Investor Presentation

6th Annual KBW US Regional Leaders Bank Conference in London

June 12, 2017

Exhibit 99.1

2

Forward Looking Statements

Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations, or beliefs

about future events or results or otherwise are not statements of historical fact, are based on certain assumptions as of the time they

are made, and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Such statements are

often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,”

“anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other statements concerning opinions

or judgment of Union Bankshares Corporation (“Union” or “UBSH”) or Xenith Bankshares, Inc. (“Xenith” or “XBKS”) or their

management about future events. Such statements include statements as to the anticipated benefits of the merger, including future

financial and operating results, cost savings and enhanced revenues as well as other statements regarding the merger. Although each

of Union and Xenith believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions

within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance,

or achievements of Union or Xenith will not differ materially from any projected future results, performance, or achievements expressed

or implied by such forward-looking statements. Actual future results and trends may differ materially from historical results or those

anticipated depending on a variety of factors, including but not limited to: (1) the businesses of Union and Xenith may not be integrated

successfully or such integration may be more difficult, time-consuming or costly than expected; (2) expected revenue synergies and

cost savings from the merger may not be fully realized or realized within the expected time frame; (3) revenues following the merger

may be lower than expected; (4) customer and employee relationships and business operations may be disrupted by the merger; (5)

the ability to obtain required regulatory and shareholder approvals, and the ability to complete the merger on the expected timeframe

may be more difficult, time-consuming or costly than expected; (6) changes in interest rates, general economic conditions, tax rates,

legislative/regulatory changes, monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the

Board of Governors of the Federal Reserve System; the quality and composition of the loan and securities portfolios; demand for loan

products; deposit flows; competition; demand for financial services in the companies’ respective market areas; their implementation of

new technologies; their ability to develop and maintain secure and reliable electronic systems; and accounting principles, policies, and

guidelines, and (7) other risk factors detailed from time to time in filings made by Union or Xenith with the Securities and Exchange

Commission (the “SEC”). Forward-looking statements speak only as of the date they are made and Union and Xenith undertake no

obligation to update or clarify these forward-looking statements, whether as a result of new information, future events or otherwise.

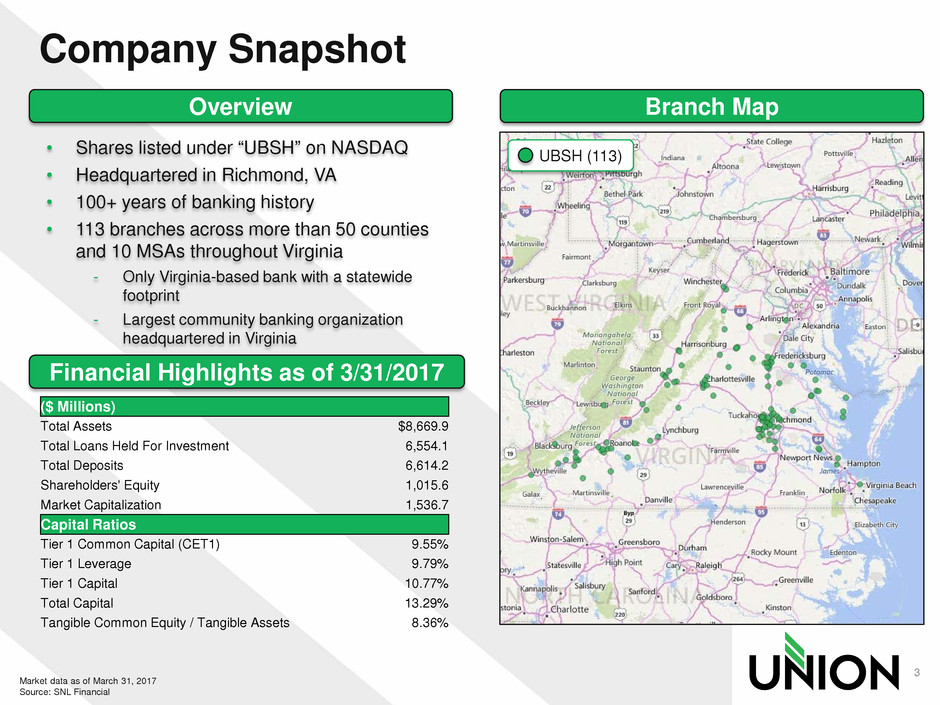

Company Snapshot

3

Overview Branch Map

• Shares listed under “UBSH” on NASDAQ

• Headquartered in Richmond, VA

• 100+ years of banking history

• 113 branches across more than 50 counties

and 10 MSAs throughout Virginia

- Only Virginia-based bank with a statewide

footprint

- Largest community banking organization

headquartered in Virginia

Financial Highlights as of 3/31/2017

Market data as of March 31, 2017

Source: SNL Financial

UBSH (113)

($ Millions)

Total Assets $8,669.9

Total Loans Held For Investment 6,554.1

Total Deposits 6,614.2

Shareholders' Equity 1,015.6

Market Capitalization 1,536.7

Capital Ratios

Tier 1 Common Capital (CET1) 9.55%

Tier 1 Leverage 9.79%

Tier 1 Capital 10.77%

Total Capital 13.29%

Tangible Common Equity / Tangible Assets 8.36%

Diversity Supports Growth in Virginia

Richmond

• State Capital

• Fortune 500 headquarters (6)

• Finance and insurance

• VCU & VCU Medical Center

Fredericksburg

• Defense and security

contractors

• Health care

• Retail

• Real Estate development

Charlottesville

• University of Virginia & Medical

College

• High-tech and professional

businesses

• Real Estate development

Northern Virginia

• Nation’s Capital

• Defense and security

contractors

• Associations (lobbyists)

• High tech

Virginia Beach - Norfolk

• Military

• Shipbuilding

• Fortune 500 headquarters (3)

• Tourism

Roanoke - Blacksburg

• Virginia Tech

• Health care

• Retail

• Fortune 500 headquarters (1)

4

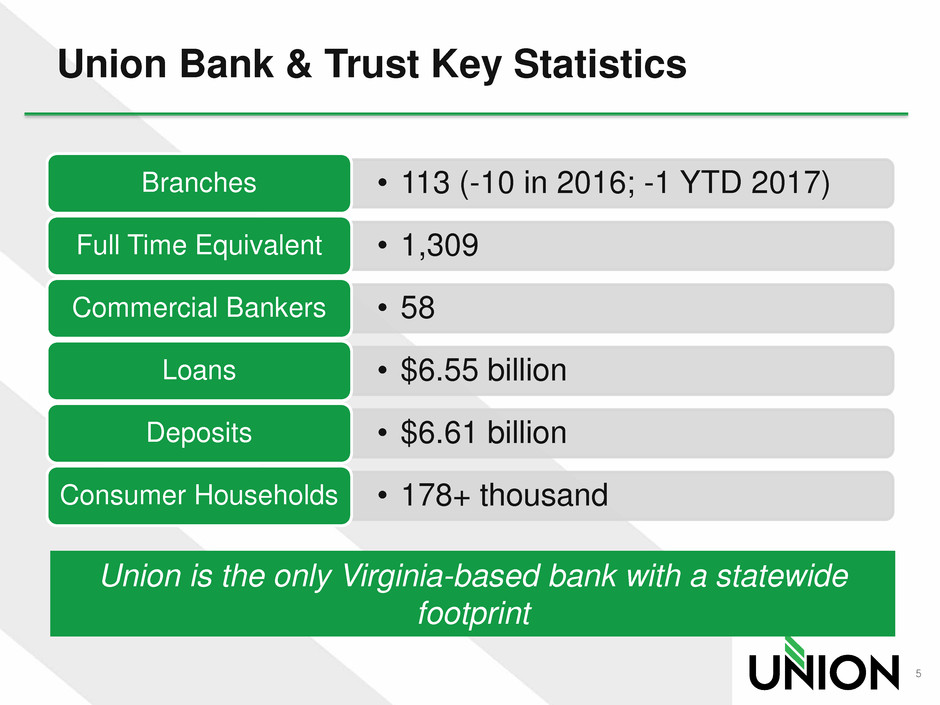

Union Bank & Trust Key Statistics

• 113 (-10 in 2016; -1 YTD 2017) Branches

• 1,309 Full Time Equivalent

• 58 Commercial Bankers

• $6.55 billion Loans

• $6.61 billion Deposits

• 178+ thousand Consumer Households

5

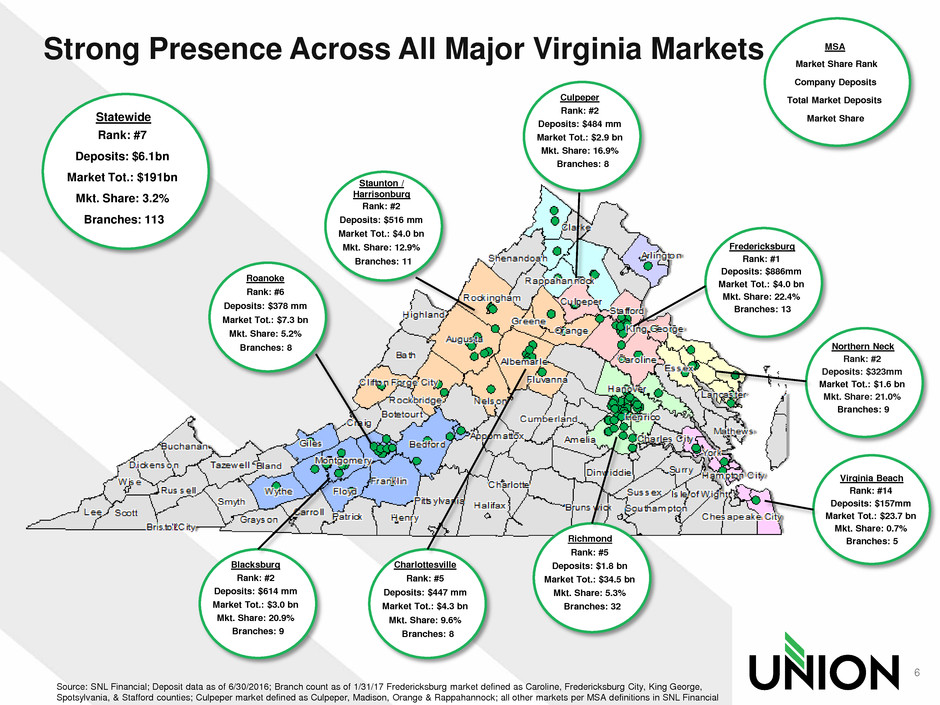

Union is the only Virginia-based bank with a statewide

footprint

MSA

Market Share Rank

Company Deposits

Total Market Deposits

Market Share

Roanoke

Deposits: $378 mm

Market Tot.: $7.3 bn

Mkt. Share: 5.2%

Rank: #6

Branches: 8

Staunton /

Harrisonburg

Rank: #2

Deposits: $516 mm

Market Tot.: $4.0 bn

Mkt. Share: 12.9%

Branches: 11

Blacksburg

Rank: #2

Deposits: $614 mm

Market Tot.: $3.0 bn

Mkt. Share: 20.9%

Branches: 9

Charlottesville

Rank: #5

Deposits: $447 mm

Market Tot.: $4.3 bn

Mkt. Share: 9.6%

Branches: 8

Richmond

Rank: #5

Deposits: $1.8 bn

Market Tot.: $34.5 bn

Mkt. Share: 5.3%

Branches: 32

Culpeper

Rank: #2

Deposits: $484 mm

Market Tot.: $2.9 bn

Mkt. Share: 16.9%

Branches: 8

Fredericksburg

Rank: #1

Deposits: $886mm

Market Tot.: $4.0 bn

Mkt. Share: 22.4%

Branches: 13

Statewide

Rank: #7

Deposits: $6.1bn

Market Tot.: $191bn

Mkt. Share: 3.2%

Branches: 113

Strong Presence Across All Major Virginia Markets

Northern Neck

Rank: #2

Deposits: $323mm

Market Tot.: $1.6 bn

Mkt. Share: 21.0%

Branches: 9

Virginia Beach

Rank: #14

Deposits: $157mm

Market Tot.: $23.7 bn

Mkt. Share: 0.7%

Branches: 5

Source: SNL Financial; Deposit data as of 6/30/2016; Branch count as of 1/31/17 Fredericksburg market defined as Caroline, Fredericksburg City, King George,

Spotsylvania, & Stafford counties; Culpeper market defined as Culpeper, Madison, Orange & Rappahannock; all other markets per MSA definitions in SNL Financial

6

Financial Highlights

7

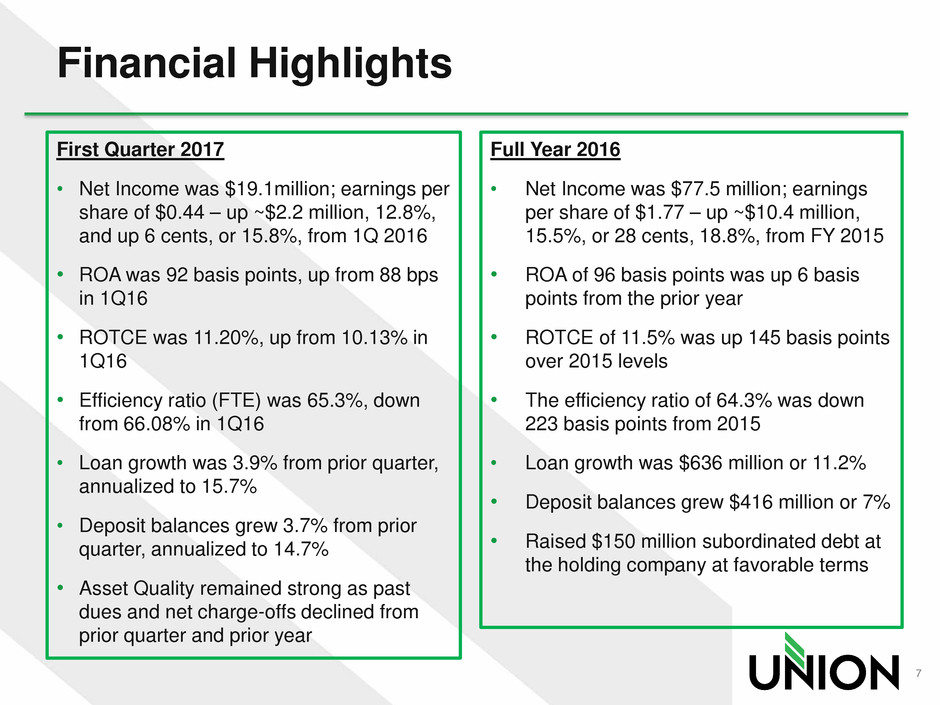

Full Year 2016

• Net Income was $77.5 million; earnings

per share of $1.77 – up ~$10.4 million,

15.5%, or 28 cents, 18.8%, from FY 2015

• ROA of 96 basis points was up 6 basis

points from the prior year

• ROTCE of 11.5% was up 145 basis points

over 2015 levels

• The efficiency ratio of 64.3% was down

223 basis points from 2015

• Loan growth was $636 million or 11.2%

• Deposit balances grew $416 million or 7%

• Raised $150 million subordinated debt at

the holding company at favorable terms

First Quarter 2017

• Net Income was $19.1million; earnings per

share of $0.44 – up ~$2.2 million, 12.8%,

and up 6 cents, or 15.8%, from 1Q 2016

• ROA was 92 basis points, up from 88 bps

in 1Q16

• ROTCE was 11.20%, up from 10.13% in

1Q16

• Efficiency ratio (FTE) was 65.3%, down

from 66.08% in 1Q16

• Loan growth was 3.9% from prior quarter,

annualized to 15.7%

• Deposit balances grew 3.7% from prior

quarter, annualized to 14.7%

• Asset Quality remained strong as past

dues and net charge-offs declined from

prior quarter and prior year

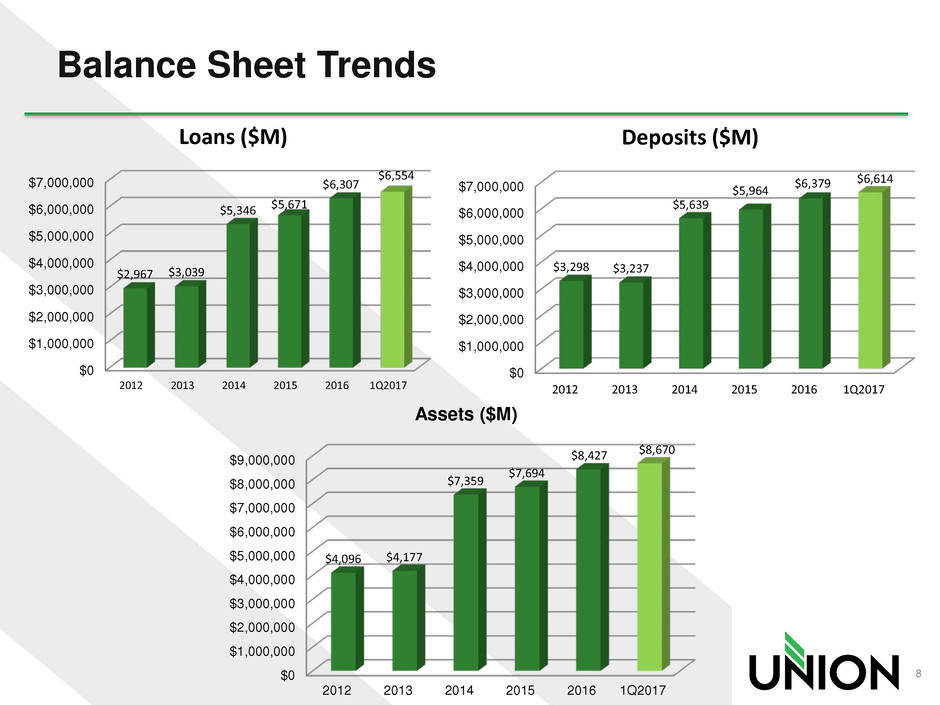

Balance Sheet Trends

8

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

2012 2013 2014 2015 2016 1Q2017

$3,298 $3,237

$5,639

$5,964

$6,379 $6,614

Deposits ($M)

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

2012 2013 2014 2015 2016 1Q2017

$2,967 $3,039

$5,346 $5,671

$6,307

$6,554

Loans ($M)

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

$8,000,000

$9,000,000

2012 2013 2014 2015 2016 1Q2017

$4,096 $4,177

$7,359

$7,694

$8,427 $8,670

Assets ($M)

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

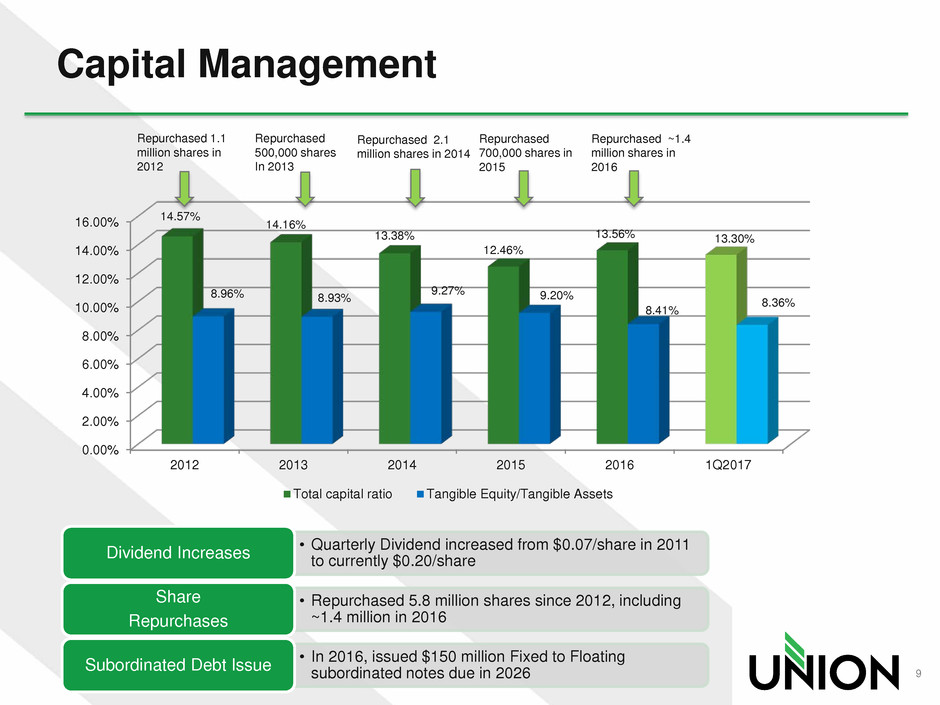

2012 2013 2014 2015 2016 1Q2017

14.57%

14.16%

13.38%

12.46%

13.56% 13.30%

8.96% 8.93%

9.27% 9.20%

8.41%

8.36%

Total capital ratio Tangible Equity/Tangible Assets

Repurchased 1.1

million shares in

2012

Capital Management

9

Repurchased

500,000 shares

In 2013

Repurchased 2.1

million shares in 2014

Repurchased

700,000 shares in

2015

Repurchased ~1.4

million shares in

2016

• Quarterly Dividend increased from $0.07/share in 2011

to currently $0.20/share Dividend Increases

• Repurchased 5.8 million shares since 2012, including

~1.4 million in 2016

Share

Repurchases

• In 2016, issued $150 million Fixed to Floating

subordinated notes due in 2026 Subordinated Debt Issue

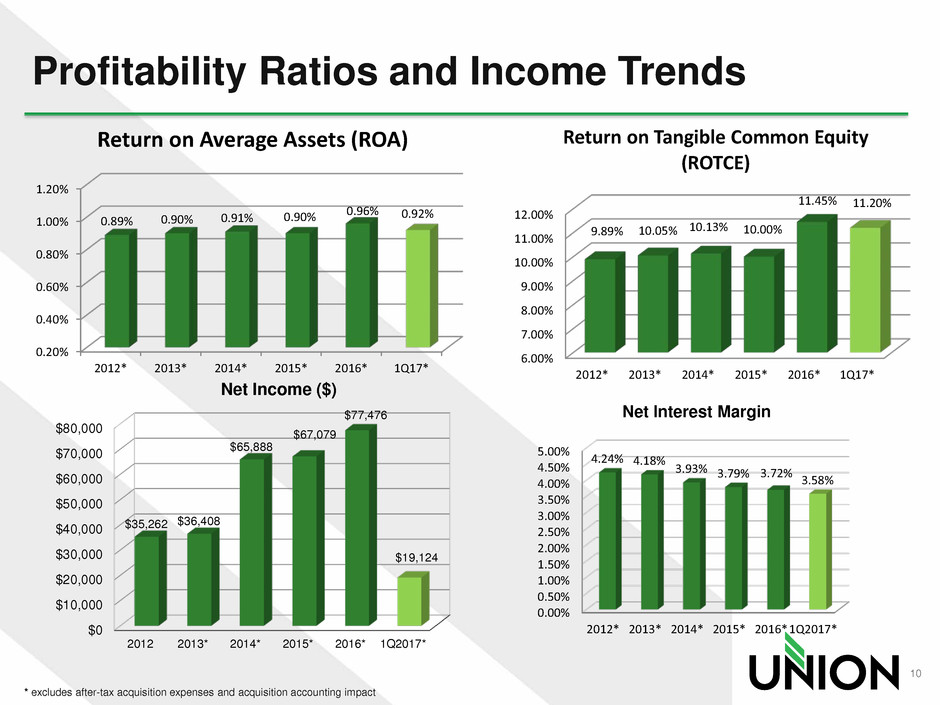

Profitability Ratios and Income Trends

* excludes after-tax acquisition expenses and acquisition accounting impact

10

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

2012* 2013* 2014* 2015* 2016* 1Q17*

0.89% 0.90% 0.91% 0.90%

0.96% 0.92%

Return on Average Assets (ROA)

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

2012* 2013* 2014* 2015* 2016* 1Q17*

9.89% 10.05% 10.13% 10.00%

11.45% 11.20%

Return on Tangible Common Equity

(ROTCE)

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

2012* 2013* 2014* 2015* 2016*1Q2017*

4.24% 4.18%

3.93% 3.79% 3.72% 3.58%

Net Interest Margin

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

2012 2013* 2014* 2015* 2016* 1Q2017*

$35,262 $36,408

$65,888

$67,079

$77,476

$19,124

Net Income ($)

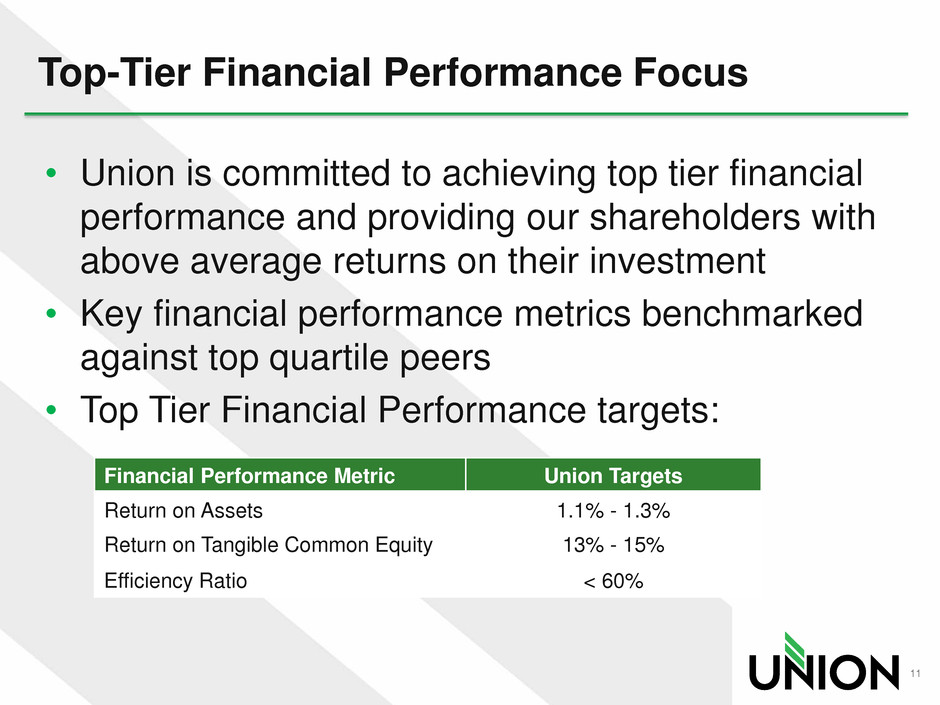

Top-Tier Financial Performance Focus

• Union is committed to achieving top tier financial

performance and providing our shareholders with

above average returns on their investment

• Key financial performance metrics benchmarked

against top quartile peers

• Top Tier Financial Performance targets:

11

Financial Performance Metric Union Targets

Return on Assets 1.1% - 1.3%

Return on Tangible Common Equity 13% - 15%

Efficiency Ratio < 60%

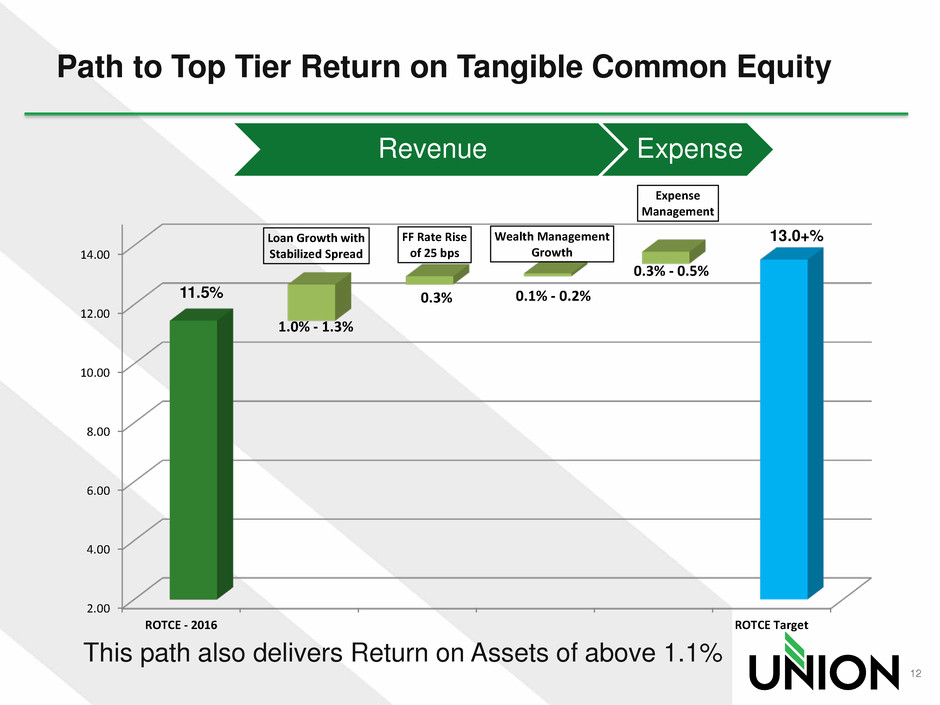

Path to Top Tier Return on Tangible Common Equity

Revenue Expense

This path also delivers Return on Assets of above 1.1%

12

2.00

4.00

6.00

8.00

10.00

12.00

14.00

ROTCE - 2016 ROTCE Target

11.5%

1.0% - 1.3%

0.3% 0.1% - 0.2%

0.3% - 0.5%

Loan Growth with

Stabilized Spread

FF Rate Rise

of 25 bps

Wealth Management

Growth

Expense

Management

13.0+%

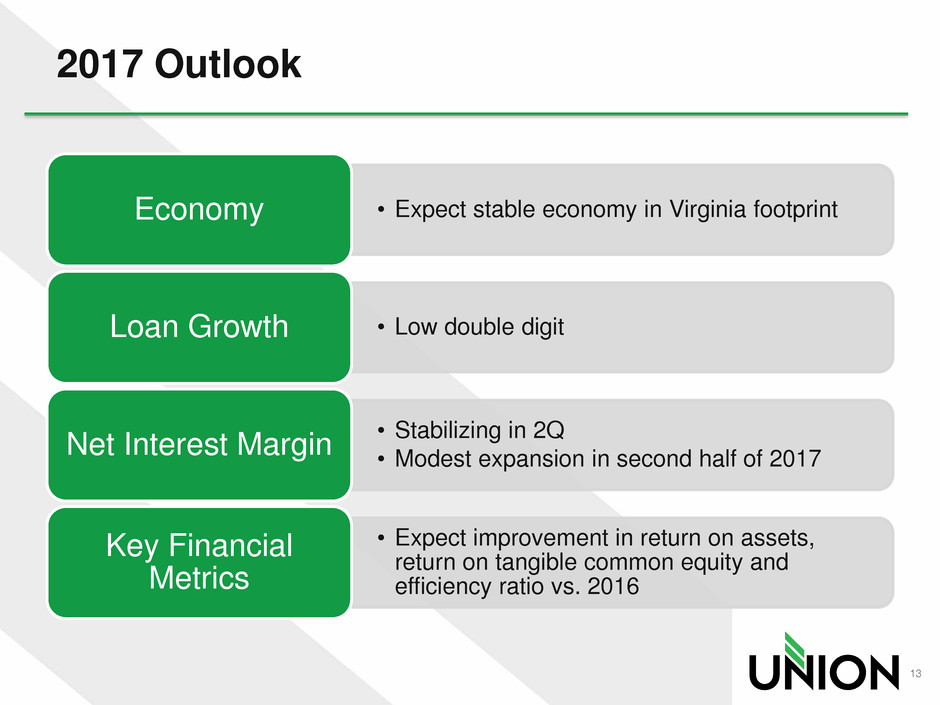

2017 Outlook

• Expect stable economy in Virginia footprint Economy

• Low double digit Loan Growth

• Stabilizing in 2Q

• Modest expansion in second half of 2017 Net Interest Margin

• Expect improvement in return on assets,

return on tangible common equity and

efficiency ratio vs. 2016

Key Financial

Metrics

13

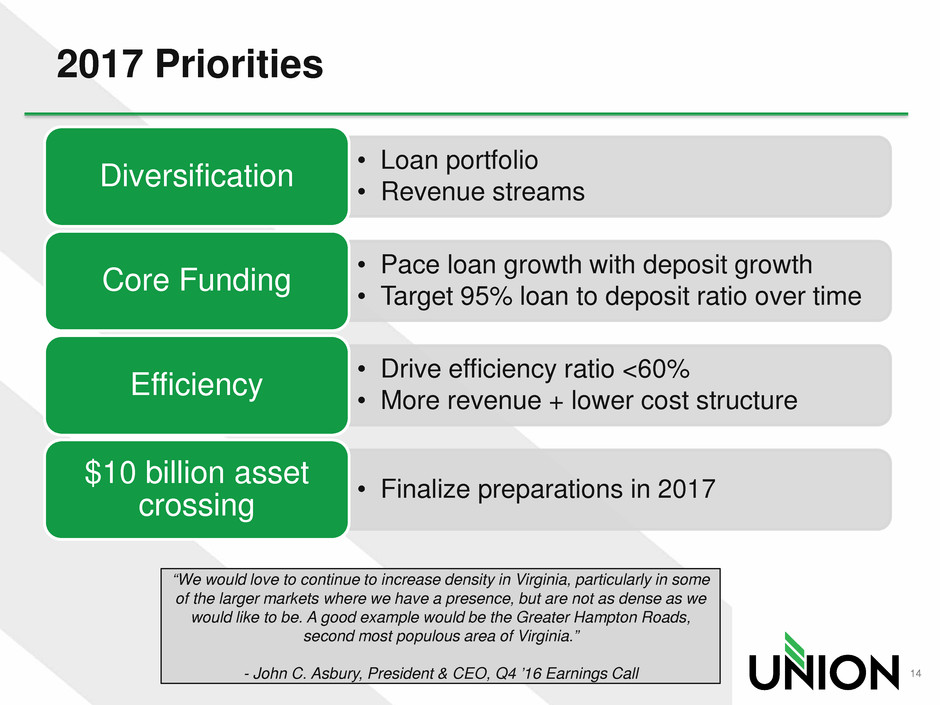

2017 Priorities

14

• Loan portfolio

• Revenue streams Diversification

• Pace loan growth with deposit growth

• Target 95% loan to deposit ratio over time Core Funding

• Drive efficiency ratio <60%

• More revenue + lower cost structure Efficiency

• Finalize preparations in 2017 $10 billion asset crossing

“We would love to continue to increase density in Virginia, particularly in some

of the larger markets where we have a presence, but are not as dense as we

would like to be. A good example would be the Greater Hampton Roads,

second most populous area of Virginia.”

- John C. Asbury, President & CEO, Q4 ’16 Earnings Call

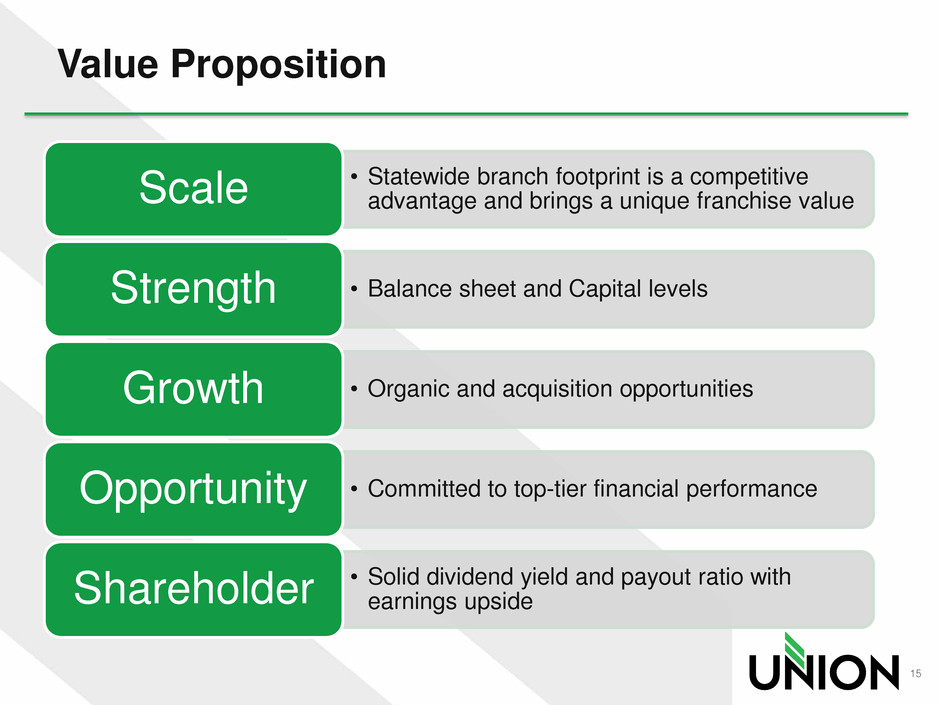

Value Proposition

• Statewide branch footprint is a competitive

advantage and brings a unique franchise value Scale

• Balance sheet and Capital levels Strength

• Organic and acquisition opportunities Growth

• Committed to top-tier financial performance Opportunity

• Solid dividend yield and payout ratio with

earnings upside Shareholder

15

Merger Details

17

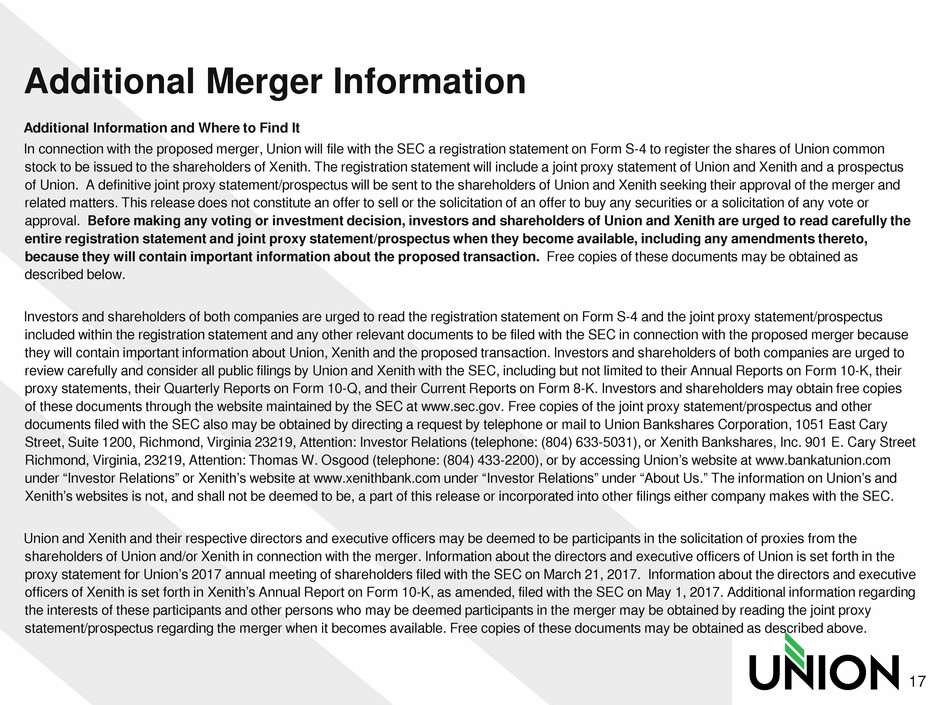

Additional Merger Information

Additional Information and Where to Find It

In connection with the proposed merger, Union will file with the SEC a registration statement on Form S-4 to register the shares of Union common

stock to be issued to the shareholders of Xenith. The registration statement will include a joint proxy statement of Union and Xenith and a prospectus

of Union. A definitive joint proxy statement/prospectus will be sent to the shareholders of Union and Xenith seeking their approval of the merger and

related matters. This release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or

approval. Before making any voting or investment decision, investors and shareholders of Union and Xenith are urged to read carefully the

entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto,

because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as

described below.

Investors and shareholders of both companies are urged to read the registration statement on Form S-4 and the joint proxy statement/prospectus

included within the registration statement and any other relevant documents to be filed with the SEC in connection with the proposed merger because

they will contain important information about Union, Xenith and the proposed transaction. Investors and shareholders of both companies are urged to

review carefully and consider all public filings by Union and Xenith with the SEC, including but not limited to their Annual Reports on Form 10-K, their

proxy statements, their Quarterly Reports on Form 10-Q, and their Current Reports on Form 8-K. Investors and shareholders may obtain free copies

of these documents through the website maintained by the SEC at www.sec.gov. Free copies of the joint proxy statement/prospectus and other

documents filed with the SEC also may be obtained by directing a request by telephone or mail to Union Bankshares Corporation, 1051 East Cary

Street, Suite 1200, Richmond, Virginia 23219, Attention: Investor Relations (telephone: (804) 633-5031), or Xenith Bankshares, Inc. 901 E. Cary Street

Richmond, Virginia, 23219, Attention: Thomas W. Osgood (telephone: (804) 433-2200), or by accessing Union’s website at www.bankatunion.com

under “Investor Relations” or Xenith’s website at www.xenithbank.com under “Investor Relations” under “About Us.” The information on Union’s and

Xenith’s websites is not, and shall not be deemed to be, a part of this release or incorporated into other filings either company makes with the SEC.

Union and Xenith and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the

shareholders of Union and/or Xenith in connection with the merger. Information about the directors and executive officers of Union is set forth in the

proxy statement for Union’s 2017 annual meeting of shareholders filed with the SEC on March 21, 2017. Information about the directors and executive

officers of Xenith is set forth in Xenith’s Annual Report on Form 10-K, as amended, filed with the SEC on May 1, 2017. Additional information regarding

the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy

statement/prospectus regarding the merger when it becomes available. Free copies of these documents may be obtained as described above.

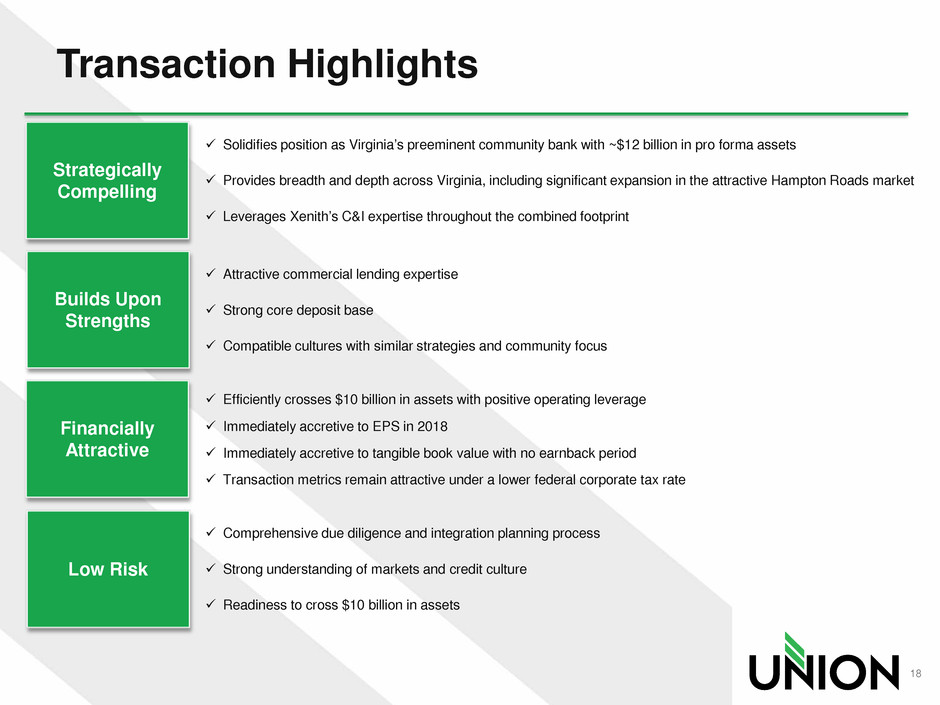

Solidifies position as Virginia’s preeminent community bank with ~$12 billion in pro forma assets

Provides breadth and depth across Virginia, including significant expansion in the attractive Hampton Roads market

Leverages Xenith’s C&I expertise throughout the combined footprint

Transaction Highlights

Attractive commercial lending expertise

Strong core deposit base

Compatible cultures with similar strategies and community focus

Efficiently crosses $10 billion in assets with positive operating leverage

Immediately accretive to EPS in 2018

Immediately accretive to tangible book value with no earnback period

Transaction metrics remain attractive under a lower federal corporate tax rate

Comprehensive due diligence and integration planning process

Strong understanding of markets and credit culture

Readiness to cross $10 billion in assets

Strategically

Compelling

Builds Upon

Strengths

Financially

Attractive

Low Risk

18

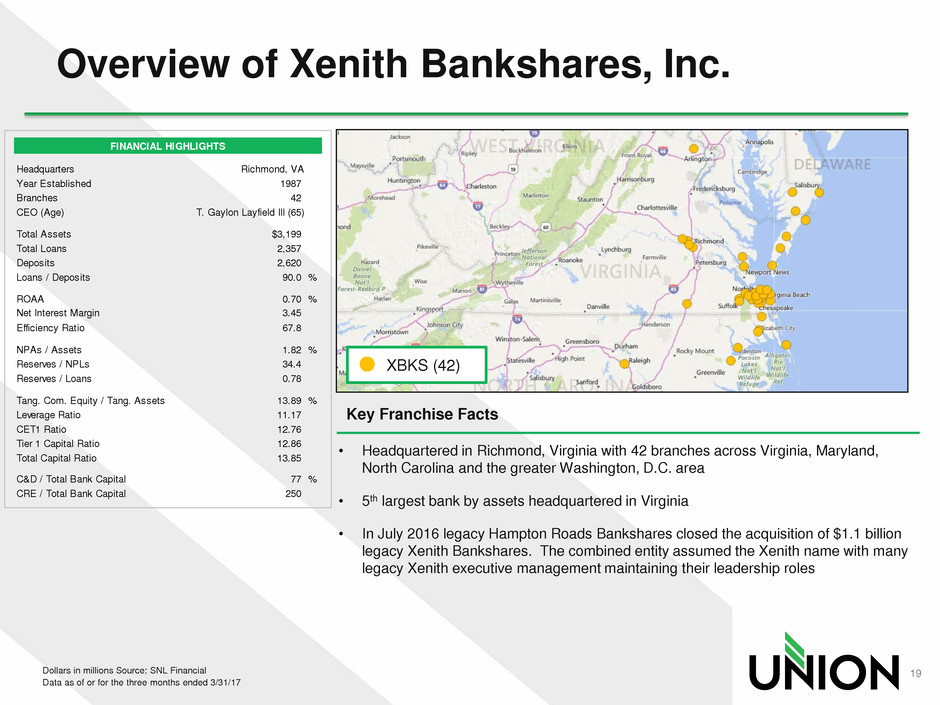

FINANCIAL HIGHLIGHTS

Headquarters Richmond, VA

Year Established 1987

Branches 42

CEO (Age) T. Gaylon Layfield III (65)

Total Assets $3,199

Total Loans 2,357

Deposits 2,620

Loans / Deposits 90.0 %

ROAA 0.70 %

Net Interest Margin 3.45

Efficiency Ratio 67.8

NPAs / Assets 1.82 %

Reserves / NPLs 34.4

Reserves / Loans 0.78

Tang. Com. Equity / Tang. Assets 13.89 %

Leverage Ratio 11.17

CET1 Ratio 12.76

Tier 1 Capital Ratio 12.86

Total Capital Ratio 13.85

C&D / Total Bank Capital 77 %

CRE / Total Bank Capital 250

Overview of Xenith Bankshares, Inc.

Dollars in millions Source: SNL Financial

Data as of or for the three months ended 3/31/17

• Headquartered in Richmond, Virginia with 42 branches across Virginia, Maryland,

North Carolina and the greater Washington, D.C. area

• 5th largest bank by assets headquartered in Virginia

• In July 2016 legacy Hampton Roads Bankshares closed the acquisition of $1.1 billion

legacy Xenith Bankshares. The combined entity assumed the Xenith name with many

legacy Xenith executive management maintaining their leadership roles

Key Franchise Facts

XBKS (42)

19

Virginia

North Carolina

Maryland

Stauntont ttauntont tt ttauntont ttaunton

Charlottesvillel tt illr svha lotte illel tt illl tt illrr svsvha lo te i lel t i lha lo te i le

Richmondici h ondiicci h ondii h ond

Roanokekoano ekkoano eoano e

Fredricksburgir r rcksF ed i bu giir r rr r rckscksF ed i bu giF ed i bu g

Norfolkf lr ko folf lf lrr kko folf lo fol

Raleighl ialeighl il ialeighl ialeigh

Greensboror rseen bo or rr rsseen bo oeen bo o

Virginia Beachi i i r ci ginia ea hi i i i i i rr cci ginia ea hi i i i ginia ea h

Ashevilleills vhe illeillills vs vhe i lei lhe i le

Washingtoni tsa hingtoni ti tssa hingtoni ta hington

Baltimorelti ralti o eltilti rralti o eltialti o e

Charlottel ttrha lottel ttl ttrrha lo tel tha lo te

40

40

95

95

85

85

66

64

81

81

77

64

70

270

95

95

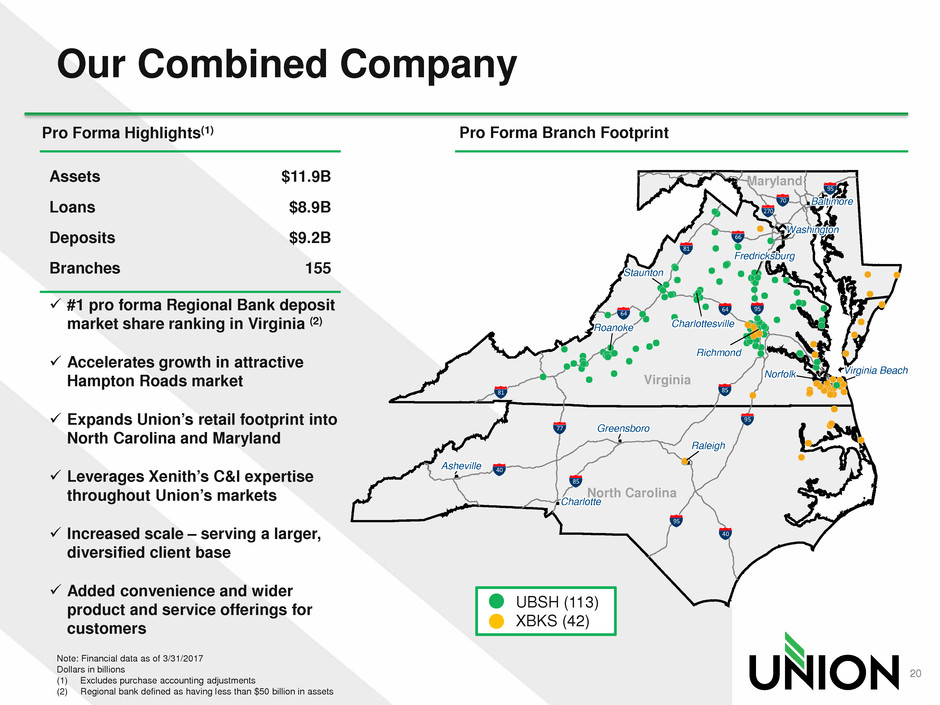

Our Combined Company

Note: Financial data as of 3/31/2017

Dollars in billions

(1) Excludes purchase accounting adjustments

(2) Regional bank defined as having less than $50 billion in assets

UBSH (113)

XBKS (42)

Pro Forma Branch Footprint Pro Forma Highlights(1)

#1 pro forma Regional Bank deposit

market share ranking in Virginia (2)

Accelerates growth in attractive

Hampton Roads market

Expands Union’s retail footprint into

North Carolina and Maryland

Leverages Xenith’s C&I expertise

throughout Union’s markets

Increased scale – serving a larger,

diversified client base

Added convenience and wider

product and service offerings for

customers

Assets $11.9B

Loans $8.9B

Deposits $9.2B

Branches 155

20

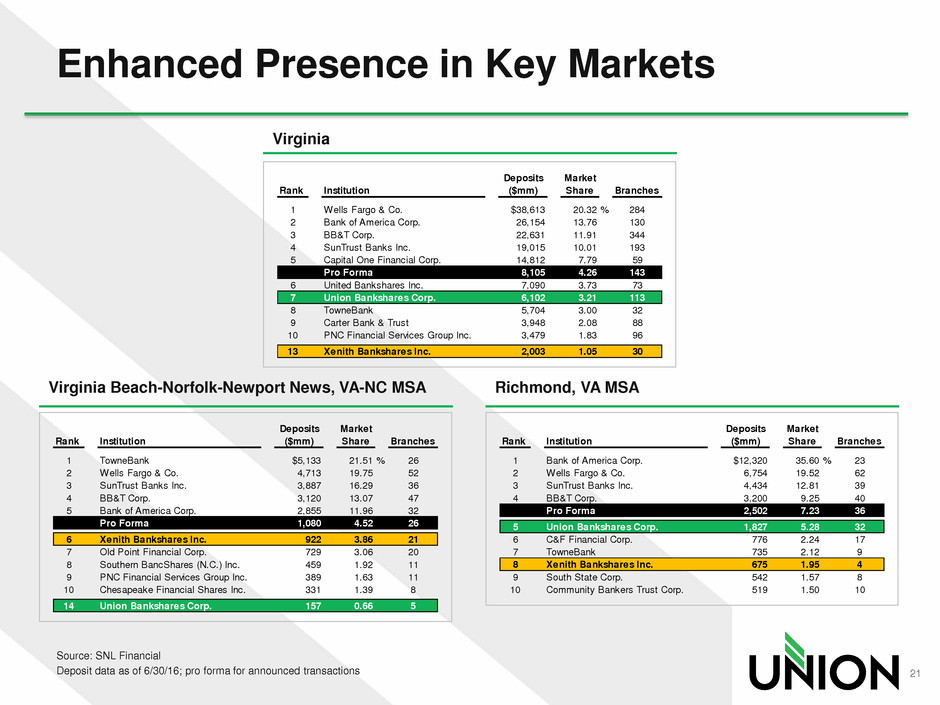

Deposits Market

Rank Institution ($mm) Share Branches

1 Wells Fargo & Co. $38,613 20.32 % 284

2 Bank of America Corp. 26,154 13.76 130

3 BB&T Corp. 22,631 11.91 344

4 SunTrust Banks Inc. 19,015 10.01 193

5 Capital One Financial Corp. 14,812 7.79 59

Pro Forma 8,105 4.26 143

6 United Bankshares Inc. 7,090 3.73 73

7 Union Bankshares Corp. 6,102 3.21 113

8 TowneBank 5,704 3.00 32

9 Carter Bank & Trust 3,948 2.08 88

10 PNC Financial Services Group Inc. 3,479 1.83 96

13 Xenith Bankshares Inc. 2,003 1.05 30

Enhanced Presence in Key Markets

Source: SNL Financial

Deposit data as of 6/30/16; pro forma for announced transactions

Virginia Beach-Norfolk-Newport News, VA-NC MSA

Deposits Market

Rank Institution ($mm) Share Branches

1 TowneBank $5,133 21.51 % 26

2 Wells Fargo & Co. 4,713 19.75 52

3 SunTrust Banks Inc. 3,887 16.29 36

4 BB&T Corp. 3,120 13.07 47

5 Bank of America Corp. 2,855 11.96 32

Pro Forma 1,080 4.52 26

6 Xenith Bankshares Inc. 922 3.86 21

7 Old Point Financial Corp. 729 3.06 20

8 Southern BancShares (N.C.) Inc. 459 1.92 11

9 PNC Financial Services Group Inc. 389 1.63 11

10 Chesapeake Financial Shares Inc. 331 1.39 8

14 Union Bankshares Corp. 157 0.66 5

Deposits Market

Rank Institution ($mm) Share Branches

1 Bank of America Corp. $12,320 35.60 % 23

2 Wells Fargo & Co. 6,754 19.52 62

3 SunTrust Banks Inc. 4,434 12.81 39

4 BB&T Corp. 3,200 9.25 40

Pro Forma 2,502 7.23 36

5 Union Bankshares Corp. 1,827 5.28 32

6 C&F Financial Corp. 776 2.24 17

7 TowneBank 735 2.12 9

8 Xenith Bankshares Inc. 675 1.95 4

9 South State Corp. 542 1.57 8

10 Community Bankers Trust Corp. 519 1.50 10

Richmond, VA MSA

Virginia

21

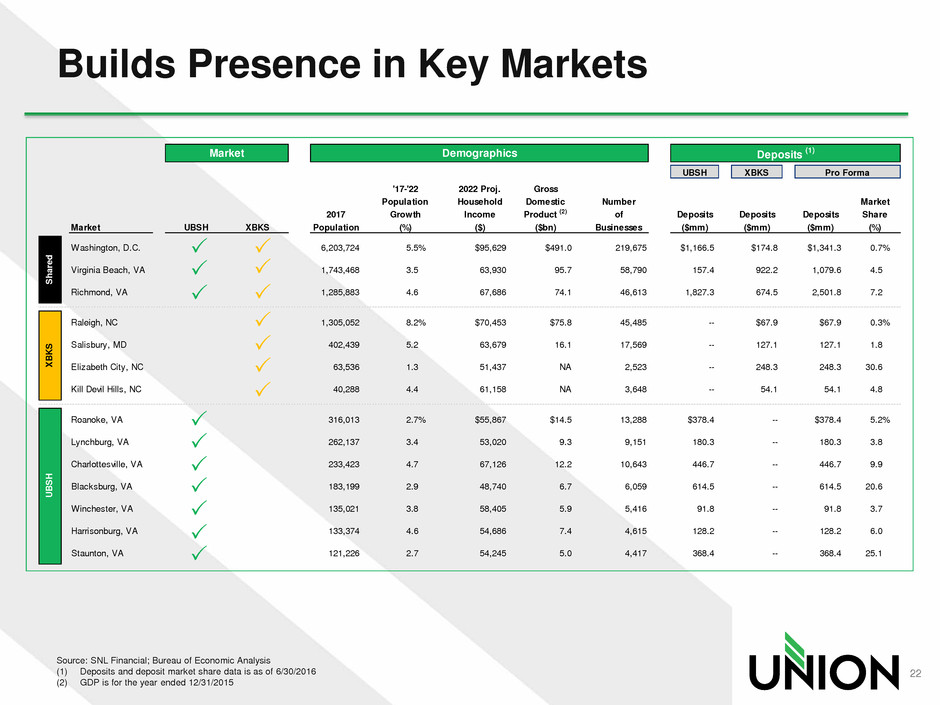

Market Demographics Deposits (1)

UBSH XBKS Pro Forma

'17-'22 2022 Proj. Gross

Population Household Domestic Number Market

2017 Growth Income Product (2) of Deposits Deposits Deposits Share

Market UBSH XBKS Population (%) ($) ($bn) Businesses ($mm) ($mm) ($mm) (%)

Washington, D.C. 6,203,724 5.5% $95,629 $491.0 219,675 $1,166.5 $174.8 $1,341.3 0.7%

Virginia Beach, VA 1,743,468 3.5 63,930 95.7 58,790 157.4 922.2 1,079.6 4.5

Richmond, VA 1,285,883 4.6 67,686 74.1 46,613 1,827.3 674.5 2,501.8 7.2

Raleigh, NC 1,305,052 8.2% $70,453 $75.8 45,485 -- $67.9 $67.9 0.3%

Salisbury, MD 402,439 5.2 63,679 16.1 17,569 -- 127.1 127.1 1.8

Elizabeth City, NC 63,536 1.3 51,437 NA 2,523 -- 248.3 248.3 30.6

Kill Devil Hills, NC 40,288 4.4 61,158 NA 3,648 -- 54.1 54.1 4.8

Roanoke, VA 316,013 2.7% $55,867 $14.5 13,288 $378.4 -- $378.4 5.2%

Lynchburg, VA 262,137 3.4 53,020 9.3 9,151 180.3 -- 180.3 3.8

Charlottesville, VA 233,423 4.7 67,126 12.2 10,643 446.7 -- 446.7 9.9

Blacksburg, VA 183,199 2.9 48,740 6.7 6,059 614.5 -- 614.5 20.6

Winchester, VA 135,021 3.8 58,405 5.9 5,416 91.8 -- 91.8 3.7

Harrisonburg, VA 133,374 4.6 54,686 7.4 4,615 128.2 -- 128.2 6.0

Staunton, VA 121,226 2.7 54,245 5.0 4,417 368.4 -- 368.4 25.1

U

B

S

H

X

B

K

S

S

ha

re

d

Builds Presence in Key Markets

Source: SNL Financial; Bureau of Economic Analysis

(1) Deposits and deposit market share data is as of 6/30/2016

(2) GDP is for the year ended 12/31/2015

22

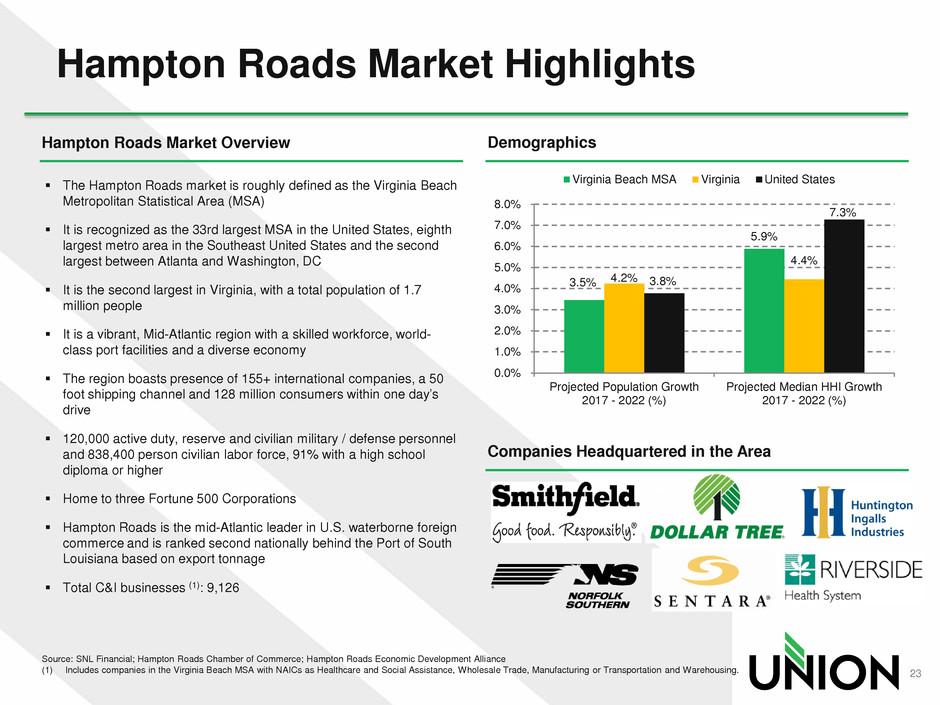

Hampton Roads Market Highlights

Source: SNL Financial; Hampton Roads Chamber of Commerce; Hampton Roads Economic Development Alliance

(1) Includes companies in the Virginia Beach MSA with NAICs as Healthcare and Social Assistance, Wholesale Trade, Manufacturing or Transportation and Warehousing.

Demographics Hampton Roads Market Overview

The Hampton Roads market is roughly defined as the Virginia Beach

Metropolitan Statistical Area (MSA)

It is recognized as the 33rd largest MSA in the United States, eighth

largest metro area in the Southeast United States and the second

largest between Atlanta and Washington, DC

It is the second largest in Virginia, with a total population of 1.7

million people

It is a vibrant, Mid-Atlantic region with a skilled workforce, world-

class port facilities and a diverse economy

The region boasts presence of 155+ international companies, a 50

foot shipping channel and 128 million consumers within one day’s

drive

120,000 active duty, reserve and civilian military / defense personnel

and 838,400 person civilian labor force, 91% with a high school

diploma or higher

Home to three Fortune 500 Corporations

Hampton Roads is the mid-Atlantic leader in U.S. waterborne foreign

commerce and is ranked second nationally behind the Port of South

Louisiana based on export tonnage

Total C&I businesses (1): 9,126

3.5%

5.9%

4.2%

4.4%

3.8%

7.3%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

Projected Population Growth

2017 - 2022 (%)

Projected Median HHI Growth

2017 - 2022 (%)

Virginia Beach MSA Virginia United States

Companies Headquartered in the Area

23

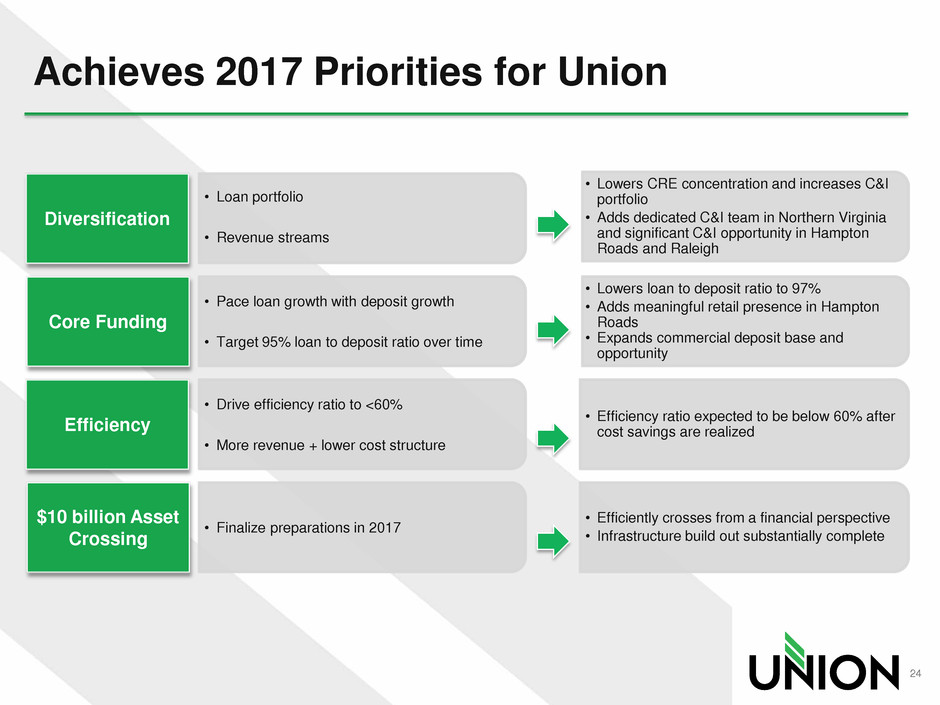

Achieves 2017 Priorities for Union

• Lowers CRE concentration and increases C&I

portfolio

• Adds dedicated C&I team in Northern Virginia

and significant C&I opportunity in Hampton

Roads and Raleigh

• Lowers loan to deposit ratio to 97%

• Adds meaningful retail presence in Hampton

Roads

• Expands commercial deposit base and

opportunity

• Efficiency ratio expected to be below 60% after

cost savings are realized

• Efficiently crosses from a financial perspective

• Infrastructure build out substantially complete

Diversification

Core Funding

Efficiency

$10 billion Asset

Crossing

• Loan portfolio

• Revenue streams

• Pace loan growth with deposit growth

• Target 95% loan to deposit ratio over time

• Drive efficiency ratio to <60%

• More revenue + lower cost structure

• Finalize preparations in 2017

24

Consideration(2)

Pro Forma Ownership

Executive Management

Board of Directors

Anticipated Close

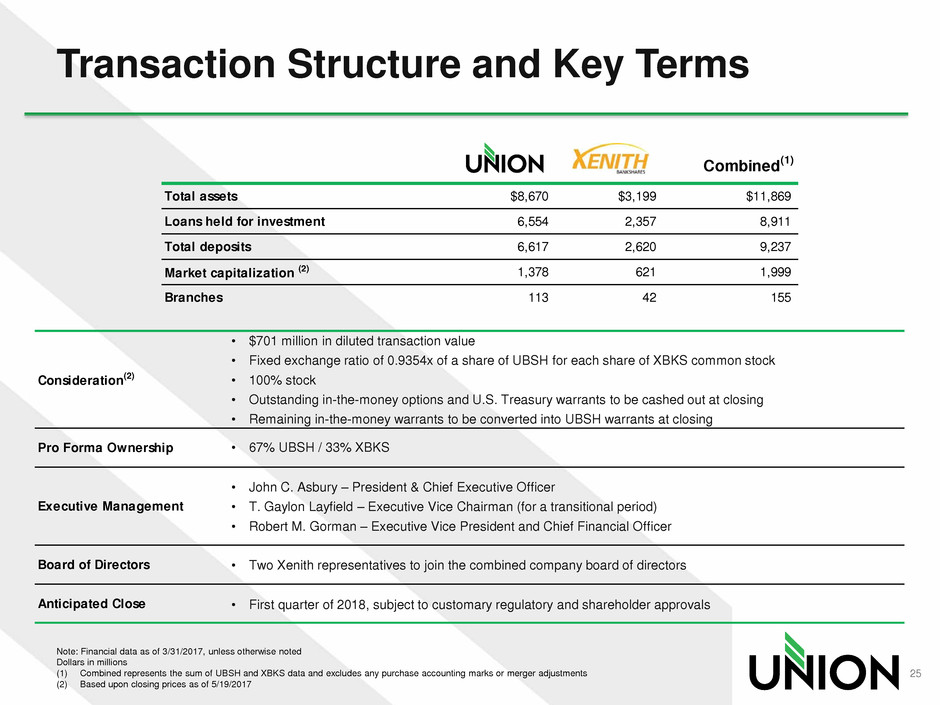

Transaction Structure and Key Terms

Note: Financial data as of 3/31/2017, unless otherwise noted

Dollars in millions

(1) Combined represents the sum of UBSH and XBKS data and excludes any purchase accounting marks or merger adjustments

(2) Based upon closing prices as of 5/19/2017

Combined(1)

Total assets $8,670 $3,199 $11,869

Loans held for investment 6,554 2,357 8,911

Total deposits 6,617 2,620 9,237

Market capitalization (2) 1,378 621 1,999

Branches 113 42 155

• $701 million in diluted transaction value

• Fixed exchange ratio of 0.9354x of a share of UBSH for each share of XBKS common stock

• 100% stock

• Outstanding in-the-money options and U.S. Treasury warrants to be cashed out at closing

• Remaining in-the-money warrants to be converted into UBSH warrants at closing

• 67% UBSH / 33% XBKS

• John C. Asbury – President & Chief Executive Officer

• T. Gaylon Layfield – Executive Vice Chairman (for a transitional period)

• Robert M. Gorman – Executive Vice President and Chief Financial Officer

• Two Xenith representatives to join the combined company board of directors

• First quarter of 2018, subject to customary regulatory and shareholder approvals

25

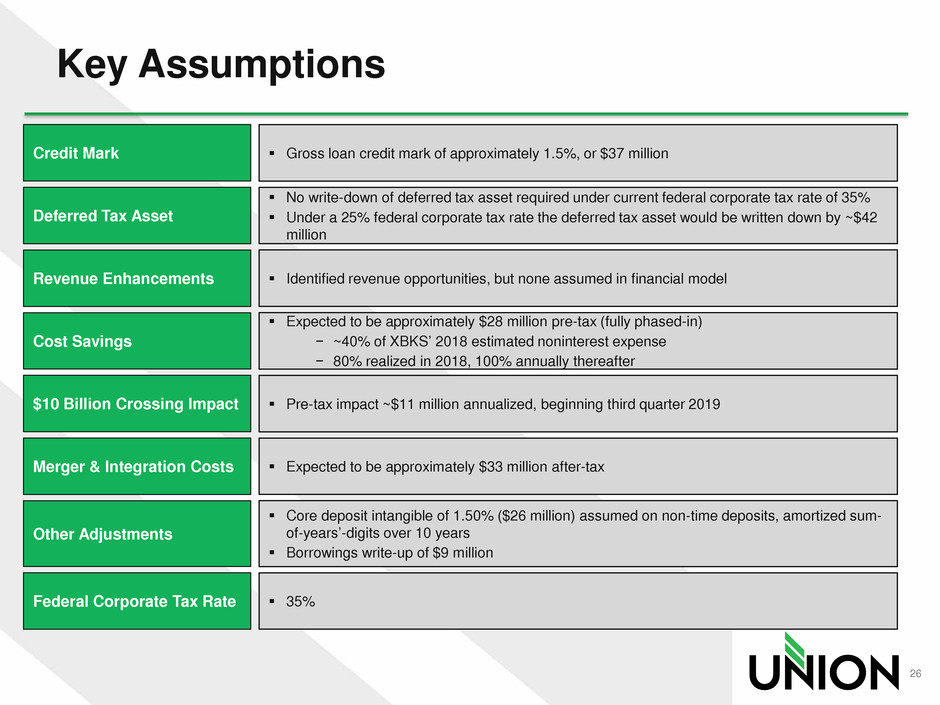

Key Assumptions

Cost Savings

Credit Mark Gross loan credit mark of approximately 1.5%, or $37 million

Expected to be approximately $28 million pre-tax (fully phased-in)

− ~40% of XBKS’ 2018 estimated noninterest expense

− 80% realized in 2018, 100% annually thereafter

Merger & Integration Costs Expected to be approximately $33 million after-tax

$10 Billion Crossing Impact Pre-tax impact ~$11 million annualized, beginning third quarter 2019

Other Adjustments

Core deposit intangible of 1.50% ($26 million) assumed on non-time deposits, amortized sum-

of-years’-digits over 10 years

Borrowings write-up of $9 million

Deferred Tax Asset

No write-down of deferred tax asset required under current federal corporate tax rate of 35%

Under a 25% federal corporate tax rate the deferred tax asset would be written down by ~$42

million

Revenue Enhancements Identified revenue opportunities, but none assumed in financial model

Federal Corporate Tax Rate 35%

26

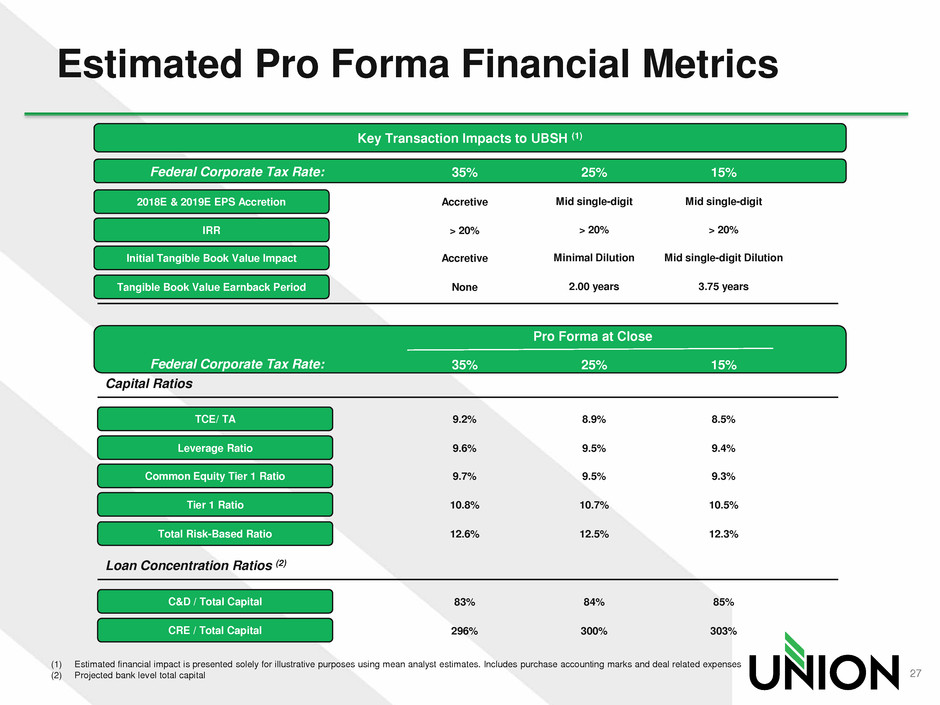

Estimated Pro Forma Financial Metrics

(1) Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purchase accounting marks and deal related expenses

(2) Projected bank level total capital

Key Transaction Impacts to UBSH (1)

2018E & 2019E EPS Accretion

IRR

Initial Tangible Book Value Impact

Tangible Book Value Earnback Period

Capital Ratios

TCE/ TA

Leverage Ratio

Common Equity Tier 1 Ratio

Tier 1 Ratio

Total Risk-Based Ratio

Loan Concentration Ratios (2)

C&D / Total Capital

CRE / Total Capital

Accretive

> 20%

Accretive

None

9.2%

9.6%

9.7%

10.8%

12.6%

8.9%

9.5%

9.5%

10.7%

12.5%

8.5%

9.4%

9.3%

10.5%

12.3%

83%

296%

84%

300%

85%

303%

Pro Forma at Close

35% Federal Corporate Tax Rate: 25% 15%

Mid single-digit

> 20%

Minimal Dilution

2.00 years

Mid single-digit

> 20%

Mid single-digit Dilution

3.75 years

35% Federal Corporate Tax Rate: 25% 15%

27

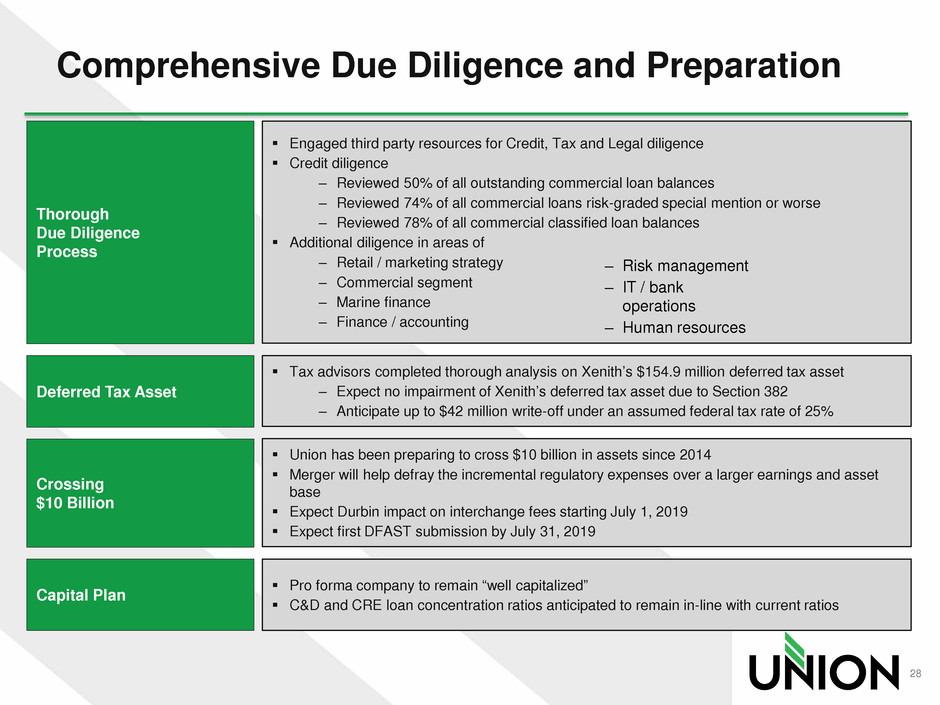

Comprehensive Due Diligence and Preparation

Deferred Tax Asset

Tax advisors completed thorough analysis on Xenith’s $154.9 million deferred tax asset

‒ Expect no impairment of Xenith’s deferred tax asset due to Section 382

‒ Anticipate up to $42 million write-off under an assumed federal tax rate of 25%

Thorough

Due Diligence

Process

Engaged third party resources for Credit, Tax and Legal diligence

Credit diligence

‒ Reviewed 50% of all outstanding commercial loan balances

‒ Reviewed 74% of all commercial loans risk-graded special mention or worse

‒ Reviewed 78% of all commercial classified loan balances

Additional diligence in areas of

‒ Retail / marketing strategy

‒ Commercial segment

‒ Marine finance

‒ Finance / accounting

Crossing

$10 Billion

Union has been preparing to cross $10 billion in assets since 2014

Merger will help defray the incremental regulatory expenses over a larger earnings and asset

base

Expect Durbin impact on interchange fees starting July 1, 2019

Expect first DFAST submission by July 31, 2019

‒ Risk management

‒ IT / bank

operations

‒ Human resources

Capital Plan

Pro forma company to remain “well capitalized”

C&D and CRE loan concentration ratios anticipated to remain in-line with current ratios

28

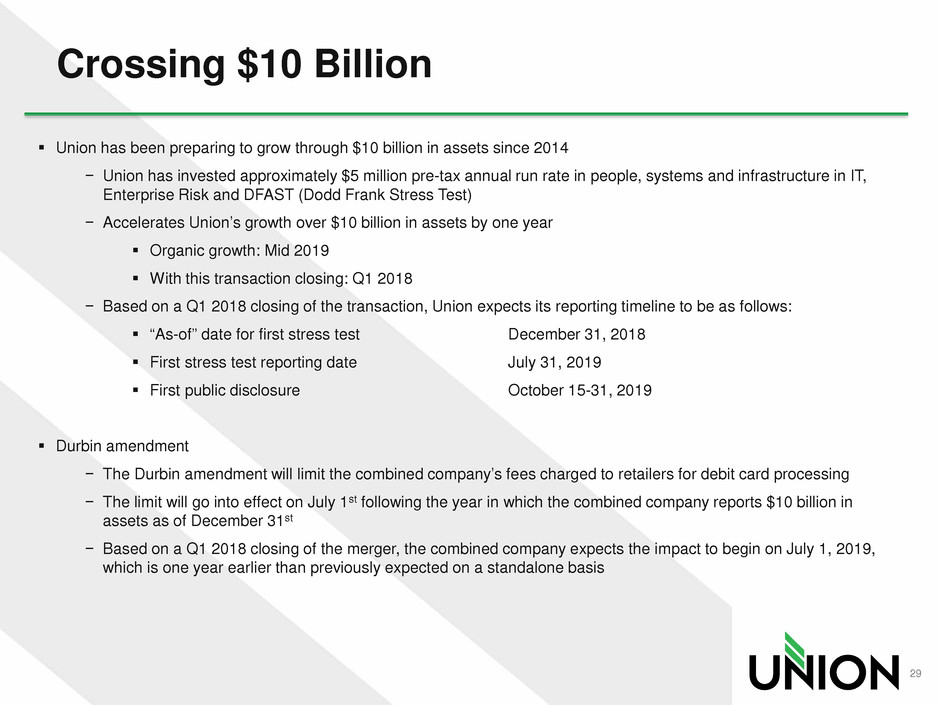

Crossing $10 Billion

Union has been preparing to grow through $10 billion in assets since 2014

− Union has invested approximately $5 million pre-tax annual run rate in people, systems and infrastructure in IT,

Enterprise Risk and DFAST (Dodd Frank Stress Test)

− Accelerates Union’s growth over $10 billion in assets by one year

Organic growth: Mid 2019

With this transaction closing: Q1 2018

− Based on a Q1 2018 closing of the transaction, Union expects its reporting timeline to be as follows:

“As-of” date for first stress test December 31, 2018

First stress test reporting date July 31, 2019

First public disclosure October 15-31, 2019

Durbin amendment

− The Durbin amendment will limit the combined company’s fees charged to retailers for debit card processing

− The limit will go into effect on July 1st following the year in which the combined company reports $10 billion in

assets as of December 31st

− Based on a Q1 2018 closing of the merger, the combined company expects the impact to begin on July 1, 2019,

which is one year earlier than previously expected on a standalone basis

29

Creates Virginia’s preeminent community bank with more than $12 billion in pro forma assets

at closing

Enhances presence in key markets and provides a platform for future growth

Financially attractive transaction for all shareholders with conservative assumptions

Proven track record of successful conversions and integrations at both companies

Deal Summary

30

Value Proposition

• Statewide branch footprint is a competitive

advantage and brings a unique franchise value Scale

• Balance sheet and Capital levels Strength

• Organic and acquisition opportunities Growth

• Committed to top-tier financial performance Opportunity

• Solid dividend yield and payout ratio with

earnings upside Shareholder

31

APPENDIX

32

CEO Succession Plan

• John Asbury became President & CEO of Union Bank &

Trust and President of Union Bankshares Corporation on

October 1; CEO of Holding company on January 2, 2017 –

succeeding Billy Beale.

• Asbury was most recently President and CEO of First National Bank of

Santa Fe, a multi-state bank located in the Southwest

• Prior to that, he was Senior Executive Vice President at Regions

responsible for all lines serving business and commercial customers and

managed a $50 billion book of business

• Senior Vice President at Bank of America – served in a variety of roles last

position responsible for all Pacific Northwest Region business banking

• Asbury joined the board on October 1

• Billy was Executive Vice Chairman through March 31 and

was re-elected to board in May 2017 and will serve as an

advisor to the CEO and Board

33

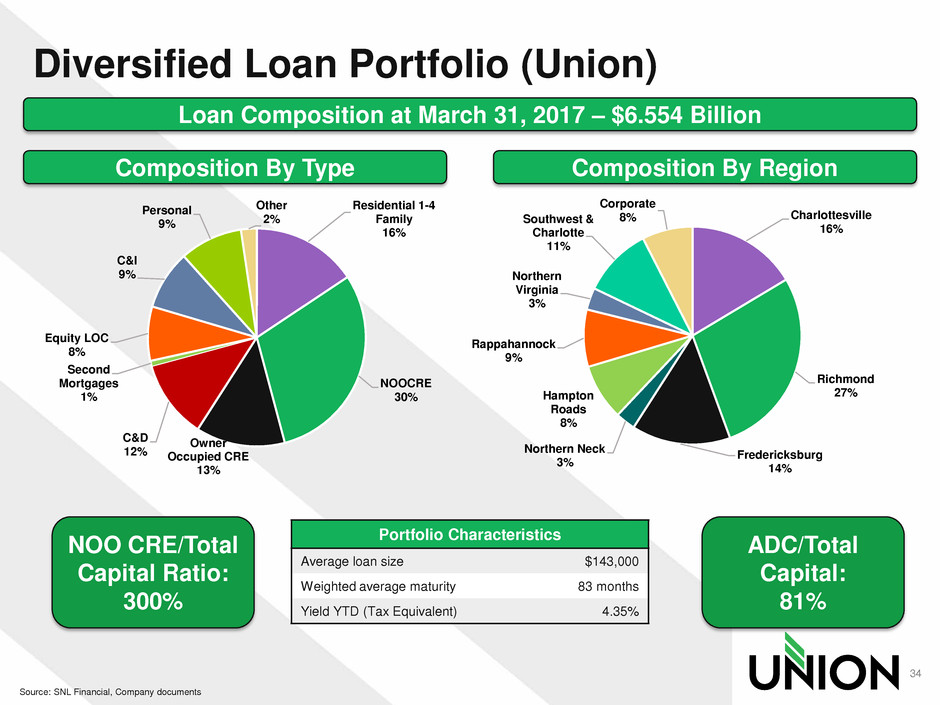

Diversified Loan Portfolio (Union)

34

Source: SNL Financial, Company documents

Loan Composition at March 31, 2017 – $6.554 Billion

Portfolio Characteristics

Average loan size $143,000

Weighted average maturity 83 months

Yield YTD (Tax Equivalent) 4.35%

Composition By Type Composition By Region

NOO CRE/Total

Capital Ratio:

300%

ADC/Total

Capital:

81%

Residential 1-4

Family

16%

NOOCRE

30%

Owner

Occupied CRE

13%

C&D

12%

Second

Mortgages

1%

Equity LOC

8%

C&I

9%

Personal

9%

Other

2% Charlottesville

16%

Richmond

27%

Fredericksburg

14%

Northern Neck

3%

Hampton

Roads

8%

Rappahannock

9%

Northern

Virginia

3%

Southwest &

Charlotte

11%

Corporate

8%

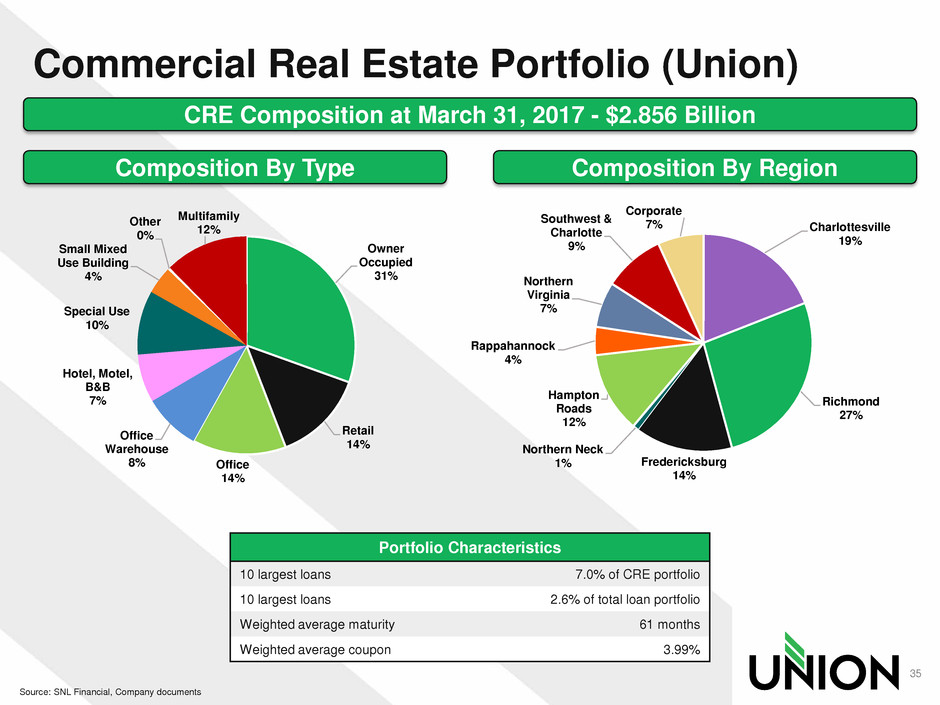

Commercial Real Estate Portfolio (Union)

35

Source: SNL Financial, Company documents

CRE Composition at March 31, 2017 - $2.856 Billion

Portfolio Characteristics

10 largest loans 7.0% of CRE portfolio

10 largest loans 2.6% of total loan portfolio

Weighted average maturity 61 months

Weighted average coupon 3.99%

Composition By Type Composition By Region

Owner

Occupied

31%

Retail

14%

Office

14%

Office

Warehouse

8%

Hotel, Motel,

B&B

7%

Special Use

10%

Small Mixed

Use Building

4%

Other

0%

Multifamily

12% Charlottesville

19%

Richmond

27%

Fredericksburg

14%

Northern Neck

1%

Hampton

Roads

12%

Rappahannock

4%

Northern

Virginia

7%

Southwest &

Charlotte

9%

Corporate

7%

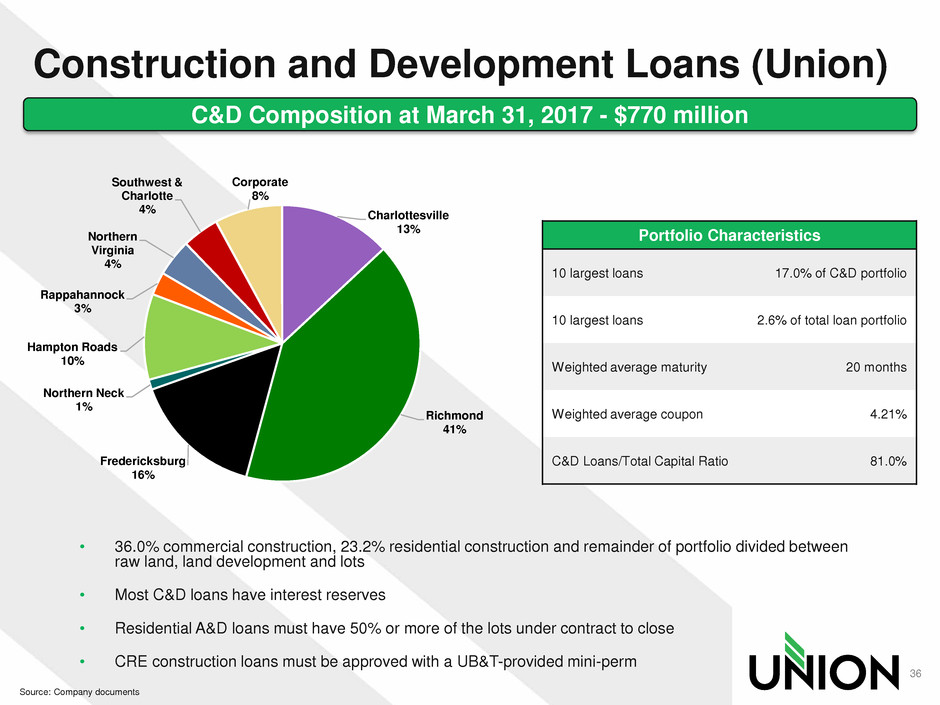

Construction and Development Loans (Union)

36

Source: Company documents

C&D Composition at March 31, 2017 - $770 million

Portfolio Characteristics

10 largest loans 17.0% of C&D portfolio

10 largest loans 2.6% of total loan portfolio

Weighted average maturity 20 months

Weighted average coupon 4.21%

C&D Loans/Total Capital Ratio 81.0%

• 36.0% commercial construction, 23.2% residential construction and remainder of portfolio divided between

raw land, land development and lots

• Most C&D loans have interest reserves

• Residential A&D loans must have 50% or more of the lots under contract to close

• CRE construction loans must be approved with a UB&T-provided mini-perm

Charlottesville

13%

Richmond

41%

Fredericksburg

16%

Northern Neck

1%

Hampton Roads

10%

Rappahannock

3%

Northern

Virginia

4%

Southwest &

Charlotte

4%

Corporate

8%

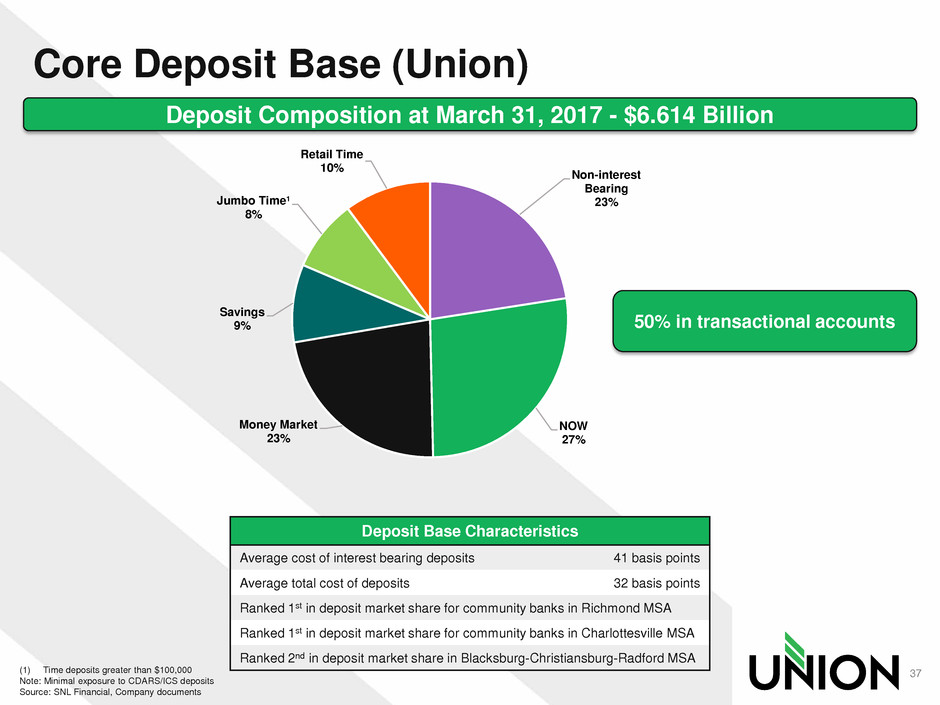

Core Deposit Base (Union)

37 (1) Time deposits greater than $100,000

Note: Minimal exposure to CDARS/ICS deposits

Source: SNL Financial, Company documents

Deposit Composition at March 31, 2017 - $6.614 Billion

Deposit Base Characteristics

Average cost of interest bearing deposits 41 basis points

Average total cost of deposits 32 basis points

Ranked 1st in deposit market share for community banks in Richmond MSA

Ranked 1st in deposit market share for community banks in Charlottesville MSA

Ranked 2nd in deposit market share in Blacksburg-Christiansburg-Radford MSA

50% in transactional accounts

Non-interest

Bearing

23%

NOW

27%

Money Market

23%

Savings

9%

Jumbo Time¹

8%

Retail Time

10%

C&D

12%

1-4 Family

24%

Multifamily

5%

Ow ner-

Occupied

CRE

13%

Non Ow ner-

Occupied

CRE

25%

C&I

9%

Consumer &

Other

11%

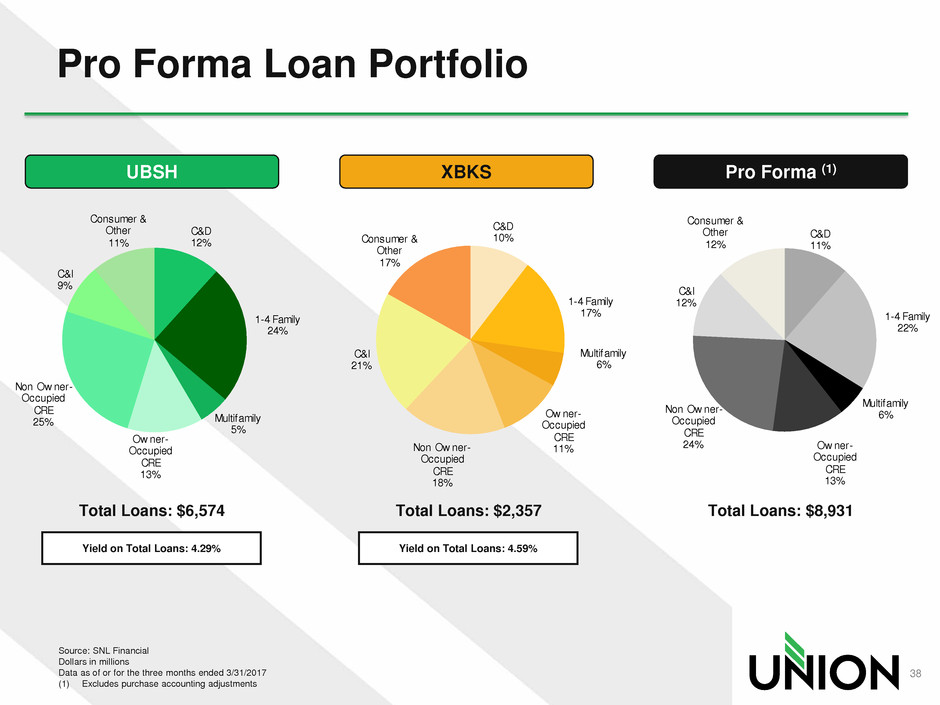

Pro Forma Loan Portfolio

Source: SNL Financial

Dollars in millions

Data as of or for the three months ended 3/31/2017

(1) Excludes purchase accounting adjustments

UBSH XBKS Pro Forma (1)

C&D

10%

1-4 Family

17%

Multifamily

6%

Ow ner-

Occupied

CRE

11%Non Ow ner-

Occupied

CRE

18%

C&I

21%

Consumer &

Other

17%

C&D

11%

1-4 Family

22%

Multifamily

6%

Ow ner-

Occupied

CRE

13%

Non Ow ner-

Occupied

CRE

24%

C&I

12%

Consumer &

Other

12%

Yield on Total Loans: 4.29% Yield on Total Loans: 4.59%

Total Loans: $6,574 Total Loans: $2,357 Total Loans: $8,931

38

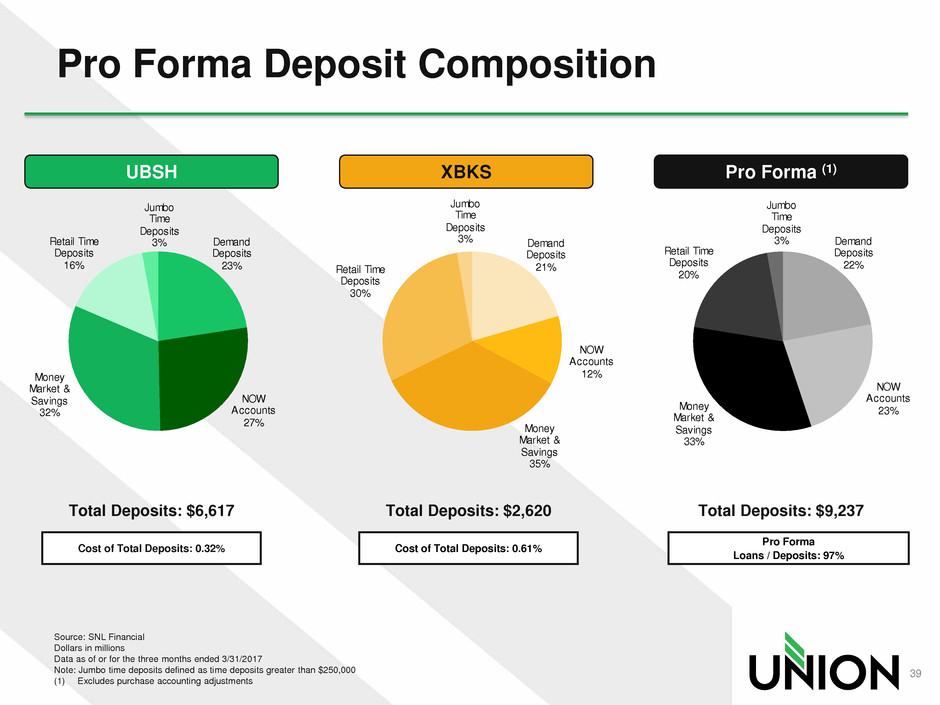

Pro Forma Deposit Composition

Source: SNL Financial

Dollars in millions

Data as of or for the three months ended 3/31/2017

Note: Jumbo time deposits defined as time deposits greater than $250,000

(1) Excludes purchase accounting adjustments

UBSH XBKS Pro Forma (1)

Demand

Deposits

23%

NOW

Accounts

27%

Money

Market &

Savings

32%

Retail Time

Deposits

16%

Jumbo

Time

Deposits

3% Demand

Deposits

21%

NOW

Accounts

12%

Money

Market &

Savings

35%

Retail Time

Deposits

30%

Jumbo

Time

Deposits

3%

Cost of Total Deposits: 0.32% Cost of Total Deposits: 0.61%

Demand

Deposits

22%

NOW

Accounts

23%Money

Market &

Savings

33%

Retail Time

Deposits

20%

Jumbo

Time

Deposits

3%

Total Deposits: $6,617 Total Deposits: $2,620 Total Deposits: $9,237

Pro Forma

Loans / Deposits: 97%

39