Investor

Presentation

Nasdaq: UBSH

May/June 2018

Exhibit 99.1

Certain statements in this presentation which are not statements of historical fact constitute forward-

looking statements within the meaning of, and subject to the protections of, Section 27A of the Securities

Act of 1933, as amended, or the “Securities Act,” and Section 21E of the Exchange Act. Forward-looking

statements include statements with respect to our beliefs, plans, objectives, goals, targets, expectations,

anticipations, assumptions, estimates, intentions and future performance and involve known and

unknown risks, many of which are beyond our control and which may cause our actual results,

performance or achievements or the commercial banking industry or economy generally, to be materially

different from future results, performance or achievements expressed or implied by such forward-looking

statements.

All statements other than statements of historical fact are forward-looking statements. You can identify

these forward-looking statements through our use of words such as “believes,” “anticipates,” “expects,”

“may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,”

“plans,” “potential” and other similar words and expressions of the future or otherwise regarding the

outlook for our future business and financial performance and/or the performance of the commercial

banking industry and economy in general. Forward-looking statements may include, without limitation:

• projections of revenues, expenses, income, income per share, net interest margins, asset growth,

loan production, asset quality, deposit growth and other performance measures;

• statements regarding the anticipated benefits from or other effects of the merger between Union

and Xenith;

• statements regarding expansion of operations, including branch openings, entrance into new

markets, development of products and services, and execution of strategic initiatives; and

• discussions of the future state of the economy, competition, regulation, taxation, our business

strategies, subsidiaries, investment risk and policies.

Forward-looking statements are subject to various risks and uncertainties, which change over time, are

based on management’s expectations and assumptions at the time the statements are made and are

not guarantees of future results. Actual future performance, outcomes and results may differ materially

from those expressed in or contemplated by these forward-looking statements due to certain risks,

uncertainties and assumptions, many of which are beyond our ability to control or predict. Certain factors

that may affect our future results include, but are not limited to:

• the possibility that any of the anticipated benefits of the merger of Xenith with and into the

Company, with the Company surviving, will not be realized or will not be realized within the

expected time period, the businesses of the Company and Xenith may not be integrated

successfully or such integration may be more difficult, time-consuming or costly than expected, the

expected revenue synergies and cost savings from the merger may not be fully realized or realized

within the expected time frame, revenues following the merger may be lower than expected, or

customer and employee relationships and business operations may be disrupted by the merger;

• changes in interest rates;

• general economic and financial market conditions;

• the Company’s ability to manage its growth or implement its growth strategy;

• the incremental cost and/or decreased revenues associated with exceeding $10 billion in assets;

• levels of unemployment in the Bank’s lending area;

• real estate values in the Bank’s lending area;

• an insufficient allowance for loan losses;

• the quality or composition of the Company’s loan or investment portfolios;

• concentrations of loans secured by real estate, particularly commercial real estate;

• the effectiveness of the Company’s credit processes and management of the Company’s credit risk;

• demand for loan products and financial services in the Company’s market area;

• the Company’s ability to compete in the market for financial services;

• technological risks and developments, and cyber attacks or events;

• performance by the Company’s counterparties or vendors;

• deposit flows;

• the availability of financing and the terms thereof;

• the level of prepayments on loans and mortgage-backed securities;

• legislative or regulatory changes and requirements;

• the impact of the federal Tax Cuts and Jobs Act (the “Tax Act”) signed into law on December 22,

2017, including, but not limited to, the effect of the lower federal corporate income tax rate,

including on the valuation of our tax assets and liabilities;

• any future refinements to our preliminary analysis of the impact of the Tax Act on us;

• changes in the effect of the Tax Act due to issuance of interpretive regulatory guidance or

enactment of corrective or supplemental legislation;

• monetary and fiscal policies of the U.S. government including policies of the U.S. Department of the

Treasury and the Federal Reserve;

• accounting principles and guidelines; and

• the risks outlined in “Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2017, in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018,

and in other annual, quarterly and current reports that we may file with the Securities and Exchange

Commission.

Should one or more of the foregoing risks materialize, or should underlying assumptions prove incorrect,

actual results or outcomes may vary materially from those described in the forward-looking statements.

Forward-looking statements included herein should not be relied upon as representing our expectations

or beliefs as of any date subsequent to the date of this presentation. Except as required by law, we

undertake no obligation to update or revise any forward-looking statements contained in this

presentation, whether as a result of new information, future events or otherwise. The factors discussed

herein are not intended to be a complete summary of all risks and uncertainties that may affect our

businesses. Though we strive to monitor and mitigate risk, we cannot anticipate all potential economic,

operational and financial developments that may adversely impact our operations and our financial

results. Forward-looking statements should not be viewed as predictions and should not be the primary

basis upon which investors evaluate an investment in our securities.

Forward Looking Statements

2

Unaudited Pro Forma Financial Information

The unaudited pro forma financial information included herein is

presented for informational purposes only and does not necessarily

reflect the financial results of the combined company had the

companies actually been combined during periods presented. The

adjustments included in this unaudited pro forma financial

information are preliminary and may be significantly revised and

may not agree to actual amounts finally recorded by Union. This

financial information does not reflect the benefits of the merger’s

expected cost savings and expense efficiencies, opportunities to

earn additional revenue, potential impacts of current market

conditions on revenues or asset dispositions, among other factors,

and includes various preliminary estimates and may not necessarily

be indicative of the financial position or results of operations that

would have occurred if the merger had been completed on the date

or at the beginning of the period indicated or which may be attained

in the future.

Non-GAAP Financial Measures

Union reports its results in accordance with United States generally

accepted accounting principles (“GAAP”). However, management

believes that certain non-GAAP performance measures used in

managing the business may provide meaningful information about

underlying trends in its business. Non-GAAP financial measures

should be viewed in addition to, and not as an alternative for,

Union’s reported results prepared in accordance with GAAP.

Please see “Reconciliation of Non-GAAP Disclosures” at the end of

this presentation for a reconciliation to the nearest GAAP financial

measure.

No Offer or Solicitation

This presentation does not constitute an offer to sell or a solicitation

of an offer to buy any securities. This presentation has been

prepared primarily for security analysts and investors to serve as a

convenient and useful reference document. Any offers to sell,

solicitations of offers to buy or sales of securities, if any, will be

made in accordance with the requirements of the Securities Act of

1933, as amended.

About Union Bankshares Corporation

Headquartered in Richmond, Virginia, Union Bankshares

Corporation (Nasdaq: UBSH) is the holding company for Union

Bank & Trust. Union Bank & Trust has 150 branches, 39 of which

are operated as Xenith Bank, a division of Union Bank & Trust of

Richmond, Virginia, and approximately 216 ATMs located

throughout Virginia, and in portions of Maryland and North Carolina.

Union Bank & Trust also operates Shore Premier Finance, a

specialty marine lender. Non-bank affiliates of the holding

company include: Union Mortgage Group, Inc., which provides a full

line of mortgage products, Old Dominion Capital Management, Inc.

and Dixon, Hubard, Feinour, & Brown, Inc., which both provide

investment advisory services, and Union Insurance Group, LLC,

which offers various lines of insurance products.

Additional Information

3

North Carolina

Virginia

Maryland

Raleighl il il il il i

Greensboror rr rr r

Roanoke

Norfolklfr llffrr ll

Richmondiiiii

Stauntont tt tt t

Charlottesvillel illttr l illl illttttrrl illl ill

Virginia Beachi i i ri i ii i i rri i ii i i

Ashevilleillillillillill

Fredericksburgir r riir r rr r rii

Washingtoni tii ttii

Baltimorel it rl il itt rrl il i

Charlottel ttrll ttttrrll

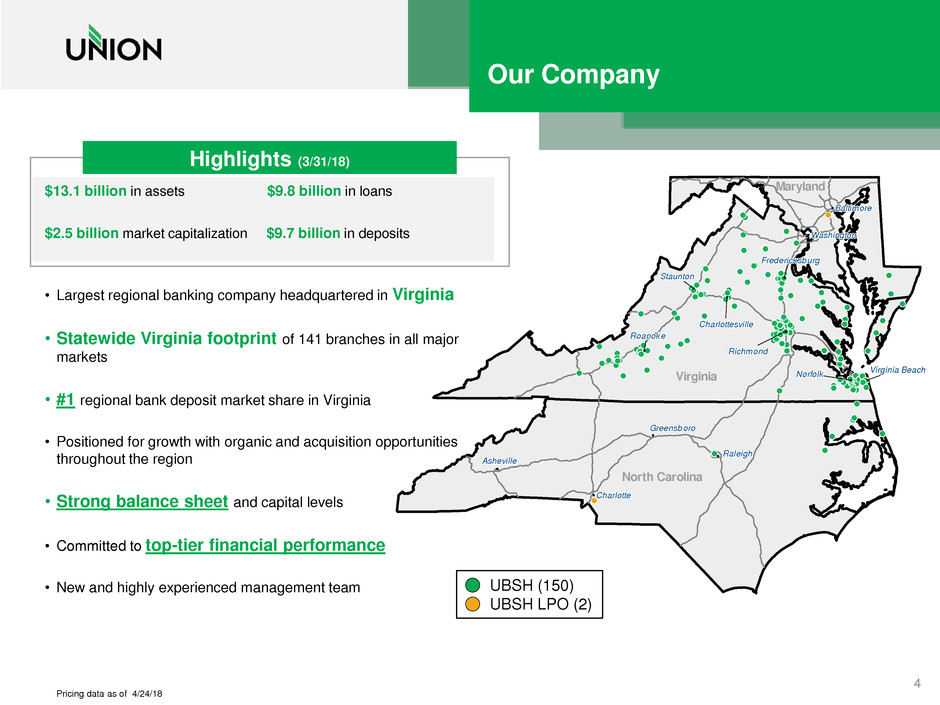

Highlights (3/31/18)

$13.1 billion in assets $9.8 billion in loans

$2.5 billion market capitalization $9.7 billion in deposits

• Largest regional banking company headquartered in Virginia

• Statewide Virginia footprint of 141 branches in all major

markets

• #1 regional bank deposit market share in Virginia

• Positioned for growth with organic and acquisition opportunities

throughout the region

• Strong balance sheet and capital levels

• Committed to top-tier financial performance

• New and highly experienced management team

Our Company

Pricing data as of 4/24/18

4

UBSH (150)

UBSH LPO (2)

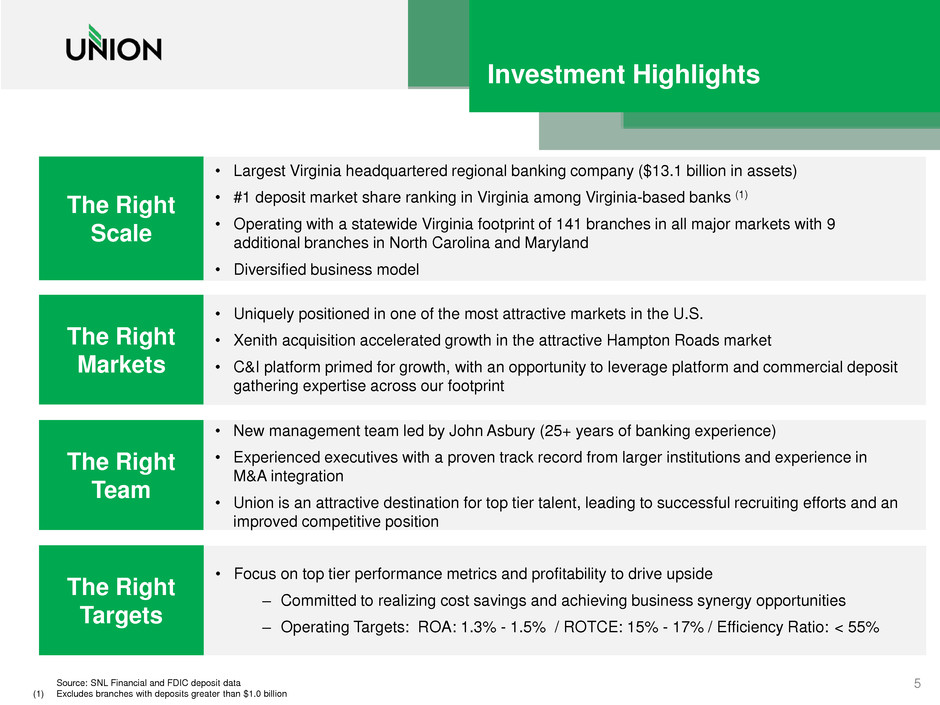

Investment Highlights

Source: SNL Financial and FDIC deposit data

(1) Excludes branches with deposits greater than $1.0 billion

The Right

Scale

The Right

Markets

The Right

Team

The Right

Targets

• Largest Virginia headquartered regional banking company ($13.1 billion in assets)

• #1 deposit market share ranking in Virginia among Virginia-based banks (1)

• Operating with a statewide Virginia footprint of 141 branches in all major markets with 9

additional branches in North Carolina and Maryland

• Diversified business model

• Uniquely positioned in one of the most attractive markets in the U.S.

• Xenith acquisition accelerated growth in the attractive Hampton Roads market

• C&I platform primed for growth, with an opportunity to leverage platform and commercial deposit

gathering expertise across our footprint

• New management team led by John Asbury (25+ years of banking experience)

• Experienced executives with a proven track record from larger institutions and experience in

M&A integration

• Union is an attractive destination for top tier talent, leading to successful recruiting efforts and an

improved competitive position

• Focus on top tier performance metrics and profitability to drive upside

– Committed to realizing cost savings and achieving business synergy opportunities

– Operating Targets: ROA: 1.3% - 1.5% / ROTCE: 15% - 17% / Efficiency Ratio: < 55%

5

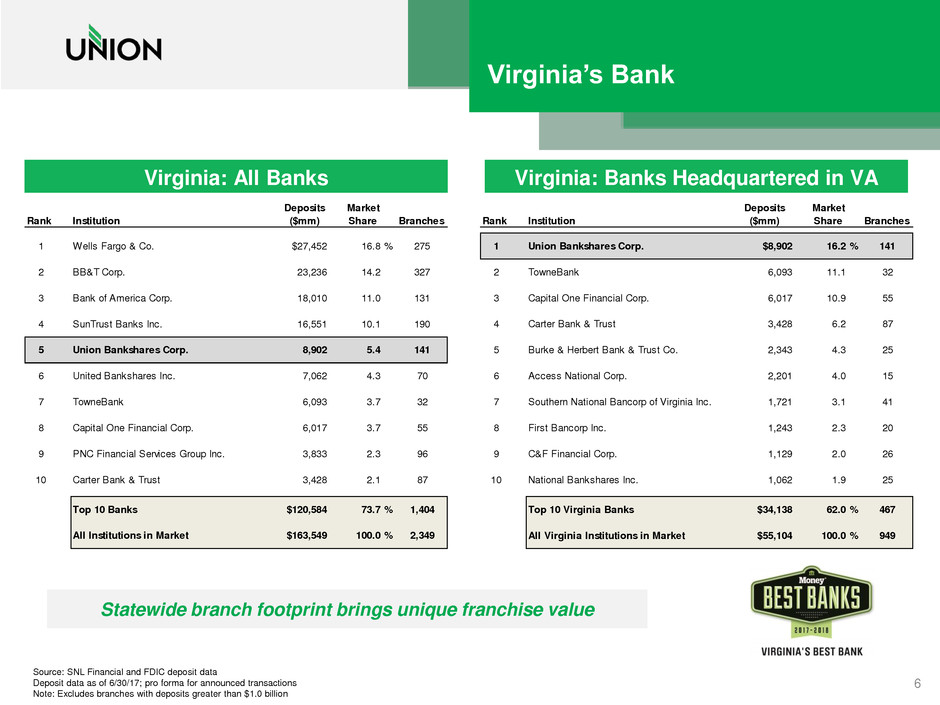

Virginia’s Bank

Virginia: Banks Headquartered in VA Virginia: All Banks

Source: SNL Financial and FDIC deposit data

Deposit data as of 6/30/17; pro forma for announced transactions

Note: Excludes branches with deposits greater than $1.0 billion

Deposits Market

Rank Institution ($mm) Share Branches

1 Wells Fargo & Co. $27,452 16.8 % 275

2 BB&T Corp. 23,236 14.2 327

3 Bank of America Corp. 18,010 11.0 131

4 SunTrust Banks Inc. 16,551 10.1 190

5 Union Bankshares Corp. 8,902 5.4 141

6 United Bankshares Inc. 7,062 4.3 70

7 TowneBank 6,093 3.7 32

8 Capital One Financial Corp. 6,017 3.7 55

9 PNC Financial Services Group Inc. 3,833 2.3 96

10 Carter Bank & Trust 3,428 2.1 87

Top 10 Banks $120,584 73.7 % 1,404

All Institutions in Market $163,549 100.0 % 2,349

Deposits Market

Rank Institution ($mm) Share Branches

1 Union Bankshares Corp. $8,902 16.2 % 141

2 TowneBank 6,093 11.1 32

3 Ca ital One Financial Corp. 6,017 10.9 55

4 Carter Bank & Trust 3,428 6.2 87

5 Burke & Herbert Bank & Trust Co. 2,343 4.3 25

6 Access National Corp. 2,201 4.0 15

7 Southern National Bancorp of Virginia Inc. 1,721 3.1 41

8 First Bancorp Inc. 1,243 2.3 20

9 C&F Financial Corp. 1,12 2.0 26

10 National Bankshares Inc. 1,062 1.9 25

Top 10 Virginia Banks $34,138 62.0 % 467

All Virginia Institutions in Market $55,104 100.0 % 949

Statewide branch footprint brings unique franchise value

6

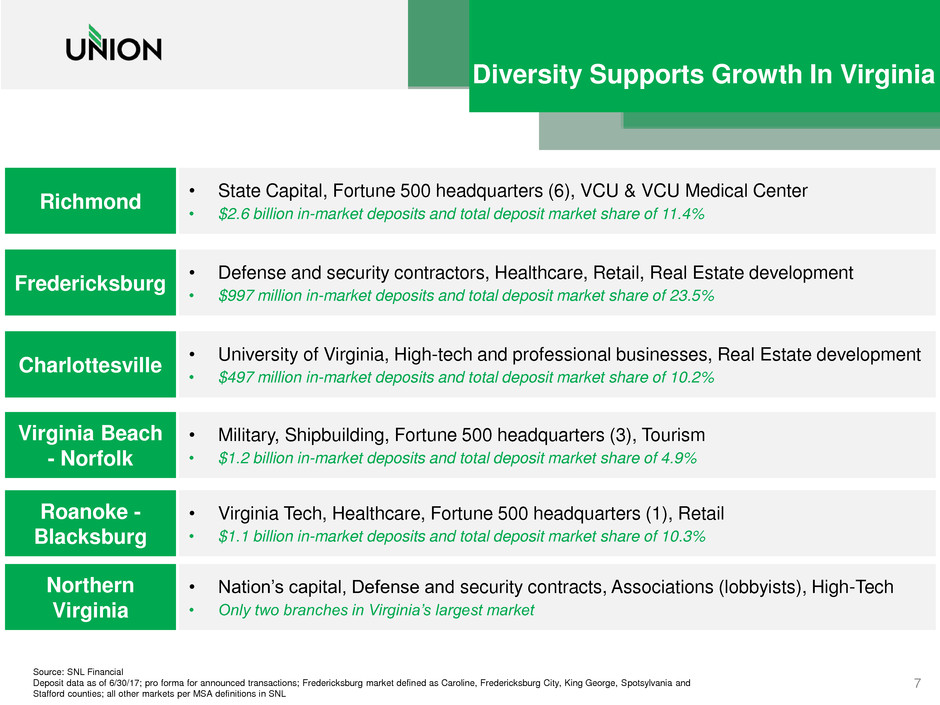

Diversity Supports Growth In Virginia

Northern

Virginia

Richmond

• State Capital, Fortune 500 headquarters (6), VCU & VCU Medical Center

• $2.6 billion in-market deposits and total deposit market share of 11.4%

• Nation’s capital, Defense and security contracts, Associations (lobbyists), High-Tech

• Only two branches in Virginia’s largest market

Roanoke -

Blacksburg

• Virginia Tech, Healthcare, Fortune 500 headquarters (1), Retail

• $1.1 billion in-market deposits and total deposit market share of 10.3%

Virginia Beach

- Norfolk

• Military, Shipbuilding, Fortune 500 headquarters (3), Tourism

• $1.2 billion in-market deposits and total deposit market share of 4.9%

Fredericksburg

• Defense and security contractors, Healthcare, Retail, Real Estate development

• $997 million in-market deposits and total deposit market share of 23.5%

Charlottesville

• University of Virginia, High-tech and professional businesses, Real Estate development

• $497 million in-market deposits and total deposit market share of 10.2%

Source: SNL Financial

Deposit data as of 6/30/17; pro forma for announced transactions; Fredericksburg market defined as Caroline, Fredericksburg City, King George, Spotsylvania and

Stafford counties; all other markets per MSA definitions in SNL

7

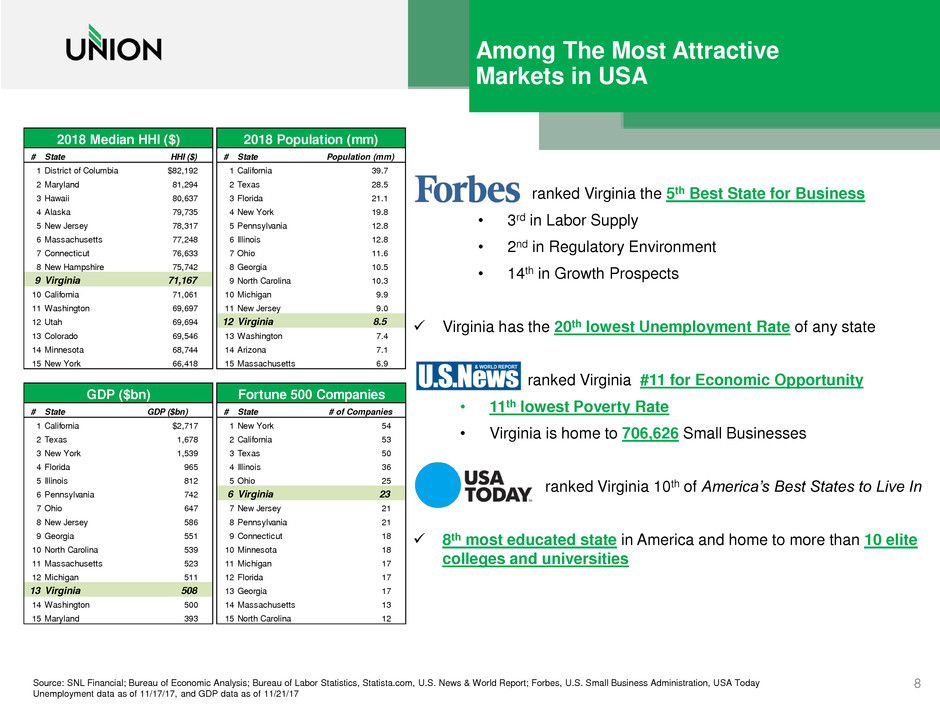

Among The Most Attractive

Markets in USA

Source: SNL Financial; Bureau of Economic Analysis; Bureau of Labor Statistics, Statista.com, U.S. News & World Report; Forbes, U.S. Small Business Administration, USA Today

Unemployment data as of 11/17/17, and GDP data as of 11/21/17

2018 Median HHI ($) 2018 Population (mm) GDP ($bn)

# State HHI ($) # State Population (mm)

1 District of Columbia $82,192 1 California 39.7

2 Maryland 81,294 2 Texas 28.5

3 Hawaii 80,637 3 Florida 21.1

4 Alaska 79,735 4 New York 19.8

5 New Jersey 78,317 5 Pennsylvania 12.8

6 Massachusetts 77,248 6 Illinois 12.8

7 Connecticut 76,633 7 Ohio 11.6

8 New Hampshire 75,742 8 Georgia 10.5

9 Virginia 71,167 9 North Carolina 10.3

10 California 71,061 10 Michigan 9.9

11 Washington 69,697 11 New Jersey 9.0

12 Utah 69,694 12 Virginia 8.5

13 Colorado 69,546 13 Washington 7.4

14 Minnesota 68,744 14 Arizona 7.1

15 New York 66,418 15 Massachusetts 6.9

GDP ($bn) Fortune 500 Companies

# State GDP ($bn) # State # of Companies

1 California $2,717 1 New York 54

2 Texas 1,678 2 California 53

3 e York 1,539 3 Texas 50

4 Florida 965 4 Illinois 36

5 Illinois 812 5 Ohio 25

6 Pennsylvania 742 6 Virginia 23

7 Ohio 647 7 New Jersey 21

8 New Jersey 586 8 Pennsylvania 21

9 Georgia 551 9 Connecticut 18

10 orth Carolina 539 10 innesota 18

11 Massachusetts 523 11 Michigan 17

12 Michigan 511 12 Florida 17

13 Virginia 508 13 Georgia 17

14 Washington 500 14 Massachusetts 13

15 Maryland 393 15 North Carolina 12

ranked Virginia the 5th Best State for Business

• 3rd in Labor Supply

• 2nd in Regulatory Environment

• 14th in Growth Prospects

Virginia has the 20th lowest Unemployment Rate of any state

ranked Virginia #11 for Economic Opportunity

• 11th lowest Poverty Rate

• Virginia is home to 706,626 Small Businesses

ranked Virginia 10th of America’s Best States to Live In

8th most educated state in America and home to more than 10 elite

colleges and universities

8

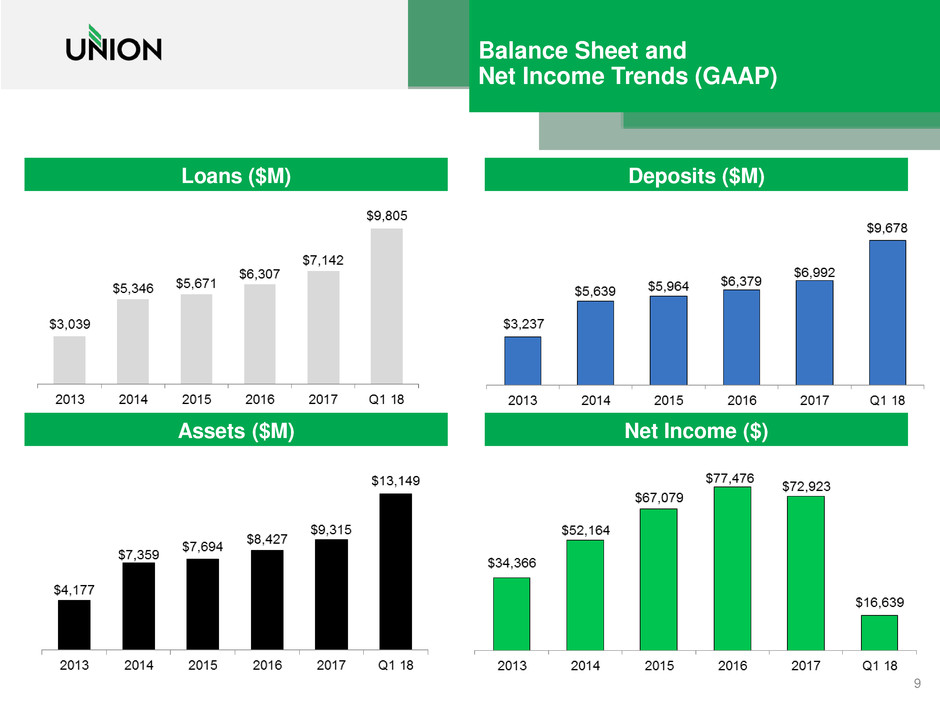

Balance Sheet and

Net Income Trends (GAAP)

Deposits ($M) Loans ($M)

Assets ($M) Net Income ($)

9

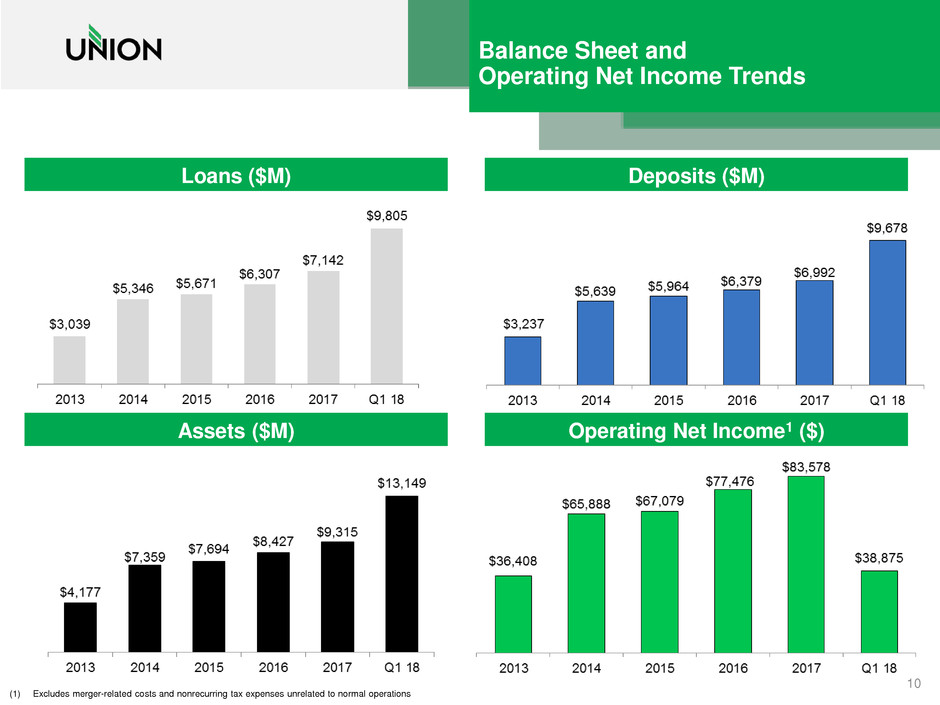

Balance Sheet and

Operating Net Income Trends

Deposits ($M) Loans ($M)

(1) Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations

Assets ($M) Operating Net Income1 ($)

10

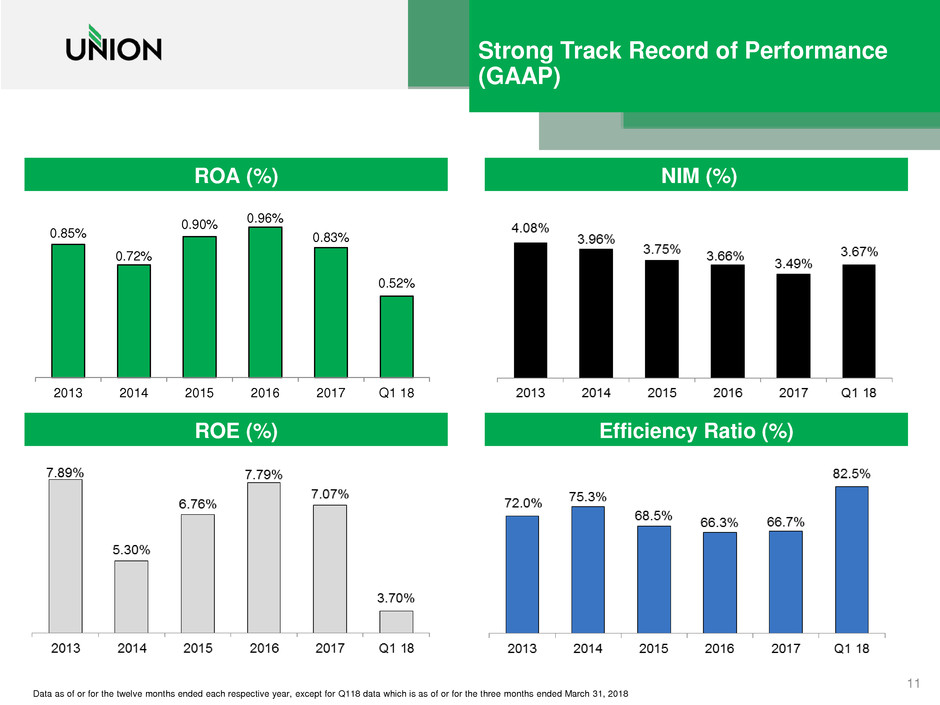

Strong Track Record of Performance

(GAAP)

NIM (%) ROA (%)

Data as of or for the twelve months ended each respective year, except for Q118 data which is as of or for the three months ended March 31, 2018

ROE (%) Efficiency Ratio (%)

11

0.85%

0.72%

0.90% 0.96%

0.83%

0.52%

2013 2014 2015 2016 2017 Q1 18

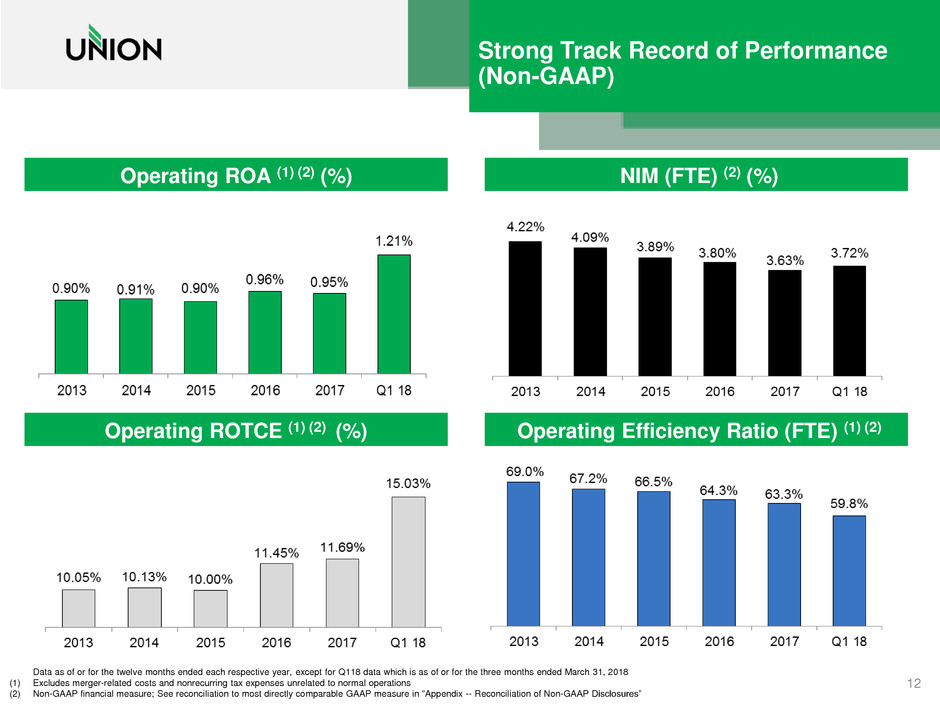

Strong Track Record of Performance

(Non-GAAP)

NIM (FTE) (2) (%) Operating ROA (1) (2) (%)

Data as of or for the twelve months ended each respective year, except for Q118 data which is as of or for the three months ended March 31, 2018

(1) Excludes merger-related costs and nonrecurring tax expenses unrelated to normal operations

(2) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures”

Operating ROTCE (1) (2) (%) Operating Efficiency Ratio (FTE) (1) (2)

(%)

12

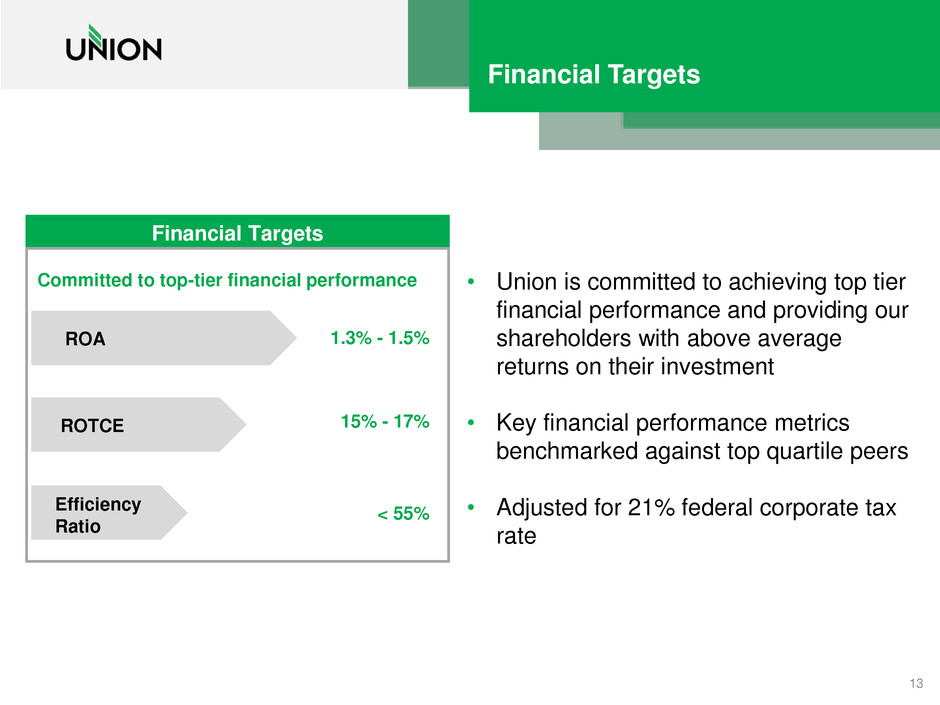

Financial Targets

Financial Targets

ROA

ROTCE

Efficiency

Ratio

1.3% - 1.5%

15% - 17%

< 55%

Committed to top-tier financial performance

13

• Union is committed to achieving top tier

financial performance and providing our

shareholders with above average

returns on their investment

• Key financial performance metrics

benchmarked against top quartile peers

• Adjusted for 21% federal corporate tax

rate

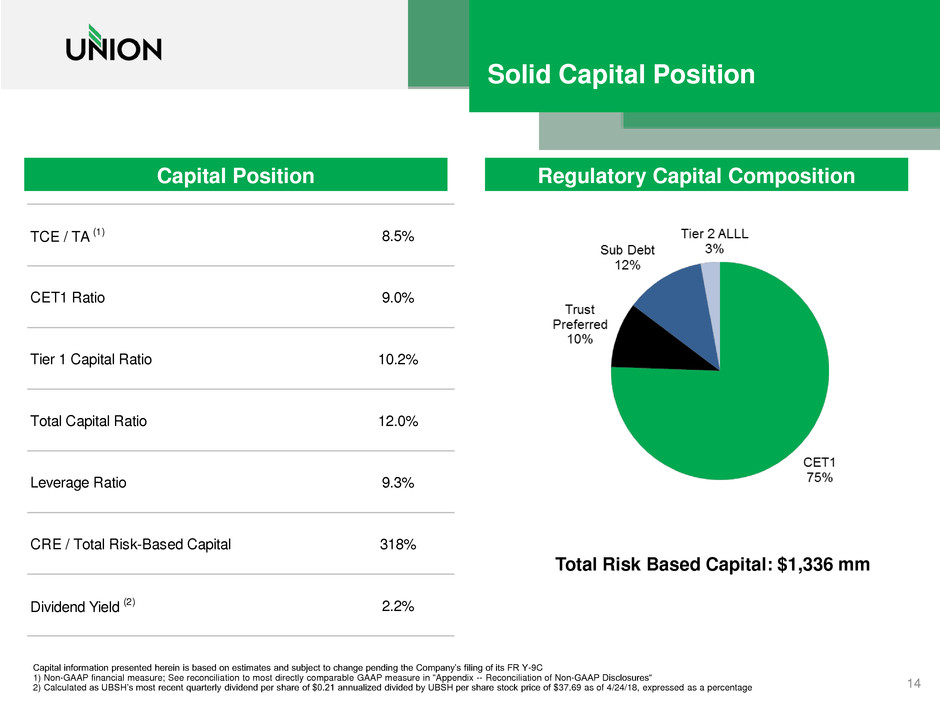

Capital information presented herein is based on estimates and subject to change pending the Company’s filing of its FR Y-9C

1) Non-GAAP financial measure; See reconciliation to most directly comparable GAAP measure in "Appendix -- Reconciliation of Non-GAAP Disclosures“

2) Calculated as UBSH’s most recent quarterly dividend per share of $0.21 annualized divided by UBSH per share stock price of $37.69 as of 4/24/18, expressed as a percentage

Solid Capital Position

Capital Position Regulatory Capital Composition

Total Risk Based Capital: $1,336 mm

14

TCE / TA (1) 8.5%

CET1 Ratio 9.0%

Tier 1 Capital Ratio 10.2%

Total Capital Ratio 12.0%

Leverage Ratio 9.3%

CRE / Total Risk-Based Capital 318%

Dividend Yield (2) 2.2%

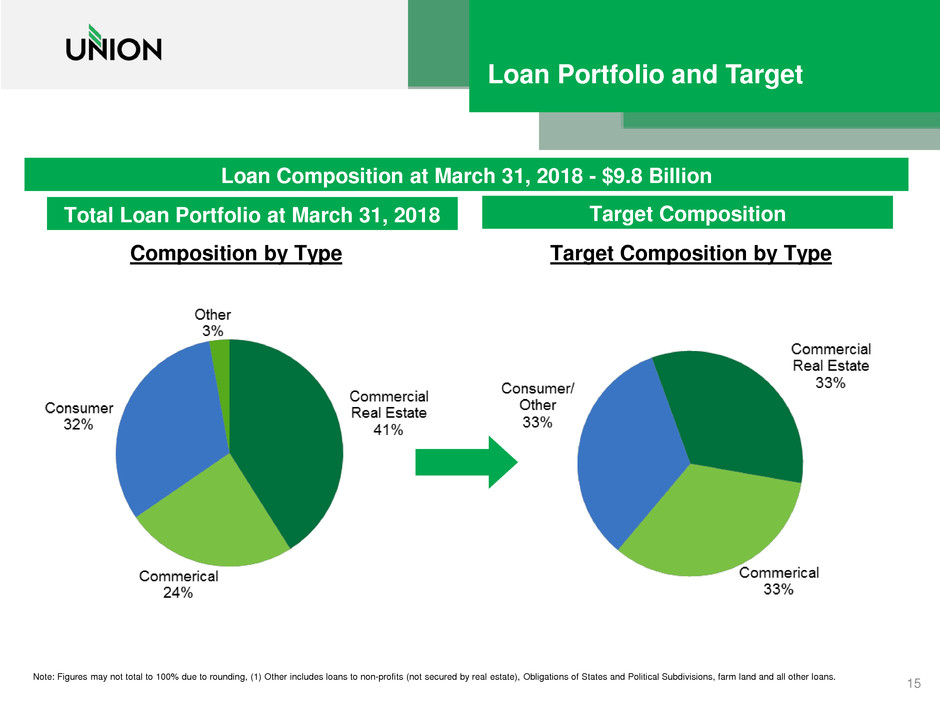

Loan Portfolio and Target

Composition by Type

Loan Composition at March 31, 2018 - $9.8 Billion

Note: Figures may not total to 100% due to rounding, (1) Other includes loans to non-profits (not secured by real estate), Obligations of States and Political Subdivisions, farm land and all other loans.

15

Target Composition by Type

Target Composition Total Loan Portfolio at March 31, 2018

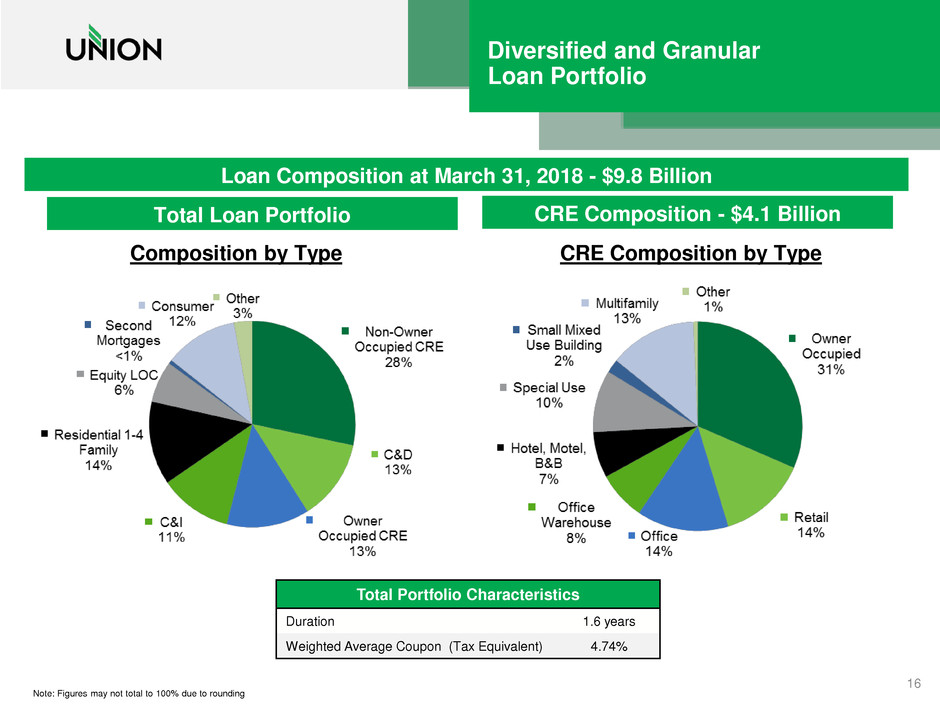

Diversified and Granular

Loan Portfolio

Composition by Type

Loan Composition at March 31, 2018 - $9.8 Billion

Total Portfolio Characteristics

Duration 1.6 years

Weighted Average Coupon (Tax Equivalent) 4.74%

Note: Figures may not total to 100% due to rounding

16

CRE Composition by Type

CRE Composition - $4.1 Billion Total Loan Portfolio

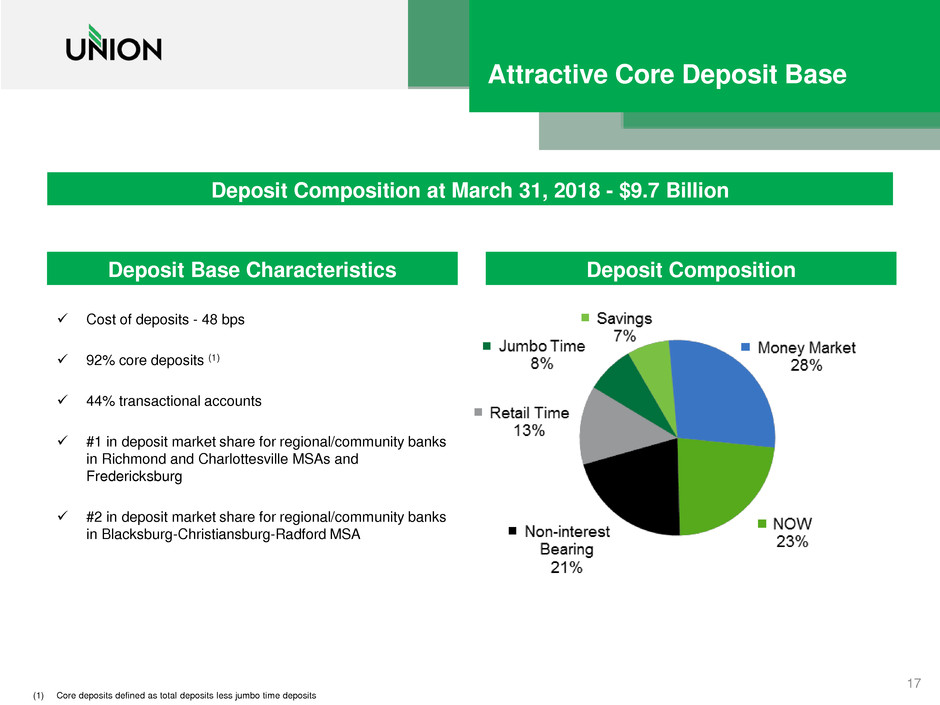

Attractive Core Deposit Base

Cost of deposits - 48 bps

92% core deposits (1)

44% transactional accounts

#1 in deposit market share for regional/community banks

in Richmond and Charlottesville MSAs and

Fredericksburg

#2 in deposit market share for regional/community banks

in Blacksburg-Christiansburg-Radford MSA

Deposit Composition Deposit Base Characteristics

17

(1) Core deposits defined as total deposits less jumbo time deposits

Deposit Composition at March 31, 2018 - $9.7 Billion

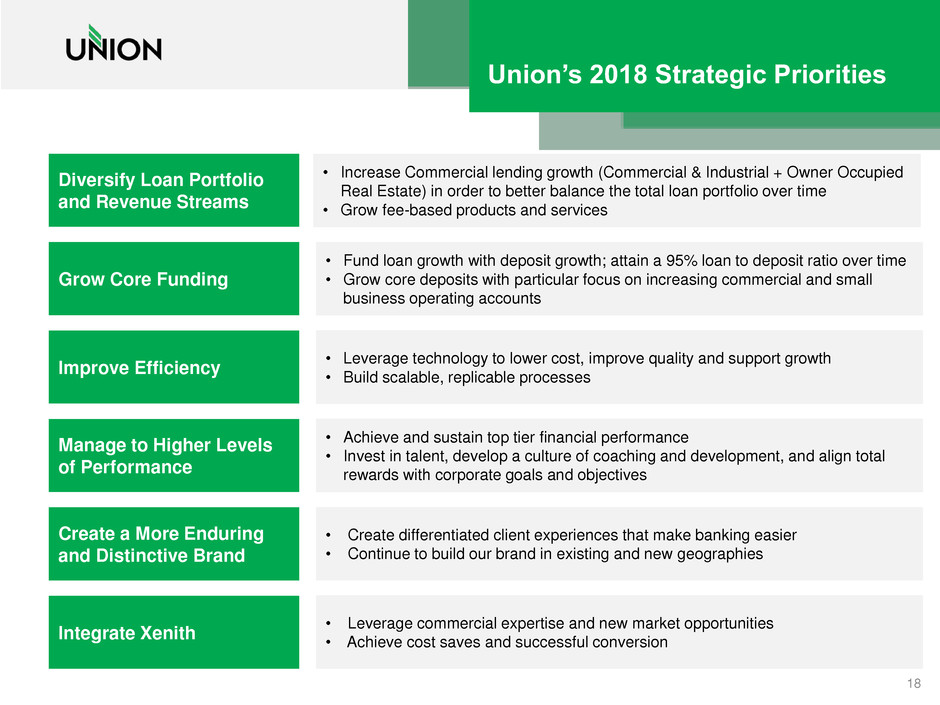

• Increase Commercial lending growth (Commercial & Industrial + Owner Occupied

Real Estate) in order to better balance the total loan portfolio over time

• Grow fee-based products and services

• Achieve and sustain top tier financial performance

• Invest in talent, develop a culture of coaching and development, and align total

rewards with corporate goals and objectives

• Leverage commercial expertise and new market opportunities

• Achieve cost saves and successful conversion

• Create differentiated client experiences that make banking easier

• Continue to build our brand in existing and new geographies

• Fund loan growth with deposit growth; attain a 95% loan to deposit ratio over time

• Grow core deposits with particular focus on increasing commercial and small

business operating accounts

• Leverage technology to lower cost, improve quality and support growth

• Build scalable, replicable processes

Manage to Higher Levels

of Performance

Diversify Loan Portfolio

and Revenue Streams

Integrate Xenith

Create a More Enduring

and Distinctive Brand

Grow Core Funding

Improve Efficiency

18

Union’s 2018 Strategic Priorities

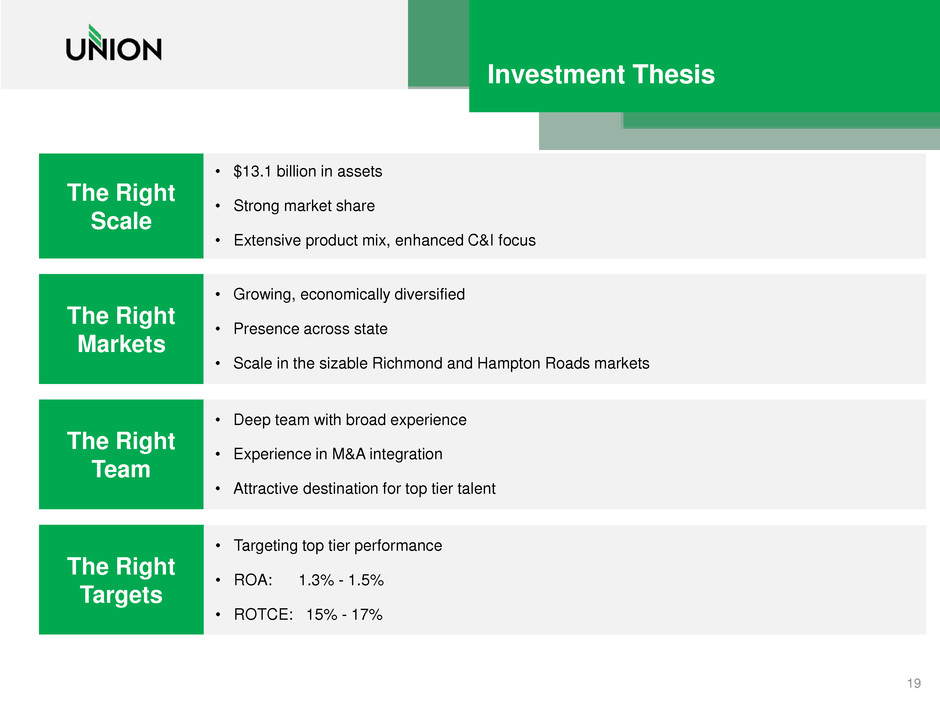

Investment Thesis

The Right

Scale

The Right

Markets

The Right

Team

The Right

Targets

• Deep team with broad experience

• Experience in M&A integration

• Attractive destination for top tier talent

• Targeting top tier performance

• ROA: 1.3% - 1.5%

• ROTCE: 15% - 17%

• $13.1 billion in assets

• Strong market share

• Extensive product mix, enhanced C&I focus

• Growing, economically diversified

• Presence across state

• Scale in the sizable Richmond and Hampton Roads markets

19

Appendix

Executive Management Team

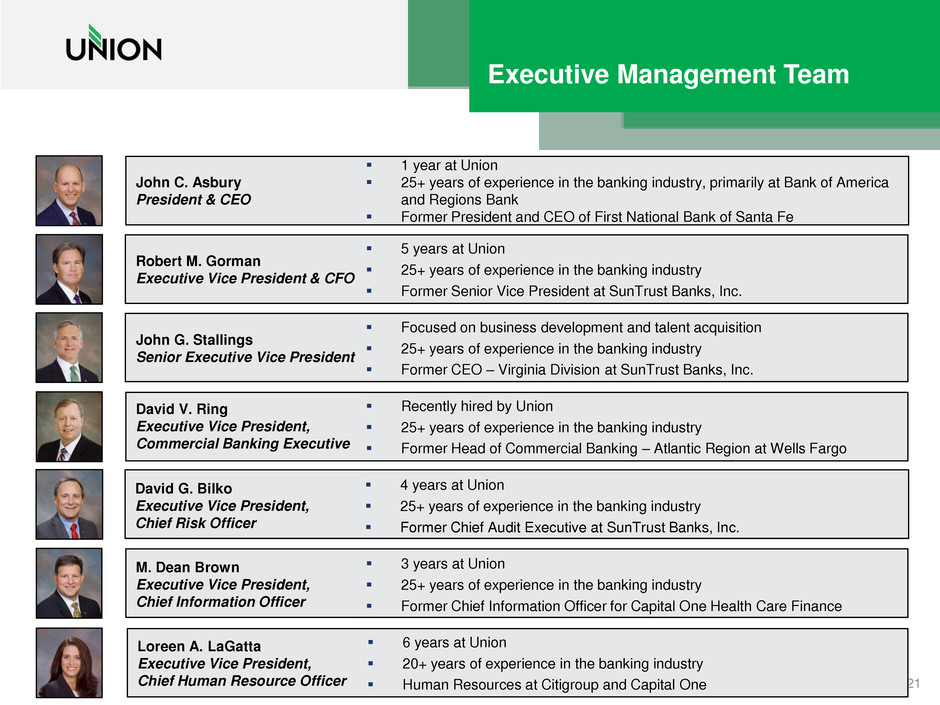

John C. Asbury

President & CEO

1 year at Union

25+ years of experience in the banking industry, primarily at Bank of America

and Regions Bank

Former President and CEO of First National Bank of Santa Fe

Robert M. Gorman

Executive Vice President & CFO

5 years at Union

25+ years of experience in the banking industry

Former Senior Vice President at SunTrust Banks, Inc.

David V. Ring

Executive Vice President,

Commercial Banking Executive

Recently hired by Union

25+ years of experience in the banking industry

Former Head of Commercial Banking – Atlantic Region at Wells Fargo

John G. Stallings

Senior Executive Vice President

Focused on business development and talent acquisition

25+ years of experience in the banking industry

Former CEO – Virginia Division at SunTrust Banks, Inc.

21

David G. Bilko

Executive Vice President,

Chief Risk Officer

4 years at Union

25+ years of experience in the banking industry

Former Chief Audit Executive at SunTrust Banks, Inc.

M. Dean Brown

Executive Vice President,

Chief Information Officer

3 years at Union

25+ years of experience in the banking industry

Former Chief Information Officer for Capital One Health Care Finance

Loreen A. LaGatta

Executive Vice President,

Chief Human Resource Officer

6 years at Union

20+ years of experience in the banking industry

Human Resources at Citigroup and Capital One

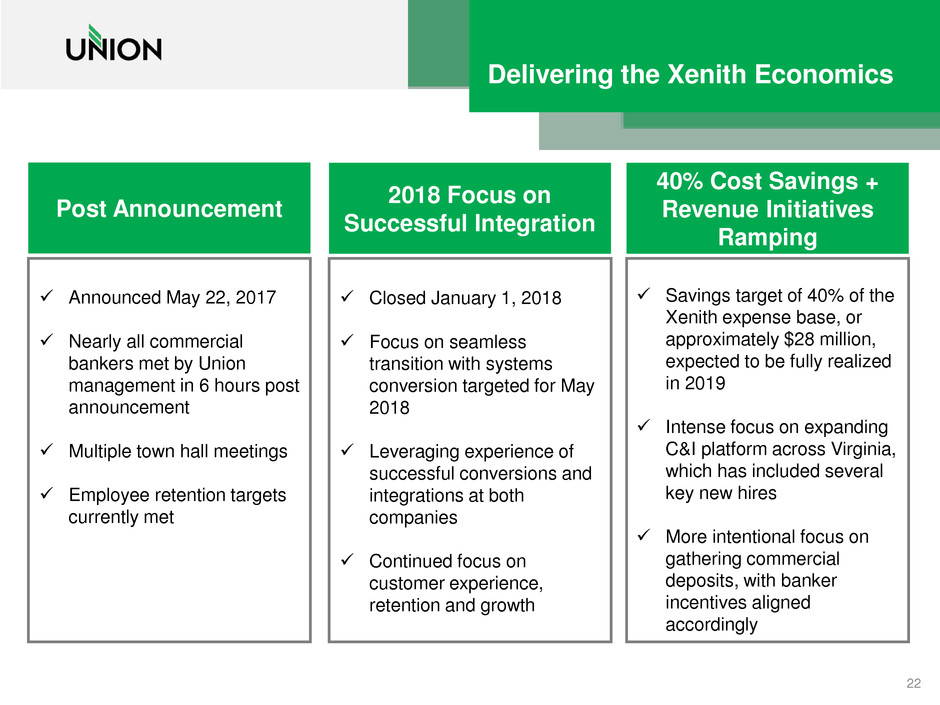

Delivering the Xenith Economics

Closed January 1, 2018

Focus on seamless

transition with systems

conversion targeted for May

2018

Leveraging experience of

successful conversions and

integrations at both

companies

Continued focus on

customer experience,

retention and growth

2018 Focus on

Successful Integration

40% Cost Savings +

Revenue Initiatives

Ramping

Savings target of 40% of the

Xenith expense base, or

approximately $28 million,

expected to be fully realized

in 2019

Intense focus on expanding

C&I platform across Virginia,

which has included several

key new hires

More intentional focus on

gathering commercial

deposits, with banker

incentives aligned

accordingly

Announced May 22, 2017

Nearly all commercial

bankers met by Union

management in 6 hours post

announcement

Multiple town hall meetings

Employee retention targets

currently met

Post Announcement

22

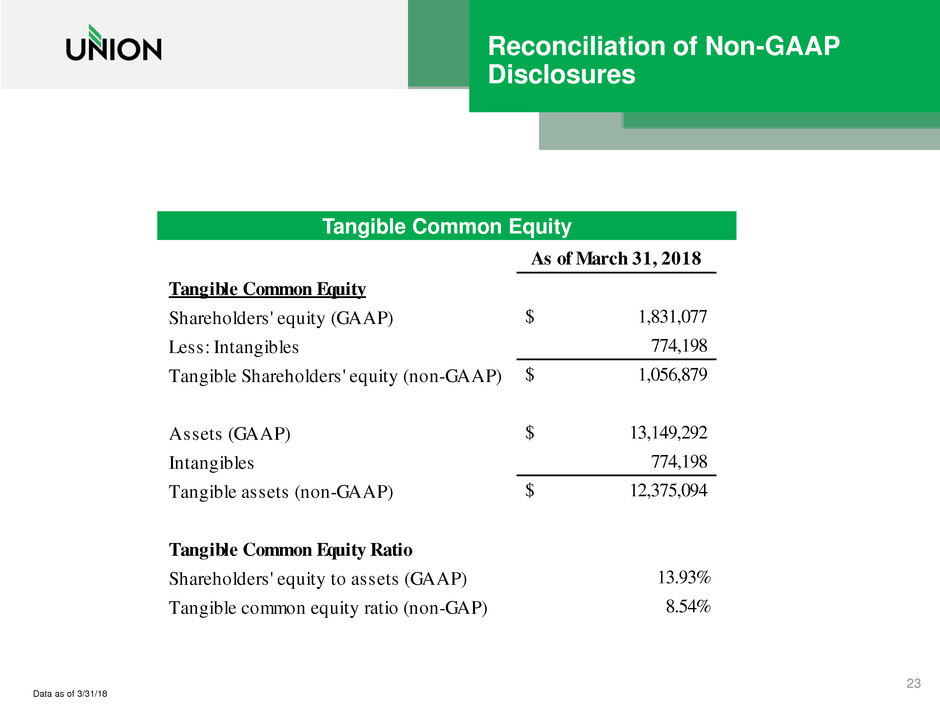

Data as of 3/31/18

Reconciliation of Non-GAAP

Disclosures

23

Tangible Common Equity

As of March 31, 2018

Tangible Common Equity

Shareholders' equity (GAAP) $ 1,831,077

Less: Intangibles 774,198

Tangible Shareholders' equity (non-GAAP) $ 1,056,879

Assets (GAAP) $ 13,149,292

Intangibles 774,198

Tangible assets (non-GAAP) $ 12,375,094

Tangible Common Equity Ratio

Shareholders' equity to assets (GAAP) 13.93%

Tangible common equity ratio (non-GAP) 8.54%

Reconciliation of Non-GAAP

Disclosures

24

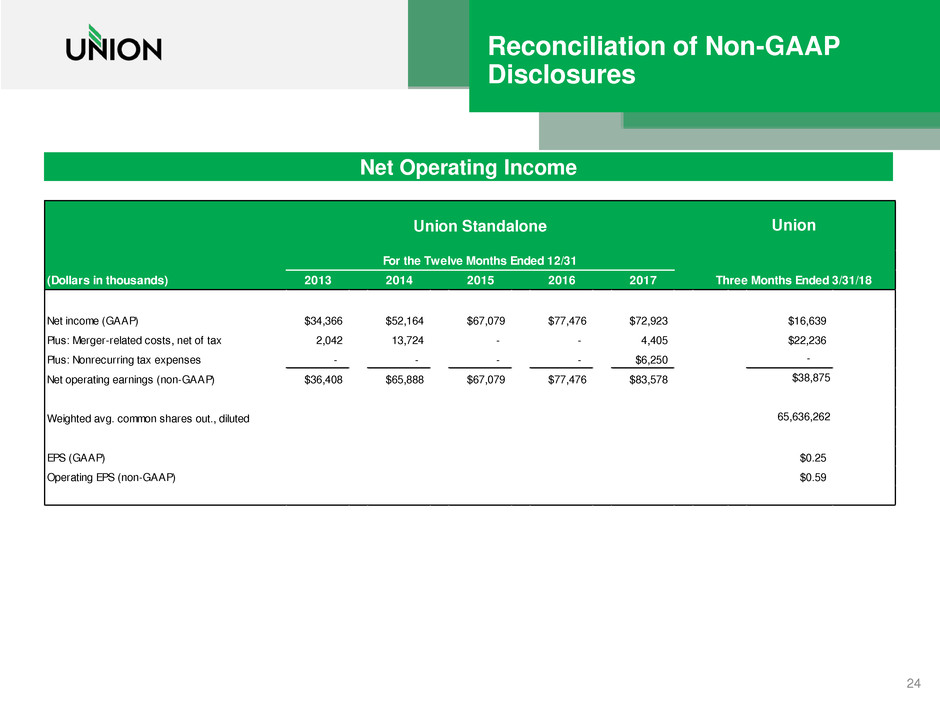

Net Operating Income

Union Standalone

For the Twelve Months Ended 12/31

(Dollars in thousands) 2013 2014 2015 2016 2017 Three Months Ended 3/31/18

Net income (GAAP) $34,366 $52,164 $67,079 $77,476 $72,923 $16,639

Plus: Merger-related costs, net of tax 2,042 13,724 - - 4,405 $22,236

Plus: Nonr curri g tax expenses - - - - $6,250 -

Net operating earnings (non-GAAP) $36,408 $65,888 $67,079 $77,476 $83,578 $38,875

Weighted avg. common shares out., diluted 65,636,262

EPS (GAAP) $0.25

Operating EPS (non-GAAP) $0.59

Union

Reconciliation of Non-GAAP

Disclosures

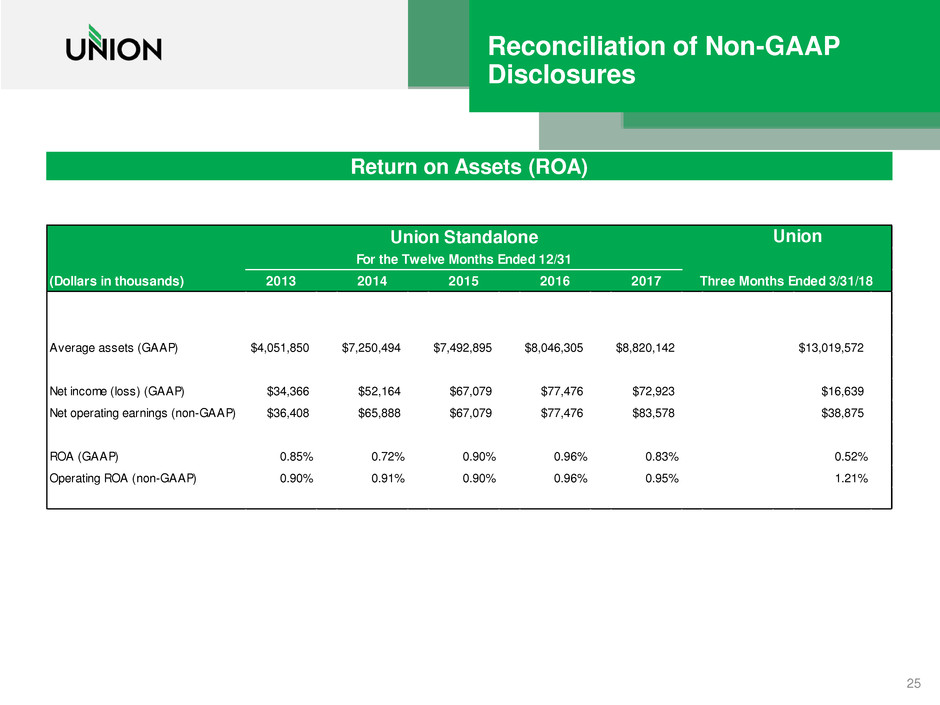

25

Return on Assets (ROA)

Union Standalone

For the Twelve Months Ended 12/31

(Dollars in thousands) 2013 2014 2015 2016 2017 Three Months Ended 3/31/18

Average assets (GAAP) $4,051,850 $7,250,494 $7,492,895 $8,046,305 $8,820,142 $13,019,572

Net income (loss) (GAAP) $34,366 $52,164 $67,079 $77,476 $72,923 $16,639

Net operating earnings (non-GAAP) $36,408 $65,888 $67,079 $77,476 $83,578 $38,875

ROA (GAAP) 0.85% 0.72% 0.90% 0.96% 0.83% 0.52%

Operating ROA (non-GAAP) 0.90% 0.91% 0.90% 0.96% 0.95% 1.21%

Union

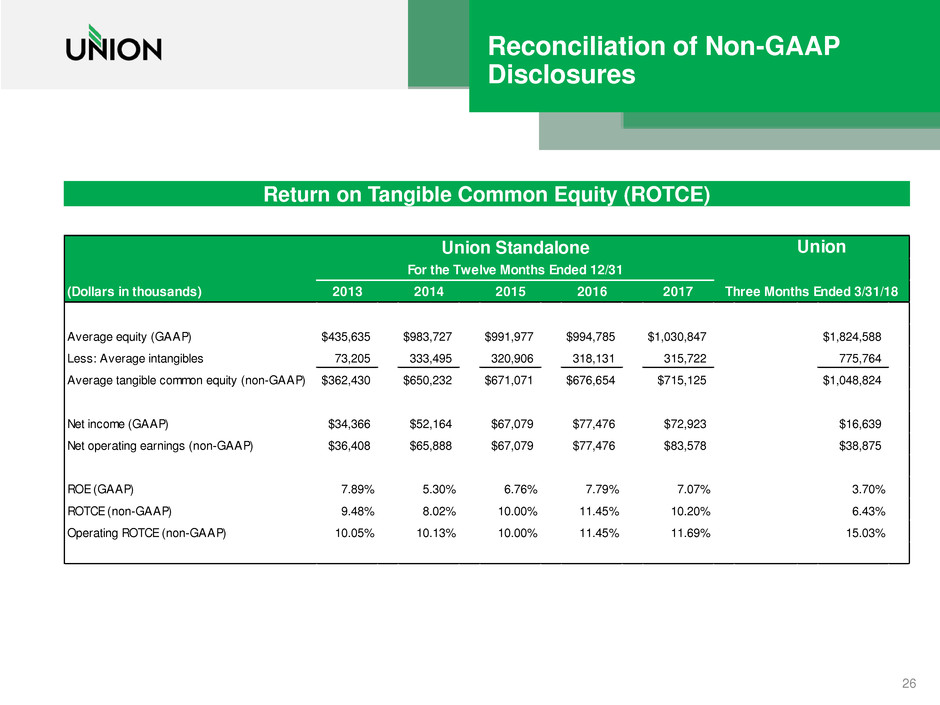

Reconciliation of Non-GAAP

Disclosures

26

Return on Tangible Common Equity (ROTCE)

Union Standalone

For the Twelve Months Ended 12/31

(Dollars in thousands) 2013 2014 2015 2016 2017 Three Months Ended 3/31/18

Average equity (GAAP) $435,635 $983,727 $991,977 $994,785 $1,030,847 $1,824,588

Less: Average intangibles 73,205 333,495 320,906 318,131 315,722 775,764

Average tangible common equity (non-GAAP) $362,430 $650,232 $671,071 $676,654 $715,125 $1,048,824

Net income (GAAP) $34,366 $52,164 $67,079 $77,476 $72,923 $16,639

Net operati g earnings (non-GAAP) $36,408 $65,888 $67,079 $77,476 $83,578 $38,875

ROE (GAAP) 7.89% 5.30% 6.76% 7.79% 7.07% 3.70%

ROTCE (non-GAAP) 9.48% 8.02% 10.00% 11.45% 10.20% 6.43%

Operating ROTCE (non-GAAP) 10.05% 10.13% 10.00% 11.45% 11.69% 15.03%

Union

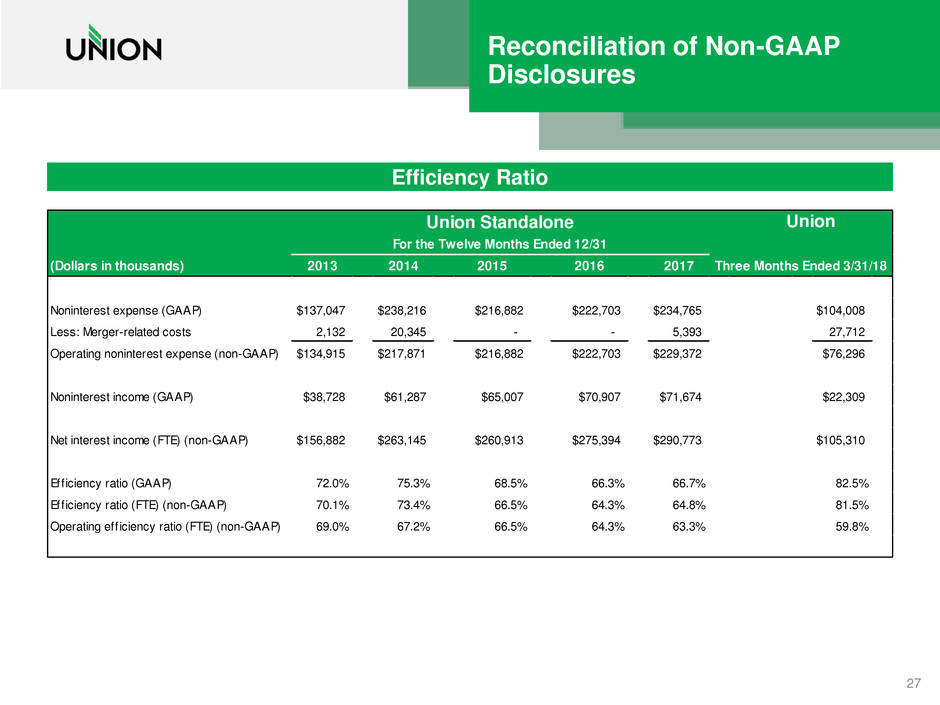

Reconciliation of Non-GAAP

Disclosures

27

Efficiency Ratio

Union Standalone

For the Twelve Months Ended 12/31

(Dollars in thousands) 2013 2014 2015 2016 2017 Three Months Ended 3/31/18

Noninterest expense (GAAP) $137,047 $238,216 $216,882 $222,703 $234,765 $104,008

Less: Merger-related costs 2,132 20,345 - - 5,393 27,712

Operating noninterest expense (non-GAAP) $134,915 $217,871 $216,882 $222,703 $229,372 $76,296

Noninterest income (GAAP) $38,728 $61,287 $65,007 $70,907 $71,674 $22,309

Net interest income (FTE) (non-GAAP) $156,882 $263,145 $260,913 $275,394 $290,773 $105,310

Efficiency ratio (GAAP) 72.0% 75.3% 68.5% 66.3% 66.7% 82.5%

Efficiency ratio (FTE) (non-GAAP) 70.1% 73.4% 66.5% 64.3% 64.8% 81.5%

Operating eff iciency ratio (FTE) (non-GAAP) 69.0% 67.2% 66.5% 64.3% 63.3% 59.8%

Union