Exhibit 99.1 Investor Presentation Nasdaq: UBSH October/November 2018

Table of Contents Union Third Quarter Investor Presentation Slides 3-28 Union/Access Merger Presentation Slides 29-49 Dated October 5, 2018 2

Forward Looking Statements Certain statements in this presentation may constitute forward-looking statements within • the quality or composition of the loan or investment portfolios; the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking • concentrations of loans secured by real estate, particularly commercial real statements include, without limitation, projections, predictions, expectations or beliefs estate; about future events or results that are not statements of historical fact. Such forward- • the effectiveness of the Company’s credit processes and management of the looking statements are based on various assumptions as of the time they are made, and Company’s credit risk; are inherently subject to known and unknown risks, uncertainties, and other factors that • demand for loan products and financial services in the Company’s market area; may cause actual results, performance or achievements to be materially different from • the Company’s ability to compete in the market for financial services; those expressed or implied by such forward-looking statements. Forward-looking • technological risks and developments, and cyber threats, attacks, or events; statements are often accompanied by words that convey projected future events or • performance by the Company’s counterparties or vendors; outcomes such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” • deposit flows; “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other • the availability of financing and the terms thereof; statements concerning opinions or judgment of the Company and its management about • the level of prepayments on loans and mortgage-backed securities; future events. • legislative or regulatory changes and requirements; • the impact of the Tax Cuts and Jobs Act of 2017 (the “Tax Act”), including, but Although Union Bankshares Corporation (“Union” or the “Company”) believes that its not limited to, the effect of the lower corporate tax rate, including on the valuation expectations with respect to forward-looking statements are based upon reasonable of the Company’s tax assets and liabilities; assumptions within the bounds of its existing knowledge of its business and operations, • any future refinements to the Company’s preliminary analysis of the impact of the there can be no assurance that actual results, performance, or achievements of the Tax Act on the Company; Company will not differ materially from any projected future results, performance, or • changes in the effect of the Tax Act due to issuance of interpretive regulatory achievements expressed or implied by such forward-looking statements. Actual future guidance or enactment of corrective or supplement legislation; results, performance or achievements may differ materially from historical results or • monetary and fiscal policies of the U.S. government including policies of the U.S. those anticipated depending on a variety of factors, including, but not limited to: Department of the Treasury and the Board of Governors of the Federal Reserve System; • the possibility that any of the anticipated benefits of the acquisition of Xenith • changes to applicable accounting principles and guidelines; and Bankshares, Inc. (“Xenith”) will not be realized or will not be realized within the • other factors, many of which are beyond the control of the Company. expected time period, the businesses of the Company and Xenith may not be integrated successfully or such integration may be more difficult, time-consuming Please refer to the “Risk Factors” and “Management’s Discussion and Analysis of or costly than expected, the expected revenue synergies and cost savings from Financial Condition and Results of Operation” sections of the Company’s Annual Report the merger may not be fully realized or realized within the expected time frame, on Form 10-K for the year ended December 31, 2017 and related disclosures in other revenues following the merger may be lower than expected, or customer and filings, which have been filed with the Securities and Exchange Commission (the “SEC”), employee relationships and business operations may be disrupted by the and are available on the SEC’s website at www.sec.gov. The actual results or merger; developments anticipated may not be realized or, even if substantially realized, they may • changes in interest rates; not have the expected consequences to or effects on the Company or its businesses or • general economic and financial market conditions in the United States generally operations. You are cautioned not to rely too heavily on the forward-looking statements and particularly in the markets in which the Company operates and which its contained in this presentation. Forward-looking statements speak only as of the date loans are concentrated, including the effects of declines in real estate values, an they are made and the Company does not undertake any obligation to update, revise or increase in unemployment levels and slowdowns in economic growth; clarify these forward-looking statements, whether as a result of new information, future • the Company’s ability to manage its growth or implement its growth strategy; events or otherwise. • the Company’s ability to recruit and retain key employees; • an insufficient allowance for loan losses; 3

Additional Information Unaudited Pro Forma Financial Information performance by investors. Please see “Reconciliation of Non- GAAP Disclosures” at the end of this presentation for a The unaudited pro forma financial information included herein is reconciliation to the nearest GAAP financial measure. presented for informational purposes only and does not necessarily reflect the financial results of the combined company had the No Offer or Solicitation companies actually been combined during periods presented. The adjustments included in this unaudited pro forma financial This presentation does not constitute an offer to sell or a solicitation information are preliminary and may be significantly revised and of an offer to buy any securities or a solicitation of any vote or may not agree to actual amounts finally recorded by Union. This approval with respect to the proposed acquisition by Union of financial information does not reflect the benefits of the Xenith Access National Bank. No offer of securities shall be made except merger’s expected cost savings and expense efficiencies, by means of a prospectus meeting the requirements of the opportunities to earn additional revenue, potential impacts of Securities Act of 1933, as amended, and no offer to sell or current market conditions on revenues or asset dispositions, among solicitation of an offer to buy shall be made in any jurisdiction in other factors, and includes various preliminary estimates and may which such offer, solicitation or sale would be unlawful. not necessarily be indicative of the financial position or results of operations that would have occurred if the merger had been About Union Bankshares Corporation completed on the date or at the beginning of the period indicated or Headquartered in Richmond, Virginia, Union Bankshares which may be attained in the future. Corporation (Nasdaq: UBSH) is the holding company for Union Non-GAAP Financial Measures Bank & Trust. Union Bank & Trust has 140 branches, 7 of which are This presentation contains certain financial information determined operated as Xenith Bank, a division of Union Bank & Trust of by methods other than in accordance with generally accepted Richmond, Virginia, and approximately 190 ATMs located accounting policies in the United States (“GAAP”). These non- throughout Virginia, and in portions of Maryland and North Carolina. GAAP disclosures have limitations as an analytical tool and should Non-bank affiliates of the holding company include: Old Dominion not be considered in isolation or as a substitute for analysis of our Capital Management, Inc. and Dixon, Hubard, Feinour, & Brown, results as reported under GAAP, nor are they necessarily Inc., which both provide investment advisory services, and Union comparable to non-GAAP performance measures that may be Insurance Group, LLC, which offers various lines of insurance presented by other companies. Management uses these non-GAAP products. measures in its analysis of performance because it believes the measures are material and will be used as measures of 4

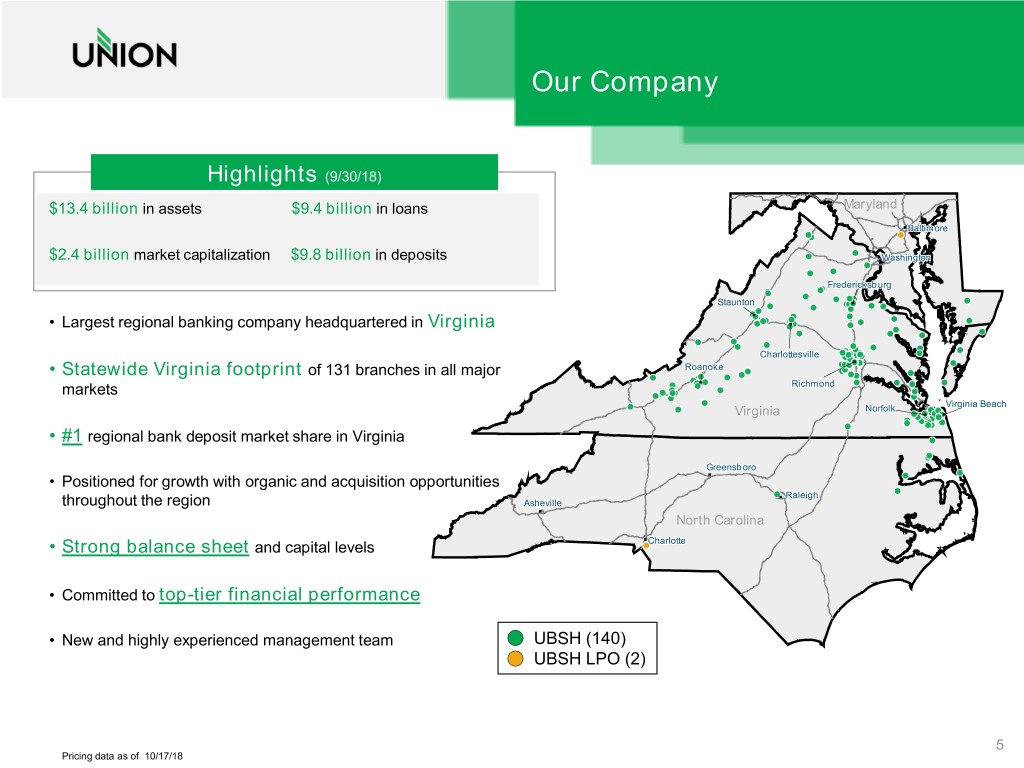

Our Company Highlights (9/30/18) $13.4 billion in assets $9.4 billion in loans Maryland BaltimoreBaltimore $2.4 billion market capitalization $9.8 billion in deposits WashingtonWashington FredericksburgFredericksburg StauntonStaunton • Largest regional banking company headquartered in Virginia CharlottesvilleCharlottesville RoanokeRoanoke • Statewide Virginia footprint of 131 branches in all major RichmondRichmond markets VirginiaVirginia BeachBeach NorfolkNorfolk Virginia • #1 regional bank deposit market share in Virginia GreensboroGreensboro • Positioned for growth with organic and acquisition opportunities RaleighRaleigh throughout the region AshevilleAsheville North Carolina CharlotteCharlotte • Strong balance sheet and capital levels CharlotteCharlotte • Committed to top-tier financial performance • New and highly experienced management team UBSH (140) UBSH LPO (2) 5 Pricing data as of 10/17/18

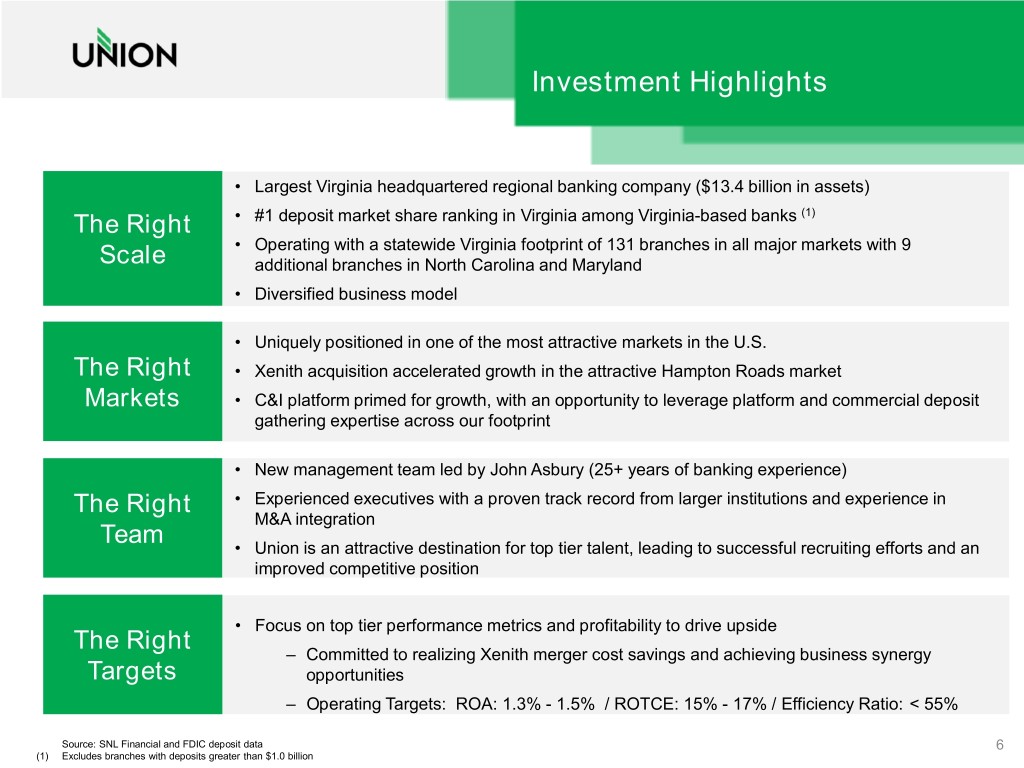

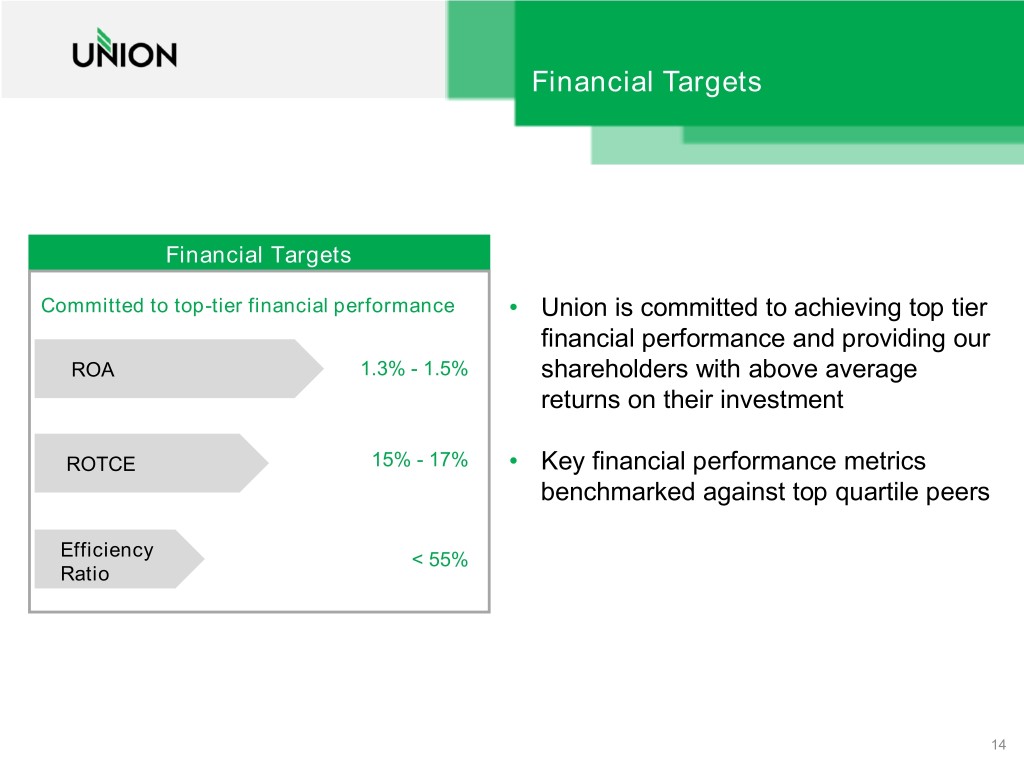

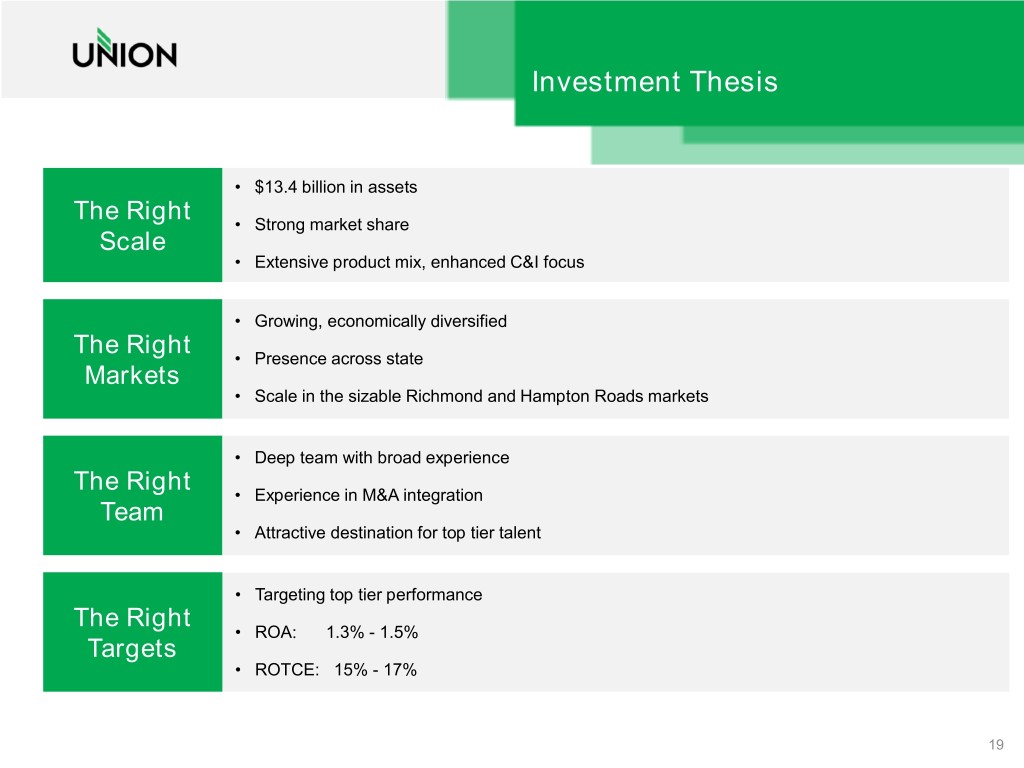

Investment Highlights • Largest Virginia headquartered regional banking company ($13.4 billion in assets) (1) The Right • #1 deposit market share ranking in Virginia among Virginia-based banks • Operating with a statewide Virginia footprint of 131 branches in all major markets with 9 Scale additional branches in North Carolina and Maryland • Diversified business model • Uniquely positioned in one of the most attractive markets in the U.S. The Right • Xenith acquisition accelerated growth in the attractive Hampton Roads market Markets • C&I platform primed for growth, with an opportunity to leverage platform and commercial deposit gathering expertise across our footprint • New management team led by John Asbury (25+ years of banking experience) The Right • Experienced executives with a proven track record from larger institutions and experience in M&A integration Team • Union is an attractive destination for top tier talent, leading to successful recruiting efforts and an improved competitive position • Focus on top tier performance metrics and profitability to drive upside The Right – Committed to realizing Xenith merger cost savings and achieving business synergy Targets opportunities – Operating Targets: ROA: 1.3% - 1.5% / ROTCE: 15% - 17% / Efficiency Ratio: < 55% Source: SNL Financial and FDIC deposit data 6 (1) Excludes branches with deposits greater than $1.0 billion

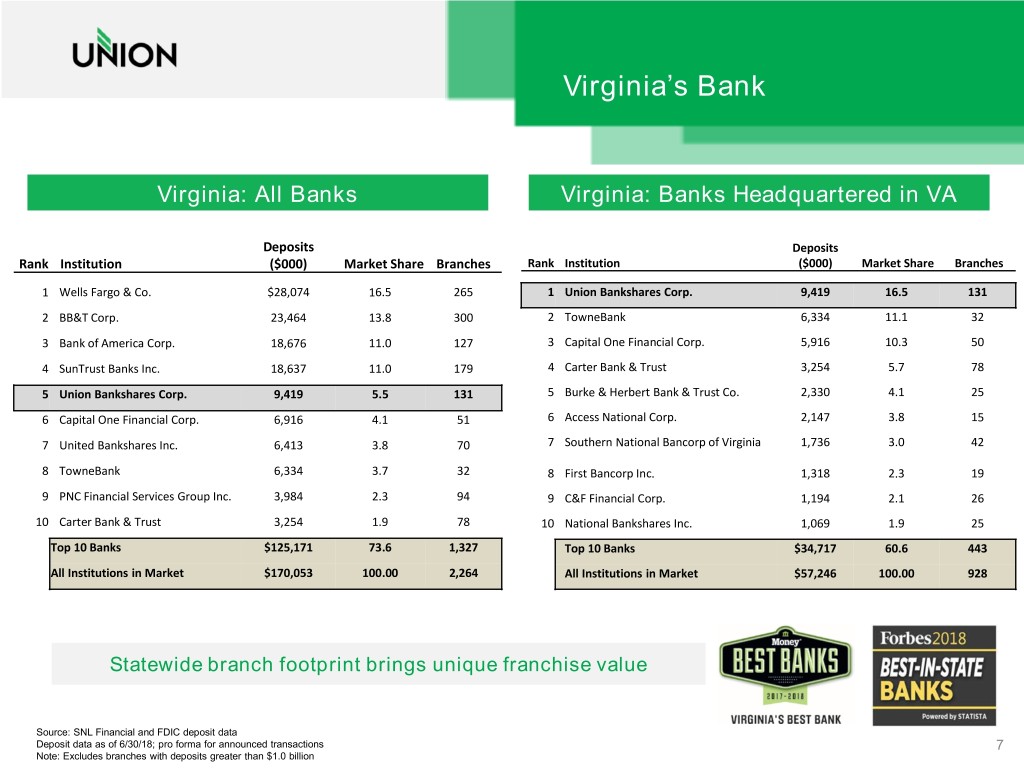

Virginia’s Bank Virginia: All Banks Virginia: Banks Headquartered in VA Deposits Deposits Rank Institution ($000) Market Share Branches Rank Institution ($000) Market Share Branches 1 Wells Fargo & Co. $28,074 16.5 265 1 Union Bankshares Corp. 9,419 16.5 131 2 BB&T Corp. 23,464 13.8 300 2 TowneBank 6,334 11.1 32 3 Bank of America Corp. 18,676 11.0 127 3 Capital One Financial Corp. 5,916 10.3 50 4 SunTrust Banks Inc. 18,637 11.0 179 4 Carter Bank & Trust 3,254 5.7 78 5 Union Bankshares Corp. 9,419 5.5 131 5 Burke & Herbert Bank & Trust Co. 2,330 4.1 25 6 Capital One Financial Corp. 6,916 4.1 51 6 Access National Corp. 2,147 3.8 15 7 United Bankshares Inc. 6,413 3.8 70 7 Southern National Bancorp of Virginia 1,736 3.0 42 8 TowneBank 6,334 3.7 32 8 First Bancorp Inc. 1,318 2.3 19 9 PNC Financial Services Group Inc. 3,984 2.3 94 9 C&F Financial Corp. 1,194 2.1 26 10 Carter Bank & Trust 3,254 1.9 78 10 National Bankshares Inc. 1,069 1.9 25 Top 10 Banks $125,171 73.6 1,327 Top 10 Banks $34,717 60.6 443 All Institutions in Market $170,053 100.00 2,264 All Institutions in Market $57,246 100.00 928 Statewide branch footprint brings unique franchise value Source: SNL Financial and FDIC deposit data Deposit data as of 6/30/18; pro forma for announced transactions 7 Note: Excludes branches with deposits greater than $1.0 billion

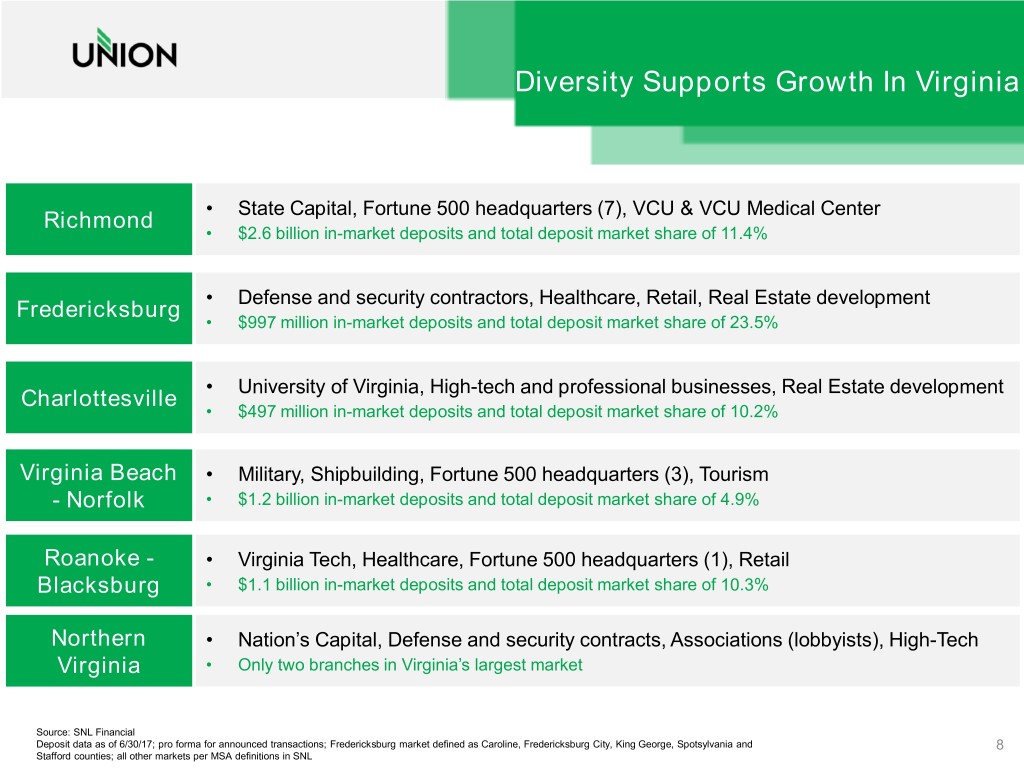

Diversity Supports Growth In Virginia • State Capital, Fortune 500 headquarters (7), VCU & VCU Medical Center Richmond • $2.6 billion in-market deposits and total deposit market share of 11.4% • Defense and security contractors, Healthcare, Retail, Real Estate development Fredericksburg • $997 million in-market deposits and total deposit market share of 23.5% • University of Virginia, High-tech and professional businesses, Real Estate development Charlottesville • $497 million in-market deposits and total deposit market share of 10.2% Virginia Beach • Military, Shipbuilding, Fortune 500 headquarters (3), Tourism - Norfolk • $1.2 billion in-market deposits and total deposit market share of 4.9% Roanoke - • Virginia Tech, Healthcare, Fortune 500 headquarters (1), Retail Blacksburg • $1.1 billion in-market deposits and total deposit market share of 10.3% Northern • Nation’s Capital, Defense and security contracts, Associations (lobbyists), High-Tech Virginia • Only two branches in Virginia’s largest market Source: SNL Financial Deposit data as of 6/30/17; pro forma for announced transactions; Fredericksburg market defined as Caroline, Fredericksburg City, King George, Spotsylvania and 8 Stafford counties; all other markets per MSA definitions in SNL

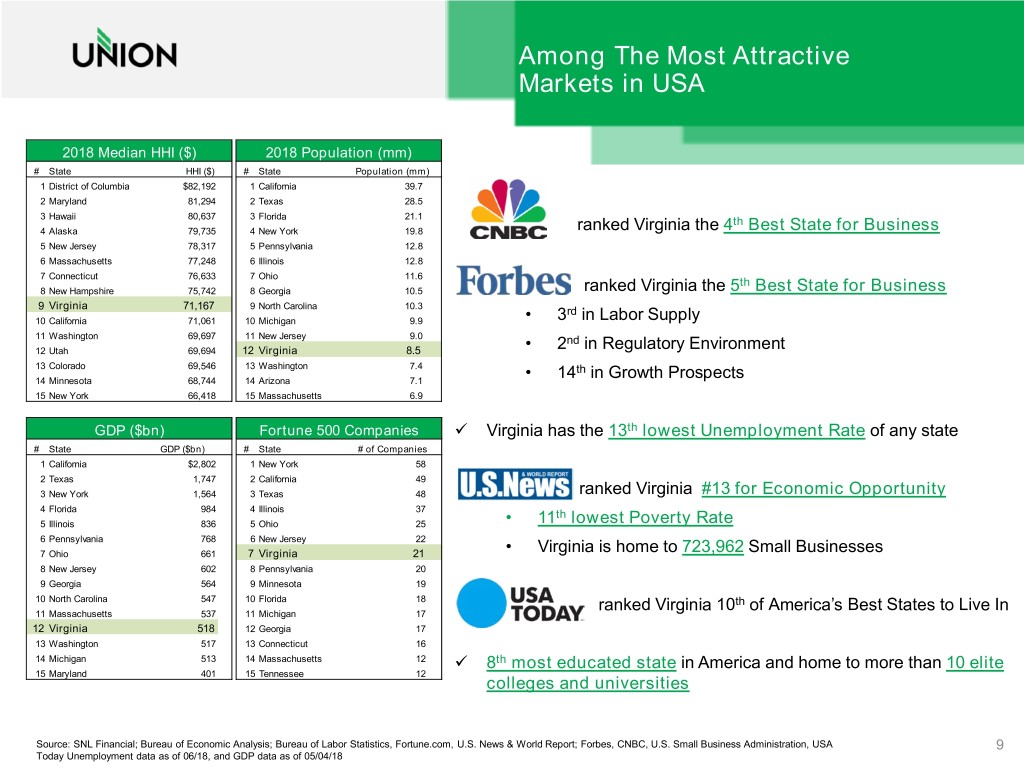

Among The Most Attractive Markets in USA 2018 Median HHI ($) 2018 Population (mm) # State HHI ($) # State Population (mm) 1 District of Columbia $82,192 1 California 39.7 2 Maryland 81,294 2 Texas 28.5 3 Hawaii 80,637 3 Florida 21.1 th 4 Alaska 79,735 4 New York 19.8 ranked Virginia the 4 Best State for Business 5 New Jersey 78,317 5 Pennsylvania 12.8 6 Massachusetts 77,248 6 Illinois 12.8 7 Connecticut 76,633 7 Ohio 11.6 th 8 New Hampshire 75,742 8 Georgia 10.5 ranked Virginia the 5 Best State for Business 9 Virginia 71,167 9 North Carolina 10.3 rd 10 California 71,061 10 Michigan 9.9 • 3 in Labor Supply 11 Washington 69,697 11 New Jersey 9.0 nd 12 Utah 69,694 12 Virginia 8.5 • 2 in Regulatory Environment 13 Colorado 69,546 13 Washington 7.4 th 14 Minnesota 68,744 14 Arizona 7.1 • 14 in Growth Prospects 15 New York 66,418 15 Massachusetts 6.9 GDP ($bn) Fortune 500 Companies Virginia has the 13th lowest Unemployment Rate of any state # State GDP ($bn) # State # of Companies 1 California $2,802 1 New York 58 2 Texas 1,747 2 California 49 3 New York 1,564 3 Texas 48 ranked Virginia #13 for Economic Opportunity 4 Florida 984 4 Illinois 37 th 5 Illinois 836 5 Ohio 25 • 11 lowest Poverty Rate 6 Pennsylvania 768 6 New Jersey 22 7 Ohio 661 7 Virginia 21 • Virginia is home to 723,962 Small Businesses 8 New Jersey 602 8 Pennsylvania 20 9 Georgia 564 9 Minnesota 19 10 North Carolina 547 10 Florida 18 th 11 Massachusetts 537 11 Michigan 17 ranked Virginia 10 of America’s Best States to Live In 12 Virginia 518 12 Georgia 17 13 Washington 517 13 Connecticut 16 14 Michigan 513 14 Massachusetts 12 8th most educated state in America and home to more than 10 elite 15 Maryland 401 15 Tennessee 12 colleges and universities Source: SNL Financial; Bureau of Economic Analysis; Bureau of Labor Statistics, Fortune.com, U.S. News & World Report; Forbes, CNBC, U.S. Small Business Administration, USA 9 Today Unemployment data as of 06/18, and GDP data as of 05/04/18

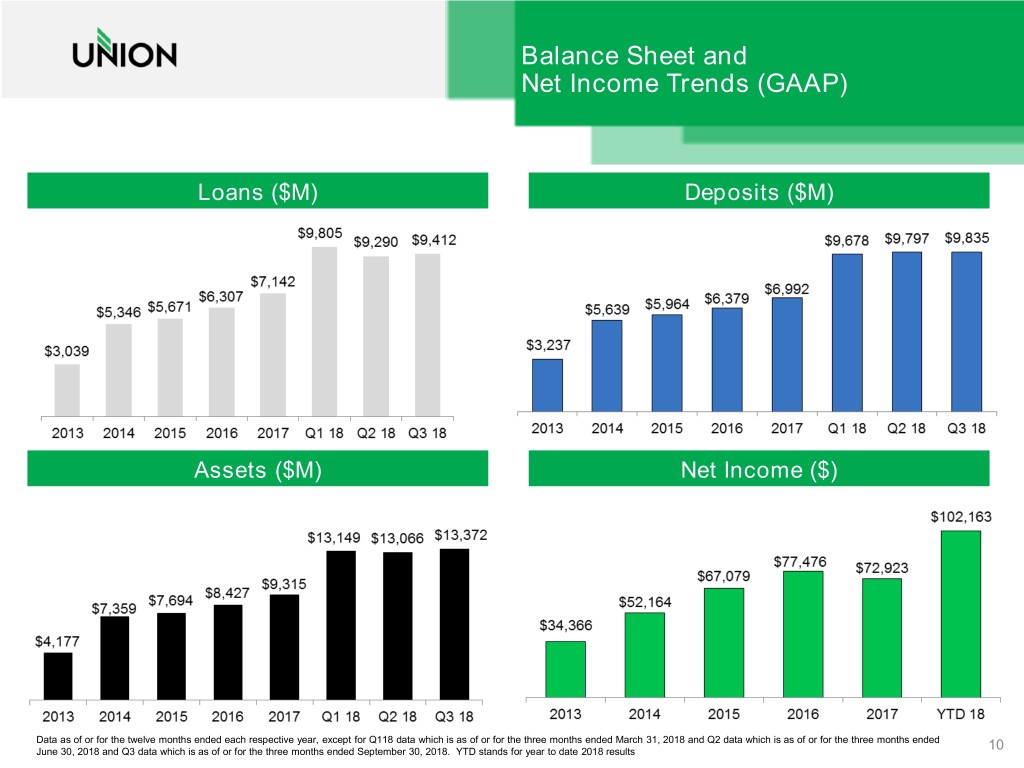

Balance Sheet and Net Income Trends (GAAP) Loans ($M) Deposits ($M) Assets ($M) Net Income ($) Data as of or for the twelve months ended each respective year, except for Q118 data which is as of or for the three months ended March 31, 2018 and Q2 data which is as of or for the three months ended 10 June 30, 2018 and Q3 data which is as of or for the three months ended September 30, 2018. YTD stands for year to date 2018 results

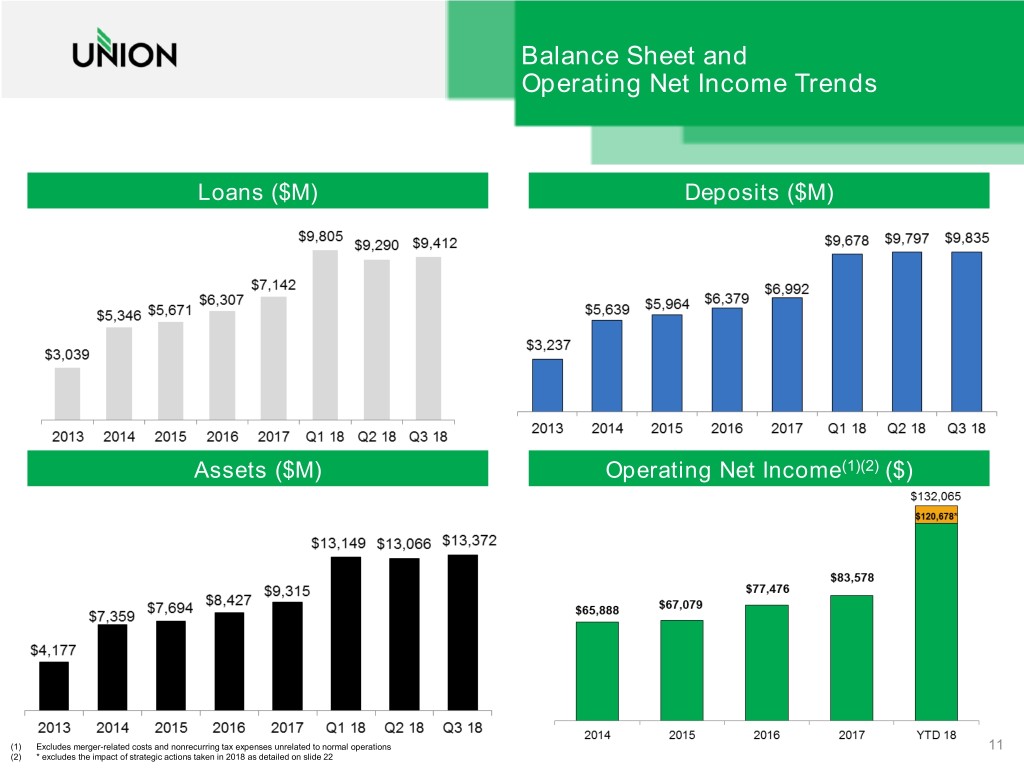

Balance Sheet and Operating Net Income Trends Loans ($M) Deposits ($M) Assets ($M) Operating Net Income(1)(2) ($) (1) Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations 11 (2) * excludes the impact of strategic actions taken in 2018 as detailed on slide 22

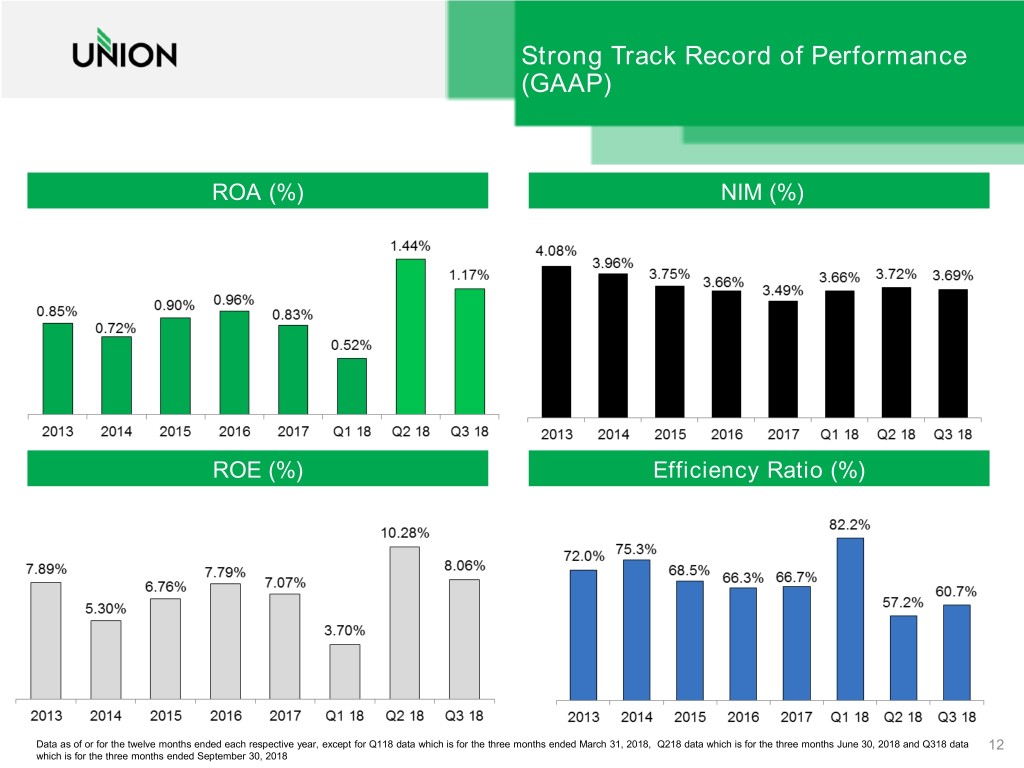

Strong Track Record of Performance (GAAP) ROA (%) NIM (%) ROE (%) Efficiency Ratio (%) Data as of or for the twelve months ended each respective year, except for Q118 data which is for the three months ended March 31, 2018, Q218 data which is for the three months June 30, 2018 and Q318 data 12 which is for the three months ended September 30, 2018

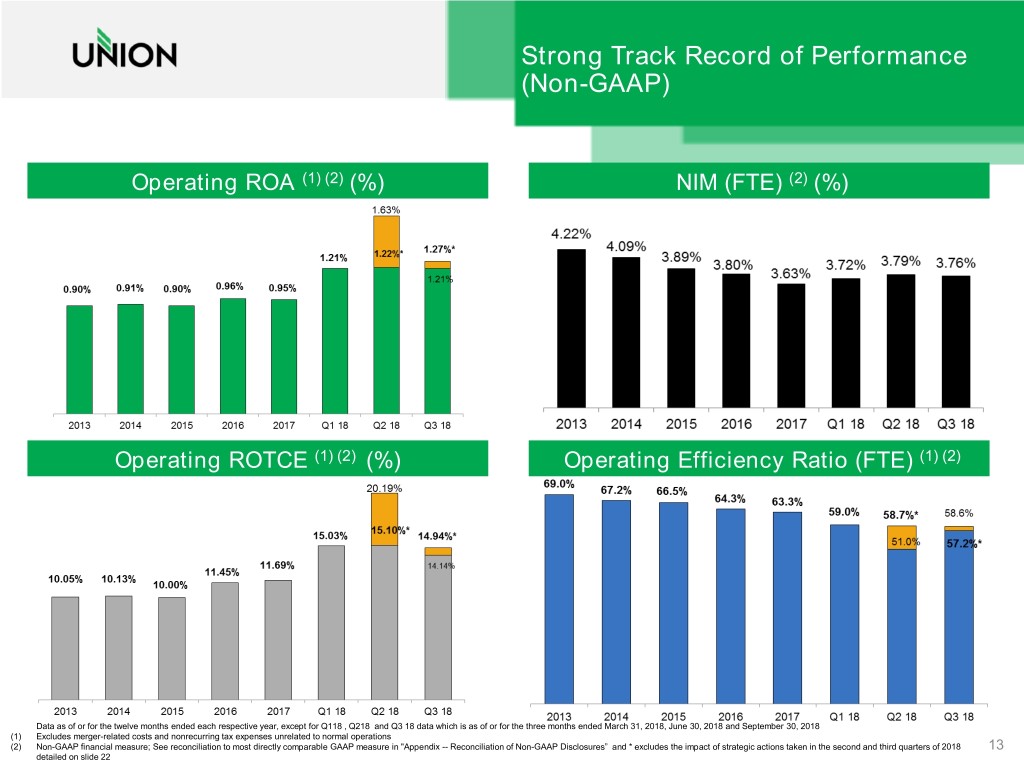

Strong Track Record of Performance (Non-GAAP) Operating ROA (1) (2) (%) NIM (FTE) (2) (%) Operating ROTCE (1) (2) (%) Operating Efficiency Ratio (FTE) (1) (2) (%) Data as of or for the twelve months ended each respective year, except for Q118 , Q218 and Q3 18 data which is as of or for the three months ended March 31, 2018, June 30, 2018 and September 30, 2018 (1) Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations (2) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures” and * excludes the impact of strategic actions taken in the second and third quarters of 2018 13 detailed on slide 22

Financial Targets Financial Targets Committed to top-tier financial performance • Union is committed to achieving top tier financial performance and providing our ROA 1.3% - 1.5% shareholders with above average returns on their investment ROTCE 15% - 17% • Key financial performance metrics benchmarked against top quartile peers Efficiency < 55% Ratio 14

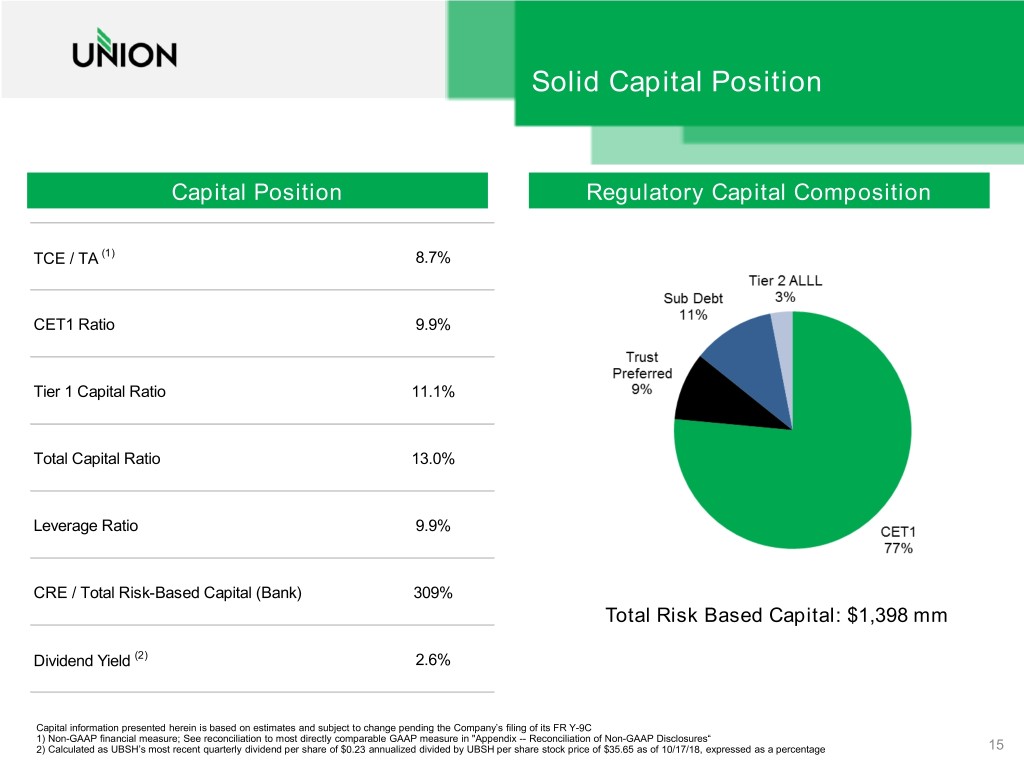

Solid Capital Position Capital Position Regulatory Capital Composition TCE / TA (1) 8.7% CET1 Ratio 9.9% Tier 1 Capital Ratio 11.1% Total Capital Ratio 13.0% Leverage Ratio 9.9% CRE / Total Risk-Based Capital (Bank) 309% Total Risk Based Capital: $1,398 mm Dividend Yield (2) 2.6% Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its FR Y-9C 1) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures“ 2) Calculated as UBSH’s most recent quarterly dividend per share of $0.23 annualized divided by UBSH per share stock price of $35.65 as of 10/17/18, expressed as a percentage 15

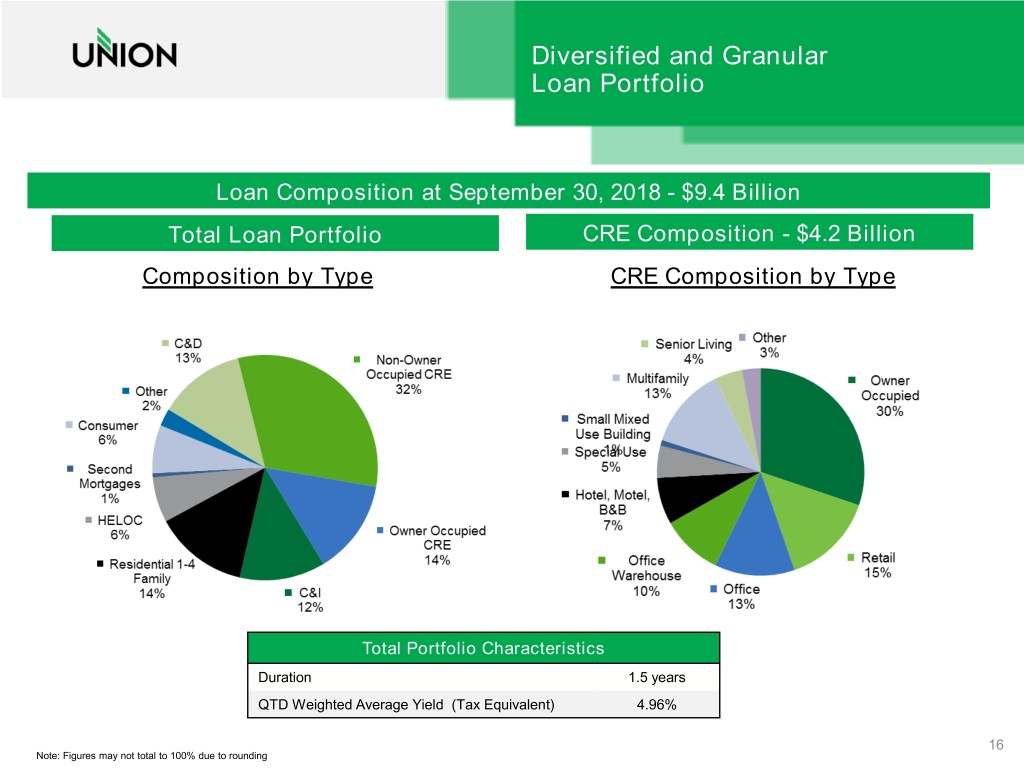

Diversified and Granular Loan Portfolio Loan Composition at September 30, 2018 - $9.4 Billion Total Loan Portfolio CRE Composition - $4.2 Billion Composition by Type CRE Composition by Type Total Portfolio Characteristics Duration 1.5 years QTD Weighted Average Yield (Tax Equivalent) 4.96% 16 Note: Figures may not total to 100% due to rounding

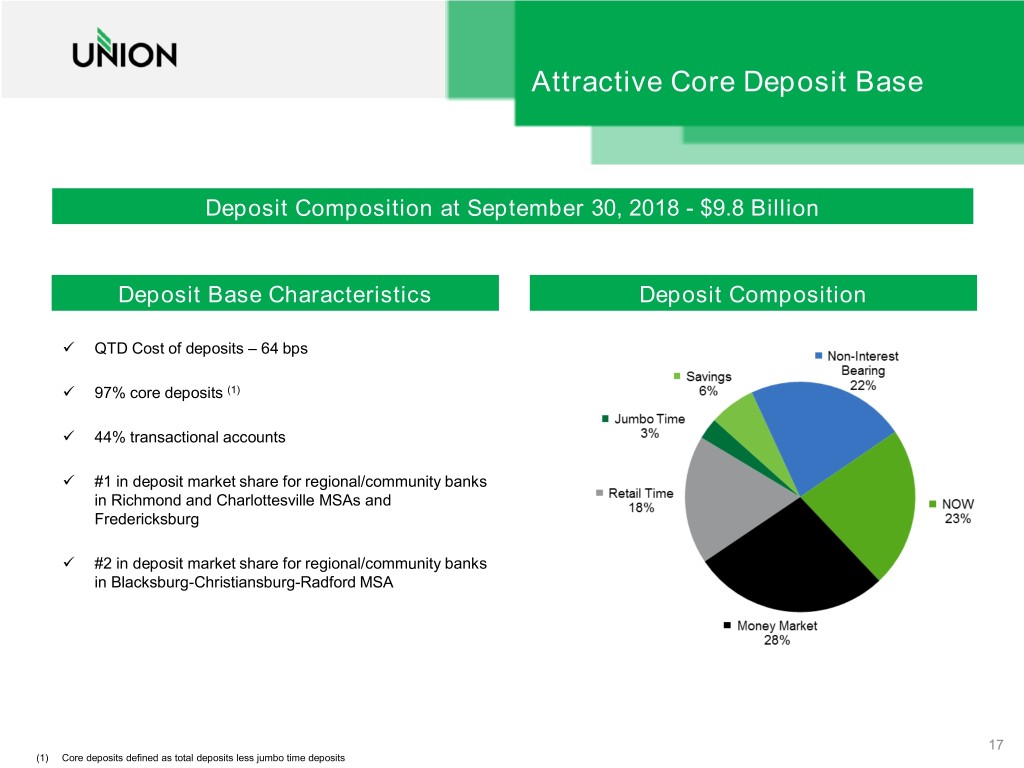

Attractive Core Deposit Base Deposit Composition at September 30, 2018 - $9.8 Billion Deposit Base Characteristics Deposit Composition QTD Cost of deposits – 64 bps 97% core deposits (1) 44% transactional accounts #1 in deposit market share for regional/community banks in Richmond and Charlottesville MSAs and Fredericksburg #2 in deposit market share for regional/community banks in Blacksburg-Christiansburg-Radford MSA 17 (1) Core deposits defined as total deposits less jumbo time deposits

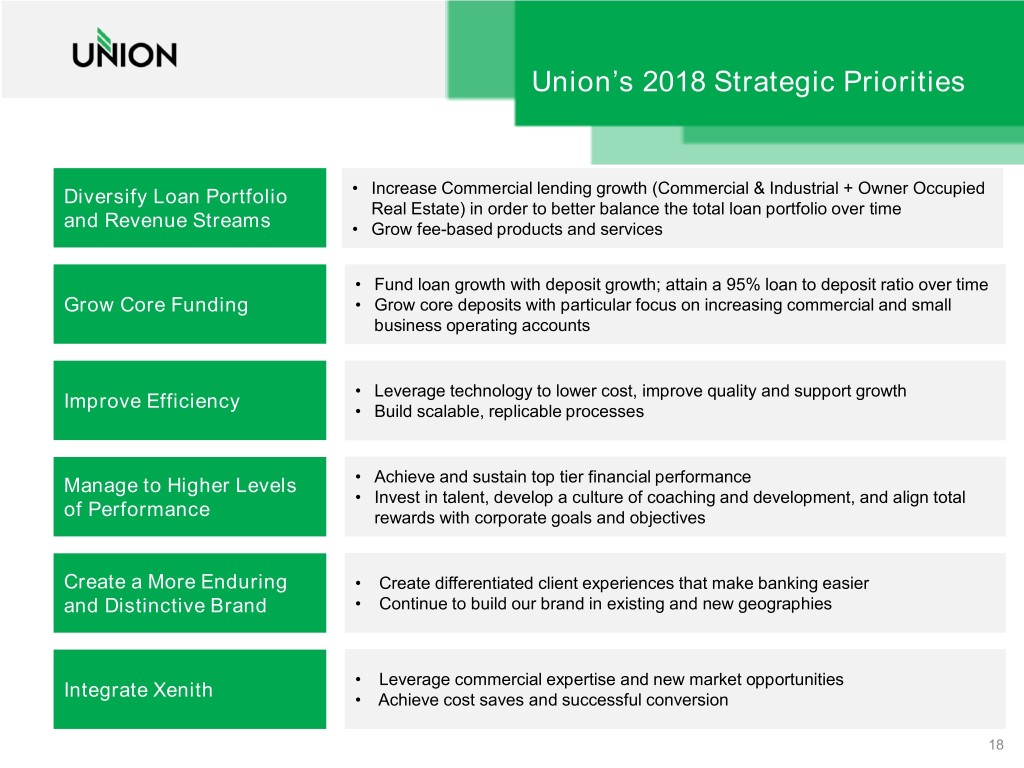

Union’s 2018 Strategic Priorities Diversify Loan Portfolio • Increase Commercial lending growth (Commercial & Industrial + Owner Occupied Real Estate) in order to better balance the total loan portfolio over time and Revenue Streams • Grow fee-based products and services • Fund loan growth with deposit growth; attain a 95% loan to deposit ratio over time Grow Core Funding • Grow core deposits with particular focus on increasing commercial and small business operating accounts • Leverage technology to lower cost, improve quality and support growth Improve Efficiency • Build scalable, replicable processes • Achieve and sustain top tier financial performance Manage to Higher Levels • Invest in talent, develop a culture of coaching and development, and align total of Performance rewards with corporate goals and objectives Create a More Enduring • Create differentiated client experiences that make banking easier and Distinctive Brand • Continue to build our brand in existing and new geographies • Leverage commercial expertise and new market opportunities Integrate Xenith • Achieve cost saves and successful conversion 18

Investment Thesis • $13.4 billion in assets The Right • Strong market share Scale • Extensive product mix, enhanced C&I focus • Growing, economically diversified The Right • Presence across state Markets • Scale in the sizable Richmond and Hampton Roads markets • Deep team with broad experience The Right • Experience in M&A integration Team • Attractive destination for top tier talent • Targeting top tier performance The Right • ROA: 1.3% - 1.5% Targets • ROTCE: 15% - 17% 19

Appendix

Delivering the Xenith Economics 40% Cost Savings + 2018 Focus on Post Announcement Revenue Initiatives Successful Integration Ramping Announced May 22, 2017 Closed January 1, 2018 Savings target of 40% of the Xenith expense base, or Nearly all commercial Focus on seamless approximately $28 million, bankers met by Union transition with systems expected to be fully realized management in 6 hours post conversion targeted for May in 2019 announcement 2018 Intense focus on expanding Multiple town hall meetings Leveraging experience of C&I platform across Virginia, successful conversions and which has included several Employee retention targets integrations at both key new hires currently met companies More intentional focus on Continued focus on gathering commercial customer experience, deposits, with banker retention and growth incentives aligned accordingly 21

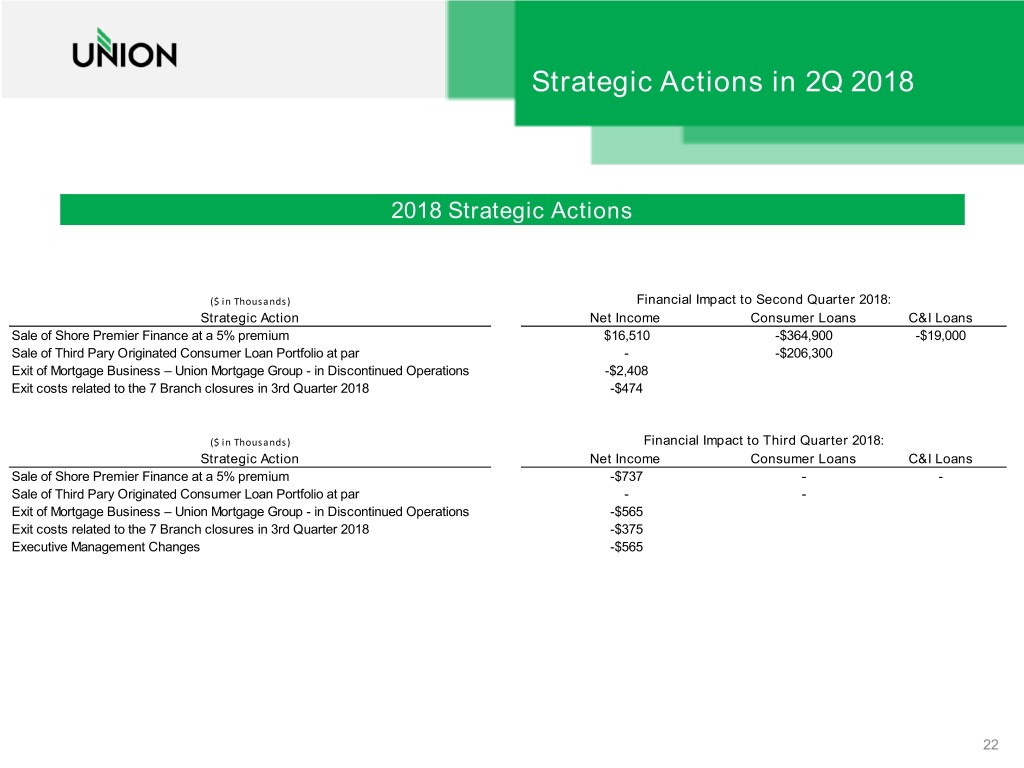

Strategic Actions in 2Q 2018 2018 Strategic Actions ($ in Thousands) Financial Impact to Second Quarter 2018: Strategic Action Net Income Consumer Loans C&I Loans Sale of Shore Premier Finance at a 5% premium $16,510 -$364,900 -$19,000 Sale of Third Pary Originated Consumer Loan Portfolio at par - -$206,300 Exit of Mortgage Business – Union Mortgage Group - in Discontinued Operations -$2,408 Exit costs related to the 7 Branch closures in 3rd Quarter 2018 -$474 ($ in Thousands) Financial Impact to Third Quarter 2018: Strategic Action Net Income Consumer Loans C&I Loans Sale of Shore Premier Finance at a 5% premium -$737 - - Sale of Third Pary Originated Consumer Loan Portfolio at par - - Exit of Mortgage Business – Union Mortgage Group - in Discontinued Operations -$565 Exit costs related to the 7 Branch closures in 3rd Quarter 2018 -$375 Executive Management Changes -$565 22

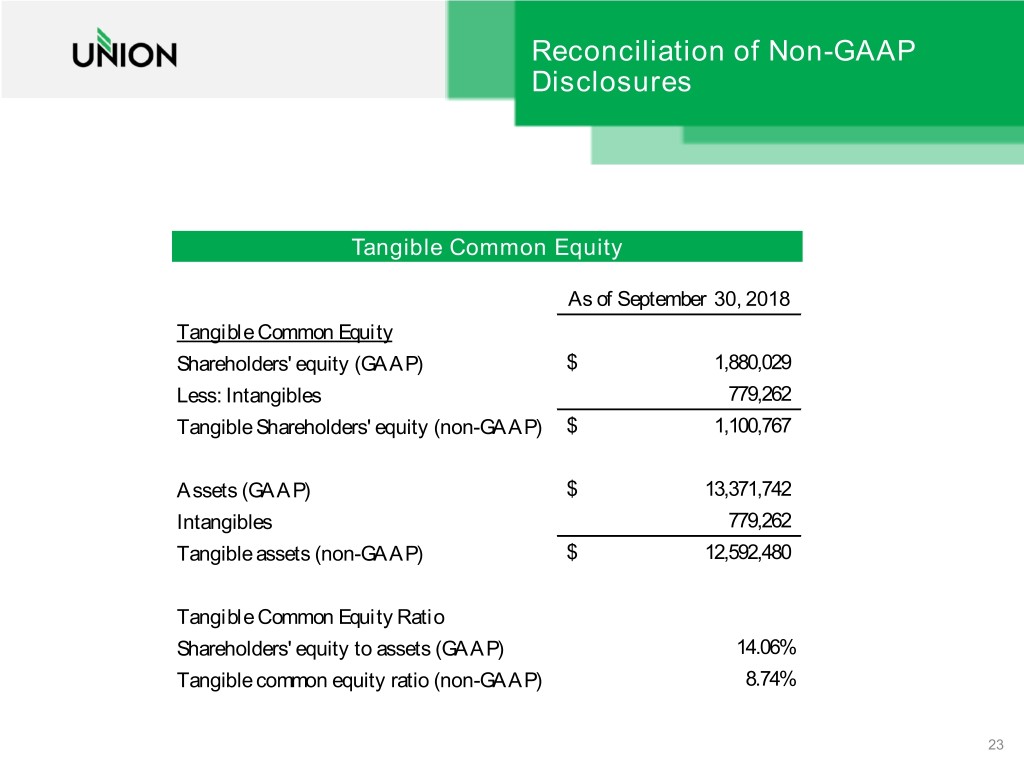

Reconciliation of Non-GAAP Disclosures Tangible Common Equity As of September 30, 2018 Tangible Common Equity Shareholders' equity (GAAP) $ 1,880,029 Less: Intangibles 779,262 Tangible Shareholders' equity (non-GAAP) $ 1,100,767 Assets (GAAP) $ 13,371,742 Intangibles 779,262 Tangible assets (non-GAAP) $ 12,592,480 Tangible Common Equity Ratio Shareholders' equity to assets (GAAP) 14.06% Tangible common equity ratio (non-GAAP) 8.74% 23

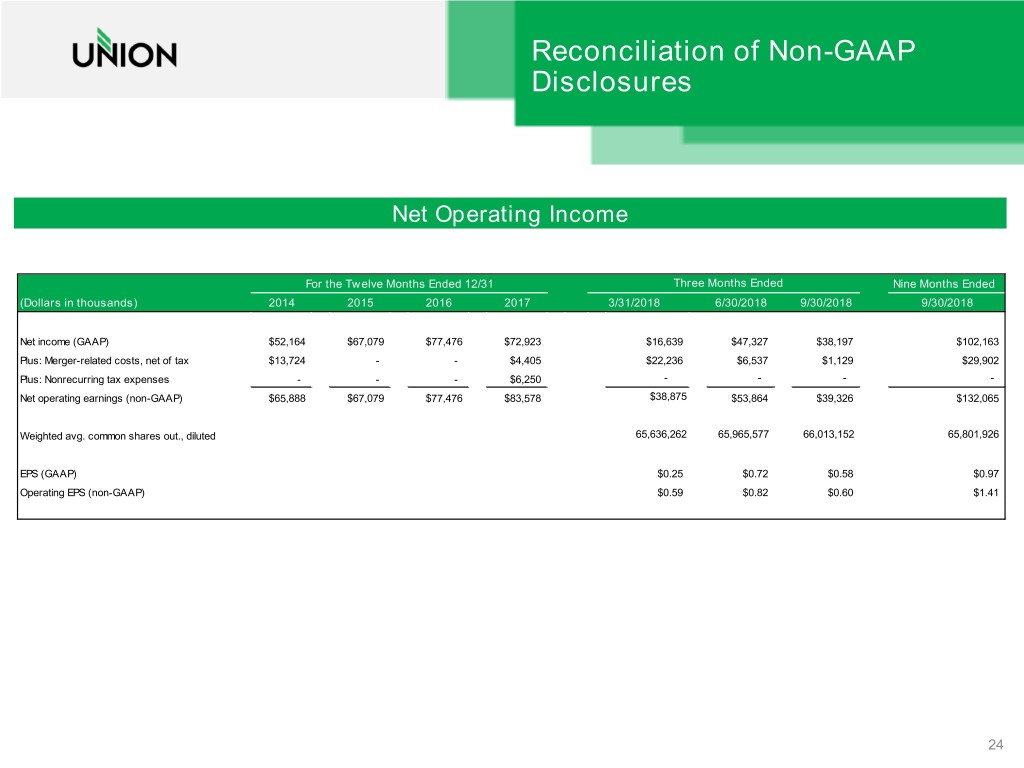

Reconciliation of Non-GAAP Disclosures Net Operating Income For the Twelve Months Ended 12/31 Three Months Ended Nine Months Ended (Dollars in thousands) 2014 2015 2016 2017 3/31/2018 6/30/2018 9/30/2018 9/30/2018 Net income (GAAP) $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 $102,163 Plus: Merger-related costs, net of tax $13,724 - - $4,405 $22,236 $6,537 $1,129 $29,902 Plus: Nonrecurring tax expenses - - - $6,250 - - - - Net operating earnings (non-GAAP) $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 $132,065 Weighted avg. common shares out., diluted 65,636,262 65,965,577 66,013,152 65,801,926 EPS ( GA A P) $0.25 $0.72 $0.58 $0.97 Operating EPS (non-GAAP) $0.59 $0.82 $0.60 $1.41 24

Reconciliation of Non-GAAP Disclosures Return on Assets (ROA) For the Twelve Months Ended 12/31 Three Months Ended (Dollars in thousands) 2013 2014 2015 2016 2017 3/31/2018 6/30/2018 9/30/2018 Average assets (GAAP) $4,051,850 $7,250,494 $7,492,895 $8,046,305 $8,820,142 $13,019,572 $13,218,227 $12,947,352 Net income (loss) (GAAP) $34,366 $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 Net operating earnings (non-GAAP) $36,408 $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 ROA (GAAP) 0.85% 0.72% 0.90% 0.96% 0.83% 0.52% 1.44% 1.17% Operating ROA (non-GAAP) 0.90% 0.91% 0.90% 0.96% 0.95% 1.21% 1.63% 1.21% 25

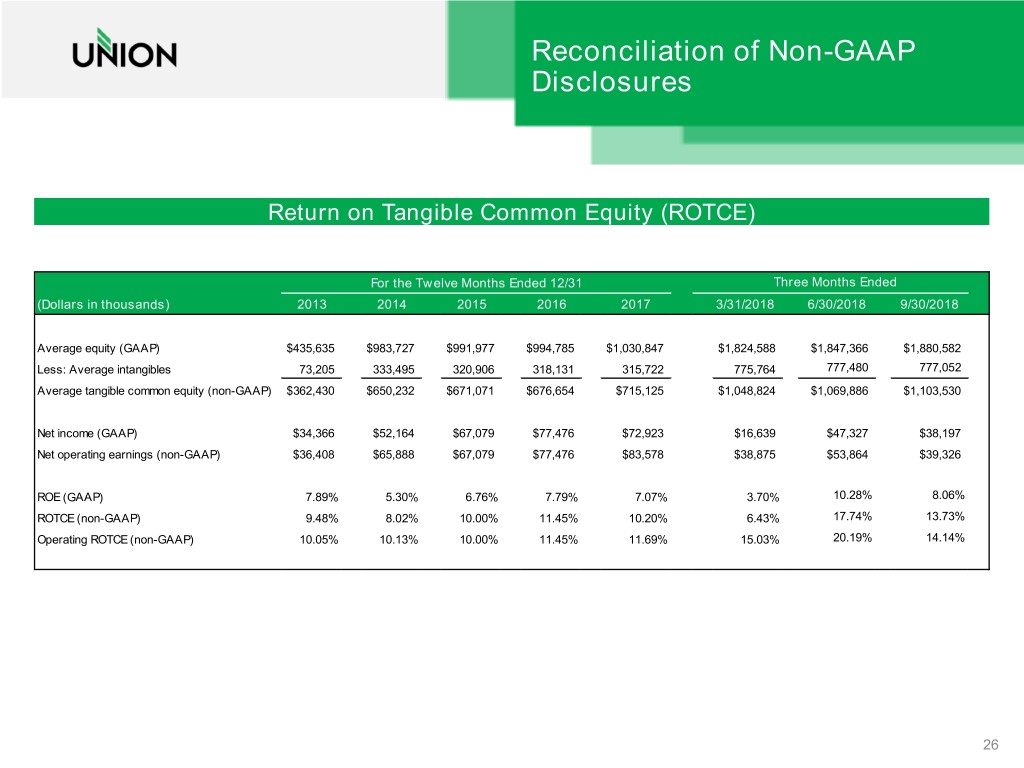

Reconciliation of Non-GAAP Disclosures Return on Tangible Common Equity (ROTCE) For the Twelve Months Ended 12/31 Three Months Ended (Dollars in thousands) 2013 2014 2015 2016 2017 3/31/2018 6/30/2018 9/30/2018 Average equity (GAAP) $435,635 $983,727 $991,977 $994,785 $1,030,847 $1,824,588 $1,847,366 $1,880,582 Less: Average intangibles 73,205 333,495 320,906 318,131 315,722 775,764 777,480 777,052 Average tangible common equity (non-GAAP) $362,430 $650,232 $671,071 $676,654 $715,125 $1,048,824 $1,069,886 $1,103,530 Net income (GAAP) $34,366 $52,164 $67,079 $77,476 $72,923 $16,639 $47,327 $38,197 Net operating earnings (non-GAAP) $36,408 $65,888 $67,079 $77,476 $83,578 $38,875 $53,864 $39,326 ROE ( GA A P) 7.89% 5.30% 6.76% 7.79% 7.07% 3.70% 10.28% 8.06% ROTCE (non-GAAP) 9.48% 8.02% 10.00% 11.45% 10.20% 6.43% 17.74% 13.73% Operating ROTCE (non-GAAP) 10.05% 10.13% 10.00% 11.45% 11.69% 15.03% 20.19% 14.14% 26

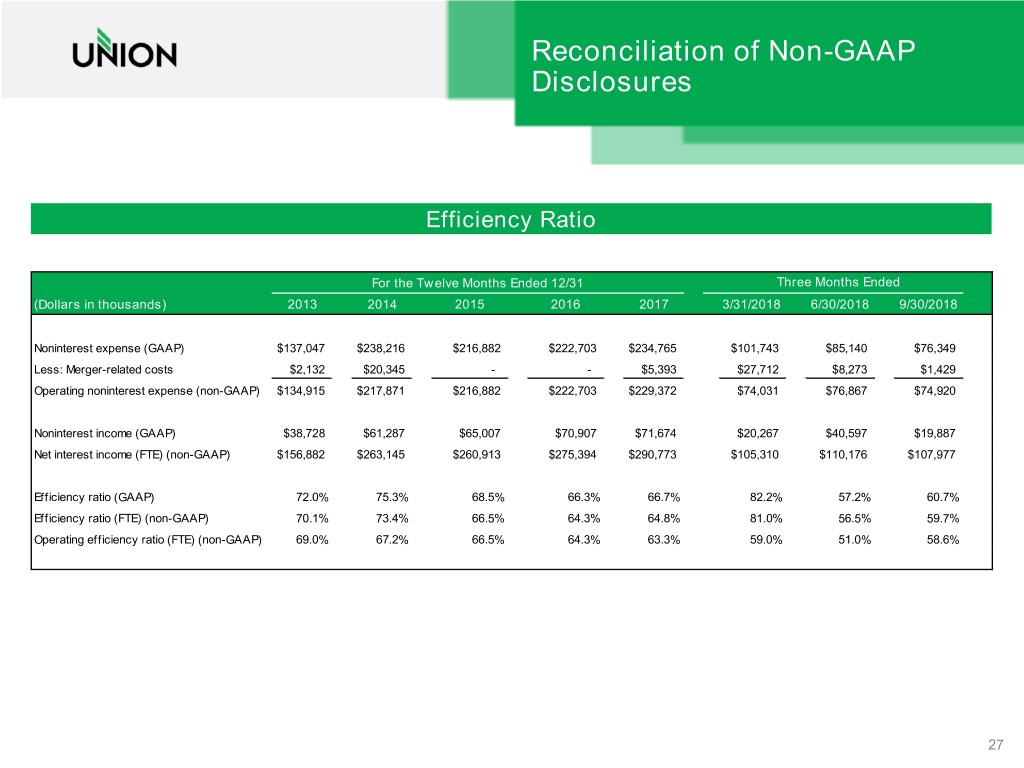

Reconciliation of Non-GAAP Disclosures Efficiency Ratio For the Twelve Months Ended 12/31 Three Months Ended (Dollars in thousands) 2013 2014 2015 2016 2017 3/31/2018 6/30/2018 9/30/2018 Noninterest expense (GAAP) $137,047 $238,216 $216,882 $222,703 $234,765 $101,743 $85,140 $76,349 Less: Merger-related costs $2,132 $20,345 - - $5,393 $27,712 $8,273 $1,429 Operating noninterest expense (non-GAAP) $134,915 $217,871 $216,882 $222,703 $229,372 $74,031 $76,867 $74,920 Noninterest income (GAAP) $38,728 $61,287 $65,007 $70,907 $71,674 $20,267 $40,597 $19,887 Net interest income (FTE) (non-GAAP) $156,882 $263,145 $260,913 $275,394 $290,773 $105,310 $110,176 $107,977 Efficiency ratio (GAAP) 72.0% 75.3% 68.5% 66.3% 66.7% 82.2% 57.2% 60.7% Efficiency ratio (FTE) (non-GAAP) 70.1% 73.4% 66.5% 64.3% 64.8% 81.0% 56.5% 59.7% Operating efficiency ratio (FTE) (non-GAAP) 69.0% 67.2% 66.5% 64.3% 63.3% 59.0% 51.0% 58.6% 27

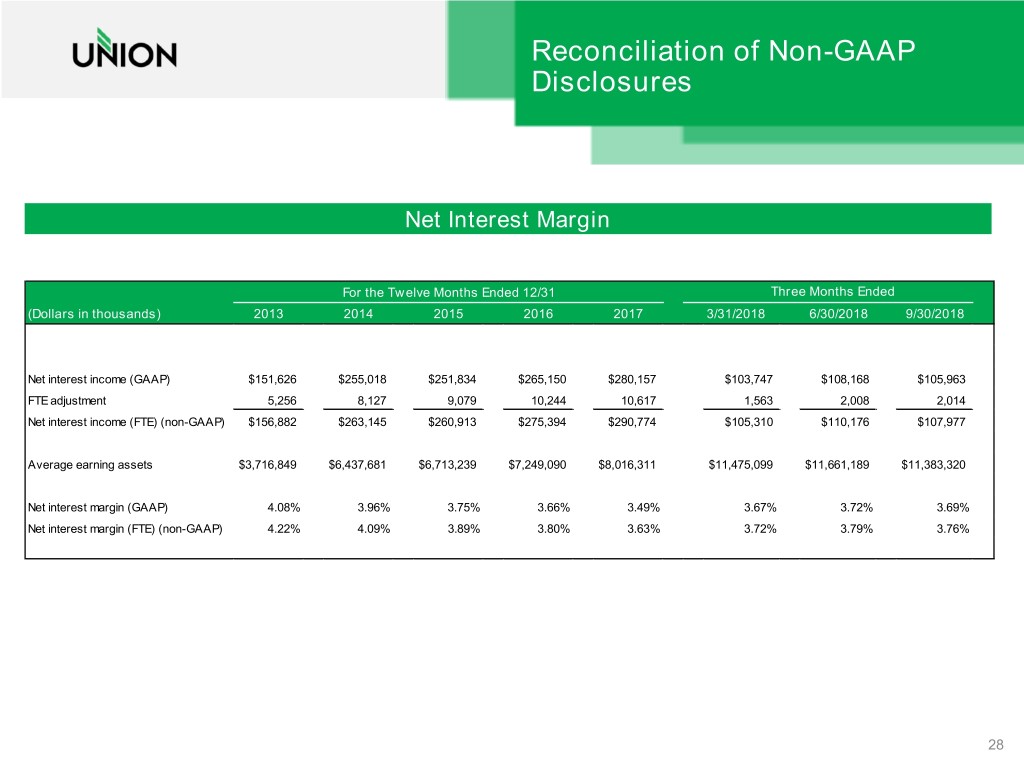

Reconciliation of Non-GAAP Disclosures Net Interest Margin For the Twelve Months Ended 12/31 Three Months Ended (Dollars in thousands) 2013 2014 2015 2016 2017 3/31/2018 6/30/2018 9/30/2018 Net interest income (GAAP) $151,626 $255,018 $251,834 $265,150 $280,157 $103,747 $108,168 $105,963 FTE adjustment 5,256 8,127 9,079 10,244 10,617 1,563 2,008 2,014 Net interest income (FTE) (non-GAAP) $156,882 $263,145 $260,913 $275,394 $290,774 $105,310 $110,176 $107,977 Average earning assets $3,716,849 $6,437,681 $6,713,239 $7,249,090 $8,016,311 $11,475,099 $11,661,189 $11,383,320 Net interest margin (GAAP) 4.08% 3.96% 3.75% 3.66% 3.49% 3.67% 3.72% 3.69% Net interest margin (FTE) (non-GAAP) 4.22% 4.09% 3.89% 3.80% 3.63% 3.72% 3.79% 3.76% 28

Merger Investor Presentation October 5, 2018

Forward Looking Statements Certain statements in this presentation may constitute “forward-looking proposed acquisition may be lower than expected, customer and employee statements” within the meaning of the Private Securities Litigation Reform relationships and business operations may be disrupted by the proposed Act of 1995. Forward-looking statements include, without limitation, acquisition, the diversion of management time on acquisition-related issues, projections, predictions, expectations, or beliefs about future events or changes in Union’s share price before closing, risks relating to the potential results and are not statements of historical fact. Such statements also dilutive effect of shares of Union common stock to be issued in the include statements as to the anticipated impact of the Union Bankshares proposed transaction, the ability to obtain regulatory, shareholder or other Corporation (“Union” or “UBSH”) acquisition of Access National Corporation approvals or other conditions to closing on a timely basis or at all, the ability (“Access” or “ANCX”), including future financial and operating results, ability to close the proposed acquisition on the expected timeframe, or at all, and to successfully integrate the combined businesses, the amount of cost that closing may be more difficult, time-consuming or costly than expected, savings, overall operational efficiencies and enhanced revenues as well as the reaction to the proposed acquisition of the companies’ customers, other statements regarding the acquisition. Such forward-looking employees and counterparties, and other risk factors, many of which are statements are based on various assumptions as of the time they are made, beyond the control of Union and Access. We refer you to the “Risk Factors” and are inherently subject to known and unknown risks, uncertainties and and “Management’s Discussion and Analysis of Financial Condition and other factors that may cause actual results, performance or achievements to Results of Operations” sections of Union’s Annual Report on Form 10-K for be materially different from any future results, performance or achievements the year ended December 31, 2017, and Access’s Annual Report on Form expressed or implied by such forward-looking statements. Forward-looking 10-K for the year ended December 31, 2017 and comparable “risk factors” statements are often accompanied by words that convey projected future sections of Union’s and Access’s Quarterly Reports on Form 10-Q and events or outcomes such as “expect,” “believe,” “estimate,” “plan,” “project,” other filings, which have been filed with the Securities and Exchange “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words Commission (the “SEC”) and are available on the SEC’s website at of similar meaning or other statements concerning opinions or judgment of www.sec.gov. All of the forward-looking statements made in this Union or Access or their management about future events. Although each of presentation are expressly qualified by the cautionary statements contained Union and Access believes that its expectations with respect to forward- or referred to herein. The actual results or developments anticipated may looking statements are based upon reasonable assumptions within the not be realized or, even if substantially realized, they may not have the bounds of its existing knowledge of its business and operations, there can expected consequences to or effects on Union, Access or their respective be no assurance that actual results, performance, or achievements of Union businesses or operations. Readers are cautioned not to rely too heavily on or Access will not differ materially from any projected future results, the forward-looking statements contained in this presentation. Forward- performance, or achievements expressed or implied by such forward- looking statements speak only as of the date they are made and neither looking statements. Actual future results, performance, or achievements Union nor Access undertakes any obligation to update, revise or clarify may differ materially from historical results or those anticipated depending these forward-looking statements, whether as a result of new information, on a variety of factors, including but not limited to, the businesses of Union future events or otherwise. and Access may not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected, expected revenue synergies and cost savings from the proposed acquisition may not be fully realized or realized within the expected time frame, revenues following the 30

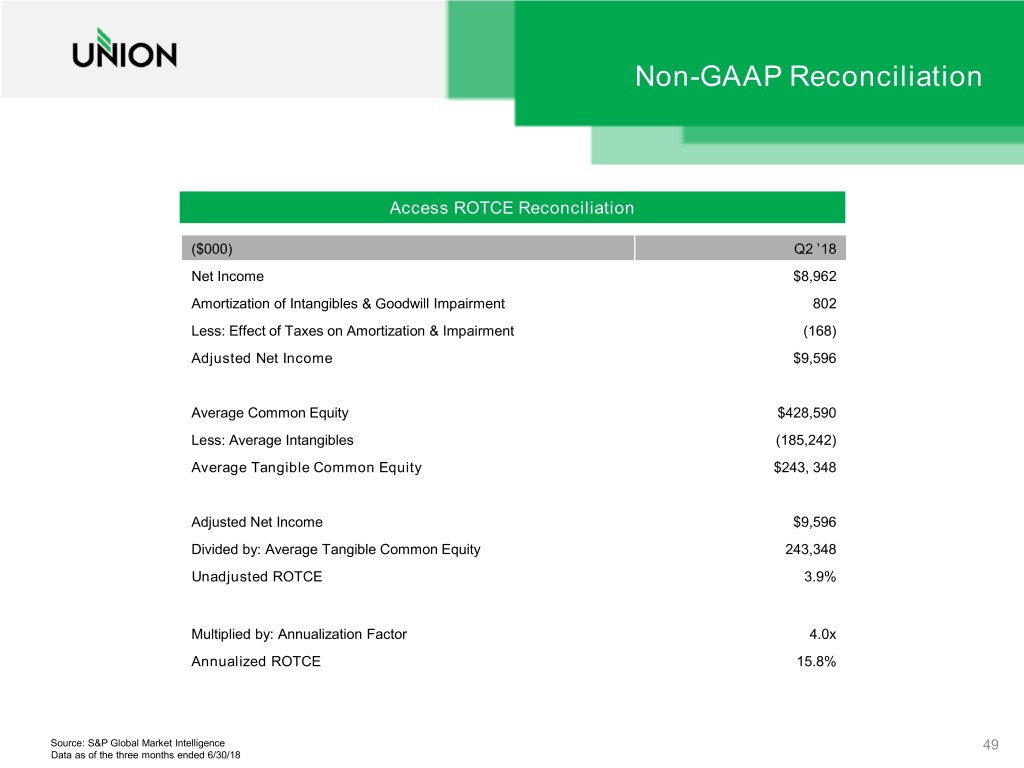

Additional Information Important Additional Information will be Filed with the SEC This presentation does not constitute an offer to sell or the solicitation of an websites is not, and shall not be deemed to be, a part of this presentation or offer to buy any securities or a solicitation of any vote or approval with incorporated into other filings either company makes with the SEC. respect to the proposed acquisition by Union of Access. No offer of securities shall be made except by means of a prospectus meeting the Participants in the Solicitation requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which Union, Access and their respective directors and certain of their executive such offer, solicitation or sale would be unlawful. officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Union or Access in connection with the In connection with the proposed acquisition, Union will file with the SEC a proposed transaction. Information about the directors and executive officers Registration Statement on Form S-4 that will include a joint proxy statement of Union and their ownership of Union common stock is set forth in the of Union and Access and a prospectus of Union (the “Joint proxy statement for Union’s 2018 annual meeting of shareholders, which Proxy/Prospectus”), and each of Union and Access may file with the SEC was filed with the SEC on March 21, 2018. Information about the directors other relevant documents concerning the proposed transaction. A definitive and executive officers of Access and their ownership of Access common Joint Proxy/Prospectus will be sent to the shareholders of Union and stock is set forth in the proxy statement for Access’s 2018 annual meeting Access. Investors and shareholders of Union and Access are urged to of shareholders, which was filed with the SEC on April 12, 2018. Information read carefully and in their entirety the Registration Statement and regarding the persons who may, under the rules of the SEC, be deemed Joint Proxy/Prospectus when they become available and any other participants in the proxy solicitation and a description of their direct and relevant documents filed with the SEC by Union and Access, as well indirect interests, by security holdings or otherwise, will be contained in the as any amendments or supplements to those documents, because Joint Proxy/Prospectus and other relevant materials to be filed with the SEC they will contain important information about the proposed when they become available. Free copies of these documents may be transaction. obtained as described above. Investors and shareholders may obtain free copies of the Registration Non-GAAP Information Statement and the Joint Proxy/Prospectus (when available) and other documents filed with the SEC by Union and Access through the website This presentation contains certain financial information determined by maintained by the SEC at www.sec.gov. Free copies of the Registration methods other than in accordance with generally accepted accounting Statement and the Joint Proxy/Prospectus and other documents filed with policies in the United States (“GAAP”). The non-GAAP financial measure is the SEC also may be obtained by directing a request by telephone or mail return on average tangible common equity (“ROTCE”). This non-GAAP to Union Bankshares Corporation, 1051 East Cary Street, Suite 1200, disclosure has limitations as an analytical tool and should not be considered Richmond, Virginia 23219, Attention: Investor Relations (telephone: (804) in isolation or as a substitute for analysis of ANCX’s results as reported 633-5031), or Access National Corporation, 1800 Robert Fulton Drive, Suite under GAAP, nor is it necessarily comparable to non-GAAP performance 300, Reston, VA 20191. Attention: Sheila Linton (telephone: (703) 871- measures that may be presented by other companies. ANCX management 2100), or by accessing Union’s website at www.bankatunion.com under uses this non-GAAP measure in its analysis of ANCX performance, “Investor Relations” or Access’s website at www.accessnationalbank.com respectively, because it believes the measure is material and will be used under “Investor Relations.” The information on Union’s and Access’s as a measure of ANCX performance by investors. For a reconciliation of this 31 non-GAAP measure to its comparable GAAP measure, see the Appendix.

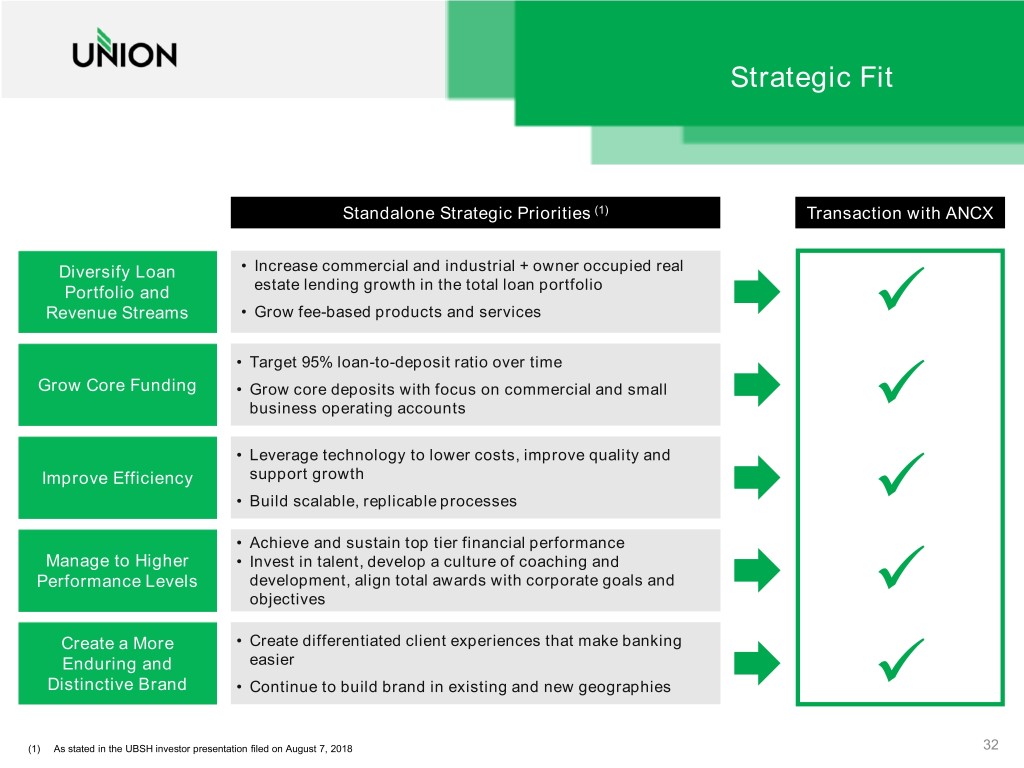

Strategic Fit Standalone Strategic Priorities (1) Transaction with ANCX Diversify Loan • Increase commercial and industrial + owner occupied real Portfolio and estate lending growth in the total loan portfolio Revenue Streams • Grow fee-based products and services • Target 95% loan-to-deposit ratio over time Grow Core Funding • Grow core deposits with focus on commercial and small business operating accounts • Leverage technology to lower costs, improve quality and Improve Efficiency support growth • Build scalable, replicable processes • Achieve and sustain top tier financial performance Manage to Higher • Invest in talent, develop a culture of coaching and Performance Levels development, align total awards with corporate goals and objectives Create a More • Create differentiated client experiences that make banking Enduring and easier Distinctive Brand • Continue to build brand in existing and new geographies (1) As stated in the UBSH investor presentation filed on August 7, 2018 32

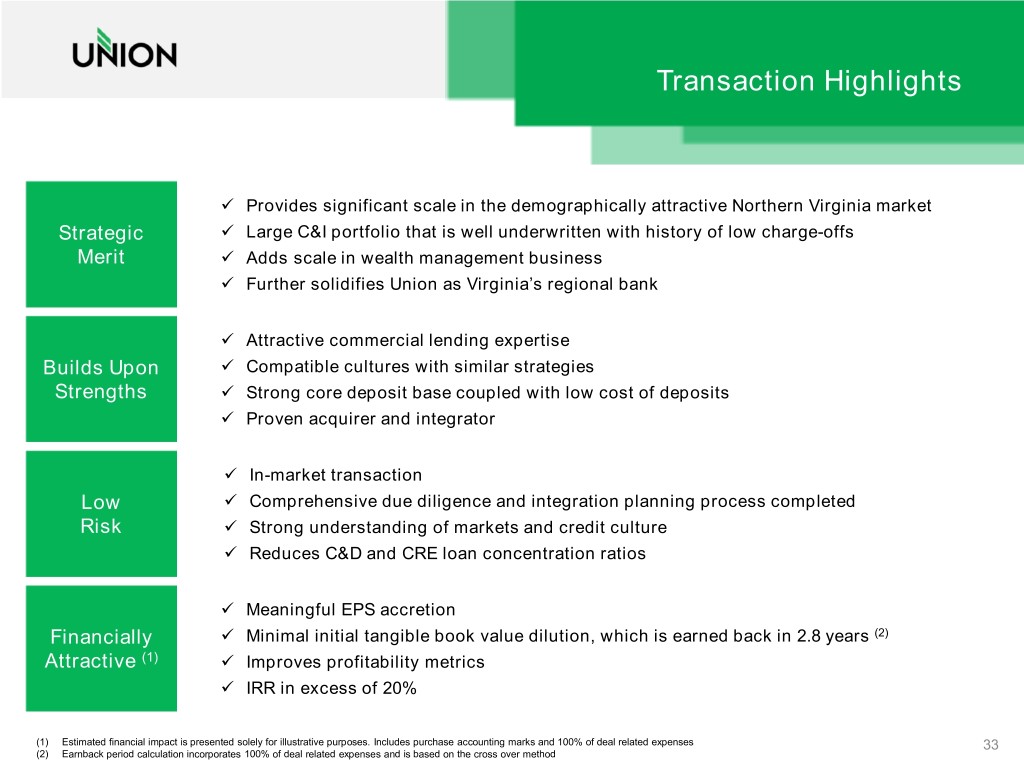

Transaction Highlights Provides significant scale in the demographically attractive Northern Virginia market Strategic Large C&I portfolio that is well underwritten with history of low charge-offs Merit Adds scale in wealth management business Further solidifies Union as Virginia’s regional bank Attractive commercial lending expertise Builds Upon Compatible cultures with similar strategies Strengths Strong core deposit base coupled with low cost of deposits Proven acquirer and integrator In-market transaction Low Comprehensive due diligence and integration planning process completed Risk Strong understanding of markets and credit culture Reduces C&D and CRE loan concentration ratios Meaningful EPS accretion Financially Minimal initial tangible book value dilution, which is earned back in 2.8 years (2) Attractive (1) Improves profitability metrics IRR in excess of 20% (1) Estimated financial impact is presented solely for illustrative purposes. Includes purchase accounting marks and 100% of deal related expenses 33 (2) Earnback period calculation incorporates 100% of deal related expenses and is based on the cross over method

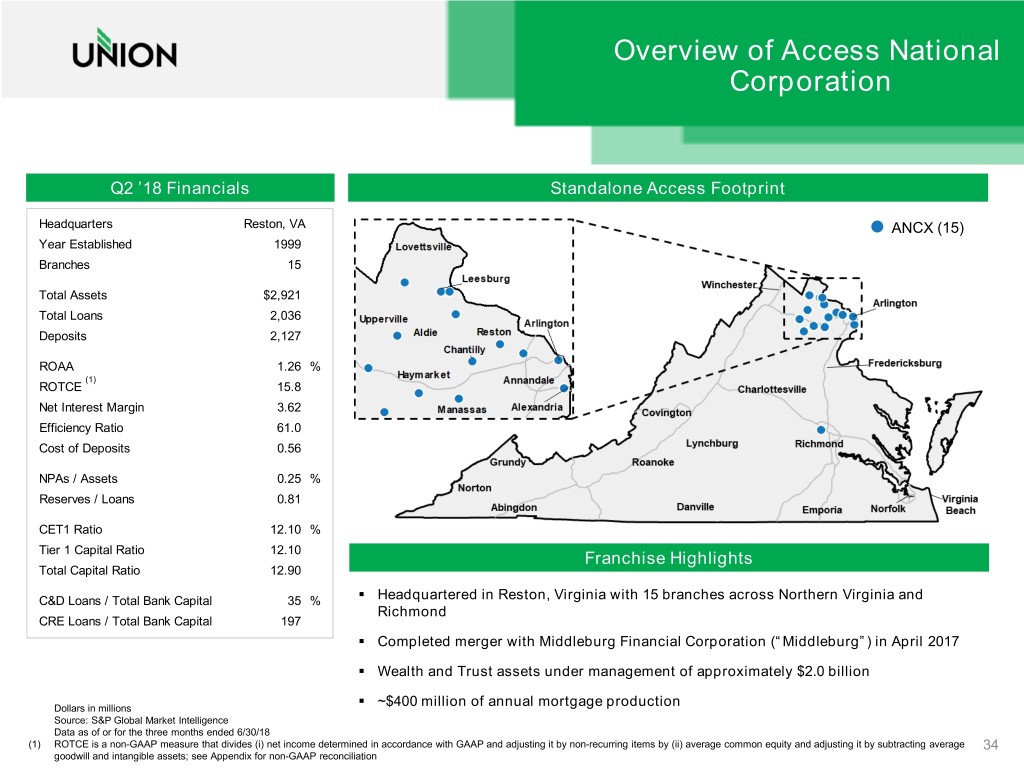

Overview of Access National Corporation Q2 ’18 Financials Standalone Access Footprint Headquarters Reston, VA ANCX (15) Year Established 1999 Branches 15 Total Assets $2,921 Total Loans 2,036 Deposits 2,127 ROAA 1.26 % (1) ROTCE 15.8 Net Interest Margin 3.62 Efficiency Ratio 61.0 Cost of Deposits 0.56 NPAs / Assets 0.25 % Reserves / Loans 0.81 CET1 Ratio 12.10 % Tier 1 Capital Ratio 12.10 Franchise Highlights Total Capital Ratio 12.90 . C&D Loans / Total Bank Capital 35 % Headquartered in Reston, Virginia with 15 branches across Northern Virginia and Richmond CRE Loans / Total Bank Capital 197 . Completed merger with Middleburg Financial Corporation (“Middleburg”) in April 2017 . Wealth and Trust assets under management of approximately $2.0 billion . Dollars in millions ~$400 million of annual mortgage production Source: S&P Global Market Intelligence Data as of or for the three months ended 6/30/18 (1) ROTCE is a non-GAAP measure that divides (i) net income determined in accordance with GAAP and adjusting it by non-recurring items by (ii) average common equity and adjusting it by subtracting average 34 goodwill and intangible assets; see Appendix for non-GAAP reconciliation

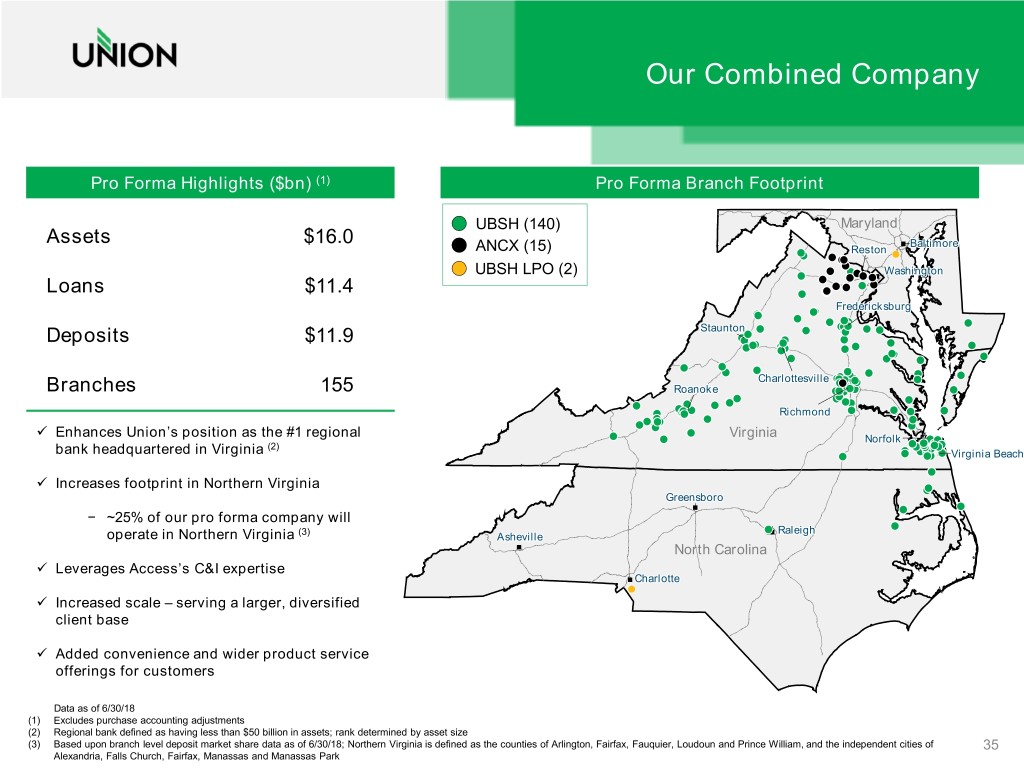

Our Combined Company Pro Forma Highlights ($bn) (1) Pro Forma Branch Footprint UBSH (140) Maryland Assets $16.0 BaltimoreBaltimore ANCX (15) RestonReston UBSH LPO (2) WashingtonWashington Loans $11.4 FredericksburgFredericksburg StauntonStaunton StauntonStaunton Deposits $11.9 CharlottesvilleCharlottesville CharlottesvilleCharlottesville Branches 155 RoanokeRoanoke RichmondRichmond Enhances Union’s position as the #1 regional Virginia NorfolkNorfolk (2) bank headquartered in Virginia VirginiaVirginia BeachBeach Increases footprint in Northern Virginia GreensboroGreensboro − ~25% of our pro forma company will (3) RaleighRaleigh operate in Northern Virginia AshevilleAsheville North Carolina Leverages Access’s C&I expertise CharlotteCharlotte Increased scale – serving a larger, diversified client base Added convenience and wider product service offerings for customers Data as of 6/30/18 (1) Excludes purchase accounting adjustments (2) Regional bank defined as having less than $50 billion in assets; rank determined by asset size (3) Based upon branch level deposit market share data as of 6/30/18; Northern Virginia is defined as the counties of Arlington, Fairfax, Fauquier, Loudoun and Prince William, and the independent cities of 35 Alexandria, Falls Church, Fairfax, Manassas and Manassas Park

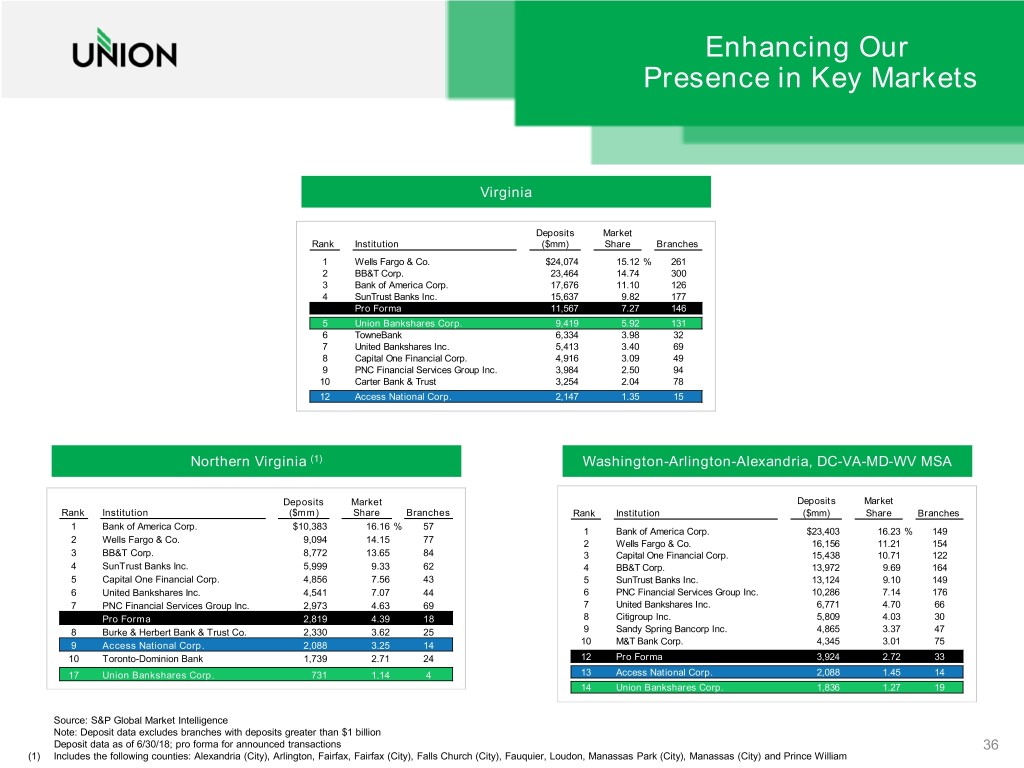

Enhancing Our Presence in Key Markets Virginia Deposits Market Rank Institution ($mm) Share Branches 1 Wells Fargo & Co. $24,074 15.12 % 261 2 BB&T Corp. 23,464 14.74 300 3 Bank of America Corp. 17,676 11.10 126 4 SunTrust Banks Inc. 15,637 9.82 177 Pro Forma 11,567 7.27 146 5 Union Bankshares Corp. 9,419 5.92 131 6 TowneBank 6,334 3.98 32 7 United Bankshares Inc. 5,413 3.40 69 8 Capital One Financial Corp. 4,916 3.09 49 9 PNC Financial Services Group Inc. 3,984 2.50 94 10 Carter Bank & Trust 3,254 2.04 78 12 Access National Corp. 2,147 1.35 15 Northern Virginia (1) Washington-Arlington-Alexandria, DC-VA-MD-WV MSA Deposits Market Deposits Market Rank Institution ($mm) Share Branches Rank Institution ($mm) Share Branches 1 Bank of America Corp. $10,383 16.16 % 57 1 Bank of America Corp. $23,403 16.23 % 149 2 Wells Fargo & Co. 9,094 14.15 77 2 Wells Fargo & Co. 16,156 11.21 154 3 BB&T Corp. 8,772 13.65 84 3 Capital One Financial Corp. 15,438 10.71 122 4 SunTrust Banks Inc. 5,999 9.33 62 4 BB&T Corp. 13,972 9.69 164 5 Capital One Financial Corp. 4,856 7.56 43 5 SunTrust Banks Inc. 13,124 9.10 149 6 United Bankshares Inc. 4,541 7.07 44 6 PNC Financial Services Group Inc. 10,286 7.14 176 7 PNC Financial Services Group Inc. 2,973 4.63 69 7 United Bankshares Inc. 6,771 4.70 66 Pro Forma 2,819 4.39 18 8 Citigroup Inc. 5,809 4.03 30 8 Burke & Herbert Bank & Trust Co. 2,330 3.62 25 9 Sandy Spring Bancorp Inc. 4,865 3.37 47 10 M&T Bank Corp. 4,345 3.01 75 9 Access National Corp. 2,088 3.25 14 10 Toronto-Dominion Bank 1,739 2.71 24 12 Pro Forma 3,924 2.72 33 17 Union Bankshares Corp. 731 1.14 4 13 Access National Corp. 2,088 1.45 14 14 Union Bankshares Corp. 1,836 1.27 19 Source: S&P Global Market Intelligence Note: Deposit data excludes branches with deposits greater than $1 billion Deposit data as of 6/30/18; pro forma for announced transactions 36 (1) Includes the following counties: Alexandria (City), Arlington, Fairfax, Fairfax (City), Falls Church (City), Fauquier, Loudon, Manassas Park (City), Manassas (City) and Prince William

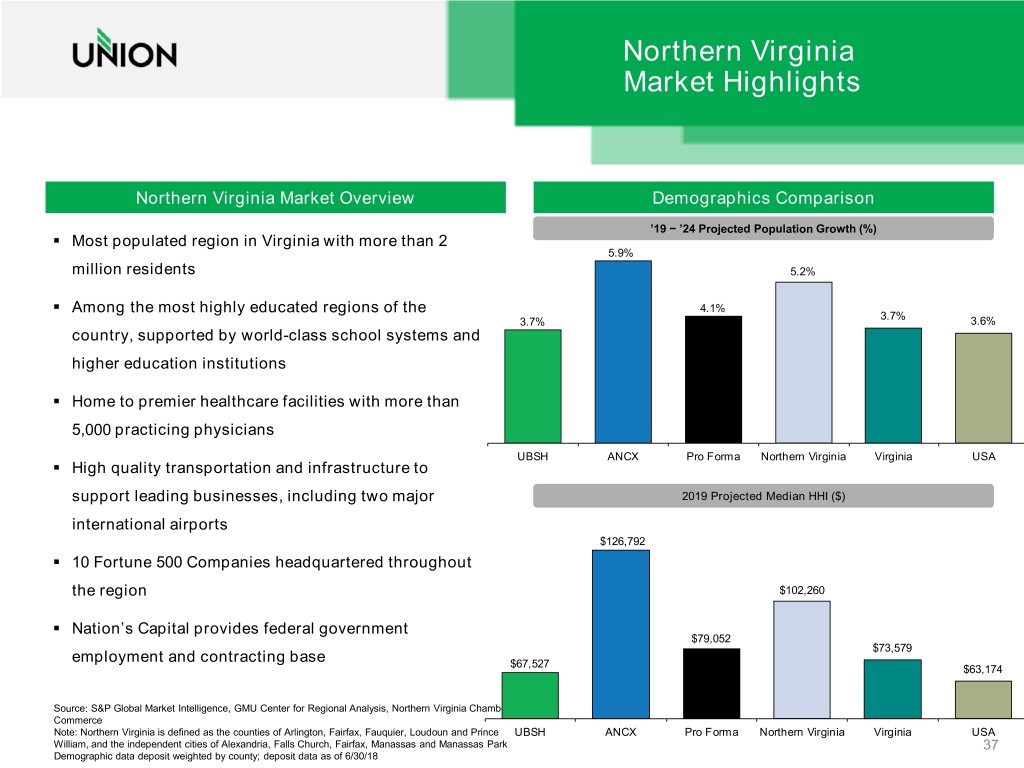

Northern Virginia Market Highlights Northern Virginia Market Overview Demographics Comparison ’19 − ’24 Projected Population Growth (%) . Most populated region in Virginia with more than 2 5.9% million residents 5.2% . 4.1% Among the most highly educated regions of the 3.7% 3.7% 3.6% country, supported by world-class school systems and higher education institutions . Home to premier healthcare facilities with more than 5,000 practicing physicians UBSH ANCX Pro Forma Northern Virginia Virginia USA . High quality transportation and infrastructure to support leading businesses, including two major 2019 Projected Median HHI ($) international airports $126,792 . 10 Fortune 500 Companies headquartered throughout the region $102,260 . Nation’s Capital provides federal government $79,052 $73,579 employment and contracting base $67,527 $63,174 Source: S&P Global Market Intelligence, GMU Center for Regional Analysis, Northern Virginia Chamber of Commerce Note: Northern Virginia is defined as the counties of Arlington, Fairfax, Fauquier, Loudoun and Prince UBSH ANCX Pro Forma Northern Virginia Virginia USA William, and the independent cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park 37 Demographic data deposit weighted by county; deposit data as of 6/30/18

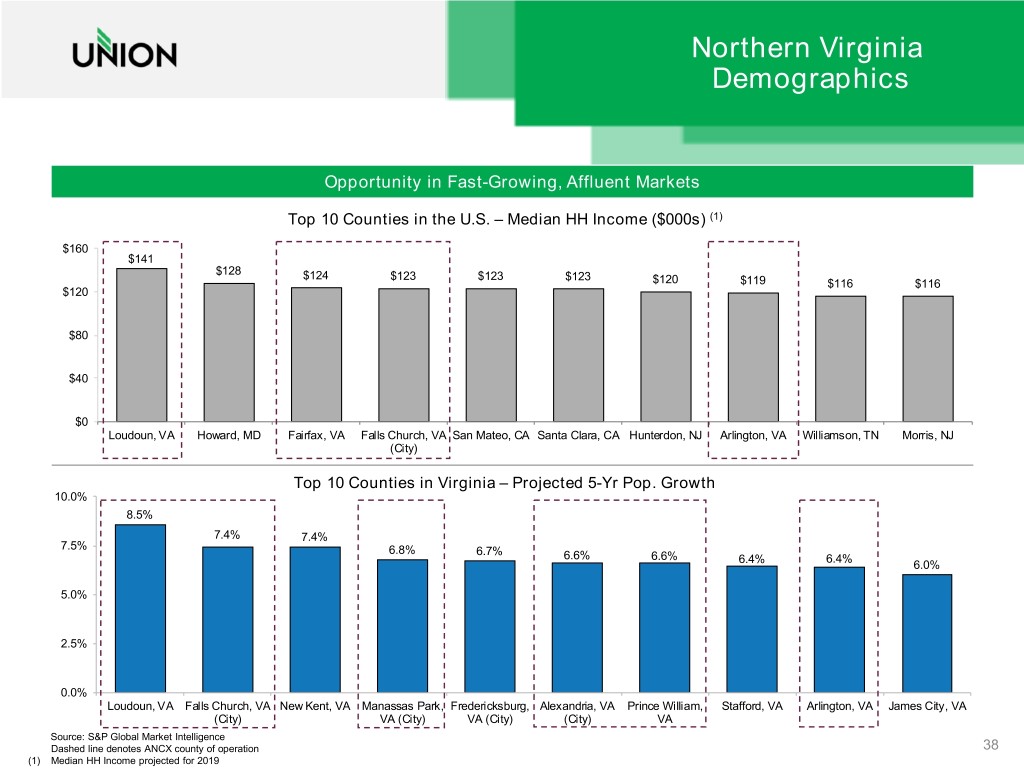

Northern Virginia Demographics Opportunity in Fast-Growing, Affluent Markets Top 10 Counties in the U.S. – Median HH Income ($000s) (1) $160 $141 $128 $124 $123 $123 $123 $120 $119 $116 $116 $120 $80 $40 $0 Loudoun, VA Howard, MD Fairfax, VA Falls Church, VA San Mateo, CA Santa Clara, CA Hunterdon, NJ Arlington, VA Williamson, TN Morris , NJ (Ci ty) Top 10 Counties in Virginia – Projected 5-Yr Pop. Growth 10.0% 8.5% 7.4% 7.4% 7.5% 6.8% 6.7% 6.6% 6.6% 6.4% 6.4% 6.0% 5.0% 2.5% 0.0% Loudoun, VA Falls Church, VA New Kent, VA Manassas Park, Fredericksburg, Alexandria, VA Prince William, Stafford, VA Arlington, VA James City, VA (Ci ty) VA (City) VA (City) (Ci ty) VA Source: S&P Global Market Intelligence Dashed line denotes ANCX county of operation 38 (1) Median HH Income projected for 2019

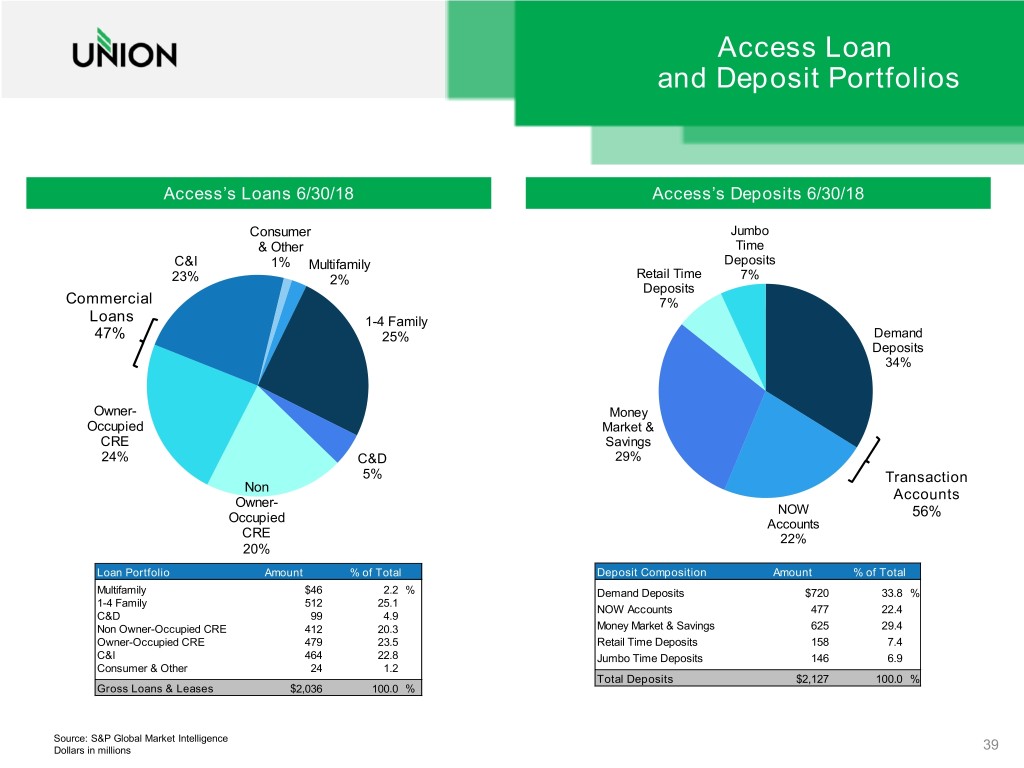

Access Loan and Deposit Portfolios Access’s Loans 6/30/18 Access’s Deposits 6/30/18 Consumer Jumbo & Other Time C&I 1% Multifamily Deposits 23% 2% Retail Time 7% Deposits Commercial 7% Loans 1-4 Family 47% 25% Demand Deposits 34% Owner- Money Occupied Market & CRE Savings 24% C&D 29% 5% Transaction Non Owner- Accounts NOW 56% Occupied Accounts CRE 22% 20% Loan Portfolio Amount % of Total Deposit Composition Amount % of Total Multifamily $46 2.2 % Demand Deposits $720 33.8 % 1-4 Family 512 25.1 NOW Accounts 477 22.4 C&D 99 4.9 Non Owner-Occupied CRE 412 20.3 Money Market & Savings 625 29.4 Owner-Occupied CRE 479 23.5 Retail Time Deposits 158 7.4 C&I 464 22.8 Jumbo Time Deposits 146 6.9 Consumer & Other 24 1.2 Total Deposits $2,127 100.0 % Gross Loans & Leases $2,036 100.0 % Source: S&P Global Market Intelligence Dollars in millions 39

Pro Forma Loan & Deposit Portfolio UBSH ANCX Pro Forma (1) Consumer Consumer Consumer & Other & Other C&I & Other C&I C&I 1% 7% 12% 8% Multifamily Commercial 14% Commercial Multifamily 23% 2% C&D 6% Loans 12% Loans Commercial 30% 26% Loans 1-4 Family 1-4 Family 47% 25% 22% Owner- Owner- Occupied Occupied CRE CRE Loans Owner- 14% 16% Occupied CRE 1-4 Family 24% C&D 22% Non 5% Owner- C&D Non Non Occupied 13% Owner- Owner- Multifamily CRE Occupied Occupied 5% 25% CRE CRE 20% 24% Yield on Loans and Leases: 4.91% Yield on Loans and Leases: 4.88% Jumbo Jumbo Jumbo Time Time Time Retail Deposits Deposits Deposits Retail Time Time 3% Demand 7% Retail 4% Demand Deposits Deposits Deposits Time 7% Deposits 18% 22% Deposits 24% Demand 16% Deposits 34% Transaction Transaction Accounts Accounts 44% Money 46% Market & Deposits Savings 29% Money NOW Transaction Money NOW Market & Accounts Accounts Market & Accounts Savings 22% NOW 56% Savings 22% 34% Accounts 34% 22% Cost of Total Deposits: 0.54% Cost of Total Deposits: 0.57% Source: S&P Global Market Intelligence Data as of or for the three months ended 6/30/18 40 (1) Excludes purchase accounting adjustments

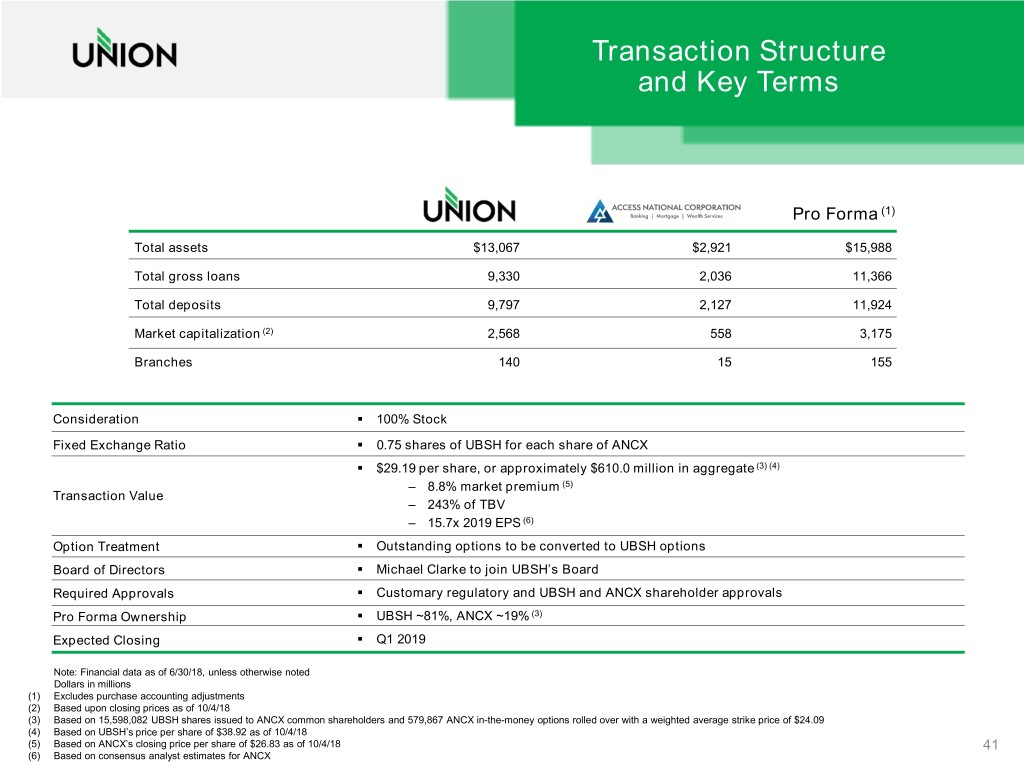

Transaction Structure and Key Terms Pro Forma (1) Total assets $13,067 $2,921 $15,988 Total gross loans 9,330 2,036 11,366 Total deposits 9,797 2,127 11,924 Market capitalization (2) 2,568 558 3,175 Branches 140 15 155 Consideration . 100% Stock Fixed Exchange Ratio . 0.75 shares of UBSH for each share of ANCX . $29.19 per share, or approximately $610.0 million in aggregate (3) (4) – 8.8% market premium (5) Transaction Value – 243% of TBV – 15.7x 2019 EPS (6) Option Treatment . Outstanding options to be converted to UBSH options Board of Directors . Michael Clarke to join UBSH’s Board Required Approvals . Customary regulatory and UBSH and ANCX shareholder approvals Pro Forma Ownership . UBSH ~81%, ANCX ~19% (3) Expected Closing . Q1 2019 Note: Financial data as of 6/30/18, unless otherwise noted Dollars in millions (1) Excludes purchase accounting adjustments (2) Based upon closing prices as of 10/4/18 (3) Based on 15,598,082 UBSH shares issued to ANCX common shareholders and 579,867 ANCX in-the-money options rolled over with a weighted average strike price of $24.09 (4) Based on UBSH’s price per share of $38.92 as of 10/4/18 (5) Based on ANCX’s closing price per share of $26.83 as of 10/4/18 41 (6) Based on consensus analyst estimates for ANCX

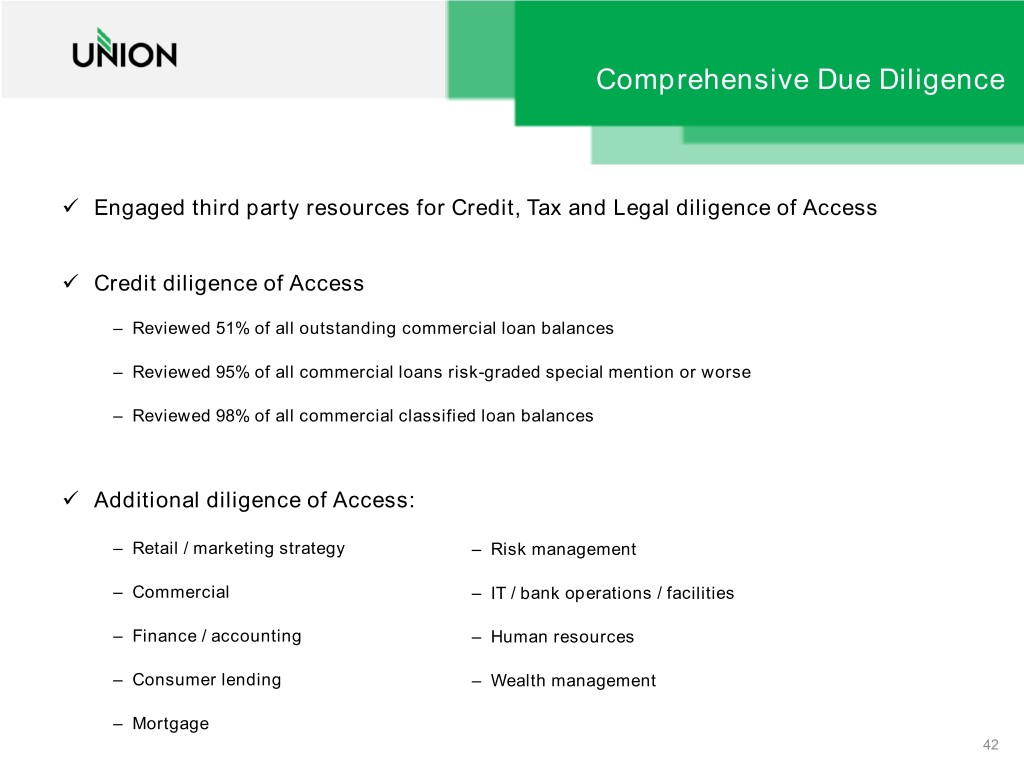

Comprehensive Due Diligence Engaged third party resources for Credit, Tax and Legal diligence of Access Credit diligence of Access ‒ Reviewed 51% of all outstanding commercial loan balances ‒ Reviewed 95% of all commercial loans risk-graded special mention or worse ‒ Reviewed 98% of all commercial classified loan balances Additional diligence of Access: ‒ Retail / marketing strategy ‒ Risk management ‒ Commercial ‒ IT / bank operations / facilities ‒ Finance / accounting ‒ Human resources ‒ Consumer lending ‒ Wealth management ‒ Mortgage 42

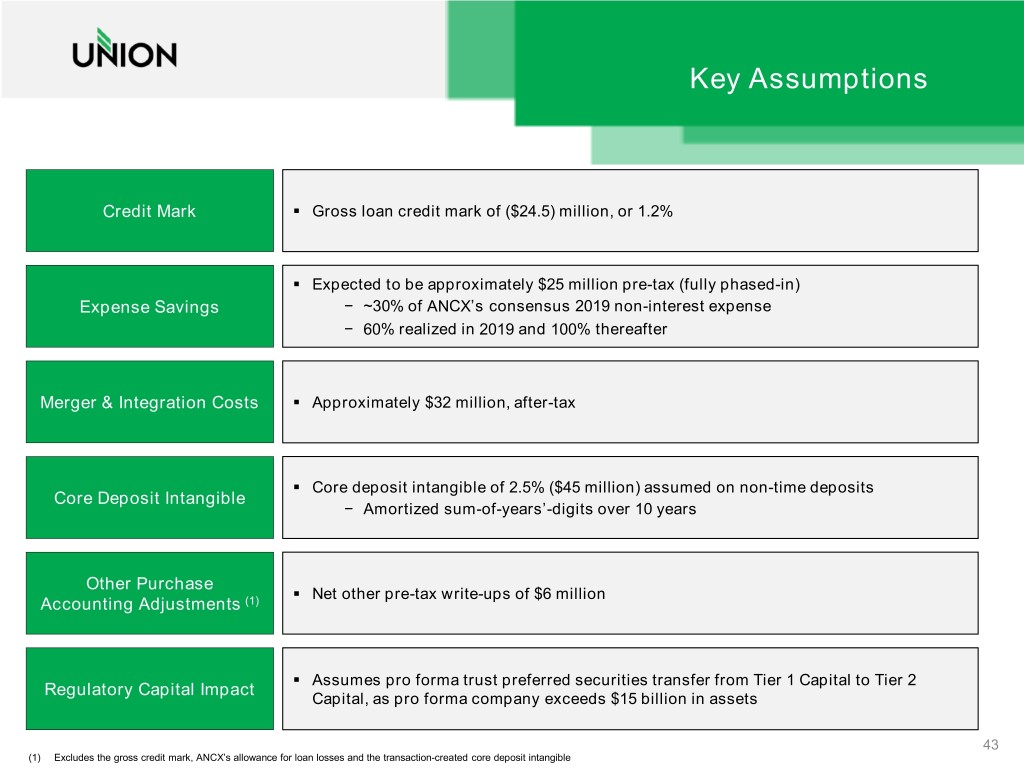

Key Assumptions Credit Mark . Gross loan credit mark of ($24.5) million, or 1.2% . Expected to be approximately $25 million pre-tax (fully phased-in) Expense Savings − ~30% of ANCX’s consensus 2019 non-interest expense − 60% realized in 2019 and 100% thereafter Merger & Integration Costs . Approximately $32 million, after-tax . Core deposit intangible of 2.5% ($45 million) assumed on non-time deposits Core Deposit Intangible − Amortized sum-of-years’-digits over 10 years Other Purchase . Net other pre-tax write-ups of $6 million Accounting Adjustments (1) . Assumes pro forma trust preferred securities transfer from Tier 1 Capital to Tier 2 Regulatory Capital Impact Capital, as pro forma company exceeds $15 billion in assets 43 (1) Excludes the gross credit mark, ANCX’s allowance for loan losses and the transaction-created core deposit intangible

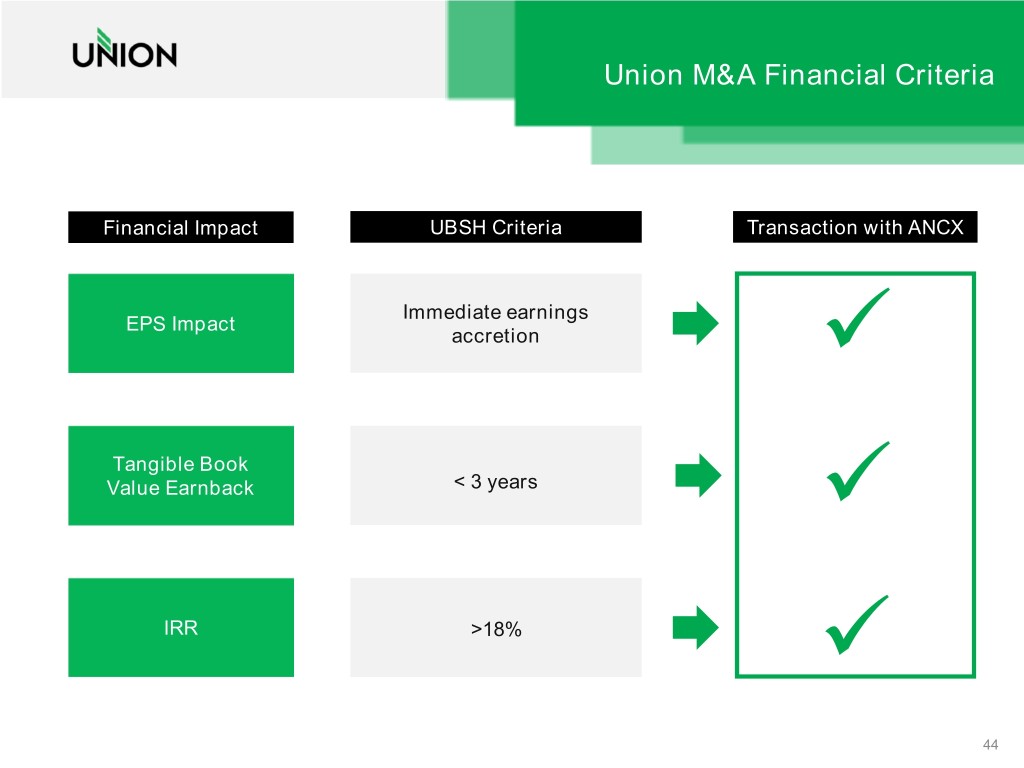

Union M&A Financial Criteria Financial Impact UBSH Criteria Transaction with ANCX Immediate earnings EPS Impact accretion Tangible Book Value Earnback < 3 years IRR >18% 44

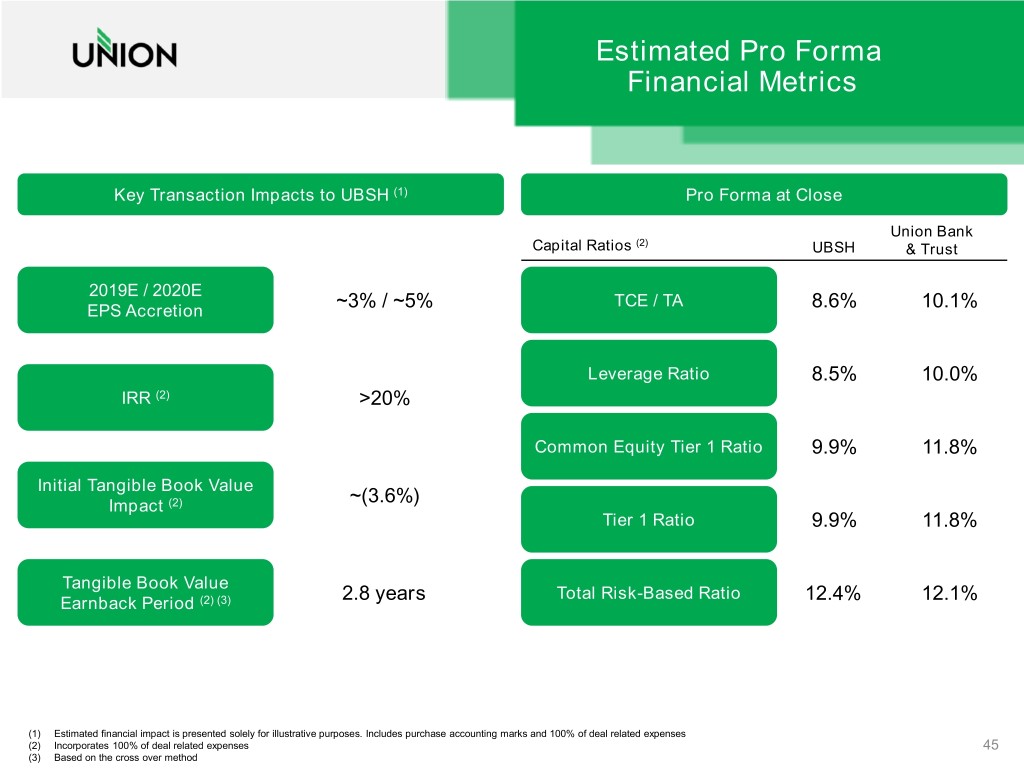

Estimated Pro Forma Financial Metrics Key Transaction Impacts to UBSH (1) Pro Forma at Close Union Bank (2) Capital Ratios UBSH & Trust 2019E / 2020E TCE / TA EPS Accretion ~3% / ~5% 8.6% 10.1% Leverage Ratio 8.5% 10.0% IRR (2) >20% Common Equity Tier 1 Ratio 9.9% 11.8% Initial Tangible Book Value Impact (2) ~(3.6%) Tier 1 Ratio 9.9% 11.8% Tangible Book Value Total Risk-Based Ratio Earnback Period (2) (3) 2.8 years 12.4% 12.1% (1) Estimated financial impact is presented solely for illustrative purposes. Includes purchase accounting marks and 100% of deal related expenses (2) Incorporates 100% of deal related expenses 45 (3) Based on the cross over method

Summary Solidifies Union’s position as Virginia’s preeminent regional bank Enhances presence in key Northern Virginia market Delivers improvements to top tier financial performance Financially attractive transaction for shareholders Proven track record of successful conversions and integrations 46

Appendix

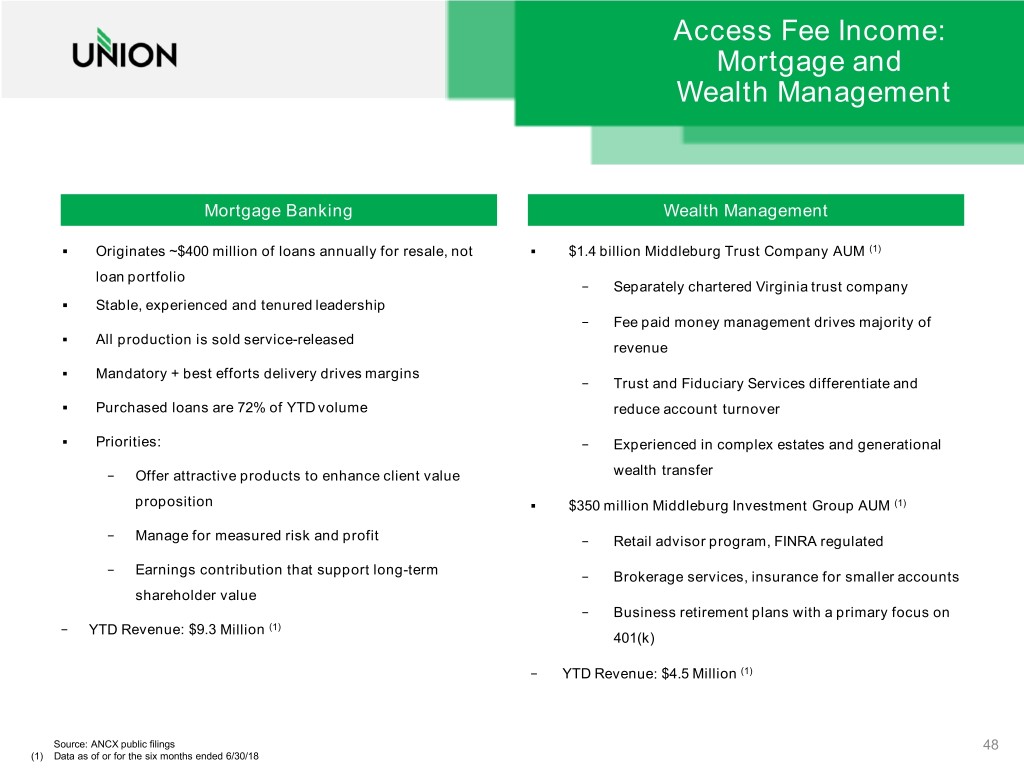

Access Fee Income: Mortgage and Wealth Management Mortgage Banking Wealth Management . Originates ~$400 million of loans annually for resale, not . $1.4 billion Middleburg Trust Company AUM (1) loan portfolio − Separately chartered Virginia trust company . Stable, experienced and tenured leadership − Fee paid money management drives majority of . All production is sold service-released revenue . Mandatory + best efforts delivery drives margins − Trust and Fiduciary Services differentiate and . Purchased loans are 72% of YTD volume reduce account turnover . Priorities: − Experienced in complex estates and generational − Offer attractive products to enhance client value wealth transfer proposition . $350 million Middleburg Investment Group AUM (1) − Manage for measured risk and profit − Retail advisor program, FINRA regulated − Earnings contribution that support long-term − Brokerage services, insurance for smaller accounts shareholder value − Business retirement plans with a primary focus on − YTD Revenue: $9.3 Million (1) 401(k) − YTD Revenue: $4.5 Million (1) Source: ANCX public filings 48 (1) Data as of or for the six months ended 6/30/18

Non-GAAP Reconciliation Access ROTCE Reconciliation ($000) Q2 ’18 Net Income $8,962 Amortization of Intangibles & Goodwill Impairment 802 Less: Effect of Taxes on Amortization & Impairment (168) Adjusted Net Income $9,596 Average Common Equity $428,590 Less: Average Intangibles (185,242) Average Tangible Common Equity $243, 348 Adjusted Net Income $9,596 Divided by: Average Tangible Common Equity 243,348 Unadjusted ROTCE 3.9% Multiplied by: Annualization Factor 4.0x Annualized ROTCE 15.8% Source: S&P Global Market Intelligence 49 Data as of the three months ended 6/30/18