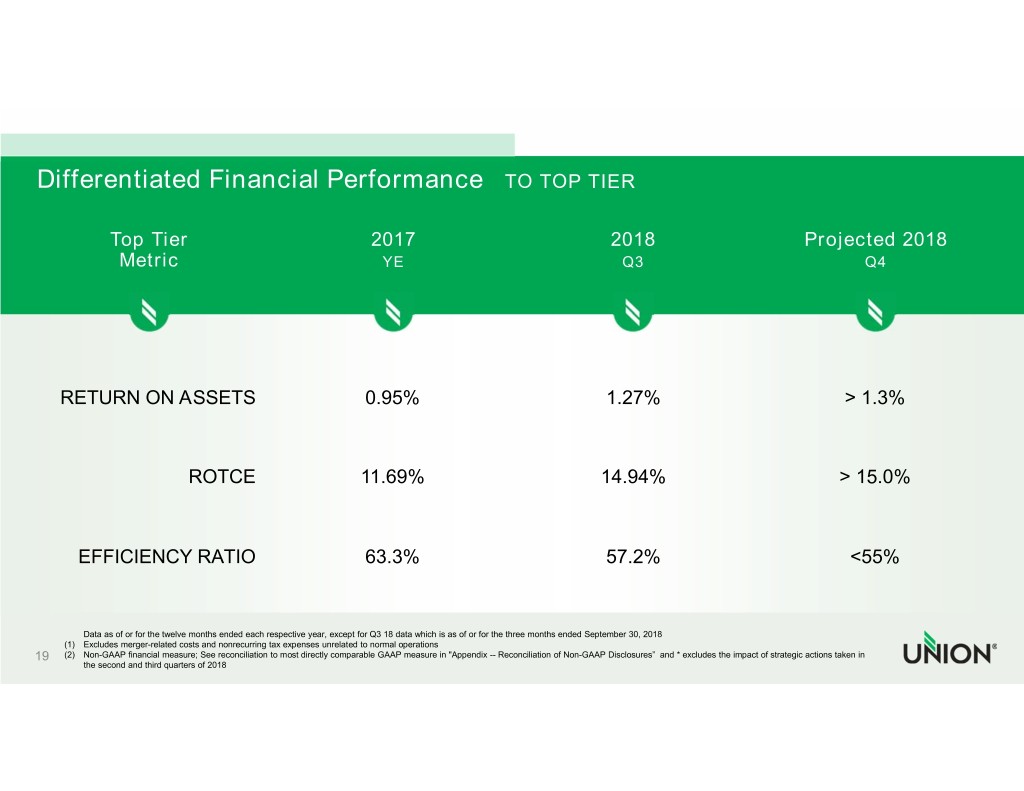

Differentiated Financial Performance TO TOP TIER Top Tier 2017 2018 Projected 2018 Metric YE Q3 Q4 RETURN ON ASSETS 0.95% 1.27% > 1.3% ROTCE 11.69% 14.94% > 15.0% EFFICIENCY RATIO 63.3% 57.2% <55% Data as of or for the twelve months ended each respective year, except for Q3 18 data which is as of or for the three months ended September 30, 2018 (1) Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations 19 (2) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures” and * excludes the impact of strategic actions taken in the second and third quarters of 2018

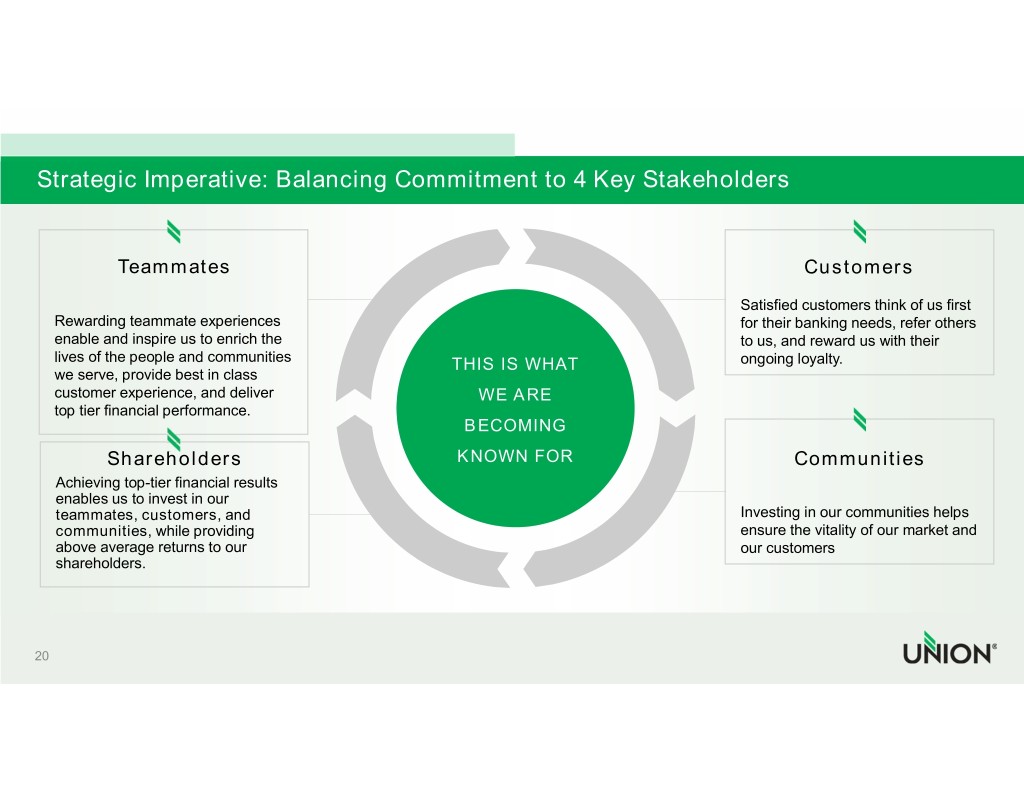

Strategic Imperative: Balancing Commitment to 4 Key Stakeholders Teammates Customers Satisfied customers think of us first Rewarding teammate experiences for their banking needs, refer others enable and inspire us to enrich the to us, and reward us with their lives of the people and communities THIS IS WHAT ongoing loyalty. we serve, provide best in class COMMERCIAL RETAIL customer experience, and deliver WE ARE top tier financial performance. BECOMING ShareholdersKNOWN FOR Communities Achieving top-tier financial results WEALTH enables us to invest in our teammates, customers, and Investing in our communities helps communities, while providing ensure the vitality of our market and above average returns to our our customers shareholders. 20

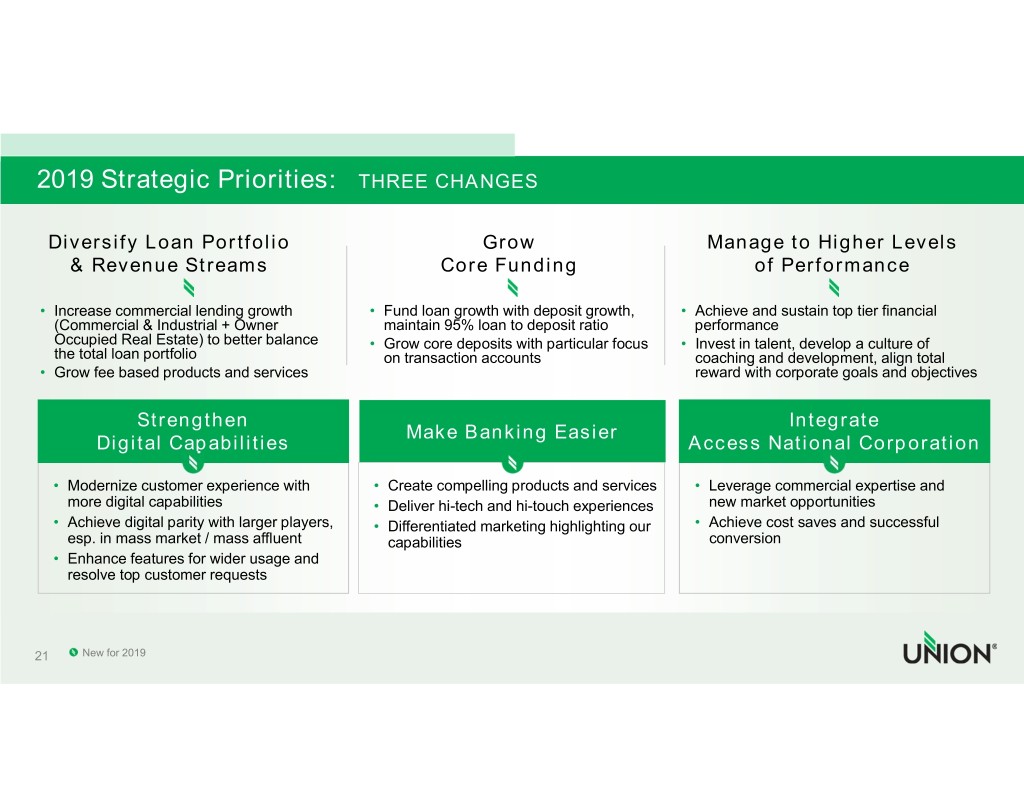

2019 Strategic Priorities: THREE CHANGES Diversify Loan Portfolio Grow Manage to Higher Levels & Revenue Streams Core Funding of Performance • Increase commercial lending growth • Fund loan growth with deposit growth, • Achieve and sustain top tier financial (Commercial & Industrial + Owner maintain 95% loan to deposit ratio performance Occupied Real Estate) to better balance • Grow core deposits with particular focus • Invest in talent, develop a culture of the total loan portfolio on transaction accounts coaching and development, align total • Grow fee based products and services reward with corporate goals and objectives Strengthen Integrate Make Banking Easier Digital Capabilities Access National Corporation • Modernize customer experience with • Create compelling products and services • Leverage commercial expertise and more digital capabilities • Deliver hi-tech and hi-touch experiences new market opportunities • Achieve digital parity with larger players, • Differentiated marketing highlighting our • Achieve cost saves and successful esp. in mass market / mass affluent capabilities conversion • Enhance features for wider usage and resolve top customer requests 21 New for 2019

Maria Tedesco PRESIDENT UNION BANK & TRUST

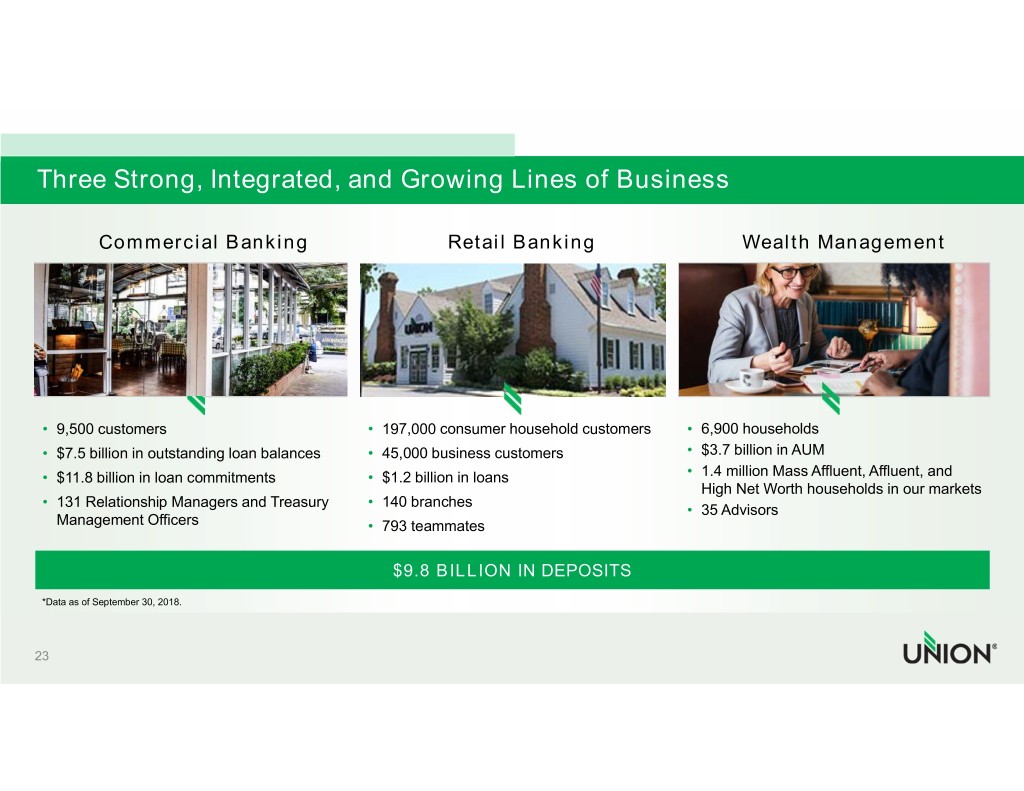

Three Strong, Integrated, and Growing Lines of Business Commercial Banking Retail Banking Wealth Management • 9,500 customers • 197,000 consumer household customers • 6,900 households • $7.5 billion in outstanding loan balances • 45,000 business customers • $3.7 billion in AUM • $11.8 billion in loan commitments • $1.2 billion in loans • 1.4 million Mass Affluent, Affluent, and High Net Worth households in our markets • 131 Relationship Managers and Treasury • 140 branches • 35 Advisors Management Officers • 793 teammates $9.8 BILLION IN DEPOSITS *Data as of September 30, 2018. 23

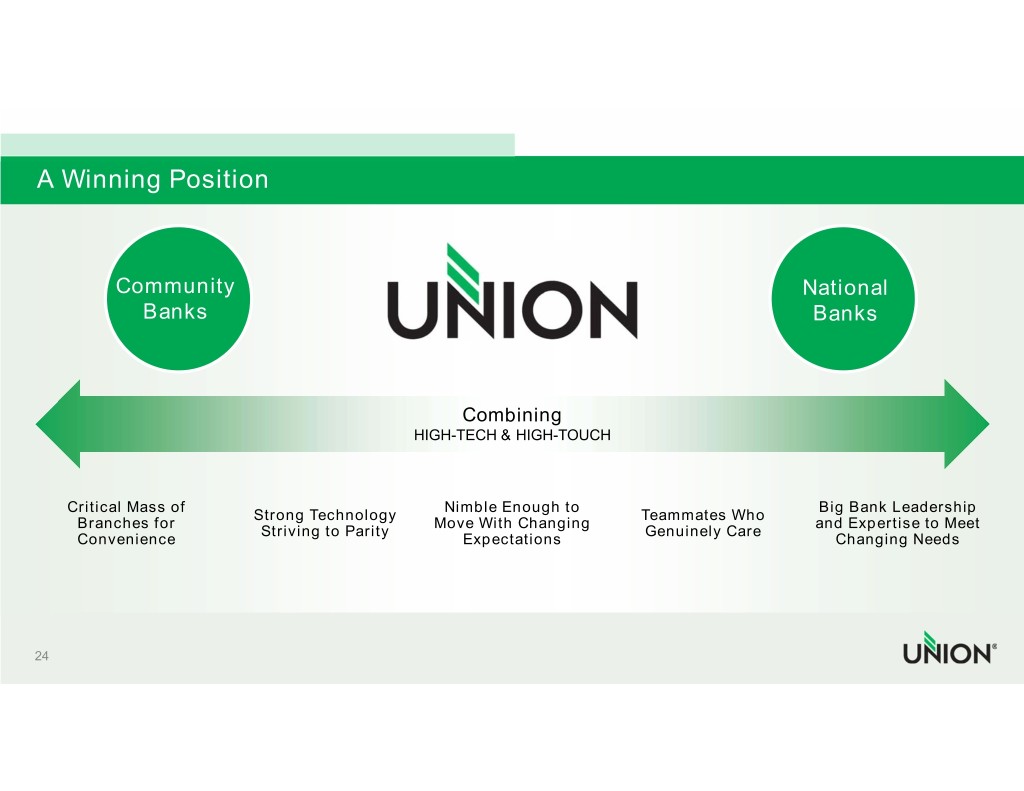

A Winning Position Community National Banks Banks Combining HIGH-TECH & HIGH-TOUCH Critical Mass of Nimble Enough to Big Bank Leadership Strong Technology Teammates Who Branches for Move With Changing and Expertise to Meet Striving to Parity Genuinely Care Convenience Expectations Changing Needs 24

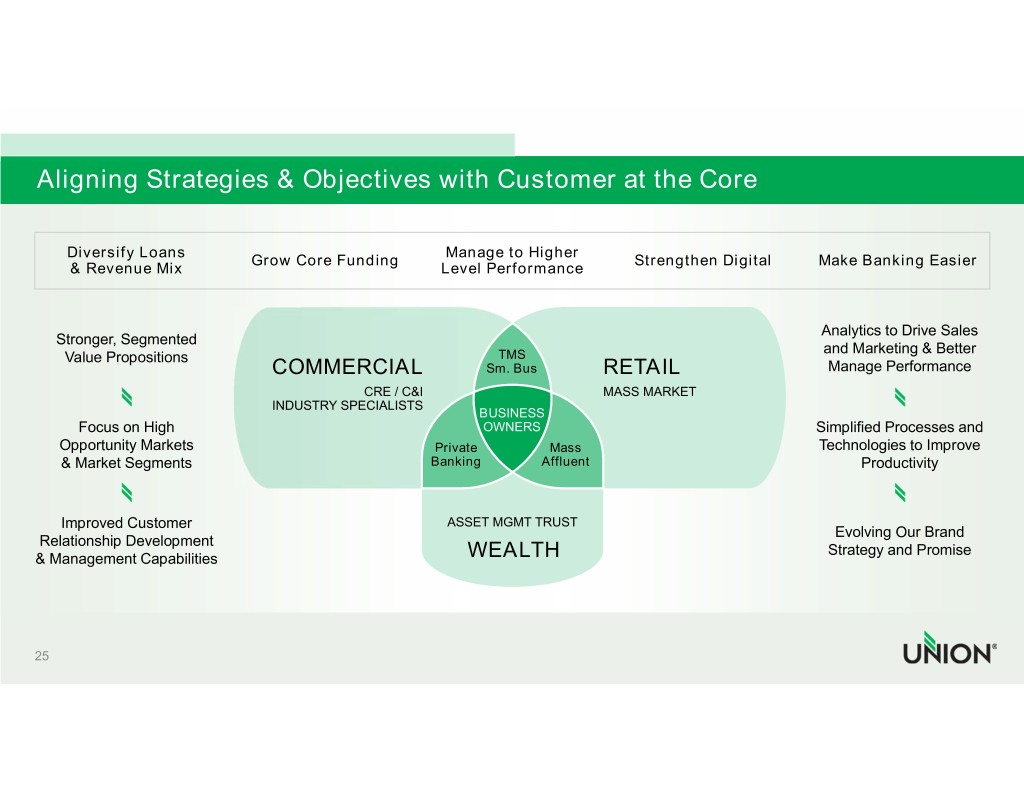

Aligning Strategies & Objectives with Customer at the Core Diversify Loans Manage to Higher Grow Core Funding Strengthen Digital Make Banking Easier & Revenue Mix Level Performance Analytics to Drive Sales Stronger, Segmented and Marketing & Better Value Propositions TMS COMMERCIAL Sm. Bus RETAIL Manage Performance CRE / C&I MASS MARKET INDUSTRY SPECIALISTS BUSINESS Focus on High OWNERS Simplified Processes and Opportunity Markets Private Mass Technologies to Improve & Market Segments Banking Affluent Productivity Improved Customer ASSET MGMT TRUST Evolving Our Brand Relationship Development Strategy and Promise & Management Capabilities WEALTH 25

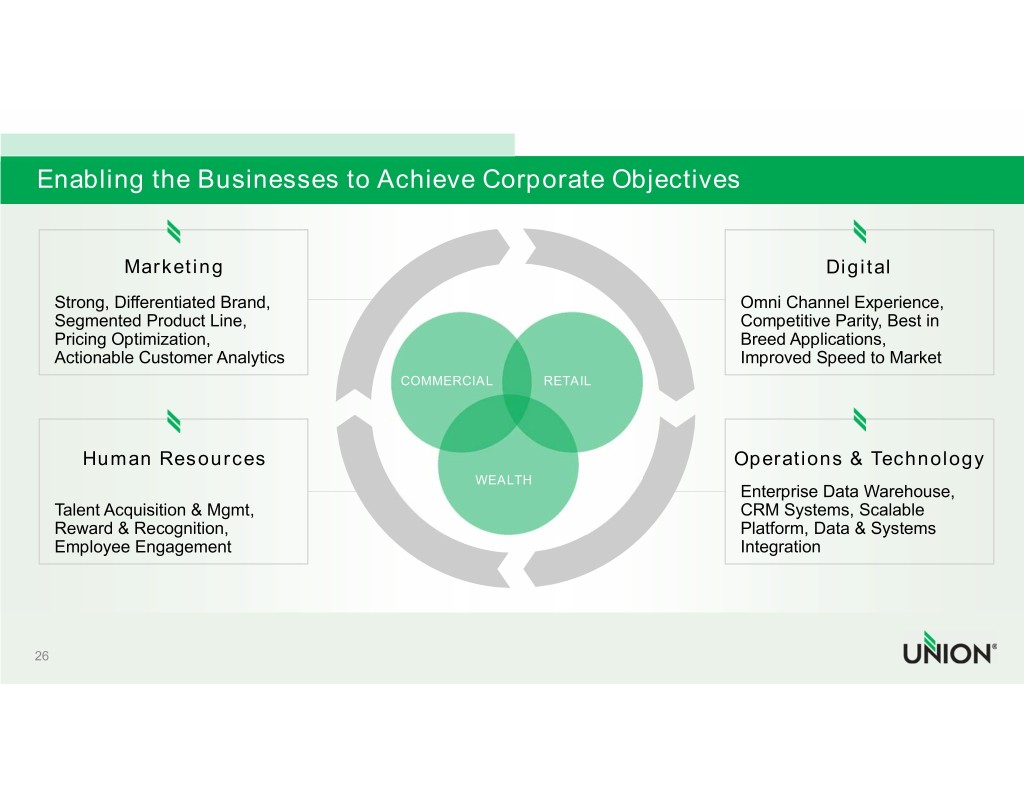

Enabling the Businesses to Achieve Corporate Objectives Marketing Digital Strong, Differentiated Brand, Omni Channel Experience, Segmented Product Line, Competitive Parity, Best in Pricing Optimization, Breed Applications, Actionable Customer Analytics Improved Speed to Market COMMERCIAL RETAIL Human Resources Operations & Technology WEALTH Enterprise Data Warehouse, Talent Acquisition & Mgmt, CRM Systems, Scalable Reward & Recognition, Platform, Data & Systems Employee Engagement Integration 26

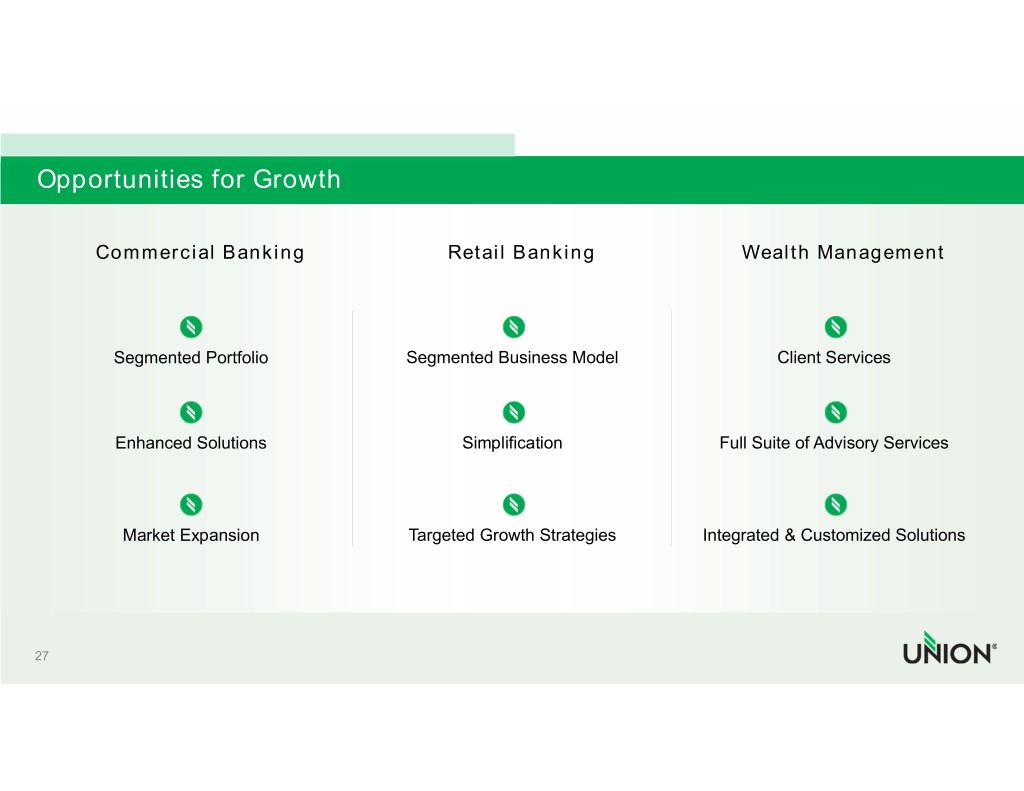

Opportunities for Growth Commercial Banking Retail Banking Wealth Management Segmented Portfolio Segmented Business Model Client Services Enhanced Solutions Simplification Full Suite of Advisory Services Market Expansion Targeted Growth Strategies Integrated & Customized Solutions 27

Ours is a Story of Growth Exciting Growth Opportunities ACROSS MARKETS AND BUSINESSES Our Markets are Broad Customer Franchise Attractive and Expanding Significant Relationship Potential Multiple Business Leveraging Ability Highly Engaged Teammates More Value to Customers and Prospects Ready to Continue to Build and Improve Union 28

David Ring COMMERCIAL BANKING GROUP EXECUTIVE

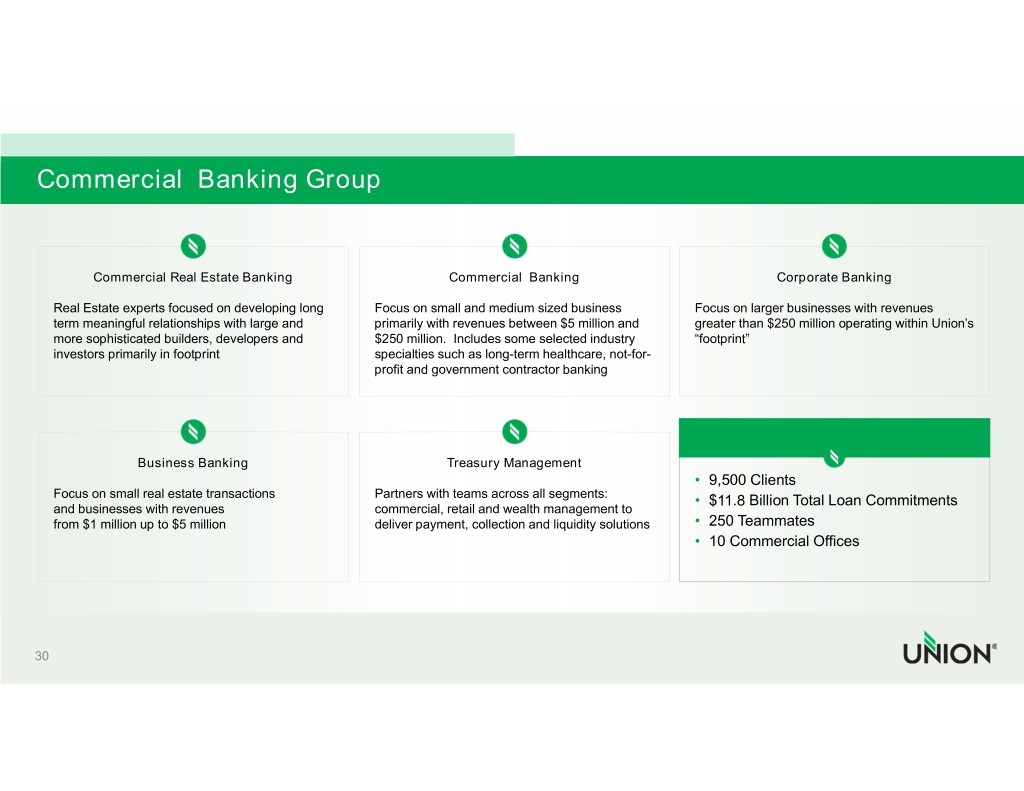

Commercial Banking Group Commercial Real Estate Banking Commercial Banking Corporate Banking Real Estate experts focused on developing long Focus on small and medium sized business Focus on larger businesses with revenues term meaningful relationships with large and primarily with revenues between $5 million and greater than $250 million operating within Union’s more sophisticated builders, developers and $250 million. Includes some selected industry “footprint” investors primarily in footprint specialties such as long-term healthcare, not-for- profit and government contractor banking Business Banking Treasury Management • 9,500 Clients Focus on small real estate transactions Partners with teams across all segments: • $11.8 Billion Total Loan Commitments and businesses with revenues commercial, retail and wealth management to from $1 million up to $5 million deliver payment, collection and liquidity solutions • 250 Teammates • 10 Commercial Offices 30

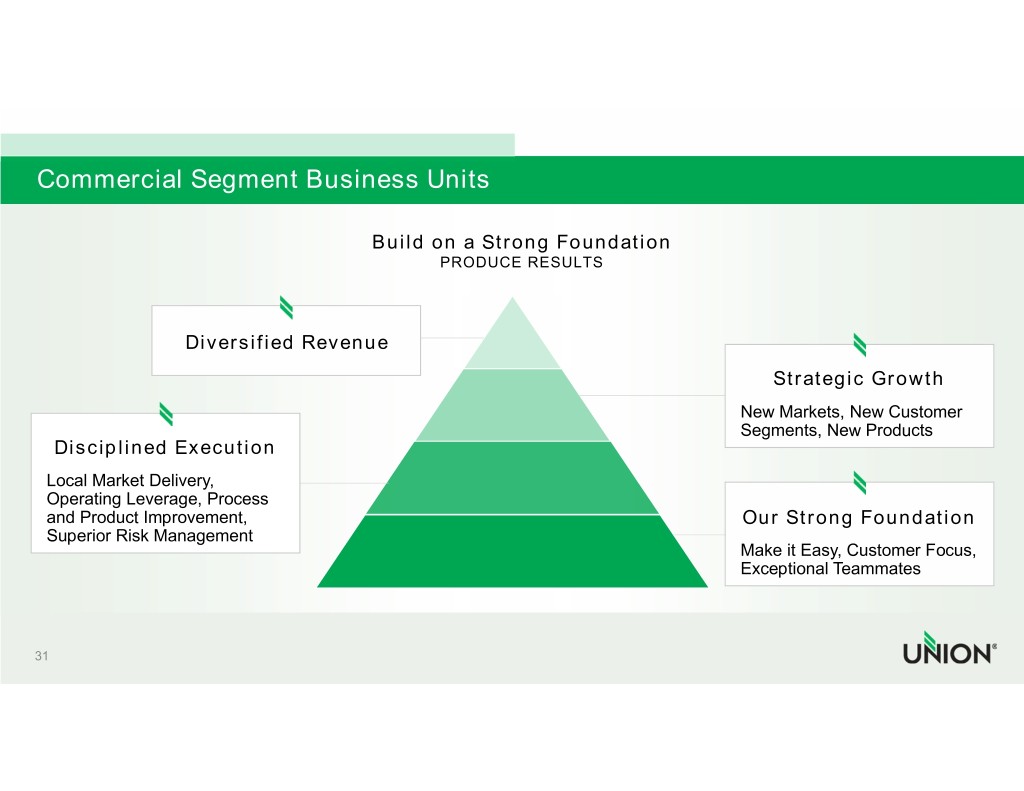

Commercial Segment Business Units Build on a Strong Foundation PRODUCE RESULTS Diversified Revenue Strategic Growth New Markets, New Customer Segments, New Products Disciplined Execution Local Market Delivery, Operating Leverage, Process and Product Improvement, Our Strong Foundation Superior Risk Management Make it Easy, Customer Focus, Exceptional Teammates 31

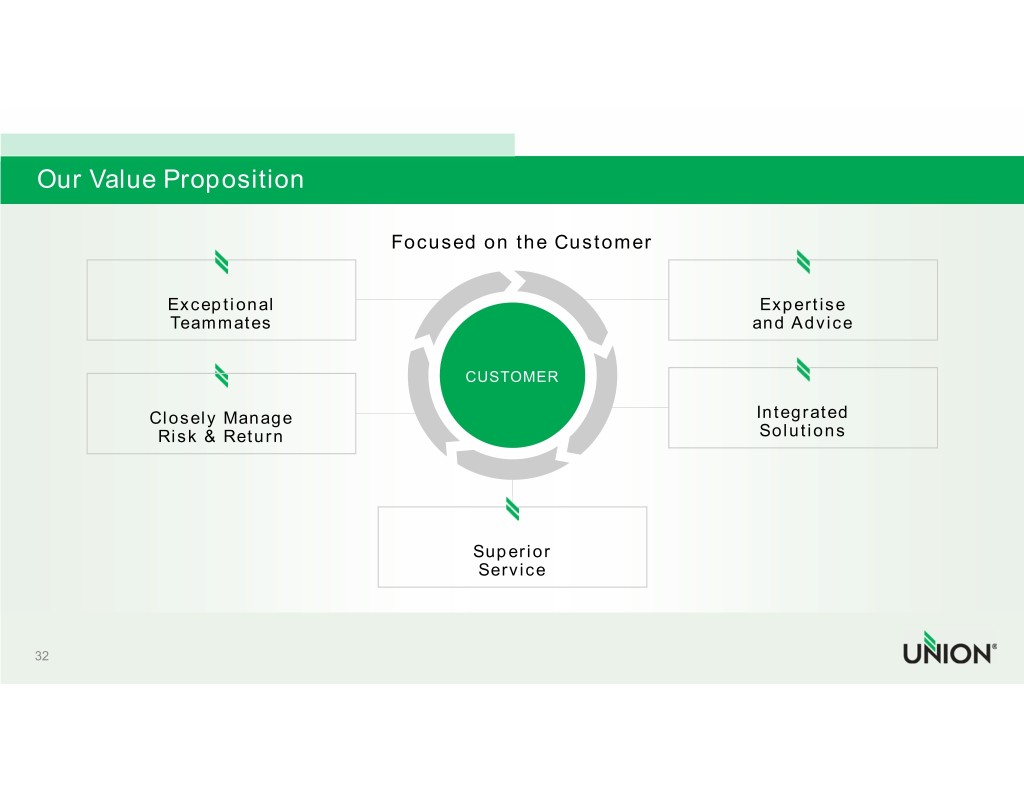

Our Value Proposition Focused on the Customer Exceptional Expertise Teammates and Advice CUSTOMER Closely Manage Integrated Risk & Return Solutions Superior Service 32

Our Value Proposition: EXPERTISE AND ADVICE “We’ve come to rely deeply on Charlie’s advice regarding our acquisition strategy.” - Stuart Farrell, Managing Partner Tuckahoe Holdings 33

Our Value Proposition: EXCEPTIONAL TEAMMATES 34

Our Value Proposition: CONSISTENT SUPERIOR SERVICE “A rare combination of financial savvy, people skills, and wisdom.” - Adam Fried, Atlantic Builders CEO describing Commercial Banker Pete Humes 35

Our Value Proposition: SEAMLESS ORCHESTRATION OF SOLUTIONS With their Union banker’s help, Keswick Vineyards is producing more award-winning wine than ever. 36

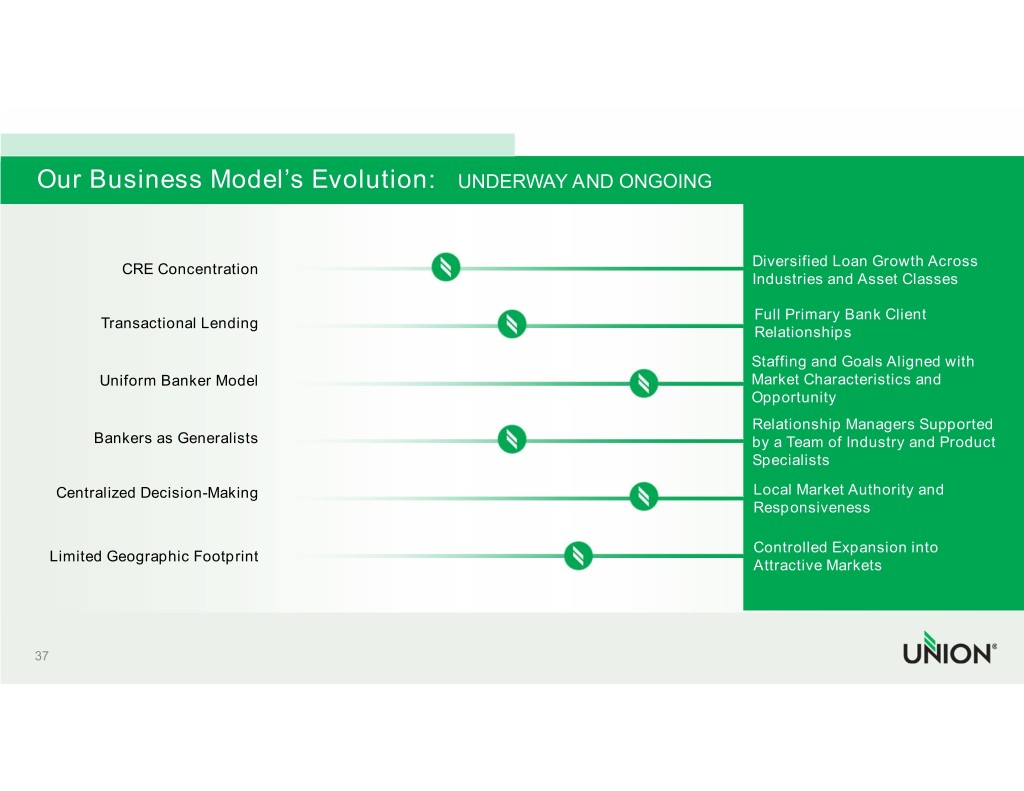

Our Business Model’s Evolution: UNDERWAY AND ONGOING Diversified Loan Growth Across CRE Concentration Industries and Asset Classes Full Primary Bank Client Transactional Lending Relationships Staffing and Goals Aligned with Uniform Banker Model Market Characteristics and Opportunity Relationship Managers Supported Bankers as Generalists by a Team of Industry and Product Specialists Centralized Decision-Making Local Market Authority and Responsiveness Controlled Expansion into Limited Geographic Footprint Attractive Markets 37

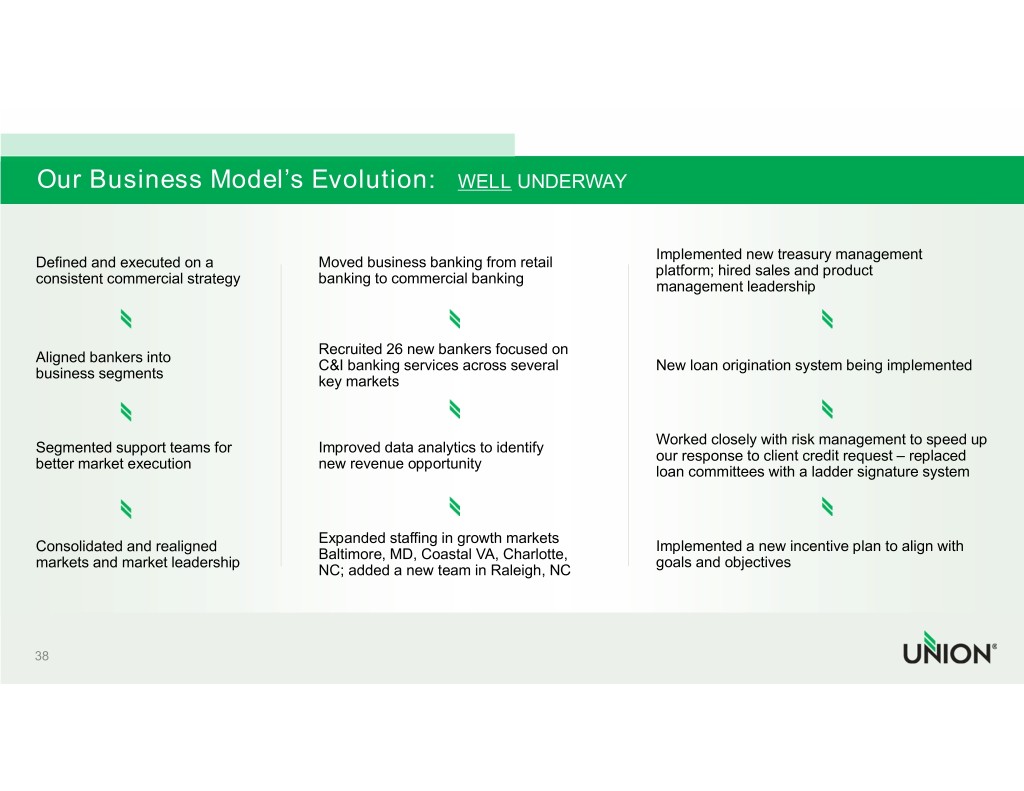

Our Business Model’s Evolution: WELL UNDERWAY Implemented new treasury management Defined and executed on a Moved business banking from retail platform; hired sales and product consistent commercial strategy banking to commercial banking management leadership Recruited 26 new bankers focused on Aligned bankers into C&I banking services across several New loan origination system being implemented business segments key markets Worked closely with risk management to speed up Segmented support teams for Improved data analytics to identify our response to client credit request – replaced better market execution new revenue opportunity loan committees with a ladder signature system Expanded staffing in growth markets Consolidated and realigned Implemented a new incentive plan to align with Baltimore, MD, Coastal VA, Charlotte, markets and market leadership goals and objectives NC; added a new team in Raleigh, NC 38

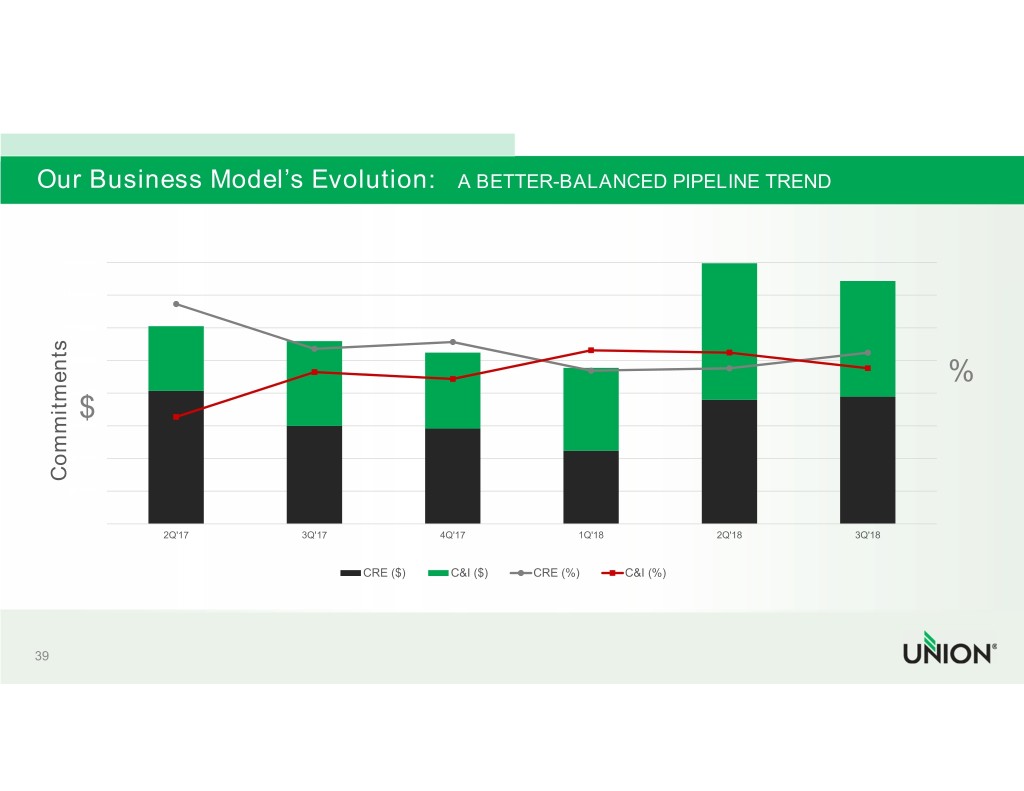

Our Business Model’s Evolution: A BETTER-BALANCED PIPELINE TREND 1600000 1400000 1200000 1000000 % 800000 $ 600000 400000 Commitments 200000 0 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 CRE ($) C&I ($) CRE (%) C&I (%) 39

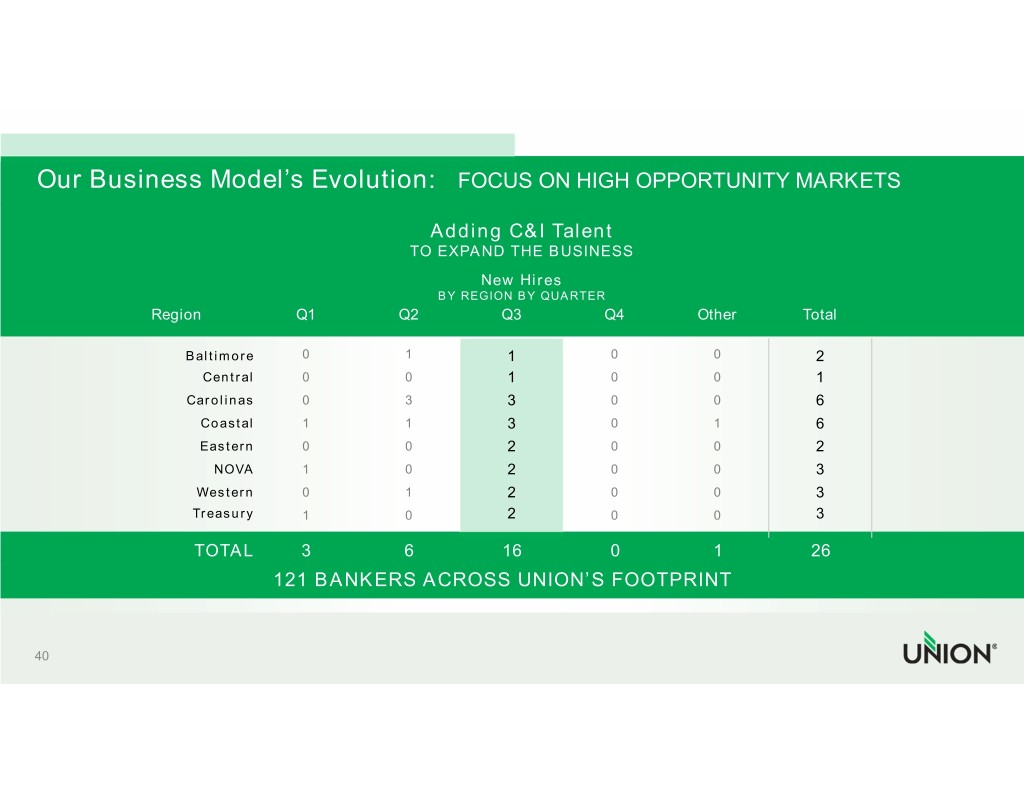

Our Business Model’s Evolution: FOCUS ON HIGH OPPORTUNITY MARKETS Adding C&I Talent TO EXPAND THE BUSINESS New Hires BY REGION BY QUARTER Region Q1 Q2 Q3 Q4 Other Total Baltimore 011 002 Central 001 001 Carolinas 033 006 Coastal 113 016 Eastern 002 002 NOVA 102 003 Western 012 003 Treasury 102 003 TOTAL36160126 121 BANKERS ACROSS UNION’S FOOTPRINT_ 40

Our Business Model’s Evolution Integrated Teams Bring the Whole Bank TO HIGH PRIORITY SEGMENTS Proud to Support COLLEGES & UNIVERSITIES Brandermill Woods RICHMOND, VA Since 1986, Brandermill Woods has been a popular place to call home. When they wanted to expand in 2012, they reached out to a bank that cared about community as much as they did. Today, Union and Brandermill Woods are building a great relationship that includes treasury management, merchant services, and commercial lending. 41

Our Business Model’s Evolution: LEVERAGING THE MODEL Market Strategy & Performance DRIVEN BY REGIONAL MANAGERS Region President Line of Business Leader Provides local leadership and is Leverage “best athlete” leader to consistently provide visible in the community expert advise to clients and coaching to teammates • Most senior bank executive in a region and face • Manages a segment team of bankers that may cross more to the community than one region • Identifies and executes a localized regional • Will focus on one segment such as CRE, C&I, Business commercial strategy Banking • Drives all business line partnerships and referrals • Ensures regional resource needs are met • Will drive differentiation and unique tactics to acquire, • Incented in Management Incentive Plan versus Commercial retain and grow client relationships faster and more Incentive Plan profitably What the Market Sees How the Business is Run 42

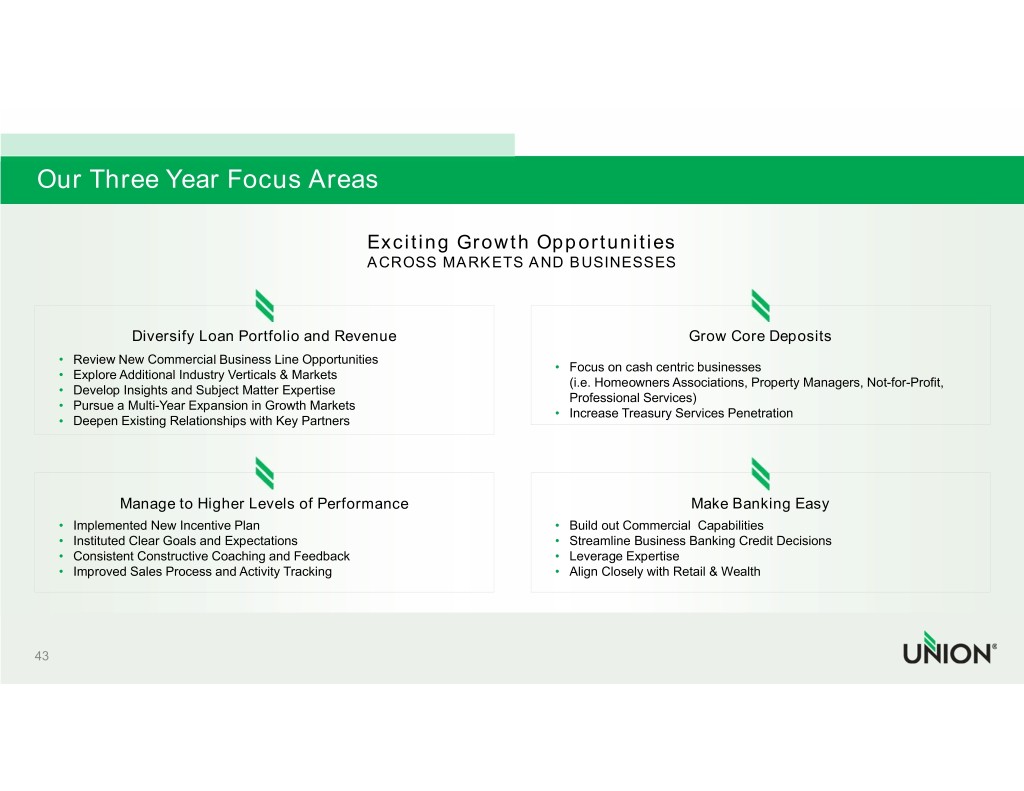

Our Three Year Focus Areas Exciting Growth Opportunities ACROSS MARKETS AND BUSINESSES Diversify Loan Portfolio and Revenue Grow Core Deposits • Review New Commercial Business Line Opportunities • Focus on cash centric businesses • Explore Additional Industry Verticals & Markets (i.e. Homeowners Associations, Property Managers, Not-for-Profit, • Develop Insights and Subject Matter Expertise Professional Services) • Pursue a Multi-Year Expansion in Growth Markets • Increase Treasury Services Penetration • Deepen Existing Relationships with Key Partners Manage to Higher Levels of Performance Make Banking Easy • Implemented New Incentive Plan • Build out Commercial Capabilities • Instituted Clear Goals and Expectations • Streamline Business Banking Credit Decisions • Consistent Constructive Coaching and Feedback • Leverage Expertise • Improved Sales Process and Activity Tracking • Align Closely with Retail & Wealth 43

Bob Martin PRESIDENT OF THE WEALTH MANAGEMENT DIVISION

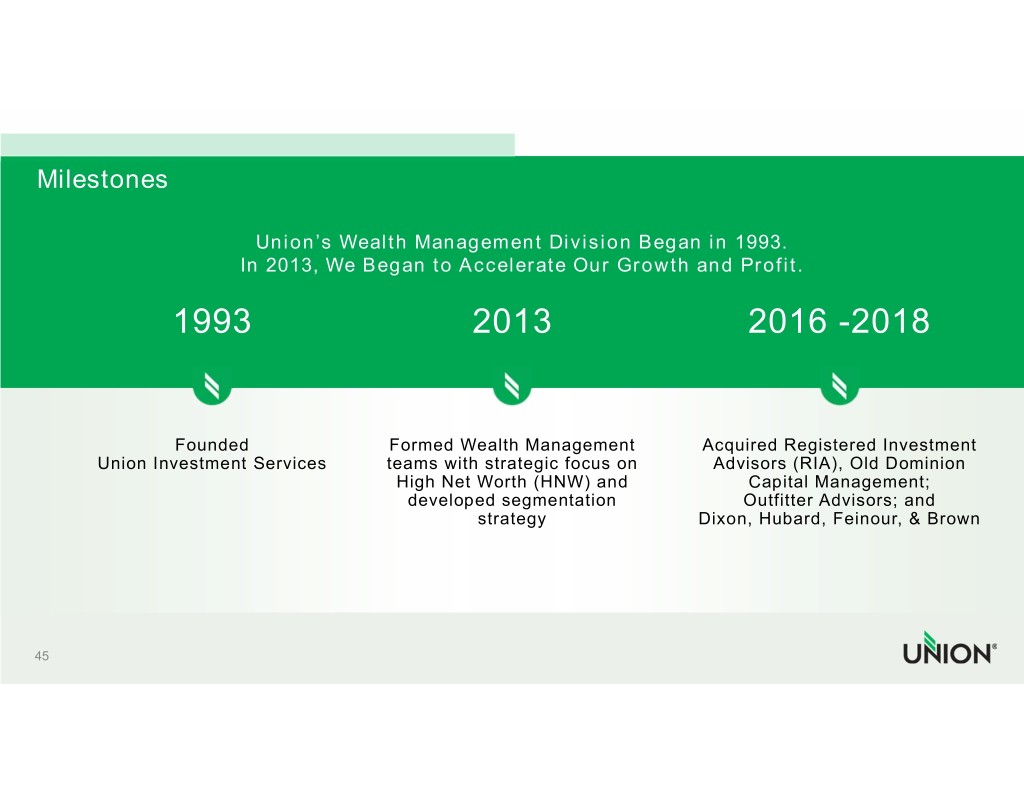

Milestones Union’s Wealth Management Division Began in 1993. In 2013, We Began to Accelerate Our Growth and Profit. 1993 2013 2016 -2018 Founded Formed Wealth Management Acquired Registered Investment Union Investment Services teams with strategic focus on Advisors (RIA), Old Dominion High Net Worth (HNW) and Capital Management; developed segmentation Outfitter Advisors; and strategy Dixon, Hubard, Feinour, & Brown 45

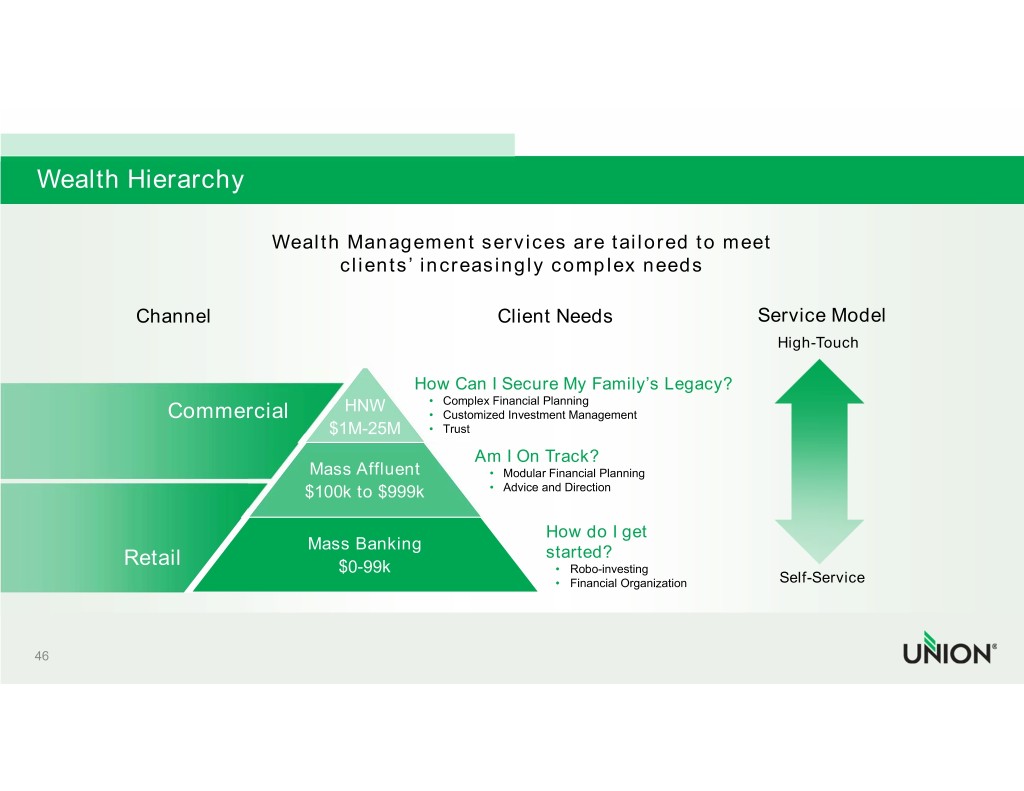

Wealth Hierarchy Wealth Management services are tailored to meet clients’ increasingly complex needs Channel Client Needs Service Model High-Touch How Can I Secure My Family’s Legacy? HNW • Complex Financial Planning Commercial • Customized Investment Management $1M-25M • Trust Am I On Track? Mass Affluent • Modular Financial Planning $100k to $999k • Advice and Direction How do I get Mass Banking Retail started? $0-99k • Robo-investing • Financial Organization Self-Service 46

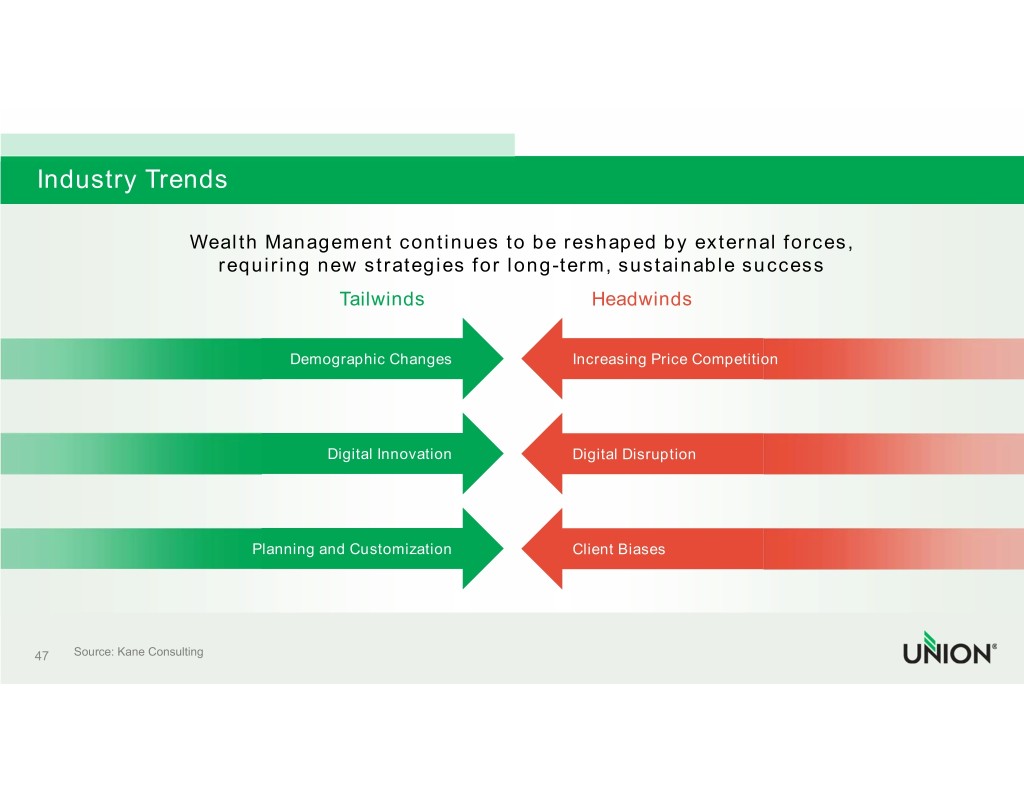

Industry Trends Wealth Management continues to be reshaped by external forces, requiring new strategies for long-term, sustainable success Tailwinds Headwinds Demographic Changes Increasing Price Competition Digital Innovation Digital Disruption Planning and Customization Client Biases 47 Source: Kane Consulting

Organic Opportunity The great wealth transfer creates additional opportunity $36T will be transferred to heirs between 2007 and 2061 Boomer-to-Millennial Wealth Transfer, 2007-2061 $36T Bequests to heirs $27T $5.6T Bequests to charity Federal estate taxes (includes lifetime giving) 48 Source: Boston College Center on Wealth and Philanthropy

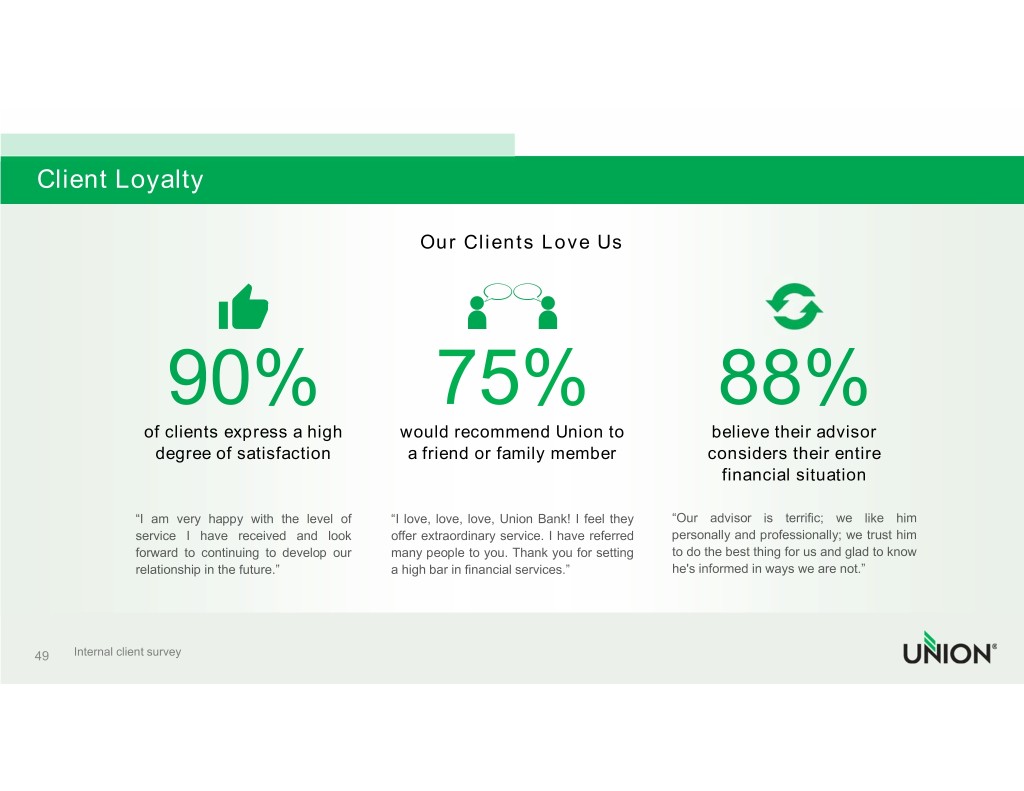

Client Loyalty Our Clients Love Us 90% 75% 88% of clients express a high would recommend Union to believe their advisor degree of satisfaction a friend or family member considers their entire financial situation “I am very happy with the level of “I love, love, love, Union Bank! I feel they “Our advisor is terrific; we like him service I have received and look offer extraordinary service. I have referred personally and professionally; we trust him forward to continuing to develop our many people to you. Thank you for setting to do the best thing for us and glad to know relationship in the future.” a high bar in financial services.” he's informed in ways we are not.” 49 Internal client survey

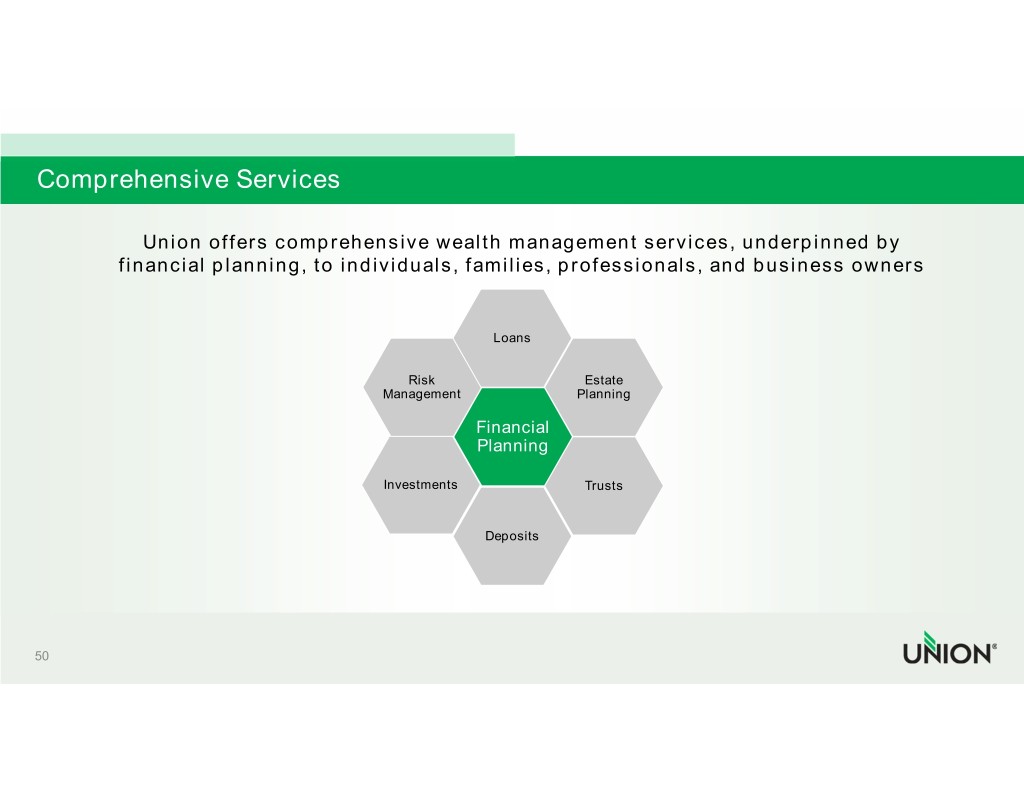

Comprehensive Services Union offers comprehensive wealth management services, underpinned by financial planning, to individuals, families, professionals, and business owners Loans Risk Estate Management Planning Financial Planning Investments Trusts Deposits 50

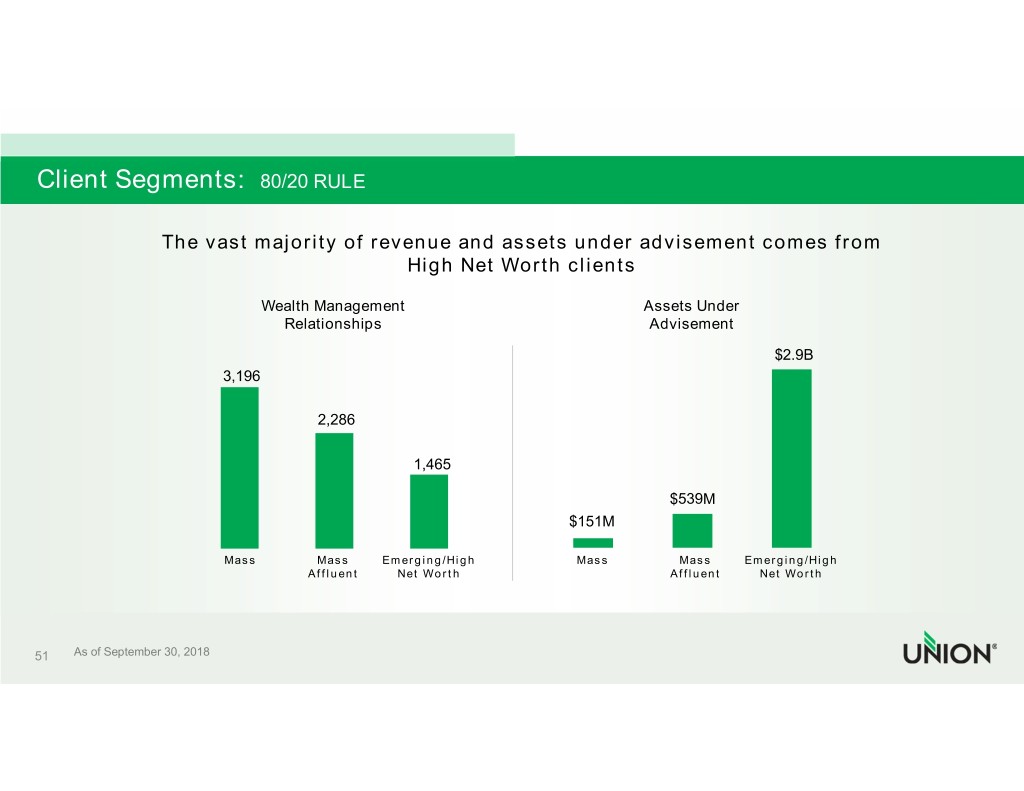

Client Segments: 80/20 RULE The vast majority of revenue and assets under advisement comes from High Net Worth clients Wealth Management Assets Under Relationships Advisement $2.9B 3,196 2,286 1,465 $539M $151M MassMass Emerging/High MassMass Emerging/High Affluent Net Worth Affluent Net Worth 51 As of September 30, 2018

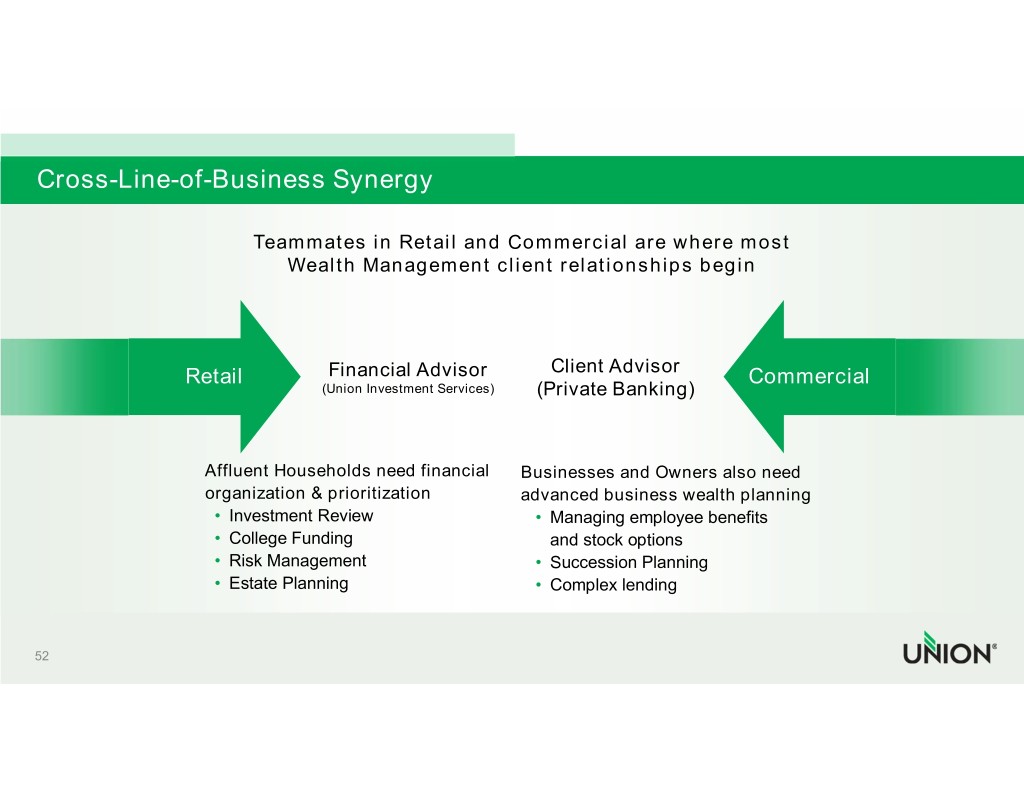

Cross-Line-of-Business Synergy Teammates in Retail and Commercial are where most Wealth Management client relationships begin Retail Financial Advisor Client Advisor Commercial (Union Investment Services) (Private Banking) Affluent Households need financial Businesses and Owners also need organization & prioritization advanced business wealth planning • Investment Review • Managing employee benefits • College Funding and stock options • Risk Management • Succession Planning • Estate Planning • Complex lending 52

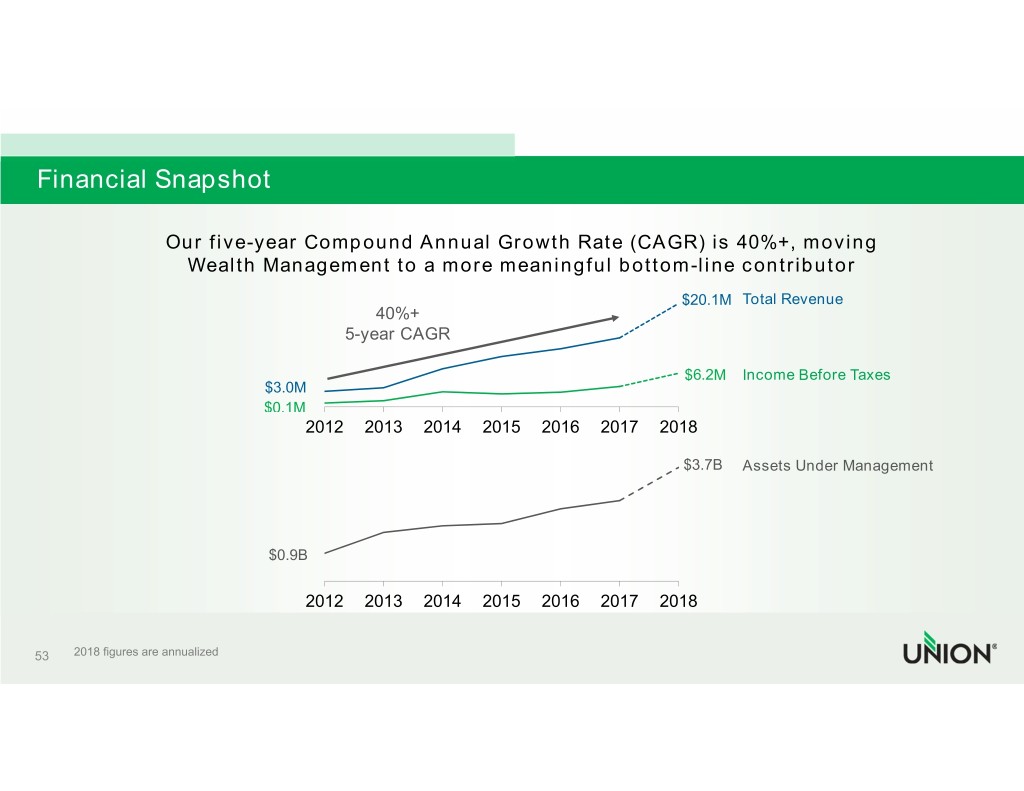

Financial Snapshot Our five-year Compound Annual Growth Rate (CAGR) is 40%+, moving Wealth Management to a more meaningful bottom-line contributor $20.1M Total Revenue 40%+ 5-year CAGR $6.2M Income Before Taxes $3.0M $0.1M 2012 2013 2014 2015 2016 2017 2018 $3.7B Assets Under Management $0.9B 2012 2013 2014 2015 2016 2017 2018 53 2018 figures are annualized

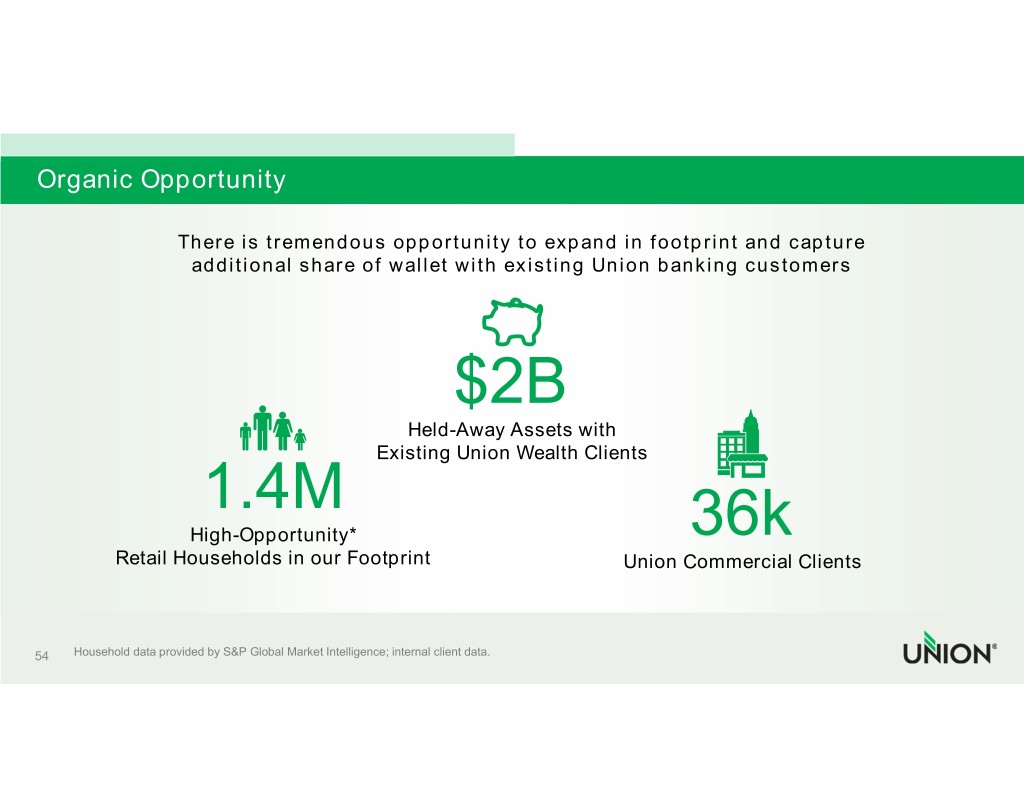

Organic Opportunity There is tremendous opportunity to expand in footprint and capture additional share of wallet with existing Union banking customers $2B Held-Away Assets with Existing Union Wealth Clients 1.4M High-Opportunity* 36k Retail Households in our Footprint Union Commercial Clients 54 Household data provided by S&P Global Market Intelligence; internal client data.

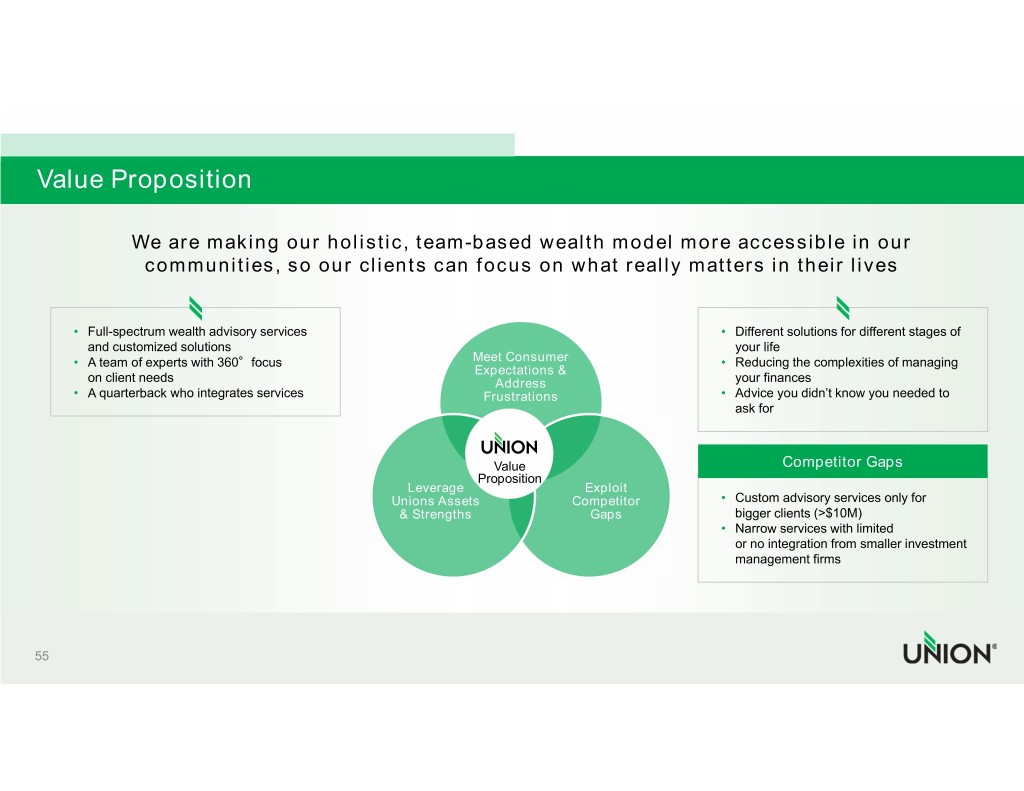

Value Proposition We are making our holistic, team-based wealth model more accessible in our communities, so our clients can focus on what really matters in their lives • Full-spectrum wealth advisory services • Different solutions for different stages of and customized solutions your life • A team of experts with 360°focus Meet Consumer • Reducing the complexities of managing Expectations & on client needs Address your finances • A quarterback who integrates services Frustrations • Advice you didn’t know you needed to ask for Value Competitor Gaps Proposition Leverage Exploit Unions Assets Competitor • Custom advisory services only for & Strengths Gaps bigger clients (>$10M) • Narrow services with limited or no integration from smaller investment management firms 55

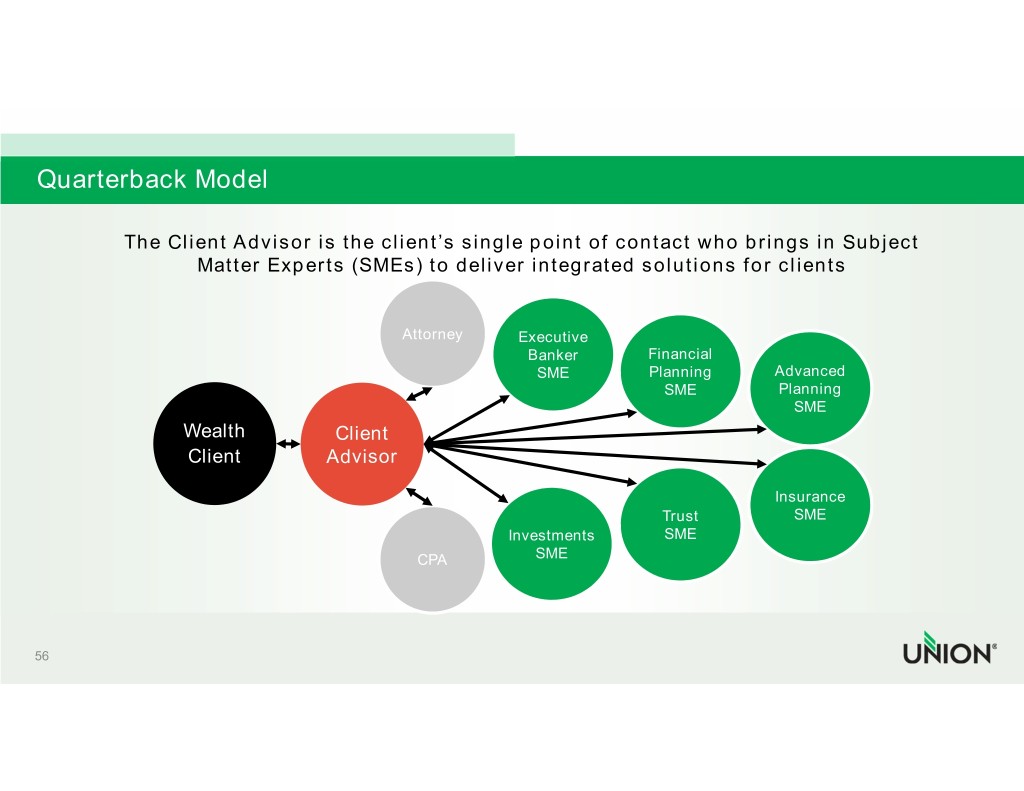

Quarterback Model The Client Advisor is the client’s single point of contact who brings in Subject Matter Experts (SMEs) to deliver integrated solutions for clients Attorney Executive Banker Financial SME Planning Advanced SME Planning SME Wealth Client Client Advisor Insurance Trust SME Investments SME CPA SME 56

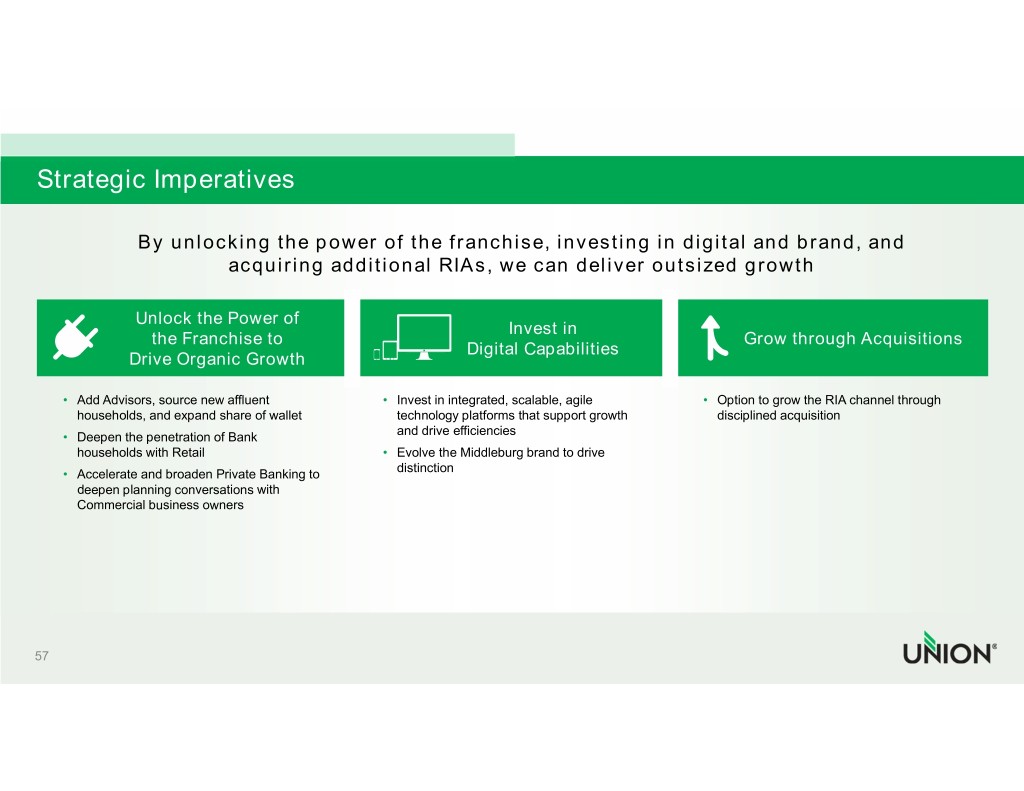

Strategic Imperatives By unlocking the power of the franchise, investing in digital and brand, and acquiring additional RIAs, we can deliver outsized growth Unlock the Power of Invest in the Franchise to Grow through Acquisitions Digital Capabilities Drive Organic Growth • Add Advisors, source new affluent • Invest in integrated, scalable, agile • Option to grow the RIA channel through households, and expand share of wallet technology platforms that support growth disciplined acquisition and drive efficiencies • Deepen the penetration of Bank households with Retail • Evolve the Middleburg brand to drive • Accelerate and broaden Private Banking to distinction deepen planning conversations with Commercial business owners 57

Impact Stories Passionate Retail service + Wealth Management partnership creates a win-win A Branch Teammate helped a customer open a new estate account following the death of his father Branch connected the customer with Wealth for counsel on executor responsibilities Then the customer’s mother passed away Because he appreciated Wealth’s guidance, he asked them to take over executor responsibilities 58

Impact Stories The right connections at the right time enables us to deepen relationships Commercial introduced Wealth to a Commercial client who was with a competitor The Client Advisor met with the prospect several times using a planning-based approach The Advisor helped the business owner realize that he was neglecting his personal finances The client is opening deposit accounts totaling $110k and investment accounts totaling ~$2M 59

Maria Tedesco PRESIDENT UNION BANK & TRUST

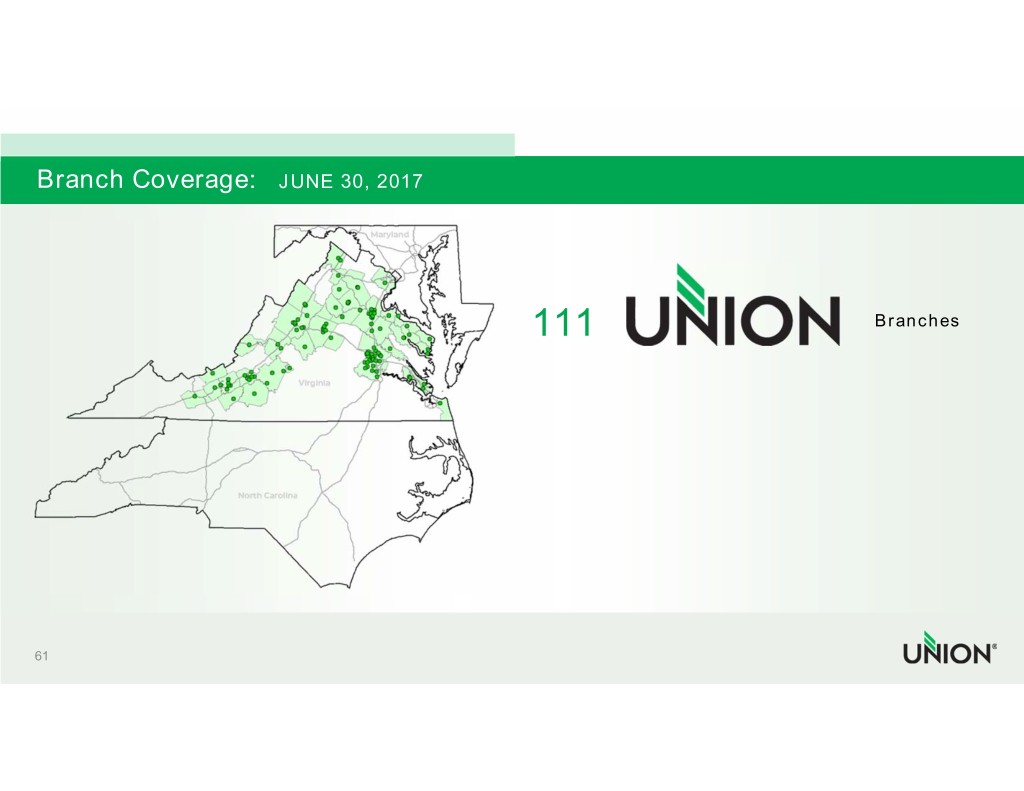

Branch Coverage: JUNE 30, 2017 111 Branches 61

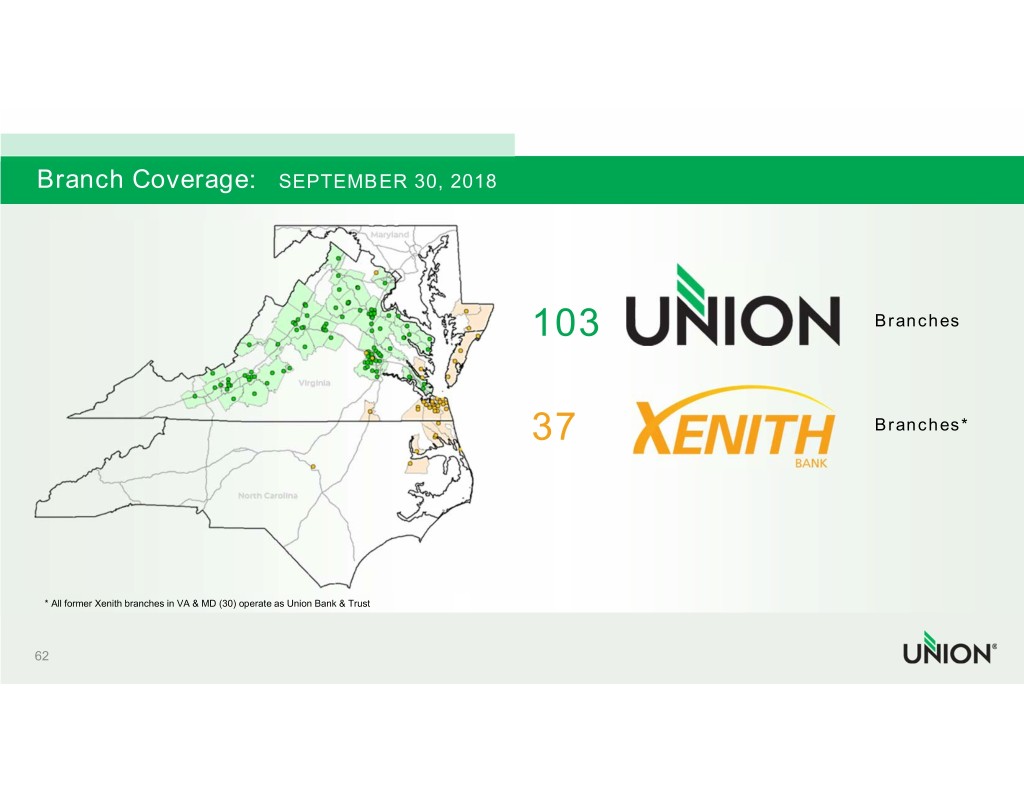

Branch Coverage: SEPTEMBER 30, 2018 103 Branches 37 Branches* * All former Xenith branches in VA & MD (30) operate as Union Bank & Trust 62

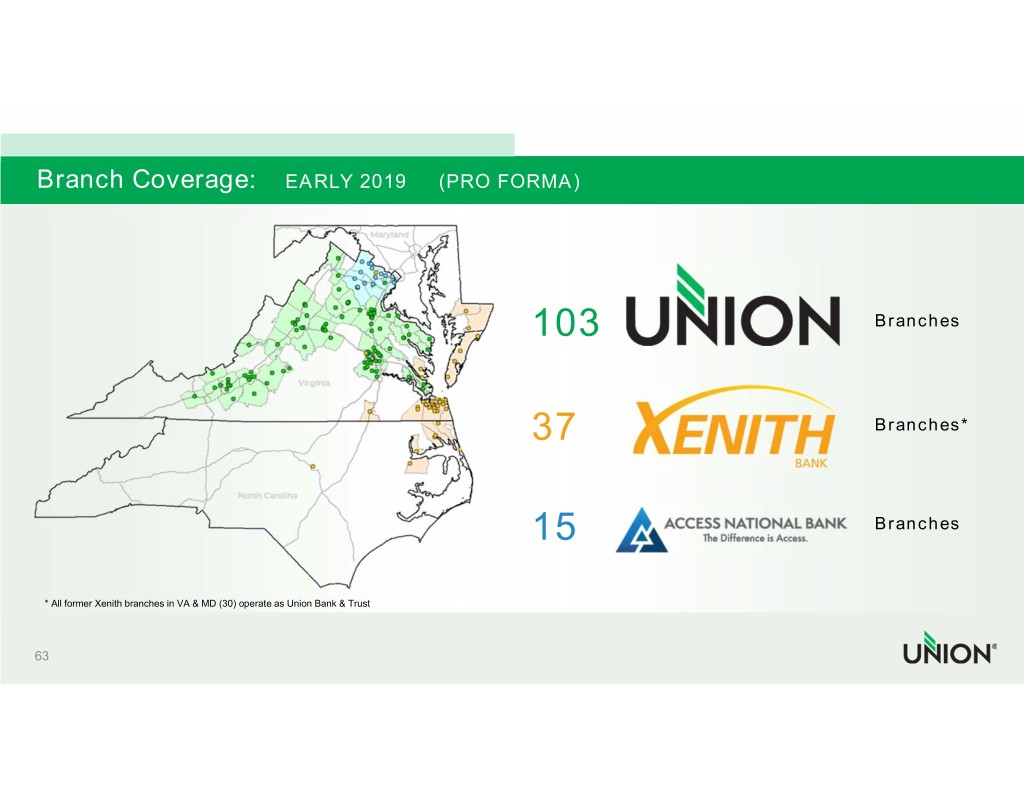

Branch Coverage: EARLY 2019 (PRO FORMA) 103 Branches 37 Branches* 15 Branches * All former Xenith branches in VA & MD (30) operate as Union Bank & Trust 63

Growing Our Retail Banking Business Focus Simplify Grow • Creating differentiated value proposition • Make it easier for our customers to do • Evolve from maintaining market position and go-to-market strategies for business with us by integrating branch to growing market position high-opportunity market segments and digital strategies, creating an omni-channel distribution network • Build on our strong customer franchise to Mass Affluent and Small Business deepen relationships and increase share • Reconfigure staffing in branches to of wallet reflect market opportunities • Segment products and markets to focus on high-growth opportunities • Streamline digital experiences across the enterprise, creating consistent customer experiences across all business lines 64

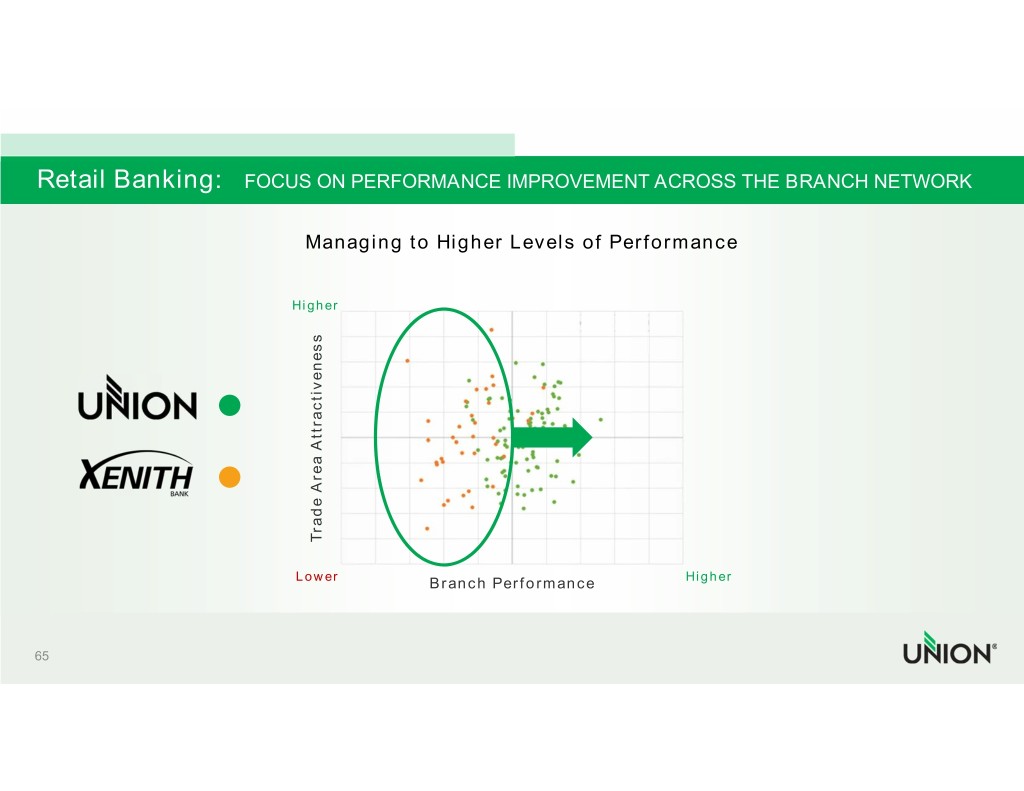

Retail Banking: FOCUS ON PERFORMANCE IMPROVEMENT ACROSS THE BRANCH NETWORK Managing to Higher Levels of Performance Higher Trade Area Attractiveness Trade Lower Branch Performance Higher 65

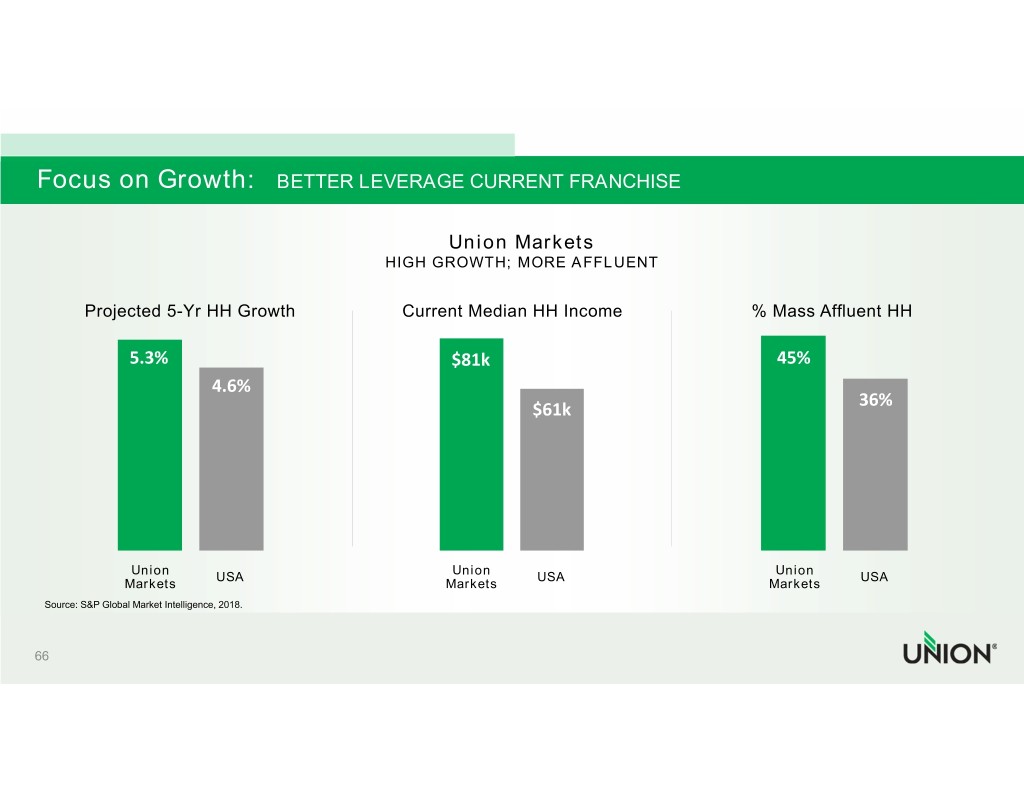

Focus on Growth: BETTER LEVERAGE CURRENT FRANCHISE Union Markets HIGH GROWTH; MORE AFFLUENT Projected 5-Yr HH Growth Current Median HH Income % Mass Affluent HH 5.3% $81k 45% 4.6% 36% $61k Union Union Union USA USA USA Markets Markets Markets Source: S&P Global Market Intelligence, 2018. 66

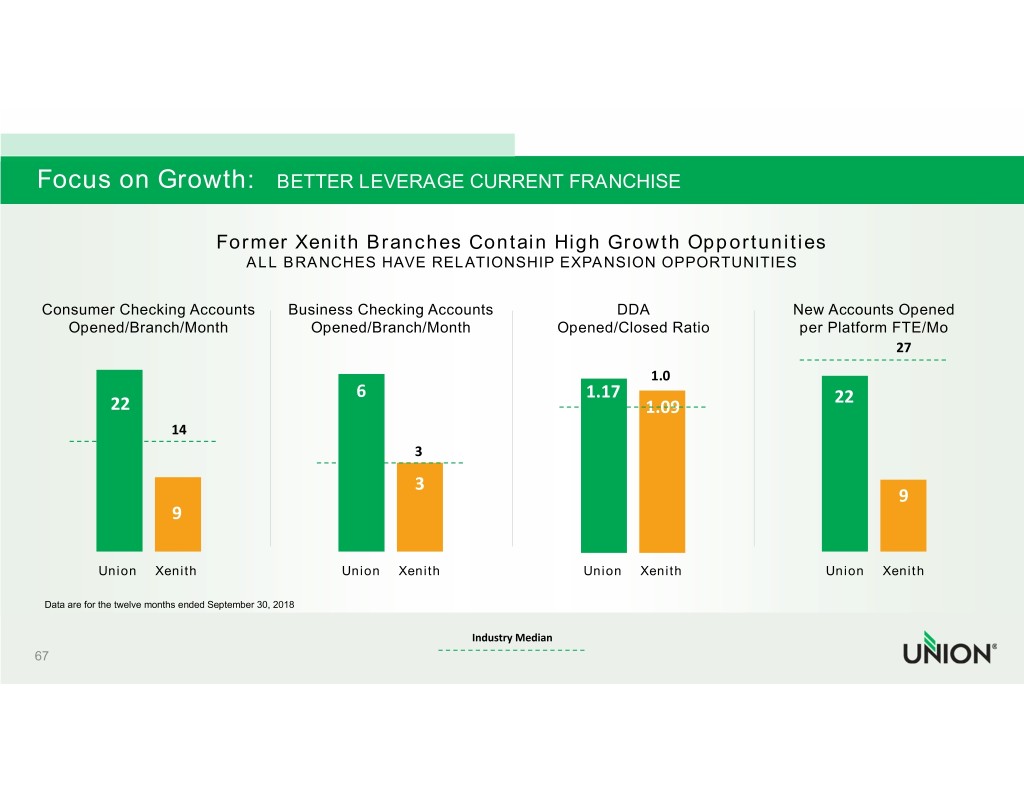

Focus on Growth: BETTER LEVERAGE CURRENT FRANCHISE Former Xenith Branches Contain High Growth Opportunities ALL BRANCHES HAVE RELATIONSHIP EXPANSION OPPORTUNITIES Consumer Checking Accounts Business Checking Accounts DDA New Accounts Opened Opened/Branch/Month Opened/Branch/Month Opened/Closed Ratio per Platform FTE/Mo 27 1.0 6 1.17 22 22 1.09 14 3 3 9 9 Union Xenith Union Xenith Union Xenith Union Xenith Data are for the twelve months ended September 30, 2018 Industry Median 67

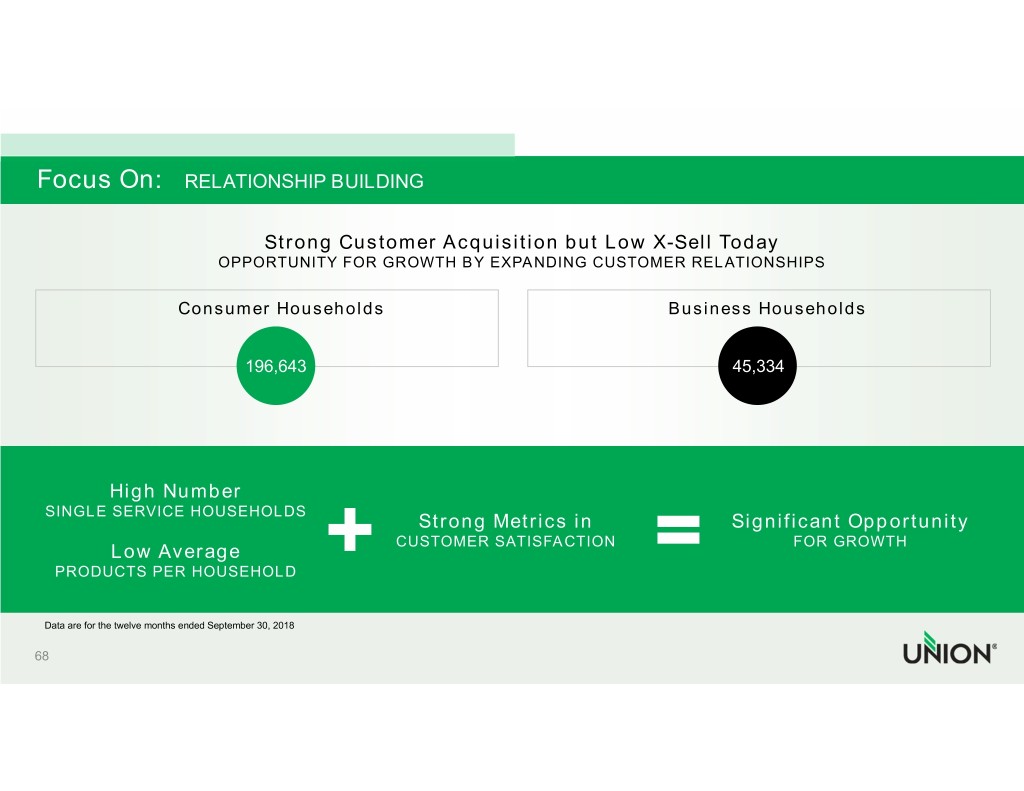

Focus On: RELATIONSHIP BUILDING Strong Customer Acquisition but Low X-Sell Today OPPORTUNITY FOR GROWTH BY EXPANDING CUSTOMER RELATIONSHIPS Consumer Households Business Households 196,643 45,334 High Number SINGLE SERVICE HOUSEHOLDS Strong Metrics in Significant Opportunity CUSTOMER SATISFACTION FOR GROWTH Low Average PRODUCTS PER HOUSEHOLD Data are for the twelve months ended September 30, 2018 68

Retail Banking: IMPERATIVES FOR SUCCESS Differentiated Integrated Simplified & Integrated Superior Value Propositions Management Efficient Distribution Customer for High-Opportunity Structure, Team Processes, Network Experience Target Segments and Approach Procedures & Practices Move team from one size Optimize branch network, Define the ideal customer Identify new retail head and Eliminate non-value fits all to products, service, tailor staffing and experience across all current talent gaps and added processes from and pricing programs configuration to market market segments & delivery align organizational customer-facing staff. tailored to the needs and characteristics & potential, channels, and eliminate structure & resources with potential of specific evaluate low-performing customer pain points. specific imperatives. customer segments. branches for improvement or consolidation, and integrate digital capabilities to create an easy and convenient omni-channel customer experience. 69

Dean Brown CHIEF INFORMATION OFFICER & HEAD OF BANK OPERATIONS

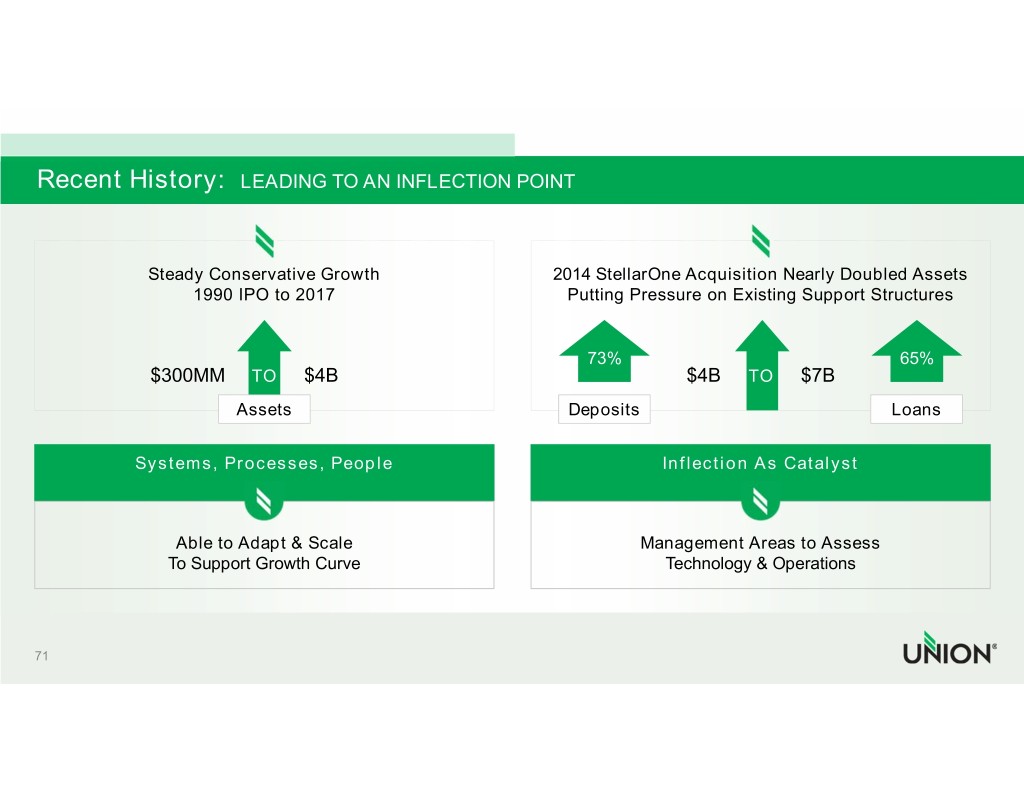

Recent History: LEADING TO AN INFLECTION POINT Steady Conservative Growth 2014 StellarOne Acquisition Nearly Doubled Assets 1990 IPO to 2017 Putting Pressure on Existing Support Structures 73% 65% $300MM TO $4B $4B TO $7B Assets Deposits Loans Systems, Processes, People Inflection As Catalyst Able to Adapt & Scale Management Areas to Assess To Support Growth Curve Technology & Operations 71

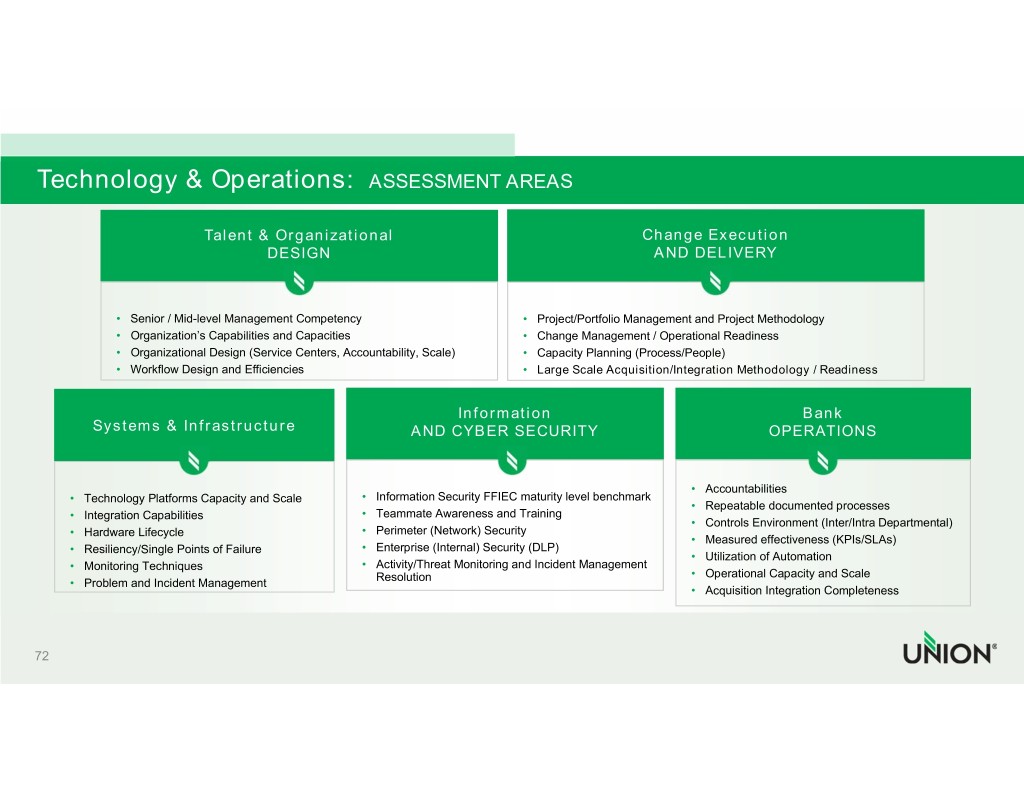

Technology & Operations: ASSESSMENT AREAS Talent & Organizational Change Execution DESIGN AND DELIVERY • Senior / Mid-level Management Competency • Project/Portfolio Management and Project Methodology • Organization’s Capabilities and Capacities • Change Management / Operational Readiness • Organizational Design (Service Centers, Accountability, Scale) • Capacity Planning (Process/People) • Workflow Design and Efficiencies • Large Scale Acquisition/Integration Methodology / Readiness Information Bank Systems & Infrastructure AND CYBER SECURITY OPERATIONS • Accountabilities • Technology Platforms Capacity and Scale • Information Security FFIEC maturity level benchmark • Repeatable documented processes • Integration Capabilities • Teammate Awareness and Training • Controls Environment (Inter/Intra Departmental) • Hardware Lifecycle • Perimeter (Network) Security • Measured effectiveness (KPIs/SLAs) • Resiliency/Single Points of Failure • Enterprise (Internal) Security (DLP) • Utilization of Automation • Monitoring Techniques • Activity/Threat Monitoring and Incident Management Resolution • Operational Capacity and Scale • Problem and Incident Management • Acquisition Integration Completeness 72

Set A New Tone Mission Vision Provide secure, high quality technology services As a valued business partner of choice, we and solutions that drive the highest value for our leverage our business knowledge & technical / customers, teammates and shareholders operational expertise to offer and enable optimal business solutions and product services. We deliver and maintain strategic, well managed, reliable, scalable, and cost effective services and capabilities through great people and a commitment to excellence. 73

Declared Imperatives: TO ACHIEVE OUR GOALS Executional Growth Engaged Protect Data & Excellence Enablement Teammates Infrastructure • Establish a Controlled • Deliver on Aggressive • A Scalable / Service Oriented • Document Information & Reliable Operating Business Priorities Organizational Design Security Framework Environment • Develop Capacity Planning • An Empowered, High Performing • Establish Internal / • Implement Risk Based Cost & Scale Operations to 2X & Accountable Team External Cyber & Controls Management Defenses Achieving • Partner, Identify • A “Soft-and-Hard”-skilled Workforce Lvl 3 FFIEC Standard • Continually Improve & Offer Solutions Efficiency of Operations • Identify & Solve for Threats, Vulnerabilities, & Incidents 74

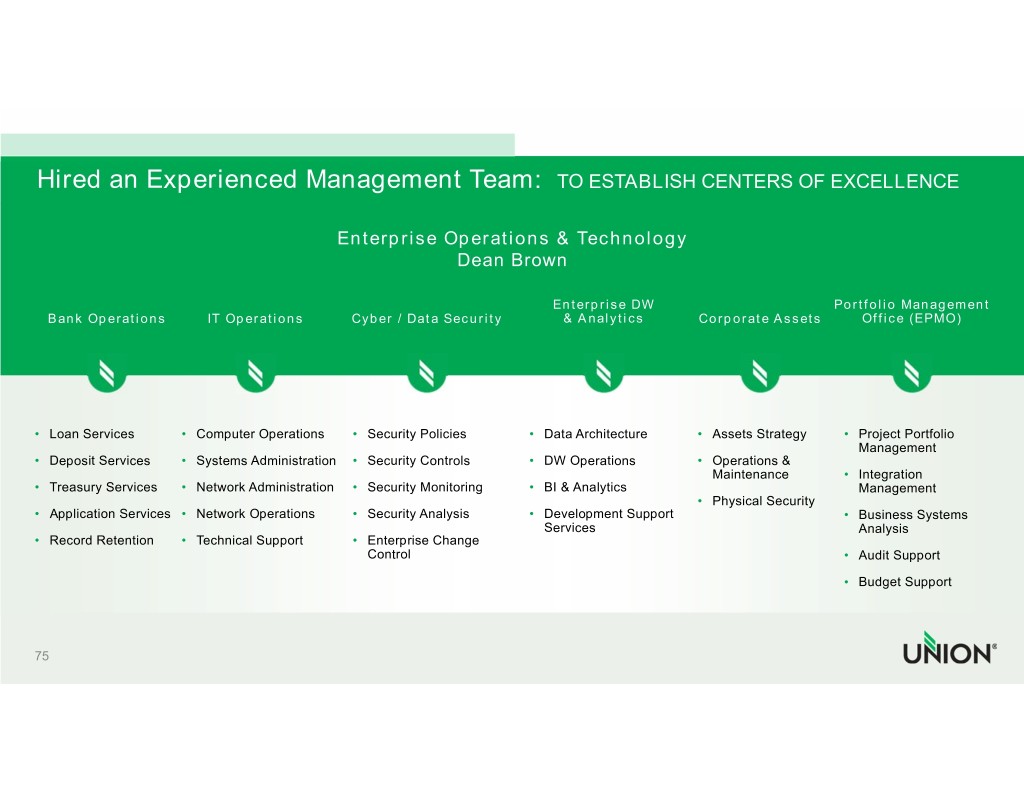

Hired an Experienced Management Team: TO ESTABLISH CENTERS OF EXCELLENCE Enterprise Operations & Technology Dean Brown Enterprise DW Portfolio Management Bank Operations IT Operations Cyber / Data Security & Analytics Corporate Assets Office (EPMO) • Loan Services • Computer Operations • Security Policies • Data Architecture • Assets Strategy • Project Portfolio Management • Deposit Services • Systems Administration • Security Controls • DW Operations • Operations & Maintenance • Integration • Treasury Services • Network Administration • Security Monitoring • BI & Analytics Management • Physical Security • Application Services • Network Operations • Security Analysis • Development Support • Business Systems Services Analysis • Record Retention • Technical Support • Enterprise Change Control • Audit Support • Budget Support 75

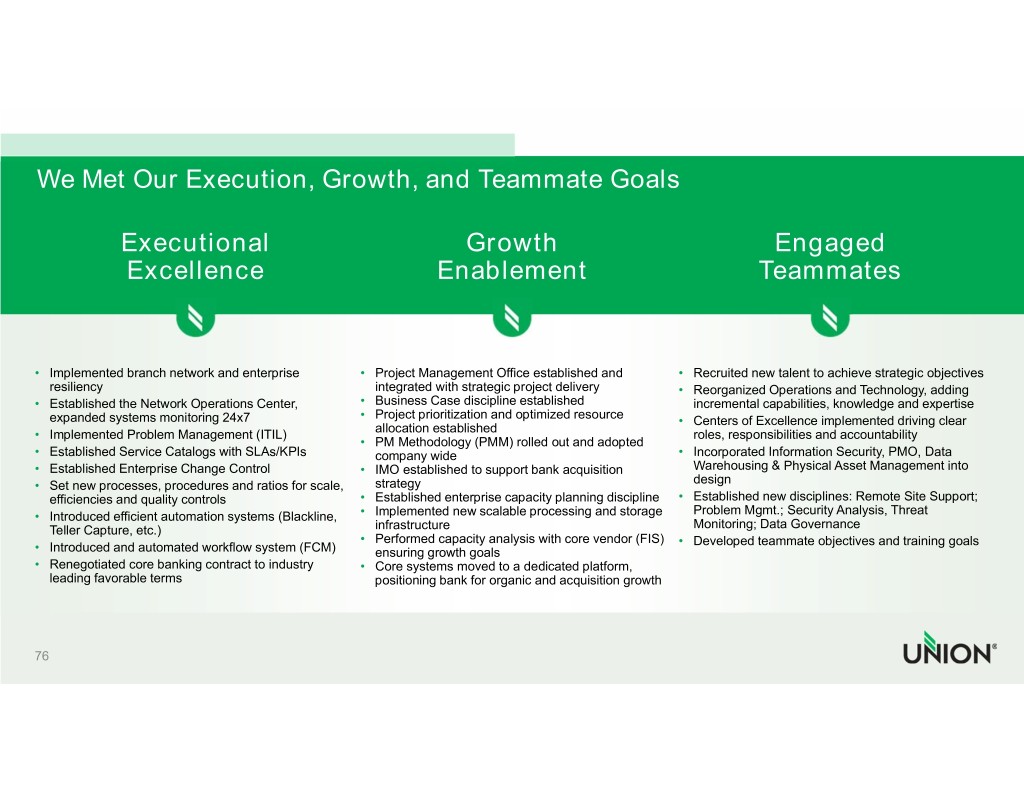

We Met Our Execution, Growth, and Teammate Goals Executional Growth Engaged Excellence Enablement Teammates • Implemented branch network and enterprise • Project Management Office established and • Recruited new talent to achieve strategic objectives resiliency integrated with strategic project delivery • Reorganized Operations and Technology, adding • Established the Network Operations Center, • Business Case discipline established incremental capabilities, knowledge and expertise • Project prioritization and optimized resource expanded systems monitoring 24x7 • Centers of Excellence implemented driving clear allocation established • Implemented Problem Management (ITIL) roles, responsibilities and accountability • PM Methodology (PMM) rolled out and adopted • Established Service Catalogs with SLAs/KPIs company wide • Incorporated Information Security, PMO, Data • Established Enterprise Change Control • IMO established to support bank acquisition Warehousing & Physical Asset Management into • Set new processes, procedures and ratios for scale, strategy design efficiencies and quality controls • Established enterprise capacity planning discipline • Established new disciplines: Remote Site Support; Problem Mgmt.; Security Analysis, Threat • Introduced efficient automation systems (Blackline, • Implemented new scalable processing and storage Teller Capture, etc.) infrastructure Monitoring; Data Governance • Performed capacity analysis with core vendor (FIS) • Developed teammate objectives and training goals • Introduced and automated workflow system (FCM) ensuring growth goals • Renegotiated core banking contract to industry • Core systems moved to a dedicated platform, leading favorable terms positioning bank for organic and acquisition growth 76

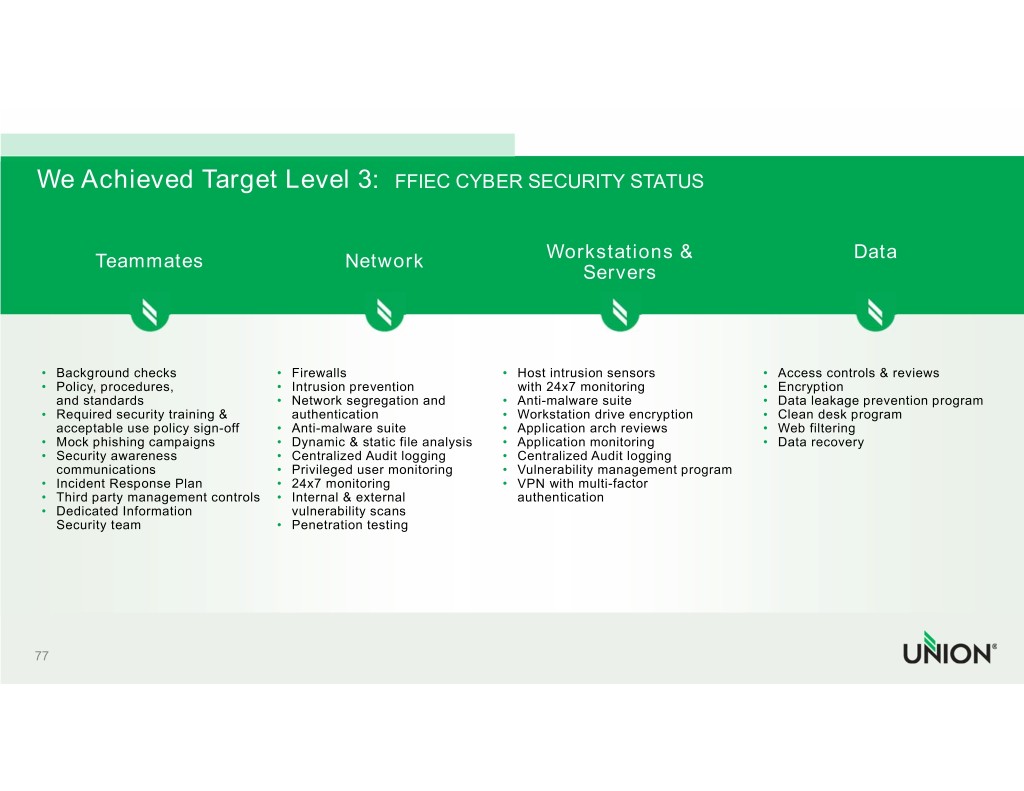

We Achieved Target Level 3: FFIEC CYBER SECURITY STATUS Teammates Network Workstations & Data Servers • Background checks • Firewalls • Host intrusion sensors • Access controls & reviews • Policy, procedures, • Intrusion prevention with 24x7 monitoring • Encryption and standards • Network segregation and • Anti-malware suite • Data leakage prevention program • Required security training & authentication • Workstation drive encryption • Clean desk program acceptable use policy sign-off • Anti-malware suite • Application arch reviews • Web filtering • Mock phishing campaigns • Dynamic & static file analysis • Application monitoring • Data recovery • Security awareness • Centralized Audit logging • Centralized Audit logging communications • Privileged user monitoring • Vulnerability management program • Incident Response Plan • 24x7 monitoring • VPN with multi-factor • Third party management controls • Internal & external authentication • Dedicated Information vulnerability scans Security team • Penetration testing 77

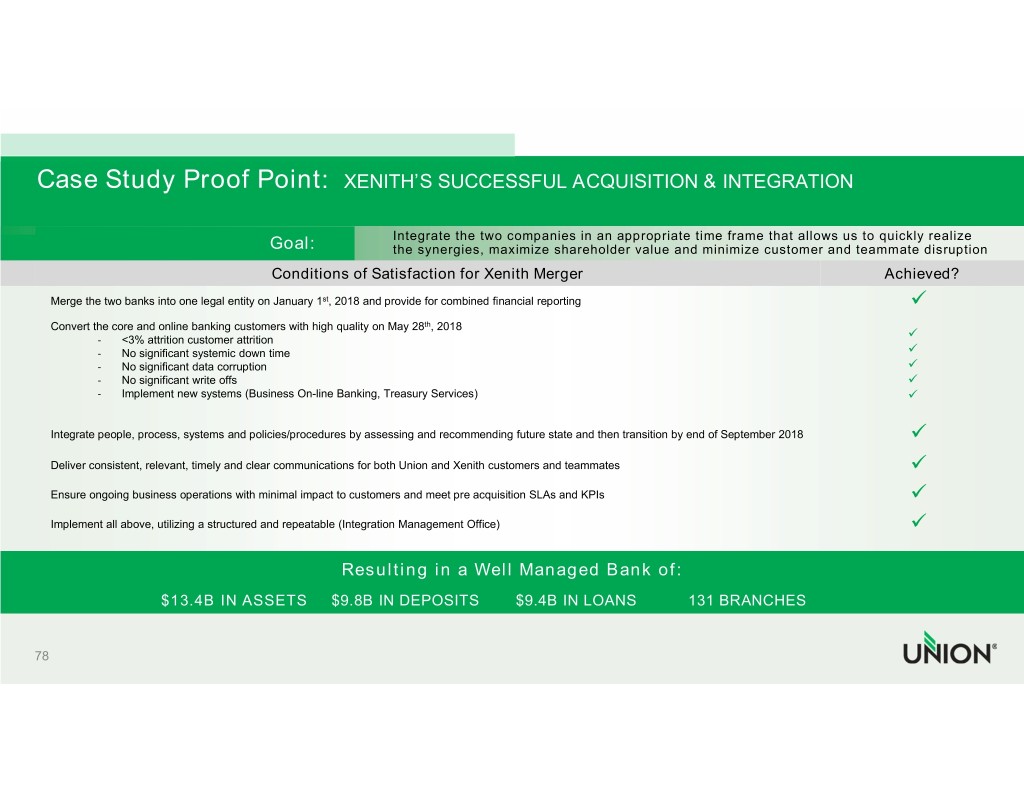

Case Study Proof Point: XENITH’S SUCCESSFUL ACQUISITION & INTEGRATION Integrate the two companies in an appropriate time frame that allows us to quickly realize Goal: the synergies, maximize shareholder value and minimize customer and teammate disruption Conditions of Satisfaction for Xenith Merger Achieved? Merge the two banks into one legal entity on January 1st, 2018 and provide for combined financial reporting Convert the core and online banking customers with high quality on May 28th, 2018 ‐ <3% attrition customer attrition ‐ No significant systemic down time ‐ No significant data corruption ‐ No significant write offs ‐ Implement new systems (Business On-line Banking, Treasury Services) Integrate people, process, systems and policies/procedures by assessing and recommending future state and then transition by end of September 2018 Deliver consistent, relevant, timely and clear communications for both Union and Xenith customers and teammates Ensure ongoing business operations with minimal impact to customers and meet pre acquisition SLAs and KPIs Implement all above, utilizing a structured and repeatable (Integration Management Office) Resulting in a Well Managed Bank of: $13.4B IN ASSETS $9.8B IN DEPOSITS $9.4B IN LOANS 131 BRANCHES 78

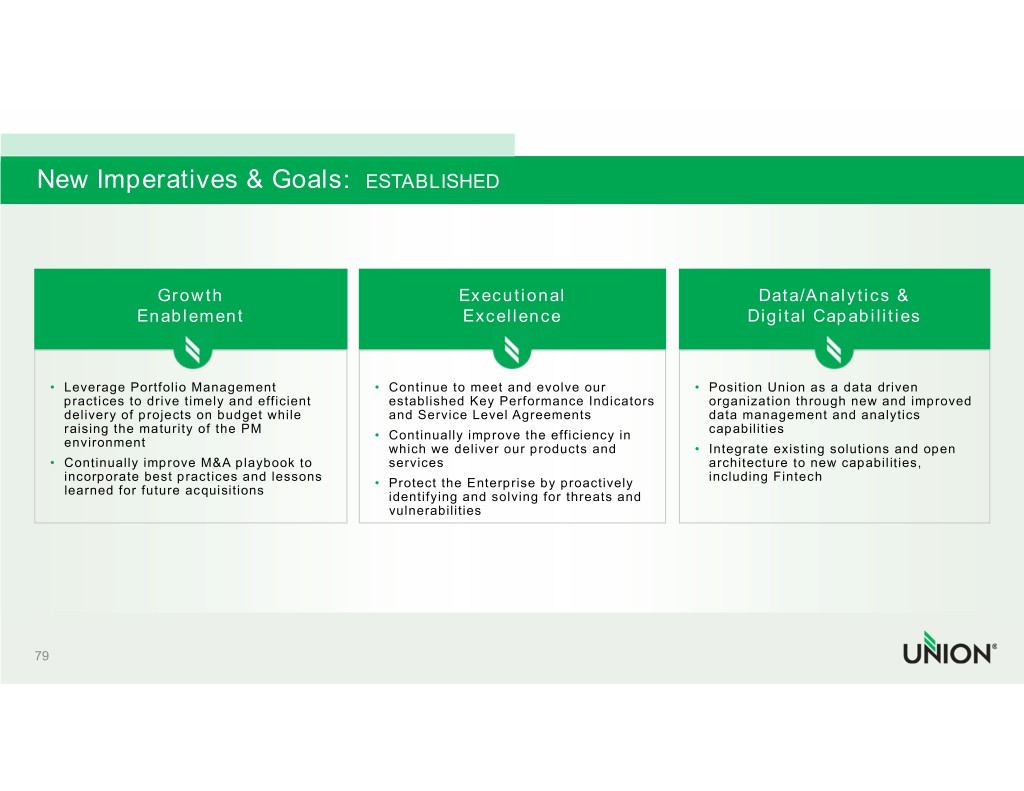

New Imperatives & Goals: ESTABLISHED Growth Executional Data/Analytics & Enablement Excellence Digital Capabilities • Leverage Portfolio Management • Continue to meet and evolve our • Position Union as a data driven practices to drive timely and efficient established Key Performance Indicators organization through new and improved delivery of projects on budget while and Service Level Agreements data management and analytics raising the maturity of the PM capabilities • Continually improve the efficiency in environment which we deliver our products and • Integrate existing solutions and open • Continually improve M&A playbook to services architecture to new capabilities, incorporate best practices and lessons including Fintech • Protect the Enterprise by proactively learned for future acquisitions identifying and solving for threats and vulnerabilities 79

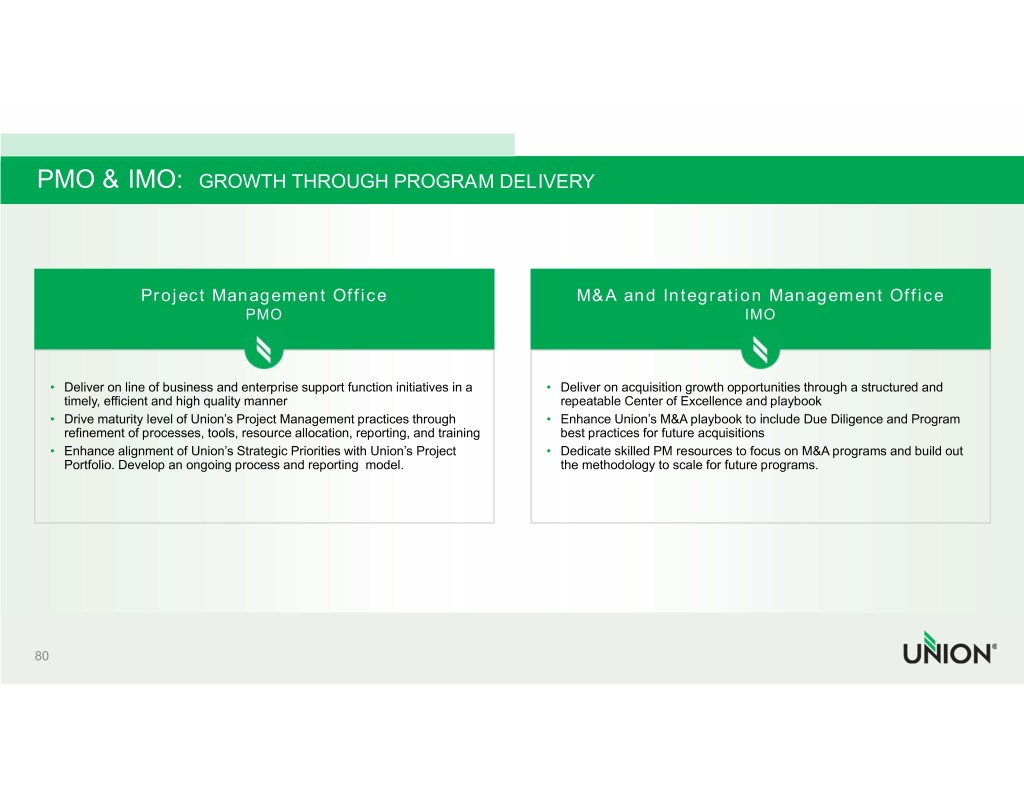

PMO & IMO: GROWTH THROUGH PROGRAM DELIVERY Project Management Office M&A and Integration Management Office PMO IMO • Deliver on line of business and enterprise support function initiatives in a • Deliver on acquisition growth opportunities through a structured and timely, efficient and high quality manner repeatable Center of Excellence and playbook • Drive maturity level of Union’s Project Management practices through • Enhance Union’s M&A playbook to include Due Diligence and Program refinement of processes, tools, resource allocation, reporting, and training best practices for future acquisitions • Enhance alignment of Union’s Strategic Priorities with Union’s Project • Dedicate skilled PM resources to focus on M&A programs and build out Portfolio. Develop an ongoing process and reporting model. the methodology to scale for future programs. 80

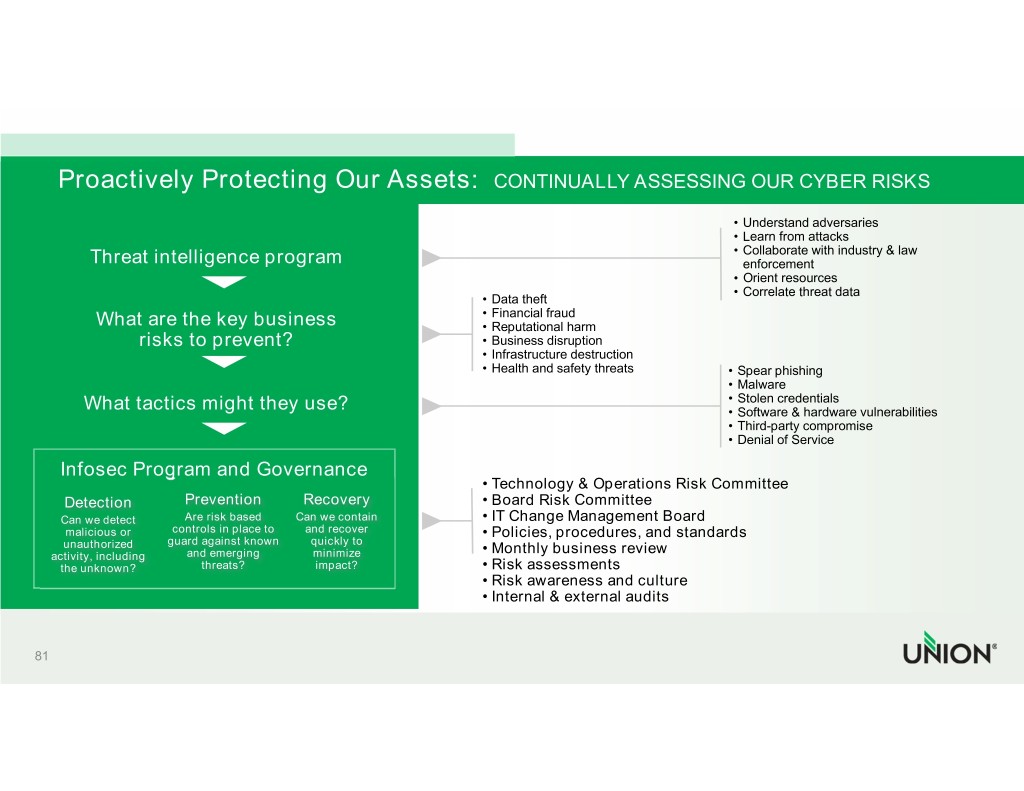

Proactively Protecting Our Assets: CONTINUALLY ASSESSING OUR CYBER RISKS • Understand adversaries • Learn from attacks • Collaborate with industry & law Threat intelligence program enforcement • Orient resources • Correlate threat data • Data theft • Financial fraud What are the key business • Reputational harm risks to prevent? • Business disruption • Infrastructure destruction • Health and safety threats • Spear phishing •Malware • Stolen credentials What tactics might they use? • Software & hardware vulnerabilities • Third-party compromise • Denial of Service Infosec Program and Governance • Technology & Operations Risk Committee Detection Prevention Recovery • Board Risk Committee Can we detect Are risk based Can we contain • IT Change Management Board malicious or controls in place to and recover • Policies, procedures, and standards unauthorized guard against known quickly to • Monthly business review activity, including and emerging minimize the unknown? threats? impact? • Risk assessments • Risk awareness and culture • Internal & external audits 81

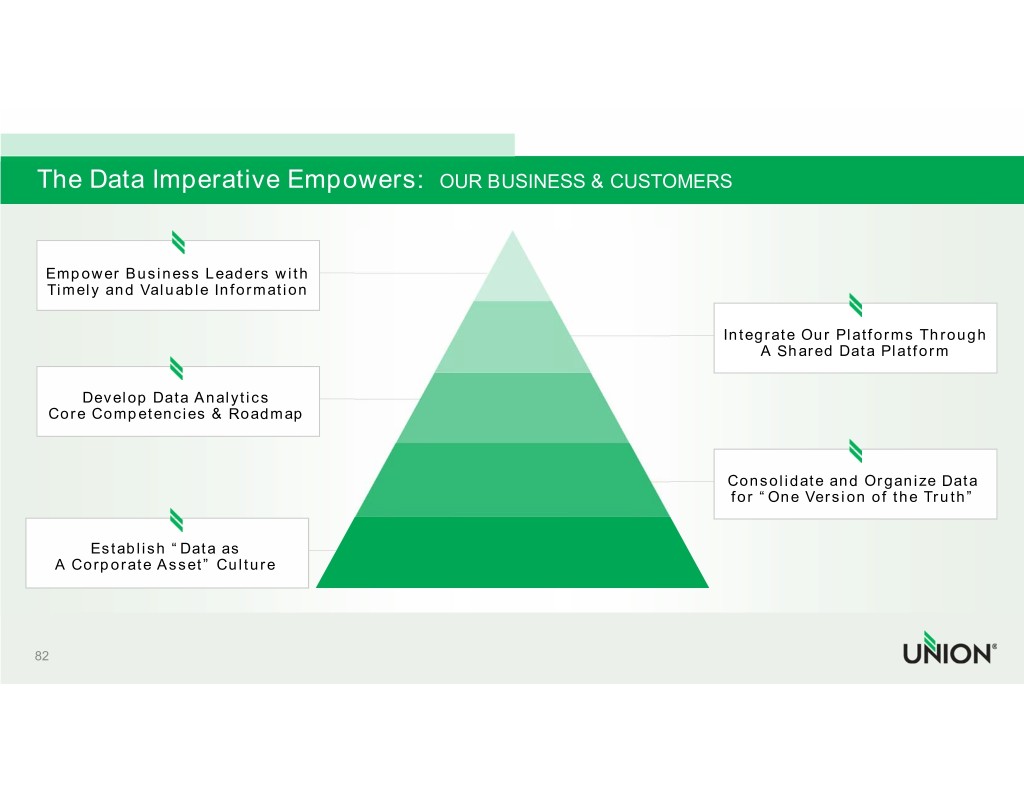

The Data Imperative Empowers: OUR BUSINESS & CUSTOMERS Empower Business Leaders with Timely and Valuable Information Integrate Our Platforms Through A Shared Data Platform Develop Data Analytics Core Competencies & Roadmap Consolidate and Organize Data for “One Version of the Truth” Establish “Data as A Corporate Asset” Culture 82

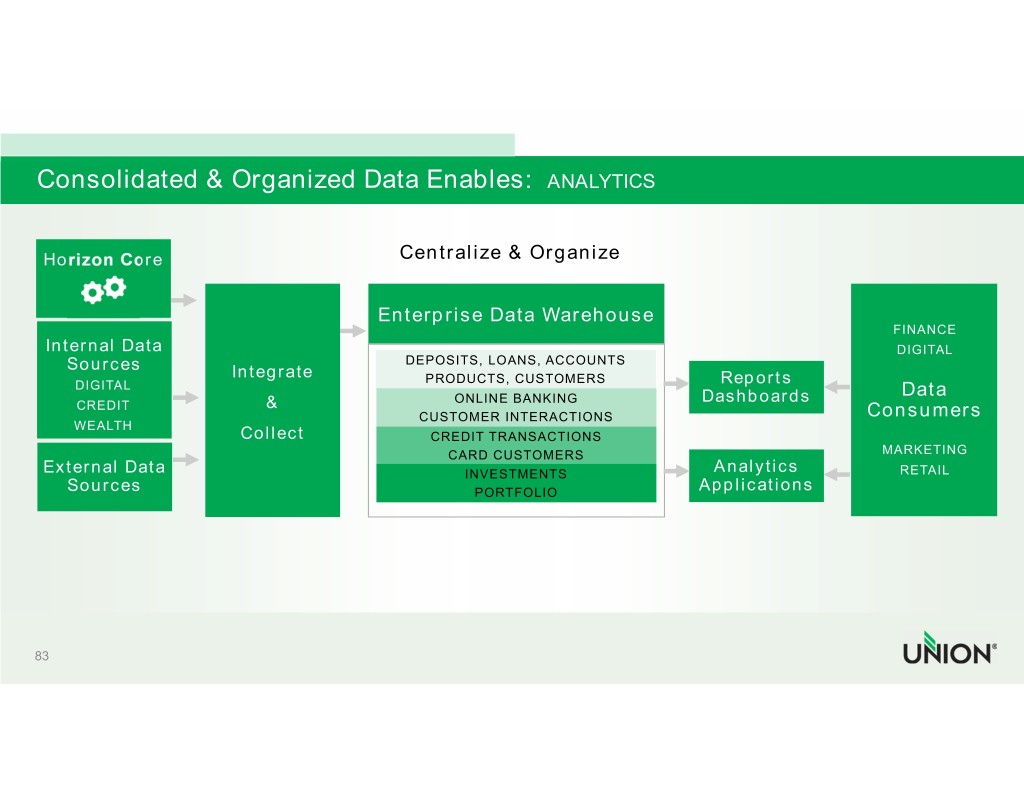

Consolidated & Organized Data Enables: ANALYTICS Horizon Core Centralize & Organize Enterprise Data Warehouse FINANCE Internal Data DIGITAL Sources DEPOSITS, LOANS, ACCOUNTS Integrate PRODUCTS, CUSTOMERS DIGITAL Reports ONLINE BANKING Dashboards Data CREDIT & CUSTOMER INTERACTIONS Consumers WEALTH Collect CREDIT TRANSACTIONS CARD CUSTOMERS MARKETING External Data INVESTMENTS Analytics RETAIL Sources PORTFOLIO Applications 83

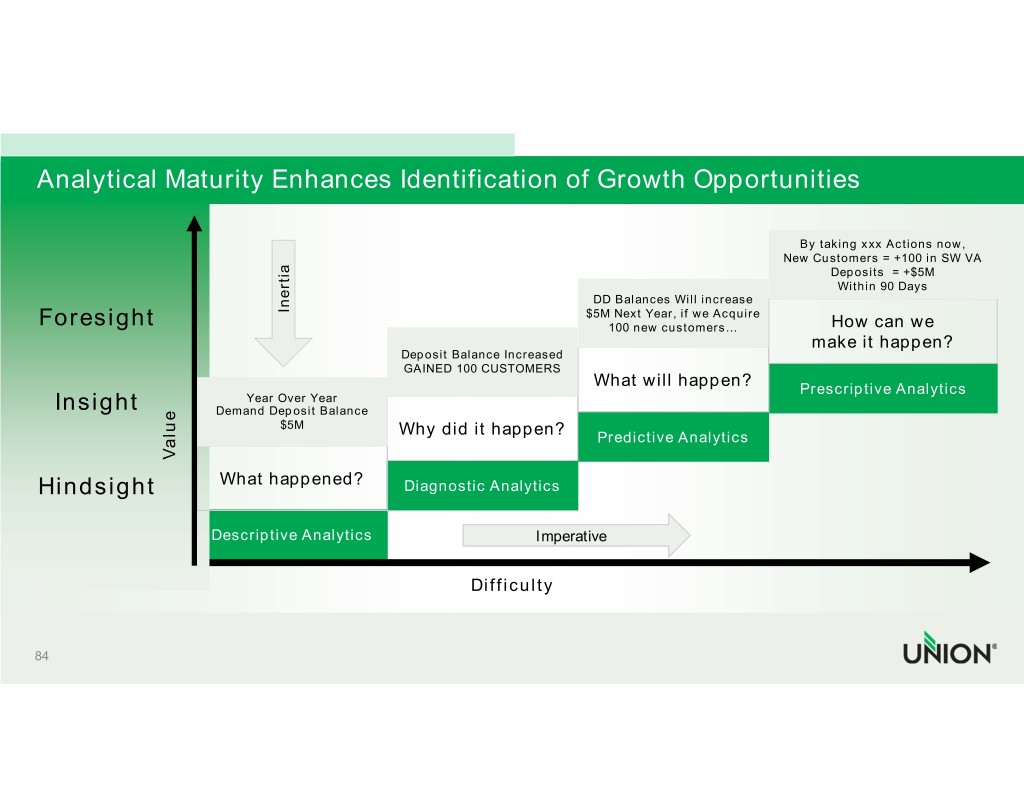

Analytical Maturity Enhances Identification of Growth Opportunities By taking xxx Actions now, New Customers = +100 in SW VA Deposits = +$5M Within 90 Days DD Balances Will increase Inertia $5M Next Year, if we Acquire Foresight 100 new customers… How can we make it happen? Deposit Balance Increased GAINED 100 CUSTOMERS What will happen? Prescriptive Analytics Year Over Year Insight Demand Deposit Balance $5M Why did it happen? Predictive Analytics Value Hindsight What happened? Diagnostic Analytics Descriptive Analytics Imperative Difficulty 84

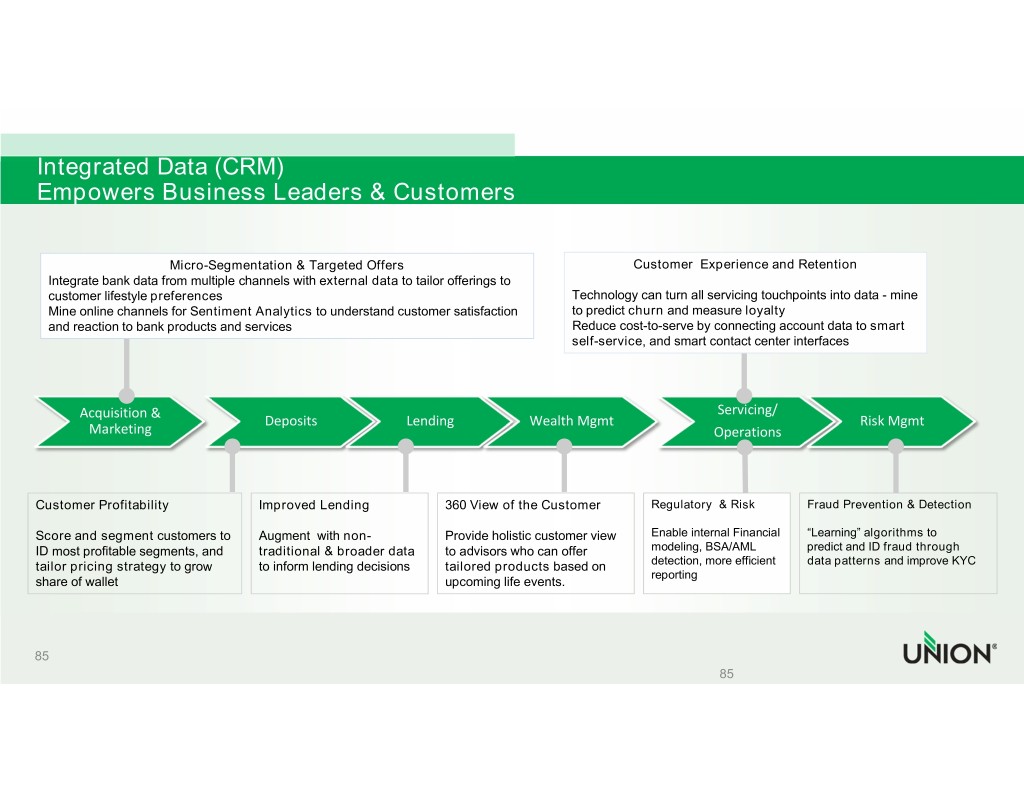

Integrated Data (CRM) Empowers Business Leaders & Customers Micro-Segmentation & Targeted Offers Customer Experience and Retention Integrate bank data from multiple channels with external data to tailor offerings to customer lifestyle preferences Technology can turn all servicing touchpoints into data - mine Mine online channels for Sentiment Analytics to understand customer satisfaction to predict churn and measure loyalty and reaction to bank products and services Reduce cost-to-serve by connecting account data to smart self-service, and smart contact center interfaces Acquisition & Servicing/ Deposits Lending Wealth Mgmt Risk Mgmt Marketing Operations Customer Profitability Improved Lending 360 View of the Customer Regulatory & Risk Fraud Prevention & Detection Score and segment customers to Augment with non- Provide holistic customer view Enable internal Financial “Learning” algorithms to ID most profitable segments, and traditional & broader data to advisors who can offer modeling, BSA/AML predict and ID fraud through tailor pricing strategy to grow to inform lending decisions tailored products based on detection, more efficient data patterns and improve KYC reporting share of wallet upcoming life events. 85 85

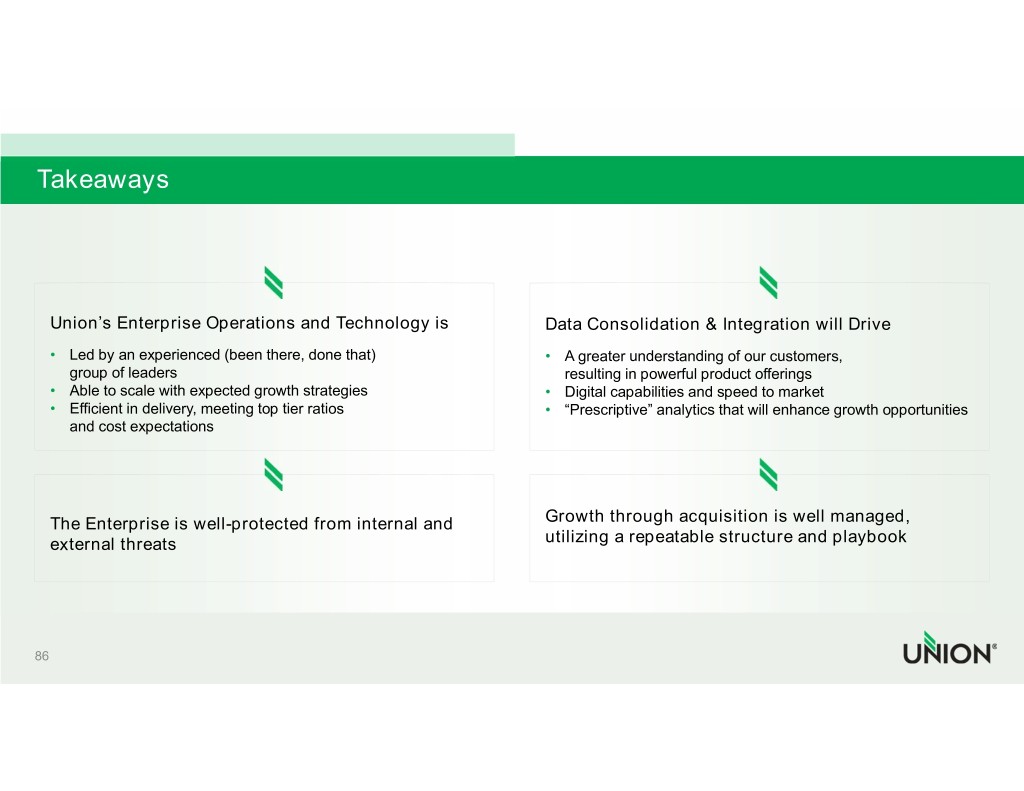

Takeaways Union’s Enterprise Operations and Technology is Data Consolidation & Integration will Drive • Led by an experienced (been there, done that) • A greater understanding of our customers, group of leaders resulting in powerful product offerings • Able to scale with expected growth strategies • Digital capabilities and speed to market • Efficient in delivery, meeting top tier ratios • “Prescriptive” analytics that will enhance growth opportunities and cost expectations The Enterprise is well-protected from internal and Growth through acquisition is well managed, external threats utilizing a repeatable structure and playbook 86

Sara Rountree HEAD OF DIGITAL STRATEGY

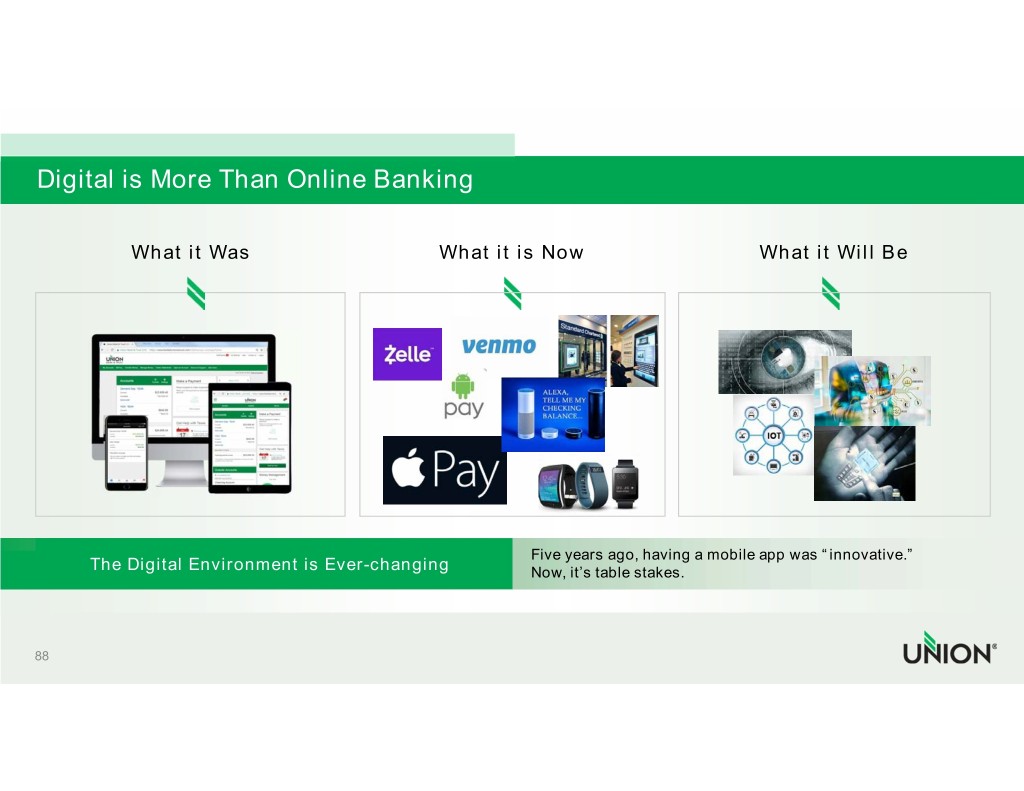

Digital is More Than Online Banking What it Was What it is Now What it Will Be Five years ago, having a mobile app was “innovative.” The Digital Environment is Ever-changing Now, it’s table stakes. 88

Digital is No Longer “A Thing” Digital is a way of doing things. A way of interacting with our customers. 89

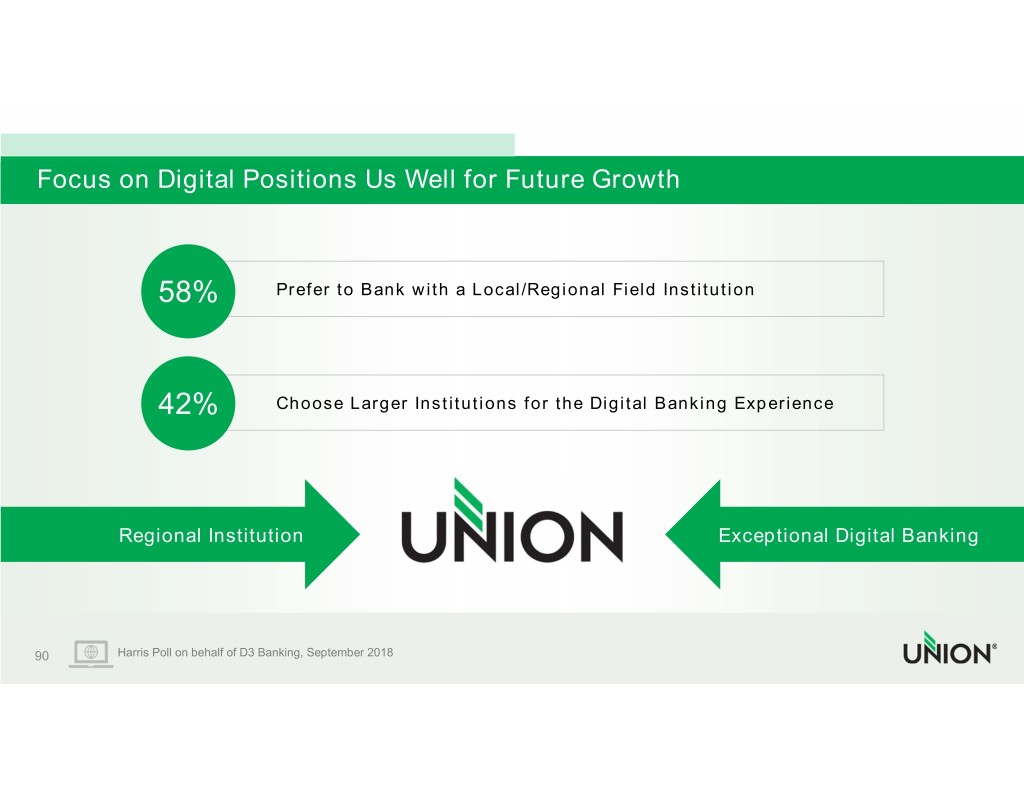

Focus on Digital Positions Us Well for Future Growth 58% Prefer to Bank with a Local/Regional Field Institution 42% Choose Larger Institutions for the Digital Banking Experience Regional Institution Exceptional Digital Banking 90 Harris Poll on behalf of D3 Banking, September 2018

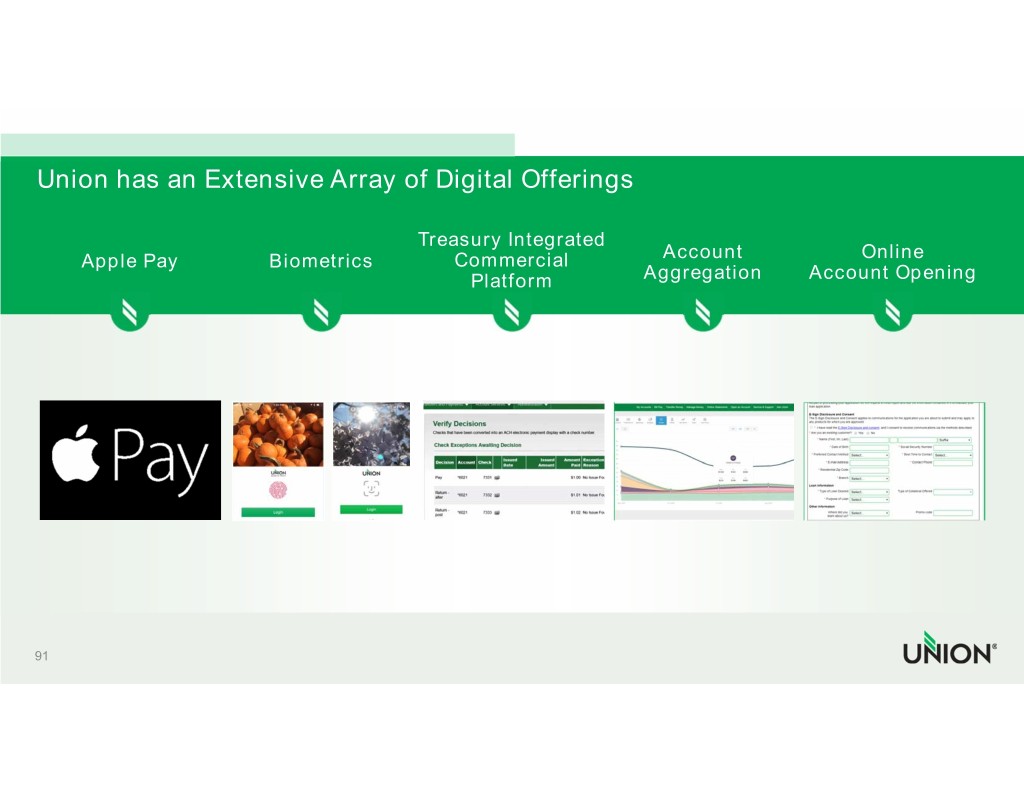

Union has an Extensive Array of Digital Offerings Treasury Integrated Apple Pay Biometrics Commercial Account Online Platform Aggregation Account Opening 91

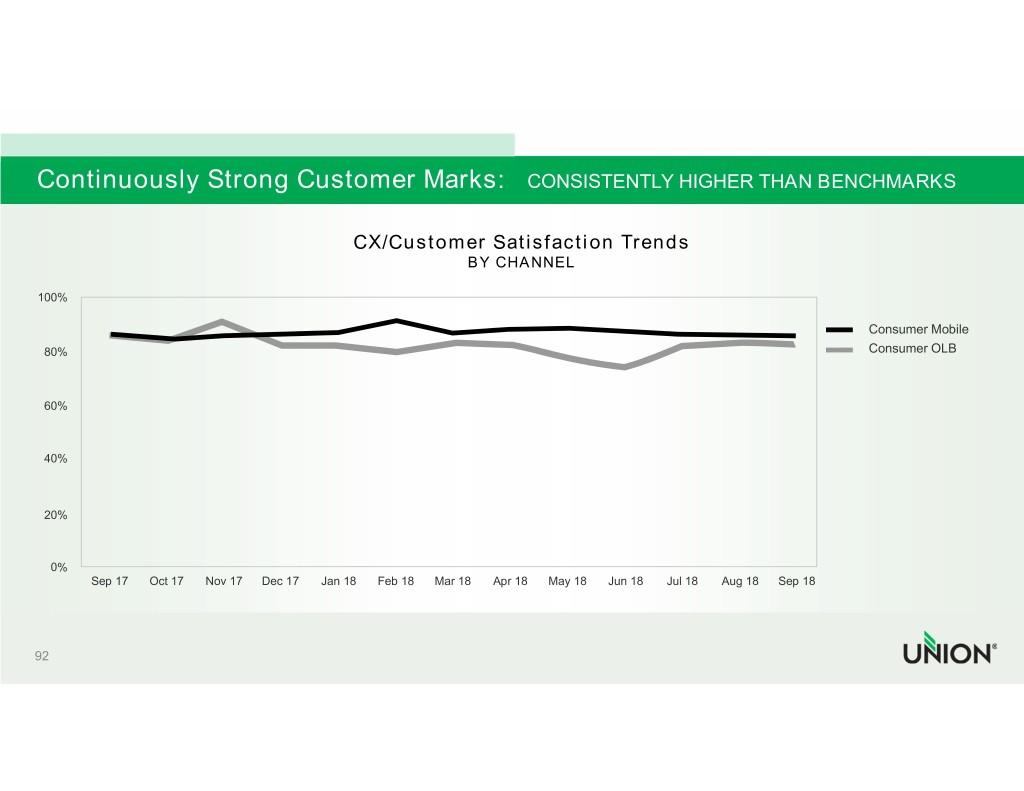

Continuously Strong Customer Marks: CONSISTENTLY HIGHER THAN BENCHMARKS CX/Customer Satisfaction Trends BY CHANNEL 100% Consumer Mobile 80% Consumer OLB 60% 40% 20% 0% Sep 17 Oct 17 Nov 17 Dec 17 Jan 18 Feb 18 Mar 18 Apr 18 May 18 Jun 18 Jul 18 Aug 18 Sep 18 92

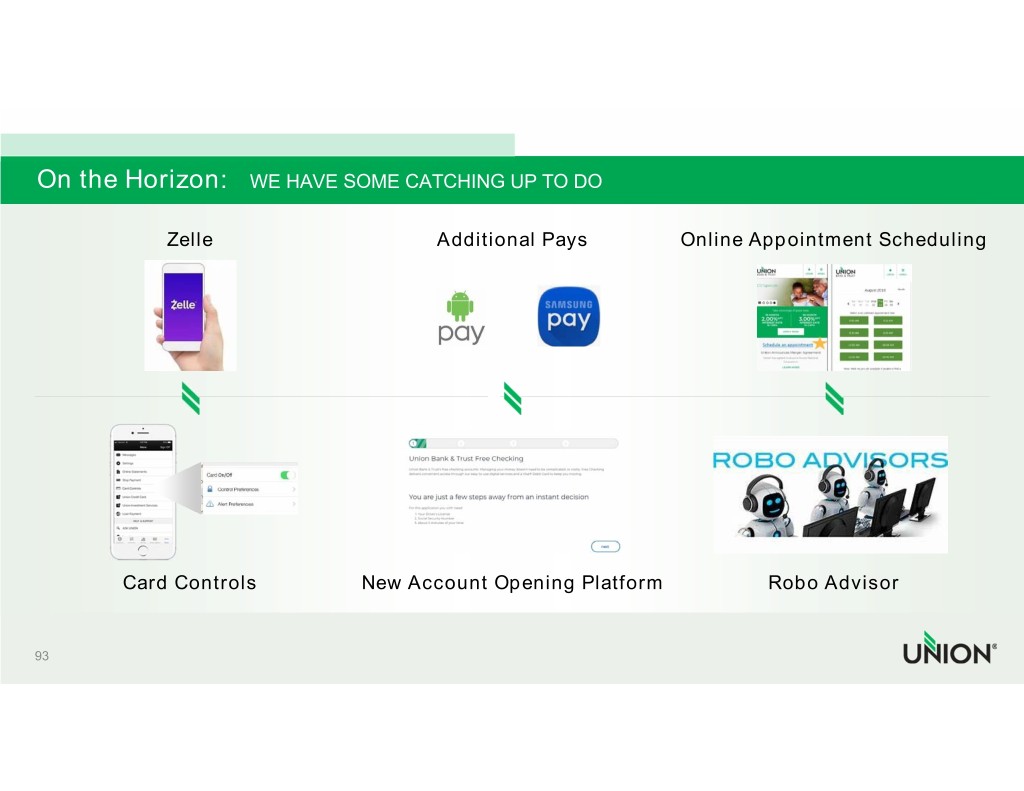

On the Horizon: WE HAVE SOME CATCHING UP TO DO Zelle Additional Pays Online Appointment Scheduling Card Controls New Account Opening Platform Robo Advisor 93

Our Approach IS NOT IS to strive to be first to market to ensure each interaction through with digital capabilities any channel is easy and exceeds our customers’ expectations 94

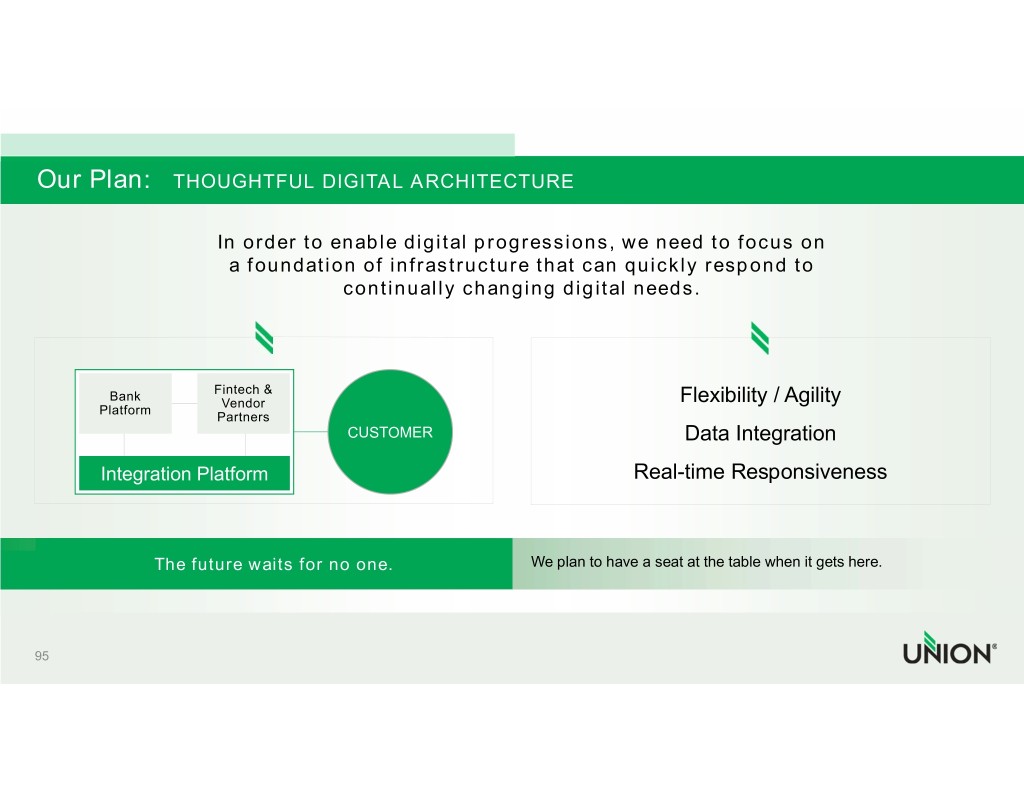

Our Plan: THOUGHTFUL DIGITAL ARCHITECTURE In order to enable digital progressions, we need to focus on a foundation of infrastructure that can quickly respond to continually changing digital needs. Fintech & Bank Vendor Flexibility / Agility Platform Partners CUSTOMER Data Integration Integration Platform Real-time Responsiveness The future waits for no one. We plan to have a seat at the table when it gets here. 95

Our Plan: FOCUS ON CUSTOMER EXPERIENCE Increased Optimize / Modernize Integrate Digital into DIGITAL OFFERINGS DIGITAL EXPERIENCES ASSISTED CHANNELS 96

Our Plan: FOCUS ON OUR TEAMMATES The Right The Right The Right The Right INFORMATION TOOLS SUPPORT PEOPLE 97

Immediate Focus Areas Catch Up Platform Evolutions TABLE STAKES ROLLOUTS Prepare Our Teammates Prepare for the Future 98

The Future of Banking Depends on DIGITAL INCLUSION

Duane Smith CHIEF MARKETING OFFICER

Marketing Vision Be the engine that drives our business growth. Corporate Brand & Reputation Retail Commercial Wealth 101

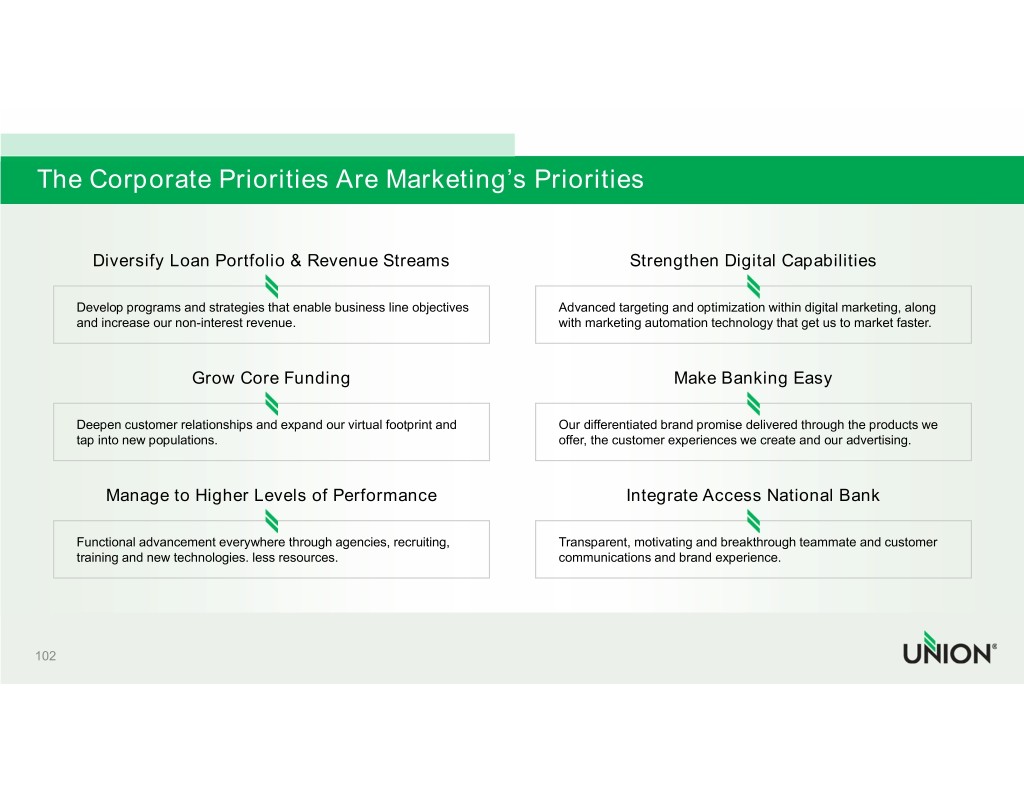

The Corporate Priorities Are Marketing’s Priorities Diversify Loan Portfolio & Revenue Streams Strengthen Digital Capabilities Develop programs and strategies that enable business line objectives Advanced targeting and optimization within digital marketing, along and increase our non-interest revenue. with marketing automation technology that get us to market faster. Grow Core Funding Make Banking Easy Deepen customer relationships and expand our virtual footprint and Our differentiated brand promise delivered through the products we tap into new populations. offer, the customer experiences we create and our advertising. Manage to Higher Levels of Performance Integrate Access National Bank Functional advancement everywhere through agencies, recruiting, Transparent, motivating and breakthrough teammate and customer training and new technologies. less resources. communications and brand experience. 102

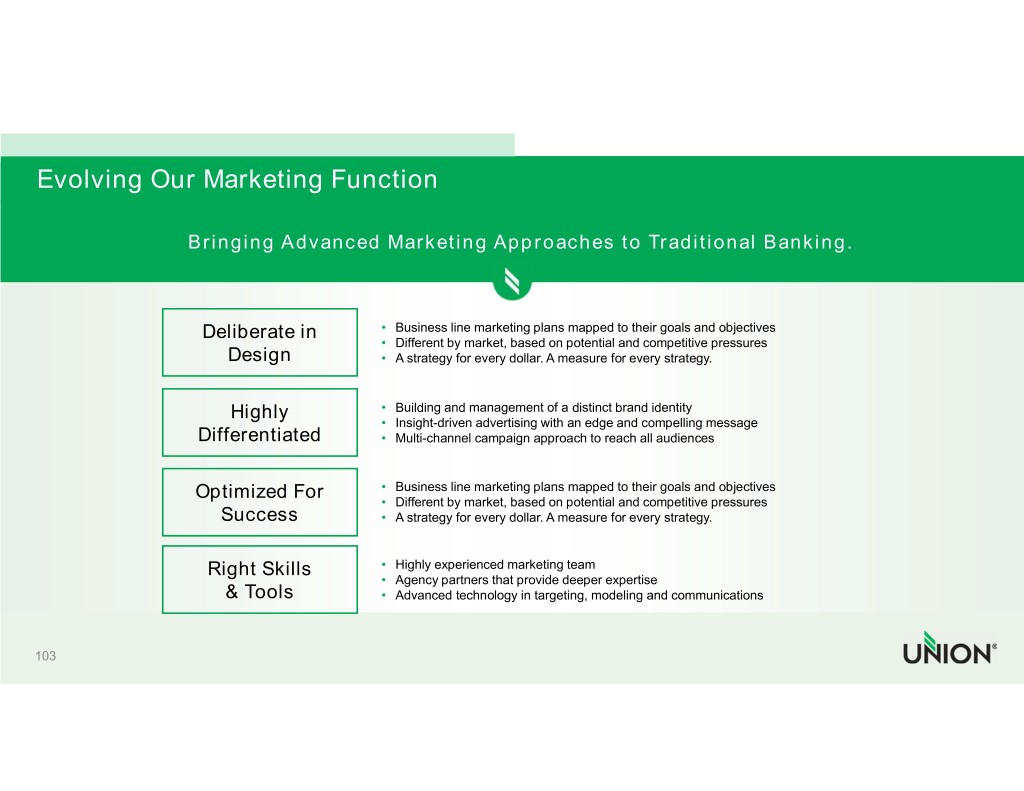

Evolving Our Marketing Function Bringing Advanced Marketing Approaches to Traditional Banking. Deliberate in • Business line marketing plans mapped to their goals and objectives • Different by market, based on potential and competitive pressures Design • A strategy for every dollar. A measure for every strategy. Highly • Building and management of a distinct brand identity • Insight-driven advertising with an edge and compelling message Differentiated • Multi-channel campaign approach to reach all audiences Optimized For • Business line marketing plans mapped to their goals and objectives • Different by market, based on potential and competitive pressures Success • A strategy for every dollar. A measure for every strategy. Right Skills • Highly experienced marketing team • Agency partners that provide deeper expertise & Tools • Advanced technology in targeting, modeling and communications 103

Marketing Team Expertise More Than Half of Our Marketing Team is New and They Bring Big Bank and Brand Experience. 104

Agency Partner Expansion Deeper Capabilities Are Coming From Expanding Our Agency and Partner Pool. Pre-2017 Current 105

Our Marketing Agenda Starts with the Union Brand “A brand is a promise that when kept creates preference.” - Peter Sealey, Ph.D. author, Consultant and former CMO, Coca-Cola We make banking easy. 106

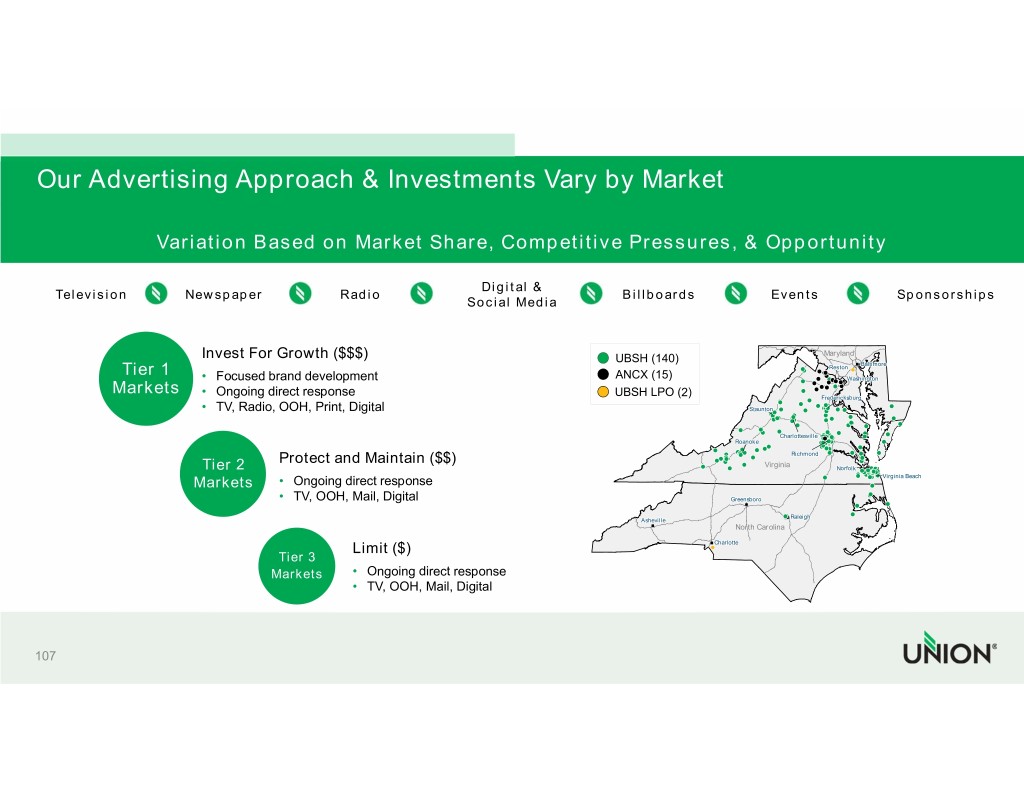

Our Advertising Approach & Investments Vary by Market Variation Based on Market Share, Competitive Pressures, & Opportunity Digital & Television Newspaper Radio Billboards Events Sponsorships Social Media Invest For Growth ($$$) UBSH (140) Maryland BaltimoreBaltimore RestonReston Tier 1 • Focused brand development ANCX (15) Washington Markets • Ongoing direct response UBSH LPO (2) FredericksburgFredericksburg StauntonStaunton • TV, Radio, OOH, Print, Digital CharlottesvilleCharlottesville RoanokeRoanoke RichmondRichmond Protect and Maintain ($$) Virginia NorfolkNorfolk Tier 2 NorfolkNorfolk VirginiaVirginia BeachBeach Markets • Ongoing direct response • TV, OOH, Mail, Digital Greensboro Raleigh AshevilleAsheville Raleigh North Carolina Limit ($) Charlotte Tier 3 Markets • Ongoing direct response • TV, OOH, Mail, Digital 107

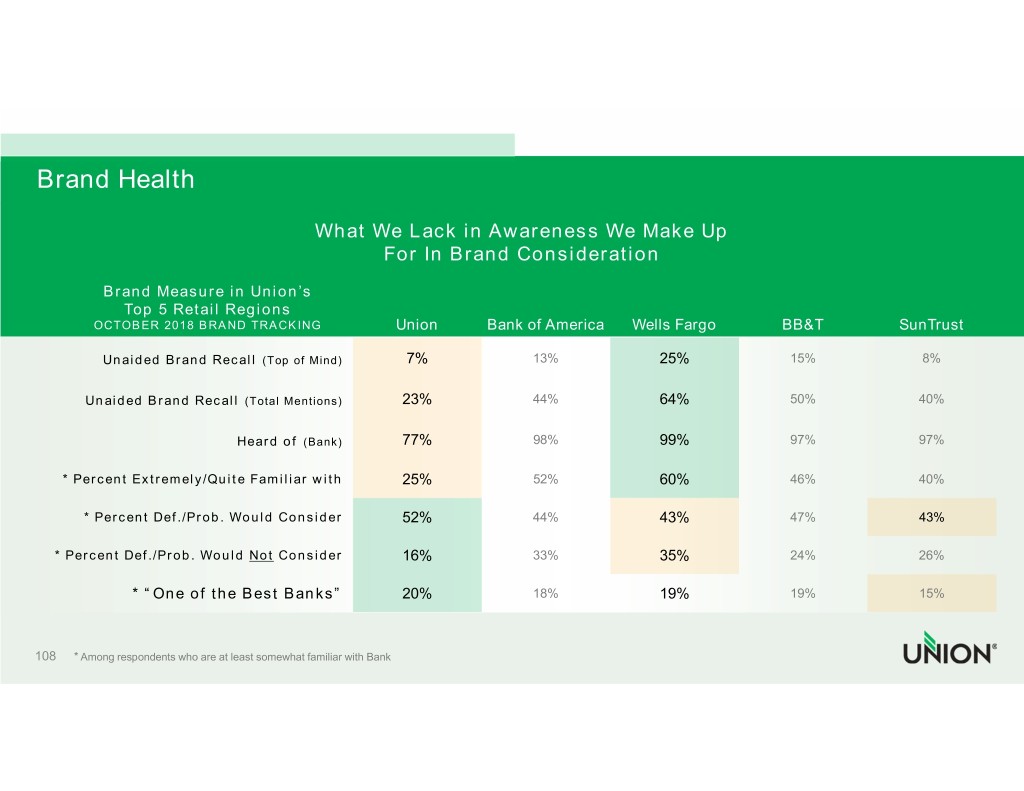

Brand Health What We Lack in Awareness We Make Up For In Brand Consideration Brand Measure in Union’s Top 5 Retail Regions OCTOBER 2018 BRAND TRACKING Union Bank of America Wells Fargo BB&T SunTrust Unaided Brand Recall (Top of Mind) 7% 13% 25% 15% 8% Unaided Brand Recall (Total Mentions) 23% 44% 64% 50% 40% Heard of (Bank) 77% 98% 99% 97% 97% * Percent Extremely/Quite Familiar with 25% 52% 60% 46% 40% * Percent Def./Prob. Would Consider 52% 44% 43% 47% 43% * Percent Def./Prob. Would Not Consider 16% 33% 35% 24% 26% * “One of the Best Banks” 20% 18% 19% 19% 15% 108 * Among respondents who are at least somewhat familiar with Bank

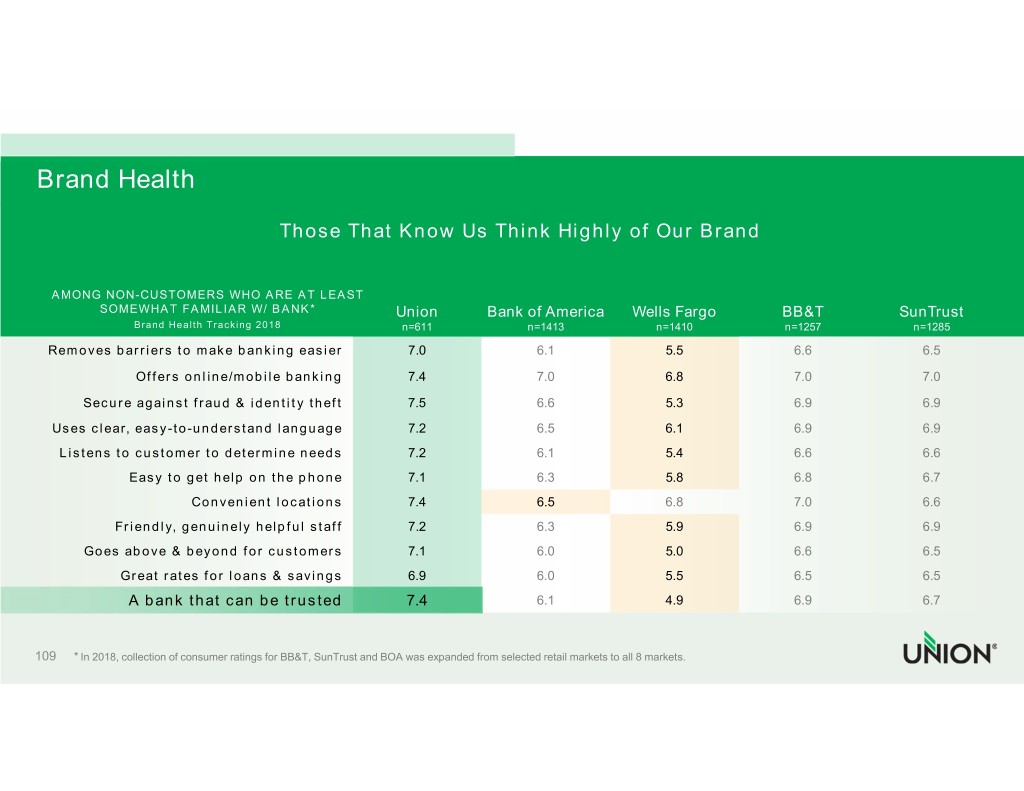

Brand Health Those That Know Us Think Highly of Our Brand AMONG NON-CUSTOMERS WHO ARE AT LEAST SOMEWHAT FAMILIAR W/ BANK* Union Bank of America Wells Fargo BB&T SunTrust Brand Health Tracking 2018 n=611 n=1413 n=1410 n=1257 n=1285 Removes barriers to make banking easier 7.0 6.1 5.5 6.6 6.5 Offers online/mobile banking 7.4 7.0 6.8 7.0 7.0 Secure against fraud & identity theft 7.5 6.6 5.3 6.9 6.9 Uses clear, easy-to-understand language 7.2 6.5 6.1 6.9 6.9 Listens to customer to determine needs 7.2 6.1 5.4 6.6 6.6 Easy to get help on the phone 7.1 6.3 5.8 6.8 6.7 Convenient locations 7.4 6.5 6.8 7.0 6.6 Friendly, genuinely helpful staff 7.2 6.3 5.9 6.9 6.9 Goes above & beyond for customers 7.1 6.0 5.0 6.6 6.5 Great rates for loans & savings 6.9 6.0 5.5 6.5 6.5 A bank that can be trusted 7.4 6.1 4.9 6.9 6.7 109 * In 2018, collection of consumer ratings for BB&T, SunTrust and BOA was expanded from selected retail markets to all 8 markets.

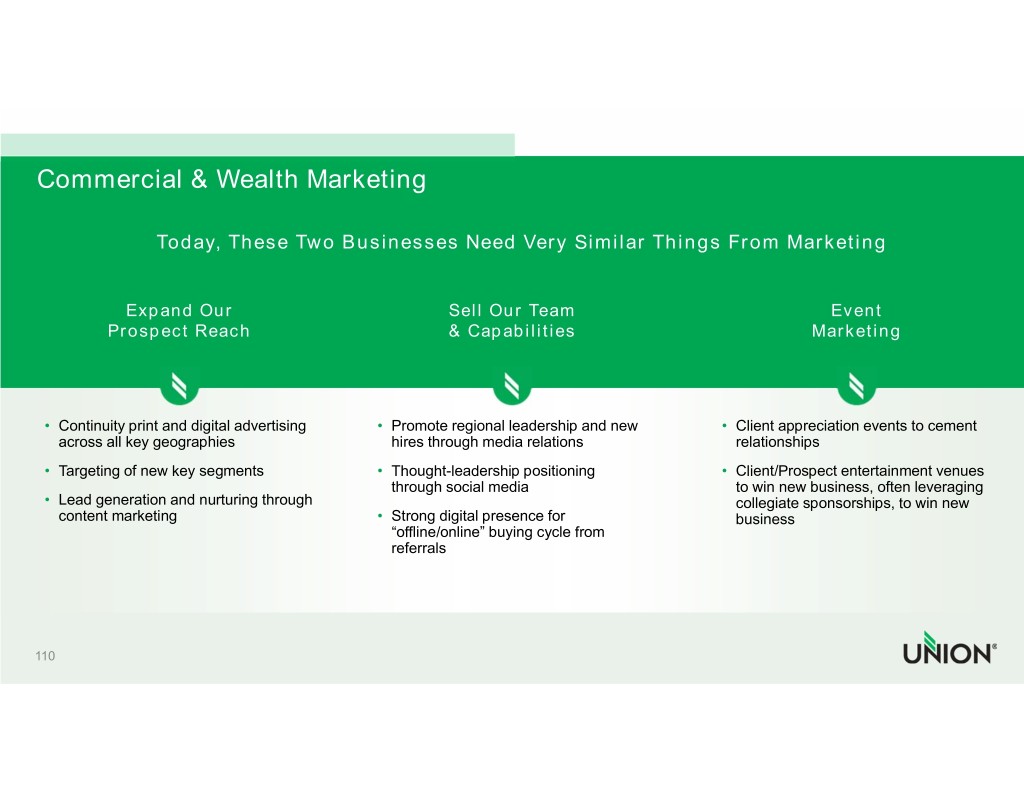

Commercial & Wealth Marketing Today, These Two Businesses Need Very Similar Things From Marketing Expand Our Sell Our Team Event Prospect Reach & Capabilities Marketing • Continuity print and digital advertising • Promote regional leadership and new • Client appreciation events to cement across all key geographies hires through media relations relationships • Targeting of new key segments • Thought-leadership positioning • Client/Prospect entertainment venues through social media to win new business, often leveraging • Lead generation and nurturing through collegiate sponsorships, to win new content marketing • Strong digital presence for business “offline/online” buying cycle from referrals 110

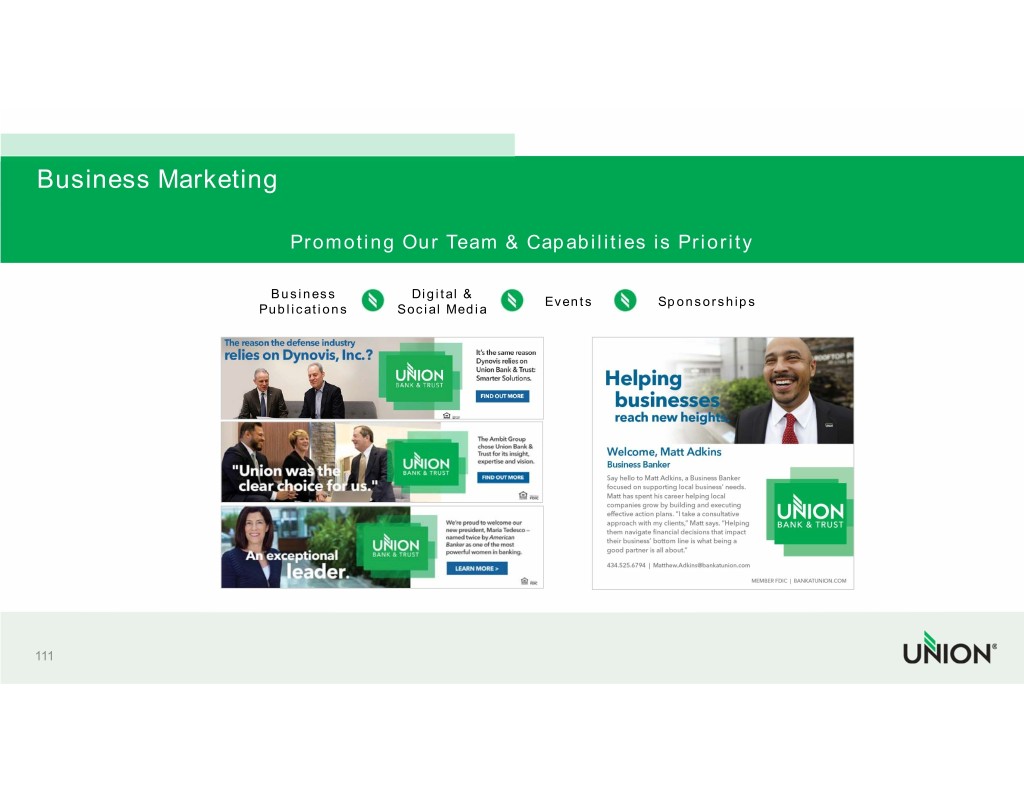

Business Marketing Promoting Our Team & Capabilities is Priority Business Digital & Events Sponsorships Publications Social Media 111

Wealth Marketing Promoting Our Team & Capabilities is Priority Business Digital & Events Sponsorships Publications Social Media 112

Retail Marketing Differentiated Drive Awareness Direct-To-Consumer Value Propositions & Consideration Marketing • Free Checking (for consumers and • Continuity, multi-channel advertising • Ongoing targeted cross-sell businesses) as an easy entry product across geographies campaigns, with modeled propensity (mail, email, digital, and outbound • Loyalty Savings Suite to enable more • Hard-hitting brand ads that calling) immediate cross-sell differentiate us from both the small community banks and the big • Lookalike modeled campaigns for • Digital solutions (e.g. Zelle) to “Make regional/national banks prospecting new households (mail and Banking Easy” digital) • Unique collection of collegiate sports • New product development for Mass sponsorships that span our footprint • Ongoing optimization of our inbound Affluent and leverage school brand equity website and phone traffic • Budgets that follow success 113

Differentiated Advertising 2017/2018 Insert video of two TV ads – one from each year. Use animation feature to hold video until I can set it up. 114

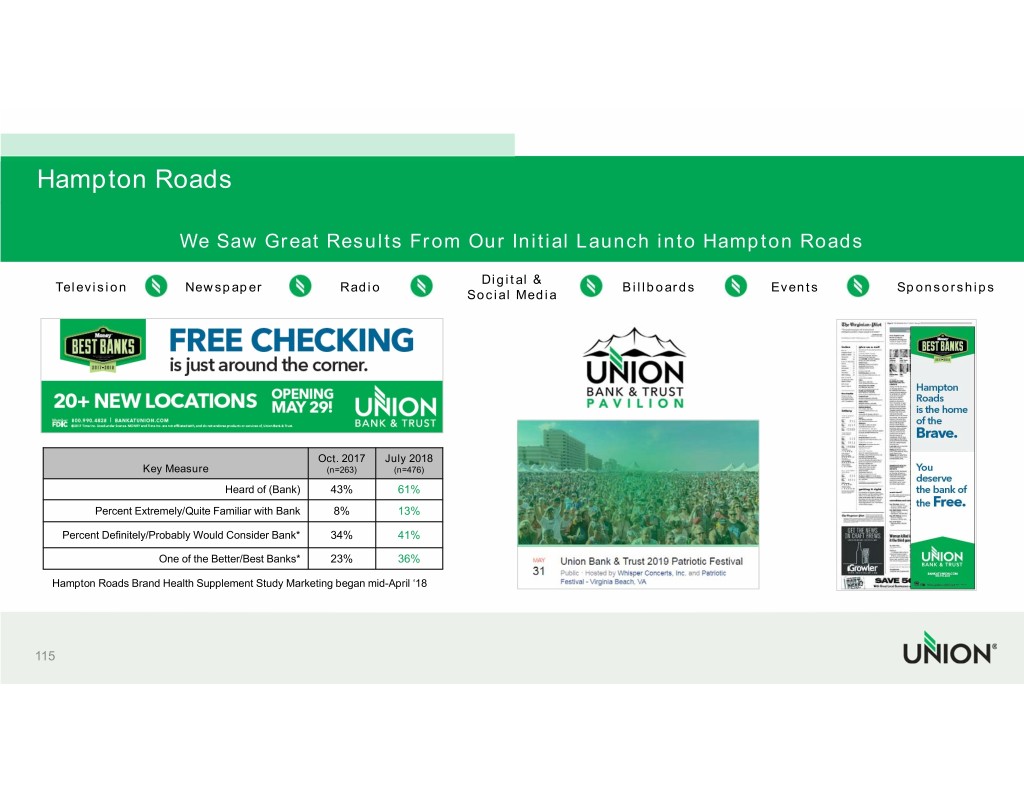

Hampton Roads We Saw Great Results From Our Initial Launch into Hampton Roads Digital & Television Newspaper Radio Billboards Events Sponsorships Social Media Oct. 2017 July 2018 Key Measure (n=263) (n=476) Heard of (Bank) 43% 61% Percent Extremely/Quite Familiar with Bank 8% 13% Percent Definitely/Probably Would Consider Bank* 34% 41% One of the Better/Best Banks* 23% 36% Hampton Roads Brand Health Supplement Study Marketing began mid-April ‘18 115

Big Plans For Differentiated Advertising In 2019 New Products and Services 3rd Party Accolades Virginia Collegiate Sports 116

Our Customer Promise We make banking easy. Ready to Bank Better? Bank at 117

Rob Gorman CHIEF FINANCIAL OFFICER

Union is Well Positioned Today Union is financially strong, boasting strong capital levels, good loan growth, excellent asset quality, and profitable operations. The acquisition of Xenith Bankshares enabled us to The Bank’s statewide franchise offers greater efficiently cross the $10 Billion threshold, and convenience for customers. combined with the pending acquisition of Access National Corporation, provides us presence across Virginia, including in the attractive Northern Virginia Union operates in many attractive markets and Hampton Road markets, and also provides C&I characterized by stable growth, where population expertise that can be leveraged throughout the growth is higher than the national average. combined footprint. Through the mergers, we also now have footholds in North Carolina and Maryland providing a platform for further expansion. Management depth and expertise enables Union to have a sharper strategic focus and excellent execution capabilities. To achieve competitive differentiation and to deliver sustainable shareholder value, Union will quickly capitalize on its advantages and address its strategic priorities. 119

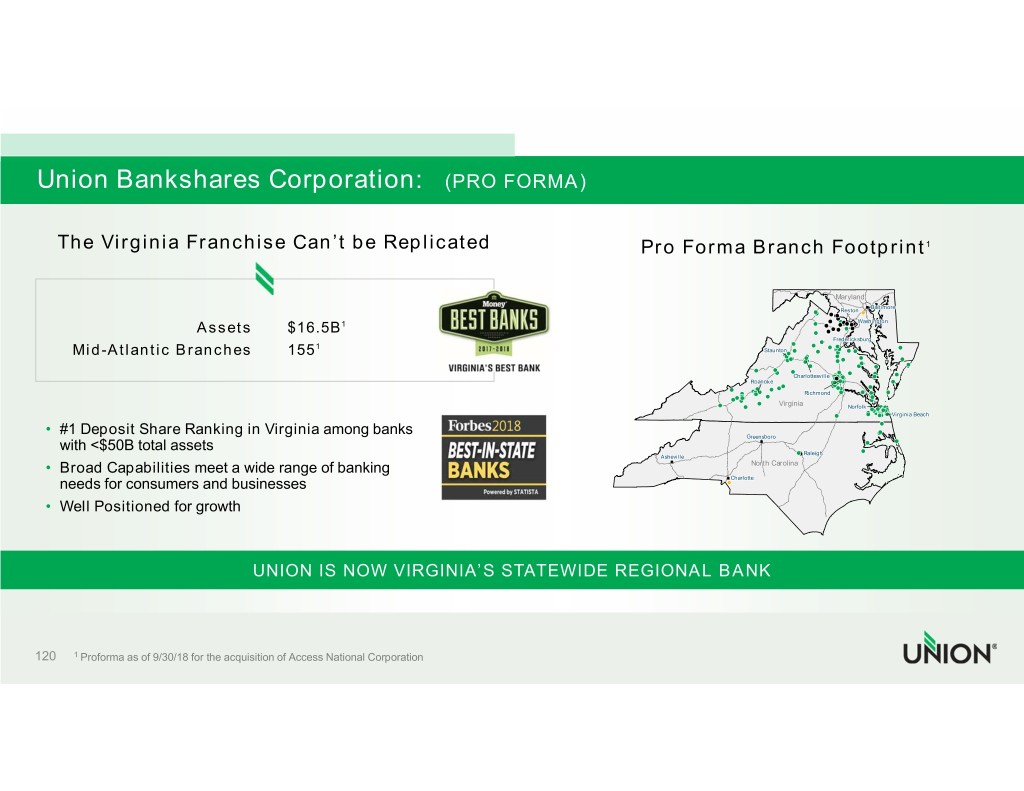

Union Bankshares Corporation: (PRO FORMA) The Virginia Franchise Can’t be Replicated Pro Forma Branch Footprint1 Maryland Baltimore RestonReston Washington 1 Assets $16.5B FredericksburgFredericksburg 1 StauntonStaunton Mid-Atlantic Branches 155 Charlottesville Roanoke Richmond Virginia Norfolk VirginiaVirginia BeachBeach VirginiaVirginia BeachBeach • #1 Deposit Share Ranking in Virginia among banks Greensboro with <$50B total assets Raleigh Asheville Raleigh • Broad Capabilities meet a wide range of banking North Carolina needs for consumers and businesses Charlotte • Well Positioned for growth UNION IS NOW VIRGINIA’S STATEWIDE REGIONAL BANK 120 1 Proforma as of 9/30/18 for the acquisition of Access National Corporation

Our Value Proposition Shareholder Scale SOLID DIVIDEND YIELD & PAYOUT RATIO W/EARNINGS UPSIDE LARGEST VA REGIONAL BANK UNIQUE VALUE IN BRANCH FOOTPRINT Opportunity COMMITTED TO TOP-TIER PERFORMANCE Strength BALANCE SHEET & CAPITAL LEVELS Growth ORGANIC & ACQUISITION OPPORTUNITIES 121

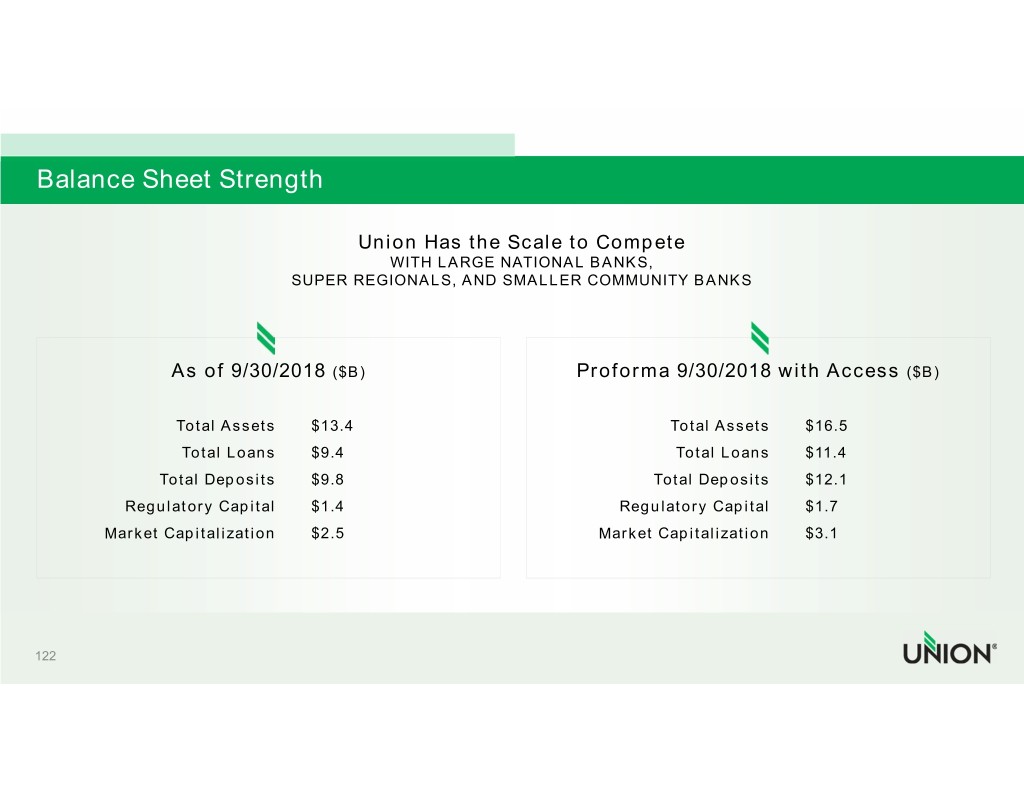

Balance Sheet Strength Union Has the Scale to Compete WITH LARGE NATIONAL BANKS, SUPER REGIONALS, AND SMALLER COMMUNITY BANKS As of 9/30/2018 ($B) Proforma 9/30/2018 with Access ($B) Total Assets $13.4 Total Assets $16.5 Total Loans $9.4 Total Loans $11.4 Total Deposits $9.8 Total Deposits $12.1 Regulatory Capital $1.4 Regulatory Capital $1.7 Market Capitalization $2.5 Market Capitalization $3.1 122

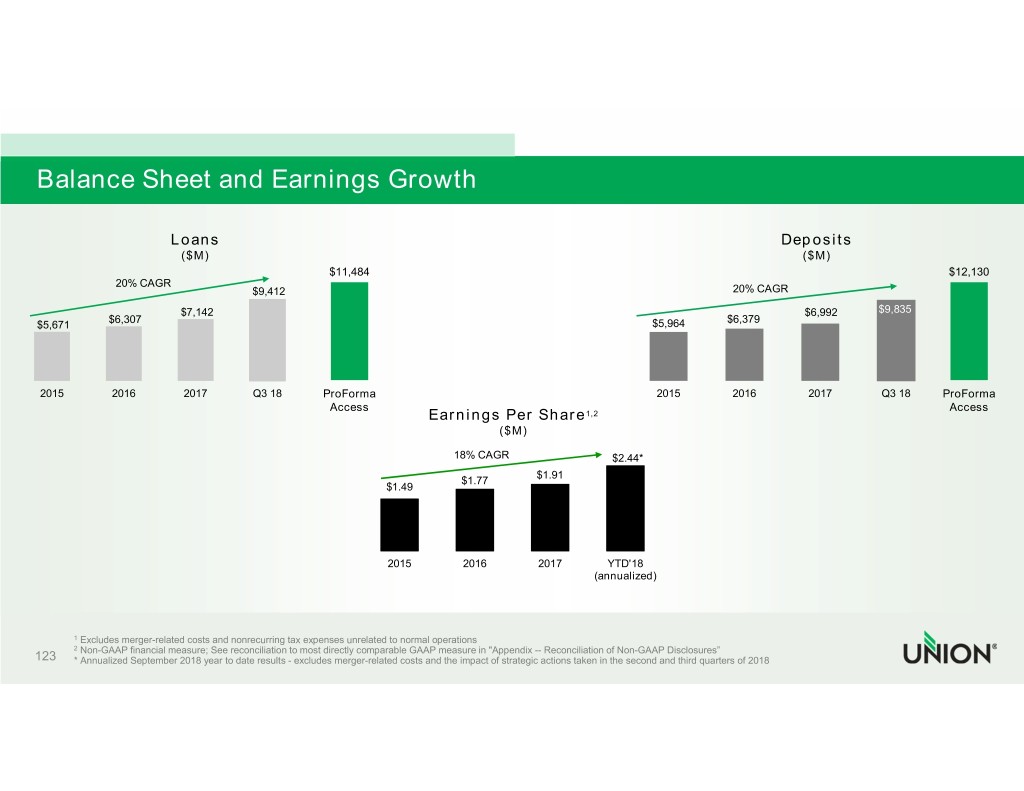

Balance Sheet and Earnings Growth Loans Deposits ($M) ($M) $11,484 $12,130 20% CAGR $9,412 20% CAGR $7,142 $6,992 $9,835 $6,307 $6,379 $5,671 $5,964 2015 2016 2017 Q3 18 ProForma 2015 2016 2017 Q3 18 ProForma Access Access Earnings Per Share1,2 ($M) 18% CAGR $2.44* $1.91 $1.77 $1.49 2015 2016 2017 YTD'18 (annualized) 1 Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations 2 Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures” 123 * Annualized September 2018 year to date results - excludes merger-related costs and the impact of strategic actions taken in the second and third quarters of 2018

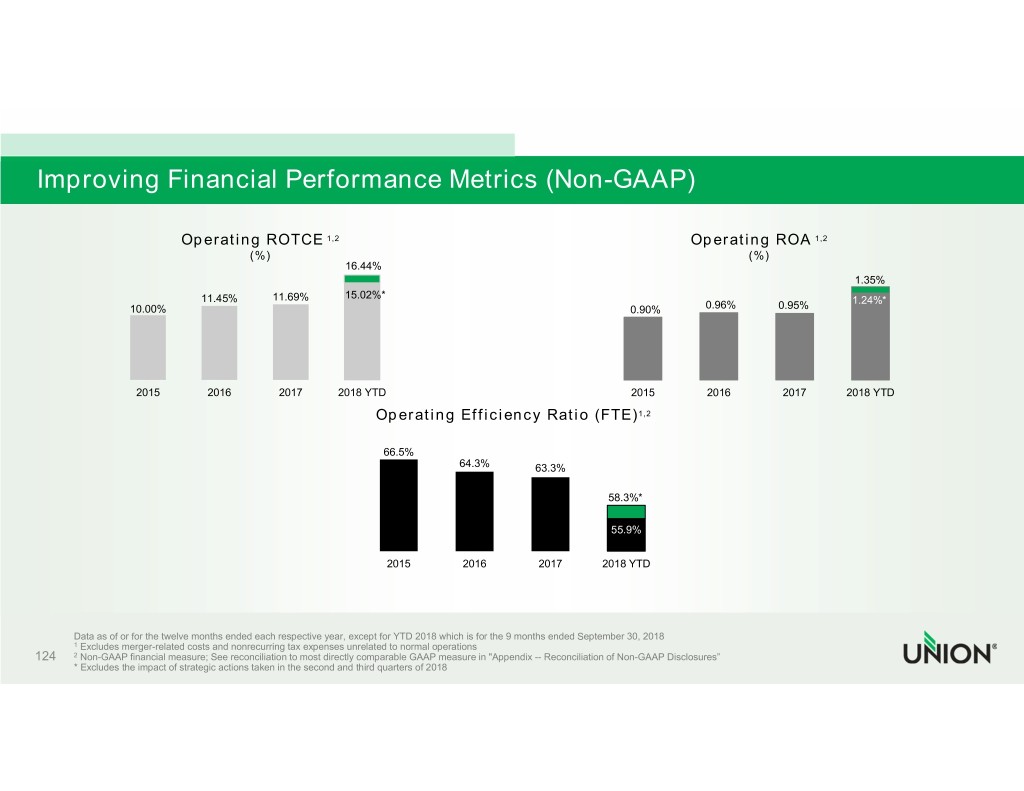

Improving Financial Performance Metrics (Non-GAAP) Operating ROTCE 1,2 Operating ROA 1,2 (%) (%) 16.44% 1.35% 11.45% 11.69% 15.02%* 1.24%* 10.00% 0.90% 0.96% 0.95% 2015 2016 2017 2018 YTD 2015 2016 2017 2018 YTD Operating Efficiency Ratio (FTE)1,2 66.5% 64.3% 63.3% 58.3%* 55.9% 2015 2016 2017 2018 YTD Data as of or for the twelve months ended each respective year, except for YTD 2018 which is for the 9 months ended September 30, 2018 1 Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations 124 2 Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures” * Excludes the impact of strategic actions taken in the second and third quarters of 2018

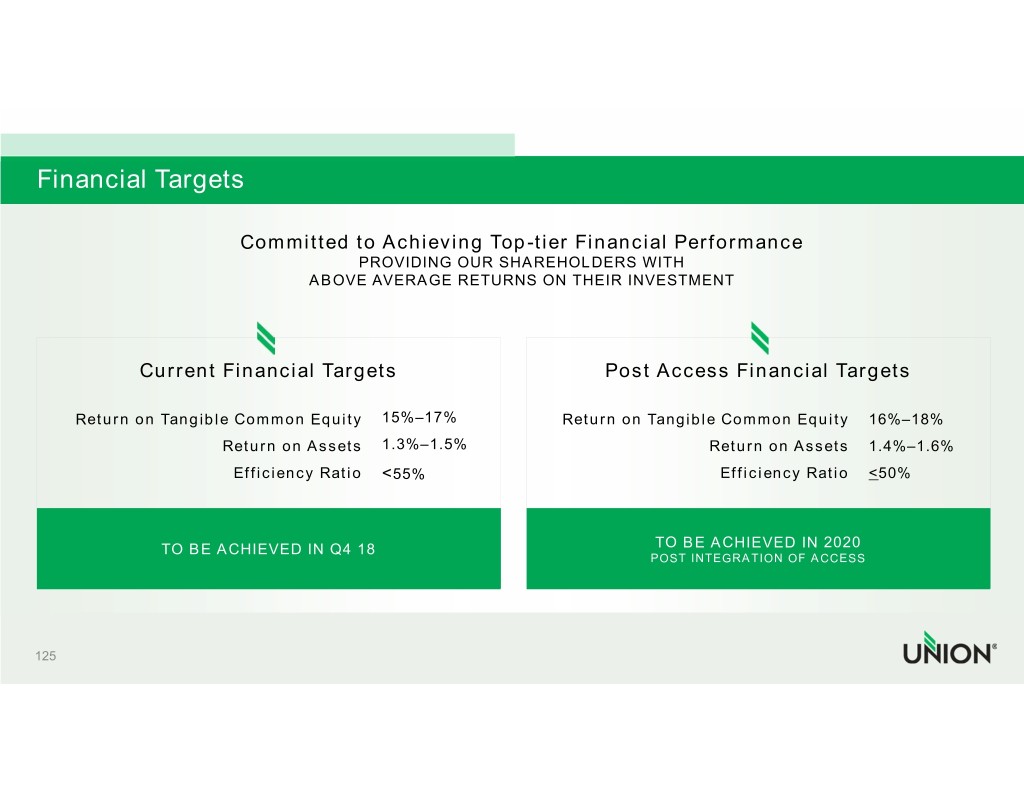

Financial Targets Committed to Achieving Top-tier Financial Performance PROVIDING OUR SHAREHOLDERS WITH ABOVE AVERAGE RETURNS ON THEIR INVESTMENT Current Financial Targets Post Access Financial Targets Return on Tangible Common Equity 15%–17% Return on Tangible Common Equity 16%–18% Return on Assets 1.3%–1.5% Return on Assets 1.4%–1.6% Efficiency Ratio <55% Efficiency Ratio <50% TO BE ACHIEVED IN Q4 18 TO BE ACHIEVED IN 2020 POST INTEGRATION OF ACCESS 125

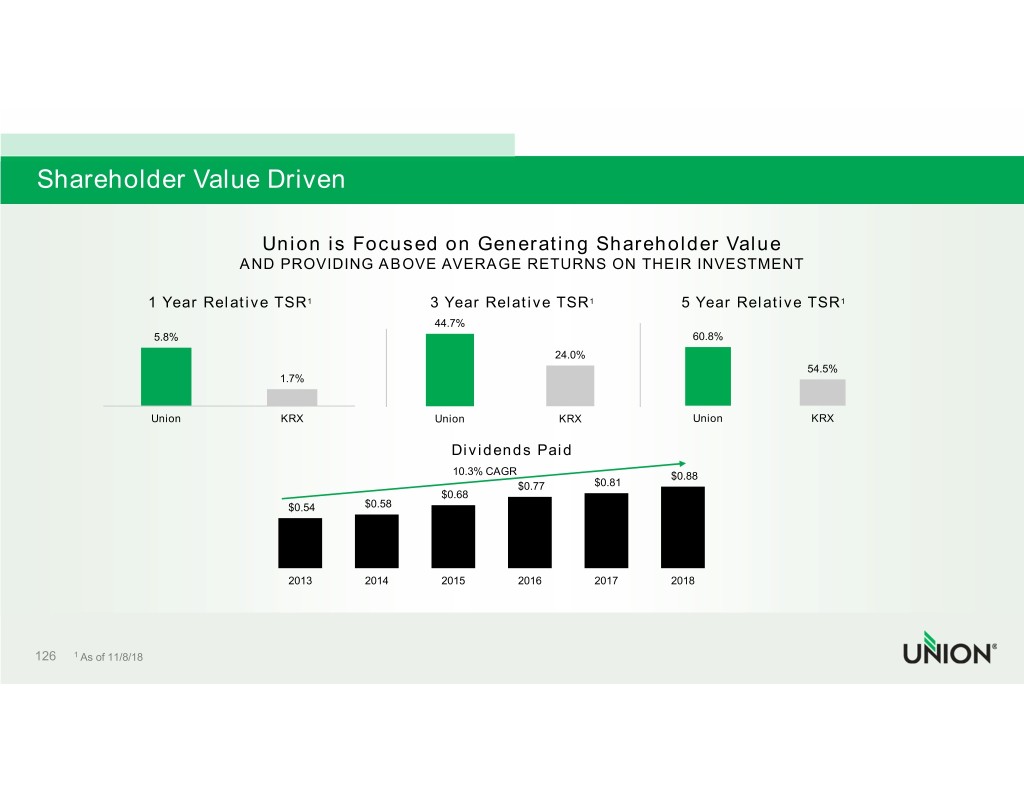

Shareholder Value Driven Union is Focused on Generating Shareholder Value AND PROVIDING ABOVE AVERAGE RETURNS ON THEIR INVESTMENT 1 Year Relative TSR1 3 Year Relative TSR1 5 Year Relative TSR1 44.7% 5.8% 60.8% 24.0% 54.5% 1.7% Union KRX Union KRX Union KRX Dividends Paid 10.3% CAGR $0.88 $0.77 $0.81 $0.68 $0.54 $0.58 2013 2014 2015 2016 2017 2018 126 1 As of 11/8/18

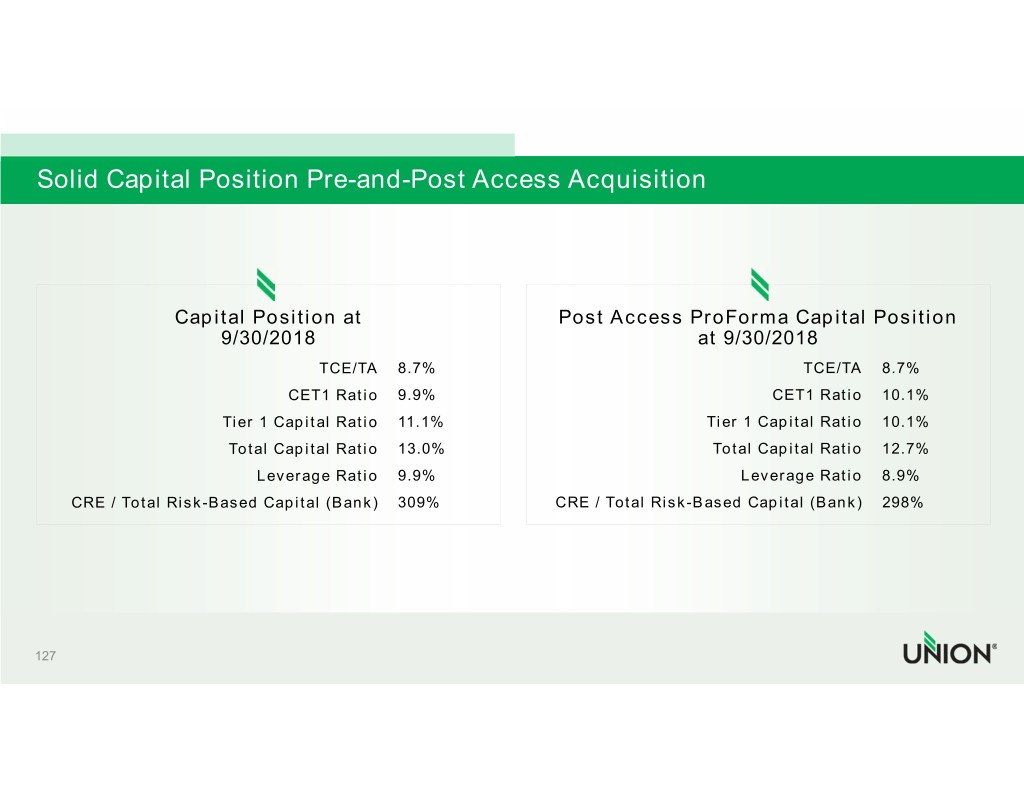

Solid Capital Position Pre-and-Post Access Acquisition Capital Position at Post Access ProForma Capital Position 9/30/2018 at 9/30/2018 TCE/TA 8.7% TCE/TA 8.7% CET1 Ratio 9.9% CET1 Ratio 10.1% Tier 1 Capital Ratio 11.1% Tier 1 Capital Ratio 10.1% Total Capital Ratio 13.0% Total Capital Ratio 12.7% Leverage Ratio 9.9% Leverage Ratio 8.9% CRE / Total Risk-Based Capital (Bank) 309% CRE / Total Risk-Based Capital (Bank) 298% 127

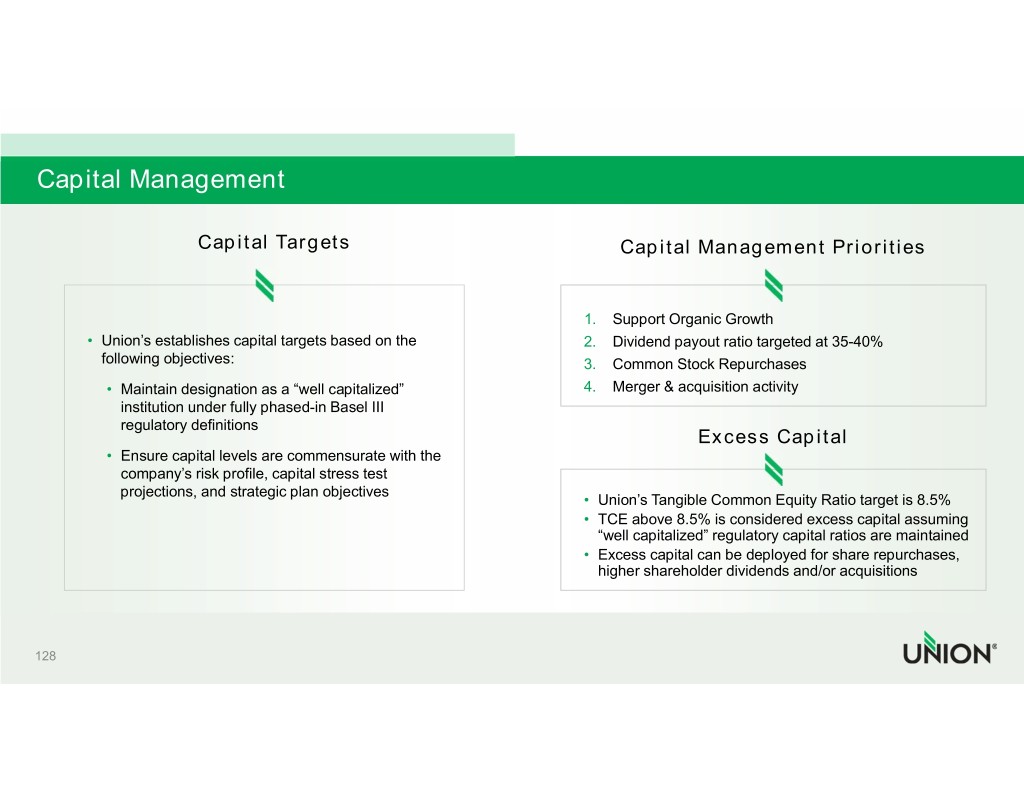

Capital Management Capital Targets Capital Management Priorities 1. Support Organic Growth • Union’s establishes capital targets based on the 2. Dividend payout ratio targeted at 35-40% following objectives: 3. Common Stock Repurchases • Maintain designation as a “well capitalized” 4. Merger & acquisition activity institution under fully phased-in Basel III regulatory definitions Excess Capital • Ensure capital levels are commensurate with the company’s risk profile, capital stress test projections, and strategic plan objectives • Union’s Tangible Common Equity Ratio target is 8.5% • TCE above 8.5% is considered excess capital assuming “well capitalized” regulatory capital ratios are maintained • Excess capital can be deployed for share repurchases, higher shareholder dividends and/or acquisitions 128

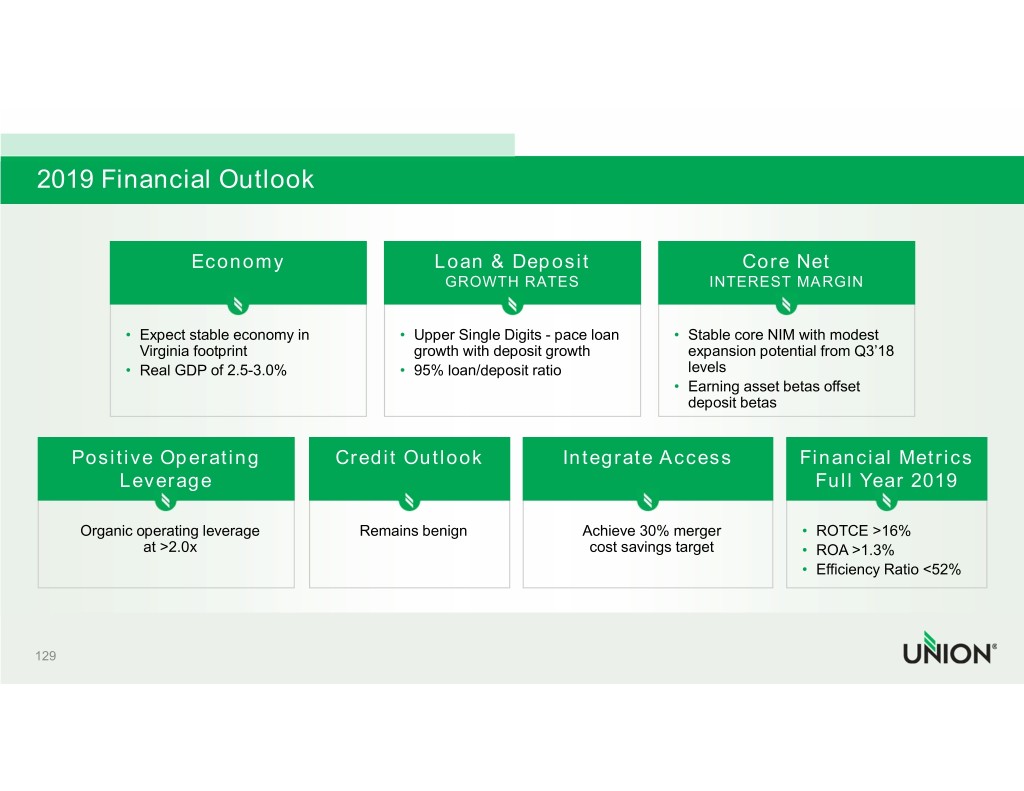

2019 Financial Outlook Economy Loan & Deposit Core Net GROWTH RATES INTEREST MARGIN • Expect stable economy in • Upper Single Digits - pace loan • Stable core NIM with modest Virginia footprint growth with deposit growth expansion potential from Q3’18 • Real GDP of 2.5-3.0% • 95% loan/deposit ratio levels • Earning asset betas offset deposit betas Positive Operating Credit Outlook Integrate Access Financial Metrics Leverage Full Year 2019 Organic operating leverage Remains benign Achieve 30% merger • ROTCE >16% at >2.0x cost savings target • ROA >1.3% • Efficiency Ratio <52% 129

John Asbury WITH A FINAL MESSAGE BEFORE QUESTIONS

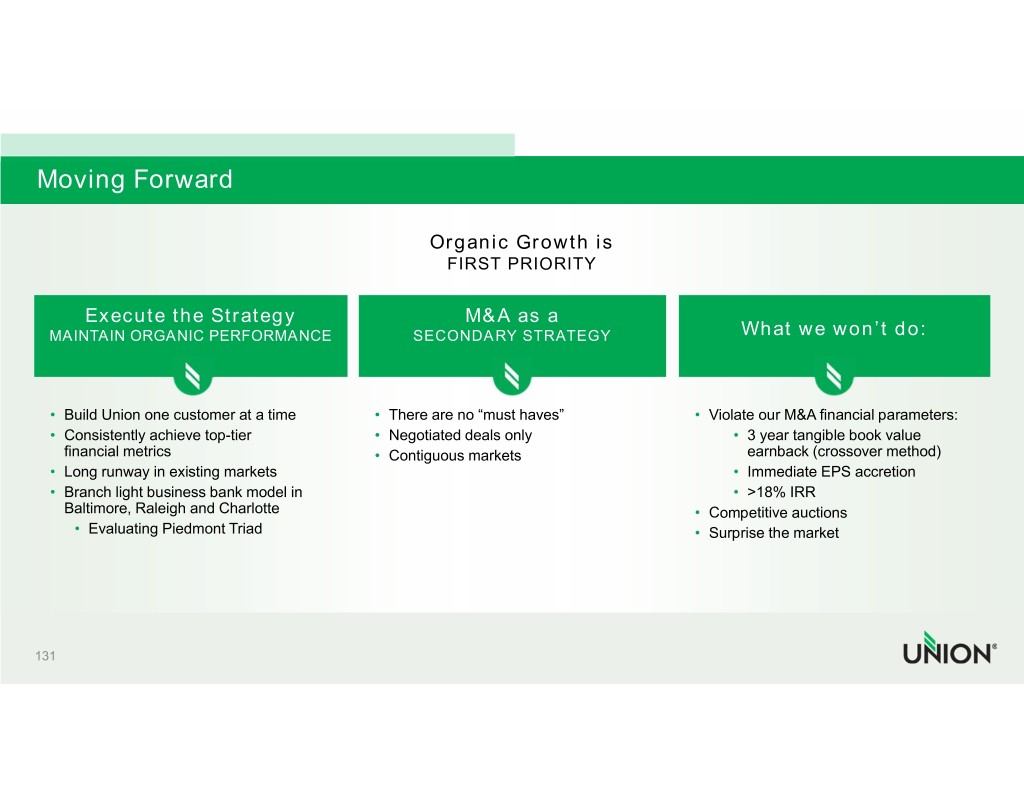

Moving Forward Organic Growth is FIRST PRIORITY Execute the Strategy M&A as a MAINTAIN ORGANIC PERFORMANCE SECONDARY STRATEGY What we won’t do: • Build Union one customer at a time • There are no “must haves” • Violate our M&A financial parameters: • Consistently achieve top-tier • Negotiated deals only • 3 year tangible book value financial metrics • Contiguous markets earnback (crossover method) • Long runway in existing markets • Immediate EPS accretion • Branch light business bank model in • >18% IRR Baltimore, Raleigh and Charlotte • Competitive auctions • Evaluating Piedmont Triad • Surprise the market 131

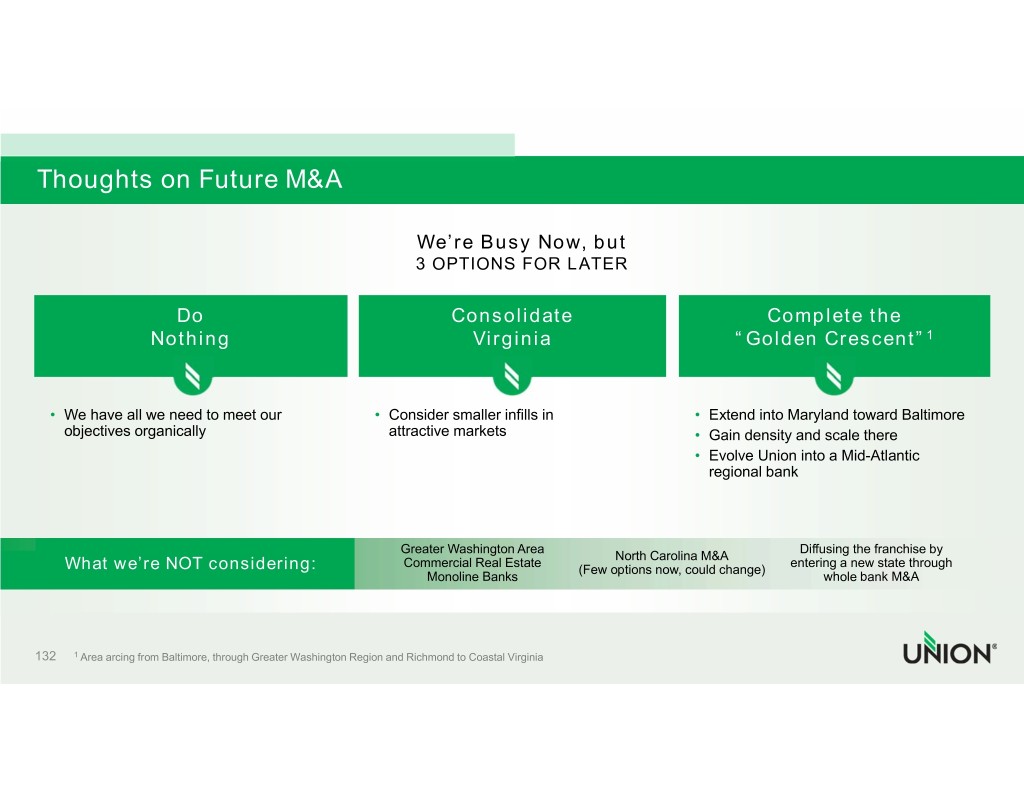

Thoughts on Future M&A We’re Busy Now, but 3 OPTIONS FOR LATER Do Consolidate Complete the Nothing Virginia “Golden Crescent”1 • We have all we need to meet our • Consider smaller infills in • Extend into Maryland toward Baltimore objectives organically attractive markets • Gain density and scale there • Evolve Union into a Mid-Atlantic regional bank Greater Washington Area Diffusing the franchise by North Carolina M&A Commercial Real Estate entering a new state through What we’re NOT considering: (Few options now, could change) Monoline Banks whole bank M&A 132 1 Area arcing from Baltimore, through Greater Washington Region and Richmond to Coastal Virginia

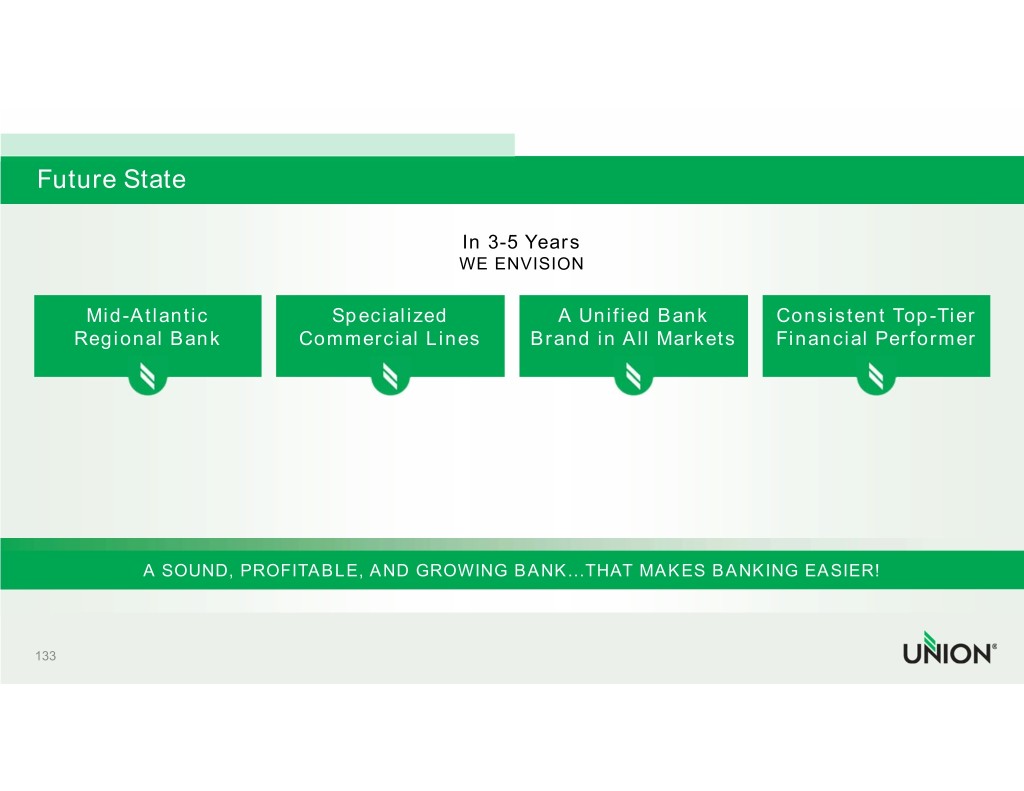

Future State In 3-5 Years WE ENVISION Mid-Atlantic Specialized A Unified Bank Consistent Top-Tier Regional Bank Commercial Lines Brand in All Markets Financial Performer A SOUND, PROFITABLE, AND GROWING BANK...THAT MAKES BANKING EASIER! 133