Investor Presentation

August/September 2016

Forward-Looking Statement

Certain statements in this report may constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include

projections, predictions, expectations, or beliefs about future events or results or otherwise and are not

statements of historical fact. Such statements are often characterized by the use of qualified words (and their

derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” or words of

similar meaning or other statements concerning opinions or judgment of the Company and its management

about future events. Although the Company believes that its expectations with respect to forward-looking

statements are based upon reasonable assumptions within the bounds of its existing knowledge of its

business and operations, there can be no assurance that actual results, performance, or achievements of the

Company will not differ materially from any future results, performance, or achievements expressed or implied

by such forward-looking statements. Actual future results and trends may differ materially from historical

results or those anticipated depending on a variety of factors, including, but not limited to, the effects of and

changes in: general economic and bank industry conditions, the interest rate environment, legislative and

regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the

stock and bond markets, accounting standards or interpretations of existing standards, mergers and

acquisitions, technology, and consumer spending and savings habits. More information is available on the

Company’s website, http://investors.bankatunion.com and on the Securities and Exchange Commission’s

website, www.sec.gov. The information on the Company’s website is not a part of this presentation. The

Company does not intend or assume any obligation to update or revise any forward-looking statements that

may be made from time to time by or on behalf of the Company.

2

Company Overview

• The largest community banking organization

headquartered in Virginia

• Holding company formed in 1993 – Banking

history goes back more than 100 years

• 7 whole bank and 16 branch acquisitions since

1993

• Assets of $8.1 Billion

• Comprehensive financial services provider offering

• Commercial and retail banking through Union Bank &

Trust

• Investment, wealth management and trust services

• Mortgages primarily through Union Mortgage Group, Inc.

3

Union’s Strengths

• Unique branch network across Virginia, competitive

banking products and services and a loyal customer

base

• Well positioned for organic growth given commercial

activity, household income levels and population growth

in its footprint

• Strong balance sheet and solid capital base

• Experienced management team

• Successful acquirer and integrator

• Proven financial performance in both good and bad

economic climates

4

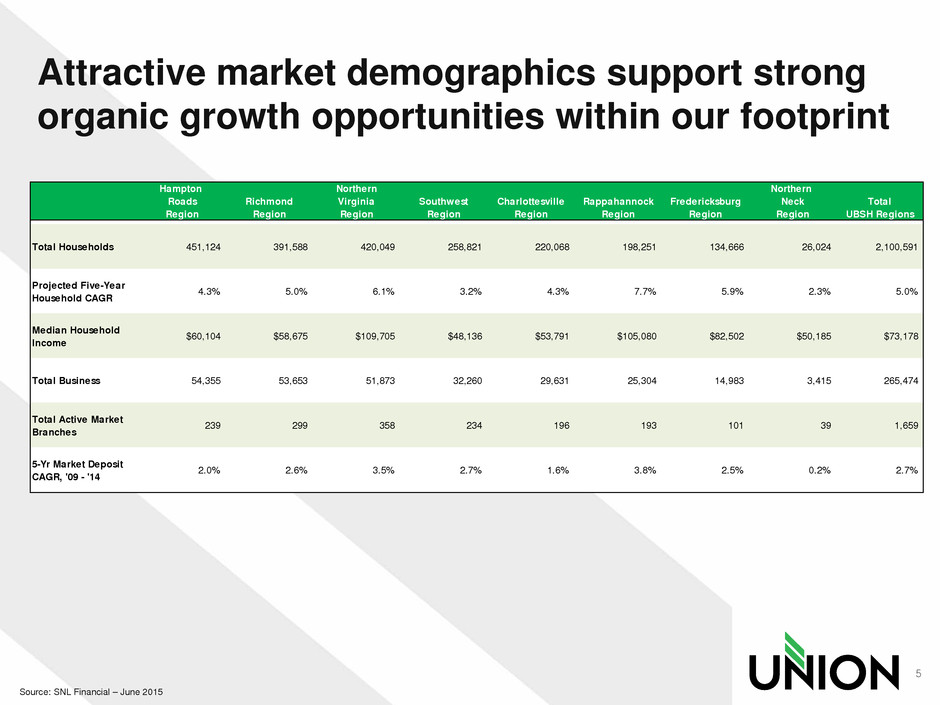

Source: SNL Financial – June 2015

Hampton Northern Northern

Roads Richmond Virginia Southwest Charlottesville Rappahannock Fredericksburg Neck Total

Region Region Region Region Region Region Region Region UBSH Regions

Total Households 451,124 391,588 420,049 258,821 220,068 198,251 134,666 26,024 2,100,591

Projected Five-Year

Household CAGR

4.3% 5.0% 6.1% 3.2% 4.3% 7.7% 5.9% 2.3% 5.0%

Median Household

Income

$60,104 $58,675 $109,705 $48,136 $53,791 $105,080 $82,502 $50,185 $73,178

Total Business 54,355 53,653 51,873 32,260 29,631 25,304 14,983 3,415 265,474

Total Active Market

Branches

239 299 358 234 196 193 101 39 1,659

5-Yr Market Deposit

CAGR, '09 - '14

2.0% 2.6% 3.5% 2.7% 1.6% 3.8% 2.5% 0.2% 2.7%

Attractive market demographics support strong

organic growth opportunities within our footprint

5

Diversity Supports Growth in Virginia

Richmond

• State Capital

• Fortune 500 headquarters (6)

• Finance and insurance

• VCU & VCU Medical Center

Fredericksburg

• Defense and security

contractors

• Health care

• Retail

• Real Estate development

Charlottesville

• University of Virginia & Medical

College

• High-tech and professional

businesses

• Real Estate development

Northern Virginia

• Nation’s Capital

• Defense and security

contractors

• Associations (lobbyists)

• High tech

Virginia Beach - Norfolk

• Military

• Shipbuilding

• Fortune 500 headquarters (3)

• Tourism

Roanoke - Blacksburg

• Virginia Tech

• Health care

• Retail

• Fortune 500 headquarters (1)

6

Union Bank & Trust

• 120 branches

• Consolidated 3 in-store branches in Winchester into a new stand-alone

branch in April. Closed 2 other branches in second quarter.

• Will close 5 in-store branches in September

• Only Virginia based bank with a statewide footprint

• 1,251 FTEs

• 58 Commercial Lenders

• $5.9 Billion Loans

• $6.1 Billion Deposits

• 176,000+ Core Consumer Households

7

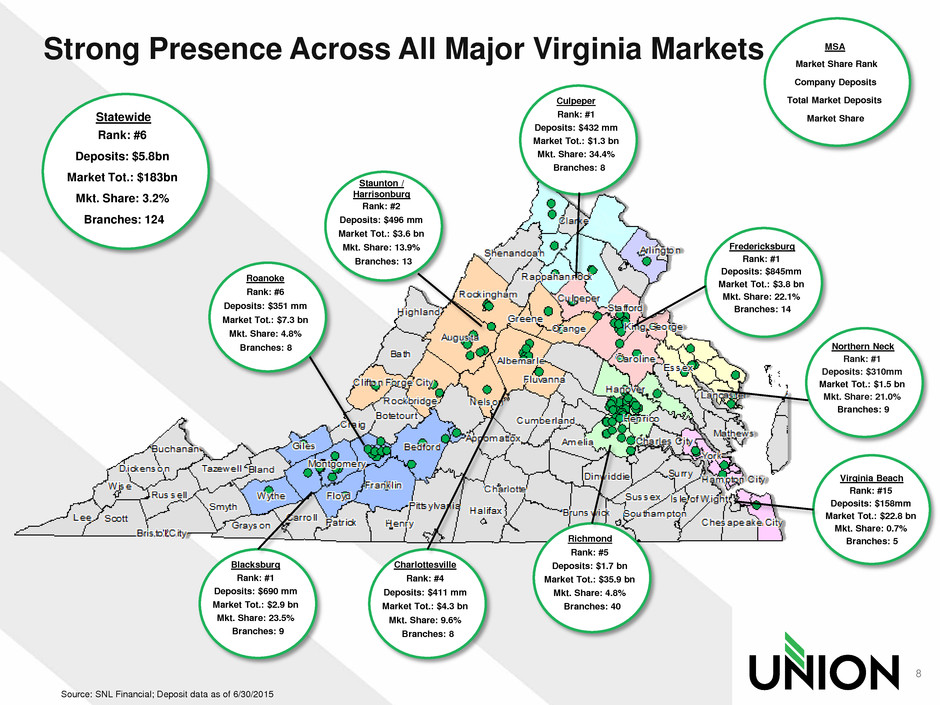

MSA

Market Share Rank

Company Deposits

Total Market Deposits

Market Share

Roanoke

Deposits: $351 mm

Market Tot.: $7.3 bn

Mkt. Share: 4.8%

Rank: #6

Branches: 8

Staunton /

Harrisonburg

Rank: #2

Deposits: $496 mm

Market Tot.: $3.6 bn

Mkt. Share: 13.9%

Branches: 13

Blacksburg

Rank: #1

Deposits: $690 mm

Market Tot.: $2.9 bn

Mkt. Share: 23.5%

Branches: 9

Charlottesville

Rank: #4

Deposits: $411 mm

Market Tot.: $4.3 bn

Mkt. Share: 9.6%

Branches: 8

Richmond

Rank: #5

Deposits: $1.7 bn

Market Tot.: $35.9 bn

Mkt. Share: 4.8%

Branches: 40

Culpeper

Rank: #1

Deposits: $432 mm

Market Tot.: $1.3 bn

Mkt. Share: 34.4%

Branches: 8

Fredericksburg

Rank: #1

Deposits: $845mm

Market Tot.: $3.8 bn

Mkt. Share: 22.1%

Branches: 14

Statewide

Rank: #6

Deposits: $5.8bn

Market Tot.: $183bn

Mkt. Share: 3.2%

Branches: 124

Strong Presence Across All Major Virginia Markets

Northern Neck

Rank: #1

Deposits: $310mm

Market Tot.: $1.5 bn

Mkt. Share: 21.0%

Branches: 9

Virginia Beach

Rank: #15

Deposits: $158mm

Market Tot.: $22.8 bn

Mkt. Share: 0.7%

Branches: 5

Source: SNL Financial; Deposit data as of 6/30/2015

8

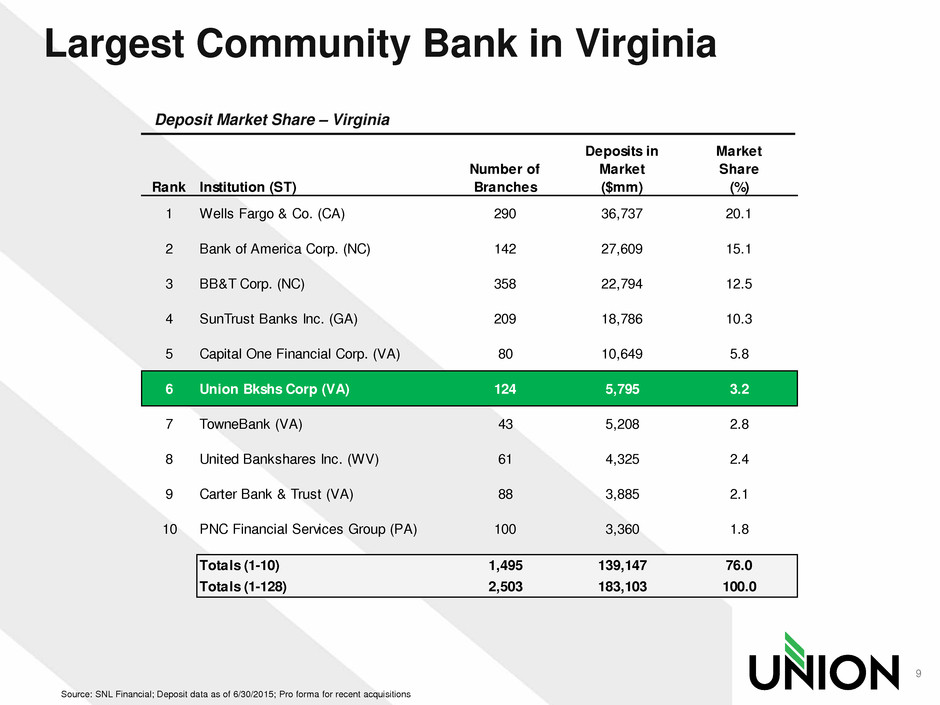

Source: SNL Financial; Deposit data as of 6/30/2015; Pro forma for recent acquisitions

Largest Community Bank in Virginia

Rank Institution (ST)

Number of

Branches

Deposits in

Market

($mm)

Market

Share

(%)

1 Wells Fargo & Co. (CA) 290 36,737 20.1

2 Bank of America Corp. (NC) 142 27,609 15.1

3 BB&T Corp. (NC) 358 22,794 12.5

4 SunTrust Banks Inc. (GA) 209 18,786 10.3

5 Capital One Financial Corp. (VA) 80 10,649 5.8

6 Union Bkshs Corp (VA) 124 5,795 3.2

7 TowneBank (VA) 43 5,208 2.8

8 United Bankshares Inc. (WV) 61 4,325 2.4

9 Carter Bank & Trust (VA) 88 3,885 2.1

10 PNC Financial Services Group (PA) 100 3,360 1.8

Totals (1-10) 1,495 139,147 76.0

Totals (1-128) 2,503 183,103 100.0

Deposit Market Share – Virginia

9

Union Wealth Management

• Trust, Asset Management, Private Banking, Brokerage and Financial

Planning services

• $2.3B in AUM and AUA, the majority of which is managed assets

• $2.3 million fiduciary and asset management fees generated in

2Q16

• Organic and Acquisitive growth opportunities

• Expand services to existing customers utilizing targeted

segmentation and marketing strategies

• Opportunities to serve retail and commercial customers of bank

• Leveraging bank brand/reputation in wealth management space

• Target advisors, teams and firms that complement our wealth

model and client service culture

• Closed on Old Dominion Capital Management ($300 million

AUM) acquisition in 2Q

10

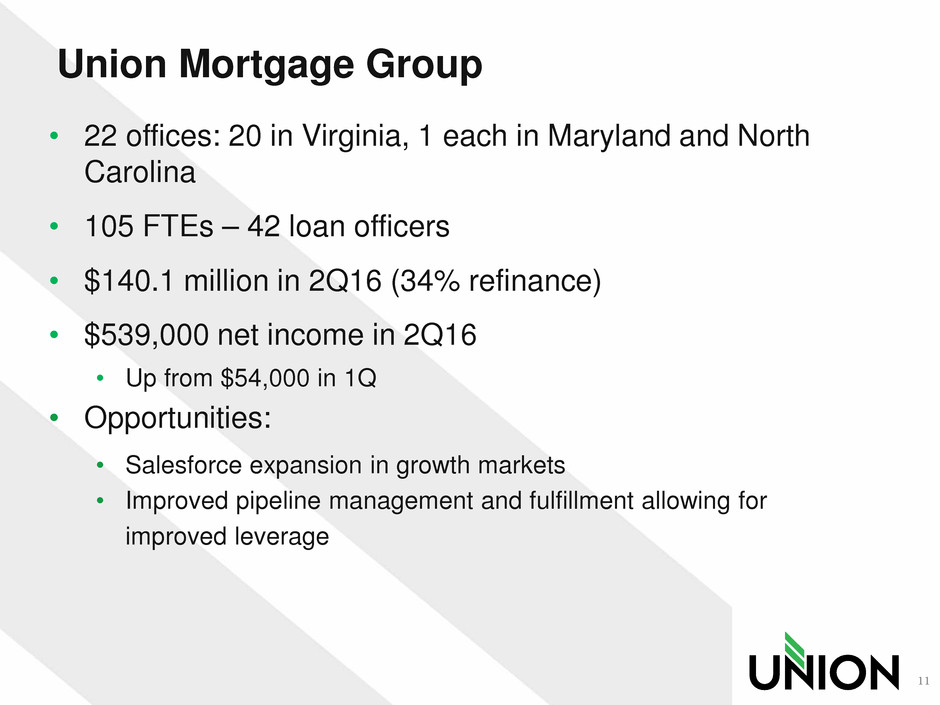

Union Mortgage Group

• 22 offices: 20 in Virginia, 1 each in Maryland and North

Carolina

• 105 FTEs – 42 loan officers

• $140.1 million in 2Q16 (34% refinance)

• $539,000 net income in 2Q16

• Up from $54,000 in 1Q

• Opportunities:

• Salesforce expansion in growth markets

• Improved pipeline management and fulfillment allowing for

improved leverage

11

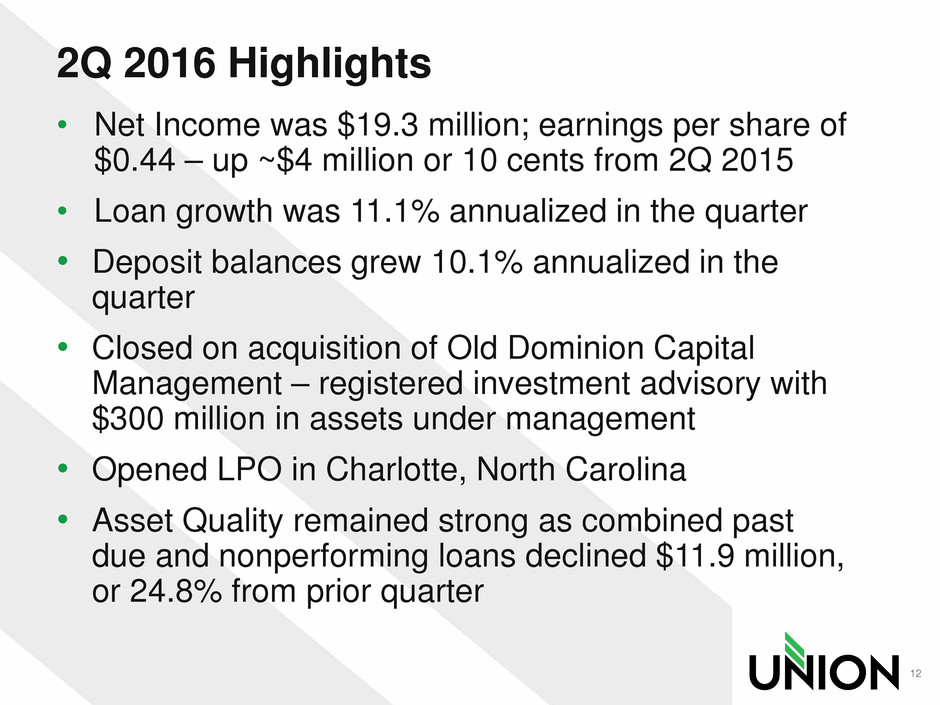

2Q 2016 Highlights

• Net Income was $19.3 million; earnings per share of

$0.44 – up ~$4 million or 10 cents from 2Q 2015

• Loan growth was 11.1% annualized in the quarter

• Deposit balances grew 10.1% annualized in the

quarter

• Closed on acquisition of Old Dominion Capital

Management – registered investment advisory with

$300 million in assets under management

• Opened LPO in Charlotte, North Carolina

• Asset Quality remained strong as combined past

due and nonperforming loans declined $11.9 million,

or 24.8% from prior quarter

12

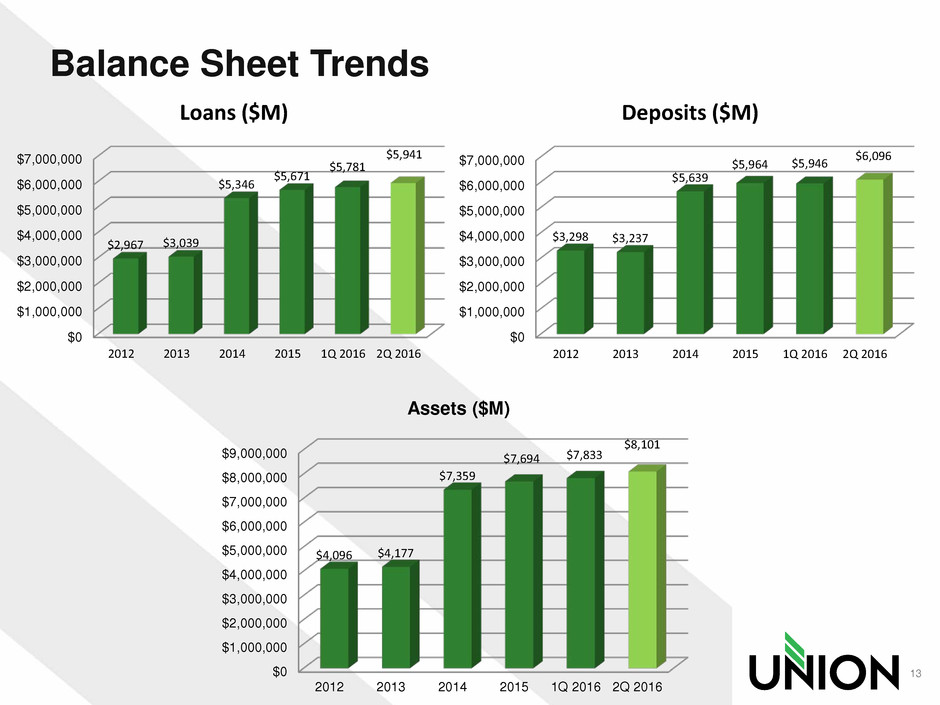

Balance Sheet Trends

13

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

2012 2013 2014 2015 1Q 2016 2Q 2016

$2,967 $3,039

$5,346

$5,671

$5,781

$5,941

Loans ($M)

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

2012 2013 2014 2015 1Q 2016 2Q 2016

$3,298 $3,237

$5,639

$5,964 $5,946

$6,096

Deposits ($M)

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

$8,000,000

$9,000,000

2012 2013 2014 2015 1Q 2016 2Q 2016

$4,096 $4,177

$7,359

$7,694 $7,833

$8,101

Assets ($M)

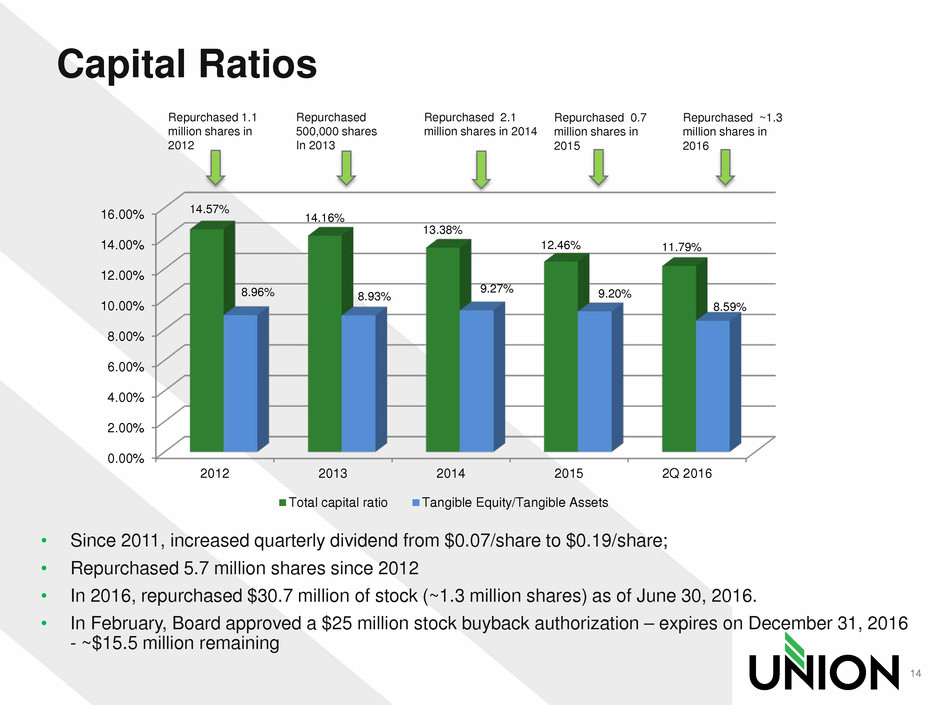

Repurchased 1.1

million shares in

2012

Capital Ratios

14

• Since 2011, increased quarterly dividend from $0.07/share to $0.19/share;

• Repurchased 5.7 million shares since 2012

• In 2016, repurchased $30.7 million of stock (~1.3 million shares) as of June 30, 2016.

• In February, Board approved a $25 million stock buyback authorization – expires on December 31, 2016

- ~$15.5 million remaining

Repurchased

500,000 shares

In 2013

Repurchased 2.1

million shares in 2014

Repurchased 0.7

million shares in

2015

Repurchased ~1.3

million shares in

2016

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

2012 2013 2014 2015 2Q 2016

14.57%

14.16%

13.38%

12.46% 11.79%

8.96% 8.93%

9.27% 9.20%

8.59%

Total capital ratio Tangible Equity/Tangible Assets

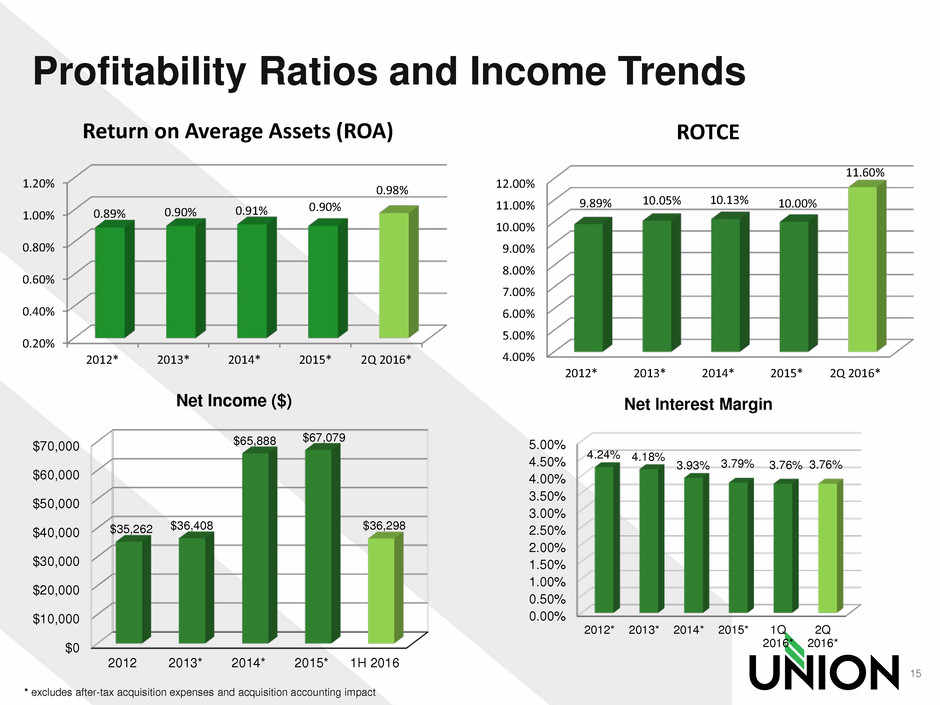

Profitability Ratios and Income Trends

* excludes after-tax acquisition expenses and acquisition accounting impact

15

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

2012* 2013* 2014* 2015* 2Q 2016*

0.89% 0.90% 0.91% 0.90%

0.98%

Return on Average Assets (ROA)

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

2012* 2013* 2014* 2015* 2Q 2016*

9.89% 10.05% 10.13% 10.00%

11.60%

ROTCE

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

2012 2013* 2014* 2015* 1H 2016

$35,262 $36,408

$65,888 $67,079

$36,298

Net Income ($)

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

2012* 2013* 2014* 2015* 1Q

2016*

2Q

2016*

4.24% 4.18%

3.93% 3.79% 3.76% 3.76%

Net Interest Margin

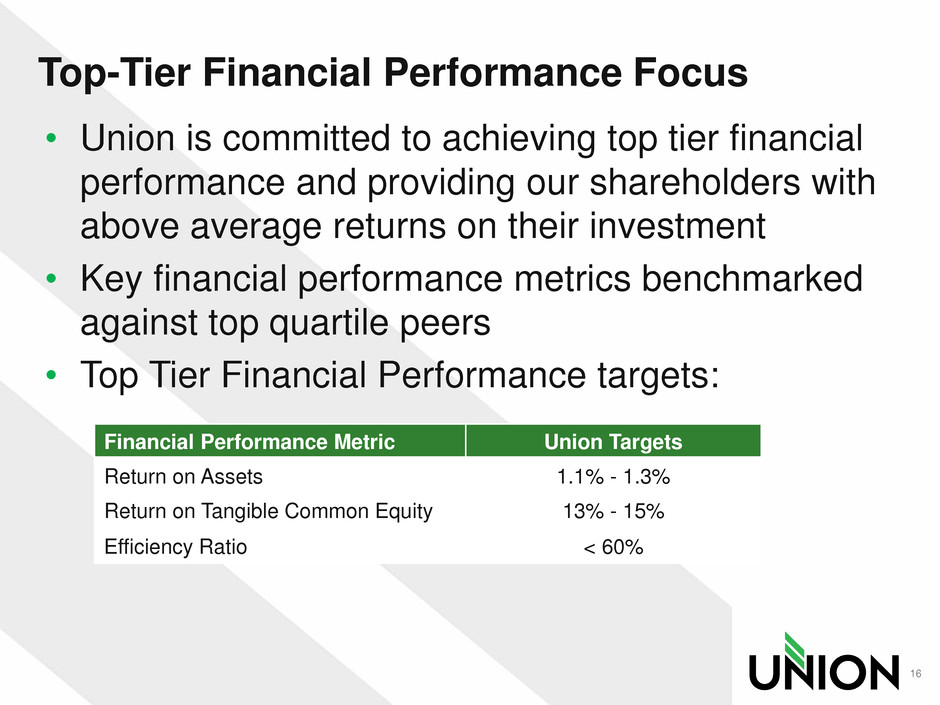

Top-Tier Financial Performance Focus

• Union is committed to achieving top tier financial

performance and providing our shareholders with

above average returns on their investment

• Key financial performance metrics benchmarked

against top quartile peers

• Top Tier Financial Performance targets:

16

Financial Performance Metric Union Targets

Return on Assets 1.1% - 1.3%

Return on Tangible Common Equity 13% - 15%

Efficiency Ratio < 60%

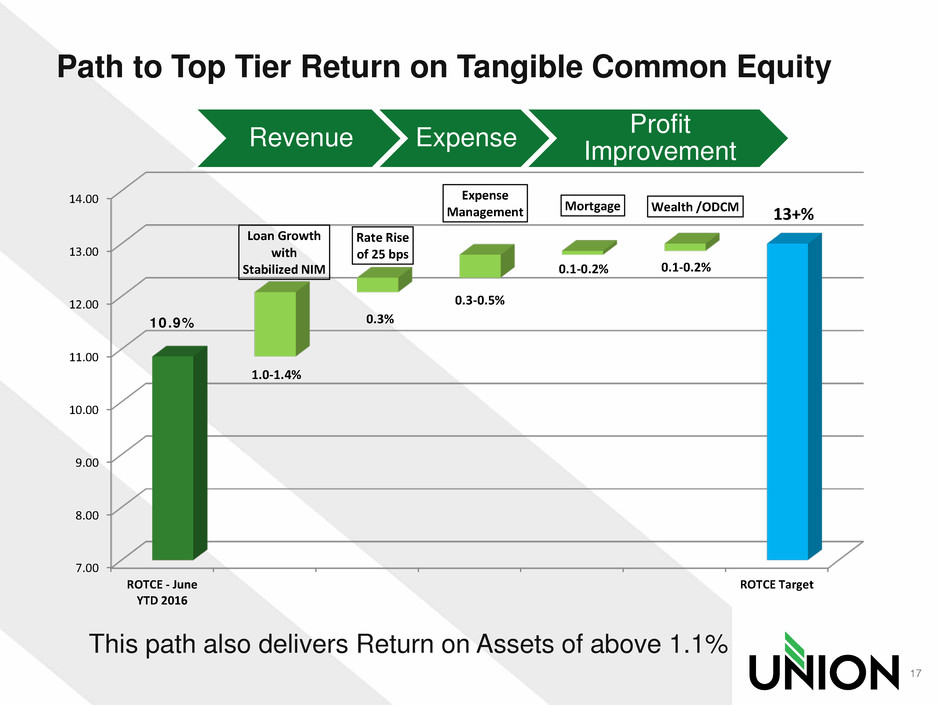

Path to Top Tier Return on Tangible Common Equity

Revenue Expense Profit Improvement

This path also delivers Return on Assets of above 1.1%

17

7.00

8.00

9.00

10.00

11.00

12.00

13.00

14.00

ROTCE - June

YTD 2016

ROTCE Target

1.0-1.4%

0.3%

0.3-0.5%

0.1-0.2% 0.1-0.2%

13+%

10.9%

Loan Growth

with

Stabilized NIM

Rate Rise

of 25 bps

Expense

Management Mortgage Wealth /ODCM

2016 Outlook

• Stable to growing economy in footprint

• High single digit loan growth

• Modest net interest margin compression for 3Q

and 4Q – assumes no rate increase by Fed

• Continued asset quality improvement – reduction

of OREO expenses

• Improving ROA, ROTCE and Efficiency Ratio

• Closing 5 branches in 3Q (reduction of 9 in total

for year)

18

Value Proposition

• Statewide Virginia branch footprint is a

competitive advantage and brings a unique

franchise value

• Strong balance sheet and capital base

• Organic growth and acquisition opportunities

• Experienced management team

• Committed to top tier financial performance

• Shareholder Value Driven

• Solid dividend yield and payout ratio with earnings

upside

19

THANK YOU!

20